Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - AeroVironment Inc | avav-20210309xex99d1.htm |

| 8-K - 8-K - AeroVironment Inc | avav-20210309x8k.htm |

Exhibit 99.2

| third Quarter Fiscal Year 2021 Earnings Presentation March 9, 2021 |

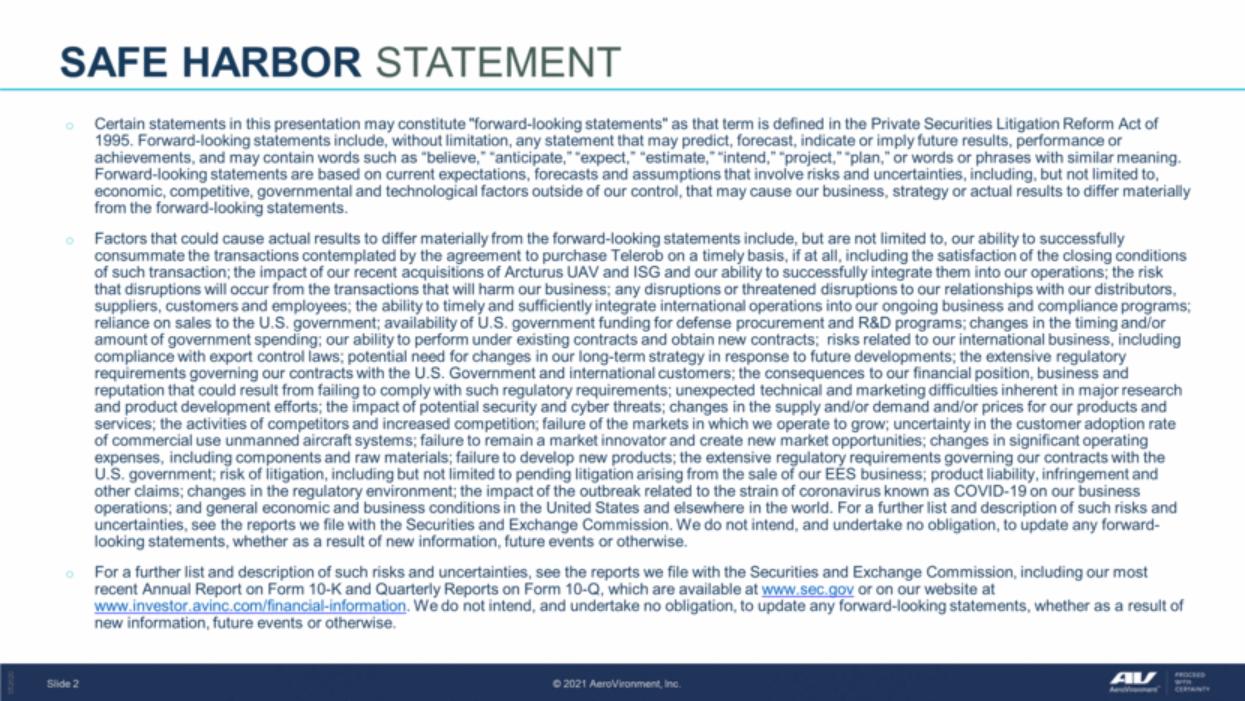

| Certain statements in this presentation may constitute "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” or words or phrases with similar meaning. Forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. Factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to, our ability to successfully consummate the transactions contemplated by the agreement to purchase Telerob on a timely basis, if at all, including the satisfaction of the closing conditions of such transaction; the impact of our recent acquisitions of Arcturus UAV and ISG and our ability to successfully integrate them into our operations; the risk that disruptions will occur from the transactions that will harm our business; any disruptions or threatened disruptions to our relationships with our distributors, suppliers, customers and employees; the ability to timely and sufficiently integrate international operations into our ongoing business and compliance programs; reliance on sales to the U.S. government; availability of U.S. government funding for defense procurement and R&D programs; changes in the timing and/or amount of government spending; our ability to perform under existing contracts and obtain new contracts; risks related to our international business, including compliance with export control laws; potential need for changes in our long-term strategy in response to future developments; the extensive regulatory requirements governing our contracts with the U.S. Government and international customers; the consequences to our financial position, business and reputation that could result from failing to comply with such regulatory requirements; unexpected technical and marketing difficulties inherent in major research and product development efforts; the impact of potential security and cyber threats; changes in the supply and/or demand and/or prices for our products and services; the activities of competitors and increased competition; failure of the markets in which we operate to grow; uncertainty in the customer adoption rate of commercial use unmanned aircraft systems; failure to remain a market innovator and create new market opportunities; changes in significant operating expenses, including components and raw materials; failure to develop new products; the extensive regulatory requirements governing our contracts with the U.S. government; risk of litigation, including but not limited to pending litigation arising from the sale of our EES business; product liability, infringement and other claims; changes in the regulatory environment; the impact of the outbreak related to the strain of coronavirus known as COVID-19 on our business operations; and general economic and business conditions in the United States and elsewhere in the world. For a further list and description of such risks and uncertainties, see the reports we file with the Securities and Exchange Commission. We do not intend, and undertake no obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. For a further list and description of such risks and uncertainties, see the reports we file with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available at www.sec.gov or on our website at www.investor.avinc.com/financial-information. We do not intend, and undertake no obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Safe Harbor Statement |

| Continue to deliver strong results despite continued challenges presented by the COVID-19 pandemic On track to achieve fiscal year 2021 objectives while delivering fourth consecutive year of profitable, double-digit, topline growth Successfully executing long-term growth strategy through recent transformative acquisitions that will accelerate our success over the near and long-term Third Quarter Fiscal Year 2021 Key Messages |

