Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - LINDSAY CORP | d81787dex991.htm |

| 8-K - 8-K - LINDSAY CORP | d81787d8k.htm |

2nd Quarter Fiscal 2021 Earnings Slide Deck Exhibit 99.2

Safe-Harbor Statement This presentation contains forward-looking statements that are subject to risks and uncertainties and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance, financial results and planned financing. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Investors should understand that a number of factors could cause future economic and industry conditions, and the Company’s actual financial condition and results of operations, to differ materially from management’s beliefs expressed in the forward-looking statements contained in this presentation. These factors include those outlined in the “Risk Factors” section of the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission, and investors are urged to review these factors when considering the forward-looking statements contained in this presentation. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For full financial statement information, please see the Company’s earnings release dated April 6, 2021.

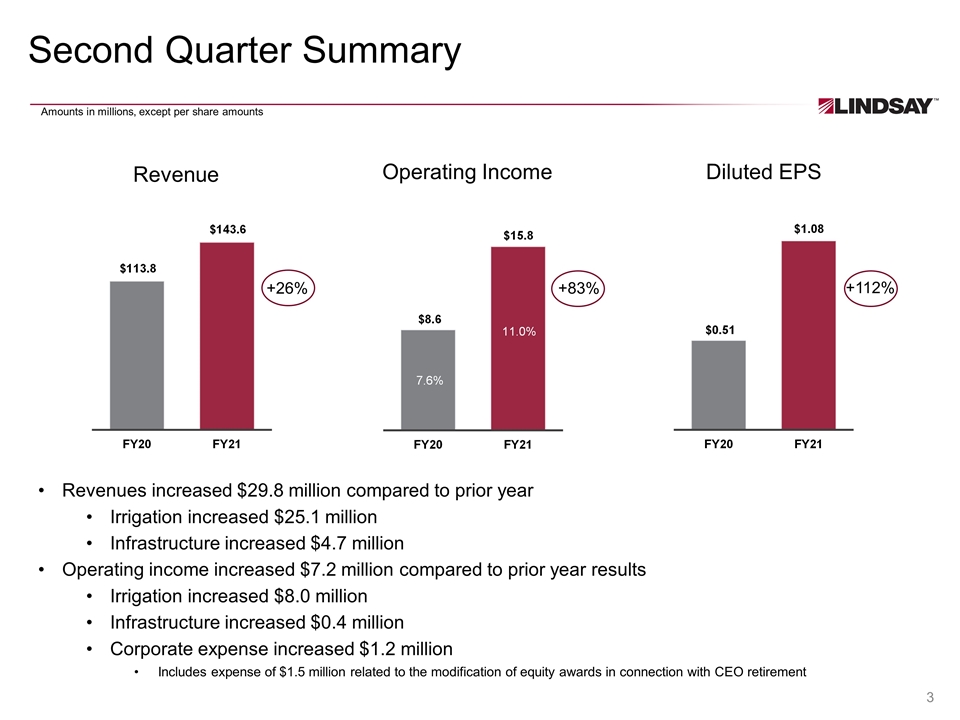

Second Quarter Summary Revenues increased $29.8 million compared to prior year Irrigation increased $25.1 million Infrastructure increased $4.7 million Operating income increased $7.2 million compared to prior year results Irrigation increased $8.0 million Infrastructure increased $0.4 million Corporate expense increased $1.2 million Includes expense of $1.5 million related to the modification of equity awards in connection with CEO retirement Amounts in millions, except per share amounts Revenue Operating Income Diluted EPS +26% +112% +83%

