Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SELECT BANCORP, INC. | tm2035509d1_8k.htm |

Exhibit 99.1

Investor Presentation 3 rd Quarter 2020

2 Statements included in this presentation which are not historical in nature are intended to be, and are hereby identified as, forward - looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 . These statements generally relate to our financial condition, results of operations, plans, objectives, future performance, or business . They usually can be identified by the use of forward - looking terminology, such as “believes,” “expects,” or “are expected to,” “plans,” “projects,” “proposes,” “goals,” “estimates,” “will,” “may,” “should,” “could,” “would,” “continues,” “intends to,” “outlook,” “pending,” or “anticipates,” or variations of these and similar words, or by discussions of strategies that involve risks and uncertainties . These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and other factors, some of which remain beyond our control, are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the forward - looking statements . Factors that could cause actual results to differ materially from the results anticipated might include, but are not limited to, the following : ( 1 ) the ongoing COVID - 19 pandemic and measures intended to prevent its spread, which include wide disruptions to business activity that may impact the financial strength of our borrowers ; ( 2 ) deterioration in the financial condition of borrowers resulting in significant increases in our loan losses and provisions for those losses and other adverse impacts to our results of operations and financial condition ; ( 3 ) the failure of assumptions underlying the establishment of reserves for possible loan losses ; ( 4 ) legislative and regulatory changes, including changes in banking, tax, and securities laws and regulations and their application by our regulators ; ( 5 ) changes in interest rates that affect the level and composition of deposits, loan demand, and the values of loan collateral, securities, and interest - sensitive assets and liabilities ; ( 6 ) changes in financial market conditions, either internationally, nationally, or locally in areas in which we conduct operations ; ( 7 ) changes in accounting principles, policies, and guidelines applicable to bank holding companies and banking ; ( 8 ) impairment of investment securities, goodwill, other intangible assets or deferred tax assets, including any of the foregoing associated with our potential acquisition activity ; ( 9 ) the effects of competition from other commercial banks, non - bank lenders, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and mutual funds, and other financial institutions operating in our market area and elsewhere, together with such competitors offering banking products and services by mail, telephone, and the Internet that compete with the services we offer in our markets ; ( 10 ) our ability to attract and retain key personnel experienced in banking and financial services ; ( 11 ) the effect of any mergers, acquisitions, or other transactions, to which we or the Bank may from time to time be a party, including management’s ability to successfully integrate any businesses acquired ; ( 12 ) operational risks, including data processing system failures or fraud ; ( 13 ) cyber - attacks and other data breaches that compromise the security of our customer information ; and ( 14 ) such other matters as discussed in this presentation or identified in the Company’s filings with the Securities and Exchange Commission (the “SEC”), particularly those matters described under the heading “Risk Factors” in our Annual Reports on Form 10 - K and our Quarterly Reports on Form 10 - Q and in our other reports filed with the SEC . We caution you not to place undue reliance on these forward - looking statements, which reflect management’s view only as of the date of this presentation . We are not obligated to update these statements or publicly release the result of any revisions to them to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events . Caution Regarding Forward - Looking Statements

3 Certain financial measures we use to evaluate our performance and discuss in this presentation are identified as being “non - GAAP financial measures . ” In accordance with the rules of the SEC, we classify a financial measure as being a non - GAAP (generally accepted accounting principles) financial measure if that financial measure excludes or includes amounts, or is subject to adjustments that have the effect of excluding or including amounts, that are included or excluded, as the case may be, in the most directly comparable measure calculated and presented in accordance with GAAP as in effect from time to time in the United States in our statements of operations, balance sheet or statements of cash flows . Non - GAAP financial measures do not include operating and other statistical measures or ratios or statistical measures calculated using exclusively either financial measures calculated in accordance with GAAP, operating measures or other measures that are not non - GAAP financial measures or both . The non - GAAP financial measures that we discuss in this presentation should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP . Moreover, the manner in which we calculate the non - GAAP financial measures that we discuss in this presentation may differ from that of other companies reporting measures with similar names . You should understand how such other banking organizations calculate their financial measures similar or with names similar to the non - GAAP financial measures we have discussed in this presentation when comparing such non - GAAP financial measures . Tangible common equity, tangible assets, and tangible book value per share are non - GAAP measures generally used by financial analysts and investment bankers to evaluate financial institutions . We calculate : (a) tangible common equity as shareholders’ equity less goodwill and core deposit intangibles, (b) tangible assets as total assets less goodwill and core deposit intangibles, and (c) tangible book value per share as tangible common equity (as described in clause (a)) divided by shares of common stock outstanding . A reconciliation of these non - GAAP measures to the most directly comparable financial measures calculated in accordance with GAAP is included under the heading “Non - GAAP Reconciliation” on slide 22 . We believe that these measures are important to many investors in the marketplace who are interested in changes from period to period in common equity, total assets, and book value per common share exclusive of changes in intangible assets . Non - GAAP Financial Measures