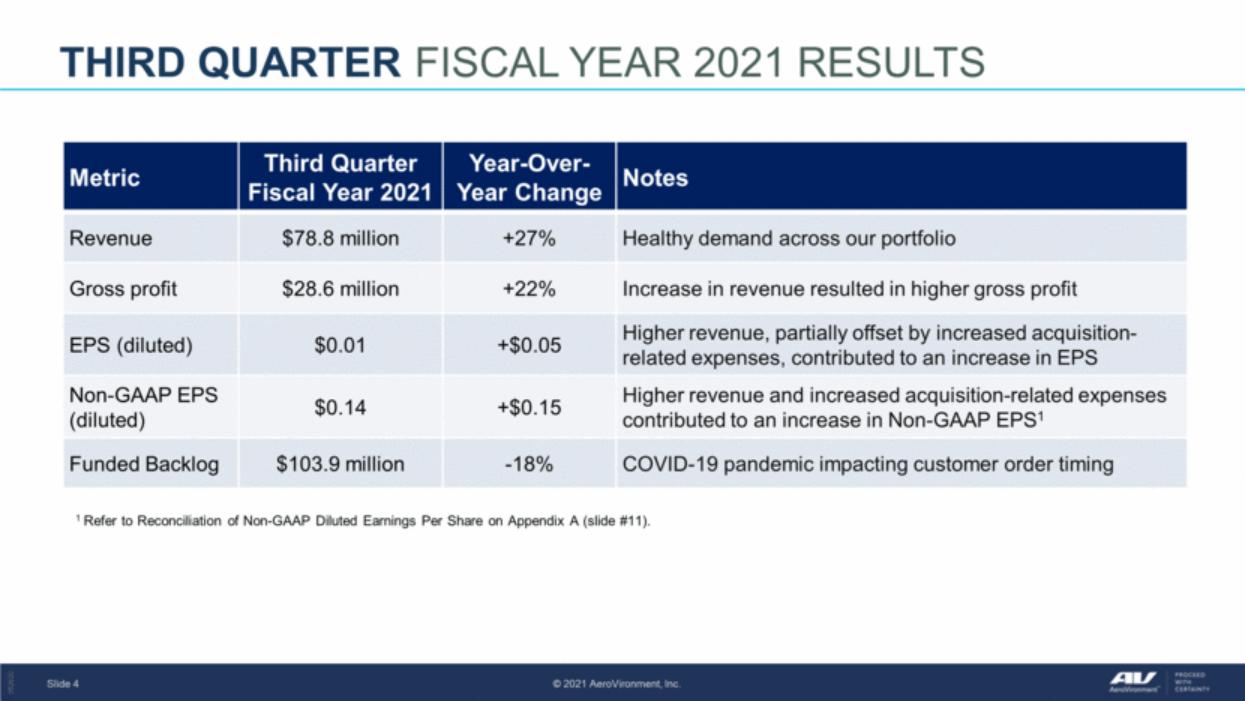

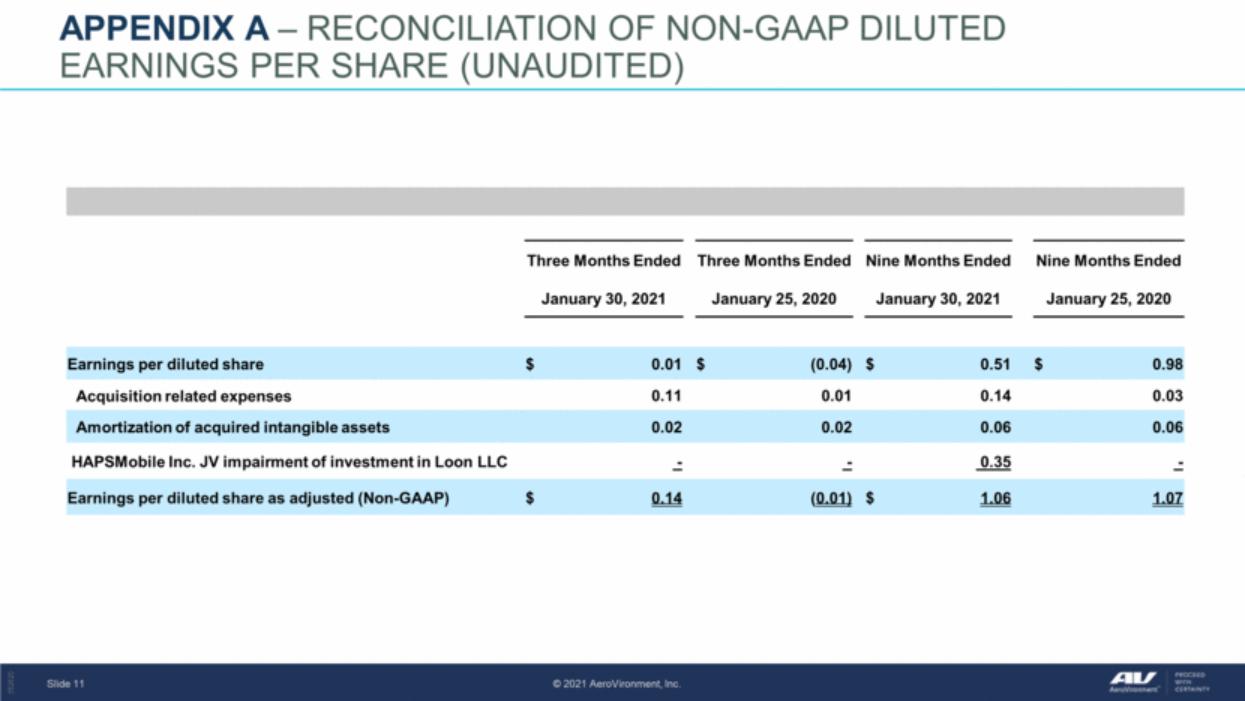

| Third Quarter Fiscal Year 2021 Results Metric Third Quarter Fiscal Year 2021 Year-Over-Year Change Notes Revenue $78.8 million +27% Healthy demand across our portfolio Gross profit $28.6 million +22% Increase in revenue resulted in higher gross profit EPS (diluted) $0.01 +$0.05 Higher revenue, partially offset by increased acquisition-related expenses, contributed to an increase in EPS Non-GAAP EPS (diluted) $0.14 +$0.15 Higher revenue and increased acquisition-related expenses contributed to an increase in Non-GAAP EPS1 Funded Backlog $103.9 million -18% COVID-19 pandemic impacting customer order timing 1 Refer to Reconciliation of Non-GAAP Diluted Earnings Per Share on Appendix A (slide #11). |