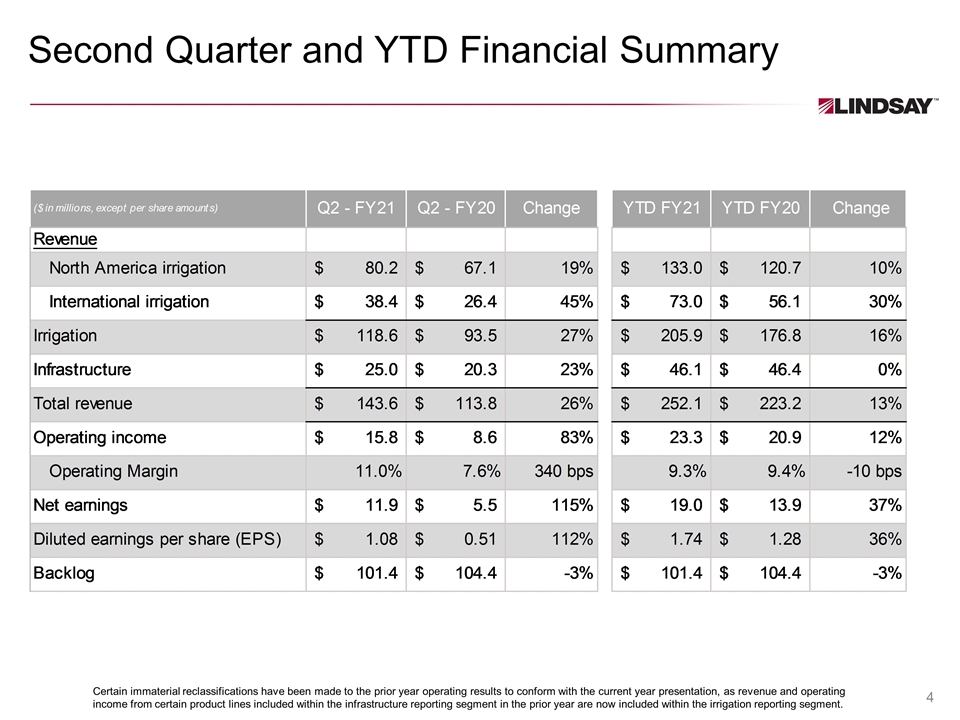

Second Quarter and YTD Financial Summary Certain immaterial reclassifications have been made to the prior year operating results to conform with the current year presentation, as revenue and operating income from certain product lines included within the infrastructure reporting segment in the prior year are now included within the irrigation reporting segment.

