Attached files

| file | filename |

|---|---|

| EX-95 - EXHIBIT 95 - Applied Minerals, Inc. | app034_ex95.htm |

| EX-10.10 - EXHIBIT 10.10 - Applied Minerals, Inc. | app034_ex10-10.htm |

| EX-32.2 - EXHIBIT 32.2 - Applied Minerals, Inc. | app034_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Applied Minerals, Inc. | app034_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Applied Minerals, Inc. | app034_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Applied Minerals, Inc. | app034_ex31-1.htm |

| EX-10.11 - EXHIBIT 10.11 - Applied Minerals, Inc. | app034_ex10-11.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2020

Commission file number: 000-31380

| APPLIED MINERALS, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 82-0096527 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 1200 Silver City Road, PO Box 432, Eureka, UT | 84628 | |

| (Address of principal executive offices) | (Zip Code) |

| (435) 433-2059 | ||

| Issuer's telephone number, including area code |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| YES ¨ | NO x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:

| YES ¨ | NO x |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| YES x | NO ¨ |

Indicate by check mark whether the registrant submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| YES x | NO ¨ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller-reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ¨ |

Accelerated Filer ¨ |

Non-accelerated Filer ¨ |

Smaller Reporting Company x |

Emerging Growth Company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| YES ¨ | NO x |

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2020, based on the last sales price on the OTC Bulletin Board on that date, was approximately $1,736,316.

The number of shares of the registrant’s common stock, $0.001 par value per share, outstanding as of April 15, 2021 was 195,105,089.

APPLIED MINERALS, INC.

YEAR 2020 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| 2 |

NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on our current expectations, assumptions, estimates and projections about our business and our industry. Words such as "believe," "anticipate," "expect," "intend," "plan," "will," "may," and other similar expressions identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements.

In the discussion under “Item 1 – Business” and “Item 9 - Management’s Discussion and Analysis of Financial Condition and Results of Operations,” we discusses a wide range of forward-looking information, including our beliefs and expectations concerning business opportunities, potential customer interest, customer activities (including but not limited to testing, scale-ups, production trials, field trials, product development), and our expectations as to sales, the amount of sales, and the timing of sales. Whether any of the foregoing will actually come to fruition, occur, be successful, or result in sales and the timing and amount of such sales is uncertain.

More generally, all forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the section of this Annual Report entitled “1A. RISK FACTORS.”

| ITEM 1. | BUSINESS |

SUMMARY

Applied Minerals, Inc. (the “Company” or “Applied Minerals” or “we” or “us”) (OTC PINK: AMNL) owns the Dragon Mine in central Utah. From the mine we extract, process, or have processed by a third party, halloysite clay and iron oxide for sale to a range of end markets. We market the minerals directly and through distributors.

We also engage in research and development and frequently work collaboratively with potential customers, consultants, distributors, and a third-party processors to process and enhance our halloysite clay products to improve the performance of our customers’ existing and new products.

Halloysite

Our halloysite clay, which we market under the DRAGONITE™ trade name, is an aluminosilicate mineral with a hollow tubular shape. DRAGONITE can utilize halloysite’s shape, high surface area, and reactivity to add significant functionality to a number of applications.

Iron Oxide

Our iron oxide, which we market under the AMIRON™ trade name, is a high purity product. We have sold it for use in cement as well as an absorbent for hydrogen sulfide gas contained in natural gas.

Sales

In 2020, we recorded revenues of $879,169, of which $274,323 was related to sales of DRAGONITE to 17 customers and $604,501 was related to sales of AMIRON to three customers.

Characterization of the Mineralization

Over the last 11 years, the Company has expended significant resources, including commissioning a resource study, to determine the amount, character and mineability of the mineralization of the deposits at the Dragon Mine.

| 3 |

Classification for SEC Purposes

The Company is classified as an “exploration stage” company for purposes of Industry Guide 7 of the U.S. Securities and Exchange Commission (“SEC”) Under Industry Guide 7, companies engaged in significant mining operations are classified into three categories, referred to as “stages” - exploration, development, and production. Exploration stage includes all companies that do not have established reserves in accordance with Industry Guide 7. Such companies are deemed to be “in the search for mineral deposits.” Notwithstanding the nature and extent of development-type or production-type activities that have been undertaken or completed, a company cannot be classified as a development or production stage company unless it has established reserves in accordance with Industry Guide 7. The mineralization indicated by the resource study (described below) we have commissioned cannot be classified as a reserve for purpose of Industry Guide 7.

In 2018, SEC adopted rules to modernize property disclosures for mining companies. Such rules go into effect in 2021. The mineralization indicated by the resource study would not qualify as a reserve under the new rules.

| 4 |

Processing Capability

In October 2017 we entered into a Purchase and Supply Agreement with BASF under which BASF, among other things, agreed to provide the Company with up to 15,000 tons of water-based processing capacity. During the fourth calendar quarter of 2019, BASF informed us of its intention to terminate its obligations under the Purchase and Supply Agreement. Per the terms of the termination of the agreement, BASF is obligated to provide the Company with water-based processing capacity into the first calendar quarter of 2021. The Company is currently seeking to obtain water-based processing capacity on a tolling basis to replace the capacity currently provided by BASF.

We have a primary processing plant with capacity to mill up to 45,000 tons of mineralization per annum for certain clay applications. This facility can also be used to mill iron oxide. The Company has a second processing facility with a capacity of up to 10,000 tons per annum that is dedicated to processing its halloysite resource. Both facilities utilize dry-based milling equipment that do not eliminate impurities such as iron oxide as effectively as wet processing but are useful in situations where wet processing in not necessary

Distribution Channels

The Company markets and sells its products directly and through distributors. The Company also uses several leading distribution organizations, E.T. Horn, Brandt Technologies, LLC, and Azelis to market its products. The Company has a an exclusive agreement with a distributor for Japan.

In October, 2017, we entered into a Purchase and Supply Agreement with the Kaolin business unit of BASF (“Supply Agreement”). The Supply Agreement provided BASF an exclusive license (a) to sell halloysite on a worldwide basis for use within the following third party markets: (i) paints and coatings; (ii) inks; (iii) rubbers (excludes flame retardant and wire and cable applications); (iv) adhesives; (v) paper, and (vi) ceramic honeycomb catalytic substrates and (b) to sell halloysite to other business units of BASF. During the fourth calendar quarter of 2019, BASF informed us of its intention to terminate its obligations under the Purchase and Supply Agreement. BASF is obligated to provide the Company with water-based processing capacity into the first calendar quarter of 2021.

INFORMATION ABOUT THE COMPANY

Applied Minerals, Inc. (OTC PINK: AMNL) owns the Dragon Mine from which we can extract halloysite clay and iron oxide, which we then process or have processed and sell. We also engage in research and development and frequently work collaboratively with potential customers, consultants, distributors, and BASF to engineer and enhance our halloysite clay and iron oxide products to improve the performance of our customers’ existing and new products.

The Dragon Mine is a 267-acre property located in central Utah, approximately 70 miles south of Salt Lake City, Utah.

We market our halloysite clay-based line of products under the tradename DRAGONITE. We have marketed our iron oxide line of products under the trade name AMIRON.

Halloysite is mined and marketed by other companies, primarily by a French company, Imerys, which owns the other major halloysite mine, which is located in New Zealand. The halloysite from that mine is sold primarily for use in ceramics and tableware. When new management came into the Company in 2009, new management decided to focus on new, premium-priced uses of halloysite. Those premium-priced uses had been, and continue to be, identified typically in published research. Because the Company is primarily dedicated to new, advanced uses of halloysite that would permit the Company to charge premium prices, the sales and marketing process is one that often takes an extended period of time. The Company’s pricing strategy is opportunistic and if significant competition develops, that strategy could be adversely affected.

| 5 |

The Company acquired the Dragon Mine primarily to exploit the mine’s halloysite resources. At the time that the Dragon Mine was acquired, it was assumed that the iron oxide mineralization would be useful only for steelmaking. Given historical price conditions and our method of mining (underground), sales of iron oxide for steelmaking would often not be economic and at best would yield marginal or low profits. The iron oxide resource at the Dragon Mine has a high content of Fe2O3. The iron oxide is of high chemical purity, a low level of heavy metals content, high surface area (25 m2/g – 125 m2/g) and reactivity.

