Attached files

| file | filename |

|---|---|

| EX-32.2 - Eastside Distilling, Inc. | ex32-2.htm |

| EX-32.1 - Eastside Distilling, Inc. | ex32-1.htm |

| EX-31.2 - Eastside Distilling, Inc. | ex31-2.htm |

| EX-31.1 - Eastside Distilling, Inc. | ex31-1.htm |

| EX-10.45 - Eastside Distilling, Inc. | ex10-45.htm |

U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to _____________

Commission File Number 000-54959

EASTSIDE DISTILLING, INC.

(Name of small business issuer as specified in its charter)

| Nevada | 20-3937596 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

8911 NE Marx Drive, Suite A2

Portland, Oregon 97220

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (971) 888-4264

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $0.0001 par value | EAST | The Nasdaq Stock Market LLC | ||

| (Title of Each Class) | (Trading Symbol) | (Name of Each Exchange on Which Registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes [ ] No [X]

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 if the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] | |

| Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262 (b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes [ ] No [X]

The aggregate market value of the voting stock held by non-affiliates of the registrant at June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter was $13,994,759 based on the last reported sales price of the registrant’s common stock as reported by the Nasdaq Stock Market on that date.

As of March 31, 2021, 11,629,307 shares of our common stock were outstanding.

Documents Incorporated by Reference: None.

EASTSIDE DISTILLING, INC.

FORM 10-K

December 31, 2020

TABLE OF CONTENTS

| 2 |

Eastside Distilling, Inc., is referred to herein as “Eastside,” “EAST,” “the Company,” “us,” or “we.”

Cautionary Note Regarding Forward-Looking Statements

The statements in this section and other sections of this Form 10-K include “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995 and involve uncertainties that could significantly impact results. Forward-looking statements give current expectations or forecasts of future events about the company or our outlook. You can identify forward-looking statements by the fact they do not relate to historical or current facts and by the use of words such as “believe,” “expect,” “estimate,” “anticipate,” “will be,” “should,” “plan,” “project,” “intend,” “could” and similar words or expressions. Examples include, among others, statements about any of the following:

| ● | Impact of the COVID-19 pandemic, and the resulting negative economic impact and related governmental actions; | |

| ● | Our ability to secure additional financing and achieve positive working capital; | |

| ● | General industry, market and economic conditions (including consumer spending patterns and preferences) and our expectations regarding growth in the markets in which we operate; | |

| ● | Our ability to introduce competitive new products on a timely basis and continue to make investments in product development and our expectations regarding the effect of new products on our operating results; | |

| ● | Our realizing the results of our competitive strengths and ability to compete with other producers and distributors of alcoholic beverage products; | |

| ● | Our continuing to focus on and ability to realize our strategic objectives; | |

| ● | Our intention to implement actions to improve profitability, manage expenses, increase sales and utilize inventory and accounts receivable balances to help satisfy our working capital needs; | |

| ● | Our continuing to follow our approach to product development; | |

| ● | Our expectation regarding product pricing and our ability to market to premium and super-premium segments of the market; | |

| ● | Our ability to retain, market and grow our existing brands, the effect that may have on other brands, and our ability to profitably sell our brands; | |

| ● | Our ability to financially support the brands in the market; | |

| ● | Our ability to protect our intellectual property, including trademarks and tradenames related to our brands; | |

| ● | The effects of competition and consolidation in the markets in which we operate; | |

| ● | The ability of our production capabilities to support our business and operations and production strategy, including our ability to continue to expand our production capacity to meet demand or outsource production to lower cost of goods sold; | |

| ● | Our expectations regarding our supply chain, including our ongoing relationships with certain key suppliers and/or any potential supply chain disruption; | |

| ● | Our ability to cultivate our distribution network and maintain relationships with our major distributors; | |

| ● | Our ability to utilize our existing distribution pipelines and channels to grow other brands in our portfolio; | |

| ● | Changes in applicable laws, policies and the application of regulations and taxes in jurisdictions in which we operate and the impact of newly enacted laws; | |

| ● | Tax rate changes (including excise tax, VAT, tariffs, duties, corporate, individual income, or capital gains), changes in related reserves, or changes in tax rules or accounting standards; | |

| ● | Our ability to expand our business and brand offerings by acquisitions, including our ability to identify, complete, and finance acquisitions, and our ability to integrate and realize the benefits of our acquisitions; | |

| ● | Our ability to position our brands as attractive acquisition candidates; |

| 3 |

| ● | Our ability to realize the anticipated benefits of our canned beverage, mobile canning and bottling operations and expected growth in the canned beverages industry; | |

| ● | Negative publicity related to our company, brands, marketing, personnel, operations, business performance, or prospects | |

| ● | Our ability to attract and retain key board, executive or employee talent; | |

| ● | Our liquidity and capital needs and ability to meet our liquidity needs and going concern requirements; and | |

| ● | Our operations, financial performance and results of operations. |

Forward-looking statements are based on assumptions and known risks and uncertainties. Although we believe we have been prudent in our assumptions, any or all of our forward-looking statements may prove to be inaccurate, and we can make no guarantees about our future performance. Should known or unknown risks or uncertainties materialize, or underlying assumptions prove inaccurate, actual results could materially differ from past results and/or those anticipated, estimated or projected.

We undertake no obligation to provide updates to forward-looking statements to the public, whether as a result of new information, future events or otherwise. You should, however, consult any subsequent disclosures we make in our filings with the United States Securities and Exchange Commission (“SEC”) on Form 10-Q or Form 8-K.

You should review the “Risk Factors” set forth elsewhere in this Annual Report for a cautionary discussion of certain risks, uncertainties and assumptions that we believe are significant to our business and may effect forward looking statements.

Use of Non-GAAP Financial Information – Certain matters discussed in this report, including the information presented in Part II under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” include measures that are not measures of financial performance under U.S. Generally Accepted Accounting Principles (“GAAP”). These non-GAAP measures should not be considered in isolation or as a substitute for any measure derived in accordance with GAAP, and also may be inconsistent with similarly titled measures presented by other companies.

Overview

Eastside Distilling, Inc. (the “Company,” “Eastside Distilling,” “we,” “us,” or “our,” below) was incorporated under the laws of Nevada in 2004 under the name of Eurocan Holdings, Ltd. In December 2014, we changed our corporate name to Eastside Distilling, Inc. to reflect our acquisition of Eastside Distilling, LLC. We manufacture, acquire, blend, bottle, import, market and sell a wide variety of alcoholic beverages under recognized brands. We employ 78 people in the United States.

Our brands span several alcoholic beverage categories, including whiskey, vodka, gin, rum, tequila and Ready-to-Drink (“RTD”). We sell our products on a wholesale basis to distributors in open states, and brokers in control states, and until March 2020, we operated four retail tasting rooms in Portland, Oregon to market our brands directly to consumers. We operate a mobile craft canning and bottling business (“Craft C+B”) that primarily services the craft beer and craft cider business. Craft C+B operates 11 mobile lines in Seattle, Washington; Portland, Oregon; and Denver, Colorado.