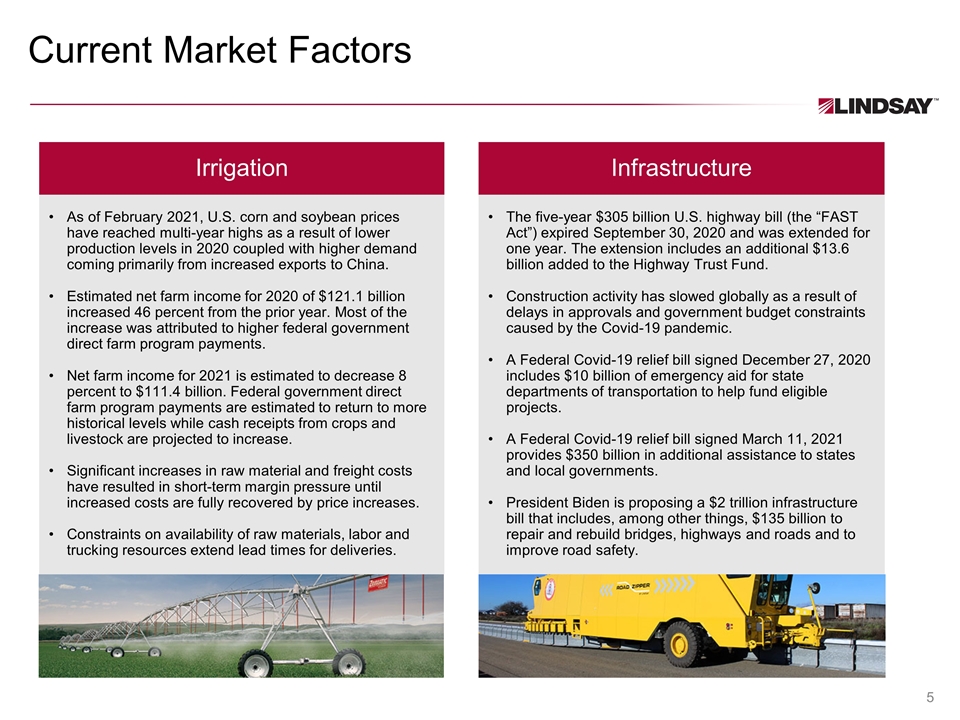

Current Market Factors As of February 2021, U.S. corn and soybean prices have reached multi-year highs as a result of lower production levels in 2020 coupled with higher demand coming primarily from increased exports to China. Estimated net farm income for 2020 of $121.1 billion increased 46 percent from the prior year. Most of the increase was attributed to higher federal government direct farm program payments. Net farm income for 2021 is estimated to decrease 8 percent to $111.4 billion. Federal government direct farm program payments are estimated to return to more historical levels while cash receipts from crops and livestock are projected to increase. Significant increases in raw material and freight costs have resulted in short-term margin pressure until increased costs are fully recovered by price increases. Constraints on availability of raw materials, labor and trucking resources extend lead times for deliveries. Irrigation Infrastructure The five-year $305 billion U.S. highway bill (the “FAST Act”) expired September 30, 2020 and was extended for one year. The extension includes an additional $13.6 billion added to the Highway Trust Fund. Construction activity has slowed globally as a result of delays in approvals and government budget constraints caused by the Covid-19 pandemic. A Federal Covid-19 relief bill signed December 27, 2020 includes $10 billion of emergency aid for state departments of transportation to help fund eligible projects. A Federal Covid-19 relief bill signed March 11, 2021 provides $350 billion in additional assistance to states and local governments. President Biden is proposing a $2 trillion infrastructure bill that includes, among other things, $135 billion to repair and rebuild bridges, highways and roads and to improve road safety.

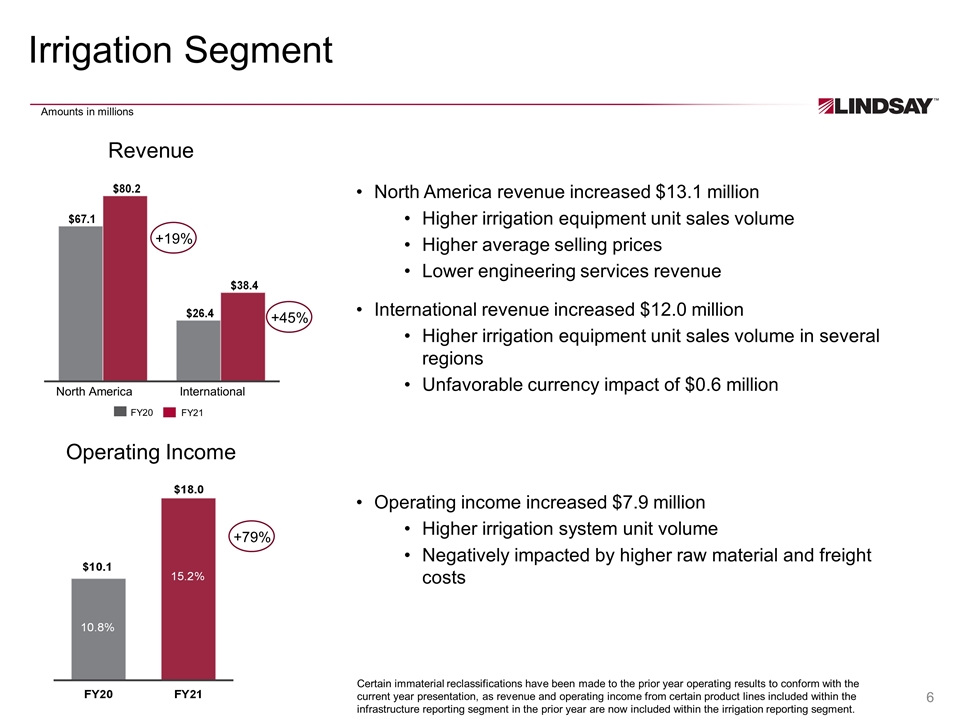

Irrigation Segment 6 North America revenue increased $13.1 million Higher irrigation equipment unit sales volume Higher average selling prices Lower engineering services revenue International revenue increased $12.0 million Higher irrigation equipment unit sales volume in several regions Unfavorable currency impact of $0.6 million Operating income increased $7.9 million Higher irrigation system unit volume Negatively impacted by higher raw material and freight costs Revenue Operating Income North America International FY20 FY21 Amounts in millions Certain immaterial reclassifications have been made to the prior year operating results to conform with the current year presentation, as revenue and operating income from certain product lines included within the infrastructure reporting segment in the prior year are now included within the irrigation reporting segment. +19% +45% +79%

