Attached files

| file | filename |

|---|---|

| EX-99.1 - FINANCIAL RESULTS PRESS RELEASE - FEDERAL SIGNAL CORP /DE/ | fss-20201231x10kexhx991.htm |

| EX-32.2 - CFO CERTIFICATION OF PERIODIC REPORT UNDER SECTION 906 OF SARBANES-OXLEY ACT - FEDERAL SIGNAL CORP /DE/ | fss-20201231x10kexhx322.htm |

| EX-32.1 - CEO CERTIFICATION OF PERIODIC REPORT UNDER SECTION 906 OF SARBANES-OXLEY ACT - FEDERAL SIGNAL CORP /DE/ | fss-20201231x10kexhx321.htm |

| EX-31.2 - CFO CERTIFICATION UNDER SECTION 302 OF SARBANES-OXLEY ACT - FEDERAL SIGNAL CORP /DE/ | fss-20201231x10kexhx312.htm |

| EX-31.1 - CEO CERTIFICATION UNDER SECTION 302 OF SARBANES -OXLEY ACT - FEDERAL SIGNAL CORP /DE/ | fss-20201231x10kexhx311.htm |

| EX-23 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - FEDERAL SIGNAL CORP /DE/ | fss-20201231x10kexhx23.htm |

| EX-21 - SUBSIDIARIES OF THE REGISTRANT - FEDERAL SIGNAL CORP /DE/ | fss-20201231x10kexhx21.htm |

| 10-K - FORM 10-K - FEDERAL SIGNAL CORP /DE/ | fss-20201231.htm |

Federal Signal Q4 2020 Earnings Call February 25, 2021 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer

Safe Harbor This presentation contains unaudited financial information and various forward-looking statements as of the date hereof and we undertake no obligation to update these forward- looking statements regardless of new developments or otherwise. Statements in this presentation that are not historical are forward-looking statements. Such statements are subject to various risks and uncertainties that could cause actual results to vary materially from those stated. Such risks and uncertainties include but are not limited to: direct and indirect impacts of the coronavirus pandemic and the associated government response, economic conditions in various regions, product and price competition, supply chain disruptions, work stoppages, availability and pricing of raw materials, risks associated with acquisitions such as integration of operations and achieving anticipated revenue and cost benefits, foreign currency exchange rate changes, interest rate changes, increased legal expenses and litigation results, legal and regulatory developments and other risks and uncertainties described in filings with the Securities and Exchange Commission (SEC). This presentation also contains references to certain non-GAAP financial information. Such items are reconciled herein, in our earnings news release provided as of the date of this presentation or in other investor materials filed with the SEC. 2

Introductory CEO Comments 3 • Profound thanks to employees for their commitment in these challenging times • COVID-19 response remains a top priority: • Safety and wellbeing of our employees • Implemented a host of measures to establish a safe workplace • Launched company-wide initiative to raise awareness about COVID-19 vaccinations • Organized on-site vaccination clinic for eligible employees at largest facility

2020 in Review 4 • Delivered 2nd highest adjusted EPS in our history • 40 bp year-over-year improvement in adjusted EBITDA margins, with both groups exceeding high end of target ranges • Despite pandemic, aggressive in taking actions to position the Company for future growth in three key areas: 1) Investments in expanding capacity at existing facilities 2) Continued funding of new product development 3) Introduced several new digital marketing tools under our “Reclaiming Tomorrow Together” initiative and launched e-commerce site, initially focusing on certain SSG product lines • Impressive cash flow generation funds organic growth initiatives, cash returns to stockholders and M&A • Issued inaugural Sustainability Report in October 2020