Total company revenue in 2020 was almost split evenly between spirits and Craft Canning; yet, the Craft Canning division contributed 80% of our gross profit and spirits contributed 20%. The impact of the COVID-19 pandemic had a significant effect on each business unit. Craft Canning revenue had over 20% growth from 2019 due to the incremental demand for packaging stimulated by the shift in on-premise beer sales from kegs to cans. The spirits portfolio had approximately 20% in revenue growth from 2019 due to a full year of Azuñia Tequila sales. Overall, the U.S. craft spirits category revenue was down $2.1 billion, or 40%, in 2020 according to the Distilled Spirits Council of the United States (“DISCUS”).

| 4 |

Principal Spirits Brands and Products During 2020

| ● | Hue-Hue (pronounced “way-way”) Coffee Rum – cold-brewed free-trade, single-origin Arabica coffee beans grown at the Finca El Paternal Estate in Huehuetenango, Guatemala that is sourced and then lightly roasted through Portland Roasting Company. The concentrated brew is then blended with premium silver rum and a trace amount of Demerara sugar. | |

| ● | Azuñia Tequila – estate-crafted, smooth, clean craft tequila with authentic flavor from the local terroir. It is the exclusive export of Agaveros Unidos de Amatitán and a second generation, family-owned-and-operated Rancho Miravalle estate, which has created tequila for over 20 years. Made with 100% pure Weber Blue Agave grown in dedicated fields of the Tequila Valley, it is harvested by hand and roasted in traditional clay hornos, and then finished with a natural, open-air fermentation process and bottled on-site in small batches using a consistent process to deliver field-to-bottle quality. | |

| ● | Portland Potato Vodka – Portland’s award-winning premium craft vodka. The key to producing our vodka is to distill it four times. While most vodka is made from grain used in whiskey, we use potatoes and natural spring water sourced from the state of Oregon. | |

| ● | Burnside Whiskey –We source the best ingredients available to produce Burnside Whiskey. We develop each blend using the various qualities of Quercus Garryana, the native Oregon Oak. Expanding on our initial experiment in 2012, we made it our mission to turn the Burnside program into a one- of-a-kind oak study. Our blends are all distinctive from one another, and the treatment of oak is equally specific. |

Principal Services Provided by Craft Canning and Bottling

Canning

| ● | Flexible packaging options in multiple sizes | |

| ● | Nitrogen dosing: Specialized equipment allowing for packaging of still products in addition to carbonated beverages | |

| ● | Velcorin: Specialized equipment that supports microbial control | |

| ● | Label application capabilities | |

| ● | Mobility packaging for clients at their production facility | |

| ● | Full-service packaging provider |

Bottling

| ● | Supplies all needed packaging and has the ability to package in two primary bottle sizes | |

| ● | Specialized packaging and quality control equipment |

We have invested heavily in the past two years expanding our business through acquisitions and making substantial investments in branding and production; however, we have not achieved profitability. The immediate task at hand is to focus on a new sustainable business strategy. Based on a complete review and analysis of our competitive position, market opportunity and assets, we have identified components of the strategy that we believe would improve operating results. Management believes the following components of the strategy are in place and working:

| ● | Strong spirits brands and products; | |

| ● | Established 3-tier national distributor partnerships; | |

| ● | Strong market position in Oregon, which is benefiting from an industrywide growth in craft spirits; | |

| ● | Experience in distilling, blending, and barrel aging for craft spirits; | |

| ● | Significantly reduced cash burn rate; | |

| ● | Valuable asset in its employees; and | |

| ● | Craft Canning division benefits from growth and accretive margin expansion opportunities generating cash flow. |

Areas that we need incremental work include the following:

| ● | Effective integration of Azuñia Tequila; | |

| ● | Increased gross margins for our spirits portfolio at industry standards; and | |

| ● | A sustainable strategy, fiscal plan, and predictable results. |

| 5 |

We plan to complete our business review in 2021 and embark on the following:

| ● | Reinvent the business model for sustainable success: |

| ○ | Reduce cash burn rate to less than $3 million per annum in 2021; | ||

| ○ | Provide adequate liquidity and funding of the operating plan; | ||

| ○ | Leverage Craft Canning growth and achieve production synergies with spirits; | ||

| ○ | Refocus spirits branding and strategy to grow and expand; | ||

| ○ | Build the Eastside brand; and | ||

| ○ | Utilize the Eastside brand for limited edition products. |

| ● | Focus strategy on value creation that establishes a sustainable growth plan with a clear competitive advantage increasing internal rate of return and value for shareholders; | |

| ● | Expand the Board of Directors and build strategic alignment; | |

| ● | Build a 3-year strategic plan; | |

| ● | Rebuild the budget process to allow for predictable measurable progress on financial goals; and | |

| ● | Build a professional company platform, deliver results, and then, acquire accretive assets. |

Eastside Distilling is unique in several specific areas: (1) to our knowledge, we are the only craft spirits company listed on Nasdaq, (2) we do not function as a traditional craft distillery with store fronts relying on local sales, (3) we are diversified with our contract manufacturing division, and (4) we have a diversified portfolio of spirits brands. We are similar to other craft distillers in that (1) we have concentrated local volume, (2) we produce small batches and remain within the volume definition of “Craft”, and (3) our brands achieve success through differentiation, discovery and distribution.

The U.S. spirits marketplace is occupied by large multi-national conglomerates with substantially more resources than Eastside Distilling. However, we can use our small size to be fast, focused, flexible in our strategy. If we attempt to grow too quickly, we may lack the underlying strength required to build scale with loyalty via strong unaided awareness and powerfully derived attributes. Moreover, attempting to focus our “frame-of-reference” to compete with the biggest brands in the most expensive venues, is likely to fail without first establishing underlying brand equity.

We will seek to utilize our public company stature to our advantage and position our spirits portfolio as a leading tier 2 spirits provider that develops brands, expands geographic presence and positions for either a sale to the tier 1 suppliers or continued ownership with growth in revenue and cash flow. We will look to grow, and vertically integrate, our Craft Canning portfolio.

Market Opportunity – Roll-up Craft Distilleries with a Vertically Integrated Production Platform

Size of the United States for the Craft Spirits Market

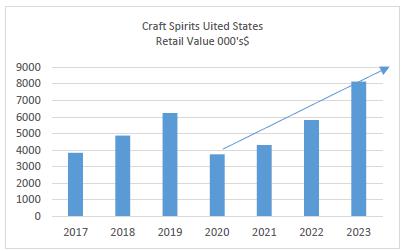

The U.S. craft spirits market retail value was estimated at $3.3 billion in 2020, down 40% from $5.5 billion in 2019 due to the COVID-19 pandemic and loss of on-premise sales. The craft spirits category is estimated to continue to struggle in the 1st half of 2021, declining at 15% and then experience explosive growth in the 2nd half as the on-premise class of trade opens, growing at 30%. Overall, we project a growth rate of 10% in 2021. The compound annual growth rate from 2020 to 2023 is forecasted to be 20%.

| 6 |

Estimated Craft Spirits Revenue Growth 20% CAGR through 2023

Source: DISCUS

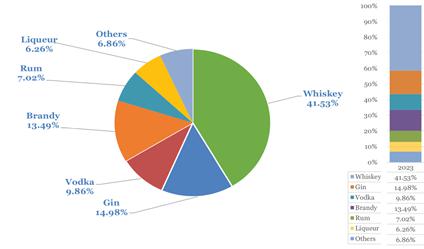

The craft spirits category share is dominated by whiskey products, followed by gin and brandy. Overall share mix continues to remain constant as growth rates tend to be consistent across product types. The rye whiskey category is growing twice that of American whiskey. While tequila is not considered a domestically produced craft spirit as all tequila is imported from Mexico, we believe Azuñia Tequila has the potential to grow and excel as an artisanal, authentic brand in the premium and super premium tequila category.

