Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - AeroVironment Inc | avav-20201203xex99d1.htm |

| 8-K - 8-K - AeroVironment Inc | avav-20201203x8k.htm |

Exhibit 99.2

| second Quarter Fiscal Year 2021 Earnings Presentation December 8, 2020 |

| Certain statements in this presentation may constitute "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” or words or phrases with similar meaning. Forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. Factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to, our ability to successfully consummate the transactions contemplated by the agreement to purchase Telerob on a timely basis, if at all, including the satisfaction of the closing conditions of such transactions; the risk that disruptions will occur from the transactions that will harm our business; any disruptions or threatened disruptions to our relationships with our distributors, suppliers, customers and employees; the ability to timely and sufficiently integrate international operations into our ongoing business and compliance programs; reliance on sales to the U.S. government; availability of U.S. government funding for defense procurement and R&D programs; changes in the timing and/or amount of government spending; our ability to perform under existing contracts and obtain new contracts; risks related to our international business, including compliance with export control laws; potential need for changes in our long-term strategy in response to future developments; the extensive regulatory requirements governing our contracts with the U.S. Government and international customers; the consequences to our financial position, business and reputation that could result from failing to comply with such regulatory requirements; unexpected technical and marketing difficulties inherent in major research and product development efforts; the impact of potential security and cyber threats; changes in the supply and/or demand and/or prices for our products and services; the activities of competitors and increased competition; failure of the markets in which we operate to grow; uncertainty in the customer adoption rate of commercial use unmanned aircraft systems; failure to remain a market innovator and create new market opportunities; changes in significant operating expenses, including components and raw materials; failure to develop new products; the extensive regulatory requirements governing our contracts with the U.S. government; risk of litigation, including but not limited to pending litigation arising from the sale of our EES business; product liability, infringement and other claims; changes in the regulatory environment; the impact of the outbreak related to the strain of coronavirus known as COVID-19 on our business operations; and general economic and business conditions in the United States and elsewhere in the world. For a further list and description of such risks and uncertainties, see the reports we file with the Securities and Exchange Commission. We do not intend, and undertake no obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. For a further list and description of such risks and uncertainties, see the reports we file with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available at www.sec.gov or on our website at www.investor.avinc.com/financial-information. We do not intend, and undertake no obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Safe Harbor Statement |

