Attached files

| file | filename |

|---|---|

| EX-99.6 - EXHIBIT 99.6 - AdaptHealth Corp. | tm2037721d4_ex99-6.htm |

| EX-99.5 - EXHIBIT 99.5 - AdaptHealth Corp. | tm2037721d4_ex99-5.htm |

| EX-99.4 - EXHIBIT 99.4 - AdaptHealth Corp. | tm2037721d4_ex99-4.htm |

| EX-99.3 - EXHIBIT 99.3 - AdaptHealth Corp. | tm2037721d4_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - AdaptHealth Corp. | tm2037721d4_ex99-1.htm |

| EX-23.1 - EXHIBIT 23.1 - AdaptHealth Corp. | tm2037721d4_ex23-1.htm |

| 8-K - FORM 8-K - AdaptHealth Corp. | tm2037721d4_8k.htm |

Exhibit 99.2

Excerpts from AdaptHealth LLC’s Confidential Preliminary Offering Memorandum dated December 14, 2020.

Non-GAAP financial measures

We refer to the terms EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) (each as defined in “Summary—Summary historical and pro forma financial data”) in various places in this offering memorandum. These are supplemental financial measures that are not prepared in accordance with GAAP. Any analysis of non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP.

The SEC has adopted rules to regulate the use in filings with the SEC and in public disclosures and press releases of “non-GAAP financial measures,” such as EBITDA, Adjusted EBITDA, Adjusted EBITDA less Patient Equipment Capex, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) and the ratios related thereto. These measures are derived on the basis of methodologies other than in accordance with GAAP. These rules govern the manner in which non-GAAP financial measures are publicly presented and require, among other things:

| · | a presentation with equal or greater prominence of the most comparable financial measure or measures calculated and presented in accordance with GAAP; and |

| · | a statement disclosing the purposes for which the registrant’s management uses the non-GAAP financial measure. |

The rules prohibit, among other things:

| · | the exclusion of charges or liabilities that require, or will require, cash settlement or would have required cash settlement, absent an ability to settle in another manner, from a non-GAAP liquidity measure; and |

| · | the adjustment of a non-GAAP performance measure to eliminate or smooth items identified as non-recurring, infrequent or unusual, when the nature of the charge or gain is such that it has occurred in the past two years or is reasonably likely to recur within the next two years. |

The non-GAAP financial measures presented in this offering memorandum may not comply with the SEC rules governing the presentation of non-GAAP financial measures. For example, some of the adjustments to EBITDA which comprise Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) as presented in this offering memorandum would not be allowed under Regulation S-X. In addition, our measurements of EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) may not be comparable to those of other companies. Please see “Summary—Summary historical and pro forma financial data” for a discussion of our use of EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) in this offering memorandum, including the reasons that we believe this information is useful to management and to investors and a reconciliation of EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) to the most closely comparable financial measure calculated in accordance with GAAP.

i

The AeroCare Acquisition

Acquisition overview

On December 1, 2020, we entered into the Merger Agreement to acquire AeroCare, one of the nation’s leading technology-enabled respiratory and HME distributors, for total consideration of approximately $2.0 billion, which includes a cash purchase price of $1.1 billion and 31 million shares (which were valued at $926 million based on the closing price on the date prior to announcement of the transaction and $1.176 billion based on the closing price as of December 10, 2020), subject to customary purchase price adjustments.

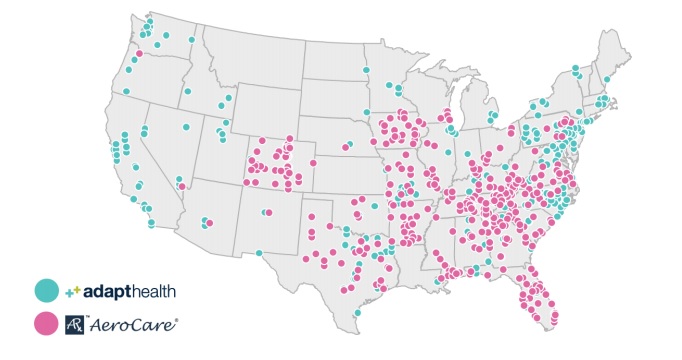

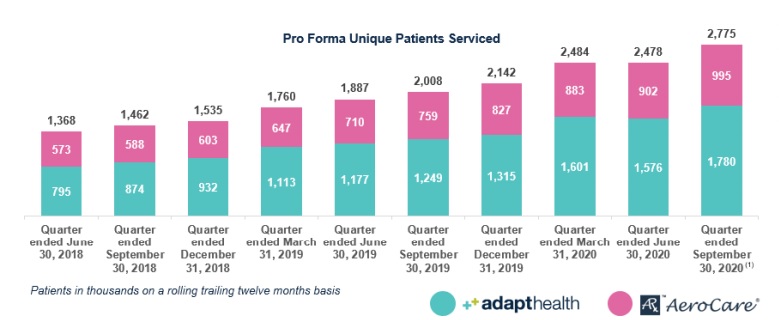

We believe that the combination of AdaptHealth and AeroCare brings together industry-leading technology platforms and strengthens our position as a leading independent HME provider creating significantly enhanced scale and geographic reach across the United States. The combined company will be a provider of home healthcare equipment, medical supplies to the home, and related services. We will operate in 47 out of the 48 U.S. continental states, offering greater managed care access, broader product availability, and enhanced customer service to our approximately 2.8 million patients.

1

Note: AdaptHealth figures may vary from previously reported figures as these calculations are periodically refreshed to account for timing of new acquisitions. Figures presented above for AeroCare assume all patients are incremental to AdaptHealth.

| (1) | AeroCare information is shown on a pro forma basis for two acquisitions that closed on October 1, 2020. |

| (1) | Pro forma for full year contribution from closed acquisitions; twelve months ended September 30, 2020 revenue includes historical contribution of PCS and Solara acquisitions, but excludes certain closed acquisitions. |

| (2) | Includes $50 million of cost synergies. |

2

AeroCare overview

AeroCare is a leading technology-enabled respiratory therapy distribution platform that serves U.S. patients with chronic conditions in their homes. AeroCare provides equipment and services for home oxygen, nebulized respiratory medications and sleep therapy for over 995,000 patients across over 300 locations in 30 states. For the twelve months ended September 30, 2020, on a pro forma, as adjusted basis, AeroCare generated net revenue of $652 million and Adjusted EBITDA of $178 million. For a reconciliation of AeroCare’s Adjusted EBITDA to net income, the most directly comparable GAAP measure, please see “—Summary historical and pro forma financial data of AeroCare.”

We believe AeroCare has consistently expanded its product mix distribution and payor channels as the market has evolved over the past several years towards broader respiratory product utilization. AeroCare’s comprehensive respiratory therapy production distribution portfolio includes oxygen concentrators, CPAPs and bi-PAPs, home ventilators, bronchodilator therapy medications and services and other home care products to patients discharged from acute care and other facilities. AeroCare’s representative customer base includes health plans, such as Aetna, Humana, UnitedHealth Group and various blue cross blue shield associations, as well as network managers like CareCentrix and StateServ Hospicelink.

