Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - OLD DOMINION ELECTRIC COOPERATIVE | cik0000885568-ex322_9.htm |

| EX-32.1 - EX-32.1 - OLD DOMINION ELECTRIC COOPERATIVE | cik0000885568-ex321_7.htm |

| EX-31.2 - EX-31.2 - OLD DOMINION ELECTRIC COOPERATIVE | cik0000885568-ex312_10.htm |

| EX-31.1 - EX-31.1 - OLD DOMINION ELECTRIC COOPERATIVE | cik0000885568-ex311_8.htm |

V

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-50039

OLD DOMINION ELECTRIC COOPERATIVE

(Exact name of Registrant as specified in its charter)

|

VIRGINIA |

|

23-7048405 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. employer identification no.) |

|

|

|

|

|

4201 Dominion Boulevard, Glen Allen, Virginia |

|

23060 |

|

(Address of principal executive offices) |

|

(Zip code) |

(804) 747-0592

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act? Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act (the “Exchange Act”). Yes ☒ No ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☐ |

|

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant. NONE

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock. The Registrant is a membership corporation and has no authorized or outstanding equity securities.

Documents incorporated by reference: NONE

OLD DOMINION ELECTRIC COOPERATIVE

2020 ANNUAL REPORT ON FORM 10-K

|

Item Number |

|

|

|

Page Number |

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

|

4 |

|

|

1A. |

|

|

15 |

|

|

1B. |

|

|

21 |

|

|

2. |

|

|

21 |

|

|

3. |

|

|

22 |

|

|

4. |

|

|

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

24 |

|

|

6. |

|

|

24 |

|

|

7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

26 |

|

7A. |

|

|

41 |

|

|

8. |

|

|

43 |

|

|

9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

72 |

|

9A. |

|

|

72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

|

|

73 |

|

|

11. |

|

|

76 |

|

|

12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

84 |

|

13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

84 |

|

14. |

|

|

85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|

|

86 |

|

|

16. |

|

|

89 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following abbreviations or acronyms used in this Form 10-K are defined below:

|

Abbreviation or Acronym |

Definition |

|

ACE |

Affordable Clean Energy rule |

|

ACES |

Alliance for Cooperative Energy Services Power Marketing, LLC |

|

Alstom |

Alstom Power, Inc. |

|

ASU |

Accounting Standards Update |

|

CAA |

Clean Air Act |

|

CCRs |

Coal combustion residuals |

|

CEC |

Choptank Electric Cooperative, Inc. |

|

CEO |

Chief Executive Officer |

|

CFO |

Chief Financial Officer |

|

Clover |

Clover Power Station |

|

CO2 |

Carbon dioxide |

|

COO |

Chief Operating Officer |

|

CSAPR |

Cross-State Air Pollution Rule |

|

DEC |

Delaware Electric Cooperative, Inc. |

|

DPSC |

Delaware Public Service Commission |

|

DOE |

United States Department of Energy |

|

EPA |

Environmental Protection Agency |

|

EPC |

Engineering, procurement, and construction |

|

EPRS |

Essential Power Rock Springs, LLC |

|

FASB |

Financial Accounting Standards Board |

|

FERC |

Federal Energy Regulatory Commission |

|

Fitch |

Fitch Ratings, Inc. |

|

GAAP |

Accounting principles generally accepted in the United States |

|

GHG |

Greenhouse gases |

|

Indenture |

Second Amended and Restated Indenture of Mortgage and Deed of Trust, dated January 1, 2011, of ODEC with Branch Banking and Trust Company, as trustee, as amended and supplemented |

|

IRC |

Internal Revenue Code of 1986, as amended |

|

LIBOR |

London Interbank Offered Rate |

|

Louisa |

Louisa Power Station |

|

Marsh Run |

Marsh Run Power Station |

|

Mitsubishi |

Mitsubishi Hitachi Power Systems Americas, Inc. |

|

Moody’s |

Moody’s Investors Service |

|

MPSC |

Maryland Public Service Commission |

|

MW |

Megawatt(s) |

|

MWh |

Megawatt hour(s) |

|

NERC |

North American Electric Reliability Corporation |

|

North Anna |

North Anna Nuclear Power Station |

|

North Anna Unit 3 |

A potential additional nuclear-powered generating unit at North Anna |

|

|

|

|

NOVEC |

Northern Virginia Electric Cooperative |

|

NOx |

Nitrogen oxide |

|

NRC |

United States Nuclear Regulatory Commission |

|

NRECA |

National Rural Electric Cooperative Association |

|

NYMEX |

New York Mercantile Exchange |

|

ODEC, We, Our, Us |

Old Dominion Electric Cooperative |

|

PJM |

PJM Interconnection, LLC |

|

PPA |

Pension Protection Act |

|

REC |

Rappahannock Electric Cooperative |

|

RGGI |

Regional Greenhouse Gas Initiative |

2

|

Abbreviation or Acronym |

Definition |

|

Rock Springs |

Rock Springs Power Station |

|

RPM |

Reliability Pricing Model |

|

RPS |

Renewable portfolio standards |

|

RTO |

Regional transmission organization |

|

RUS |

United States Department of Agriculture Rural Utilities Service |

|

S&P |

Standard & Poor’s Financial Services LLC |

|

SEPA |

Southeastern Power Administration |

|

SO2 |

Sulfur dioxide |

|

SVEC |

Shenandoah Valley Electric Cooperative |

|

TEC |

TEC Trading, Inc. |

|

VAPCB |

Virginia Air Pollution Control Board |

|

Virginia Power |

Virginia Electric and Power Company |

|

VSCC |

Virginia State Corporation Commission |

|

Wildcat Point |

Wildcat Point Generation Facility |

|

WOPC |

White Oak Power Constructors |

|

XBRL |

Extensible Business Reporting Language |

3

OVERVIEW

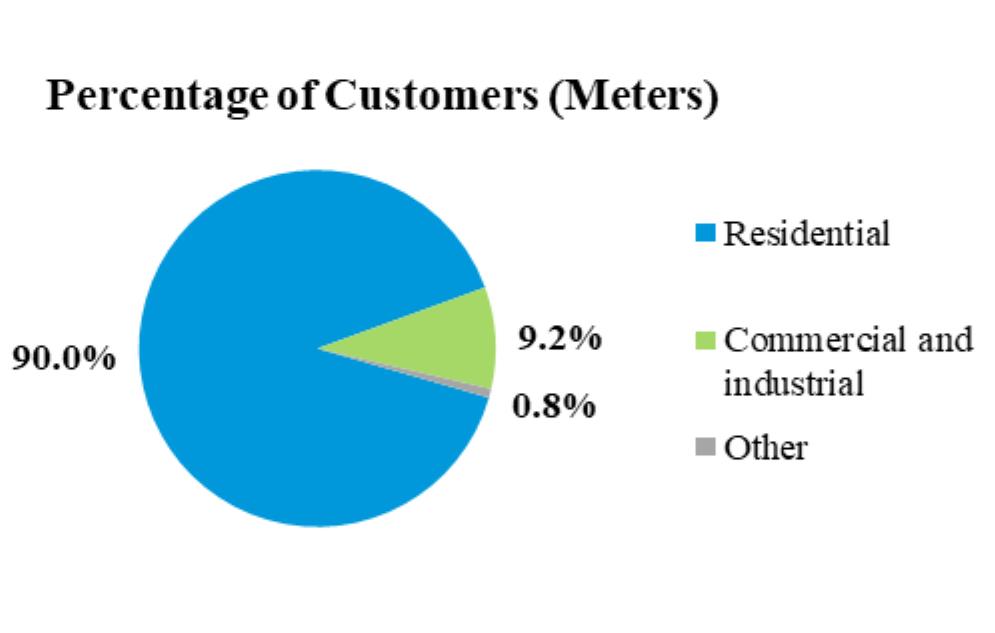

Old Dominion Electric Cooperative was incorporated under the laws of the Commonwealth of Virginia in 1948 as a not-for-profit wholesale power supply cooperative. We are organized for the purpose of supplying the power our member distribution cooperatives require to serve their customers on a cost-effective basis. We serve their power requirements pursuant to long-term, all-requirements wholesale power contracts. Through our member distribution cooperatives, we served approximately 600,000 retail electric customers (meters), representing a total population of approximately 1.5 million people in 2020.

