Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - ZILLOW GROUP, INC. | q42020992.htm |

| EX-99.1 - EX-99.1 - ZILLOW GROUP, INC. | q42020991.htm |

| 8-K - 8-K - ZILLOW GROUP, INC. | z-20210210.htm |

1 | Q4.2020

Dear Shareholders: Our survey results and visitor traffic data have always indicated that people want to move. What changed in 2020 is many now have the ability to move, and they have turned to Zillow to dream and shop for their next home in numbers not previously seen in our 15-year history. Our vision that began all those many years ago remains at our core. We are building a seamless transaction for customers to meet the desire for technology-enabled renting, buying, selling, and financing. We have made notable steps in this direction as we execute across Zillow’s suite of products and services: - We are increasingly connecting more customers with partner agents across the country, resulting in accelerating revenue in our IMT segment. - We recently launched Zillow Homes in-house brokerage services on Zillow Offers transactions, an innovation that is improving the customer experience and boosting data quality. - We continue to build our Zillow Home Loans business, nearly tripling full-year 2020 originations revenue compared to 2019, and Q4 originations revenue grew nearly 7x. - We expanded Zillow Closing Services to 25 markets during 2020, and a vast majority of our customers are already choosing to close with us when they buy a home through Zillow Offers. We are also investing aggressively in technologies and services that make it easier for our customers to transition from today’s dreamers and shoppers into tomorrow's buyers, sellers and renters. As part of our quest, today we announced our intent to acquire ShowingTime.com, Inc. for $500 million in cash. ShowingTime is an industry-leading real estate showing software provider that facilitated more than 50 million in-person home tours in 2020. The addition of ShowingTime to our suite of real estate technology solutions gives us the opportunity to accelerate a widely-adopted solution for the complexity of scheduling a tour. ShowingTime’s technology already extends into the broader real estate industry, and we intend to grow its adoption by agents to the benefit of all industry participants and customers. Customers arrive at Zillow simply trying to move, and we want to deliver for them in every way we can, via our own services and through our best-in-class partners. We are excited about the opportunity ahead and look forward to continuing to serve our customers as we help our partners grow their businesses. 2 | Q4.2020 Feb. 10, 2021

Fourth-Quarter and Full-Year 2020 Highlights: Zillow Group delivered strong fourth-quarter results, beating our outlook at a consolidated level and for all three reporting segments. ● Consolidated Q4 revenue of $789 million and revenue for each segment exceeded the high end of our Q4 outlook range. ○ IMT segment revenue grew 33% to $424 million year over year. ○ Homes segment revenue of $304 million continued to reaccelerate, with home purchases returning to Q4 2019 levels. ○ Mortgages segment revenue grew 190% year over year to $61 million, driven by the strength in mortgage origination revenue. ● Full year 2020 consolidated revenue grew 22%, despite the negative impact of COVID-19 on results during the first half of 2020. ● On a GAAP basis, consolidated net income (loss) was $46 million in Q4 and $(162) million for 2020. Segment income (loss) before income taxes was $145 million, $(67) million, and $7 million for the IMT, Homes, and Mortgages segments in Q4 and $263 million,$(320) million, and $5 million for full year 2020, respectively. ● Consolidated Adjusted EBITDA1 was $170 million in Q4 and $343 million for 2020. Adjusted EBITDA (loss) by segment was: $203 million, $(47) million, and $14 million for the IMT, Homes, and Mortgages segments in Q4, and $556 million, $(242) million, and $29 million for the full year, respectively. Full-year results were driven primarily by IMT segment Adjusted EBITDA margin expanding to 38% from 24% in 2019, along with improved Mortgages and Homes segment margins. ● Cash and investments grew to $3.9 billion at the end of Q4, up from $3.8 billion at the end of Q3. ● Traffic to Zillow Group’s mobile apps and websites reached a Q4 record of 201 million average monthly unique users, growing 16% year over year and driving 2.2 billion visits during the same period, up 27% from a year ago. Full-year 2020 visits were a record 9.6 billion, up 19% from the previous year. 1 Adjusted EBITDA and segment-level Adjusted EBITDA are non-GAAP financial measures; they are not calculated or presented in accordance with U.S. generally accepted accounting principles, or GAAP. Please see the below sections “Use of Non-GAAP Financial Measures” and “Adjusted EBITDA” for more information about our presentation of Adjusted EBITDA and segment-level Adjusted EBITDA, including a reconciliation to the most directly comparable GAAP financial measure, which is net income (loss) on a consolidated basis and income (loss) before income taxes for each segment, for the relevant period. 3 | Q4.2020

