Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - INTERNATIONAL TOWER HILL MINES LTD | tm211093d1_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - INTERNATIONAL TOWER HILL MINES LTD | tm211093d1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - INTERNATIONAL TOWER HILL MINES LTD | tm211093d1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - INTERNATIONAL TOWER HILL MINES LTD | tm211093d1_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - INTERNATIONAL TOWER HILL MINES LTD | tm211093d1_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - INTERNATIONAL TOWER HILL MINES LTD | tm211093d1_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-33638

INTERNATIONAL TOWER HILL MINES LTD.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 98-0668474 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

2300-1177 West Hastings Street, Vancouver, British Columbia, Canada (Address of principal executive offices)

|

V6E 2K3 (Zip code)

|

|

Registrant’s telephone number, including area code: (604) 683-6332 |

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol | Name of each exchange on which registered: |

| Common Shares, no par value | THM | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: N/A

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer x | Smaller reporting company x |

| Emerging Growth Company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Based on the last sale price on the NYSE American of the registrant’s Common Shares on June 30, 2020 (the last business day of the registrant’s most recently completed second fiscal quarter) of $1.78 per share, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $173.1 million.

As of March 1, 2021, the registrant had 194,908,184 Common Shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

To the extent specifically referenced in Part III, portions of the registrant’s definitive Proxy Statement on Schedule 14A to be filed with the Securities and Exchange Commission in connection with the registrant’s 2021 Annual Meeting of Shareholders are incorporated by reference into this report.

Table of Contents

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING ESTIMATES OF MEASURED, INDICATED

AND INFERRED RESOURCES AND PROVEN AND PROBABLE RESERVES

International Tower Hill Mines Ltd. (“we”, “us”, “our,” “ITH” or the “Company”) is a mineral exploration company engaged in the acquisition and exploration of mineral properties. As used in this Annual Report on Form 10-K, the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101—Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”)—CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (“SEC Industry Guide 7”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves.

“Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable.

Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations if such disclosure includes the grade or quality and the quantity for each category of mineral resource and mineral reserve; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, information contained in this report and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The term “mineralized material” as used in this Annual Report on Form 10-K, although permissible under SEC Industry Guide 7, does not indicate “reserves” by SEC Industry Guide 7 standards. We cannot be certain that any part of the mineralized material will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”. Investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

CAUTIONARY NOTE TO ALL INVESTORS CONCERNING ECONOMIC ASSESSMENTS THAT INCLUDE INFERRED RESOURCES

The Company currently holds or has the right to acquire interests in an advanced stage exploration project in Alaska referred to as the Livengood Gold Project (the “Livengood Gold Project” or the “Project”). Mineral resources that are not mineral reserves have no demonstrated economic viability. The preliminary assessments on the Project are preliminary in nature and include “inferred mineral resources” that have a great amount of uncertainty as to their existence, and are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies. There is no certainty that such inferred mineral resources at the Project will ever be realized. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable.

1

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements or information within the meaning of the United States Private Securities Litigation Reform Act of 1995 concerning anticipated results and developments in the operations of the Company in future periods, planned exploration activities, the adequacy of the Company’s financial resources and other events or conditions that may occur in the future. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible” and similar expressions, or statements that events, conditions or results “will,” “may,” “could” or “should” (or the negative and grammatical variations of any of these terms) occur or be achieved. These forward-looking statements may include, but are not limited to, statements concerning:

| · | the Company’s future cash requirements, the Company’s ability to meet its financial obligations as they come due, and the Company’s ability to be able to raise the necessary funds to continue operations on acceptable terms, if at all; |

| · | the preparation, timing, costs, and any anticipated contents of an updated pre-feasibility study (“PFS”) for the Livengood Gold Project, including the ability to incorporate work done since the April 2017 NI 43-101 report and further de-risk and identify the optimal project configuration for the Livengood Gold Project; |

| · | the potential to improve the block model or production schedule at the Livengood Gold Project; |

| · | the potential for opportunities to improve recovery or further reduce costs at the Livengood Gold Project; |

| · | the Company’s ability to potentially include the results of its optimization process in the PFS or any future financial analysis of the Project and the estimated cost of such optimization process; |

| · | the Company’s ability to carry forward and incorporate into future engineering studies of the Livengood Gold Project updated mine design, production schedule, and recovery concepts identified during the optimization process; |

| · | the Company’s potential to carry out an engineering phase that will evaluate and optimize the Livengood Gold Project configuration and capital and operating expenses, including determining the optimum scale for the Livengood Gold Project; |

| · | the Company’s strategies and objectives, both generally and specifically in respect of the Livengood Gold Project; |

| · | the Company’s belief that there are no known environmental issues that are anticipated to materially impact the Company’s ability to conduct mining operations at the Livengood Gold Project; |

| · | the potential for the expansion of the estimated resources at the Livengood Gold Project; |

| · | the potential for a production decision concerning, and any production at, the Livengood Gold Project; |

| · | the sequence of decisions regarding the timing and costs of development programs with respect to, and the issuance of the necessary permits and authorizations required for, the Livengood Gold Project; |

| · | the Company’s estimates of the quality and quantity of the resources at the Livengood Gold Project; |

| · | the timing and cost of any future exploration programs at the Livengood Gold Project, and the timing of the receipt of results therefrom; |

| · | the expected levels of overhead expenses; and |

| · | future general business and economic conditions, including changes in the price of gold and the overall sentiment of the markets for public equity. |

Such forward-looking statements reflect the Company’s current views with respect to future events and are subject to certain known and unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others:

| · | the demand for, and level and volatility of the price of, gold; |

| · | conditions in the financial markets generally, the overall sentiment of the markets for public equity, interest rates and currency rates; |

| · | general business and economic conditions, including the effect of the COVID-19 pandemic on such conditions; |

| · | government regulation and proposed legislation (and changes thereto or interpretations thereof); |

| · | defects in title to claims, or the ability to obtain surface rights, either of which could affect the Company’s property rights and claims; |

