Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Great Elm Capital Corp. | gecc-8k_20200930.htm |

| EX-99.3 - EX-99.3 - Great Elm Capital Corp. | gecc-ex993_7.htm |

| EX-99.1 - EX-99.1 - Great Elm Capital Corp. | gecc-ex991_8.htm |

Exhibit 99.2

Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal securities laws. These statements are often, but not always, made through the use of words or phrases such as “expect,” “anticipate,” “should,” “will,” “estimate,” “designed,” “seek,” “continue,” “upside,” “potential” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are: conditions in the credit markets, the price of GECC common stock, the performance of GECC’s portfolio and investment manager and risks associated with the economic impact of the COVID-19 pandemic on GECC and its portfolio companies. Information concerning these and other factors can be found in GECC’s Annual Report on Form 10-K and other reports filed with the SEC. GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. You should consider the investment objective, risks, charges and expenses of GECC carefully before investing. GECC’s filings with the SEC contain this and other information about GECC and are available by contacting GECC at the phone number and address at the end of this presentation. The SEC also maintains a website that contains the aforementioned documents. The address of the SEC’s website is http://www.sec.gov. These documents should be read and considered carefully before investing. The performance, distributions and financial data contained herein represent past performance, distributions and results and neither guarantees nor is indicative of future performance, distributions or results. Investment return and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than the original cost. GECC’s market price and net asset value will fluctuate with market conditions. Current performance may be lower or higher than the performance data quoted. All information and data, including portfolio holdings and performance characteristics, is as of September 30, 2020, unless otherwise noted, and is subject to change. This presentation does not constitute an offer of any securities for sale. Forward Looking Statement

About Great Elm BDC Great Elm BDC Investment Objective Investment Strategy Externally managed, total-return-focused BDC Liquid balance sheet Employees and affiliates of Great Elm Capital Management, Inc., GECC’s investment manager, own approximately 43.6% of GECC’s outstanding shares To generate both current income and capital appreciation, while seeking to protect against the risk of capital loss To apply the key principles of value investing to the capital structures of middle-market companies and to acquire majority stakes in income-generating specialty finance businesses Portfolio (as of 9/30/2020) $264.5 million of total assets; $169.5 million of portfolio fair value; $60.5 million of net asset value Debt investments carry a weighted average current yield of 10.1%1 42 investments (34 debt, 8 equity) in 29 companies across 23 industries (1) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date.

Third Quarter 2020 Overview: Capital Deployment During Q3 2020, monetized $18.2 million across 12 investments, in whole or in part, at a weighted average current yield of 9.58% and a weighted average price of $0.97 This includes the complete exit of 1 position during the quarter During Q3 2020, deployed $34.5 million into 11 investments at a weighted average current yield of 12.31% and a weighted average price of $0.91 Capital deployed into both secured and unsecured investments GECCL 6.50% Notes due September 2022 GECCN 6.50% Notes due June 2024 GECCM 6.75% Notes due January 2025 Attractive Fixed Rate Debt Deployment of Capital Monetization of Investments

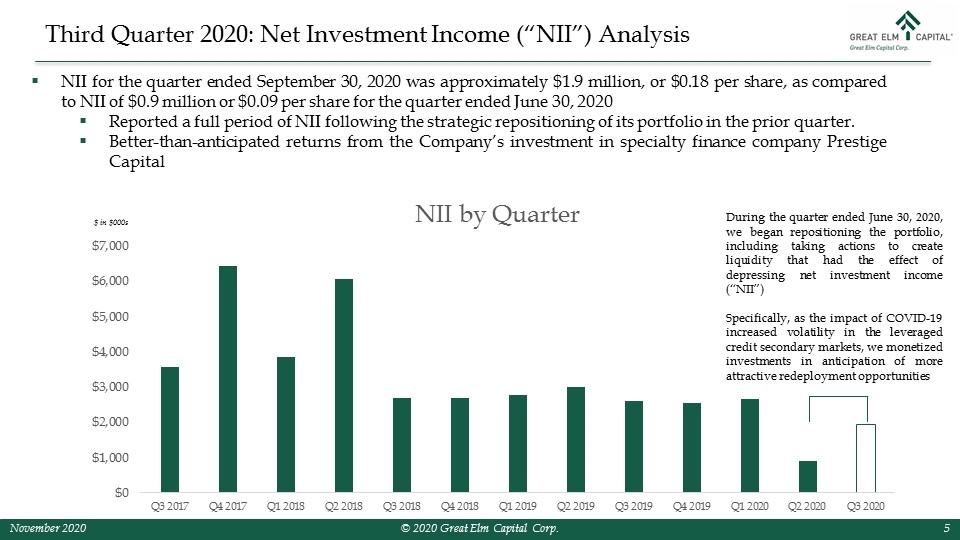

Third Quarter 2020: Net Investment Income (“NII”) Analysis NII for the quarter ended September 30, 2020 was approximately $1.9 million, or $0.18 per share, as compared to NII of $0.9 million or $0.09 per share for the quarter ended June 30, 2020 Reported a full period of NII following the strategic repositioning of its portfolio in the prior quarter. Better-than-anticipated returns from the Company’s investment in specialty finance company Prestige Capital During the quarter ended June 30, 2020, we began repositioning the portfolio, including taking actions to create liquidity that had the effect of depressing net investment income (“NII”) Specifically, as the impact of COVID-19 increased volatility in the leveraged credit secondary markets, we monetized investments in anticipation of more attractive redeployment opportunities $ in $000s