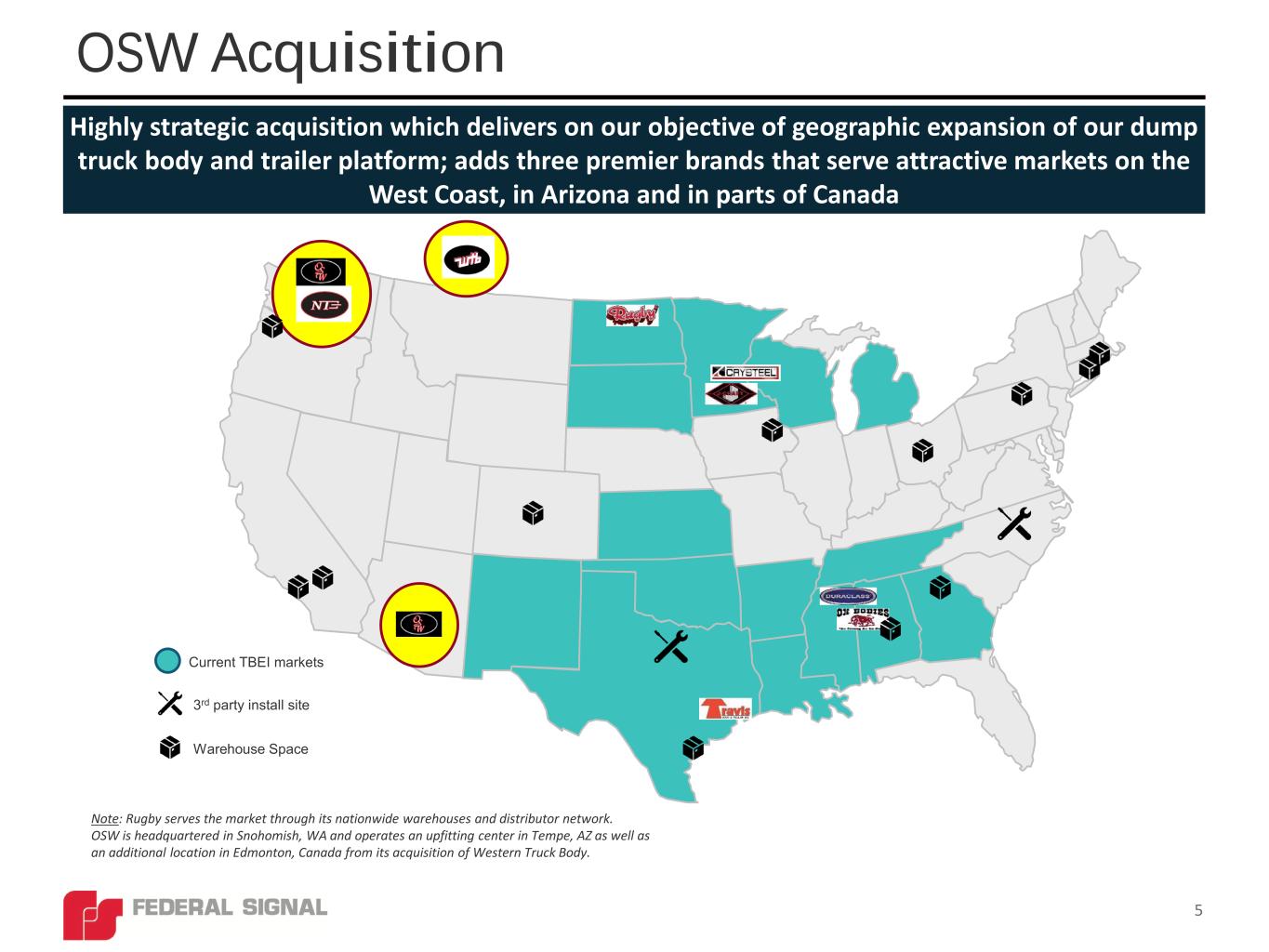

Warehouse Space 3rd party install site Current TBEI markets Note: Rugby serves the market through its nationwide warehouses and distributor network. OSW is headquartered in Snohomish, WA and operates an upfitting center in Tempe, AZ as well as an additional location in Edmonton, Canada from its acquisition of Western Truck Body. Highly strategic acquisition which delivers on our objective of geographic expansion of our dump truck body and trailer platform; adds three premier brands that serve attractive markets on the West Coast, in Arizona and in parts of Canada OSW Acquisition 5

OSW Acquisition 6 • OSW’s results in 2020 were impacted by pandemic, but it has strong brands, several long-term contracts and a reputation for making a quality product • Acquisition extends our current product offerings, and fills several gaps in TBEI’s existing trailer portfolio • Expect acquisition to be neutral to 2021 earnings, with opportunity for long- term value creation through the application of our eighty-twenty initiatives, organic growth and additional bolt-on acquisitions

Full-Year Financial Highlights * 7* Comparisons versus full year 2019 • Net sales of $1.13 B, vs. $1.22 B • Operating income of $131.4 M, vs. $147.1 M • Adjusted EBITDA of $182.2 M, vs. $191.3 M • Adjusted EBITDA margin of 16.1%, vs. 15.7% • Above high end of target range • ESG and SSG both reported adjusted EBITDA margin above target range at 18.5% and 18.3%, respectively • GAAP EPS of $1.56, vs. $1.76 • Adjusted EPS of $1.67, vs. $1.79

Q4 Highlights * 8* Comparisons versus Q4 of 2019, unless otherwise noted • Net sales of $295 M, vs. $314 M • Operating income of $33.8 M, vs. $36.4 M • Adjusted operating margin of 12.0%, vs. 11.9% • Adjusted EBITDA of $47.0 M, vs. $48.5 M • Adjusted EBITDA margin of 15.9%, vs. 15.4% • GAAP EPS of $0.42, vs. $0.48 • Adjusted EPS of $0.44, vs. $0.48 • Orders of $276 M, up $10 M, or 4% vs. Q3 of 2020 • Backlog of $304 M • Strong order intake increased backlog to ~$330 M by end of January 2021

9 Group and Corporate Results $ millions, except % Q4 2020 Q4 2019 % Change ESG Orders 224.8$ 270.9$ -17% Sales 237.6 252.2 -6% Operating income 33.3 33.0 1% Operating margin 14.0% 13.1% Adjusted EBITDA 44.2 43.8 1% Adjusted EBITDA margin 18.6% 17.4% SSG Orders 51.3 62.3 -18% Sales 57.2 62.2 -8% Operating income 10.3 11.8 -13% Operating margin 18.0% 19.0% Adjusted EBITDA 11.2 12.6 -11% Adjusted EBITDA margin 19.6% 20.3% Corporate expenses 9.8 8.4 17% Consolidated Orders 276.1 333.2 -17% Sales 294.8 314.4 -6% Operating income 33.8 36.4 -7% Operating margin 11.5% 11.6% Adjusted EBITDA 47.0 48.5 -3% Adjusted EBITDA margin 15.9% 15.4%

