Attached files

| file | filename |

|---|---|

| EX-23 - EX-23 - LINDSAY CORP | d42017dex23.htm |

| EX-21 - EX-21 - LINDSAY CORP | d42017dex21.htm |

| EX-24 - EX-24 - LINDSAY CORP | d42017dex24.htm |

| EX-31.1 - EX-31.1 - LINDSAY CORP | d42017dex311.htm |

| EX-31.2 - EX-31.2 - LINDSAY CORP | d42017dex312.htm |

| EX-32 - EX-32 - LINDSAY CORP | d42017dex32.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended August 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-13419

Lindsay Corporation

(Exact name of registrant as specified in its charter)

| Delaware |

47-0554096 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| 2222 North 111th Street, Omaha, Nebraska |

68164 | |

| (Address of principal executive offices) | (Zip Code) |

402-829-6800

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $1.00 par value | New York Stock Exchange, Inc. (Symbol LNN) |

Indicate by check mark if the registrant is a well-known seasoned issuer, (as defined in Rule 405 of the Securities Act). Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of Common Stock of the registrant, all of which is voting, held by non-affiliates based on the closing sales price on the New York Stock Exchange, Inc. on February 28, 2015 was $1,006,419,747.

As of October 13, 2015, 11,289,393 shares of the registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement pertaining to the Registrant’s 2016 annual stockholders’ meeting are incorporated herein by reference into Part III.

TABLE OF CONTENTS

2

PART I

INTRODUCTION

Lindsay Corporation, along with its subsidiaries (collectively called “Lindsay” or the “Company”), is a global leader in providing a variety of proprietary water management and road infrastructure products and services. The Company has been involved in the manufacture and distribution of agricultural irrigation equipment since 1955 and has grown from a regional company to an international water efficiency solutions and highway infrastructure firm with worldwide sales and distribution. Lindsay, a Delaware corporation, maintains its corporate offices in Omaha, Nebraska. The Company has operations which are categorized into two major reporting segments. Industry segment financial information and geographic area financial information about Lindsay is included in Note Q to the consolidated financial statements.

Irrigation Segment – The Company’s irrigation segment includes the manufacture and marketing of center pivot, lateral move, and hose reel irrigation systems which are used principally in the agricultural industry to increase or stabilize crop production while conserving water, energy and labor. The irrigation segment also manufactures and markets repair and replacement parts for its irrigation systems and controls. In addition, the irrigation segment also designs and manufactures water pumping stations and controls for the agriculture, golf, landscape and municipal markets and filtration solutions for groundwater, agriculture, industrial and heat transfer markets. The Company continues to strengthen irrigation product offerings through innovative technology such as GPS positioning and guidance, variable rate irrigation, wireless irrigation management, machine-to-machine (M2M) communication technology solutions and smartphone applications. The Company’s primary domestic irrigation manufacturing facilities are located in Lindsay, Nebraska; Hartland, Wisconsin; Olathe, Kansas and Fresno, California. Internationally, the Company has production operations in Brazil, France, China, Turkey and South Africa as well as distribution and sales operations in the Netherlands, Australia and New Zealand. The Company also exports equipment from the U.S. to other international markets.

Infrastructure Segment – The Company’s infrastructure segment includes the manufacture and marketing of moveable barriers, specialty barriers, crash cushions and end terminals, road marking and road safety equipment, large diameter steel tubing, and railroad signals and structures. The infrastructure segment also provides outsourced manufacturing and production services. The principal infrastructure manufacturing facilities are located in Rio Vista, California; Milan, Italy and Omaha, Nebraska.

PRODUCTS BY SEGMENT

IRRIGATION SEGMENT

Products - The Company manufactures and markets its center pivot, lateral move irrigation systems, and irrigation controls in the U.S. and internationally under its Zimmatic® brand. The Company also manufactures and markets hose reel travelers under the Perrot™ and Greenfield® brands in Europe and South Africa. The Company also produces or markets chemical injection systems, variable rate irrigation systems, flow meters, weather stations, soil moisture sensors and remote monitoring and control systems which it sells under its GrowSmart® brand. In addition to whole systems, the Company manufactures and markets repair and replacement parts for its irrigation systems and controls. The Company also designs and manufactures water pumping stations and controls for the agriculture, golf, landscape and municipal markets under its Watertronics® brand and filtration solutions for groundwater, agriculture, industrial and heat transfer markets, worldwide, under its LAKOS® brand. Furthermore, the Company designs and manufactures innovative M2M communication technology solutions, data acquisition and management systems and custom electronic equipment for critical applications under its Elecsys™ brand.

The Company’s irrigation systems are primarily of the standard sized center pivot type, with a small portion of its products consisting of the lateral move type. Both are automatic move systems consisting of sprinklers

3

mounted on a water carrying pipeline which is supported approximately 11 feet off the ground by a truss system suspended between moving towers.

A typical center pivot in the U.S. is approximately 1,300 feet long and is designed to circle within a quarter-section of land, which comprises 160 acres, wherein it irrigates approximately 125 to 130 acres. A center pivot or lateral move system can also be custom designed and can irrigate from 25 to 600+ acres.

A center pivot system represents a significant investment to a farmer. In a dry land conversion to center pivot irrigation, approximately one-half of the investment is for the pivot itself, and the remainder is attributable to installation of additional equipment such as wells, pumps, underground water pipes, electrical supply and a concrete pad upon which the pivot is anchored. The Company’s center pivot and lateral move irrigation systems can be enhanced with a family of integrated proprietary products such as water pumping stations, GPS monitoring and other automated controls.

The Company also manufactures and distributes hose reel travelers. Hose reel travelers are typically deployed in smaller or irregular fields and usually are easy to operate, easy to move from field to field, and a lower investment than a typical standard center pivot.

The Company also markets proprietary remote monitoring and automation technology for pivot and drip irrigation systems that is sold on a subscription basis under the FieldNET® product name. FieldNET® technology allows growers to remotely monitor and operate irrigation equipment, saving time and reducing water and energy consumption. The technology uses cellular or radio frequency communication systems to remotely acquire data relating to various conditions in an irrigated field, including operational status of the irrigation system, position of the irrigation system, water flow rates, weather and soil conditions and similar data. The system can remotely control the irrigation system, including changing position, varying water flow rates, and controlling pump station and diesel generator operation. Data management and control is achieved using applications running on either a personal computer-based internet browser or various mobile devices connected to the internet.

Other Types of Irrigation – Center pivot and lateral move irrigation systems compete with three other types of irrigation: flood, drip, and other mechanical devices such as hose reel travelers and solid set sprinklers. The bulk of the worldwide irrigation is accomplished by the traditional method of flood irrigation. Flood irrigation is accomplished by either flooding an entire field, or by providing a water source (ditches or a pipe) along the side of a field, which is planed and slopes slightly away from the water source. The water is released to the crop rows through gates in the ditch or pipe, or through siphon tubes arching over the ditch wall into some of the crop rows. It runs down through the crop row until it reaches the far end of the row, at which time the water source is moved and another set of rows are flooded. Disadvantages or limitations of flood irrigation include that it cannot be used to irrigate uneven, hilly, or rolling terrain, it can be wasteful or inefficient and coverage can become inconsistently applied. In “drip” or “low flow” irrigation, perforated plastic pipe or tape is installed on the ground or buried underground at the root level. Several other types of mechanical devices, such as hose reel travelers, irrigate the remaining irrigated acres.