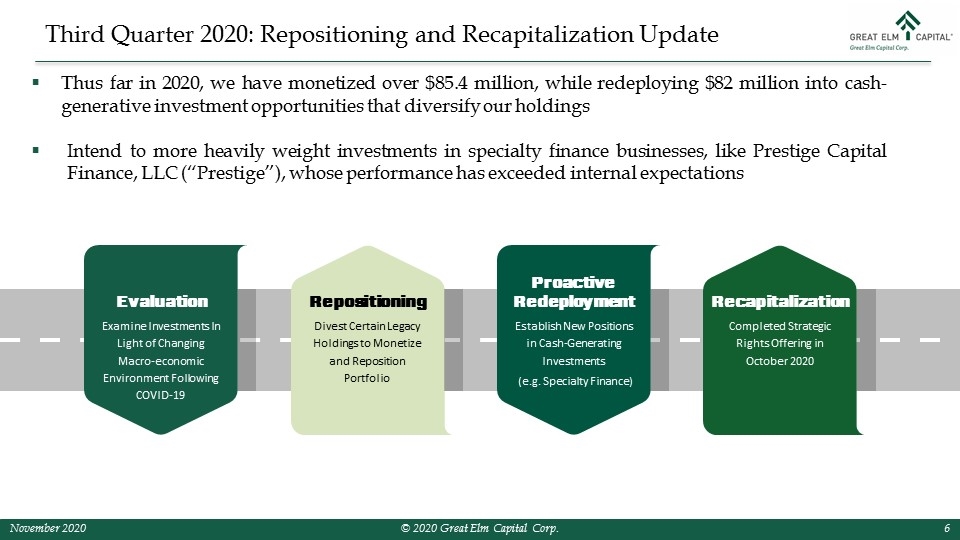

Portfolio Review: GECC Overview Third Quarter 2020: Repositioning and Recapitalization Update Thus far in 2020, we have monetized over $85.4 million, while redeploying $82 million into cash-generative investment opportunities that diversify our holdings Intend to more heavily weight investments in specialty finance businesses, like Prestige Capital Finance, LLC (“Prestige”), whose performance has exceeded internal expectations Examine Investments In Light of Changing Macro-economic Environment Following COVID-19 Evaluation Divest Certain Legacy Holdings to Monetize and Reposition Portfolio Repositioning Establish New Positions in Cash-Generating Investments (e.g. Specialty Finance) Proactive Redeployment Completed Strategic Rights Offering in October 2020 Recapitalization

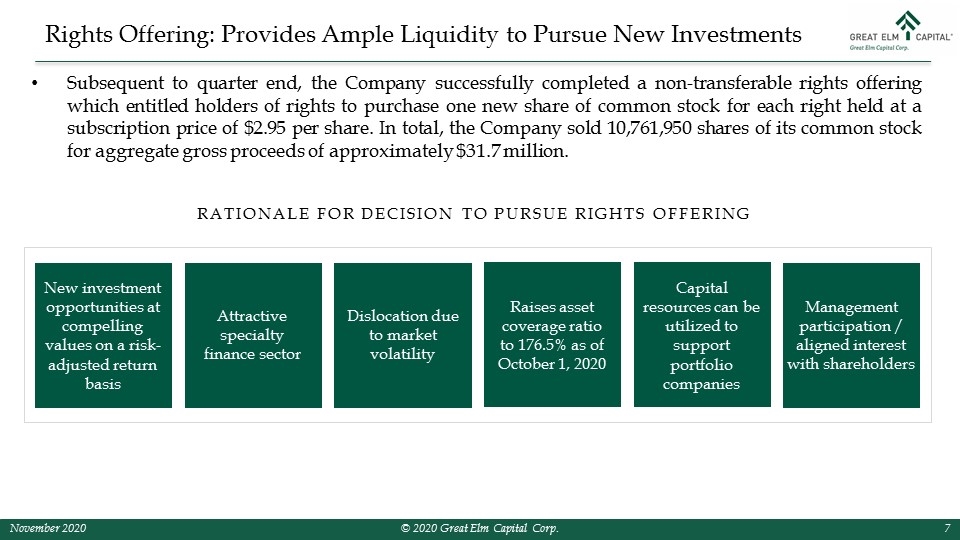

Portfolio Review: GECC Overview Rights Offering: Provides Ample Liquidity to Pursue New Investments Subsequent to quarter end, the Company successfully completed a non-transferable rights offering which entitled holders of rights to purchase one new share of common stock for each right held at a subscription price of $2.95 per share. In total, the Company sold 10,761,950 shares of its common stock for aggregate gross proceeds of approximately $31.7 million. RATIONALE FOR DECISION TO PURSUE RIGHTS OFFERING New investment opportunities at compelling values on a risk-adjusted return basis Attractive specialty finance sector Dislocation due to market volatility Raises asset coverage ratio to 176.5% as of October 1, 2020 Capital resources can be utilized to support portfolio companies Management participation / aligned interest with shareholders

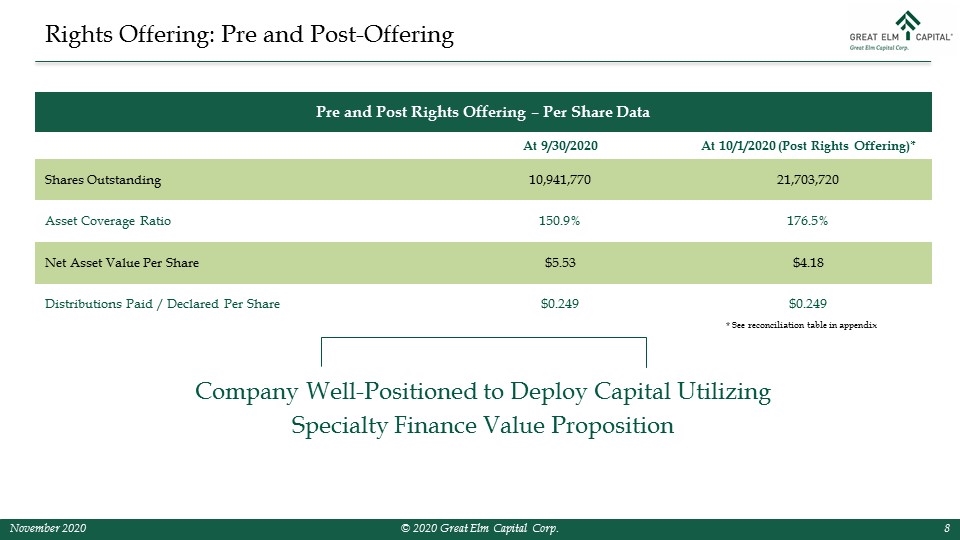

Portfolio Review: GECC Overview Rights Offering: Pre and Post-Offering At 9/30/2020 At 10/1/2020 (Post Rights Offering)* Shares Outstanding 10,941,770 21,703,720 Asset Coverage Ratio 150.9% 176.5% Net Asset Value Per Share $5.53 $4.18 Distributions Paid / Declared Per Share $0.249 $0.249 Pre and Post Rights Offering – Per Share Data Company Well-Positioned to Deploy Capital Utilizing Specialty Finance Value Proposition * See reconciliation table in appendix