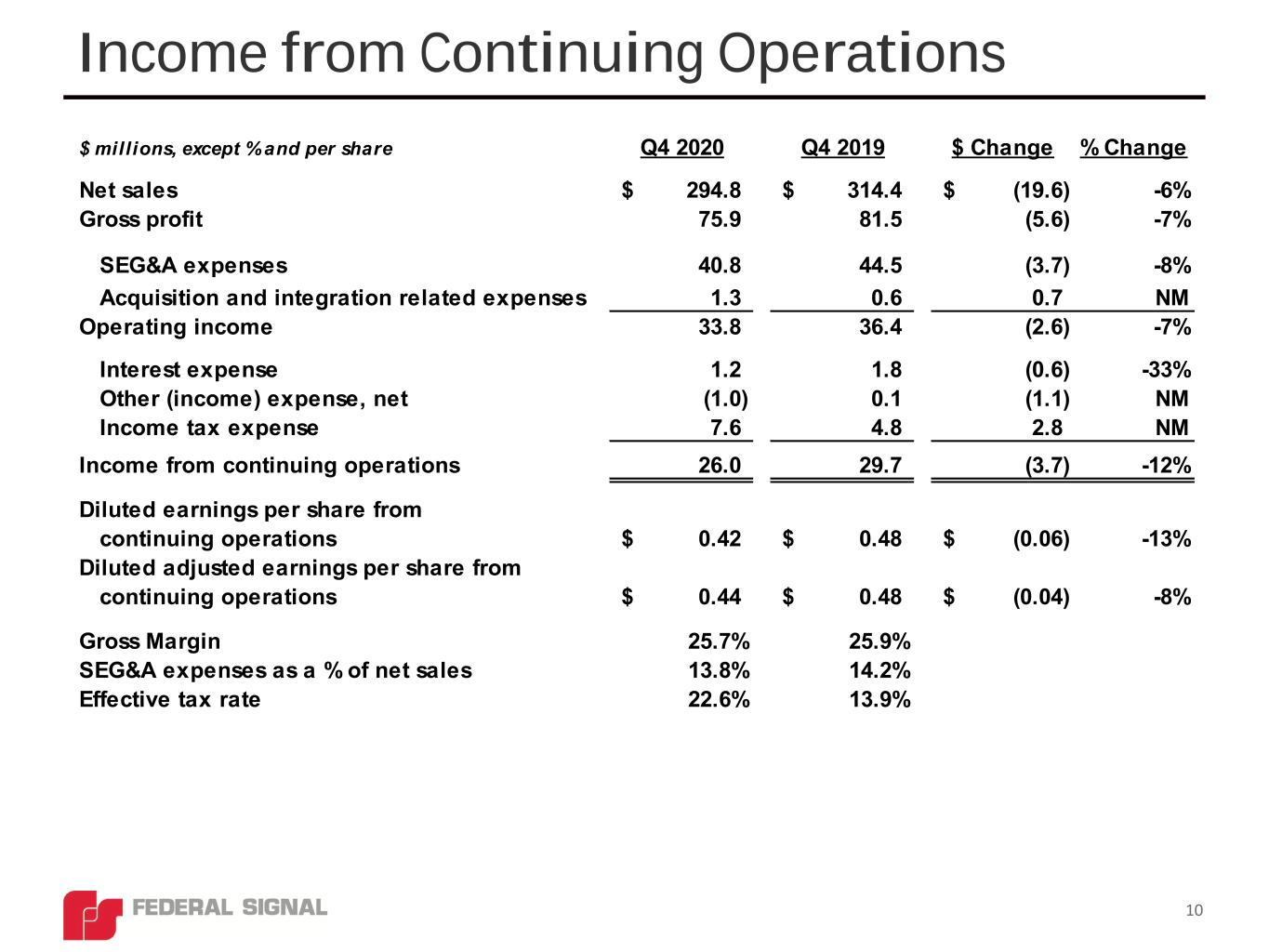

Income from Continuing Operations 10 $ millions, except % and per share Q4 2020 Q4 2019 $ Change % Change Net sales 294.8$ 314.4$ (19.6)$ -6% Gross profit 75.9 81.5 (5.6) -7% SEG&A expenses 40.8 44.5 (3.7) -8% Acquisition and integration related expenses 1.3 0.6 0.7 NM Operating income 33.8 36.4 (2.6) -7% Interest expense 1.2 1.8 (0.6) -33% Other (income) expense, net (1.0) 0.1 (1.1) NM Income tax expense 7.6 4.8 2.8 NM Income from continuing operations 26.0 29.7 (3.7) -12% Diluted earnings per share from continuing operations 0.42$ 0.48$ (0.06)$ -13% Diluted adjusted earnings per share from continuing operations 0.44$ 0.48$ (0.04)$ -8% Gross Margin 25.7% 25.9% SEG&A expenses as a % of net sales 13.8% 14.2% Effective tax rate 22.6% 13.9%