Center pivot, lateral move, and hose reel traveler irrigation offers significant advantages when compared with other types of irrigation. It requires less labor and monitoring; can be used on sandy ground, which, due to poor water retention ability, must have water applied frequently; can be used on uneven ground, thereby allowing previously unsuitable land to be brought into production; can also be used for the application of fertilizers, insecticides, herbicides, or other chemicals (termed “fertigation” or “chemigation”); and conserves water and chemicals through precise control of the amount and timing of the application.

Markets - Water is an essential and critical requirement for crop production, and the extent, regularity, and frequency of water application can be a critical factor in crop quality and yield. The fundamental factors which govern the demand for center pivot and lateral move systems are essentially the same in both the U.S. and international markets. Demand for center pivot and lateral move systems is determined by whether the value of the increased crop production and cost savings attributable to center pivot or lateral move irrigation exceeds any

4

increased costs associated with purchasing, installing, and operating the equipment. Thus, the decision to purchase a center pivot or lateral move system, in part, reflects the profitability of agricultural production, which is determined primarily by the prices of agricultural commodities and other farming inputs.

The current demand for center pivot systems has three sources: conversion to center pivot systems from less water efficient, more labor intensive types of irrigation; replacement of older center pivot systems, which are beyond their useful lives or are technologically obsolete; and conversion of dry land farming to irrigated farming. Demand for center pivots and lateral move irrigation equipment also depends upon the need for the particular operational characteristics and advantages of such systems in relation to alternative types of irrigation, primarily flood. More efficient use of the basic natural resources of land, water, and energy helps drive demand for center pivot and lateral move irrigation equipment. Increasing global population not only increases demand for agricultural output, but also places additional and competing demands on land, water, and energy. The Company expects demand for center pivots and lateral move systems to continue to increase relative to other irrigation methods because center pivot and lateral move systems are preferred where the soil is sandy, the terrain is not flat, the land area to be irrigated is sizeable; there is a shortage of reliable labor; water supply is restricted and conservation is preferred or critical; and/or fertigation or chemigation will be utilized.

United States Market – In the United States, the Company sells its branded irrigation systems, including Zimmatic®, to over 200 independent dealer locations, who resell to their customer, the farmer. Dealers assess their customer’s requirements, design the most efficient solution, assemble and erect the system in the field, and provide additional system components, primarily relating to water supply (wells, pumps, pipes) and electrical supply (on-site generation or hook-up to power lines). Lindsay dealers generally are established local agribusinesses, many of which also deal in related products, such as well drilling and water pump equipment, farm implements, grain handling and storage systems, and farm structures.

International Market – The Company sells center pivot and lateral move irrigation systems throughout the world. International sales accounted for approximately 39 percent of the Company’s total irrigation segment revenues in both fiscal 2015 and 2014. The Company sells direct to consumers as well as through an international dealer network and has production and sales operations in Brazil, France, China, Turkey and South Africa as well as distribution and sales operations in the Netherlands, Australia and New Zealand serving the key South American, European, Chinese, African, Russian/Ukrainian, Middle East, Australian, and New Zealand markets. The Company also exports irrigation equipment from the U.S. to international markets.

The Company’s international markets differ with respect to the need for irrigation, the ability to pay, demand, customer type, government support of agriculture, marketing and sales methods, equipment requirements, and the difficulty of on-site erection. The Company’s industry position is such that it believes that it will likely be considered as a potential supplier for most major international agricultural development projects utilizing center pivot or lateral move irrigation systems.

Competition – Four primary manufacturers control a substantial majority of the U.S. center pivot irrigation system industry. The international irrigation market includes participation and competition by the leading U.S. manufacturers as well as various regional manufacturers. The Company competes in certain product lines with several manufacturers, some of whom may have greater financial resources than the Company. The Company competes by continuously improving its products through ongoing research and development activities. The Company continues to strengthen irrigation product offerings through innovative technology such as GPS positioning and guidance, variable rate irrigation, wireless irrigation management, and smartphone applications as well as through the acquisition of products and services that allow the Company to provide a more comprehensive solution to growers’ needs. The Company’s engineering and research expenses related to irrigation totaled approximately $9.6 million, $7.8 million, and $8.1 million for fiscal years 2015, 2014, and 2013, respectively. Competition also occurs in areas of price and seasonal programs, product quality, durability, controls, product characteristics, retention and reputation of local dealers, customer service, and, at certain times of the year, the availability of systems and their delivery time. On balance, the Company believes it competes favorably with respect to these factors.

5

INFRASTRUCTURE SEGMENT

Products – Quickchange® Moveable Barrier™ The Company’s Quickchange® Moveable Barrier™ system, commonly known as the Road Zipper System™, is composed of three parts: 1) T-shaped concrete barriers that are connected to form a continuous wall, 2) a Barrier Transfer Machine™ (“BTM™”) capable of moving the barrier laterally across the pavement, and 3) the variable length barriers necessary for accommodating curves. A barrier element is approximately 32 inches high, 12-24 inches wide, 3 feet long and weighs 1,500 pounds. The barrier elements are interconnected by very heavy duty steel hinges to form a continuous barrier. The BTM™ employs an inverted S-shaped conveyor mechanism that lifts the barrier, moving it laterally before setting it back on the roadway surface.

In permanent applications, the Road Zipper System™ increases capacity and reduces congestion by varying the number of traffic lanes to match the traffic demand, and promotes safety by maintaining the physical separation of opposing lanes of traffic. Roadways with fixed medians have a set number of lanes in each direction and cannot adjust to traffic demands that may change over the course of a day, or to capacity reductions caused by traffic incidents or road repair and maintenance. Applications include high volume highways where expansion may not be feasible due to lack of additional right-of-way, environmental concerns, or insufficient funding. The Road Zipper System™ is particularly useful in busy commuter corridors and at choke points such as bridges and tunnels. Road Zipper Systems™ can also be deployed at roadway or roadside construction sites to accelerate construction, improve traffic flow and safeguard work crews and motorists by positively separating the work area and traffic. Examples of types of work completed with the help of a Road Zipper System™ include highway reconstruction, paving and resurfacing, road widening, median and shoulder construction, and repairs to tunnels and bridges.

The Company offers a variety of equipment lease options for Road Zipper Systems™ and BTM™ equipment used in construction applications. The leases extend for periods of one month or more for equipment already existing in the Company’s lease fleet. Longer lease periods may be required for specialty equipment that must be built for specific projects. These systems have been in use since 1987. Typical sales for a highway safety or road improvement project range from $2.0 - $20.0 million, making them significant capital investments.

Crash Cushions and End Terminals – The Company offers a complete line of redirective and non-redirective crash cushions which are used to enhance highway safety at locations such as toll booths, freeway off-ramps, medians and roadside barrier ends, bridge supports, utility poles and other fixed roadway hazards. The Company’s primary crash cushion products cover a full range of lengths, widths, speed capacities and application accessories and include the following brand names: TAU®, Universal TAU-II®, TAU-II-R™, TAU-B_NR™, ABSORB 350® and Walt™. In addition to these products the Company also offers guardrail end terminal products such as the X-Tension® and X-Lite® systems. The crash cushions and end terminal products compete with other vendors in the world market. These systems are generally sold through a distribution channel that is domiciled in particular geographic areas.

