Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - AdaptHealth Corp. | ahco-20191231xex32.htm |

| EX-31.2 - EX-31.2 - AdaptHealth Corp. | ahco-20191231ex312a8695e.htm |

| EX-31.1 - EX-31.1 - AdaptHealth Corp. | ahco-20191231ex3112ed484.htm |

| EX-23.1 - EX-23.1 - AdaptHealth Corp. | ahco-20191231ex2314adea6.htm |

| EX-21.1 - EX-21.1 - AdaptHealth Corp. | ahco-20191231ex21190ab9b.htm |

| EX-10.18 - EX-10.18 - AdaptHealth Corp. | ahco-20191231ex1018e343d.htm |

| EX-4.5 - EX-4.5 - AdaptHealth Corp. | ahco-20191231ex458c59e46.htm |

| EX-3.3 - EX-3.3 - AdaptHealth Corp. | ahco-20191231ex33f3c2189.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001‑38399

AdaptHealth Corp.

(Exact name of registrant as specified in its charter)

|

Delaware |

82‑3677704 |

|

(State of Other Jurisdiction of incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

220 West Germantown Pike Suite 250, Plymouth Meeting, PA |

19462 |

|

(Address of principal executive offices) |

(Zip code) |

Registrant’s telephone number, including area code: (610) 630‑6357

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Name Of Each Exchange |

|

Title of Each Class |

|

Trading Symbol(s) |

|

On Which Registered |

|

Class A Common Stock, par value $0.0001 per share |

|

AHCO |

|

The Nasdaq Stock Market LLC |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically; every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.0405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☒ |

Non-accelerated filer ☐ |

Smaller reporting company ☒ |

|

|

|

|

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☒

As of June 28, 2019, the last business day of the Registrant's most recently completed second fiscal quarter, the aggregate market value of the shares of Class A Common Stock, par value $0.0001 per share, held by non-affiliates of the Registrant, computed based on the closing sale price of $10.13 per share on June 28, 2019, as reported by The Nasdaq Stock Market LLC, was approximately $253.3 million. Shares of Common Stock held by each executive officer and director and by each shareholder affiliated with a director or an executive officer have been excluded from this calculation because such persons may be deemed to be affiliates. As of March 3, 2020, there were 42,247,356 shares of the Registrant’s Class A Common Stock issued and outstanding and 31,063,799 shares of the Registrant’s Class B Common Stock issued and outstanding.

Documents Incorporated by Reference

The information called for by Part III is incorporated by reference to the Definitive Proxy Statement for the 2020 Annual Meeting of Stockholders of the Registrant which will be filed with the U.S. Securities and Exchange Commission not later than April 29, 2020.

1

CAUTIONARY STATEMENT

In this Annual Report on Form 10-K, including "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in Item 7, and the documents incorporated by reference herein, we make forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. These statements may be preceded by, followed by or include the words "may," "might," "will," "will likely result," "should," "estimate," "plan," "project," "forecast," "intend," "expect," "anticipate," "believe," "seek," "continue," "target" or similar expressions.

These forward-looking statements are based on information available to us as of the date they were made, and involve a number of risks and uncertainties which may cause them to turn out to be wrong. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward- looking statements. Some factors that could cause actual results to differ include:

|

· |

the ability to maintain the listing of our Class A Common Stock on Nasdaq; |

|

· |

competition and the ability of our business to grow and manage growth profitably; |

|

· |

changes in applicable laws or regulations; |

|

· |

fluctuations in the U.S. and/or global stock markets; |

|

· |

the possibility that we may be adversely affected by other economic, business, and/or competitive factors; and |

|

· |

other risks and uncertainties set forth in this Form 10-K, as well as all documents incorporated by reference herein. |

2

We are a leading provider of home healthcare equipment, supplies and related services in the United States. We focus primarily on providing (i) sleep therapy equipment, supplies and related services (including CPAP and bi PAP services) to individuals suffering from obstructive sleep apnea (“OSA”), (ii) home medical equipment (“HME”) to patients discharged from acute care and other facilities, (iii) oxygen and related chronic therapy services in the home and (iv) other HME medical devices and supplies on behalf of chronically ill patients with diabetes care, wound care, urological, ostomy and nutritional supply needs. We service beneficiaries of Medicare, Medicaid and commercial payors. As of December 31, 2019, we serviced approximately 1.2 million patients annually in 49 states through our network of 173 locations in 35 states. Following our acquisition of the Patient Care Solutions business (“PCS”) from McKesson Corporation in January 2020, we service approximately 1.4 million patients annually in all 50 states through our network of 187 locations in 38 states. Our principal executive offices are located at 220 West Germantown Pike, Suite 250, Plymouth Meeting, Pennsylvania 19462.

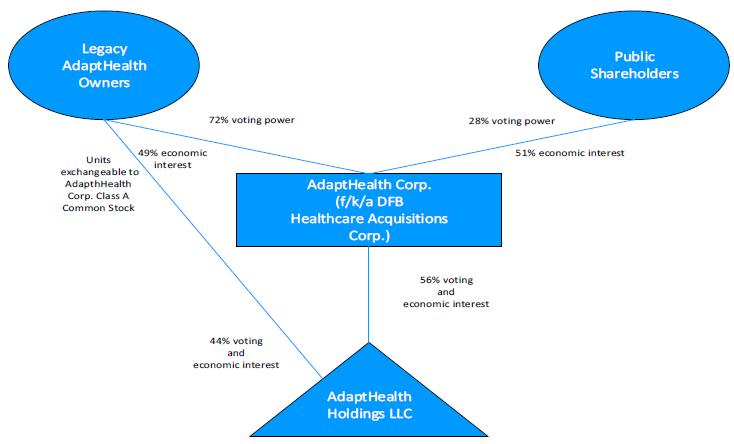

We were originally formed in November 2017 as a special purpose acquisition company under the name DFB Healthcare Acquisitions Corp. for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination involving one or more businesses. On November 8, 2019, we completed our initial business combination, (the “Business Combination”) with AdaptHealth Holdings LLC (“AdaptHealth Holdings”), a Delaware limited liability company, pursuant to an Agreement and Plan of Merger, dated as of July 8, 2019 (as amended, the "Merger Agreement”), by and among DFB Healthcare Acquisitions Corp. a Delaware corporation (DFB Healthcare Acquisitions Corp. prior to the Business Combination is referred to herein as “DFB”), DFB Merger Sub LLC, a Delaware limited liability company (the “Merger Sub”), our wholly owned subsidiary, AdaptHealth Holdings LLC, AH Representative LLC (the “AdaptHealth Holdings Unitholders’ Representative”), BM AH Holdings, LLC, Access Point Medical Inc. (together the “Blocker Companies”) and, solely for the purposes described therein, Clifton Offshore Investments L.P., a British Virgin Islands limited partnership (the “A Blocker Seller”), BlueMountain Foinaven Master Fund L.P., a Cayman Islands exempted limited partnership, BMSB L.P. a Delaware limited partnership, BlueMountain Fursan Fund L.P. a Cayman Islands exempted limited partnership (collectively, the “BM Blocker Sellers” and together with the A Blocker Seller, the “Blocker Sellers”). The transactions contemplated by the Merger Agreement are collectively referred to herein as the "Business Combination". As part of the Business Combination, we changed our name from DFB Healthcare Acquisitions Corp. to AdaptHealth Corp. (“we”, “us”, “our”, “AdaptHealth” or the “Company”). Refer to Note 11, Stockholders’ Equity, included in our consolidated financial statements for the year ended December 31, 2019 included in this report for additional information.