Projected 2023 Mix of Craft Spirits

Source: Arizton

According to DISCUS, distilled spirits sales in the U.S. were up 5.3% in 2019, increasing by $1.5 billion, to a new record of $29 billion. Key spirits category drivers of sales growth in 2019 included: American whiskey, up 10.8%, or $387 million, to $4 billion; rye was an important component of the overall American whiskey category growth with sales up 14.7%, or $30 million, reaching $235 million; tequila/mezcal, up 12.4%, or $372 million, to $3.4 billion; mezcal surpassed $100 million in sales for the first time totaling $105 million. Pre-mixed cocktails were up 7.5%, or $25 million, to $351 million. Volumes rose by 3.3% to a record 239 million cases, an increase of 7.6 million cases from 2018. The trend underscored the decades long trend in market premiumization as consumers shifted their purchases toward more expensive spirits, resulting in a faster rate of growth in revenue over the rate of growth in physical shipments. According to DISCUS, in 2019, the spirits industry again gained market share over beer and wine sales. Revenues grew by half a percent to 37.8% of the total beverage alcohol market. This was the 10th year of market share gains for the spirits industry. Each percentage point gain in market share is worth $770 million in additional revenue to the industry.

Key Salient Areas We Target and Focus Our Spirits Portfolio

| ● | Premiumization – Craft spirits are anticipated to cost more and be more premium. Overall consumer behavior continues to drink less but consume premium alcoholic beverages. |

| 7 |

| ● | Experiential Branding – Brands that consumers can discover and become an integral part of consumer lifestyles and self-expression are on the rise. This trend will continue as users search for authenticity. | |

| ● | Farm to Flask – Better ingredients, authentic production processes and a better taste experience will continue to be interesting attributes. Craft spirits, which have a unique sense of identity and originality, continue to gain popularity. | |

| ● | Artisanal and Handmade – Batch produced limited quantities with the highest care, attention and quality are important to consumers seeking special, premium products. This trend is a critical driver of craft growth. |

Spirits Aficionados that Appreciate Authentic, Hand Crafted, Batch Produced Products

The overall target for Eastside Distilling is a “psychographic target” that transcends demographics and focuses on what consumers want versus who they are.

Our Strategy

Our overall strategy is to build Eastside Distilling to a leader in the craft spirits and craft packaging marketplace. We will continue to focus our spirits portfolio on a “house of brands” architecture with Azuñia Tequila, Burnside Whiskey, Portland Potato Vodka, Hue-Hue Coffee Rum and the Eastside brand of limited edition premium spirits products. We aim to grow these brands to either be an attractive acquisition candidate for the tier 1 producers in the spirits industry or be a consistent stream of earnings for the spirits portfolio generated from scale, scope and differentiation.

In terms of strategic sequence, we are focused on initiating the turnaround and then beginning the rapid value creation phase for shareholders through the following:

| 1) | The first and most critical step is to reduce the year on year cash burn. In 2019, the cash burn rate (adjusted EBITDA + interest expense) was approximately $10 million and in 2020, it was $6 million. The primary source of this cash burn was the investment in the Redneck Riviera brand. Management believed we would need to increase our investment in Redneck Riviera three-fold to maintain the velocity in the national off-premise chain accounts. We recently terminated the license for the Redneck Riviera brand and will now focus our investment on the remaining brands in the portfolio. In addition, we will assess gross profit to cash operating costs as a scorecard matrix to ensure we maintain a sustainable operating cash burn rate in 2021 below $3 million and make incremental progress toward lowering that cash burn rate. | |

| 2) | The second critical step is to establish proper liquidity and improve underlying fundamentals in net working capital. We over-invested in working capital in prior years and collateralized our barrel inventory to raise incremental capital. With the divestiture of the Redneck Riviera brand, we have reduced barrel inventory by 40%. We plan to convert a substantial portion of the remaining barrel inventory to cash by utilizing the barrel product for Eastside limited edition products. We intend to use cash from both debt and equity financings to augment cash generated from reducing working capital to fund operations this year. | |

| 3) | Given the vision for Eastside Distilling to be a national leader in craft spirits and craft contract packaging, it is imperative that management work diligently to professionalize the Company and prepare to scale and expand. To this end, we are focused on converting from manual to automated systems. We have recently hired a Controller and Vice President of Financial Planning and Analysis. This capability will bring faster monthly close, added controls to the accounting systems, stronger 3-year strategic plans and robust phased fiscal budgets. In addition, with the goal of scale and expansion, we will be better prepared to evaluate the optimal return for expenditures by business unit, brand, market, and event. | |

| 4) | Volume and market share, with profit, is the goal for our spirits portfolio. We are a company inspired by craft spirits and the art of craftmanship. We focus on creating unique high-quality artisan products that are rare and hard to get. Our Craft Canning division embraces the same inspiration to package craft beverages with quality and precision. We build experiential brands that are uniquely relevant to our target audience. We focus on creating relationships between our brands and consumers that are deep and enduring. |

| 8 |

To help achieve our strategy, we are focused on the following:

| ● | Identifying and completing strategic brand development in-house and acquisitions that fill out our product portfolio and/or our distribution strategy; | |

| ● | Achieving world-class spirit rebranding with the collaboration of Neil Powell Studios; | |

| ● | Achieving brand penetration through our national distribution platform “up and down the street” with our 3-tier distribution network; | |

| ● | Maximizing our margins through (a) premium unique brands and products, (b) optimizing price and price promotion, and (c) targeted cost leverage utilizing our “operations center of excellence” that will focus on buy/make/deliver best practice model; | |

| ● | Monetizing our diverse and growing branded-product portfolio through select and focused geographic expansion; and, | |

| ● | Building a sustainable business model that owns a unique competitive advantage through our brands, products, people, infrastructure and distributors. |

Our Strengths

We believe the following competitive strengths will help enable the implementation of our growth strategies:

| ● | Experiential brands with the potential to be highly relevant/unique yet scalable/expandable: As consumers generally “drink the image,” our brands will (a) strive to be discovered versus marketed, (b) create experiences versus interactions, (c) be relevant and unique vs only relevant or unique; and (d) be iconic and admired by our target audience. We will accomplish these goals by building brands that have a deep connection to product attributes and consumer values. When combined, we will create brand gestalt that is highly regarded and highly desired. | |

| ● | Artisan products that are craft inspired and driven by the art of craftmanship: We will seek to provide the most interesting products as measured by individual product attribute ratings and combined derived attribute ratings. In the end, the most important measurement is purchase intent driven by strategic attribute ratings. | |

| ● | Experienced distilling and blending experts: We believe that our team of expert blenders and distillers, with highly regarded palates and experience is important to us maintaining a high-quality, artisanal character to our products as well as adding to our consumer appeal. | |