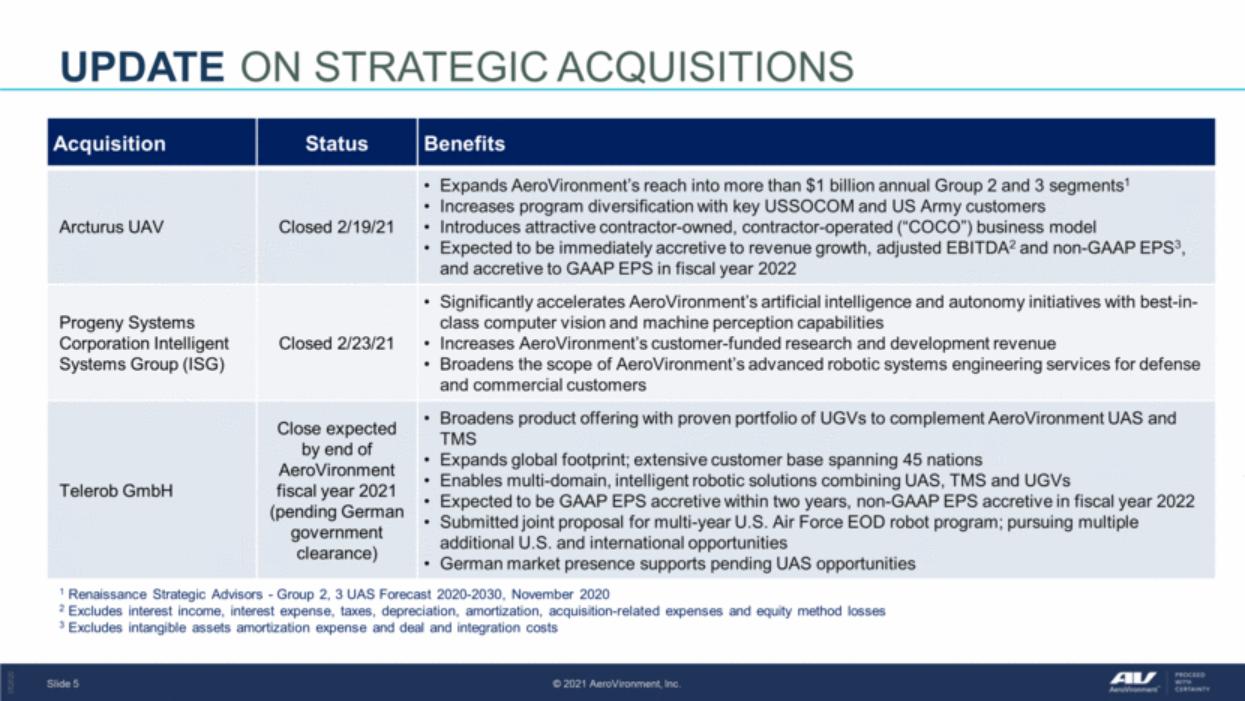

| Update on Strategic Acquisitions Acquisition Status Benefits Arcturus UAV Closed 2/19/21 Expands AeroVironment’s reach into more than $1 billion annual Group 2 and 3 segments1 Increases program diversification with key USSOCOM and US Army customers Introduces attractive contractor-owned, contractor-operated (“COCO”) business model Expected to be immediately accretive to revenue growth, adjusted EBITDA2 and non-GAAP EPS3, and accretive to GAAP EPS in fiscal year 2022 Progeny Systems Corporation Intelligent Systems Group (ISG) Closed 2/23/21 Significantly accelerates AeroVironment’s artificial intelligence and autonomy initiatives with best-in-class computer vision and machine perception capabilities Increases AeroVironment’s customer-funded research and development revenue Broadens the scope of AeroVironment’s advanced robotic systems engineering services for defense and commercial customers Telerob GmbH Close expected by end of AeroVironment fiscal year 2021 (pending German government clearance) Broadens product offering with proven portfolio of UGVs to complement AeroVironment UAS and TMS Expands global footprint; extensive customer base spanning 45 nations Enables multi-domain, intelligent robotic solutions combining UAS, TMS and UGVs Expected to be GAAP EPS accretive within two years, non-GAAP EPS accretive in fiscal year 2022 Submitted joint proposal for multi-year U.S. Air Force EOD robot program; pursuing multiple additional U.S. and international opportunities German market presence supports pending UAS opportunities 1 Renaissance Strategic Advisors - Group 2, 3 UAS Forecast 2020-2030, November 2020 2 Excludes interest income, interest expense, taxes, depreciation, amortization, acquisition-related expenses and equity method losses 3 Excludes intangible assets amortization expense and deal and integration costs |