Industry Overview

The HME industry provides critical medical products and recurring supply services, designed to improve quality of life, to patients in their homes. The HME industry allows patients with complex and chronic conditions to transition to their homes and achieve a greater level of independence, which is often lost in facility-based settings. While the industry has traditionally treated outpatient and lower acuity ailments, recent technological improvements have helped make higher acuity treatment more affordable and, in turn, have allowed the industry to shift to the treatment of more advanced acute ailments. The equipment and supplies that HME providers deliver can include respiratory products, mobility, diabetes management, nutritional and other general home needs (bathroom needs, nutritional needs, hospital beds, etc.).

According to the Centers for Medicare & Medicaid Services (“CMS”), the HME industry has grown from $40 billion in 2010 to $56 billion in 2018 (representing a 4.3% CAGR), of which the Company estimates its total addressable market for its sleep therapy, oxygen services, mobility products and hospice HME business lines to be approximately $12 billion to $15 billion in 2018. During that time Medicaid data shows a continued shift of long-term services and supports spending into the home, with 57% of that spending going to home and community-based services in 2016. According to CMS, the HME market is projected to continue to grow at a 6.1% CAGR over the next nine years. As a result of the acquisition of the diabetic, wound care, ostomy and urological supplies business of PCS in January 2020,

3

the Company believes it has more than doubled its addressable market to more than $25 billion. Primary drivers of continued market growth include:

|

· |

Aging U.S. Population: The population of adults aged 65 and older in the U.S., a significant group of end users of AdaptHealth’s products and services, is expected to continue to grow and thus grow AdaptHealth’s market opportunity. According to CMS, in the U.S., the population of adults between the ages of 65 and 84 is expected to grow at a 2.5% CAGR through 2030, while the population of adults over 85 is projected to grow at a 2.9% CAGR during that same time period. Not only is the elderly population expected to grow, but it is also expected to make up a larger percentage of the total U.S. population. According to the U.S. Census Bureau, the U.S. geriatric population was approximately 15% of the total population in 2014 and is expected to grow to approximately 24% of the total population by 2060. This growth emphasizes the need for companies such as AdaptHealth to provide efficient and effective equipment to a patient’s home, shortening the amount of time that the patient population spends in an inpatient setting. |

|

· |

Increasing Prevalence of Chronic Conditions: HME is necessary to help treat significant health issues affecting millions of Americans. For example, chronic obstructive pulmonary disease was the third leading cause of death in the U.S. in 2014 with over 15 million reported diagnoses, according to the Centers for Disease Control and Prevention (“CDC”). Congestive heart failure (“CHF”), another condition where HME plays a role in successful treatment, impacts more than five million Americans, according to the CDC. The CDC also estimates that more than 9% of the US population suffers from diabetes. Finally, according to the American Sleep Apnea Association, OSA affects 20 million people across the nation, with 15 million undiagnosed, including many individuals younger than 65 years old. As these conditions continue to increase in prevalence, AdaptHealth expects that the demand within the HME industry for suppliers, such as AdaptHealth, will grow with it, positioning AdaptHealth to be able to expand its market reach and penetration. |

|

· |

Advancements in Technology: Continuing development of technology and supply logistics has enabled more efficient and effective delivery of care in the home along with the collection of data that can be used for ongoing treatment. This, in turn, has helped grow AdaptHealth’s total addressable market. With improvements in technology, physicians are often able to monitor patients’ adherence to prescribed therapy which previously required admission to a facility. With the advancement of technology, physicians are more confident in shifting care to a patient’s home and patients are more comfortable receiving care in this setting. |

|

· |

Increasing Prevalence of and Preference for In-Home Treatments: The number of conditions that can be treated in the home continues to grow, with recent additions including chronic wound care, sleep testing, dialysis and chemotherapy. In-home care is also increasingly becoming the preferred method of treatment, particularly for the elderly population. According to the AARP Public Policy Institute, 90% of patients over age 55 have indicated a preference to receive care in the home rather than in an institutional setting. Patient preference is supported by data that has shown that the efficacy of home care is often equivalent to that of facility-based care. The home setting provides comfort and convenience for a population that often faces barriers to receiving effective traditional treatment, such as transportation and adherence. By bringing the care to them, the elderly population can maintain a higher quality of life while still receiving high-quality care and equipment. As a result, more companies within the healthcare industry that are primarily facility-based are beginning to shift towards in-home offerings. |

|

· |

Home Care is the Lowest Cost Setting: Not only is in-home care typically just as effective as care delivered in a facility-based setting, but it has also proven to be more cost effective. The cost-effectiveness of in-home care is particularly important within the context of government pressures to lower the cost of care, pushing payors, such as Medicare and Medicaid, and clinicians to seek care settings that are less costly than hospitals and inpatient facilities. On a daily basis, home healthcare has been estimated by Cain Brothers & Company, LLC to be approximately seven times less expensive than care provided in skilled nursing facilities, the closest acuity site of care. Home care generally offers a significant cost reduction opportunity relative to facility-based care without sacrificing quality. |

4

Business Strategy

AdaptHealth’s strategy is to grow its revenue while expanding margins through targeted strategies for organic growth as well as opportunistic acquisitions that take advantage of AdaptHealth’s scalable, integrated technology platform.

|

· |

Drive Market Share Gains in the HME Market: AdaptHealth plans to leverage its technological and clinical advantages as well as its relationships with key constituents across the HME supply chain to deepen its presence in the HME market. AdaptHealth has built a strong network of highly diversified referral relationships that its sales force will continue to grow to help expand market penetration in certain geographies. Primary referral sources include acute care hospitals, sleep laboratories, pulmonologist offices, skilled nursing facilities and hospice operators, with no one source accounting for greater than 2% of its revenue as of December 31, 2019. AdaptHealth believes that maintaining and broadening these relationships will drive organic growth. AdaptHealth’s ability to provide many products across its contracted payors is particularly valuable, especially to providers and facilities that discharge patients with a variety of product needs and insurance coverages. While some of its HME competitors focus on certain specific product lines, AdaptHealth is able to offer a wide array of products to its customers. AdaptHealth believes that its strong referral relationships and its broad product portfolio will help drive market share growth. |

|

· |

Grow through Acquisitions: The HME industry is highly fragmented, with more than 6,000 unique suppliers. AdaptHealth believes that ongoing reimbursement changes will continue the consolidation trend in the HME industry that has accelerated in recent years. AdaptHealth believes that in the current environment, companies with the ability to scale operations possess competitive advantages that can drive volume to their platforms. As one of a limited number of national HME companies, AdaptHealth plans to continue to evaluate acquisitions and execute upon attractive opportunities to help drive growth. For the year ended December 31, 2019, AdaptHealth completed 18 acquisitions for aggregate consideration of $67 million (excluding amounts related to contingent consideration), which are expected to add annual net revenues of approximately $116 million. Three of these acquisitions were closed in the fourth quarter of 2019 and represent approximately $18 million in anticipated annual net revenue in 2020. |

|

· |

Improve Profitability with Technology-Enabled Platform: AdaptHealth plans to leverage its integrated technology system (based upon third party applications and proprietary software products) to reduce costs and improve operational efficiency in its current business and the businesses it acquires. During 2018 and 2019, AdaptHealth has deployed its technology solutions with respect to 39 acquisitions and has established the ability to improve logistics performance and operating margins. AdaptHealth intends to continue to improve its technology platform to enhance its communications with referral sources and provide better patient service. |