2

| · | the Company’s ability to secure the necessary services and supplies on favorable terms in connection with its programs at the Livengood Gold Project and other activities; |

| · | the Company’s ability to attract and retain key staff, particularly in connection with the permitting and development of any mine at the Livengood Gold Project; |

| · | the accuracy of the Company’s resource estimates (including with respect to size and grade) and the geological, operational and price assumptions on which these are based; |

| · | the timing of the ability to commence and complete planned work programs at the Livengood Gold Project; |

| · | delays or unanticipated issues in updating the PFS for the Livengood Gold Project; |

| · | the timing of the receipt of and the terms of the consents, permits and authorizations necessary to carry out exploration and development programs at the Livengood Gold Project and the Company’s ability to comply with such terms on a safe and cost-effective basis; |

| · | the ongoing relations of the Company with the lessors of its property interests and applicable regulatory agencies; |

| · | the metallurgy and recovery characteristics of samples from certain of the Company’s mineral properties and whether such characteristics are reflective of the deposit as a whole; and |

| · | the continued development of and potential construction of any mine at the Livengood Gold Project property not requiring consents, approvals, authorizations or permits that are materially different from those identified by the Company. |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including without limitation those discussed in Part I, Item 1A, Risk Factors, of this Annual Report on Form 10-K, which are incorporated herein by reference, as well as other factors described elsewhere in this report and the Company’s other reports filed with the SEC.

The Company’s forward-looking statements contained in this Annual Report on Form 10-K are based on the beliefs, expectations and opinions of management as of the date of this report. The Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements.

CAUTIONARY NOTE REGARDING SIMILAR OR ADJACENT MINERAL PROPERTIES

This Annual Report on Form 10-K contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine. Readers are cautioned that the Company has no interest in or right to acquire any interest in any such properties, and that mineral deposits on adjacent or similar properties, and any results of the mining or exploitation thereof, are not indicative of mineral deposits on the Company’s properties, or any potential results of the mining or exploitation thereof.

3

GLOSSARY OF TERMS

The following is a glossary of certain terms that may be used in this report.

| “alteration” | Changes in the chemical or mineralogical composition of a rock, generally produced by weathering or hydrothermal solutions |

| “anomalous” | Departing from the expected or normal |

| “April 2017 Report” | The technical report entitled “Canadian National Instrument 43-101 Technical Report Pre-feasibility Study on the Livengood Gold Project, Livengood, Alaska, USA” dated April 10, 2017 and prepared by certain Qualified Persons under NI 43-101, as filed under the Company’s profile on SEDAR at www.sedar.com |

| “As” | Arsenic |

| “basalt” | A dark coloured igneous rock, commonly extrusive – the fine-grained equivalent of gabbro |

| “biotite” | A common rock forming mineral of the mica group |

| “Board” | The Board of Directors of ITH |

| “chert” | A microcrystalline or cryptocrystalline sedimentary rock, consisting chiefly of interlocking crystals of quartz less than about 30 microns in diameter |

| “clastic” | Pertaining to a rock or sediment composed principally of fragments derived from pre-existing rocks or minerals and transported some distance from their places of origin; also said of the texture of such a rock |

| “cm” | Centimeters |

| “common shares” | The common shares without par value in the capital of ITH as the same are constituted on the date hereof |

| “conglomerate” | A coarse grained clastic sedimentary rock, composed of rounded to sub-angular fragments larger than 2mm in diameter set in a fine-grained matrix of sand or silt, and commonly cemented by calcium carbonate, iron oxide, silica or hardened clay |

| “Corvus” | Corvus Gold Inc., a company subsisting under the laws of British Columbia which was spun off from the Company in August, 2010 |

| “deformation” | A general term for the processes of folding, faulting, shearing, compression, or extension of rocks as a result of various earth forces |

| “deposit” | A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing reserves or ore, unless final legal, technical and economic factors are resolved |

| “diamond drill” | A type of rotary drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of the long hollow rods through which water is pumped to the cutting face. The drill cuts a core of rock which is recovered in long cylindrical sections, an inch or more in diameter |

| “dip” | The angle that a stratum or any planar feature makes with the horizontal, measured perpendicular to the strike and in the vertical plane |

| “dike” | A tabular body of igneous rock that cuts across the structure of adjacent rocks or cuts massive rocks |

| “director” | A member of the Board of Directors of ITH |

| “disseminated” | Fine particles of mineral dispersed throughout the enclosing rock |

| “epigenetic” | Of or relating to a mineral deposit of origin later than that of the enclosing rocks |

| “g/t” | Grams per metric tonne |

| “gabbro” | A group of dark coloured, basic intrusive igneous rocks – the approximate intrusive equivalent of basalt |

4

| “grade” | To contain a particular quantity of ore or mineral, relative to other constituents, in a specified quantity of rock |

| “host” | A rock or mineral that is older than rocks or minerals introduced into it or formed within it |

| “host rock” | A body of rock serving as a host for other rocks or for mineral deposits, or any rock in which ore deposits occur |

| “hydrothermal” | A term pertaining to hot aqueous solutions of magmatic origin which may transport metals and minerals in solution |

| “intrusion” | The process of the emplacement of magma in pre-existing rock, magmatic activity. Also, the igneous rock mass so formed |

| “intrusive” | Of or pertaining to intrusion, both the process and the rock so formed |

| “kg” | Kilograms |

| “km” | Kilometers |

| “lode” | A vein of metal ore in the earth |

| “m” | Meters |

| “mm” | Millimeters |

| “mafic” | Said of an igneous rock composed chiefly of dark, ferromagnesian minerals, also, said of those minerals |

| “magma” | Naturally occurring molten rock material, generated within the earth and capable of intrusion and extrusion, from which igneous rocks have been derived through solidification and related processes |

| “magmatic” | Of, or pertaining to, or derived from, magma |

| “massive” | Said of a mineral deposit, especially of sulphides, characterized by a great concentration of ore in one place, as opposed to a disseminated or veinlike deposit |

| “mineral reserve” | The economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of “modifying factors” (which are defined in NI 43-101 as considerations used to convert mineral resources to mineral reserves, including but not, mining processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors). Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which mineral reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a mineral reserve must be demonstrated by a pre-feasibility study or feasibility study. |

| “mineral resource” | A concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. |

| “mineralization” | The concentration of metals and their chemical compounds within a body of rock |

| “NI 43-101” | National Instrument 43-101 of the Canadian Securities Administrators entitled “Standards of Disclosure for Mineral Projects” |

| “NSR” | Net smelter return |

| “NYSE American” | NYSE American (formerly, NYSE MKT and the American Stock Exchange) |

| “ophiolite” | An assemblage of mafic and ultramafic igneous rocks ranging from spilite and basalt to gabbro and peridotite, and always derived from them by later metamorphism, whose origin is associated with an early phase of the development of a geosyncline |