INFORMATION ABOUT THE DRAGON MINE

History of the Dragon Mine

The Dragon Mine was first mined in the third quarter of the 19th century and has since been mined by various owners and operators. It was mined for iron oxide from the late nineteenth century until approximately 1931 and it was mined for halloysite clay from approximately 1931 to 1976. From 1949 to 1976, the halloysite was sold for use as a petroleum cracking catalyst. A fire closed the mine in 1976. No mining took place from 1976 until 2001, at which point the Company leased the property with an option to buy it. The Company purchased the property in 2005.

Prior to a change in management in 2009, the Company did relatively little to categorize the mineralization at the Dragon Mine or to identify and exploit markets for the minerals. Since new management was installed in 2009, the Company has used and proposes to continue to use a consulting geologist to categorize the mineralization at the Dragon Mine and management has identified, developed and exploited premium-priced markets for halloysite and, with respect to the single $5 million sale noted above, iron oxide.

Resource Development/Exploration Drilling Expenses

In 2020 and 2019 the Company spent $201,234 and $196,351, respectively, on exploration and resource development.

| 6 |

More Detailed Description of the Mineralization at the Dragon Mine

Clays. Kaolinite and halloysite are clays and members of the kaolin group of clays. Both are aluminosilicate clays. Kaolinite and halloysite are essentially chemically identical but have different morphologies (shapes). Kaolinite typically appears in plates or sheets. Halloysite, in contrast, typically appears in the shape of hollow tubes. On average, the halloysite tubes have a length in the range of 0.5 - 3.0 microns, an exterior diameter in the range of 50 - 70 nanometers and an internal diameter (lumen) in the range of 15 - 30 nanometers. Formation of halloysite occurs when kaolinite sheets roll into tubes due to the strain caused by a lattice mismatch between the adjacent silicon dioxide and aluminum oxide layers. Halloysite is non-toxic and natural, demonstrating high biocompatibility without posing any risk to the environment.

Kaolinite is one of the world’s most common minerals. U.S. production in 2016 was approximately 7.3 million tons.

Halloysite is, by comparison, a rarer mineral and we believe worldwide production is less than 25,000 tons, the majority of which is used in ceramic applications.

Iron Oxide. Hematite is the mineral form of iron oxide, which exists in a range of colors, including black to steel or silver-gray and brown to reddish brown, or red.

Geothite is an iron hydroxide oxide mineral, which exists in a range of colors, including yellowish to reddish to dark brown. If goethite is sufficiently heated to eliminate its contained water, it is transformed into hematite.

Mixtures of goethite and hematite are the color brown.

STATUS OF THE COMPANY FOR SEC REPORTING PURPOSES

The Company is classified as an “exploration stage” company for purposes of Industry Guide 7 of the U.S. Securities and Exchange Commission.

Under Industry Guide 7, companies engaged in significant mining operations are classified into three categories, referred to as “stages” - exploration, development, and production.

Exploration stage includes all companies engaged in the search for mineral deposits (that is, reserves), which are not in either the development or production stage. In order to be classified as a development or production stage company, the company must have already established reserves. Notwithstanding the nature and extent of development-type or production-type activities that have been undertaken or completed, a company cannot be classified as a development or production stage company unless it has established reserves.

| 7 |

Under Industry Guide 7, a “reserve” is “that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.” Generally speaking, a company may not declare reserves, unless, among other requirements, a competent professional engineer conducts a detailed engineering and economic study and prepares a “bankable” or “final” feasibility study that “demonstrates that a mineral deposit can be mined profitably at a commercial rate.”

The Company has commissioned an ongoing study described above that was conducted using the standards of the JORC Code of the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves. The mineralization described in the study does not qualify as reserves for purposes of Industry Guide 7

In 2018, SEC adopted rules to modernize property disclosures for mining companies. Such rules go into effect in 2021. The mineralization indicated by the resource study would not qualify as a reserve under the new rules.

Despite the fact that the Company has not established reserves for purposes of Industry Guide 7, the Company has mined, processed and sold, and intends to continue to mine, process, and sell halloysite clay and iron oxide from the Dragon Mine.

A consequence of the absence of reserves under Industry Guide 7 is that the mining company, such as the Company, is deemed to lack an objective basis to assert that it has a deposit with mineralization that can be economically and legally extracted or produced and sold to produce revenue.

PROCESSING CAPABILITIES

In October 2017 we entered into a Purchase and Supply Agreement with BASF under which BASF, among other things, agreed to provide the Company with up to 15,000 tons of water-based processing capacity. During the fourth calendar quarter of 2019, BASF informed us of its intention to terminate its obligations under the Purchase and Supply Agreement. Per the terms of the termination of the agreement, BASF is obligated to provide the Company with water-based processing capacity into the first calendar quarter of 2021. The Company is currently seeking to obtain water-based processing capacity on a tolling basis to replace the capacity currently provided by BASF.

We have a primary processing plant with capacity to mill up to 45,000 tons of mineralization per annum for certain clay applications. This facility can also be used to mill iron oxide. Additionally, the Company has a second processing facility with a capacity of up to 10,000 tons per annum that is dedicated to processing its halloysite resource. Both facilities utilize dry-based milling equipment that do not eliminate impurities such as iron oxide as effectively as wet processing but are useful in situations where wet processing in not necessary.

MINING AND PRODUCTION ACTIVITY IN 2020 AND 2019

The following table discloses for the twelve (12) months ended December 31, 2020 and 2019, respectively (i) the number of tons of halloysite clay and iron oxide extracted by the Company from the Dragon Mine and (ii) the number of tons of finished product produced by the Company:

| 2020 | 2019 | |||||||

| Tons extracted | ||||||||

| Halloysite clay | 150 | 135 | ||||||

| Iron oxide | 14,900 | 1,894 | ||||||

| Products produced (tons) | ||||||||

| Halloysite clay | 150 | 135 | ||||||

| Iron oxide | 14,900 | 1,894 | ||||||

| 8 |

CUSTOMERS

DRAGONITE

During 2020 the Company sold its DRAGONITE halloysite clay product to approximately 17 customers. The Company is currently working with a number of prospective customers for its DRAGONITE halloysite clay product and hopes to convert one or more of these prospective customers during 2021. However, the Company cannot provide any assurances that it will be successful in doing so.

AMIRON

During October 2019 the Company announced it had signed an agreement to supply a manufacture of cement up to 30,000 tons of AMIRON per year over a two-year period. The Company expects to sell the majority of its iron production to this customer during 2021.

Sales by Customer Use

The table below discloses the percentage of total revenue by product category for the twelve months ended December 31, 2020 and 2019. “Testing” represents revenue generated from the sale of products used for laboratory testing by customers or potential customers. “Scale-Ups” represents revenue generated from the sale of products to customers or potential customers to determine whether our products perform successfully within a production-scale environment. “Commercial Production” represents revenue generated from the sale of products to customers that are either consumed by the costumer or incorporated into a product that is sold by a customer to a third-party. “Other” represents revenue generated from the sale of products for which the Company is not aware of the use by a potential customer.

| Percentages of Sales Classified by Customer Use | ||||||||

| 2020 | 2019 | |||||||

| Sales for: | ||||||||

| Commercial Production | 45 | 89 | ||||||

| Scale-Ups | 20 | 4 | ||||||

| Testing | 35 | 7 | ||||||

| Other | * | * | ||||||

| Total | 100 | 100 | ||||||

* < 1%

| 9 |

SALES AND MARKETING

The Company markets and sells its products directly and/or through distributors.