- 30% -50% -40% -30% -20% -10% 0% 10% 20% 30% Nov-17 Feb-18 May-18 Aug-18 Nov-18 Feb-19 May-19 Aug-19 Nov-19 Feb-20 May-20 Aug-20 Nov-20 Note: Market data as of market close November 3, 2020, shares outstanding as of September 30, 2020 * Non - GAAP measure; See “Non - GAAP Financial Measures” on slide 3 and “Non - GAAP Reconciliation” on slide 22 for additional information . Source: S&P Global Market Intelligence; Company Documents 4 Select Bancorp, Inc., the holding company for Select Bank & Trust, was incorporated in 2003 and is headquartered in Dunn, N.C. and offers a range of retail, small business and commercial banking services. We serve communities in North and South Carolina and Virginia through 22 full - service banking offices. North Carolina locations include Burlington, Charlotte, Clinton, Cornelius, Dunn, Elizabeth City, Fayetteville, Franklin, Goldsboro, Greenville, Highlands, Holly Springs, Leland, Lillington, Lumberton, Morehead City, Raleigh, Sylva, and Wilmington plus 3 loan production offices in Durham, Wilson, and Winston - Salem. Our South Carolina branches are located in Blacksburg and Rock Hill and Virginia location in Virginia Beach. While our presence in these communities and the markets surrounding these communities is important, we are committed to offering banking services that allow our customers to bank with us on their own schedules from wherever they are. Our goal is to provide a common sense approach to banking with knowledgeable staff and great products and services. NASDAQ: SLCT ▪ Shares Outstanding: 17,786,552 ▪ Market Cap: $143.5 million ▪ P/TBV*: 84.5% ▪ P/LTM EPS : 20.2x ▪ Average Daily Volume : 29,280 Company Overview 3 Year Total Return Charlotte Raleigh Greenville Wilmington Columbia Greenville Virginia Beach Branch Locations Loan Production Offices

5 Why Select Bancorp? x Attractive franchise in North Carolina, upstate South Carolina and Virginia Beach, Virginia x Emerging presence in three of North Carolina’s most attractive markets: Raleigh, Charlotte, and Wilmington x Improving performance with capacity for earnings growth x Proven ability to successfully execute and integrate acquisitions x Strong credit culture – unwavering underwriting standards have led to exceptional asset quality x Expanded reach into vibrant Virginia market with acquisition of Virginia Beach branch as well as further expansion into western North Carolina with recent purchase of 3 branches x Scarcity value - very few Carolinas based community banks of our size

Building Blocks to the Future Our goal is to be the bank of choice in the communities we serve by providing exceptional customer service, superior products and experienced bankers using a common sense approach to banking. Opportunities For Efficiencies Experienced and Successful Leadership Team Superior Products and Services Potential for Increased Market Share 6 Seasoned Acquiror

7 Recent Highlights and Initiatives ▪ Acquisition of 3 branches in western North Carolina with over $185 million in deposits closed in the second quarter of 2020 ▪ Opened new branch in Cornelius, NC (greater Charlotte area) in February of 2020 ▪ Two new loan production offices opened for business in late 2019, one in Durham and one in Winston - Salem ▪ Acquisition of branch in Virginia Beach with approximately $25+ million in deposits closed in the second quarter of 2019 ▪ Expanded presence in the Raleigh area with opening of new branch in Holly Springs in the first quarter of 2019 Source: S&P Global Market Intelligence, Janney Montgomery Scott, Company Documents

