Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - SPIRIT REALTY CAPITAL, INC. | src-ex993_8.htm |

| EX-99.1 - EX-99.1 PRESS RELEASE - SPIRIT REALTY CAPITAL, INC. | src-ex991_7.htm |

| 8-K - 8-K - SPIRIT REALTY CAPITAL, INC. | src-8k_20210219.htm |

Supplemental Financial & Operating Information fourth QUARTER ENDED December 31, 2020 Exhibit 99.2

TABLE OF CONTENTS Corporate Headquarters 2727 N. Harwood St. Suite 300 Dallas, Texas 75201 Phone: 972-476-1900 www.spiritrealty.com Investor Relations (972) 476-1903 InvestorRelations@spiritrealty.com Transfer Agent American Stock Transfer & Trust Company, LLC Phone: 866-703-9065 www.amstock.com Please see Appendix at the back of this supplement for Definitions and Explanations used throughout this supplement and a disclosure regarding Forward-Looking Statements.

Q4 2020 highlights Net income per share of $0.24, FFO per share of $0.73 and AFFO per share of $0.74 Operational Performance: Occupancy of 99.6%, Lost Rent of 3.4% (or 1.0% excluding movie theaters) and Property Cost Leakage of 1.9% Invested $436.3 million, including the acquisition of 99 properties, and generated gross proceeds of $43.6 million on the sale of 17 properties Ending Corporate Liquidity of $1.0 billion and Adjusted Debt / Annualized Adjusted EBITDAre of 5.3x or 5.0x assuming the settlement of the 4.1 million open forward equity contracts Issued 8.9 million shares of common stock, generating net proceeds of $310.9 million, to settle certain forward contracts Note: Data is as of or for the quarter ended December 31, 2020.

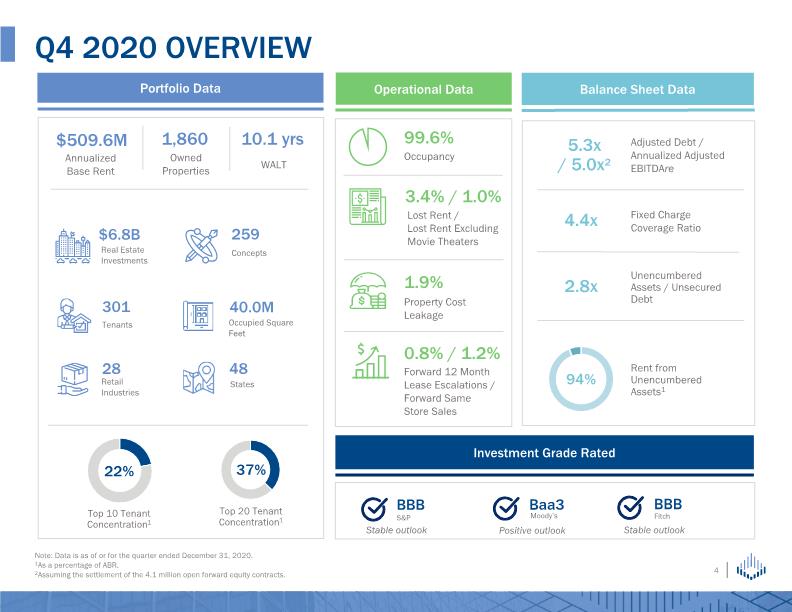

Q4 2020 Overview Portfolio Data Operational Data Balance Sheet Data $509.6M 37% Top 10 Tenant Concentration1 22% Investment Grade Rated Baa3 Moody’s 0.8% / 1.2% Forward 12 Month Lease Escalations / Forward Same Store Sales Annualized Base Rent Top 20 Tenant Concentration1 5.3x / 5.0x2 Adjusted Debt / Annualized Adjusted EBITDAre 4.4x Fixed Charge Coverage Ratio Concepts 259 10.1 yrs WALT 99.6% Occupancy 1.9% Property Cost Leakage 94% Rent from Unencumbered Assets1 Unencumbered Assets / Unsecured Debt 2.8x 3.4% / 1.0% Lost Rent / Lost Rent Excluding Movie Theaters Note: Data is as of or for the quarter ended December 31, 2020. 1As a percentage of ABR. 2Assuming the settlement of the 4.1 million open forward equity contracts. Stable outlook Positive outlook Stable outlook