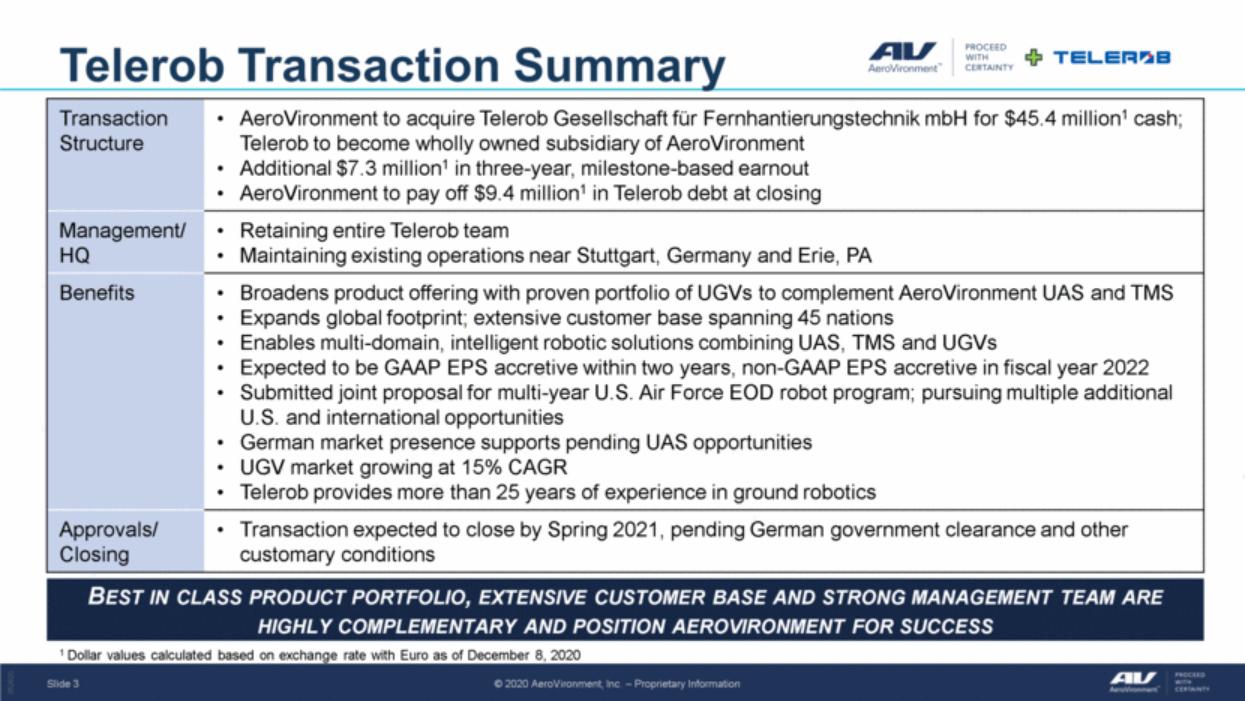

| Telerob Transaction Summary Transaction Structure AeroVironment to acquire Telerob Gesellschaft für Fernhantierungstechnik mbH for $45.4 million1 cash; Telerob to become wholly owned subsidiary of AeroVironment Additional $7.3 million1 in three-year, milestone-based earnout AeroVironment to pay off $9.4 million1 in Telerob debt at closing Management/ HQ Retaining entire Telerob team Maintaining existing operations near Stuttgart, Germany and Erie, PA Benefits Broadens product offering with proven portfolio of UGVs to complement AeroVironment UAS and TMS Expands global footprint; extensive customer base spanning 45 nations Enables multi-domain, intelligent robotic solutions combining UAS, TMS and UGVs Expected to be GAAP EPS accretive within two years, non-GAAP EPS accretive in fiscal year 2022 Submitted joint proposal for multi-year U.S. Air Force EOD robot program; pursuing multiple additional U.S. and international opportunities German market presence supports pending UAS opportunities UGV market growing at 15% CAGR Telerob provides more than 25 years of experience in ground robotics Approvals/ Closing Transaction expected to close by Spring 2021, pending German government clearance and other customary conditions Best in class product portfolio, extensive customer base and strong management team are highly complementary and position aerovironment for success 1 Dollar values calculated based on exchange rate with Euro as of December 8, 2020 |

| Continue to deliver strong results during unprecedented and challenging COVID-19 pandemic, keeping us on track to achieve fiscal year 2021 objectives Achieved significant milestones during quarter in key growth initiatives within tactical UAS, tactical missile systems and HAPS Successfully executing long-term growth strategy, including deploying strong balance sheet with Telerob acquisition, while delivering significant value to shareholders Second Quarter Fiscal Year 2021 Key Messages Executing our plan for fourth consecutive year of profitable topline growth |