| ● | Experienced marketing and branding: Our new CEO has over 23 years beverage experience with 16 years in alcoholic beverages. He has created Miller Sharp’s non-alcoholic beer for Miller Brewing, he acquired and grew Stolichnaya vodka for Allied Domecq, and he received the Edgar Bronfman award for outstanding leadership in the spirits industry. Our new Chief Branding Officer brings over 20 years in branding and marketing with several world class agencies. As brand marketing director, she has repackaged and repositioned Beefeater Gin, Kahlua Liqueur, Sauza Tequila and provided marketing direction for other top brands like Makers Mark and Canadian Club. Our new Vice President of Financial Planning and Analysis has over 20 years in the alcoholic beverage industry with Pernod Ricard, Diageo, Bacardi and Heineken, specifically working with brand management to support test market analysis, new product development, sales and operations planning process and marketing matrix measurement/return. Finally, Eastside Distilling has established a strong relationship with Neil Powell Studios, an acclaimed branding firm, to provide us with packaging and digital branding expertise. |

| 9 |

| ● | Key distribution relationships: We have distribution arrangements with several of the largest wine and spirits distributors in the United States, such as RNDC. We have also maintained our relationship with Park Street, a provider of back-office administrative and logistical services for alcohol and beverage companies. We believe these relationships will help accomplish our goal of having our premium spirits sold and distributed nationwide. | |

| ● | Expanded production: With the recent arrival of our new Senior Vice President of Operations, we now have the ability to create an “operational center of excellence” for the entire company. Our new Senior Vice President of Operations has over 20 years’ experience in classic consumer goods manufacturing, including change management, scale & expansion, CRM (integrated, data-driven software solutions), line engineering, black belt methodology and team leadership. The Company plans to combine all purchasing, manufacturing and logistics/warehousing under our new Senior Vice President of Operations. |

Our Product Approach

Our approach to our craft spirits involves five important aspects:

| ● | Commitment to high quality unique artisan products inspired by craft spirits and driven by the highest standards of craftmanship: We create and deliver extraordinary products that have unique qualities in ingredients, distilling, blending or barrel aging that offer consumers a special experience. | |

| ● | Authentic craft products and yet scalable and expandable: We believe our unwavering commitment to produce authentic craft spirits that delight our consumers can be scaled and consistent with proper care given to consistency and quality of our production process. | |

| ● | Unique talent and experience: Every spirit reflects the craft inspiration, the highest standards of craftmanship and the creativity and capability of our entire team. Eastside recently announced a new Head Distiller to protect our standards, guide our process and innovate new products. |

| ● | Strategic spirit portfolio architecture: We will focus on a “house of brands” portfolio architecture that focuses on experiential brands, artisan products, “up and down the street” distribution and micro guerilla marketing. Our portfolio architecture will seek to offer the most unique, high quality and high margin products. | |

| ● | Build consumer relationships, affinity and loyalty: The goal is to build an ongoing relationship with our brands and consumers that fosters loyalty and word of mouth. |

Production and Supply

Bringing a brand to market involves several important stages, including bottle and label design, raw materials procurement, filling the bottles, and packaging the bottles in various configurations for shipment. To achieve a unique flavor profile for each brand, we use one or more of the following techniques: infusion of fruit, addition of natural flavorings, blending of products, and aging in selected casks. Once the final profile is approved and quality control standards are met, we filter the liquid as needed and bottle or can the product.

We rely on a limited number of suppliers for the sourcing of our spirit products and raw materials, including our distillate products and other ingredients. These suppliers consist of third-party producers in the U.S and Mexico. We are in the process of reviewing our contract with Agaveros Unidos de Amatitan, SA. de CV., which was part of the acquisition of the Azuñia Tequila assets in 2019. We do not have long-term, written agreements with any of our other suppliers for the production of raw materials. However, we believe that we have consistent and reliable third-party sources for the needed materials. We produce and bottle all our spirits for distribution, regardless of whether the distillation phase of the process was at our facility or at one of our suppliers.

| 10 |

Most recently, we have consolidated all procurement, manufacturing, logistics, and warehousing under the responsibility of our Senior Vice President of Operations. We have created a “center of operational excellence” that will lead and manage the following: (1) company procurement of raw materials and finished goods from Agaveros Unidos de Amatitan, SA. de CV, (2) Craft C+B contract manufacturing, (3) craft spirits direct manufacturing, and (4) company logistics and warehousing. This initiative will decrease waste, fully utilize and deploy resources, and establish a platform for expansion.

Distribution Network

Since 2018 with the introduction of Redneck Riviera Whiskey, we developed a national distribution network and currently have distribution and brokerage relationships with three-tier distributors in 49 U.S. states. Despite the divestiture of Redneck Riviera Whiskey from our product portfolio, we continue to enjoy our relationship with a national distributor network.

U.S. Distribution

Producers and importers of beverage alcohol in the U.S. must sell their products through a three-tier distribution system. Typically, a brand is first sold to a network of distributors, or wholesalers, covering the U.S., in either “open” states or “control” states. In the 33 open states, the distributors are generally large, privately held companies. In the 17 control states, the states themselves function as the distributor, and regulate suppliers, including our Company. The distributors and wholesalers in turn sell to individual retailers, such as liquor stores, restaurants, bars, supermarkets and other outlets licensed to sell alcoholic beverages. In larger states, such as New York, more than one distributor may handle a brand in separate geographical areas. In control states, producers and importers sell their products directly to state liquor authorities, which distribute the products and either operate retail outlets or license the retail sales function to private companies, while maintaining strict control over pricing and profit.

The U.S. spirits industry has consolidated dramatically over the last ten years due to merger and acquisition activity. Eight major spirits companies currently dominate the industry, each of which owns and operates its own importing businesses. All companies, including these large companies, are required by law to sell their products through wholesale distributors in the United States. The major companies continue to exert increasing influence over the regional distributors and as a result, it has become increasingly difficult for smaller companies to get their products recognized by distributors. Before the onset of the COVID-19 pandemic, over 2,000 craft distillers operated in the United States. Since the COVID-19 pandemic commenced, it is estimated that the total number will be reduced to 1,200.

Importation

We hold the federal importer and wholesaler license required by the Alcohol and Tobacco Tax and Trade Bureau of the U.S. Treasury Department and the requisite state licenses within the states in which we conduct business.

Our inventory is maintained in offsite bonded warehouses at our producers, our bonded warehouse in Milwaukie, Oregon, and at bonded warehouses managed by Park Street, our fulfillment and logistics partner. We also typically have inventory in transit that we ship nationally through our network of licensed and bonded carriers.

Wholesalers and Distributors

In the United States, we are required by law to use state-licensed distributors or, in the control states, state-owned agencies performing this function, to sell our brands to retail outlets. As a result, we depend on distributors for sales, product placement and retail store penetration. All of the distributors with whom currently work also distribute our competitors’ products and brands. As a result, we must foster and maintain our relationships with our distributors. Through our internal sales team, we have established relationships for our brands with wholesale distributors in the forty-nine states where we sell our products, and our products are sold in the U.S. by these wholesale distributors, as well as by various state beverage alcohol control agencies.

| 11 |

Significant Customers

Sales to one customer, the Oregon Liquor Control Commission, accounted for approximately 18% and 16% of our consolidated sales for the years ended December 31, 2020 and 2019, respectively.

Sales Team

We have a total sales force of approximately 10 people, with an average of over ten years of industry experience with premium beverage alcohol brands.