AeroCare is exceptionally well-positioned in a large and growing market as a key link between patients, physicians, payors and original equipment manufacturers with a trusted brand in the home. Through its highly integrated technology platform, AeroCare is transforming operational workflows and enhancing information transparency to drive growth, margins and care quality. AeroCare is highly efficient and has a replicable M&A and integration engine, with 50 acquisitions closed since 2017 and over 150 acquisitions closed since its inception. In addition, AeroCare is committed to providing only the highest quality of care and services for their patients which is shown through their high Google ratings. In September 2020, AeroCare generated 19,000 5-star reviews.

AeroCare was founded in 2000 and is currently headquartered in Orlando, FL. As of September 30, 2020, AeroCare employed approximately 3,800 individuals.

Strategic rationale for the AeroCare Acquisition

We believe the AeroCare Acquisition will provide the following strategic benefits:

| · | Combination will be a leading independent HME provider with significantly enhanced scale and geographic reach: The combined company will be a one-stop-shop provider of HME products and services, offering a comprehensive line of oxygen and ventilation, sleep, mobility, wound care, diabetes, incontinence and urology products. This combination will further solidify AdaptHealth’s position as the second largest overall HME provider in the United States. Our geographic footprint will span across 47 states and serve approximately 2.8 million patients per annum. We believe that our enhanced scale will increase our ability to provide patients with a broader range of products delivered more efficiently than competitors, which in turn, improves the patient experience. In addition, as a leading provider with national scale, we believe that we are well positioned to drive stakeholders value by entering new markets through acquisitions and increasing market share in existing markets. |

| · | Expands our presence in attractive and fast growing HME markets: AeroCare brings a highly complementary footprint and access to the fast-growing Southeastern geographies where it maintains a substantial presence. The expansion into high growth states such as Florida, Tennessee, Texas, Georgia and South Carolina is expected to be significantly accretive to growth. Each of these states is growing organically at over 10% for the twelve months ended August 31, 2020 compared to the year ended December 31, 2019. We believe the increased geographic diversification will not only drive topline growth and market share but also make our financial profile more stable and resilient to changes in reimbursement or regulatory policies. |

3

| · | Combines two industry leading technology platforms: Historically, each company has focused on using technology to reduce costs and advance the patient and referral experiences in ordering home medical equipment and supplies. The combined company will maintain a long-term strategy of delivering connected healthcare in the home, leveraging our advanced technology-enabled platform. AeroCare has developed technology that streamlines delivery and patient communication, and we have made significant progress in the technology of e-prescribing and revenue cycle management. Through the combination of our collective technology strategies, we anticipate being able to achieve both a better customer experience as well as a more efficient operating model. We believe that the integration of AeroCare will enhance our existing platform and help accelerate our growth trajectory. |

| · | Provides multiple pathways for future growth, including additional acquisitions in a highly fragmented market: The combined company addresses the large and growing HME ($12 to $15 billion), diabetes ($16 billion) and home medical supplies ($10 billion) markets. Furthermore, positive industry tailwinds such as aging demographics and the increased prevalence of chronic conditions are expected to drive organic growth. Additionally, we believe we are well positioned to continue our M&A strategy and grow through accretive acquisitions. We operate in a highly fragmented market that is made up of thousands of smaller HME competitors and diabetes companies. This combination provides us with additional scale and financial breadth to capitalize on ample future acquisition opportunities. Both companies have extensive and successful M&A track records, having completed over 110 acquisitions between them since 2017. |

| · | Strengthens the financial profile of the combined business through achievable cost synergies: We expect that the enhanced capabilities of the combined company will be able to deliver significant cost synergies with the potential for additional revenue synergies that will be accretive to our earnings and operating cash flows. We expect to generate pre-tax run rate cost synergies of approximately $50 million per annum, including approximately $25 million in 2021, which is comprised primarily of revenue cycle management and branch support, direct and indirect spend, branch consolidation, technology, and general and administrative savings. We expect to incur approximately $20 million in costs to achieve these synergies, which are expected to be fully realized by 2022. Furthermore, we believe revenue synergies are potentially achievable and include PAP 90-day compliance, PAP resupply compliance, payment collections efficiency, and cross-selling respiratory medications and diabetes products. Overall, we expect the synergies realized during this combination to lead to enhanced EBITDA margins and financial strength. |

| · | Produces a strong senior leadership team with strong cultural alignment: The combination brings together two experienced leadership teams with deep domain expertise in the HME industry and across healthcare who are both committed to the vision of providing quality home health equipment to patients nationwide. By leveraging our respective teams’ strengths and sharing of best practices, we believe that the combined company will be strongly positioned to serve the evolving HME market. |

Reimbursement landscape

CMS’s decision to cancel the 2021 competitive bidding program is a significant development for AdaptHealth. CMS is proposing to reimburse all HME other than off-the-shelf back and knee braces at current rates, to schedule the next round of competitive bidding in 2024, and to make the higher blended rates in rural territory permanent. In total, we believe these changes to the competitive bidding program are significantly positive to the business, and we expect the rate changes for the off-the-shelf back and knee braces to be immaterial to AdaptHealth. For the twelve months ended September 30, 2020, on a pro forma, as adjusted basis, approximately one-third of our revenue is subject to Medicare competitive bidding.

4

Recent developments

Commitment Letter

We intend to fund the cash portion of the consideration for the AeroCare Acquisition and associated costs through cash on hand and incremental debt, including the notes offered hereby and the transactions described below.

In connection with the entry into the Merger Agreement, we entered into a debt commitment letter (the “Commitment Letter”), dated as of December 1, 2020, with Jefferies Finance LLC (“Jefferies Finance”), pursuant to which Jefferies Finance (together with any additional commitment parties party thereto) committed to provide to us (i) a senior secured term loan B facility in an aggregate principal amount of up to $900.0 million (the “Term B Facility”) and (ii) a senior unsecured bridge facility in an aggregate principal amount of up to $450.0 million (the “Bridge Facility”). The proceeds of the notes offered hereby will reduce commitments in respect of the Bridge Facility on a dollar-for-dollar basis, and upon the consummation of this offering, we do not expect to enter into the Bridge Facility. On or prior to the consummation of the AeroCare Acquisition, the commitments in respect of the Term B Facility may be automatically reduced on a dollar-for-dollar basis by certain debt incurrences (excluding the notes) and equity issuances by the Issuer, our parent entities or any of our or their respective subsidiaries.