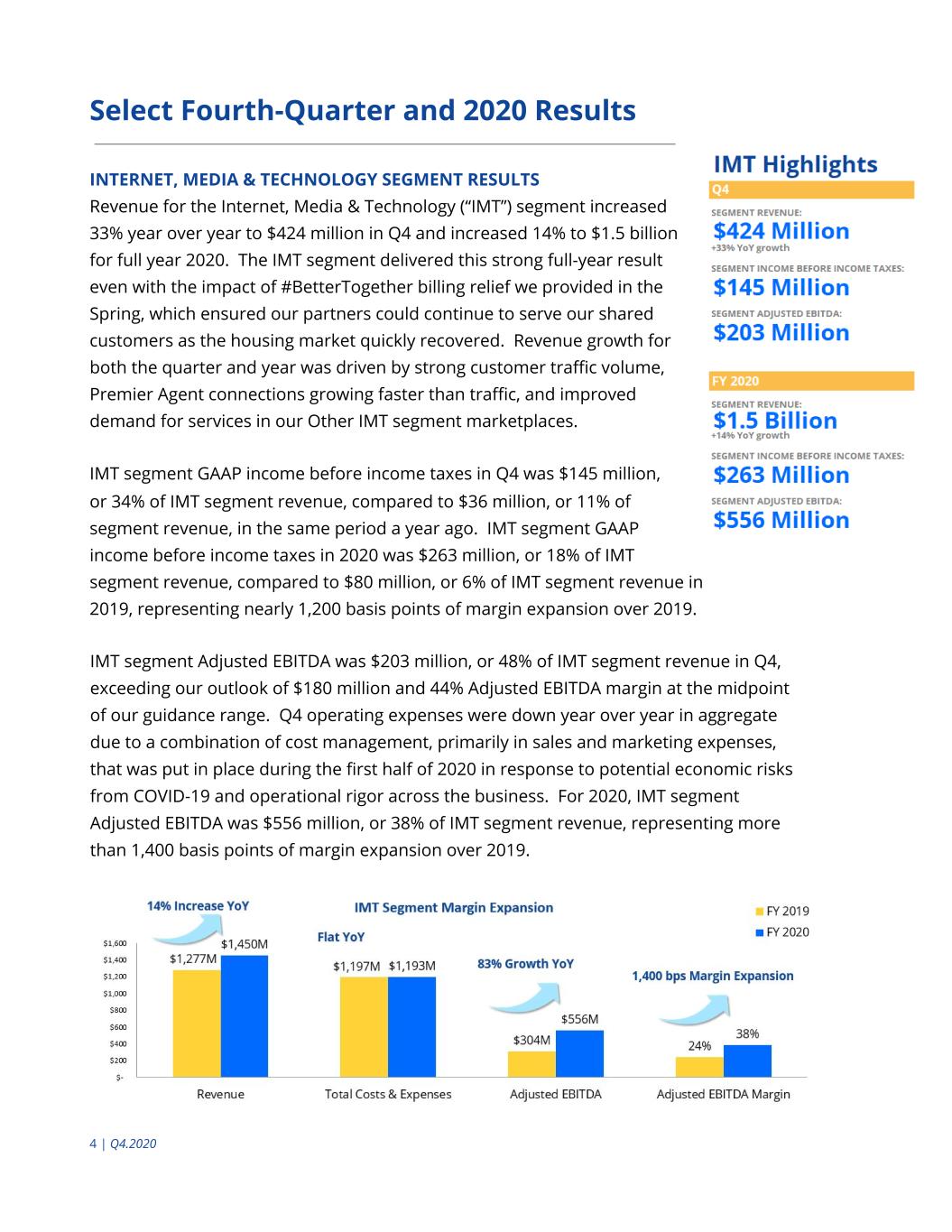

Select Fourth-Quarter and 2020 Results INTERNET, MEDIA & TECHNOLOGY SEGMENT RESULTS Revenue for the Internet, Media & Technology (“IMT”) segment increased 33% year over year to $424 million in Q4 and increased 14% to $1.5 billion for full year 2020. The IMT segment delivered this strong full-year result even with the impact of #BetterTogether billing relief we provided in the Spring, which ensured our partners could continue to serve our shared customers as the housing market quickly recovered. Revenue growth for both the quarter and year was driven by strong customer traffic volume, Premier Agent connections growing faster than traffic, and improved demand for services in our Other IMT segment marketplaces. IMT segment GAAP income before income taxes in Q4 was $145 million, or 34% of IMT segment revenue, compared to $36 million, or 11% of segment revenue, in the same period a year ago. IMT segment GAAP income before income taxes in 2020 was $263 million, or 18% of IMT segment revenue, compared to $80 million, or 6% of IMT segment revenue in 2019, representing nearly 1,200 basis points of margin expansion over 2019. IMT segment Adjusted EBITDA was $203 million, or 48% of IMT segment revenue in Q4, exceeding our outlook of $180 million and 44% Adjusted EBITDA margin at the midpoint of our guidance range. Q4 operating expenses were down year over year in aggregate due to a combination of cost management, primarily in sales and marketing expenses, that was put in place during the first half of 2020 in response to potential economic risks from COVID-19 and operational rigor across the business. For 2020, IMT segment Adjusted EBITDA was $556 million, or 38% of IMT segment revenue, representing more than 1,400 basis points of margin expansion over 2019. 4 | Q4.2020

