Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CEDAR FAIR L P | fun-20210315.htm |

Investor Presentation March 2021

Some of the information in this presentation that is not historical in nature constitutes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements as to the Company's expectations, beliefs and strategies regarding the future. These forward- looking statements may involve risks and uncertainties that are difficult to predict, may be beyond our control and could cause actual results to differ materially from those described in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Important factors, including the impacts of the COVID-19 pandemic, general economic conditions, adverse weather conditions, competition for consumer leisure time and spending, unanticipated construction delays, changes in the Company’s capital investment plans and projects and other factors discussed from time to time by the Company in its reports filed with the Securities and Exchange Commission (the “SEC”) could affect attendance at the Company’s parks and cause actual results to differ materially from the Company's expectations or otherwise to fluctuate or decrease. Additional information on risk factors that may affect the business and financial results of the Company can be found in the Company's Annual Report on Form 10-K and in the filings of the Company made from time to time with the SEC. The Company undertakes no obligation to publicly update or revise any forward- looking statements, whether as a result of new information, future events, information, circumstances or otherwise that arise after the publication of this document. Forward-Looking Statements 2

FUN Overview 3

Cedar Fair Executive Team Richard Zimmerman CEO Tim Fisher COO Brian Witherow CFO Kelley Semmelroth CMO Duff Milkie GC Craig Heckman HRO Dave Hoffman CAO 4

5 Our Purpose “To Make People Happy” 5

KEY STATISTICS Entertained 28M visitors in 2019 841 rides and attractions 124 roller coasters 2,300+ hotel rooms PARKS PORTFOLIO Own and operate 11 amusement parks 9 outdoor water parks (in-park) 4 outdoor water parks (unique gates) 1 indoor water park resort 6

Compelling Investment Rationale 1 2 Best-in-class parks and brands with loyal, high-repeat customer base 3 High barriers to entry 4 Resilient operating performance through economic cycles 6 Industry-experienced management with history of delivering results High quality assets and significant real estate holdings (and underlying asset value) Strong business model and steady growth in revenues and free cash flow 5 Cedar Fair entered the COVID-19 disruption from a position of strength Company well-positioned to take advantage of post-COVID-19 pent-up demand 7