Specialty Barriers – The Company also offers specialty barrier products such as the SAB™, ArmorGuard™, PaveGuard™ and DR46™ portable barrier and/or barrier gate systems. These products offer portability and flexibility in setting up and modifying barriers in work areas and provide quick opening, high containment gates for use in median or roadside barriers. The gates are generally used to create openings in barrier walls of various types for both construction and incident management purposes. The DR46™ is an energy absorbing barrier to shield motorcyclists from impacting guardrail posts which is an area of focus by departments of transportation and government regulators for reducing the amount and severity of injuries.

Road Marking and Road Safety Equipment – The Company also offers preformed tape and a line of road safety accessory products. The preformed tape is used primarily in temporary applications such as markings for work zones, street crossings, and road center lines or boundaries. The road safety equipment consists of mostly plastic and rubber products used for delineation, slowing traffic, and signaling. The Company also manages an ISO 17025 certified testing laboratory that performs full-scale impact testing of highway safety products in

6

accordance with the National Cooperative Highway Research Program (“NCHRP”) Report 350, the Manual for Assessing Safety Hardware (“MASH”), and the European Norms (“EN1317 Norms”) for these types of products. The NCHRP Report 350 and MASH guidelines are procedures required by the U.S. Department of Transportation Federal Highway Administration (“FHWA”) for the safety performance evaluation of highway features. The EN1317 Norms are being used to qualify roadway safety products for the European markets.

Other Products – The Company’s Diversified Manufacturing, Rail and Tubing business unit manufactures and markets railroad signals and structures and large diameter steel tubing, and provides outsourced manufacturing and production services for other companies. The Company continues to develop new relationships for infrastructure manufacturing in industries outside of agriculture and irrigation. The Company’s customer base includes certain large industrial companies and railroads. Each customer benefits from the Company’s design and engineering capabilities as well as the Company’s ability to provide a wide spectrum of manufacturing services, including welding, machining, painting, forming, galvanizing and assembling hydraulic, electrical, and mechanical components.

Markets – The Company’s primary infrastructure market includes moveable concrete barriers, delineation systems, crash cushions and similar protective equipment. The U.S. roadway infrastructure market includes projects such as new roadway construction, bridges, tunnels, maintenance and resurfacing, the purchase of rights-of-way for roadway expansion and development of technologies for relief of roadway congestion. Much of the U.S. highway infrastructure market is driven by government (state and federal) spending programs. For example, the U.S. government funds highway and road improvements through the Federal Highway Trust Fund Program. This program provides funding to improve the nation’s roadway system. Matching funding from the various states may be required as a condition of federal funding. In the long term, the Company believes that the federal program provides a solid platform for growth in the U.S. market, as it is generally acknowledged that additional funding will be required for infrastructure development and maintenance in the future.

The global market for the Company’s infrastructure products continues to be driven by population growth and the need for improved road safety. International sales accounted for approximately 30 percent and 41 percent of the Company’s total infrastructure segment revenues in fiscal 2015 and 2014, respectively. The international market is presently very different from country to country. The standardization in performance requirements and acceptance criteria for highway safety devices adopted by the European Committee for Standardization is expected to lead to greater uniformity and a larger installation program. Prevention programs put in place in various countries to lower highway traffic fatalities may also lead to greater demand. The Company has recently started distributing infrastructure products in South America, the Middle East and Asia. The Company expects to continue expanding in international markets as populations grow and markets become more established.

Competition – The Company competes in certain product lines with several manufacturers, some of whom may have greater financial resources than the Company. The Company competes by continuously improving its products through ongoing research and development activities. The Company’s engineering and research expenses related to infrastructure products totaled approximately $3.3 million for each of the fiscal years ended 2015, 2014 and 2013. The Company competes with certain products and companies in its crash cushion business, but has limited competition in its moveable barrier line, as there is not another moveable barrier product today comparable to the Road Zipper System™. However, the Company’s barrier product does compete with traditional “safety shaped” concrete barriers and other safety barriers.

Distribution methods and channels – The Company has dedicated production and sales operations in the United States and Italy. Sales efforts consist of both direct sales and sales programs managed by its network of distributors and third-party representatives. The sales teams have responsibility for new business development and assisting distributors and dealers in soliciting large projects and new customers. The distributor and dealer networks have exclusive territories and are responsible for developing sales and providing service, including product maintenance, repair and installation. The typical dealer sells an array of safety supplies, road signs, crash cushions, delineation equipment and other highway products. Customers include Departments of Transportation, municipal transportation road agencies, roadway contractors, subcontractors, distributors and dealers. Due to the

7

project nature of the roadway construction and congestion management markets, the Company’s customer base changes from year-to-year. Due to the limited life of projects, it is rare that a single customer will account for a significant amount of revenues in consecutive years. The customer base also varies depending on the type of product sold. The Company’s moveable barrier products are typically sold to transportation agencies or the contractors or suppliers serving those agencies. In contrast, distributors account for a majority of crash cushion sales since those products have lower price points and tend to have shorter lead times.

GENERAL

Certain information generally applicable to both of the Company’s reportable segments is set forth below.

The following table describes the Company’s total revenues for the past three fiscal years. United States export revenue is included in International based on the region of destination.

| For the years ended August 31, | ||||||||||||||||||||||||

| $ in millions |

2015 | 2014 | 2013 | |||||||||||||||||||||

| Revenues | % of Total Revenues |

Revenues | % of Total Revenues |

Revenues | % of Total Revenues |

|||||||||||||||||||

| United States |

$ | 350.3 | 63 | $ | 377.7 | 61 | $ | 428.9 | 62 | |||||||||||||||

| International |

$ | 209.9 | 37 | $ | 240.2 | 39 | $ | 261.9 | 38 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Revenues |

$ | 560.2 | 100 | $ | 617.9 | 100 | $ | 690.8 | 100 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

SEASONALITY

Irrigation equipment sales are seasonal by nature. Farmers generally order systems to be delivered and installed before the growing season. Shipments to customers located in Northern Hemisphere countries usually peak during the Company’s second and third fiscal quarters for the spring planting period. Sales of infrastructure products are traditionally higher during prime road construction seasons and lower in the winter. The primary construction season for Northern Hemisphere countries is from March until late September which corresponds to the Company’s third and fourth fiscal quarters.

CUSTOMERS

The Company is not dependent for a material part of either segment’s business upon a single customer or upon a limited number of customers. The loss of any one customer would not have a material adverse effect on the Company’s financial condition, results of operations or cash flow.

ORDER BACKLOG

As of August 31, 2015, the Company had an order backlog of $48.0 million compared with $79.6 million at August 31, 2014. The order backlog at August 31, 2014 included a $12.7 million Road Zipper System™ order from the Golden Gate Bridge Highway & Transportation District that was recognized as revenue in fiscal 2015. The current period includes $9.5 million of backlog from Elecsys Corporation. The Company’s backlog can fluctuate from period to period due to the seasonality, cyclicality, timing and execution of contracts. Backlog typically represents long-term projects as well as short lead-time orders, therefore it is generally not a good indication of the next quarter’s revenues.

