Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Simpson Manufacturing Co., Inc. | ssd-20201116.htm |

Off-Season Stockholder Engagement STRENGTH BUILT IN November | 2020

Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 2 IE of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend,“ "plan,“ "target," "continue," "predict," "project," "change," "result," "future," "will," "could," "can," "may," "likely," "potentially,“ or similar expressions that concern our strategy, plans, expectations or intentions. Forward-looking statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing and other statements that are not historical facts. Although we believe that the expectations, opinions, projections and comments reflected in these forward-looking statements are reasonable, such statements involve risks and uncertainties and we can give no assurance that such statements will prove to be correct. Actual results may differ materially from those expressed or implied in such statements. Forward-looking statements are subject to inherent uncertainties, risk and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in our forward-looking statements include the impact of COVID-19 on our operations and supply chain, and the operations of our customers, suppliers and business partners and those discussed under Item 1A. Risk Factors and Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations in our most recent Annual Report on Form 10-K and subsequent filings with the SEC. To the extent that COVID-19 adversely affects our business and financial results, it may also have the effect of heightening many of such risk and other factors. We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition. 2

Investment Highlights Industry leader with unique business model, strong brand recognition and trusted reputation Diversified product offerings and geographies mitigates exposure to cyclical U.S. housing market Leadership position in wood products with significant opportunities in all addressable markets Industry-leading gross profit and operating margins Strong balance sheet enables financial flexibility and stockholder returns 74% of cash flow from operations returned to stockholders since 2017(1) (1) Time frame represents January 1, 2017 to September 30, 2020. 3