5

| “RC” | A method of drilling whereby rock cuttings generated by the drill bit are flushed up from the bit face to the surface through the drill rods by air or drilling fluids for collection and analysis |

| “Sb” | Antimony |

| “sedimentary” | Pertaining to or containing sediment (typically, solid fragmental material transported and deposited by wind, water or ice that forms in layers in loose unconsolidated form), or formed by its deposition |

| “sill” | A tabular igneous intrusion that parallels the planar structure of the surrounding rock |

| “strike” | The direction taken by a structural surface |

| “tabular” | Said of a feature having two dimensions that are much larger or longer than the third, or of a geomorphic feature having a flat surface, such as a plateau |

| “Canadian Tax Act” | Income Tax Act (Canada) |

| “tectonic” | Pertaining to the forces involved in, or the resulting structures of, tectonics |

| “tectonics” | A branch of geology dealing with the broad architecture of the outer part of the earth, that is, the major structural or deformational features and their relations, origin and historical evolution |

| “TSX” | Toronto Stock Exchange |

| “ultramafic” | Said of an igneous rock composed chiefly of mafic minerals |

| “vein” | An epigenetic mineral filling of a fault or other fracture, in tabular or sheet-like form, often with the associated replacement of the host rock; also, a mineral deposit of this form and origin |

| “volcaniclastic” | Pertaining to a clastic rock containing volcanic material in whatever proportion, and without regard to its origin or environment |

USE OF NAMES

In this Annual Report on Form 10-K, unless the context otherwise requires, the terms "we", "us", "our", "ITH", "International Tower Hill", the "Company" or the "Corporation" refer to International Tower Hill Mines Ltd. and its subsidiaries.

CURRENCY

All dollar amounts in this Annual Report on Form 10-K are presented in United States dollars unless otherwise stated. References to C$ refer to Canadian currency.

6

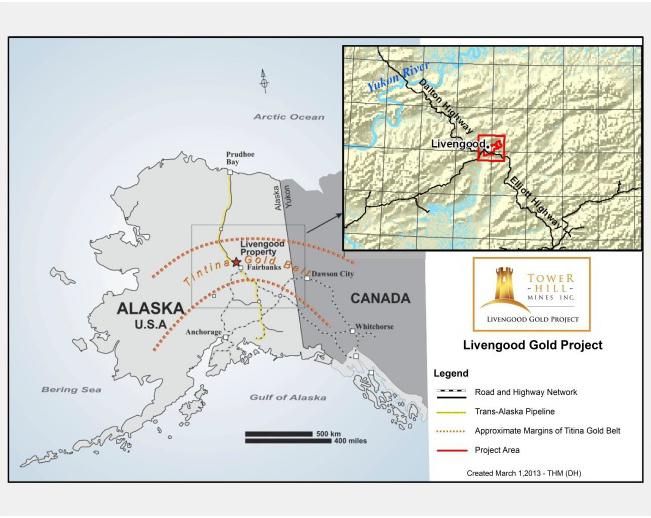

Overview

ITH is a mineral exploration company engaged in the acquisition and exploration of mineral properties. The Company currently holds or has the right to acquire interests in an advanced stage exploration project in Alaska referred to as the “Livengood Gold Project” or the “Project”. The Company is in the process of optimizing the Livengood Gold Project as discussed below. The Company has not yet begun preparation for the extraction of mineralization from the deposit or reached commercial production. The Company has a 100% interest in its Livengood Gold Project, which as of August 26, 2016 (the date of last measure), has a mineral resource of 497 million measured tonnes at an average grade of 0.68 g/tonne (10.84 million ounces), 28 million indicated tonnes at an average grade of 0.69 g/tonne (0.62 million ounces) and 53 million inferred tonnes at an average grade of 0.66 g/tonne (1.1 million ounces). In 2017, the Company issued the results of a pre-feasibility study that was summarized in the April 2017 Report which converted a portion of the mineral resources at the Project into proven reserves of 378 million tonnes at an average grade of 0.71 g/tonne (8.62 million ounces) and probable reserves of 14 million tonnes at an average grade of 0.72 g/tonne (353,000 ounces) based on a gold price of $1,250 per ounce. All work presently underway or planned by the Company is directed at preparing an updated pre-feasibility study to be released in a new NI 43-101 report for the Livengood Gold Project and maintaining necessary environmental baseline activities. A more complete description of the Livengood Gold Project and the current activities is set forth in Part I, Item 2 and Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report on Form 10-K.

Since 2006, the Company has focused primarily on the acquisition and exploration of mineral properties in Alaska and Nevada by acquiring through staking, purchase, lease or option (primarily from AngloGold Ashanti (U.S.A.) Exploration Inc. (“AngloGold”) in a transaction which closed on August 4, 2006) interests in a number of mineral properties in Alaska (Livengood Gold Project, Terra, LMS, BMP, Chisna, Coffee Dome, West Tanana, Gilles, West Pogo, Caribou, Blackshell and South Estelle) and Nevada (North Bullfrog and Painted Hills) that it believed had the potential to host large precious or base metal deposits. Since early 2008, the Company’s primary focus has been the exploration and advancement of the Livengood Gold Project and the majority of its resources have been directed to that end. In August 2010, ITH undertook a corporate spin-out arrangement transaction whereby all of its mineral property interests other than the Project were transferred to Corvus and Corvus was spun out as an independent and separate public company. Since the completion of that transaction, the sole mineral property held by the Company has been the Livengood Gold Project and the Company has focused exclusively on the ongoing exploration and potential development of the Livengood Gold Project.

