Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Urban Edge Properties | ue-20201116.htm |

INVESTOR PRESENTATION NOVEMBER 2020

Forward Looking Statements Forward-looking statements are not guarantees of future performance. They represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Our actual future results, financial condition and business may differ materially from those expressed in these forward-looking statements. You can find many of these statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “may” or other similar expressions in this presentation. Many of the factors that will determine the outcome of forward-looking statements are beyond our ability to control or predict and include, among others: (i) the economic, political and social impact of, and uncertainty relating to, the COVID-19 pandemic, including (a) the effectiveness or lack of effectiveness of governmental relief in providing assistance to large and small businesses, particularly our retail enants,t that have suffered significant declines in revenues as a result of mandatory business shut-downs, “shelter-in-place” or “stay-at-home” orders and social distancing practices, as well as to individuals adversely impacted by the COVID-19 pandemic, (b) the duration of any such orders or other formal recommendations for social distancing and the speed and extent to which revenues of our retail tenants recover following the lifting of any such orders or recommendations, (c) the potential impact of any such events on the obligations of the Company’s tenants to make rent and other payments or honor other commitments under existing leases, (d) the potential adverse impact on returns from redevelopment projects, and (e) the broader impact of the severe economic contraction and increase in unemployment that has occurred in the short term and negative consequences that will occur if these trends are not quickly reversed; (ii) the loss or bankruptcy of major tenants, particularly in light of the adverse impact to the financial health of many retailers that has occurred and continues to occur as a result of the COVID-19 pandemic; (iii) the ability and willingness of the Company’s tenants to renew their leases with the Company upon expiration, the Company’s ability to re-lease its properties on the same or better terms, or at all, in the event of nonrenewal or in the event the Company exercises its right to replace an existing tenant, particularly, in light of the adverse impact to the financial health of many retailers that has occurred and continues to occur as a result of the COVID-19 pandemic and the significant uncertainty as to when and the conditions under which potential tenants will be able to operate physical retail locations in future; (iv) the impact of e-commerce on our tenants’ business; (v) macroeconomic conditions, such as a disruption of, or lack of access to the capital markets, as well as the recent significant decline in the Company’s share price from prices prior to the spread of the COVID-19 pandemic; (vi) the Company’s success in implementing its business strategy and its ability to identify, underwrite, finance, consummate and integrate diversifying acquisitions and investments; (vii) changes in general economic conditions or economic conditions in the markets in which the Company competes, and their effect on the Company’s revenues, earnings and funding sources, and on those of its tenants; (viii) increases in the Company’s borrowing costs as a result of changes in interest rates and other factors, including the potential phasing out of LIBOR after 2021; (ix) the Company’s ability to pay down, refinance, restructure or extend its indebtedness as it becomes due and potential limitations on the Company’s ability to borrow funds under its existing credit facility as a result of covenants relating to the Company’s financial results in the second quarter of 2020 or future quarters; (x) potentially higher costs associated with the Company’s development, redevelopment and anchor repositioning projects, and the Company’s ability to lease the properties at projected rates; (xi) the Company’s liability for environmental matters; (xii) damage to the Company’s properties from catastrophic weather and other natural events, and the physical effects of climate change; (xiii) the Company’s ability and willingness to maintain tsi qualification as a REIT in light of economic, market, legal, tax and other considerations; (xiv) information technology security breaches; and (xv) the loss of key executives. For further discussion of factors that could materially affect the outcome of our forward-looking statements, see “Risk Factors” in Part I, Item 1A, of our Annual Report on Form 10-K for the year ended December 31, 2019 and our Form 10-Q for the quarter ended September 30, 2020, and the other documents filed by the Company with the Securities and Exchange Commission. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date of this presentation. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances occurring after the date of this presentation. 2

Highlights 1. Third quarter results • FFO as Adjusted was $0.19/share, down 34% compared to 3Q19 and flat compared to 2Q20 • SP NOI with and without redevelopment decreased by 20% vs 3Q19 driven by elevated bad debt expense • SP occupancy increased to 93.0%, up 30 bp compared to 3Q19 and up 40 bp compared to 2Q20, primarily due to the AAA Wholesale lease in Lodi, NJ • Executed 16 new leases, renewals, and options totaling 311K sf • Generated average cash rent spreads of 16% on same-space leases totaling 163K sf 2. COVID-19 business update(1) • Collection rate has continued to improve since April. Collected 87% of October gross rent, 83% for the third quarter and 77% for the second quarter • 98% of portfolio GLA and ABR is open which compares to 55% of portfolio GLA and 50% of portfolio ABR open at the end of May • Rent deferrals totaling ~$8 million, or 2% of annual gross rent have been executed or approved, which have resulted in value creation from eliminating use restrictions, expanding no-build areas and increasing lease term in connection with the deferral agreements 3. Leasing activity is strong with approximately 1 million sf of activity: • Grocer demand remains the most robust: - Recently executed – ShopRite (Huntington), Uncle Giuseppe’s (Briarcliff Commons) - Actively negotiating – Aldi, Stop & Shop, Sprouts and others • Discounters and off-price retailers in negotiation: TJX, Burlington, BJ’s, Five Below • Shop space demand remains active with a variety of tenant categories: health/beauty, wireless/cell phone, optical, mattress, medical/urgent care • Restaurant and food service tenants continue to pursue new locations: - In line – Sweetgreen, Ramen Shop, Jersey Mike’s - Pads – Shake Shack, Panda Express, Chick-fil-A • Approximately $9 million of future annual gross rent (~2% increase) from leases executed, but not rent commenced 3

Highlights (continued) 4. Active development projects of $132M under way, driven by executed leases expected to generate an 8% unleveraged return • Largest projects include leases at Huntington Commons, Broomall Commons, Lodi, Briarcliff Commons and Plaza at Woodbridge 5. Cash flow stream is becoming stronger and more diversified • ~60% of our estimated asset value is grocery-anchored - expected leasing activity will increase this rate to 70%+(2) • ~10% of our estimated asset value is anchored by Home Depot or Lowe’s, offering comparable stability to grocery-anchored properties • ~5% of our estimated asset value is industrial and is expected to increase given the demand in our markets - Recently executed 130K sf industrial lease at Lodi - evaluating four other properties for industrial conversion/densification • Residential, medical office and self-storage will likely account for an increasing percentage of our asset value as we densify our properties 6. “Big Four” asset redevelopment update • Bergen: Creating a more dynamic open-air retail experience; adding ~800 residential units and ~200K sf of office and other uses • Yonkers: Adding ~500 residential units and increasing GLA by 50-60K sf • Hudson: De-malling interior space; adding a mix of retailers and industrial or self-storage uses; backfilling Toys “R” Us box with a grocer • Bruckner: Repositioning asset with improved retail mix 7. Balance sheet is one of the strongest in the sector(3) • Net debt to EBITDA of 6.7x; $420 million of cash • Refinanced $119 million CMBS mortgage on Montehiedra with a new $82 million ten-year mortgage on June 1, 2020 ($36M forgiven) • Indebtedness comprises 33 individual, non-recourse mortgages totaling $1.6 billion with a weighted average term to maturity of 6 years–no corporate debt • 45 unencumbered properties that were valued at $1.2 billion at 12/31/19 8. Expect to announce new dividend policy prior to year end (1) COVID-19 business update as of November 12, 2020. (2) Includes Costco, BJ’s, Walmart and Target locations selling groceries. (3) Asset and debt balances are as of September 30, 2020, adjusted to reflect the $250 million payback of amounts previously drawn on the line of credit. 4

Urban Edge Team Chris Weilminster Mark Langer Herb Eilberg Jeff Olson EVP, Chief Operating Officer EVP, Chief Financial Officer Chief Investment Officer Chairman and Chief Executive Officer Rob Milton Jen Holmes Scott Auster Bob DiVita Judy Knop EVP & General Counsel Chief Accounting Officer SVP, Leasing SVP, Deputy General Counsel SVP, Development & Construction Ehud Kupperman Cecilia Li Leigh Lyons Dan Reilly Paul Schiffer SVP, Development SVP, Information Technology SVP, Leasing SVP, Property Accounting VP, Leasing Experienced leadership team with proven track record through multiple cycles 5

High-Quality, Irreplaceable Portfolio • Concentrated in first-ring suburbs within the NY metropolitan area, the most densely-populated, supply-constrained market in the country - Average of 240,000 people living within a 3-mile radius - Northern New Jersey, our largest market, is one of the most supply-constrained regions of the country with only 11 square feet of retail gross leasable area per capita • Impossible to replicate as assets of comparable quality rarely trade • Anchored by high-volume, value and necessity retailers - Average supermarket generates $816 PSF in annual sales(1) - Top tenants: Home Depot, TJX, Lowe’s, Best Buy and Walmart(2) • Portfolio ripe with significant redevelopment opportunities (1) Based on most recent sales for supermarkets reporting with at least one full year of operations as of September 30, 2020. (2) Based on annualized base rent as of September 30, 2020. 6

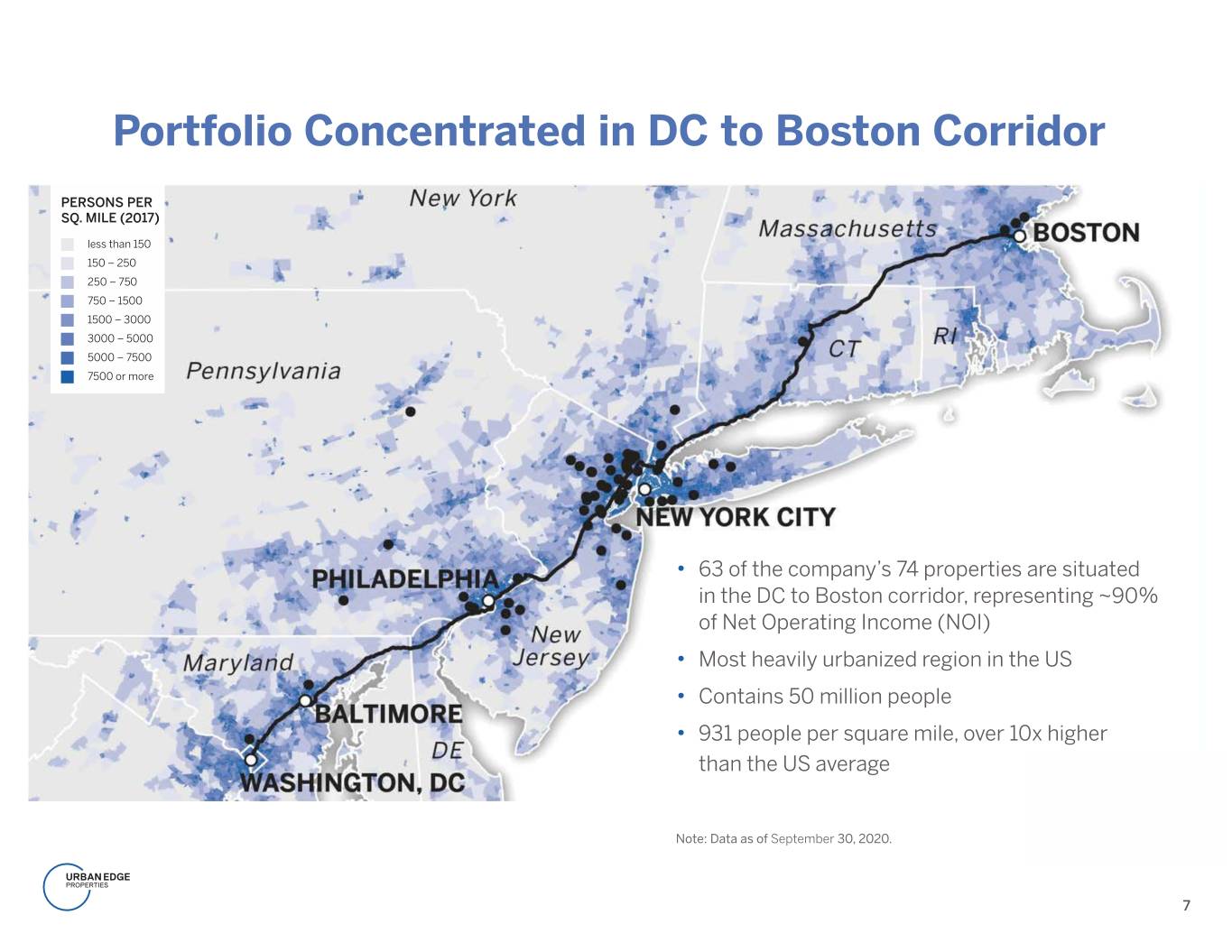

Portfolio Concentrated in DC to Boston Corridor PERSONS PER SQ. MILE (2017) less than 150 150 – 250 250 – 750 750 – 1500 1500 – 3000 3000 – 5000 5000 – 7500 7500 or more • 63 of the company’s 74 properties are situated in the DC to Boston corridor, representing ~90% of Net Operating Income (NOI) • Most heavily urbanized region in the US • Contains 50 million people • 931 people per square mile, over 10x higher than the US average Note: Data as of September 30, 2020. 7