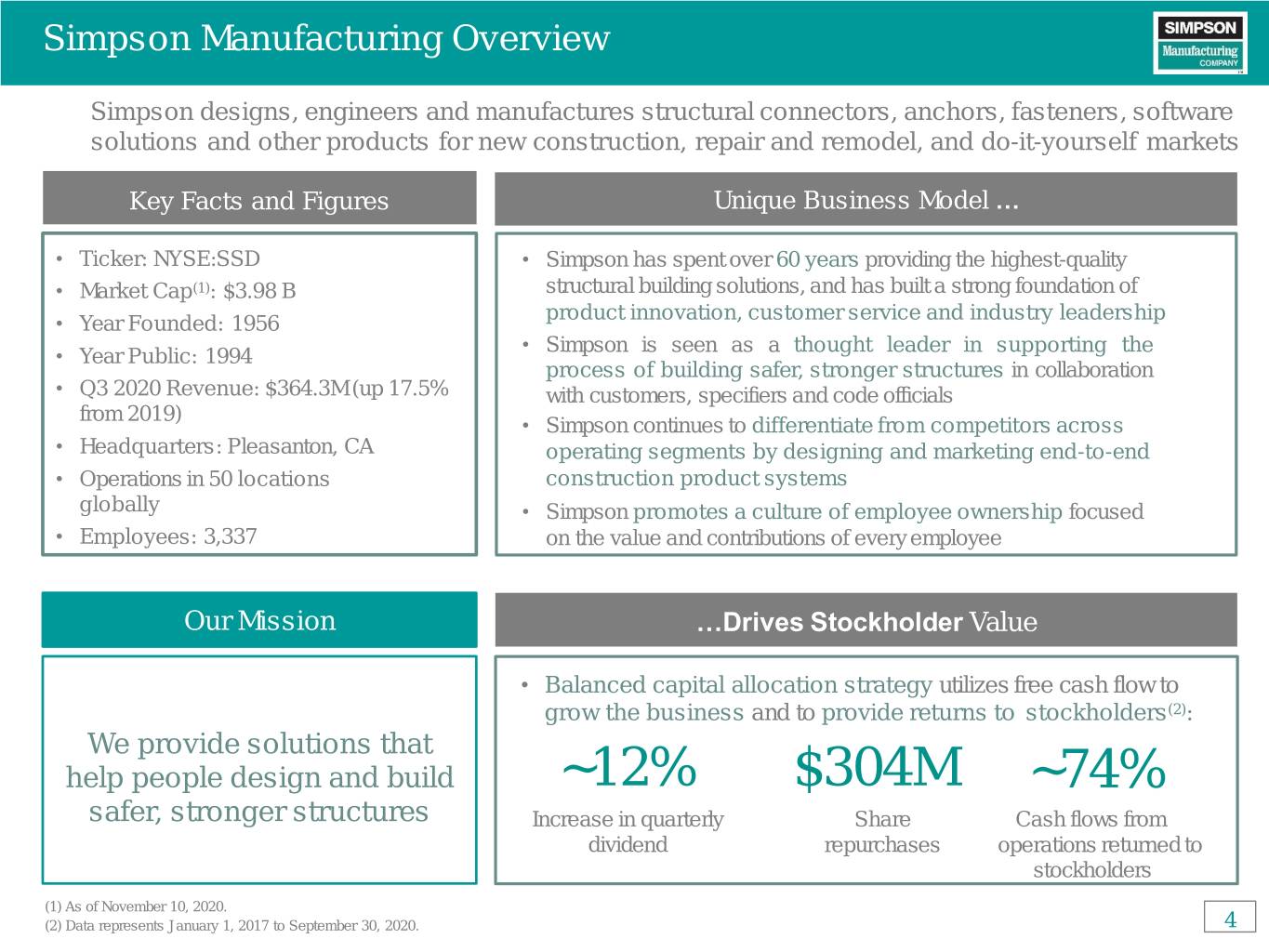

Simpson Manufacturing Overview Simpson designs, engineers and manufactures structural connectors, anchors, fasteners, software solutions and other products for new construction, repair and remodel, and do-it-yourself markets Key Facts and Figures Unique Business Model … • Ticker: NYSE:SSD • Simpson has spent over 60 years providing the highest-quality • Market Cap(1): $3.98 B structural building solutions, and has built a strong foundation of product innovation, customer service and industry leadership • Year Founded: 1956 • Simpson is seen as a thought leader in supporting the • Year Public: 1994 process of building safer, stronger structures in collaboration • Q3 2020 Revenue: $364.3M (up 17.5% with customers, specifiers and code officials from 2019) • Simpson continues to differentiate from competitors across • Headquarters: Pleasanton, CA operating segments by designing and marketing end-to-end • Operations in 50 locations construction product systems globally • Simpson promotes a culture of employee ownership focused • Employees: 3,337 on the value and contributions of every employee Our Mission …Drives Stockholder Value • Balanced capital allocation strategy utilizes free cash flow to grow the business and to provide returns to stockholders(2): We provide solutions that help people design and build ~12% $304M ~74% safer, stronger structures Increase in quarterly Share Cash flows from dividend repurchases operations returned to stockholders (1) As of November 10, 2020. (2) Data represents January 1, 2017 to September 30, 2020. 4

Response to COVID-19 The health, safety and wellbeing of our employees is our top priority as we work to ensure a safe work environment, protect our employees and serve our customers Crisis Management Team Actions Taken Established a Crisis Management Team (CMT) to Solutions to support safe work places include: monitor new COVID-19 related developments and support • Social distancing, mask wearing, temperature our operations to respond to the ever-changing landscape screening and increased cleaning • Members include: our CEO, CFO, President of Sales, General Counsel, and Heads of HR, Manufacturing, – Includes staggered shift schedules IT, Internal Communications, and Safety – Use of EPA-registered disinfectants for facilities • Currently the CMT meets twice per week, at onset of and equipment the pandemic met daily • The CMT provides updates to the Board on a regular – Hands-free soap and towel dispensers basis • Restructuring of working spaces and addition of barriers to separate personnel Key goals include: • Facility closures in necessary instances • Support of safe working environments in our operations • Instituted work-from-home (WFH) for certain • Regular communications to inform and update employees and office staff when possible employees on the status of working conditions and • Increased travel restrictions, particularly focused on safety measures taken air travel and in-person group environments • Oversight of training on COVID-19 safety practices Near-Term Outlook • Continued part or full-time WFH with investment in technology and programs to support WFH conditions • Resumed hiring across the business to meet strong production and sales volumes • Eased travel restrictions based on business need • Repayment of credit lines and evaluation of M&A opportunities in support of our growth strategy 5