We supply our member distribution cooperatives’ power requirements, consisting of demand requirements and energy requirements, through a portfolio of resources including owned generating facilities, power purchase contracts, and spot market energy purchases. Our generating facilities are fueled by a mix of natural gas, nuclear, coal, and fuel oil. We are a member of a regional transmission organization, PJM, and we participate in its energy, capacity, and transmission services markets to serve our member distribution cooperatives. See “Power Supply Resources” below and properties in Item 2 for a description of these resources.

We are owned entirely by our members, which are the primary purchasers of the power we sell. We have two classes of members. Our Class A members are customer-owned electric distribution cooperatives that supply the power requirements of their retail customers. Our sole Class B member is TEC, a taxable corporation owned by our member distribution cooperatives. Our member distribution cooperatives primarily serve rural, suburban, and recreational areas of the mid-Atlantic region. See “Members—Service Territories and Customers” below.

We are a power supply cooperative. In general, a cooperative is a business organization owned by its members, which are also either the cooperative’s wholesale or retail customers. Cooperatives are designed to give their members the opportunity to satisfy their collective needs in a particular area of business more effectively than if the members acted independently. As not-for-profit organizations, cooperatives are intended to provide services to their members on a cost-effective basis, in part by eliminating the need to produce profits or a return on equity in excess of required margins. Margins earned by a cooperative that are not distributed to its members constitute patronage capital, a cooperative’s principal source of equity. Patronage capital is held for the account of the members without interest and returned when the board of directors of the cooperative deems it appropriate to do so.

Electric distribution cooperatives form power supply cooperatives to acquire power supply resources, typically through the construction of generating facilities or the development of other power purchase arrangements, at a lower cost than if they were acquiring those resources alone.

We are a not-for-profit electric cooperative and currently are exempt from federal income taxation under IRC Section 501(c)(12).

MEMBERS

Member Distribution Cooperatives

General

Our member distribution cooperatives provide electric services, consisting of power supply, transmission services, and distribution services (including metering and billing services) to residential, commercial, and industrial customers. We have eleven member distribution cooperatives that serve customers in 70 counties in Virginia, Delaware, and Maryland. The member distribution cooperatives’ distribution business involves the operation of substations, transformers, and electric lines that deliver power to their customers.

4

Eight of our member distribution cooperatives provide electric services on the Virginia mainland:

BARC Electric Cooperative

Community Electric Cooperative

Mecklenburg Electric Cooperative

Northern Neck Electric Cooperative

Prince George Electric Cooperative

Rappahannock Electric Cooperative

Shenandoah Valley Electric Cooperative

Southside Electric Cooperative

Three of our member distribution cooperatives provide electric services on the Delmarva Peninsula:

A&N Electric Cooperative in Virginia

Choptank Electric Cooperative, Inc. in Maryland

Delaware Electric Cooperative, Inc. in Delaware

The member distribution cooperatives are not our subsidiaries, but rather our owners. We have no interest in their assets, liabilities, equity, revenues, or margins.

Revenues from our member distribution cooperatives and the percentage each contributed to total revenues from sales to our member distribution cooperatives in 2020 were as follows:

|

Member Distribution Cooperatives |

|

Revenues |

|

|||

|

|

|

(in millions) |

|

|

|

|

|

Rappahannock Electric Cooperative |

|

$ |

237.6 |

|

30.8 |

% |

|

Shenandoah Valley Electric Cooperative |

|

|

144.5 |

|

18.7 |

|

|

Delaware Electric Cooperative, Inc. |

|

|

110.0 |

|

14.3 |

|

|

Choptank Electric Cooperative, Inc. |

|

|

73.7 |

|

9.6 |

|

|

Southside Electric Cooperative |

|

|

56.9 |

|

7.4 |

|

|

A&N Electric Cooperative |

|

|

48.0 |

|

6.2 |

|

|

Mecklenburg Electric Cooperative |

|

|

36.8 |

|

4.8 |

|

|

Prince George Electric Cooperative |

|

|

22.9 |

|

3.0 |

|

|

Northern Neck Electric Cooperative |

|

|

20.2 |

|

2.6 |

|

|

Community Electric Cooperative |

|

|

11.0 |

|

1.4 |

|

|

BARC Electric Cooperative |

|

|

9.2 |

|

1.2 |

|

|

Total |

|

$ |

770.8 |

|

100.0 |

% |

In 2020, there was no individual customer of any of our member distribution cooperatives that constituted 1% or more of our revenues from our member distribution cooperatives.

Service Territories and Customers

The territories served by our member distribution cooperatives cover large portions of Virginia, Delaware, and Maryland. These service territories range from the extended suburbs of Washington, D.C. to the North Carolina border and from the Atlantic shores of Virginia, Delaware, and Maryland to the Appalachian Mountains.

Our member distribution cooperatives’ service territories encompass primarily rural, suburban, and recreational areas. Our member distribution cooperatives’ customers’ requirements for capacity and energy generally are seasonal and increase in winter and summer as home heating and cooling needs increase and then decline in the spring and fall as the weather becomes milder. Our member distribution cooperatives also serve major industries which include manufacturing, poultry, telecommunications, agriculture, forestry and wood products, health care, and recreation.

5

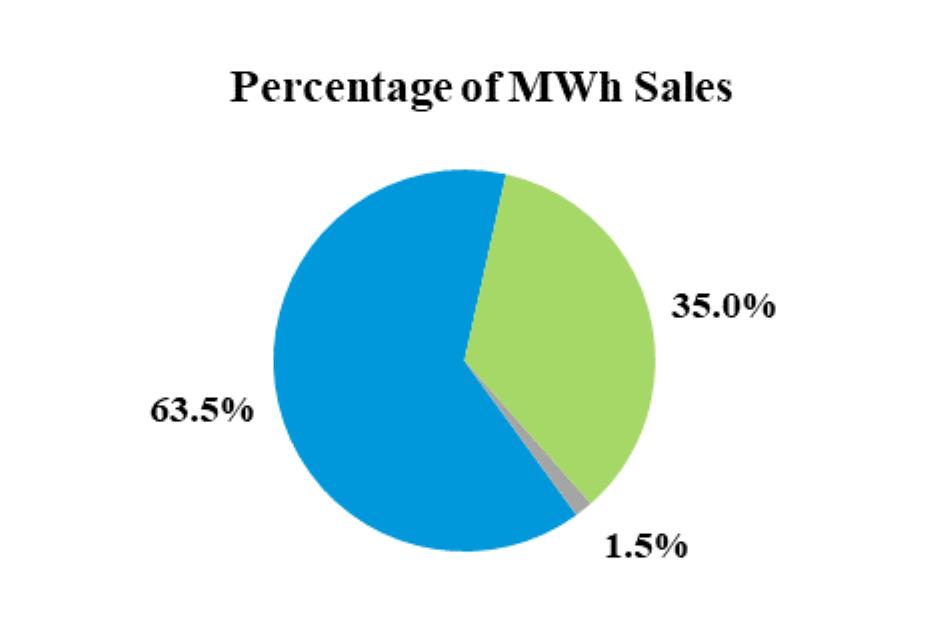

Our member distribution cooperatives’ sales of energy in 2020 totaled approximately 11,500,000 MWh. These sales were divided by customer class as follows:

From 2015 through 2020, our eleven member distribution cooperatives experienced a compound annual growth rate of 1.9% in the number of customers (meters) and energy sales measured in MWh was relatively flat.

Our eleven member distribution cooperatives’ average number of customers per mile of energized line has been relatively unchanged from 2015 to 2020 at approximately 9.5 customers per mile. System densities of our member distribution cooperatives in 2020 ranged from 6.3 customers per mile in the service territory of BARC Electric Cooperative to 14.6 customers per mile in the service territory of A&N Electric Cooperative. In 2020, the average service density for all electric distribution cooperatives in the United States was approximately 8 customers per mile.