11 Adjusted Earnings per Share ($ in millions) 2020 2019 2020 2019 Income from continuing operations 26.0$ 29.7$ 96.1$ 108.4$ Add: Income tax expense 7.6 4.8 28.5 30.2 Income before income taxes 33.6 34.5 124.6 138.6 Add: Acquisition and integration-related expenses 1.3 0.6 2.1 2.5 Pension-related charges (1) (0.2) - 2.3 - Restructuring - - 1.3 - Coronavirus-related expenses (2) 0.1 - 2.3 - Purchase accounting effects (3) 0.2 0.3 0.7 0.8 Adjusted income before income taxes 35.0 35.4 133.3 141.9 Adjusted income tax expense (4) (5) (7.8) (5.9) (30.3) (31.8) Adjusted income from continuing operations 27.2$ 29.5$ 103.0$ 110.1$ Diluted EPS 0.42$ 0.48$ 1.56$ 1.76$ Adjusted diluted EPS 0.44$ 0.48$ 1.67$ 1.79$ (5) Adjusted income tax expense for the three and tw elve months ended December 31, 2019 excludes the tax effects of acquisition and integration-related expenses and purchase accounting effects, w here applicable. Adjusted income tax expense for the three and tw elve months ended December 31, 2019 also excludes an $0.8 million benefit from changes in state deferred tax valuation allow ances. Three Months December 31, Twelve Months Ended December 31, (1) Pension-related charges in the tw elve months ended December 31, 2020 relate to charges incurred in connection w ith the w ithdraw al from a multi-employer pension plan. During the three months ended December 31, 2020, an adjustment w as recorded to reduce the estimate of the charge, initially recorded in the second quarter of 2020. Such charges are included as a component of Other (income) expense, net on the Consolidated Statement of Operations. (4) Adjusted income tax expense for the three and tw elve months ended December 31, 2020 w as recomputed after excluding the impact of acquisition and integration-related expenses, pension-related charges, restructuring activity, coronavirus-related expenses and purchase accounting effects, w here applicable. (3) Purchase accounting effects relate to adjustments to exclude the step-up in the valuation of equipment acquired in connection w ith acquisitions that w as sold subsequent to the acquisition dates in the three and tw elve months ended December 31, 2020 and 2019, as w ell as to exclude the depreciation of the step-up in the valuation of the rental f leet acquired in the JJE transaction. (2) Coronavirus-related expenses in the three and tw elve months ended December 31, 2020 include direct expenses incurred as a result of the coronavirus pandemic, that are incremental to, and separable from, normal operations. Such expenses primarily relate to incremental paid time off provided to employees and costs incurred to implement enhanced w orkplace safety protocols.

