Attached files

| file | filename |

|---|---|

| EX-99.1 - NEWS RELEASE - WESCO INTERNATIONAL INC | wcc-4q2020earnings.htm |

| 8-K - FORM 8-K - WESCO INTERNATIONAL INC | wcc-20210209.htm |

1 Fourth Quarter 2020 Webcast Presentation February 9, 2021 NYSE: WCC

2 Forward-Looking Statements All statements made herein that are not historical facts should be considered as forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. These statements include, but are not limited to, statements regarding the process to divest certain legacy WESCO businesses in Canada, including the expected length of the process, the expected benefits and costs of the transaction between WESCO and Anixter International Inc., including anticipated future financial and operating results, synergies, accretion and growth rates, and the combined company's plans, objectives, expectations and intentions, statements that address the combined company's expected future business and financial performance, and other statements identified by words such as "anticipate," "plan," "believe," "estimate," "intend," "expect," "project," "will" and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of WESCO's management, as well as assumptions made by, and information currently available to, WESCO's management, current market trends and market conditions and involve risks and uncertainties, many of which are outside of WESCO's and WESCO's management's control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements. Those risks, uncertainties and assumptions include the risk of any unexpected costs or expenses resulting from the transaction, the risk of any litigation or post-closing regulatory action relating to the transaction, the risk that the transaction could have an adverse effect on the ability of the combined company to retain customers and retain and hire key personnel and maintain relationships with its suppliers, customers and other business relationships and on its operating results and business generally, the risk that problems may arise in successfully integrating the businesses of the companies or that the combined company could be required to divest one or more businesses, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits, the risk that the leverage of the company may be higher than anticipated, the impact of natural disasters, health epidemics and other outbreaks, especially the outbreak of COVID-19 since December 2019, which may have a material adverse effect on the combined company's business, results of operations and financial conditions, the risk that the divesture of certain legacy WESCO businesses in Canada may take longer than expected and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond each company's control. Additional factors that could cause results to differ materially from those described above can be found in WESCO's Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and WESCO's other reports filed with the U.S. Securities and Exchange Commission ("SEC"). Non-GAAP Measures In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles ("U.S. GAAP") above, this slide presentation includes certain non-GAAP financial measures. These financial measures include pro forma gross profit, adjusted gross profit gross margin, adjusted gross margin, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA, adjusted EBITDA margin, pro forma adjusted EBITDA, financial leverage, pro forma financial leverage, free cash flow, adjusted income from operations, adjusted operating margin, adjusted provision for income taxes, adjusted net income, adjusted net income attributable to WESCO International, Inc., adjusted net income attributable to common stockholders, and adjusted earnings per diluted share. The Company believes that these non-GAAP measures are useful to investors as they provide a better understanding of sales performance, and the use of debt and liquidity on a comparable basis. Additionally, certain non-GAAP measures either focus on or exclude items impacting comparability of results such as merger-related costs and fair value adjustments, an out-of-period adjustment related to inventory absorption accounting, gain on sale of a U.S. operating branch, and the related income tax effect of such items, allowing investors to more easily compare the Company's financial performance from period to period. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above.

3 Agenda Business Overview Financial Results Overview John Engel Chairman, President & CEO Executive Vice President & CFO Dave Schulz

4 2020 Summary Transformation well underway…substantial value creation has begun Exceeding Our Expectations • Successfully closed Anixter transaction; integration is going exceptionally well – Synergy capture exceeding expectations, raised external targets in November 2020 – Increased scale and complementary capabilities driving cross-sell pipeline and positive sales momentum – New organization up and running, high-performance culture in place • Rapid COVID response to support employee safety, customer operations and supply chain needs • Leveraged competitive capabilities to gain share against unprecedented macro challenges Outperforming The Markets • Leading scale and diversified portfolio • Service differentiation and complete supply chain solutions • Well positioned to capitalize on attractive secular growth trends LED Adoption Communications + Ongoing Emerging Significant upside potential on sales growth, cost, margin, and cash flow targets