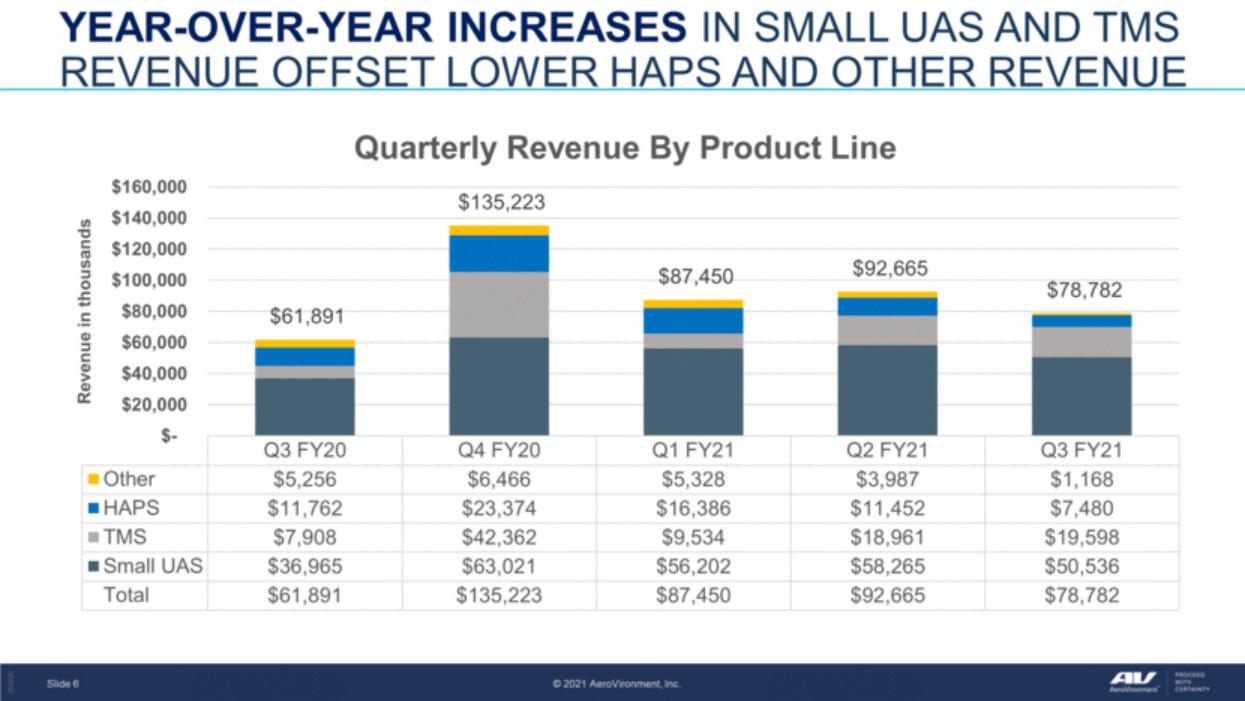

| YEAR-OVER-YEAR INCREASES IN SMALL UAS AND TMS REVENUE OFFSET LOWER HAPS AND OTHER REVENUE |

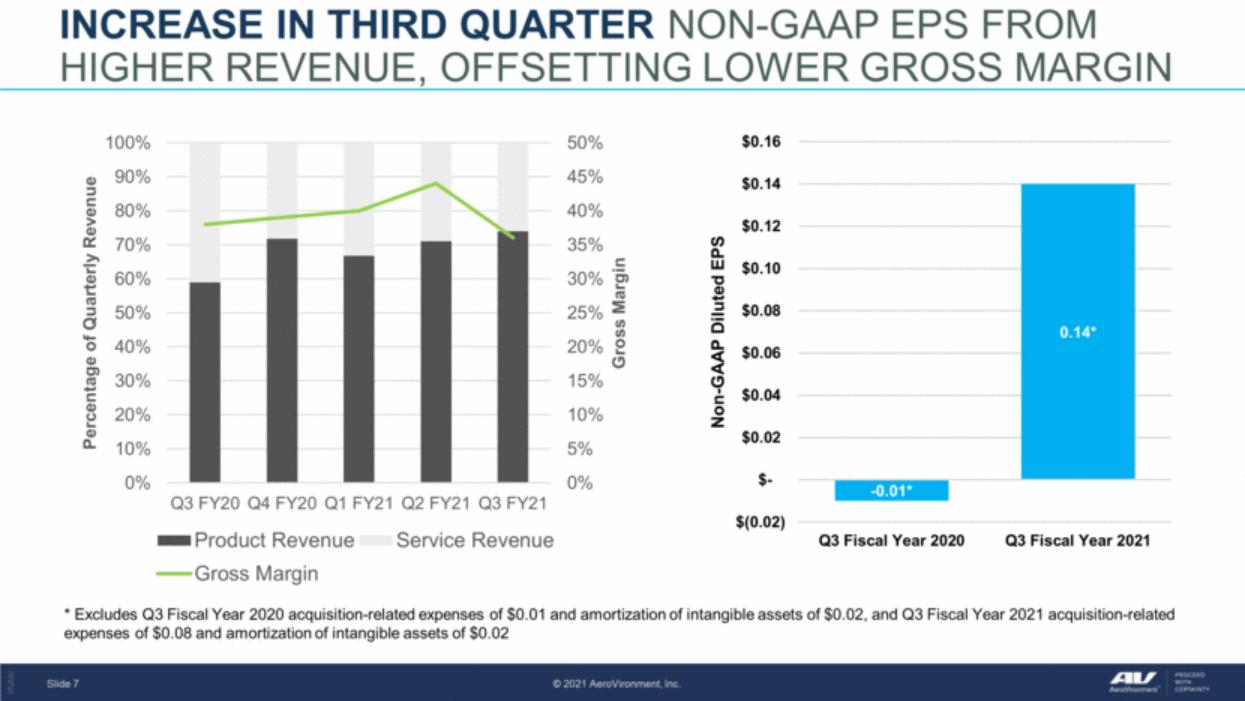

| increase in Third Quarter non-gaap eps from higher revenue, offsetting lower gross margin * Excludes Q3 Fiscal Year 2020 acquisition-related expenses of $0.01 and amortization of intangible assets of $0.02, and Q3 Fiscal Year 2021 acquisition-related expenses of $0.08 and amortization of intangible assets of $0.02 - 0.01 * 0.14 * $(0.02) $- $0.02 $0.04 $0.06 $0.08 $0.10 $0.12 $0.14 $0.16 Q3 Fiscal Year 2020 Q3 Fiscal Year 2021 Non - GAAP Diluted EPS 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q3 FY20 Q4 FY20 Q1 FY21 Q2 FY21 Q3 FY21 Gross Margin Percentage of Quarterly Revenue Product Revenue Service Revenue Gross Margin |