8 Corporate Leadership A native of North Carolina, Bill has been in the banking industry since 1983. Bill has served as President and Chief Executive Officer of Select Bank & Trust since 2014. He served as President and Chief Executive Officer of New Century Bank (predecessor to Select Bank) from 2008 – 2014 and as Chief Executive Officer of the former New Century Bank of Fayetteville from 2004 - 2008. He is a graduate of the University of North Carolina in Chapel Hill, N.C. William L. “Bill” Hedgepeth II President & Chief Executive Officer A native of Delaware, Keith has been in the banking industry since 1980. He has served as Chief Banking Officer since January 2017. He previously served as Regional Executive for the bank’s New Hanover and Brunswick County, North Carolina markets. He founded Port City Capital Bank in Wilmington in 2001 and served as the bank’s President and Chief Executive Officer until the bank was sold in 2006. He is a graduate of St. Andrews Presbyterian College in Laurinburg, N.C. W. Keith Betts Chief Banking Officer A native of Georgia, Mark has been in the banking industry since 2004. Mark has served as Chief Financial Officer of Select Bank since 2014. He served as Chief Financial Officer of Millennium Bank from 2009 - 2014 and as Chief Financial Officer of Asheville Savings Bank from 2007 - 2008. He also served as Controller and interim Chief Financial Officer of Gateway Bank from 2004 - 2007. He is a graduate of East Carolina University in Greenville, N.C. Mark A. Jeffries Chief Financial Officer A native of North Carolina, Lynn has been in the banking industry since 2003. Lynn was named Chief Operating Officer in 2017, after serving as chief administrative officer for Select Bank & Trust since 2014. She served as Corporate Ethics Officer and Human Resources Director from 2011 - 2014 and as the Human Resources Director from 2003 - 2014. Lynn is certified as a Senior Professional of Human Resources (SPHR) and as a Corporate Compliance Ethics Professional (CCEP). She is a graduate of Wake Technical Community College in Raleigh, N.C. Lynn H. Johnson Chief Operating Officer A native of Virginia, Rick has been in the banking industry since 1981. He has served as Chief Credit Officer for Select Bank & Trust since 2014. He served as Chief Credit Officer for New Century Bank from 2012 - 2014 and as a Senior Credit Administrator from 2008 - 2012. He is a graduate of Appalachian State University in Boone, N.C. David Richard “Rick” Tobin, Jr. Chief Credit Officer J. Gary Ciccone Chairman of the Board Mr. Ciccone has served as chairman of the board of directors of Select Bank & Trust and Select Bancorp, Inc. since April 2008. As owner and vice president of Nimocks , Ciccone & Townsend in Fayetteville, he has extensive experience in real estate development and commercial real estate brokerage while also developing and managing numerous commercial properties. Mr. Ciccone holds a B.S. in Business Administration from the University of North Carolina at Chapel Hill and a law degree from the University of North Carolina School of Law, Chapel Hill, N.C.

9 Franchise Footprint Source: S&P Global Market Intelligence Striving to be The Bank of Choice in the Communities We Serve Wilmington Virginia Beach Dunn Mt. Pleasant Savannah Johnson City Norfolk Elizabeth City 22 Branches ● 3 Loan Production Offices ● Over 200 Employees Branch Locations Loan Production Offices

6.6% 11.8% 7.1% 7.3% 10.9% 6.0% 6.6% 4.9% 6.3% 4.8% 10.2% 6.8% 0.0% 2.5% 5.0% 7.5% 10.0% 12.5% 15.0% Proj. 2026 Population Growth (%) Proj. 2026 Household Income Growth (%) Unemployment Rate Charlotte-Concord-Gastonia, NC-SC Raleigh, NC Wilmington, NC North Carolina Burlington, NC 5.0% Charlotte - Concord - Gastonia, NC - SC 9.8% Cullowhee, NC 5.2% Elizabeth City, NC 4.8% Fayetteville, NC 28.3% Gaffney, SC 2.1% Goldsboro, NC 6.5% Greenville, NC 9.8% Lumberton, NC 3.7% Morehead City, NC 2.1% Raleigh - Cary, NC 4.0% Virginia Beach - Norfolk - Newport News, VA - NC 2.0% Wilmington, NC 4.0% Non - MSA Deposits 12.8% 10 Emerging Presence in Attractive Markets *Wilmington MSA includes Leland, NC office Sources: S&P Global Market Intelligence, Charlotte Chamber of Commerce, Research Triangle Park, Wake County Economic Development, Town of Garner, North Carolina Ports, Trip Advisor Charlotte, NC Raleigh, NC Wilmington, NC ▪ Key industries are financial services, healthcare and technology ▪ Greater than 53% of the United States population lives within two hours of Charlotte via plane ▪ Home to Research Triangle Park, the nation’s largest research park, which houses more than 250 firms with over 50,000 employees ▪ Industries of focus include: information technology, life sciences and advanced manufacturing ▪ The nearby town of Garner will soon be the site of a new Amazon distribution center with 1,500 new jobs ▪ The Port of Wilmington is one of the most active along the east coast - boasts 1 million sq. ft. of covered storage space, 125 acres of open storage, 6,740 ft. of frontage on the wharf, and a channel depth of 42 feet ▪ Ranked 3 rd of the “10 Top Destinations on the Rise” in the United States by Trip Advisor in 2018 Deposit Breakdown as of 6/30/20* Market Demographics

