Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - LEAF GROUP LTD. | leaf-20201106xex99d1.htm |

| 8-K - 8-K - LEAF GROUP LTD. | leaf-20201106x8k.htm |

Exhibit 99.2

Leaf Group Issues Letter to Shareholders

SANTA MONICA, Calif., November 9, 2020 (GLOBE NEWSWIRE) – Leaf Group Ltd. (NYSE: LEAF), a diversified consumer internet company, today issued the following letter to its shareholders in response to a recent public letter from a group of Leaf Group shareholders (the “Investor Group”):

Dear Valued Shareholders,

The Investor Group recently made a new proposal to the Leaf Group Board of Directors, which was disclosed in letters they sent to the Board on October 22, 2020 and November 2, 2020 (copies of which are attached to this letter). The proposal includes the following terms:

| ● | The appointment to the Leaf Group Board of two new Directors affiliated with the Investor Group—Robert Majteles and Michael McConnell; |

| ● | The capping of the size of the Board at a total of seven Directors; |

| ● | The establishment of a new strategic review committee composed of the Investor Group’s two Director nominees and one current outside Leaf Group Director of the Board’s choosing, which would select new financial and legal advisors for the strategic review and oversee the process; |

| ● | Sean Moriarty remaining CEO of the Company; and |

| ● | Mr. Moriarty receiving a stock award package in connection with a sale of the Company which would result in him receiving at least $6 million if the Company is sold for at least $9.00 per share. |

It is clear that the proposal’s provisions have one purpose: to force the near-term sale of the Company. The Investor Group has been pursuing a sale since it began its campaign in June 2020, and as we have said before, we believe that the Investor Group’s continued efforts to force a sale are driven by a narrow and self-serving agenda that is directly at odds with the best interests of our broader investor base.

We believe that it is in all shareholders’ best interest for the Company to continue to drive results to increase shareholder value.

NOW IS NOT THE TIME FOR A SECOND STRATEGIC REVIEW

This view is grounded in the fact that, in line with our fiduciary obligations, we have thoroughly assessed the merits of a potential second strategic review, including consulting with a number of leading investment bankers. This evaluation process has left us highly confident that initiating another strategic review so soon after the completion of our last review would be ill-advised, particularly in light of our recent financial performance. We firmly believe that our current strategic plan is the best way to enhance shareholder value, and that another review has the potential to damage the business.

The recent performance of our business and stock price bear this out. Since completing our strategic review in May 2020, Leaf Group has posted stellar results. As previously announced, for Q3 2020 the Company delivered $63.3 million in revenue, a 58% year-over-year growth in revenue and our strongest revenue growth in over a decade. We also reported $2.6 million in Adjusted EBITDA, a $2.3 million

Exhibit 99.2

improvement over the prior year period. We continue to demonstrate strong momentum toward our 2022 targets of over $250 million in revenue and $20 million in Adjusted EBITDA.