Our sales personnel are engaged in the day-to-day management of our distributors, which includes setting quotas, coordinating promotional plans for our brands, maintaining adequate levels of stock, brand education and training and sales calls with distributor personnel. Our sales team also maintains relationships with key chain and retail customers through independent sales calls. They also schedule promotional events, create local brand promotion plans, host in-store tastings, where permitted, and provide wait staff and bartender training and education for our brands.

In addition, we have also engaged Park Street, a provider of back-office administrative, fulfillment, and logistical services for alcohol and beverage distributors, which services include state compliance, logistics planning, order processing, order fulfillment, distributor chargeback and bill-support management and certain accounting and reporting services. In addition, Park Street provides a factoring service that we can take advantage of to improve cash flow.

Advertising, Marketing and Promotion

To build our brands, we must effectively communicate with three distinct audiences: distributors, retail trade and end consumers. Advertising, marketing and promotional activities help to establish and reinforce the image of our brands in our efforts to build substantial brand value. In the spirits category, consumers “drink the image,” so brand identity is paramount.

We have shifted our marketing model from an exclusive external partnership to internal marketing overseen by our Chief Branding Officer and Chief Executive Officer. We have focused our marketing methodology to conducting quantitative external reviews based on consumer research for all brand and product development. We have developed our fundamental strategy to “position and proof” – position brands and products through quantitative research and then market test to build a “proof of concept” prior to regional or national launch. We have partnered with the Studios of Neil Powell to create, build and produce product packaging and support material.

We are implementing a micro-guerilla marketing strategy that drives tactics to build brand equity and increase sales. We focus on “Impact Stacking” that combines advertising, price promotions, point-of-sale materials, event sponsorship, in-store and off-premise promotions, public relations, and social media marketing to deliver the biggest impact to our target audience and make the most of our limited resources. We have reduced the cost of external partnerships to manage all marketing by (a) extending research to quantitative methodology that better predicts success, (b) leveraging internal marketing expertise that is more cost effective, (c) better positioning brands to include both consumer values and product attributes, and (d) more optimal utilization of resources with focus and elimination of waste.

We now focus on building the spirits portfolio strategy and architecture to better focus and align our brands and products. We also employ a more classical approach to branding based on the capability of our new Chief Branding Officer (“CBO”) and new CEO. Our new CBO has decades of experience in building brands and transforming spirits brands working with advertising agencies and strategic brand consultants. Our CEO has extensive experience in beverage innovation, strategic brand building and micro marketing techniques with a proven track record of value creation in the beverage category.

Intellectual Property

Trademarks are an important aspect of our business. We sell our products under a number of trademarks which we own. Our brands are protected by trademark registrations or are the subject of pending applications for trademark registration in the U.S. where we distribute, or plan to distribute, our brands. The trademarks may be registered in the names of our subsidiaries. In the U.S., trademark registrations need to be renewed every ten years. We expect to register our trademarks in additional markets as we expand our distribution territories.

| 12 |

Seasonality

Our business has historically followed the spirits industry seasonality trends with peak sales generally occurring in the fourth calendar quarter in spirits, primarily due to seasonal holiday buying. Our Craft C+B business typically has peak sales mid to late summer. However, as our business has evolved and as we continue to expand our footprint in the national distribution platform, our sales growth has been more dependent on the timing of successful sales efforts and shipment of product to customers, but there remains a concentration of buying and stocking our chains ahead of the holiday season.

Competition

In spirits, our industry is highly fragmented and very competitive. The threat of new entrants is high; however, the craft spirits segment in the United States is estimated to be down 40% in revenue in 2020 due to the COVID-19 pandemic. The number of craft distilleries is also down from 2,000 to an estimated 1,200. The next three years will produce significant growth for craft spirits off of a lower base.

We believe that Eastside Distilling will compete on the basis of quality, authenticity, sustainability, artisanal and experiential. Our premium brands compete with other alcoholic and nonalcoholic beverages for market share. We compete with numerous tier 1 multinational producers and distributors of beverage alcohol products, many of which have greater resources than us.

Over the past ten years, the U.S. wine and spirits industry has undergone dramatic consolidation and realignment of brands and brand ownership. The number of major importers in the U.S. has declined significantly. Today, we believe eight major companies dominate the market: Diageo PLC, Pernod Ricard S.A., Bacardi Limited, Brown-Forman Corporation, Beam Suntory Inc., Davide Campari-Milano S.p.A., and Rémy Cointreau S.A. These competitors have substantially greater resources than we do.

We believe we are a meaningful tier 2 participant that is in a prime position to build our platform and potentially partner with small-to-mid-size spirit brands as opposed to the major importers and tier 1 multinationals. Given our size relative to our major tier 1 competitors, most of which have multi-billion dollar operations, we believe that we can provide greater focus on smaller brands and tailor transaction structures based on individual brand owner preferences. However, our relative capital position and resources may limit our marketing capabilities, our ability to expand into new markets and our negotiating ability with our distributors.

By focusing on the premium and super-premium segments of the market, which typically have higher prices per case and gross profit margins, and having an established, experienced marketing & sales force, we believe we are able to gain relatively significant attention from our distributors for a company of our size. Also, the continued consolidation among the major companies, and the downsizing of craft distilleries due to the COVID-19 pandemic are expected to create opportunities for small to mid-size wine and spirits companies to expand and increase market share.

The mobile canning and bottling industry is highly fragmented and very competitive. The threat of new entrants is high. Moreover, we compete at the hyper-local scale, where we have a few concentrated customers. One of our greatest threats associated with losing customers is the customer’s own growth and success. As new brewers grow, they are able to afford the investment in their own canning line. We believe the mobile canning industry is in the very early stages of development.

Government Regulation

We are subject to the jurisdiction of the Federal Alcohol Administration Act, U.S. Customs laws, and the Alcoholic Beverage Control laws of all fifty states, among many other regulations.

| 13 |

The U.S. Treasury Department’s Alcohol and Tobacco Tax and Trade Bureau regulates the production, blending, bottling, sales and advertising and transportation of alcohol products. Also, each state regulates the advertising, promotion, transportation, sale and distribution of alcohol products within its jurisdiction. We are also required to conduct business in the U.S. only with holders of licenses to import, warehouse, transport, distribute and sell spirits.

We are subject to U.S. regulations on the advertising, marketing and sale of beverage alcohol. These regulations range from a complete prohibition of the marketing of alcohol in some states to restrictions on advertising style, media and messages.

Labeling of spirits is also regulated in many markets, varying from health warning labels to importer identification, alcohol strength and other consumer information. All beverage alcohol products sold in the U.S. must include warning statements related to risks of drinking beverage alcohol products.

In the U.S. control states, the state liquor commissions act in place of distributors and decide which products are to be purchased and offered for sale in their respective states. Products are selected for purchase and sale through listing procedures which are generally made available to new products only at periodically scheduled listing interviews. Consumers may purchase products not selected for listings only through special orders, if at all.

The distribution of alcohol-based beverages is also subject to extensive federal and state taxation in the U.S. and internationally. Most foreign countries impose excise duties on wines and distilled spirits, although the form of such taxation varies from a simple application on units of alcohol by volume to intricate systems based on the imported or wholesale value of the product. Several countries impose additional import duty on distilled spirits, often discriminating between categories in the rate of such tariffs. If we begin distributing our products internationally, import and excise duties could have a significant effect on our sales, both through reducing the consumption of alcohol and through encouraging consumer switching into lower-taxed categories of alcohol.