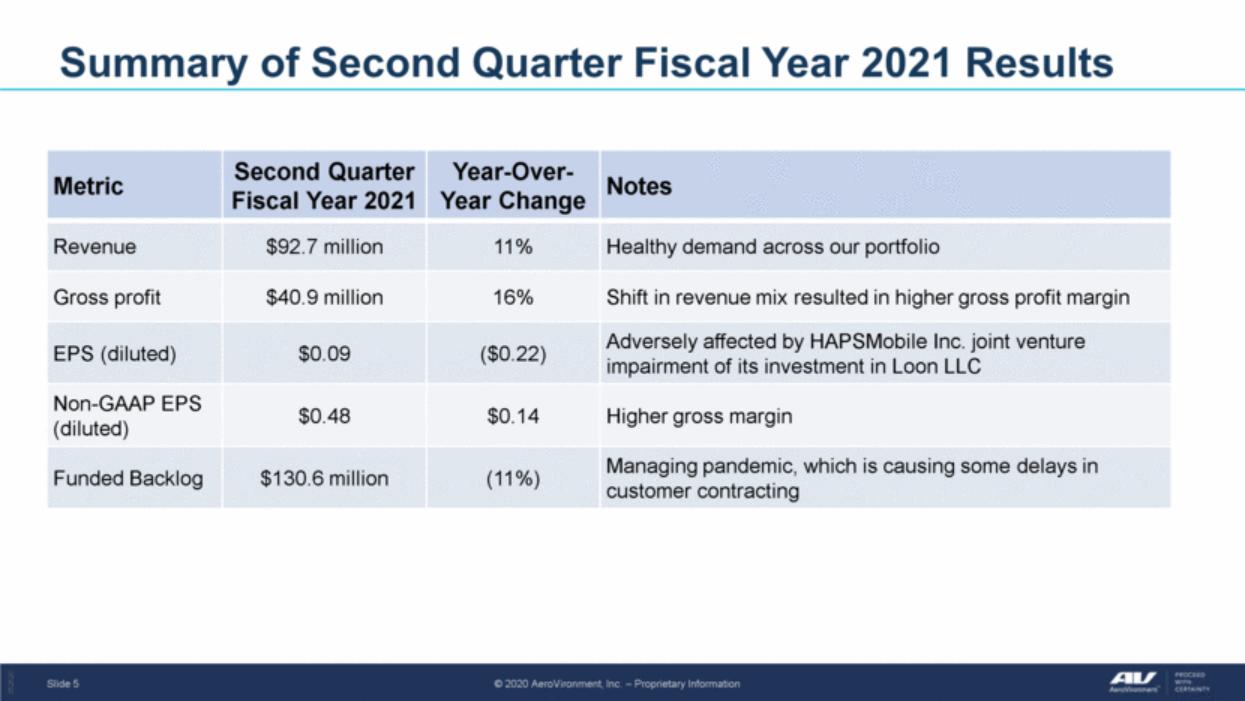

| Summary of Second Quarter Fiscal Year 2021 Results Metric Second Quarter Fiscal Year 2021 Year-Over-Year Change Notes Revenue $92.7 million 11% Healthy demand across our portfolio Gross profit $40.9 million 16% Shift in revenue mix resulted in higher gross profit margin EPS (diluted) $0.09 ($0.22) Adversely affected by HAPSMobile Inc. joint venture impairment of its investment in Loon LLC Non-GAAP EPS (diluted) $0.48 $0.14 Higher gross margin Funded Backlog $130.6 million (11%) Managing pandemic, which is causing some delays in customer contracting |

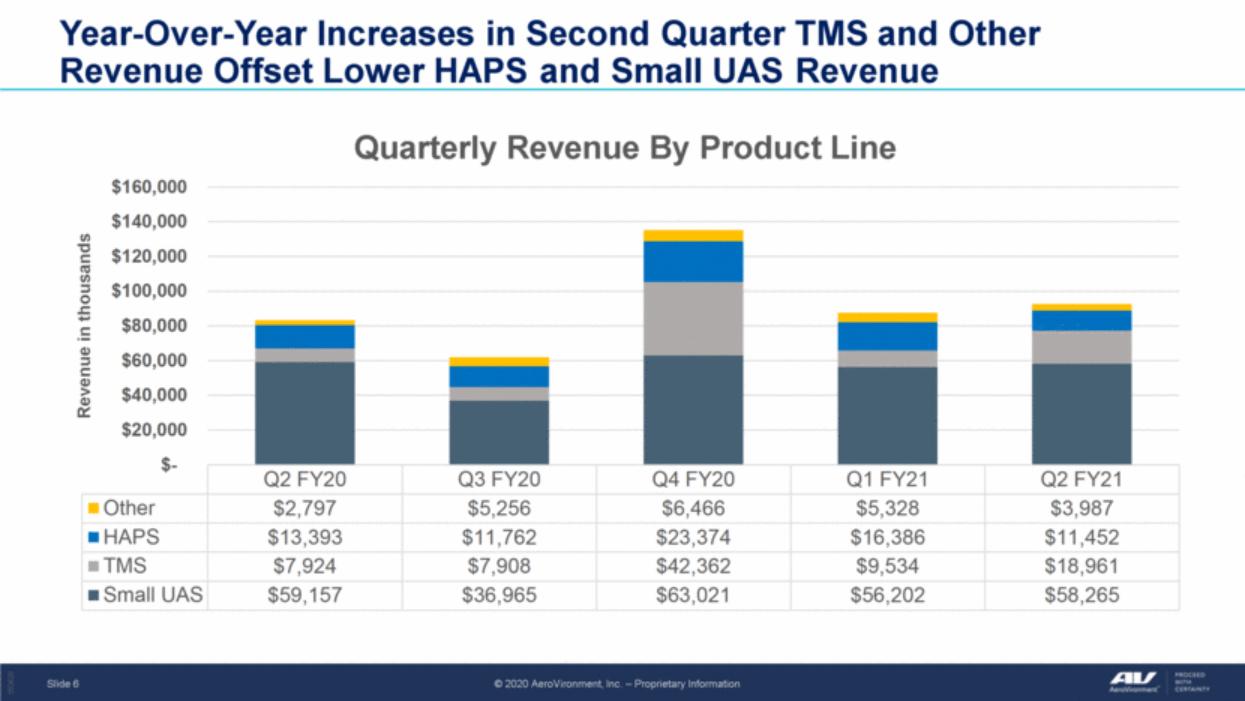

| Year-Over-Year Increases in Second Quarter TMS and Other Revenue Offset Lower HAPS and Small UAS Revenue |