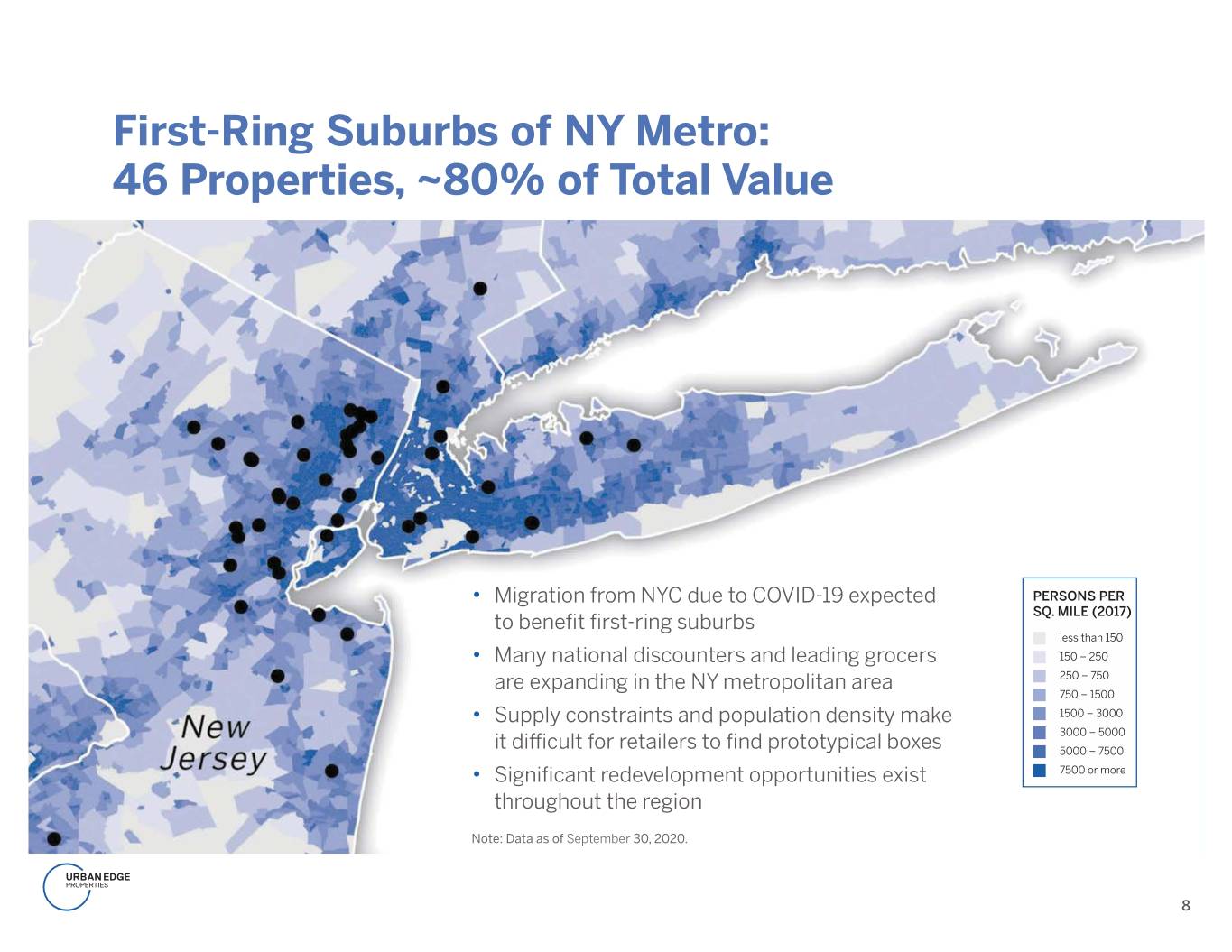

First-Ring Suburbs of NY Metro: 46 Properties, ~80% of Total Value • Migration from NYC due to COVID-19 expected PERSONS PER SQ. MILE (2017) to benefit first-ring suburbs less than 150 • Many national discounters and leading grocers 150 – 250 are expanding in the NY metropolitan area 250 – 750 750 – 1500 • Supply constraints and population density make 1500 – 3000 3000 – 5000 it difficult for retailers to find prototypical boxes 5000 – 7500 • Significant redevelopment opportunities exist 7500 or more throughout the region Note: Data as of September 30, 2020. 8

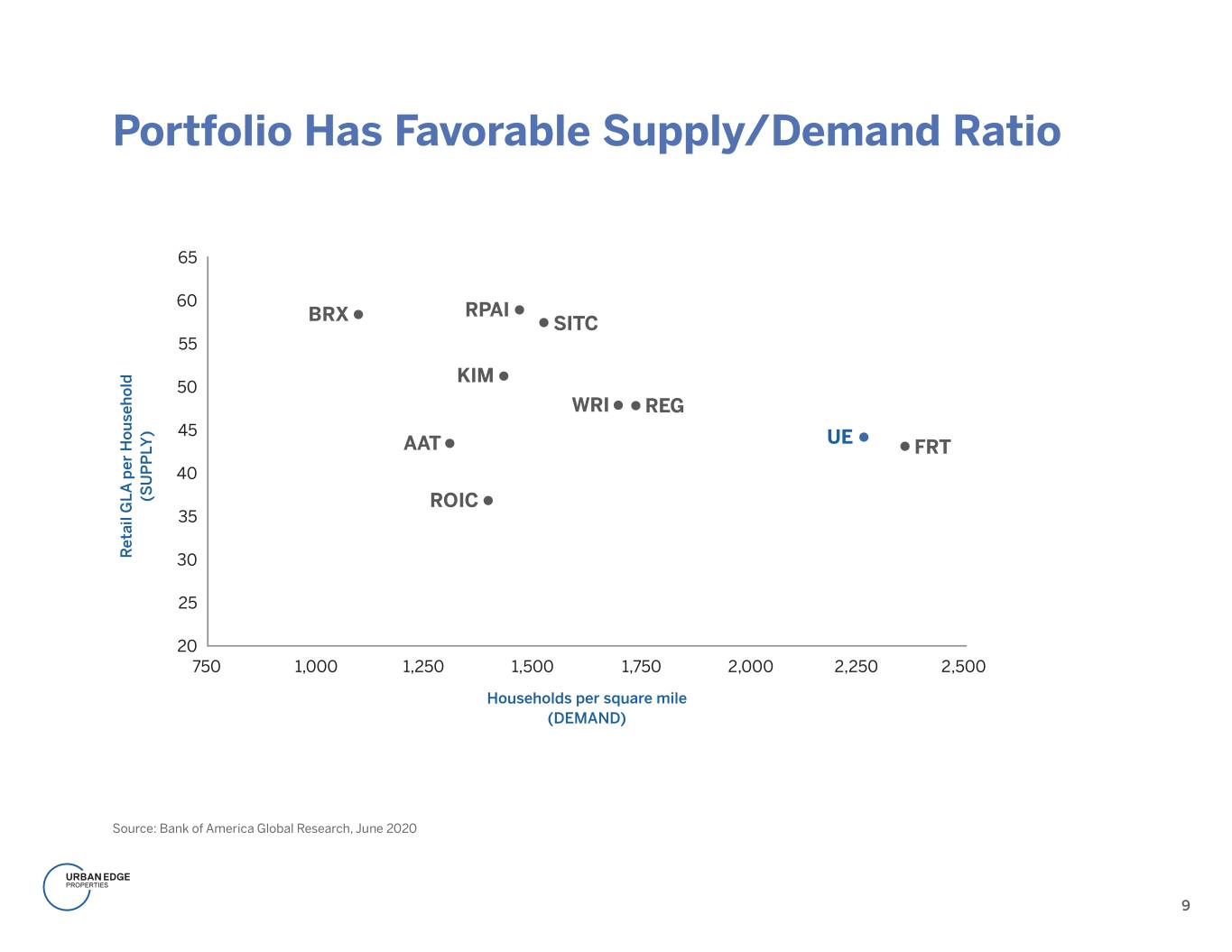

Portfolio Has Favorable Supply/Demand Ratio 65 60 RPAI BRX SITC 55 KIM 50 WRI REG 45 UE AAT FRT 40 (SUPPLY) ROIC 35 Retail GLA per Household Household per GLA Retail 30 25 20 750 1,000 1,250 1,500 1,750 2,000 2,250 2,500 Households per square mile (DEMAND) Source: Bank of America Global Research, June 2020 9

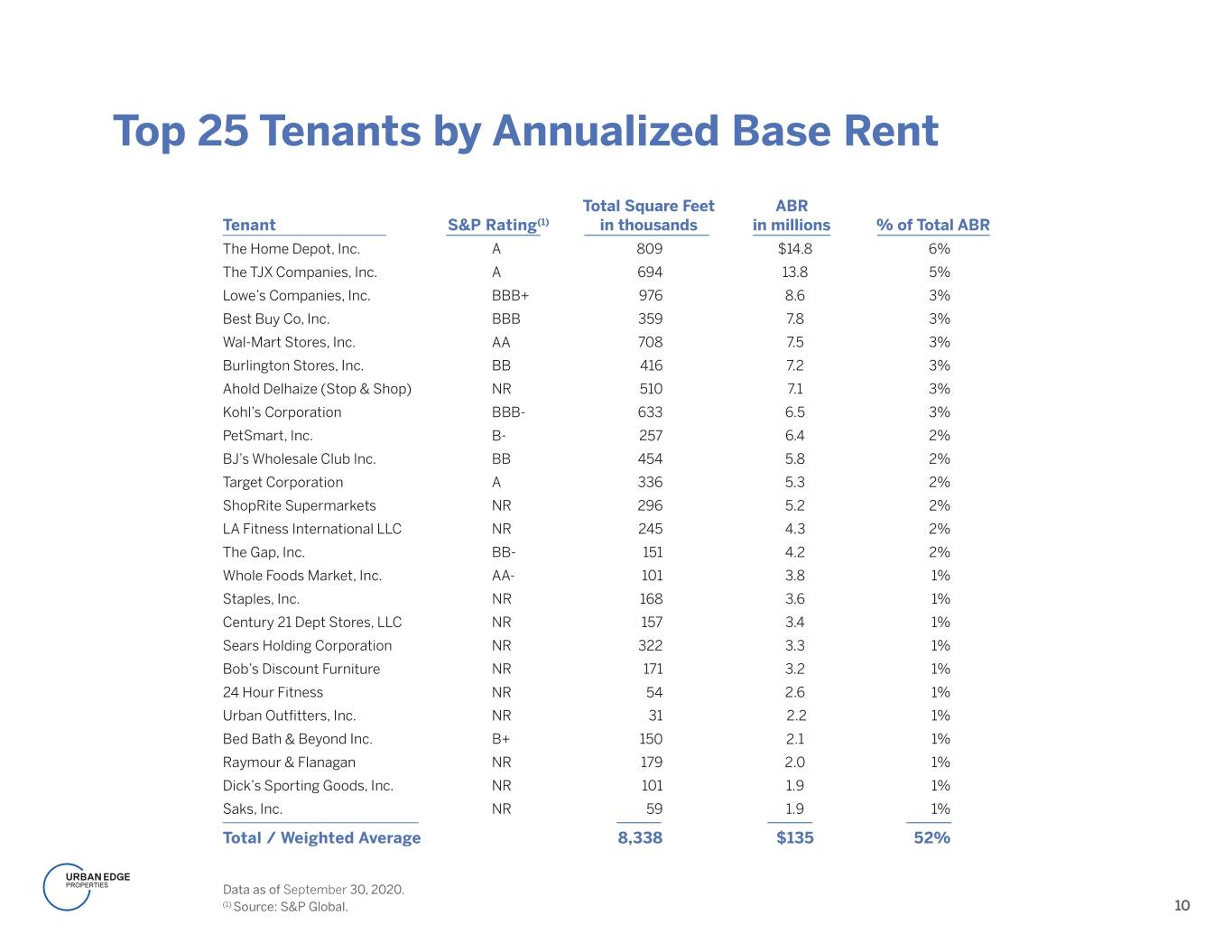

Top 25 Tenants by Annualized Base Rent Total Square Feet ABR Tenant S&P Rating(1) in thousands in millions % of Total ABR The Home Depot, Inc. A 809 $14.8 6% The TJX Companies, Inc. A 694 13.8 5% Lowe’s Companies, Inc. BBB+ 976 8.6 3% Best Buy Co, Inc. BBB 359 7.8 3% Wal-Mart Stores, Inc. AA 708 7.5 3% Burlington Stores, Inc. BB 416 7.2 3% Ahold Delhaize (Stop & Shop) NR 510 7.1 3% Kohl’s Corporation BBB- 633 6.5 3% PetSmart, Inc. B- 257 6.4 2% BJ’s Wholesale Club Inc. BB 454 5.8 2% Target Corporation A 336 5.3 2% ShopRite Supermarkets NR 296 5.2 2% LA Fitness International LLC NR 245 4.3 2% The Gap, Inc. BB- 151 4.2 2% Whole Foods Market, Inc. AA- 101 3.8 1% Staples, Inc. NR 168 3.6 1% Century 21 Dept Stores, LLC NR 157 3.4 1% Sears Holding Corporation NR 322 3.3 1% Bob’s Discount Furniture NR 171 3.2 1% 24 Hour Fitness NR 54 2.6 1% Urban Outfitters, Inc. NR 31 2.2 1% Bed Bath & Beyond Inc. B+ 150 2.1 1% Raymour & Flanagan NR 179 2.0 1% Dick’s Sporting Goods, Inc. NR 101 1.9 1% Saks, Inc. NR 59 1.9 1% Total / Weighted Average 8,338 $135 52% Data as of September 30, 2020. (1) Source: S&P Global. 10