The head office and principal executive address of ITH is located at 1177 West Hastings Street, Suite 2300, Vancouver, British Columbia, Canada V6E 2K3, and its registered and records office is located at 745 Thurlow Street, Suite 2400, Vancouver, British Columbia, Canada V6E 0C5.

2020

Livengood Gold Project Developments

During the year ended December 31, 2020, the Company made a decision to embark on a new phase for the Livengood Gold Project as a result of the favorable macro-economic backdrop for gold.

On May 8, 2020, the Company announced that the Board had approved a work plan to prepare an updated PFS on the Livengood Gold Project. The Company stated that it believed that the strength in the price of gold arising from the unprecedented accommodative fiscal and monetary stimulus from central banks and governments globally provided the necessary macroeconomic backdrop to support the advancement of the large, highly-levered, and long-life gold asset at Livengood.

On July 15, 2020, the Company announced that it had finalized the key contracts for completion of a PFS in respect of the Livengood Gold Project and expected to release the results of the PFS and the associated NI 43-101 Technical Report in October 2021. The comprehensive study will incorporate work that has been done since the last NI 43-101 report was completed to further de-risk and identify the optimal project configuration. The Company has engaged BBA, Inc. as its lead consultant and retained Whittle Consulting, Resource Modeling, Inc., Resource Development Associates, Easton Process Consulting and NewFields Companies, LLC to provide specialized technical support.

7

On August 31, 2020, the Company entered into an At Market Issuance (“ATM”) Sales Agreement with B. Riley Securities, Inc. (“B. Riley”), pursuant to which the Company was entitled, at its discretion and from time-to-time during the term of the sales agreement, to sell through B. Riley such number of common shares of the Company as would result in aggregate gross proceeds to the Company of up to $10.3 million (the “ATM Offering”).

On September 2, 2020, the Company announced that its existing three largest shareholders had each taken their pro-rata share of the ATM Offering, resulting in the issuance of 5,670,997 common shares (representing 3% of the 187.6 million shares previously issued and outstanding) at the September 1, 2020 closing market price of $1.40 per share for aggregate gross proceeds of $7.9 million.

On October 16, 2020, the Company announced that it had raised the full $10.3 million available pursuant to the ATM Offering with B. Riley. The Company issued a total of 7,334,513 common shares at an average price of $1.40 for gross proceeds of $10.3 million. The Company stated it intended to use the net proceeds of the Offering for working capital and general corporate purposes, including the completion of the PFS announced in May 2020 to further de-risk the Livengood Gold Project and for environmental baseline studies.

Director Changes

The Company announced the appointment of Christopher Papagianis to the Company’s Board effective June 1, 2020. Mr. Papagianis was nominated for election as a director in accordance with an investor rights agreement with the Company’s largest shareholder, Paulson & Co. Inc. (“Paulson”), and fills a vacancy created by the June 1, 2020 resignation of Damola Adamolekun, the previous Paulson designee.

2021

Outlook

On January 12, 2021, the Company announced that the Board had approved a 2021 budget of $5.6 million and endorsed the associated 2021 work program to advance the Livengood Gold Project. The key element of the 2021 work program is the completion of the PFS on the Livengood Gold Project that is planned for release in October 2021. The work program will also advance the baseline environmental data collection in critical areas of hydrology and waste rock geochemical characterization needed to support future permitting, as well as advance community engagement.

The Company remains open to a strategic alliance to help support the future development of the Project while considering all other appropriate financing options. The size of the gold resource, the Project’s favorable location, and the Company’s proven team are some of the reasons the Company could potentially attract a strategic partner with a long-term development horizon who understands the Project is highly leveraged to gold prices.

Regulatory, Environmental and Social Matters

All of the Company’s currently proposed exploration is in the State of Alaska. In Alaska, low impact, initial stage surface exploration such as stream sediment, soil and rock chip sampling does not require any permits. The State of Alaska requires an APMA (Alaska Placer Mining Application) exploration permit for all substantial surface disturbances such as trenching, road building and drilling. These permits are reviewed by related state and federal agencies that can comment on and require specific changes to proposed work plans to minimize impacts on the environment. The permitting process for significant disturbances generally requires 30 days for processing and all work must be bonded. The Company currently has all necessary permits with respect to its currently planned exploration activities in Alaska. Although the Company has never had an issue with the timely processing of APMA permits, there can be no assurances that delays in permit approval will not occur.

8

ITH has established a Technical Committee, which has adopted a formal, written charter. As set out in its charter, the overall purpose of the Technical Committee is to assist the Board in fulfilling its oversight responsibilities with respect to the Company’s continuing commitment to improving the environment and ensuring that activities are carried out and facilities are operated and maintained in a safe and environmentally sound manner that reflects the Company’s ideals and principles of sustainable development. The primary function of the Technical Committee is to monitor, review and provide oversight with respect to the technical aspects of the Company’s projects as well as monitor policies, standards, and programs relative to health, safety, community relations and environmental-related matters. The Technical Committee also advises the Board and makes recommendations for the Board’s consideration regarding health, safety, community relations and environmental-related issues.

Although not set out in a specific policy, the Company strives to be a positive influence in the local communities where its mineral projects are located, not only by contributing to the welfare of such communities through donations of money and supplies, as appropriate, but also through hiring local workers to assist in ongoing exploration programs when appropriate. The Company considers building and maintaining strong relationships with local communities to be fundamental to its ability to continue to operate in such regions and to assist in the eventual development (if any) of mining operations in such regions, and it attaches considerable importance to commencing and fostering such relationships from the beginning of its involvement in any particular area.

Corporate Structure

ITH was incorporated under the Company Act (British Columbia) under the name “Ashnola Mining Company Ltd.” on May 26, 1978. ITH’s name was changed to “Tower Hill Mines Ltd.” on June 1, 1988, and subsequently changed to “International Tower Hill Mines Ltd.” on March 15, 1991. ITH has been transitioned under, and is now governed by, the Business Corporations Act (British Columbia).