RAW MATERIALS AND COMPONENTS

Raw materials used by the Company include coil steel, angle steel, plate steel, zinc, tires, gearboxes, concrete, rebar, fasteners, and electrical and hydraulic components (motors, switches, cable, valves, hose and stators). The Company has, on occasion, faced shortages of certain such materials. The Company believes it currently has ready access from assorted domestic and foreign suppliers to adequate supplies of raw materials and components.

CAPITAL EXPENDITURES

Capital expenditures for fiscal 2015, 2014, and 2013 were $15.2 million, $17.7 million and $11.1 million, respectively. Capital expenditures for fiscal 2016 are estimated to be approximately $15.0 million to $20.0

8

million, largely focused on manufacturing capacity expansion and productivity improvements. The Company’s management does maintain flexibility to modify the amount and timing of some of the planned expenditures in response to economic conditions.

PATENTS, TRADEMARKS, AND LICENSES

Lindsay’s Zimmatic®, Greenfield®, GrowSmart®, Perrot™, Road Zipper System™, Quickchange® Moveable Barrier™, ABSORB 350®, FieldNET®, TAU®, Universal TAU-II®, TAU-II-R™, TAU-B_NR™, X-Tension®, X-Lite® CableGuard™, TESI™, SAB™, ArmourGuard™, PaveGuard™, DR46™, U-MAD™, Watertronics®, LAKOS® and other trademarks are registered or applied for in the major markets in which the Company sells its products. In addition, the Company owns multiple patents dealing with cellular communication techniques, cathodic protection measurement methods and data compression and transmission. Lindsay follows a policy of applying for patents on all significant patentable inventions in markets deemed appropriate. Although the Company believes it is important to follow a patent protection policy, Lindsay’s business is not dependent, to any material extent, on any single patent or group of patents.

EMPLOYEES

The number of persons employed by the Company and its wholly-owned subsidiaries at fiscal year ends 2015, 2014, and 2013 were 1,324, 1,202 and 1,262, respectively. None of the Company’s U.S. employees are represented by a union. Certain of the Company’s non-U.S. employees are unionized due to local governmental regulations.

ENVIRONMENTAL AND HEALTH AND SAFETY MATTERS

Like other manufacturing concerns, the Company is subject to numerous laws and regulations that govern environmental and occupational health and safety matters. The Company believes that its operations are substantially in compliance with all such applicable laws and regulations and that it holds all necessary permits in each jurisdiction in which its facilities are located. Environmental and health and safety regulations are subject to change and interpretation. In some cases, compliance with applicable regulations or standards may require the Company to make additional capital and operational expenditures. The Company, however, is not currently aware of any material expenditures required to comply with such regulations, other than information related to the environmental remediation activities described in Note N, Commitments and Contingencies, to the Company’s consolidated financial statements. The Company accrues for the anticipated cost of investigation and remediation when the obligation is probable and can be reasonably estimated. Any revisions to these estimates could be material to the operating results of any fiscal quarter or fiscal year, however the Company does not expect such additional expenses would have a material adverse effect on its liquidity or financial condition.

FINANCIAL INFORMATION ABOUT FOREIGN AND U.S. OPERATIONS

The Company’s primary production facilities are located in the United States. The Company has smaller production and sales operations in Brazil, France, Italy, China, Turkey and South Africa as well as distribution and sales operations in the Netherlands, Australia and New Zealand. Where the Company exports products from the United States to international markets, the Company generally ships against prepayment, an irrevocable letter of credit confirmed by a U.S. bank or another secured means of payment or with credit insurance from a third party. For sales within both U.S. and foreign jurisdictions, prepayments or other forms of security may be required before credit is granted, however most local sales are made based on payment terms after a full credit review has been performed. Most of the Company’s financial transactions are in U.S. dollars, although some export sales and sales from the Company’s foreign subsidiaries are conducted in other currencies. Approximately 20 percent and 23 percent of total consolidated Company sales were conducted in currencies other than the U.S. dollar in fiscal 2015 and 2014. To reduce the uncertainty of foreign currency exchange rate movements on these sales and purchase commitments conducted in local currencies, the Company monitors its risk of foreign currency fluctuations and, at times, may enter into forward exchange or option contracts for transactions denominated in a currency other than U.S. dollars.

In addition to the transactional foreign currency exposures mentioned above, the Company also has translation exposure resulting from translating the financial statements of its international subsidiaries into U.S. dollars. In

9

order to reduce this translation exposure, the Company, at times, utilizes foreign currency forward contracts to hedge its net investment exposure in its foreign operations. For information on the Company’s foreign currency risks, see Item 7A of Part II of this report.

INFORMATION AVAILABLE ON THE LINDSAY WEBSITE

The Company makes available free of charge on its website homepage, under the tab “Investor Relations – SEC Filings”, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC. The Company’s internet address is http://www.lindsay.com; however, information posted on its website is not part of this Annual Report on Form 10-K. The following documents are also posted on the Company’s website homepage, under the tabs “Investor Relations – Governance – Committees” and “Investor Relations – Governance – Ethics”:

Audit Committee Charter

Compensation Committee Charter

Corporate Governance and Nominating Committee Charter

Code of Business Conduct and Ethics

Corporate Governance Principles

Code of Ethical Conduct

Employee Complaint Procedures for Accounting and Auditing Matters

Special Toll-Free Hotline Number and E-mail Address for Making Confidential or Anonymous Complaints

These documents are also available in print to any stockholder upon request, by sending a letter addressed to the Secretary of the Company.

The following are certain of the more significant risks that may affect the Company’s business, financial condition and results of operations.

The Company’s irrigation revenues are highly dependent on the agricultural industry and weather conditions. The Company’s irrigation revenues are cyclical and highly dependent upon the need for irrigated agricultural crop production which, in turn, depends upon many factors, including total worldwide crop production, the profitability of agricultural crop production, agricultural commodity prices, net farm income, availability of financing for farmers, governmental policies regarding the agricultural sector, water and energy conservation policies, the regularity of rainfall and regional climate change. As farm income decreases, farmers may postpone capital expenditures or seek less expensive irrigation alternatives.

Weather conditions, particularly leading up to the planting and early growing season, can significantly affect the purchasing decisions of consumers of irrigation equipment. Natural calamities such as regional floods, hurricanes or other storms, and droughts can have significant effects on seasonal irrigation demand. Drought conditions, which generally impact irrigation equipment demand positively over the long term, can adversely affect demand if water sources become unavailable or if governments impose water restriction policies to reduce overall water availability.

Volatility in global markets with respect to currency exchange rates, commodity prices including market prices for grain and oil, and potential changes in interest rates can adversely affect the Company’s worldwide sales, operating margins and the competitiveness of the Company’s products.

The Company conducts operations in a variety of locations around the world, which means that market fluctuations in currencies, commodities and interest rates can affect demand for the Company’s products and the

10

cost of production. These factors all impact end customers’ purchase decisions and are therefore interconnected, making it difficult to predict how any single factor might impact customers’ decisions to purchase the Company’s products.

Foreign Currency Exchange Rates. For the fiscal year ended August 31, 2015, approximately 37 percent of the Company’s consolidated revenues were generated from international sales and United States export revenue to international regions. Most of the Company’s international sales involve some level of export from the U.S., either of components or completed products. The strengthening of the U.S. dollar and/or the weakening of local currencies can increase the cost of the Company’s products in those foreign markets. The impact of these changes can make these products less competitive relative to local producing competitors and, in extreme cases, can result in the Company’s products not being cost-effective for customers. As a result, the Company’s international sales and profit margins could decline.