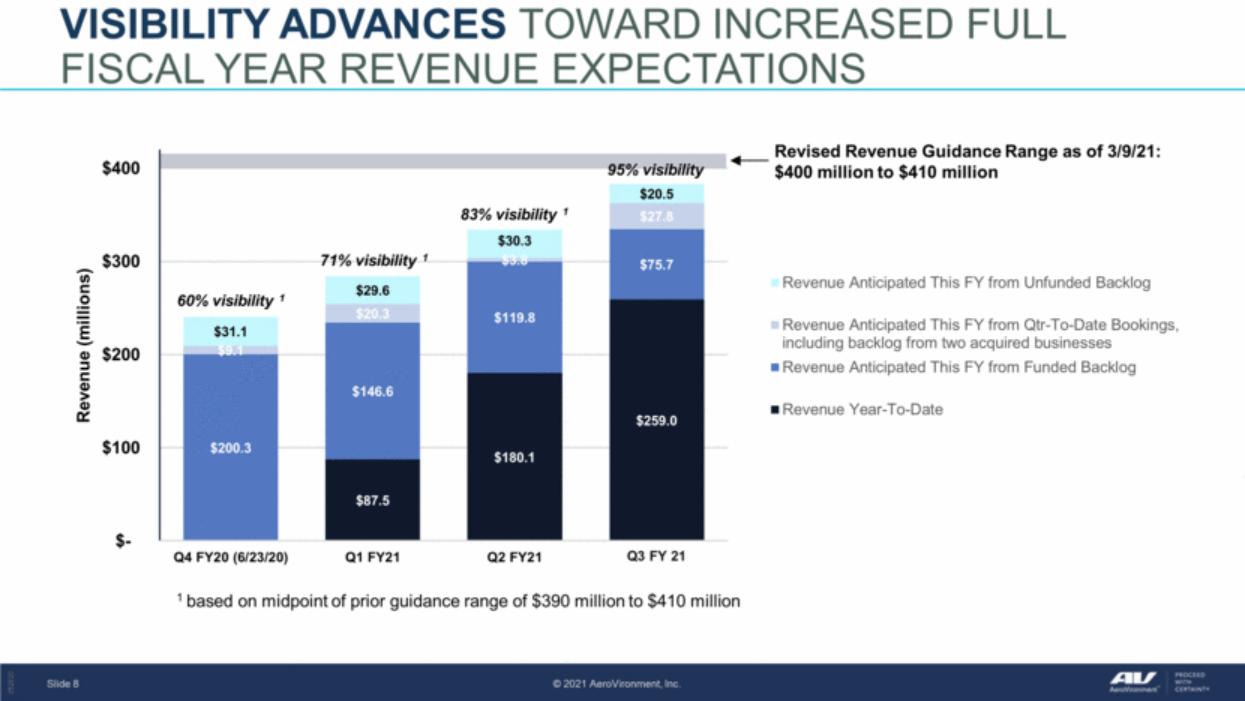

| Visibility Advances Toward Increased Full Fiscal Year Revenue Expectations Revised Revenue Guidance Range as of 3/9/21: $400 million to $410 million 60% visibility 1 71% visibility 1 83% visibility 1 Q3 FY 21 95% visibility 1 based on midpoint of prior guidance range of $390 million to $410 million $87.5 $180.1 $259.0 $200.3 $146.6 $119.8 $75.7 $9.1 $20.3 $3.8 $27.8 $31.1 $29.6 $30.3 $20.5 $- $100 $200 $300 $400 Q4 FY20 (6/23/20) Q1 FY21 Q2 FY21 Q3 FY21 Revenue (millions) Revenue Anticipated This FY from Unfunded Backlog Revenue Anticipated This FY from Qtr-To-Date Bookings, including backlog from two acquired businesses Revenue Anticipated This FY from Funded Backlog Revenue Year-To-Date |