E.T. Horn acts as exclusive distributor for AMIRON in the following states: Washington, Oregon, Idaho, Montana, Wyoming, California, Nevada, Utah, Arizona, New Mexico. It acts as exclusive distributor of DRAGONITE in those states plus Texas, Oklahoma, Arkansas, and Louisiana.

Brandt Technologies, LLC acts as exclusive distributor for DRAGONITE and AMIRON in North Dakota, South Dakota, Nebraska, Kansas, Missouri, Iowa, Minnesota, Wisconsin, Illinois, Indiana, Kentucky, Ohio, and Michigan.

Azelis acts as exclusive distributor for DRAGONITE in Mississippi. Alabama, Tennessee, Georgia, Florida, South Carolina, North Carolina, Virginia, West Virginia, Maryland, Delaware, Pennsylvania, New Jersey, Connecticut, New York, Vermont, Massachusetts, New Hampshire, and Maine. The Company intends to engage a distributor for AMIRON in these states.

The Company has an exclusive agreement with a distributor for Japan.

In October, 2017, we entered into an supply agreement with the Kaolin business unit of BASF Corp. (“Supply Agreement”). The Supply Agreement provided that the Company will sell halloysite to BASF and BASF may process and/or treat and will have an exclusive license to sell halloysite on a worldwide basis for use within the following third party markets: (i) paints and coatings; (ii) inks; (iii) rubbers (excludes flame retardant and wire and cable applications); (iv) adhesives; (v) paper, and (vi) ceramic honeycomb catalytic substrates and (b) use by other business units of BASF provided that such BASF business unit only uses or sells the halloysite as part of a product another product. Under the terms of the Supply Agreement, each party is reimbursed from the proceeds of sale for its direct costs and the Company and the BASF Kaolin business unit equally share the profits of any sales of halloysite by the Kaolin business unit. The Supply Agreement has an initial term of three years and automatically renews unless one party terminates.

During the fourth calendar quarter of 2019, BASF terminated its right to market DRAGONITE under the Agreement. At the date of termination of the Agreement, no sales of halloysite had been made by the Kaolin business unit.

APPLICATION MARKETS

DRAGONITE

The following is a description of the application markets in which the Company has commercial customers for halloysite-based DRAGONITE products:

Molecular Sieves and Catalysts.

Molecular Sieves. DRAGONITE™ is a binder to zeolite crystals to enhance a molecular sieve’s productivity in critical functions such as drying of natural gas and air, separation of liquid from product streams, and separation of impurities from a gas stream. DRAGONITE possesses a dispersion ability that allows it to combine with the zeolite crystals without reducing the rate of diffusion of liquids and gases. DRAGONITE’s fine particle size, porosity, and thermal stability also ensure that adsorbates diffuse rapidly through the sieve without affecting the adsorbent blend’s physical properties.

Catalysts. DRAGONITE can be used as a catalyst and catalyst support for the hydrotreatment and hydrodemetalation of hydrocarbonaceous feedstocks. DRAGONITE can be used to remove impurities such as metals, sulfur, nitrogen, and asphaltenes. Crude oil petroleum must be processed in order to make it into gasoline and other fuels.. Catalytic cracking involves the addition of a catalyst to speed up the cracking. The reactive nature of halloysite lends itself to being a catalyst especially for high sulfur oil. Halloysite can also be used as a support for catalysts, which are applied to the halloysite as a coating.

Halloysite from the Dragon Mine was mined and processed as a catalyst for petroleum cracking from 1949 to 1976.

Flame Retardant Additives

Flame retardant additives are widely used in flammable and flame resistant plastics and are found in electronics, building insulation, polyurethane foam, and wire and cable.

Plastic manufacturers typically mix or load a small amount of flame retardant into plastic to lower the risk of flammability of their products. We believe that DRAGONITE can be used as a partial replacement for Alumina Trihydrate (ATH) and Magnesium Hydroxide (MDH) in certain applications and as a synergist to ATH and MDH in other applications.

| 10 |

At typical loadings, ATH and MDH can adversely affect certain mechanical properties of plastics. We believe that DRAGONITE, in conjunction with ATH and MDH, exhibits a synergistic performance. Our research and development indicates that DRAGONITE can be used to replace 50% - 75% of antimony trioxide (ATO) in plastic without affecting flame retardancy, retaining the same rating under UL 94, the Standard for Safety of Flammability of Plastic Materials for Parts in Devices and Appliances testing.

We believe that in certain applications the use of DRAGONITE instead of other fire retardant products may allow a manufacturer to use less fire retardant and may, in addition, may enable the manufacturer to reduce the weight of the manufactured part. DRAGONITE-XR does not release its naturally bound water until 400°C, making it suitable for polymers processed under extreme conditions.

Other clays compete in the markets for partially replacing ATH, MDH, and ATO.

Binders for Ceramics

DRAGONITE is an effective binder for traditional ceramic products (any of various hard, brittle, heat-resistant and corrosion-resistant materials made by shaping and then firing a nonmetallic mineral, such as clay, at a high temperature). Binders are substances that improve the mechanical strength of green ceramic bodies so they can pass through production steps before firing without breakage. We believe that DRAGONITE, when used as a binder, also effectuates an improvement in the casting rate of the ceramic manufacturing process. This would equate to an increase in manufacturing efficiency.

Nucleation of Polymers; Reinforcement of Polymers.

Nucleation. Plastics and polymers are composed of long molecular chains that form irregular, entangled coils in a melted resin, the phase in which a resin is liquid and its molecules can move about freely. In semi-crystalline polymers, the chains rearrange upon freezing and form partly ordered regions. Examples of semi-crystalline polymers are polyethylene (PE), polypropylene (PP), Nylon 6 and Nylon 6-6. Crystallization of a polymer occurs as a result of nucleation, a process that starts with small, nanometer-sized domains upon which the polymer chains arrange in an orderly manner to develop larger crystals. The overall rate of crystallization of a polymer be can increased by a nucleating agent. In plastic molding processes, especially in injection molding, the plastic part must remain in the mold until crystallization is complete (freezing). To the extent that crystallization is accelerated, the time in the mold can be reduced, thereby resulting in productivity enhancement. We believe that DRAGONITE added to a resin at a loading of just 1% can significantly speed up the process of crystallization.

We believe DRAGONITE can be effective as a nucleating agent for both polyethylene and polypropylene.

Reinforcement Fillers. Many plastics are reinforced with a filler to enhance the mechanical properties of a polymer. Reinforced plastics, in certain instances, can compete with stiffer materials like metal while also offering an opportunity to reduce the weight of a manufactured part (“light-weighting”).

We believe that the utilization of DRAGONITE as a reinforcing filler can result in the improvement of one or more mechanical properties of a polymer such as modulus (the measure of how well a polymer resists breaking when pulled apart), strength (the measure of the stress needed to break a polymer), and impact resistance (the measure of a polymer’s resistance when impacted by a sharp and sudden stress).

Paints and Coatings

Halloysite has been shown to improve the adhesion and impact resistance properties of polymer-based paints and coatings. Additionally, halloysite has been shown to significantly improve the corrosion resistance of paints and coatings over synthetic anti-corrosion agents. Paints and coatings are one of the application markets on which BASF is focused as part of its Supply Agreement with the Company.

Other Opportunities.

Other potential markets that present opportunities for halloysite but as to which the Company does not have commercial customers include cement (halloysite may increase tensile strength more than twice the increase in compressive strength while reducing permeability), batteries (the silicon material in halloysite, which is an aluminasilicate, may be extracted from halloysite and used in anode in lithium ion batteries and halloysite may be used in electrolyte in batteries), and controlled release carrier in cosmetics and in other applications.