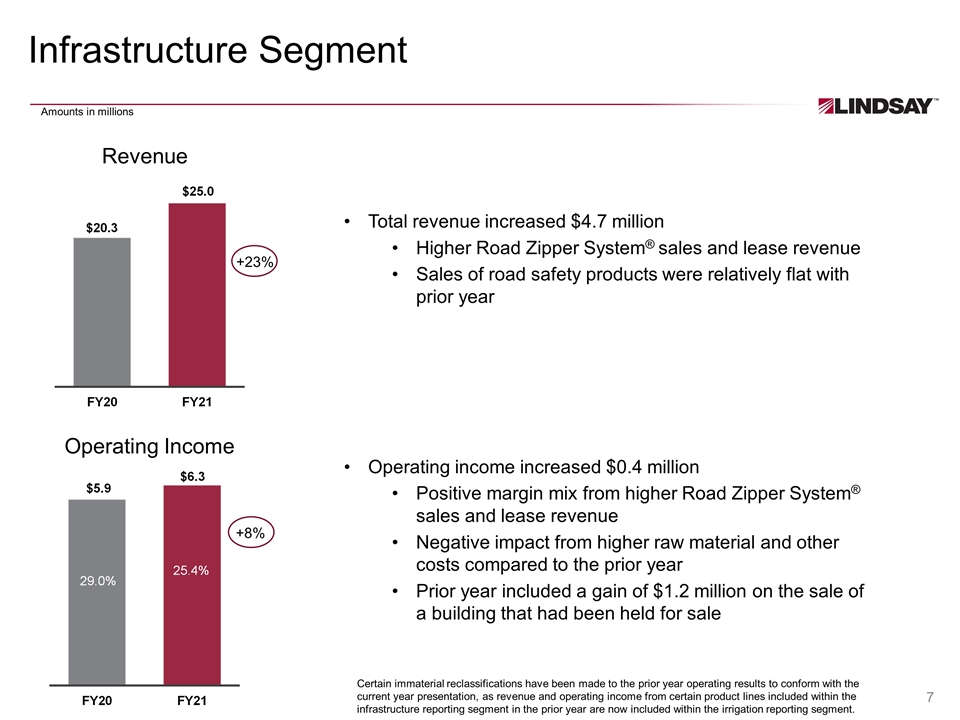

Infrastructure Segment Total revenue increased $4.7 million Higher Road Zipper System® sales and lease revenue Sales of road safety products were relatively flat with prior year Operating income increased $0.4 million Positive margin mix from higher Road Zipper System® sales and lease revenue Negative impact from higher raw material and other costs compared to the prior year Prior year included a gain of $1.2 million on the sale of a building that had been held for sale Revenue Operating Income Amounts in millions Certain immaterial reclassifications have been made to the prior year operating results to conform with the current year presentation, as revenue and operating income from certain product lines included within the infrastructure reporting segment in the prior year are now included within the irrigation reporting segment. +23% +8%