|

· |

Expand Product Portfolio: In addition to its other growth initiatives, AdaptHealth also plans to augment its product portfolio to help drive growth. While AdaptHealth offers a suite of products to its referrers and patients, it has identified several key expansion opportunities, including products in the respiratory device, respiratory medicine, diabetes management, orthotic bracing and hospice HME markets. AdaptHealth believes that these products will deepen its portfolio and allow it to further address key clinical conditions which, in turn, are expected to help drive growth across its customer base. AdaptHealth’s scale has helped it to be successful in the past when bidding on Medicare contracts. |

|

· |

Utilize Value-Based Reimbursement Arrangements: AdaptHealth’s broad HME service offerings and technology-enabled infrastructure provide the opportunity to enter into value-based reimbursement arrangements with its payors and referrers (including large multi-specialty physician groups, hospital systems, and accountable care organizations) pursuant to which AdaptHealth provides certain HME services on a per-patient, per-month basis or shares in reduction of HME service costs over baseline periods. Such arrangements are attractive to risk-bearing providers (such as capitated medical groups) and payors wishing to reduce administrative costs related to HME services. |

5

Competitive Strengths

AdaptHealth believes that the following strengths will continue to enable it to provide high quality products and services to its customers and to create value for stockholders.

|

· |

Differentiated Technology-Enabled Platform: Over the last five years, AdaptHealth has developed an integrated technology system (based upon best-in-class third party applications and proprietary software products) which AdaptHealth believes provides a competitive advantage within the HME industry. AdaptHealth’s integrated platform distinguishes itself from other industry participants by automating processes that can be complex, prone to mistakes and inefficient. AdaptHealth believes that its platform’s ease of use, improved compliance and automated, integrated workflow for delivery of care appeals to physicians and payors. Additionally, AdaptHealth believes its adoption of e-prescribing solutions enhances transparency and reduces clinical errors and delays. AdaptHealth believes such systems provide better patient service by reducing the time between an order’s receipt and the delivery of the products to the patient. AdaptHealth believes its model is scalable, supporting future organic growth while also allowing for timely on-boarding of acquisitions. AdaptHealth believes that this differentiated technology platform will help generate business from new clients, as other competitors either lack the resources to modernize their technology infrastructure or utilize systems which do not easily allow for changes from traditional, less automated models. |

|

· |

National Scale and Operational Excellence: Following AdaptHealth’s acquisition of PCS in January 2020, AdaptHealth services approximately 1.4 million patients annually across all 50 states and performs over 10,000 equipment and supply deliveries a day through 187 locations, consisting of 140 patient servicing centers, 38 distribution only depots and 9 administrative offices. AdaptHealth also has relationships with national healthcare distribution companies to drop ship certain HME products directly to patients’ homes in one to two days. AdaptHealth believes that its scale makes AdaptHealth attractive to payors as it is able to service its patients across the nation. As of December 31, 2019, AdaptHealth has been able to build a network of more than 1,200 payors, including 10 national and over 150 regional insurers. AdaptHealth’s payor network allows the organization to provide in-network rates for most prospective patients, unlike many of its competitors. AdaptHealth believes that this, in turn, makes it more attractive to referral sources and helps to drive volume. AdaptHealth has a broad distribution network to leverage with respect to timely and efficient delivery of products. AdaptHealth has strategically located small depots across the country based upon equipment volume and drive times to support its delivery fleet and help enhance operational success. |

|

· |

Experienced Management Team: AdaptHealth is led by a proven management team with significant experience in the HME and healthcare services industries. The team has domain knowledge within the industry having been employed at various healthcare organizations throughout their careers. Multiple members of the management team have also built independent HME companies and have the proven ability to scale a business within the HME industry. Additionally, several members of the management team have experience within their specific roles in both private and public company settings. Given the complexity of the highly regulated industry in which AdaptHealth operates, AdaptHealth believes that management’s experience is a meaningful differentiator relative to its competitors. |

|

· |

Proven M&A Success: AdaptHealth’s integrated technology platform includes scalable and centralized front-end and back office processes that facilitate the effective onboarding of potential acquisitions and help achieve cost synergies. AdaptHealth has demonstrated its ability to execute upon acquisitions, deploying over $320 million in capital to complete 64 transactions from its founding through December 31, 2019. As AdaptHealth continues to grow it expects to deploy incrementally more capital and integrate substantially larger targets over time, which in turn it expects will be a source of continued growth for AdaptHealth. For the year ended December 31, 2019, AdaptHealth completed 18 acquisitions for aggregate consideration of $67 million (excluding amounts related to contingent consideration). |

6

Company Operations

Product Offering. AdaptHealth delivers home medical equipment and supplies directly to a patient’s home upon discharge from a hospital and/or receipt of referral. The breadth of AdaptHealth’s products is particularly valuable to acute care hospitals, sleep laboratories and long-term care facilities that discharge patients with complex conditions and multiple product needs.

AdaptHealth is often paid a fixed monthly amount for certain HME products as designated by CMS or commercial payors, such as CPAP, wheelchairs, hospital beds, oxygen concentrators, continuous glucose monitors and other similar products. These types of equipment accounted for approximately 40% of AdaptHealth’s revenue for the year ended December 31, 2019.

For other products, which include those deemed to be consumables, AdaptHealth receives a single payment upon shipment of the product. Sales of these products, which include CPAP masks and related supplies, diabetes management supplies, wound care supplies, wheelchair cushions accessories, orthopedic bracing, breast pumps and supplies, walkers, commodes and canes, nutritional supplies and incontinence supplies, accounted for approximately 60% of AdaptHealth’s revenue for the year ended December 31, 2019.

Supply Chain. AdaptHealth plays an important role in delivering HME products to patients in their homes. Manufacturers of home medical equipment sell their products to AdaptHealth and ship them to AdaptHealth directly. AdaptHealth also contracts with national healthcare distribution companies to ship certain HME products directly to patients’ homes. These distributors invoice AdaptHealth for the cost of shipped products at the time of sale. AdaptHealth receives referrals from a variety of sources, such as acute care hospitals, sleep laboratories, pulmonologist offices, skilled nursing facilities and hospice operators. AdaptHealth’s products are either shipped to patients’ homes by AdaptHealth-operated or contracted delivery trucks or shipped using proprietary or third-party distribution services. AdaptHealth bills payors and patients directly for the products that are delivered and for the services that are provided. Following AdaptHealth’s acquisition of PCS in January 2020, AdaptHealth services approximately 1.4 million patients annually across all 50 states and performs over 10,000 equipment and supply deliveries a day through 187 locations, consisting of 140 patient servicing centers, 38 distribution-only depots and 9 administrative offices, to help service its patient population efficiently and effectively.

Operating Structure

Management. AdaptHealth is led by a proven management team with experience in the HME industry across a variety of healthcare organizations. AdaptHealth adopts a centralized approach for key business processes, including M&A activity, revenue cycle management, strategic purchases, payor contracting, finance, compliance, legal, human resources, IT and sales management. In addition, AdaptHealth has centralized many of the functions relating to its CPAP and other resupply businesses. However, AdaptHealth believes that the personalized nature of customer requirements and referral relationships, characteristic of the home healthcare business, mandate that it emphasize a localized operating structure as well. AdaptHealth focuses on regional management to respond promptly and effectively to local market demands and opportunities. AdaptHealth’s regional managers are responsible and accountable for maintaining and developing relationships with referral sources, customer service for non-CPAP supply product lines and logistics for non-drop-shipped products.