4.4% 3.4% 6.6% 4.8% 9.6% 8.5% 4.8% 10.2% 6.8% 0.0% 2.5% 5.0% 7.5% 10.0% 12.5% 15.0% Proj. 2026 Population Growth (%) Proj. 2026 Household Income Growth (%) Unemployment Rate Greenville, NC Fayetteville, NC North Carolina 11 Continued Focus on Our Historical Markets *Due to changes in MSA definitions, Dunn is now part of the Fayetteville MSA Sources : S&P Global Market Intelligence, Dunn Area Chamber of Commerce, NC Department of Military and Veterans Affairs, Fayetteville Cumberland County Economic Development Corporation, Greenville Office of Economic Development, East Carolina University Dunn, NC Fayetteville, NC Greenville, NC ▪ Top employers in the Dunn area include: Campbell University, Harnett Health, and Delhaize America ▪ Close to the major U.S. interstates 95 and 40 as well as US 301 and 421 ▪ Fort Bragg draws a large military presence, employing 65,000+ individuals (both civilian and active duty) ▪ Other key industries include healthcare, logistics, and manufacturing ▪ Healthcare is a major industry in Greenville with Vidant Medical Center as the top employer ▪ Home to East Carolina University and its Division of Health Sciences, which includes the School of Dental Medicine, Brody School of Medicine, the College of Allied Health Sciences and the College of Nursing ▪ 29.7% of the population has earned at least a bachelor’s degree Market Demographics* Deposits In Historical Markets as of 6/30/20* $384,177 133,119 $- $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 $450,000 Fayetteville, NC Greenville, NC ($000s)