Grain Pricing. Changes in grain prices can impact the return on investment of the Company’s products. Grain prices are influenced by both global and local markets. The primary benefit of many of the Company’s irrigation products is to increase grain yields and the resulting revenue for farmers. As grain prices decline, the breakeven point of incremental production is more difficult to achieve, reducing or eliminating the profit and return on investment from the purchase of the Company’s products. As a result, changes in grain prices can significantly impact the Company’s sales levels in the U.S. and international markets.

Manufacturing Input Costs. Certain of the Company’s input costs, such as the cost of steel, zinc, and other raw materials, may increase rapidly from time to time. Due to price competition in the market for irrigation equipment and certain infrastructure products, the Company may not be able to recoup increases in these costs through price increases for its products, which would result in reduced profitability. Whether increased operating costs can be passed through to the customer depends on a number of factors, including farm income and the price of competing products. The cost of raw materials can be volatile and is dependent on a number of factors, including availability, demand, and freight costs.

Oil Pricing. The decline in oil prices could impact the Company’s irrigation markets, either by negatively affecting the biofuels market or by reducing government revenues of oil producing countries that purchase or subsidize the purchase of irrigation equipment. Biofuels production is a significant source of grain demand in the U.S. and certain international markets. While ethanol production levels are currently mandated within the U.S., potential mandate changes or price declines for ethanol producing companies could reduce the demand for grains. In addition, a number of ethanol producers in the U.S. are cooperatives partially owned by farmers. Reduced profit of ethanol production could reduce income for farmers which could, in turn, reduce the demand for irrigation equipment.

Interest Rates. Interest rates globally have been at historically low levels. In some international markets we have begun to see these rates rise and it is expected that global rates will continue to increase, potentially very quickly in the U.S., as the economy improves. An increase in interest rates will make it more difficult for end customers to cost-effectively fund the purchase of new equipment, which could reduce the Company’s sales.

The Company’s infrastructure revenues are highly dependent on government funding of transportation projects and subject to compliance with government regulations. The demand for the Company’s infrastructure products depends to a large degree on the amount of government spending authorized to improve road and highway systems. For example, the U.S. government funds highway and road improvements through the Federal Highway Trust Fund Program and matching funding from states may be required as a condition of federal funding. Currently funding is provided primarily through a series of temporary highway funding bills that have been passed over the previous several years. Until and unless a long-term U.S. highway bill is passed, uncertainties and limitations on growth could impact the infrastructure business. If highway funding is reduced or delayed, it may reduce demand for the Company’s infrastructure products.

In addition, the Company’s road safety products are required to meet certain standards as outlined by the various governments worldwide. The Federal Highway Administration (“FHWA”) has recently indicated the intention to

11

mandate the Manual for Assessing Safety Hardware (“MASH”) standards subject to approval by states for use in each respective jurisdiction. In addition, state Departments of Transportation (“DOT”) have the ability to require compliance with MASH standards prior to the FHWA mandating such practices. MASH was previously optional and most road safety products in the market have not been approved under this standard. The Company will likely incur R&D and testing expense to comply with these standards. In addition, the adoption of the new standards could impact the Company’s competitive position in the market which could have a significant impact on the sales and profitability from its road safety product line. The timeline for adoption of the MASH standard has not been determined.

The Company’s profitability may be negatively affected by the disruption or termination of the supply of parts, materials, and components from third-party suppliers. The Company uses a limited number of suppliers for certain parts, materials, and components in the manufacturing process. Disruptions or delays in supply or significant price increases from these suppliers could adversely affect the Company’s operations and profitability. Such disruptions, terminations or cost increases could result in cost inefficiencies, delayed sales or reduced sales.

The Company’s international equipment sales are highly dependent on foreign market conditions and are subject to additional risk and restrictions. For the fiscal year ended August 31, 2015, approximately 37 percent of the Company’s consolidated revenues were generated from international sales and United States export revenue to international regions. International revenues are primarily generated from Australia, New Zealand, Canada, Central and Western Europe, Mexico, the Middle East, Africa, China, Russia/Ukraine, and Central and South America. In addition to risks relating to general economic and political stability in these countries, the Company’s international sales are affected by international trade barriers, including governmental policies on tariffs, taxes, import or export licensing requirements, trade sanctions, and foreign currency exchange rates. In addition, the collectability of receivables can be difficult to estimate, particularly in areas of political instability or with governments with which the Company has limited experience or where there is a lack of transparency as to the current credit condition. The Company does business in a number of countries that are particularly susceptible to disruption from changing social economic conditions as well as terrorism, political hostilities, sanctions, war and similar incidents.

Compliance with applicable environmental and health and safety regulations or standards may require additional capital and operational expenditures. Like other manufacturing concerns, the Company is subject to numerous laws and regulations which govern environmental and occupational health and safety matters. The Company believes that its operations are substantially in compliance with all such applicable laws and regulations and that it holds all necessary permits in each jurisdiction in which its facilities are located. Environmental and health and safety regulations are subject to change and interpretation. Compliance with applicable regulations or standards may require the Company to make additional capital and operational expenditures.

The Company’s Lindsay, Nebraska site was added to the list of priority superfund sites of the U.S. Environmental Protection Agency (the “EPA”) in 1989. The Company and its environmental consultants have developed a remedial alternative work plan, under which the Company continues to work with the EPA to define and implement steps to better contain and remediate the remaining contamination. Although the Company has accrued all reasonably estimable costs associated with remediation of the site, it is expected that additional testing and environmental monitoring and remediation could be required in the future as part of the Company’s ongoing discussions with the EPA regarding the development and implementation of the remedial action plans. In addition, the current investigation has not yet been completed and does not include all potentially affected areas on the site. Due to the current stage of discussions with the EPA and the uncertainty of the remediation actions that may be required with respect to these affected areas, the Company believes that meaningful estimates of costs or range of costs cannot currently be made and accordingly have not been accrued. The Company’s ongoing remediation activities at its Lindsay, Nebraska facility are described in Note N, Commitments and Contingencies, to the Company’s consolidated financial statements.

12

The Company’s consolidated financial results are reported in U.S. dollars while certain assets and other reported items are denominated in the currencies of other countries, creating currency translation risk. The reporting currency for the Company’s consolidated financial statements is the U.S. dollar. Certain of the Company’s assets, liabilities, expenses and revenues are denominated in other countries’ currencies. Those assets, liabilities, expenses and revenues are translated into U.S. dollars at the applicable exchange rates to prepare the Company’s consolidated financial statements. Therefore, increases or decreases in exchange rates between the U.S. dollar and those other currencies affect the value of those items as reflected in the Company’s consolidated financial statements. Substantial fluctuations in the value of the U.S. dollar compared to those other currencies could have a significant impact on the Company’s results.