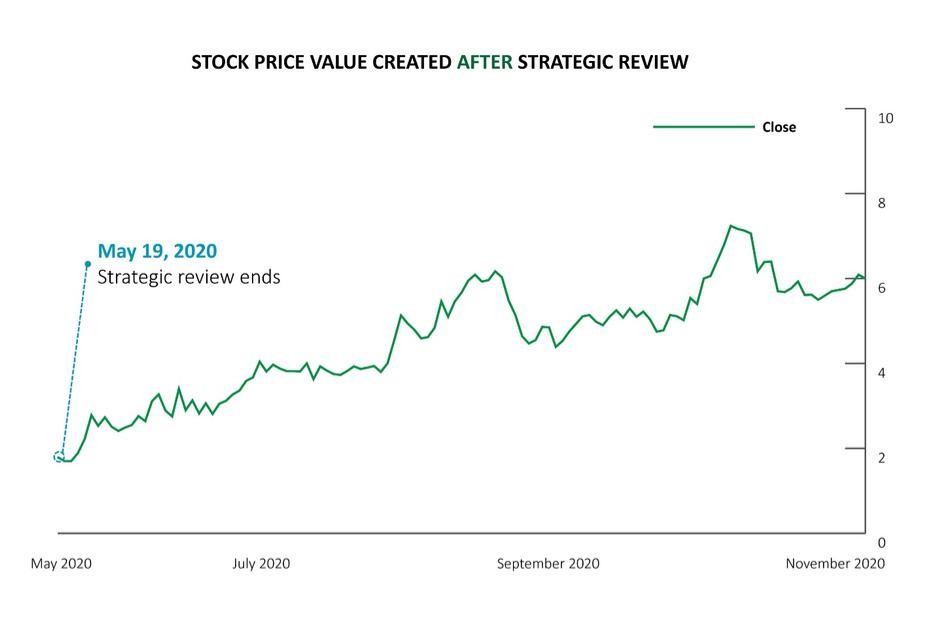

Our recent stock market performance supports the Board’s strategic direction, with Leaf Group’s stock up over 300% since the conclusion of our last strategic review in May 2020.

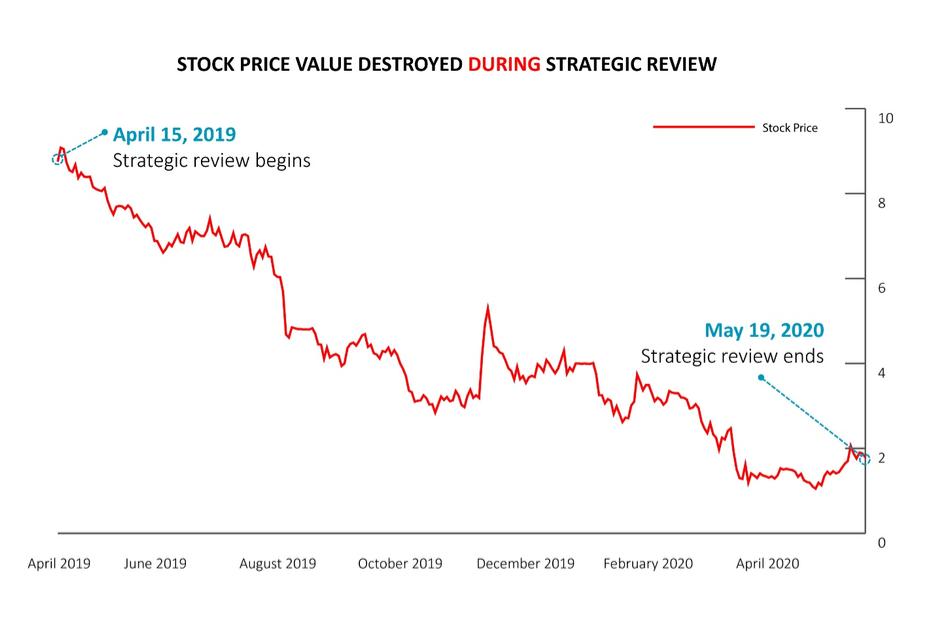

With the Company performing well and its current direction supported by the market, now is not the time to risk disrupting momentum that is benefiting shareholders. To that end, the following stock charts are illuminating. The first shows Leaf Group’s stock performance from when we launched our strategic review after similar pressure from certain members of the Investor Group on April 15, 2019, through the conclusion of the review on May 19, 2020:

Compare that to the following chart, which shows the Company’s stock price growth since announcing the conclusion of the strategic review in May 2020:

Exhibit 99.2

The activist campaign in the spring of 2019 and the resulting strategic review process destroyed shareholder value. And while we are pleased with how our stock performance has improved since May 2020, we have no doubt that the Investor Group’s current aggressive PR campaign continues to be an overhang on the stock. Investors should be asking themselves how much additional value a second review process would destroy, in addition to how much the Investor Group’s self-serving efforts have already cost them.