The Term B Facility and the Bridge Facility are available to (i) to finance the AeroCare Acquisition in part, (ii) to refinance certain of our and AeroCare’s indebtedness and (iii) to pay fees and expenses incurred in connection therewith. The funding of the Term B Facility and the Bridge Facility provided for in the Commitment Letter is contingent on the satisfaction of customary conditions, including, among other things, (i) the execution and delivery of definitive documentation in accordance with the terms sets forth in the Commitment Letter and (ii) the consummation of the AeroCare Acquisition in accordance with the terms of the Merger Agreement. The definitive documentation governing such debt financing has not been finalized, and, accordingly, the actual terms may differ from the description of such terms in the Commitment Letter. See “Description of other indebtedness—Term B Facility.”

We are currently considering various alternatives for our permanent capital structure with respect to the $600.0 million aggregate principal amount in new senior secured term loan borrowings that we expect to incur in connection with the AeroCare Acquisition, which may include an incremental term loan A facility or a combination of a term loan B facility and an incremental term loan A facility. See “Use of proceeds” and “Capitalization.”

Credit Agreement Amendment

On December 14, 2020, we entered into an amendment to the Credit Agreement (the “Credit Agreement Amendment”) to, among other things, permit the AeroCare Acquisition and the incurrence of indebtedness in connection therewith (including the issuance of the notes offered hereby).

Pinnacle acquisition

On October 1, 2020, the Company acquired 100% of the equity interests of Pinnacle Medical Solutions, Inc. (“Pinnacle”). Pinnacle is primarily engaged in the business of distributing insulin pumps, insulin pump supplies, continuous glucose monitoring systems and diabetes test strips in the United States. The total consideration consisted of (i) a cash payment of $81.5 million at closing, (ii) the issuance of 1.0 million shares of Class A Common Stock at closing, (iii) the potential issuance of up to 0.2 million shares of Class A Common Stock in the future which were held back and subject to potential indemnification matters, and (iv) a potential contingent earnout payment of up to $15.0 million based on certain conditions after closing. The cash paid at closing included $2.6 million withheld in escrow to fund certain potential indemnification matters.

5

Put/Call Agreement

On May 25, 2020, we and AdaptHealth Holdings entered into the Put/Call Agreement with certain of the BlueMountain Entities (collectively, the “Option Parties”). On December 9, 2020, we delivered notice exercising our right under the Put/Call Agreement to require the Option Parties to sell 1,898,967 shares of Class A Common Stock to us at a price per share of $15.76, resulting in a $29.9 million payment to the Option Parties (the “Call Exercise”). We expect to settle the Call Exercise on December 14, 2020. See “Certain relationships and related party transactions—Post-Business Combination transactions—BlueMountain Put/Call Agreement.”

Up-C Unwinding

In anticipation of the closing of the AeroCare Acquisition, AdaptHealth will complete an internal restructuring such that, for the fiscal year ending December 31, 2021, it will no longer be an “Up-C”. In connection with this restructuring, a subsidiary of AdaptHealth will merge with and into AdaptHealth Holdings and the members of AdaptHealth Holdings (other than AdaptHealth) will receive one share of Class A Common Stock in exchange for each Consideration Unit. Following the Up-C Unwinding, AdaptHealth Holdings will be a wholly owned subsidiary of AdaptHealth. The Up-C Unwinding is intended to reduce the Company’s tax compliance costs and enhance its ability to structure future acquisitions and will result in the Class A Common Stock being the Company’s only class of Common Stock outstanding.

In addition, on December 7, 2020 prior to the Up-C Unwinding, certain members of the Company’s management elected to exchange an aggregate of 4,652,351 Consideration Units directly or indirectly held thereby for Class A Common Stock subject to the terms of the Exchange Agreement. We elected to deliver an amount in cash as set forth in the Exchange Agreement in lieu of delivering shares of Class A Common Stock for 1,507,808 of such Consideration Units surrendered for exchange pursuant to the Exchange Agreement. The amount in cash delivered in lieu of shares of Class A Common Stock was in an amount sufficient to permit such members of the Company’s management to satisfy their tax obligations in connection with such exchange.

Impact of the COVID-19 pandemic

Our and AeroCare’s priorities during the COVID-19 pandemic remain protecting the health and safety of our respective employees (including patient-facing employees providing respiratory and other services), maximizing the availability of our respective services and products to support patient health needs, and maintaining the operational and financial stability of our respective businesses.

In response to the COVID-19 pandemic and the National Emergency Declaration, dated March 13, 2020, we and AeroCare activated certain business interruption protocols, including acquisition and distribution of personal protective equipment to our respective patient-facing employees, accelerated capital expenditures of certain products and relocation of significant portions of our respective workforces to “work-from-home” status. We also increased our cash liquidity by, among other things, seeking recoupable advance payments of approximately $46 million made available by CMS under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) legislation, which were received in April 2020. AeroCare secured a $20 million incremental loan facility in April 2020. In addition, in April 2020, we received distributions of the CARES Act provider relief funds of approximately $17 million, and AeroCare received $13.8 million, targeted to offset lost revenue and expenditures incurred in connection with the COVID-19 pandemic. The provider relief funds are subject to certain restrictions and are subject to recoupment if not used for designated purposes.

As a result of these actions, and the lack of disruption to date of our respective vendors’ ability to supply product despite the COVID-19 pandemic, we and AeroCare have been able to substantially maintain our respective operations. The U.S. Department of Health and Human Services (“HHS”) has indicated that the CARES Act provider relief funds are subject to ongoing reporting and changes to the terms and conditions. We are currently in the process of determining how much of the CARES Act provider relief funds we and AeroCare will be entitled to based on the terms and conditions of the program, including recent guidance issued by HHS in October 2020. To the extent that reporting requirements and terms and conditions are modified, it may affect our and AeroCare’s ability to comply and may require the return of funds. Furthermore, HHS has indicated that it will be closely monitoring and, along with the Office of Inspector General of the Department of Health and Human Services (the “OIG-HHS”), auditing providers to ensure that recipients comply with the terms and conditions of relief programs and to prevent fraud and abuse. For any deliberate omissions, misrepresentations or falsifications of any information given to HHS, providers may be subject to civil, criminal, and administrative penalties, including the revocation of Medicare billing privileges, exclusion from federal health care programs, and the imposition of fines, civil damages, and imprisonment.

6

While the impact of the COVID-19 pandemic, the National Emergency Declaration and the various state and local government imposed stay-at-home restrictions did not have a material impact on our consolidated operating results for the three months ended March 31, 2020, we and AeroCare began to experience declines in net revenues commencing in April 2020 with respect to certain services associated with elective medical procedures (such as commencement of new CPAP services and medical equipment and, in our case, orthopedic supply related to facility discharges), and commencement of bi-PAP services on behalf of new patients. In response to these declines, as well as specific over-staffing conditions associated with recently completed acquisitions, we conducted a workforce assessment and implemented a reduction in force in April 2020, resulting in the elimination of approximately 6% of our workforce. In connection with the workforce reductions, we incurred a one-time charge for severance and related expenses of approximately $1.6 million.