Employees

As of March 31, 2021, we have 78 employees, 10 of whom are in sales and marketing, 56 in production/canning/bottling, and 12 of whom are in administration. All employees are full-time with the exception of one part-time employee in sales and two part-time employees in canning. We will continue to monitor our staffing in light of the impacts of the coronavirus and streamlining on our operations for working capital needs.

Geographic Information

Eastside Distilling currently sells its products in 49 states.

The statements in this section describe the most significant risks to our business and should be considered carefully in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the “Notes to Consolidated Financial Statements” to this Annual Report on Form 10-K, as well as our other disclosures in this Annual Report. We may have other risks that we have not yet identified or that we currently believe are immaterial but may become material.

RISKS RELATING TO OUR BUSINESS

Internal disagreements of our Board of Directors could have materially adverse consequences

We have a dynamic board of directors consisting of independent and non-independent members. Our board seeks to stimulate the flow of ideas, identify key issues, consider alternatives, and make informed decisions through a deliberative process. Our directors have a diverse range of experiences and perspectives. In some cases, our directors have actual or possible conflicts of interests or have financial or other interests in proposed transactions with the Company. As a result of all of these factors, members of our board of directors may disagree on how to oversee the business of the Company, the Company’s long-term strategic, financial, or organizational goals, the Company’s standards and policies, or other Company matters.

| 14 |

These disagreements can evolve into disputes, and some of these disputes may have adverse consequences, including a reduced level of trust among board members, unresolved issues, an inability to act on corporate matters, instability on the board, and reduced management and employee morale. They can also significantly delay or prevent the achievement of our business objectives or have an adverse impact on our business performance. In some cases, if disputes cannot be resolved internally, they can result in director resignation or removal, proxy contests, litigation, or stock market delisting.

Failure to retain & recruit executive management and to build morale and performance

Eastside Distilling’s success depends upon the efforts and abilities of our executive management team, key senior management, and a high-quality employee base, as well as our ability to attract, motivate, reward, and retain them. If one of our executive officers or critical senior management terminates his or her employment, we may not be able to replace their expertise, fully integrate new personnel or replicate the prior working relationships. The loss of critical employees might significantly delay or prevent the achievement of our business objectives. Qualified individuals with the breadth of skills and experience in our industry that we require are in high demand, and we may incur significant costs to attract them. Difficulties in hiring or retaining key executive or employee talent, or the unexpected loss of experienced employees could have an adverse impact on our business performance. In addition, we could experience business disruption and/or increased costs related to organizational changes, reductions in workforce, or other cost-cutting measures.

We recently experienced significant changes to our executive leadership team. Both our corporate controller and Vice President of Financial Planning and Analysis resigned effective December 2020 due to concerns of stability, functionality, and over-reaching Board involvement. This has been a significant set-back to the Company. We have recently recruited two new employees to fill these roles and we are currently on-boarding in the first quarter 2021.

There is substantial uncertainty relating to our acquisition of the assets of Intersect Beverage, LLC

On September 12, 2019, the Company completed the acquisition of the Azuñia Tequila brand, the direct sales team, existing product inventory, supply chain relationships and contractual agreements from Intersect Beverage, LLC, an importer and distributor of tequila and related products. We have encountered integration difficulties since the acquisition, including difficulties in assimilating the operations and products, failing to realize synergies, unanticipated costs, low profit margins, diversion of management’s attention from other business concerns, and issues relating to employee transition. Moreover, the Company has discovered a number of inappropriate and problematic trade and sales practices relating to the Company’s sales of the Azuñia Tequila brand of products. The Company has commenced an internal investigation into these trade practices and the effects, if any, such practices may have on the Company’s historical results of operation, as well as any potential violation of laws or regulations applicable to the Company. The results of the investigation could lead to one or more material adverse effects on the Company, including actions for violation of law or regulation, penalties or other monetary liability, suspension, or forfeiture of one or more licenses to operate our business. Moreover, the investigation may result in assertion of one or more claims of indemnification or other legal action arising out of the acquisition.

Negative impact of COVID-19 pandemic

Our business continues to be susceptible to disruption from any number of current and ongoing challenges brought on by the COVID-19 pandemic. The impact of consumer business and government responses to the COVID-19 pandemic has had a significant impact on the operations and financial condition of many businesses. Those include employees being required to work remotely, not travel and otherwise alter their normal working conditions. For instance, our sales staff have had limited opportunity to interact with customers. Businesses have been closed, including establishments that sell our products, and supply chains and manufacturing have been disrupted. Consumer buying habits have shifted and may continue to shift, which may result in fewer sales of our products. These and other impacts from the COVID-19 pandemic and any other similar crisis could have a material impact on our operations and financial results.

| 15 |

In addition, our results and financial condition may be adversely affected by federal or state legislation (or other similar laws, regulations, orders or other governmental or regulatory actions) that would impose new or more severe restrictions on our ability to operate our business or impact the economy or our customers and suppliers, a severe downturn in the economy or financial and lending markets.

The degree to which COVID-19 may impact our results of operations and financial condition is unknown at this time and will depend on future developments, including the ultimate severity and the duration of the pandemic, and further actions that may be taken by governmental authorities or businesses or individuals on their own initiatives in response to the pandemic.

Negative impact of operating losses every quarter since our inception

We believe that we will continue to incur net losses in 2021 as we expect to make continued investment in product development, sales and marketing, brand support and to incur administrative expenses as we seek to grow our brands. We also anticipate that our cash needs will exceed our income from sales in 2021. Some of our products may not achieve widespread market acceptance and may not generate sales and profits to justify our investment in them. We expect we will continue to experience losses and negative cash flow. Results of operations will depend upon numerous factors, some of which are beyond our control, including new entrants, competitive activity, government regulations and increase in tax. We also incur substantial operating expenses at the corporate level, including costs directly related to being a reporting company with the SEC.

Failure to secure additional capital and achieve adequate liquidity to grow and compete

We will require additional capital to operate, grow and compete, and failure to obtain such additional capital could limit our operations and our growth. Unfortunately, we have not generated sufficient cash from operations to finance additional capital needs, and we will need to raise additional funds through private or public equity and/or debt financing. We cannot assure that additional financing will be available to us on acceptable terms or at all. If additional capital is either unavailable or cost prohibitive, our operations and growth may be limited, and we may need to change our business strategy to slow the rate of, or eliminate, our expansion or to reduce or curtail our operations. Also, any additional financing we undertake could impose covenants upon us that restrict our operating flexibility, and, if we issue equity securities to raise capital, our existing shareholders may experience dilution and the new securities may have rights, preferences and privileges senior to those of our common stock.

Failure to effectively manage debt

We have incurred significant debt under promissory notes and inventory financing lines. Much of our debt is secured by our bulk spirit inventory and other assets, including assets in our Craft Canning business. Our ability to meet our debt service obligations depends upon our operating and financial performance, which is subject to general economic and competitive conditions and to financial, business, and other factors affecting our operations, many of which are beyond our control. If we are unable to service our debt, we may need to sell inventory and other material assets, restructure or refinance our debt, or seek additional equity capital. Prevailing economic conditions and global credit markets could adversely impact our ability to do so.