3-Year Relative Price Performance Recent stock price performance reflects clarity surrounding business strategy and durability, growth prospects and operational efficiencies SSD: +63% S&P 500: +36% DJUSBM: +35% Proxy Peers: +33% Nov-2017 Mar-2018 Jul-2018 Nov-2018 Mar-2019 Jul-2019 Nov-2019 Mar-2020 Jul-2020 Nov-2020 Simpson Manufacturing Co. Proxy Peers S&P 500 DJ US TM/Building Materials & Fixtures Index Note: Proxy peer average includes: AAON, AMWD, APOG, AWI, EXP, ROCK, IIIN, DOOR, PATK, PGTI, NX, SUM, TREX, USCR and WMS. Note: As of November 2, 2020. 6

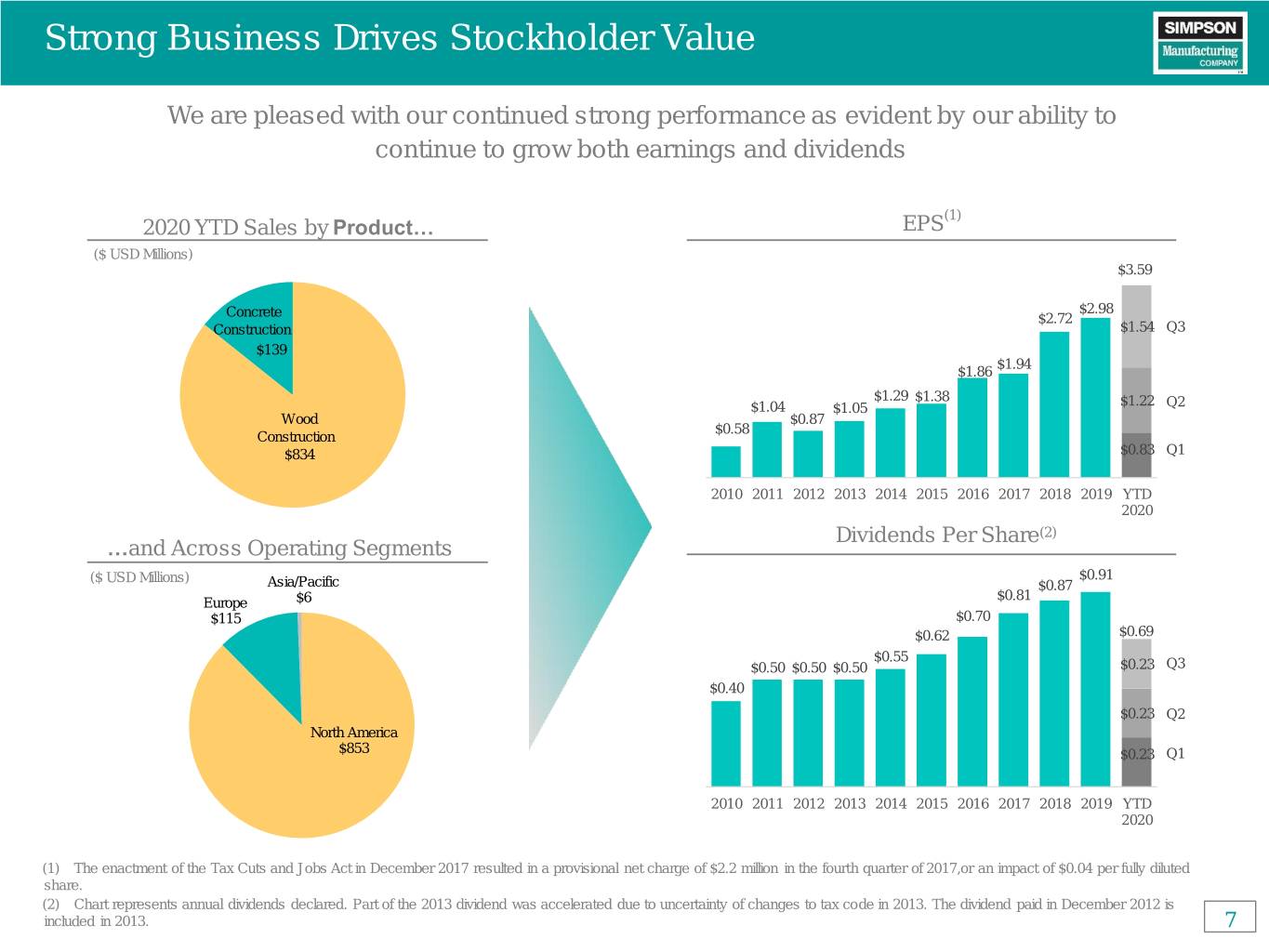

Strong Business Drives Stockholder Value We are pleased with our continued strong performance as evident by our ability to continue to grow both earnings and dividends (1) 2020 YTD Sales by Product… EPS ($ USD Millions) $3.59 $2.98 Concrete $2.72 Construction $1.54 Q3 $139 $1.94 $1.86 $1.29 $1.38 $1.22 $1.04 $1.05 Q2 Wood $0.87 $0.58 Construction $834 $0.83 Q1 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 YTD 2020 Dividends Per Share(2) …and Across Operating Segments ($ USD Millions) $0.91 Asia/Pacific $0.87 $0.81 Europe $6 $115 $0.70 $0.62 $0.69 $0.55 $0.50 $0.50 $0.50 $0.23 Q3 $0.40 $0.23 Q2 North America $853 $0.23 Q1 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 YTD 2020 (1) The enactment of the Tax Cuts and Jobs Act in December 2017 resulted in a provisional net charge of $2.2 million in the fourth quarter of 2017,or an impact of $0.04 per fully diluted share. (2) Chart represents annual dividends declared. Part of the 2013 dividend was accelerated due to uncertainty of changes to tax code in 2013. The dividend paid in December 2012 is included in 2013. 7

Disciplined Capital Allocation Strategy Simpson has maintained a strong balance sheet and ample liquidity to maintain day-to-day operations Since 2017(1) Simpson has returned 74% of cash flow from operations to stockholders through dividends and repurchases of its common stock We are focused on effective working capital management and prudent cash preservation in the COVID-19 environment, while continuing to support our growth