Offsetting the declines in net revenues associated with the decline in elective medical procedures, we and AeroCare continue to experience an increase in net revenue associated with increased demand for certain respiratory products (such as oxygen) and increased sales in our resupply businesses (primarily as a result of the increased ability to contact patients at home as a result of continuing remote education and work-from-home directives). From April 2020 through September 2020, we also experienced an increase in revenue associated with the one-time sale of certain respiratory equipment (primarily ventilators, bi-level PAP devices and oxygen concentrators) to hospitals and local health agencies. Additionally, suspension of Medicare sequestration through December 31, 2020 (resulting in a 2% increase in Medicare payments to all providers), and recent regulatory guidance from CMS expanding telemedicine and reducing documentation requirements during the emergency period, are expected to result in increased net revenues for certain products and services. Despite the ongoing effects of the COVID-19 pandemic throughout the summer and fall of 2020, our volume of new CPAP and bi-PAP services has substantially rebounded from April 2020 levels; however, there can be no assurance that these services will not decline in connection with a resurgence of the COVID-19 pandemic or otherwise.

The full extent of the impact of the continuing COVID-19 pandemic on our and AeroCare’s respective businesses, operations and financial results will depend on numerous evolving factors that we may not be able to accurately predict. For additional information on risk factors that could impact our and AeroCare’s results, please refer to “Risk factors” in this offering memorandum.

Summary historical and pro forma financial data

Summary historical and pro forma financial data of AdaptHealth

The following table presents AdaptHealth’s summary historical and pro forma financial data and operating statistics. The consolidated statements of operations and cash flows for the years ended December 31, 2019 and 2018 and the consolidated balance sheets as of December 31, 2019 and 2018 have been derived from our audited consolidated financial statements incorporated by reference in this offering memorandum. The consolidated statements of operations and cash flows for the year ended December 31, 2017 and the consolidated balance sheet as of December 31, 2017 have been derived from our audited consolidated financial statements not included or incorporated by reference in this offering memorandum.

The summary consolidated statements of operations and cash flows for the nine months ended September 30, 2020 and 2019 and the consolidated balance sheets as of September 30, 2020 and 2019 have been derived from our unaudited condensed consolidated financial statements incorporated by reference in this offering memorandum. Our unaudited condensed consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of management, include all adjustments (consisting only of normal recurring accruals) necessary for a fair statement of the financial position and results of operations as of the dates and for the periods indicated. The summary unaudited pro forma consolidated statement of operations for the twelve months ended September 30, 2020 gives pro forma effect to the PCS Acquisition, the Solara Acquisition, the Public Equity Offering, the July Notes Offering, the Deerfield Exchange and the Transactions as if they had occurred on January 1, 2019. The unaudited pro forma consolidated balance sheet as of September 30, 2020 gives pro forma effect to the Transactions as if they were completed on September 30, 2020. The summary unaudited pro forma financial data for the twelve months ended September 30, 2020 have been derived by adding our pro forma consolidated statement of operations data for the year ended December 31, 2019 to our pro forma consolidated statements of operations data for the nine months ended September 30, 2020 and deducting our pro forma consolidated statements of operations data for the nine months ended September 30, 2019.

7

The Issuer is an indirect subsidiary of AdaptHealth and the sole differences between the consolidated financial results of AdaptHealth and its subsidiaries (including the Issuer, AdaptHealth Intermediate and AdaptHealth Holdings), on the one hand, and the consolidated financial results of the Issuer and its subsidiaries on a standalone basis, on the other hand, relate to (A) the minority interest held in AdaptHealth Holdings by the holders of the AdaptHealth Units, (B) the Preferred Notes and the Put/Call Agreement, which are obligations of AdaptHealth Holdings (and not obligations of the Issuer) and (C) the deferred income taxes related to the investment in AdaptHealth Holdings and the liability related to the Tax Receivable Agreement. Pursuant to the requirements of the Credit Facilities, AdaptHealth, AdaptHealth Holdings and AdaptHealth Intermediate may not own any assets other than the equity interests of their subsidiaries. Accordingly, all cash of AdaptHealth, AdaptHealth Holdings and AdaptHealth Intermediate is contributed to, or held for the benefit of, the Issuer, and the consolidated assets, equity accounts and liabilities of the Issuer do not materially differ from the consolidated assets, equity accounts and liabilities of AdaptHealth, AdaptHealth Holdings and AdaptHealth Intermediate.

| Historical | Pro forma | |||||||||||||||||||||||

Year ended December 31, | Nine months ended September 30 | Twelve months ended September 30, | ||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2019 | 2020 | 2020 | |||||||||||||||||||

| (audited) | (unaudited) | |||||||||||||||||||||||

| Consolidated statements of operations data: | ||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Net revenue | $ | 192,559 | $ | 345,278 | $ | 529,644 | $ | 380,103 | $ | 707,960 | $ | 1,679,427 | ||||||||||||

| Costs and expenses | ||||||||||||||||||||||||

| Cost of net revenue (1) | 165,707 | 293,384 | 440,387 | 317,174 | 604,777 | 1,428,081 | ||||||||||||||||||

| General and administrative expenses | 9,482 | 18,069 | 56,493 | 31,508 | 57,745 | 107,287 | ||||||||||||||||||

| Depreciation and amortization, excluding patient equipment depreciation | 1,282 | 2,734 | 3,068 | 2,439 | 6,398 | 31,609 | ||||||||||||||||||

| Total costs and expenses | 176,471 | 314,187 | 499,948 | 351,121 | 668,920 | 1,566,977 | ||||||||||||||||||

| Operating income (loss) | 16,088 | 31,091 | 29,696 | 28,982 | 39,040 | 112,450 | ||||||||||||||||||

| Interest expense, net | 5,041 | 7,453 | 39,304 | 31,651 | 27,826 | 101,692 | ||||||||||||||||||

| Loss on extinguishment of debt, net | 324 | 1,399 | 2,121 | 2,121 | 5,316 | 5,316 | ||||||||||||||||||

| Income (loss) before income taxes from continuing operations | 10,723 | 22,239 | (11,729 | ) | (4,790 | ) | 5,898 | 5,442 | ||||||||||||||||

| Income tax expense (benefit) | 249 | (2,098 | ) | 1,156 | 5,444 | 2,290 | 5,372 | |||||||||||||||||

| Income (loss) from continuing operations | 10,474 | 24,337 | (12,885 | ) | (10,234 | ) | 3,608 | 70 | ||||||||||||||||

| Loss from discontinued operations, net of tax | 207 | — | — | — | — | — | ||||||||||||||||||

| Net income (loss) | 10,267 | 24,337 | (12,885 | ) | (10,234 | ) | 3,608 | 70 | ||||||||||||||||