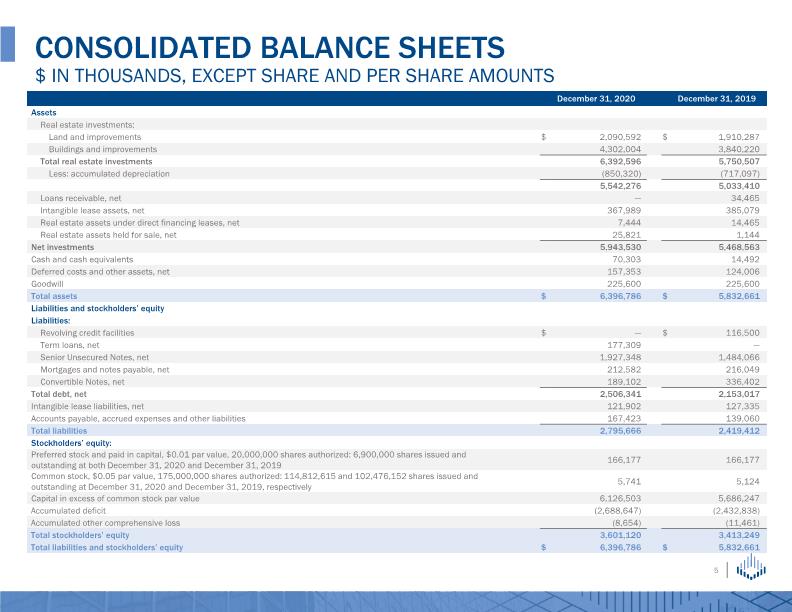

CONSOLIDATED BALANCE SHEETS $ IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS

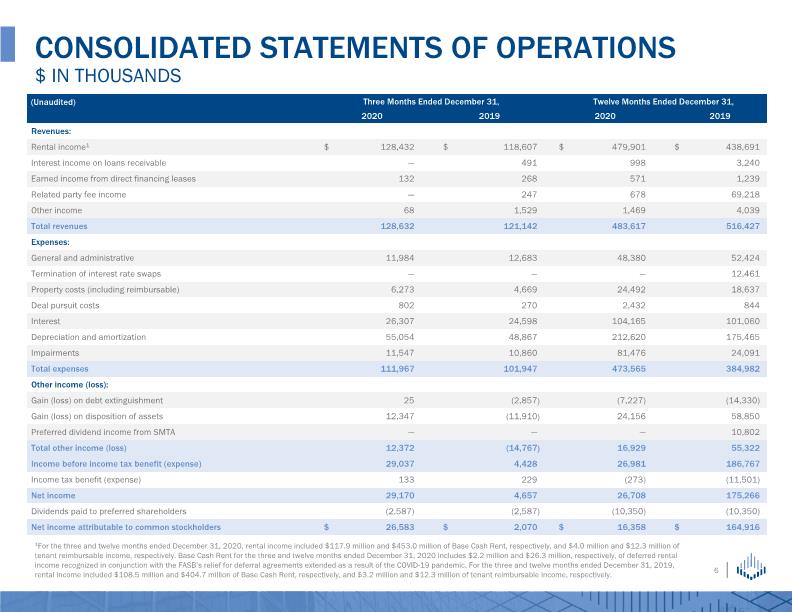

CONSOLIDATED STATEMENTS OF OPERATIONS $ IN THOUSANDS 1For the three and twelve months ended December 31, 2020, rental income included $117.9 million and $453.0 million of Base Cash Rent, respectively, and $4.0 million and $12.3 million of tenant reimbursable income, respectively. Base Cash Rent for the three and twelve months ended December 31, 2020 includes $2.2 million and $26.3 million, respectively, of deferred rental income recognized in conjunction with the FASB’s relief for deferral agreements extended as a result of the COVID-19 pandemic. For the three and twelve months ended December 31, 2019, rental income included $108.5 million and $404.7 million of Base Cash Rent, respectively, and $3.2 million and $12.3 million of tenant reimbursable income, respectively.