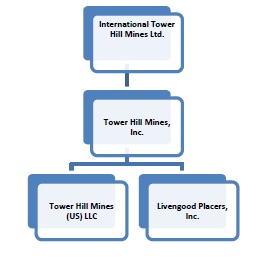

ITH has three material subsidiaries:

| · | Tower Hill Mines, Inc. (“TH Alaska”), a corporation incorporated in Alaska on June 27, 2006, which holds most of the Company’s Alaskan mineral properties and is 100% owned by ITH; |

| · | Tower Hill Mines (US) LLC, a limited liability company formed in Colorado on June 27, 2006, which carries on the Company’s administrative and personnel functions and is wholly owned by TH Alaska; and |

| · | Livengood Placers, Inc., a corporation incorporated in Nevada on June 11, 1998, which holds certain Alaskan properties and is 100% owned by TH Alaska. |

The following corporate chart sets forth all of ITH’s material subsidiaries:

9

Competition

ITH is an exploration stage company. The Company competes with other mineral resource exploration and development companies for financing, technical expertise and the acquisition of mineral properties. Many of the companies with whom the Company competes have greater financial and technical resources. Accordingly, these competitors may be able to spend greater amounts on the acquisition, exploration and development of mineral properties. This competition could adversely impact the Company’s ability to finance further exploration and to achieve the financing necessary for the Company to develop its mineral properties.

Availability of Raw Materials and Skilled Employees

All aspects of the Company’s business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, drilling, logistical planning, preparation of feasibility studies, permitting, construction and operation of a mine, financing and accounting. Since commencing its current operations in mid-2006, the Company has found and retained appropriate employees and consultants and believes it will continue to be able to do so in the future.

All of the raw materials the Company requires to carry on its business are readily available through normal supply or business contracting channels in Canada and the United States. Since commencing exploration activities at the Livengood Gold Project in mid-2006, the Company has been able to secure the appropriate personnel, equipment and supplies required to conduct its contemplated programs. While it has experienced difficulty in procuring some equipment, such as drill equipment or services, experienced drillers and timely assay laboratory services in previous years, the recent overall slowdown in the mineral exploration business has resulted in more equipment and services being made available on a timely basis. As a result, the Company does not believe that it will experience any shortages of required personnel, equipment or supplies in the foreseeable future.

Employees

At December 31, 2020, the Company had three employees. The Company also uses consultants with specific skills to assist with various aspects of project evaluation, engineering, community engagement and investor relations, and corporate governance.

Seasonality

As the Company’s mineral exploration activity takes place in Alaska, its business is seasonal. Due to the northern climate, exploration work on the Livengood Gold Project can be limited due to excessive snow cover and cold temperatures. In general, surface sampling work is limited to May through September and surface drilling from March through November, although some locations afford opportunities for year-round exploration operations and others, such as road-accessible wetland areas, may only be explored while frozen in the winter.

Available Information

ITH maintains an internet website at www.ithmines.com. The Company makes available, free of charge, through the Investors section of its website, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Exchange Act, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC and its Annual Information Form, press releases and material change reports and other reports filed on the System for Electronic Document Analysis and Retrieval (SEDAR). The Company’s SEC filings are available with the Canadian Securities Administrators from the SEC’s internet website at www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers that file electronically. The Company’s SEDAR filings are available from the Canadian Securities Administrators’ internet website at www.sedar.com under the Company’s profile. The contents of these websites are not incorporated into this report and the references to the URLs for these websites are intended to be inactive textual references only.

You should carefully consider the following risk factors in addition to the other information included in this Annual Report on Form 10-K. Each of these risk factors could materially and adversely affect our business, operating results and financial condition, as well as materially and adversely affect the value of an investment in our common shares. The risks described below are not the only ones facing the Company. Additional risks that we are not presently aware of, or that we currently believe are immaterial, may also adversely affect our business, operating results and financial condition. We cannot assure you that we will successfully address these risks or that other unknown risks exist that may affect our business.

10

Risks Related to Our Business

Our success depends on the development and operation of the Livengood Gold Project, which is our only project.

Our only property at this time is our Livengood Gold Project, which is in the exploration stage. The April 2017 Report indicates that the Project generates a minimal positive return at a gold price of $1,250 per ounce. The Company would need to see higher gold prices over a sustained period for the Project to be commercially viable. While management is exploring opportunities identified in the April 2017 Report for optimization and reducing Project costs, there can be no assurance that any such efforts will be successful, that any of the optimization opportunities or cost savings will in fact be realized or that the price of gold will increase sufficiently, and be sustained for a sufficient period, to warrant a decision to develop the Project. No assurance can be given that any level of recovery of ore reserves will be realized or that any identified mineral deposit will ever qualify as a commercial mineable ore body which can be legally and economically exploited. If we are not able to identify commercially viable mineral deposits or profitably extract minerals from such deposits, if the Project is not developed, or if the Project is otherwise subject to deterioration, destruction or significant delay, we may never generate revenues and our shareholders may lose all or a substantial portion of their investment.

While we may be successful in outlining potential optimizations that might improve the economics of the Project, there can be no assurance that any such optimizations can actually be incorporated into the Project.

While a review of the pre-feasibility test work to date on the Project indicates that there is the potential to further optimize the specific parameters of the Project, and that such optimizations may result in lower capital costs and operating costs for the Project, there can be no assurance that such optimizations can be achieved or that it will be possible to change the scope, size, scale and parameters of any revised Project configuration to incorporate the optimized results. Even if such optimization test work shows that optimization will improve capital or operating costs for the Project, it may not be possible to re-scale the Project so as to take advantage of all or any part of the optimized processes and therefore it may not be possible to derive any benefit from the optimization work or studies carried out. If we are not able to actually incorporate the optimized results, our business would be materially adversely affected and our shareholders could lose all or a substantial portion of their investment.

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses and have had no revenue from operations since inception, and we expect to continue to incur losses in the foreseeable future. We have not commenced commercial production on the Livengood Gold Project and we have no other mineral properties. We have no revenues from operations and we do not anticipate generating revenues from operations until we are able, if ever, to begin production at the Livengood Gold Project. We will continue to incur operating losses until the Livengood Gold Project begins to generate sufficient revenues to fund continuing operations, which cannot be assured. The Project is currently in the exploration stage and, as contemplated in the April 2017 Report, is not commercially viable in the current gold market. Our activities may not result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at the Livengood Gold Project.