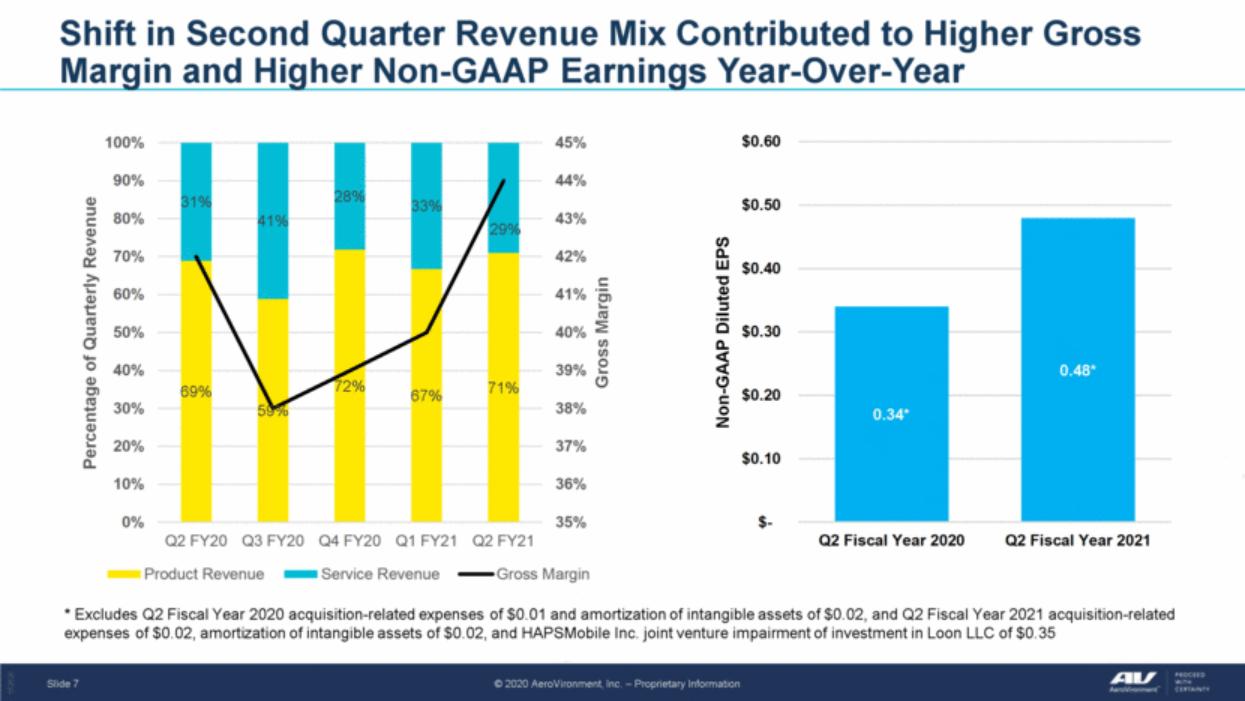

| Shift in Second Quarter Revenue Mix Contributed to Higher Gross Margin and Higher Non-GAAP Earnings Year-Over-Year * Excludes Q2 Fiscal Year 2020 acquisition-related expenses of $0.01 and amortization of intangible assets of $0.02, and Q2 Fiscal Year 2021 acquisition-related expenses of $0.02, amortization of intangible assets of $0.02, and HAPSMobile Inc. joint venture impairment of investment in Loon LLC of $0.35 0.34 * 0.48 * $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 Q2 Fiscal Year 2020 Q2 Fiscal Year 2021 Non - GAAP Diluted EPS 69% 59% 72% 67% 71% 31% 41% 28% 33% 29% 35% 36% 37% 38% 39% 40% 41% 42% 43% 44% 45% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q2 FY20 Q3 FY20 Q4 FY20 Q1 FY21 Q2 FY21 Gross Margin Percentage of Quarterly Revenue Product Revenue Service Revenue Gross Margin |

