Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MMA Capital Holdings, LLC | mmac-20201105xex99d1.htm |

| 8-K - 8-K - MMA Capital Holdings, LLC | mmac-20201105x8k.htm |

Exhibit 99.2

| Shareholder Presentation November 10, 2020 Nasdaq: MMAC www.mmacapitalholdings.com 3600 O’Donnell Street, Suite 600, Baltimore, MD 21224 (443) 263-2900 |

| Disclaimer • This presentation and any related oral statements contain forward-looking statements intended to qualify for the safe harbor contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements often include words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “focus,” “intend,” ”may,” “plan,” “potential,” “project,” “see,” “seek,” “should,” “will,” “would,” and similar words or expressions and are made in connection with discussions of future events and future operating or financial performance. • Forward-looking statements reflect our management’s expectations at the date of this presentation regarding future conditions, events or results. They are not guarantees of future performance. By their nature, forward-looking statements are subject to risks and uncertainties, including the uncertain impact of the COVID-19 pandemic. Our actual results and financial condition may differ materially from what is anticipated by the forward-looking statements. There are many factors that could cause actual conditions, events or results to differ from those anticipated by the forward-looking statements contained in this presentation. Readers are cautioned not to place undue reliance on forward-looking statements in this presentation or that we may make from time to time, and to consider carefully the factors discussed in Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, which was filed with the Securities and Exchange Commission (“SEC”) on March 13, 2020 and Part II, Item 1A. “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, which was filed with the SEC on November 9, 2020. We do not undertake to update any forward-looking statements included in this presentation. MMA Capital Holdings, Inc. 2 |

| Mission MMA Capital Holdings, Inc. (“MMAC”) focuses on infrastructure-related investments that generate positive environmental and social impacts and deliver attractive risk-adjusted total returns to our shareholders. MMA Capital Holdings, Inc. 3 |