We face various risks related to health epidemics, pandemics and similar outbreaks, which may have material adverse effects on our business, financial position, results of operations and/or cash flows.

We face various risks related to health epidemics, pandemics and similar outbreaks, including the global outbreak of COVID-19. The continued spread of COVID-19 has led to disruption and volatility in the global capital markets, which increases the cost of capital and adversely impacts access to capital. If significant portions of the population are unable to work effectively, including because of illness, quarantines, government actions, facility closures or other restrictions in connection with the COVID-19 pandemic, our operations will likely be impacted. In addition, our costs may increase as a result of the COVID-19 outbreak. These cost increases may not be fully recoverable or adequately covered by insurance.

11

It is possible that the continued spread of COVID-19 could also adversely affect our business partners, delay our plans to advance the Livengood Gold Project or cause other unpredictable events. We continue to work with our stakeholders to address this global pandemic responsibly. In addition, we continue to monitor the situation, to assess further possible implications to our business, and to take actions in an effort to mitigate adverse consequences.

We cannot at this time predict the impact of the COVID-19 pandemic, but it could have material adverse effects on our business, financial position, results of operations and/or cash flows.

We are an exploration stage company and have no history producing metals from our properties. Any future revenues and profits are uncertain.

We have no history of mining or refining any mineral products or metals and the Livengood Gold Project is not currently producing. There can be no assurance that the Livengood Gold Project will be successfully placed into production, produce minerals in commercial quantities, or otherwise generate operating earnings. Advancing properties from the exploration stage into development and commercial production requires significant capital and time and will be subject to further feasibility studies, permitting requirements and construction of the mine, processing plants, roads and related works and infrastructure. We will continue to incur losses until such time, if ever, as our mining activities successfully reach commercial production levels and generate sufficient revenue to fund continuing operations. There is no certainty that we will produce revenue from any source, operate profitably or provide a return on investment in the future.

We will require additional financing to fund exploration and, if warranted, development and production. Failure to obtain additional financing could have a material adverse effect on our financial condition and results of operation and could cast uncertainty on our ability to continue as a going concern.

Advancing properties from exploration into the development stage requires significant capital and time, and successful commercial production from a property, if any, will be subject to completing feasibility studies, permitting and construction of the mine, processing plants, roads, and other related works and infrastructure. The Company does not presently have sufficient financial resources or a source of operating cash flow to complete the permitting process and, if a production decision is made, the construction of a mine at the Livengood Gold Project. The completion of the permitting process and any construction of a mine at the Livengood Gold Project will depend upon the Company’s ability to obtain financing through the sale of its equity securities, enter into a joint venture or strategic alliance relationship, secure significant debt financing or find alternative means of financing. There is no assurance that the Company will be successful in obtaining the required financing on favorable terms or at all. Even if the results of exploration are encouraging, the Company may not be able to obtain sufficient financing to conduct the further exploration that may be necessary to determine whether or not a commercially mineable deposit exists.

Our ability to obtain additional financing in the future will depend upon a number of factors, including prevailing capital market conditions, the status of the national and worldwide economy, our business performance and the price of gold and other precious metals. Capital markets worldwide have been adversely affected in the past few years, including in 2020, by substantial losses by financial institutions and market volatility due to the onset of the COVID-19 pandemic, among other things. Failure to obtain such additional financing on favorable terms or at all could result in delay or indefinite postponement of further mining operations or exploration and development and the possible partial or total loss of our interests in the Livengood Gold Project.

Resource exploration is a highly speculative business, and certain inherent exploration risks could have a negative effect on our business.

Our long-term success depends on our ability to identify mineral deposits on the Livengood Gold Project and other properties we may acquire, if any, that can then be developed into commercially viable mining operations. Resource exploration is a highly speculative business and involves a high degree of risk, including, among other things, unprofitable efforts resulting both from the failure to discover mineral deposits and from finding mineral deposits which, though present, are insufficient in size and grade at the then prevailing market conditions to return a profit from production. Substantial expenditures are required to establish proven and probable mineral reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis. The marketability of minerals which may be acquired or discovered by the Company will be affected by numerous factors beyond the control of the Company and cannot be accurately predicted. These factors include market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital.

12

Mineral resource estimates are based on interpretation and assumptions and could be inaccurate or yield less mineral production under actual conditions than is currently estimated. Any material changes in these estimates will affect the economic viability of placing a property into production.

The mineral resource estimates included in our reports are estimates only and no assurance can be given that any particular level of recovery of minerals will in fact be realized or that an identified reserve or resource will ever qualify as a commercially mineable (or viable) deposit which can be legally and economically exploited. The estimating of mineral resources and mineral reserves is a subjective process and the accuracy of mineral resource and mineral reserve estimates is a function of the quantity and quality of available data, the accuracy of statistical computations, and the assumptions used and judgments made in interpreting available engineering and geological information. There is significant uncertainty in any mineral resource or mineral reserve estimate and the actual deposits encountered and the economic viability of a deposit may differ materially from the Company’s estimates. In addition, the grade of mineralization ultimately mined may differ from that indicated by drilling results and such differences could be material. Because we have not commenced actual production, mineralization estimates, including mineral resource estimates, for the Livengood Gold Project may require adjustments or downward revisions, and such adjustments or revisions may be material.

Until ore is actually mined and processed, mineral resources, mineral reserves and grades of mineralization must be considered as estimates only. The grade of ore ultimately mined, if any, may differ from that indicated by any pre-feasibility or definitive feasibility studies and drill results. There can be no assurance that minerals recovered in small scale laboratory tests will be duplicated in large scale tests under on-site conditions or in production scale operations. Extended declines in market prices for gold may render portions or all of our mineral resources uneconomic and result in reduced reported mineralization or adversely affect the commercial viability determinations reached by us. Material changes in estimates of mineralization, grades, stripping ratios, recovery rates or of our ability to extract such mineralization may affect the economic viability of projects and the value of our Livengood Gold Project. The estimated resources described in our reports should not be interpreted as assurances of mine life or of the profitability of future operations. Estimated mineral resources and mineral reserves may have to be re-estimated based on changes in applicable commodity prices, further exploration or development activity or actual production experience. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence mineral resource or mineral reserve estimates. Market price fluctuations for gold, silver or base metals, increased production costs or reduced recovery rates or other factors may render any particular reserves uneconomical or unprofitable to develop at a particular site or sites. A reduction in estimated reserves could require material write downs in investment in the affected mining property and increased amortization, reclamation and closure charges. Mineral resources are not mineral reserves and there is no assurance that any mineral resources will ultimately be reclassified as proven or probable reserves. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

There are differences in U.S. and Canadian practices for reporting reserves and resources.