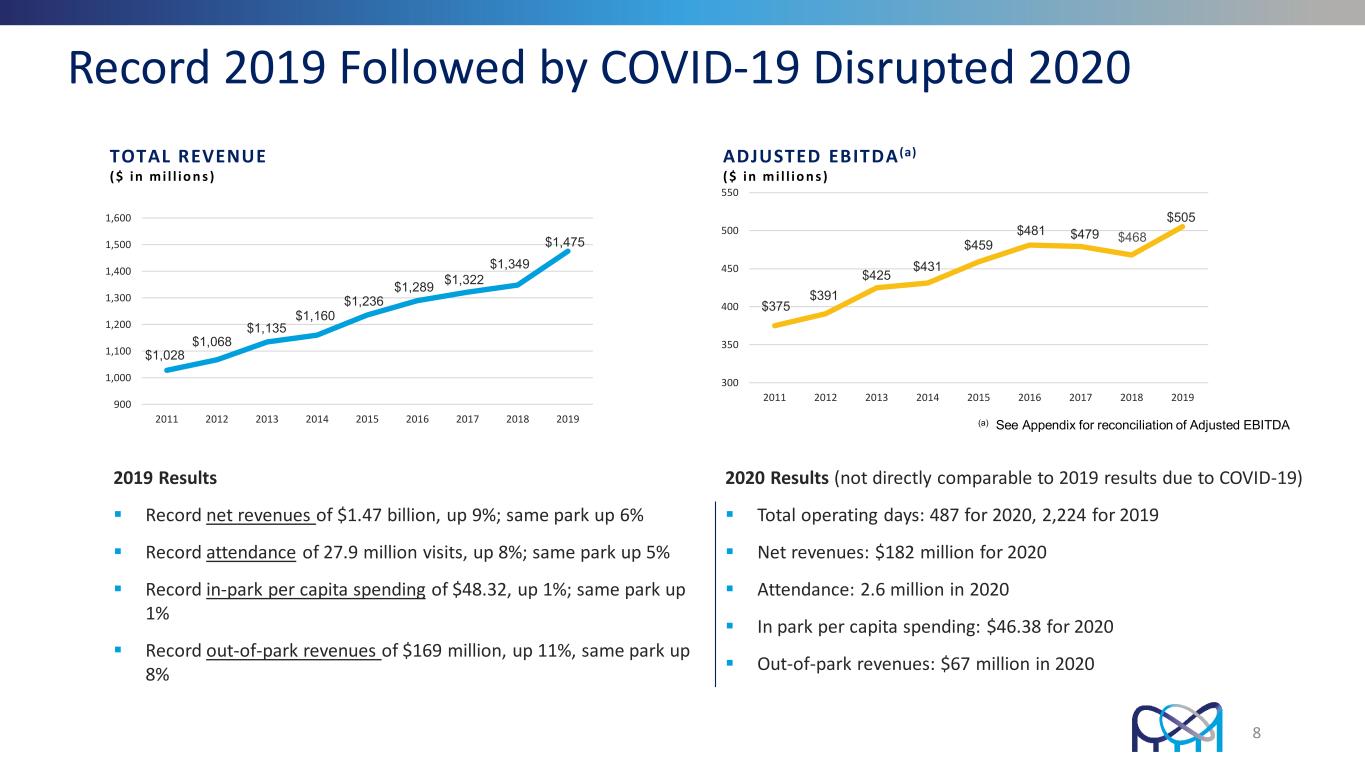

Record 2019 Followed by COVID-19 Disrupted 2020 2019 Results Record net revenues of $1.47 billion, up 9%; same park up 6% Record attendance of 27.9 million visits, up 8%; same park up 5% Record in-park per capita spending of $48.32, up 1%; same park up 1% Record out-of-park revenues of $169 million, up 11%, same park up 8% 2020 Results (not directly comparable to 2019 results due to COVID-19) Total operating days: 487 for 2020, 2,224 for 2019 Net revenues: $182 million for 2020 Attendance: 2.6 million in 2020 In park per capita spending: $46.38 for 2020 Out-of-park revenues: $67 million in 2020 ADJUSTED EBITDA(a) ( $ in m i l l io n s ) $1,028 $1,068 $1,135 $1,160 $1,236 $1,289 $1,322 $1,349 $1,475 900 1,000 1,100 1,200 1,300 1,400 1,500 1,600 2011 2012 2013 2014 2015 2016 2017 2018 2019 TOTAL REVENUE ( $ in m i l l io n s ) $375 $391 $425 $431 $459 $481 $479 $505 300 350 400 450 500 550 2011 2012 2013 2014 2015 2016 2017 2018 2019 $468 (a) See Appendix for reconciliation of Adjusted EBITDA 8

3% 4% 2019 Operating Results 1% Net Revenues $1.47B Ended 12/31/19 Lift from prior year Adjusted EBITDA 8%$505M 9% Attendance 8%27.9M In-Park Per Capita Spending 1%$48.32 Out-of-Park Revenues 11%$169M 9

Strong Long-Term Growth and Recession Resilient Acquisitions: 1992 – Dorney Park 1995 – World of Fun 1997 – Knott’s Berry Farm 2001 – Michigan’s Adventure 2004 – Geauga Lake 2006 – Paramount Parks (five parks) 2019 – Schlitterbahn (two water parks) – Sawmill Creek Resort & Conference Center $0 $100 $200 $300 $400 $500 $600 ($ in m ill io ns ) Adj. EBITDA Financial Crisis 2001 = (6.1%) 2002 = 11.4% 2009 = (11.0%) 2010 = 13.2% Early 2000’s RecessionEarly 1990’s Recession (a) (a) See Appendix for Reconciliation of Adjusted EBITDA 10

2021 Outlook 11

2021 Scheduled Opening Dates – All Parks to Open 12

Liquidity Outlook • The Company’s liquidity position at Dec. 31, 2020, totaled approximately $736 million • Sufficient liquidity to meet the Company’s cash obligations and remain in compliance with debt covenants at least through the first quarter of 2022, even if operations are again suspended in 2021 • Based on cost saving measures taken to date, anticipated net cash outflows will average $40-50 million per month until the second quarter, when several factors occur: • Operating costs in April begin to ramp up as we prepare parks to open in mid to late-May • A modest amount of capital investment to address compliance and infrastructure needs, and to reactivate and complete several key projects from 2020 • Scheduled interest payments due on our outstanding bonds, averaging approximately $23 million per month in Q2 • Cash generation starting in mid-May from daily park and resort operations, as well as an uptick in season pass sales • Should operations again be suspended across the portfolio, we are prepared to quickly and effectively reduce the average monthly cash burn rate back to the $35-40 million range 13