12 Deposit Market Share 1 Community Banks defined as banks with less than $10.0B in assets 2 Includes Jackson and Macon counties (branches acquired from Entegra Financial) Source: S&P Global Market Intelligence, Janney Montgomery Scott ▪ Top 10 deposit market share in 9 of our 14 MSAs of operation ▪ Top 10 deposit market share in 13 of our 18 counties of operation Harnett County, NC 2020 Rank Parent Company Name State # of Branches Total Deposits ($000) Total Deposit Market Share (%) 1 Truist Financial Corp. NC 5 362,014 29.83 2 Select Bancorp Inc. NC 2 216,758 17.86 3 First Citizens BancShares Inc. NC 3 205,796 16.96 4 First Bancorp NC 3 157,253 12.96 5 First Federal Financial Corp. NC 4 114,083 9.40 6 PNC Financial Services Group PA 2 67,447 5.56 7 Fidelity BancShares (N.C.) Inc NC 2 64,792 5.34 8 United Community Banks Inc. GA 1 22,874 1.88 9 Woodforest Financial Grp Inc. TX 1 2,565 0.21 Market Total 23 1,213,582 100.00 June 2020 Western North Carolina Market ² 2020 Rank Parent Company Name State # of Branches Total Deposits ($000) Total Deposit Market Share (%) 1 PNC Financial Services Group PA 1 1,349,068 49.53 2 First Citizens BancShares Inc. NC 6 499,047 18.32 3 United Community Banks Inc. GA 4 257,940 9.47 4 Wells Fargo & Co. CA 4 240,460 8.83 5 Select Bancorp Inc. NC 3 202,231 7.42 6 Nantahala B&TC NC 1 65,387 2.40 7 Regions Financial Corp. AL 1 60,727 2.23 8 Truist Financial Corp. NC 1 31,428 1.15 9 Jackson SB SSB NC 1 17,719 0.65 Market Total 22 2,724,007 100.0 June 2020 North Carolina Community Banks 1 2020 Rank Parent Company Name State # of Branches Total Deposits ($000) Total Deposit Market Share (%) 1 Live Oak Bancshares, Inc. NC 1 5,882,050 17.89 2 First Bancorp NC 96 5,641,541 17.16 3 Southern BancShares (N.C.), Inc. NC 54 2,444,146 7.43 4 Fidelity BancShares (N.C.), Inc. NC 52 2,313,426 7.04 5 HomeTrust Bancshares, Inc. NC 20 1,706,319 5.19 6 Select Bancorp, Inc. NC 19 1,283,591 3.90 7 Peoples Bancorp of North Carolina, Inc. NC 21 1,157,897 3.52 8 North State Bancorp NC 7 1,019,702 3.10 9 UB Bancorp NC 15 765,699 2.33 10 First Carolina Financial Services, Inc. NC 5 689,874 2.10 11 Uwharrie Capital Corp NC 10 676,604 2.06 12 American National Bankshares Inc. VA 7 662,429 2.01 13 Piedmont Federal Savings Bank NC 10 656,618 2.00 14 F & M Financial Corporation NC 11 641,072 1.95 15 Aquesta Financial Holdings, Inc. NC 8 520,707 1.58 16 Oak Ridge Financial Services, Inc. NC 4 473,543 1.44 17 PB Financial Corporation NC 5 431,700 1.31 18 Carter Bank & Trust VA 22 416,799 1.27 19 Dogwood State Bank NC 5 395,328 1.20 20 KS Bancorp, Inc. NC 10 386,750 1.18 Market Total 603 32,877,946 100.0 June 2020

13 Creating Value Through M&A Merger Details Announced: July 21, 2017 Completed: December 15, 2017 Deal Value: $40.6 million Consideration: 70% Stock/30% Cash Target Financials (Announcement) Assets: $259.2 million Loans: $206.2million Deposits: $208.5 million LTM Earnings: $0.77 million Acquired 2 Branches of Yadkin Bank Leland, North Carolina Morehead City, North Carolina Transaction Details Announced: June 19, 2015 Completed: December 11, 2015 Deposits Transferred: $30.8 million Loans Acquired: $9.1 million ▪ Proven ability to successfully execute and integrate acquisitions ▪ Select Bancorp continues to seek meaningful opportunities to grow via acquisition ▪ Ideal targets will have a significant presence in growing markets where Select can leverage its higher lending limit and additional products for maximum results Target Markets Myrtle Beach Charlotte Virginia Beach/Norfolk Winston - Salem/Greensboro Durham Merger Details Announced: September 30, 2013 Completed: July 25, 2014 Deal Value: $29.9 million Consideration: 100% Stock Target Financials (Announcement) Assets: $265.3 million Loans: $209.7 million Deposits: $215.4 million LTM Earnings: $2.2 million Source: S&P Global Market Intelligence Acquired 3 Branches of Entegra Bank Franklin, North Carolina Sylva, North Carolina Highlands, North Carolina Transaction Details Announced: December 23, 2019 Completed: April 17, 2020 Deposits Transferred: $186.2 million Loans Acquired: $108.2 million