IT. AdaptHealth has established an integrated, technology-enabled, centralized platform, distinguishing itself from many of its competitors who traditionally use less automated processes that are typically complex, can be prone to mistakes and are inefficient. AdaptHealth’s technology enables automated, compliant, and integrated workflow into patients’ delivery of care. AdaptHealth believes that this advanced technology platform provides it with a competitive advantage through its unique components that cater to patients and physicians. AdaptHealth believes that its technology platform has several characteristics that appeal to physicians, including its ease of use, the improved compliance it enables through its integrated systems and the automated, integrated workflow it provides for patients’ delivery of care. Additionally, AdaptHealth’s e-prescribing capabilities enhance transparency and reduce transcription and other errors. AdaptHealth believes that patients are also better served due to the efficiency from time of order to delivery and the seamless integration across points of care enabled by AdaptHealth’s platform. The integrated system also provides

7

AdaptHealth management with critical information in a timely manner, allowing them to track performance levels company wide.

AdaptHealth has formed close relationships with its third-party software providers, including Apacheta Corporation, Brightree, Parachute Health and SnapWorx, LLC, to optimize its HME workflow. An example of this optimization is AdaptHealth’s automated point-of-delivery technology, which tracks AdaptHealth’s drivers and produces paperless, secure delivery tickets which are uploaded directly to the patient’s file and available immediately on an enterprise-wide basis. In addition, to address ongoing and growing threats related to cyberattacks, AdaptHealth continues to deploy market leading defense tools to protect and secure its networks and data.

Revenue Cycle Management. AdaptHealth’s revenue cycle management and billing processes have both manual and computerized elements that are designed to maintain the integrity of revenue and accounts receivable. Third-party payors that can accommodate electronic claims submission, such as Medicare, certain state Medicaid payors and many commercial payors, are billed electronically on a daily basis. For other payors who are unable to accept electronic submissions, AdaptHealth generates paper claims and invoices.

AdaptHealth contracts with several business process outsourcing providers to provide certain billing and administrative functions related to revenue cycle management. These providers are based in the Philippines, India and Central America and provide AdaptHealth with the ability to scale its workforce in a cost-effective manner. As of December 31, 2019, approximately 1,430 full-time equivalent personnel were provided to AdaptHealth under such arrangements. Following AdaptHealth’s acquisition of PCS in January 2020, approximately 1,500 full-time equivalent personnel are provided to AdaptHealth under such arrangements.

Sales and Marketing

Sales activities are generally carried out by AdaptHealth’s full-time sales representatives with assistance from on-site liaisons in certain markets who interact directly with hospital discharge coordinators and patients. AdaptHealth’s sales team works closely with AdaptHealth’s trained respiratory therapists in carrying out their daily sales activities. AdaptHealth primarily acquires new patients through referrals. Sources of referrals include acute care hospitals, sleep laboratories, pulmonologist offices, skilled nursing facilities and hospice operators, among others. AdaptHealth’s sales representatives maintain continual contact with medical professionals across these facilities. AdaptHealth believes that its relationships with its referral sources are strong and that these entities will continue to be a source of organic growth through new patients. While AdaptHealth views its referral sources as fundamental to its business, no single referral source accounted for more than 2% of its revenues as of December 31, 2019.

Acquisitions

Continuing to grow through accretive acquisitions is a key element of AdaptHealth’s growth strategy, and AdaptHealth continuously reviews its pipeline of potential acquisition candidates. AdaptHealth maintains a dedicated M&A integration team and leverages its scalable front-end and back-office technology platform to facilitate acquisition integration to help realize short-term cost saving synergies and longer-term revenue growth synergies.

During the year ended December 31, 2019, AdaptHealth completed acquisitions involving 18 companies for total purchase consideration of approximately $67 million (excluding amounts related to contingent consideration). For the year ended December 31, 2018, AdaptHealth completed acquisitions involving 21 companies for total purchase consideration of approximately $171 million.

Suppliers

AdaptHealth purchases medical equipment from a variety of suppliers. AdaptHealth’s sleep therapy equipment and supplies are primarily provided by two suppliers, and its mobility and home services products (such as hospital beds, wheelchairs, walkers and commodes) are principally supplied by a single supplier. Notwithstanding its significant supply relationships with these vendors, AdaptHealth believes that it is not dependent upon any single supplier and that its product needs can be met by an adequate number of qualified manufacturers.

8

Facilities

AdaptHealth does not own any properties and leases its headquarters facility located at 220 West Germantown Pike, Suite 250, Plymouth Meeting, PA. As of December 31, 2019, AdaptHealth served approximately 1.2 million patients annually across 49 states and performed over 7,000 equipment and supply deliveries a day through 173 locations, consisting of 128 patient servicing centers, 36 distribution-only depots and 9 administrative offices. Following AdaptHealth’s acquisition of PCS in January 2020, AdaptHealth services approximately 1.4 million patients annually across all 50 states and performs over 10,000 equipment and supply deliveries a day through 187 locations, consisting of 140 patient servicing centers, 38 distribution-only depots and 9 administrative offices. Full service locations are typically between 300 and 5,000 square feet, and are usually a combination office and warehouse space. Many of these facilities are accredited to provide patient services, and their adjacent warehouse space is used for storage of adequate supplies of equipment and accessories for such patient services. AdaptHealth believes that these facilities are adequate to meet its current needs, and expects to add additional facilities in connection with its growth strategies. AdaptHealth believes that such additional space, when required, will be available on commercially reasonable terms, consistent with historical cost trends.

Employees

As of December 31, 2019, AdaptHealth had approximately 2,590 employees. Following AdaptHealth’s acquisition of PCS in January 2020, AdaptHealth has approximately 3,060 employees. AdaptHealth believes that relations between its management and employees are good.

Competition

The HME market is fragmented and highly competitive. AdaptHealth competes with other large national providers, including AeroCare, Apria Healthcare, Lincare and Rotech; regional providers, including DASCO Home Medical Equipment, Binson’s Medical Equipment, Inc., Norco, Inc. and Protech Home Medical Corp.; and product-specific providers, including Breg, Inc., Byram Healthcare Centers, Inc., Inogen, Inc. and Acelity L.P. Inc, as well as over 6,000 local organizations. In addition, non-HME providers, including CVS, Amazon and certain manufacturers of HME equipment, are considering entering or expanding their presence in the HME market.

Consolidation of the HME market is a continuing trend, as required technology investments and reduced reimbursements put financial pressure on smaller providers. Larger HME providers with integrated technology and automated processes are generally better positioned to gain market share and more attractive vendor pricing. Competitive bidding also emphasizes the importance of relationships with both the payors and referral sources. Because payors typically select a limited number of exclusive suppliers and physicians typically refer based on timely delivery and consistency, relationships with both are critical to the success of competitors in the market.

AdaptHealth believes that the most important competitive factors in the regional and local markets are:

|

· |

Reputation with referral sources, including local physicians and hospital-based professionals; |

|

· |

Service quality and efficient, responsive referral process; |

|

· |

Differentiated technology platform that provides a superior physician and patient experience; |

|

· |

Comprehensive offering across the home medical equipment space; |

|

· |

Broad network of payor contracts and regional insurers; |

|

· |

Overall ease of doing business; and |

|

· |

Quality of patient care, including clinical expertise. |

9

AdaptHealth believes that it competes favorably with competitors on the basis of these and other factors.