5 Second Half Priorities and Achievements •Sales momentum accelerated in 2H 2020 and has continued into 2021 Take share Workday-adjusted sales up 4% sequentially in Q4 versus typical seasonal decline Cross selling initiatives underway with new wins captured in each business Entered 2021 with record year-end backlog Return to growth in January 2021 with sales per workday up LSD versus prior year Deliver Synergies Tracking to previously increased synergy targets with upside Reduced headcount by over 650 through integration initiatives Adjusted gross margin up YoY for second consecutive quarter due to improved sales processes and benefits of scale Integration management office fully established and driving daily execution Focus free cash flow generation on debt reduction Generated $124 million of free cash flow in Q4 and $586 million in FY 2020 Reduced net debt by $389 million and leverage by 0.4x in first six months post-acquisition Completed debt refinancing in January 2021 that reduces interest expense by $20 million per year

6 Fourth Quarter Results Overview Dave Schulz Executive Vice President & Chief Financial Officer

7 Cost Synergy Target Timeline •Introducing calendar year targets $39 $130 $200 $250 2H 2020 FY 2021 FY 2022 TTM 1H 2023 Cumulative Realized Cost Synergy Target $M COGS 20% OPEX 80% Target Cost Synergy Mix $37 $115 $160 $175 Cumulative one-time operating expenses

8 $180 $586 FY 2019 FY 2020 Free Cash Flow & Liquidity •Strong free cash flow generation and liquidity supports future growth Free Cash Flow Capital Deployment Cash & Debt Maturity Liquidity 251% of adjusted net income 80% of adjusted net income • Strong free cash flow in Q4 and FY 2020 • Net debt reduction of $109 million in Q4 and $389 million in 2H 2020 • Leverage reduced 0.4x since Anixter acquisition closed in June • Liquidity of ~$1.1 billion1 – Invested cash: $259 million – Revolver availability: $802 million – AR facility availability: $75 millionCash 2021 2022 2023 2024 2025 and beyond $259 $530 $1,009 $350 $3,079 $M $M As of 12/31/20 As of 12/31/20 1Excludes $175 million and $100 million of incremental AR facility and Revolver capacity, respectively, resulting from amendments completed on January 5, 2021 2 $500 million senior notes due 2021 were redeemed on January 14, 2021 Bonds Bank lines 2 On-track to rapidly delever to target leverage range of 2.0–3.5x by June 2023

9 Q4 2019 Pro Forma1 Q3 2020 Q4 2020 Versus Q4 2019 Versus Q3 2020 Sales $4,352 $4,142 $4,129 (5)% flat Adjusted Gross Profit2 850 814 811 (5)% flat % of sales 19.5% 19.6% 19.6% +10 bps flat Adjusted Income from Operations2 185 200 172 (7)% (14)% % of sales 4.3% 4.8% 4.2% (10) bps (60) bps Adjusted EBITDA2 229 252 216 (6)% (14)% % of sales 5.3% 6.1% 5.2% (10) bps (90) bps Adjusted Diluted EPS2 $1.66 $1.22 Fourth Quarter Results Overview Year-over-year margin improvement and accelerating sales momentum in Q4 1 Information as filed as an exhibit to Form 8-K on November 4, 2020. 2 Adjusted Gross profit, Adjusted Income from Operations, Adjusted EBITDA and Adjusted earnings per diluted share have been adjusted to exclude merger-related costs and fair value adjustments, an out-of-period adjustment related to inventory absorption accounting, gain on sale of a U.S. operating branch in the third quarter, and the related income tax effects. See appendix for reconciliation. $M Except per share amounts • Sequential sales +4% on comparable workday basis • Effective October 1, 2020 reinstated salaries and merit adjustments, and resumed retirement matching contributions • Record year-end backlog