14 Target Map Branch Locations Loan Production Offices

15 Financial Overview ¹Non - GAAP measure; See “Non - GAAP Financial Measures” on slide 3 and “Non - GAAP Reconciliation” on slide 22 for additional information. ²Derived from audited financial statements. ³Unaudited Source: S&P Global Market Intelligence, Company Documents In $000s except for per share data 12/31/16² 12/31/17² 12/31/18² 12/31/19 ² 3/31/2020³ 6/30/2020³ 9/30/2020³ Balance Sheet Total Assets $846,640 $1,194,135 $1,258,525 $1,275,076 $1,263,494 $1,618,960 $1,771,946 Gross Loans $677,195 $982,724 $986,620 $1,030,903 $1,041,120 $1,253,454 $1,286,402 Total Deposits $679,661 $995,044 $980,427 $992,838 $982,651 $1,338,753 $1,472,780 Loans/Deposits 99.64% 98.75% 100.57% 103.74% 105.79% 93.37% 87.35% Capital Common Equity $104,273 $136,115 $209,611 $212,775 $212,085 $211,538 $213,367 Total Equity/Assets 12.57% 11.40% 16.66% 16.69% 16.79% 13.07% 12.04% Tang. Common Equity/Tang. Assets¹ 11.51% 9.27% 14.85% 14.94% 15.04% 10.65% 9.82% Tier 1 Capital 14.03% 11.04% 18.44% 17.52% 17.23% 13.89% 13.68% Leverage Ratio 12.99% 12.64% 15.65% 15.84% 15.98% 12.06% 11.00% Profitability Measures Net Interest Margin 4.06% 4.14% 4.19% 4.04% 4.03% 3.45% 3.73% Non Interest Income/Average Assets 0.39% 0.34% 0.38% 0.43% 0.46% 0.37% 0.41% Non Interest Expense/Average Assets 2.69% 2.76% 2.66% 2.74% 2.93% 2.58% 2.39% Efficiency Ratio 62.90% 63.94% 60.48% 64.43% 69.77% 68.80% 67.82% ROAA 0.81% 0.35% 1.12% 1.03% 0.35% 0.18% 0.58% ROAE 6.61% 2.93% 8.51% 6.08% 2.07% 1.28% 4.56% EPS $0.58 $0.27 $0.87 $0.69 $0.06 $0.04 $0.14 Net Income $6,754 $3,185 $13,782 $13,035 $1,104 $681 $2,457 Asset Quality NPAs/Assets 1.18% 0.69% 1.01% 1.23% 1.31% 1.11% 0.96% NPAs (excl TDRs)/Assets 0.76% 0.28% 0.66% 0.74% 0.87% 0.71% 0.62% NCOs/Avg Loans 0.02% 0.13% 0.00% 0.08% 0.00% 0.16% 0.04% Reserves/Loans 1.24% 0.90% 0.88% 0.81% 1.02% 0.96% 1.06% Reserves/NPAs 83.87% 107.27% 68.14% 53.08% 63.94% 67.12% 79.88% Quarters EndedTwelve Months Ended

61.79 62.90 63.94 60.48 64.43 72.72 0.00 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 2015Y 2016Y 2017Y 2018Y 2019Y 2020YTD² 7.97 7.51 3.46 10.82 7.29 3.48 0.00 2.00 4.00 6.00 8.00 10.00 12.00 2015Y 2016Y 2017Y 2018Y 2019Y 2020YTD² 4.34 4.06 4.14 4.19 4.04 3.80 3.50 3.60 3.70 3.80 3.90 4.00 4.10 4.20 4.30 4.40 2015Y 2016Y 2017Y 2018Y 2019Y 2020YTD² 16 Return on Average Tangible Common Equity¹ (%) Return on Average Assets (%) Net Interest Margin (FTE) (%) Efficiency Ratio (%) ¹Non - GAAP measure; See “Non - GAAP Financial Measures” on slide 3 and “Non - GAAP Reconciliation” on slide 22 for additional information. Note: 2017 and 2018 includes $865,727 and $1,826,449 of merger expenses; 2017 also includes $2,591,000 of expense related to ch anges in tax law . ²Year to date as of September 30, 2020 Source: S&P Global Market Intelligence Performance Highlights 0.86 0.81 0.35 1.12 1.03 0.38 0.00 0.20 0.40 0.60 0.80 1.00 1.20 2015Y 2016Y 2017Y 2018Y 2019Y 2020YTD²