Delaware and Maryland each currently grant all retail customers the right to choose their power supplier. Virginia currently grants a limited number of large retail customers the right to choose their power suppliers and then only in very limited circumstances. The laws of each state grant utilities, including our member distribution cooperatives, the exclusive right to provide transmission and distribution (including metering and billing) services and to be the default providers of power to their customers in service territories certified by their respective state public service commissions. See “Regulation of Member Distribution Cooperatives” and “Competition” below.

Wholesale Power Contracts

Our financial relationships with our member distribution cooperatives are based primarily on our contractual arrangements for the supply of power and related transmission and ancillary services. These arrangements are set forth in our wholesale power contracts with our member distribution cooperatives that are effective until January 1, 2054, and beyond this date unless either party gives the other at least three years notice of termination. The wholesale power contracts are all-requirements contracts. Each contract obligates us to sell and deliver to a member distribution cooperative, and obligates that member distribution cooperative to purchase and receive from us, all power that it requires for the operation of its system, with limited exceptions, to the extent that we have the power and facilities available to do so.

An exception to the all-requirements obligations of our member distribution cooperatives relates to the ability of our eight mainland Virginia member distribution cooperatives to purchase hydroelectric power allocated to them from SEPA, a federal power marketing administration. We estimate that purchases under this exception constituted less than 3% of our member distribution cooperatives’ total energy requirements in 2020.

There are two additional limited exceptions to the all-requirements nature of the contracts. One exception permits each of our member distribution cooperatives to receive up to the greater of 5% of its demand and associated energy or 5 MW and associated energy from its owned generation or from other suppliers. The other exception permits our member distribution cooperatives to purchase additional power from other suppliers in limited circumstances following approval by our board of directors. As of December 31, 2020, none of our member distribution cooperatives had utilized this latter exception.

6

If all of our member distribution cooperatives elected to fully utilize the 5% or 5 MW exception, we estimate the current impact would be a reduction of approximately 178 MW of demand and associated energy. The following table summarizes the cumulative removal of load requirements under this exception.

|

As of December 31, |

|

MW |

|

|

|

2018 |

|

|

107 |

|

|

2019 |

|

|

108 |

|

|

2020 |

|

|

111 |

|

As of January 1, 2021, the cumulative removal of load requirements under this exception was approximately 140 MW. We do not anticipate that either the current or potential full utilization of this exception by our member distribution cooperatives will have a material impact on our financial condition, results of operations, or cash flows.

Each member distribution cooperative is required to pay us monthly for power furnished under its wholesale power contract in accordance with our formula rate. The formula rate, which has been filed with and accepted by FERC, is designed to recover our total cost of service and create a firm equity base. See “Regulation—Rate Regulation” below and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Factors Affecting Results—Formula Rate” in Item 7.

More specifically, the formula rate is intended to meet all of our costs, expenses, and financial obligations associated with our ownership, operation, maintenance, repair, replacement, improvement, modification, retirement, and decommissioning of our generating plants, transmission system, or related facilities; services provided to the member distribution cooperatives; and the acquisition and transmission of power or related services, including:

|

|

• |

payments of principal and premium, if any, and interest on all indebtedness issued by us (other than payments resulting from the acceleration of the maturity of the indebtedness); |

|

|

• |

any additional cost or expense, imposed or permitted by any regulatory agency; and |

|

|

• |

additional amounts necessary to meet the requirement of any rate covenant with respect to coverage of principal and interest on our indebtedness contained in any indenture or contract with holders of our indebtedness. |

The rates established under the wholesale power contracts are designed to enable us to comply with financing, regulatory, and governmental requirements that apply to us from time to time.

In accordance with the wholesale power contracts, our board of directors will review our formula rate at least every three years to determine if it reflects and recovers all costs and expenses indicated above, and if it represents the best way to allocate these costs and expenses among our member distribution cooperatives. In making this review, our board of directors will consider if the formula rate results in the proper price signals to our member distribution cooperatives. Due to changes in the energy sector generally and PJM specifically, the review of our formula rate often identifies new or changing bases for the costs we incur. We will not modify our formula rate in any manner that would result in a failure to recover all of our costs and other amounts described above.

Regulation of Member Distribution Cooperatives

Of our 11 member distribution cooperatives, eight currently participate in RUS loan or guarantee programs. These member distribution cooperatives have entered into loan documents with RUS that we understand contain affirmative and negative covenants, including with respect to matters such as accounting, issuances of securities, rates and charges for the sale of power, construction or acquisition of facilities, and the purchase and sale of power. In addition, we understand financial covenants in these member distribution cooperatives’ loan documents require them to design rates to achieve an interest coverage ratio and a debt service coverage ratio. Finally, we understand that the principal loan documentation of our member distribution cooperatives that do not participate in RUS loan or guarantee programs contains similar covenants.

Our member distribution cooperatives in Virginia are subject to rate regulation by the VSCC in the provision of electric services to their customers, but they have the ability to pass through changes in their wholesale power costs, including the demand and energy costs we charge our member distribution cooperatives, to their customers. Our Virginia

7

member distribution cooperatives also may adjust their rates for distribution service by a maximum net increase or decrease of 5%, on a cumulative basis, in any three-year period without approval by the VSCC. Additionally, they may make adjustments to their rates to collect fixed costs through a new or modified fixed monthly charge rather than through volumetric charges associated with energy usage, so long as such adjustments are revenue neutral.

Our Delaware and Maryland member distribution cooperatives are not regulated by their respective public service commissions, including with respect to wholesale power costs which are a pass-through to their customers.

We are not subject to any RPS; however, DEC has committed to comply with the Delaware RPS even though it is not required by law to do so, which it meets through purchases of renewable energy credits, and owned and purchased resources pursuant to the 5% or 5 MW exception in its wholesale power contract with us. See “Wholesale Power Contracts” above.

Competition

Delaware and Maryland each have laws unbundling the power component (also known as the generation component) of electric service to retail customers, while maintaining regulation of transmission and distribution services. All retail customers in Delaware, including customers of DEC, are currently permitted to purchase power from a registered supplier only after DEC approves the supplier’s ability to do business in its service territory. All retail customers in Maryland, including customers of CEC, are currently permitted to purchase power from the registered supplier of their choice. As of March 1, 2021, no retail customer of DEC or CEC has switched to an alternative power supplier.

In Virginia, retail choice in the selection of a power supplier is available to customers that consume at least 5 MW of power individually or in the aggregate (with aggregation subject to the approval of the VSCC) and that do not account for more than 1% of the incumbent utility's peak load during the past year. Currently, one 5 MW customer of one of our member distribution cooperatives has elected to choose an alternate supplier under this provision. Retail choice is also available to any Virginia customer whose noncoincident peak demand exceeds 90 MW. Additionally, all Virginia retail customers may select an alternative power supplier that provides 100% renewable energy if their incumbent utility, such as one of our member distribution cooperatives, does not offer this same option. As of December 31, 2020, eight of our nine Virginia member distribution cooperatives provided this option.

Currently, we do not anticipate that any of these limited rights to retail choice of our member distribution cooperatives’ customers, individually or in the aggregate, will have a material impact on our financial condition, results of operations, or cash flows.

TEC

TEC is owned by our member distribution cooperatives and currently is our only Class B member. We have a power sales contract with TEC under which we may sell to TEC power that we do not need to meet the needs of our member distribution cooperatives. TEC then sells this power to the market under market-based rate authority granted by FERC. In recent years, we have had no sales to TEC and TEC has had no sales to third parties. Additionally, we have a separate contract under which we may purchase natural gas from TEC; however, we have not purchased natural gas from TEC in recent years. TEC does not engage in speculative trading.