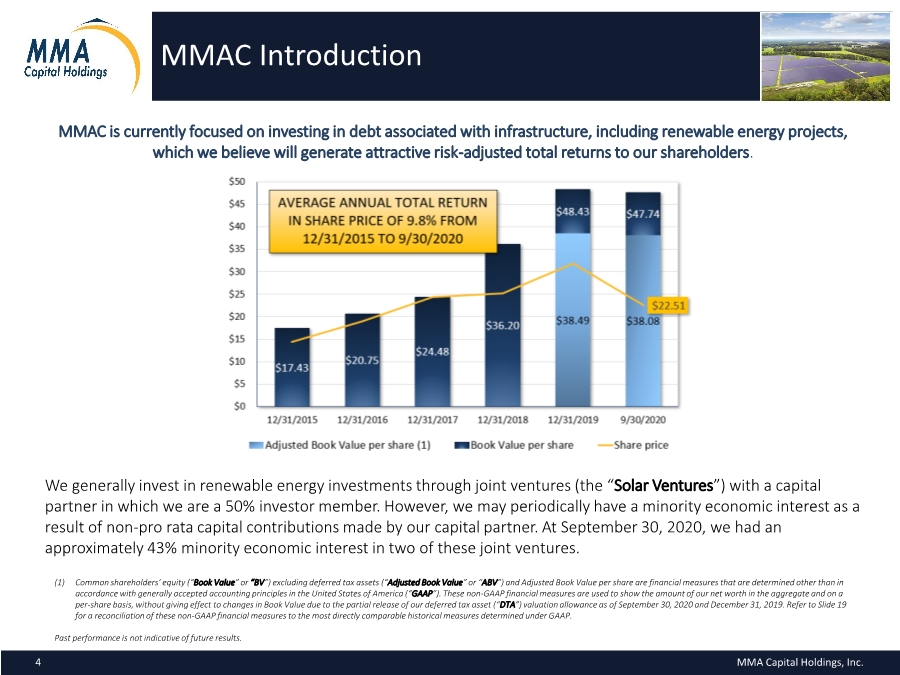

| MMAC Introduction MMAC is currently focused on investing in debt associated with infrastructure, including renewable energy projects, which we believe will generate attractive risk-adjusted total returns to our shareholders. (1) Common shareholders’ equity (“Book Value” or “BV”) excluding deferred tax assets (“Adjusted Book Value” or “ABV”) and Adjusted Book Value per share are financial measures that are determined other than in accordance with generally accepted accounting principles in the United States of America (“GAAP”). These non-GAAP financial measures are used to show the amount of our net worth in the aggregate and on a per-share basis, without giving effect to changes in Book Value due to the partial release of our deferred tax asset (“DTA”) valuation allowance as of September 30, 2020 and December 31, 2019. Refer to Slide 19 for a reconciliation of these non-GAAP financial measures to the most directly comparable historical measures determined under GAAP. Past performance is not indicative of future results. MMA Capital Holdings, Inc. 4 We generally invest in renewable energy investments through joint ventures (the “Solar Ventures”) with a capital partner in which we are a 50% investor member. However, we may periodically have a minority economic interest as a result of non-pro rata capital contributions made by our capital partner. At September 30, 2020, we had an approximately 43% minority economic interest in two of these joint ventures. |

| Impact of COVID-19 and the General Economy • During the first nine months of 2020, COVID-19 and the general economy have not prevented us from operating our business and making investments, and the Company was in compliance with all its debt covenants. • However, the long-term impact of COVID-19 on our operational and financial performance will depend on future developments, including the duration, spread and intensity of COVID-19, and the measures taken to control it, all of which remain uncertain and difficult to predict. The adverse impact on our business, results of operations, financial condition and cash flows could be material. • In addition, certain components of the national and some local renewable energy finance markets, such as the Electric Reliability Council of Texas, or ERCOT, have been and may further be affected by changing market dynamics, resulting in supply and demand imbalances, particularly for tax equity investments. • At September 30, 2020, all Solar Venture loans were generally on schedule, assessed to be adequately secured and expected to be repaid in full, but we continue to closely monitor loan performance and expected sources of repayment. • Origination activity at the Solar Ventures during the first nine months of 2020 has not been meaningfully impacted by COVID-19. • The Company’s 80% ownership interest in a joint venture which owns a mixed-use town center development was determined to be permanently impaired during the second quarter of 2020 given the impacts of the downturn in the economy stemming from COVID-19. Consequently, this investment was written down to its fair value at June 30, 2020, and the Company recognized a related $9.0 million impairment loss in the second quarter of 2020. • Although we have not recognized other permanent impairment charges in 2020, it is reasonably possible that we may be required to recognize additional material permanent impairment charges over the next 12 months, particularly if underlying economic conditions continue to deteriorate. MMA Capital Holdings, Inc. 5 |

| 3Q20 Key Updates FINANCIAL RESULTS ▪ BV increased $3.1 million in the third quarter of 2020 to $277.6 million at September 30, 2020, and BV per share increased $0.50 in the third quarter of 2020 to $47.74 at September 30, 2020 ▪ This increase was primarily driven by the impact of strong returns on renewable energy investments ▪ BV includes $56.2 million of net DTAs at September 30, 2020 ▪ ABV increased $4.3 million in the third quarter of 2020 to $221.5 million at September 30, 2020, and ABV per share increased $0.71 in the third quarter of 2020 to $38.08 at September 30, 2020 RENEWABLE ENERGY INVESTING ▪ The Company generated an unlevered net return on investment from our renewable energy investments, as measured on a twelve-month trailing basis, of 11.1% and 12.2% for the periods ended September 30, 2020 and September 30, 2019, respectively ▪ Most of our investments were made through the Solar Ventures, which closed $92.3 million of loan commitments across five loans during the quarter ▪ At September 30, 2020, loans funded through the Solar Ventures had an aggregate unpaid principal balance (“UPB”) and total fair value (“FV”) of $745.8 million, a weighted-average (“WA”) remaining maturity of seven months and a WA coupon of 10.0% • While the dollar amount of origination volume at the Solar Ventures declined for both the third quarter of 2020 compared to the third quarter of 2019 and for the first nine months of 2020 compared to the first nine months of 2019 due to the amount of available capital and a desire to not overextend the Company’s liquidity, our pipeline remains strong DEBT CAPITALIZATION ▪ At September 30, 2020, the Company had debt with a UPB of $231.6 million, a reported carrying value of $238.4 million, an estimated FV of $188.2 million and a WA effective interest rate of 3.9% ▪ Based on carrying values, at September 30, 2020, senior debt to BV was 0.52x, total debt to BV was 0.86x, senior debt to ABV was 0.65x and total debt to ABV was 1.08x MMA Capital Holdings, Inc. 6 |