THE INVESTOR GROUP IS SEEKING TO FURTHER ITS OWN INTERESTS AT THE EXPENSE OF OTHER SHAREHOLDERS

The Investor Group is clearly pushing the Company to do something that Leaf Group’s Board, management team and third-party advisors agree would harm the Company and shareholder value. Its Directors will control the new strategic review committee with its handpicked financial and legal advisors to ensure they drive the result that they seek. The next logical question is, “What are the Investor Group’s motivations and are they aligned with the interests of all other shareholders?”

After the Leaf Group Board was pressured to launch a strategic review in April 2019, Investor Group member Oak Management Group sold 769,388 shares of Leaf Group common stock from November 2019 through May 2020 at prices as low as $1.10 per share. Oak Managing Partner Fred Harman disclosed that these sales were driven by a need to raise capital for his firm’s other investments.

Additionally, Spectrum sold 500,000 Leaf Group shares at $5.13 per share on October 5, 2020 — a day when Leaf Group’s stock price on the open market fluctuated between $5.74 and $6.19. We urge our

Exhibit 99.2

shareholders to question what motivation Spectrum could possibly have for selling such a large amount of stock below market value other than a need to liquidate its Leaf Group position.

Even the Investor Group’s new willingness not to conduct the strategic alternative process if certain targets are met is illusory. For a strategic process not to be run, the Company’s 45-day moving average stock price must remain at or over $9.00 per share during the first quarter of 2021. The initial $9.00 price target would mark a 56% increase from the closing price of Leaf Group’s stock on the day our Board received the Investor Group’s proposal, and a more than 400% increase from the Company’s stock price at the conclusion of our strategic review in May 2020. This already tremendous hurdle would grow over time, with the minimum average stock price allowed under the terms of the proposal increasing in each successive quarter in 2021.

We believe based on our regular interactions with our shareholders that most are seeking sustainable, long-term value generation. The actions of select members of the Investor Group suggest a narrow, short-term and self-serving agenda that does not prioritize the interests of our broader shareholder base.

THE INVESTOR GROUP’S PROPOSED DIRECTORS ARE LIKELY TO ADVANCE ITS INTERESTS AT THE EXPENSE OF OTHER SHAREHOLDERS

Given that the Investor Group’s goals do not appear to align with those of the broader investor base, shareholders should also ask whether its two Director candidates are likely to act in the best interests of all shareholders. The following charts illustrate just how closely its Director candidates are affiliated with certain members of the Investor Group:

Exhibit 99.2

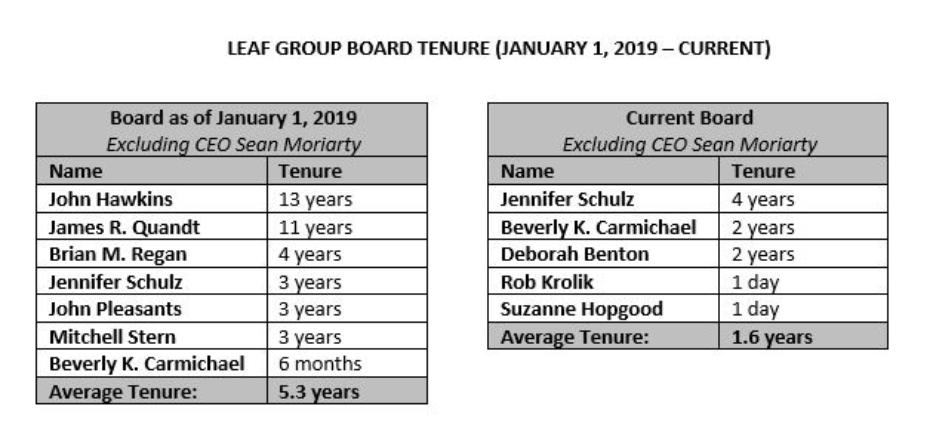

As we announced earlier today, we have just named two new Directors—Rob Krolik and Suzanne Hopgood – to our Board of Directors. You can find more information about these Directors, who were selected with the support of a leading outside search firm, in our press release here https://ir.leafgroup.com/investor-overview/investor-press-releases/press-release-details/2020/Leaf-Group-Announces-New-Appointments-to-Board-of-Directors/. This announcement is just the latest step in our efforts to overhaul our Board. The Board now includes five independent Directors, all of whom have been on the Board for four years or less, and we are confident that this refreshed Board has the relevant experience and fresh perspectives needed to help guide the Company into its next chapter. Importantly, the current Board also reflects a goal that we and many of our investors value highly in having a diverse group of individuals—our six Directors include four women and one person of color.

Our Board continues to evaluate a wide range of strategic alternatives and remains committed to acting in the best interest of its shareholders. We thank you for your support.

Sincerely,

The Independent Committee

Deborah A. BentonBeverly K. Carmichael

Chair of the BoardDirector

About Leaf Group

Leaf Group Ltd. (NYSE: LEAF) is a diversified consumer internet company that builds enduring, creative-driven brands that reach passionate audiences in large and growing lifestyle categories, including fitness and wellness (Well+Good, Livestrong.com and MyPlate App), and home, art and design (Saatchi Art, Society6 and Hunker). For more information about Leaf Group, visit www.leafgroup.com.

Cautionary Information Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements

Exhibit 99.2

set forth in this communication include, among other things, statements regarding potential synergies achieved from acquisitions, the impact of strategic operational changes and the Company’s future financial performance. In addition, statements containing words such as “guidance,” “may,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “projections,” “business outlook,” and “estimate” or similar expressions constitute forward-looking statements. Actual results may differ materially from the results predicted and reported results should not be considered an indication of future performance. These forward-looking statements involve risks and uncertainties regarding the Company’s future financial performance; could cause actual results or developments to differ materially from those indicated due to a number of factors affecting Leaf Group’s operations, markets, products and services; and are based on current expectations, estimates and projections about the Company’s industry, financial condition, operating performance and results of operations, including certain assumptions related thereto. Potential risks and uncertainties that could affect the Company’s operating and financial results are described in Leaf Group’s annual report on Form 10-K for the fiscal year ending December 31, 2019 filed with the Securities and Exchange Commission (http://www.sec.gov) on March 16, 2020, as such risks and uncertainties may be updated from time to time in Leaf Group’s quarterly reports on Form 10-Q filed with the Securities and Exchange Commission, including, without limitation, information under the captions “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations.” These risks and uncertainties include, among others: risks associated with political and economic instability domestically and internationally including those resulting from the COVID-19 pandemic, which have and could lead to fluctuations in the availability of credit, decreased business and consumer confidence and increased unemployment; the Company’s ability to execute its business plan to return to compliance with the continued listing criteria of the New York Stock Exchange (“NYSE”); the Company’s ability to continue to comply with applicable listing standards within the available cure period; changes by the Small Business Administration or other governmental authorities regarding the Coronavirus Aid, Relief and Economic Security Act of 2020 (the “CARES Act”), the Paycheck Protection Program (“PPP”) or related administrative matters; the Company’s ability to comply with the terms of the PPP loan and the CARES Act, including to use the proceeds of the PPP loan; the Company’s ability to successfully drive and increase traffic to its marketplaces and media properties; changes in the methodologies of internet search engines, including ongoing algorithmic changes made by Google, Bing and Yahoo!; the Company’s ability to attract new and repeat customers and artists to its marketplaces and successfully grow its marketplace businesses; the potential impact on advertising-based revenue from lower ad unit rates, a reduction in online advertising spending, a loss of advertisers, lower advertising yields, increased availability of ad blocking software, particularly on mobile devices and/or ongoing changes in ad unit formats; the Company’s dependence on various agreements with a specific business partner for a significant portion of its advertising revenue; the effects of shifting consumption of media content and online shopping from desktop to mobile devices and/or social media platforms; the Company’s history of incurring net operating losses; the Company’s ability to obtain capital when desired on favorable terms; potential write downs, reserves against or impairment of assets including receivables, goodwill, intangibles (including media content) or other assets; the Company’s ability to effectively integrate, manage, operate and grow acquired businesses; the Company’s ability to retain key personnel; the Company’s ability to prevent any actual or perceived security breaches; the Company’s ability to expand its business internationally; the Company’s ability to generate long-term value for its stockholders; and any ongoing actions taken and future actions that may be taken by activist stockholders. From time to time, the Company may consider acquisitions or divestitures that, if consummated, could be material. Any forward-looking statements regarding financial metrics are based upon the assumption that no such acquisition or divestiture is consummated during the relevant periods. If an acquisition or divestiture were consummated, actual results could differ materially from any forward-looking statements. Any forward-looking statement made by the Company in this press

