Attached files

| file | filename |

|---|---|

| EX-32.2 - ARGENTUM 47, INC. | ex32-2.htm |

| EX-32.1 - ARGENTUM 47, INC. | ex32-1.htm |

| EX-31.2 - ARGENTUM 47, INC. | ex31-2.htm |

| EX-31.1 - ARGENTUM 47, INC. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2020

or

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION FROM ______ TO ______.

Commission File Number: 0-54557

ARGENTUM 47, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 27-3986073 | |

(State or other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

| 34 St. Augustine´s Gate, Hedon, HU12 8EX, Hull, United Kingdom. | 00000 | |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number: +(44) 1482 891 591/ +1 (321) 200-0142

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of exchange on which registered | ||

| NA | NA | NA |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Sec.232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| Emerging growth company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS

DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court. Yes [ ] No [ ]

APPLICABLE ONLY TO CORPORATE ISSUERS

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of November 11, 2020, there were 590,989,409 outstanding shares of the Registrant’s Common Stock, $0.001 par value.

INDEX

| 2 |

Argentum 47, Inc. and Subsidiaries

Consolidated Financial Statements

September 30, 2020

(Unaudited)

CONTENTS

| F-1 |

Argentum 47, Inc. and Subsidiaries

| September 30, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash | $ | 46,936 | $ | 326,245 | ||||

| Accounts receivable | 5,264 | 7,422 | ||||||

| Marketable securities at fair value | 583,539 | 204,239 | ||||||

| Prepaids | 5,401 | 9,484 | ||||||

| Total current assets | 641,140 | 547,390 | ||||||

| Non-Current Assets | ||||||||

| Intangibles, net | 292,766 | 309,876 | ||||||

| Goodwill | 142,924 | 142,924 | ||||||

| Right-of-use leased asset | 64,020 | 75,786 | ||||||

| Fixed assets, net | 3,062 | 3,672 | ||||||

| Total non-current assets | 502,772 | 532,258 | ||||||

| Total assets | $ | 1,143,912 | $ | 1,079,648 | ||||

| Liabilities and Stockholders’ Deficit | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 130,234 | $ | 129,579 | ||||

| Accounts payable and accrued liabilities - related parties | 471,877 | 458,518 | ||||||

| Short term payable for acquisition | 167,915 | 171,650 | ||||||

| Current portion of operating lease liability | 13,019 | 13,374 | ||||||

| Accrued interest | 100,955 | 94,771 | ||||||

| Notes payable | 260,584 | 260,584 | ||||||

| Total current liabilities | 1,144,584 | 1,128,476 | ||||||

| Non-Current Liabilities | ||||||||

| Long term payable for acquisition | 65,508 | 64,460 | ||||||

| Fixed price convertible notes payable, related party | 982,140 | 982,140 | ||||||

| Long term operating lease liability | 51,001 | 62,412 | ||||||

| Total non-current liabilities | 1,098,649 | 1,109,012 | ||||||

| Total liabilities | $ | 2,243,233 | $ | 2,237,488 | ||||

| Commitments and contingencies (Note 14) | ||||||||

| Stockholders’ Deficit | ||||||||

| Preferred stock, 50,000,000 shares authorized,

$.001 par value Preferred stock series “B” convertible, 45,000,000 designated, 45,000,000 and 45,000,000 shares issued and outstanding, respectively. | $ | 45,000 | $ | 45,000 | ||||

| Preferred stock series “C” convertible, 5,000,000 designated, 3,300,000 and 3,200,000 shares issued and outstanding, respectively. | 3,300 | 3,200 | ||||||

| Common stock: 950,000,000 shares authorized; $0.001 par value: 590,989,409 and 590,989,409 shares issued and outstanding, respectively. | 590,989 | 590,989 | ||||||

| Additional paid in capital | 11,460,607 | 11,431,707 | ||||||

| Accumulated deficit | (13,205,665 | ) | (13,223,188 | ) | ||||

| Accumulated other comprehensive income / (loss) | 6,448 | (5,548 | ) | |||||

| Total stockholders’ deficit | (1,099,321 | ) | (1,157,840 | ) | ||||

| Total liabilities and stockholders’ deficit | $ | 1,143,912 | $ | 1,079,648 | ||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| F-2 |

Argentum 47, Inc. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income (Loss)

For the three and nine months ended September 30, 2020 and September 30, 2019 (Unaudited)

| For the three months ended | For the nine months ended | |||||||||||||||

| September 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 | |||||||||||||

| Revenue | $ | 19,382 | $ | 23,549 | $ | 65,785 | $ | 86,582 | ||||||||

| General and administrative expenses | 24,240 | 60,946 | 79,932 | 153,255 | ||||||||||||

| Compensation | 63,451 | 93,834 | 206,989 | 347,538 | ||||||||||||

| Professional services | 36,801 | 8,071 | 125,389 | 77,999 | ||||||||||||

| Depreciation | 726 | 656 | 1,976 | 1,930 | ||||||||||||

| Amortization of intangibles | 5,703 | 5,704 | 17,110 | 17,110 | ||||||||||||

| Total operating expenses | 130,921 | 169,211 | 431,396 | 597,832 | ||||||||||||

| Loss from continuing operations | $ | (111,539 | ) | $ | (145,662 | ) | $ | (365,611 | ) | $ | (511,250 | ) | ||||

| Other income (expenses): | ||||||||||||||||

| Interest expense | $ | (14,773 | ) | $ | (9,698 | ) | $ | (44,156 | ) | $ | (49,300 | ) | ||||

| Change in fair value of acquisition payable | (902 | ) | (4,188 | ) | (3,476 | ) | (12,800 | ) | ||||||||

| Amortization of debt discount | - | (24,663 | ) | - | (126,312 | ) | ||||||||||

| (Loss) / gain on available for sale securities, net | (116,708 | ) | 466,832 | 379,300 | (525,185 | ) | ||||||||||

| Gain on extinguishment of debt and other liabilities | - | - | 40,471 | - | ||||||||||||

| Loss on disposal of fixed asset | - | - | (260 | ) | - | |||||||||||

| Other income | - | - | 12,612 | - | ||||||||||||

| Exchange rate gain / (loss) | 13,953 | (7,325 | ) | (1,357 | ) | (8,383 | ) | |||||||||

| Total other income (expenses) | (118,430 | ) | 420,958 | 383,134 | (721,980 | ) | ||||||||||

| Net (loss) / income from continuing operations | $ | (229,969 | ) | $ | 275,296 | $ | 17,523 | $ | (1,233,230 | ) | ||||||

| Discontinued operations (Note 6) | ||||||||||||||||

| Net loss from operations of discontinued subsidiary (including loss due to fixed assets write off of $164 during the nine months ended September 30, 2019) | $ | - | $ | (132 | ) | $ | - | $ | (35,005 | ) | ||||||

| Net (loss) / income | $ | (229,969 | ) | $ | 275,164 | $ | 17,523 | $ | (1,268,235 | ) | ||||||

| Net (loss) / income per common share from continuing operations - basic | $ | (0.00 | ) | $ | 0.00 | $ | 0.00 | $ | (0.00 | ) | ||||||

| Net (loss) / income per common share from continuing operations - diluted | $ | (0.00 | ) | $ | 0.00 | $ | 0.00 | $ | (0.00 | ) | ||||||

| Net loss per common share from discontinued operations - basic | $ | - | $ | (0.00 | ) | $ | - | $ | (0.00 | ) | ||||||

| Net loss per common share from discontinued operations - diluted | $ | - | $ | (0.00 | ) | $ | - | $ | (0.00 | ) | ||||||

| Weighted average number of common shares outstanding - basic | 590,989,409 | 590,989,409 | 590,989,409 | 567,176,296 | ||||||||||||

| Weighted average number of common shares outstanding - diluted | 590,989,409 | 1,393,641,384 | 1,882,911,897 | 567,176,296 | ||||||||||||

| Comprehensive (loss) / income: | ||||||||||||||||

| Net (loss) / income | $ | (229,969 | ) | $ | 275,164 | $ | 17,523 | $ | (1,268,235 | ) | ||||||

| (Loss) / gain on foreign currency translation | (22,890 | ) | 16,593 | 11,996 | 19,395 | |||||||||||

| Comprehensive (loss) / income | $ | (252,859 | ) | $ | 291,757 | $ | 29,519 | $ | (1,248,840 | ) | ||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| F-3 |