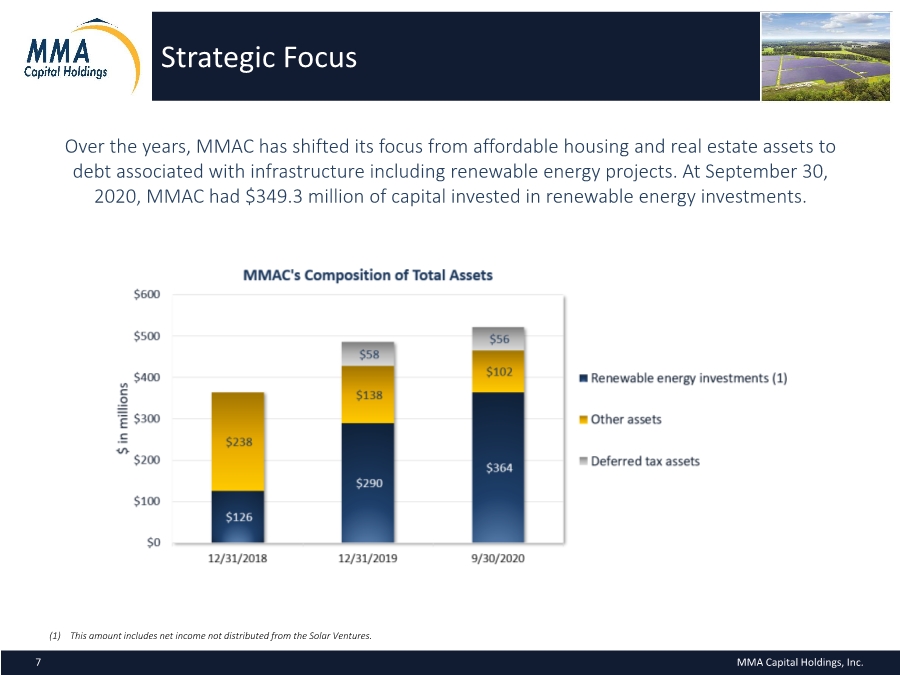

| Strategic Focus Over the years, MMAC has shifted its focus from affordable housing and real estate assets to debt associated with infrastructure including renewable energy projects. At September 30, 2020, MMAC had $349.3 million of capital invested in renewable energy investments. MMA Capital Holdings, Inc. 7 (1) This amount includes net income not distributed from the Solar Ventures. |

| GROWING MMAC is strategically focused on investing in infrastructure with a current emphasis on providing debt financing to an underserved segment of the renewable energy market. We primarily make loans to developers, constructors and system owners for the late-stage development and construction of commercial, utility and community solar scale photovoltaic (“PV”) facilities in the United States. The Solar Ventures typically lend on a senior secured basis collateralized by solar projects but may also invest in subordinated loans and revolving loans. The Solar Ventures may also finance non-solar renewable technologies, such as wind and battery storage, or provide equipment financing and other customized debt solutions for borrowers. Investment Focus (1) SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight Report Q3 2020. The projections factor in the impact of COVID-19. Solar is expected to see 37% annual growth in 2020. Forecasts have increased considerably as impacts from Covid-19 have been less severe than anticipated.(1) Solar accounted for 37% of all new electricity generating capacity added in the U.S. in Q1 2020, similar to the share of new capacity added in full year of 2019.(1) LARGE Fewer financing sources, less competition and attractive risk-adjusted returns by financing projects before they reach commercial operation. FRAGMENTED MMA Capital Holdings, Inc. 8 |