AMIRON

The AMIRON line of natural iron oxide-based products can be used in technical and pigmentary application markets. In October 2019 the Company signed an agreement to supply a manufacture of cement up to 30,000 tons of AMIRON per year over a two-year period. The Company expects to sell the majority of its iron production to this customer during 2021.

| 11 |

THE SALES PROCESS

The Company sells its products using employees, agents, and distributors, selling on a global basis.

DRAGONITE

The Company markets its DRAGONITE into two general types of application markets.

The first type is a market in which halloysite has not been previously used, or is to be used as an additive in substitution for another additive, to enhance a functionality of an application. This type of market requires a number of steps to be completed before a sale can be consummated. Like any new material that will be incorporated into a commercial manufacturing process, a significant amount of testing must be performed by a customer before DRAGONITE can be incorporated into a manufacturing process and a product. Sales of this type often require working with the potential customers’ existing formulations, which can vary from potential customer to potential customer.

Working with a potential customer could include identifying a solution, such as (i) surface coating or (ii) when to introduce DRAGONITE into the formulation or (iii) the conditions under which it should be introduced or (iv) changes, deletions, additions, or substitutions involving other elements of the customer’s formulation. Without the customer’s collaboration in identifying a solution, DRAGONITE could be unsuccessful in achieving the customer’s goals. This process can take an extended period of time (years in the case of discoloration of polymers as a result of the introduction of DRAGONITE) and, in some cases, there is no solution. In this type of market, price can be an important consideration and in some cases, we are not able to compete.

The second type of market is one in which halloysite clay is currently being used in traditional application markets. Within these established markets, we believe our DRAGONITE products often offers an enhanced value proposition with respect to purity and other properties sought by customers, although in some cases DRAGONITE’s purity and/or other properties may not be required or useful. The pricing of our products relative to those of our competitors, however, will always be a significant factor in determining our ability to penetrate these markets.

AMIRON

The Company encounters the same types of challenges marketing AMIRON, as it faces in marketing DRAGONITE. In particular, the Company must compete on price and quality in relation to competitive materials.

The Company is not currently devoting significant efforts or resources to marketing AMIRON. It cannot be assured that we will be successful in penetrating markets for AMIRON.

RESEARCH, DEVELOPMENT AND TESTING

The Company’s research and development and testing efforts are focused on the continued creation of commercial applications for our halloysite-based products and our iron oxides. The Company conducts research and development efforts internally and occasionally through consultants. The Company is using BASF to conduct research. The Company also conducts product research and development collaboratively with distributors, customers and potential customers.

In 2020 and 2019, the Company spent approximately $6,587 and $18,800 on testing and research, respectively.

TRADEMARKS AND PATENTS

We have trademarked the name DRAGONITE and AMIRON. We believe these trademarks are important to the successful marketing of our product offering.

| 12 |

REGULATION

The Utah Department of Natural Resources sets the guidelines for exploration and other mineral related activities based on provisions of the Mined Land Reclamation Act, Title 40-8, Utah Code Annotated 1953, as amended, and the General Rules and Rules of Practice and Procedures, R647-1 through R647-5. We have received a large mine permit from the Department. The Company does not believe that such regulations, including environmental regulations, have or will adversely affect the Company’s business or have a material impact on capital expenditures, earnings and competitive position of the Company.

We carry a Mine Safety and Health Administration (MSHA) license (#4202383) for the Dragon Mine and report as required to MSHA. The Company is subject to extensive regulation and periodic inspections by the Mine Safety and Health Administration, which was created by the Mine Safety and Health Act of 1977. The regulations generally are designed to assure the health and safety of miners and our mine is periodically inspected by MSHA. The Company does not believe that such regulations have or will materially adversely affect the Company’s business or have a material impact on capital expenditures, earnings and competitive position of the Company.

The clays that the Company mines, including halloysite, may contain various levels of crystalline silica when mined. Crystalline silica is considered a hazardous substance under regulations promulgated by the U.S. Occupational Health and Safety Administration (OSHA) and U.S. Mine Health and Safety Administration (MSHA) and as a result is subject to permissible exposure limits (PELs), both in the mine and at the workplaces of our customers. The Company is required to provide Safety Data Sheets (SDS) at the mine and accompanying sales of products to customers. The Company must also apply hazard warning to labels of containers of the product sold to customers, if levels of crystalline silica are present above specified thresholds. Kaolin and halloysite are also subject to PELs.

| 13 |

EMPLOYEES

As of April 15, 2020, the Company had 10 employees. None of our employees are covered by a collective bargaining agreement, we have never experienced a work stoppage, and we consider our labor relations to be excellent.

| ITEM 1A. | RISK FACTORS |

AN INVESTMENT IN OUR SECURITIES IS VERY SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING RISK FACTORS, ALONG WITH THE OTHER MATTERS RELATED TO RISK REFERRED TO HEREIN THIS ANNUAL REPORT, BEFORE YOU DECIDE TO BUY OUR SECURITIES. IF YOU DECIDE TO BUY OUR SECURITIES, YOU SHOULD BE ABLE TO AFFORD A COMPLETE LOSS OF YOUR INVESTMENT.

Our business activities are subject to significant risks, including those described below. Every investor, or potential investor, in our securities should carefully consider these risks. If any of the described risks actually occurs, our business, financial position and results of operations could be materially and adversely affected. Such risks are not the only ones we face, and additional risks and uncertainties not presently known to us or that we currently deem immaterial may also significantly and adversely affect our business.

SPECIFIC RISKS APPLICABLE TO APPLIED MINERALS

LOSSES, DEFICITS, GOING CONCERN.

We have experienced annual operating losses for as long as we have financial records (since 1998). For the years ended December 31, 2020 and 2019, the Company sustained losses from continuing operations of $3,287,711 and $5,973,132, respectively. At December 31, 2020 and 2019, the Company had accumulated deficits of $122,022,140 and $118,734,429, respectively. We have very limited cash as of the date of this report, negative cash flow, and continuing unprofitable operations. Accordingly, our independent registered public accounting firm, MaloneBailey, LLP, has included a going concern paragraph in its opinion on our financial statements.

We may need to seek additional financing to support our continued operations; however, there are no assurances that any such financing can be obtained on favorable terms, if at all, especially in light of the restrictions imposed on the incurrence of additional debt by the Series A Notes and the Series 2023 Notes.

Material Weakness in our Internal Control over Financial Reporting

We have identified material weaknesses in our internal control over financial reporting. If we fail to develop or maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential stockholders could lose confidence in our financial reporting, which could harm our business and the trading price of our stock.

During the preparation of our consolidated financial statements for the year ended December 31, 2020, we and our independent registered public accounting firm, identified deficiencies in our internal control over financial reporting, as defined in the standards established by the Public Company Accounting Oversight Board. Management determined the control deficiencies constitute material weaknesses in our internal control over financial reporting.

The existence of a material weakness could result in errors in our financial statements, cause us to fail to meet our reporting obligations and cause investors to lose confidence in our reported financial information, leading to a decline in the trading price of our stock

MATURITY OF OUTSTANDING PIK-ELECTION CONVERTIBLE NOTES.

Unless the Company becomes quite successful its outstanding PIK-Election Convertible Notes may not elect to voluntarily convert into common stock. Unless the Company is able to generate significant cash flow, the Company may not have sufficient funds to pay outstanding PIK-Election Convertible Notes when such notes mature. Unless the stock price increases very significantly, the Company may not be able to force conversion of the notes before maturity.

| 14 |

The Company has two series of convertible, PIK notes outstanding, 3% PIK-Election Convertible Notes due May 1, 2023 ("Series A Notes") and 3% PIK-Election Notes due August 1, 2023 (“Series 2023 Notes”). As of April 15, 2021, the outstanding balance of the Series A Notes was approximately $29.2 million and the outstanding balance of the Series 2023 Notes was approximately $17.5 million. If the Company continues to pay interest in additional PIK Notes, the outstanding balances will increase to approximately $50.4 million in 2023.