Argentum 47, Inc. and Subsidiaries

Consolidated Statements of Changes in Stockholders’ Deficit

For the three and nine months ended September 30, 2020 and September 30, 2019 (Unaudited)

For the Three Months Ended September 30, 2019:

| Series “B” Preferred Stock | Series “C” Preferred Stock | Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Income / (Loss) | Deficit | |||||||||||||||||||||||||||||||

| Balance - June 30, 2019 | 45,000,000 | $ | 45,000 | 3,200,000 | $ | 3,200 | 590,989,409 | $ | 590,989 | $ | 11,431,707 | $ | (12,896,614 | ) | $ | 16,394 | $ | (809,324 | ) | |||||||||||||||||||||

| Net income | - | - | - | - | - | - | - | 275,164 | - | 275,164 | ||||||||||||||||||||||||||||||

| Gain on foreign currency translation | - | - | - | - | - | - | - | - | 16,593 | 16,593 | ||||||||||||||||||||||||||||||

| Balance - September 30, 2019 | 45,000,000 | $ | 45,000 | 3,200,000 | $ | 3,200 | 590,989,409 | $ | 590,989 | $ | 11,431,707 | $ | (12,621,450 | ) | $ | 32,987 | $ | (517,567 | ) | |||||||||||||||||||||

For the Three Months Ended September 30, 2020:

| Series “B” Preferred Stock | Series “C” Preferred Stock | Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Income | Equity | |||||||||||||||||||||||||||||||

| Balance - June 30, 2020 | 45,000,000 | $ | 45,000 | 3,300,000 | $ | 3,300 | 590,989,409 | $ | 590,989 | $ | 11,460,607 | $ | (12,975,696 | ) | $ | 29,338 | $ | (846,462 | ) | |||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | (229,969 | ) | - | (229,969 | ) | ||||||||||||||||||||||||||||

| Loss on foreign currency translation | - | - | - | - | - | - | - | - | (22,890 | ) | (22,890 | ) | ||||||||||||||||||||||||||||

| Balance - September 30, 2020 | 45,000,000 | $ | 45,000 | 3,300,000 | $ | 3,300 | 590,989,409 | $ | 590,989 | $ | 11,460,607 | $ | (13,205,665 | ) | $ | 6,448 | $ | (1,099,321 | ) | |||||||||||||||||||||

For the Nine Months Ended September 30, 2019:

| Series “B” Preferred Stock | Series “C” Preferred Stock | Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Income / (Loss) | Deficit | |||||||||||||||||||||||||||||||

| Balance - December 31, 2018 | 45,000,000 | $ | 45,000 | 3,200,000 | $ | 3,200 | 525,534,409 | $ | 525,534 | $ | 10,188,062 | $ | (11,353,215 | ) | $ | 13,592 | $ | (577,827 | ) | |||||||||||||||||||||

| Common stock issued as conversion of loan notes and accrued interest | - | - | - | - | 65,455,000 | 65,455 | 1,243,645 | - | - | 1,309,100 | ||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | (1,268,235 | ) | - | (1,268,235 | ) | ||||||||||||||||||||||||||||

| Gain on foreign currency translation | - | - | - | - | - | - | - | - | 19,395 | 19,395 | ||||||||||||||||||||||||||||||

| Balance - September 30, 2019 | 45,000,000 | $ | 45,000 | 3,200,000 | $ | 3,200 | 590,989,409 | $ | 590,989 | $ | 11,431,707 | $ | (12,621,450 | ) | $ | 32,987 | $ | (517,567 | ) | |||||||||||||||||||||

For the Nine Months Ended September 30, 2020:

| Series “B” Preferred Stock | Series “C” Preferred Stock | Common Stock | Additional Paid-in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Income / (Loss) | Deficit | |||||||||||||||||||||||||||||||

| Balance - December 31, 2019 | 45,000,000 | $ | 45,000 | 3,200,000 | $ | 3,200 | 590,989,409 | $ | 590,989 | $ | 11,431,707 | $ | (13,223,188 | ) | $ | (5,548 | ) | $ | (1,157,840 | ) | ||||||||||||||||||||

| Series C preferred stock issued as a signing bonus | - | - | 100,000 | 100 | - | - | 28,900 | - | - | 29,000 | ||||||||||||||||||||||||||||||

| Net income | - | - | - | - | - | - | - | 17,523 | - | 17,523 | ||||||||||||||||||||||||||||||

| Gain on foreign currency translation | - | - | - | - | - | - | - | - | 11,996 | 11,996 | ||||||||||||||||||||||||||||||

| Balance - September 30, 2020 | 45,000,000 | $ | 45,000 | 3,300,000 | $ | 3,300 | 590,989,409 | $ | 590,989 | $ | 11,460,607 | $ | (13,205,665 | ) | $ | 6,448 | $ | (1,099,321 | ) | |||||||||||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| F-4 |

Argentum 47, Inc. And Subsidiaries

Consolidated Statements of Cash Flows

For the nine months ended September 30, 2020 and September 30, 2019 (Unaudited)

| September 30, 2020 | September 30, 2019 | |||||||

| Cash flows from operating activities | ||||||||

| Net (loss) / income | $ | 17,523 | $ | (1,268,235 | ) | |||

| Adjustments to reconcile net income / (loss) from operations to net cash used in operating activities: | ||||||||

| Depreciation | 1,976 | 2,007 | ||||||

| Amortization of intangibles | 17,110 | 17,110 | ||||||

| Stock compensation | 29,000 | - | ||||||

| Amortization of debt discount | - | 126,312 | ||||||

| (Gain) / loss on available for sale securities, net | (379,300 | ) | 525,185 | |||||

| Gain on extinguishment of debt and other liabilities | (40,471 | ) | - | |||||

| Change in fair value of acquisition payable | 3,476 | - | ||||||

| Loss due to fixed assets write off | 260 | 164 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 2,158 | 6,401 | ||||||

| Prepaids | 4,083 | (1,021 | ) | |||||

| Other current assets | - | 4,732 | ||||||

| Assets of discontinued operations | - | (1,972 | ) | |||||

| Accounts payable and accrued liabilities | 41,125 | 23,378 | ||||||

| Accounts payable and accrued liabilities - related parties | 13,359 | 247,382 | ||||||

| Accrued interest | 6,184 | 42,627 | ||||||

| Net cash used in operating activities: | $ | (283,517 | ) | $ | (275,930 | ) | ||

| Cash Flows used in investing activities: | ||||||||

| Purchase of office furniture and equipment | $ | (1,639 | ) | $ | (1,282 | ) | ||

| Net cash used in investing activities | $ | (1,639 | ) | $ | (1,282 | ) | ||

| Cash flows from financing activities: | ||||||||

| Proceeds from loans - related parties | $ | 3,500 | $ | 96,678 | ||||

| Repayment of loans - related parties | (3,500 | ) | (30,000 | ) | ||||

| Net cash provided by financing activities | $ | - | $ | 66,678 | ||||

| Net decrease in cash | $ | (285,156 | ) | $ | (210,534 | ) | ||

| Effect of Exchange Rates on Cash | 5,847 | 19,430 | ||||||

| Cash at Beginning of Period | $ | 326,245 | $ | 193,807 | ||||

| Cash at End of Period | $ | 46,936 | $ | 2,703 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for interest | $ | - | $ | 9,000 | ||||

| Cash paid for income taxes | $ | - | $ | - | ||||

| Supplemental disclosure of non-cash investing and financing activities: | ||||||||

| Notes payable and accrued interest converted into common stock | $ | - | $ | 1,309,100 | ||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| F-5 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