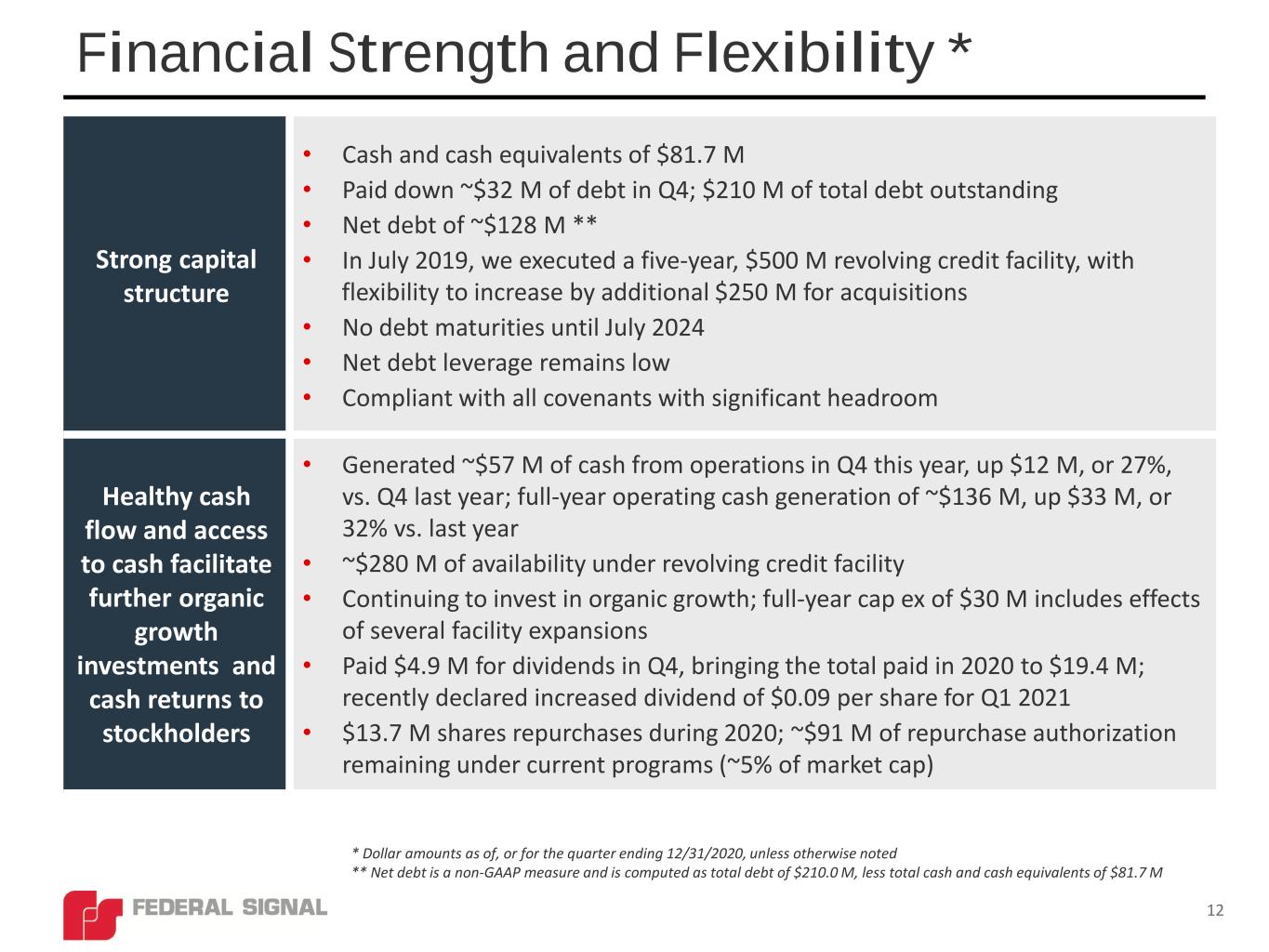

12 Financial Strength and Flexibility * * Dollar amounts as of, or for the quarter ending 12/31/2020, unless otherwise noted ** Net debt is a non-GAAP measure and is computed as total debt of $210.0 M, less total cash and cash equivalents of $81.7 M Strong capital structure • Cash and cash equivalents of $81.7 M • Paid down ~$32 M of debt in Q4; $210 M of total debt outstanding • Net debt of ~$128 M ** • In July 2019, we executed a five-year, $500 M revolving credit facility, with flexibility to increase by additional $250 M for acquisitions • No debt maturities until July 2024 • Net debt leverage remains low • Compliant with all covenants with significant headroom Healthy cash flow and access to cash facilitate further organic growth investments and cash returns to stockholders • Generated ~$57 M of cash from operations in Q4 this year, up $12 M, or 27%, vs. Q4 last year; full-year operating cash generation of ~$136 M, up $33 M, or 32% vs. last year • ~$280 M of availability under revolving credit facility • Continuing to invest in organic growth; full-year cap ex of $30 M includes effects of several facility expansions • Paid $4.9 M for dividends in Q4, bringing the total paid in 2020 to $19.4 M; recently declared increased dividend of $0.09 per share for Q1 2021 • $13.7 M shares repurchases during 2020; ~$91 M of repurchase authorization remaining under current programs (~5% of market cap)

Looking Ahead 13 • Remain focused on delivering strong results, while continuing to execute long-term strategy • Balance sheet provides opportunities to drive both organic growth and M&A • Aftermarket business has grown to represent ~25% of ESG revenues; additional projects underway to drive further growth • Closely monitoring actions new administration may take to boost economy, including federal stimulus packages and investment in infrastructure • Expect that infrastructure bill could provide meaningful benefits for most of our product offerings • Continue to be bullish about safe-digging opportunity and optimistic that recent increase in oil may generate increased demand for industrial products • Anticipating year-over-year headwind of ~$8 M associated with cost saving actions taken in 2020 which may return in 2021 • Monitoring recent increases in material costs and potential supply chain pressure and responding accordingly • M&A pipeline remains active