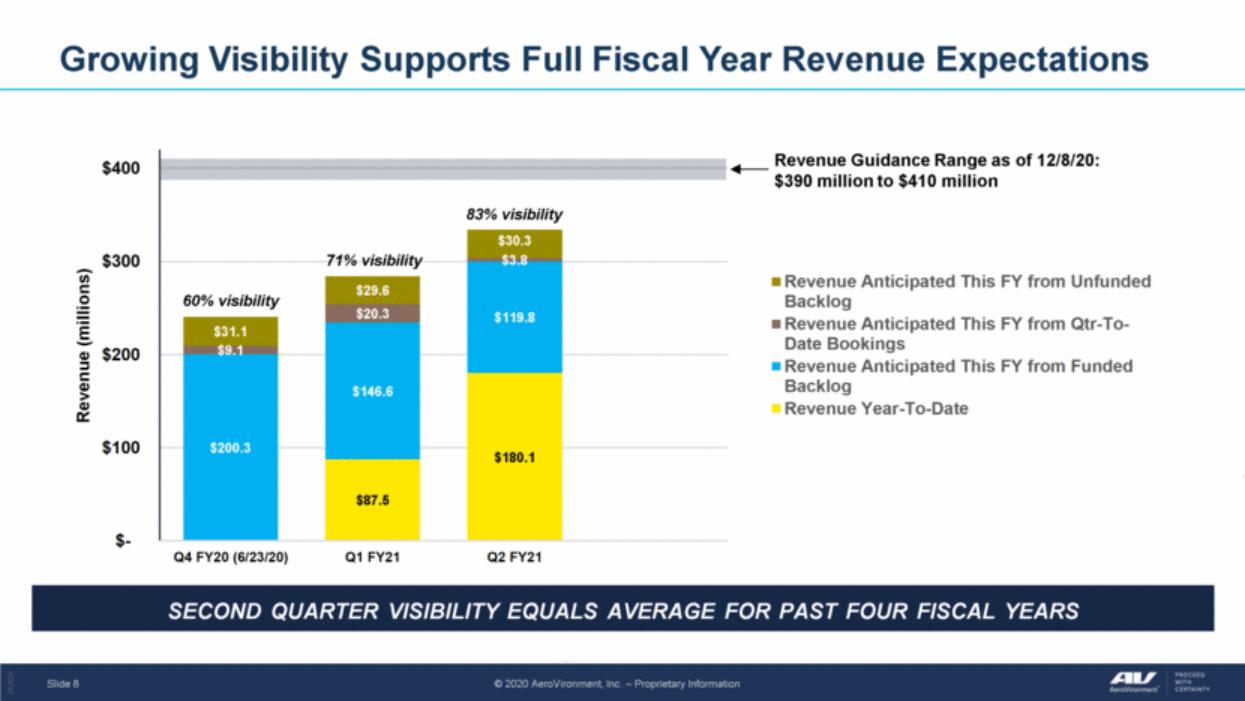

| Growing Visibility Supports Full Fiscal Year Revenue Expectations second quarter visibility equals average for past four fiscal years Revenue Guidance Range as of 12/8/20: $390 million to $410 million 60% visibility 71% visibility 83% visibility $87.5 $180.1 $200.3 $146.6 $119.8 $9.1 $20.3 $3.8 $31.1 $29.6 $30.3 $- $100 $200 $300 $400 Q4 FY20 (6/23/20) Q1 FY21 Q2 FY21 Q3 FY21 Revenue (millions) Revenue Anticipated This FY from Unfunded Backlog Revenue Anticipated This FY from Qtr-To- Date Bookings Revenue Anticipated This FY from Funded Backlog Revenue Year-To-Date |

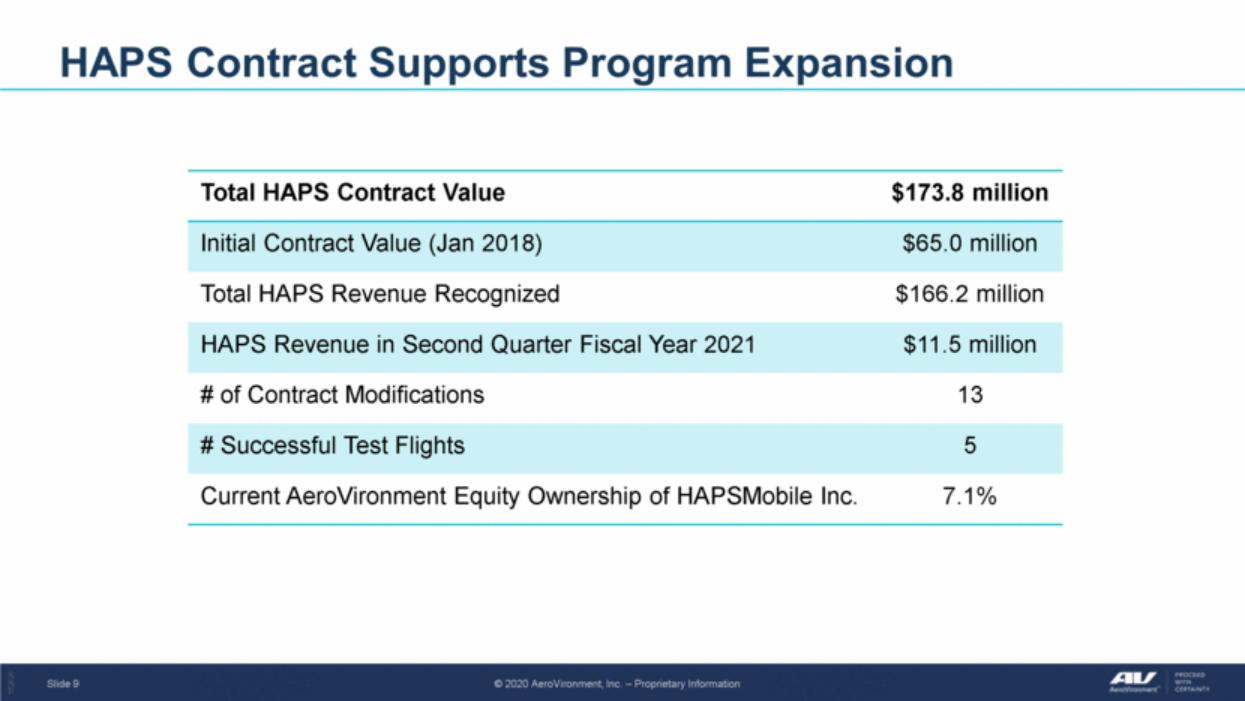

| Total HAPS Contract Value $173.8 million Initial Contract Value (Jan 2018) $65.0 million Total HAPS Revenue Recognized $166.2 million HAPS Revenue in Second Quarter Fiscal Year 2021 $11.5 million # of Contract Modifications 13 # Successful Test Flights 5 Current AeroVironment Equity Ownership of HAPSMobile Inc. 7.1% HAPS Contract Supports Program Expansion |