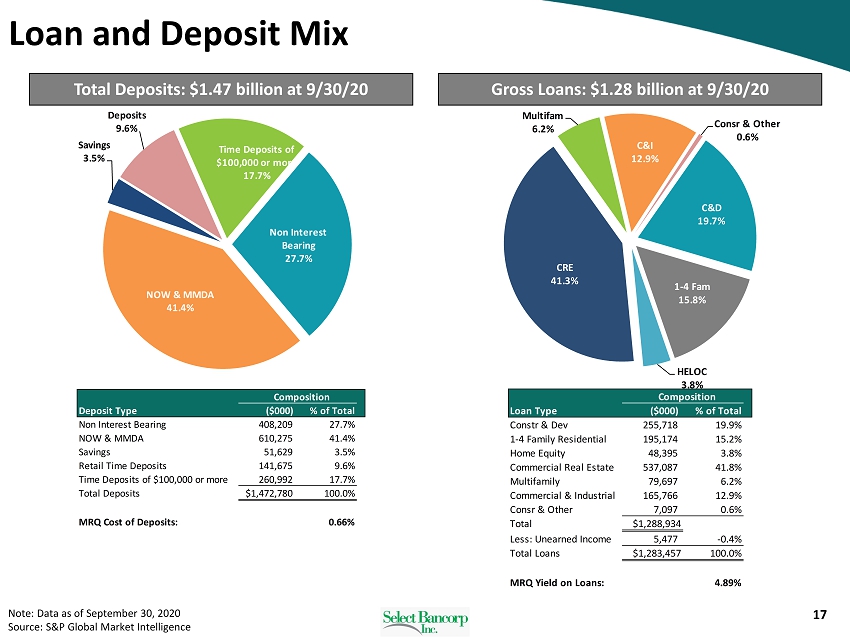

C&D 19.7% 1 - 4 Fam 15.8% HELOC 3.8% CRE 41.3% Multifam 6.2% C&I 12.9% Consr & Other 0.6% Non Interest Bearing 27.7% NOW & MMDA 41.4% Savings 3.5% Retail Time Deposits 9.6% Time Deposits of $100,000 or more 17.7% 17 Note: Data as of September 30, 2020 Source: S&P Global Market Intelligence Total Deposits: $1.47 b illion at 9/30/20 Gross Loans: $1.28 billion at 9/30/20 Loan and Deposit Mix Composition Deposit Type ($000) % of Total Non Interest Bearing 408,209 27.7% NOW & MMDA 610,275 41.4% Savings 51,629 3.5% Retail Time Deposits 141,675 9.6% Time Deposits of $100,000 or more 260,992 17.7% Total Deposits $1,472,780 100.0% MRQ Cost of Deposits: 0.66% Composition Loan Type ($000) % of Total Constr & Dev 255,718 19.9% 1-4 Family Residential 195,174 15.2% Home Equity 48,395 3.8% Commercial Real Estate 537,087 41.8% Multifamily 79,697 6.2% Commercial & Industrial 165,766 12.9% Consr & Other 7,097 0.6% Total $1,288,934 Less: Unearned Income 5,477 -0.4% Total Loans $1,283,457 100.0% MRQ Yield on Loans: 4.89%

1.14 1.24 0.90 0.88 0.81 1.06 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 2015Y 2016Y 2017Y 2018Y 2019Y 2020Q3 10,113 10,029 8,236 12,723 15,681 16,976 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 2015Y 2016Y 2017Y 2018Y 2019Y 2020Q3 0.12 0.02 0.13 0.00 0.08 0.05 0.00 0.05 0.10 0.15 0.20 0.25 2015Y 2016Y 2017Y 2018Y 2019Y 2020YTD¹ 1.24 1.18 0.69 1.01 1.23 0.96 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 2015Y 2016Y 2017Y 2018Y 2019Y 2020Q3 18 NPAs/Total Assets (%) Nonperforming Assets ($000) Net Charge - offs/Average Loans (%) Loan Loss Reserve/Gross Loans (%) ¹Year to date as of September 30, 2020 Source : S&P Global Market Intelligence, Public Company Documents Credit Quality