Expansion of the Company’s business may result in unanticipated adverse consequences. The Company routinely considers possible expansions of the business, both domestically and in foreign locations. Acquisitions, partnerships, joint ventures or other similar major investments require significant managerial resources, which may be diverted from the Company’s other business activities. The risks of any expansion of the business through investments, acquisitions, partnerships or joint ventures are increased due to the significant capital and other resources that the Company may have to commit to any such expansion, which may not be recoverable if the expansion initiative to which they were devoted is not fully implemented or is ultimately unsuccessful. As a result of these risks and other factors, including general economic risk, the Company may not be able to realize projected returns from any recent or future acquisitions, partnerships, joint ventures or other investments.

Security breaches and other disruptions to the Company’s information technology infrastructure could interfere with its operations and could compromise the Company’s and its customers’ and suppliers’ information, exposing the Company to liability that could cause its business and reputation to suffer. In the ordinary course of business, the Company relies upon information technology networks and systems to process, transmit and store electronic information, and to manage or support a variety of business functions, including supply chain, manufacturing, distribution, invoicing and collection of payments. The Company uses information technology systems to record, process and summarize financial information and results of operations for internal reporting purposes and to comply with regulatory financial reporting, legal and tax requirements. Additionally, the Company collects and stores sensitive data, including intellectual property, proprietary business information and the proprietary business information of customers and suppliers, as well as personally identifiable information of customers and employees, in data centers and on information technology networks. The secure operation of these networks and the processing and maintenance of this information is critical to the Company’s business operations and strategy. Despite security measures and business continuity plans, the Company’s information technology networks and infrastructure may be vulnerable to damage, disruptions or shutdowns due to attacks by hackers or breaches due to employee error or malfeasance or other disruptions during the process of upgrading or replacing computer software or hardware, power outages, computer viruses, telecommunication or utility failures or natural disasters or other catastrophic events. The occurrence of any of these events could compromise the Company’s networks, and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability or regulatory penalties under laws protecting the privacy of personal information, disrupt operations, and damage the Company’s reputation, which could adversely affect the Company’s business.

ITEM 1B – Unresolved Staff Comments

None.

13

The Company’s facilities are well maintained, in good operating condition and are suitable for present purposes. These facilities, together with both short-term and long-term planned capital expenditures, are expected to meet the Company’s manufacturing needs in the foreseeable future. The Company does not anticipate any difficulty in retaining occupancy of any leased facilities, either by renewing leases prior to expiration or by replacing them with equivalent leased facilities. The following are the Company’s significant properties.

| Segment |

Geographic Location (s) |

Own/ Lease |

Lease Expiration |

Square Feet |

Property Description | |||||

| Corporate

|

Omaha, Nebraska

|

Lease

|

2019

|

30,000

|

Corporate headquarters

| |||||

| Irrigation |

Lindsay, Nebraska | Own | N/A | 300,000 | Principal U.S. manufacturing plant consists of eight separate buildings located on 122 acres

| |||||

| Irrigation

|

Corlu, Turkey

|

Lease

|

2024

|

280,000

|

Manufacturing plant for irrigation products

| |||||

| Irrigation

|

Fresno, California

|

Own

|

N/A

|

94,000

|

Manufacturing plant for filtration products

| |||||

| Infrastructure

|

Omaha, Nebraska

|

Own

|

N/A

|

83,000

|

Manufacturing plant for infrastructure products

| |||||

| Irrigation |

Hartland, Wisconsin | Own | N/A | 73,000 | Manufacturing plant for water pumping stations and controls

| |||||

| Irrigation |

La Chapelle, France | Own | N/A | 72,000 | Manufacturing plant for irrigation products

| |||||

| Irrigation |

Bellville, South Africa | Lease | 2019 | 71,000 | Manufacturing plant for irrigation products

| |||||

| Irrigation |

Mogi Mirim, Sao Paulo, Brazil | Own | N/A | 67,000 | Manufacturing plant for irrigation products

| |||||

| Irrigation |

Olathe, Kansas | Own | N/A | 60,000 | Manufacturing plant for machine to machine products

| |||||

| Irrigation |

Tianjin, China and Beijing, China | Lease | 2017 | 58,000 | Manufacturing plant for irrigation products

| |||||

| Infrastructure |

Milan, Italy | Own | N/A | 45,000 | Manufacturing plant for infrastructure products

| |||||

| Infrastructure |

Rio Vista, California | Own | N/A | 30,000 | Manufacturing plant for infrastructure products

|

In the ordinary course of its business operations, the Company is involved, from time to time, in commercial litigation, employment disputes, administrative proceedings, business disputes and other legal proceedings. No such current proceedings, individually or in the aggregate, are expected to have a material effect on the business or financial condition of the Company. Note N, Commitments and Contingencies, sets forth information about capital and other operating expenditures relating to environmental remediation activities at the Company’s Lindsay, Nebraska facility.

ITEM 4 – Mine Safety Disclosures

Not applicable

14

PART II

ITEM 5 - Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Holders

Lindsay Common Stock trades on the New York Stock Exchange, Inc. (NYSE) under the ticker symbol LNN. As of October 13, 2015, there were approximately 162 stockholders of record.

Price Range of Common Stock

The following table sets forth for the periods indicated the range of the high and low stock prices and dividends paid per share:

| Fiscal 2015 Stock Price | Fiscal 2014 Stock Price | |||||||||||||||||||||||

| High | Low | Dividends | High | Low | Dividends | |||||||||||||||||||

| First Quarter |

$ | 89.50 | $ | 73.01 | $ | 0.270 | $ | 90.00 | $ | 71.13 | $ | 0.130 | ||||||||||||

| Second Quarter |

$ | 90.30 | $ | 80.02 | $ | 0.270 | $ | 92.93 | $ | 75.76 | $ | 0.260 | ||||||||||||

| Third Quarter |

$ | 89.33 | $ | 74.20 | $ | 0.270 | $ | 91.60 | $ | 77.50 | $ | 0.260 | ||||||||||||

| Fourth Quarter |

$ | 91.93 | $ | 72.25 | $ | 0.280 | $ | 89.82 | $ | 76.02 | $ | 0.270 | ||||||||||||

| Year |

$ | 91.93 | $ | 72.25 | $ | 1.090 | $ | 92.93 | $ | 71.13 | $ | 0.920 | ||||||||||||

Purchases of Equity Securities by the Issuer and Affiliated Purchases

The table below sets forth information with respect to purchases of the Company’s common stock made by or on behalf of the Company during the three months ended August 31, 2015:

ISSUER PURCHASES OF EQUITY SECURITIES

| Period |

Total Number of Shares Purchased |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Approximate Dollar Value of Shares That May Yet Be Purchased Under the Plans or Programs (1) ($ in thousands) |

||||||||||||

| June 1, 2015 to June 30, 2015 |

88,596 | $ | 81.51 | 88,596 | $ | 23,256 | ||||||||||

| July 1, 2015 to July 31, 2015 |

82,284 | $ | 85.54 | 82,284 | $ | 116,216 | ||||||||||

| August 1, 2015 to August 31, 2015 |

49,397 | $ | 84.21 | 49,397 | $ | 112,057 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

220,277 | $ | 83.62 | 220,277 | $ | 112,057 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

(1) On January 3, 2014, the Company announced that its Board of Directors authorized a share repurchase program of up to $150.0 million of common stock, effective as of January 2, 2014, through January 2, 2016. On July 22, 2015, the Company announced that its Board of Directors increased its outstanding share repurchase authorization by $100.0 million. Under the program, shares may be repurchased in privately negotiated and/or open market transactions as well as under formalized trading plans in accordance with the guidelines specified under Rule 10b5-1 of the Securities Exchange Act of 1934, as amended.