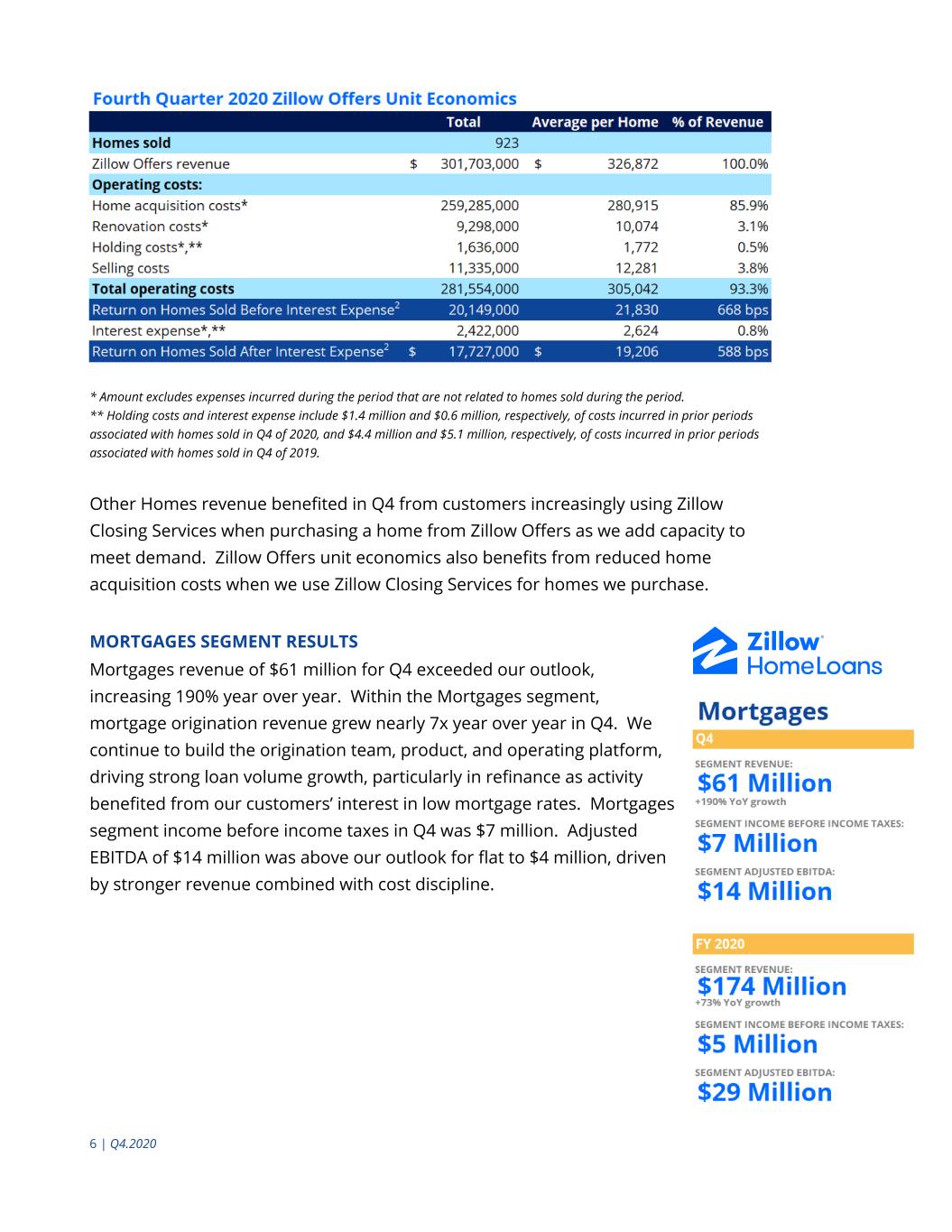

Premier Agent Premier Agent revenue growth accelerated in Q4, up 35% year over year to $314 million. While we benefited from favorable housing industry tailwinds, we continue to focus on providing outstanding service and optimizing to connect more high-intent customers with more high-performing partner agents. Other IMT Revenue Other IMT revenue, which includes rentals, new construction, display advertising, and business technology solutions for real estate professionals, increased 27% year over year to $110 million in Q4. Rentals revenue was the primary driver of the increase in Q4, with 54% year-over-year revenue growth as we continued to see adoption of new product offerings and strong rental demand. HOMES SEGMENT RESULTS We continued to accelerate our Homes segment activity in Q4, purchasing 1,789 homes and selling 923 homes in Zillow Offers. We ended the quarter with 1,531 homes in inventory, up from 665 homes at the end of Q3. Operational execution, combined with the ongoing tailwind of a strong housing market, resulted in Homes segment revenue of $304 million, exceeding the high end of our Q4 outlook range. Zillow Offers gross profit was $27 million in Q4, and average Zillow Offers gross profit per home sold was $29,547. Homes segment loss before income taxes was $67 million in Q4. Homes segment Adjusted EBITDA was a loss of $47 million, exceeding the high end of our outlook. Adjusted EBITDA outperformance was primarily due to stronger-than-expected home price appreciation in our markets, as well as a higher proportion of homes sold in Q4 that were acquired recently. These homes generated higher gross profit per home than those acquired prior to the pause in home purchases in the first half of 2020. We also delivered nearly 250 basis points in operational improvements per home in renovation, holding, and selling costs compared to Q3. We continued to make progress assessing the right level of renovation and improved operational rigor across the business. Average return on homes sold before interest expense2 was a gain of $21,830 per home, or 668 basis points as a percentage of revenue. 2Average Return on Homes Sold After Interest Expense and Average Return on Homes Sold Before Interest Expense are non-GAAP financial measures; they are not calculated or presented in accordance with GAAP. Please see the below sections “Use of Non-GAAP Financial Measures” and “Non-GAAP Average Return on Homes Sold After Interest Expense” for more information about our presentation of these non-GAAP measures, including reconciliation to the most directly comparable GAAP financial measures, which are Zillow Offers gross profit and average gross profit per home. 5 | Q4.2020

* Amount excludes expenses incurred during the period that are not related to homes sold during the period. ** Holding costs and interest expense include $1.4 million and $0.6 million, respectively, of costs incurred in prior periods associated with homes sold in Q4 of 2020, and $4.4 million and $5.1 million, respectively, of costs incurred in prior periods associated with homes sold in Q4 of 2019. Other Homes revenue benefited in Q4 from customers increasingly using Zillow Closing Services when purchasing a home from Zillow Offers as we add capacity to meet demand. Zillow Offers unit economics also benefits from reduced home acquisition costs when we use Zillow Closing Services for homes we purchase. MORTGAGES SEGMENT RESULTS Mortgages revenue of $61 million for Q4 exceeded our outlook, increasing 190% year over year. Within the Mortgages segment, mortgage origination revenue grew nearly 7x year over year in Q4. We continue to build the origination team, product, and operating platform, driving strong loan volume growth, particularly in refinance as activity benefited from our customers’ interest in low mortgage rates. Mortgages segment income before income taxes in Q4 was $7 million. Adjusted EBITDA of $14 million was above our outlook for flat to $4 million, driven by stronger revenue combined with cost discipline. 6 | Q4.2020

Fourth-Quarter Financial Details OPERATING EXPENSE SUMMARY Total consolidated costs and expenses were $700 million in Q4, down 31% from $1 billion a year ago, primarily due to lower Homes segment cost of revenue. Fewer homes were sold year over year in Q4 as a result of the Homes segment continuing to rebuild inventory from the buying pause earlier in the year. The following table presents certain costs and expenses by segment for the periods presented (in thousands, unaudited): BALANCE SHEET & CASH FLOW SUMMARY We ended Q4 with a cash and investment balance of $3.9 billion, the highest in our history, up from $3.8 billion at the end of Q3. Outlook The following table presents our outlook for the three months ending March 31, 2021 (in millions): 7 | Q4.2020