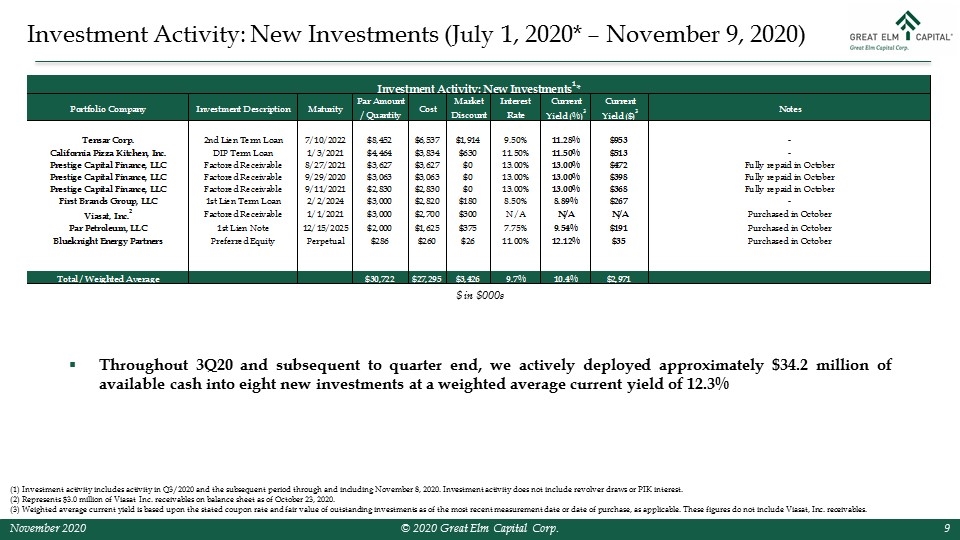

Investment Activity: New Investments (July 1, 2020* – November 9, 2020) Throughout 3Q20 and subsequent to quarter end, we actively deployed approximately $34.2 million of available cash into eight new investments at a weighted average current yield of 12.3% $ in $000s (1) Investment activity includes activity in Q3/2020 and the subsequent period through and including November 8, 2020. Investment activity does not include revolver draws or PIK interest. (2) Represents $3.0 million of Viasat Inc. receivables on balance sheet as of October 23, 2020. (3) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding investments as of the most recent measurement date or date of purchase, as applicable. These figures do not include Viasat, Inc. receivables.

Specialty Finance Investments

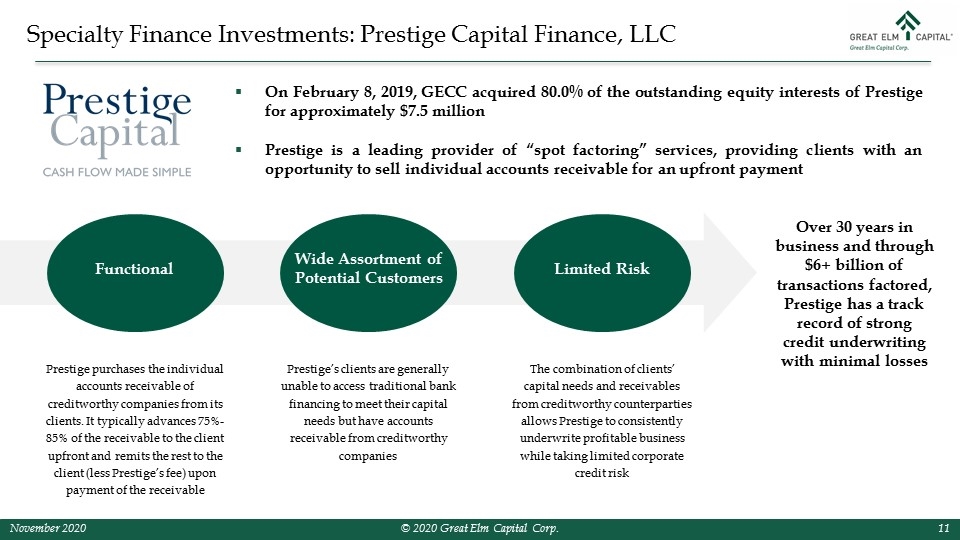

On February 8, 2019, GECC acquired 80.0% of the outstanding equity interests of Prestige for approximately $7.5 million Prestige is a leading provider of “spot factoring” services, providing clients with an opportunity to sell individual accounts receivable for an upfront payment Specialty Finance Investments: Prestige Capital Finance, LLC Functional Prestige purchases the individual accounts receivable of creditworthy companies from its clients. It typically advances 75%-85% of the receivable to the client upfront and remits the rest to the client (less Prestige’s fee) upon payment of the receivable Wide Assortment of Potential Customers Prestige’s clients are generally unable to access traditional bank financing to meet their capital needs but have accounts receivable from creditworthy companies Limited Risk The combination of clients’ capital needs and receivables from creditworthy counterparties allows Prestige to consistently underwrite profitable business while taking limited corporate credit risk Over 30 years in business and through $6+ billion of transactions factored, Prestige has a track record of strong credit underwriting with minimal losses