| Income attributable to noncontrolling interests | 580 | 1,077 | 2,111 | 1,336 | 2,222 | 5,137 | ||||||||||||||||||

| Net income (loss) attributable to AdaptHealth Corp. | $ | 9,687 | $ | 23,260 | $ | (14,996 | ) | $ | (11,570 | ) | $ | 1,386 | $ | (5,067 | ) | |||||||||

| Consolidated statements of cash flows data: | ||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Net cash provided by operating activities | $ | 45,930 | $ | 68,427 | $ | 60,418 | $ | 43,174 | $ | 145,287 | ||||||||||||||

| Net cash used in investing activities | (15,077 | ) | (96,284 | ) | (84,870 | ) | (62,399 | ) | (627,097 | ) | ||||||||||||||

| Net cash provided by (used in) financing activities | (30,263 | ) | 48,768 | 76,144 | 2,862 | 677,250 | ||||||||||||||||||

| Balance sheet data (as of period end): | ||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Cash and cash equivalents | $ | 4,274 | $ | 25,186 | $ | 76,878 | $ | 8,823 | $ | 272,318 | $ | 258,785 | ||||||||||||

| Total assets | 111,984 | 368,957 | 546,121 | 427,987 | 1,548,826 | 3,892,253 | ||||||||||||||||||

| Total liabilities | 112,621 | 266,188 | 575,370 | 564,685 | 1,109,111 | 2,286,398 | ||||||||||||||||||

| Total long-term debt, including current portion | 54,781 | 134,185 | 396,833 | 419,432 | 731,209 | 1,795,459 | ||||||||||||||||||

| Total secured debt, including long-term debt and capital lease obligations | 65,728 | 155,996 | 278,292 | 347,210 | 270,868 | 870,868 | ||||||||||||||||||

| Total stockholders’ equity (deficit) / members’ equity (deficit) | (637 | ) | 102,769 | (29,249 | ) | (136,698 | ) | 439,715 | 1,605,855 | |||||||||||||||

| Other financial data: | ||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| EBITDA(2) | $ | 43,580 | $ | 77,569 | $ | 90,142 | $ | 71,938 | $ | 91,585 | $ | 287,513 | ||||||||||||

| Adjusted EBITDA(2) | 45,035 | 84,447 | 123,021 | 89,352 | 126,254 | 344,148 | ||||||||||||||||||

| Adjusted EBITDA less Patient Equipment Capex(2) | 19,186 | 45,083 | 75,601 | 53,763 | 83,971 | 194,837 | ||||||||||||||||||

| Adjusted EBITDA (pro forma, as adjusted)(2) | 488,382 | |||||||||||||||||||||||

Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted)(2) | 339,071 | |||||||||||||||||||||||

8

Pro forma, as September 30, | ||||

| Pro forma, as adjusted financial data(3): | ||||

| (in thousands, except ratios) | ||||

| Total debt(4) | $ | 1,865,034 | ||

| Net debt(5) | 1,735,343 | |||

| Interest expense (excluding change in fair value of interest rate swaps)(6) | 102,625 | |||

| Ratio of Adjusted EBITDA (pro forma, as adjusted) to interest expense (excluding change in fair value of interest rate swaps)(7) | 4.8 | x | ||

| Ratio of total debt to Adjusted EBITDA (pro forma, as adjusted)(8) | 3.8 | x | ||

| Ratio of total net debt to Adjusted EBITDA (pro forma, as adjusted)(9) | 3.6 | x | ||

(1) Includes patient equipment depreciation of $26,534 in 2017, $45,143 in 2018, $59,499 in 2019, $42,638 in the nine months ended September 30, 2019, $51,463 in the nine months ended September 30, 2020 and $148,770 in the pro forma for the twelve months ended September 30, 2020.

(2) The following table reconciles net income (loss) attributable to AdaptHealth Corp., the most directly comparable GAAP measure, to EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted).

Management believes the presentation of these measures is relevant and useful because it allows investors to view our performance in a manner similar to the method management uses, adjusted for items management believes makes it easier to compare its results with other companies that have different financing and capital structures. EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted), as management defines them, may not be comparable to EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted), Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) or similarly titled measurements used by other companies. Items added into our calculation of EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) that will not occur on a continuing basis may have associated cash payments. EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) should be viewed in conjunction with measurements that are computed in accordance with GAAP. A reconciliation of EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) to net income (loss) attributable to AdaptHealth Corp., the most closely comparable financial measure calculated in accordance with GAAP, is set forth in the table below.

As noted in the introductory paragraphs, the summary historical and pro forma financial data set forth in this “—Summary historical and pro forma financial data of AdaptHealth” section, including EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) and related ratios, are for AdaptHealth, and not for the Issuer and its subsidiaries. See “Basis of presentation.”

In addition, certain limitations under the covenants in the indenture that will govern the notes, as well as in the Credit Facilities, are based on ratios that are calculated by reference to measures similar to EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) and such ratios may be similar to the ratios presented in the table above. However, such measures are not identical to EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) as we define it in this offering memorandum, and such ratios are not identical to the ratios presented in the table above. If we do not meet the applicable ratio requirement at the applicable time, such covenants would prohibit us from incurring debt, making restricted payments or investments or taking certain other actions, other than, in some cases, pursuant to specified exceptions. See “Description of other indebtedness” and “Description of notes.”

EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) and the related ratios presented in the table above are not calculated or presented in accordance with GAAP. As a result, these financial measures have limitations as analytical and comparative tools, and you should not consider these items in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| · | they do not reflect all of our cash expenditures or future requirements for capital expenditures or contractual commitments; |

| · | they do not reflect changes in, or cash requirements for, working capital needs; |

| · | they do not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on indebtedness; |

| · | they do not reflect income tax expense or the cash requirements to pay taxes; and |

| · | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often be replaced in the future, and EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) do not reflect any cash requirements for such replacements. |

9

| Historical | Pro Forma | |||||||||||||||||||||||

Year ended December 31, | Nine months ended September 30, | Twelve months ended September 30, | ||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2019 | 2020 | 2020 | |||||||||||||||||||

| (audited) | (unaudited) | |||||||||||||||||||||||

| Non-GAAP reconciliation: | ||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Net income (loss) attributable to AdaptHealth Corp. | $ | 9,687 | $ | 23,260 | $ | (14,996 | ) | $ | (11,570 | ) | $ | 1,386 | $ | (5,067 | ) | |||||||||

| Income attributable to noncontrolling interest | 580 | 1,077 | 2,111 | 1,336 | 2,222 | 5,137 | ||||||||||||||||||

| Interest expense (income) – Excluding change in fair value of interest rate swaps | 5,041 | 8,000 | 27,878 | 19,292 | 27,826 | 102,625 | ||||||||||||||||||

| Interest expense (income) – Change in fair value of interest rate swaps | — | (547 | ) | 11,426 | 12,359 | — | (933 | ) | ||||||||||||||||