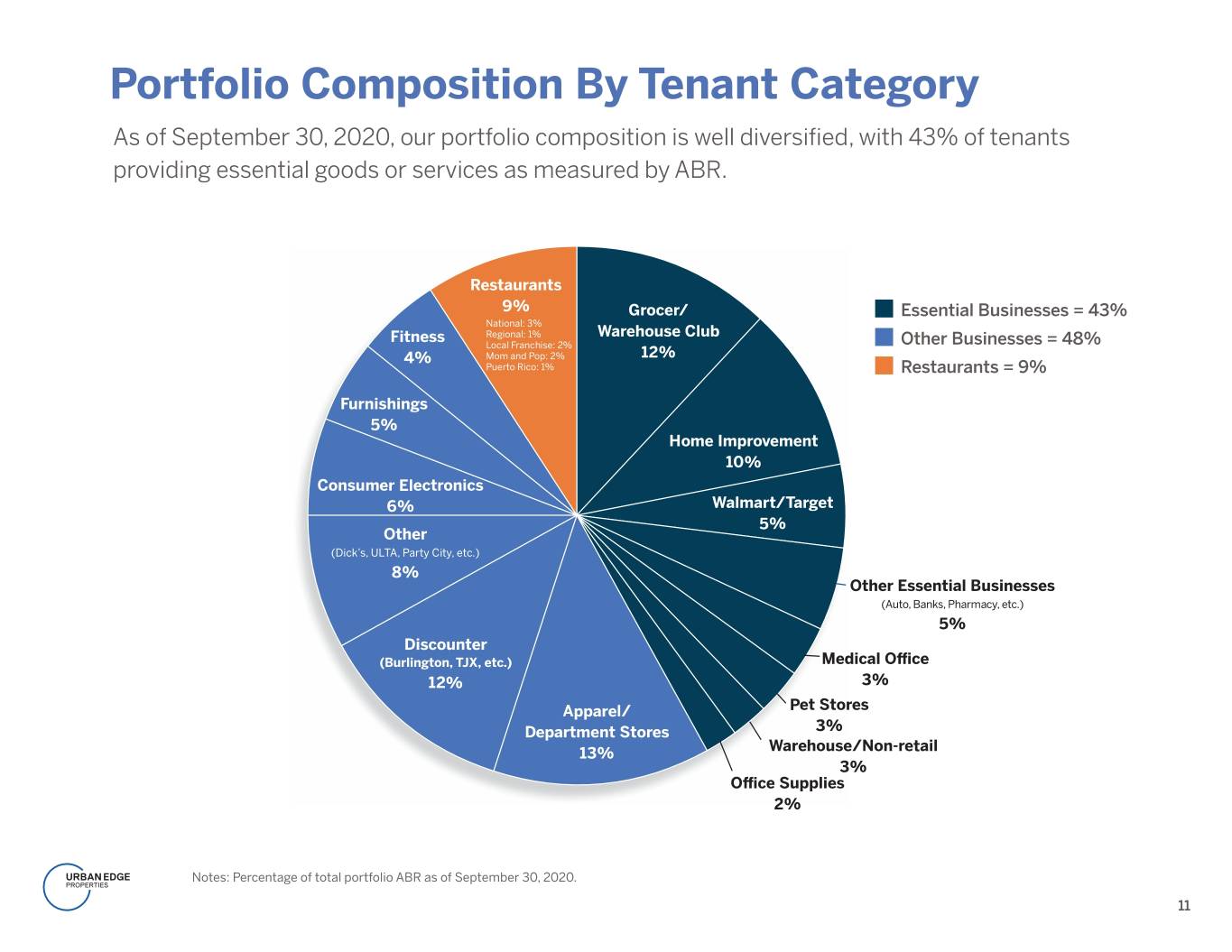

Portfolio Composition By Tenant Category As of September 30, 2020, our portfolio composition is well diversified, with 43% of tenants providing essential goods or services as measured by ABR. Restaurants 9% Grocer/ Essential Businesses = 43% National: 3% Fitness Regional: 1% Warehouse Club Local Franchise: 2% Other Businesses = 48% 4% Mom and Pop: 2% 12% Puerto Rico: 1% Restaurants = 9% Furnishings 5% Home Improvement 10% Consumer Electronics 6% Walmart/Target 5% Other (Dick’s, ULTA, Party City, etc.) 8% Other Essential Businesses (Auto, Banks, Pharmacy, etc.) 5% Discounter (Burlington, TJX, etc.) Medical Office 12% 3% Apparel/ Pet Stores Department Stores 3% 13% Warehouse/Non-retail 3% Office Supplies 2% Notes: Percentage of total portfolio ABR as of September 30, 2020. 11

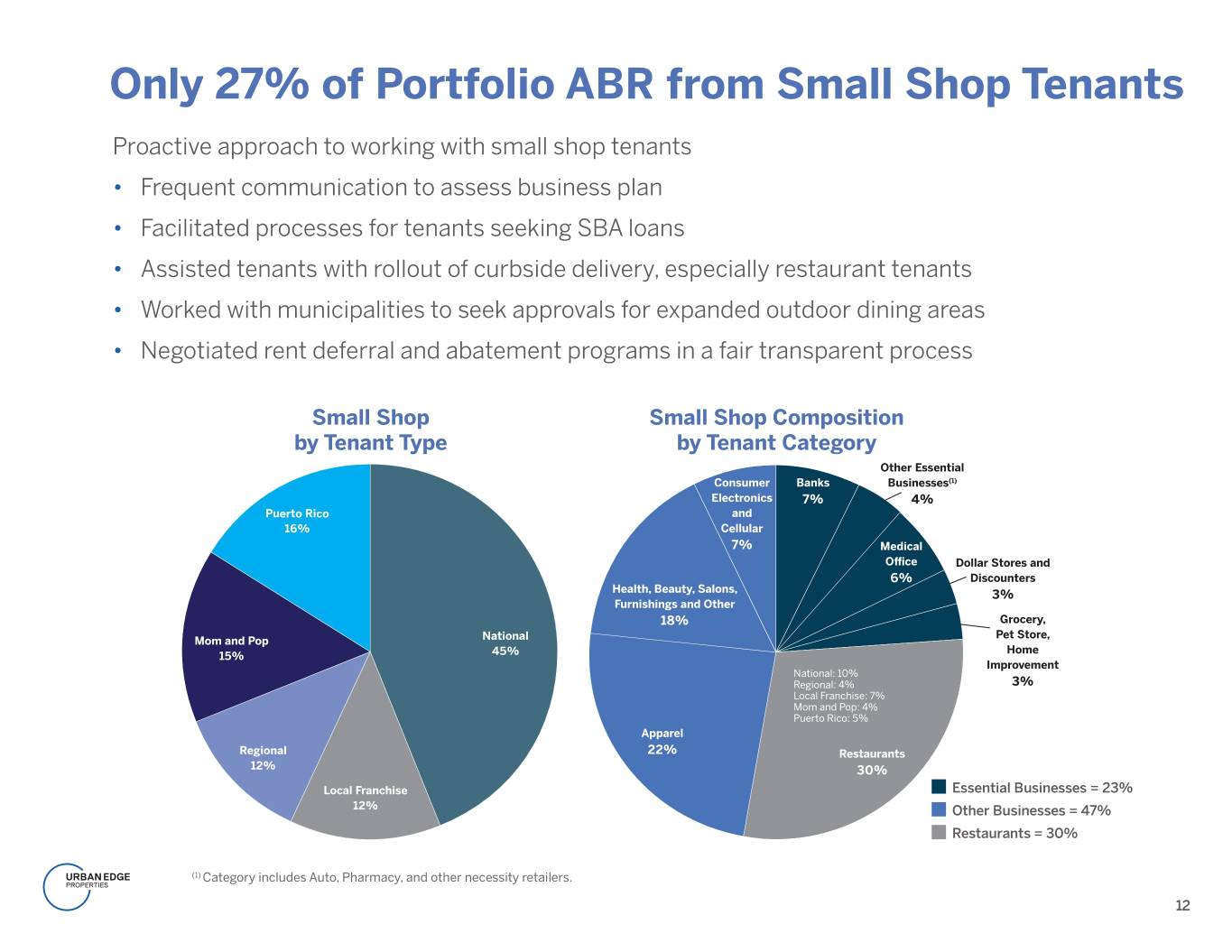

Only 27% of Portfolio ABR from Small Shop Tenants Proactive approach to working with small shop tenants • Frequent communication to assess business plan • Facilitated processes for tenants seeking SBA loans • Assisted tenants with rollout of curbside delivery, especially restaurant tenants • Worked with municipalities to seek approvals for expanded outdoor dining areas • Negotiated rent deferral and abatement programs in a fair transparent process Small Shop Small Shop Composition by Tenant Type by Tenant Category Other Essential Consumer Banks Businesses(1) Electronics 7% 4% Puerto Rico and 16% Cellular 7% Medical Office Dollar Stores and 6% Discounters Health, Beauty, Salons, 3% Furnishings and Other 18% Grocery, Pet Store, Mom and Pop National Home 15% 45% Improvement National: 10% Regional: 4% 3% Local Franchise: 7% Mom and Pop: 4% Puerto Rico: 5% Apparel Regional 22% Restaurants 12% 30% Local Franchise Essential Businesses = 23% 12% Other Businesses = 47% Restaurants = 30% (1) Category includes Auto, Pharmacy, and other necessity retailers. 12

LEASING

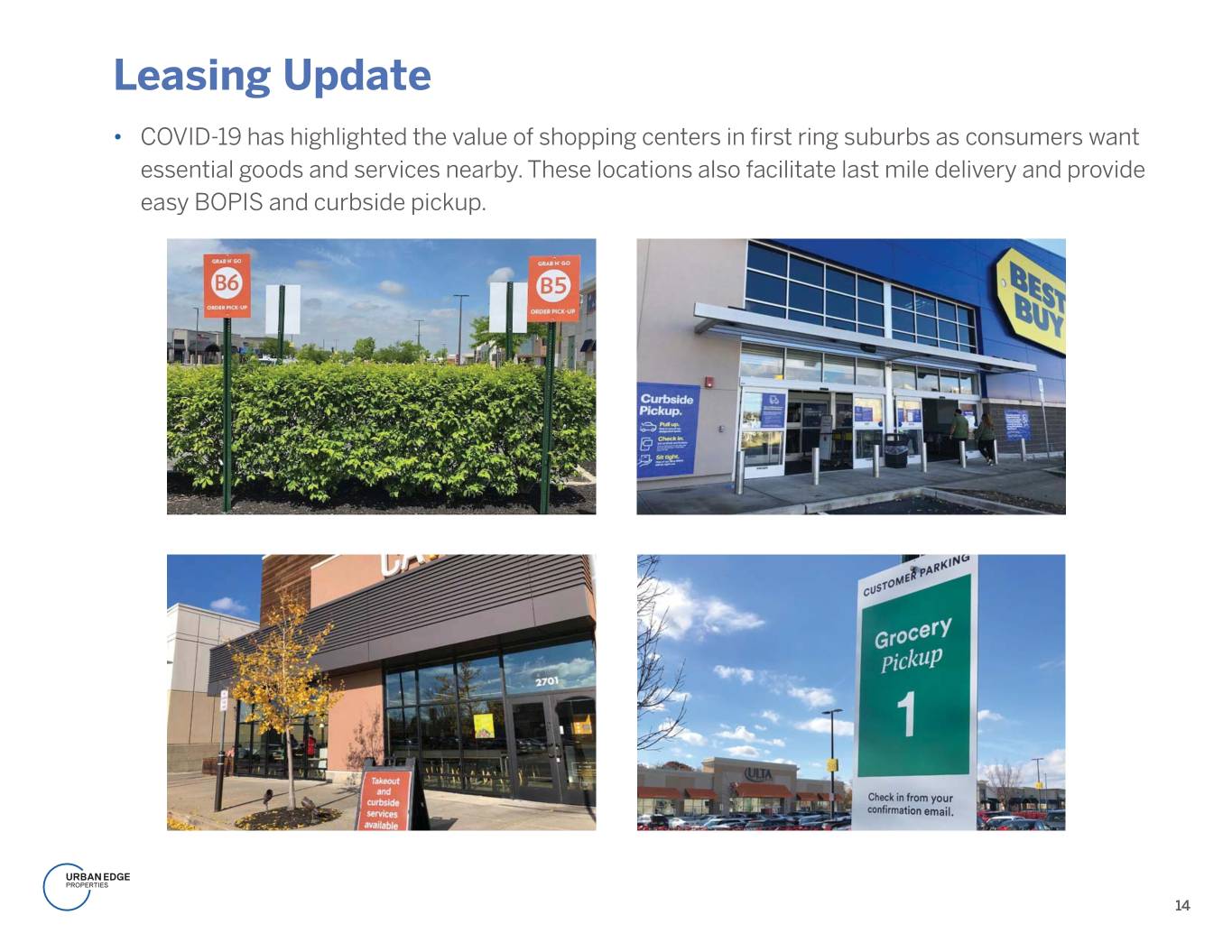

Leasing Update • COVID-19 has highlighted the value of shopping centers in first ring suburbs as consumers want essential goods and services nearby. These locations also facilitate last mile delivery and provide easy BOPIS and curbside pickup. 14