Our reserve and resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we report reserves and resources in accordance with Canadian practices. These practices are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred mineral resources (and in certain circumstances, deposits that are not measured, indicated or inferred mineral resources but that are targeted for further exploration), which are generally not permitted in disclosure filed with the SEC by U.S. issuers. In the United States and in Canada, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that all or any part of measured, indicated or inferred mineral resources will ever be converted into reserves.

13

Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations if such disclosure includes the grade or quality and the quantity for each category of mineral resource and mineral reserve; however, the SEC only permits issuers to report “resources” as in place, tonnage and grade without reference to unit measures.

Accordingly, information concerning descriptions of mineralization, reserves and resources contained in our reports may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

Increased costs could affect our ability to bring our projects into production and, once in production, our financial condition and ability to be profitable.

Management anticipates that costs at the Livengood Gold Project will frequently be subject to variation from one year to the next due to a number of factors, such as changing ore grade, metallurgy and revisions to mine plans, if any, in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities such as fuel, rubber and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production less profitable or not profitable at all. A material increase in costs could also impact our ability to maintain operations and have a significant effect on the Company’s profitability in the event that a production decision is made.

The volatility of the price of gold could adversely affect any future operations and, if warranted, our ability to develop our properties.

Even if commercial quantities of mineral deposits are discovered by the Company, there is no guarantee that a profitable market will exist for the sale of the metals produced, if any. The Company’s long-term viability and profitability, the value of the Company’s properties, the market price of its common shares and the Company’s ability to raise funding to conduct continued exploration and development, if warranted, depend, in large part, upon the market price of gold. The decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the price of gold may prevent the Company’s property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold prices.

The price of gold has experienced significant movement over short periods of time, and is affected by numerous factors beyond the control of the Company, including economic and political conditions, expectations of inflation, currency exchange fluctuations, interest rates, global or regional demand, sale or purchase of gold by various central banks and financial institutions, speculative activities and increased production due to improved mining and production methods. The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. There can be no assurance that the price of gold will be such that any such deposits can be mined at a profit. The volatility in gold prices is illustrated by the following table, which presents the high, low and average fixed price in U.S. dollars for an ounce of gold, based on the London Bullion Market Association P.M. fix, over the past five years:

| High | Low | Average | |||||||||||

| 2016 | $ | 1,366 | $ | 1,077 | $ | 1,250 | |||||||

| 2017 | $ | 1,346 | $ | 1,151 | $ | 1,257 | |||||||

| 2018 | $ | 1,355 | $ | 1,178 | $ | 1,269 | |||||||

| 2019 | $ | 1,546 | $ | 1,270 | $ | 1,393 | |||||||

| 2020 | $ | 2,067 | $ | 1,474 | $ | 1,771 | |||||||

| January 1, 2021 to March 1, 2021 | $ | 1,943 | $ | 1,743 | $ | 1,838 | |||||||

14

Our results of operations could be affected by currency fluctuations.

The Livengood Gold Project is located in the United States, with most costs associated with the Project paid in U.S. dollars, and the Company maintains its accounts in Canadian and U.S. dollars, making it subject to foreign currency fluctuations. There can be significant swings in the exchange rate between the U.S. and Canadian dollar. There are no plans at this time to hedge against any exchange rate fluctuations in currencies. Adverse foreign currency fluctuations may cause losses and materially affect the Company’s financial position and results.

Resource exploration, development and production involve a high degree of risk and we do not maintain insurance with respect to certain of these risks, which exposes us to significant risk of loss.

Resource exploration, development and production involve a high degree of risk. Our operations are, and any future development or mining operations we may conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to:

| · | economically insufficient mineralized material; |

| · | fluctuation in exploration, development and production costs; |

| · | labor disputes; |

| · | unanticipated variations in grade and other geologic problems; |

| · | water conditions; |

| · | difficult surface or underground conditions; |

| · | mechanical and equipment failure; |

| · | failure of pit walls or dams; |

| · | environmental hazards; |

| · | industrial accidents; |

| · | metallurgical and other processing problems; |

| · | unusual or unexpected rock formations; |

| · | personal injury, cave-ins, landslides, flooding, fire, explosions, and rock-bursts; |

| · | metal losses; |

| · | power outages; |

| · | periodic interruptions due to inclement or hazardous weather conditions; and |

| · | decrease in the value of mineralized material due to lower gold prices. |

These risks could result in damage to, or destruction of, mineral properties, facilities or other property, personal injury, environmental damage, delays in operations, increased cost of operations, monetary losses and possible legal liability. Although the Company maintains or can be expected to maintain insurance within ranges of coverage consistent with industry practice, no assurance can be given that the Company will be able to obtain insurance to cover all of these risks at economically feasible premiums or at all. The Company may elect not to insure where premium costs are disproportionate to the Company’s perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration and production activities, if warranted. Should events such as these that are not covered by insurance arise, they could reduce or eliminate our assets and shareholder equity as well as result in increased costs and a decline in the value of our assets or common shares.

15

We may not be able to obtain all required permits and licenses to place any of our properties into production.

The current and future operations of the Company require licenses and permits from various governmental authorities. There can be no assurance that the Company will be able to obtain all necessary licenses and permits that may be required to carry out exploration, development and mining operations at its projects, on reasonable terms or at all. Costs related to applying for and obtaining permits and licenses may be prohibitive and could delay our planned exploration and development activities. Failure to comply with permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Delays in obtaining, or a failure to obtain, any such licenses and permits, or a failure to comply with the terms of any such licenses and permits that the Company does obtain, could delay or prevent production of the Livengood Gold Project and have a material adverse effect on the Company.

Title to the Livengood Gold Project may be subject to defects in title or other claims, which could affect our property rights and claims.

