Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INDEPENDENCE HOLDING CO | tm2035505d1_8k.htm |

Exhibit 99.1

1 20 20 Annual Meeting of Stockholders November 1 0 , 20 20 Independence Holding Company © 2017 The IHC Group

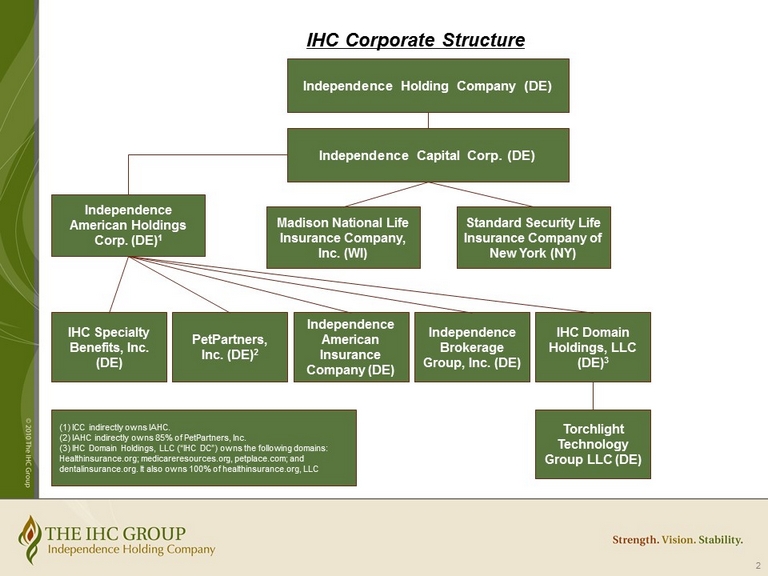

2 IHC Corporate Structure 3 Independence Holding Company (DE) Independence Capital Corp. (DE) Madison National Life Insurance Company, Inc. (WI) Standard Security Life Insurance Company of New York (NY) Independence American Holdings Corp. (DE) 1 Independence Brokerage Group, Inc. (DE ) Independence American Insurance Company (DE) PetPartners, Inc. (DE) 2 IHC Specialty Benefits, Inc. (DE) IHC Domain Holdings, LLC ( DE) 3 (1) ICC indirectly owns IAHC. (2) IAHC indirectly owns 85% of PetPartners , Inc. ( 3) IHC Domain Holdings, LLC (“IHC DC”) owns the following domains: Healthinsurance.org; medicareresources.org, petplace.com; and dentalinsurance.org. It also owns 100% of healthinsurance.org, LLC Torchlight Technology Group LLC (DE)

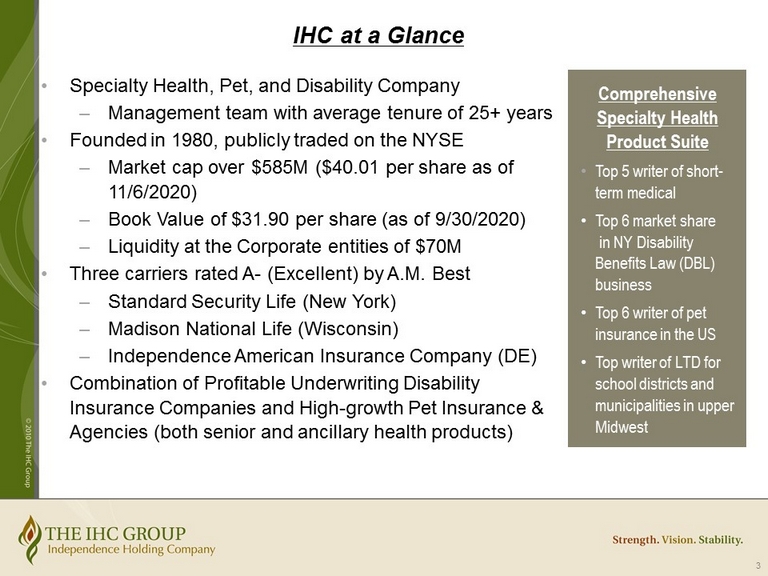

3 IHC at a Glance • Specialty Health, Pet, and Disability Company – Management team with average tenure of 25+ years • Founded in 1980, publicly traded on the NYSE – Market cap over $585M ($40.01 per share as of 11/6/2020 ) – Book Value of $ 31.90 per share (as of 9/30/2020 ) – Liquidity at the Corporate entities of $ 70M • Three carriers rated A - (Excellent) by A.M. Best – Standard Security Life (New York) – Madison National Life (Wisconsin) – Independence American Insurance Company (DE ) • Combination of Profitable Underwriting Disability Insurance Companies and High - growth Pet Insurance & Agencies (both senior and ancillary health products ) Comprehensive Specialty Health Product Suite • Top 5 writer of short - term medical • Top 6 market share in NY Disability Benefits Law (DBL) business • Top 6 writer of pet insurance in the US • Top writer of LTD for school districts and municipalities in upper Midwest