Our debt agreements contain limits on our ability to, among other things, incur additional debt, grant liens, undergo certain fundamental changes, make investments, and dispose of inventory. We are also required to maintain compliance with a total leverage ratio and an interest coverage ratio, and for our secured inventory to have a market value relative to our outstanding debt balance.

The amount and terms of our debt, could have important consequences, including the following:

| ● | prematurely pay down our outstanding debt balance if the market value of our bulk spirits falls and we need to remain within our borrowing base covenants; | |

| ● | we may be more vulnerable to economic downturns, less able to withstand competitive pressures, and less flexible in responding to changing business and economic conditions; |

| 16 |

| ● | we may be more limited in our ability to execute on our strategy and have flexibility to operate or restructure our business; | |

| ● | our cash flow from operations may be allocated to the payment of outstanding debt and not to developing and growing our brands; | |

| ● | we might not generate sufficient cash flow from operations or other sources to enable us to meet our payment obligations under the facility and to fund other liquidity needs; | |

| ● | an inability to incur additional debt, including for working capital, acquisitions, or other needs. |

If we breach a loan covenant or miss a payment, the lenders could accelerate the repayment of debt and foreclose on our inventory and other assets. We might not have sufficient assets to repay our debt upon acceleration. If we are unable to repay or refinance the debt upon acceleration or at maturity, the lenders could initiate a bankruptcy proceeding against us or collection proceedings with respect to our assets securing the facility, which could materially decrease the value of our common stock.

Failure of our brands to achieve anticipated consumer acceptance, sales, growth, or profitability.

Although our brands continue to achieve acceptance, most of our brands are relatively new and have not achieved national brand recognition. We have not yet had success growing a brand to a sufficient level to realize profitability and be in a position to sell the brand for a profit. Also, brands we may develop and/or acquire in the future may not establish widespread brand recognition. Accordingly, if consumers do not accept our brands at scale, our sales will be limited, and we will not be able to penetrate our markets. Our profitability depends in part on achieving scale. We will need to achieve wider market acceptance of our brands and materially increase sales to achieve profitability.

Failure to obtain satisfactory performance from our suppliers or loss of our existing suppliers

Other than our long-term exclusive agreement with Agaveros Unidos de Amatitan, SA. de CV (“Agaveros Unidos”) for the Azuñia Tequila brand, we do not have long-term, written agreements with any of our suppliers. The termination of our relationships or an adverse change in the terms of these arrangements (including with Agaveros Unidos) could have a negative impact on our business. If our suppliers increase their prices, we may not be able to secure alternative suppliers, and may not be able to raise the prices of our products to cover all or even a portion of the increased costs. Also, our suppliers’ failure to perform satisfactorily or handle increased orders, delays in shipments of products from suppliers or the loss of our existing suppliers, especially our key suppliers, could cause us to fail to meet orders for our products, lose sales, incur additional costs and/or expose us to product quality issues. In turn, this could cause us to lose credibility in the marketplace and damage our relationships with distributors, ultimately leading to a decline in our business and results of operations. If we are not able to renegotiate these contracts on acceptable terms or find suitable alternatives, our business, financial condition or results of operations could be negatively impacted.

We have yet to assume the Intersect Beverage, LLC contract with Agaveros Unidos, which we are renegotiating. That contract runs through July 2039 and has set pricing for the tequila and bottling services Agaveros Unidos provides. The contract also includes an exclusivity clause. We are committed to purchase 24,000 9-liter cases in 2020 and 35,000 9-liter cases in 2021. We have no expressed commitments beyond 2021. A breach of this contract, including minimum purchase commitments, could lead to a $2 million penalty and termination of the contract, and result in a failure of the Azuñia Tequila brand. We are currently evaluating our options relating to amending and renegotiating the contract.

Failure of our distributors to distribute our products adequately within their territories

We are required by law to use state-licensed distributors or, in 17 states known as “control states,” state-owned agencies performing this function, to sell our products to retail outlets, including liquor stores, bars, restaurants and national chains in the United States. We have established relationships for our brands with a limited number of wholesale distributors; however, failure to maintain those relationships could significantly and adversely affect our business, sales and growth. We currently distribute our products in 49 states.

| 17 |

Over the past decade there has been increasing consolidation, both intrastate and interstate, among distributors. As a result, many states now have only two or three significant distributors. Also, there are several distributors that now control distribution for several states. If we fail to maintain good relations with a distributor, our products could, in some instances be frozen out of one or more markets entirely. The ultimate success of our products also depends in large part on our distributors’ ability and desire to distribute our products to our desired U.S. target markets, as we rely significantly on them for product placement and retail store penetration. In addition, all of our distributors also distribute competitive brands and product lines. We cannot assure you that our U.S. distributors will continue to purchase our products, commit sufficient time and resources to promote and market our brands and product lines, or that they can or will sell them to our desired or targeted markets. If they do not, our sales will be harmed, resulting in a decline in our results of operations.

Failure of our products to secure and maintain listings in the control states

In the control states, the state liquor commissions act in place of distributors and decide which products are to be purchased and offered for sale in their respective states. Products selected for listing in control states must generally reach certain volumes and/or profit levels to maintain their listings. Products in control states are selected for purchase and sale through listing procedures, which are generally made available to new products only at periodically scheduled listing interviews. Products not selected for listings can only be purchased by consumers in the applicable control state through special orders, if at all. If, in the future, we are unable to maintain our current listings in the control states, or secure and maintain listings in those states for any additional products we may develop or acquire, sales of our products could decrease significantly, which would have a material adverse financial effect on our results of operations and financial condition.

Failure to maintain adequate inventory levels

We maintain relatively large inventories of our product aging in barrels, as well as, to meet customer delivery requirements. We have used our barreled spirits inventory at market value as collateral in our financing. If we do not make timely payments on our financing obligations, or we breach our covenants in any financing document, including maintaining loan-to-value ratios, the lenders may foreclose and take possession of our inventory. In addition, this inventory is always at risk of loss due to theft, fire, evaporation, spoilage, or other damage, and any such loss, whether insured against or not, could cause us to fail to meet our orders and harm our sales and operating results. Also, our inventory may become obsolete as we introduce new products, cease to produce old products or modify the design of our products’ packaging, which would increase our operating losses and negatively impact our results of operations.

Failure to acquire additional distilleries, brands, or products that are complementary to our existing portfolio

A component of our growth strategy may be the acquisition of additional brands that are complementary to our existing portfolio through the acquisition of such brands or their corporate owners, directly as brand acquisitions or through mergers, joint ventures, long-term exclusive distribution arrangements and/or other strategic relationships. For example, in September 2019, we acquired the high-end, luxury tequila brand, Azuñia, to complement our portfolio and provide us with a brand in the high-growth tequila category. In addition, we acquired MotherLode in March 2017, which provides contract canning, bottling and packaging services for existing and emerging spirits producers, and in January 2019, we completed the acquisition of Craft Canning, which significantly adds to our contract canning, bottling and packaging services. If we are unable to identify or have the financial ability to acquire suitable brand candidates and successfully execute our acquisition strategy, our growth will be limited. In addition, our entry into and expansion of our contract bottling, canning, and packaging services as a result of our acquisitions of MotherLode and Craft Canning may not be successful, and we may not realize the benefits of these co-packing operations and may face certain risks, including safety concerns, product contamination, and equipment malfunctions or breakdowns, among other things associated with our manufacturing operations. In addition, if our bottling, canning, or packaging services fail to meet our customers’ expectations, or there is an overall decline in demand for bottling, canning, or packaging services, our reputation, business, results of operations and financial condition could be adversely affected.

