Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Harvest Capital Credit Corp | exhibit322december31202012.htm |

| EX-32.1 - EX-32.1 - Harvest Capital Credit Corp | exhibit321december31202012.htm |

| EX-31.2 - EX-31.2 - Harvest Capital Credit Corp | exhibit312december31202012.htm |

| EX-31.1 - EX-31.1 - Harvest Capital Credit Corp | exhibit311december31202012.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 | ||||

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

COMMISSION FILE NUMBER: 1-35906

HARVEST CAPITAL CREDIT CORPORATION

(Exact name of registrant as specified in its charter)

Delaware (State of Incorporation) | 46-1396995 (I.R.S. Employer Identification Number) | ||||

767 Third Avenue, 29th Floor New York, NY (Address of principal executive offices) | 10017 (Zip Code) | ||||

Registrant’s telephone number, including area code: (212) 906-3589

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbols | Name of Each Exchange on Which Registered | ||||||

| Common Stock, par value $0.001 per share | HCAP | Nasdaq Global Market | ||||||

| 6.125% Notes due 2022 | HCAPZ | Nasdaq Global Market | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No þ.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No þ.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ☐.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||||||||

| Non-accelerated filer | þ | Smaller reporting company | ¨ | |||||||||||

| Emerging growth company | ¨ | |||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ.

The aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant as of June 30, 2020, was approximately $16.7 million based upon the last sale price for the Registrant’s common stock on that date.

There were 5,968,296 shares of the Registrant’s common stock outstanding as of March 12, 2021.

Documents Incorporated by Reference

None.

1

2

HARVEST CAPITAL CREDIT CORPORATION

FORM 10-K FOR THE FISCAL YEAR

ENDED DECEMBER 31, 2020

TABLE OF CONTENTS

| Page | ||||||||

3

PART I

Item 1.Business

Company

Harvest Capital Credit Corporation ("we," "us," and the "Company") is an externally managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company, or "BDC", under the Investment Company Act of 1940, or the “1940 Act.” We have also elected to be treated for U.S. federal income tax purposes as a regulated investment company, or "RIC", under Subchapter M of the Internal Revenue Code of 1986, as amended, or the "Code", and we intend to satisfy the Code requirements to receive RIC tax treatment annually. We provide customized financing solutions to small to mid-sized companies. We generally target companies with annual revenues of less than $100 million and annual EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) of less than $15 million.

We were formed as a Delaware corporation on November 14, 2012. We completed our initial public offering on May 7, 2013. Immediately prior to the initial public offering, we acquired Harvest Capital Credit LLC in a merger whereby the outstanding limited liability company membership interests of Harvest Capital Credit LLC were converted into shares of our common stock and we assumed and succeeded to all of Harvest Capital Credit LLC’s assets and liabilities, including its entire portfolio of investments. Harvest Capital Credit LLC, which was formed in February 2011 and commenced operations in September 2011, was founded by certain members of HCAP Advisors LLC, or “HCAP Advisors,” our investment adviser and administrator, and JMP Group, Inc. (now JMP Group LLC), or “JMP Group.” Harvest Capital Credit LLC is considered to be our predecessor for accounting purposes, and as such, its financial statements are our historical financial statements.

As used herein, the terms “we”, “us,” and the “Company” refer to Harvest Capital Credit LLC for the periods prior to our initial public offering and refer to Harvest Capital Credit Corporation for the periods after the initial public offering.

Our investment objective is to generate both current income and capital appreciation primarily by making direct investments in the form of senior debt, subordinated debt and, to a lesser extent, minority equity investments in privately-held U.S. small to mid-sized companies. The companies in which we invest are typically highly leveraged, and, in most cases, our investments in such companies are not rated by any rating agency. If such investments were rated, we believe that they would likely receive a rating below investment grade (i.e., below BBB or Baa), which is often referred to as “junk.” Indebtedness of below investment grade quality is regarded as having predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. While our primary investment focus is on making loans to, and selected equity investments in, privately-held U.S. small to mid-sized companies, we may also invest in other investments such as loans to larger, publicly-traded companies, high-yield bonds and distressed debt securities. In addition, we may also invest in debt and equity securities issued by collateralized loan obligation funds.

As a BDC, we are required to comply with numerous regulatory requirements. We are permitted to, and expect to continue to, finance our investments using debt and equity. However, our ability to use debt is limited in certain significant respects. See “Regulation as a BDC.”

As a RIC, we generally will not pay corporate-level U.S. federal income taxes on any net ordinary income or capital gains that we timely distribute to our stockholders as dividends. To maintain our RIC treatment, we must meet specified source-of-income and asset diversification requirements and distribute annually to our stockholders at least 90.0% of our ordinary net income and realized net short-term capital gains in excess of realized net long-term capital losses, if any. See “-Taxation as a Regulated Investment Company.”

The Proposed Merger With Portman Ridge Finance Corporation

On December 23, 2020, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Portman Ridge Finance Corporation, a Delaware corporation (“PTMN”), Rye Acquisition Sub Inc., a Delaware corporation and a direct wholly-owned subsidiary of PTMN (“Acquisition Sub”), and Sierra Crest Investment Management LLC, a Delaware limited liability company and the external investment adviser to PTMN (“Sierra Crest”). The Merger Agreement provides that (i) Acquisition Sub will merge with and into the Company (the “First Merger”), with the Company continuing as the surviving corporation and as a wholly-owned subsidiary of PTMN, and (ii) immediately after the effectiveness of the First Merger, we will merge with and into PTMN (the “Second Merger” and, together with the First Merger, the “Mergers”), with PTMN continuing as the surviving corporation. Sierra Crest is expected to manage the combined company following the Mergers.

4

The transaction is the result of a review of strategic alternatives by our board of directors and a special committee thereof (the “HCAP Special Committee”) comprised solely of the independent directors of our board of directors. Our board of directors (other than directors affiliated with HCAP Advisors, who abstained from voting), on the unanimous recommendation of the HCAP Special Committee, has approved the Merger Agreement and the transactions contemplated thereby. The boards of directors of each of PTMN and Acquisition Sub, and the managing member of Sierra Crest, have also each unanimously approved the Merger Agreement and the transactions contemplated thereby.

Under the terms of the proposed transaction, at the closing of the First Merger (the “Closing”), PTMN will issue, in respect of all of the issued and outstanding shares of our common stock (excluding shares held by our subsidiaries or held, directly or indirectly, by PTMN or Acquisition Sub and all treasury shares (“Canceled Shares”)), in the aggregate, a number of shares of common stock, par value $0.01 per share, of PTMN (“PTMN Common Stock”) equal to 19.9% of the number of shares of PTMN Common Stock issued and outstanding immediately prior to the Closing (the “Total Stock Consideration”). In addition, subject to the terms and conditions of the Merger Agreement, at the Closing, PTMN will pay, in respect of all the issued and outstanding shares of our common stock (excluding Canceled Shares) in the aggregate, an amount of cash equal to the amount by which (i) our net asset value at Closing exceeds (ii) the product of (A) the Total Stock Consideration multiplied by (B) the quotient of (i) PTMN’s net asset value at closing divided by (ii) the number of shares of PTMN Common Stock issued and outstanding as of the determination date (the “Determination Date”) which is two days prior to the Closing (the “Aggregate Cash Consideration”). In addition, as additional consideration to the holders of shares of our common stock that are issued and outstanding immediately prior to the Closing (excluding any Canceled Shares), Sierra Crest will pay or cause to be paid to such holders an aggregate amount in cash equal to $2.15 million.

