Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KANSAS CITY SOUTHERN | ksu-20210316.htm |

KCS © K A N S A S C IT Y S O U TH E R N J.P. Morgan 2021 Virtual Industrials Conference March 16, 2021 Exhibit 99.1

KCS © K A N S A S C IT Y S O U TH E R N Safe Harbor Statement This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended and the Private Securities Litigation Reform Act of 1995. In addition, management may make forward- looking statements orally or in other writing, including, but not limited to, in press releases, quarterly earnings calls, executive presentations, in the annual report to stockholders and in other filings with the Securities and Exchange Commission. Readers can usually identify these forward-looking statements by the use of such words as "may," "will," "should," "likely," "plans," "projects," "expects," "anticipates," "believes" or similar words. These statements involve a number of risks and uncertainties. Actual results could materially differ from those anticipated by such forward-looking statements as a result of a number of factors or combination of factors including, but not limited: public health threats or outbreaks of communicable diseases, such as the ongoing COVID-19 pandemic and its impact on KCS’s business, suppliers, consumers, customers, employees and supply chains; rail accidents or other incidents or accidents on KCS’s rail network or at KCS’s facilities or customer facilities involving the release of hazardous materials, including toxic inhalation hazards; legislative and regulatory developments and disputes, including environmental regulations; loss of the rail concession of Kansas City Southern’s subsidiary, Kansas City Southern de México, S.A. de C.V.; domestic and international economic, political and social conditions; disruptions to the Company’s technology infrastructure, including its computer systems; increased demand and traffic congestion; the level of trade between the United States and Asia or Mexico; fluctuations in the peso-dollar exchange rate; natural events such as severe weather, hurricanes and floods; the outcome of claims and litigation involving the Company or its subsidiaries; competition and consolidation within the transportation industry; the business environment in industries that produce and use items shipped by rail; the termination of, or failure to renew, agreements with customers, other railroads and third parties; fluctuation in prices or availability of key materials, in particular diesel fuel; access to capital; climate change and the market and regulatory responses to climate change; dependency on certain key suppliers of core rail equipment; changes in securities and capital markets; unavailability of qualified personnel; labor difficulties, including strikes and work stoppages; acts of terrorism or risk of terrorist activities, war or other acts of violence; and other factors affecting the operation of the business; and other risks identified in this presentation, in KCS's Annual Report on Form 10-K for the year ended December 31, 2020, and in other reports filed by KCS with the Securities and Exchange Commission. Forward-looking statements reflect the information only as of the date on which they are made. KCS does not undertake any obligation to update any forward-looking statements to reflect future events, developments, or other information. Reconciliation to U.S. GAAP Financial Information In addition to disclosing financial results in accordance with U.S. GAAP, the accompanying presentation contains non-GAAP financial measures. These non-GAAP measures should be viewed as a supplement to and not a substitute for our U.S. GAAP measures of performance and liquidity, and the financial results calculated in accordance with U.S. GAAP and reconciliations from these results should be carefully evaluated. All reconciliations to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP can be found on the KCS's website in the Investors section. This presentation contains forecasted financial measures within. Operating Ratio, Adjusted Diluted Earnings per Share, and Free Cash Flow are non- GAAP financial measures. The Company did not reconcile these forecasted financial measures to the most comparable GAAP measure because certain information necessary to calculate such measures on a GAAP basis was unavailable or dependent on the timing of future events outside of the Company's control. At the time the Company made these forward looking statements, the GAAP numbers included the strengthening or weakening of the Mexican Peso to U.S. Dollar and changes in fuel price, both of which could have a significant impact on the Company's consolidated results. Therefore, the Company was unable to reconcile, without unreasonable efforts, the forecasted financial measures to the most comparable GAAP measure. 2

KCS © K A N S A S C IT Y S O U TH E R N BUSINESS UPDATE 3

KCS © K A N S A S C IT Y S O U TH E R N QTD* volumes -3% YoY: – QTD volumes impacted by softer Lazaro intermodal, global microchip shortage and Polar Vortex – Strong Chemicals and Energy volume performance – March rebounding nicely: volumes +6% YoY, revenues +5% YoY Volume comparisons grow easier in the last week of March Fuel surcharge lag headwind: ~90bps OR / $0.09 EPS Congestion/weather-related headwind: ~100bps / $0.06 EPS 1QTD* Business Update 4 *1QTD volumes as of 3/15/2021 1QTD* Volume/Revenue Performance Volume Revenue 1QTD* Reported -3% -5% Excluding the impact of fuel price and F/X, QTD* revenues are -2% YoY $2.60 $2.70 $2.80 $2.90 $3.00 $3.10 YTD OHD Fuel Prices Have Increased 17%