* Zillow Group has not provided a quantitative reconciliation of forecasted GAAP net income (loss) to forecasted total Adjusted EBITDA or of forecasted GAAP income (loss) before income taxes to forecasted segment Adjusted EBITDA within this communication because the company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to: income taxes which are directly impacted by unpredictable fluctuations in the market price of the company’s capital stock; depreciation and amortization expense from new acquisitions; impairments of assets; gains or losses on extinguishment of debt and acquisition-related costs. These items, which could materially affect the computation of forward-looking GAAP net income (loss) and income (loss) before income taxes, are inherently uncertain and depend on various factors, many of which are outside of Zillow Group’s control. For more information regarding the non-GAAP financial measures discussed in this communication, please see “Use of Non- GAAP Financial Measures” below. ** We have excluded from our outlook for Weighted average shares outstanding - diluted any potentially dilutive impact of the conversion of our convertible senior notes due in 2023, 2024, 2025 and 2026. The maximum number of shares underlying these convertible senior notes is 40.1 million shares of Class C capital stock. Consolidated Outlook We expect Q1 consolidated revenue to be $1.069 billion to $1.112 billion, as we believe revenue growth in our IMT and Mortgages segments will accelerate year over year and improve sequentially from Q4 in the Homes segment. We expect consolidated Adjusted EBITDA to be between $114 million and $138 million, up from $5 million in Q1 2020, primarily driven by IMT segment revenue growth and operating leverage. Internet, Media & Technology Segment In Q1, we expect IMT segment revenue to be between $415 million and $428 million, up 27% year over year at the midpoint of our outlook, due to continued strength in customer traffic and partner demand, increased connections in Premier Agent and strong partner retention. IMT segment operating costs and expenses are expected to be flat year over year in Q1 despite the growth in revenue, as we continue our focus on operational rigor. We expect Q1 IMT segment Adjusted EBITDA margin of 42% at the midpoint of our Adjusted EBITDA outlook, approximately 1,600 basis points above Q1 2020. Q1 Adjusted EBITDA margin will also benefit from the timing of certain seasonal advertising and marketing programs that are instead targeted to begin later this year. Premier Agent In Q1, Premier Agent revenue is expected to be between $314 million and $322 million, up 31% year over year at the midpoint of our outlook. Homes Segment In Q1, we expect Homes segment revenue to be between $595 million and $620 million, and Adjusted EBITDA loss between $(55) million and $(45) million. 8 | Q4.2020

Mortgages Segment In Q1, Mortgages segment revenue is expected to be between $59 million and $64 million, and Adjusted EBITDA to be between $(3) million and $1 million based upon current capacity, expected market conditions and additional investments in operations. Summary 3https://www.zillowgroup.com/news/terry-lees-zillow-offer-story/ 9 | Q4.2020 Looking ahead, our Zillow economists have made bold predictions for an even stronger housing market in 2021 than what we experienced in 2020. They are projecting the number of home sales to grow 21% for the year, as well as double-digit home price appreciation. A Great Reshuffling is under way as people rethink where they live with a new lens of flexibility and possibility. As a result, we believe residential real estate will continue its brisk trajectory, as people have an increasing desire and ability to move. Customers are simultaneously showing hunger for the kind of integrated, seamless experience Zillow can now provide. Retired elementary school teacher Terry Lee3 shared her recent experience, which perfectly illustrates the goodness that can happen when all of the pieces come together. After 44 years in her Atlanta home, she felt intimidated by the prospect of making repairs and selling, especially with the health risks posed by COVID-19. Following a suggestion from her son, she accepted a Zillow Offer, used a Premier Agent to help her shop, got financing through Zillow Home Loans, and Zillow Closing Services handled the closing. It’s stories like Terry’s that get us excited about the road ahead. Watch the full story here We are connecting services together for our customers and using our low cost of customer acquisition across multiple products to compete against an industry of largely single-point solution providers with high customer-acquisition costs. We now have the building blocks in place, and our story ahead will be about execution and scaling as we strive to improve the digital experience for the broader industry alongside our partners. We continue to be in the early pages of the story and look forward to sharing future chapters with you in the quarters and years ahead. Sincerely, Rich Barton, Co-founder & CEO Allen Parker, CFO

Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks and uncertainties, including, without limitation, statements regarding our business outlook for 2021; the future performance and operation of the Homes, IMT and Mortgages segments in 2021 and beyond; the current and future health and stability of the residential housing market and economy; and our expectations regarding future shifts in behavior by consumers and employees. Statements containing words such as “may,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “predict,” “will,” “projections,” “continue,” “estimate,” “outlook,” “guidance,” “would,” “could,” or similar expressions, constitute forward-looking statements. Forward-looking statements are made based on assumptions as of February 10, 2021, and although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee these results. Differences in Zillow Group’s actual results from those described in these forward-looking statements may result from actions taken by Zillow Group as well as from risks and uncertainties beyond Zillow Group’s control. Factors that may contribute to such differences include, but are not limited to, the impact of the COVID-19 pandemic or other public health crises and any associated economic downturn on Zillow Group’s future financial position, operations and financial performance; the magnitude, duration and severity of the COVID-19 pandemic and the availability and widespread distribution and use of effective vaccines; the impact of actions taken by governments, businesses and individuals in response to the COVID-19 pandemic, including changes in laws or regulations that limit Zillow Group’s ability to operate; the current and future health and stability of the economy, financial conditions and residential housing market, including any extended slowdown in the real estate markets as a result of the COVID-19 pandemic or changes that reduce demand for Zillow Group’s products and services, lower Zillow Group’s profitability or reduce Zillow Group’s access to credit; the satisfaction of conditions precedent to the closing of Zillow Group's proposed acquisition of ShowingTime.com, Inc., including expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Act; Zillow Group’s ability to execute on strategy; Zillow Group’s ability to maintain and effectively manage an adequate rate of growth; Zillow Group’s ability to innovate and provide products and services that are attractive to its users and advertisers; Zillow Group’s investment of resources to pursue strategies that may not prove effective; Zillow Group’s ability to compete successfully against existing or future competitors; the impact of pending or future legal proceedings, including those described in Zillow Group’s filings with the Securities and Exchange Commission, or SEC; Zillow Group’s ability to successfully integrate and realize the benefits of its past or future strategic acquisitions or investments; Zillow Group’s ability to comply with MLS rules and requirements to access and use listing data, and to maintain or establish relationships with listings and data providers; the ability of Zillow Group to operate its mortgage originations business, including the ability to obtain sufficient financing; the reliable performance of Zillow Group’s network infrastructure and content delivery processes; Zillow Group’s ability to obtain or maintain licenses and permits to support our current and future businesses; actual or anticipated changes to our products and services; the impact of natural disasters and other catastrophic events; and Zillow Group’s ability to protect its intellectual property. The foregoing list of risks and uncertainties is illustrative but not exhaustive. For more information about potential factors that could affect Zillow Group’s business and financial results, please review the “Risk Factors” described in Zillow Group’s Annual Report on Form 10-K for the year ended December 31, 2019, and in Zillow Group’s Quarterly Report on Form 10-Q for the three months ended September 30, 2020, filed with the SEC and in Zillow Group’s other filings with the SEC. Except as may be required by law, Zillow Group does not intend, and undertakes no duty to update this information to reflect future events or circumstances. Use of Non-GAAP Financial Measures This communication includes references to Adjusted EBITDA (in total and for each segment, and including forecasted Adjusted EBITDA and EBITDA margin), Average Return on Homes Sold Before Interest Expense and Average Return on Homes Sold After Interest Expense, which are non-GAAP financial measures not prepared in conformity with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures are not prepared under a comprehensive set of accounting rules and, therefore, should only be reviewed alongside results reported under GAAP.

Adjusted EBITDA To provide investors with additional information regarding our financial results, this communication includes references to Adjusted EBITDA (in total and for each segment, and including forecasted Adjusted EBITDA and EBITDA margin), which is a non-GAAP financial measure. We have provided a reconciliation within this communication of Adjusted EBITDA in total to net income (loss) and Adjusted EBITDA by segment to income (loss) before income taxes for each segment, the most directly comparable GAAP financial measures. Adjusted EBITDA is a key metric used by our management and board of directors to measure operating performance and trends, and to prepare and approve our annual budget. In particular, the exclusion of certain expenses in calculating Adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis. Our use of Adjusted EBITDA in total and for each segment has limitations as an analytical tool, and you should not consider these measures in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: ▪ Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; ▪ Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; ▪ Adjusted EBITDA does not consider the potentially dilutive impact of share-based compensation; ▪ Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; ▪ Adjusted EBITDA does not reflect impairment costs; ▪ Adjusted EBITDA does not reflect the gain (loss) on extinguishment of the 2021 Notes; ▪ Adjusted EBITDA does not reflect interest expense or other income; ▪ Adjusted EBITDA does not reflect income taxes; and ▪ Other companies, including companies in our own industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, you should consider Adjusted EBITDA in total and for each segment alongside other financial performance measures, including various cash flow metrics, net income (loss) and income (loss) before income taxes for each segment and our other GAAP results.

The following tables present Adjusted EBITDA along with the most directly comparable GAAP financial measure, which is net income (loss) on a consolidated basis and income (loss) before income taxes for each segment along with the calculation of Adjusted EBITDA margin and associated year over year growth rates and the most directly comparable GAAP financial measure and related year over year growth rates, which is net income (loss) margin on a consolidated basis and income (loss) before income taxes margin for each segment, for the periods presented (in thousands, unaudited): Three Months Ended December 31, 2019 to 2020 % Change Year Ended December 31, 2019 to 2020 % Change2020 2019 2020 2019 Revenue: Homes segment Zillow Offers $ 301,703 $ 603,228 (50) % $ 1,710,535 $ 1,365,250 25 % Other (1) 2,442 — N/A 4,840 — N/A Total Homes segment revenue 304,145 603,228 (50) % 1,715,375 1,365,250 26 % IMT segment: Premier Agent 314,213 233,482 35 % 1,046,954 923,876 13 % Other (2) 109,625 86,183 27 % 403,278 353,020 14 % Total IMT segment revenue 423,838 319,665 33 % 1,450,232 1,276,896 14 % Mortgages segment 60,969 21,054 190 % 174,210 100,691 73 % Total revenue $ 788,952 $ 943,947 (16) % $ 3,339,817 $ 2,742,837 22 % Other Financial Data: Segment income (loss) before income taxes: Homes segment $ (66,621) $ (107,923) 38 % $ (320,254) $ (312,120) (3) % IMT segment 145,369 36,221 301 % 262,984 80,060 228 % Mortgages segment 7,305 (12,654) 158 % 4,514 (44,962) 110 % Total segment income (loss) before income taxes $ 86,053 $ (84,356) 202 % $ (52,756) $ (277,022) 81 % Net income (loss) $ 46,036 $ (101,210) 145 % $ (162,115) $ (305,361) 47 % Adjusted EBITDA: Homes segment $ (46,890) $ (82,525) 43 % $ (241,969) $ (241,326) — % IMT segment 203,093 87,659 132 % 556,137 303,863 83 % Mortgages segment 13,648 (8,311) 264 % 28,825 (23,653) 222 % Total Adjusted EBITDA $ 169,851 $ (3,177) 5,446 % $ 342,993 $ 38,884 782 % (1) Other Homes segment revenue relates to revenue associated with the title and escrow services provided through Zillow Closing Services. (2) Other IMT segment revenue includes revenue generated by rentals, new construction and display advertising, as well as revenue from the sale of various other advertising and business technology solutions for real estate professionals, including dotloop.