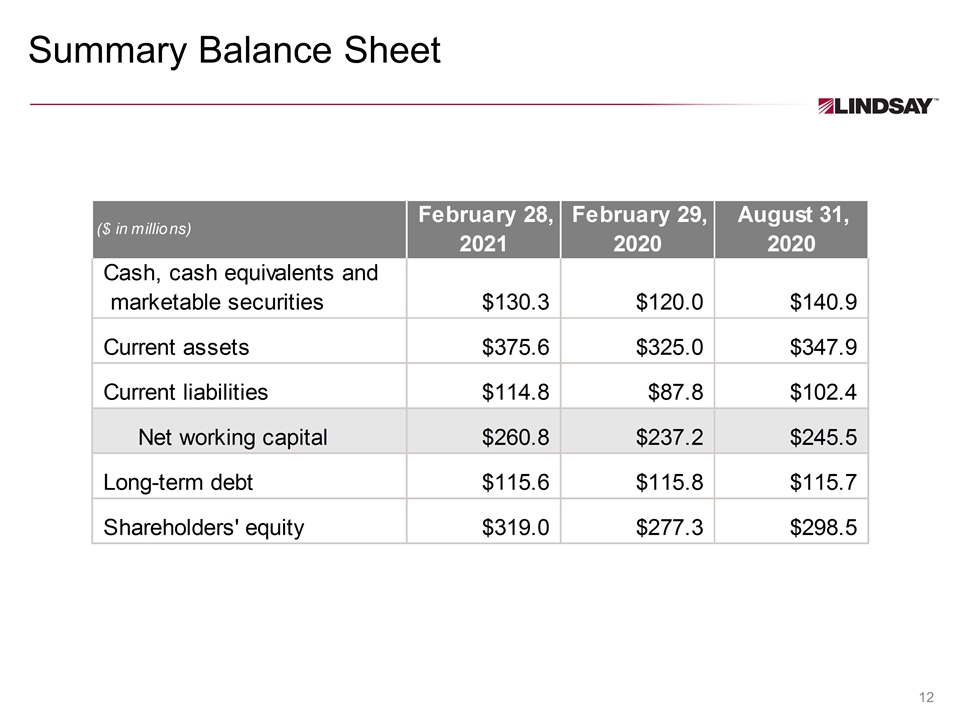

COVID-19 Update Innovative Market Leader – Sustainable Solutions Lindsay’s products and technologies support the following critical infrastructure sectors as defined by the Department of Homeland Security (CISA.gov) and other global government agencies: Food and Agriculture – our irrigation business supports the production of food and the conservation of water and energy Transportation Systems – our infrastructure business supports the movement of people and goods efficiently, safely and securely Lindsay’s production facilities are considered “business essential” and will remain operational as long as we 1) have demand for our products, 2) are allowed to remain open by local governments, and 3) can provide for the safety of our employees. At the present time, all of our facilities are operational. Other potential business impacts associated with COVID-19 include but are not limited to: additional facility closures and the duration of such closures, supply chain disruption and additional costs, logistics delays, border closures, workforce disruption, reduced demand for our products and services, delay in the implementation of projects and other effects that may result from a general economic downturn. Lindsay is well positioned with a strong balance sheet and sufficient liquidity as we face the uncertainty and challenges presented by the COVID-19 pandemic. As of February 28, 2021, we have: Available liquidity of $180.3 million, with $130.3 million in cash, cash equivalents and marketable securities and $50.0 million available under revolving credit facility Total debt of $116.3 million, of which $115.0 million matures in 2030 A funded debt to EBITDA leverage ratio (as defined in our credit agreements) of 1.4 compared to a covenant limit of 3.0

Financial Flexibility Strengthening our balance sheet and managing leverage. Managing operations to minimize customer disruption and ensure continuity of supply. Business Continuity Safety First Prioritizing safety with work-from-home policy, safety practices at all locations and restricting non-essential travel. Playing Offense Positioning Lindsay to emerge a stronger company. Our COVID-19 Response Protecting the health and well-being of our employees is a top priority, as is maintaining frequent communication and providing important updates.

Innovation Leadership: Addressing Global Megatrends Capitalizing on global megatrends Key Trends Food Security Water Scarcity Land Availability Mobility Safety Reducing Emissions Labor Savings

Strong Commitment to Sustainable Practices Our mission is to provide solutions that conserve natural resources, enhance the quality of life for people, and expand our world’s potential. Investing in sustainable technologies Improving our operational footprint Empowering and protecting our people Engaging in our local communities Operating with integrity 1 2 3 4 5