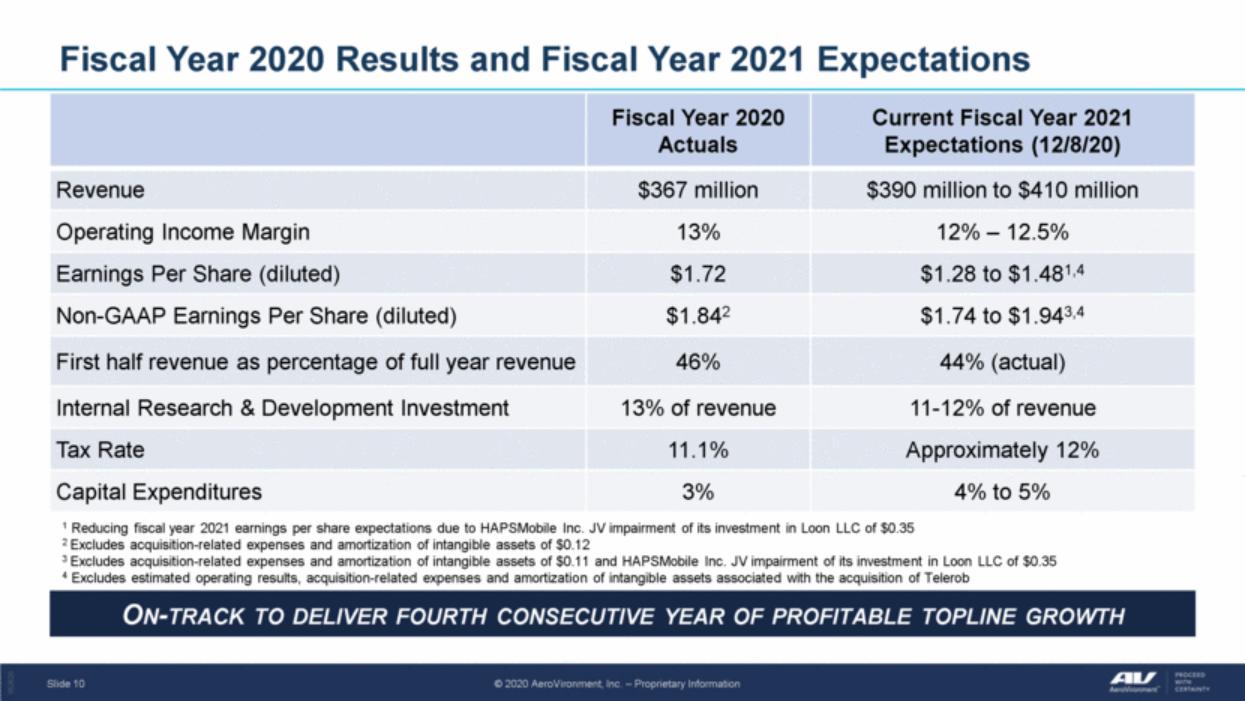

| Fiscal Year 2020 Results and Fiscal Year 2021 Expectations Fiscal Year 2020 Actuals Current Fiscal Year 2021 Expectations (12/8/20) Revenue $367 million $390 million to $410 million Operating Income Margin 13% 12% – 12.5% Earnings Per Share (diluted) $1.72 $1.28 to $1.481,4 Non-GAAP Earnings Per Share (diluted) $1.842 $1.74 to $1.943,4 First half revenue as percentage of full year revenue 46% 44% (actual) Internal Research & Development Investment 13% of revenue 11-12% of revenue Tax Rate 11.1% Approximately 12% Capital Expenditures 3% 4% to 5% On-track to deliver fourth consecutive year of profitable topline growth 1 Reducing fiscal year 2021 earnings per share expectations due to HAPSMobile Inc. JV impairment of its investment in Loon LLC of $0.35 2 Excludes acquisition-related expenses and amortization of intangible assets of $0.12 3 Excludes acquisition-related expenses and amortization of intangible assets of $0.11 and HAPSMobile Inc. JV impairment of its investment in Loon LLC of $0.35 4 Excludes estimated operating results, acquisition-related expenses and amortization of intangible assets associated with the acquisition of Telerob |