Dividends

The Company paid a total of $12.8 million and $11.7 million in dividends during fiscal 2015 and fiscal 2014, respectively. The Company currently expects that cash dividends comparable to those paid historically will continue to be paid in the future, although there can be no assurance as to future dividends as they depend on future earnings, capital requirements and financial condition.

15

Company Stock Performance

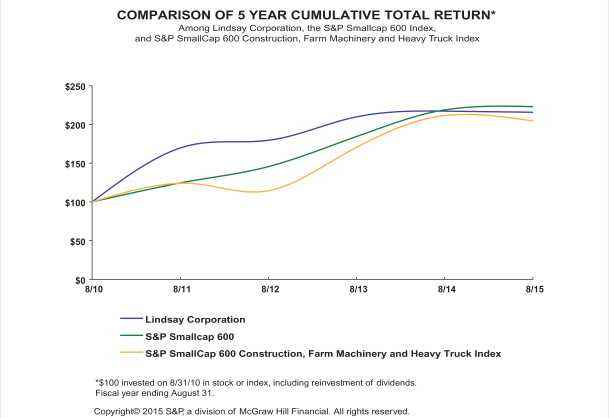

The following graph compares the cumulative 5-year total return attained by stockholders on the Company’s Common Stock relative to the cumulative total returns of the S&P Small Cap 600 Index and the S&P Small Cap 600 Construction, Farm Machinery and Heavy Truck index for the five-year period ended August 31, 2015. An investment of $100 (with the reinvestment of all dividends) is assumed to have been made in the Company’s Common Stock and in each of the indexes on August 31, 2010 and the graph shows its relative performance through August 31, 2015.

| 8/10 | 8/11 | 8/12 | 8/13 | 8/14 | 8/15 | |||||||||||||||||||

| Lindsay Corporation |

100.00 | 169.63 | 179.33 | 209.82 | 217.06 | 215.53 | ||||||||||||||||||

| S&P Smallcap 600 |

100.00 | 124.44 | 145.47 | 184.30 | 218.76 | 222.70 | ||||||||||||||||||

| S&P SmallCap 600 Construction, Farm Machinery and Heavy Truck Index |

100.00 | 124.13 | 114.48 | 170.50 | 211.34 | 204.51 | ||||||||||||||||||

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

16

ITEM 6 – Selected Financial Data

| For the Years Ended August 31, | ||||||||||||||||||||

| $ in millions, except per share amounts |

2015(1) | 2014(2) | 2013 | 2012(3) | 2011 | |||||||||||||||

| Operating revenues |

$ | 560.2 | $ | 617.9 | $ | 690.8 | $ | 551.3 | $ | 478.9 | ||||||||||

| Gross profit |

$ | 156.3 | $ | 171.0 | $ | 194.8 | $ | 148.5 | $ | 129.8 | ||||||||||

| Gross margin |

27.9% | 27.7% | 28.2% | 26.9% | 27.1% | |||||||||||||||

| Operating expenses |

$ | 105.6 | $ | 92.6 | $ | 87.8 | $ | 83.0 | $ | 73.2 | ||||||||||

| Operating income |

$ | 50.7 | $ | 78.4 | $ | 107.0 | $ | 65.5 | $ | 56.6 | ||||||||||

| Operating margin |

9.0% | 12.7% | 15.5% | 11.9% | 11.8% | |||||||||||||||

| Net earnings |

$ | 26.3 | $ | 51.5 | $ | 70.6 | $ | 43.3 | $ | 36.8 | ||||||||||

| Net margin |

4.7% | 8.3% | 10.2% | 7.9% | 7.7% | |||||||||||||||

| Diluted net earnings per share |

$ | 2.22 | $ | 4.00 | $ | 5.47 | $ | 3.38 | $ | 2.90 | ||||||||||

| Cash dividends per share |

$ | 1.090 | $ | 0.920 | $ | 0.475 | $ | 0.385 | $ | 0.345 | ||||||||||

| Property, plant and equipment, net |

$ | 78.7 | $ | 72.5 | $ | 65.1 | $ | 56.2 | $ | 58.5 | ||||||||||

| Total assets |

$ | 536.5 | $ | 526.6 | $ | 512.3 | $ | 415.5 | $ | 381.1 | ||||||||||

| Long-term obligations |

$ | 117.2 | $ | - | $ | - | $ | - | $ | 4.3 | ||||||||||

| Return on beginning assets (4) |

5.0% | 10.1% | 17.0% | 11.4% | 11.3% | |||||||||||||||

| Diluted weighted average shares |

11,855 | 12,882 | 12,901 | 12,810 | 12,692 | |||||||||||||||

(1) Fiscal 2015 includes operating results of Elecsys Corporation acquired in the second quarter of fiscal 2015 and SPF Water Engineering, LLC acquired in the fourth quarter of fiscal 2015

(2) Fiscal 2014 includes operating results of Claude Laval Corporation acquired in fourth quarter of fiscal 2013.

(3) Fiscal 2012 includes the operating results of IRZ Consulting, LLC acquired in the fourth quarter of fiscal 2011.

(4) Defined as net earnings divided by beginning of period total assets.

ITEM 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations

Concerning Forward-Looking Statements - This Annual Report on Form 10-K, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains not only historical information, but also forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements that are not historical are forward-looking and reflect expectations for future Company performance. In addition, forward-looking statements may be made orally or in press releases, conferences, reports, on the Company’s worldwide web site, or otherwise, in the future by or on behalf of the Company. When used by or on behalf of the Company, the words “expect,” “anticipate,” “estimate,” “believe,” “intend” and similar expressions generally identify forward-looking statements. For these statements throughout the Annual Report on Form 10-K, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The entire sections entitled “Financial Overview and Outlook” and “Risk Factors” should be considered forward-looking statements.

Forward-looking statements involve a number of risks and uncertainties, including but not limited to those discussed in the “Risk Factors” section contained in Item 1A. Readers should not place undue reliance on any forward-looking statement and should recognize that the statements are predictions of future results which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described herein, as well as others not now anticipated. The risks and uncertainties described herein are not exclusive and further information concerning the Company and its businesses, including factors that potentially could materially affect the Company’s financial results, may emerge from time to time. Except as required by law, the Company assumes no obligation to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements.

17

Company Overview

The Company manufactures and markets center pivot, lateral move, and hose reel irrigation systems. The Company also produces and markets irrigation controls, chemical injection systems and remote monitoring and control systems. These products are used by farmers to increase or stabilize crop production while conserving water, energy, and labor. Through its acquisitions, the Company has been able to enhance its capabilities in providing innovative, turn-key solutions to customers through the integration of its proprietary pump stations, controls and designs. The Company sells its irrigation products primarily to a world-wide independent dealer network, who resell to their customers, the farmers. The Company’s primary production facilities are located in the United States. The Company has smaller production and sales operations in Brazil, France, China, Turkey and South Africa as well as distribution and sales operations in the Netherlands, Australia and New Zealand. The Company also manufactures and markets, through distributors and direct sales to customers, various infrastructure products, including moveable barriers for traffic lane management, crash cushions, preformed reflective pavement tapes and other road safety devices, through its production facilities in the United States and Italy and has produced road safety products in irrigation manufacturing facilities in China and Brazil. In addition, the Company’s infrastructure segment produces large diameter steel tubing and railroad signals and structures, and provides outsourced manufacturing and production services for other companies.