8

POWER SUPPLY RESOURCES

General

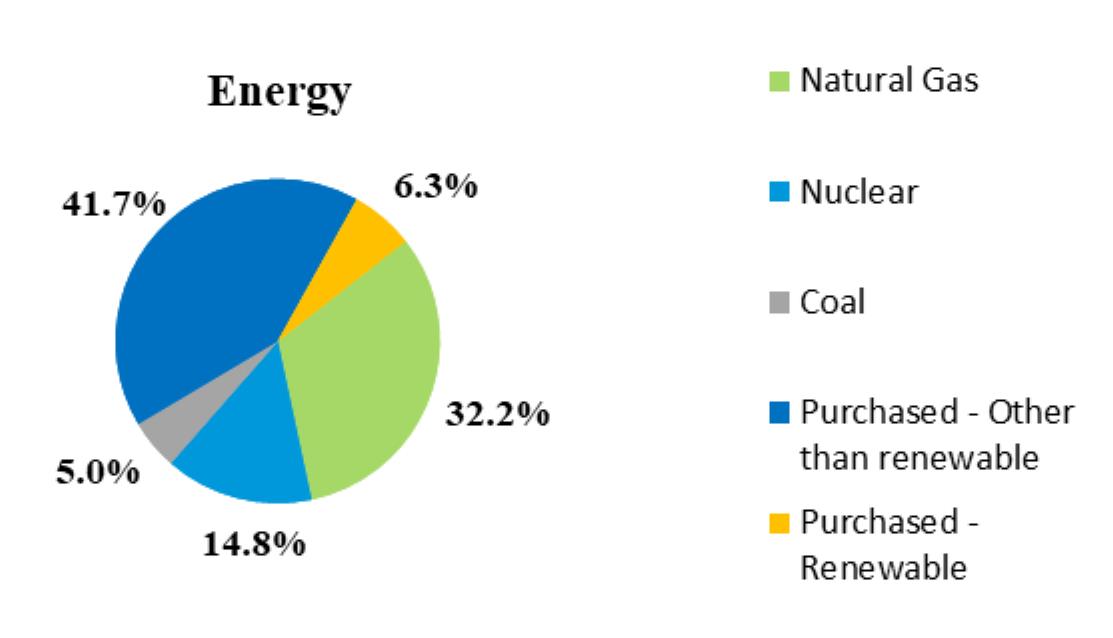

We provide power to our members through a combination of our interests in Wildcat Point, a natural gas-fired combined cycle generation facility; North Anna, a nuclear power station; Clover, a coal-fired generation facility; two natural gas-fired combustion turbine facilities (Louisa and Marsh Run, and prior to September 14, 2018, Rock Springs); diesel-fired distributed generation facilities; and physically-delivered forward power purchase contracts and spot market energy purchases. Our energy supply resources for the past three years were as follows:

|

|

|

Year Ended December 31, |

|||||||||||

|

|

|

2020 |

|

2019 |

|

2018 |

|||||||

|

|

|

(in MWh and percentages) |

|||||||||||

|

Generated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wildcat Point (1) |

|

3,030,617 |

|

24.5 |

% |

3,400,633 |

|

27.2 |

% |

3,126,313 |

|

23.0 |

% |

|

North Anna |

|

1,832,792 |

|

14.8 |

|

1,777,573 |

|

14.2 |

|

1,855,680 |

|

13.7 |

|

|

Clover |

|

620,324 |

|

5.0 |

|

640,119 |

|

5.1 |

|

1,437,719 |

|

10.6 |

|

|

Louisa |

|

360,984 |

|

3.0 |

|

494,283 |

|

4.0 |

|

544,390 |

|

4.0 |

|

|

Marsh Run |

|

582,648 |

|

4.7 |

|

716,390 |

|

5.8 |

|

572,434 |

|

4.2 |

|

|

Rock Springs (2) |

|

— |

|

— |

|

— |

|

— |

|

212,957 |

|

1.6 |

|

|

Distributed Generation |

|

2,536 |

|

— |

|

2,327 |

|

— |

|

1,434 |

|

— |

|

|

Total Generated |

|

6,429,901 |

|

52.0 |

|

7,031,325 |

|

56.3 |

|

7,750,927 |

|

57.1 |

|

|

Purchased: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other than renewable: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term and short-term |

|

2,715,944 |

|

22.0 |

|

2,665,167 |

|

21.3 |

|

2,924,477 |

|

21.5 |

|

|

Spot market |

|

2,438,563 |

|

19.7 |

|

2,047,654 |

|

16.4 |

|

2,091,063 |

|

15.4 |

|

|

Total Other than renewable |

|

5,154,507 |

|

41.7 |

|

4,712,821 |

|

37.7 |

|

5,015,540 |

|

36.9 |

|

|

Renewable (3) |

|

784,224 |

|

6.3 |

|

752,405 |

|

6.0 |

|

808,052 |

|

6.0 |

|

|

Total Purchased |

|

5,938,731 |

|

48.0 |

|

5,465,226 |

|

43.7 |

|

5,823,592 |

|

42.9 |

|

|

Total Available Energy |

|

12,368,632 |

|

100.0 |

% |

12,496,551 |

|

100.0 |

% |

13,574,519 |

|

100.0 |

% |

|

|

(1) |

Wildcat Point achieved commercial operation on April 17, 2018. |

|

|

(2) |

Rock Springs and related assets were sold on September 14, 2018. |

|

|

(3) |

Related to our contracts from renewable facilities from which we obtain renewable energy credits. We may sell these renewable energy credits to our member distribution cooperatives and non-members. |

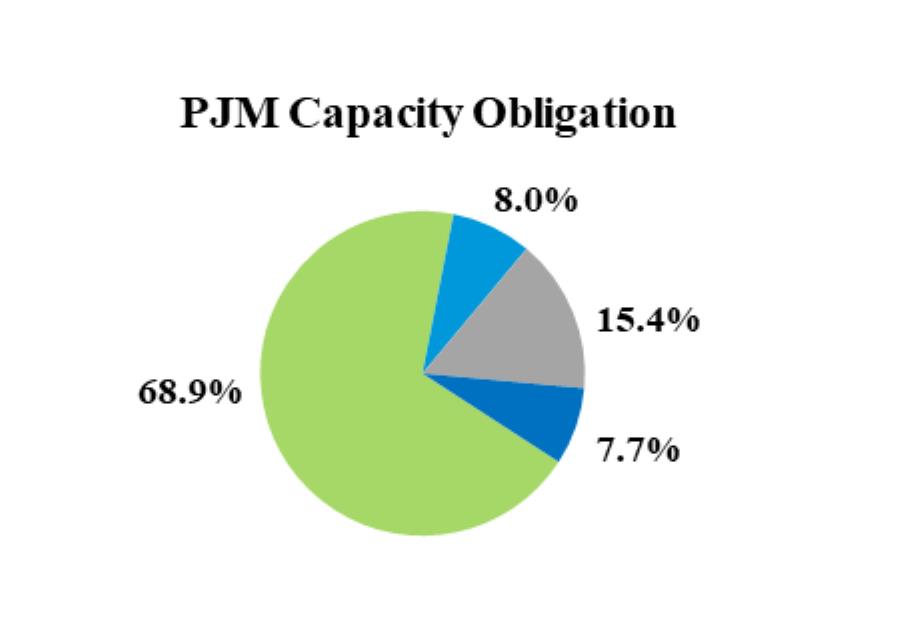

In 2020, our generating facilities satisfied approximately 92.3% of our weighted average PJM capacity obligation of approximately 2,712 MW. For a description of our generating facilities, see Item 2. In 2020, we satisfied the remainder of our PJM capacity obligation through the PJM RPM capacity auction process and purchased capacity contracts. See “PJM” below. The energy requirements not met by our owned generating facilities were obtained from multiple suppliers under various long-term and short-term physically-delivered forward power purchase contracts and spot market purchases. See “Power Purchase Contracts” below.