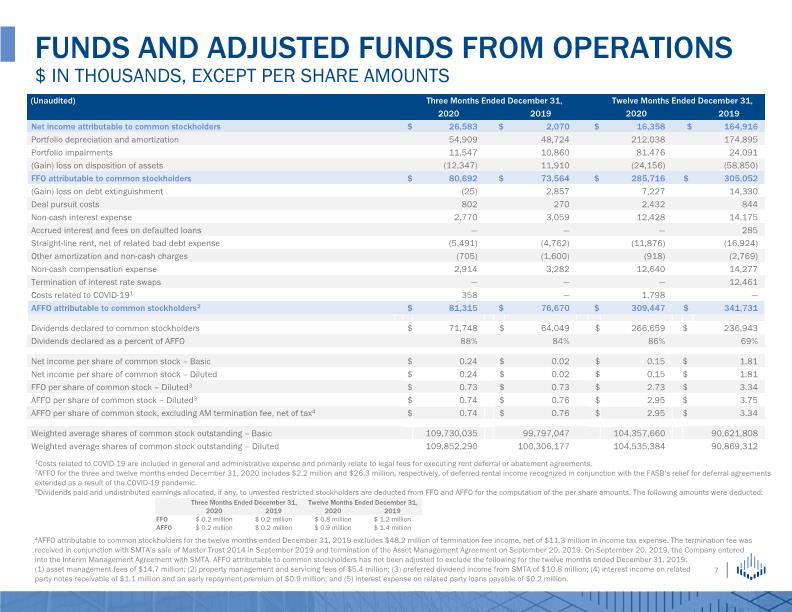

FUNDS AND ADJUSTED FUNDS FROM OPERATIONS $ IN THOUSANDS, EXCEPT PER SHARE AMOUNTS 1Costs related to COVID-19 are included in general and administrative expense and primarily relate to legal fees for executing rent deferral or abatement agreements. 2AFFO for the three and twelve months ended December 31, 2020 includes $2.2 million and $26.3 million, respectively, of deferred rental income recognized in conjunction with the FASB’s relief for deferral agreements extended as a result of the COVID-19 pandemic. 3Dividends paid and undistributed earnings allocated, if any, to unvested restricted stockholders are deducted from FFO and AFFO for the computation of the per share amounts. The following amounts were deducted: 4AFFO attributable to common stockholders for the twelve months ended December 31, 2019 excludes $48.2 million of termination fee income, net of $11.3 million in income tax expense. The termination fee was received in conjunction with SMTA’s sale of Master Trust 2014 in September 2019 and termination of the Asset Management Agreement on September 20, 2019. On September 20, 2019, the Company entered into the Interim Management Agreement with SMTA. AFFO attributable to common stockholders has not been adjusted to exclude the following for the twelve months ended December 31, 2019: (1) asset management fees of $14.7 million; (2) property management and servicing fees of $5.4 million; (3) preferred dividend income from SMTA of $10.8 million; (4) interest income on related party notes receivable of $1.1 million and an early repayment premium of $0.9 million; and (5) interest expense on related party loans payable of $0.2 million.