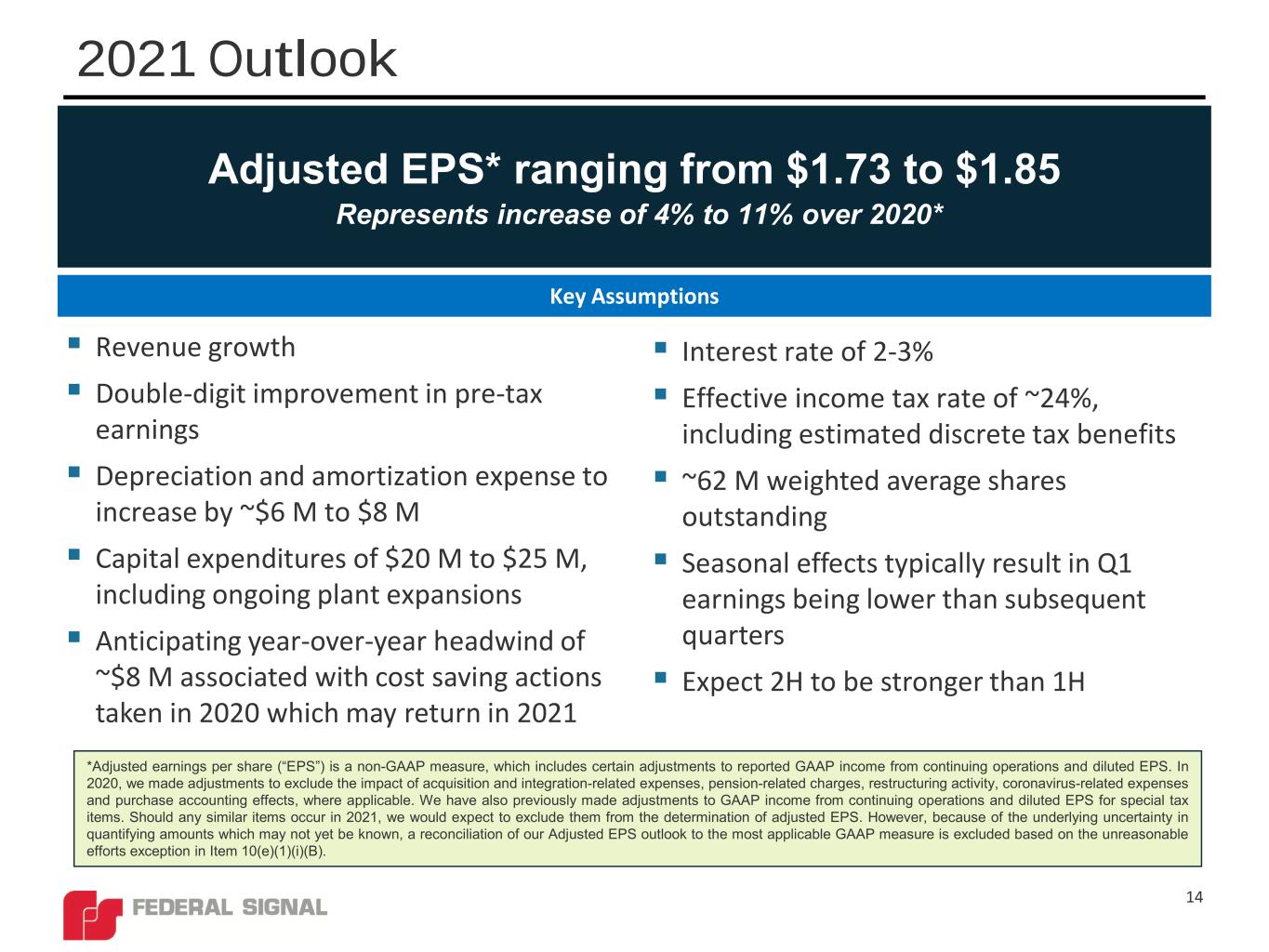

2021 Outlook Adjusted EPS* ranging from $1.73 to $1.85 Represents increase of 4% to 11% over 2020* 14 Revenue growth Double-digit improvement in pre-tax earnings Depreciation and amortization expense to increase by ~$6 M to $8 M Capital expenditures of $20 M to $25 M, including ongoing plant expansions Anticipating year-over-year headwind of ~$8 M associated with cost saving actions taken in 2020 which may return in 2021 Key Assumptions Interest rate of 2-3% Effective income tax rate of ~24%, including estimated discrete tax benefits ~62 M weighted average shares outstanding Seasonal effects typically result in Q1 earnings being lower than subsequent quarters Expect 2H to be stronger than 1H *Adjusted earnings per share (“EPS”) is a non-GAAP measure, which includes certain adjustments to reported GAAP income from continuing operations and diluted EPS. In 2020, we made adjustments to exclude the impact of acquisition and integration-related expenses, pension-related charges, restructuring activity, coronavirus-related expenses and purchase accounting effects, where applicable. We have also previously made adjustments to GAAP income from continuing operations and diluted EPS for special tax items. Should any similar items occur in 2021, we would expect to exclude them from the determination of adjusted EPS. However, because of the underlying uncertainty in quantifying amounts which may not yet be known, a reconciliation of our Adjusted EPS outlook to the most applicable GAAP measure is excluded based on the unreasonable efforts exception in Item 10(e)(1)(i)(B).

Federal Signal Q4 2020 Earnings Call 15 Q&A February 25, 2021 Jennifer Sherman, President & Chief Executive Officer Ian Hudson, SVP, Chief Financial Officer

Investor Information Stock Ticker - NYSE:FSS Company website: federalsignal.com/investors HEADQUARTERS 1415 West 22nd Street, Suite 1100 Oak Brook, IL 60523 INVESTOR RELATIONS CONTACTS 630-954-2000 Ian Hudson SVP, Chief Financial Officer IHudson@federalsignal.com Svetlana Vinokur VP, Treasurer and Corporate Development SVinokur@federalsignal.com 16