| Hunt Investment Management(1) (“External Manager”) is part of Hunt Companies, Inc. (“Hunt”), which was founded in 1947 and is privately owned. Hunt is dedicated to fostering long-term partnerships through the development, investment, management and financing of real estate and infrastructure. Our External Manager, which also does business as MMA Energy Capital (“MEC”), has an investment origination team with extensive experience in the renewable energy and project development industry with $2.9 billion of originations for the Solar Ventures since their inception in 2015. External Manager Economic Alignment with Shareholders Hunt, together with MMAC directors and executive officers, own approximately 17% of MMAC’s common shares (1) Additional information about Hunt Investment Management, LLC is described in its brochure (Part 2A of Form ADV) available at www.adviserinfo.sec.gov. Senior management team responsible for MMAC has an average of 25 years of relevant experience Experienced Management Team with Proven Track Record MMA Capital Holdings, Inc. 9 |

| Our Competitive Advantage Typically reviews approximately $2 billion of directly sourced opportunities annually No reliance on brokers Typical pipeline of approximately $800 million $1.8 billion of investments fully repaid with a WA internal rate of return (“IRR”) of 16.2%,(1) which exceeded the WA underwritten IRR Strong reputation and relationships with seasoned developers in the renewable energy industry Ability to execute and deliver underwritten returns $626.9 million of originations in 2020, of which approximately 84% were with repeat customers $2.9 billion of originations life-to-date 110+ years of collective experience in the renewable energy and project development industry Comprehensive credit analysis, underwriting and loan structuring In-house underwriting, credit analysis and diligence No loss of principal to date on any of the 143 repaid project loans originated for the Solar Ventures Through our External Manager, MMAC has access to an extensive renewable energy loan origination platform. (1) WA IRR is measured as the total return in dollars of all repaid loans divided by the total commitment amount associated with such loans, where (i) the total return for each repaid loan was calculated as the product of each loan’s IRR and its commitment amount and (ii) IRR for each repaid loan was established by solving for a discount rate that made the net present value of all loan cash flows equal zero. All figures are estimated and unaudited. Past performance is not indicative of future results. MMA Capital Holdings, Inc. 10 |

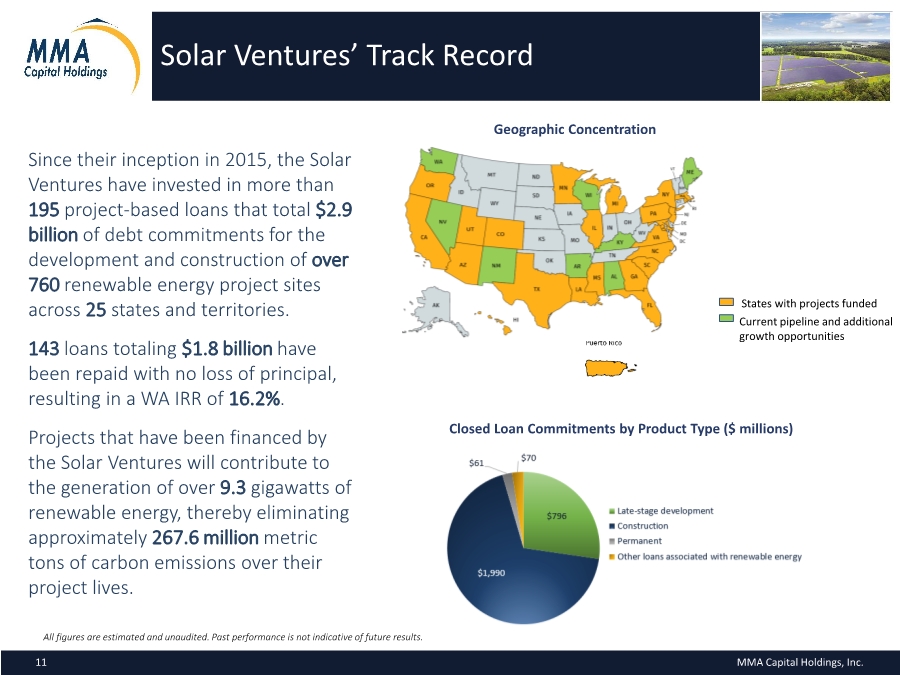

| Solar Ventures’ Track Record Since their inception in 2015, the Solar Ventures have invested in more than 195 project-based loans that total $2.9 billion of debt commitments for the development and construction of over 760 renewable energy project sites across 25 states and territories. 143 loans totaling $1.8 billion have been repaid with no loss of principal, resulting in a WA IRR of 16.2%. Projects that have been financed by the Solar Ventures will contribute to the generation of over 9.3 gigawatts of renewable energy, thereby eliminating approximately 267.6 million metric tons of carbon emissions over their project lives. All figures are estimated and unaudited. Past performance is not indicative of future results. Geographic Concentration Closed Loan Commitments by Product Type ($ millions) States with projects funded Current pipeline and additional growth opportunities MMA Capital Holdings, Inc. 11 |