Each person who as of the effective time of the First Merger is a record holder of shares of our common stock will be entitled, with respect to all or any portion of such shares, to make an election (an “Election”) to receive payment for their shares of our common stock in cash, subject to the conditions and limitations set forth in the Merger Agreement. Any record holder of shares of our common stock at the record date who does not make an Election will be deemed to have elected to receive payment for their shares of our common stock in the form of PTMN Common Stock. Each share of our common stock (other than a Canceled Share) with respect to which an Election has been made will be converted into the right to receive an amount in cash equal to the Per Share Cash Price (as defined below), subject to adjustment under the terms of the Merger Agreement.

The “Per Share Cash Price” means the quotient of (i) the sum of (A) the product of Total Stock Consideration multiplied by the PTMN Per Share Price (as defined below) plus (B) the Aggregate Cash Consideration, divided by (ii) the number of shares of our common stock issued and outstanding immediately prior to the Closing. The “PTMN Per Share Price” is defined as the average of the volume weighted average price per share of PTMN Common Stock on Nasdaq on each of the ten consecutive trading days ending with the Determination Date.

Each share of our common stock (other than a Canceled Share) with respect to which an Election has not been made will be converted into the right to receive a number of validly issued, fully paid and non-assessable shares of PTMN Common Stock, equal to the number of shares of PTMN Common Stock with a value equal to the Per Share Cash Price based on the PTMN Per Share Price, subject to adjustment under the terms of the Merger Agreement.

While each holder of our common stock will be entitled to make an Election, the maximum aggregate number of shares of PTMN Common Stock available for all of our stockholders will be fixed to equal the Total Stock Consideration and, accordingly, the aggregate amount of cash available to our stockholders will be fixed. As a result, depending on the Elections made by other stockholders, if a holder of our common stock elects to receive cash in connection with the Mergers, such holder will likely receive a portion of its merger consideration in PTMN Common Stock, and if a holder of our common stock elects to receive PTMN Common Stock in connection with the Mergers, such holder will likely receive a portion of the merger consideration in cash.

The Merger Agreement contains customary representations, warranties and covenants, including, among others, covenants relating to the operation of each of PTMN’s and our businesses during the period prior to the Closing. We have agreed to convene and hold a stockholder meeting for the purpose of seeking the adoption of the Merger Agreement by the holders of at least a majority of the outstanding shares of our common stock entitled to vote thereon.

The Merger Agreement contains “no-shop” provisions that restrict our ability to solicit or initiate discussions or negotiations with third parties regarding other proposals to acquire the Company, and we are restricted in our ability to respond to such proposals. The Merger Agreement also contains customary termination rights. In particular, at any time prior to receipt of the requisite Company stockholder approval, we may terminate the Merger Agreement in order to substantially concurrently

5

enter into a binding definitive agreement providing for the consummation of a Superior Proposal (as defined in the Merger Agreement), subject to our compliance with notice and other specified conditions contained in the non-solicitation covenants, including giving PTMN the opportunity to propose revisions to the terms of the transactions contemplated by the Merger Agreement during a period following notice, and provided that we have not otherwise materially breached any provision of the non-solicitation covenants. If we terminate the Merger Agreement as provided in the foregoing sentence or the Merger Agreement is terminated under certain other circumstances, upon notice by PTMN, we must pay PTMN a termination fee equal to approximately $2.1 million, minus any amounts that we previously paid to PTMN in the form of expense reimbursement. Similarly, if the Merger Agreement is terminated under certain other circumstances by PTMN, upon notice by us, PTMN must pay us a termination fee equal to approximately $2.1 million.

The consummation of the Mergers is subject to the satisfaction or (to the extent permitted by law) waiver of certain customary closing conditions, including obtaining the requisite Company stockholder approval. The obligation of each party to consummate the Mergers is also conditioned upon the other party’s representations and warranties being true and correct (subject to certain materiality exceptions) and the other party having performed in all material respects its obligations under the Merger Agreement.

Concurrently with our and PTMN’s entry into the Merger Agreement, we also entered into a letter agreement with Mr. Jolson (the “Jolson Letter Agreement”). Pursuant to the Jolson Letter Agreement, Mr. Jolson has agreed (i) to elect to receive shares of PTMN Common Stock as consideration in connection with the Mergers for all of the 894,273 shares of our common stock beneficially owned directly by Mr. Jolson and indirectly by Mr. Jolson through the Joseph A. Jolson 1991 Trust (the “Jolson Shares”), (ii) to not, directly or indirectly, transfer, sell, offer, exchange, assign, pledge, convey any legal or beneficial ownership interest in or otherwise dispose of, or encumber any of the Jolson Shares or enter into any contract, option, or other agreement with respect to, or consent to, a transfer of, any of the Jolson Shares or his voting or economic interest therein other than pursuant to the Merger Agreement and in connection with the Mergers during the period commencing on the date of the Jolson Letter Agreement and ending on the closing date of the Mergers and (iii) to not transfer any shares of PTMN Common Stock received in exchange for the Jolson Shares in the First Merger (the “Locked Up Securities”) or enter into any swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership of the Locked Up Securities for 90 days following the Closing.

Sierra Crest and HCAP Advisors have engaged in discussions regarding a transition services agreement pursuant to which HCAP Advisors would provide certain consulting services to Sierra Crest relating to HCAP’s existing investment portfolio subsequent to the Closing. As of the date hereof negotiations are still ongoing.

Available Information

Our principal executive offices are located at 767 Third Avenue, 29th Floor, New York, New York 10017, and our telephone number is (212) 906-3589. We maintain a website at http://www.harvestcapitalcredit.com. We make available on or through our website certain reports, including any amendments to those reports, and other documents that we file with or furnish to the Securities and Exchange Commission, or the "SEC." These include our annual reports on Form 10-K, our quarterly reports on Form 10-Q, and our current reports on Form 8-K, among other filings. We make this information available on our website free of charge as soon as reasonable practicable after we electronically file the information with, or furnish it to, the SEC. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports and other public filings are also available free of charge on the EDGAR Database on the SEC's website at www.sec.gov. The information on our website is not incorporated by reference in this annual report on Form 10-K.