Federal Signal Q4 2020 Earnings Call 17 Appendix

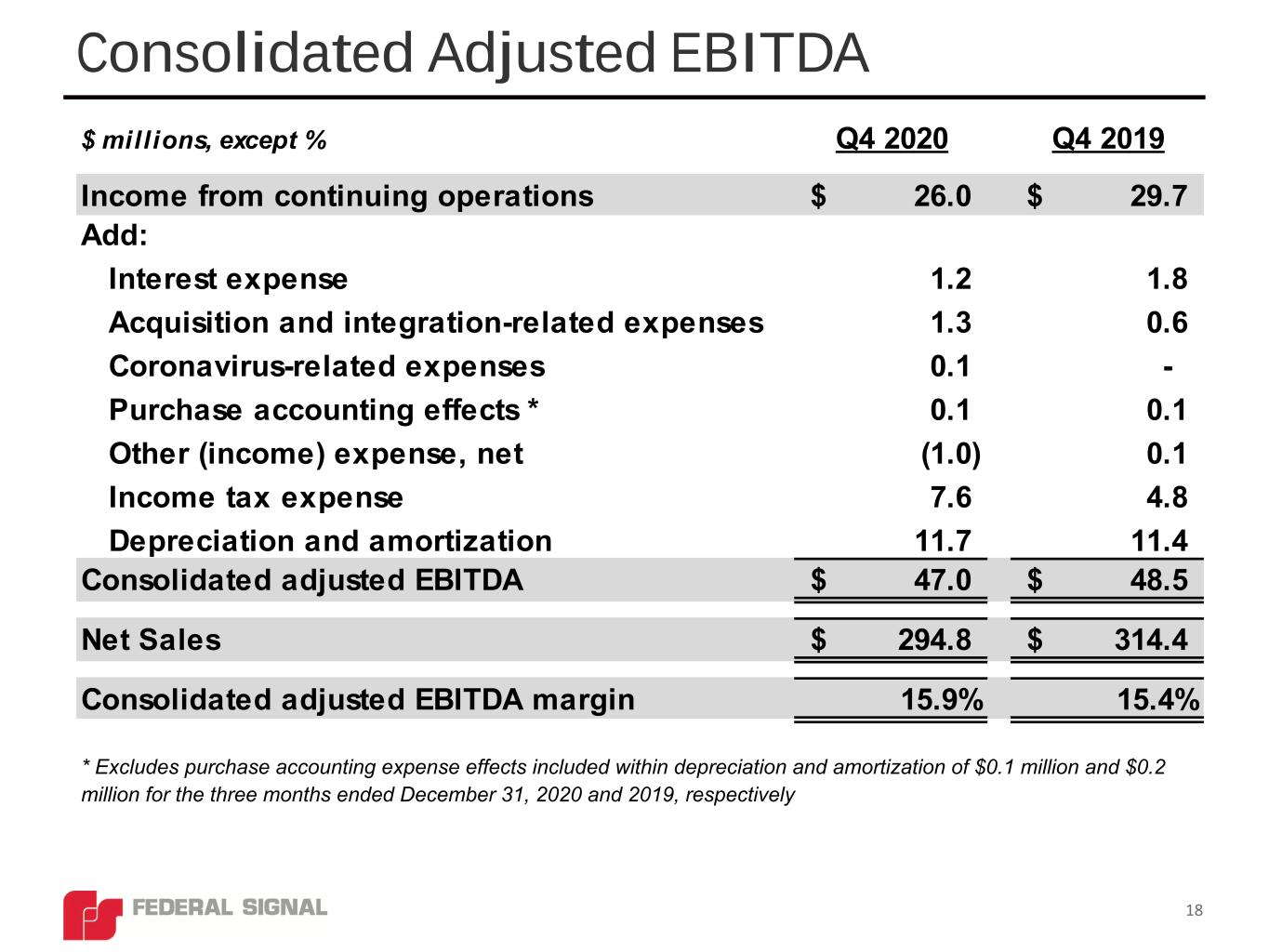

Consolidated Adjusted EBITDA 18 $ millions, except % Q4 2020 Q4 2019 Income from continuing operations 26.0$ 29.7$ Add: Interest expense 1.2 1.8 Acquisition and integration-related expenses 1.3 0.6 Coronavirus-related expenses 0.1 - Purchase accounting effects * 0.1 0.1 Other (income) expense, net (1.0) 0.1 Income tax expense 7.6 4.8 Depreciation and amortization 11.7 11.4 Consolidated adjusted EBITDA 47.0$ 48.5$ Net Sales 294.8$ 314.4$ Consolidated adjusted EBITDA margin 15.9% 15.4% * Excludes purchase accounting expense effects included within depreciation and amortization of $0.1 million and $0.2 million for the three months ended December 31, 2020 and 2019, respectively