Business Optimization Initiative • Enterprise-wide initiative designed to produce a better guest experience, rationalize our cost structure and improve profitability • Focused on the high-value areas of costs and revenues, including marketing, labor, procurement and consumer-facing technology • Certain transformative improvements, such as implementing a centralized procurement system, could take longer to reach full maturity and maximum potential • Targeting 200 to 300 basis points of margin improvement on a revenue base consistent with 2019 performance levels and normal business operations • Reaching target would imply an EBITDA margin approaching our highest historical margins • Ability to drive historically high margins largely dependent on operating without COVID-19 restrictions and at historically comparable attendance levels 14

Business Optimization Initiative - Areas of Opportunity Marketing • Offers near-term cost savings opportunity • Shift weighting to more cost-efficient and flexible advertising platforms • Look to reduce the use of traditional, higher- cost options such as broadcast or print media • Increase use of lower-cost, data-driven channels for real-time optimization, better flexibility, more precise targeting • Utilize CRM for guest feedback and sending direct, fast and low-cost guest messaging • Leverage local/regional news media via news releases other PR efforts 15

Business Optimization Initiative - Areas of Opportunity Seasonal Labor • Seasonal/part-time labor represents approximately 35% of operating expenses and offers a primary cost-saving opportunity • New Workforce Management System to be implemented in 2021 across all but TX parks • Tailored Kronos-based software providing park operators leading-edge management tools • Dashboard assessment of real-time, in-park labor utilization • Improved labor efficiencies to help offset market rate pressures and potential minimum wage hikes 16

Business Optimization Initiative - Areas of Opportunity Procurement • Represents the optimization initiative’s highest cost-savings category - could take several years to fully mature • Recently added Chief Procurement Officer • Responsible for building a centralized capability across our 13 properties • Better leverage our scale, optimize the supply chain, and streamline the process of acquiring equipment, goods and services • Improve our operational effectiveness and cost efficiencies across the enterprise • Currently targeting quick wins in food & beverage, merchandise & games, and operating supplies 17

Business Optimization Initiative - Areas of Opportunity Revenue • Reducing discount channels increasingly drives guests to parks’ e-commerce sites • Promotes sale of season passes and all-season products versus one-time day pass purchase • Deploy technology-driven solutions to enhance the end-to-end guest experience • Enhanced functionality of our mobile app offers guests mobile ordering and touchless pay options • Use of mobile technologies reduces lines, generates more transactions per hour • Expand online retail capabilities, increasing the reach and availability of park merchandise • Expanded business intelligence capabilities to drive more data-driven decisions • Improved pricing practices to drive revenue lift • Optimization of in-park revenue streams, such as Food & Beverage and Merch & Games • Greater focus and visibility into consumer insights 18

Long-Range Plan 19

Long-Range Plan: Core Strategies • Broaden the Guest Experience • Aimed at driving more visits from existing guests and incremental visits from new, unique guests • Traditional rides, such as roller coasters and water attractions, still play an important role • Expanded use of limited-duration events and more immersive experiences – “Seasons of FUN” model that drives urgency to visit • Food & beverage to continue to play an outsized role in the guest experience • Expand the Season Pass Program • Remains our strongest growing channel – approximately 53% of total attendance in 2019 • Continued evolution of the program, including the broad rollout of PassPerks, our season pass loyalty program • Increase Market Penetration through Targeted Marketing Efforts • Key opportunities exist with several demographic groups with the fastest population growth rates • Pursue Adjacent Development • Continued evolution of our accommodations and resort offerings 20

Consumer Insights Research We’ve held numerous Focus Groups to explore which types of entertainment experiences are most likely to motivate visitation. Key Findings: • Something for everyone - consumers are seeking entertainment options that can accommodate all types of people, ages and interests • Disconnecting to connect – despite the pervasiveness of technology, people still appreciate simple fun that fosters connection • Consumers are on the hunt for “never before” experiences • Craving atmosphere and experiences with a “sense of place” • Consumers see “local” as more authentic • Authentic diversity is differentiating – consumers are drawn to places that celebrate the diversity of the area in an authentic way 21

Consumer Insights Research Rides and events remain top reasons for visiting our parks, with high-park-interest guests driven by water parks and family coasters. Top Reasons to Visit Parks: • Family Rides • Thrill Coasters • Water Rides • Seasonal Events • Anniversary Celebrations 22