Legal Proceedings

AdaptHealth is involved in investigations, claims, lawsuits and other proceedings arising in the ordinary course of its business. These matters involve personnel and employment issues, regulatory matters, personal injury, contract and other proceedings arising in the ordinary course of business, which have not resulted in any material losses to date. Although AdaptHealth does not expect the outcome of these proceedings will have a material adverse effect on its financial condition or results of operations, such matters are inherently unpredictable. Therefore, AdaptHealth could incur judgments or enter into settlements or claims that could materially impact its financial condition or results of operations.

In addition, on July 25, 2017, AdaptHealth Holdings was served with a subpoena by the U.S. Attorney’s Office for the United States District Court for the Eastern District of Pennsylvania (“EDPA”) pursuant to 18 U.S.C. §3486 to produce certain audit records and internal communications regarding ventilator billing. The investigation appears to be focused on billing practices regarding one payor that contracted for bundled payments for certain ventilators. AdaptHealth Holdings has cooperated with investigators and, through agreement with the EDPA, has submitted all information requested. An independent third party was retained by AdaptHealth Holdings that identified overpayments and underpayments for ventilator billings related to the payor, and a remittance was sent to reconcile that account. AdaptHealth Holdings has cooperated and fully complied with the subpoena. On October 3, 2019 AdaptHealth received a follow-up civil investigative demand from the EDPA regarding a document previously produced to the EDPA and patients included in the review by the independent third party. AdaptHealth has responded to the EDPA and supplemented its production as requested. At this time, AdaptHealth Holdings cannot provide any assurance as to whether the EDPA will seek additional information or pursue this matter further.

Government Regulation

The federal government and all states in which AdaptHealth currently operates regulate various aspects of AdaptHealth’s business. In particular, AdaptHealth’s operations are subject to federal laws that regulate the reimbursement of its products and services under various government programs and that are designed to prevent fraud and abuse. AdaptHealth’s operations are also subject to state laws governing, among other things, pharmacies, nursing services, medical equipment suppliers and certain types of home health activities. Certain of its employees are subject to state laws and regulations governing the licensure and professional practice of respiratory therapy, pharmacy and nursing.

AdaptHealth maintains a Compliance Program that meets the guidelines set forth by the Office of Inspector General of CMS, and provides ongoing compliance training designed to keep AdaptHealth’s officers, directors and employees well-educated and up-to-date regarding developments on relevant topics and to emphasize AdaptHealth’s policy of strict compliance. Federal and state laws require that AdaptHealth obtain facility and other regulatory licenses and that AdaptHealth enroll as a supplier with federal and state health programs.

As a healthcare provider, AdaptHealth is subject to extensive regulation to prevent fraud and abuse and laws regulating reimbursement under various government programs. The marketing, billing, documenting and other practices of healthcare companies are all subject to government scrutiny. To ensure compliance with Medicare, Medicaid and other regulations, regional health insurance carriers and state agencies often conduct audits and request customer records and other documents to support AdaptHealth’s claims submitted for payment of services rendered to customers. Similarly, government agencies and their contractors periodically open investigations and obtain information from healthcare providers pursuant to the legal process. Violations of federal and state regulations can result in severe criminal, civil and administrative penalties and sanctions, including disqualification from Medicare and other reimbursement programs, which could have a material adverse effect on AdaptHealth’s financial condition and results of operations.

Numerous federal and state laws and regulations, including HIPAA and the HITECH Act, govern the collection, dissemination, security, use and confidentiality of patient-identifiable health information. As part of

10

AdaptHealth’s provision of, and billing for, healthcare equipment and services, AdaptHealth is required to collect and maintain patient-identifiable health information. New health information standards, whether implemented pursuant to HIPAA, the HITECH Act, congressional action or otherwise, could have a significant effect on the manner in which AdaptHealth handles healthcare-related data and communicate with payers, and the cost of complying with these standards could be significant. If AdaptHealth does not comply with existing or new laws and regulations related to patient health information, it could be subject to criminal or civil sanctions.

Healthcare is an area of rapid regulatory change. Changes in the laws and regulations and new interpretations of existing laws and regulations may affect permissible activities, the relative costs associated with doing business, and reimbursement amounts paid by federal, state and other third-party payers. AdaptHealth cannot predict the future of federal, state and local regulation or legislation, including Medicare and Medicaid statutes and regulations, or possible changes in national healthcare policies. Future legislative and regulatory changes could have a material adverse effect on AdaptHealth’s financial condition and results of operations.

Implemented Regulation

As a provider of home oxygen, respiratory and other chronic therapy equipment to the home healthcare market, AdaptHealth participates in Medicare Part B, the Supplementary Medical Insurance Program, which was established by the Social Security Act of 1965. Providers of home oxygen and other respiratory therapy services and equipment have historically been heavily dependent on Medicare reimbursement due to the high proportion of elderly persons suffering from respiratory disease. Durable medical equipment, including oxygen equipment, is traditionally reimbursed by Medicare based on fixed fee schedules.

Impact of the ACA and MIPPA. The ACA, the Medicare Improvements for Patients and Providers Act of 2008 (“MIPPA”), the Medicare, Medicaid and SCHIP Extension Act of 2007 (“SCHIP Extension Act”), the Deficit Reduction Act of 2005 (“DRA”) and the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (“MMA”) contain provisions that directly impacted reimbursement for the primary respiratory and other durable medical equipment (“DME”) products provided by AdaptHealth.

In recent years, the U.S. Congress and certain state legislatures have considered and passed a large number of laws intended to result in significant change to the ACA. The law has been subject to legislative and regulatory changes and court challenges, and the current presidential administration and certain members of Congress have stated their intent to repeal or make additional significant changes to the ACA, its implementation or its interpretation. In 2017, the Tax Cuts and Jobs Acts was enacted, which, among other things, removed penalties for not complying with ACA’s individual mandate to carry health insurance. In addition, the president has signed an executive order that directs agencies to minimize “economic and regulatory burdens” of the ACA. Because the penalty associated with the individual mandate was eliminated, a federal judge in Texas ruled in December 2018 that the entire ACA was unconstitutional. However, the law remains in place pending appeal. These changes and court challenges may impact the number of individuals that elect to obtain public or private health insurance or the scope of such coverage, if purchased. The presidential administration and the U.S. Congress may take further action regarding the ACA, including, but not limited to, repeal or replacement. Additionally, all or a portion of the ACA and related subsequent legislation may be modified, repealed or otherwise invalidated through further legislation or judicial challenge, which could result in lower numbers of insured individuals, and reduced coverage for insured individuals. There is uncertainty regarding whether, when, and how the ACA will be further changed, what alternative provisions, if any, will be enacted, and the impact of alternative provisions on providers and other healthcare industry participants. Government efforts to repeal or change the ACA or to implement alternative reform measures could cause AdaptHealth’s revenues to decrease to the extent such legislation reduces Medicaid and/or Medicare reimbursement rates.