JMP Group

We were founded by certain members of HCAP Advisors, our investment adviser and administrator, and JMP Group, a full-service investment banking and asset management firm. JMP Group currently holds an equity interest in us and, through its subsidiaries, owns a majority equity interest in HCAP Advisors. JMP Group conducts its primary business activities through two wholly-owned subsidiaries: (i) Harvest Capital Strategies, LLC ("HCS"), an SEC-registered investment adviser that focuses on venture capital and real estate funds, middle-market lending and private equity; and (ii) JMP Securities LLC, a full-service investment bank that provides equity research, institutional brokerage and investment banking services to growth companies and their investors. The shares of common stock of JMP Group are traded on the New York Stock Exchange (NYSE: JMP). Joseph A. Jolson, our Chief Executive Officer and Chairman of our board of directors, is also the Chief Executive Officer and Chairman of the board of directors of JMP Group.

6

Investment Adviser

Our investment adviser’s investment team is led by Joseph A. Jolson (our Chief Executive officer and Chairman of our board of directors), Richard P. Buckanavage (our President and Managing Director - Head of Business Development), and James Fowler, (our Chief Investment Officer), and is supported by the investment staff at HCAP Advisors, as well as investment professionals from JMP Group. In addition, HCAP Advisors expects to draw upon JMP Group’s over 20-year history in the investment management business and to benefit from the JMP Group investment professionals’ significant capital markets, trading and research expertise developed through investments in different industries and over numerous companies in the United States.

HCAP Advisors has an investment committee (the "Investment Committee") that is responsible for approving all key investment decisions that are made by HCAP Advisors on HCAP's behalf. The members of the HCAP Investment Committee are Messrs. Joseph Jolson, Richard Buckanavage, James J. Fowler, and Bryan B. Hamm. The members of the HCAP Investment Committee have extensive investment experience and collectively currently manage or oversee an investment portfolio that includes alternative assets such as venture capital and real estate funds, middle-market lending, private equity and HCAP. All key investment decisions made by HCAP Advisors on HCAP's behalf, including screening, initial approvals, final commitment, funding, and material amendments, require approval from three of the four members of the HCAP Investment Committee and must include the approval of Mr. Jolson and Mr. Buckanavage.

Business Strategy

Our investment objective is to generate both current income and capital appreciation primarily by making direct investments in the form of senior debt, subordinated debt and, to a lesser extent, minority equity investments. We have adopted the following business strategy to achieve our investment objective:

Capitalize on our investment adviser’s extensive relationships with small to mid-sized companies, private equity sponsors and other intermediaries. HCAP Advisors maintains extensive relationships with financial intermediaries, entrepreneurs, financial sponsors, management teams, small and mid-sized companies, attorneys, accountants, investment bankers, commercial bankers and other non-bank providers of capital throughout the United States,, which we expect will produce attractive investment opportunities for us. HCAP Advisors has been the sole or lead originator in a majority of our completed investment transactions. HCAP Advisors will also benefit from the resources and relationships of JMP Group, which maintains offices in San Francisco, New York City, Chicago, Boston, West Palm Beach, and Minneapolis.

Leverage the skills of our experienced investment adviser. The principals of HCAP Advisors have experience advising, investing in and lending to small and mid-sized companies and have been active participants in the primary leveraged credit markets. Throughout their careers, they have navigated various economic cycles as well as several market disruptions. We believe this experience and understanding allows them to select and structure better investments for us and to efficiently monitor and provide managerial assistance to our portfolio companies.

Apply disciplined underwriting policies. Lending to small to mid-sized private companies requires in-depth due diligence and credit underwriting expertise, which the principals of our investment adviser have gained throughout their extensive careers. HCAP Advisors has implemented disciplined and consistent underwriting policies in every transaction. These policies include a thorough analysis of each potential portfolio company’s competitive position, financial performance, management team, operating discipline, growth potential and industry considerations.

Maintain rigorous portfolio management. The principals of HCAP Advisors have significant investing and board-level experience with small to mid-sized companies, and as a result, we expect that our investment adviser will be a value-added partner to, and remain in close contact with, our directly originated portfolio companies. After originating an investment in a company, the investment professionals of HCAP Advisors will monitor each investment closely, typically receiving monthly, quarterly and annual financial statements, meeting face-to-face with our portfolio companies, as well as frequent informal communication with portfolio companies. In addition, our portfolio company investments generally contain financial covenants, and we obtain compliance certificates relating to those covenants quarterly from our portfolio companies. We believe that HCAP Advisors' initial and ongoing portfolio review process will allow it to effectively monitor the performance and prospects of our portfolio companies.

“Enterprise value” lending. We and HCAP Advisors take an enterprise value approach to the loan structuring and underwriting process. “Enterprise value” is the value that a portfolio company’s most recent investors place on the portfolio

7

company or “enterprise.” The value of the enterprise is determined by multiplying (x) the number of shares of common stock of the portfolio company outstanding on the date of calculation, on a fully diluted basis (assuming the conversion of all outstanding convertible securities and the exercise of all outstanding options and warrants), by (y) the price per share paid by the most recent purchasers of equity securities of the portfolio company plus the value of the portfolio company's liabilities. We generally secure a subordinated lien or a senior secured lien position against the enterprise value of a portfolio company and we obtain pricing enhancements in the form of warrants and other fees that we expect will build long-term asset appreciation in our portfolio. “Enterprise value” lending requires an in-depth understanding of the companies and markets served. We believe the experience that our investment adviser possesses gives us enhanced capabilities in making these qualitative “enterprise value” evaluations, which we believe can produce a high quality loan portfolio with enhanced returns for our stockholders.

Opportunity for enhanced returns. To enhance our loan portfolio returns, in addition to receiving interest, we may obtain warrants to purchase the equity of our portfolio companies, as additional consideration for making loans. The warrants we obtain generally include a “cashless exercise” provision to allow us to exercise these rights without requiring us to make any additional cash investment. Obtaining warrants in our portfolio companies allows us to participate in the equity appreciation of our portfolio companies, which we expect will enable us to generate higher returns for our investors. We may also make a direct equity investment in a portfolio company in conjunction with a debt investment, which may provide us with additional equity upside in our investment. Furthermore, we seek to enhance our loan portfolio returns by obtaining ancillary structuring and other fees related to the origination, investment, disposition or liquidation of debt and investment securities.

Investment Criteria

We use the following criteria and guidelines in evaluating investment opportunities and constructing our portfolio. However, not all of these criteria and guidelines have been, or will be, met in connection with each of our investments.

Value orientation / Positive cash flow. We place a premium on analysis of business fundamentals from an investor’s perspective and have a distinct value orientation. We target companies with proven business models in which we can invest at reasonable multiples of operating cash flow. We also typically invest in companies with a history of profitability. We generally do not invest in start-up companies, “turn-around” situations or companies that we believe have unproven business plans.

Experienced management teams with meaningful equity ownership. We target portfolio companies that have management teams with significant relevant industry experience coupled with meaningful equity ownership. We believe management teams with these attributes are more likely to manage the companies in a manner that protects our debt investment and enhances the value of our equity investment.

Niche market leaders with defensible market positions. We target companies that have developed defensible and/or leading positions within their respective markets or market niches and are well positioned to capitalize on growth opportunities. We favor companies that demonstrate significant competitive advantages, which we believe helps to protect their market position and profitability.