Three Months Ended December 31, 2019 to 2020 % Change 2019 to 2020 Margin Change Basis Points Year Ended December 31, 2019 to 2020 % Change 2019 to 2020 Margin Change Basis PointsPercentage of Revenue: 2020 2019 2020 2019 Segment income (loss) before income taxes: Homes segment (22) % (18) % (22) % (400) (19) % (23) % 17 % 400 IMT segment 34 % 11 % 209 % 2,300 18 % 6 % 200 % 1,200 Mortgages segment 12 % (60) % 120 % 7,200 3 % (45) % 107 % 4,800 Total segment income (loss) before income taxes 11 % (9) % 222 % 2,000 (2) % (10) % 80 % 800 Net income (loss) 6 % (11) % 155 % 1,700 (5) % (11) % 55 % 600 Adjusted EBITDA: Homes segment (15) % (14) % (7) % (100) (14) % (18) % 22 % 400 IMT segment 48 % 27 % 78 % 2,100 38 % 24 % 58 % 1,400 Mortgages segment 22 % (39) % 156 % 6,100 17 % (23) % 174 % 4,000 Total Adjusted EBITDA 22 % — % N/A 2,200 10 % 1 % 900 % 900 The following tables present a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure, which is net income (loss) on a consolidated basis and income (loss) before income taxes for each segment, for each of the periods presented (in thousands, unaudited): Three Months Ended December 31, 2020 Homes IMT Mortgages Corporate Items (2) Consolidated Reconciliation of Adjusted EBITDA to Net Income and Income (Loss) Before Income Taxes: Net income (1) N/A N/A N/A N/A $ 46,036 Income tax expense N/A N/A N/A N/A 601 Income (loss) before income taxes $ (66,621) $ 145,369 $ 7,305 $ (39,416) $ 46,637 Other income — — (1,146) (1,657) (2,803) Depreciation and amortization expense 4,114 21,973 1,967 — 28,054 Share-based compensation expense 12,319 35,751 4,375 — 52,445 Loss on extinguishment of 2021 Notes — — — 4,943 4,943 Interest expense 3,298 — 1,147 36,130 40,575 Adjusted EBITDA $ (46,890) $ 203,093 $ 13,648 $ — $ 169,851 Three Months Ended December 31, 2019 Homes IMT Mortgages Corporate Items (2) Consolidated Reconciliation of Adjusted EBITDA to Net Loss and Income (Loss) Before Income Taxes: Net loss (1) N/A N/A N/A N/A $ (101,210) Income tax benefit N/A N/A N/A N/A (458) Income (loss) before income taxes $ (107,923) $ 36,221 $ (12,654) $ (17,312) $ (101,668) Other income — — (350) (11,683) (12,033) Depreciation and amortization expense 3,030 19,105 1,444 — 23,579 Share-based compensation expense 11,724 32,333 2,961 — 47,018 Interest expense 10,644 — 288 28,995 39,927 Adjusted EBITDA $ (82,525) $ 87,659 $ (8,311) $ — $ (3,177)