Note 1 - Organization and Nature of Operations

Argentum 47, Inc., formerly Global Equity International Inc. (the “Company”, “we”, “us”, “our” or “ARG”), a reporting company since June 21, 2012, was organized under the laws of the state of Nevada on October 1, 2010. Global Equity Partners, Plc. (“GEP”), a private company, was organized under the laws of the Republic of Seychelles on September 2, 2009. On November 15, 2010, GEP executed a reverse recapitalization with ARG. On August 22, 2014, we formed a Dubai subsidiary of GEP called GE Professionals DMCC. On June 10, 2016, ARG incorporated its wholly owned subsidiary, called GEP Equity Holdings Limited (“GEP EH”), under the laws of the Republic of Seychelles. On March 14, 2017, the Company´s board of directors unanimously voted to transfer the ownership of GE Professionals DMCC (Dubai) to GEP EH. On June 5, 2017, the Company sold 100% of the issued and outstanding common stock of GEP to a citizen of the Republic of Thailand by entering into a Stock Purchase and Debt Assumption Agreement. On December 12, 2017, ARG incorporated another wholly owned subsidiary, called Argentum 47 Financial Management Limited (“Argentum FM”), under the Companies Act 2006 of England and Wales as a private limited company. Argentum FM was formed to serve as a holding Company for the acquisition of various advisory firms.

On March 29, 2018, the Company formally changed its name from Global Equity International, Inc. to Argentum 47, Inc.

On August 1, 2018, Argentum FM entered into a Share Purchase Agreement with a third party, pursuant to which Argentum FM acquired 100% of the ordinary shares of Cheshire Trafford (U.K.) Limited of Hull, United Kingdom (“Cheshire Trafford”). Cheshire Trafford was incorporated under the laws of the United Kingdom on January 26, 1976, as a limited liability company.

On March 18, 2019, the Board of Directors of GEP Equity Holdings Limited decided to commence the process to formally, and legally, liquidate GE Professionals DMCC and its related employment placement services business with an effective date of March 31, 2019. This decision was made so to allow management of Argentum 47, Inc. to fully concentrate on the Company´s core businesses, Independent Financial Advisory and Business Consulting. Accordingly, GE Professionals DMCC has been presented as a discontinued operation for all periods presented in the accompanying unaudited consolidated financial statements and footnotes (See Note 6). On February 11, 2020, the liquidation proceedings of GE Professionals DMCC were completed and it is formally liquidated.

The Company´s consolidated revenues from continuing operations are generated from business consulting services and by acting as broker for sale of Lump Sum or Single Premium Insurance Policies and/or the sale of Regular Premium Investment or Insurance Policies that are issued by third party insurance companies.

Note 2 - Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the United States Securities and Exchange Commission for interim financial information. Accordingly, they do not include all the information and disclosures necessary for a comprehensive presentation of financial position, results of operations, or cash flows. It is management’s opinion, however, that all material adjustments (consisting of normal recurring adjustments) have been made which are necessary for a fair financial statement presentation.

| F-6 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

The unaudited interim consolidated financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K, which contains the audited financial statements and notes thereto, together with the Management’s Discussion and Analysis, for the year ended December 31, 2019. The interim results for the period ended September 30, 2020 are not necessarily indicative of results for the full fiscal year.

Note 3 - Going Concern

The accompanying unaudited consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These unaudited consolidated financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

As reflected in the accompanying unaudited consolidated financial statements, the Company had a net income of $17,523 and net cash used in operations of $283,517 for the nine months ended September 30, 2020; working capital deficit, stockholder’s deficit and accumulated deficit of $503,444, $1,099,321 and $13,205,665, respectively as of September 30, 2020. It is management’s opinion that these factors raise substantial doubt about the Company’s ability to continue as a going concern for twelve months from the issuance date of this report.

The ability for the Company to mitigate this risk and continue its operations is primarily dependent on management’s plans as follows:

| a) | Maximizing the revenues of Cheshire Trafford (U.K.) Limited, the Independent Financial Advisory firm we acquired on August 1, 2018, by way of servicing the current client base in the most professional and efficient manner possible. | |

| b) | Organically growing the amount of Funds under Administration of Cheshire Trafford (U.K.) Limited to new and higher levels. | |

| c) | Consummating and executing all current engagements related to the business consulting division. | |

| d) | Continually engaging with new clients via our business consulting division. | |

| e) | Continuing to source funding, via equity or debt, for acquisition, growth and working capital from one or various European Funds. The Company is currently negotiating terms for a $10 million funding agreement with a European regulated Fund. | |

| f) | Acquiring and managing more Independent Financial Advisory firms with funds under administration located around the globe. | |

| g) | Sell the Company´s investment in marketable securities, when possible. |

In March 2020, the outbreak of the COVID-19 Coronavirus caused by a novel strain of the coronavirus was recognized as a Global Pandemic by the World Health Organization, and the outbreak has become increasingly widespread all over the World, including the geographical locations in which the Company and its subsidiaries operate. The COVID-19 Coronavirus Pandemic has and will continue affecting economies and businesses around the Globe. The Company continues to monitor the impact of the COVID-19 Coronavirus outbreak closely. Amongst the factors that could impact our results are the effectiveness of COVID-19 Coronavirus mitigation measures, global economic conditions, reduced business and consumer spending due to both job losses and reduced investing activity, and other factors. These factors could result in increased or decreased demand for our products and services. For the quarter ended September 30, 2020 and still to date, most European countries are still slowly easing out of the mandated lock-down imposed by their respective Governments due to the COVID-19 pandemic and its ramifications.

| F-7 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

Impact of COVID-19 on Company’s Customers and Financial Performance

While the Company´s recurring revenues were not materially affected during the nine months ended September 30, 2020, the Company´s ability to speed-up the process of writing new business was hindered to a degree. This hindrance was mainly due to the fact that most of the Company´s new business clients that are seeking financial advice are of a certain age whereby they prefer to meet in person with one of our independent financial advisers and sign the paperwork in situ, and this has proven to be a slow process due to travel restrictions. However, the Company does believe that from now onwards, its team of Independent Financial Advisors (“IFA”) will be able to start organizing and attending these “face to face” meetings with these new business clients and will, therefore, be able to close most or all of the new business that was put in motion during the quarter ended September 30, 2020.