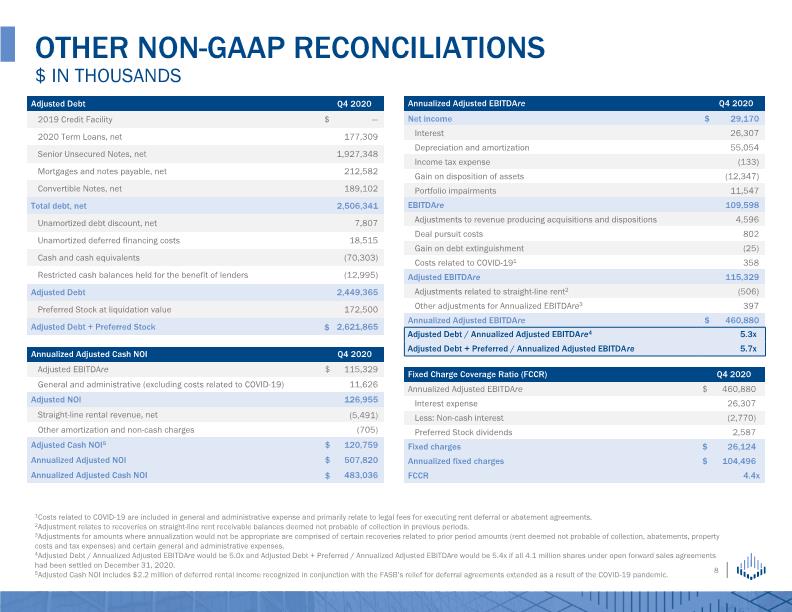

Other NON-GAAP RECONCILIATIONS $ in thousands 1Costs related to COVID-19 are included in general and administrative expense and primarily relate to legal fees for executing rent deferral or abatement agreements. 2Adjustment relates to recoveries on straight-line rent receivable balances deemed not probable of collection in previous periods. 3Adjustments for amounts where annualization would not be appropriate are comprised of certain recoveries related to prior period amounts (rent deemed not probable of collection, abatements, property costs and tax expenses) and certain general and administrative expenses. 4Adjusted Debt / Annualized Adjusted EBITDAre would be 5.0x and Adjusted Debt + Preferred / Annualized Adjusted EBITDAre would be 5.4x if all 4.1 million shares under open forward sales agreements had been settled on December 31, 2020. 5Adjusted Cash NOI includes $2.2 million of deferred rental income recognized in conjunction with the FASB’s relief for deferral agreements extended as a result of the COVID-19 pandemic.

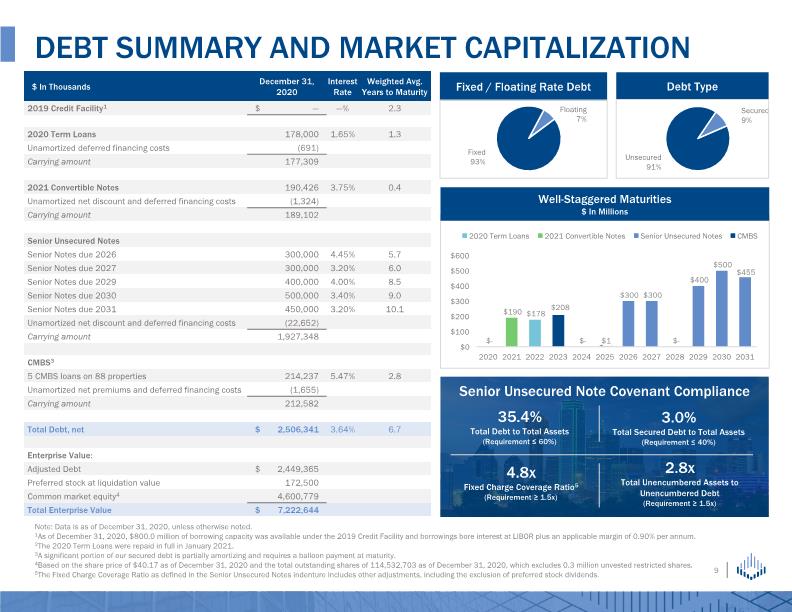

Debt Summary and Market Capitalization Note: Data is as of December 31, 2020, unless otherwise noted. 1As of December 31, 2020, $800.0 million of borrowing capacity was available under the 2019 Credit Facility and borrowings bore interest at LIBOR plus an applicable margin of 0.90% per annum. 2The 2020 Term Loans were repaid in full in January 2021. 3A significant portion of our secured debt is partially amortizing and requires a balloon payment at maturity. 4Based on the share price of $40.17 as of December 31, 2020 and the total outstanding shares of 114,532,703 as of December 31, 2020, which excludes 0.3 million unvested restricted shares. 5The Fixed Charge Coverage Ratio as defined in the Senior Unsecured Notes indenture includes other adjustments, including the exclusion of preferred stock dividends. Debt Type Fixed / Floating Rate Debt 35.4% Total Debt to Total Assets (Requirement ≤ 60%) Senior Unsecured Note Covenant Compliance 3.0% Total Secured Debt to Total Assets (Requirement ≤ 40%) 4.8x Fixed Charge Coverage Ratio5 (Requirement ≥ 1.5x) 2.8x Total Unencumbered Assets to Unencumbered Debt (Requirement ≥ 1.5x) Well-Staggered Maturities $ In Millions