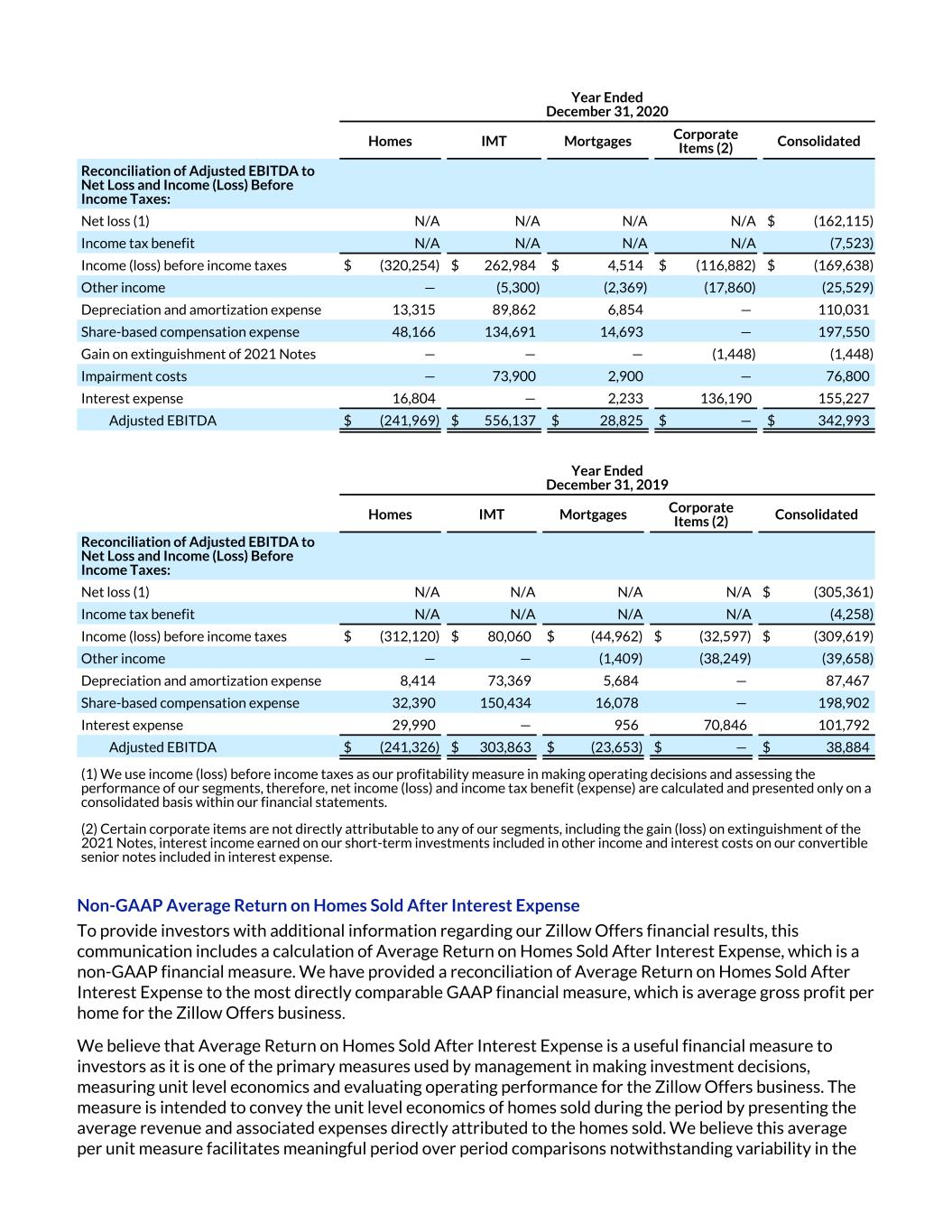

Year Ended December 31, 2020 Homes IMT Mortgages Corporate Items (2) Consolidated Reconciliation of Adjusted EBITDA to Net Loss and Income (Loss) Before Income Taxes: Net loss (1) N/A N/A N/A N/A $ (162,115) Income tax benefit N/A N/A N/A N/A (7,523) Income (loss) before income taxes $ (320,254) $ 262,984 $ 4,514 $ (116,882) $ (169,638) Other income — (5,300) (2,369) (17,860) (25,529) Depreciation and amortization expense 13,315 89,862 6,854 — 110,031 Share-based compensation expense 48,166 134,691 14,693 — 197,550 Gain on extinguishment of 2021 Notes — — — (1,448) (1,448) Impairment costs — 73,900 2,900 — 76,800 Interest expense 16,804 — 2,233 136,190 155,227 Adjusted EBITDA $ (241,969) $ 556,137 $ 28,825 $ — $ 342,993 Year Ended December 31, 2019 Homes IMT Mortgages Corporate Items (2) Consolidated Reconciliation of Adjusted EBITDA to Net Loss and Income (Loss) Before Income Taxes: Net loss (1) N/A N/A N/A N/A $ (305,361) Income tax benefit N/A N/A N/A N/A (4,258) Income (loss) before income taxes $ (312,120) $ 80,060 $ (44,962) $ (32,597) $ (309,619) Other income — — (1,409) (38,249) (39,658) Depreciation and amortization expense 8,414 73,369 5,684 — 87,467 Share-based compensation expense 32,390 150,434 16,078 — 198,902 Interest expense 29,990 — 956 70,846 101,792 Adjusted EBITDA $ (241,326) $ 303,863 $ (23,653) $ — $ 38,884 (1) We use income (loss) before income taxes as our profitability measure in making operating decisions and assessing the performance of our segments, therefore, net income (loss) and income tax benefit (expense) are calculated and presented only on a consolidated basis within our financial statements. (2) Certain corporate items are not directly attributable to any of our segments, including the gain (loss) on extinguishment of the 2021 Notes, interest income earned on our short-term investments included in other income and interest costs on our convertible senior notes included in interest expense. Non-GAAP Average Return on Homes Sold After Interest Expense To provide investors with additional information regarding our Zillow Offers financial results, this communication includes a calculation of Average Return on Homes Sold After Interest Expense, which is a non-GAAP financial measure. We have provided a reconciliation of Average Return on Homes Sold After Interest Expense to the most directly comparable GAAP financial measure, which is average gross profit per home for the Zillow Offers business. We believe that Average Return on Homes Sold After Interest Expense is a useful financial measure to investors as it is one of the primary measures used by management in making investment decisions, measuring unit level economics and evaluating operating performance for the Zillow Offers business. The measure is intended to convey the unit level economics of homes sold during the period by presenting the average revenue and associated expenses directly attributed to the homes sold. We believe this average per unit measure facilitates meaningful period over period comparisons notwithstanding variability in the

number of homes sold during a period and indicates ability to generate average returns on assets sold after considering home purchase costs, renovation costs, holding costs and selling costs. We calculate the Average Return on Homes Sold After Interest Expense as revenue associated with homes sold during the period less direct costs attributable to those homes divided by the number of homes sold during the period. Specifically, direct costs include, with respect to each home sold during the period (1) home acquisition and renovation costs, which in turn include certain labor costs directly associated with these activities; (2) holding and selling costs; and (3) interest costs incurred. Included in direct holding and interest expense amounts for the periods presented are holding and interest costs recorded as period expenses in prior periods associated with homes sold in the presented period, which are not calculated in accordance with, or as an alternative for, GAAP and should not be considered in isolation or as a substitute for results reported under GAAP. Excluded from certain of these direct cost amounts are costs recorded in the presented period related to homes that remain in inventory at the end of the period, as shown in the tables below. We make these period adjustments because we believe presenting Average Return on Homes Sold After Interest Expense in this manner provides a focused view on a subset of our assets - homes sold during the period - and reflecting costs associated with those homes sold from the time we acquire to the time we sell the home, which may be useful to investors. Average Return on Homes Sold After Interest Expense is intended to illustrate the performance of homes sold during the period and is not intended to be a segment or company performance metric. Average Return on Homes Sold After Interest Expense is a supplemental measure of operating performance for a subset of assets and has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Average Return on Homes Sold After Interest Expense does not reflect capital expenditure requirements for such replacements or for new capital expenditure requirements; • Average Return on Homes Sold After Interest Expense does not consider the potentially dilutive impact of share-based compensation; • Average Return on Homes Sold After Interest Expense does not include period costs that were not eligible for inventory capitalization associated with homes held in inventory at the end of the period; • Average Return on Homes Sold After Interest Expense does not reflect indirect expenses included in cost of revenue, sales and marketing, technology and development, or general and administrative expenses, some of which are recurring cash expenditures necessary to operate the business; and • Average Return on Homes Sold After Interest Expense does not reflect income taxes. The calculation of Average Return on Homes Sold After Interest Expense includes only those expenses directly attributed to the homes sold during the period. To arrive at return on homes sold after interest expense, the Company deducts from Zillow Offers gross profit (1) holding costs incurred in the presented period and prior periods for homes sold during the presented period that are included in sales and marketing expense, (2) selling costs incurred in the presented period for homes sold during the presented period that are included in sales and marketing expense and (3) interest expense incurred in the presented period and prior periods for homes sold during the presented period. The Company adds to Zillow Offers gross profit (1) inventory valuation adjustments recorded during the presented period associated with homes that remain in inventory at period end, net of inventory valuation adjustments recorded in prior periods related to homes sold in the presented period, and indirect expenses included in cost of revenue and (2) share-based compensation expense and depreciation and amortization expense included in cost of revenue. The following table presents the calculation of Zillow Offers average gross profit per home and Average Return on Homes Sold After Interest Expense and a reconciliation of return on homes sold after interest expense to Zillow Offers gross profit for the periods presented (unaudited):