Prestige is a highly profitable company In 2019, Prestige’s pretax income was approximately $2.8 million on average book equity of $3.1 million Through the first nine months of 2020, Prestige’s pretax income was approximately $3.9 million on average book equity of $3.6 million 2020 third quarter clients include two companies that fund the manufacturing and importing of masks, swab transport containers and disinfectant wipes and a nondurable goods distributor based in Rhode Island GECC earns a high rate of return on its investment in Prestige Despite not acquiring Prestige until February 2019, GECC received $1.6 million in distributions from Prestige throughout 2019, representing an approximate 24% annualized yield on its investment Through the first nine months of 2020, GECC received $1.8 million in distributions, representing an approximate 32% annualized yield on its investment Prestige Capital Finance, LLC – Third Quarter 2020 Update “Overflow” opportunities that would allow GECC to participate in certain of Prestige’s larger factoring transactions directly Significant Mutual Benefits Greater access to capital allows Prestige to increase the size of the transactions it can pursue, which may further enhance its growth Rates of return may be higher than traditional leveraged credit investments Proprietary to GECC and unique to portfolio

The positive trends our investment in Prestige continues to exhibit leads us explore complementary opportunities in other niche areas of specialty finance We are focused on acquiring controlling interests in a number of sub-categories of specialty finance, including: Factoring Asset based lending Equipment leasing Hard money real estate lending Trade claim acquisition In addition, we believe that owning controlling interests in businesses in the above disciplines may create proprietary “overflow” investment opportunities As an investor in niche specialty finance businesses, we can help our partners grow by creatively structuring transactions and utilizing our liquid balance sheet Specialty Finance Investments: Additional Investments

Portfolio Review (Quarter Ended 9/30/2020)

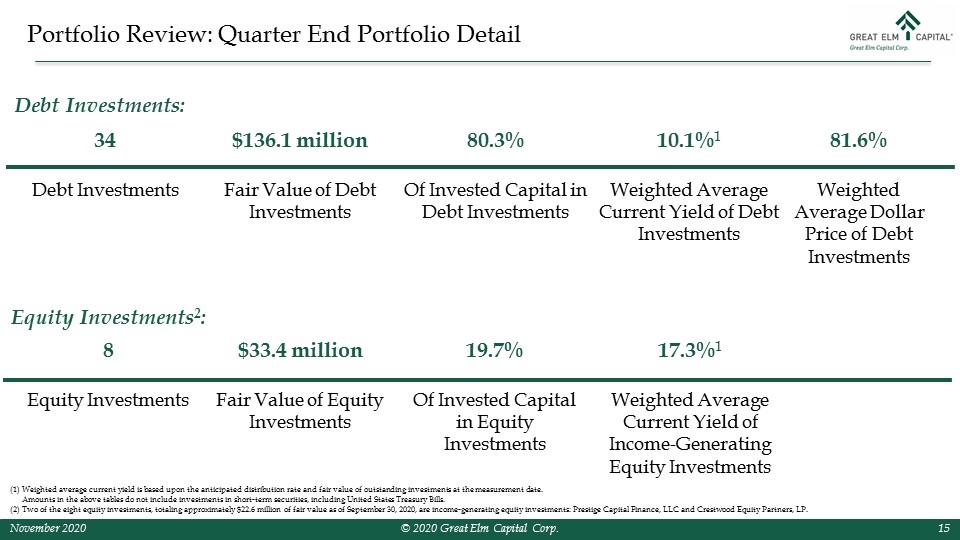

Portfolio Review: Quarter End Portfolio Detail 34 Debt Investments $136.1 million Fair Value of Debt Investments 81.6% Weighted Average Dollar Price of Debt Investments 10.1%1 Weighted Average Current Yield of Debt Investments 80.3% Of Invested Capital in Debt Investments 8 Equity Investments $33.4 million Fair Value of Equity Investments Debt Investments: Equity Investments2: 19.7% Of Invested Capital in Equity Investments (1) Weighted average current yield is based upon the anticipated distribution rate and fair value of outstanding investments at the measurement date. Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills. (2) Two of the eight equity investments, totaling approximately $22.6 million of fair value as of September 30, 2020, are income-generating equity investments: Prestige Capital Finance, LLC and Crestwood Equity Partners, LP. 17.3%1 Weighted Average Current Yield of Income-Generating Equity Investments