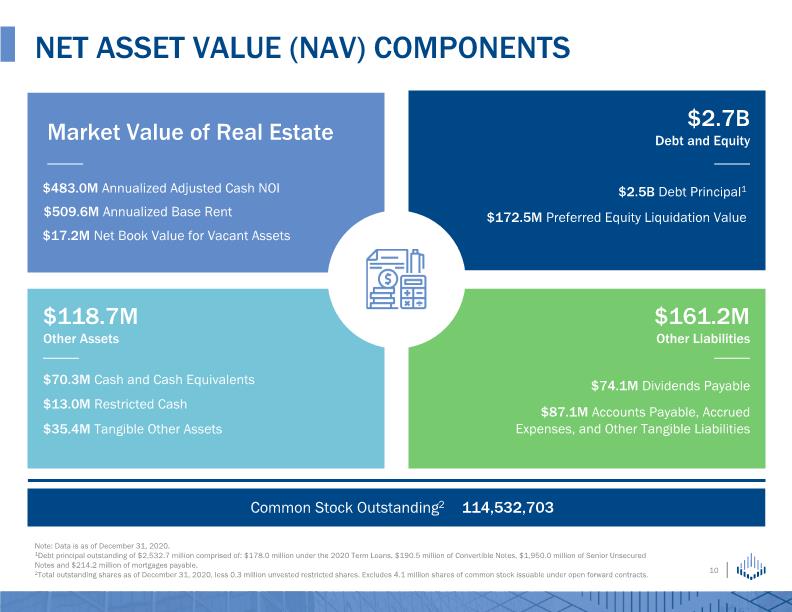

Net Asset Value (NAV) Components Market Value of Real Estate $2.7B Debt and Equity $118.7M Other Assets $161.2M Other Liabilities $509.6M Annualized Base Rent $17.2M Net Book Value for Vacant Assets $2.5B Debt Principal1 $172.5M Preferred Equity Liquidation Value $70.3M Cash and Cash Equivalents $13.0M Restricted Cash $35.4M Tangible Other Assets $74.1M Dividends Payable $87.1M Accounts Payable, Accrued Expenses, and Other Tangible Liabilities $483.0M Annualized Adjusted Cash NOI Note: Data is as of December 31, 2020. 1Debt principal outstanding of $2,532.7 million comprised of: $178.0 million under the 2020 Term Loans, $190.5 million of Convertible Notes, $1,950.0 million of Senior Unsecured Notes and $214.2 million of mortgages payable. 2Total outstanding shares as of December 31, 2020, less 0.3 million unvested restricted shares. Excludes 4.1 million shares of common stock issuable under open forward contracts.

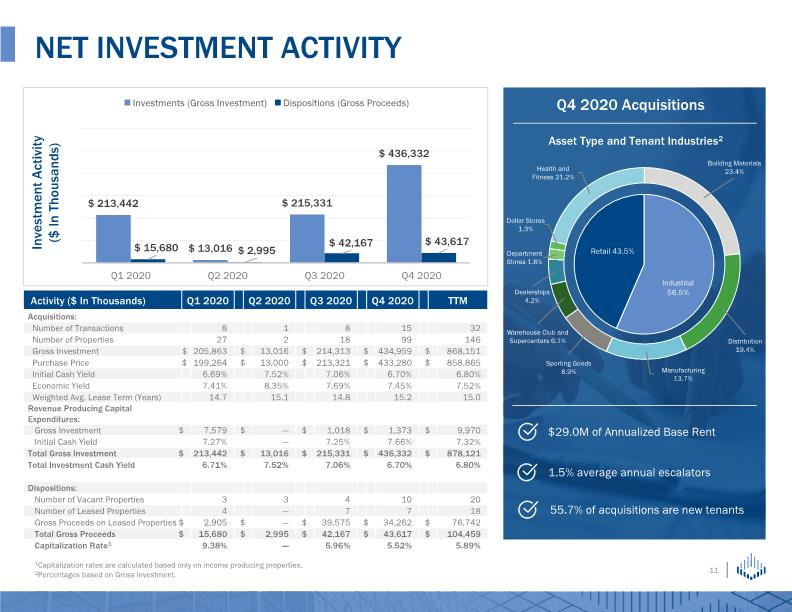

NET INVESTMENT ACTIVITY Asset Type and Tenant Industries2 1Capitalization rates are calculated based only on income producing properties. 2Percentages based on Gross Investment.