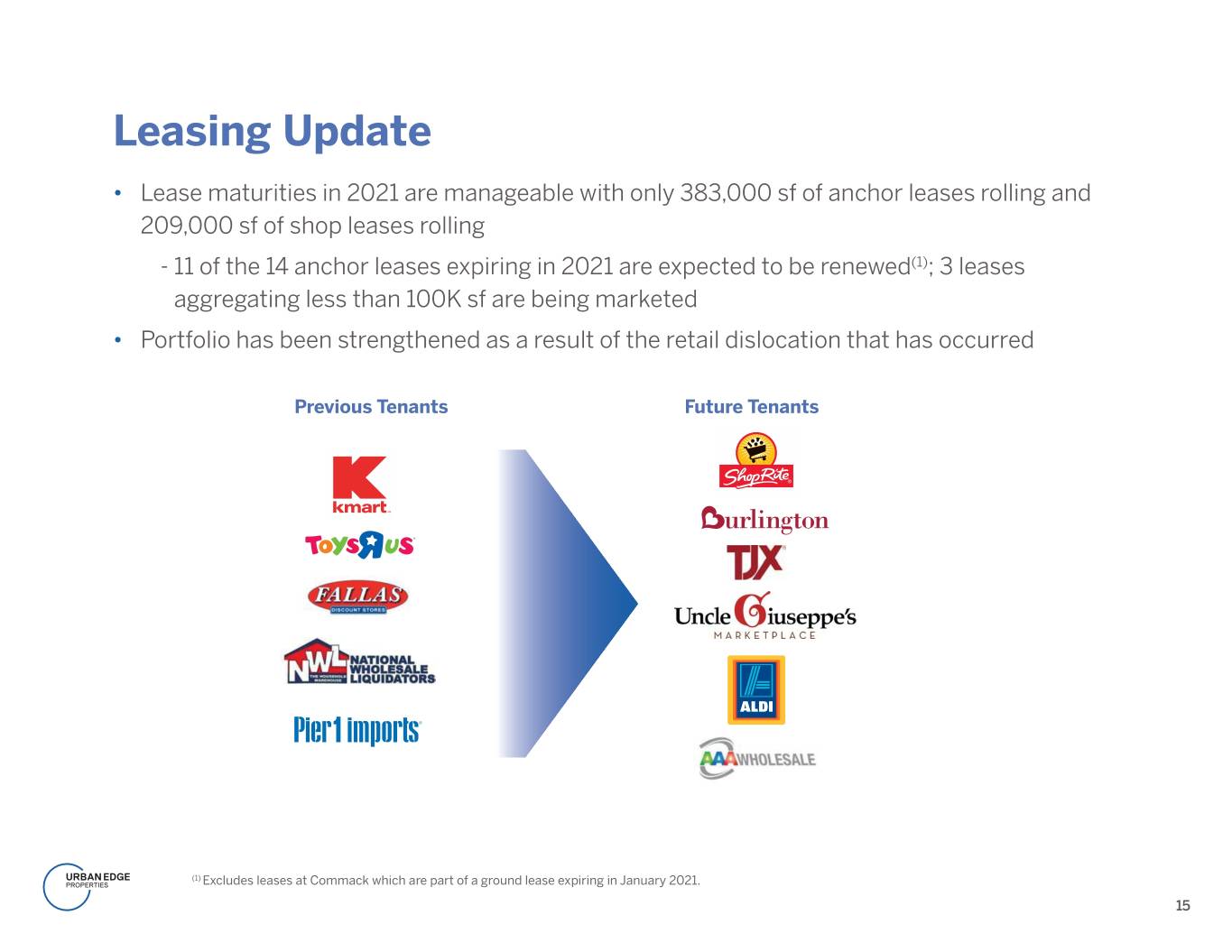

Leasing Update • Lease maturities in 2021 are manageable with only 383,000 sf of anchor leases rolling and 209,000 sf of shop leases rolling - 11 of the 14 anchor leases expiring in 2021 are expected to be renewed(1); 3 leases aggregating less than 100K sf are being marketed • Portfolio has been strengthened as a result of the retail dislocation that has occurred Previous Tenants Future Tenants (1) Excludes leases at Commack which are part of a ground lease expiring in January 2021. 15

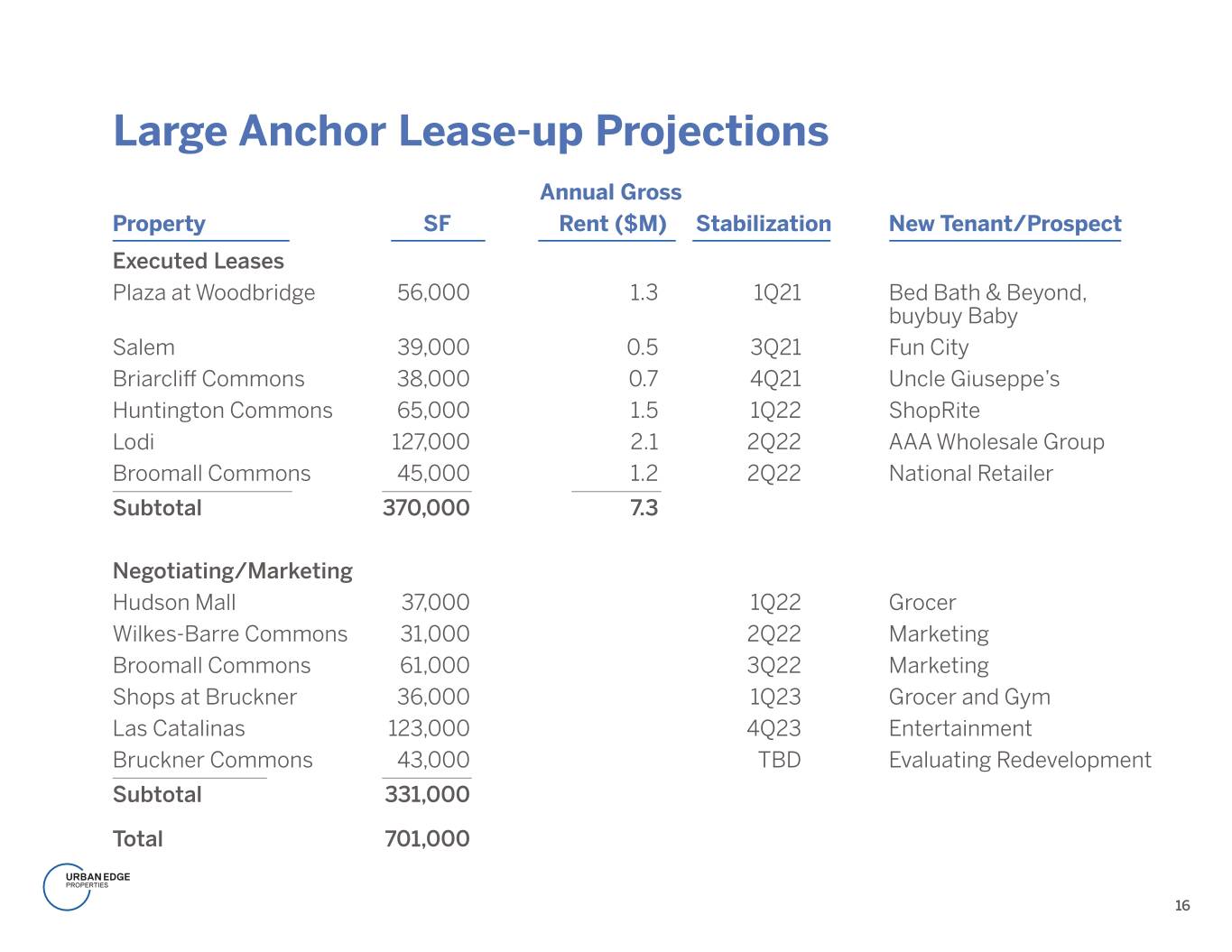

Large Anchor Lease-up Projections Annual Gross Property SF Rent ($M) Stabilization New Tenant/Prospect Executed Leases Plaza at Woodbridge 56,000 1.3 1Q21 Bed Bath & Beyond, buybuy Baby Salem 39,000 0.5 3Q21 Fun City Briarcliff Commons 38,000 0.7 4Q21 Uncle Giuseppe’s Huntington Commons 65,000 1.5 1Q22 ShopRite Lodi 127,000 2.1 2Q22 AAA Wholesale Group Broomall Commons 45,000 1.2 2Q22 National Retailer Subtotal 370,000 7.3 Negotiating/Marketing Hudson Mall 37,000 1Q22 Grocer Wilkes-Barre Commons 31,000 2Q22 Marketing Broomall Commons 61,000 3Q22 Marketing Shops at Bruckner 36,000 1Q23 Grocer and Gym Las Catalinas 123,000 4Q23 Entertainment Bruckner Commons 43,000 TBD Evaluating Redevelopment Subtotal 331,000 Total 701,000 16

DEVELOPMENT

Development Update • As of September 30, 2020, we had $132 million of active redevelopment projects under way, of which $91 million remains to be funded. These projects are expected to generate an 8% unleveraged yield and create additional value from cap rate compression • Pursuing entitlements at Bergen Town Center, Bruckner, Hudson Mall and Yonkers Gateway Center to densify these properties with mixed-use components • Portfolio offers numerous densification opportunities, which benefits from the flexible format of shopping centers and the fact that 75% of our land consists of parking lots 18