23 “Seasons of FUN” Model: Creates Urgency to Visit

Offer Guests Immersive Experiences 24

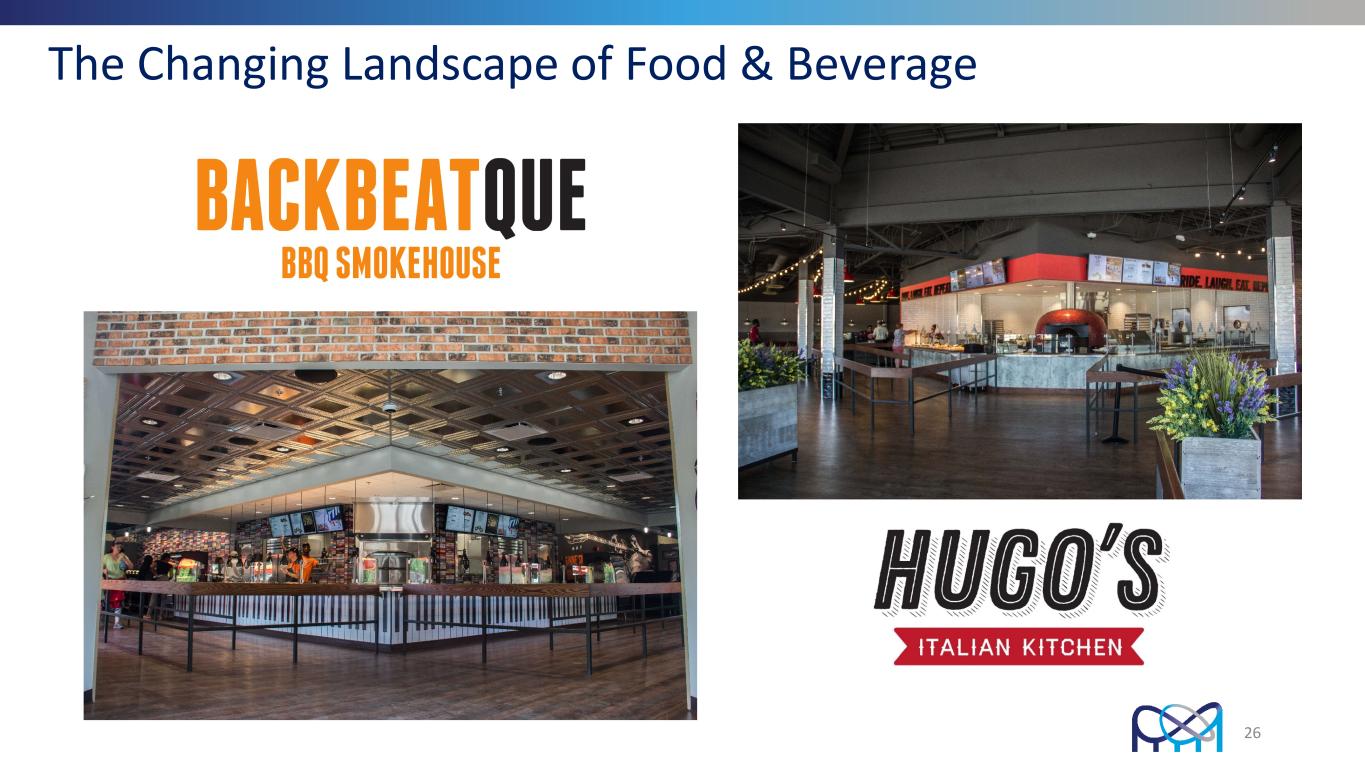

Food & Beverage Playing A Key Role • Our research confirms food and beverage today play a critical role in the guest experience • Consumers want unique experiences, offerings they can’t get at home • We have enhanced existing F&B facilities, added more immersive dining experiences • Executive chefs and additional culinary talent hired at each park • Since 2011, F&B revenues up more than 50%; F&B per cap up more than 35% 25