9

Our total available energy and total PJM capacity obligation resources by fuel type and purchase type for 2020 are detailed below:

We plan to continue purchasing energy in the future by utilizing a combination of physically-delivered forward power purchase contracts, as well as spot market purchases. As we have done in the past, we expect to adjust our portfolio of power supply resources to reflect our projected power requirements and changes in the market. To assist us in these efforts, we engage ACES, an energy trading and risk management company. Specifically, ACES assists us in negotiating power purchase contracts, evaluating the credit risk of counterparties, modeling our power requirements, bidding and dispatch of the generating facilities that we operate, and executing and settling energy transactions. See “Market Price Risk” in Item 7A.

Power Supply Planning and CO2 Emission Goals

By utilizing various long-term and short-term planning processes and models, we continually evaluate power supply options available to us to meet the needs of our member distribution cooperatives. We have policies that establish targets that define how our projected power needs will be met, and one of the ways we manage these targets is the utilization of hedging. We use hedging instruments, including forwards, futures, financial transmission rights, and options, to manage our power and fuel market price risks. These hedging instruments have varying time periods ranging from one month to multiple years in advance. We also evaluate other power supply options including the acquisition, development, or disposition of generating facilities.

As part of our ongoing power supply planning process, on February 3, 2021, we announced a goal to achieve net zero CO2 emissions by 2050, and set an interim goal to reduce our carbon intensity (pounds of CO2 emitted per MWh) by 50% (from 2005 levels) by 2030. As of December 31, 2020, we have reduced our carbon intensity by approximately 44% from 2005 levels.

PJM

PJM is an RTO that coordinates the transmission of wholesale electricity in all or parts of 13 states in the eastern United States and the District of Columbia. As a federally regulated RTO, PJM must act independently and impartially in managing the regional transmission system and the wholesale electricity market. PJM is primarily responsible for ensuring the reliability of the largest centrally dispatched energy market in North America. PJM coordinates the continuous buying, selling, and delivery of wholesale electricity throughout its members’ service territories. PJM system operators continuously conduct dispatch operations and monitor the status of the transmission grid of its participants. PJM also oversees a regional planning process for transmission expansion to ensure the continued reliability of the PJM electric system. PJM coordinates and establishes policies for the generation, purchase, and sale of capacity and energy in the control areas of its members.

All of our member distribution cooperatives’ service territories are located in PJM. As a member of PJM, we are subject to the operations of PJM, and our generating facilities are under dispatch direction of PJM. We transmit power to our member distribution cooperatives through the transmission facilities subject to operational control of PJM. We have agreements with PJM that provide us with access to transmission facilities under PJM’s operational control as necessary to deliver energy to our member distribution cooperatives. We own a limited amount of transmission facilities. See “Transmission” in Item 2.

10

PJM balances its participants’ power requirements with the power resources available to supply those requirements. Based on this evaluation of supply and demand, PJM schedules and dispatches available generating facilities throughout its region in a manner intended to meet the demand for energy in the most reliable and cost-effective manner. Thus, PJM directs the dispatch of these facilities even though it does not own them. When PJM cannot dispatch the most economical generating facilities due to transmission constraints, PJM will dispatch more expensive generating facilities to meet the required power requirements. PJM participants whose power requirements cause the redispatch are obligated to pay the additional costs to dispatch the more expensive generating facilities. These additional costs are commonly referred to as congestion costs. PJM conducts the auction of financial transmission rights for future periods to provide market participants an opportunity to hedge these congestion costs.

The PJM energy market consists of day-ahead and real-time markets. PJM’s day-ahead market is a forward market in which hourly locational marginal prices are calculated for the following day based on the prices at which the owners of generating facilities, including ODEC, offer to run their facilities to meet the requirements of energy customers. PJM’s real-time market is a spot market in which current locational marginal prices are calculated at five-minute intervals for generating facilities and hourly for participants’ power requirements.

PJM rules require that load serving entities, such as ODEC, meet certain minimum capacity obligations. These obligations can be met through a combination of owned generation resources and purchases under bilateral agreements and from forward capacity auctions under PJM’s capacity construct, known as RPM. PJM compensates us for the capacity of our generating facilities made available without regard to whether our generating facilities are dispatched. The purpose of PJM’s capacity construct is to develop a longer-term pricing program for capacity resources, to provide localized pricing for capacity, and to reduce the resulting investment risk to owners of generating resources, thus encouraging new investment in generating facilities. The value of capacity resources can vary by location and RPM provides for the recognition of the locational value. To date, PJM has conducted capacity auctions for capacity to be supplied through May 31, 2022. Each annual auction is typically held 36 months before each subsequent delivery year, and incremental auctions may be held at prescribed dates after the base residual auction for each delivery year to adjust for changes to the load forecast and the availability of capacity. However, capacity auctions were suspended until PJM complied with FERC’s ruling on PJM’s Minimum Offer Price Rule. The next capacity auction is scheduled for May 2021 for the 2022/2023 delivery year. Subsequent auctions are currently scheduled to be held on an accelerated basis at approximate six-month intervals and the traditional annual auction process will likely resume in May 2024.

The PJM tariff includes a component referred to as capacity performance, which is intended to improve the reliability of the power grid by increasing the availability of generating units, especially during emergency conditions. Generation owners, such as ODEC, are exposed to significant charges if their generation units do not perform during emergency conditions.

Power Purchase Contracts

We purchase significant amounts of power in the market from investor-owned utilities and power marketers through long-term and short-term physically-delivered forward power purchase contracts. We also purchase power in the spot energy market. This approach to meeting our member distribution cooperatives’ energy requirements is not without risks. See risk factors in Item 1A. To mitigate these risks, we attempt to match our energy purchases with our energy needs to reduce our spot market purchases of energy and sales of excess energy. Additionally, we utilize policies, procedures, and various hedging instruments to manage our power market price risks. These policies and procedures, developed in consultation with ACES, are designed to strike an appropriate balance between minimizing costs and reducing energy cost volatility. See “Market Price Risk” in Item 7A.

We have power purchase contracts for 300 MW from wind, solar, and landfill gas facilities that are operational. We have entered into additional contracts to purchase power from 85 MW of utility-scale solar and greater than 50 MW of distributed solar projects across our service territories in Virginia, Delaware, and Maryland. We currently anticipate that these projects will become operational between 2021 and 2023. Our contracts for renewables allow us to buy output, including renewable energy credits, from the renewable facilities at predetermined prices. We may sell these renewable energy credits to our member distribution cooperatives and non-members. We do not own or operate any of these facilities and are not responsible for their operational costs or performance.

11

Fuel Supply

Natural Gas

Wildcat Point and our combustion turbine facilities are fueled by natural gas and are located adjacent to natural gas transmission pipelines. We are responsible for procuring the natural gas to be used by all of our units at these facilities and have developed and utilize a natural gas supply strategy. The strategy includes securing transportation contracts and incorporating the ability to use No. 2 distillate fuel oil as a backup fuel for Louisa and Marsh Run. We have identified our primary natural gas suppliers and have negotiated the contracts needed for procurement of physical natural gas. We have put in place strategies and mechanisms to financially hedge our natural gas needs. We anticipate that sufficient supplies of natural gas will be available in the future to support the operation of Wildcat Point and our combustion turbine facilities, but significant price volatility may occur. See “Market Price Risk” in Item 7A.

Nuclear

Virginia Power, as operating agent of North Anna, has the sole authority and responsibility to procure nuclear fuel for the facility. Virginia Power advises us that it primarily uses long-term contracts to support North Anna’s nuclear fuel requirements and that worldwide market conditions are continuously evaluated to ensure a range of supply options at reasonable prices, which are dependent upon the market environment. We are not a direct party to any of these procurement contracts and we do not control their terms or duration. Virginia Power advises us that current agreements, inventories, and spot market availability are expected to support North Anna’s current and planned fuel supply needs for the near term and that additional fuel is purchased as required to attempt to ensure optimal cost and inventory levels.

Virginia Power, as operating agent of Clover, has the sole authority and responsibility to procure coal for the facility. We are not a direct party to any of these procurement contracts and we do not control their terms or duration. As of December 31, 2020 and December 31, 2019, based on Clover running at full capacity, there was a 35-day and a 58-day supply of coal, respectively. We anticipate that sufficient supplies of coal will be available in the future to operate the facility when dispatched by PJM.