strategy • Improve cash flow through better Cash Flow from management of working capitaland Operations overall balance sheet discipline Share Repurchases Organic Growth Dividends Investments • Repurchased $62.7 million of Simpson • Focus primarily on organic growth • Maintained quarterly cash dividends common stock in the nine months opportunities through strategic capital consistently since 2004 ended September 30, 2020 investments in the business • $37.3 million available for share • Q3 2020 strategic asset purchase of repurchases (of $100 million small software application to authorization through 2020) strengthen value proposition • Q4 2020 strategic asset purchase of small connector manufacturer in the United Kingdom to expand market share in Europe (1) Time frame represents January 1, 2017 to September 30, 2020. 8

Successful Execution of 2020 Plan(1) We've made significant progress on our 2020 Plan through the implementation of strategic changes to our business to ensure the long-term sustainability and profitability of our operations KEY OBJECTIVES FY 2016 Actual 2020 PLAN As of Q3 2020(2) Net Sales CAGR estimated to increase 9-10% compared FOCUS ON ORGANIC • ~8% Organic Net Sales • $861M Net Sales to FY 2019 1 GROWTH CAGR ~10% Organic Net Sales CAGR through FY 2019 25 – 26.5% Operating • 31.8% Operating • ~26% - 27% Operating RATIONALIZE COST Expenses as a % of Net Expenses as a % of Net Expenses as a % of Net Sales; 27.9% as of FY 2019 STRUCTURE TO Sales Sales 2 ~19% OperatingIncome INCREASE • 16.4% OperatingIncome • ~16% - 17%Operating Margin; 15.9% as of FY PROFITABILITY Margin Income Margin 2019 Achieved significant IMPROVE WORKING • Working with external expense reductions and • 2x Inventory Turn consultant to identify CAPITAL MANAGEMENT new initiatives expected to 3 Rate further improvementsto & BALANCE SHEET lead to cost containment inventory management DISCIPLINE beyond 2020 Plan goals (1) Note: Updated as of November 5, 2019. The initial 2020 plan was unveiled on October 30, 2017. (2) Based on Q3 2020 10-Q filing. (3) See slide 17 for Return on Invested Capital (ROIC) definition. 9