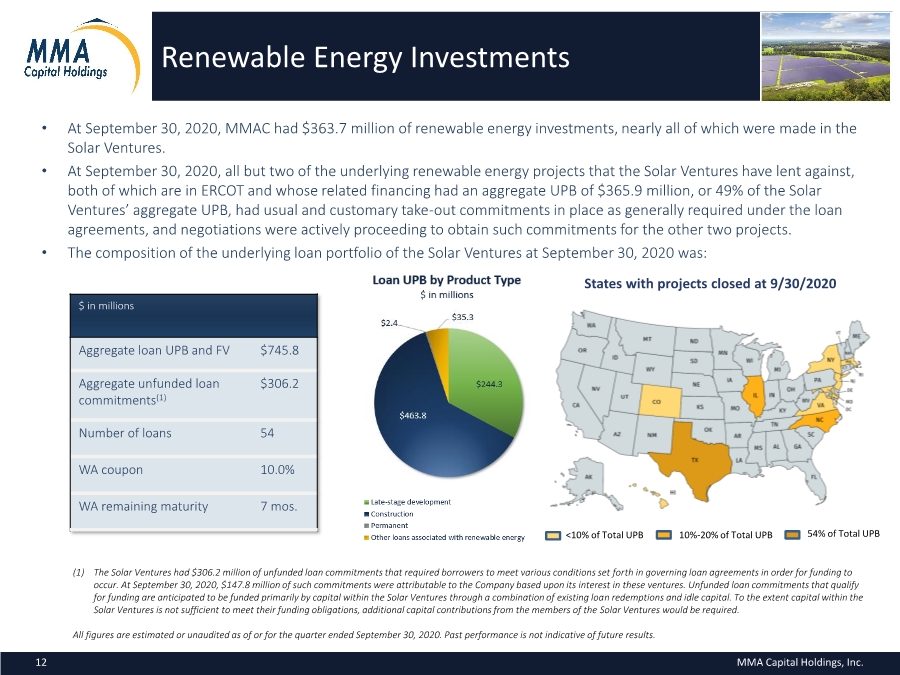

| Renewable Energy Investments • At September 30, 2020, MMAC had $363.7 million of renewable energy investments, nearly all of which were made in the Solar Ventures. • At September 30, 2020, all but two of the underlying renewable energy projects that the Solar Ventures have lent against, both of which are in ERCOT and whose related financing had an aggregate UPB of $365.9 million, or 49% of the Solar Ventures’ aggregate UPB, had usual and customary take-out commitments in place as generally required under the loan agreements, and negotiations were actively proceeding to obtain such commitments for the other two projects. • The composition of the underlying loan portfolio of the Solar Ventures at September 30, 2020 was: $ in millions Aggregate loan UPB and FV $745.8 Aggregate unfunded loan commitments(1) $306.2 Number of loans 54 WA coupon 10.0% WA remaining maturity 7 mos. (1) The Solar Ventures had $306.2 million of unfunded loan commitments that required borrowers to meet various conditions set forth in governing loan agreements in order for funding to occur. At September 30, 2020, $147.8 million of such commitments were attributable to the Company based upon its interest in these ventures. Unfunded loan commitments that qualify for funding are anticipated to be funded primarily by capital within the Solar Ventures through a combination of existing loan redemptions and idle capital. To the extent capital within the Solar Ventures is not sufficient to meet their funding obligations, additional capital contributions from the members of the Solar Ventures would be required. All figures are estimated or unaudited as of or for the quarter ended September 30, 2020. Past performance is not indicative of future results. States with projects closed at 9/30/2020 MMA Capital Holdings, Inc. 12 <10% of Total UPB 10%-20% of Total UPB 54% of Total UPB |