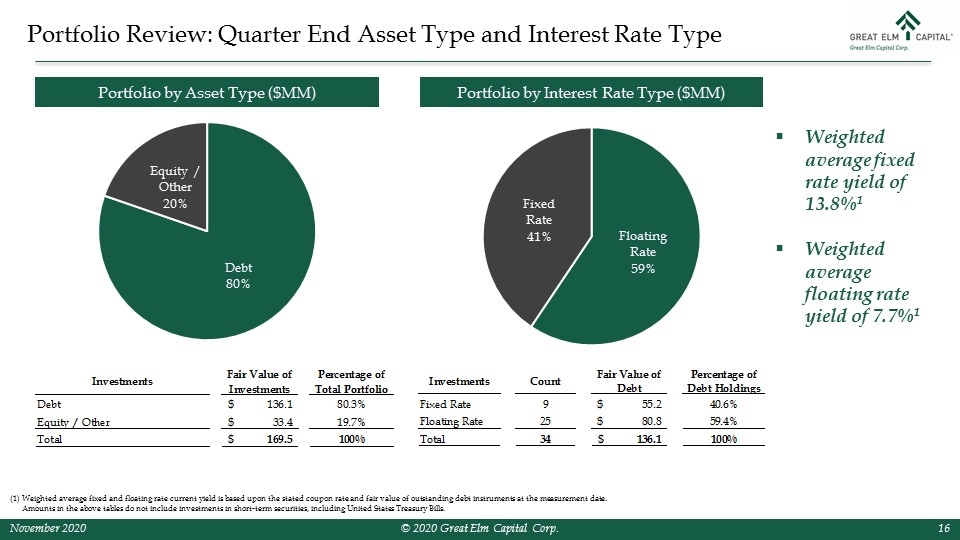

Portfolio by Asset Type ($MM) Portfolio by Interest Rate Type ($MM) Weighted average fixed rate yield of 13.8%1 Weighted average floating rate yield of 7.7%1 (1) Weighted average fixed and floating rate current yield is based upon the stated coupon rate and fair value of outstanding debt instruments at the measurement date. Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills. Portfolio Review: Quarter End Asset Type and Interest Rate Type Investments Fair Value of Investments Percentage of Total Portfolio Investments Count Fair Value of Debt Percentage of Debt Holdings Debt $136.1 0.80294985250737461 Fixed Rate 7 $45.24810317 0.37389042493462155 Equity / Other $33.4 0.19705014749262537 Floating Rate 22 $75.771586429999999 0.62610957506537845 Total $169.5 1 Total 29 $121.01968959999999 1 Investments Fair Value of Investments Percentage of Total Portfolio Investments Count Fair Value of Debt Percentage of Debt Holdings Debt $121.01969 0.82742321100483618 Fixed Rate 9 $55.2 0.40558412931667898 Equity / Other $25.241242 0.17257678899516379 Floating Rate 25 $80.8 0.59368111682586333 Total $146.260932 1 Total 34 $136.1 0.99926524614254231

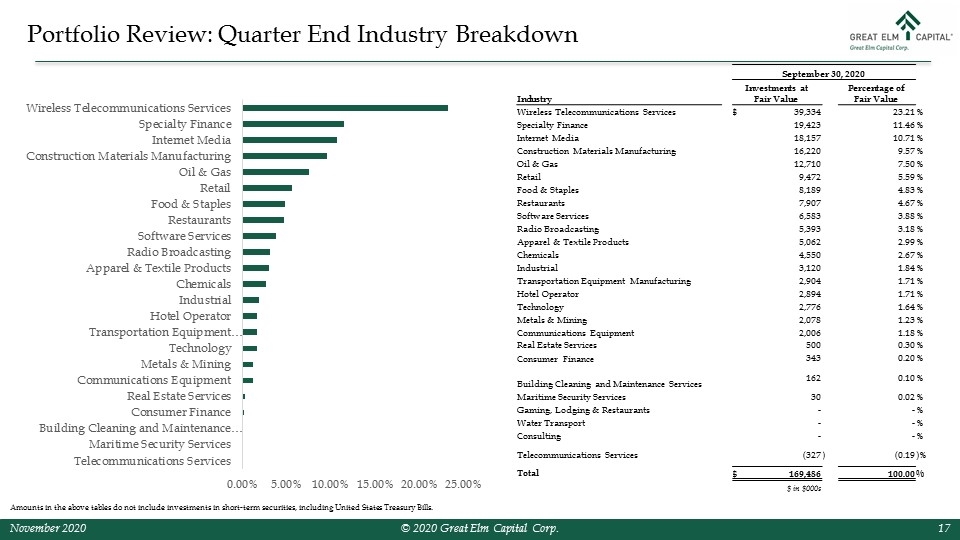

Portfolio Review: Quarter End Industry Breakdown Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills. September 30, 2020 Industry Investments at Fair Value Percentage of Fair Value Wireless Telecommunications Services $ 39,334 23.21 % Specialty Finance 19,423 11.46 % Internet Media 18,157 10.71 % Construction Materials Manufacturing 16,220 9.57 % Oil & Gas 12,710 7.50 % Retail 9,472 5.59 % Food & Staples 8,189 4.83 % Restaurants 7,907 4.67 % Software Services 6,583 3.88 % Radio Broadcasting 5,393 3.18 % Apparel & Textile Products 5,062 2.99 % Chemicals 4,550 2.67 % Industrial 3,120 1.84 % Transportation Equipment Manufacturing 2,904 1.71 % Hotel Operator 2,894 1.71 % Technology 2,776 1.64 % Metals & Mining 2,078 1.23 % Communications Equipment 2,006 1.18 % Real Estate Services 500 0.30 % Consumer Finance 343 0.20 % Building Cleaning and Maintenance Services 162 0.10 % Maritime Security Services 30 0.02 % Gaming, Lodging & Restaurants - - % Water Transport - - % Consulting - - % Telecommunications Services (327 ) (0.19 )% Total $ 169,486 100.00 % $ in $000s