General

We are subject to regulation by FERC and, to a limited extent, state public service commissions. Some of our operations also are subject to regulation by the Virginia Department of Environmental Quality, the Maryland Department of the Environment, the DOE, the NRC, and other federal, state, and local authorities. Compliance with future laws or regulations may increase our operating and capital costs by requiring, among other things, changes in the design or operation of our generating facilities.

Rate Regulation

We establish our rates for power furnished to our member distribution cooperatives pursuant to our formula rate, which has been accepted by FERC. The VSCC, the DPSC, and the MPSC do not have jurisdiction over our rates, charges, and services.

Our formula rate is intended to permit us to collect revenues, which, together with revenues from all other sources, are equal to all of our costs and expenses, plus a targeted amount equal to 20% of our total interest charges, plus additional equity contributions as approved by our board of directors. See “Factors Affecting Results—Formula Rate” in Item 7.

FERC may review our rates upon its own initiative or upon complaint and order a reduction of any rates determined to be unjust, unreasonable, or otherwise unlawful and order a refund for amounts collected during such proceedings in excess of the just, reasonable, and lawful rates.

Our charges to TEC are established under our market-based sales tariff filed with FERC.

12

Other Regulation

In addition to its jurisdiction over rates, FERC also regulates the issuance of securities and assumption of liabilities by us, as well as mergers, consolidations, the acquisition of securities of other utilities, and the disposition of property under FERC jurisdiction. Under FERC regulations, we are prohibited from selling, leasing, or otherwise disposing of the whole of our facilities subject to FERC jurisdiction, or any part of such facilities having a value in excess of $10 million without FERC approval. We are also required to seek FERC approval prior to merging or consolidating our facilities with those of any other entity having a value in excess of $10 million.

The VSCC, the DPSC, and the MPSC oversee the siting of our utility facilities in their respective jurisdictions.

We are subject to federal, state, and local laws and regulations, and permits designed to both protect human health and the environment and to regulate the emission, discharge, or release of pollutants into the environment. We believe that we are in material compliance with all current requirements of such environmental laws and regulations and permits. However, as with all electric utilities, the operation of our generating units could be affected by future changes in environmental laws and regulations. We continue to monitor activity related to changes in environmental laws and regulations, including new requirements that could apply to our operations. Capital expenditures and increased operating costs required to comply with any future regulations could be significant. See risk factors in Item 1A. Our capital expenditures for environmental improvements at our generating facilities were approximately $0.2 million and $0.3 million in 2020 and 2019, respectively.

Clean Air Act (“CAA”)

Currently, the most significant environmental law affecting our operations is the CAA. The CAA requires, among other things, that owners and operators of fossil fuel-fired power stations limit emissions of SO2, particulate matter, mercury, and NOx. Additionally, regulatory programs are in place for new units and for major modifications of existing facilities, and are being proposed for existing units to limit emissions of CO2 and other GHG. Discussed below are certain standards and regulations under the CAA that impact us.

|

|

• |

Cross-State Air Pollution Rule (“CSAPR”) |

|

|

o |

The rule requires power plants to reduce SO2 and NOx emissions that contribute to ozone and fine particle pollution in other states. |

|

|

o |

Based upon published allocations/new source set-aside allowances for Virginia and Maryland, we anticipate that we will continue to be able to purchase NOx allowances and a limited number of SO2 allowances to maintain compliance under the CSAPR program for Wildcat Point, Clover, Louisa, and Marsh Run. |

|

|

• |

Acid Rain Program |

|

|

o |

The program requires fossil fuel-fired plants to have SO2 allowances equal to the number of tons of SO2 they emit into the atmosphere annually. |

|

|

o |

Clover receives an annual allocation of SO2 allowances at no cost based on its baseline operations since it is a facility that was built before the Acid Rain Program. |

|

|

o |

Wildcat Point, Louisa, and Marsh Run however, need to obtain allowances under the Acid Rain Program. Because they are primarily gas-fired generating facilities, the number of SO2 allowances these newer facilities must obtain is typically minimal and can be supplied from any excess SO2 allowances allocated to Clover. |

|

|

o |

These regulations set thresholds for GHG emissions that define when permits are required for new sources, as well as modifications to existing industrial facilities. |

|

|

o |

Future renewal of certain permits for Wildcat Point, Clover, Louisa, and Marsh Run may be affected. |

13

|

|

Other environmental laws affect our operations and they are discussed below.

Regional Greenhouse Gas Initiative (“RGGI”)

|

|

• |

RGGI, as implemented under the laws of participating northeastern and Mid-Atlantic States, including Virginia, Delaware, and Maryland, provides the framework for and administers a cap-and-trade program to regulate and reduce CO2 emissions. |

|

|

• |

In 2020, the Virginia General Assembly passed legislation, to authorize Virginia to join RGGI in 2021 (see “Virginia Clean Economy Act below). |

|

|

• |

We are required to purchase RGGI CO2 allowances for each ton of CO2 emitted by Wildcat Point, Clover, Louisa, and Marsh Run. |

|

|

• |

We continue to project that there will be an adequate supply of CO2 allowances available for purchase through RGGI auctions or in the secondary market to support these generating facilities. |

Virginia Clean Economy Act

|

|

• |

In 2019, the VAPCB approved a regulation that reduces and limits CO2 emissions from large (greater than 25 MW) electric power generating facilities. |

|

|

• |

Virginia joined RGGI in 2021 and established the RGGI program with an effective starting date of January 1, 2021. (See “RGGI” above.) |

|

|

• |

The act requires that the VAPCB establish rules by 2025 to reduce CO2 emissions from the electric sector between 2031 and 2050 and specifies that no emission allowances are to be issued in 2050 or future years. |

|

|

• |

The act requires that substantially all investor-owned utility generating facilities that emit CO2 as a by-product of combustion close by December 31, 2045, which would include Clover, which we co-own with Virginia Power, an investor-owned utility. However, if the reliability or security of providing electric service to customers is threatened, a petition may be made by Virginia Power to the VSCC requesting relief from the closure requirement. |

|

|

• |

We will continue to be engaged in the development and implementation of the Virginia Clean Economy Act. |

Clean Water Act

|

|

• |

The act regulates water intake structures, discharges of cooling water, storm water runoff, and other wastewater discharges at our generating facilities. |

|

|

• |

Our water permits are subject to periodic review and renewal proceedings. |

|

|

• |

We do not currently expect a significant impact on our facility operations and will continue to follow revised rulemaking requirements to determine potential future impacts related to our facilities. |

Resource Conservation and Recovery Act

|

|

• |

This act imposes requirements relating to the disposal of CCRs generated by coal combustion at electric generating facilities. |

|

|

• |

These requirements include establishing technical requirements for CCR landfills and surface impoundments, and for monitoring and cleanup of affected soil or groundwater. |

|

|

• |

We do not currently expect the operations at Clover to be significantly affected and will continue to monitor the implementation of the CCR rule and the potential impact on the operations at Clover. |

Future Regulation

New legislative and regulatory proposals are frequently introduced on both the federal level and state level that modify the environmental regulatory programs applicable to our facilities. Changing regulatory requirements can increase

14

our capital and operating costs and adversely affect the ability to operate our existing facilities, as well as restrict the construction of new facilities.

We anticipate that the most material new regulations are likely to arise under the CAA. Pending regulatory proceedings could result in modifications to certain National Ambient Air Quality Standards, the effect of which can ultimately include stricter emission requirements on new or existing facilities.

There also may be further developments relating to GHG emissions reporting, control, and facility permitting. The Clean Power Plan would have required states to implement specific plans to reduce CO2 emissions. That regulation was revoked and was replaced with ACE, which was vacated and remanded on January 19, 2021 by the United States Court of Appeals for the District of Columbia Circuit. Continuing efforts to further reduce GHG emissions may lead to some form of replacement of ACE, which could result in limitations on the operations of our generating facilities and/or adversely affect our financial condition, results of operations, or cash flows.