The description of the risks associated with maturity and mandatory conversion set forth below is limited to the Series A Notes, but the risks related to the Series 2013 Notes are similar.

The Series A Notes mature on May 1, 2023. The Series 2023 Notes mature on August 1, 2023.

The holders of the Series A Notes may convert their principal and accrued but unpaid interest into shares of common stock of the Company at any time. As of April 15, 2021, the conversion price of the Series A Notes was $0.36 per share and would have converted into approximately 81.9 million shares of common stock of the Company. As of April 15, 2021, the conversion price of the Series 2023 Notes was $0.57 per share and would have converted into approximately 30.8 million shares of common stock of the Company.

The Series A Notes are mandatorily convertible by the Company at any time when (i) the volume weighted average price of the shares of the common stock of the Company is equal to or greater than $1.00 for thirty (30) consecutive trading days and (ii) the closing market price of the shares of the common stock of the Company is equal to or greater than $1.00.

As of April 15, 2021, the Series 2023 are mandatorily convertible by the Company at any time when the weighted average trading price of a share of the Company’s common stock is in excess of $0.57 for ten (10) consecutive trading days.

The Series A Notes and Series 2023 Notes contain significant negative covenants that limit or eliminate, without the consent of a majority by principal of the each series of Notes, among other things, mergers, sales of assets, dividends, borrowings, secured transactions, liens and transactions with affiliates.

| 15 |

PENETRATING MARKETS

For the Company to survive, we must penetrate our target markets and achieve sales levels and generate sufficient cash flow to break-even. To be a success, we must do better than that. As outlined below, and in light of the disclosures above, there is significant uncertainty that we will be able to do so.

Many of the applications for which we are selling for our halloysite-based material are applications for which halloysite has not been used previously. As a result, there are a number of obstacles that we need to overcome to achieve sales in these markets. It may be necessary to convince manufacturers to change their manufacturing processes and substitute our halloysite-based material for the product they are currently using, and in some cases, to use our halloysite-based material where no product was used before.

The process beginning with introducing our halloysite-based material to manufacturers and ending with the manufacturers using our products in their production (i) can encounter inertia, skepticism, and different corporate priorities, (ii) requires educating potential customers (some of whom can be resistant) on whether our product actually works for the manufacturer’s particular need, the benefits of our material, and how to test and use our material (how much to add, when to add, and so forth), and (iii) often requires working with potential customers to assure that the potential customers test the materials under proper conditions to assure that our products provide the desired results, do not adversely affect the customer’s product and do not interfere with the other constituents of, or processes to make, the customer’s product. In summary, while we believe that our halloysite-based material often adds significant value, we can say two things about the process that ends with manufacturers using our halloysite-based material: it can take a long time and there is no certainty that we will be able to convince enough manufacturers to use our halloysite-base material.

Similarly, we have attempted to sell our iron oxides, which are natural, into markets where synthetic iron oxides have been used in the past. In trying to make such sales, we encounter the same or similar types of problems described in the preceding paragraph

Other applications for our halloysite-based material and our iron oxides are applications for which halloysite or natural iron oxides have been used previously. To penetrate these markets, we face the difficulties encountered by any company trying to enter an established market competing against established players that may be in better financial condition that we are and are already familiar to, and in many cases have relationships with, the potential customers, which may make purchasing from such competitors more attractive than purchasing from us. While we believe that in many cases, our products are superior to those already in the market; there is uncertainty that we will be able to penetrate those markets to a sufficient degree. Because individual halloysite and iron oxide deposits can differ in significant respects, we may have to demonstrate that our halloysite or iron oxide will actually work for the manufacturer’s particular need and thus we can encounter the problems discussed in the third paragraph of this section.

COMPETITION

Competition from Other Miners of Halloysite

Currently there is limited competition involving the sale of our halloysite-based DRAGONITE products in our advanced-applications target markets. If our DRAGONITE products penetrate our advanced-application target markets, we may face significant competition from competitors as well as from non-halloysite solutions often sold by larger, more established companies. The basis for competition is performance, price and reliability. The Company’s pricing strategy is opportunistic and if significant competition develops, that strategy could be adversely affected.

Despite the widespread occurrences of halloysite, large deposits from which high purity halloysite can be economically extracted are comparatively rare. These include deposits with high-grade zones that are dominantly halloysite and lower grade deposits where halloysite can be readily separated to give a high purity product. Relatively pure halloysite typically occurs as narrow lenses or pockets in altered rock and often requires selective mining and sorting to produce a high-grade product. Halloysite is often associated with fine-grained kaolinite, silica or other fine-grained mineral contaminants and as such, for many applications, requiring beneficiation methods that rely primarily on wet processing.

| 16 |

To our knowledge, significant production of high-grade halloysite from large deposits for specialist industrial use at present is limited to the Dragon Mine and open pit mines owned by Imerys, a large French minerals company, in Northland, New Zealand, and in mines in Turkey and in China

The New Zealand mines produce about 15,000 tons of halloysite per year. The raw clay from New Zealand contains around 50% halloysite, 50% silica minerals (quartz, cristobalite, tridymite, amorphous silica), and minor feldspar. It must be processed to eliminate the crystalline silica materials. A 2014 Safety Data Sheet for Imerys’ product states “This product contains between 1% and 10% of quartz (fine fraction), and quartz (fine fraction) is classified as STOT RE1, which means definitely toxic to humans or toxic effect was determined in animal experiments after repeated exposure.”

Our Safety Data Sheet indicates that our processed halloysite “may contain naturally occurring Respirable Crystalline Silica (CAS #’s 14808-60-7 and 14464-46-1) at trace concentration levels below HazCom 2012 and GHS Revision 3 hazard classification limits. Per XRC analysis, which combines the analytical capabilities of X-Ray Diffraction, Computer Controlled Scanning Electron Microscopy/Energy Dispersive Spectroscopy and Raman Spectroscopy to conduct particle-by-particle inter-instrumental relocation and physicochemical/mineralogical analysis - naturally occurring trace level substances in these products, including Respirable Crystalline Silica, are inextricably bound, environmentally unavailable and at de minimis concentrations. Thus, in the current and anticipated future physical state of these products, they are believed to be incapable of causing harm under normal conditions of use or as a result of extreme upset.” Our halloysite does not contain cristobalite.

| 17 |

Imerys’ halloysite has low amounts of Fe2O3. Some of our raw halloysite may contain more Fe2O3 but it can be processed out through bleaching or can be reduced through blending with purer halloysite.

To our knowledge, Imerys has not made any significant efforts so that its halloysite can penetrate that advanced markets that the Company is attempting to penetrate.

Halloysite from Turkey is sold for use in catalysts for a very low price, but it may not have the same functionality as the Company’s halloysite. For some uses such functionality may not be necessary.

Halloysite from China is being sold for use in molecular sieves.

A company owning a deposit in Idaho claims to have proven and probable reserves of halloysite of 382,000 tons and that it will produce halloysite products and market them for some of several uses. Some of those uses are the same as the uses for which the Company is marketing its Dragonite.

Smaller deposits occur in many countries including Japan, Korea, China, Thailand, Indonesia, Australia, South America, and Europe. It is reported that halloysite from China, Brazil, Poland, and Turkey is sold commercially, but halloysite from other locations may be sold commercially. Halloysite is typically used for ceramics and paper coating.