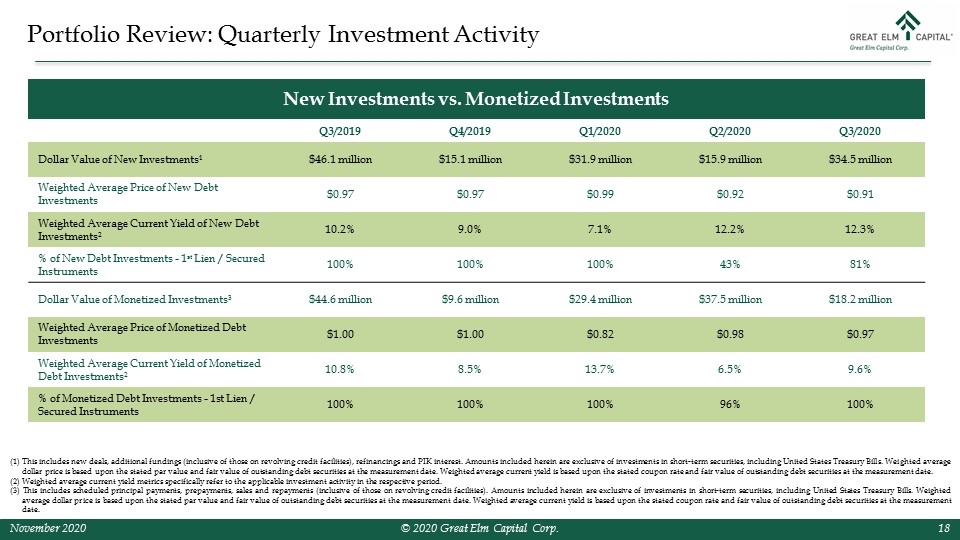

Portfolio Review: Quarterly Investment Activity Q3/2019 Q4/2019 Q1/2020 Q2/2020 Q3/2020 Dollar Value of New Investments1 $46.1 million $15.1 million $31.9 million $15.9 million $34.5 million Weighted Average Price of New Debt Investments $0.97 $0.97 $0.99 $0.92 $0.91 Weighted Average Current Yield of New Debt Investments2 10.2% 9.0% 7.1% 12.2% 12.3% % of New Debt Investments - 1st Lien / Secured Instruments 100% 100% 100% 43% 81% Dollar Value of Monetized Investments3 $44.6 million $9.6 million $29.4 million $37.5 million $18.2 million Weighted Average Price of Monetized Debt Investments $1.00 $1.00 $0.82 $0.98 $0.97 Weighted Average Current Yield of Monetized Debt Investments2 10.8% 8.5% 13.7% 6.5% 9.6% % of Monetized Debt Investments - 1st Lien / Secured Instruments 100% 100% 100% 96% 100% (1) This includes new deals, additional fundings (inclusive of those on revolving credit facilities), refinancings and PIK interest. Amounts included herein are exclusive of investments in short-term securities, including United States Treasury Bills. Weighted average dollar price is based upon the stated par value and fair value of outstanding debt securities at the measurement date. Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. (2) Weighted average current yield metrics specifically refer to the applicable investment activity in the respective period. (3) This includes scheduled principal payments, prepayments, sales and repayments (inclusive of those on revolving credit facilities). Amounts included herein are exclusive of investments in short-term securities, including United States Treasury Bills. Weighted average dollar price is based upon the stated par value and fair value of outstanding debt securities at the measurement date. Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. New Investments vs. Monetized Investments

Financial Review (Quarter Ended 9/30/2020)

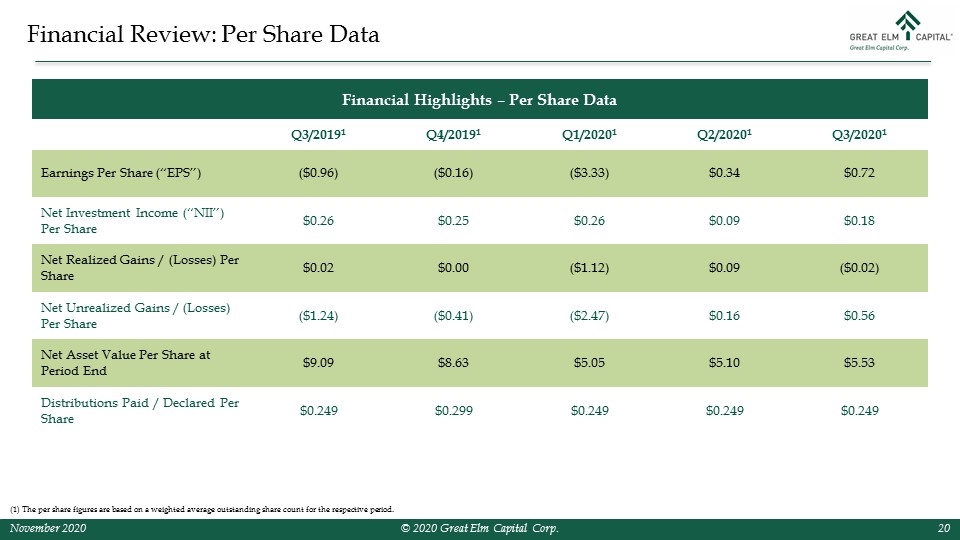

Financial Review: Per Share Data Q3/20191 Q4/20191 Q1/20201 Q2/20201 Q3/20201 Earnings Per Share (“EPS”) ($0.96) ($0.16) ($3.33) $0.34 $0.72 Net Investment Income (“NII”) Per Share $0.26 $0.25 $0.26 $0.09 $0.18 Net Realized Gains / (Losses) Per Share $0.02 $0.00 ($1.12) $0.09 ($0.02) Net Unrealized Gains / (Losses) Per Share ($1.24) ($0.41) ($2.47) $0.16 $0.56 Net Asset Value Per Share at Period End $9.09 $8.63 $5.05 $5.10 $5.53 Distributions Paid / Declared Per Share $0.249 $0.299 $0.249 $0.249 $0.249 (1) The per share figures are based on a weighted average outstanding share count for the respective period. Financial Highlights – Per Share Data