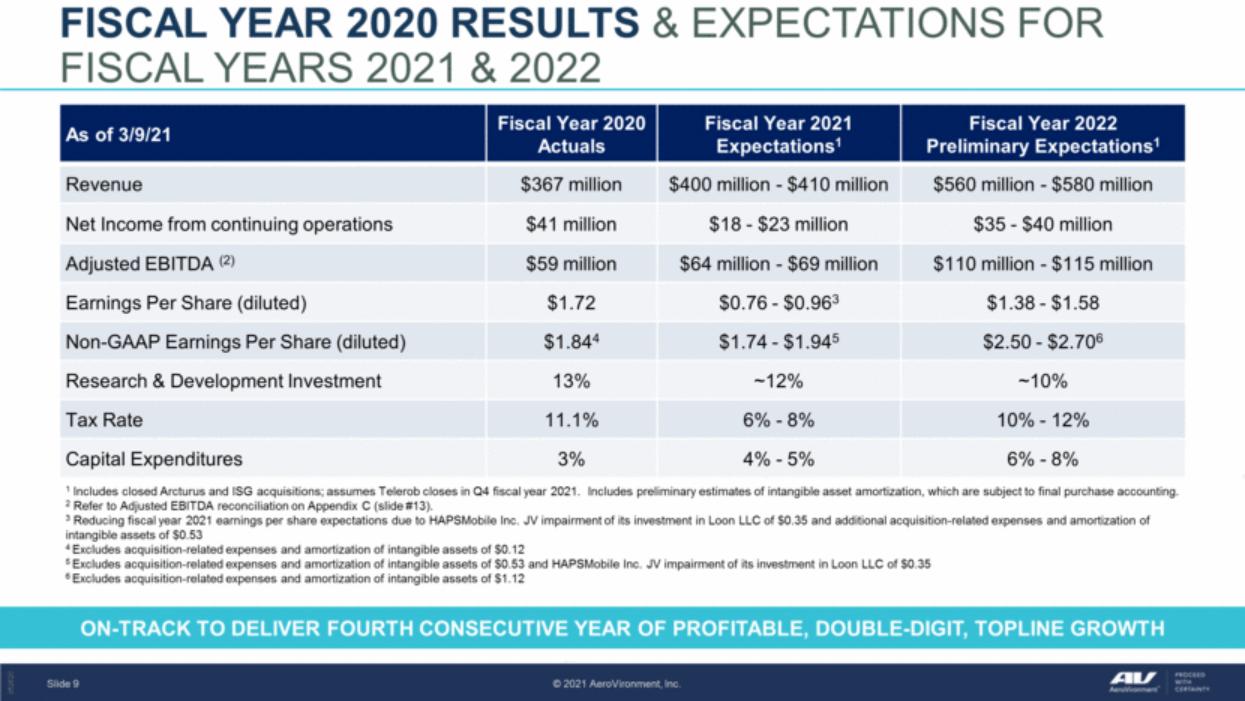

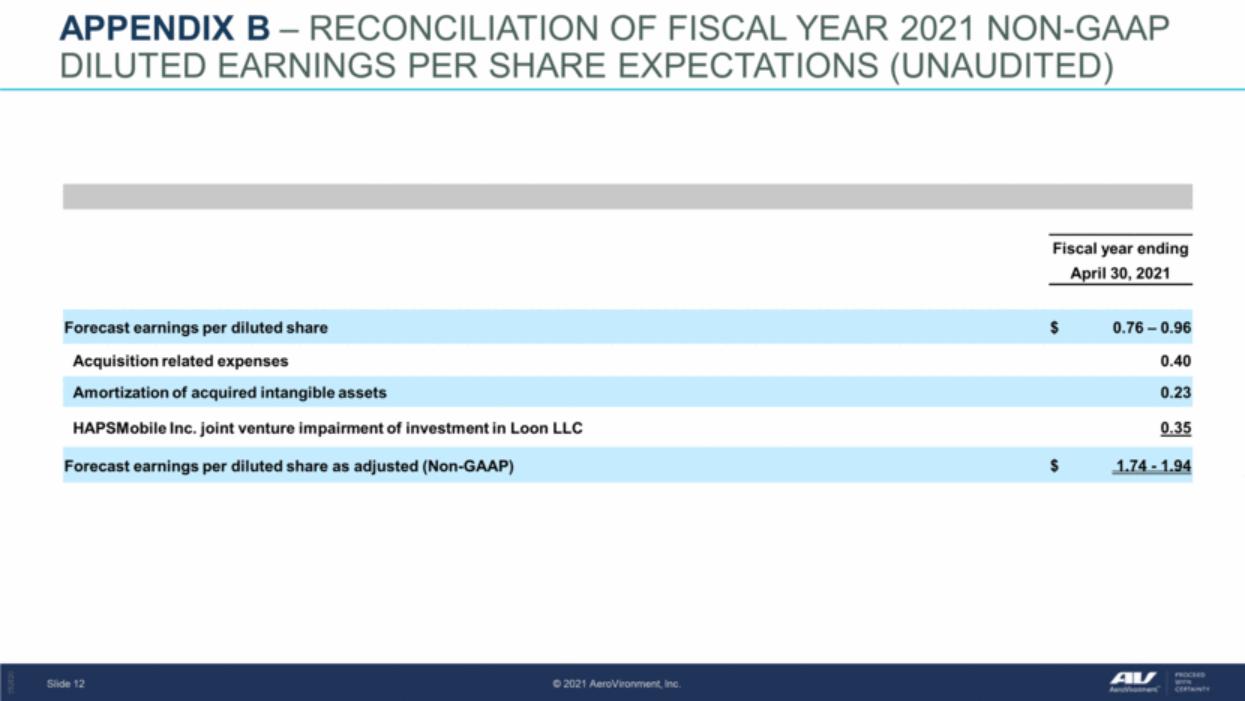

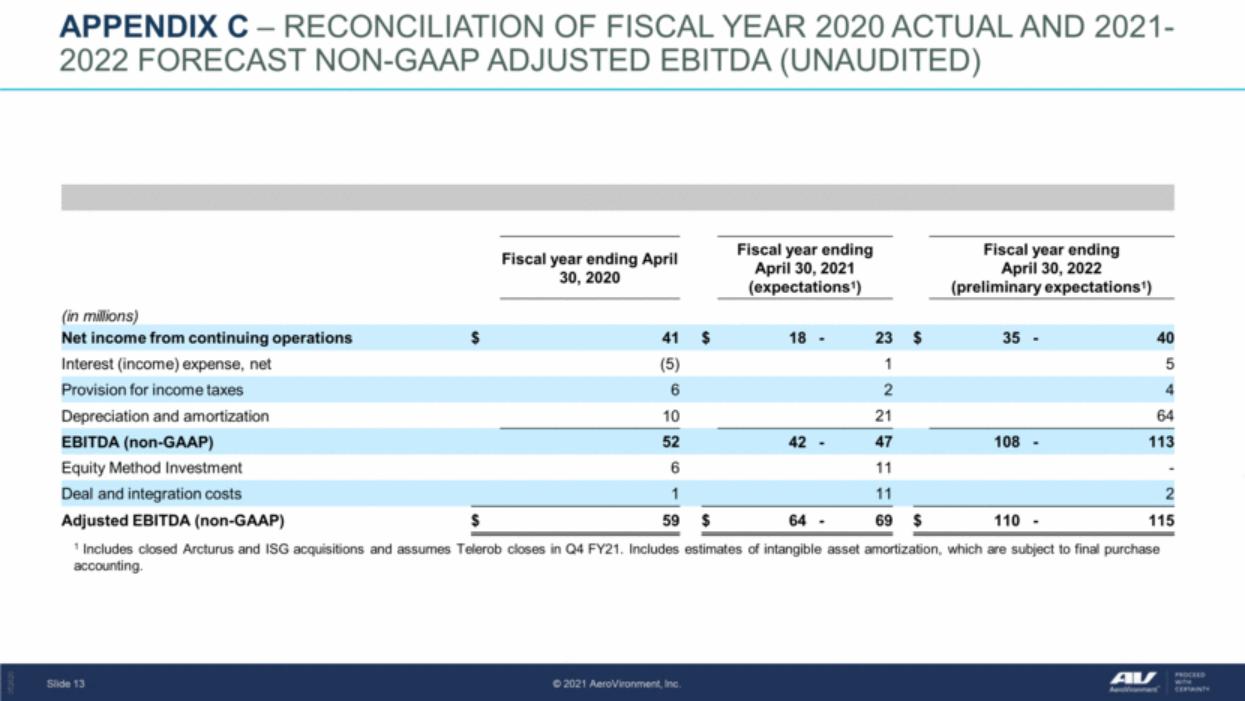

| Fiscal Year 2020 Results & Expectations for Fiscal Years 2021 & 2022 As of 3/9/21 Fiscal Year 2020 Actuals Fiscal Year 2021 Expectations1 Fiscal Year 2022 Preliminary Expectations1 Revenue $367 million $400 million - $410 million $560 million - $580 million Net Income from continuing operations $41 million $18 - $23 million $35 - $40 million Adjusted EBITDA (2) $59 million $64 million - $69 million $110 million - $115 million Earnings Per Share (diluted) $1.72 $0.76 - $0.963 $1.38 - $1.58 Non-GAAP Earnings Per Share (diluted) $1.844 $1.74 - $1.945 $2.50 - $2.706 Research & Development Investment 13% ~12% ~10% Tax Rate 11.1% 6% - 8% 10% - 12% Capital Expenditures 3% 4% - 5% 6% - 8% On-track to deliver fourth consecutive year of profitable, double-digit, topline growth 1 Includes closed Arcturus and ISG acquisitions; assumes Telerob closes in Q4 fiscal year 2021. Includes preliminary estimates of intangible asset amortization, which are subject to final purchase accounting. 2 Refer to Adjusted EBITDA reconciliation on Appendix C (slide #13). 