The Changing Landscape of Food & Beverage 26

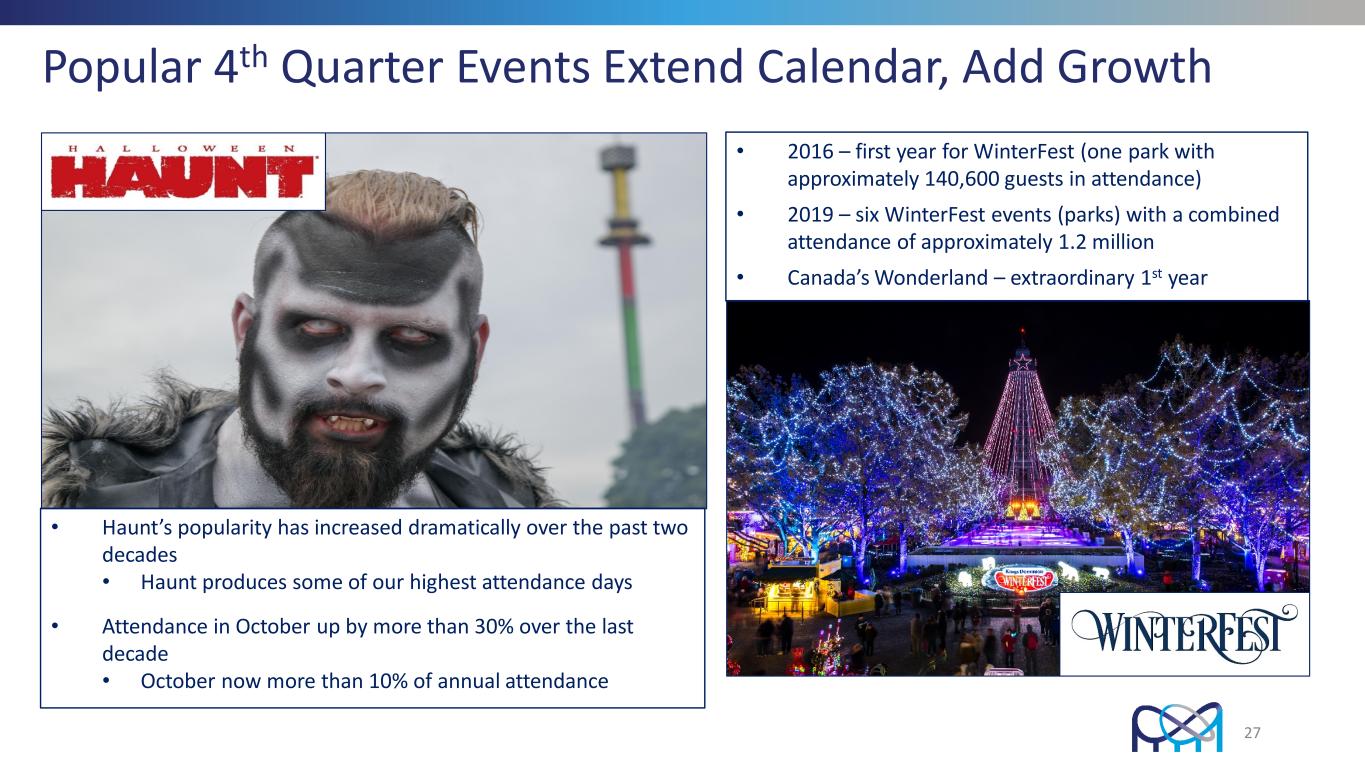

Popular 4th Quarter Events Extend Calendar, Add Growth • 2016 – first year for WinterFest (one park with approximately 140,600 guests in attendance) • 2019 – six WinterFest events (parks) with a combined attendance of approximately 1.2 million • Canada’s Wonderland – extraordinary 1st year • Haunt’s popularity has increased dramatically over the past two decades • Haunt produces some of our highest attendance days • Attendance in October up by more than 30% over the last decade • October now more than 10% of annual attendance 27

Season Pass Channel Growth Strong • At Dec. 31, 2020, approximately 1.8 million season passes were outstanding and valid through the 2021 season • Season pass visitation comprised 62% of 2020 total attendance, compared with 53% for 2019 (all same park) and up from 27% in 2009 • While season pass sales were largely disrupted in 2020 due to COVID-19, season passes sold for 2019 exceeded 2.6 million units, nearly double the number sold in 2009 • Season pass visitation in 2019 topped 14 million visits versus our total attendance of 27.9 million guests Season Pass Group Sales Retail / Other 2019 Season Pass Group Sales Retail / Other Season Pass Group Sales Retail / Other 2009 Season Pass Group Sales Retail / Other 28

Loyalty Program: Evolution of the Season Pass Objectives: • Address affordability concerns for value-oriented guests while maintaining admissions price integrity • Drive higher unit sales through “stickier” retention • Increase the average visitation of our season passholder base Goal: Transition program to Long-term Relationship-based model (from Seasonal Transactional) • Loyalty Program builds lifetime value for guests 29