Note 4 - Summary of Significant Accounting Policies

Principles of Consolidation

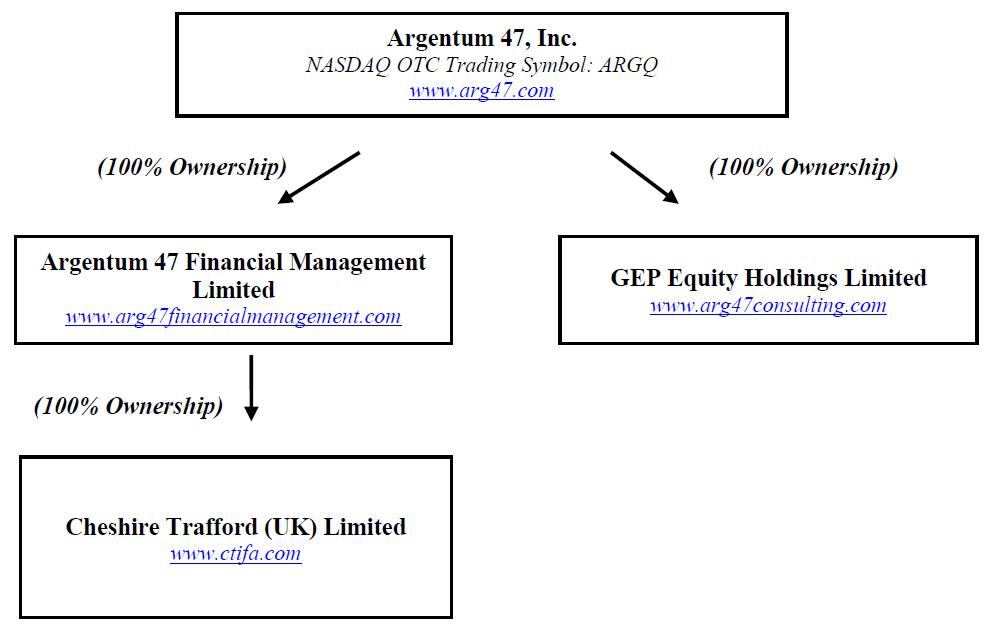

Argentum 47, Inc. (“ARG”) is the parent company of its two 100% owned subsidiaries called GEP Equity Holdings Limited (“GEP EH”) and Argentum 47 Financial Management Limited (“Argentum FM”). Argentum FM is the parent company of its 100% owned subsidiary, Cheshire Trafford U.K. Limited (U.K.) since August 1, 2018 pursuant to a Share Purchase Agreement dated August 1, 2018. GEP EH was the parent company of its liquidated GE Professionals DMCC (Dubai) until February 11, 2020. GE Professionals DMCC has been presented as a discontinued operation for the three months ended September 30, 2019 and the nine months ended September 30, 2020 and 2019 as the Company was liquidated on February 11, 2020. All significant inter-company accounts and transactions have been eliminated in consolidation.

Reclassifications

Certain amounts in the unaudited consolidated statements of operations for the three and nine months ended September 30, 2019 have been reclassified from Interest expense to Change in fair value of acquisition payable to conform to the presentation for the three and nine months ended September 30, 2020. This reclassification increased Change in fair value of acquisition payable, in Other expenses of the unaudited consolidated statements of operations for the three and nine months ended September 30, 2019 by $4,188 and $12,800, respectively and decreased Interest expense in Other expenses of the unaudited consolidated statements of operations for the three and nine months ended September 30, 2019 by the same amount.

Use of Estimates

The preparation of unaudited consolidated financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the unaudited consolidated financial statements and the reported amounts of revenue and expenses during the reporting period.

Making estimates requires management to exercise significant judgment. It is at least reasonably possible that the estimate of the effect of a condition, situation, or set of circumstances that existed at the date of the unaudited consolidated financial statements, which management considered in formulating its estimate could change in the near term due to one or more future non-confirming events. Accordingly, the actual results could differ from those estimates. Significant estimates in the accompanying unaudited consolidated financial statements include accounts receivable and related revenues for our subsidiary, Cheshire Trafford, allowance for doubtful accounts and loans, estimates of fair value of securities received for services, estimates of fair value of securities held, depreciation period of fixed assets, valuation of fair value of assets acquired and liabilities assumed of acquired businesses, fair value of business purchase consideration, fair value of the lease liabilities, valuation allowance on deferred tax assets and equity valuations for non-cash equity grants.

| F-8 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

Risks and Uncertainties

The Company’s operations are subject to significant risk and uncertainties including financial, operational, competition and potential risk of business failure.

Segment Reporting

A business segment is a group of assets and operations engaged in providing products or services that are subject to risks and returns that are different from those of other business segments. A geographical segment is engaged in providing products or services within a particular economic environment that is subject to risks and returns that are different from those of segments operating in other economic environments.

The Company uses “the management approach” in determining reportable operating segments. The management approach considers the internal organization and reporting used by the Company’s chief operating decision maker for making operating decisions and assessing performance as the source for determining the Company’s reportable segments. The Company’s chief operating decision maker is the Chief Executive Officer of the Company, who reviews operating results to make decisions about allocating resources and assessing performance for the entire Company.

Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents. At September 30, 2020 and December 31, 2019, the Company had no cash equivalents. At times balances may exceed federally insured limits of $250,000. We have not experienced any losses related to these balances. At September 30, 2020 and December 31, 2019, balance in one financial institution exceeded federally insured limits by $0 and $73,480, respectively.

Accounts Receivable and Allowance for Doubtful Accounts

The Company recognizes accounts receivable in connection with the services provided. The Company recognizes an allowance for doubtful accounts based on an analysis of current receivables aging and expected future write-offs, as well as an assessment of specific identifiable customer accounts considered at risk or uncollectible. There was no allowance for bad debt at September 30, 2020 and December 31, 2019.

Foreign currency policy

The Company’s accounting policies related to the consolidation and accounting for foreign operations are as follows: The accompanying consolidated financial statements are presented in U.S. dollars. The functional currency of the Company’s discontinued Dubai subsidiary is the Arab Emirates Dirham (“AED”) and the functional currency of the Company’s U.K. subsidiaries is Great Britain Pounds (“GBP”). All foreign currency balances and transactions are translated into United States dollars (“$” and/or “USD”) as the reporting currency. Assets and liabilities are translated at the exchange rate in effect at the balance sheet date. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period. Equity transactions are translated at each historical transaction date spot rate. Translation adjustments arising from the use of different exchange rates from period to period are included as a component of our stockholders’ deficit as “Accumulated other comprehensive income (loss).” Gains and losses resulting from foreign currency transactions are included in the non-operating income or expenses of the statement of operations.

| F-9 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

Investments

(A) Classification of Securities

Marketable Securities

As of January 1, 2018, the Company adopted Accounting Standards Update (“ASU”) 2016-01, “Financial Instruments - Overall (Topic 825-10): “Recognition and Measurement of Financial Assets and Financial Liabilities.”

At the time of the acquisition, a marketable security is designated as held-to-maturity, available-for-sale, or trading, which depends on the ability and intent to hold such security to maturity. Securities classified as trading and available-for-sale are reported at fair value, while securities classified as held-to-maturity are reported at amortized cost.

All changes in the fair value of the securities are reported in the earnings as they occur in a single line item “Gain (loss) on available for sale securities, net.” Therefore, no gain/loss is recognized on the sale of securities.

Cost Method Investments

Securities that are not classified as marketable securities are accounted for under the cost method. These securities are recorded at their original cost basis and are subject to impairment testing.

(B) Other than Temporary Impairment

The Company reviews its equity investment portfolio for any unrealized losses that would be deemed other than temporary and require the recognition of an impairment loss in the statement of operations. If the cost of an investment exceeds its fair value, the Company evaluates, among other factors, general market conditions, the duration and extent to which the fair value is less than cost, and the Company’s intent and ability to hold the investments. Management also considers the type of security, related industry, and sector performance, as well as published investment ratings and analyst reports, to evaluate its portfolio. Once a decline in fair value is determined to be other than temporary, an impairment charge is recorded and a new cost basis in the investment is established. If market, industry, and/or investee conditions deteriorate, the Company may incur future impairments. The Company did not record any such impairment during the three and nine months ended September 30, 2020 or September 30, 2019.

Fixed Assets

Fixed assets are stated at cost of acquisition less accumulated depreciation. Depreciation is provided based on estimated useful lives of the assets. Cost of improvements that substantially extend the useful lives of assets are capitalized. Repairs and maintenance expenses are charged to expense when incurred. In case of sale or disposal of an asset, the cost and related accumulated depreciation are removed from the consolidated financial statements.

Leases

On January 1, 2019, the Company adopted ASU 2016-02, Leases (Topic 842) which requires a lessee to recognize on the balance sheet the assets and liabilities for the rights and obligations created by leases. Leases will continue to be classified as either financing or operating, with classification affecting the recognition, measurement and presentation of expenses and cash flows arising from a lease. We adopted this standard by applying the optional transition method on the adoption date and did not adjust comparative periods. In addition, the Company elected the practical expedient to not reassess whether any expired contracts contained leases. Furthermore, the Company has elected to not apply the recognition standards of ASU 2016-02 to operating leases with effective terms of twelve months or less (“Short-Term Leases”). For Short-Term Leases, the Company recognizes lease payments on a straight-line basis over the lease term in the period in which the obligation for those payments is incurred. On the adoption date, all of the Company’s contracts containing leases were expired or were Short Term Leases. Accordingly, upon the adoption of ASU 2016-02, there was no cumulative effect adjustment.

| F-10 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

Beneficial Conversion Feature

For conventional convertible debt where the rate of conversion is below market value, the Company records any “beneficial conversion feature” (“BCF”) intrinsic value as additional paid in capital and related debt discount.