3 Reducing fiscal year 2021 earnings per share expectations due to HAPSMobile Inc. JV impairment of its investment in Loon LLC of $0.35 and additional acquisition-related expenses and amortization of intangible assets of $0.53 4 Excludes acquisition-related expenses and amortization of intangible assets of $0.12 5 Excludes acquisition-related expenses and amortization of intangible assets of $0.53 and HAPSMobile Inc. JV impairment of its investment in Loon LLC of $0.35 6 Excludes acquisition-related expenses and amortization of intangible assets of $1.12 |

| Investor Relations ir@avinc.com +1 (805) 520-8350 |

| Appendix A – Reconciliation of Non-GAAP Diluted Earnings Per Share (Unaudited) Three Months Ended Three Months Ended Nine Months Ended Nine Months Ended January 30, 2021 January 25, 2020 January 30, 2021 January 25, 2020 Earnings per diluted share $ 0.01 $ (0.04) $ 0.51 $ 0.98 Acquisition related expenses 0.11 0.01 0.14 0.03 Amortization of acquired intangible assets 0.02 0.02 0.06 0.06 HAPSMobile Inc. JV impairment of investment in Loon LLC - - 0.35 - Earnings per diluted share as adjusted (Non-GAAP) $ 0.14 (0.01) $ 1.06 1.07 |