| Other Assets ▪ Investments in a mixed-use development and land in Spanish Fort, AL ▪ A tax-exempt infrastructure bond secured by sales and land taxes with a reported carrying value of $24.1 million at September 30, 2020 ▪ A total return swap on the above-mentioned bond that was treated as a secured borrowing with a reported carrying value of $23.4 million at September 30, 2020 ▪ An 80% equity investment in a joint venture that owns the Spanish Fort Town Center and land with a reported carrying value of $9.7 million at September 30, 2020 ▪ Land development project in Winchester, VA with a reported carrying value of $15.4 million at September 30, 2020 ▪ Subordinated tax-exempt bond secured by an affordable housing property in Atlanta, GA with a reported carrying value of $6.2 million at September 30, 2020 ▪ Limited partnership interest in the South Africa Workforce Housing Fund with a reported carrying value of $1.6 million at September 30, 2020 ▪ The Fund matured in April 2020, but it does not anticipate fully exiting its remaining investments until December 31, 2022 ▪ 7.2 million common shares of a residential real estate investment trust listed on the Johannesburg Stock Exchange with a reported carrying value of $2.6 million NOL CARRY FORWARDS ▪ At September 30, 2020, the Company had $374.9 million of NOLs that were available to offset $102.9 million of future income taxes ▪ Most of our NOLs expire between 2028 and 2035 ▪ At September 30, 2020, the reported carrying value of the Company’s net DTA was $56.2 million ▪ A valuation allowance was maintained at September 30, 2020 against the portion of our DTAs that correspond to federal and state NOL carryforwards that we expected will expire prior to utilization based upon our forecast of pretax book income NON-CORE REAL ESTATE-RELATED INVESTMENTS In addition to our infrastructure investments, we continue to own a limited number of other assets, which remain the focus of our recycling efforts. MMA Capital Holdings, Inc. 13 |

| Capitalization ▪ At September 30, 2020, the facility had $120.0 million of total commitments across five participants. The UPB and reported carrying value of the amounts borrowed under this facility was $103.7 million. The facility bears an interest rate of one-month LIBOR (subject to a 1.50% floor, which is currently in effect) + 2.75% on drawn balances until maturity in September 2022. ▪ Obligations are guaranteed by the Company and secured by a pledge of the entities that hold MMAC’s interests in the Solar Ventures. The facility carries financial covenants and collateral performance tests which are customary for facilities of this type. ▪ We have other asset-backed senior debt with aggregate UPBs and reported carrying values of $41.2 million and $41.0 million, respectively, that bear a WA interest rate of 3.9%. $32.9 million of this UPB was incurred in 2020. LIBOR-BASED LONG- TERM SUBORDINATED DEBT ▪ Our subordinated debt, which is senior only to shareholders’ equity and has limited financial covenants, has a UPB of $86.7 million, bears an interest rate of three-month LIBOR plus a 2.0% spread and amortizes 2.0% annually until a balloon payment at maturity in 2035. At September 30, 2020, the reported carrying value was $93.8 million, while the fair value was estimated to be $44.1 million. ▪ The interest rate risk associated with this debt is partially hedged until October 2026 with interest rate swaps, which effectively fix $35 million of LIBOR exposure at 1.61%, and a $35 million 3.0% interest rate cap. RENEWABLE ENERGY REVOLVER OTHER DEBT We utilize on-balance sheet leverage to support our investments and increase our total returns to our shareholders. We have worked to expand our access to the capital markets and have entered into debt transactions with capital partners to finance our renewable energy investments. We expect to continuously evaluate ways to optimize the Company’s capitalization, with a focus on prudently deploying debt. MMA Capital Holdings, Inc. 14 |

| Future • Staying true to our mission Moving forward, we expect MMAC to grow its BV, ABV and Share Price by: • Increasing the Company’s return on invested capital by redeploying equity that has been and is targeted to be recycled from non-core investments into infrastructure-related investments, including debt associated with renewable energy projects • Leveraging our investments prudently • Lowering our overhead in total and as a percentage of equity • Exploring opportunities in other infrastructure-related investments MMA Capital Holdings, Inc. 15 |

| Appendix – Select Financial Data The select financial data provided in this Appendix can be found in MMAC’s Quarterly Report on Form 10-Q for the three and nine-month periods ended September 30, 2020, which was filed on November 9, 2020. MMA Capital Holdings, Inc. 16 |