| Income tax expense (benefit) | 249 | (2,098 | ) | 1,156 | 5,444 | 2,290 | 5,372 | |||||||||||||||||

| Depreciation and amortization | 27,816 | 47,877 | 62,567 | 45,077 | 57,861 | 180,379 | ||||||||||||||||||

| Loss from discontinued operations, net of tax | 207 | — | — | — | — | — | ||||||||||||||||||

| EBITDA | $ | 43,580 | $ | 77,569 | $ | 90,142 | $ | 71,938 | $ | 91,585 | $ | 287,513 | ||||||||||||

| Loss on extinguishment of debt, net(a) | 324 | 1,399 | 2,121 | 2,121 | 5,316 | 5,316 | ||||||||||||||||||

| Equity-based compensation expense(b) | 49 | 884 | 11,070 | 5,806 | 10,969 | 18,270 | ||||||||||||||||||

| Transaction costs(c) | — | 2,514 | 15,984 | 8,232 | 16,612 | 24,364 | ||||||||||||||||||

| Severance(d) | 826 | 1,920 | 2,301 | 721 | 3,245 | 4,825 | ||||||||||||||||||

| Other non-recurring (income) expense(e) | 256 | 161 | 1,403 | 534 | (1,473 | ) | 3,860 | |||||||||||||||||

| Adjusted EBITDA | $ | 45,035 | $ | 84,447 | $ | 123,021 | $ | 89,352 | $ | 126,254 | $ | 344,148 | ||||||||||||

| AeroCare pro forma cost savings(f) | 50,000 | |||||||||||||||||||||||

Pro forma Adjusted EBITDA and cost savings related to acquisitions(g) | 94,234 | |||||||||||||||||||||||

| Adjusted EBITDA (pro forma, as adjusted) | $ | 488,382 | ||||||||||||||||||||||

| Less: Patient equipment capex(h) | (25,849 | ) | (39,364 | ) | (47,420 | ) | (35,589 | ) | (42,283 | ) | (149,311 | ) | ||||||||||||

| Adjusted EBITDA less Patient Equipment Capex | 19,186 | 45,083 | 75,601 | 53,763 | 83,971 | |||||||||||||||||||

Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) | $ | 339,071 | ||||||||||||||||||||||

(a) Represents write offs of deferred financing costs in 2020, 2019 and 2018 and prepayment penalty expense related to refinancing of debt offset by gain on debt extinguishment in 2018.

(b) Represents equity-based compensation expense to employees and non-employee directors. The higher expense for the nine months ended September 30, 2020 versus the comparable prior year period is due to year-to-date expense for awards granted in late 2019, and overall increased equity-compensation grant activity in 2020. The expense for the year ended December 31, 2019 includes expense resulting from accelerated vesting and modification of certain awards in that period.

(c) Represents transaction costs related to acquisitions, the 2019 Recapitalization, and the Business Combination.

(d) Represents severance costs related to acquisition integration and internal AdaptHealth restructuring and workforce reduction activities.

(e) The nine months ended September 30, 2020 includes $2.9 million of reductions in the fair value of contingent consideration liabilities related to acquisitions, a $0.6 million gain in connection with the sale of a cost method investment, offset by a $1.5 million expense associated with the PCS Transition Services Agreement and $0.5 million of other non-recurring expenses. The year ended December 31, 2019 includes a net $0.9 million increase in the fair value of contingent consideration liabilities and $0.5 million of other non-recurring expenses.

10

(f) Represents the estimated impact of annualized pre-tax cost savings associated with initiatives to be implemented by management following the completion of the AeroCare Acquisition, primarily from centralization, scale and efficiency improvements in revenue cycle management, branch locations, general and administrative, and vendor cost savings. We expect to incur approximately $20 million in costs to achieve these cost savings, which are expected to be fully realized by 2022.

(g) Represents $81.7 million in Adjusted EBITDA from 18 acquisitions by AdaptHealth and $12.5 million in Adjusted EBITDA from 12 acquisitions by AeroCare, in each case completed after September 30, 2019 and including twelve months of Adjusted EBITDA as well as expected cost synergies related to such acquisitions. Such figures are unaudited and have not been reviewed by AdaptHealth’s or AeroCare’s independent auditors. Neither AdaptHealth nor AeroCare has historically experienced significant seasonality in its respective business. See also “―Summary historical and pro forma financial data of AeroCare.”

(h) Represents the value of the patient equipment received during the respective period without regard to whether the equipment is purchased or financed through lease transactions.

(3) Represents financial measures for the twelve months ended September 30, 2020, on a pro forma, as adjusted basis.

(4) Total debt includes the Preferred Notes of AdaptHealth Holdings, as the sole source of payment of cash interest is AdaptHealth LLC, the Issuer.

(5) Net debt as of September 30, 2020 represents total debt on a pro forma, as adjusted basis, less cash and cash equivalents on a pro forma, as adjusted basis of $130 million. The pro forma, as adjusted cash and cash equivalents amount reflects the cash purchase price for certain acquisitions completed subsequent to September 30, 2020, but does not reflect the payment by the Company in December 2020 of (i) $29.9 million to the Option Parties pursuant to the Call Exercise on December 14, 2020 (for more information on the Call Exercise, see “Summary—Recent developments—Put/Call Agreement”) or (ii) $44.3 million to exercise its right to deliver cash in lieu of shares of Class A Common Stock in exchange for certain Consideration Units held by members of management in order for them to satisfy their tax obligations arising from the conversion of such individual’s Consideration Units. See “—Recent developments—Up-C Unwinding.”

(6) Represents interest expense excluding the change in fair value of interest rate swaps for the twelve months ended September 30, 2020, calculated on a pro forma basis. Each one eighth percent increase or decrease in the interest rates governing our indebtedness would result in an approximately $1.7 million change in annual interest expense on our indebtedness.

(7) The ratio of Adjusted EBITDA (pro forma, as adjusted) to interest expense is determined by dividing Adjusted EBITDA (pro forma, as adjusted) by interest expense on a pro forma, as adjusted basis.

(8) The ratio of total debt to Adjusted EBITDA (pro forma, as adjusted) is determined by dividing total debt on a pro forma, as adjusted basis by Adjusted EBITDA (pro forma, as adjusted).

(9) The ratio of total net debt to Adjusted EBITDA (pro forma, as adjusted) is determined by dividing total net debt on a pro forma, as adjusted basis by Adjusted EBITDA (pro forma, as adjusted).

Summary historical and pro forma financial data of AeroCare

The following table presents AeroCare’s summary historical and pro forma financial data. The consolidated statements of operations and cash flows for the years ended December 31, 2019 and 2018 and the consolidated balance sheets as of December 31, 2019 and 2018 have been derived from AeroCare’s audited consolidated financial statements incorporated by reference in this offering memorandum.