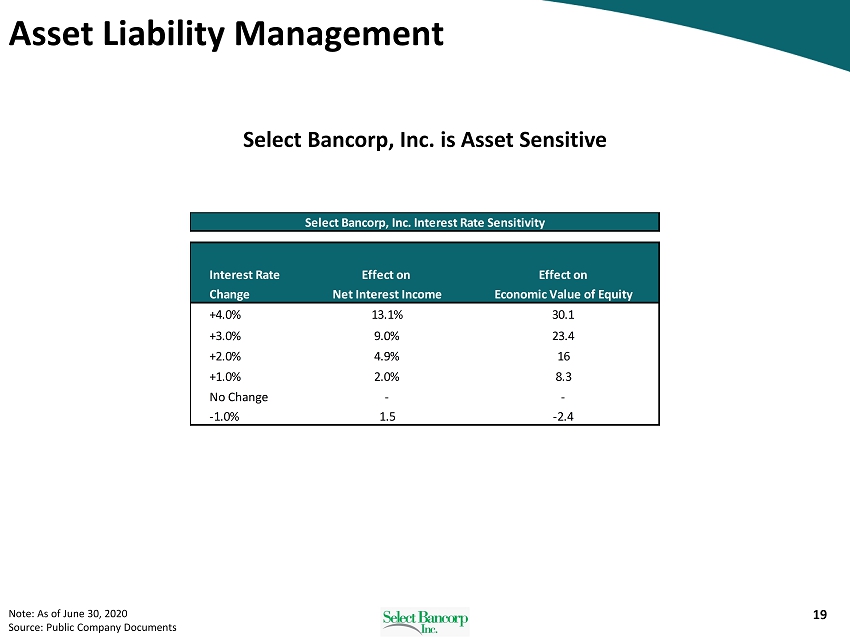

19 Note: As of June 30, 2020 Source: Public Company Documents Asset Liability Management Select Bancorp, Inc. is Asset Sensitive Interest Rate Effect on Effect on Change Net Interest Income Economic Value of Equity +4.0% 13.1% 30.1 +3.0% 9.0% 23.4 +2.0% 4.9% 16 +1.0% 2.0% 8.3 No Change - - -1.0% 1.5 -2.4 Select Bancorp, Inc. Interest Rate Sensitivity

20 ¹SLCT Price/ Tangible Book Value is based on TBV per share of $ 9.55. Tangible book value is a non - GAAP measure. See “Non - GAAP Financial Measures” on slide 3 and “Non - GAAP Reconciliation” on slide 22 for additional information. Source: S&P Global Market Intelligence; Data as of November 3, 2020 Relative Market Valuation Price / Tangible Book Value¹ (%) 68.3 71.6 74.1 74.8 78.8 79.3 82.4 84.5 93.5 97.0 103.5 112.0 0.0 20.0 40.0 60.0 80.0 100.0 120.0 BOTJ OPOF CFFI BAYK ESXB PEBK FBSS SLCT NKSH FCCO SFST AMNB

21 ¹Tangible common equity and tangible book value are Non - GAAP measures. See “Non - GAAP Financial Measures” on slide 3 and “Non - GAAP Reconciliation” on slide 22 for additional information. Source: S&P Global Market Intelligence Capital Structure Select Bancorp, Inc. Select Bank & Trust Company $000's (except per share data) 9/30/20 $000's 9/30/20 Borrowings Bank Capital Structure Borrowings $45,000 Total Equity $202,001 Trust Preferred Securities ("TRUPS") 12,372 Unrealized Loss / (Gain) (1,532) Total Borrowings $57,372 Disallowable Goodwill & Intangibles (43,591) Disallowable Def Tax Assets (204) Shareholders' Equity Other 0 Common Stock 17,787 Tier I Capital 156,674 Retained Earnings 56,917 Tier II Qualifying Debt 0 Capital Surplus & AOCI 138,663 Qualifying ALLL 13,561 Total Common Equity 213,367 Total Risk-based Capital $170,235 Total Shareholders' Equity $213,367 Tangible Book Value¹ Regulatory Capital Ratios Tangible Common Equity $169,776 Leverage Ratio 9.58% Shares Outstanding 17,786,552 Tier I Risk-based Capital 11.97% Tangible Book Value per Share $9.55 Total Risk-based Capital 13.00%

22 Non - GAAP Reconciliation Reconciliation of Tangible Common Equity and Tangible Assets Calculations Select Bancorp, Inc. GAAP Reconciliation (Unaudited) (Dollars in thousands, except per share data) As of September 30, 2020 Tangible Common Equity: Common Shareholders' Equity - GAAP 213,367$ Adjustments Goodwill (41,914) Core Deposit Intangible (1,677) Tangible Common Equity 169,776$ Tangible Assets: Total Assets - GAAP 1,771,946$ Adjustments Goodwill (41,914) Core Deposit Intangible (1,677) Tangible Assets 1,728,355$ Common Shares Outstanding 17,786,552 Tangible Common Equity to Tangible Assets Ratio 9.82% Tangible Book Value Per Share 9.55$

23