10 Industry-leading businesses diversified by products, services, end markets and geographies WESCO’s Three Strategic Business Units (SBUs) Utility & Broadband Solutions (UBS) Electrical & Electronic Solutions (EES) Communications & Security Solutions (CSS) 40% of total company sales 33% of total company sales 27% of total company sales Construction | Industrial | OEM | CIG | Lighting Utility | Broadband | Integrated Supply Technology | Financial | Government | Healthcare | Education • Contractors and specialty integrators • Industrial, automation, commercial, institutional, and government • OEM and global complex manufacturing • Turn-key lighting and energy solutions • Cloud and data center • Contractors and integrators • Security solutions • Professional audio/video • In-building wireless • Safety solutions • IOUs, public power, and contractors • Global Service Providers, wireless and broadband operators • Integrated Supply solutions INDUSTRIES SERVING % of SALES (2020 Pro Forma) Legacy Anixter Legacy WESCO Legend

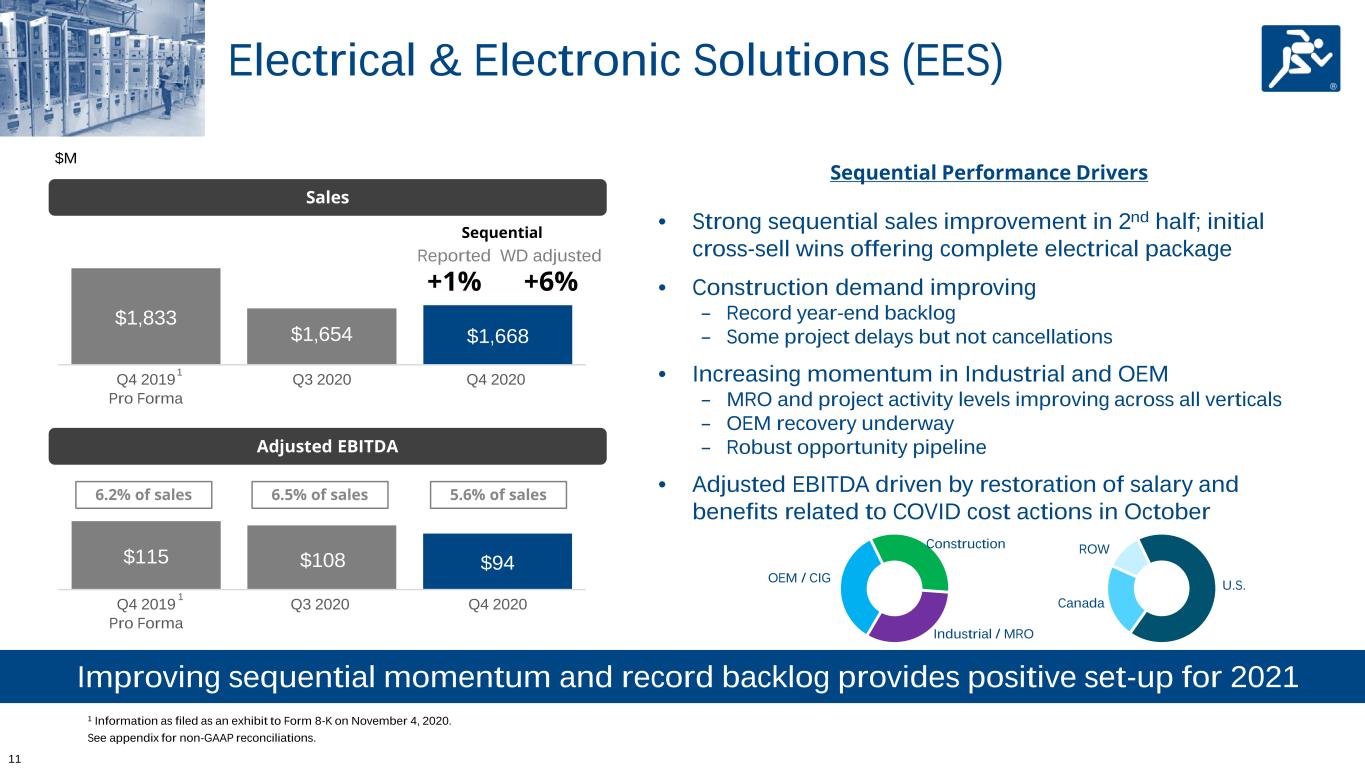

11 Construction Industrial / MRO OEM / CIG $115 $108 $94 Q4 2019 Pro Forma Q3 2020 Q4 2020 $1,833 $1,654 $1,668 Q4 2019 Pro Forma Q3 2020 Q4 2020 Electrical & Electronic Solutions (EES) •Improving sequential momentum and record backlog provides positive set-up for 2021 See appendix for non-GAAP reconciliations. Sales Adjusted EBITDA $M 6.2% of sales 6.5% of sales 5.6% of sales Reported +1% WD adjusted +6% Sequential Sequential Performance Drivers • Strong sequential sales improvement in 2nd half; initial cross-sell wins offering complete electrical package • Construction demand improving – Record year-end backlog – Some project delays but not cancellations • Increasing momentum in Industrial and OEM – MRO and project activity levels improving across all verticals – OEM recovery underway – Robust opportunity pipeline • Adjusted EBITDA driven by restoration of salary and benefits related to COVID cost actions in October U.S. Canada ROW 1 Information as filed as an exhibit to Form 8-K on November 4, 2020. 1 1