Three Months Ended December 31, Calculation of Average Gross Profit per Home 2020 2019 Zillow Offers revenue $ 301,703,000 $ 603,228,000 Zillow Offers cost of revenue 274,431,000 581,398,000 Zillow Offers gross profit $ 27,272,000 $ 21,830,000 Homes sold 923 1,902 Average Zillow Offers gross profit per home $ 29,547 $ 11,477 Reconciliation of Non-GAAP Measure to Nearest GAAP Measure Zillow Offers gross profit $ 27,272,000 $ 21,830,000 Holding costs included in sales and marketing (1) (986,000) (7,424,000) Selling costs included in sales and marketing (2) (11,335,000) (26,125,000) Interest expense (3) (2,422,000) (9,310,000) Direct and indirect expenses included in cost of revenue (4) 4,773,000 8,339,000 Share-based compensation expense and depreciation and amortization expense included in cost of revenue 425,000 504,000 Return on homes sold after interest expense $ 17,727,000 $ (12,186,000) Homes sold 923 1,902 Average return on homes sold after interest expense $ 19,206 $ (6,407) (1) Amount represents holding costs incurred related to homes sold in the presented period that were not eligible for inventory capitalization and were therefore expensed as period costs in the presented period and prior periods. These costs primarily include homeowners association dues, property taxes, insurance, utilities, and cleaning and maintenance costs incurred during the time a home is held for sale after the renovation period is complete. On a GAAP basis, the Company incurred a total of $2.4 million and $8.3 million of holding costs included in sales and marketing expense for the three months ended December 31, 2020 and 2019, respectively. (2) Amount represents selling costs incurred related to homes sold in the presented period that were not eligible for inventory capitalization and were therefore expensed as period costs in the presented period. These costs primarily include agent commissions paid upon the sale of a home. (3) Amount represents interest expense incurred related to homes sold in the presented period that was not eligible for inventory capitalization and was therefore expensed as a period cost in the presented period and prior periods. (4) Amount includes inventory valuation adjustments recorded during the period associated with homes that remain in inventory at period end, net of inventory valuation adjustments recorded in prior periods related to homes sold in the presented period, holding costs incurred in the renovation period that are eligible for inventory capitalization and are expensed in the period presented when the associated home is sold, as well as corporate costs allocated to Zillow Offers such as headcount expenses and hosting-related costs related to the operation of our website.

Year Ended December 31, Calculation of Average Gross Profit per Home 2020 2019 Zillow Offers revenue $ 1,710,535,000 $ 1,365,250,000 Zillow Offers cost of revenue 1,612,317,000 1,315,345,000 Zillow Offers gross profit $ 98,218,000 $ 49,905,000 Homes sold 5,337 4,313 Average Zillow Offers gross profit per home $ 18,403 $ 11,571 Reconciliation of Non-GAAP Measure to Nearest GAAP Measure Zillow Offers gross profit $ 98,218,000 $ 49,905,000 Holding costs included in sales and marketing (1) (18,994,000) (15,865,000) Selling costs included in sales and marketing (2) (71,344,000) (59,178,000) Interest expense (3) (22,130,000) (20,205,000) Direct and indirect expenses included in cost of revenue (4) 5,279,000 22,513,000 Share-based compensation expense and depreciation and amortization expense included in cost of revenue 1,631,000 1,155,000 Return on homes sold after interest expense $ (7,340,000) $ (21,675,000) Homes sold 5,337 4,313 Average return on homes sold after interest expense $ (1,375) $ (5,026) (1) Amount represents holding costs incurred related to homes sold in the presented period that were not eligible for inventory capitalization and were therefore expensed as period costs in the presented period and prior periods. These costs primarily include homeowners association dues, property taxes, insurance, utilities, and cleaning and maintenance costs incurred during the time a home is held for sale after the renovation period is complete. On a GAAP basis, the Company incurred a total of $11.3 million and $22.6 million of holding costs included in sales and marketing expense for the years ended December 31, 2020 and 2019, respectively. (2) Amount represents selling costs incurred related to homes sold in the presented period that were not eligible for inventory capitalization and were therefore expensed as period costs in the presented period. These costs primarily include agent commissions paid upon the sale of a home. (3) Amount represents interest expense incurred related to homes sold in the presented period that was not eligible for inventory capitalization and was therefore expensed as a period cost in the presented period and prior periods. (4) Amount includes inventory valuation adjustments recorded during the period associated with homes that remain in inventory at period end, net of inventory valuation adjustments recorded in prior periods related to homes sold in the presented period, holding costs incurred in the renovation period that are eligible for inventory capitalization and are expensed in the period presented when the associated home is sold, as well as corporate costs allocated to Zillow Offers such as headcount expenses and hosting-related costs related to the operation of our website.