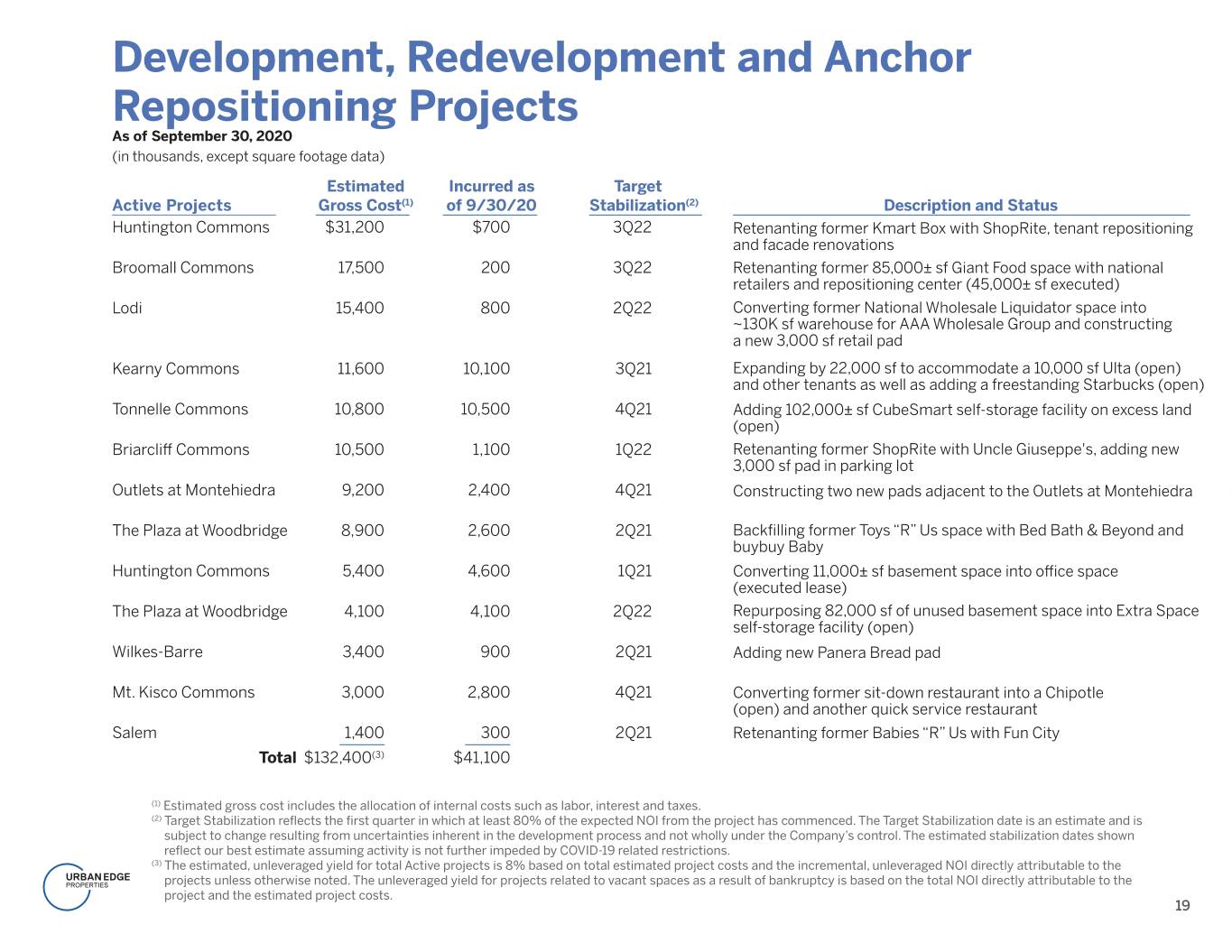

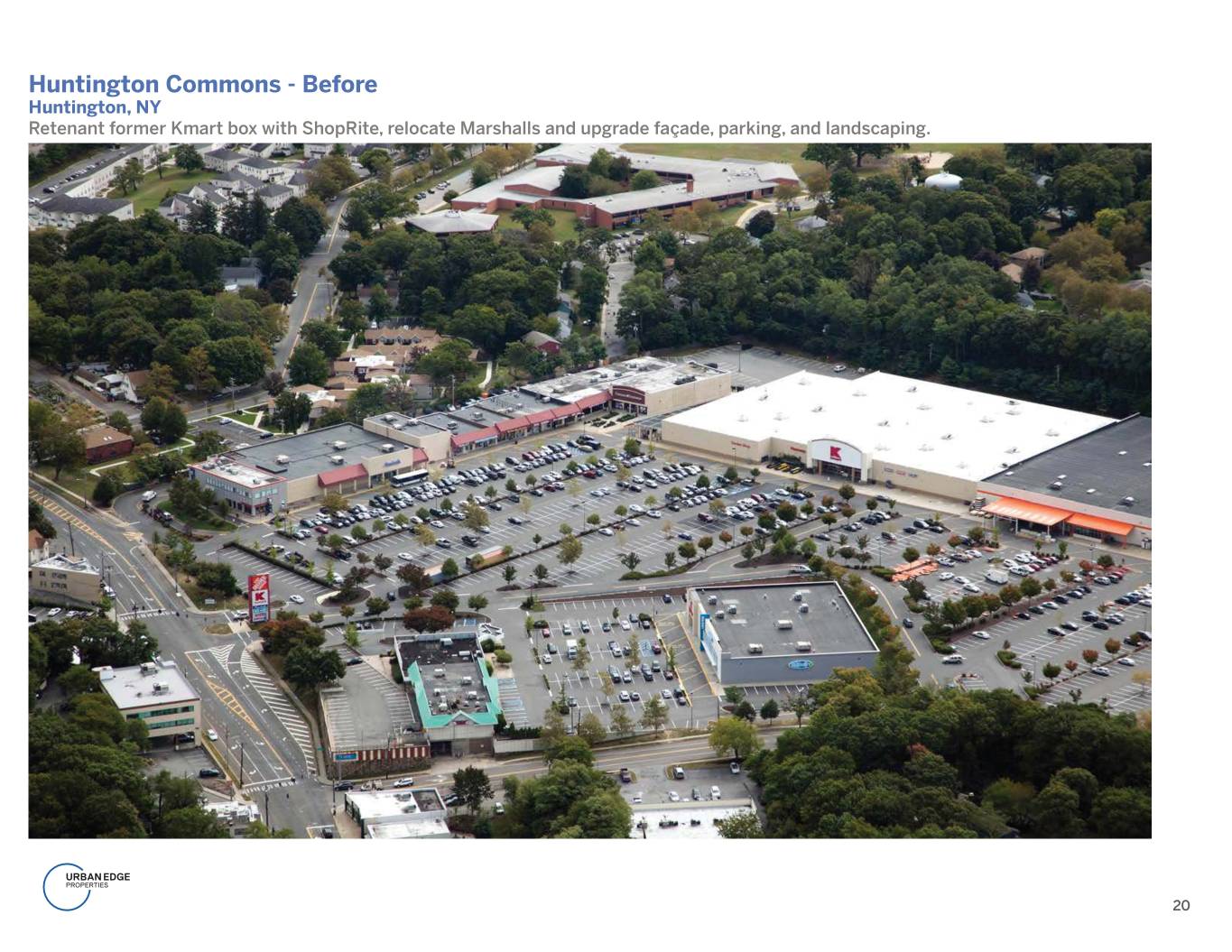

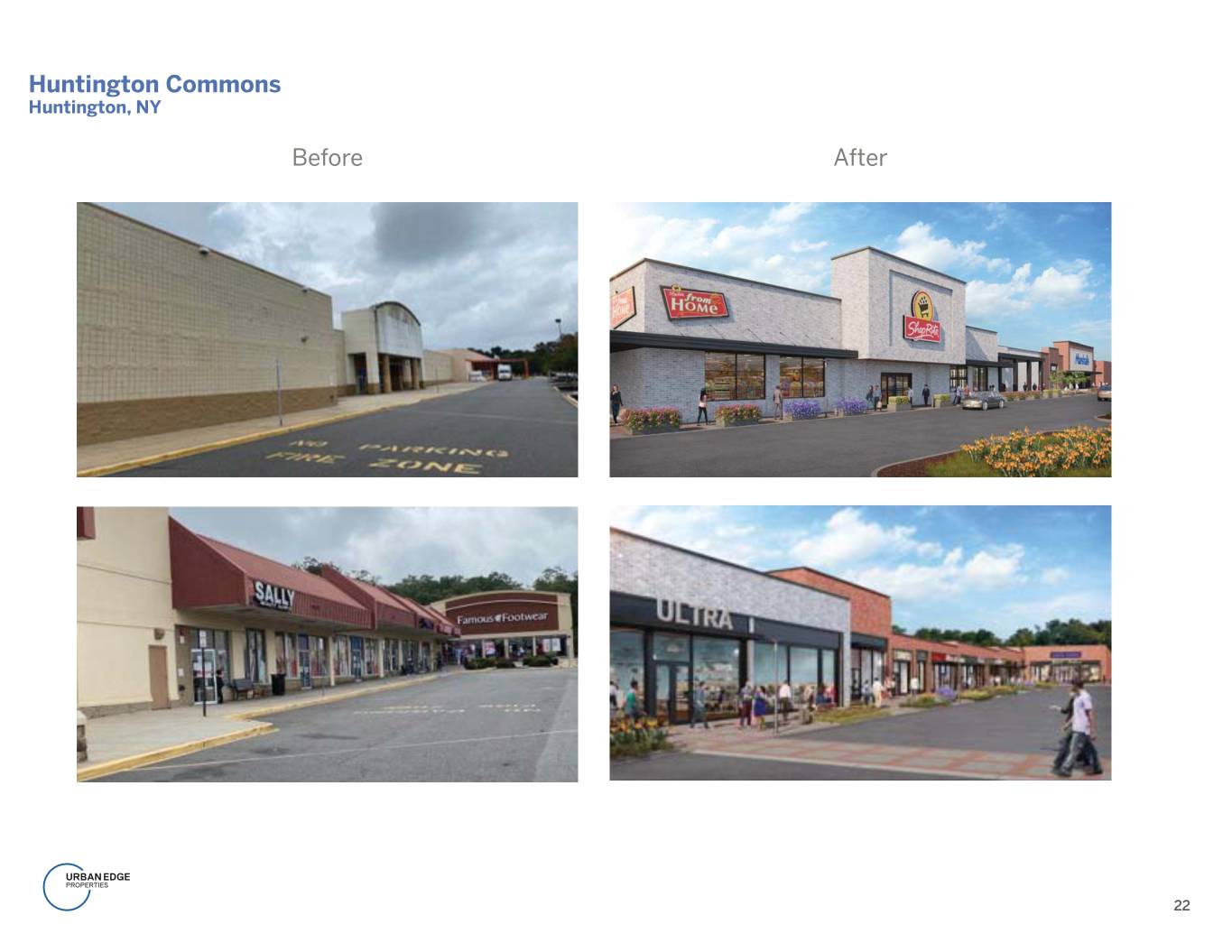

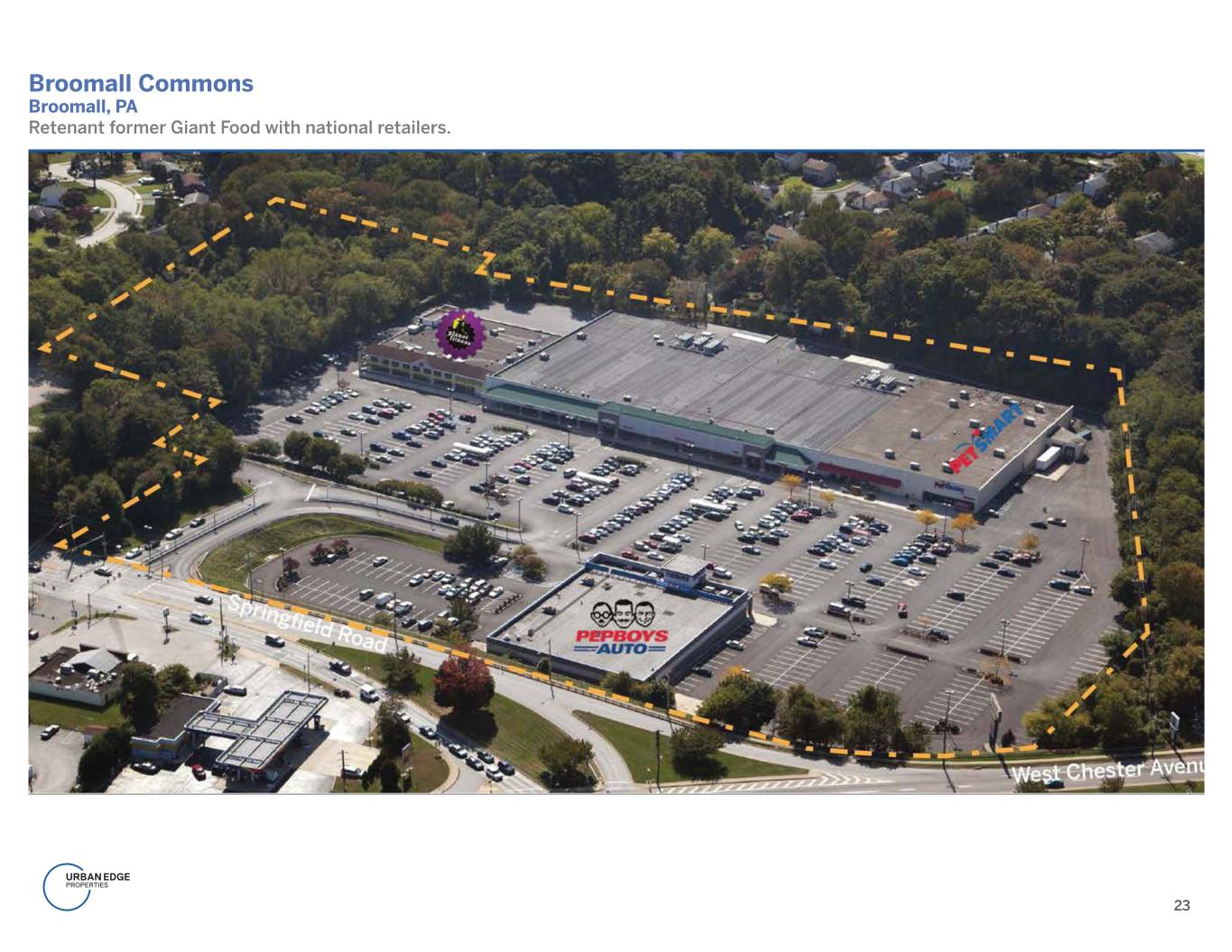

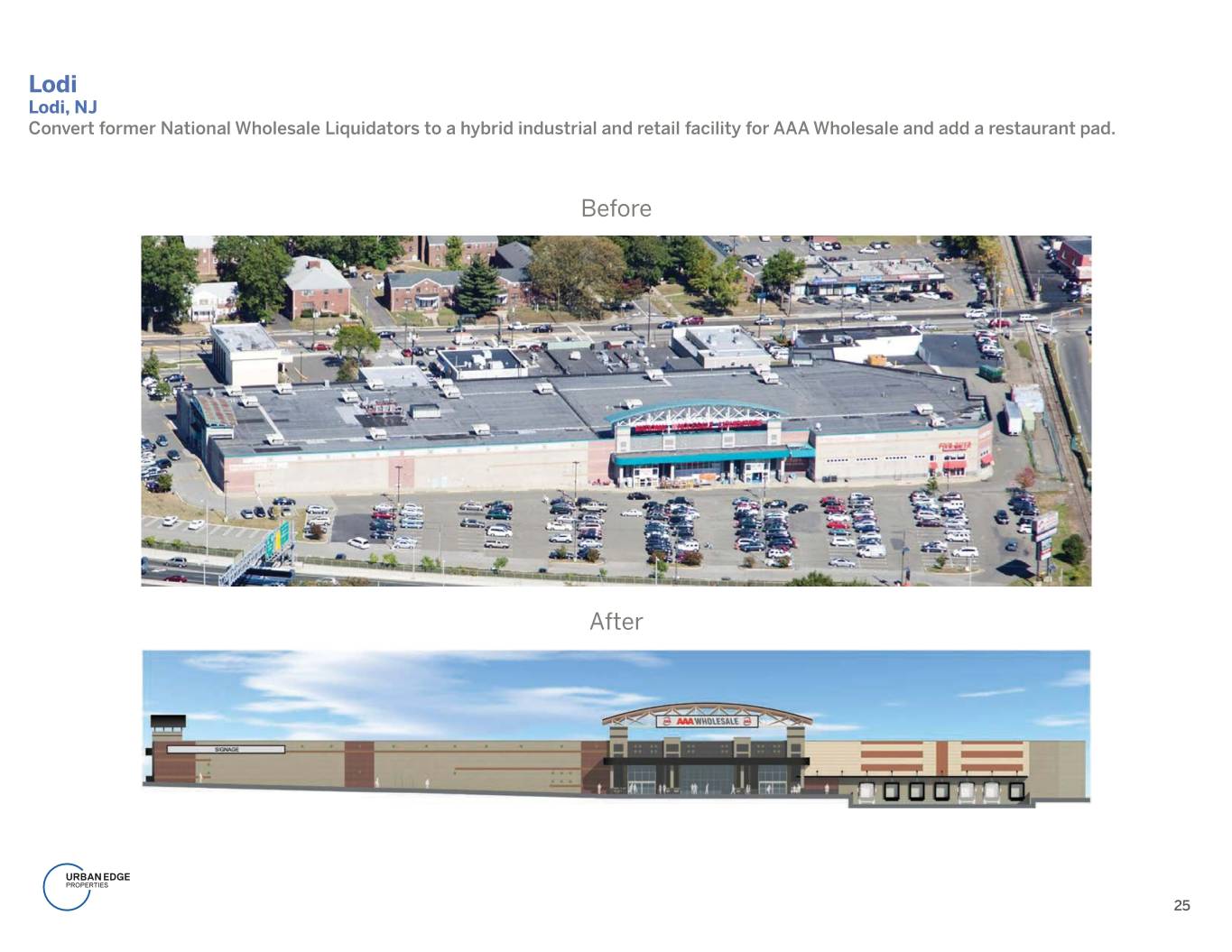

Development, Redevelopment and Anchor Repositioning Projects As of September 30, 2020 (in thousands, except square footage data) Estimated Incurred as Target Active Projects Gross Cost(1) of 9/30/20 Stabilization(2) Description and Status Huntington Commons $31,200 $700 3Q22 Retenanting former Kmart Box with ShopRite, tenant repositioning and facade renovations Broomall Commons 17,500 200 3Q22 Retenanting former 85,000± sf Giant Food space with national retailers and repositioning center (45,000± sf executed) Lodi 15,400 800 2Q22 Converting former National Wholesale Liquidator space into ~130K sf warehouse for AAA Wholesale Group and constructing a new 3,000 sf retail pad Kearny Commons 11,600 10,100 3Q21 Expanding by 22,000 sf to accommodate a 10,000 sf Ulta (open) and other tenants as well as adding a freestanding Starbucks (open) Tonnelle Commons 10,800 10,500 4Q21 Adding 102,000± sf CubeSmart self-storage facility on excess land (open) Briarcliff Commons 10,500 1,100 1Q22 Retenanting former ShopRite with Uncle Giuseppe's, adding new 3,000 sf pad in parking lot Outlets at Montehiedra 9,200 2,400 4Q21 Constructing two new pads adjacent to the Outlets at Montehiedra The Plaza at Woodbridge 8,900 2,600 2Q21 Backfilling former Toys “R” Us space with Bed Bath & Beyond and buybuy Baby Huntington Commons 5,400 4,600 1Q21 Converting 11,000± sf basement space into office space (executed lease) The Plaza at Woodbridge 4,100 4,100 2Q22 Repurposing 82,000 sf of unused basement space into Extra Space self-storage facility (open) Wilkes-Barre 3,400 900 2Q21 Adding new Panera Bread pad Mt. Kisco Commons 3,000 2,800 4Q21 Converting former sit-down restaurant into a Chipotle (open) and another quick service restaurant Salem 1,400 300 2Q21 Retenanting former Babies “R” Us with Fun City Total $132,400(3) $41,100 (1) Estimated gross cost