The degree or extent to which the halloysite from other deposits can or will compete with our halloysite-based products is subject to a variety of factors, including the following:

| ● | Deposits of halloysite are formed under a variety of geological conditions of hydrothermal alteration and weathering. As a result, the nature and extent of impurities, the length of the tube, thickness of the walls, and the size of the pore or lumen can all vary. In many deposits, the halloysite is mixed with significant amounts of other clays, limiting its usefulness for certain applications. Other deposits can contain significant amounts of crystalline silica and/or cristobalite, which may limit the usefulness for certain applications and/or require additional processing, although given the fine grain of silica and cristobalite, there are limits to the ability to eliminate them. Other deposits contain more iron oxide than is acceptable, requiring additional processing. Other deposits may be of high quality. |

| ● | Some deposits are subject to difficulties relating to mining. Some deposits are located in geographically isolated areas. |

The global resource base for economically mineable halloysite might be expanded to meet substantial growth in demand, especially if demand was for higher-value markets that would justify higher costs for mining and processing out containments. Such expansion might be anticipated both through the discovery of new deposits and through the adoption of more elaborate process methods to separate halloysite occurring within lower-grade sources. Competition from the other halloysite producers could arise and could adversely affect sales and margins and such competition would be based on performance and/or price. In particular, competition could affect the Company’s sales strategy of opportunistic pricing.

Competition from Suppliers of Alternative Solutions to Halloysite

When we market halloysite for use in situations where halloysite has not been previously used, or is to be used as an additive in substitution for another additive to enhance certain functionality of an application, we will face competition from suppliers of other solutions and the competition will be based on performance, price and reliability.

Competition for Iron Oxide

We expect to compete with companies that, in some cases, may be larger and better capitalized than us. Because individual iron oxide deposits can differ in significant respects, our iron oxide may not be suitable for certain uses and we may have to demonstrate that our iron oxide will actually work for the manufacturer’s particular need and we can encounter problems in getting manufacturers to test our product and even if such tests are successful, to use our iron oxide. We also compete with synthetic iron oxide.

| 18 |

THE COMPANY’S SUCCESS DEPENDS ON OUR SENIOR MANAGEMENT

Our senior management has played a critical role in leading the effort to commercialize our halloysite-based products and iron oxides. If the Company loses the services of members of senior management, there is no assurance that the Company would be able to attract and retain qualified replacements.

| 19 |

OTHER MORE GENERALIZED RISKS AND UNCERTAINTIES

The actual Dragon Mine profitability or economic feasibility may be adversely affected by any of the following factors, among others:

| ● | Changes in tonnage, grades and characteristics of mineralization to be mined and processed; |

| ● | Higher input and labor costs; |

| ● | The quality of the data on which engineering assumptions were made; |

| ● | Adverse geotechnical conditions; |

| ● | Availability and cost of adequate and skilled labor force and supply and cost of water and power; |

| ● | Availability and terms of financing; |

| ● | Environmental or other government laws and regulations related to the Dragon Mine; |

| ● | Changes in tax laws, including percentage depletion and net operating loss carryforwards; |

| ● | Weather or severe climate impacts; |

| ● | Potential delays relating to social and community issues; |

| ● | Industrial accidents, including in connection with the operation of mining and transportation equipment and accidents associated with the preparation and ignition of blasting operations, milling equipment and conveyor systems; |

| ● | Underground fires or floods; |

| ● | Unexpected geological formations or conditions (whether in mineral or gaseous form); |

| ● | Ground and water conditions; |

| ● | Accidents in underground operations; |

| ● | Failure of mining pit slopes; |

| ● | Seismic activity; and |

| ● | Other natural phenomena, such as lightning, cyclonic or storms, floods or other inclement weather conditions. |

THERE IS COMPREHENSIVE FEDERAL, STATE AND LOCAL REGULATION OF THE EXPLORATION AND MINING INDUSTRY THAT COULD HAVE A NEGATIVE IMPACT OUR MINING OPERATIONS.

Exploration and mining operations are subject to federal, state and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground, the discharge of materials into the environment, restoration the property after mining operations are completed. Exploration and mining operations and some of the products we sell are also subject to federal, state and/or local laws and regulations that seek to maintain health and safety standards. No assurance can be given that standards imposed by federal, state or local authorities will not be changed or that any such changes would not have material adverse effects on our activities, including mine closure. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on our financial position. Additionally, we may be subject to liability for pollution or other environmental damages that we may elect not to insure against due to prohibitive premium costs and other reasons. Additionally, we may be subject to liability for pollution or other environmental damages that we may elect not to insure against due to prohibitive premium costs and other reasons.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

PRINCIPAL OFFICE

The corporate office is located at 1200 Silver City Road, Eureka, UT 84628.

| 20 |

MINING PROPERTY

The following section describes our right, title, or claim to the Dragon Mine property.

The Dragon Mine property, located in Juab County, Utah, within the Tintic Mining District, has been principally exploited for halloysite clay and iron oxide. It is located approximately 2 miles southwest of Eureka, Utah and can be accessed via state highway and county road. There is no evidence of a water source on the property.

The property covers approximately 267 acres with a large mining permit covering 40 acres allowing for the extraction of minerals. The property consists of 38 patented and six unpatented mining claims located in the following sections: T10S, R2W, sections 29, 30, 31, and T10S, R3W, Section 36, all relative to the Salt Lake Base Meridian. The Company pays approximately $800 in annual maintenance fees to the U.S. Department of Interior Bureau of Land Management to maintain rights to its unpatented claims. The BLM Claim Numbers are: UMC385543, UMC 385544, UMC394659, UMC394660, UMC408539, and UMC408540.

The Company has no underlying royalty agreements with any third-party with respect to the Dragon Mine. We leased the property in 2001 and in 2005 we purchased the property for $500,000 in cash. As more fully explained in the “Business” section, the property has two mining areas, the Dragon Pit, which contains high purity halloysite, mixed clays and iron oxide and the Western Area, which contains mixed clays and iron oxides.

| 21 |

Processing Facilities at Dragon Mine; Plant and Equipment

The Company has two dry-process facilities at its Dragon Mine property. One facility, is able process halloysite clay and iron oxide, has a capacity of up to 45,000 ton per year for certain types of clay processing and includes a Hosokawa Alpine mill. Before processing, the mineral is crushed. If only crushing is needed for a particular product, our production capacity will be significantly higher. The other facility is dedicated to dry processing of halloysite clay resource and has an annual capacity of up to 10,000 tons per year.

In October 2017 we entered into a Purchase and Supply Agreement with BASF under which BASF, among other things, agreed to provide the Company with up to 15,000 tons of water-based processing capacity. During the fourth calendar quarter of 2019, BASF informed us of its intention to terminate its obligations under the Purchase and Supply Agreement. Per the terms of the termination of the agreement, BASF is obligated to provide the Company with water-based processing capacity into the first calendar quarter of 2021. The Company is currently seeking to obtain water-based processing capacity on a tolling basis to replace the capacity currently provided by BASF.

We believe the physical plant and equipment utilized at the Dragon Mine are in satisfactory condition to continue our current mining and processing activity except where the Company anticipates using a third party to beneficiate its halloysite. The Company continually reviews the adequacy of its physical plant and equipment inventory and expects to invest accordingly to ensure that the size and quality of its physical plant and equipment can meet its needs. Currently, our physical plant includes, but is not limited to, two processing mills, a dry house, a site office, a general storage facility, an equipment repair facility, and a structure housing three IR compressors, which are used to power the mill and certain drilling equipment used underground. Our mining equipment includes, but is not limited to, a road header, an underground drill, a deep drill, a skid steer, a front-end loader and a number of other pieces traditionally used to mine underground. There are some pieces of equipment we choose to rent on a daily basis rather than own or lease to own. The Company uses diesel fuel and propane and has water transported to the property from an external source. The property has sufficient access to roads to enable the transportation of materials and products. The property also has a well-equipped laboratory used for quality control and research.

SEC Industry Guide 7 and Resource Study

As of the filing of this report, the Company was classified as an exploration stage company for purposes of Industry Guide 7 of the U.S. Securities and Exchange Commission.