Summary Balance Sheet

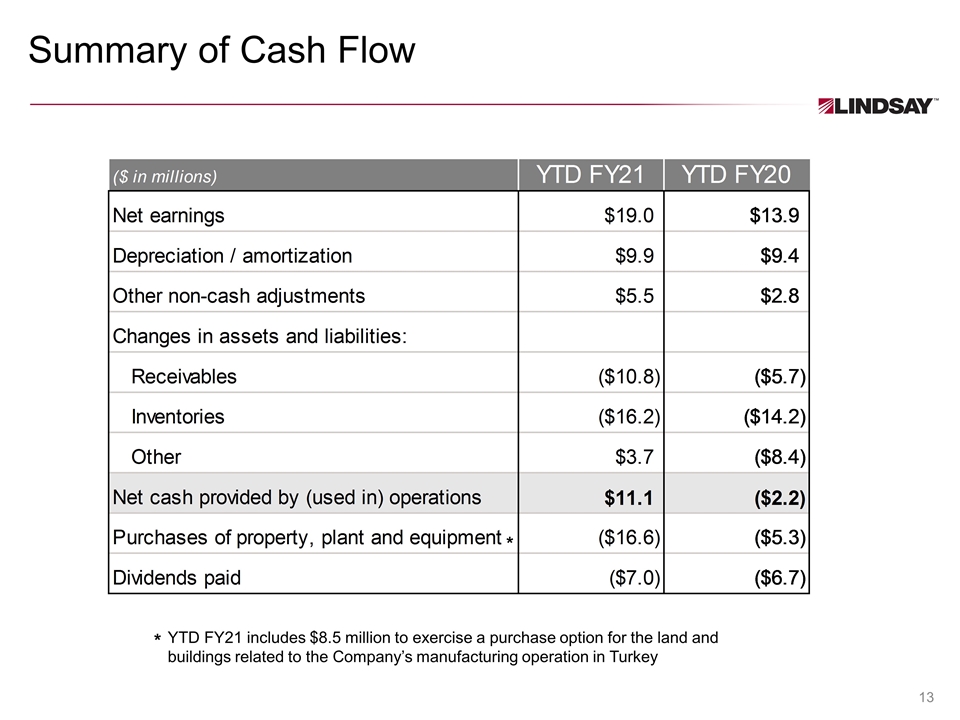

Summary of Cash Flow * YTD FY21 includes $8.5 million to exercise a purchase option for the land and buildings related to the Company’s manufacturing operation in Turkey *

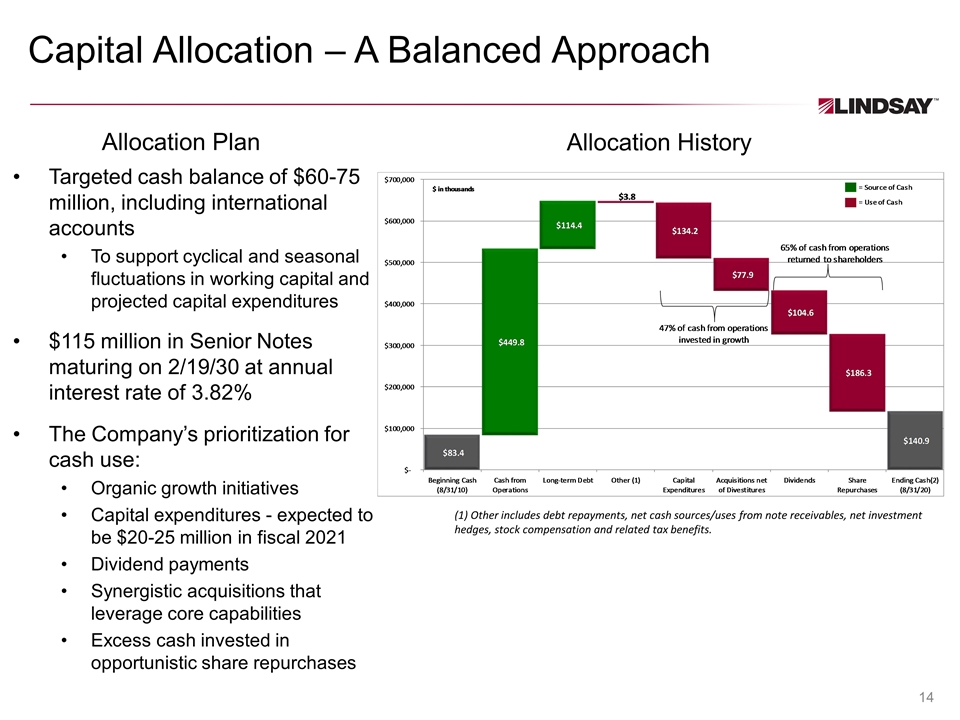

Capital Allocation – A Balanced Approach Allocation History (1) Other includes debt repayments, net cash sources/uses from note receivables, net investment hedges, stock compensation and related tax benefits. Targeted cash balance of $60-75 million, including international accounts To support cyclical and seasonal fluctuations in working capital and projected capital expenditures $115 million in Senior Notes maturing on 2/19/30 at annual interest rate of 3.82% The Company’s prioritization for cash use: Organic growth initiatives Capital expenditures - expected to be $20-25 million in fiscal 2021 Dividend payments Synergistic acquisitions that leverage core capabilities Excess cash invested in opportunistic share repurchases Allocation Plan