If we are successful in acquiring additional brands or related service businesses, we may still fail to achieve our target margins or maintain profitability levels that would justify our investment in those additional brands or services or fail to realize operating and economic efficiencies or other planned benefits with respect to those additional brands or services. For Craft Canning, we will need to provide increased capital to expand operations and for Azuñia Tequila we will need to increase our gross profit margins substantially, grow sales, reduce cost and leverage distribution to become cash flow positive.

| 18 |

The addition of new products or businesses entails numerous risks with respect to integration and other operating issues, any of which could have a detrimental effect on our results of operations and/or the value of our equity. These risks include, but are not limited to, the following:

| ● | difficulties in assimilating acquired operations or products, including failure to realize synergies; | |

| ● | failure to realize or anticipate benefits or to execute on our planned strategy for the acquired brand or business; | |

| ● | unanticipated costs that could materially adversely affect our results of operations; | |

| ● | negative effects on reported results of operations from acquisition-related charges and amortization of acquired intangibles; |

| ● | diversion of management’s attention from other business concerns; | |

| ● | adverse effects on existing business relationships with suppliers, distributors and retail customers; | |

| ● | risks of entering new markets or markets in which we have limited prior experience; and | |

| ● | the potential inability to retain and motivate key employees of acquired businesses. |

Our ability to grow through the acquisition of additional brands is also dependent upon identifying acceptable acquisition targets and opportunities, our ability to consummate prospective transactions on favorable terms, or at all, and the availability of capital to complete the necessary acquisition arrangements. We intend to finance our brand acquisitions through a combination of our available cash resources, third-party financing and, in appropriate circumstances, the further issuance of equity and/or debt securities. Acquiring additional brands could have a significant effect on our financial position and could cause substantial fluctuations in our quarterly and yearly operating results. Also, acquisitions could result in the recording of significant goodwill and intangible assets on our financial statements, the amortization or impairment of which would reduce reported earnings in subsequent years.

Failure to protect our trademarks and trade secrets

Our business and prospects depend in part on our ability to develop favorable consumer recognition of our brands and trademarks. Although we apply for registration of our brands and trademarks, they could be imitated in ways that we cannot prevent. Also, we rely on trade secrets and proprietary know-how, concepts and formulas. Our methods of protecting this information may not be adequate. Moreover, we may face claims of misappropriation or infringement of third parties’ rights that could interfere with our use of this information. Defending these claims may be costly and, if unsuccessful, may prevent us from continuing to use this proprietary information in the future and result in a judgment or monetary damages being levied against us. We do not maintain non-competition agreements with all of our key personnel or with some of our key suppliers. If competitors independently develop or otherwise obtain access to our trade secrets, proprietary know-how or recipes, the appeal, and thus the value, of our brand portfolio could be reduced, negatively impacting our sales and growth potential.

Failure of our key or service product information technology systems, cyber-security breach or cyber-related fraud

We rely on information technology (“IT”) systems, networks, and services, including internet sites, data hosting and processing facilities and tools, hardware (including laptops and mobile devices), and software and technical applications and platforms, some of which are managed, hosted, provided and/or used by third-parties or their vendors, to assist us in the management of our business.

| 19 |

Increased IT security threats and more sophisticated cyber-crime pose a potential risk to the security of our IT systems, networks, and services, as well as to the confidentiality, availability, and integrity of our data. If the IT systems, networks, or service providers we rely upon fail to function properly, or if we suffer a loss or disclosure of business or other sensitive information, due to any number of causes, ranging from catastrophic events to power outages to security breaches, and our business continuity plans do not effectively address these failures on a timely basis, we may suffer interruptions in our ability to manage operations and reputational, competitive and/or business harm, which may adversely affect our business operations and/or financial condition. In addition, such events could result in unauthorized disclosure of material confidential information, and we may suffer financial and reputational damage because of lost or misappropriated confidential information belonging to us or to our partners, our employees, customers, suppliers, or consumers. In any of these events, we could also be required to spend significant financial and other resources to remedy the damage caused by a security breach or to repair or replace networks and IT systems.

Negative impact of litigation and litigation risks

From time to time, we become involved in various litigation matters and claims, including employment, regulatory proceedings, administrative proceedings, governmental investigations, and contract disputes. We face potential claims or liability for, among other things, breach of contract, defamation, libel, fraud, or negligence. We may also face employment-related litigation, including claims of age discrimination, sexual harassment, gender discrimination, immigration violations, or other local, state, and federal labor law violations. Because of the uncertain nature of litigation and insurance coverage decisions, the outcome of such actions and proceedings cannot be predicted with certainty and an unfavorable resolution of one or more of them could have a material adverse effect on our business, financial condition, results of operations, cash flows, reputation, brand identity and the trading price of our securities. Any such litigation, with or without merit, could also result in substantial expenditures of time and money, and divert attention of our management team from other tasks important to the success of our business.

On December 15, 2020, Grover Wickersham filed a complaint in the United States District Court for the District Court of Oregon against the Company. Mr. Wickersham, the former CEO and Chairman of the Board of the Company, has asserted causes of action for fraud in the inducement, breach of contract, breach of the implied covenant of good faith and fair dealing, defamation, interference with economic advantage, elder financial abuse, and dissemination of false and misleading proxy materials The Company disputes the allegations and intends to defend the case vigorously.

RISKS RELATED TO OUR INDUSTRY

Demand for our products may be adversely affected by changes in category trends and consumer preferences

Consumer preferences may shift due to a variety of factors, including changes in demographic and social trends, public health initiatives, product innovations, changes in vacation or leisure, dining and beverage consumption patterns and a downturn in economic conditions, any or all of which may reduce consumers’ willingness to purchase distilled spirits or cause a shift in consumer preferences toward beer, wine or non-alcoholic beverages or other products. Our success depends in part on fulfilling available opportunities to meet consumer needs and anticipating changes in consumer preferences with successful new products and product innovations.

In addition, the legalization of marijuana in any of the jurisdictions in which we sell our products may result in a reduction in sales. Studies have shown that sales of alcohol may decrease in jurisdictions where marijuana has been legalized (e.g. Alaska, Arizona, California, Colorado, Illinois, Maine, Massachusetts, Michigan, Montana, Nevada, Oregon, Vermont, Washington and the District of Columbia). As a result, marijuana sales may adversely affect our sales and profitability.

We face substantial competition in our industry

We compete on the basis of product taste and quality, brand image, price, service and ability to innovate in response to consumer preferences. The global spirits industry is highly competitive and is dominated by several large, well-funded international companies. Many of our current and potential competitors have longer operating histories and have substantially greater financial, sales, marketing and other resources than we do, as well as larger installed customer bases, greater name recognition and broader product offerings. Some of these competitors can devote greater resources to the development, promotion, sale and support of their products. As a result, it is possible that our competitors may either respond to industry conditions or consumer trends more rapidly or effectively or resort to price competition to sustain market share, which could adversely affect our sales and profitability.

| 20 |

Class actions or other litigation relating to alcohol abuse or the misuse of alcohol