Under Industry Guide 7, companies engaged in significant mining operations are classified into three categories, referred to as “stages”- exploration, development, and production. Exploration stage includes all companies engaged in the search for mineral deposits (reserves). In order to be classified as a development or production stage company, a company must have already established reserves. Unless a company has established reserves, it cannot be classified as a development or production stage company, notwithstanding the nature and extent of development-type or production- type activities that have been undertaken or completed.

The Company has commissioned a study of the mine’s “resources” that was conducted using the standards of the JORC Code of the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves. The mineralization described in the study does not qualify as reserves under Industry Guide 7.

In 2018, SEC adopted rules to modernize property disclosures for mining companies. Such rules go into effect in 2021. The mineralization indicated by the resource study would not qualify as a reserve under the new rules.

For purposes of Industry Guide 7, a consequence of the absence of reserves is that the mining company, such as the Company, is deemed to lack an objective basis to assert that it has a deposit with mineralization that can be economically and legally extracted or produced and sold to produce revenue.

Despite the fact that the Company has not established reserves, the Company has mined, processed and sold, and intends to continue to mine, process, and sell, halloysite clay and iron oxide from the Dragon Mine.

| 22 |

Exploration Agreement

On December 22, 2017, the Company and Continental Mineral Claims, Inc. (“CMC”) entered into an Exploration Agreement with Option to Purchase (“Agreement”). The Company granted to CMC the exclusive right and option to enter upon and conduct mineral exploration activities (the “Exploration License”) for Metallic Minerals on the Company’s Dragon Mine minesite in Utah (the “Mining Claims”). Metallic Minerals are defined to include minerals with a high specific gravity and metallic luster, such as gold, silver, lead, copper, zinc, molybdenum, titanium, tungsten, uranium, tin, iron, etc., but shall exclude any such Metallic Minerals that are intermingled within any economically-recoverable, non-metallic mineral deposits located at or above an elevation of 5,590 feet above sea level. Non-metallic minerals include clay and iron oxide, the minerals mined by the Company. The Company believes that all economic recoverable non-metallic mineral deposits are well above 5,590 feet above sea level. The Exploration License is for a period of ten years.

In consideration of the Exploration License CMC paid the Company $350,000 upon the execution of the agreement and paid it $150,000 on the first anniversary of the Exploration License in December 2018. CMC will pay the Company $250,000 on or before each subsequent anniversary during the Exploration License term following the first anniversary of the Effective Date of this Agreement unless the Exploration License is terminated earlier by CMC by exercising the option or failing to make the required payment for the Exploration License.

In March 2020 CMC exercised its option to acquire 100% of the Metallic Rights within the Mining Claims from the Company, subject to the terms and conditions of the Agreement. The proceeds paid to the Company upon the exercise of the option totalled $1,050,000.

| 23 |

Upon the exercise of the option, the Company retained the all rights and title to (1) the surface interest (with exception of those rights associated with the Metallic Rights), and (2) all non-metallic minerals (expressly including all industrial minerals including clays and iron oxides).

Upon the exercise of the option the Company retained protections against unreasonable interference of its current and future mining operations by CMC. CMC may not do anything that may, at the Company’s determination, adversely impact the Company’s Mining Operations. “Mining Operations” shall mean the activities incident to mineral extraction, permitting, and any operations by CMC or the Company relating to the removal of minerals, respectively, that are or may reasonably be conducted on the Mining Claims, including the exploration for, and development, active mining, removing, producing and selling of any minerals, including the Metallic Minerals. The Agreement states that the parties understand that the Company is willing to enter into the Agreement only if it is assured that CMC will not have any right to unreasonably interfere with the Company’s current mining operations and possible future Mining Operations on the Mining Claims.

| ITEM 3. | LEGAL PROCEEDINGS |

As of the date of this report, there is no pending or threatened litigation. We may become involved in or subject to, routine litigation, claims, disputes, proceedings and investigations in the ordinary course of business, could have a material adverse effect on our financial condition, cash flows or results of operations.

| ITEM 4. | MINE SAFETY DISCLOSURES |

The information concerning mine safety violations or other regulatory matters required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and this Item is included in Exhibit 95 to this 10-K.

| ITEM 5. | MARKET PRICE FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDERS MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Prices for Our Common Stock

Our common stock is quoted on the OTC under the symbol “AMNL.” The following quotations reflect inter-dealer prices, without retail mark-up, mark-down, or commission, and may not represent actual transactions.

| Year 2020 | Year 2019 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter | $ | 0.02 | $ | 0.01 | $ | 0.06 | $ | 0.03 | ||||||||

| Second Quarter | $ | 0.01 | $ | 0.01 | $ | 0.04 | $ | 0.03 | ||||||||

| Third Quarter | $ | 0.01 | $ | 0.01 | $ | 0.04 | $ | 0.02 | ||||||||

| Fourth Quarter | $ | 0.04 | $ | 0.01 | $ | 0.03 | $ | 0.01 | ||||||||

Record Holders

As of December 31, 2020, there were approximately 600 holders of record of our common stock. This number does not include an indeterminate number of shareholders whose shares are held by brokers in street name.

Dividends

Since we became a reporting company in 2002, we have never declared or paid any cash dividend on our common stock. We have no current plans to declare dividends. We are subject to restrictions or limitations relating to the declaration or payment of dividends under the Series A Notes and Series 2023 Notes.

Equity Compensation Plans

Plans Approved by Stockholders

Shareholders approved the 2012 Long-Term Incentive Plan (“2012 LTIP”) and the 2016 Incentive Plan. (“2016 IP”).

The number of shares subject to the 2012 LTIP for issuance or reference was 8,900,000 of which 6,663,249 were outstanding at December 31, 2020. The number of shares subject to the 2016 IP was 15,000,000 of which 7,140,000 were outstanding at December 31, 2020.

| 24 |

Plans Not Approved by Stockholders

Prior to the adoption of the 2012 LTIP, the Company granted options to purchase 12,378,411 shares of common stock under individual arrangements. As of December 31, 2020, only 4,104,653 options under such individual arrangements are outstanding.

In May and August, 2016, the Company adopted the 2016 Long-Term Incentive Plan (“2016 LTIP”). The number of shares of common stock for issuance or for reference purposes subject to the 2016 LTIP was 2,000,000. The Company granted options to purchase 1,993,655 shares of common stock under the 2016 LTIP.

In 2017, prior to the adoption of the 2017 Incentive Plan (“2017 IP”) in August 2017, the Company granted options to purchase 870,000 shares of common stock under individual arrangements.

The number of shares of common stock for issuance or for reference purposes subject to the 2017 IP was 40 million. The Company granted options to purchase 38,889,958 shares of common stock under the 2017 IP of which 35,889,958 were outstanding at December 31, 2020.

Equity Compensation Information

As of December 31, 2020

| Number of securities to be issued upon exercise of outstanding options | Weighted-average exercise price of outstanding options | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders (1) | 13,803,249 | $ | 0.59 | 10,096,751 | ||||||||

| Equity compensation plans not approved by security holders (2) | 42,858,266 | $ | 0.18 | 4,116,387 | ||||||||

| Total | 56,661,515 | $ | 0.28 | 14,213,138 | ||||||||

| (1) | Includes 7,140,000 options granted under the 2016 IP and 6,663,249 options granted under the 2012 LTIP. |

| (2) | Includes 1,993,655 options granted under the 2016 LTIP, 35,889,958 options granted under the 2017 IP and 4,974,653 options granted under individual arrangements. |

| 25 |

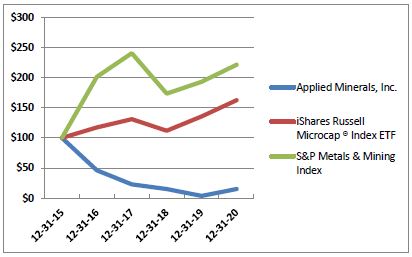

Comparison of 5-Year Cumulative Returns

| 12-31-16 | 12-31-17 | 12-31-18 | 12-31-19 | 12-31-20 | |||||||||||||

| Applied Minerals, Inc. | $ | 46 | $ | 23 | $ | 15 | $ | 4 | $ | 15 | |||||||

| iShares Russell Microcap ® Index ETF | $ | 118 | $ | 131 | $ | 112 | $ | 136 | $ | 163 | |||||||

| S&P Metals & Mining Index | $ | 202 | $ | 241 | $ | 174 | $ | 193 | $ | 222 | |||||||