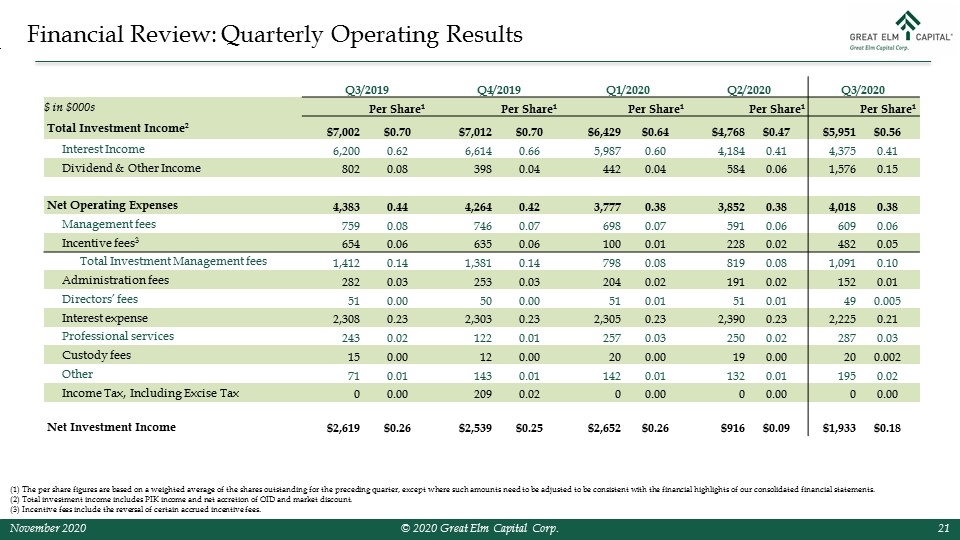

Financial Review: Quarterly Operating Results (1) The per share figures are based on a weighted average of the shares outstanding for the preceding quarter, except where such amounts need to be adjusted to be consistent with the financial highlights of our consolidated financial statements. (2) Total investment income includes PIK income and net accretion of OID and market discount. (3) Incentive fees include the reversal of certain accrued incentive fees. Q3/2019 Q4/2019 Q1/2020 Q2/2020 Q3/2020 $ in $000s Per Share1 Per Share1 Per Share1 Per Share1 Per Share1 Total Investment Income2 $7,002 $0.70 $7,012 $0.70 $6,429 $0.64 $4,768 $0.47 $5,951 $0.56 Interest Income 6,200 0.62 6,614 0.66 5,987 0.60 4,184 0.41 4,375 0.41 Dividend & Other Income 802 0.08 398 0.04 442 0.04 584 0.06 1,576 0.15 Net Operating Expenses 4,383 0.44 4,264 0.42 3,777 0.38 3,852 0.38 4,018 0.38 Management fees 759 0.08 746 0.07 698 0.07 591 0.06 609 0.06 Incentive fees3 654 0.06 635 0.06 100 0.01 228 0.02 482 0.05 Total Investment Management fees 1,412 0.14 1,381 0.14 798 0.08 819 0.08 1,091 0.10 Administration fees 282 0.03 253 0.03 204 0.02 191 0.02 152 0.01 Directors’ fees 51 0.00 50 0.00 51 0.01 51 0.01 49 0.005 Interest expense 2,308 0.23 2,303 0.23 2,305 0.23 2,390 0.23 2,225 0.21 Professional services 243 0.02 122 0.01 257 0.03 250 0.02 287 0.03 Custody fees 15 0.00 12 0.00 20 0.00 19 0.00 20 0.002 Other 71 0.01 143 0.01 142 0.01 132 0.01 195 0.02 Income Tax, Including Excise Tax 0 0.00 209 0.02 0 0.00 0 0.00 0 0.00 Net Investment Income $2,619 $0.26 $2,539 $0.25 $2,652 $0.26 $916 $0.09 $1,933 $0.18

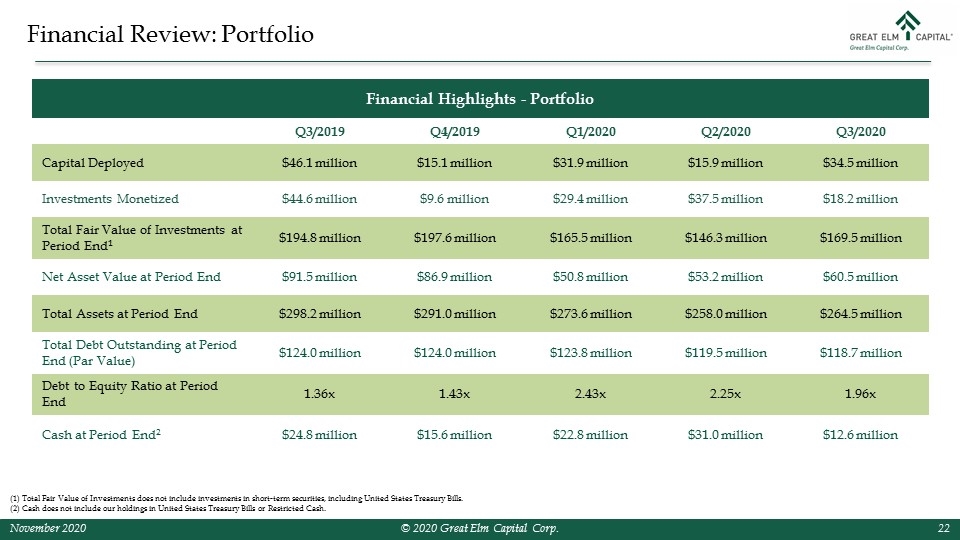

Financial Review: Portfolio Q3/2019 Q4/2019 Q1/2020 Q2/2020 Q3/2020 Capital Deployed $46.1 million $15.1 million $31.9 million $15.9 million $34.5 million Investments Monetized $44.6 million $9.6 million $29.4 million $37.5 million $18.2 million Total Fair Value of Investments at Period End1 $194.8 million $197.6 million $165.5 million $146.3 million $169.5 million Net Asset Value at Period End $91.5 million $86.9 million $50.8 million $53.2 million $60.5 million Total Assets at Period End $298.2 million $291.0 million $273.6 million $258.0 million $264.5 million Total Debt Outstanding at Period End (Par Value) $124.0 million $124.0 million $123.8 million $119.5 million $118.7 million Debt to Equity Ratio at Period End 1.36x 1.43x 2.43x 2.25x 1.96x Cash at Period End2 $24.8 million $15.6 million $22.8 million $31.0 million $12.6 million Total Fair Value of Investments does not include investments in short-term securities, including United States Treasury Bills. Cash does not include our holdings in United States Treasury Bills or Restricted Cash. Financial Highlights - Portfolio