Human Capital

Our success depends upon the skills and collective strengths of all of our employees. We focus on the health, safety, and well-being of our employees. Our workforce is composed of operational staff at our generating facilities and headquarters staff. We are not a party to any collective bargaining agreement. As of March 1, 2021, we had 137 employees, including 50 employees at our generating facilities and 87 employees at our headquarters office. The average tenure of our employees is 11 years.

The following risk factors and all other information contained in this report should be considered carefully when evaluating ODEC. These risk factors could affect our actual results and cause these results to differ materially from those expressed in any forward-looking statements of ODEC. Other risks and uncertainties, in addition to those that are described below, may also impair our business operations. We consider the risks listed below to be material, but you may view risks differently than we do and we may omit a risk that we consider immaterial but you consider important. An adverse outcome of any of the following risks could materially affect our business or financial condition. These risk factors should be read in conjunction with the other detailed information set forth elsewhere in this report, including Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, including “Caution Regarding Forward-looking Statements,” and “Notes to Consolidated Financial Statements” in Item 8.

FINANCIAL, MARKET, AND ECONOMIC RISKS

Our financial condition is largely dependent upon our member distribution cooperatives.

Our financial condition is largely dependent upon our member distribution cooperatives satisfying their obligations to us under their wholesale power contracts. In 2020, 63.8% of our revenues from sales to our member distribution cooperatives were received from our three largest members, REC, SVEC, and DEC. The wholesale power contracts require our member distribution cooperatives to pay us for power furnished to them in accordance with our FERC formula rate. See “Members—Member Distribution Cooperatives—Wholesale Power Contracts” in Item 1 and “Factors Affecting Results—Formula Rate” in Item 7. Our board of directors, which is composed of representatives of our members, can approve changes in the rates we charge to our member distribution cooperatives without seeking FERC approval, with limited exceptions.

One of those exceptions requiring FERC approval relates to modifications to our formula rate. The formula rate is intended to allocate our costs based on how they are incurred. As the factors impacting our costs change with the evolving energy sector and PJM market, the potential increases for disagreements with or among our member distribution cooperatives about cost allocation. When changes are necessary, we apply to FERC to modify our formula rate. As a result, one or more of our member distribution cooperatives, or its customers, could challenge the proposed modifications. Such a challenge likely would not cause us to fail to recover all of our costs and other amounts to be collected under the wholesale power contracts, but it could interfere with our ability to work as effectively as an organization as otherwise would be the case.

15

Our member distribution cooperatives’ ability to collect their costs from their members may have an impact on our financial condition. Economic conditions may make it difficult for some customers of our member distribution cooperatives to pay their power bills in a timely manner, which could ultimately affect the timeliness of our member distribution cooperatives’ payments to us.

We rely on purchases of fuel and energy from other suppliers which exposes us to market price risk and could increase our operating costs.

We supply our member distribution cooperatives with all of their power (energy and demand) requirements, with limited exceptions. Our costs to provide this energy and demand are passed through to our member distribution cooperatives under our wholesale power contracts. We obtain the power to serve their requirements from our generating facilities and purchases of power from other power suppliers.

We are subject to changes in fuel costs for our generating facilities, which could increase the cost of generating power. We are also exposed to changes in purchased power costs. Increases in fuel costs and purchased power costs increase the cost to our member distribution cooperatives. Factors that could influence fuel and purchased power costs include:

|

|

• |

weather; |

|

|

• |

supply and demand; |

|

|

• |

the availability of competitively priced alternative energy sources; |

|

|

• |

constraints related to the transportation of fuels; |

|

|

• |

price competition among fuels used to produce electricity, including natural gas, coal, and oil; |

|

|

• |

availability, dispatch, and efficient operation of our generating facilities; |

|

|

• |

transmission constraints; |

|

|

• |

the impact of implementation of new technologies in the power industry, such as energy storage technologies; |

|

|

• |

federal, state, and local energy and environmental regulation and legislation, including increased regulation of the extraction or firing of natural gas and coal; and |

|

|

• |

war, acts and threats of terrorism, sabotage, natural disasters, pandemics, and other catastrophic events. |

In 2020, we purchased approximately 48.0% of our energy resources. These purchases consisted of a combination of purchases under physically-delivered forward contracts and purchases of energy in the spot market. Purchases of energy from other suppliers will continue in the future and could increase because the operation of our generating facilities is subject to many risks, including changes in their dispatch, shutdown, or breakdown or failure of equipment.

Purchasing power helps us mitigate high fixed costs related to the ownership of generating facilities but exposes us to significant market price risk because energy prices can fluctuate substantially. When we enter into long-term power purchase contracts or agree to purchase energy at a date in the future, we utilize our judgment and assumptions in our models. Our judgment and assumptions relate to factors such as future demand for power and market prices of energy and the price of commodities, such as natural gas, used to generate electricity. Our models cannot predict what will actually occur and our results may vary materially from what our models forecast, which may in turn impact our resulting costs to our members. Our models become less reliable the further into the future that the estimates are made. Although we have developed strategies to attempt to meet our power requirements in an economical manner and we have implemented a hedging strategy to limit our exposure to variability in the market, we still may purchase energy at a price which is higher than other utilities’ costs of generating energy or future market prices of energy. For further discussion of our market price risk, see Item 7A.

Counterparties under power purchase and natural gas arrangements may fail to perform their obligations to us.

Because we rely substantially on the purchase of energy and natural gas from other suppliers, we are exposed to the risk that counterparties will default in performance of their obligations to us. On an on-going basis, we analyze and monitor the default risks of counterparties and other credit issues related to these purchases, and we may require our

16

counterparties to post collateral with us; however, defaults may still occur. Defaults may take the form of failure to physically deliver the purchased energy or natural gas. If a default occurs, we may be forced to enter into alternative contractual arrangements or purchase energy or natural gas in the forward or spot markets at then-current market prices that may exceed the prices previously agreed upon with the defaulting counterparty. We cannot be assured that the defaulting counterparty will compensate us for any damages resulting from the breach of their obligations.

The use of hedging instruments could impact our liquidity.

We use various hedging instruments, including forwards, futures, financial transmission rights, and options, to manage our power market price risks. These hedging instruments generally include collateral requirements that require us to deposit funds or post letters of credit with counterparties when their credit exposure to us is in excess of agreed upon credit limits. When commodity prices decrease to levels below the levels where we have hedged future costs, we may be required to use a material portion of our cash or revolving credit facility to cover these collateral requirements.

Adverse changes in our credit ratings may require us to provide credit support for some of our obligations and could negatively impact our liquidity and our ability to access capital.

S&P, Moody’s, and Fitch currently rate our outstanding obligations issued under our Indenture at “A+,” “A2,” and “A+,” respectively. Additionally, we have an issuer credit rating of “A+” from S&P, and an implied senior unsecured rating of “A+” from Fitch. If these agencies were to downgrade our ratings, particularly below investment grade, we may be required to deposit funds or post letters of credit related to our power purchase arrangements, which may reduce our available liquidity and impact our access to future liquidity resources. To the extent that we would have to provide additional credit support as a result of a downgrade in our credit ratings, our ability to access additional credit may be limited and our liquidity may be materially impaired. Also, we may be required to pay higher interest rates on our revolving credit facility and financings that we may need to undertake in the future, and our potential pool of future investors and funding sources could decrease.

Poor market performance will affect the asset values in our nuclear decommissioning trust and our defined benefit retirement plans, which may increase our costs.

We are required to maintain a funded trust to satisfy our future obligation to decommission North Anna. A decline in the market value of those assets due to poor investment performance or other factors may increase our funding requirements for these obligations which may increase our costs.

We participate in the NRECA Retirement Security Plan and the Deferred Compensation Pension Restoration Plan. The cost of these plans is funded by our payments to NRECA. Poor performance of investments in these benefit plans may increase our costs to make up our allocable portion of any underfunding.

REGULATORY, LEGISLATIVE, AND ACCOUNTING RISKS

Our generating assets may be impacted by regulatory changes in PJM.