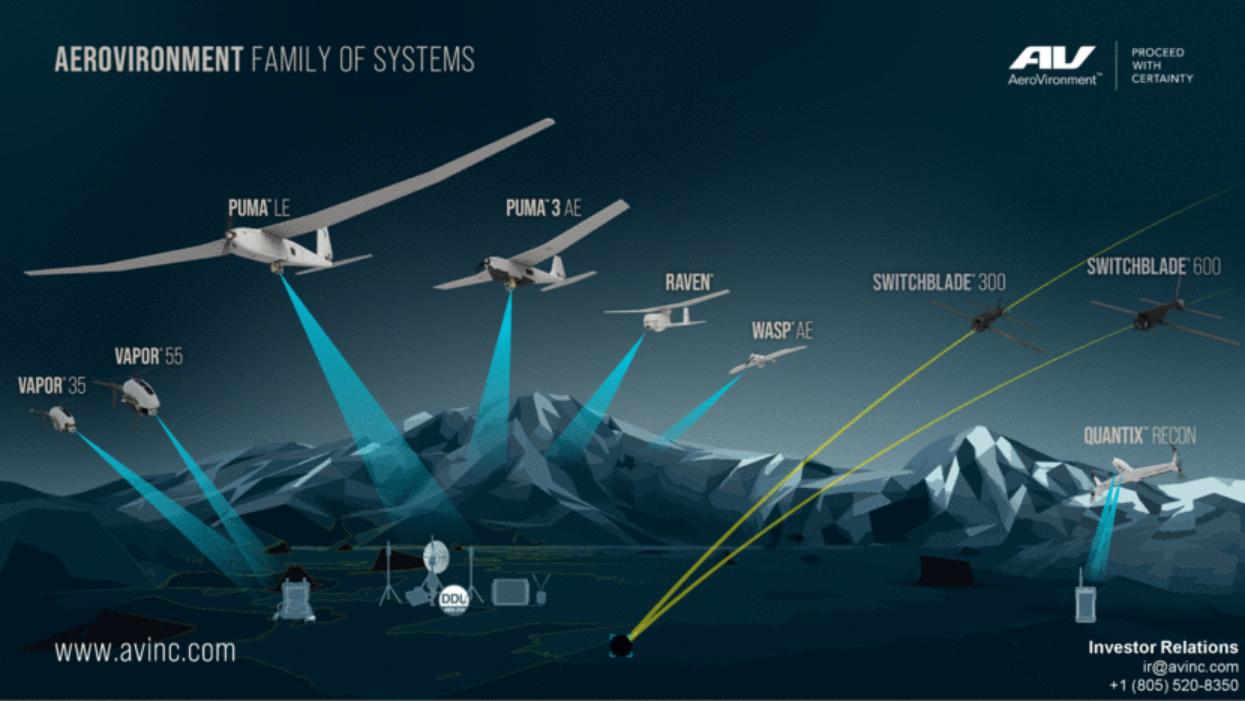

| Investor Relations ir@avinc.com +1 (805) 520-8350 |

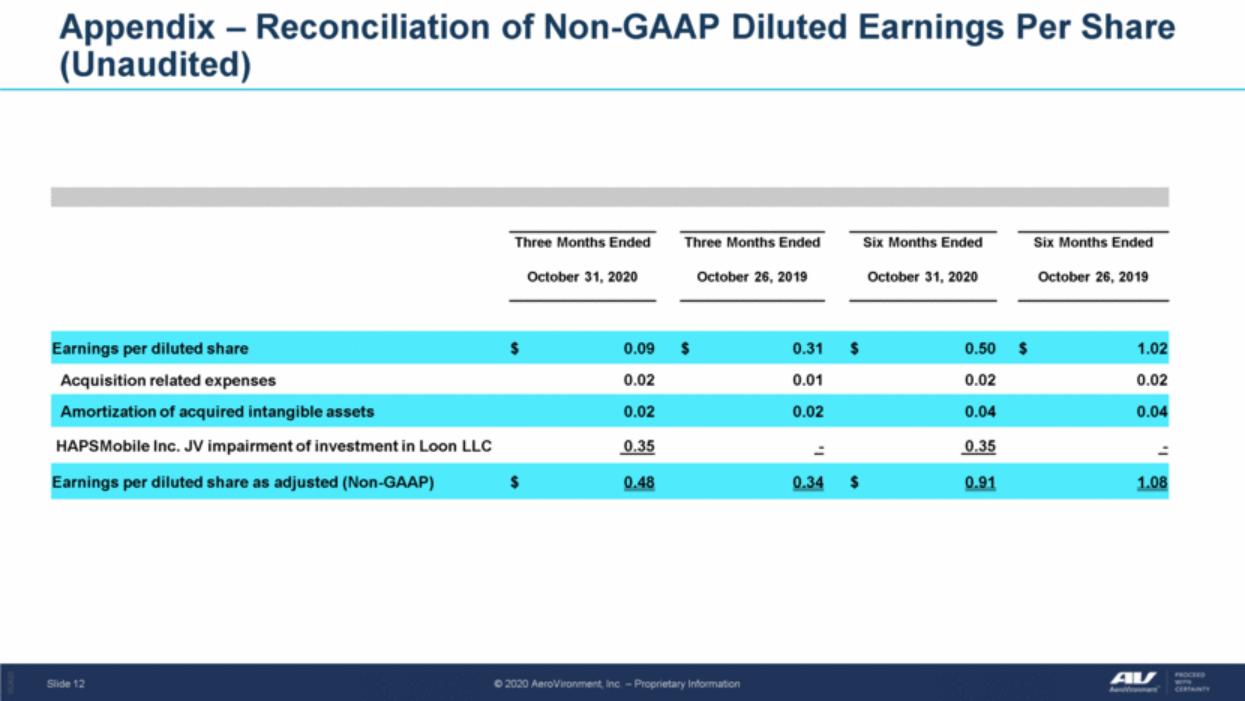

| Appendix – Reconciliation of Non-GAAP Diluted Earnings Per Share (Unaudited) Three Months Ended Three Months Ended Six Months Ended Six Months Ended October 31, 2020 October 26, 2019 October 31, 2020 October 26, 2019 Earnings per diluted share $ 0.09 $ 0.31 $ 0.50 $ 1.02 Acquisition related expenses 0.02 0.01 0.02 0.02 Amortization of acquired intangible assets 0.02 0.02 0.04 0.04 HAPSMobile Inc. JV impairment of investment