Exhibit 99.2

release is based only on information currently available to the Company and speaks only as of the date on which it is made. The Company undertakes no obligation to revise or update any forward-looking information, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except as required by law, and may not provide this type of information in the future.

Investor Contacts

Shawn Milne

Investor Relations

415-264-3419

shawn.milne@leafgroup.com

Media Contacts

John Christiansen/Matt Reid

Sard Verbinnen & Co

415-618-8750/310-201-2040

LeafGroup-SVC@sardverb.com

Sharna Daduk

VP, Communications

Sharna.daduk@leafgroup.com

Exhibit 99.2

October 22, 2020

Board of Directors Leaf Group Ltd.

1655 26th Street

Santa Monica, CA 90404

Dear Members of the Board of Directors of Leaf Group:

We are reaching out to you because we have had no contact with the full Board of Directors since June. Over the last two months, we have raised many different ideas with the designated independent committee and have agreed to keep those discussions confidential. However, based on infrequent communication with the committee and no forward momentum to resolve our concerns, we believe it is in the best interests of Leaf’s management and employees, the Board, and all of Leaf’s shareholders to present a proposal to the full Board.

The key elements of the proposal are:

| ● | Mr. Moriarty remains CEO of the Company. |

| ● | Mr. Moriarty receives a meaningful award of new stock options to purchase shares of Leaf Common stock to further align executive compensation with increases in stockholder value. A vesting schedule will accelerate this new grant 100% upon a change in control transaction. We will work with you and publicly support this new award. |

| ● | We will propose two new directors who will join the Board immediately, both of whom will be well-qualified, experienced individuals and will otherwise satisfy traditional new director review. These directors will be nominated for election at the next annual meeting as well. |

| ● | The Board will be capped at seven directors in total, and we will vote in favor of all director nominees recommended by the Board. |

| ● | The Board will create a three-person Strategic Review Committee, composed of the two new directors we have proposed and one current outside director chosen by the Company. The Board will commit to start a Strategic Review process at its discretion, but no later than March 31, 2020, unless certain performance targets are met. Mr. Moriarty’s role will be determined by the Strategic Review Committee, but could including being recused from the process. |

We believe this proposal strongly aligns the interests of all constituencies. While we recognize the Board has constituted a committee to speak with us, it is now time for us to include Mr. Moriarty and any other interested outside director in a substantive discussion concerning the details of this proposal.

We respectfully request a call on October 26th or 27th. Thank you.

Sincerely,

/s/ Vic Parker |

| /s/ Fred Harman |

Vic Parker | | Fred Harman |

Exhibit 99.2

November 2, 2020

Board of Directors Leaf Group Ltd.

1655 26th Street

Santa Monica, CA 90404

Dear Members of the Board of Directors of Leaf Group:

Please find the below responses to your requested information regarding our proposal to the Board dated October 22, 2020.