* Cumulative return assumes a $100 investment of each respective security at December 31, 2015.

| 26 |

| ITEM 6. | SELECTED FINANCIAL DATA |

| Year Ended December 31 (in 000’s except per share data) | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

| Revenue | $ | 879.2 | $ | 486.0 | $ | 4,873.2 | $ | 2,444.7 | $ | 4,013.1 | ||||||||||

| Net loss | $ | (3,287.7 | ) | $ | (5,973.1 | ) | $ | (3,326.0 | ) | $ | (14,910.7 | ) | $ | (7,639.8 | ) | |||||

| Net loss - basic | $ | (0.02 | ) | $ | (0.03 | ) | $ | (0.02 | ) | $ | (0.13 | ) | $ | (0.07 | ) | |||||

| Net loss - diluted | $ | (0.02 | ) | $ | (0.03 | ) | $ | (0.02 | ) | $ | (0.13 | ) | $ | (0.07 | ) | |||||

| Cash and equivalents | $ | 669.6 | $ | 52.8 | $ | 2,892.3 | $ | 47.7 | $ | 1,049.9 | ||||||||||

| Total assets | $ | 1,900.3 | $ | 1,489.2 | $ | 4,137.0 | $ | 3,324.2 | $ | 6,079.5 | ||||||||||

| Long-term liabilities | $ | 46,265.1 | $ | 43,842.6 | $ | 36,825.3 | $ | 35,291.9 | $ | 25,229.7 | ||||||||||

| Shareholders’ (deficit) | $ | (47,829.4 | ) | $ | (44,784.1 | ) | $ | (34,118.7 | ) | $ | (33,200.8 | ) | $ | (20,968.1 | ) | |||||

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

OVERVIEW

Applied Minerals, Inc. is a global producer of DRAGONITE halloysite clay and AMIRON advanced natural iron oxides. We are a vertically integrated operation focused on developing grades of DRAGONITE and AMIRON that can be utilized for both traditional and advanced end-market applications. We have mineral production capacity of up to approximately 55,000 tons per year.

See “ITEM 1. BUSINESS” for further details regarding both our business strategy.

Impact of COVID-19 Pandemic on Financial Statements

In December 2019, a novel strain of COVID-19 was reported in China. Since then, COVID-19 has spread globally, to include Canada, the United States and several European countries. The spread of COVID-19 from China to other countries has resulted in the World Health Organization (WHO) declaring the outbreak of COVID-19 as a “pandemic,” or a worldwide spread of a new disease, on March 11, 2020. Many countries around the world have imposed quarantines and restrictions on travel and mass gatherings to slow the spread of the virus and have closed non-essential businesses.

As local jurisdictions continue to put restrictions in place, our ability to continue to operate our business may also be limited. Such events may result in a period of business, supply and product manufacturing disruption, and in reduced operations, any of which could materially affect our business, financial condition and results of operations. In response to COVID-19, the Company implemented remote working and thus far, has not experienced a significant disruption or delay in our operations

To date, COVID-19 has not had a material financial impact on the Company. However, COVID-19 has caused severe disruptions in transportation and limited access to the Company’s facility, resulting in limited support from its staff and professional advisors. The small size of the Company’s accounting staff and the additional responsibilities emanating from COVID-19 may cause a delay in the Company’s ability to complete subsequent reports in a timely manner.

| 27 |

RECENT ISSUED ACCOUNTING PRONOUNCEMENTS

In December 2019, the FASB issued ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes, as part of its initiative to reduce complexity in accounting standards. The amendments in this update simplify the accounting for income taxes by removing certain exceptions to the general principles in Topic 740. The amendments also improve consistent application of and simplify GAAP for other areas of Topic 740 by clarifying and amending existing guidance. The amendments within ASU No. 2019-12 are effective for financial statements issued for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020, and early adoption is permitted. The Company is currently assessing the impact of this update on its consolidated financial statements.

| 28 |

Results of Operations - 2020 Compared to 2019

The following sets forth, for the periods indicated, certain components of our operating earnings, including such data stated as percentage of revenues:

| Twelve Months Ended December 31 | Variance | |||||||||||||||||||||||

| 2020 | % of Rev. | 2019 | % of Rev. | Amount | % | |||||||||||||||||||

| REVENUES | $ | 879,169 | 100 | % | $ | 486,046 | 100 | % | $ | 393,123 | 81 | % | ||||||||||||

| OPERATING EXPENSES: | ||||||||||||||||||||||||

| Production costs | 1,245,776 | 142 | % | 934,865 | 192 | % | 310,911 | 33 | % | |||||||||||||||

| Exploration costs | 201,234 | 23 | % | 196,351 | 40 | % | 4,883 | 2 | % | |||||||||||||||

| General and administrative * | 2,265,805 | 258 | % | 3,398,267 | 699 | % | (1,132,462 | ) | (33 | )% | ||||||||||||||

| Total Operating Expenses | 3,712,815 | 422 | % | 4,529,483 | 931 | % | (816,668 | ) | (18 | )% | ||||||||||||||

| Operating Loss | (2,833,646 | ) | (322 | )% | (4,043,437 | ) | (832 | )% | 1,209,791 | (30 | )% | |||||||||||||

| OTHER INCOME (EXPENSE): | ||||||||||||||||||||||||

| Interest expense, net, including amortization of deferred financing cost and debt discount | (1,809,397 | ) | (206 | )% | (2,183,003 | ) | (449 | )% | 373,606 | (17 | )% | |||||||||||||

| Other income | 1,355,332 | 154 | % | 253,308 | 52 | % | 1,102,023 | 435 | % | |||||||||||||||

| Total Other (Expense) | (454,065 | ) | (52 | )% | (1,929,695 | ) | (397 | )% | 1,475,630 | (76 | )% | |||||||||||||

| Net Loss | $ | (3,287,711 | ) | (374 | )% | $ | (5,973,132 | ) | (1,229 | )% | $ | 2,685,421 | (45 | )% | ||||||||||

| * | Includes $75,669 and $249,116 of non-cash stock compensation expense for 2020 and 2019, respectively, related to employee, director and consultant stock options. |

Revenue generated during 2020 was $879,169 compared to $486,046 of revenue generated during the same period in 2019, an increase of $393,123 or 81%. The increase was driven primarily by a $537,042, or 796%, increase in sales of AMIRON iron oxide, partially offset by a $142,233, or 34%, decrease in sales of DRAGONITE halloysite clay.

Sales of DRAGONITE during 2020 totaled $274,323, a decrease of $142,233, or approximately 34% when compared to 2019. The decline was driven primarily by the absence of a sale of $288,000 to a large manufacture of molecular sieves that occurred during 2019, partially offset by $53,000 of sales to a manufacturer of high-performance polymer-based proppants, $47,000 of sales to a manufacturer of acrylic adhesives and $40,000 of sales of DRAGONITE-loaded polymer masterbatch to a large manufacturer of lawn and garden equipment.

Sales of AMIRON during 2020 totaled $604,501, an increase of $537,042, or approximately 796%, when compared to 2019. The increase was driven by a (i) $473,146, or 711%, increase in sales to a cement manufacturer and (ii) $64,800 sale to a manufacturer of hydrogen sulfide scavengers that did not occur in 2019.

Revenue for 2019 included $5,000 of tolling milling, which was not realized during 2020.

| 29 |