includes the allocation of internal costs such as labor, interest and taxes. (2) Target Stabilization reflects the first quarter in which at least 80% of the expected NOI from the project has commenced. The Target Stabilization date is an estimate and is subject to change resulting from uncertainties inherent in the development process and not wholly under the Company’s control. The estimated stabilization dates shown reflect our best estimate assuming activity is not further impeded by COVID-19 related restrictions. (3) The estimated, unleveraged yield for total Active projects is 8% based on total estimated project costs and the incremental, unleveraged NOI directly attributable to the projects unless otherwise noted. The unleveraged yield for projects related to vacant spaces as a result of bankruptcy is based on the total NOI directly attributable to the project and the estimated project costs. 19

Huntington Commons - Before Huntington, NY Retenant former Kmart box with ShopRite, relocate Marshalls and upgrade façade, parking, and landscaping. 20

Huntington Commons - After Huntington, NY 21

Huntington Commons Huntington, NY Before After 22

Broomall Commons Broomall, PA Retenant former Giant Food with national retailers. 23

Broomall Commons Broomall, PA 24

Lodi Lodi, NJ Convert former National Wholesale Liquidators to a hybrid industrial and retail facility for AAA Wholesale and add a restaurant pad. Before After 25

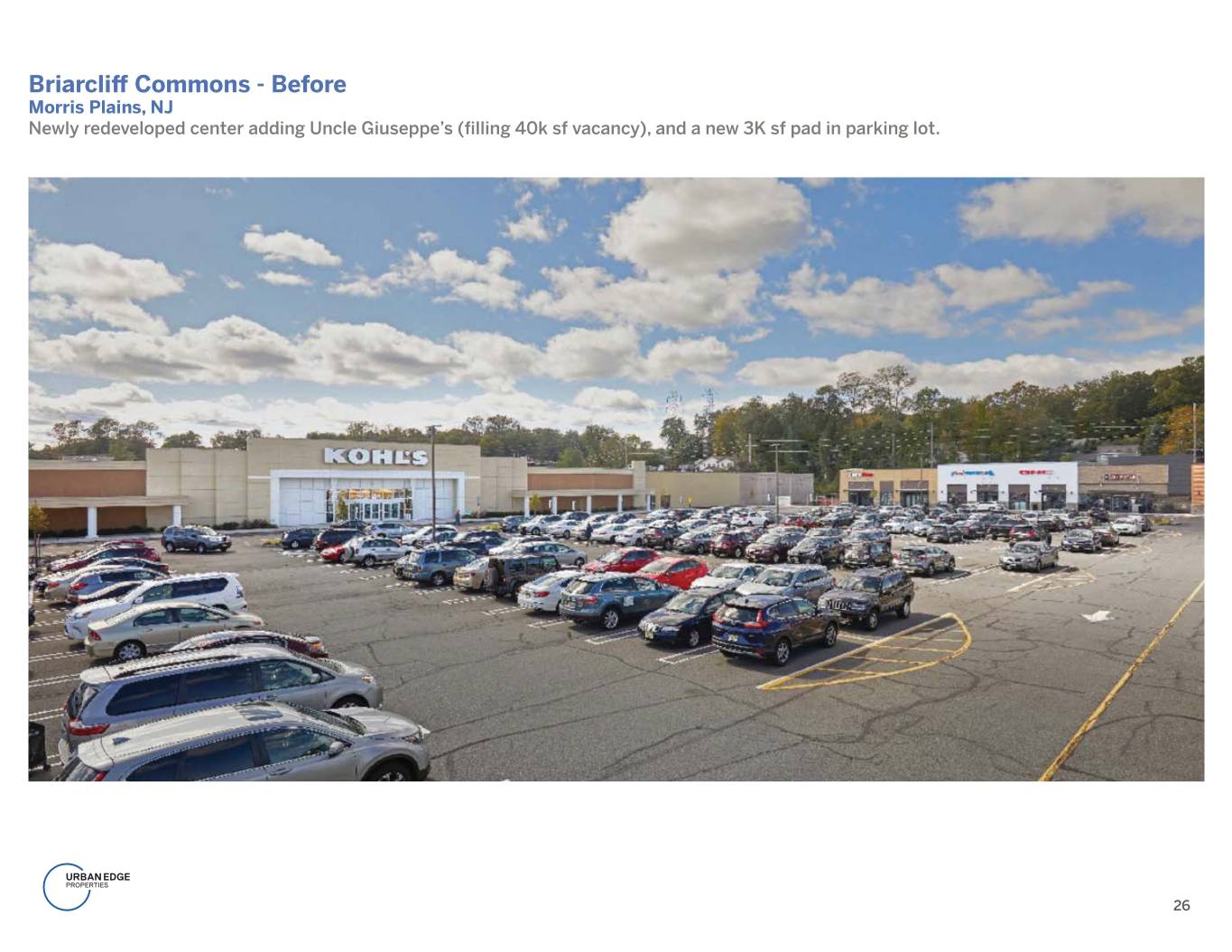

Briarcliff Commons - Before Morris Plains, NJ Newly redeveloped center adding Uncle Giuseppe’s (filling 40k sf vacancy), and a new 3K sf pad in parking lot. 26

Briarcliff Commons Morris Plains, NJ Before After 27

Hudson Mall Jersey City, NJ 28

Hudson Mall Hudson Mall Jersey City, NJ Jersey City, NJ Current Future 29

Bergen Town Center Paramus, NJ 30

Bergen Town Center Paramus, NJ New Jersey State Highway Route 4 Legend Anchor Vertical Core Retail Education Restaurants Office Entertainment Hotel Forest Ave Forest Health & Wellness Residential Spring Valley Ave 31