There are risks that title to the Livengood Gold Project may be challenged or impugned. The Livengood Gold Project is located in the State of Alaska and may be subject to prior unrecorded agreements or transfers or native land claims, and title may be affected by undetected defects. There may be valid challenges to the title of the Livengood Gold Project which, if successful, could impair development or operations. This is particularly the case in respect of those portions of our properties in which we hold our interest solely through a lease with the claim holders, as such interest is substantially based on contract and has been subject to a number of assignments (as opposed to a direct interest in the property).

Some of the mining claims at the Livengood Gold Project are U.S. federal or Alaska state “unpatented” mining claims. There is a risk that a portion of such unpatented mining claims could be determined to be invalid, in which case the Company could lose the right to mine any minerals contained within those mining claims. Unpatented mining claims are created and maintained in accordance with the applicable U.S. federal and Alaska state mining laws. Unpatented mining claims are unique property interests and are generally considered to be subject to greater title risk than other real property interests due to the validity of unpatented mining claims often being uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the provisions of the U.S. General Mining Law of 1872 (the “Mining Law”). Unpatented mining claims are always subject to possible challenges of third parties or validity contests by the United States federal government or the Alaska state government, as applicable. The validity of an unpatented mining claim, in terms of both its location and its maintenance, is dependent on strict compliance with a complex body of federal and state statutory and decisional law. Title to the unpatented mining claims may also be affected by undetected defects such as unregistered agreements or transfers and there are few public records that definitively determine the issues of validity and ownership of unpatented mining claims. The Company has not obtained full title opinions for the majority of its mineral properties. Not all the mineral properties in which the Company has an interest have been surveyed, and their actual extent and location may be in doubt. Should the federal government impose a royalty or additional tax burdens on the properties that lie within public lands, the resulting mining operations could be seriously impacted, depending upon the type and amount of the burden.

The leases and agreements pursuant to which the Company has interests, or the right to acquire interests, in a significant portion of the Livengood Gold Project provide that the Company must make a series of cash payments over certain time periods or expend certain minimum amounts on the exploration of the properties. Failure by the Company to make such payments or make such expenditures in a timely fashion may result in the Company losing its interest in such properties. There can be no assurance that the Company will have, or be able to obtain, the necessary financial resources to be able to maintain all of its property agreements in good standing, or to be able to comply with all of its obligations thereunder, which could result in the Company forfeiting its interest in one or more of its mineral properties.

The Company may not have and may not be able to obtain surface or access rights to all or a portion of the Livengood Gold Project.

Although the Company acquires the rights to some or all of the minerals in the ground subject to the mineral tenures that it acquires, or has a right to acquire, in most cases it does not thereby acquire any rights to, or ownership of, the surface to the areas covered by its mineral tenures. In such cases, applicable mining laws usually provide for rights of access to the surface for the purpose of carrying on mining activities, however, the enforcement of such rights through the courts can be costly and time consuming. It is necessary to negotiate surface access or to purchase the surface rights if long-term access is required. There can be no guarantee that, despite having the right at law to access the surface and carry on mining activities, the Company will be able to negotiate satisfactory agreements with any such existing landowners/occupiers for such access or purchase such surface rights, and therefore it may be unable to carry out planned exploration or mining activities. In addition, in circumstances where such access is denied, or no agreement can be reached, the Company may need to rely on the assistance of local officials or the courts in such jurisdiction, the outcomes of which cannot be predicted with any certainty. The inability of the Company to secure surface access or purchase required surface rights could materially and adversely affect the timing, cost or overall ability of the Company to develop any mineral deposits it may locate.

16

We are subject to significant governmental regulations which affect our operations and costs of conducting our business.

Any exploration activities carried on by the Company are, and any future development or mining operations we may conduct will be, subject to extensive laws and regulations governing various matters, including:

| · | mineral concession acquisition, exploration, development, mining and production; |

| · | management of natural resources; |

| · | exports, price controls, taxes and fees; |

| · | labor standards on occupational health and safety, including mine safety; |

| · | post-closure reclamation; |

| · | environmental standards, waste disposal, toxic substances, explosives, land use and environmental protection; and |

| · | dealings with indigenous peoples and historic and cultural preservation. |

Companies engaged in exploration activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Failure to comply with applicable laws, regulations and permits may result in civil or criminal fines or penalties, enforcement actions thereunder, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions, any of which could result in the Company incurring significant expenditures. The Company may also be required to compensate third parties suffering loss or damage as a result of our mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits.

It is also possible that future laws and regulations could cause additional expense, capital expenditures, restrictions on or suspension of the Company’s operations and delays in the exploration and development of the Company’s properties.

Legislation has been proposed that would significantly affect the mining industry and our business.

In recent years, members of the United States Congress have repeatedly introduced bills which would supplant or alter the provisions of the Mining Law. If adopted, such legislation, among other things, could eliminate or greatly limit the right to a mineral patent, impose federal royalties on mineral production from unpatented mining claims located on United States federal lands (which includes certain of the mining claims at the Livengood Gold Project), result in the denial of permits to mine after the expenditure of significant funds for exploration and development, reduce estimates of mineral reserves and reduce the amount of future exploration and development activity on U.S. federal lands, all of which could have a material and adverse effect on the Company’s ability to operate and its cash flow, results of operations and financial condition.

17

Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations.

The activities of the Company are subject to environmental regulations in the jurisdictions in which we operate. Environmental legislation generally provides for restrictions and prohibitions on spills, releases or emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner involving stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations and future changes in these laws and regulations may require significant capital outlays, cause material changes or delays in our current and planned operations and future activities and reduce the profitability of operations. It is possible that future changes in these laws or regulations could have a significant adverse impact on the Livengood Gold Project or some portion of our business, causing us to re-evaluate those activities at that time.

Examples of current U.S. federal laws which may affect our current operations and may impact future business and operations include, but are not limited to, the following:

The Comprehensive Environmental, Response, Compensation, and Liability Act (“CERCLA”), and comparable state statutes, impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring cleanup actions, demands for reimbursement for government-incurred cleanup costs, or natural resource damages, or for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. The Federal Resource Conservation and Recovery Act (“RCRA”), and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.