MIPPA delayed the implementation of a Medicare competitive bidding program for oxygen equipment and certain other DME items that was scheduled to begin on July 1, 2008, and instituted a 9.5% price reduction nationwide for these items as of January 1, 2009. The SCHIP Extension Act reduced Medicare reimbursement amounts for covered Part B drugs, including inhalation drugs that AdaptHealth provides, beginning April 1, 2008. DRA provisions negatively impacted reimbursement for oxygen equipment beginning in 2009 through the implementation of a capped rental arrangement. MMA changed the pricing formulas used to establish payment rates for inhalation drug therapies resulting

11

in significantly reduced reimbursement beginning in 2005, established a competitive acquisition program for DME, established a Recovery Audit Contractors program, which implemented a new method for recovery of Medicare overpayments by utilizing private companies operating on a contingent fee basis to identify and recoup Medicare overpayments, and implemented quality standards and accreditation requirements for DME suppliers. The RACs are empowered to audit claims submitted by healthcare providers and to withhold future payments, including in cases where the reimbursement rules are unclear or subject to differing interpretations. This activity, as well as the activity of intermediaries and others involved in government reimbursement, may include changes in long-standing interpretations of reimbursement rules, which could adversely impact AdaptHealth’s future financial condition and results of operations. In October 2008, CMS established Zone Program Integrity Contractors (“ZPICs”), who are responsible for ensuring the integrity of all Medicare-related claims. The ZPICs assumed the responsibilities previously held by Medicare’s Program Safeguard Contractors (“PSCs”). These legislative and regulatory provisions, as currently in effect have and will continue to adversely impact AdaptHealth’s financial condition and results of operations.

Impact of Competitive Bidding. In December 2003, MMA was signed into law. The MMA legislation directly impacted reimbursement for the primary respiratory and other DME products that AdaptHealth provides. Among other things, MMA established a competitive acquisition program for DME that was expected to commence in 2008, but was subsequently delayed by further legislation. MMA instructed CMS to establish and implement programs under which competitive acquisition areas would be established throughout the United States for purposes of awarding contracts for the furnishing of competitively priced items of DME, including oxygen equipment. The program was initially intended to be implemented in phases such that competition under the program would occur in nine of the largest metropolitan statistical areas (“MSAs”) in the first year and an additional 70 of the largest MSAs in a second, subsequent round of bidding. The second round was subsequently expanded to include 91 MSAs.

For each competitive acquisition area, CMS is required to conduct a competition under which providers submit bids to supply certain covered items of DME. Successful bidders are expected to meet certain program quality standards in order to be awarded a contract, and only successful bidders can supply the covered items to Medicare beneficiaries in the acquisition area (there are, however, regulations in place that allow non-contracted providers to continue to provide equipment and services to their existing customers at the new prices determined through the bidding process). The contracts are expected to be re-bid at least every three years. CMS is required to award contracts to multiple entities submitting bids in each area for an item or service but has the authority to limit the number of contractors in a competitive acquisition area to the number it determines to be necessary to meet projected demand. CMS concluded the bidding process for the first round of MSAs in September 2007. However, in July 2008, Congress enacted the MIPPA legislation which retroactively delayed the implementation of competitive bidding and reduced Medicare prices nationwide by 9.5% beginning in 2009 for the product categories, including oxygen, that were initially included in competitive bidding.

In 2009, CMS reinstituted the bidding process in the nine largest MSA markets. Reimbursement rates from the re-bidding process were publicly released by CMS on June 30, 2010. CMS announced average savings of approximately 32% off the current payment rates in effect for the product categories included in competitive bidding. As of January 1, 2011, these payment rates were in effect in the nine markets only (Charlotte, Cincinnati, Cleveland, Dallas, Kansas City, Miami, Orlando, Pittsburgh and Riverside). AdaptHealth’s annual Medicare revenues from the product categories in the nine markets affected by competitive bidding were approximately $5.6 million at the time the program commenced.

On January 30, 2013, CMS announced new, lower Medicare pricing for the second round of competitive bidding effective July 1, 2013. CMS announced average savings of approximately 45% for the product categories included in Round 2. The ACA legislation requires CMS to expand competitive bidding further to additional geographic markets (certain markets may be excluded at the discretion of CMS) or to use competitive bid pricing information to adjust the payment amounts otherwise in effect for areas that are not competitive acquisition areas by January 1, 2016.

CMS is required by law to re-compete competitive bidding contracts at least once every three years. With the Round 1 rebid contracts expiring on December 31, 2013, new Round 1 re-compete contracts and pricing went into effect on January 1, 2014. Round 1 re-compete bidding occurred in the same nine Metropolitan Statistical Areas (“MSAs”) as the Round 1 rebid. CMS’ contract prices under the Round 1 re-compete averaged 37% below Medicare’s fee schedule rates for the six product categories.

12

On March 7, 2019, CMS announced plans to consolidate the competitive bidding areas included in the Round 2 re-compete and Round 1 2017 DMEPOS Competitive Bidding Program into a single round of competition referred to as “Round 2021.” Round 2021 contracts are scheduled to become effective on January 1, 2021, and extend through December 31, 2023. The competitive bidding process has historically put pressure on the amount AdaptHealth is reimbursed in the markets in which it exists as well as in areas that are not subject to the Competitive Bidding Program. The rates required to win future competitive bids could continue to compress reimbursement rates. AdaptHealth will continue to monitor developments regarding the Competitive Bidding Program. While AdaptHealth cannot predict the outcome of the Competitive Bidding Program on its business in the future nor the Medicare payment rates that will be in effect in future years for the items subjected to competitive bidding, the program may materially adversely affect its future financial condition and results of operations.

Durable Medical Equipment Medicare Administrative Contractor. In order to ensure that Medicare beneficiaries only receive medically necessary and appropriate items and services, the Medicare program has adopted a number of documentation requirements. For example, the DME MAC Supplier Manuals provide that clinical information from the “patient’s medical record” is required to justify the initial and ongoing medical necessity for the provision of DME. Some DME MACs, CMS staff and government subcontractors have recently taken the position, among other things, that the “patient’s medical record” refers not to documentation maintained by the DME supplier but instead to documentation maintained by the patient’s physician, healthcare facility or other clinician, and that clinical information created by the DME supplier’s personnel and confirmed by the patient’s physician is not sufficient to establish medical necessity. It may be difficult, and sometimes impossible, for AdaptHealth to obtain documentation from other healthcare providers. Moreover, auditors’ interpretations of these policies are inconsistent and subject to individual interpretation, leading to significant increases in individual supplier and industry-wide perceived error rates. High error rates lead to further audit activity and regulatory burdens. If these or other burdensome positions are generally adopted by auditors, DME MACs, other contractors or CMS in administering the Medicare program, AdaptHealth would have the right to challenge these positions as being contrary to law. If these interpretations of the documentation requirements are ultimately upheld, however, it could result in AdaptHealth making significant refunds and other payments to Medicare, and AdaptHealth’s future revenues and cash flows from Medicare may be reduced. AdaptHealth cannot currently predict the adverse impact these interpretations of the Medicare documentation requirements might have on its financial condition and results of operations, but such impact could be material.

Federal and state budgetary and other cost-containment pressures will continue to impact the home respiratory care industry. AdaptHealth cannot predict whether new federal and state budgetary proposals will be adopted or the effect, if any, such proposals would have on its financial condition and results of operations.

Availability of Information

We file or furnish annual, quarterly and current reports, proxy statements and other documents with the Securities and Exchange Commission (the “SEC”) under the Exchange Act. The SEC maintains an internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers, including us, that file electronically with the SEC.

We also make available free of charge through our website, https://www.adapthealth.com/investor-relations, electronic copies of certain documents that we file with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information on our website or any other website is not incorporated by reference into, and does not constitute a part of, this Annual Report.

We operate in a rapidly changing environment that involves a number of risks. The following discussion highlights some of these risks. and others are discussed elsewhere in this report. These and other risks could materially and adversely affect our business, revenue, financial condition and results of operations.

13

Risks Related to Our Business and Industry

AdaptHealth’s revenue could be impacted by federal and state changes to reimbursement and other aspects of Medicaid and Medicare.