Diverse and Highly Qualified Board Our Board is committed to being effective stewards of stockholder capital and possesses the diversity of skills and experiences to oversee the business James Andrasick Jennifer Chatman Karen Colonias Chairman Former CEO Paul J. Cortese Professor of Mgmt. President & CEO Matson Navigation Haas School of Business, Simpson Manufacturing UC Berkeley Celeste Volz Ford Gary Cusumano Robin Greenway MacGillivray Former Chairman Founder & CEO The Newhall Land and Former Senior Vice Stellar Solutions Farming Company President — One AT&T Integration, AT&T Michael Bless Phil Donaldson Director Skills and Expertise Executive Leadership 8 CEO Century Aluminum Executive VP & CFO Company Andersen Corporation Public Company Board 4 Business Strategy 8 Mergers & Acquisitions 8 Gender Diversity Director Tenure Independence Financial Expertise 5 9+ Years < 4 Years Financial Literacy 8 3 directors 2 directors International Business 5 50% 88% Men Average Industry Experience 5 50% Female Women Independent 50% Tenure of Corporate Governance Directors 9.3 years Directors 8 Risk Management 5 4-8 Years Talent Management/HR 4 3 directors Technology 3 Indicates director joined over past 3 years 10

The Board’s Role and Responsibilities Our Board of Directors oversees, monitors and directs management in the long-term interest of Simpson and our stockholders THE BOARD’S KEY RESPONSIBILITIES INCLUDE: Choosing and Overseeing monitoring Interviewing and management’s Establishing performance of the nominating director relations the appropriate CEO and Determining candidates and with governments, ‘Tone at the establishing executive monitoring the communities and Top’ succession plans compensation board’s performance other constituents Approving our Determining risk Setting Evaluating any Approving long-term strategy appetite; setting standards for proposed and adopting and annual standards for corporate transaction that corporate operating plan, managing risk: social creates a seeming governance monitoring monitoring risk responsibility conflict between guidelines performance and management and the best interests and providing advice monitoring of stockholders committee to management compliance and those of charters management 11

Board Oversight of Risk Management Our Board is actively involved in overseeing the Company’s risk management, regularly reviewing information regarding operational, financial, legal and strategic risks to make decisions in the best interests of the Company and its stockholders Board of Directors Compensation and Audit and Finance Corporate Strategy and Nominating and Leadership Development Committee Acquisitions Committee Governance Committee Committee Oversees management of Oversees management of Oversees management of Oversees management of risks related to financial risks related to risks related to corporate risks related to statements, the financial compensation strategy and strategic governance of the reporting process and policies and practices acquisitions company and the Board, cybersecurity applicable to executives, including board and employee benefit plans committee composition and the administration of equity plans, as well as succession and Leadership development Management Team While each committee is responsible for evaluating certain risks and overseeing the management of these risks, our entire Board is regularly informed about such risks in Board meetings and management reports 12