For the business overall, the global, long-term drivers of water conservation, population growth, increasing importance of biofuels, and the need for safer, more efficient transportation solutions remain positive. Key factors which impact demand for the Company’s irrigation products include agricultural commodity prices, net farm income, worldwide agricultural crop production, the profitability of agricultural crop production, availability of financing, governmental policies regarding the agricultural sector, water and energy conservation policies, the regularity of rainfall, regional climate change, and foreign currency exchange rates. A key factor which impacts demand for the Company’s infrastructure products is the amount of spending authorized by governments to improve road and highway systems. Much of the U.S. highway infrastructure market is driven by government spending programs. For example, the U.S. government funds highway and road improvements through the Federal Highway Trust Fund Program. This program provides funding to improve the nation’s roadway system. In July 2015, the U.S. government enacted an $8 billion temporary highway-funding bill to fund highway and bridge projects, the latest in a series of short term funding bills over the last several years. Matching funding from the various states may be required as a condition of federal funding.

The Company continues to have an ongoing, structured, acquisition process that it expects to generate additional growth opportunities throughout the world in irrigation/water solutions. Lindsay is committed to achieving earnings growth by global market expansion, improvements in margins, and strategic acquisitions. Since 2001, the Company has utilized acquisitions and greenfield efforts to expand its product lines and add to its operations in Europe, South America, South Africa, the Netherlands, Australia, New Zealand, China and Turkey. The addition of those operations has allowed the Company to strengthen its market position in those regions.

New Accounting Standards Issued But Not Yet Adopted

See Note B, New Accounting Pronouncements, to the Company’s consolidated financial statements for information regarding recently issued accounting pronouncements.

Critical Accounting Policies and Estimates

In preparing the consolidated financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”), management must make a variety of decisions which impact the reported amounts and the related disclosures. Such decisions include the selection of the appropriate accounting principles to be applied and the assumptions on which to base accounting estimates. In reaching such decisions, management applies judgment based on its understanding and analysis of the relevant facts and circumstances. Certain of the Company’s accounting policies are critical, as these policies are most important to the presentation of the Company’s consolidated results of operations and financial condition. They require the greatest use of judgments and estimates by management based on the Company’s historical experience and management’s knowledge and understanding of current facts and circumstances. Management periodically re-evaluates and adjusts the

18

estimates that are used as circumstances change. Following are the accounting policies management considers critical to the Company’s consolidated results of operations and financial condition:

Revenue Recognition

The Company’s revenue recognition accounting policy is critical because it can significantly impact the Company’s consolidated results of operations and financial condition. The Company’s basic criteria necessary for revenue recognition are: 1) evidence of a sales arrangement exists, 2) delivery of goods has occurred, 3) the sales price to the buyer is fixed or determinable, and 4) collectability is reasonably assured. The Company recognizes revenue when these criteria have been met and when title and risk of loss transfers to the customer. The Company generally has no post-delivery obligations to its independent dealers other than standard warranties. Revenues and gross profits on intercompany sales are eliminated in consolidation. Revenues from the sale of the Company’s products are recognized based on the delivery terms in the sales contract. If an arrangement involves multiple deliverables, revenues from the arrangement are allocated to the separate units of accounting based on their relative selling price.

The Company offers a subscription-based service for wireless management and recognizes subscription revenue on a straight-line basis over the contract term. The Company leases certain infrastructure property held for lease to customers such as moveable concrete barriers and Road Zipper SystemsTM. Revenues for the lease of infrastructure property held for lease are recognized on a straight-line basis over the lease term.

The costs related to revenues are recognized in the same period in which the specific revenues are recorded. Shipping and handling fees billed to customers are reported in revenue. Shipping and handling costs incurred by the Company are included in cost of sales. Customer rebates, cash discounts and other sales incentives are recorded as a reduction of revenues at the time of the original sale. Estimates used in the recognition of operating revenues and cost of operating revenues include, but are not limited to, estimates for product warranties, product rebates, cash discounts and fair value of separate units of accounting on multiple deliverables.

Inventories

The Company’s accounting policy on inventories is critical because the valuation and costing of inventory is essential to the presentation of the Company’s consolidated results of operations and financial condition. Inventories are stated at the lower of cost or market. Cost is determined by the last-in, first-out (LIFO) method for the Company’s Lindsay, Nebraska inventory and three warehouses in Idaho, Georgia and Texas. Cost is determined by the first-in, first-out (FIFO) method for inventory at operating locations in Nebraska, California, Wisconsin, China, Turkey and Australia. Cost is determined by the weighted average cost method for inventory at the Company’s other operating locations in Kansas, Washington, Brazil, France, Italy and South Africa. At all locations, the Company reserves for obsolete, slow moving, and excess inventory by estimating the net realizable value based on the potential future use of such inventory.

Environmental Remediation Liabilities

The Company’s accounting policy on environmental remediation is critical because it requires significant judgments and estimates by management, involves changing regulations and approaches to remediation plans, and any revisions could be material to the operating results of any fiscal quarter or fiscal year. The Company is subject to an array of environmental laws and regulations relating to the protection of the environment. In particular, the Company committed to remediate environmental contamination of the groundwater at and land adjacent to its Lindsay, Nebraska facility (the “site”) with the EPA. The Company and its environmental consultants have developed a remedial alternative work plan, under which the Company continues to work with the EPA to define and implement steps to better contain and remediate the remaining contamination.

Environmental remediation liabilities include costs directly associated with site investigation and clean up, such as materials, external contractor costs and incremental internal costs directly related to the remedy. Estimates used to record environmental remediation liabilities are based on the Company’s best estimate of probable future costs based on site-specific facts and circumstances. Estimates of the cost for the likely remedy are developed

19

using internal resources or by third-party environmental engineers or other service providers. The Company records the undiscounted environmental remediation liabilities that represent the points in the range of estimates that are most probable or the minimum amount when no amount within the range is a better estimate than any other amount.

In fiscal 2013, the Company and the EPA conducted a periodic five-year review of the status of the remediation of the contamination of the site. The Company intends to complete additional investigation of the soil and groundwater on the site during the first half of calendar 2016. Based on this investigation, the Company will then assess revisions to its remediation plan and expects to meet with the EPA toward the end of calendar 2016 to determine how to proceed. While any revisions could be material to the operating results of any fiscal quarter or fiscal year, the Company does not expect such additional expenses would have a material adverse effect on its liquidity or financial condition.

The Company accrues the anticipated cost of environmental remediation when the obligation is probable and can be reasonably estimated. Although the Company has accrued all reasonably estimable costs associated with remediation of the site, additional testing and environmental monitoring and remediation could be required in the future as part of the Company’s ongoing discussions with the EPA regarding the development and implementation of the remedial action plans. In addition, the current investigation has not yet been completed and does not include all potentially affected areas on the site. Due to the current stage of discussions with the EPA and the uncertainty of the remediation actions that may be required with respect to these potentially affected areas, the Company believes that meaningful estimates of costs or range of costs cannot currently be made and accordingly have not been accrued.

Trade Receivables and Allowances