AdaptHealth derived approximately 32% of its revenue for the year ended December 31, 2019 from Medicare and various state-based Medicaid programs. These programs are subject to statutory and regulatory changes affecting overall spending, base rates or basis of payment, retroactive rate adjustments, annual caps that limit the amount that can be paid (including deductible and coinsurance amounts) for rehabilitation therapy services rendered to Medicare beneficiaries, administrative or executive orders and government funding restrictions, all of which may materially adversely affect the rates and frequency at which these programs reimburse AdaptHealth. For example, the Medicaid Integrity Contractor program is increasing the scrutiny placed on Medicaid payments and could result in recoupments of alleged overpayments in an effort to rein in Medicaid spending. Recent budget proposals and legislation at both the federal and state levels have called for cuts in reimbursement for healthcare providers participating in the Medicare and Medicaid programs. Enactment and implementation of measures to reduce or delay reimbursement or overall Medicare or Medicaid spending could result in substantial reductions in AdaptHealth’s revenue and profitability. Payors may disallow AdaptHealth’s requests for reimbursement based on determinations that certain costs are not reimbursable or reasonable because either adequate or additional documentation was not provided or because certain services were not covered or considered reasonably necessary. Additionally, revenue from these payors can be retroactively adjusted after a new examination during the claims settlement process or as a result of post-payment audits.

AdaptHealth’s business may be adversely impacted by healthcare reform efforts, including repeal of or significant modifications to, the ACA.

In recent years, the U.S. Congress and certain state legislatures have considered and passed a number of laws that are intended to result in significant changes to the healthcare industry. However, there is significant uncertainty regarding the future of the Patient Protection and Affordable Care Act (“ACA”), the most prominent of these reform efforts. The law has been subject to legislative and regulatory changes and court challenges, and the current presidential administration and certain members of Congress have stated their intent to repeal or make additional significant changes to the ACA, its implementation or its interpretation. In 2017, the Tax Cuts and Jobs Acts was enacted, which, effective January 1, 2019, among other things, removed penalties for not complying with ACA’s individual mandate to carry health insurance. In addition, President Trump has signed an executive order that directs agencies to minimize “economic and regulatory burdens” of the ACA. Because the penalty associated with the individual mandate was eliminated, a federal judge in Texas ruled in December 2018 that the entire ACA was unconstitutional. The presidential administration and the Centers for Medicare and Medicaid Services have both stated that the ruling will have no immediate effect, and on December 18, 2019, the Fifth Circuit U.S. Court of Appeals upheld the lower court’s finding that the individual mandate is unconstitutional and remanded the case back to the lower court to reconsider its earlier invalidation of the full ACA. Pending review, the law remains in effect, but it is unclear at this time what effect the latest ruling will have on the status of the ACA. These changes and court challenges may impact the number of individuals that elect to obtain public or private health insurance or the scope of such coverage, if purchased. The presidential administration and the U.S. Congress may take further action regarding the ACA, including, but not limited to, repeal or replacement. Additionally, all or a portion of the ACA and related subsequent legislation may be modified, repealed or otherwise invalidated through further legislation or judicial challenge, which could result in reduced funding for state Medicaid programs, lower numbers of insured individuals, and reduced coverage for insured individuals. There is uncertainty regarding whether, when, and how the ACA will be further changed, what alternative provisions, if any, will be enacted, and the impact of alternative provisions on providers and other healthcare industry participants. Government efforts to repeal or change the ACA or to implement alternative reform measures could cause AdaptHealth’s revenues to decrease to the extent such legislation reduces Medicaid and/or Medicare reimbursement rates.

14

AdaptHealth is affected by continuing efforts by private third-party payors to control their costs. If AdaptHealth agrees to lower its reimbursement rates due to pricing pressures from private third-party payors, AdaptHealth’s financial condition and results of operations would likely deteriorate.

AdaptHealth derived approximately 57% of its revenue for the year ended December 31, 2019 from third-party private payors. Such payors continually seek to control the cost of providing healthcare services through direct contracts with healthcare providers, increased oversight and greater enrollment of patients in managed care programs and preferred provider organizations. These private payors are increasingly demanding discounted fee structures, including setting reimbursement rates based on Medicare fee schedules and the assumption by the healthcare provider of all or a portion of the financial risk. Reimbursement payments under private payor programs may not remain at current levels and may not be sufficient to cover the costs allocable to patients eligible for reimbursement pursuant to such programs, and AdaptHealth may suffer deterioration in pricing flexibility, changes in payor mix and growth in operating expenses in excess of increases in payments by private third-party payors. AdaptHealth may be compelled to lower its prices due to increased pricing pressures, which could adversely impact AdaptHealth’s financial condition and results of operations.

Changes in governmental or private payor supply replenishment schedules could adversely affect AdaptHealth.

AdaptHealth generated approximately 42% of its revenue for the year ended December 31, 2019 through the sale of masks, tubing and other ancillary products related to patients utilizing CPAP devices. Medicare, Medicaid and private payors limit the number of times per year that patients may purchase such supplies. To the extent that any governmental or private payor revises their resupply guidelines to reduce the number of times such supplies can be purchased, such reductions could adversely impact AdaptHealth’s revenue, financial condition and results of operations.

AdaptHealth generates a significant portion of its revenue from the provision of sleep therapy equipment and supplies to patients, and AdaptHealth is therefore highly dependent on it for its success.

Approximately 58% of AdaptHealth’s revenue for the year ended December 31, 2019 was generated from the provision of sleep therapy equipment and supplies to patients. AdaptHealth’s ability to execute its growth strategy therefore depends upon the adoption by patients, physicians and sleep centers, among others, of AdaptHealth’s sleep therapy equipment and supplies to treat their patients suffering from OSA. There can be no assurance that AdaptHealth will continue to maintain broad acceptance among physicians and patients. Any failure by AdaptHealth to satisfy physician or patient demand or to maintain meaningful market acceptance will harm its business and future prospects.

AdaptHealth may be adversely affected by consolidation among health insurers and other industry participants.

In recent years, a number of health insurers have merged or increased efforts to consolidate with other non-governmental payors. Insurers are also increasingly pursuing alignment initiatives with healthcare providers. Consolidation within the health insurance industry may result in insurers having increased negotiating leverage and competitive advantages, such as greater access to performance and pricing data. AdaptHealth’s ability to negotiate prices and favorable terms with health insurers in certain markets could be affected negatively as a result of this consolidation. In addition, the shift toward value-based payment models could be accelerated if larger insurers, including those engaging in consolidation activities, find these models to be financially beneficial. There can be no assurance that AdaptHealth will be able to negotiate favorable terms with payors and otherwise respond effectively to the impact of increased consolidation in the payor industry or vertical integration efforts.

AdaptHealth’s payor contracts are subject to renegotiation or termination, which could result in a decrease in AdaptHealth’s revenue or profits.