PJM, an RTO regulated by FERC, coordinates and establishes policies for the generation, purchase, and sale of capacity and energy in the control areas of its members. We are a member of PJM and we participate in its energy, capacity, and transmission markets to serve our member distribution cooperatives. All of our member distribution cooperatives’ service territories are located in PJM. As a member of PJM, we are subject to the operations of PJM, and our generating facilities are under dispatch direction of PJM. Material regulatory changes by FERC impacting the operations of PJM, including the design of the wholesale markets or its interpretation of market rules, or changes to pricing rules or rules involving revenue calculations, could adversely impact our costs or operations. See “Power Supply Resources—PJM” in Item 1.

Environmental regulation may limit our operations or increase our costs or both.

We are required to comply with numerous federal, state, and local laws and regulations, relating to the protection of the environment. We believe that we have obtained all material environmental approvals currently required to own and operate our existing facilities or that necessary approvals have been applied for and will be issued in a timely manner. We may incur significant additional costs because of compliance with these requirements. Failure to comply with

17

environmental laws and regulations could have a material effect on us, including potential civil or criminal liability and the imposition of fines or expenditures of funds to bring our facilities into compliance. Delay in obtaining, or failure to obtain and maintain in effect, any environmental approvals, or the delay or failure to satisfy any applicable environmental regulatory requirements related to the operation of our existing facilities or the sale of energy from these facilities could result in significant additional cost to us.

ACE, a replacement rule for the Clean Power Plan, regulating carbon emissions relating to existing sources such as power plants, was vacated on January 19, 2021, by the United States Court of Appeals for the District of Columbia Circuit. We are closely monitoring the EPA rulemaking related to ACE, and we currently cannot predict the potential impact on our existing facilities due to the uncertainties and complexities of the regulations.

Virginia joined RGGI in 2021 pursuant to the 2019 regulation that established an emission limitation program to reduce CO2 from electric power facilities. This regulation is expected to result in increased costs. See “Regulation—Environmental—Virginia Clean Economy Act” in Item 1.

We cannot predict the cost or the effect of any future environmental legislation or regulation. New environmental laws or regulations, the revision or reinterpretation of existing environmental laws or regulations, or penalties imposed for non-compliance with existing environmental laws or regulations may require us to incur additional expenses and could have a material adverse effect on the cost of power we supply our member distribution cooperatives. See “Regulation—Environmental” in Item 1.

Failure to comply with regulatory reliability standards, and other regulatory requirements could subject us to substantial monetary penalties.

As a result of the Energy Policy Act of 2005, as amended, owners, operators, and users of bulk electric systems, including ODEC, are subject to mandatory reliability standards enacted by NERC and its regional entities, and enforced by FERC. We must follow these standards, which are in place to require that proper functions are performed to ensure the reliability of the bulk power system. Although the standards are developed by the NERC Standards Committee, which includes representatives of various electric energy sectors, and must be just and reasonable, the standards are legally binding and compliance may require increased capital expenditures and costs to provide electricity to our member distribution cooperatives under our wholesale power contracts. If we are found to be in non-compliance with any mandatory reliability standards we could be subject to sanctions, including potentially substantial monetary penalties. New, revised or reinterpreted laws or regulations related to reliability standards or participation in wholesale power markets could also result in substantial monetary penalties if ODEC is found to have violated or failed to comply with applicable standards, laws, and regulations.

Potential changes in accounting practices may adversely affect our financial results.

We cannot predict the impact that future changes in accounting standards or practices may have on companies in general, the energy industry, or our operations specifically. New accounting standards could be issued that could change the way we record revenues, expenses, assets, and liabilities. These changes in accounting standards could adversely affect our reported earnings or increase reported liabilities.

OPERATIONAL RISKS

We are subject to risks associated with owning an interest in a nuclear generating facility.

We have an 11.6% undivided ownership interest in North Anna, which provided approximately 14.8% of our energy requirements in 2020. Ownership of an interest in a nuclear generating facility involves risks, including:

|

|

• |

potential liabilities relating to harmful effects on the environment and human health resulting from the operation of the facility and the storage, handling, and disposal of radioactive materials; |

|

|

• |

significant capital expenditures relating to maintenance, operation, and repair of the facility, including repairs required by the NRC; |

|

|

• |

limitations on the amounts and types of insurance commercially available to cover losses that might arise in connection with operation of the facility; |

18

|

|

• |

liability for damages resulting from nuclear incidents at facilities owned by others pursuant to the Price-Anderson Act of 1988, which can result in retroactive nuclear insurance premiums; and |

|

|

• |

uncertainties regarding the technological and financial aspects of decommissioning a nuclear plant at the end of its licensed life. |

The NRC has broad authority under federal law to impose licensing and safety-related requirements for the operation of North Anna. If the facility is not in compliance, the NRC may impose fines or shut down the units until compliance is achieved, or both depending upon its assessment of the situation. Revised safety requirements issued by the NRC have, in the past, necessitated substantial capital expenditures at other nuclear generating facilities. North Anna’s operating and safety procedures may be subject to additional federal or state regulatory scrutiny as a result of worldwide events related to nuclear facilities. In addition, if a serious nuclear incident at North Anna did occur, it could have a material but presently indeterminable adverse effect on our operations or financial condition. Further, any unexpected shut down at North Anna as a result of regulatory non-compliance or unexpected maintenance will require us to purchase replacement energy.

We may have operational deficiencies or catastrophic events related to our generating and transmission facilities.

The operation of our generating or transmission facilities involves risks, including the breakdown or failure of power generation equipment, transmission lines, piping or other equipment or processes, fuel supply delivery, and performance below expected levels of output or efficiency. The occurrence of any of these events could result in:

|

|

• |

substantial charges assessed by PJM as a result of the expectation that generating facilities would be available if called upon to be dispatched; |

|

|

• |

significant additional capital expenditures to repair or replace the affected facilities; or |

|

|

• |

the purchase of potentially more costly replacement power on the open market. |

TECHNOLOGY, CYBERSECURITY RISKS, AND OTHER THREATS

If we are unable to protect our information systems against service interruption, misappropriation of data, or breaches of security, our operations could be disrupted and our reputation may be damaged.

We operate in a highly regulated industry that requires the continued operation of advanced information technology systems and network infrastructure. We rely on networks, information systems, and other technology, including the internet and third-party hosted servers, to support a variety of business processes and activities. Cyber security incidents could compromise our information related to the operation or maintenance of our generating facilities and could adversely affect our ability to operate or manage our facilities effectively. We also use third-party vendors to electronically process certain of our business transactions. Information systems, both ours and those of third-party information processors, are vulnerable to cyber security breach. Our generating facilities and information technology systems, or those of Virginia Power, the co-owner of North Anna and Clover, could be directly or indirectly affected by deliberate or unintentional cyber incidents. These incidents may be caused by failures during routine operations such as system upgrades or user errors, as well as network or hardware failures, malicious or disruptive software, computer hackers, rogue employees or contractors, cyber-attacks by criminal groups or activist organizations, geopolitical events, natural disasters, failures or impairments of telecommunications networks, or other catastrophic events. In addition, such incidents could result in unauthorized disclosure of material confidential information, including personal information or sensitive business information.

If our technology systems are breached or otherwise fail, we may be unable to fulfill critical business functions, including the operation of our generating facilities and our ability to effectively maintain certain internal controls over financial reporting. Further, our generating facilities rely on an integrated transmission system, a disruption of which could negatively impact our ability to deliver power to our member distribution cooperatives. A major cyber incident could result in significant business disruption and expense to repair security breaches or system damage and could lead to litigation, regulatory action, including penalties or fines, and an adverse effect on our reputation. We also may have

19

future compliance obligations related to new mandatory and enforceable NERC reliability standards which address the impacts of geomagnetic disturbances and other physical security risks to the reliable operation of the bulk power system.

Technological advancements and other changes impacting power requirements of our member distribution cooperatives’ customers may alter energy and demand requirements for power from us.