Diversified customer and supplier base. We prefer to invest in companies that have a diversified customer and supplier base. Companies with a diversified customer and supplier base are generally better able to endure economic downturns, industry consolidation and shifting customer preferences.

Limiting portfolio concentration. We seek to avoid concentrated exposure to a particular sector, which serves to diversify our portfolio and help to mitigate the risks of an economic downturn in any particular industry sector. In addition, we seek to diversify our portfolio from a geographic and a single borrower concentration perspective to mitigate the risk of an economic downturn in any particular part of the U.S. or concentration risk with respect to a particular borrower. We have adopted a guideline that we will generally refrain from investing more than 15% of our portfolio in any single industry sector.

Ability to exert meaningful influence. We seek to target investment opportunities in which we are the lead/sole investor in our tranche and in which we can add value through rigorous portfolio management and exercising certain rights and remedies available to us when necessary.

Private equity sponsorship. When feasible, we seek to invest in companies in conjunction with private equity sponsors who have proven capabilities in building value. We believe that a private equity sponsor can serve as a committed partner and advisor that will actively work with the company and its management team to meet company goals and create value. We assess

8

a private equity sponsor’s commitment to a portfolio company by, among other things, the capital contribution it has made or will make in the portfolio company.

Security interest. We generally seek a first or second priority security interest in all of the portfolio company’s tangible and intangible assets as collateral for our debt investment, subject in some cases to permitted exceptions. Although we do not intend to operate as an asset-based lender, the estimated liquidation value of the assets, if any, collateralizing the debt securities that we hold is evaluated as a potential source of repayment. We evaluate both tangible assets, such as accounts receivable, inventory and equipment, and intangible assets, such as intellectual property, customer lists, networks and databases.

Covenants. We seek to negotiate covenants in connection with our investments that afford our portfolio companies with flexibility in managing their businesses, but also act as a tool to minimize our loss of capital. Such restrictions may include affirmative and negative covenants, default penalties, lien protection, change of control provisions and board rights, including either observation or participation rights. Our investments generally have cross-default and material adverse change provisions, require the provision of periodic financial reports and operating metrics, and limit the portfolio company’s ability to incur additional debt, sell assets, engage in transactions with affiliates and consummate an extraordinary transaction, such as a merger, acquisition or recapitalization. In addition, we may require other performance or financial-based covenants, as we deem appropriate.

Exit strategy. We generally seek to invest in companies that we believe possess attributes that will provide us with the ability to exit our investments within a pre-established investment horizon. We expect to exit our investments typically through one of three scenarios: (i) the sale of the company resulting in repayment of all outstanding debt, (ii) the recapitalization of the company through which our loan is replaced with debt or equity from a third party or parties or (iii) the repayment of the initial or remaining principal amount of our loan then outstanding at maturity. In some investments, there may be scheduled amortization of some portion of our loan which would result in a partial exit of our investment prior to the maturity of the loan.

Investment Process

The investment professionals of HCAP Advisors have responsibility for originating investment opportunities, evaluating potential investments, transaction due diligence, preparation of a preliminary deal evaluation memorandum, negotiation of definitive terms and conditions, securing approval from the Investment Committee, negotiation of legal documentation and monitoring/management of portfolio investments. There are six key elements of our investment process:

•Origination

•Evaluation

•Structuring/Negotiation

•Due Diligence/Underwriting

•Documentation/Closing

•Portfolio Management/Investment Monitoring.

Origination

HCAP Advisors develops investment opportunities through a relationship network of financial intermediaries, entrepreneurs, financial sponsors, management teams, small- and mid-sized companies, attorneys, accountants, investment bankers, commercial bankers and other non-bank providers of capital throughout the United States. This investment sourcing network has been developed by the principals of HCAP Advisors, and enabled them to originate investments in every region of the United States. We believe that the strength of this network should enable HCAP Advisors to receive the first look at many investment opportunities. We believe that directly originating our own senior debt and subordinated debt investments and equity co-investments gives us greater control over due diligence, structure, terms and ultimately results in stronger investment performance. As a lead and often sole investor in the particular tranche of the capital structure, we also expect to obtain board or observation rights, which allow us to take a more active role in monitoring our investment after we close the investment.

We also expect HCAP Advisors’ relationship with JMP Group, which, through HCS, also manages a family of venture capital and real estate funds, and middle-market lending and private equity funds, to generate investment opportunities for us. We may, from time to time, and subject to the conditions included in our existing SEC co-investment exemptive relief under the 1940 Act (the "Exemptive Relief"), co-invest alongside certain accounts and funds affiliated with JMP Group.

9

Evaluation

An initial review of the potential investment opportunity will be performed by one or more of HCAP Advisors’ investment professionals. During the initial review process, the investment professionals may solicit input regarding industry and market dynamics from credit analysts and/or equity research analysts within our investment adviser and JMP Group. If the investment opportunity does not meet our investment criteria, feedback will be delivered timely through our origination channels. To the extent an investment appears to meet our investment criteria, the investment professionals of HCAP Advisors will begin preliminary due diligence.

Structuring/Negotiation

When an investment professional of HCAP Advisors identifies an investment opportunity that appears to meet our investment criteria, one or more of its investment professionals will prepare a pre-screen memorandum. During the process, comprehensive and proprietary models are created to evaluate a range of outcomes based on sensitized variables including various economic environments, changes in the cost of production, and various product or service supply/demand and pricing scenarios. HCAP Advisors’ investment professionals will perform preliminary due diligence and tailor a capital structure to match the historical financial performance and growth strategy of the potential portfolio company.

The pre-screen memorandum will also include the following:

•transaction description;

•company description, including product or service analysis, market position, industry dynamics, customer and supplier analysis, and management evaluation;

•quantitative and qualitative analysis of historical financial performance and preparation of 5-year financial projections;

•competitive landscape;

•business strengths and weaknesses;

•quantitative and qualitative analysis of business owner(s) (including private equity firm);

•potential investment structure, leverage multiples and expected yield calculations; and

•outline of key due diligence areas.

The Investment Committee then reviews the pre-screen memorandum and determines whether the opportunity fits our general investment criteria and should be considered for further due diligence. If the Investment Committee makes a positive determination, HCAP Advisors’ investment professionals will then negotiate and execute a non-binding term sheet with the potential portfolio company and conduct further due diligence.

During the formal approval process for investments, HCAP Advisors’ investment professionals regularly communicate with at least one member of the Investment Committee throughout in order to ensure efficiency as well as clarity for our prospective portfolio companies and clients.