12 Communications & Security Solutions (CSS) Continue to take share with industry-leading value propositions in attractive high-growth markets Sequential Performance Drivers • Improving sales momentum in Q4 to close out a strong 2020 with continued share gains • Network infrastructure growth driven by increasing global enterprise accounts, data centers, in-building wireless, and professional A/V applications • Security solutions driven by expanding secure network and IP security applications; continued share gains and robust pipeline in place • Adjusted EBITDA and margins remain strong YoY $1,433 $1,389 $1,369 Q4 2019 Pro Forma Q3 2020 Q4 2020 $111 $121 $112 Q4 2019 Pro Forma Q3 2020 Q4 2020 7.7% of sales 8.7% of sales 8.2% of sales Reported (1)% WD adjusted +3% Sequential Network Infrastructure Security Solutions Other U.S. Canada ROW Sales Adjusted EBITDA See appendix for non-GAAP reconciliations. 1 Information as filed as an exhibit to Form 8-K on November 4, 2020. 1 1 $M

13 Sequential Performance Drivers • Strong results in 2020 with continued share gains • Utility strength continues with grid modernization activities, project backlog, lighting and automation driving demand • Strong broadband growth driven by 5G buildouts, FTTx deployments and increasing remote work applications • Adjusted EBITDA and margins remain strong YoY Utility & Broadband Solutions (UBS) Unmatched supply chain capabilities enable WESCO to continue to take share $1,086 $1,099 $1,091 Q4 2019 Pro Forma Q3 2020 Q4 2020 $79 $86 $79 Q4 2019 Pro Forma Q3 2020 Q4 2020 7.2% of sales 7.8% of sales 7.3% of sales Sequential Reported (1)% WD adjusted +4% Utility Integrated Supply Broadband U.S. Canada ROW Sales Adjusted EBITDA See appendix for non-GAAP reconciliations. 1 Information as filed as an exhibit to Form 8-K on November 4, 2020. 1 1 $M