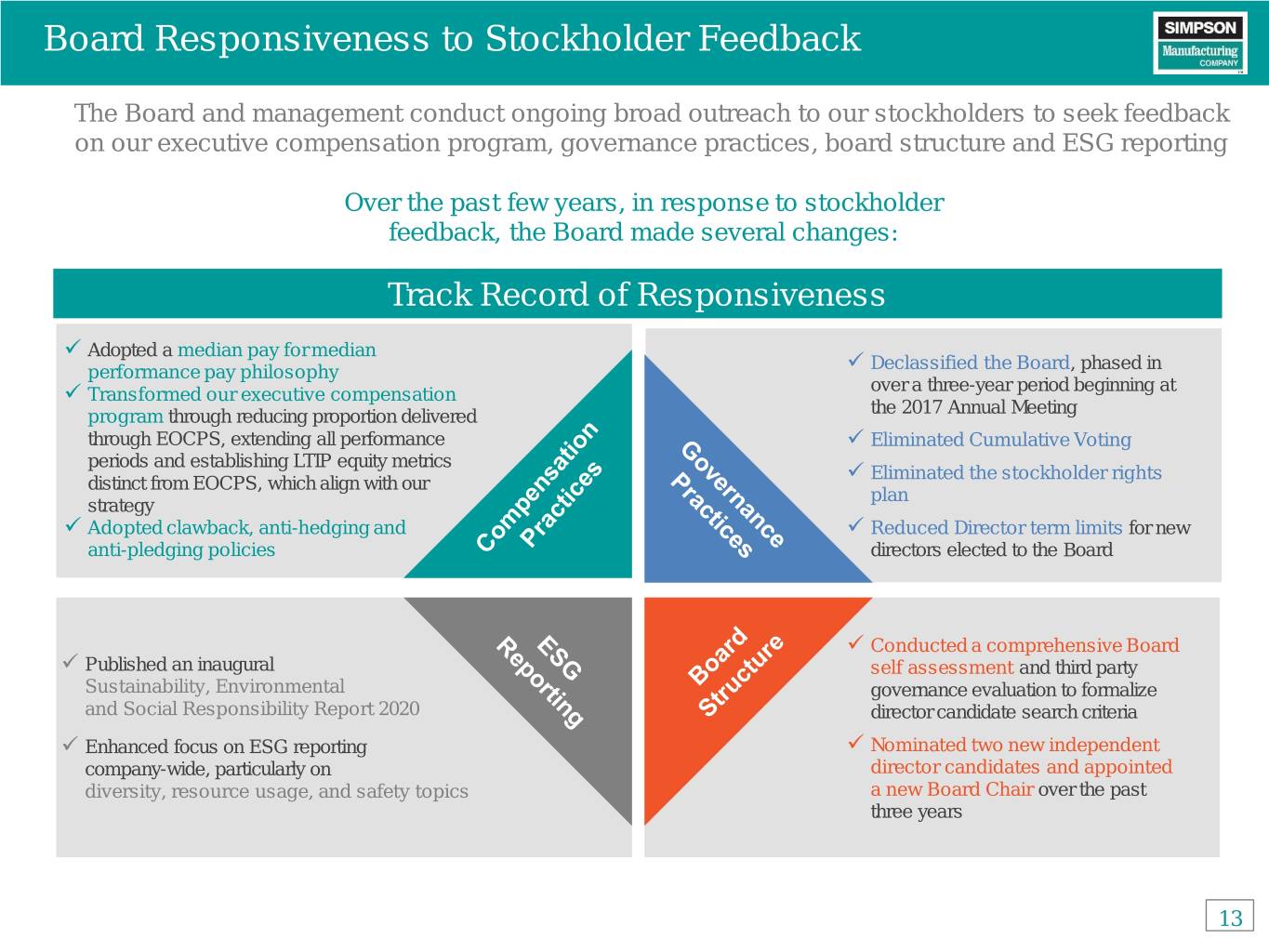

Board Responsiveness to Stockholder Feedback The Board and management conduct ongoing broad outreach to our stockholders to seek feedback on our executive compensation program, governance practices, board structure and ESG reporting Over the past few years, in response to stockholder feedback, the Board made several changes: Track Record of Responsiveness Adopted a median pay for median performance pay philosophy Declassified the Board, phased in over a three-year period beginning at Transformed our executive compensation program through reducing proportion delivered the 2017 Annual Meeting through EOCPS, extending all performance Eliminated Cumulative Voting periods and establishing LTIP equity metrics Eliminated the stockholder rights distinct from EOCPS, which align with our plan strategy Adopted clawback, anti-hedging and Reduced Director term limits for new anti-pledging policies directors elected to the Board Conducted a comprehensive Board Published an inaugural self assessment and third party Sustainability, Environmental governance evaluation to formalize and Social Responsibility Report 2020 director candidate search criteria Enhanced focus on ESG reporting Nominated two new independent company-wide, particularly on director candidates and appointed diversity, resource usage, and safety topics a new Board Chair over the past three years 13