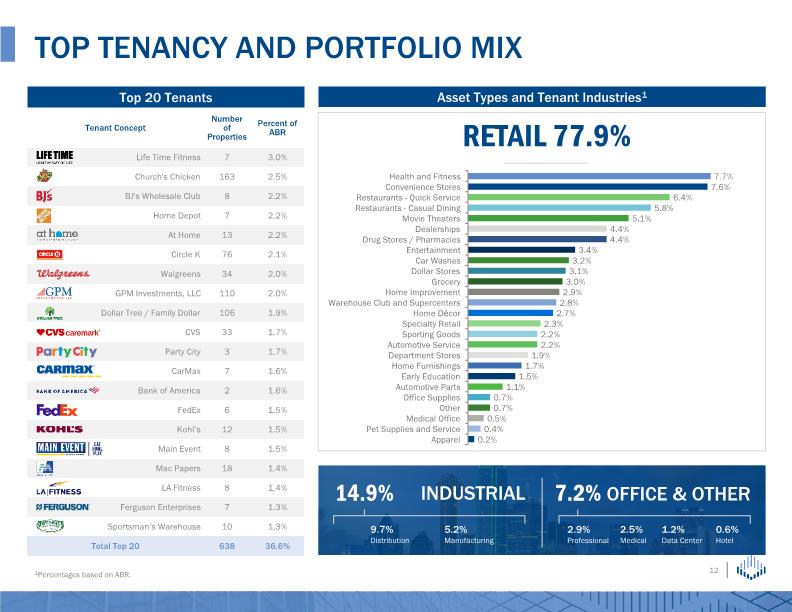

Top 20 Tenants Asset Types and Tenant Industries1 RETAIL 77.9% INDUSTRIAL Top Tenancy and Portfolio Mix 14.9% 9.7% Distribution 5.2% Manufacturing OFFICE & OTHER 7.2% 2.9% Professional 2.5% Medical 1.2% Data Center 0.6% Hotel 1Percentages based on ABR.

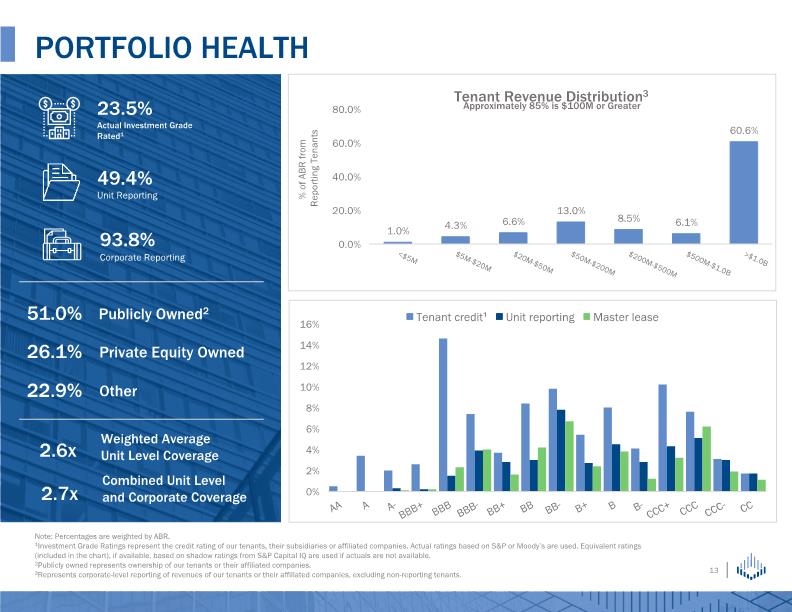

Portfolio Health % of ABR from Reporting Tenants Note: Percentages are weighted by ABR. 1Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies. Actual ratings based on S&P or Moody’s are used. Equivalent ratings (included in the chart), if available, based on shadow ratings from S&P Capital IQ are used if actuals are not available. 2Publicly owned represents ownership of our tenants or their affiliated companies. 3Represents corporate-level reporting of revenues of our tenants or their affiliated companies, excluding non-reporting tenants.