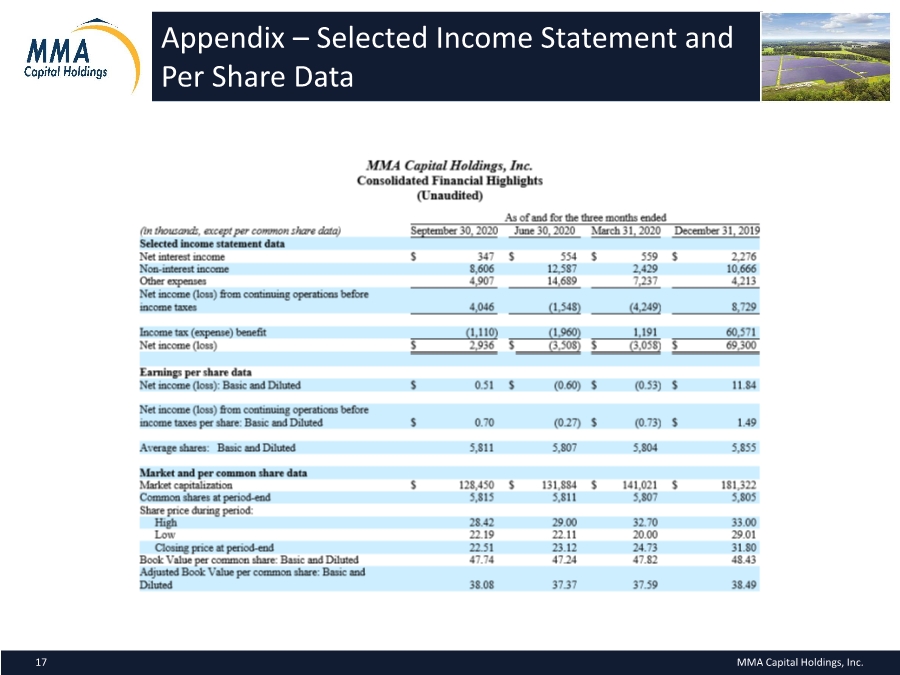

| Appendix Appendix – Selected Income Statement and Per Share Data MMA Capital Holdings, Inc. 17 |

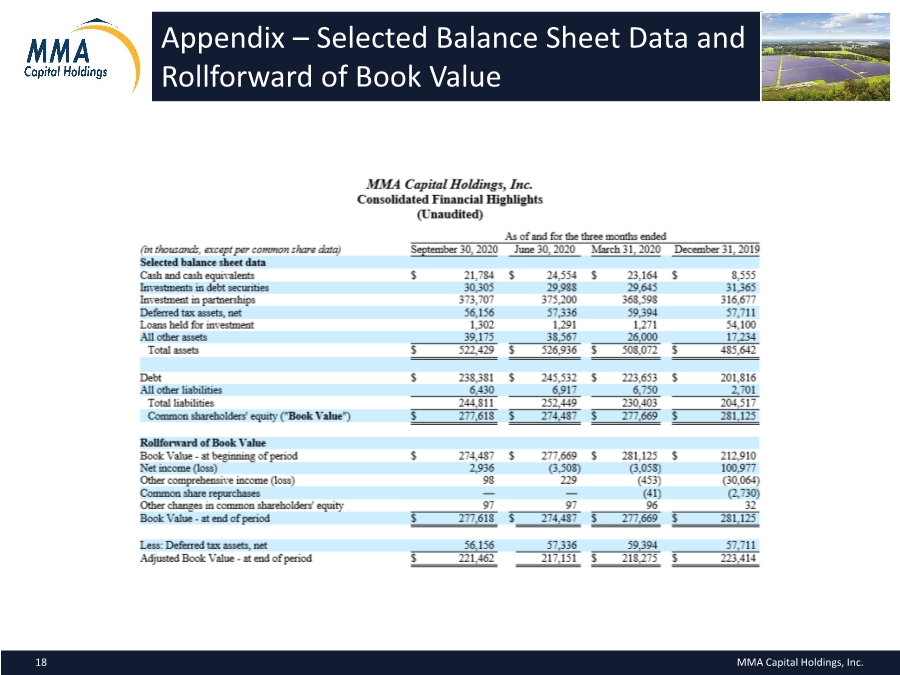

| Appendix Appendix – Selected Balance Sheet Data and Rollforward of Book Value MMA Capital Holdings, Inc. 18 |