The majority of AdaptHealth’s payor contracts are subject to unilateral termination by either party on between 30 and 90 days’ prior written notice. Such contracts are routinely amended (sometimes by unilateral action by payors regarding payment policy), renegotiated, subjected to a bidding process with AdaptHealth’s competitors, or terminated altogether. Sometimes in the renegotiation process, certain lines of business may not be renewed or a payor may enlarge

15

its provider network or otherwise adversely change the way it conducts its business with AdaptHealth. In other cases, a payor may reduce its provider network in exchange for lower payment rates. AdaptHealth’s revenue from a payor may also be adversely affected if the payor alters its utilization management expectations and/or administrative procedures for payments and audits, changes its order of preference among the providers to which it refers business or imposes a third-party administrator, network manager or other intermediary. Any reduction in AdaptHealth’s projected home respiratory therapy/home medical equipment revenues as a result of these or other factors could lead to a reduction in AdaptHealth’s revenues. There can be no assurance that AdaptHealth’s payor contracts will not be terminated or altered in ways that are unfavorable to AdaptHealth as a result of renegotiation or such administrative changes. Payors may decide to refer business to their owned provider subsidiaries, such as specialty pharmaceuticals and/or HME networks owned by such payors or by third-party management companies. These activities could materially reduce AdaptHealth’s revenue from these payors.

If AdaptHealth fails to manage the complex and lengthy reimbursement process, its revenue, financial condition and results of operations could suffer.

Because AdaptHealth depends upon reimbursement from Medicare, Medicaid and third-party payors for a significant majority of its revenues, AdaptHealth’s revenue, financial condition and results of operations may be affected by the reimbursement process, which in the healthcare industry is complex and can involve lengthy delays between the time that services are rendered and the time that the reimbursement amounts are settled. Depending on the payor, AdaptHealth may be required to obtain certain payor-specific documentation from physicians and other healthcare providers before submitting claims for reimbursement. Certain payors have filing deadlines and will not pay claims submitted after such time. AdaptHealth cannot ensure that it will be able to effectively manage the reimbursement process and collect payments for its equipment and services promptly.

If the Centers for Medicare and Medicaid Services (“CMS”) require prior authorization or implement changes in documentation necessary for AdaptHealth’s products, AdaptHealth’s revenue, financial condition and results of operations could be negatively impacted.

CMS has established and maintains a Master List of Items Frequently Subject to Unnecessary Utilization of certain DMEPOS that the Secretary determined, based on prior payment experience, are frequently subject to unnecessary utilization. This list identifies items that CMS has determined could potentially be subject to Prior Authorization as a condition of Medicare payment. Since 2012, CMS has also maintained a list of categories of DMEPOS items to include face-to-face encounters with practitioners and written orders before furnishing the items to beneficiaries. On November 8, 2019 CMS combined and harmonized the two lists to create a single unified Master List of DMEPOS Items Potentially Subject to Face-To-Face Encounter and Written Order Prior to Delivery and/or Prior Authorization Requirements (“Master List”). In November 2019, CMS also reduced the financial threshold for inclusion on the Master List. With certain exceptions for reductions in Payment Threshold, items remain on the Master List for 10 years from the date the item was added to the Master List. The presence of an item on the Master List does not automatically mean that a prior authorization is required. Currently, CMS selects items from the Master List for inclusion on the “Required Prior Authorization List.” The expanded Master List would increase the number of DMEPOS items potentially eligible to be selected for prior authorization, face-to-face encounter and written order prior to delivery requirements as a condition of payment.

On April 22, 2019, CMS has added items that are a part of AdaptHealth’s product lines to the Master List of Items Frequently Subject to Unnecessary Utilization. If CMS adds additional products to the Master List, expands Prior Authorization requirements or expands Face-to-Face Encounter and Written Order Prior to Delivery requirements to products in AdaptHealth’s product line, such requirements may adversely impact AdaptHealth’s revenue, financial condition and results from operations.

Reimbursement claims are subject to audits by various governmental and private payor entities from time to time and such audits may negatively affect AdaptHealth’s revenue, financial condition and results of operations.

AdaptHealth receives a substantial portion of its revenues from the Medicare program. Medicare reimbursement claims made by healthcare providers, including HME providers, are subject to audit from time to time by governmental

16

payors and their agents, such as Medicare Administrative Contractors (“MACs”) that act as fiscal intermediaries for all Medicare billings, auditors contracted by CMS, and insurance carriers, as well as HHS-OIG, CMS and state Medicaid programs. These include specific requirements imposed by the Durable Medical Equipment Medicare Administrative Contractor (“DME MAC”) Supplier Manuals. To ensure compliance with Medicare, Medicaid and other regulations, government agencies or their contractors, including MACs, Recovery Audit Contractors and Zone Program Integrity Contractors, often conduct audits and request customer records and other documents to support our claims submitted for payment of services rendered. In many instances, there are only limited publicly-available guidelines and methodologies for determining errors with certain audits. As a result, there can be a significant lack of clarity regarding required documentation and audit methodology. The clarity and completeness of each patient medical file, some of which is the work product of physicians not employed by AdaptHealth, is essential to successfully challenging any payment denials. For example, the DME MAC Supplier Manuals provide that clinical information from the “patient’s medical record” is required to justify the initial and ongoing medical necessity for the provision of DME. Some DME MACs, CMS staff and government subcontractors have taken the position, that the “patient’s medical record” refers not to documentation maintained by the Durable Medical Equipment (“DME”) supplier but instead to documentation maintained by the patient’s physician, healthcare facility or other clinician, and that clinical information created by the DME supplier’s personnel and confirmed by the patient’s physician is not sufficient to establish medical necessity. If the physicians working with AdaptHealth’s patients do not adequately document, among other things, their diagnoses and plans of care, AdaptHealth’s risks related to audits and payment denials in general are greater. Depending on the nature of the conduct found in such audits and whether the underlying conduct could be considered systemic, the resolution of these audits could adversely impact AdaptHealth’s revenue, financial condition and results of operations.

CMS has developed and instituted various audit programs under which CMS contracts with private companies to conduct claims and medical record audits. These audits are in addition to those conducted by existing MACs. Some contractors are paid a percentage of the overpayments recovered. One type of audit contractor, the Recovery Audit Contractors (“RACs”), receive claims data directly from MACs on a monthly or quarterly basis and are authorized to review previously paid claims. It is unclear whether CMS intends to conduct RAC prepayment reviews in the future and if so, what providers and claims would be the focus of those reviews.

Moreover, the ACA now requires that overpayments be reported and returned within 60 days of identification of the overpayment. Any overpayment retained after this deadline will now be considered an “obligation” for purposes of the False Claims Act and subject to fines and penalties. CMS currently has a six-year “lookback period,” for reporting and returning the “identified” overpayment. Private payors also reserve rights to conduct audits and make monetary adjustments.

AdaptHealth’s third-party payors may also, from time to time, request audits of the amounts paid, or to be paid, to AdaptHealth. AdaptHealth could be adversely affected in some of the markets in which it operates if the auditing payor alleges substantial overpayments were made to AdaptHealth due to coding errors or lack of documentation to support medical necessity determinations.

AdaptHealth cannot currently predict the adverse impact, if any, that these audits, methodologies and interpretations might have on its financial condition and results of operations.

Significant reimbursement reductions and/or exclusion from markets or product lines could adversely affect AdaptHealth.

All Medicare Durable Medical Equipment, Prosthetics, Orthotics, & Supplies (“DMEPOS”) Competitive Bidding Program contracts expired on December 31, 2018, and, as a result, there is a temporary gap in the entire DMEPOS Competitive Bidding Program that CMS expects will last until December 31, 2020.

On March 7, 2019, CMS announced plans to consolidate the competitive bidding areas (‘CBAs”) included in the Round 1 2017 and Round 2 Recompete DMEPOS Competitive Bidding Programs into a single round of competition named “Round 2021.” Round 2021 contracts are scheduled to become effective on January 1, 2021, and extend through December 31, 2023. The bid window for the Round 2021 DMEPOS Competitive Bidding Program closed on September 18, 2019.

17