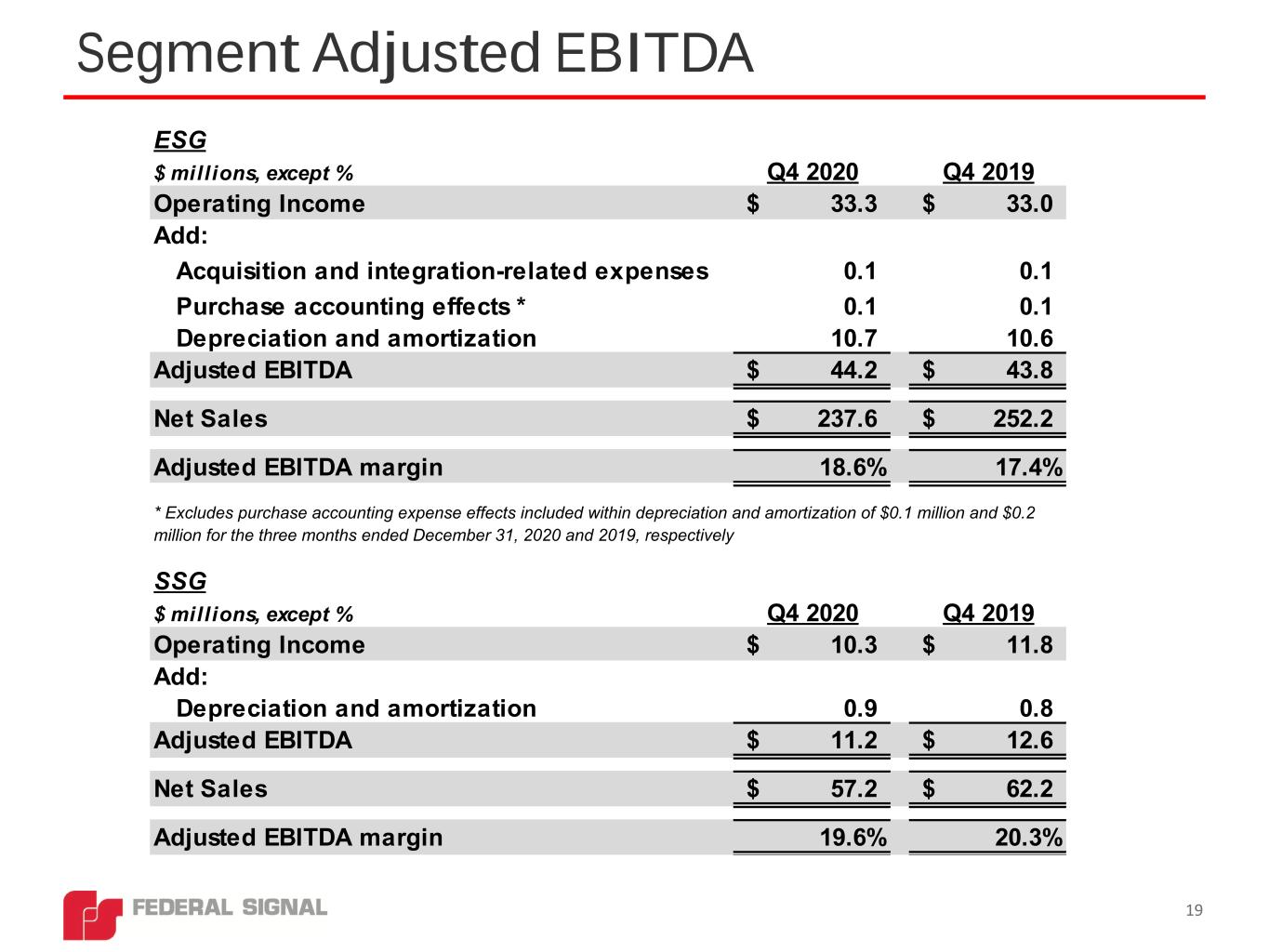

Segment Adjusted EBITDA 19 ESG $ millions, except % Q4 2020 Q4 2019 Operating Income 33.3$ 33.0$ Add: Acquisition and integration-related expenses 0.1 0.1 Purchase accounting effects * 0.1 0.1 Depreciation and amortization 10.7 10.6 Adjusted EBITDA 44.2$ 43.8$ Net Sales 237.6$ 252.2$ Adjusted EBITDA margin 18.6% 17.4% SSG $ millions, except % Q4 2020 Q4 2019 Operating Income 10.3$ 11.8$ Add: Depreciation and amortization 0.9 0.8 Adjusted EBITDA 11.2$ 12.6$ Net Sales 57.2$ 62.2$ Adjusted EBITDA margin 19.6% 20.3% * Excludes purchase accounting expense effects included within depreciation and amortization of $0.1 million and $0.2 million for the three months ended December 31, 2020 and 2019, respectively

Non-GAAP Measures • Adjusted income from continuing operations and earnings per share (“EPS”) - The Company believes that modifying its 2020 and 2019 income from continuing operations and diluted EPS provides additional measures which are representative of the Company’s underlying performance and improves the comparability of results between reporting periods. During the three and twelve months ended December 31, 2020 and 2019, adjustments were made to reported GAAP income from continuing operations and diluted EPS to exclude the impact of acquisition and integration-related expenses, pension-related charges, restructuring activity, coronavirus-related expenses, purchase accounting, and special tax items, where applicable. • Adjusted EBITDA and adjusted EBITDA margin - The Company uses adjusted EBITDA and the ratio of adjusted EBITDA to net sales ("adjusted EBITDA margin"), at both the consolidated and segment level, as additional measures which are representative of its underlying performance and to improve the comparability of results across reporting periods. We believe that investors use versions of these metrics in a similar manner. For these reasons, the Company believes that adjusted EBITDA and adjusted EBITDA margin, at both the consolidated and segment level, are meaningful metrics to investors in evaluating the Company’s underlying financial performance. • Consolidated adjusted EBITDA is a non-GAAP measure that represents the total of income from continuing operations, interest expense, acquisition and integration-related expenses, restructuring activity, coronavirus- related expenses, purchase accounting effects, other income/expense, income tax expense, and depreciation and amortization expense. Consolidated adjusted EBITDA margin is a non-GAAP measure that represents the total of income from continuing operations, interest expense, acquisition and integration-related expenses, restructuring activity, coronavirus-related expenses, purchase accounting effects, other income/expense, income tax expense, and depreciation and amortization expense divided by net sales for the applicable period(s). • Segment adjusted EBITDA is a non-GAAP measure that represents the total of segment operating income, acquisition and integration-related expenses, restructuring activity, coronavirus-related expenses, purchase accounting effects and depreciation and amortization expense, as applicable. Segment adjusted EBITDA margin is a non-GAAP measure that represents the total of segment operating income, acquisition and integration-related expenses, restructuring activity, coronavirus-related expenses, purchase accounting effects and depreciation and amortization expense, as applicable, divided by net sales for the applicable period(s). Segment operating income includes all revenues, costs and expenses directly related to the segment involved. In determining segment income, neither corporate nor interest expenses are included. Segment depreciation and amortization expense relates to those assets, both tangible and intangible, that are utilized by the respective segment. Other companies may use different methods to calculate adjusted EBITDA and adjusted EBITDA margin. 20