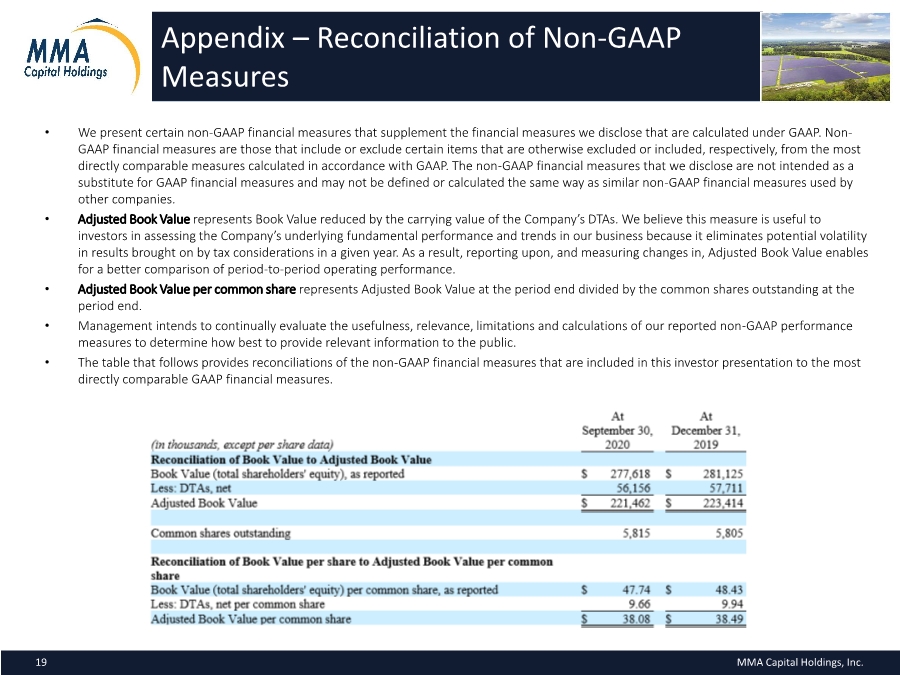

| Appendix Appendix – Reconciliation of Non-GAAP Measures MMA Capital Holdings, Inc. 19 • We present certain non-GAAP financial measures that supplement the financial measures we disclose that are calculated under GAAP. Non- GAAP financial measures are those that include or exclude certain items that are otherwise excluded or included, respectively, from the most directly comparable measures calculated in accordance with GAAP. The non-GAAP financial measures that we disclose are not intended as a substitute for GAAP financial measures and may not be defined or calculated the same way as similar non-GAAP financial measures used by other companies. • Adjusted Book Value represents Book Value reduced by the carrying value of the Company’s DTAs. We believe this measure is useful to investors in assessing the Company’s underlying fundamental performance and trends in our business because it eliminates potential volatility in results brought on by tax considerations in a given year. As a result, reporting upon, and measuring changes in, Adjusted Book Value enables for a better comparison of period-to-period operating performance. • Adjusted Book Value per common share represents Adjusted Book Value at the period end divided by the common shares outstanding at the period end. • Management intends to continually evaluate the usefulness, relevance, limitations and calculations of our reported non-GAAP performance measures to determine how best to provide relevant information to the public. • The table that follows provides reconciliations of the non-GAAP financial measures that are included in this investor presentation to the most directly comparable GAAP financial measures. |

| Nasdaq: MMAC For more information, please visit our website at www.mmacapitalholdings.com Or, contact Investor Relations directly at 443-263-2900 | 855-650-6932 info@mmacapitalholdings.com MMA Capital Holdings, Inc. 20 |