1. Question: Your letter does not identify your two proposed directors. For clarity, please provide us with their names and contact information so that our Nominating and Corporate Governance Committee can contact them and obtain the relevant information to consider their candidacy. As we have discussed several times previously, the Nominating and Corporate Governance Committee will put them through the identical process that it has for other potential director candidates.

| ● | Our proposal is to permanently cap the size of the Company’s Board of Directors at seven directors. The Board will consist of the current members of the Board, in addition to the two new directors we propose, effective immediately upon a settlement. |

| ● | The two directors that we propose are: |

o Mr. Robert Majteles

o Mr. Michael McConnell

2. Question: Your proposal indicates that the Board would commit to start a Strategic Review process no later than March 31, 2021 unless certain performance targets are met. We assume under your proposal that the foregoing would be publicly disclosed in connection with a settlement. Is this assumption correct? Additionally please provide us with the performance targets that you propose that would result in a Strategic Review process not being initiated.

| ● | A Strategic Review would be undertaken if Leaf Group stock trades under certain quarterly share price targets using a 45-day moving average starting January 1st, 2021. If by the dates below, the moving average on the stock is at or below the prices indicated, then the Board will immediately commence a Strategic Review process. |

Date | | Share Price | | Enterprise Value/2022 Revenue Target |

3/31/2021 | | $9.00 | | 0.91x |

6/30/2021 | | $9.50 | | 0.96x |

9/30/2021 | | $10.00 | | 1.02x |

12/31/2021 | | $10.50 | | 1.07x |

| ● | The Board will create a three-person Strategic Review Committee to oversee the process, composed of the two new directors we have proposed, and one current outside director chosen by the Company. The committee will immediately hire outside financial and independent legal advisors to assist in the review. |

| ● | Yes, the performance targets would be publicly disclosed in connection with a settlement. |

Exhibit 99.2

3. Question: Your proposal states that Mr. Moriarty would receive “a meaningful award of new stock options to purchase shares of Leaf Common Stock to further align executive compensation with increases in stockholder value.” Please provide us with specifics on the stock option award you propose to give Mr. Moriarty.

| ● | We will publicly support Mr. Moriarty receiving the following stock award package subsequent to a successful Strategic Review process in which the business is sold in its entirety or in separate transactions for all the Company’s assets by no later than 12/31/2021. The award is forfeited if a successful sale of the whole Company or all of the Company’s assets is not consummated by 12/31/2021. |

| ● | Mr. Moriarty would be awarded a bonus grant equaling $6 million if the Company is sold for $9.00 per share. Mr. Moriarty would receive a bonus grant equaling 2.00% of the incremental market value increase above $9.00 per share. |

| ● | This proposal assumes the number of fully diluted shares outstanding remains 27,954,000. |

| ● | This plan is in addition to Mr. Moriarty’s current compensation plan. |

| ● | Please see the below table for examples of a sale at various share prices: |

Stock Price Per Share |

| Incremental Compensation | | Cumulative Compensation |

$9 | | $6,000,000 | | $6,000,000 |

$10 | | $559,080 | | $6,559,080 |

$11 | | $559,080 | | $7,118,160 |

$12 | | $559,080 | | $7,677,240 |

$13 | | $559,080 | | $8,236,320 |

$14 | | $559,080 | | $8,795,400 |

$15 | | $559,080 | | $9,354,480 |

$16 | | $559,080 | | $9,913,560 |

$17 | | $559,080 | | $10,472,640 |

$18 | | $559,080 | | $11,031,720 |

$19 | | $559,080 | | $11,590,800 |

$20 | | $559,080 | | $12,149,880 |

We respectfully request a call to discuss the details of this proposal with Mr. Moriarty and any other interested outside director on November 4th or 5th. Thank you for your consideration.

Sincerely,

/s/ Vic Parker |

| /s/ Fred Harman |

Vic Parker | | Fred Harman |