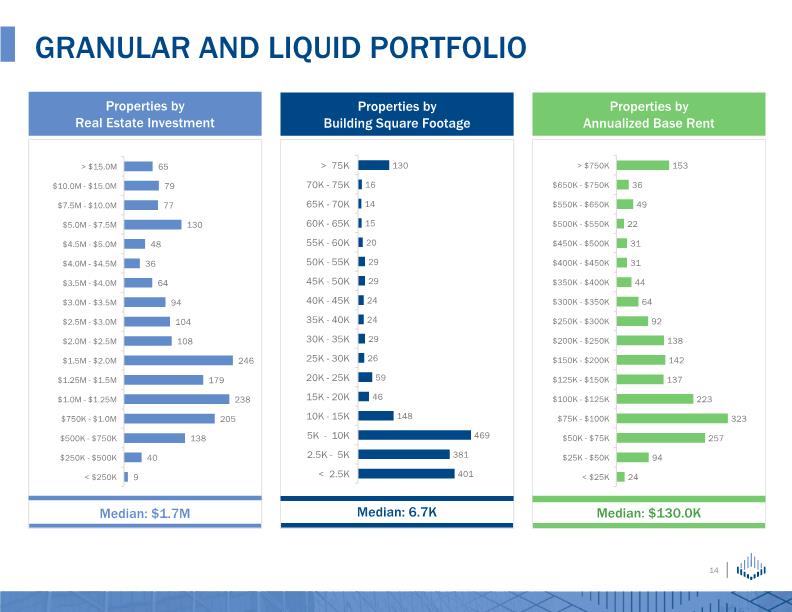

Granular and Liquid Portfolio

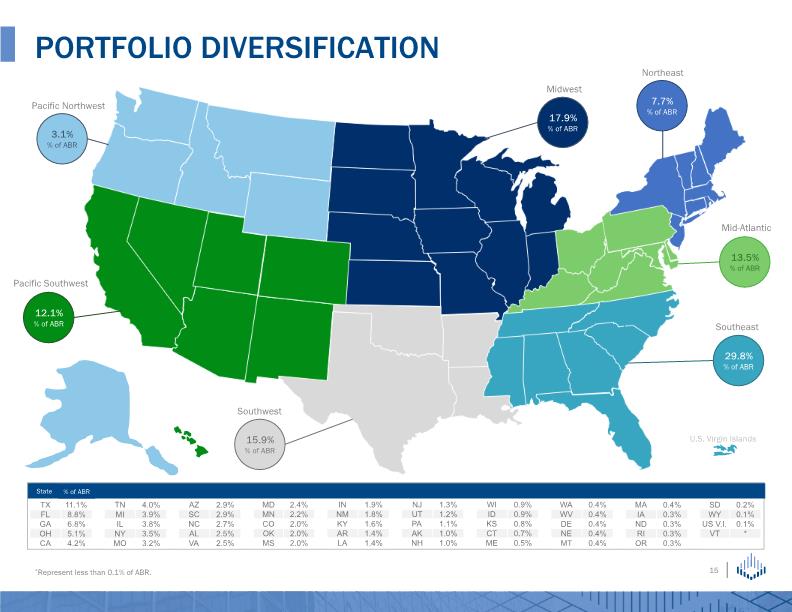

PORTFOLIO DIVERSIFICATION *Represent less than 0.1% of ABR. % of ABR State Southeast Mid-Atlantic Pacific Southwest Pacific Northwest 15.9% % of ABR Southwest Midwest Northeast 7.7% % of ABR 29.8% % of ABR 13.5% % of ABR 12.1% % of ABR 3.1% % of ABR 17.9% % of ABR U.S. Virgin Islands