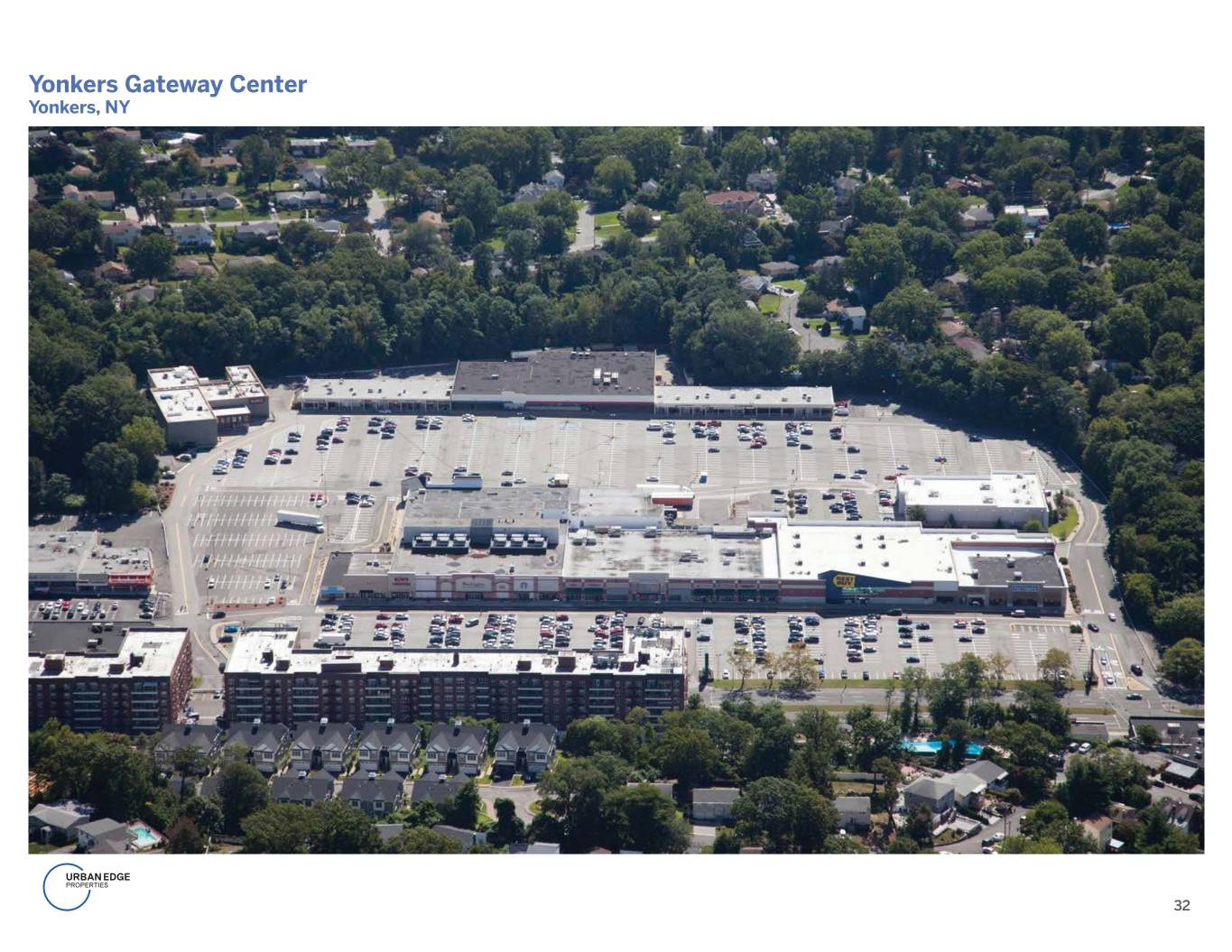

Yonkers Gateway Center Yonkers, NY 32

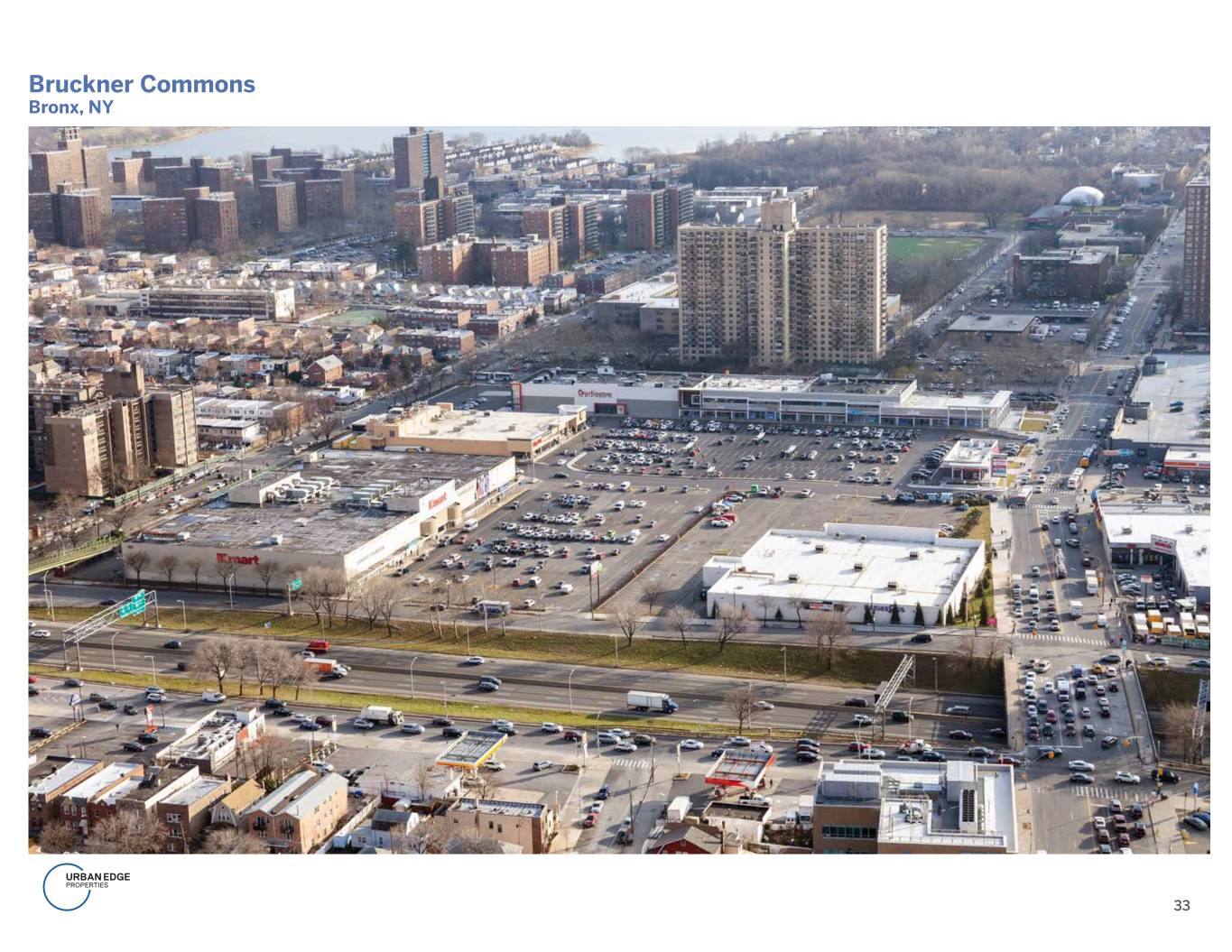

Bruckner Commons Bronx, NY 33

ACQUISITIONS AND DISPOSITIONS

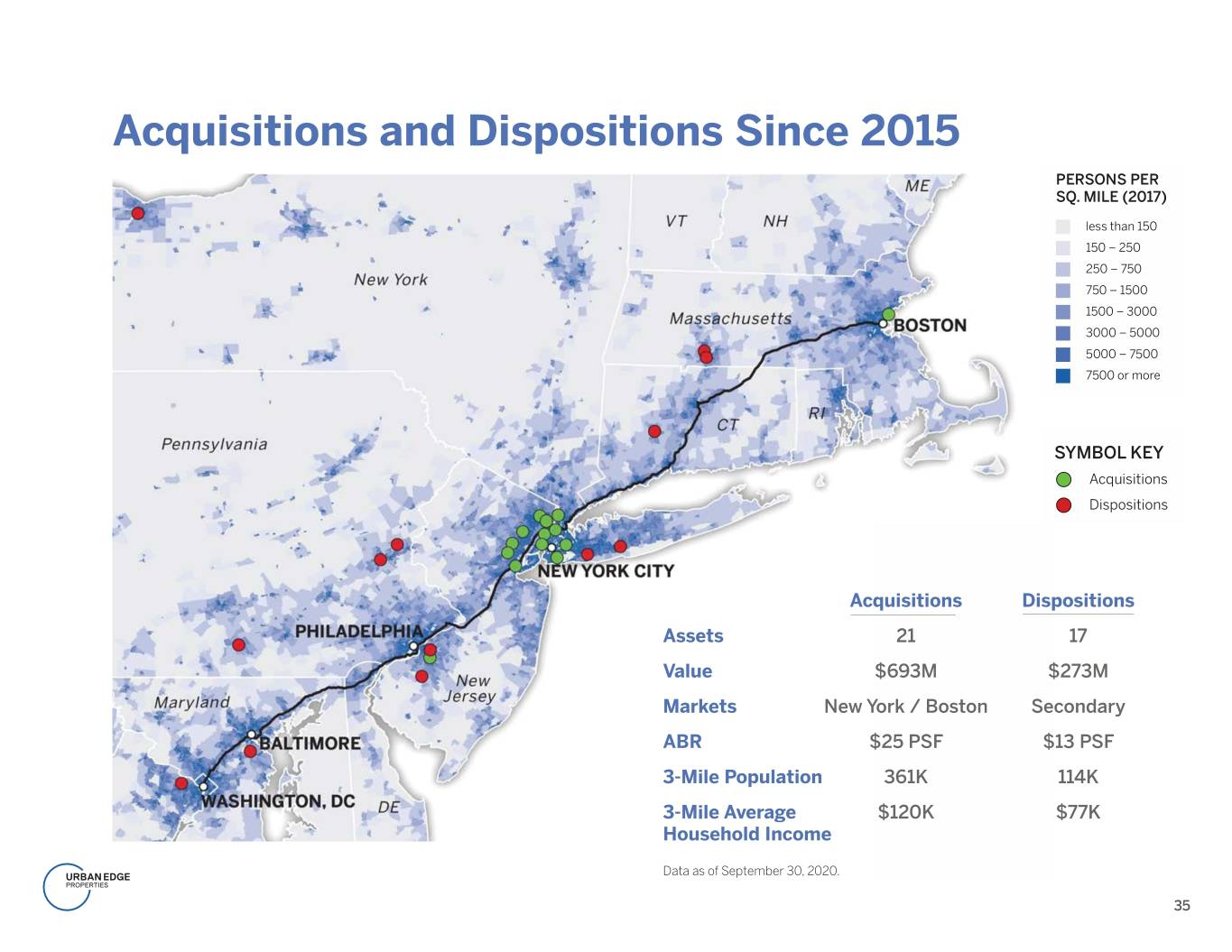

Acquisitions and Dispositions Since 2015 PERSONS PER SQ. MILE (2017) less than 150 150 – 250 250 – 750 750 – 1500 1500 – 3000 3000 – 5000 5000 – 7500 7500 or more SYMBOL KEY Acquisitions Dispositions Acquisitions Dispositions Assets 21 17 Value $693M $273M Markets New York / Boston Secondary ABR $25 PSF $13 PSF 3-Mile Population 361K 114K 3-Mile Average $120K $77K Household Income Data as of September 30, 2020. 35

LIQUIDITY AND BALANCE SHEET

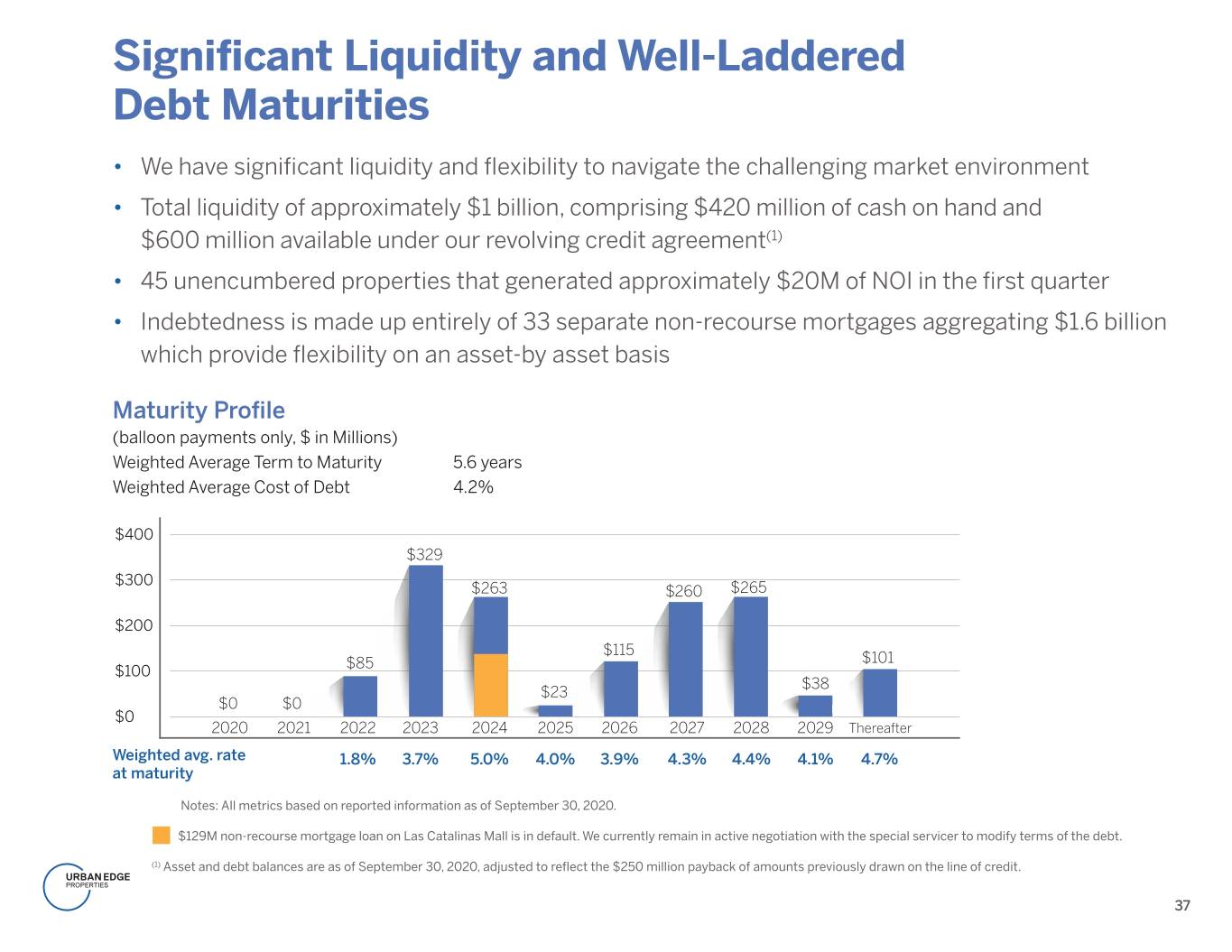

Significant Liquidity and Well-Laddered Debt Maturities • We have significant liquidity and flexibility to navigate the challenging market environment • Total liquidity of approximately $1 billion, comprising $420 million of cash on hand and $600 million available under our revolving credit agreement(1) • 45 unencumbered properties that generated approximately $20M of NOI in the first quarter • Indebtedness is made up entirely of 33 separate non-recourse mortgages aggregating $1.6 billion which provide flexibility on an asset-by asset basis Maturity Profile (balloon payments only, $ in Millions) Weighted Average Term to Maturity 5.6 years Weighted Average Cost of Debt 4.2% $400 $329 $300 $263 $260 $265 $200 $115 $85 $101 $100 $38 $23 $0 $0 $0 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 Thereafter Weighted avg. rate 1.8% 3.7% 5.0% 4.0% 3.9% 4.3% 4.4% 4.1% 4.7% at maturity Notes: All metrics based on reported information as of September 30, 2020. $129M non-recourse mortgage loan on Las Catalinas Mall is in default. We currently remain in active negotiation with the special servicer to modify terms of the debt. (1) Asset and debt balances are as of September 30, 2020, adjusted to reflect the $250 million payback of amounts previously drawn on the line of credit. 37