When the Company records a BCF, intrinsic value of the BCF is recorded as a debt discount against the face amount of the respective debt instrument. The discount is amortized over the life of the debt. If a conversion of the underlying debt occurs, a proportionate share of the unamortized amounts is immediately expensed.

Debt Issue Costs

The Company may pay debt issue costs in connection with raising funds through the issuance of debt whether convertible or not or with other consideration. These costs are recorded as debt discounts and are amortized over the life of the debt to the statement of operations as amortization of debt discount.

Original Issue Discount

If debt is issued with an original issue discount, the original issue discount is recorded to debt discount, reducing the face amount of the note and is amortized over the life of the debt to the statement of operations as amortization of debt discount. If a conversion of the underlying debt occurs, a proportionate share of the unamortized amounts is immediately expensed.

Valuation of Derivative Instruments

ASC 815 “Derivatives and Hedging” requires that embedded derivative instruments be bifurcated and assessed, along with free-standing derivative instruments such as warrants, on their issuance date and measured at their fair value for accounting purposes. In determining the appropriate fair value, the Company uses the Black-Scholes option pricing formula. Upon conversion of a note where the embedded conversion option has been bifurcated and accounted for as a derivative liability, the Company records the shares at fair value, relieves all related notes, derivatives and debt discounts and recognizes a net gain or loss on debt extinguishment.

Business combinations

The Company accounts for its business acquisitions under the acquisition method of accounting as indicated in ASC No. 805, “Business Combinations”, which requires the acquiring entity in a business combination to recognize the fair value of all assets acquired, liabilities assumed and any non-controlling interest in the acquiree, and establishes the acquisition date as the fair value measurement point. Accordingly, the Company recognizes assets acquired and liabilities assumed in business combinations, including contingent assets and liabilities and non-controlling interest in the acquiree, based on fair value estimates as of the date of acquisition.

| F-11 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

Where applicable, the consideration for the acquisition includes amounts resulting from a contingent consideration arrangement, measured at its acquisition-date fair value. Subsequent changes in such fair values are adjusted against the cost of acquisition where they qualify as measurement period adjustments (see below). The subsequent accounting for changes in the fair value of the contingent consideration that do not qualify as measurement period adjustments depends on how the contingent consideration is classified. Contingent consideration that is classified as equity is not re-measured at subsequent reporting dates and its subsequent settlement is accounted for within equity. Contingent consideration that is classified as an asset or a liability is re-measured at subsequent reporting dates at fair value, with changes in fair value recognized in statement of operations.

The measurement period is the period from the date of acquisition to the date the group obtains complete information about facts and circumstances that existed as of the acquisition date, resulting in a final valuation, and is subject to a maximum of one year from acquisition date.

Goodwill and Other Intangible Assets

In accordance with ASC No. 805, the Company recognizes and measures goodwill, if any, as of the acquisition date, as the excess of the fair value of the consideration paid over the fair value of the identified net assets acquired. Goodwill and intangible assets acquired in a business combination and determined to have an indefinite useful life are not amortized, but instead are reviewed for impairment annually or more frequently if impairment indicators arise. Intangible assets with estimable useful lives are amortized over such lives and reviewed for impairment if impairment indicators arise. For the purpose of impairment testing, goodwill is allocated to each of the group’s reporting units expected to benefit from the synergies of the combination. Reporting units to which goodwill has been allocated are tested for impairment annually, or more frequently when there is an indication that the unit may be impaired. If the fair value of a reporting unit is less than it´s carrying amount, an impairment loss calculated as the amount by which the carrying value exceeds the fair value is recorded to goodwill but cannot exceed the goodwill amount. An impairment loss recognized for goodwill is not reversed in a subsequent period. On disposal of a subsidiary or the relevant reporting unit, the attributable amount of goodwill is included in the determination of the profit or loss on disposal.

Impairment of Long-Lived Assets

The Company reviews long-lived assets, such as property and equipment for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the asset. Assets to be disposed of by sale would be separately presented in the balance sheet and reported at the lower of the carrying amount or fair value less costs related to the sale and are no longer depreciated. The assets and liabilities of a group classified as held for sale would be presented separately in the appropriate asset and liability sections of the balance sheet.

Discontinued operations

Components of an entity divested or discontinued are recognized in the consolidated statements of operations until the date of divestment or discontinuation. For periods prior to the designation as discontinued operations, we reclassify the results of operations to discontinued operations. Gains or losses on divestment or winding up of subsidiaries are stated as the difference between the sales or disposal amount and the carrying amount of the net assets at the time of sale or winding up plus sales or winding up costs.

| F-12 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

The assets and liabilities for business components meeting the criteria for discontinued operations are reclassified and presented separately as assets of discontinued operations and liabilities relating to discontinued operations in the accompanying unaudited consolidated balance sheet. The change in presentation for discontinued operations does not have any impact on our financial condition or results of operations. We combine the cash flows and assets and liabilities attributable to discontinued operations with the respective cash flows and assets and liabilities from continuing operations in the accompanying unaudited consolidated statement of cash flows.

Revenue Recognition

As of January 1, 2018, the Company adopted Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (“ASC 606”), that affects the timing of when certain types of revenue will be recognized.

Revenue is recognized when the Company satisfies a performance obligation by transferring services promised in a contract to a customer, in an amount that reflects the consideration that the Company expects to receive in exchange for those services. A single contract could include one or multiple performance obligations. For those contracts that have multiple performance obligations, the Company allocates the total transaction price to each performance obligation based on its relative standalone selling price, which is determined based on the Company´s overall pricing objectives, taking into consideration market conditions and other factors. Performance obligations in the Company´s contracts generally include general due diligence, assistance in designing client’s capitalization strategy, introductions to potential capital funding sources and arranging third party insurance policies.

Revenue is recognized by evaluating our revenue contracts with customers based on the five-step model under ASC 606:

| 1. | Identify the contract with the customer; and | |

| 2. | Identify the performance obligations in the contract; and | |

| 3. | Determine the transaction price; and | |

| 4. | Allocate the transaction price to separate performance obligations; and | |

| 5. | Recognize revenue when (or as) each performance obligation is satisfied. |

The Company generates its revenue from continuing operations by providing following services:

| a) | Business consulting services including advisory services to various clients. | |

| b) | Earning commissions from insurance companies on insurance policy sales and renewals, which are based on a percentage of the insurance products sold. |

Most of the Company´s business consultancy and advisory services contracts are based on a combination of both fixed fee arrangements and performance based or contingent arrangement. In addition, the Company generates initial and trail commissions by acting as a broker of third-party lump sum or single premium insurance policies and regular premium investment or insurance policies. Fees from clients for advisory and consulting services are dependent on the extent and value of the services provided. The Company recognizes revenue when the promised services are rendered to the customer in the amount that best reflects the consideration to which the Company expects to be entitled in exchange for those services.

| F-13 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

In fixed-fee billing arrangements, the Company agrees to a pre-established fee in exchange for a predetermined set of professional services. The Company sets the fees based on its estimates of the costs and timing for completing the engagements. The Company generally recognizes revenues under fixed fee billing arrangements using the input method, which is based on work completed to date versus the Company´s estimates of the total services to be provided under the engagement.

Performance based or contingent arrangements represent forms of variable consideration. In these arrangements, the Company´s fees are linked to the attainment of contractually defined objectives with its clients. These arrangements include conditional payments, commonly referred to as cash success fees and/or equity success fees. The Company typically satisfies its performance obligations for these services over time as the related contractual objectives are met. The Company determines the transaction price based on the expected probability of achieving the agreed upon outcome and recognizes revenue earned to date by applying the input method.

Reimbursable expenses, including those relating to travel, out-of-pocket expenses, outside consultants and other outside service costs, are generally included in revenues, and an equivalent amount of reimbursable expenses is included in costs of services in the period in which the expense is incurred.