11

The summary consolidated statements of operations and cash flows for the nine months ended September 30, 2020 and 2019 and the consolidated balance sheet as of September 30, 2020 have been derived from AeroCare’s unaudited consolidated financial statements incorporated by reference in this offering memorandum. AeroCare’s unaudited consolidated financial statements have been prepared on the same basis as its audited consolidated financial statements and, in the opinion of AeroCare’s management, include all adjustments (consisting only of normal recurring accruals) necessary for a fair statement of the financial position and results of operations as of the dates and for the periods indicated.

Year ended December 31, | Nine months ended September 30 | Twelve months ended September 30, | ||||||||||||||||||

| 2018 | 2019 | 2019 | 2020 | 2020 | ||||||||||||||||

| (audited) | (unaudited) | |||||||||||||||||||

| Consolidated statements of operations data: | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net revenue | $ | 393,418 | $ | 533,649 | $ | 379,245 | $ | 497,664 | $ | 652,068 | ||||||||||

| Costs and expenses | ||||||||||||||||||||

| Cost of net revenue | 158,187 | 218,369 | 152,675 | 201,907 | 267,601 | |||||||||||||||

| Selling, general and administrative expenses | 204,270 | 261,213 | 187,932 | 228,807 | 302,088 | |||||||||||||||

| Depreciation and amortization | 5,406 | 6,868 | 4,846 | 6,055 | 8,077 | |||||||||||||||

| Total costs and expenses | 367,863 | 486,450 | 345,453 | 436,769 | 577,766 | |||||||||||||||

| Operating income (loss) | 25,555 | 47,199 | 33,792 | 60,895 | 74,302 | |||||||||||||||

| Other income (expense): | ||||||||||||||||||||

| Other income | 2,207 | 3,103 | 2,208 | 2,705 | 3,600 | |||||||||||||||

| Interest expense | (7,610 | ) | (14,370 | ) | (9,766 | ) | (11,486 | ) | (16,090 | ) | ||||||||||

| Loss on early extinguishment of debt | (1,227 | ) | (1,509 | ) | (1,509 | ) | — | —- | ||||||||||||

| Total other expense | (6,630 | ) | (12,776 | ) | (9,067 | ) | (8,781 | ) | (12,490 | ) | ||||||||||

| Income before provision for income taxes | 18,925 | 34,423 | 24,725 | 52,114 | 61,812 | |||||||||||||||

| Provision for income taxes | 3,036 | 4,001 | 2,694 | 8,179 | 9,486 | |||||||||||||||

| Net income | $ | 15,889 | $ | 30,422 | $ | 22,031 | $ | 43,935 | $ | 52,326 | ||||||||||

| Consolidated statements of cash flows data: | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net cash provided by operating activities | $ | 91,202 | $ | 110,982 | $ | 78,125 | $ | 125,012 | ||||||||||||

| Net cash used in investing activities | (109,751 | ) | (134,138 | ) | (83,734 | ) | (128,073 | ) | ||||||||||||

| Net cash provided by (used in) financing activities | 32,212 | 13,897 | (4,227 | ) | 18,828 | |||||||||||||||

| Balance sheet data (as of period end): | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cash and cash equivalents | $ | 25,709 | $ | 16,450 | $ | 32,217 | $ | 32,217 | ||||||||||||

| Total assets | 324,715 | 410,641 | 496,937 | 496,937 | ||||||||||||||||

| Total liabilities | 319,310 | 480,096 | 522,982 | 522,982 | ||||||||||||||||

| Total long-term debt, including current portion | 233,238 | 367,170 | 389,202 | 389,202 | ||||||||||||||||

| Total redeemable convertible preferred stock | 37,179 | 97,086 | 103,092 | 103,092 | ||||||||||||||||

| Total stockholders’ equity (deficit) | (31,774 | ) | (166,541 | ) | (129,137 | ) | (129,137 | ) | ||||||||||||

| Other financial data: | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| EBITDA(1) | $ | 83,750 | $ | 121,745 | $ | 86,810 | $ | 128,255 | $ | 163,190 | ||||||||||

| Adjusted EBITDA(1) | 87,042 | 124,655 | 89,407 | 129,979 | 165,227 | |||||||||||||||

| Adjusted EBITDA less Patient Equipment Capex(1) | 21,190 | 41,039 | 27,987 | 59,867 | 72,919 | |||||||||||||||

| Adjusted EBITDA (pro forma, as adjusted)(1) | 177,771 | |||||||||||||||||||

| Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted)(1) | 85,463 | |||||||||||||||||||

(1) The following table reconciles net income, the most directly comparable GAAP measure, to EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted).

EBITDA, Adjusted EBITDA, Adjusted EBITDA (pro forma, as adjusted) and Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) are not calculated or presented in accordance with GAAP. As a result, these financial measures have limitations as analytical and comparative tools, and you should not consider these items in isolation, or as a substitute for analysis of our results as reported under GAAP.

12

| Year ended December 31, | Nine months ended September 30, | Twelve months ended September 30, | |||||||||||||||||||

| 2018 | 2019 | 2019 | 2020 | 2020 | |||||||||||||||||

| (audited) | (unaudited) | ||||||||||||||||||||

| Non-GAAP reconciliation: | |||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||

| Net income | $ | 15,889 | $ | 30,422 | $ | 22,031 | $ | 43,935 | $ | 52,326 | |||||||||||

| Interest expense | 7,610 | 14,370 | 9,766 | 11,486 | 16,090 | ||||||||||||||||

| Income tax expense (benefit) | 3,036 | 4,001 | 2,694 | 8,179 | 9,486 | ||||||||||||||||

| Depreciation and amortization expense | 57,215 | 72,952 | 52,319 | 64,655 | 85,288 | ||||||||||||||||

| EBITDA | $ | 83,750 | $ | 121,745 | $ | 86,810 | $ | 128,255 | $ | 163,190 | |||||||||||

| Loss on extinguishment of debt, net | 1,227 | 1,509 | 1,509 | — | — | ||||||||||||||||

| Equity-based compensation expense | 2,065 | 1,401 | 1,088 | 1,724 | 2,037 | ||||||||||||||||

| Adjusted EBITDA | $ | 87,042 | $ | 124,655 | $ | 89,407 | $ | 129,979 | $ | 165,227 | |||||||||||

| Pro forma Adjusted EBITDA and cost savings related to acquisitions(a) | 12,544 | ||||||||||||||||||||

| Adjusted EBITDA (pro forma, as adjusted) | $ | 177,771 | |||||||||||||||||||

| Less: Patient equipment capex | (65,852 | ) | (83,616 | ) | (61,420 | ) | (70,112 | ) | (92,308 | ) | |||||||||||

| Adjusted EBITDA less Patient Equipment Capex | $ | 21,190 | $ | 41,039 | $ | 27,987 | $ | 59,867 | |||||||||||||

| Adjusted EBITDA less Patient Equipment Capex (pro forma, as adjusted) | $ | 85,463 | |||||||||||||||||||

(a) Represents Adjusted EBITDA from 12 acquisitions by AeroCare completed after September 30, 2019 and including twelve months of Adjusted EBITDA as well as expected cost synergies related to such acquisitions. Such figures are unaudited and have not been reviewed by AeroCare’s independent auditors. AeroCare has not historically experienced significant seasonality in its respective business.