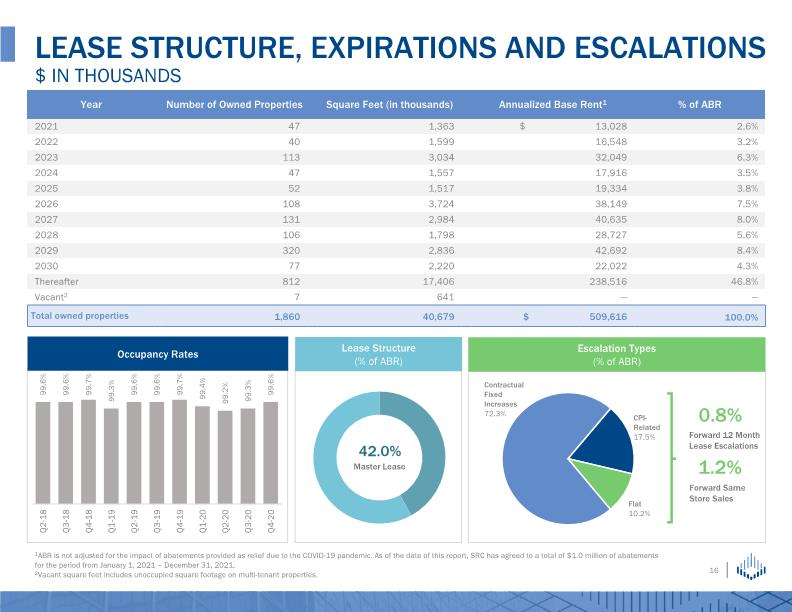

LEASE STRUCTURE, EXPIRATIONS AND ESCALATIONS $ in thousands 1.2% Forward Same Store Sales Occupancy Rates Forward 12 Month Lease Escalations 0.8% Lease Structure (% of ABR) 42.0% Master Lease Escalation Types (% of ABR) 1ABR is not adjusted for the impact of abatements provided as relief due to the COVID-19 pandemic. As of the date of this report, SRC has agreed to a total of $1.0 million of abatements for the period from January 1, 2021 – December 31, 2021. 2Vacant square feet includes unoccupied square footage on multi-tenant properties.

Appendix

NON-GAAP DEFINITIONS AND EXPLANATIONS

OTHER DEFINITIONS AND EXPLANATIONS

FORWARD-LOOKING STATEMENTS AND RISK FACTORS The information in this supplemental report should be read in conjunction with the accompanying earnings press release, as well as the Company's Annual Report on Form 10-K and other information filed with the Securities and Exchange Commission. This supplemental report is not incorporated into such filings. This document is not an offer to sell or a solicitation to buy securities of Spirit Realty Capital, Inc. Any offer or solicitation shall be made only by means of a prospectus approved for that purpose. This supplemental report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this supplemental report, the words “estimate,” “anticipate,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “seek,” “approximately” or “plan,” or the negative of these words or similar words or phrases that are predictions of or indicate future events or trends and which do not relate solely to historical matters are intended to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions of management. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise, and Spirit may not be able to realize them. Spirit does not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following risks and uncertainties, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: industry and economic conditions; volatility and uncertainty in the financial markets, including potential fluctuations in the CPI; Spirit's success in implementing its business strategy and its ability to identify, underwrite, finance, consummate, integrate and manage diversifying acquisitions or investments; the financial performance of Spirit's retail tenants and the demand for retail space; Spirit's ability to diversify its tenant base; the nature and extent of future competition; increases in Spirit's costs of borrowing as a result of changes in interest rates and other factors; Spirit's ability to access debt and equity capital markets; Spirit's ability to pay down, refinance, restructure and/or extend its indebtedness as it becomes due; Spirit's ability and willingness to renew its leases upon expiration and to reposition its properties on the same or better terms upon expiration in the event such properties are not renewed by tenants or Spirit exercises its rights to replace existing tenants upon default; the impact of any financial, accounting, legal or regulatory issues or litigation that may affect Spirit or its major tenants; Spirit's ability to manage its expanded operations; Spirit's ability and willingness to maintain its qualification as a REIT under the Internal Revenue Code of 1986, as amended; the impact on Spirit’s business and those of its tenants from epidemics, pandemics or other outbreaks of illness, disease or virus (such as the strain of coronavirus known as COVID-19); and other risks inherent in the real estate business, including tenant defaults, potential liability relating to environmental matters, illiquidity of real estate investments and potential damages from natural disasters discussed in Spirit's most recent filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this supplemental report. While forward-looking statements reflect Spirit's good faith beliefs, they are not guarantees of future performance. Spirit disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by law. In addition to U.S. GAAP financial measures, this presentation contains and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in this Appendix if the reconciliation is not presented on the page in which the measure is published.