Due Diligence/Underwriting

Once a non-binding term sheet has been negotiated and executed with the potential portfolio company and, in limited circumstances, the prospective portfolio company has remitted a good faith deposit, we begin our formal underwriting and due diligence process by requesting additional due diligence materials from the prospective portfolio company and arranging additional on-site visits with management and relevant employees. HCAP Advisors typically requests the following information as part of the due diligence process:

•annual and interim (including monthly) financial information;

•completion of a quality of earnings assessment by an accounting firm;

•capitalization tables showing details of equity capital raised and ownership;

•recent presentations to investors or board members covering the portfolio company’s current status and market opportunity;

•detailed business plan, including an executive summary and discussion of market opportunity;

•detailed background on all senior members of management, including background checks by third party;

•detailed forecast for the current and subsequent five fiscal years;

•information on competitors and the prospective portfolio company’s competitive advantage;

10

•completion of Phase I (and, if necessary, Phase II) environmental assessment;

•marketing information on the prospective portfolio company’s products, if any;

•information on the prospective portfolio company’s intellectual property; and

•information on the prospective portfolio company from its key customers or clients.

The due diligence process generally includes a formal visit to the prospective portfolio company’s location and interviews with the prospective portfolio company’s senior management team and key operational employees. Outside sources of information are reviewed, including industry publications, market articles, Internet publications, or publicly available information on competitors.

Documentation/Closing

Upon completion of the due diligence process and review and analysis of all of the information provided by the prospective portfolio company and obtained externally, the investment professionals assigned to the opportunity prepare an investment memorandum for review and approval. The Investment Committee will reconvene to evaluate the opportunity, review the investment memorandum and discuss the findings of the due diligence process. If the opportunity receives final approval, HCAP Advisors’ principals, with the assistance of outside legal counsel, will be responsible for preparing and negotiating transaction documents and ensuring that the documents accurately reflect the terms and conditions approved by the Investment Committee. Funding requires final approval by the Investment Committee.

Portfolio Management/Investment Monitoring

HCAP Advisors employs several methods of evaluating and monitoring the performance of our portfolio companies, which, depending on the particular investment, may include the following processes, procedures, and reports:

•review of available monthly or quarterly financial statements compared against the prior year’s comparable period and the company’s financial projections;

•review and discussion, if applicable, of the management discussion and analysis that will accompany its financial results;

•review of the company’s quarterly results and overall general business performance and assessment of the company’s compliance with all covenants (financial or otherwise), including preparation of a portfolio monitoring report or “PMR” (on a quarterly basis), which will be distributed to the members of the Investment Committee;

•periodic, and often, face-to-face meetings with management team and owners (including private equity firm if applicable); and

•attendance at board of directors meetings at portfolio companies through formal board seat or board observation rights.

Once the investment adviser has had the opportunity to review all quarterly PMRs, a meeting will be held with the investment professionals to review all of the PMRs to ensure consensus on risk rating, action steps (if any), and valuation.

In connection with the preparation of PMRs, each investment receives a quarterly risk rating following the five-level numeric investment rating system outlined below. The investment rating system uses a five-level numeric scale. In determining an investment rating, HCAP Advisors takes into account various aspects of a company's performance during the measurement period and assigns an investment rating to each aspect, which are then averaged. Such averages may form, but do not necessarily determine, the investment rating assigned to a portfolio company. The following is a description of the conditions associated with each investment rating:

11

| Investment Rating | Summary Description | ||||

| 1 | Investment Rating 1 is used for investments that are performing above expectations, and whose risks remain favorable compared to the expected risk at the time of the original investment. | ||||

| 2 | Investment Rating 2 is used for investments that are performing within expectations and whose risks remain neutral compared to the expected risk at the time of the original investment. All new loans are initially rated 2. | ||||

| 3 | Investment Rating 3 is used for investments that are performing below expectations and that require closer monitoring, but where no loss of return or principal is expected. Portfolio companies with a rating of 3 may be out of compliance with financial covenants. | ||||

| 4 | Investment Rating 4 is used for investments that are performing substantially below expectations and whose risks have increased substantially since the original investment. These investments are often in workout. Investments with a rating of 4 are those for which there is an increased possibility of loss of return, but no loss of principal is expected. | ||||

| 5 | Investment Rating 5 is used for investments that are performing substantially below expectations and whose risks have increased substantially since the original investment. These investments are almost always in workout. Investments with a rating of 5 are those for which loss of return and principal is expected. | ||||

Determination of Net Asset Value and Portfolio Valuation Process

The net asset value per share of our common stock will be determined quarterly by dividing the value of our total assets minus liabilities by the total number of shares of common stock outstanding at the date as of which the determination is made. We will conduct the valuation of our assets, pursuant to which our net asset value will be determined, at all times consistent with U.S. generally accepted accounting principles, or “GAAP,” and the 1940 Act.

In calculating the fair value of our total assets, investments for which market quotations are readily available will be valued at such market quotations, which will generally be obtained from an independent pricing service or one or more broker-dealers or market makers.

We expect that there will not be a readily available market value for a substantial portion of our portfolio investments, and we will value those debt and equity securities that are not publicly traded or whose market value is not ascertainable at fair value as determined in good faith by our board of directors pursuant to our valuation policy and the 1940 Act. HCAP Advisors also employs an independent third party valuation firm to assist in determining the fair value of our portfolio investments, as described below.

In accordance with authoritative accounting guidance, and with the assistance of any independent third-party valuation firms that we employ, we perform detailed valuations of our debt and equity investments on an individual basis, using market, income, and bond yield approaches as appropriate. In general, we utilize a bond yield method for the majority of our debt investments, as long as it is appropriate. If, in our judgment, the bond yield approach is not appropriate, we may use the market approach, or, in certain cases, an alternative methodology potentially including an asset liquidation or expected recovery model. For our equity investments, we generally utilize the market and income approaches.

Under the bond yield approach, we use bond yield models to determine the present value of the future cash flow streams of our debt investments. We review various sources of transactional data, including private mergers and acquisitions involving debt investments with similar characteristics, and assess the information to benchmark appropriate discount rates in the valuation process.

Under the market approach, we estimate the enterprise value of the portfolio companies in which we invest. There is no one methodology to estimate enterprise value, and in fact, for any one portfolio company, enterprise value is best expressed as a range of fair values, from which we derive a single estimate of enterprise value. To estimate the enterprise value of a portfolio company, we analyze various factors, including the portfolio company’s historical and projected financial results. Typically, private companies are valued based on multiples of EBITDA, cash flows, net income, revenues or, in limited cases, book value. We generally require portfolio companies to provide annual audited and quarterly and monthly unaudited financial statements, as well as annual projections for the upcoming fiscal year, though in some cases we have waived, and in the future may determine to waive, the requirement to provide audited financial statements based on facts and circumstances that make the portfolio company's audit impracticable.

12

Under the income approach, we generally prepare and analyze discounted cash flow models based on projections of the future free cash flows of the business. The discount rates used are determined based upon the portfolio company's weighted average cost of capital.

The types of factors that the board of directors may take into account in determining fair value include, among other things, comparisons of financial ratios of the portfolio companies that issued such private equity securities to peer companies that are public, the nature and realizable value of any collateral, the portfolio company’s ability to make payments and its earnings and discounted cash flow, the markets in which the portfolio company does business, and other relevant factors, including in discerning whether the impact of the COVID-19 pandemic on a portfolio company and its earnings is temporary or permanent in nature and the resulting significance thereof on our valuation of our investment. When an external event such as a purchase transaction, public offering or subsequent equity sale occurs, we will consider the pricing indicated by the external event to corroborate the private equity valuation.