| Appendix B – Reconciliation of Fiscal Year 2021 Non-GAAP Diluted Earnings Per Share Expectations (Unaudited) Fiscal year ending April 30, 2021 Forecast earnings per diluted share $ 0.76 – 0.96 Acquisition related expenses 0.40 Amortization of acquired intangible assets 0.23 HAPSMobile Inc. joint venture impairment of investment in Loon LLC 0.35 Forecast earnings per diluted share as adjusted (Non-GAAP) $ 1.74 - 1.94 |

| Appendix C – Reconciliation of Fiscal Year 2020 actual and 2021-2022 forecast Non-GAAP adjusted ebitda (Unaudited) Fiscal year ending April 30, 2020 Fiscal year ending April 30, 2021 (expectations1) Fiscal year ending April 30, 2022 (preliminary expectations1) (in millions) Net income from continuing operations $ 41 $ 18 - 23 $ 35 - 40 Interest (income) expense, net (5) 1 5 Provision for income taxes 6 2 4 Depreciation and amortization 10 21 64 EBITDA (non-GAAP) 52 42 - 47 108 - 113 Equity Method Investment 6 11 - Deal and integration costs 1 11 2 Adjusted EBITDA (non-GAAP) $ 59 $ 64 - 69 $ 110 - 115 1 Includes closed Arcturus and ISG acquisitions and assumes Telerob closes in Q4 FY21. Includes estimates of intangible asset amortization, which are subject to final purchase accounting. |