Robust Corporate Responsibility Program At Simpson, we are committed to operating in a safe and environmentally responsible manner to protect our employees, customers and communities, while benefiting society, the economy and the environment Manufacturing Processes Sustainable Building Practices We look to minimize the amount of waste generated by our We support practices established by the US Green Building manufacturing processes through companywide Council’s Leadership in Energy and Environmental Design Lean practices (LEED) Green Building Rating System, NAHB Green, and state- and city-specific green building codes • Our production lines and facilities do not produce regulated • We support green building systems by developing products that external emissions use or incorporate engineered wood and insulated concrete forms • Our R&D engineers are focused on material efficiencies and • We use advanced framing techniques to reduce material usage innovative product features that minimize waste and improve energy performance in wood-frame construction • Our concrete construction products contribute to the longevity and • We use non-toxic materials for connector products that require sustainability of the projects on which they’re used painting Recycling Resource Conservation We support the Circular Economy by minimizing our recognized We ensure eco-friendly, cost-effective operations by working waste streams and sending unused steel from our processes hard to improve energy efficiencies including energy-efficient back upstream for reintroduction into the material supply chain lighting, heating and cooling systems Both our Stockton, California (our largest manufacturing Our Boulstrup facility in facility) and Sewen, Denmark is now mostly Raw Steel End Switzerland facilities are powered by hydropower and Materials Production User powered by solar energy, wind power which enabled the which contributes to a facility to reduce its annual significant reduction in our oil requirement by 65% carbon emissions We have increased our total steel recycling year-over-year Simpson reduced its water consumption since 2015 with >149M pounds total over the past five years every year for the past five years For more information, please see our inaugural Sustainability, Environmental and Social Responsibility Report 2020 14