The following is a description of our valuation process. Investments are measured at fair value as determined in good faith by our management team and HCAP Advisors' investment professionals, reviewed by the audit committee (which consists entirely of directors who are not "interested persons," as such term is defined in Section 2(a)(19) of the 1940 Act, of the Company) of the board of directors, and ultimately approved by our board of directors, based on, among other factors, consistently applied valuation procedures on each measurement date.

The board of directors undertakes a multi-step valuation process at each measurement date:

•Our valuation process generally begins with each investment initially being valued by our management and HCAP Advisors' investment professionals, and/or, if applicable, by an independent third-party valuation firm.

•Preliminary valuation conclusions are documented and discussed with our senior management.

•The audit committee of our board of directors reviews and discusses the preliminary valuations and recommends valuations to our board of directors for approval.

•The board of directors discusses valuations and determines the fair value of each investment in our portfolio in good faith, based upon the input of our senior management, HCAP Advisors' investment professionals, and an independent third-party valuation firm (to the extent any such firm reviewed the investment during the applicable quarter), and the recommendation of the board of directors' audit committee.

The nature of the materials and input that our board of directors receives in the valuation process varies depending on the nature of the investment and the other facts and circumstances. For example, in the case of investments that are Level 1 or 2 assets, a formal report by our management or HCAP Advisors' investment professionals, called a portfolio monitoring report, or “PMR,” is not generally prepared, and no independent third-party valuation firm is engaged due to the availability of quotes in markets for such investments or similar assets. In the case of investments that are Level 3 assets, however, our board of directors generally receives a report on material Level 3 investments on a quarterly basis (i) from our management or HCAP Advisors' investment professionals in the form of a PMR, (ii) from an independent third-party valuation firm, or (iii) in some cases, both. In the case of investments that are Level 3 assets and have an investment rating of 1 (performing above expectations), we generally engage an independent third-party valuation firm to review all such material investments at least annually. In quarters where an external valuation is not prepared for such investments, our management or HCAP Advisors’ investment professionals generally prepare a PMR. In the case of investments that are Level 3 assets and have an investment rating of 2 through 5 (with performance ranging from within expectations to substantially below expectations), we generally engage an independent third-party valuation firm to review such material investments quarterly (and may receive a PMR in addition to the review of the independent third-party valuation firm where the Level 3 assets have an investment rating of 3 through 5). However, in certain cases for Level 3 assets, we may determine that it is more appropriate for HCAP Advisors’ investment professionals to prepare a PMR instead of engaging an independent third-party valuation firm on a quarterly basis, because a third-party valuation is not cost effective or the nature of the investment does not warrant a quarterly third-party valuation. In addition, under certain unique circumstances, we may determine that a formal valuation report is not likely to be informative, and neither a third-party valuation report nor a report from management or HCAP Advisors’ investment professionals is prepared. Such circumstances might include, for example, an instance in which the investment has paid off after the period end date but before the board of directors meets to discuss the valuations. Further, Level 3 debt investments that have closed within six months of the measurement date are valued at cost unless unique circumstances dictate otherwise.

13

Due to the inherent uncertainty in determining the fair value of investments that do not have a readily observable fair value, and the subjective judgments and estimates involved in those determinations, the fair value determinations by our board of directors, even though determined in good faith, may differ materially from the values that would have been used had a readily available market value existed for such investments, and the differences could be material.

Derivatives

We may utilize hedging techniques such as entering into interest rate swaps to mitigate potential interest rate risk on our indebtedness. Such interest rate swaps would principally be used to protect us against higher costs on our indebtedness resulting from increases in both short-term and long-term interest rates.

We also may use various hedging and other risk management strategies to seek to manage various risks, including changes in currency exchange rates and market interest rates. Such hedging strategies would be utilized to seek to protect the value of our portfolio investments, for example, against possible adverse changes in the market value of securities held in our portfolio.

Managerial Assistance

As a BDC, we offer, through HCAP Advisors, and must provide upon request, managerial assistance to certain of our portfolio companies. This assistance may involve, among other things, monitoring the operations of these portfolio companies, participating in board of directors and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance.

We may receive fees for these services, though we may reimburse HCAP Advisors for its expenses related to providing such services on our behalf, which shall not exceed the amount we receive from such companies for providing this assistance and will not count against the $1.4 million cap on amounts payable by the Company under the administration agreement.

Competition

We compete for investments with other BDCs and investment funds, as well as traditional financial services companies such as commercial banks and other financing sources. A number of our competitors are larger and have greater financial, technical, marketing and other resources than we have. For example, some competitors may have a lower cost of funds and access to funding sources that are not available to us. Furthermore, many of our competitors are not subject to the regulatory restrictions that the 1940 Act imposes on us as a BDC or that the Code imposes on us as a RIC. We believe we compete effectively with these entities primarily on the basis of the experience, industry knowledge and contacts of the principals of our investment adviser, its responsiveness and efficient investment analysis and decision-making processes, its creative financing products and highly customized investment terms. We do not intend to compete primarily on the interest rates we offer and believe that some competitors make loans with rates that are comparable or lower than our rates.

Employees

We do not have any employees. Our day-to-day investment operations are managed by HCAP Advisors, and each of our officers is an employee of HCAP Advisors or another affiliate. The partners and investment professionals of HCAP Advisors and the members of the Investment Committee that support us are not employed by us and receive no compensation directly from us in connection with the management of our portfolio. However, through their financial interests in and/or employment with HCAP Advisors, they are indirectly compensated by us through the investment advisory fees we pay to HCAP Advisors.

As of March 12, 2021, our investment adviser had a total of five full-time officers and employees, who expect to draw upon the resources of JMP Group, including its investment professionals as well as finance and operational professionals, in connection with our investment activities. In addition, we reimburse HCAP Advisors for the allocable portion of overhead and other expenses incurred by it in performing its obligations under the administration agreement, including rent and the allocable portion of the compensation of our executive officers and their respective staffs. For a more detailed discussion of the administration agreement with HCAP Advisors, see “Administration Agreement.”

14

Investment Advisory Agreement

HCAP Advisors serves as our investment adviser pursuant to an investment advisory and management agreement. HCAP Advisors is registered as an investment adviser under the Investment Advisers Act of 1940, or the "Advisers Act". Subject to the overall supervision of our board of directors, HCAP Advisors manages our day-to-day operations, and provides investment advisory and management services to us.

Under the terms of our investment advisory and management agreement, HCAP Advisors:

•determines the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes;

•identifies, evaluates and negotiates the structure of the investments we make;

•executes, closes, services and monitors the investments we make;

•perform due diligence on our prospective portfolio companies;

•determine the securities and other assets that we will purchase, retain or sell; and

•such other investment advisory, research and related services as we may, from time to time, reasonably require for the investment of our funds.