The payment terms and conditions in the Company´s customer contracts vary. Differences between the timing of billings and the recognition of revenue are recognized as either accrued accounts receivable, an asset or deferred revenues, a liability. Revenues recognized for services performed but not yet billed to clients are recorded as accrued accounts receivable. Client pre-payments and retainers are classified as deferred revenues and recognized over future periods as earned in accordance with the applicable engagement agreement.

We receive consideration in the form of cash and/or securities. We measure securities received at fair value on the date of receipt. If securities are received in advance of completion of our services, the fair value will be recorded as deferred revenue and recognized as revenue as the services are completed.

All revenues are generated from clients whose operations are based outside of the United States and relate to the insurance brokerage business. For the nine months ended September 30, 2020 and 2019, the Company had following concentrations of revenues from continuing operations:

| September 30, 2020 | September 30, 2019 | |||||||

| Initial advisory fees | 0 | % | 4.87 | % | ||||

| Ongoing advisory fees | 28.41 | % | 30.57 | % | ||||

| Initial and renewal commissions | 4.99 | % | 6.51 | % | ||||

| Trail or recurring commissions | 66.60 | % | 57.30 | % | ||||

| Others | 0 | % | 0.75 | % | ||||

| 100 | % | 100 | % | |||||

| F-14 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

At September 30, 2020 and December 31, 2019, the Company had the following concentrations of accounts receivables with customers:

| Customer | September 30, 2020 | December 31, 2019 | ||||||

| Customer 1 | 26.84 | % | 26.68 | % | ||||

| Customer 2 | 11.91 | % | 8.59 | % | ||||

| Customer 3 | 10.08 | % | 6.94 | % | ||||

| Customer 4 | 9.77 | % | 25.24 | % | ||||

| Others having a concentration of less than 10% | 41.40 | % | 32.55 | % | ||||

| 100 | % | 100 | % | |||||

Share-based payments

Under ASC 718 “Compensation – Stock Compensation”, the Company recognizes all forms of share-based payments to employees, including stock option grants, warrants and restricted stock grants at their fair value on the grant date, which is based on the estimated number of awards that are ultimately expected to vest.

On January 1, 2019, the Company adopted ASU 2018-07 “Compensation – Stock Compensation” whereby share based payment awards issued to non-employees will be treated the same as for employees. The guidance has been applied using the modified prospective method which may result in a cumulative effect adjustment to retained earnings on the adoption date. The adoption of ASU 2018-07 did not result in a cumulative effect adjustment.

Share based payments, excluding restricted stock, are valued using a Black-Scholes pricing model.

When computing fair value, the Company considered the following variables:

| ● | The risk-free interest rate assumption is based on the U.S. Treasury yield for a period consistent with the expected term of the share-based payment in effect at the time of the grant. | |

| ● | The expected term is developed by management estimate. | |

| ● | The Company has not paid any dividends on common stock since inception and does not anticipate paying dividends on its common stock soon. | |

| ● | The expected volatility is based on management estimates which are based upon our historical volatility. | |

| ● | The forfeiture rate is based on historical experience. |

Earnings per Share

The basic net earnings (loss) per share are computed by dividing net income (loss) by weighted average number of shares of common stock outstanding during each period. Diluted earnings (loss) per share are computed by dividing net income (loss) by the weighted average number of shares of common stock and common stock equivalents outstanding during the period.

At September 30, 2020 and December 31, 2019, the Company had common stock equivalents of 511,922,488 and 363,755,756 common shares, respectively, in the form of convertible notes, which, if converted, may be dilutive. See Note 9(D).

At September 30, 2020 and December 31, 2019, the Company had common stock equivalents of 780,000,000 and 770,000,000 common shares, respectively, in the form of convertible preferred stock, which, if converted, may be dilutive. See Note 10(A).

| F-15 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

| Number of Common Shares | ||||||||

| September 30, 2020 | December 31, 2019 | |||||||

| Potential dilutive common stock | ||||||||

| Convertible notes | * | 511,922,488 | * | 363,755,756 | ||||

| Series “B” preferred stock | 450,000,000 | 450,000,000 | ||||||

| Series “C” preferred stock | 330,000,000 | 320,000,000 | ||||||

| Total potential dilutive common stock | 1,291,922,488 | 1,133,755,756 | ||||||

| Weighted average number of common shares – Basic | 590,989,409 | 573,178,505 | ||||||

| Weighted average number of common shares – Dilutive | 1,882,911,897 | 1,706,934,261 | ||||||

* Convertible debt cannot be converted until December 2021.

As of September 30, 2020, and December 31, 2019, diluted weighted average number of common shares exceeds total authorized common shares. However, 780,000,000 and 770,000,000 common shares as of September 30, 2020 and December 31, 2019, respectively would result from the conversion of the preferred “B” and preferred “C” stock into common stock. The option to convert the abovementioned preferred “B” and “C” stock into common stock could not be any earlier than December 31, 2022. See Note 10(A)

Comprehensive Income / (Loss)

The Comprehensive Income Topic of the FASB Accounting Standards Codification establishes standards for reporting and presentation of comprehensive income and its components in a full set of financial statements. Comprehensive income (loss) for the nine months ended September 30, 2020 and 2019, includes only foreign currency translation gain / (loss), and is presented in the Company’s consolidated statements of comprehensive income / (loss).

Changes in Accumulated Other Comprehensive Income (Loss) by Component during the nine months ended September 30, 2019 were as follows:

| Balance, December 31, 2018 | $ | 13,592 | ||

| Foreign currency translation adjustment for the period | 19,395 | |||

| Balance, September 30, 2019 | $ | 32,987 |

Changes in Accumulated Other Comprehensive Income (Loss) by Component during the nine months ended September 30, 2020 were as follows:

| Balance, December 31, 2019 | $ | (5,548 | ) | |

| Foreign currency translation adjustment for the period | 11,996 | |||

| Balance, September 30, 2020 | $ | 6,448 |

Fair Value of Financial Assets and Liabilities

The Company measures assets and liabilities at fair value based on an expected exit price as defined by the authoritative guidance on fair value measurements, which represents the amount that would be received on the sale of an asset or paid to transfer a liability, as the case may be, in an orderly transaction between market participants. As such, fair value may be based on assumptions that market participants would use in pricing an asset or liability.

| F-16 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

The authoritative guidance on fair value measurements establishes a consistent framework for measuring fair value on either a recurring or nonrecurring basis whereby inputs, used in valuation techniques, are assigned a hierarchical level. The following are the hierarchical levels of inputs to measure fair value:

| ● | Level 1: Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets. | |

| ● | Level 2: Inputs reflect quoted prices for identical assets or liabilities in markets that are not active; quoted prices for similar assets or liabilities in active markets; inputs other than quoted prices that are observable for the assets or liabilities; or inputs that are derived principally from or corroborated by observable market data by correlation or other means. | |

| ● | Level 3: Unobservable inputs reflecting the Company’s assumptions incorporated in valuation techniques used to determine fair value. These assumptions are required to be consistent with market participant assumptions that are reasonably available. |

The carrying amounts reported in the balance sheet for prepaid expenses, accounts receivable, accounts payable, accounts payable to related parties, loans payable to related parties and notes payable, approximate fair value are based on the short-term nature of these instruments.

The Company measures its derivative liabilities and marketable securities at fair market value on a recurring basis and measures its non-marketable securities at fair value on a non-recurring basis. Consequently, the Company may have gains and losses reported in the statement of operations.

The following is the Company’s assets and liabilities measured at fair value on a recurring and nonrecurring basis at September 30, 2020 and December 31, 2019, using quoted prices in active markets for identical assets (Level 1), significant other observable inputs (Level 2), and significant unobservable inputs (Level 3):

| September 30, 2020 | December 31, 2019 | |||||||

| Level 1 – Marketable Securities – Recurring | $ | 583,539 | $ | 204,239 | ||||

The following section describes the valuation methodologies the Company uses to measure financial instruments at fair value:

Marketable Securities — The Level 1 position consists of the Company’s investment in equity securities of stock held in publicly traded companies. The valuation of these securities is based on quoted prices in active markets.