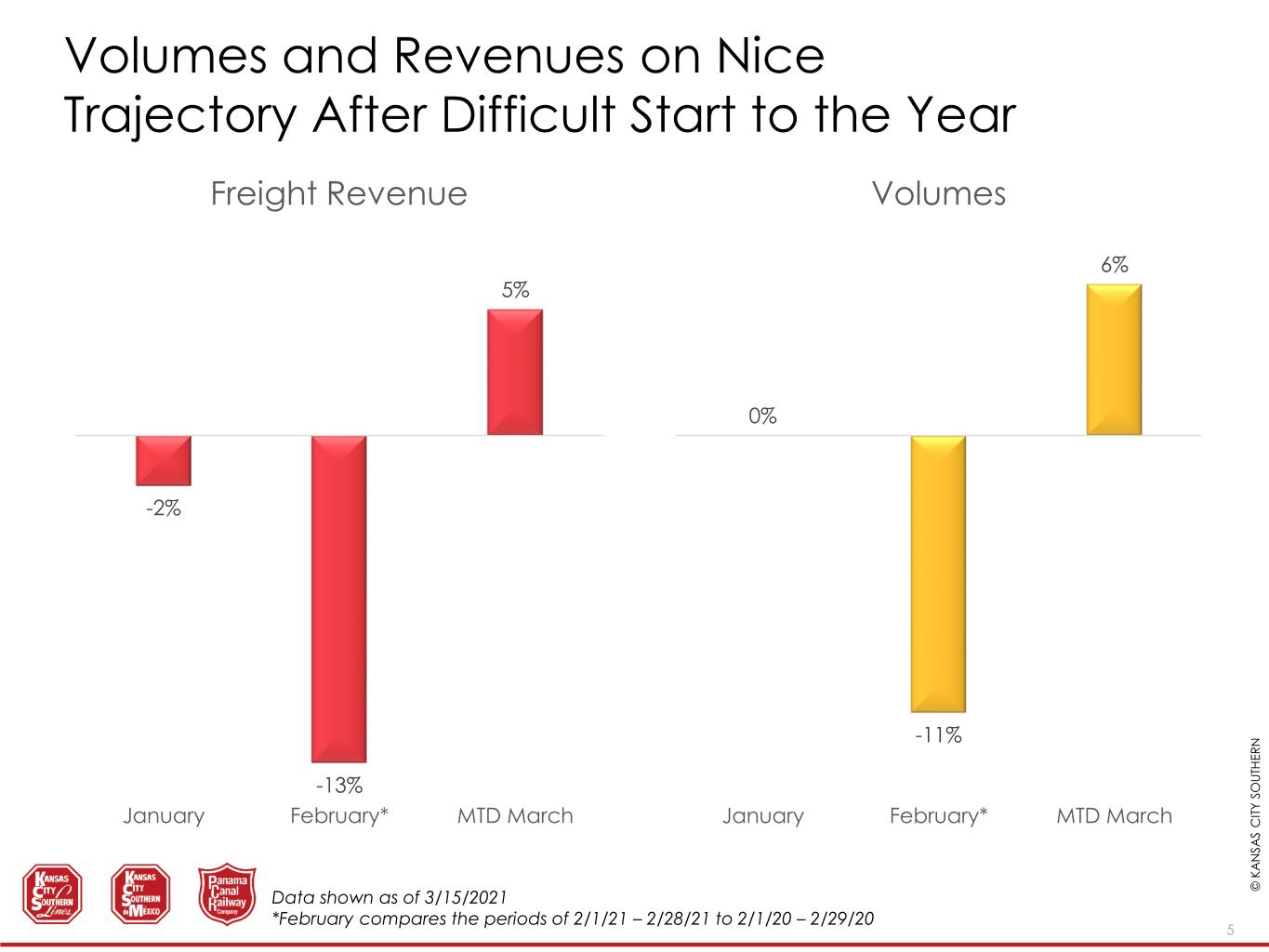

KCS © K A N S A S C IT Y S O U TH E R N Volumes and Revenues on Nice Trajectory After Difficult Start to the Year -2% -13% 5% January February* MTD March Freight Revenue 5 Data shown as of 3/15/2021 *February compares the periods of 2/1/21 – 2/28/21 to 2/1/20 – 2/29/20 0% -11% 6% January February* MTD March Volumes

KCS © K A N S A S C IT Y S O U TH E R N Volumes and Service Recovering After Polar Vortex 6 6 8 10 12 14 16 1 -F e b 3 -F e b 5 -F e b 7 -F e b 9 -F e b 1 1 -F e b 1 3 -F e b 1 5 -F e b 1 7 -F e b 1 9 -F e b 2 1 -F e b 2 3 -F e b 2 5 -F e b 2 7 -F e b 1 -M a r 3 -M a r 5 -M a r 7 -M a r 9 -M a r 1 1 -M a r 1 3 -M a r 1 5 -M a r Velocity (m.p.h.) 22 26 30 34 38 1 -F e b 3 -F e b 5 -F e b 7 -F e b 9 -F e b 1 1 -F e b 1 3 -F e b 1 5 -F e b 1 7 -F e b 1 9 -F e b 2 1 -F e b 2 3 -F e b 2 5 -F e b 2 7 -F e b 1 -M a r 3 -M a r 5 -M a r 7 -M a r 9 -M a r 1 1 -M a r 1 3 -M a r 1 5 -M a r Dwell (hours) 3,700 4,200 4,700 5,200 5,700 6,200 6,700 7,200 7,700 8,200 1 -F e b 3 -F e b 5 -F e b 7 -F e b 9 -F e b 1 1 -F e b 1 3 -F e b 1 5 -F e b 1 7 -F e b 1 9 -F e b 2 1 -F e b 2 3 -F e b 2 5 -F e b 2 7 -F e b 1 -M a r 3 -M a r 5 -M a r 7 -M a r 9 -M a r 1 1 -M a r 1 3 -M a r 1 5 -M a r Daily Carloads • Volumes and service metrics continue to recover from the polar vortex • Operations have returned to pre-weather event levels • Customers along the Texas gulf coast are in various stages of recovery Data shown as of 3/15/2021