4 Executive Summary • 2020 continuing excellent underwriting results in Group LTD & Life, NY DBL/PFL and Specialty Health • Pet Division – 48% CAGR in pet premiums 2018 – 2020 (est.) – Key relationship with American Kennel Club (AKC) and white - label distribution deals • Controlled distribution for senior and ancillary health products – 170 seat call center selling primarily MA – Call center for USAA members desiring ACA or ancillary health – 235 career advisors • Excess liquidity (unleveraged) provides capital for rapid growth

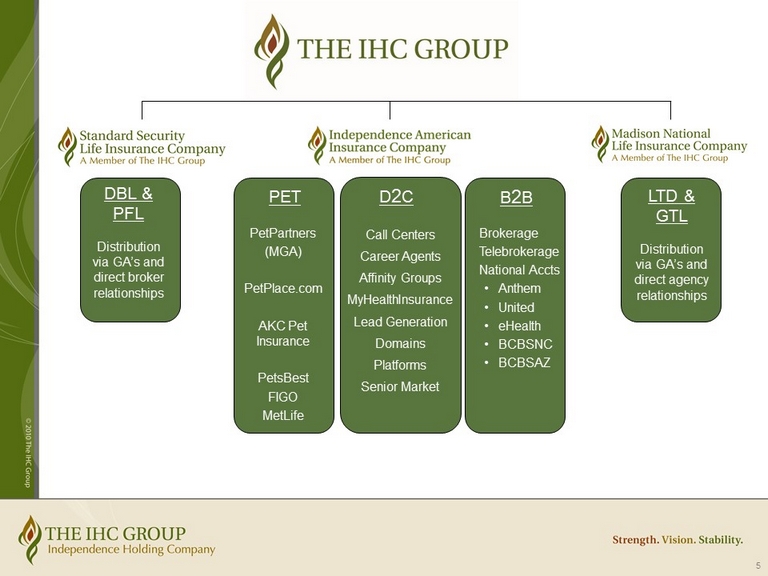

5 PET PetPartners (MGA) PetPlace.com AKC Pet Insurance PetsBest FIGO MetLife D 2 C Call Centers Career Agents Affinity Groups MyHealthInsurance Lead Generation Domains Platforms Senior Market Brokerage Telebrokerage National Accts • Anthem • United • eHealth • BCBSNC • BCBSAZ B 2 B DBL & PFL Distribution via GA’s and direct broker relationships LTD & GTL Distribution via GA’s and direct agency relationships

6 STM & F ixed I ndemnity Individual & Association • Plans are available online and are active within 24 hours of applying • Duration rules have recently changed allowing states to determine the plan duration. Extend STM is available in 20 states • STM and FI more attractive due to elimination of penalty DBL & PFL Group • Electronic application submission that allows agents to conveniently submit applications via DBL customized website and receive instant policy numbers • System is complemented by electronic delivery of policy kits • Less than 24 hour turnaround on all new business and administrative changes • Comprehensive interactive website for agents, policyholders and claimants Group Life & LTD Group • Expertise in public sector market: #1 writer of employer paid Life and Disability for schools in 8 midwestern states • Significant website functionality to expand self service capabilities for both employers and claimants • Provide full suite of employer paid and worksite products Pet Insurance Individual + Group • Fully customizable benefits, 24/7 Televet , Pet Rx, discounts for employees, affinity groups and multi - pet households • Industry first group product coming in 2021 Dental & Vision Group + Individual • Fast growing and highly profitable individual line being marketed by Anthem, WBEs , eHealth and others • New quoting and enrollment platforms for groups create value for producers Products Product Features Unique Specialty Product Offerings with a History of Innovation and Underwriting Profitability These lines of business have consistently generated underwriting profits for over 5 years

7 Pet Insurance • One of the fastest growing insurance coverage, yet there remains tremendous growth potential as less than 2% of pets are insured in US vs. 25%+ in European countries • Collectively, our pet division will underwrite $ 117M of premium (approximately 200,000 dogs and cats) by the end of this year and we expect continued significant growth in 2021 and beyond. – Our carrier (“IAIC”) underwrites for PetPartners (“PPI ”), has an exclusive relationship with the American Kennel Club (“AKC”) and is rapidly expanding through well - known brands (“white - labeling”) and – 3 well - known managing general agencies: MetLife, Figo and PetsBest • In 2021, we will accelerate generation of non - risk revenue through the newest brand asset to the Pet Division, TailTrax , a subscription based app with Tele - Vet and other high - touch engagement features, as well as generate revenues from Petplace.com, which is one of the leading sites for veterinarian - curated pet information.