HCAP Advisors’ services under the investment advisory and management agreement are not exclusive, and it is free to furnish similar services to other entities so long as its services to us are not impaired. Under the investment advisory and management agreement, HCAP Advisors also provides on our behalf managerial assistance to those portfolio companies to which we are required to provide such assistance.

Management Fee

Pursuant to our investment advisory and management agreement, we pay HCAP Advisors a fee for investment advisory and management services consisting of a base management fee and a two-part incentive fee.

Base Management Fee. The base management fee is calculated at an annual rate of (i) 2.0% of our gross assets up to and including $350 million, (ii) 1.75% of our gross assets above $350 million and up to and including $1 billion, and (iii) 1.5% of our gross assets above $1 billion, and is payable quarterly in arrears. For purposes of calculating the base management fee, the term “gross assets” includes all assets, including any assets acquired with the proceeds of leverage, but excludes cash and cash equivalents. HCAP Advisors benefits when we incur debt or use leverage. The base management fee is calculated based on the average value of our gross assets at the end of the two most recently completed calendar quarters. Base management fee for any partial quarter will be appropriately prorated.

Incentive Fee. The incentive fee has two parts, as follows:

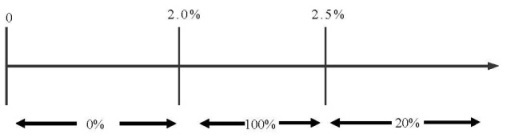

One component of the incentive fee is calculated and payable quarterly in arrears based on our pre-incentive fee net investment income for the immediately preceding calendar quarter and is 20% of the amount, if any, by which our pre-incentive fee net investment income for the immediately preceding calendar quarter exceeds a 2.0% (which is 8.0% annualized) hurdle rate, subject to a “catch-up” provision pursuant to which HCAP Advisors receives 100% of our pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than 2.5% (10.0% annualized). The effect of this "catch-up" provision is that, if pre-incentive fee net investment income exceeds 2.5% in any calendar quarter, HCAP Advisors will receive 20% of our pre-incentive fee net investment income as if a hurdle rate did not apply. For this purpose, pre-incentive fee net investment income means interest income, dividend income and any other income (including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive from portfolio companies) accrued during the calendar quarter, minus our operating expenses for the quarter (including the base management fee, expenses payable under the administration agreement (as defined below), and any interest expense and any dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of

15

investments with a deferred interest feature (such as original issue discount, or "OID", debt instruments with payment-in-kind, or "PIK", interest and zero coupon securities), accrued income that we have not yet received in cash. Since the hurdle rate is fixed, as interest rates rise, it is easier for HCAP Advisors to surpass the hurdle rate and receive an incentive fee based on net investment income. The foregoing incentive fee is subject to a total return requirement, which provides that no incentive fee in respect of our pre-incentive fee net investment income will be payable except to the extent 20% of the cumulative net increase in net assets resulting from operations over the then current and 11 preceding quarters exceeds the cumulative incentive fees accrued and/or paid for the 11 preceding quarters. In other words, any ordinary income incentive fee that is payable in a calendar quarter is limited to the lesser of (i) 20% of the amount by which our pre-incentive fee net investment income for such calendar quarter exceeds the 2.0% hurdle rate, subject to the “catch-up” provision, and (ii) (x) 20% of the cumulative net increase in net assets resulting from operations for the then current and 11 preceding calendar quarters minus (y) the cumulative incentive fees accrued and/or paid for the 11 preceding calendar quarters. For the foregoing purpose, the “cumulative net increase in net assets resulting from operations” is the amount, if positive, of the sum of pre-incentive fee net investment income, realized gains and losses and unrealized appreciation and depreciation of the Company for the then current and 11 preceding calendar quarters.

Pre-incentive fee net investment income, expressed as a rate of return on the value of our net assets (defined as total assets less senior securities constituting indebtedness and preferred stock) at the end of the then current quarter, does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. Because of the structure of the incentive fee, it is possible that we may pay an incentive fee in a quarter where we incur a loss. For example, if we receive pre-incentive fee net investment income in excess of the quarterly minimum hurdle rate, we will pay the applicable incentive fee even if we have incurred a loss in that quarter due to realized and unrealized capital losses. Our net investment income used to calculate this component of the incentive fee is also included in the amount of our gross assets used to calculate the base management fee. These calculations are adjusted for any share issuances or repurchases during the current quarter.

The following is a graphical representation of the calculation of the income-related portion of the incentive fee:

Quarterly Incentive Fee Based on Net Investment Income

Pre-incentive Fee Net Investment Income

(expressed as a percentage of the value of net assets)

Percentage of Pre-Incentive Fee Net Investment Income Allocated to First Component of Incentive Fee

The second component of the incentive fee (the "capital gains incentive fee") is determined and payable in arrears as of the end of each calendar year (or upon termination of the investment advisory and management agreement, as of the termination date) and equals 20.0% of our cumulative aggregate realized capital gains less cumulative aggregate realized capital losses and aggregate unrealized capital depreciation, in each case calculated from the commencement date. If the difference is positive, then the capital gains incentive fee for such year is 20.0% of such amount, as noted above, less the aggregate amount of capital gains incentive fee payments previously paid to HCAP Advisors in all prior years. If such amount is negative, then no capital gains incentive fee will be payable for such year. If the investment advisory and management agreement is terminated as of a date that is not a calendar year end, the termination date shall be treated as though it were a calendar year end for purposes of calculating and paying a capital gains incentive fee.

16

Payment of Our Expenses

We bear all costs and expenses that are incurred in our operation and transactions and not specifically assumed by HCAP Advisors pursuant to the investment advisory and management agreement or the administration agreement. These costs and expenses include, but are not limited to, those relating to:

•our organization;

•calculating our net asset value (including the cost and expenses of any independent valuation firms);

•expenses, including travel expense, incurred by HCAP Advisors or payable to third parties performing due diligence on prospective portfolio companies, monitoring our investments and, if necessary, enforcing our rights;

•interest payable on debt, if any, incurred to finance our investments;

•offerings of our securities;

•investment advisory and management fees;

•distributions on our shares;

•administration fees payable under the administration agreement;

•the allocated costs incurred by HCAP Advisors, as our administrator, in providing managerial assistance to those portfolio companies that request it;

•amounts payable to third parties relating to, or associated with, making investments;

•transfer agent and custodial fees;

•registration fees;

•listing fees;

•taxes;

•independent director fees and expenses;

•preparing and filing reports or other documents with the SEC;

•preparation of any reports, proxy statements or other notices to our stockholders, including printing costs;

•our fidelity bond;

•directors and officers/errors and omissions liability insurance, and any other insurance premiums;

• indemnification payments;

• expenses relating to the development and maintenance of our website;

•direct costs and expenses of administration, including audit and legal costs; and

•all other expenses reasonably incurred by us or our investment adviser in connection with administering our business, such as the allocable portion of overhead under the administration agreement, including rent and the allocable portion of the cost of our officers and their respective staffs.