14 Q1 2021 Drivers • Estimate ~$28 million of realized cost synergies • 2 fewer workdays in Q1 21 than prior year 2021 Outlook Sales growth and cost synergies drive growth and profitability in 2021 FY 2021 Outlook 2020 Pro Forma Sales1 $16.0B 2021 Outlook: Market growth 3% - 5% Plus: share gain / cross sell 1% - 2% Less: impact of one fewer workday in 2021 and divestitures (~1%) Reported Sales 3% - 6% 2020 Pro Forma Adjusted EBITDA $855M 2021 Outlook: Adjusted EBITDA Margin2 5.4% - 5.7% Effective Tax Rate ~23% Adjusted EPS2 $5.50 - $6.00 Free Cash Flow ~100% of Adjusted Net Income Capital Expenditures $100 - $120M Workdays 2021 2020 Jan 19 22 Feb 20 20 Mar 23 22 Q1 62 64 2021 Adjusted EBITDA Margin Outlook2 2020 Pro Forma Adjusted EBITDA Margin 5.3% Plus: improving mix, market outperformance, and operating leverage 50 – 80 bps Less: COVID restoration, incentive compensation, and benefits ~(90) bps Plus: ~$90M incremental realized synergies ~55 bps 2021 Adjusted EBITDA margin 5.4% - 5.7% Continuing to deliver on our integration commitments in 2021 1 Adjusted to account for a difference in workdays in Q2 2020 versus the pro forma financial information filed on Form 8-K on November 4, 2020. 2 Adjusted EBITDA is defined as EBITDA before other, net, non-cash stock-based compensation and merger-related costs; Adjusted EPS only excludes merger-related costs and the related income tax effects.

15 Summary •WESCO’s new era is off to an exceptional start • Excellent performance against a COVID-driven environment in 2020 • Strong execution, substantial progress made on integration in first six months – Delivering integration commitments while maintaining momentum in base business – New organization structure and strengthened management team in place – Generating initial cross-selling results in all three businesses – Synergies on track with high confidence on delivering upside • Excellent free cash flow generation demonstrates resilient business model and consistent strength through the cycle; on-track to rapidly delever • Entering 2021 from position of strength • Exceptionally well positioned to capitalize on evolving secular growth trends

APPENDIX

17 Glossary 1H: First half of fiscal year 2H: Second half of fiscal year A/V: Audio/visual COGS: Cost of goods sold CIG: Commercial, Institutional, and Government CSS: Communications & Security Solutions (business unit) EES: Electrical & Electronic Solutions (business unit) ETR: Effective tax rate FTTx: Fiber-to-the-x (last mile fiber optic network connections) HSD: High-single digit LSD: Low-single digit Executed synergies: Initiatives fully implemented – actions taken to generate savings Realized synergies: Savings that impact financial results versus pro forma 2019 One-time operating expenses: Operating expenses that are in or will be realized in the P&L (including cash and non-cash) Leverage: Debt, net of cash, divided by trailing-twelve-month adjusted EBITDA MRO: Maintenance, repair, and operating MSD: Mid-single digit PF: Pro Forma OEM: Original equipment manufacturer OPEX: Operating expenses ROW: Rest of world Seq: Sequential TTM: Trailing twelve months UBS: Utility & Broadband Solutions (business unit) WD: Workday YoY: Year-over-year Abbreviations Definitions

18 Workdays Q1 Q2 Q3 Q4 FY 2019 63 64 63 62 252 2020 64 64 64 61 253 2021 62 64 64 62 252

19 Adjusted EPS Reported Results Adjusted Results Reported Results Adjusted Results ($M, except for EPS) Income from operations 92.8$ 79.0$ 171.8$ 347.0$ 175.0$ 522.0$ Interest expense, net 74.3 - 74.3 226.6 - 226.6 Other, net (0.9) - (0.9) (2.4) - (2.4) Income before income taxes 19.4 79.0 98.4 122.8 175.0 297.8 Income tax (0.9) 22.2 2 21.3 22.8 41.8 2 64.6 Effective tax rate -4.6% 21.6% 18.6% 21.7% Net income 20.3 56.8 77.1 100.0 133.2 233.2 Less: Non-controlling interests 0.3 - 0.3 (0.5) - (0.5) Net income attributable to WESCO 20.0 56.8 76.8 100.5 133.2 233.7 Preferred stock dividends 14.4 - 14.4 30.1 - 30.1 Net income attributable to common stockholders 5.6 56.8 62.4 70.4 133.2 203.6 Diluted Shares 51.1 51.1 46.6 46.6 Adjusted Diluted EPS 0.11$ 1.22$ 1.51$ 4.37$ Q4 2020 YTD 2020 Adjustments (1) Adjustments (1) 2 The adjustments to income from operations have been tax effected at rates of 28.2% and 23.9% for the three and twelve months ended December 31, 2020, respectively. 1 Adjustments include merger-related costs and fair value adjustments, an out-of-period adjustment related to inventory absorption accounting, gain on sale of a U.S. operating branch, and the related income tax effects.