13

AdaptHealth is subject, directly or indirectly, to U.S. federal and state healthcare fraud and abuse and false claims laws and regulations. Prosecutions under such laws have increased in recent years and AdaptHealth may become subject to such litigation. If AdaptHealth is unable to or has not fully complied with such laws, it could face substantial penalties.

AdaptHealth’s operations are subject to various state and federal fraud and abuse laws, including, without limitation, the federal Anti-Kickback Statute, the federal Stark Law and the federal False Claims Act. These laws may impact, among other things, AdaptHealth’s sales, marketing and education programs.

The federal Anti-Kickback Statute prohibits persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing or arranging for a good or service, for which payment may be made under a federal healthcare program such as the Medicare and Medicaid programs. Several courts have interpreted the statute’s intent requirement to mean that if any one purpose of an arrangement involving remuneration is to induce referrals of federal healthcare covered business, the statute has been violated. In addition, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. The Anti-Kickback Statute is broad and, despite a series of narrow safe harbors, prohibits many arrangements and practices that are lawful in businesses outside of the healthcare industry. Penalties for violations of the federal Anti-Kickback Statute include criminal penalties and civil sanctions such as fines, imprisonment and possible exclusion from Medicare, Medicaid and other federal healthcare programs. Many states have also adopted laws similar to the federal Anti-Kickback Statute, some of which apply to the referral of patients for healthcare items or services reimbursed by any source, not only the Medicare and Medicaid programs.

The federal Ethics in Patient Referrals Act of 1989, commonly known as the “Stark Law,” prohibits, subject to certain exceptions, physician referrals of Medicare and, as applicable under state law, Medicaid patients to an entity providing certain “designated health services” if the physician or an immediate family member has any financial relationship with the entity. The Stark Law also prohibits the entity receiving the referral from billing any good or service furnished pursuant to an unlawful referral. Various states have corollary laws to the Stark Law, including laws that require physicians to disclose any financial interest they may have with a healthcare provider to their patients when referring patients to that provider. Both the scope and exceptions for such laws vary from state to state.

14

The federal False Claims Act prohibits persons from knowingly filing, or causing to be filed, a false claim to, or the knowing use of false statements to obtain payment from the federal government. The False Claims Act defines “knowingly” to include actual knowledge, acting in deliberate ignorance of the truth or falsity of information, or acting in deliberate disregard of the truth or falsity of information. False Claims Act liability includes liability for reverse false claims for avoiding or decreasing an obligation to pay or transmit money to the government. This includes False Claims Act liability for failing to report and return overpayments within 60 days of the date on which the overpayment is “identified.” Penalties under the False Claims Act can include exclusion from the Medicare program. In addition, the government may assert that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the False Claims Act. Suits filed under the False Claims Act, known as qui tam actions, can be brought by any individual on behalf of the government and such individuals, commonly known as “whistleblowers,” may share in any amounts paid by the entity to the government in fines or settlement. The frequency of filing qui tam actions has increased significantly in recent years, causing greater numbers of medical device, pharmaceutical and healthcare companies to have to defend a False Claims Act action. When an entity is determined to have violated the federal False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus civil penalties for each separate false claim. Various states have also enacted laws modeled after the federal False Claims Act.

For example, as previously disclosed, on July 25, 2017, AdaptHealth was served with a subpoena by the U.S. Attorney’s Office for the United States District Court for the Eastern District of Pennsylvania (“EDPA”) pursuant to 18 U.S.C. §3486 (investigation of a federal health care offense) to produce certain audit records and internal communications regarding ventilator billing. The investigation appears to be focused on billing practices regarding one payor that contracted for bundled payments for certain ventilators. AdaptHealth has cooperated with investigators and, through agreement with the EDPA, has submitted all information requested. An independent third party was retained by AdaptHealth that identified overpayments and underpayments for ventilator billings related to the payor, and a remittance was sent to reconcile that account. On October 3, 2019, AdaptHealth received a follow-up civil investigative demand from the EDPA regarding a document previously produced to the EDPA and patients included in the review by the independent third party. AdaptHealth has responded to the EDPA and supplemented its production as requested. On November 9, 2020, the EDPA indicated to the Company that the investigation remained ongoing and confirmed that a qui tam complaint had been filed in connection with the matter. The EDPA also requested additional information regarding certain patient services and claims refunds processed by AdaptHealth in 2017. The Company is compiling this information and will supplement its production in early January 2021. While AdaptHealth cannot provide any assurance as to whether the EDPA will seek additional information or pursue this matter further, the Company does not believe that the investigation will have a material adverse effect on the Company.

HIPAA, and its implementing regulations, also created additional federal criminal statutes that prohibit knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program or obtain, by means of false or fraudulent pretenses, representations, or promises, any of the money or property owned by, or under the custody or control of, any healthcare benefit program, regardless of the payor (e.g., public or private) and knowingly and willfully falsifying, concealing or covering up by any trick or device a material fact or making any materially false statements in connection with the delivery of, or payment for, healthcare benefits, items or services relating to healthcare matters. Similar to the federal Anti-Kickback Statute, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation.

From time to time, AdaptHealth has been and is involved in various governmental audits, investigations and reviews related to its operations. Reviews and investigations can lead to government actions, resulting in the assessment of damages, civil or criminal fines or penalties, or other sanctions, including restrictions or changes in the way AdaptHealth conducts business, loss of licensure or exclusion from participation in Medicare, Medicaid or other government programs. Additionally, as a result of these investigations, healthcare providers and entities may face litigation or have to agree to settlements that can include monetary penalties and onerous compliance and reporting requirements as part of a consent decree or corporate integrity agreement, or Corporate Integrity Agreement (“CIA”). If AdaptHealth fails to comply with applicable laws, regulations and rules, its financial condition and results of operations could be adversely affected. Furthermore, becoming subject to these governmental investigations, audits and reviews may result in substantial costs and divert management’s attention from the business as AdaptHealth cooperates with the government authorities, regardless of whether the particular investigation, audit or review leads to the identification of underlying issues.

AdaptHealth is unable to predict whether it could be subject to actions under any of these laws, or the impact of such actions. If AdaptHealth is found to be in violation of any of the laws described above or other applicable state and federal fraud and abuse laws, AdaptHealth may be subject to penalties, including civil and criminal penalties, damages, fines, exclusion from Medicare, Medicaid and other government healthcare reimbursement programs and the curtailment or restructuring of its operations.

15