Changes in Level 1 marketable securities measured at fair value for the nine months ended September 30, 2020 were as follows:

| Balance, December 31, 2019 | $ | 204,239 | ||

| Sales and settlements during the period | - | |||

| Gain on available for sale marketable securities, net | 379,300 | |||

| Balance, September 30, 2020 | $ | 583,539 |

| F-17 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

Non-Marketable Securities at Fair Value on a Non-Recurring Basis — Certain assets are measured at fair value on a nonrecurring basis. The level 3 position consist of investments accounted for under the cost method. The Level 3 position consists of investments in equity securities held in private companies.

Management believes that an “other-than-temporary impairment” would be justified, as according to ASC 320-10 an investment is considered impaired when the fair value of an investment is less than its amortized cost basis. The impairment is considered either temporary or other-than-temporary. The accounting literature does not define other-than-temporary. It does, however, state that other-than-temporary does not mean permanent, although, all permanent impairments are considered other-than-temporary. The literature does provide some examples of factors, which may be indicative of an “other-than-temporary impairment”, such as:

| ● | the length of time and extent to which market value has been less than cost; | |

| ● | the financial condition and near-term prospects of the issuer; and | |

| ● | the intent and ability of the holder to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in market value. |

Management believes that the fair value of its investment has been correctly measured, as the length of time that the stock has been less than cost is nominal. See Note 7(B)

Recent Accounting Pronouncements

There are no new accounting pronouncements that we expect to have an impact on the Company’s consolidated financial statements except as discussed below:

Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity (“ASU 2020-06”)

In August 2020, the FASB issued ASU 2020-06, which simplifies the guidance on the issuer’s accounting for convertible debt instruments by removing the separation models for (1) convertible debt with a cash conversion feature and (2) convertible instruments with a beneficial conversion feature. As a result, entities will not separately present in equity an embedded conversion feature in such debt. Instead, they will account for a convertible debt instrument wholly as debt, unless certain other conditions are met. The elimination of these models will reduce reported interest expense and increase reported net income for entities that have issued a convertible instrument that was within the scope of those models before the adoption of ASU 2020-06. Also, ASU 2020-06 requires the application of the if-converted method for calculating diluted earnings per share and treasury stock method will be no longer available. The provisions of ASU 2020-06 are applicable for fiscal years beginning after December 15, 2021, with early adoption permitted no earlier than fiscal years beginning after December 15, 2020. The Company is currently evaluating the impact of ASU 2020-06 on its unaudited consolidated financial statements.

Note 5 – Acquisition of Cheshire Trafford (U.K.) Limited

On August 1, 2018, the Company completed the acquisition of Cheshire Trafford (UK) Limited (“Cheshire Trafford”) pursuant to a Share Purchase Agreement dated as of August 1, 2018 and acquired 100% of the ordinary shares of Cheshire Trafford.

Cheshire Trafford acts as a broker for the sale of Lump Sum or Single Premium Insurance Policies and Regular Premium Investment or Insurance Policies that are issued by reputable third-party insurance companies.

| F-18 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

The purchase consideration for the acquisition of Cheshire Trafford is based on a formula of 2.7 times Cheshire Trafford’s projected annual recurring revenues for the calendar year ending December 31, 2018. We took the gross revenues of Cheshire Trafford for the five months ended May 31, 2018 and annualized those recurring revenues and multiplied those revenues by 2.7 times in arriving at the contractual purchase consideration of $516,795. The purchase consideration is payable in following three installments:

| ● | The first installment of $175,710 has been paid upon closing of the transaction. | |

| ● | The second installment of $170,542 was due 18 months after the acquisition date which was February 1, 2020. Management is still currently in negotiation with the seller about a possible reduction in the second instalment per the terms of the acquisition agreement. | |

| ● | The third installment of $170,542 is due 36 months after the acquisition date. |

The second and third installments could be reduced (but not increased) in the event that Cheshire Trafford’s trailing or recurring revenues are less than agreed recurring income target of GBP 144,185 during the 12-month period commencing on the Acquisition date; hence these two installments were treated as contingent purchase consideration. Based on the historical data available regarding the recurring/trail revenues of Cheshire Trafford, Management believed that there was a 95% probability that Cheshire Trafford would achieve the recurring income target of GBP 144,185 during the 12-month period ending on July 31, 2019. Hence, the contingent purchase consideration was adjusted to consider this probability factor. (See below for update)

To calculate the fair value of the contingent purchase consideration, our Management has discounted the remaining two installments of $341,084 to be paid, at a discount rate of 6% (our borrowing rate for the purpose of acquisitions) to arrive at the present value of $284,298 at the acquisition date. Total fair value of the purchase consideration is as follows:

| Fair Value | ||||

| Cash payment | $ | 175,710 | ||

| Fair value of contingent consideration | 284,298 | |||

| Total Fair Value of Purchase Consideration | $ | 460,008 | ||

Below table depicts the allocation of fair value of the purchase consideration to the fair value of the net assets of Cheshire Trafford at the acquisition date:

| Assets acquired | Fair Value | |||

| Cash | $ | 4,743 | ||

| Accounts receivable – net | 6,555 | |||

| Intangibles – customer list | 342,194 | |||

| Goodwill | 142,924 | |||

| Property and equipment, net | 614 | |||

| 497,030 | ||||

| Liabilities assumed | ||||

| Accounts payable and accrued liabilities | 4,012 | |||

| Due to director of Cheshire Trafford | 33,010 | |||

| (37,022 | ) | |||

| Purchase consideration allocated | $ | 460,008 | ||

| F-19 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

This acquisition was accounted for under the acquisition method of accounting. Accordingly, the Company recognized amounts for identifiable assets acquired and liabilities assumed at their initial estimated acquisition date fair values. During the purchase price measurement period, which may be one year from the business acquisition date, the Company may record adjustments to the assets acquired and liabilities assumed based on completion of valuations.

The excess of the purchase consideration over the fair value of assets acquired net of liabilities assumed was initially recognized as the fair value of customer list intangible asset totaling to $485,118. Upon finalizing the fair value of customer list intangible based on the Multi Period Excess Earnings Model, Management believed that fair value of the customer list intangible asset amounted to $342,194 and the remaining $142,924 is recognized as goodwill at December 31, 2018. This intangible asset is amortized on a straight-line basis over a life of 15 years which is the average service duration of a customer that has invested with Cheshire Trafford.

| Estimated life of intangibles | 15 years | |||

| Fair value of customer list intangible asset at date of acquisition | $ | 485,118 | ||

| Fair value adjustment at December 31, 2018 | (142,924 | ) | ||

| Adjusted fair value of customer list intangible asset at December 31, 2018 | $ | 342,194 | ||

| Amortization charge for 5 months ended December 31, 2018 | (9,505 | ) | ||

| Net Book Value at December 31, 2018 | $ | 332,689 | ||

| Amortization charge for the period | (22,813 | ) | ||

| Net Book Value at December 31, 2019 | $ | 309,876 | ||

| Amortization charge for the period | (17,110 | ) | ||

| Net Book Value at September 30, 2020 | $ | 292,766 | ||

As at December 31, 2019, the management recalculated the third installment of the purchase price consideration as the recurring income period of 12 months ended on July 31, 2019 based upon the terms of the purchase agreement. Accordingly, the fair value of contingent acquisition payable was reduced, and the Company recorded a gain on revaluation of payable for acquisition of $67,897 during the year ended December 31, 2019. The total amount owed under the purchase agreement was $233,423 as of September 30, 2020.