in Loon LLC 0.35 - 0.35 - Earnings per diluted share as adjusted (Non-GAAP) $ 0.48 0.34 $ 0.91 1.08 |

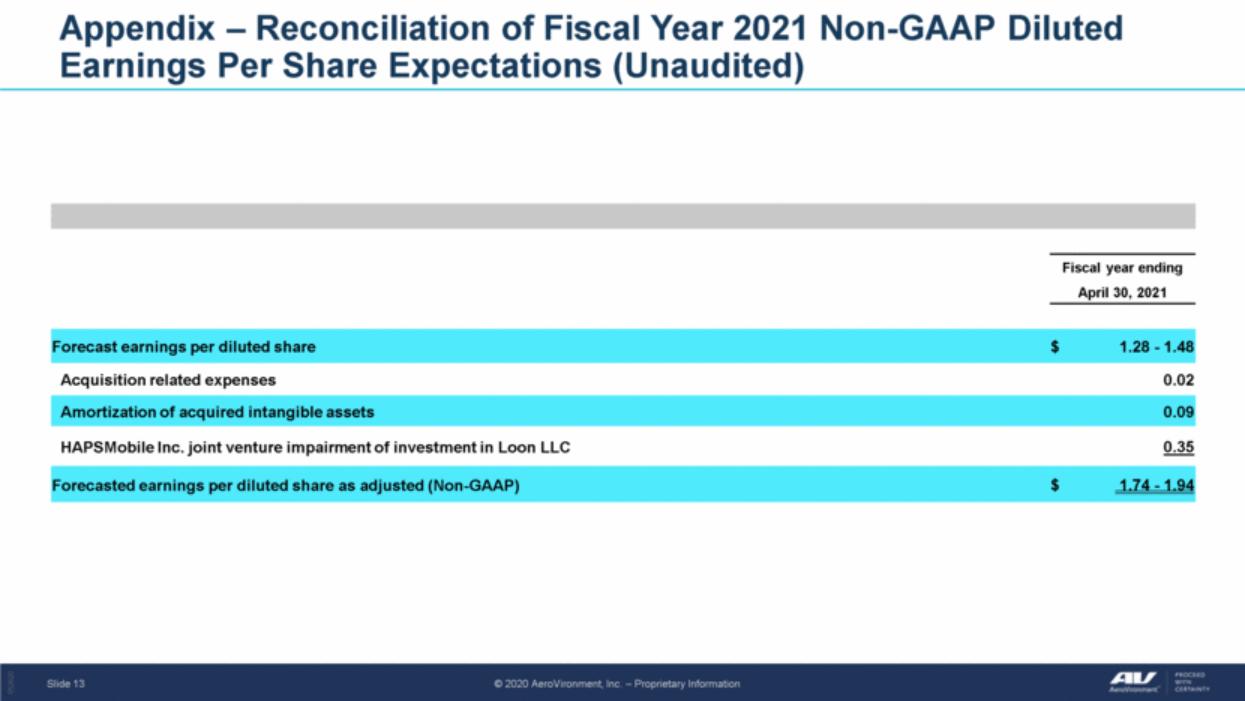

| Appendix – Reconciliation of Fiscal Year 2021 Non-GAAP Diluted Earnings Per Share Expectations (Unaudited) Fiscal year ending April 30, 2021 Forecast earnings per diluted share $ 1.28 - 1.48 Acquisition related expenses 0.02 Amortization of acquired intangible assets 0.09 HAPSMobile Inc. joint venture impairment of investment in Loon LLC 0.35 Forecasted earnings per diluted share as adjusted (Non-GAAP) $ 1.74 - 1.94 |