COVID-19 BUSINESS UPDATE

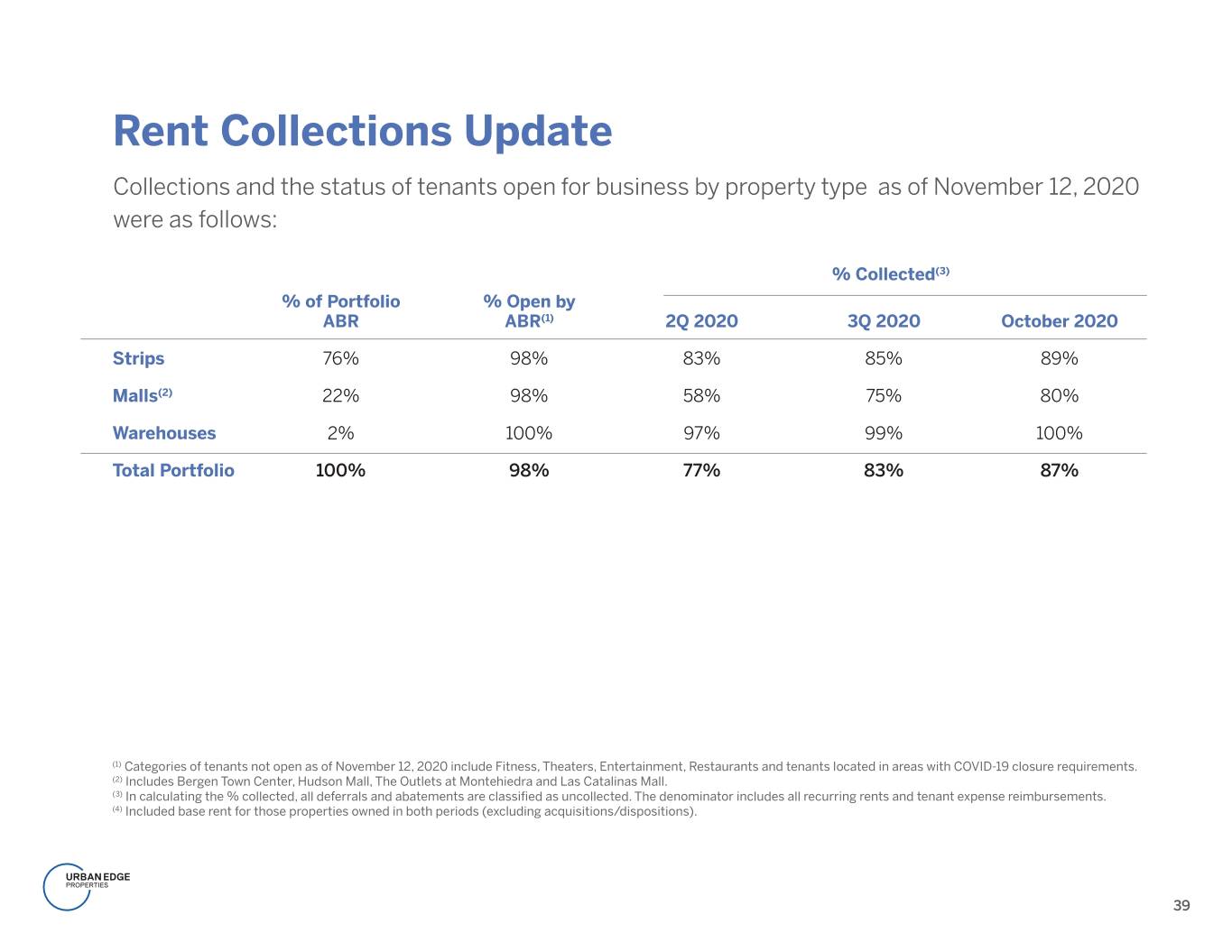

Rent Collections Update Collections and the status of tenants open for business by property type as of November 12, 2020 were as follows: % Collected(3) % of Portfolio % Open by ABR ABR(1) 2Q 2020 3Q 2020 October 2020 Strips 76% 98% 83% 85% 89% Malls(2) 22% 98% 58% 75% 80% Warehouses 2% 100% 97% 99% 100% Total Portfolio 100% 98% 77% 83% 87% (1) Categories of tenants not open as of November 12, 2020 include Fitness, Theaters, Entertainment, Restaurants and tenants located in areas with COVID-19 closure requirements. (2) Includes Bergen Town Center, Hudson Mall, The Outlets at Montehiedra and Las Catalinas Mall. (3) In calculating the % collected, all deferrals and abatements are classified as uncollected. The denominator includes all recurring rents and tenant expense reimbursements. (4) Included base rent for those properties owned in both periods (excluding acquisitions/dispositions). 39

Actively Engaged in Tenant Recovery Efforts • New mall websites keep customers updated on store hours with a “pop up” take out and curbside pick-up promotion to support open and operating tenant businesses throughout the pandemic • Hosted “Prepare to Comply”, a Q&A webinar held on the SBA’s Paycheck Protection Program to help tenants navigate through the assistance program • Distributed “Open for Take Out” street signs and property A-frames to support tenant business visibility • Launched Grab N’ Go, flexible and convenient parking zones for direct-to-car delivery or by our shoppers for quick order and pick-up parking • Maintained our “commitment to communicate” throughout the pandemic with property teams ensuring on-going communication with tenants to best facilitate their reopening • Marketing campaigns being executed to promote store openings, tenant protocols in place, the new Grab N’ Go program and communications to help ease shoppers returning to stores 40

Supporting Our Communities In response to the COVID-19 pandemic, Urban Edge has been working closely with local municipal leaders to address immediate needs of those living in the neighborhoods served by our properties. Our focus has been to utilize our assets and skillsets in partnership with other organizations to support those in need. These efforts have included: • Launching the RAP4Bronx initiative out of Bruckner Commons in partnership with Bronx Community Board 9, Bronx Private Industry Council, The Skyline Charitable Foundation and York Studios to support the hardest hit district within the Bronx with essential items and meal distribution • Delivering hot meals to hospitals, police and EMS teams in Bergen County, Yonkers, the Bronx and Jersey City, and purchasing these meals from our tenants to support their businesses • Donating critical personal protective equipment to local organizations, such as the Hogar Cuna San Cristobal Orphanage in Puerto Rico, the Paramus Food Pantry and the Montefiore Medical Center • Donating and delivering personal care, cleaning, and food supplies to organizations such as the Office of Aging in Yonkers, Paramus Food Pantry in Bergen County, and AngelaCares in Jersey City • Raising funds from employees and the community in support of a number of hospitals, local food organizations and other entities, such as the Hackensack Hospital COVID-19 Relief Fund, the RAP4Bronx efforts, and the Hogar Cuna San Cristobal Orphanage. Urban Edge has been focused on supporting our local communities and is taking action to safeguard the health of our tenants, shoppers and employees 41

Summary • Robust leasing activity pipeline with over 1 million sf of activity under way • Balance sheet is one of the best in the shopping center sector, significant liquidity and no corporate debt other than line of credit - $1 billion in liquidity ($0.4B in cash and $0.6B available on line of credit) • Redevelopment pipeline is extracting value from the land embedded in our portfolio and providing ability to diversify with non-retail uses including industrial, residential, medical office and self-storage • Strong and diversified tenant base that is anchored by high-volume, value and necessity retailers, who have demonstrated their resilience even in uncertain times - Top tenants are home improvement stores, mass merchandisers, supermarkets, big-box electronics, and discount retailers including industry leaders such as Home Depot, Lowe’s, Walmart, Target, Stop & Shop, ShopRite, Best Buy, The TJX Companies and Burlington • Strip centers offer flexible format to adapt to changing retail environment • Portfolio concentrated in markets with the highest number of households and the lowest competitive supply of retail GLA per capita located in first ring suburbs of NY Metro • Highly experienced team with a proven track record of execution 42

Non-GAAP Financial Measures & Operating Metrics Non-GAAP Financial Measures The Company uses certain non-GAAP performance measures, in addition to the primary GAAP presentations, as we believe these measures improve the understanding of the Company’s operational results. We continually evaluate the usefulness, relevance, limitations, and calculation of our reported non-GAAP performance measures to determine how best to provide relevant information to the investing public, and thus such reported measures are subject to change. The Company’s non-GAAP performance measures have limitations as they do not include all items of income and expense that affect operations, and accordingly, should always be considered as supplemental financial results. The following non-GAAP measures are commonly used by the Company and investing public to understand and evaluate our operating results and performance: • FFO: The Company believes Funds From Operations (FFO) is a useful, supplemental measure of its operating performance that is a recognized metric used extensively by the real estate industry and, in particular real estate investment trusts (REITs). FFO, as defined by the National Association of Real Estate Investment Trusts (Nareit) and the Company, is net income (computed in accordance with GAAP), excluding gains (or losses) from sales of depreciable real estate and land when connected to the main business of a REIT, impairments on depreciable real estate or land related to a REIT’s main business and rental property depreciation and amortization expense. The Company believes that financial analysts, investors and shareholders are better served by the presentation of comparable period operating results generated from FFO primarily because it excludes the assumption that the value of real estate assets diminish predictably. FFO does not represent cash flows from operating activities in accordance with GAAP, should not be considered an alternative to net income as an indication of our performance, and is not indicative of cash flow as a measure of liquidity or our ability to make cash distributions. • FFO as Adjusted: The Company provides disclosure of FFO as Adjusted because it believes it is a useful supplemental measure of its core operating performance that facilitates comparability of historical financial periods. FFO as Adjusted is calculated by making certain adjustments to FFO to account for items the Company does not believe are representative of ongoing core operating results, including non-comparable revenues and expenses. The Company’s method of calculating FFO as Adjusted may be different from methods used by other REITs and, accordingly, may not be comparable to such other REITs. • Cash NOI: The Company uses cash Net Operating Income (NOI) internally to make investment and capital allocation decisions and to compare the unlevered performance of our properties to our peers. The Company believes cash NOI is useful to investors as a performance measure because, when compared across periods, cash NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and acquisition and disposition activity on an unleveraged basis, providing perspective not immediately apparent from net income. The Company calculates cash NOI using net income as defined by GAAP reflecting only those income and expense items that are incurred at the property level, adjusted for non-cash rental income and expense, and income or expenses that we do not believe are representative of ongoing operating results, if any. In addition, the Company uses cash NOI margin, calculated as cash NOI divided by total revenue, which the Company believes is useful to investors for similar reasons. • Same-property Cash NOI: The Company provides disclosure of cash NOI on a same-property basis, which includes the results of properties that were owned and operated for the entirety of the reporting periods being compared. Information provided on a same-property basis excludes properties under development, redevelopment or that involve anchor repositioning where a substantial portion of the gross leasable area (GLA) is taken out of service and also excludes properties acquired or sold during the periods being compared. As such, same-property cash NOI assists in eliminating disparities in net income due to the development, redevelopment, acquisition or disposition of properties during the periods presented, and thus provides a more consistent performance measure for the comparison of the operating performance of the Company’s properties. While there is judgment surrounding changes in designations, a property is removed from the same-property pool when it is designated as a redevelopment property because it is undergoing significant renovation or retenanting pursuant to a formal plan that is expected to have a significant impact on its operating income. A development or redevelopment property is moved back to the same-property pool once a substantial portion of the NOI growth expected from the development or redevelopment is reflected in both the current and comparable prior year period, generally one year after at least 80% of the expected NOI from the project is realized on a cash basis. Acquisitions are moved into the same-property pool once we have owned the property for the entirety of the comparable periods and the property is not under significant development or redevelopment. The Company also provides disclosure of cash NOI on a same-property basis adjusted to include redevelopment properties. Same-property cash NOI may include other adjustments. 43

Non-GAAP Financial Measures & Operating Metrics (cont) • EBITDAre and Adjusted EBITDAre: Earnings Before Interest, Tax, Depreciation and Amoritization (EBITDAre) and Adjusted EBITDAre are supplemental, non-GAAP measures utilized by us in various financial ratios. The White Paper on EBITDAre, approved by Nareit’s Board of Governors in September 2017, defines EBITDAre as net income (computed in accordance with GAAP), adjusted for interest expense, income tax expense, depreciation and amortization, losses and gains on the disposition of depreciated property, impairment write-downs of depreciated property and investments in unconsolidated joint ventures, and adjustments to reflect the entity’s share of EBITDAre of unconsolidated joint ventures. EBITDAre and Adjusted EBITDAre are presented to assist investors in the evaluation of REITs, as a measure of the Company’s operational performance as they exclude various items that do not relate to or are not indicative of our operating performance and because they approximate key performance measures in our debt covenants. Accordingly, the Company believes that the use of EBITDAre and Adjusted EBITDAre, as opposed to income before income taxes, in various ratios provides meaningful performance measures related to the Company’s ability to meet various coverage tests for the stated periods. Adjusted EBITDAre may include other adjustments not indicative of ongoing operating results as detailed in the Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre included herein. The Company also presents the ratio of net debt (net of cash) to annualized Adjusted EBITDAre as of September 30, 2020, and net debt (net of cash) to total market capitalization, which it believes is useful to investors as a supplemental measure in evaluating the Company’s balance sheet leverage. The Company believes net income is the most directly comparable GAAP financial measure to the non-GAAP performance measures outlined above. Reconciliations of these measures to net income have been provided in the Company’s most recently available public filings at http://investors.uedge.com/news, and a reconciliation of net debt to EBITDAre and Adjusted EBITDAre is provided herein. Operating Metrics The Company presents certain operating metrics related to our properties, including occupancy, leasing activity and rental rates. Operating metrics are used by the Company and are useful to investors in facilitating an understanding of the operational performance for our properties. Occupancy metrics represent the percentage of occupied gross leasable area based on executed leases (including properties in development and redevelopment) and includes leases signed, but for which rent has not yet commenced. Same-property portfolio occupancy includes properties that have been owned and operated for the entirety of the relevant periods being compared. Occupancy metrics presented for the Company’s same-property portfolio excludes properties under development, redevelopment or that involve anchor repositioning where a substantial portion of the gross leasable area is taken out of service and also excludes properties acquired within the past 12 months or properties sold during the periods being compared. 44

888 Seventh Avenue New York, NY 10019 212.956.2556