Note 6 – Discontinued Operations

In March 2019, Management decided that it made overall economic sense for the Company to close its employment placement services business in Dubai; hence, in order to fully concentrate on its core business of Independent Financial Advisory services and consultancy business, the Board of Directors decided to initiate liquidation proceedings of the Dubai subsidiary “GE Professionals DMCC” and discontinue the related employment placement services business. As a result, Dubai subsidiary operations for the three months ended September 30, 2019 and the nine months ended September 30, 2019 and 2020 are treated as discontinued operations in the accompanying unaudited consolidated financial statements. The consolidated statements of operations only comprise the continuing operations. Net loss from the discontinued operations is presented on a single line after the net loss from the continuing operations.

There were no assets and liabilities from discontinued operations at September 30, 2020 and December 31, 2019.

| F-20 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

Statement of Operations from discontinued operations for the three months ended September 30, 2019 was as follows:

| September 30, 2020 | September 30, 2019 | |||||||

| Revenue | N/A | $ | - | |||||

| General and administrative expenses | N/A | $ | 132 | |||||

| Net loss from discontinued operations | N/A | $ | (132 | ) | ||||

Statement of Operations from discontinued operations for the nine months ended September 30, 2020 and 2019 was as follows:

| September 30, 2020 | September 30, 2019 | |||||||

| Revenue | $ | - | $ | - | ||||

| General and administrative expenses | $ | - | $ | 9,452 | ||||

| Compensation expense | - | 22,743 | ||||||

| Professional services | - | 2,382 | ||||||

| Depreciation | - | 77 | ||||||

| Loss from discontinued operations | $ | - | $ | (34,654 | ) | |||

| Other income (expenses) | ||||||||

| Loss due to fixed assets write off | $ | - | $ | (164 | ) | |||

| Exchange rate loss | - | (187 | ) | |||||

| Total other (expenses) / income | $ | - | $ | (351 | ) | |||

| Net loss from discontinued operations | $ | - | $ | (35,005 | ) | |||

Note 7 – Investments

| A. | Marketable Securities at Fair Value |

Following is the summary of Company’s investment in marketable securities at fair value as at September 30, 2020 and December 31, 2019:

| September 30, 2020 | December 31, 2019 | |||||||||||||||

| Company | No. of Shares | Book value | No. of Shares | Book value | ||||||||||||

| DUO | 5,835,392 | $ | 583,539 | 5,835,392 | $ | 204,239 | ||||||||||

| 5,835,392 | $ | 583,539 | 5,835,392 | $ | 204,239 | |||||||||||

At September 30, 2020, the Company revalued 5,835,392 common shares at their quoted market price of $0.1 per share, to $583,539; hence, recording a net gain on available for sale securities of $379,300 into the statement of operations for the nine months ended September 30, 2020. For the nine months ended September 30, 2019, loss on available for sale securities was $525,185.

| F-21 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

| B. | Investments at Cost |

The Company, through its subsidiary, GEP Equity Holdings Limited, holds the following common equity securities in private and reporting companies as at September 30, 2020 and December 31, 2019:

| September 30, 2020 | December 31, 2019 | ||||||||||||||||||

| Company | No. of Shares | Book value | No. of Shares | Book value | Status | ||||||||||||||

| PDI | 5,006,521 | $ | - | 5,006,521 | $ | - | Private Company | ||||||||||||

| 5,006,521 | $ | - | 5,006,521 | $ | - | ||||||||||||||

The Company, through its subsidiary, GEP Equity Holdings Limited, holds the following preferred equity securities in private and reporting companies as at September 30, 2020 and December 31, 2019:

| September 30, 2020 | December 31, 2019 | ||||||||||||||||||

| Company | No. of Shares | Book value | No. of Shares | Book value | Status | ||||||||||||||

| PDI | 450,000 | $ | - | 450,000 | $ | - | Private Company | ||||||||||||

| 450,000 | $ | - | 450,000 | $ | - | ||||||||||||||

Note 8 – Fixed Assets

Following table reflects net book value of furniture and equipment as of September 30, 2020 and December 31, 2019:

| Furniture and Equipment | ||||

| Useful Life | 3 to 10 years | |||

| Cost | ||||

| Balance as at December 31, 2019 | $ | 46,447 | ||

| Addition during the period | 1,639 | |||

| Disposals during the period | (17,291 | ) | ||

| Translation rate differences | (1,292 | ) | ||

| Balance as at September 30, 2020 | $ | 29,503 | ||

| Accumulated depreciation | ||||

| Balance as at December 31, 2019 | $ | 42,775 | ||

| Depreciation expense for the period – continuing operations | 1,976 | |||

| Disposals during the period | (17,025 | ) | ||

| Translation rate differences | (1,285 | ) | ||

| Balance as at September 30, 2020 | $ | 26,441 | ||

| Net book value as at September 30, 2020 | $ | 3,062 | ||

| Net book value as at December 31, 2019 | $ | 3,672 | ||

| F-22 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

Note 9 – Debt, Accounts Payable and Accrued Liabilities

| (A) | Accounts Payable and Other Accrued Liabilities |

The following table represents breakdown of accounts payable and other accrued liabilities as of September 30, 2020 and December 31, 2019, respectively:

| September 30, 2020 | December 31, 2019 | |||||||

| Accrued salaries and benefits | $ | 61,843 | $ | 61,452 | ||||

| Accounts payable and other accrued liabilities | 68,391 | 68,127 | ||||||

| $ | 130,234 | $ | 129,579 | |||||

| (B) | Accounts Payable and Accrued Liabilities – Related Parties |

The following table represents the accounts payable and accrued expenses to related parties as of September 30, 2020 and December 31, 2019, respectively:

| September 30, 2020 | December 31, 2019 | |||||||

| Accrued salaries and benefits | $ | 446,285 | $ | 382,165 | ||||

| Expenses payable | 25,592 | 76,353 | ||||||

| $ | 471,877 | $ | 458,518 | |||||

| (C) | Short Term Notes Payable |

Following is the summary of all non-convertible notes, net of debt discount, including the accrued interest at December 31, 2019:

| Date of Note | Principal | Accrued Interest | Total | |||||||||

| November 26, 2013 – JSP | $ | - | $ | 37,971 | $ | 37,971 | ||||||

| September 30, 2018 – EDEN | 260,584 | 8,058 | 268,642 | |||||||||

| Balance – December 31, 2019 | $ | 260,584 | $ | 46,029 | $ | 306,613 | ||||||

Following is the summary of all non-convertible notes, net of debt discount, including the accrued interest at September 30, 2020:

| Date of Note | Principal | Accrued Interest | Total | |||||||||

| November 26, 2013 – JSP | $ | - | $ | - | $ | - | ||||||

| September 30, 2018 – EDEN | 260,584 | 8,058 | 268,642 | |||||||||

| Balance – September 30, 2020 | $ | 260,584 | $ | 8,058 | $ | 268,642 | ||||||

| F-23 |

Argentum 47, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited)

| ● | On November 26, 2013, the Company secured from a private individual, a twelve-month fixed price convertible loan amounting to $450,000 having an interest at 10% per annum and an agreed fixed conversion price of $0.5 per share. During the year ended December 31, 2014, the Company recorded a total accrued interest of $42,971 on this Note. On December 23, 2014, the Company fully repaid the principal note balance of $450,000 in cash and also paid $5,000 on account of accrued interest payment, thereby leaving an accrued and unchanged interest balance of $37,971 as of December 31, 2019. |

During the nine months ended September 30, 2020, the Company wrote off the aged accrued interest balance of $37,971 as this is past the State of Nevada´s Statute of Limitations of six years for written debt agreements and recorded a gain on debt extinguishment of $37,971 in the unaudited consolidated statement of operations.

| ● | On October 17, 2013, the Company secured a non-convertible three-month bridge loan for 200,000 GBP (equivalent to $319,598) with the agreement to repay the principal plus 5% per month interest on or before January 18, 2014. The note holder received, as a form of guarantee, 1,600,000 shares of an investment we held then in a company called Direct Security Integration Inc. The shares used as a form of guarantee formed part of the assets of our Company at that time but are not considered an asset since the date we provided them to the lender as we were no longer in control of such shares. |