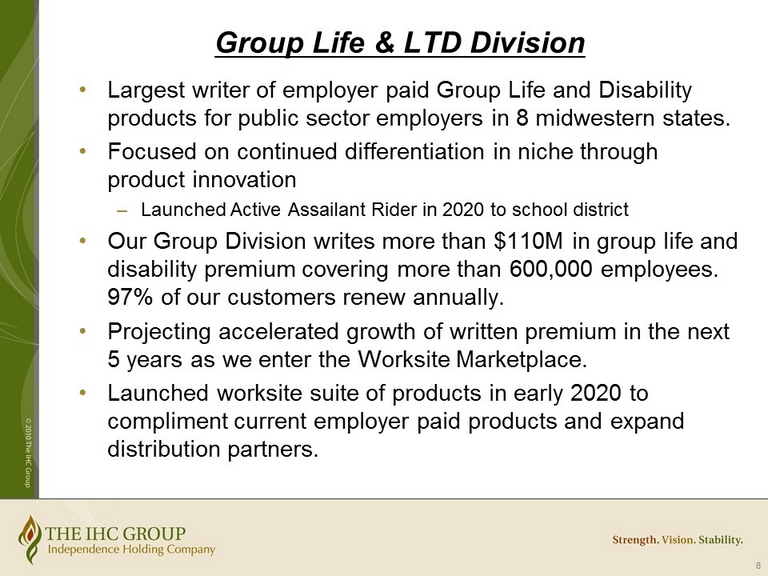

8 Group Life & LTD Division • Largest writer of employer paid Group Life and Disability products for public sector employers in 8 midwestern states. • Focused on continued differentiation in niche through product innovation – Launched Active Assailant Rider in 2020 to school district • Our Group Division writes more than $ 110M in group life and disability premium covering more than 600,000 employees. 97% of our customers renew annually. • Projecting accelerated growth of written premium in the next 5 years as we enter the Worksite Marketplace . • Launched worksite suite of products in early 2020 to compliment current employer paid products and expand distribution partners .

9 New York Disability Benefits Law (DBL) Paid Family Leave (PFL) • R anked 6th in DBL/PFL market in New York State • Annual DBL/PFL premiums of $115M with 70K policies and 1M lives. Growing to approximately $192M in 2021 as a result of an 89% PFL rate increase • NY DBL is state mandated coverage for all employers who employ 1 or more persons – Provides coverage for all non - occupational disabilities, including pregnancy – Maximum benefit $170 per week // Maximum benefit duration of 26 weeks – Carrier sets premium rate but there are minimum loss ratio requirements • Enriched DBL C overage has been offered by SSL since 2011 – Higher maximum benefit, shorter waiting periods, and/or a longer maximum duration • PFL B enefit allows for parent bonding with newborn or adopted child, caring for seriously ill family members and will help military families during times of need – Maximum benefit (once completely phased in starting January 1, 2021) will be for 12 weeks at 67% of an employee’s weekly wage up to a maximum benefit of approximately $869 per week – Coverage is mandatory and 100% funded by the employee – Premium rate is set by the NYDFS • New York, along with New Jersey, California, Hawaii, Puerto Rico, and Rhode Island is one of six jurisdictions in the U.S. that have required DBL coverage

10 IHC Per - Share Value ❑ As market prices warrant, buy back shares of IHC ❑ Recent price levels: ❑ IHC book value $31.90 as of September 30, 2020 ➢ IHC Price to Book Ratio was 1.25 at November 6, 2020 ❑ Russell 2000 Insurance: Life Index Price to Book Ratio was 0.42 as of 9/30/20 ❑ NASDAQ Insurance Index Price to Book Ratio was 1.16 as of 9/30/20

11 Strategic Objectives Next 3 Years • Expand pet insurance footprint – Focus on our close relationship with American Kennel Club and the breeders – Continuing to add new “white label” and affinity partners – in particular through insurance company partners – Launch of subscription version of TailTrax app with exceptional functionality – Successful relaunch of www.petplace.com generating organic leads – Relaunching PetPartners brand, significant investments in social/digital marketing – Developing group policy and simplified rating structure for voluntary worksite benefits market – Continue to be underwriter for three leading MGAs • Expand owned distribution channels and lead generation – Emphasize online sales and direct - to - consumer channels through call center, advisors, and transactional websites – Improve lead flow to call centers, advisors and PPI through organic, paid and referral relationships • Continue to accelerate adoption of our WBE by independent agents and launch Enhanced WBE in 2021 • Maintain excellent underwriting results and expand distribution of Group Life & LTD and DBL/PFL

12 Forward - Looking Statements Certain statements in this presentation are “forward - looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, cash flows, plans, objectives, future performance and business of IHC. Forward - looking statements by their nature address matters that are, to differing degrees, uncertain. With respect to IHC, particular uncertainties that could adversely or positively affect our future results include, but are not limited to, economic conditions in the markets in which we operate, new federal or state governmental regulation, our ability to effectively operate, integrate and leverage any past or future strategic acquisition, and other factors which can be found in our news releases and filings with the Securities and Exchange Commission. These uncertainties may cause IHC’s actual future results to be materially different than those expressed in this presentation. IHC does not undertake to update its forward - looking statements.