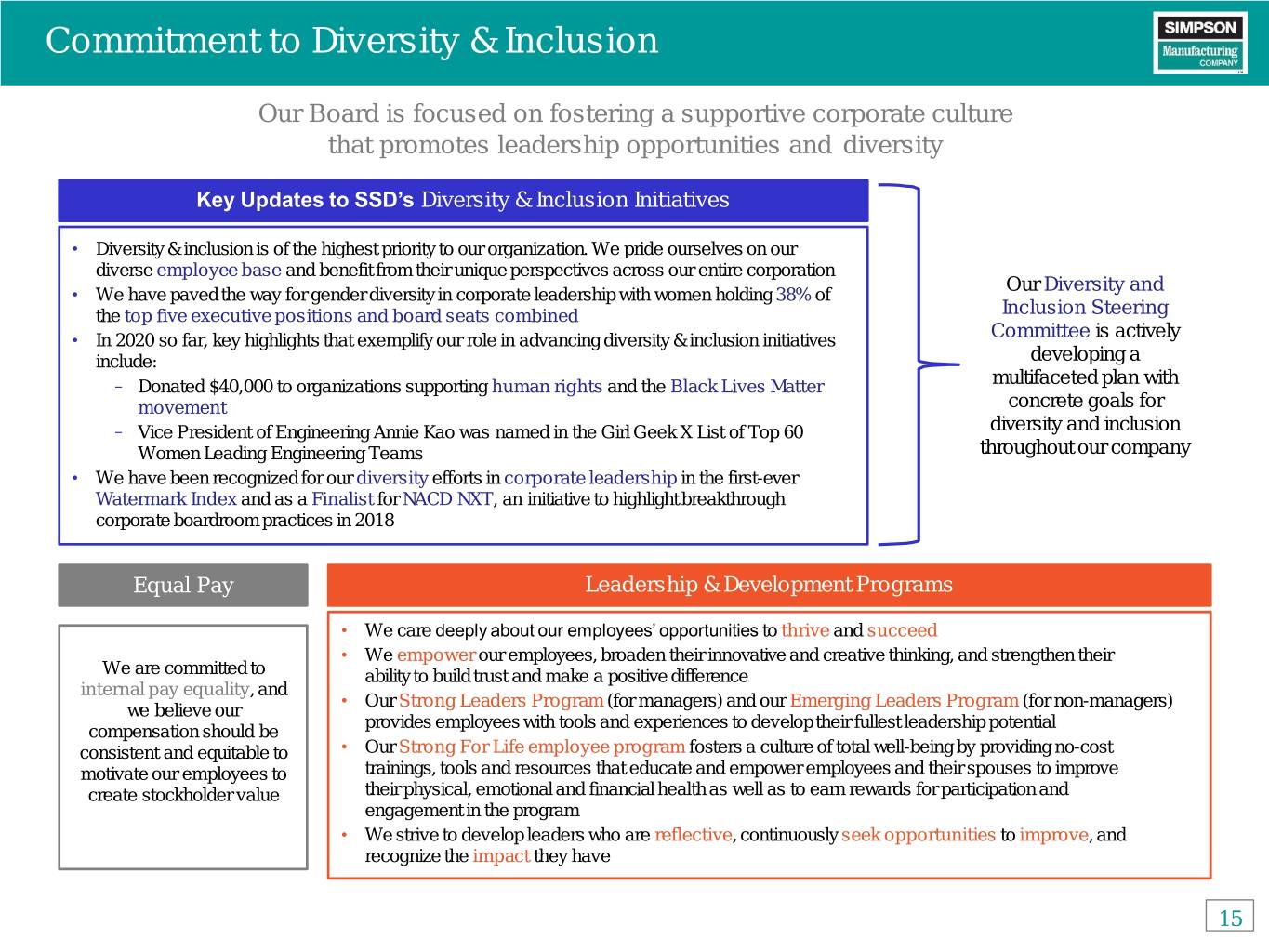

Commitment to Diversity & Inclusion Our Board is focused on fostering a supportive corporate culture that promotes leadership opportunities and diversity Key Updates to SSD’s Diversity & Inclusion Initiatives • Diversity & inclusion is of the highest priority to our organization. We pride ourselves on our diverse employee base and benefit from their unique perspectives across our entire corporation Our Diversity and • We have paved the way for gender diversity in corporate leadership with women holding 38% of the top five executive positions and board seats combined Inclusion Steering • In 2020 so far, key highlights that exemplify our role in advancing diversity & inclusion initiatives Committee is actively include: developing a – Donated $40,000 to organizations supporting human rights and the Black Lives Matter multifaceted plan with movement concrete goals for – Vice President of Engineering Annie Kao was named in the Girl Geek X List of Top 60 diversity and inclusion Women Leading Engineering Teams throughout our company • We have been recognized for our diversity efforts in corporate leadership in the first-ever Watermark Index and as a Finalist for NACD NXT, an initiative to highlight breakthrough corporate boardroom practices in 2018 Equal Pay Leadership & Development Programs • We care deeply about our employees’ opportunities to thrive and succeed • We empower our employees, broaden their innovative and creative thinking, and strengthen their We are committed to ability to build trust and make a positive difference internal pay equality, and • Our Strong Leaders Program (for managers) and our Emerging Leaders Program (for non-managers) we believe our provides employees with tools and experiences to develop their fullest leadership potential compensation should be consistent and equitable to • Our Strong For Life employee program fosters a culture of total well-being by providing no-cost motivate our employees to trainings, tools and resources that educate and empower employees and their spouses to improve create stockholder value their physical, emotional and financial health as well as to earn rewards for participation and engagement in the program • We strive to develop leaders who are reflective, continuously seek opportunities to improve, and recognize the impact they have 15

Executive Compensation Program At our 2020 Annual Meeting of stockholders, Simpson received strong support for its executive compensation program, with approximately 99% of votes cast approving. The Board was pleased with the strong support and therefore the Compensation Committee decided to maintain the program for 2020 2020 Program Design 2020 TARGET CEO COMPENSATION MIX(1) Salary Salary is positioned to 50th percentile of peer group 50% 50% Long Annual Operating Quarterly Operating Long Term TermIncentive Profit Profit Incentive EOCPS 60%60% 80% PSUs EOCPS 20% 50% 50% Three-year revenue Three-year ROIC Base Salary growth following grant following grant 20% Term Incentive Term - 20% RSUs 80% Performance Based Three-year staggered vesting Long (20% / 40% / 40%) (1) Reflects current program targets, not actual performance. 16

Return on Invested Capital (“ROIC”) Definition When referred to in this presentation, the Company’s return on invested capital (“ROIC”) for a fiscal period is calculated based on (i) the net income of the last four quarters as presented in the Company’s condensed consolidated statements of operations prepared pursuant to generally accepted accounting principles in the U.S. (“GAAP”), as divided by (ii) the average of the sum of the total stockholders’ equity and the total long-term liabilities at the beginning of and at the end of such period, as presented in the Company’s consolidated balance sheets prepared pursuant to GAAP for that applicable year. For the purposes of comparability in this calculation, total long-term liabilities excludes long-term finance lease liabilities, which were recognized as of June 30, 2019 as a result of the January 1, 2019 adoption of ASU 2016-02. As such, the Company’s ROIC, a ratio or statistical measure, is calculated using exclusively financial measures presented in accordance with GAAP. 17

SIMPSON’S PEOPLE MAKE THE DIFFERENCE simpsonmfg.com/financials 18