20 Adjusted EBITDA $M EES CSS UBS Corporate Total Net income attributable to common stockholders 66$ 89$ 64$ (213)$ 6$ Preferred stock dividends - - - 14 14 Provision for income taxes - - - (1) (1) Interest expense, net - - - 74 74 Depreciation and amortization 11 13 8 10 42 EBITDA 77$ 102$ 72$ (116)$ 135$ Other, net (2) (3) - 4 (1) Stock-based compensation expense - - - 3 3 Merger-related costs - - - 40 40 Merger-related fair value adjustments 4 10 2 - 16 Out-of-period adjustment 15 3 5 - 23 Adjusted EBITDA 94$ 112$ 79$ (69)$ 216$ Adjusted EBITDA margin % 5.6% 8.2% 7.3% 5.2% EBITDA, Adjusted EBITDA and Adjusted EBITDA margin % by Segment Three Months Ended December 31, 2020

21 Gross Profit and Free Cash Flow $M December 31, 2020 December 31, 2019 Net sales 4,129$ 2,099$ Cost of goods sold (1) 3,357 1,709 Gross profit 772$ 390$ Adjustments (2) 39 - Adjusted gross profit 811$ 390$ Gross margin 18.7% 18.6% Adjusted gross margin 19.6% 18.6% December 31, 2020 December 31, 2019 December 31, 2020 December 31, 2019 Cash flow provided by operations 125$ 108$ 544$ 224$ Less: capital expenditures (14) (14) (57) (44) Add: merger-related expenditures 13 - 99 - Free cash flow 124$ 94$ 586$ 180$ Adjusted net income 77 55 233 225 % of adjusted net income 161% 170% 251% 80% Twelve Months Ended, Gross Profit Three Months Ended, Free Cash Flow Three Months Ended,

22 Capital Structure and Leverage $M Pro Forma Reported December 31, 2020 December 31, 2019 Net income attributable to common stockholders 116$ 223$ Net loss attributable to noncontrolling interests (1) (1) Preferred stock dividends 30 - Provision for income taxes 56 60 Interest expense, net 256 66 Depreciation and amortization 153 62 EBITDA 610$ 410$ Other, net 5 (2) Stock-based compensation 35 19 Merger-related costs and fair value adjustments 207 3 Out-of-period adjustment 19 - Gain on sale of asset (20) - Adjusted EBITDA 855$ 430$ Maturity December 31, 2020 December 31, 2019 Receivables Securitization (variable) 950$ 415$ 2023 Inventory Revolver (variable) 250 - 2025 2021 Senior Notes (fixed) 500 500 2021 2023 Senior Notes AXE (fixed) 59 - 2023 2024 Senior Notes (fixed) 350 350 2024 2025 Senior Notes AXE (fixed) 4 - 2025 2025 Senior Notes (fixed) 1,500 - 2025 2028 Senior Notes (fixed) 1,325 - 2028 Other 47 28 Various Total debt 1 4,985$ 1,293$ Less: cash and cash equivalents 449 151 Total debt, net of cash 4,536$ 1,142$ Leverage 5.3x 2.7x Financial Leverage Twelve Months Ended, Debt As of, 1 Total debt is presented in the consolidated balance sheets net of debt discount and debt issuance costs, and includes adjustments to record the long-term debt assumed in the merger with Anixter at its acquisition date fair value.