PASSPERKS Loyalty Program – Mutually Beneficial Good for the Passholder Surprise our most highly engaged guests with unexpected discounts, offers and chances for exclusive prizes and experiences • Earn rewards with each park visit • Create anticipation among passholders to expect the unexpected • Incentivize frequent visitations by offering “Bring-a-Friend” tickets or in- park discounts on food and merchandise • Invite our most frequent passholders to enter lucky drawings where prizes include exclusive guest experiences and other unique offerings Good for Cedar Fair Optimizes the in-park experience while capturing valuable, consumer-driven data with highly valued guest incentives • For 2021, loyalty program to include 10 of our 13 properties (future rollout at Knott’s Berry Farm and Schlitterbahn water parks) • Create urgency among season passholders to drive incremental park visits • Use loyalty program incentives and rewards to drive higher retention rates and renewals over multiple years • Incentivize guests to use the season pass portal and mobile dining applications 30

SP Payment Plan + Loyalty Program Meet Objectives CEDAR FAIR SEASON PASS PROGRAM Key Objectives Payment Plan Loyalty Program Subscription Model Affordability YES NO YES Retention NO YES YES Visitation NO YES NO Pricing Power YES YES NO Purchase Urgency YES NO NO + 31

Market Sizing Study Study performed to better measure the current penetration of markets feeding our parks and gain a better understanding of the consumer segments within those markets Key Findings: • Strong attendance penetration among demographic groups in decline • Lowest penetration among groups with the fastest population growth rates • Key opportunities exist with several demographic segments across multiple parks: • Older Non-Families • Families with Young Children • Millennial Non-Families • Asian American and U.S. Hispanic Households • High-Income Households • Near-term priority to focus on the tourism market in Southern California 32

Evolution of the Accommodations Channel • Substantial growth of accommodations portfolio last 8 years: • Total hotel rooms grew to more than 2,300 from 1,900 (includes Schlitterbahn and Sawmill Creek Resort) • Total luxury RV sites increased to more than 600 • Accommodations Revenue: • > $80 million in 2019, up 35% since 2011 (includes Schlitterbahn and Sawmill Creek Resort) 33

• Waterfront property at Cedar Point entrance • 237 rooms and suites with tropically themed indoor waterpark paradise and outdoor pool • Renovation restarted – to be completed over next 9-12 mos. • Resort property minutes from Cedar Point • 236-room hotel and conference center, restaurants, Tom Fazio-designed golf course • Under review for restart over the next 12-18 mos. Adjacent Development – Accommodations Renovations paused during COVID-19 disruption 34

35 Cedar Point Sports Center Indoor Center • Opened January 2020 • 145,000 square feet • Court space accommodates 10 basketball courts and 20 volleyball courts • AAU basketball, JO volleyball, wrestling, cheer, gymnastics Outdoor Facility • Opened March 2017 • 10 multi-use fields with clubhouse • Baseball, softball, soccer, lacrosse • Prior to COVID-19, performance was pacing well ahead of the original pro-forma model

Fully reopen all parks and resort properties in our 13 markets, correlating park calendars and operating costs with anticipated demand and revenue generation Actively manage cash burn to its lowest possible levels, particularly in the year’s first half as our parks are preparing to open in May Focus on reestablishing growth in the core business and paying down debt to return net leverage back inside 5.0x Adjusted EBITDA as quickly and responsibly as possible Responsibly begin to reinvest capital resources on items of necessity, including essential compliance and infrastructure needs and select projects that were paused in 2020 Key Takeaways – 2021 Strategies 36

Objectives: 1) Enhance the guest experience 2) Realize cost savings across the enterprise 3) Create incremental revenue streams Focus: Pursue cost efficiencies in the big-ticket areas of marketing, labor and procurement, and broaden the use of consumer technologies to increase throughput and create incremental sources of revenue Opportunity: Implementation of operating model enhancements performed over the next 12-18 months • Targeting 200-300 basis points of margin improvement on 2019 performance levels and normalized business operations (approaching Company’s highest historical margin) Key Takeaways – Business Optimization Program 37

Appendix 38

Capital Structure – Debt Maturities Amounts in Millions Total debt outstanding of ~$3.0B at 12/31/20 Cash on hand totaled $376.7M at 12/31/20 2020 cash interest payments totaled $130M Full-year cash interest costs projected to be approximately $175M in 2021-2023 $75 $300 $264 $450 $1,000 $500 $300 $500 0 300 600 900 1200 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 Revolver Capacity Term Debt Senior Notes 39

Adjusted EBITDA Reconciliation 40