Limitation of Liability and Indemnification

The investment advisory and management agreement provides that HCAP Advisors and its officers, managers, partners, controlling persons, members, directors, employees, agents and affiliates are not liable to us or any of our stockholders for any act or omission by it or its employees in the supervision or management of our investment activities or for any loss sustained by us or our stockholders, except that the foregoing exculpation does not extend to any act or omission constituting willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations under the investment advisory and management agreement. The investment advisory and management agreement also provides for indemnification by us of HCAP Advisors’ members, managers, partners, directors, officers, employees, agents and control persons for liabilities incurred by it in connection with their services to us, subject to the same limitations and to certain conditions.

Duration and Termination

Our board of directors approved the investment advisory and management agreement at its first meeting, held on January 17, 2013. The investment advisory and management agreement was originally executed as of April 29, 2013 for an initial term of two years. Our board of directors most recently re-approved the investment advisory and management agreement on March 5, 2020 for an additional one-year term.

Unless earlier terminated as described below, including upon the completion of the Mergers, the investment advisory and management agreement provides that it will remain in effect if approved annually by our board of directors or by the affirmative vote of the holders of a majority of our outstanding voting securities, including, in either case, approval by a

17

majority of our directors who are not parties to such agreement or who are not “interested persons,” as such term is defined in Section 2(a)(19) of the 1940 Act, of any such party. The investment advisory and management agreement will automatically terminate in the event of its assignment. The investment advisory and management agreement may also be terminated by either party without penalty upon not more than 60 days’ written notice to the other party. See “Risk Factors - Our investment adviser has the right to resign on 60 days’ notice, and we may not be able to find a suitable replacement within that time, resulting in a disruption in our operations that could adversely affect our financial condition, business and results of operations.”

The investment advisory and management agreement will automatically terminate without penalty upon the completion of the Mergers. See "—The Proposed Merger With Portman Ridge Finance Corporation" above.

Board Approval of the Investment Advisory and Management Agreement

In consideration of its re-approval of the investment advisory and management agreement with HCAP Advisors during a meeting held on March 5, 2020, the board of directors focused on information it had received relating to, among other things:

•the nature, extent, and quality of the advisory and other services to be provided to us by our investment adviser, including, without limitation, in relation to the origination and underwriting of investments in middle market and lower middle market private companies and information with respect to our investment adviser’s portfolio management process;

•the performance of the Company and HCAP Advisors, including, without limitation, comparative data with respect to the performance of BDCs with similar investment objectives;

•comparative data with respect to advisory fees or similar expenses paid by other BDCs with similar investment objectives, as well as other externally managed BDCs;

•our operating expenses and expense ratio compared to BDCs with similar investment objectives, including, without limitation, consideration of administrative fees paid by other BDCs with similar investment objectives, as well as other externally managed BDCs, given HCAP Advisors’ provision of administrative services to the Company under the administration agreement and receipt of administrative fees for such services;

•any existing and potential sources of indirect income to HCAP Advisors from its relationships with us and the profitability of those relationships, including, without limitation, administrative fees paid to HCAP Advisors in its capacity as the administrator under the administration agreement with the Company;

•information about the services to be performed, the cost of such services, and the personnel performing such services under the investment advisory and management agreement, including, without limitation, the experience of such personnel in originating investments in the middle market and lower middle market;

•the organizational capability and financial condition of HCAP Advisors;

•the extent to which economies of scale would be realized if the Company grows and whether fee levels reflect these economies of scale for the benefit of the Company's stockholders, including, without limitation, consideration that the investment advisory and management agreement includes breakpoints that provide for the reduction of the base management fee as the Company’s gross assets increase above certain thresholds; and

•such other matters as the board of directors determined were relevant to their consideration of the investment advisory and management agreement.

In connection with their consideration of the renewal of the investment advisory and management agreement, our board of directors gave weight to each of the factors described above, but did not identify one particular factor as controlling their decision. Based on the information reviewed and the discussions, the board of directors, including a majority of the directors who are not “interested persons” as defined in the 1940 Act, concluded that the investment management fee rates are reasonable in relation to the services to be provided and approved the renewal of the investment advisory and management agreement.

18

Organization of the Investment Adviser

HCAP Advisors is a Delaware limited liability company. The principal executive offices of HCAP Advisors are located at 767 Third Avenue, 29th Floor, New York, New York 10017.

Administration Agreement

HCAP Advisors also serves as our administrator pursuant to an administration agreement, which became effective on April 29, 2018. Prior to April 29, 2018, another affiliate of JMP Group, JMP Credit Advisors, served as our administrator. Pursuant to the aforementioned administration agreement, HCAP Advisors furnishes us with office facilities, equipment and clerical, bookkeeping, recordkeeping services at such office facilities and other such services as our administrator, subject to review by our board of directors, shall from time to time determine to be necessary or useful to perform its obligations under the administration agreement. Under the administration agreement, HCAP Advisors also performs, or oversees the performance of, our required administrative services, which include, among other things, being responsible for maintaining the financial and other records which we are required to maintain and preparing reports required to be filed with the SEC or any other regulatory authority. In addition, HCAP Advisors assists us in determining and publishing our net asset value, oversees the preparation and filing of our tax returns and the printing and dissemination of reports to our stockholders, and generally oversees the payment of our expenses and the performance of administrative and professional services rendered to us by others.

In full consideration of the provision of the services of HCAP Advisors as our administrator, we reimburse HCAP Advisors for the costs and expenses incurred by it in performing its obligations and providing personnel and facilities under the administration agreement. Payments under the administration agreement are equal to an amount based upon our allocable portion of HCAP Advisors' overhead in performing its obligations under the administration agreement, including rent and our allocable portion of the cost of our executive officers and their respective staffs. In addition, if HCAP Advisors provides managerial assistance to our portfolio companies, we may receive fees from the applicable portfolio company in exchange for such services. We will generally reimburse HCAP Advisors at cost for the managerial assistance services they provide to any portfolio company, which amount will not exceed the amount that we receive from such portfolio company for providing this assistance and will not count against the $1.4 million cap on amounts payable by us under the administration agreement.

Our board of directors or a committee thereof discusses with our administrator the methodology employed in determining how the expenses are allocated to us. Our board of directors or a committee thereof also assesses the reasonableness of such reimbursements for expenses allocated to us based on the breadth, depth and quality of such services. In addition, our board of directors or a committee thereof consider other factors in assessing the reasonableness of the fee, including the amounts paid for such services by other BDCs and the costs that may be associated with obtaining similar services from other third-party service providers.

Similar to arrangements in prior years with our previous administrator, HCAP Advisors has agreed to a cap on amounts payable by us under the administration agreement. This cap set the maximum amount that would be payable by us under the administration agreement to $1.4 million for each of 2018, 2019 and 2020.

The existence of a cap, and the determination of a proper cap amount, in subsequent years will be determined by the mutual agreement of the independent members of our board of directors, on our behalf, and the administrator. The administration agreement may be terminated by either party without penalty upon 60 days’ written notice to the other.