Summary

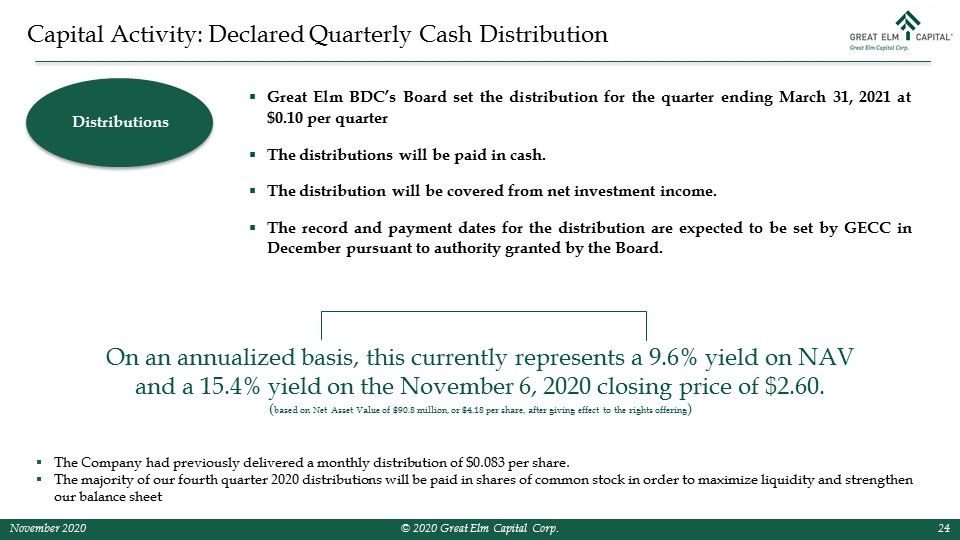

The Company had previously delivered a monthly distribution of $0.083 per share. The majority of our fourth quarter 2020 distributions will be paid in shares of common stock in order to maximize liquidity and strengthen our balance sheet Capital Activity: Declared Quarterly Cash Distribution Distributions Great Elm BDC’s Board set the distribution for the quarter ending March 31, 2021 at $0.10 per quarter The distributions will be paid in cash. The distribution will be covered from net investment income. The record and payment dates for the distribution are expected to be set by GECC in December pursuant to authority granted by the Board. On an annualized basis, this currently represents a 9.6% yield on NAV and a 15.4% yield on the November 6, 2020 closing price of $2.60. (based on Net Asset Value of $90.8 million, or $4.18 per share, after giving effect to the rights offering)

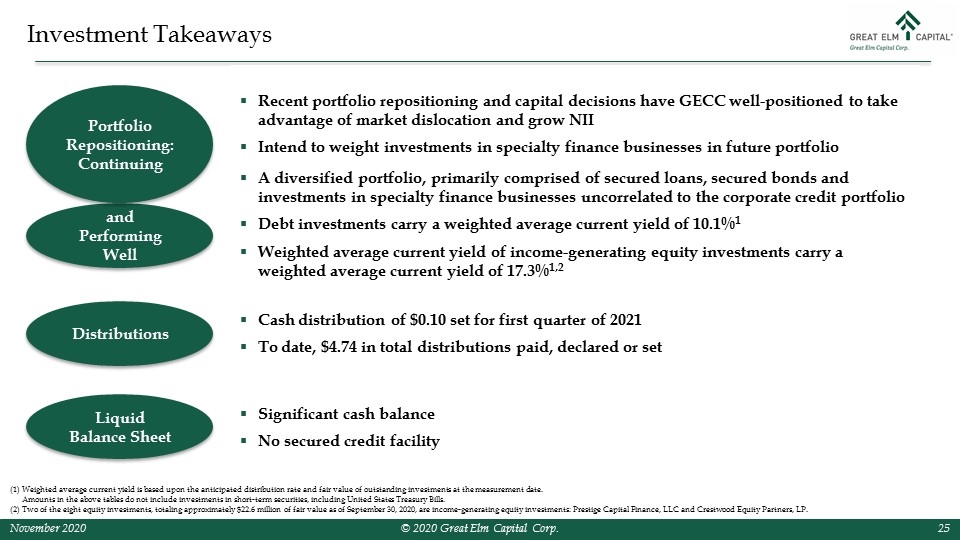

Investment Takeaways Recent portfolio repositioning and capital decisions have GECC well-positioned to take advantage of market dislocation and grow NII Intend to weight investments in specialty finance businesses in future portfolio Significant cash balance No secured credit facility A diversified portfolio, primarily comprised of secured loans, secured bonds and investments in specialty finance businesses uncorrelated to the corporate credit portfolio Debt investments carry a weighted average current yield of 10.1%1 Weighted average current yield of income-generating equity investments carry a weighted average current yield of 17.3%1,2 and Performing Well Liquid Balance Sheet Portfolio Repositioning: Continuing Distributions Cash distribution of $0.10 set for first quarter of 2021 To date, $4.74 in total distributions paid, declared or set (1) Weighted average current yield is based upon the anticipated distribution rate and fair value of outstanding investments at the measurement date. Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills. (2) Two of the eight equity investments, totaling approximately $22.6 million of fair value as of September 30, 2020, are income-generating equity investments: Prestige Capital Finance, LLC and Crestwood Equity Partners, LP.

Appendix Financial Statements Pro-Forma Balance Sheet General Risks Contact Information

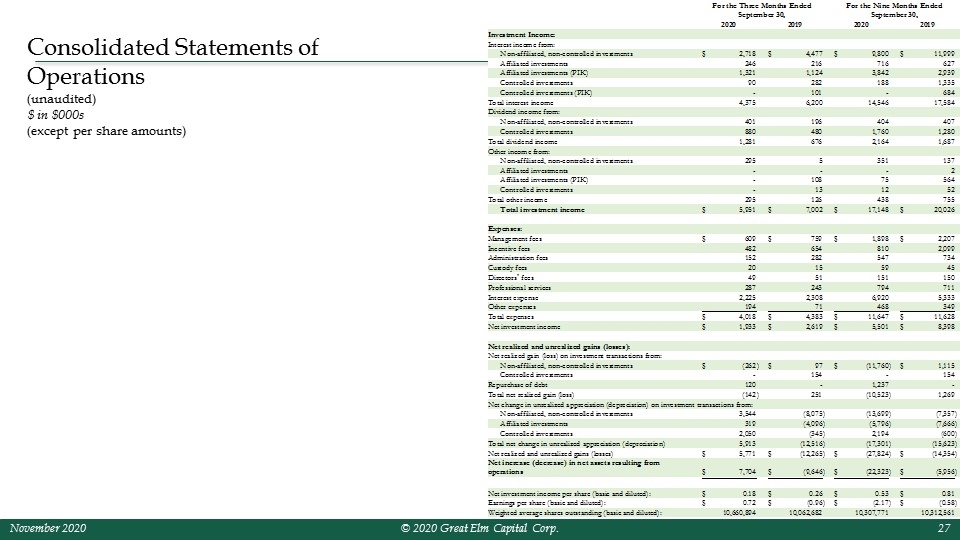

Consolidated Statements of Operations (unaudited) $ in $000s (except per share amounts)

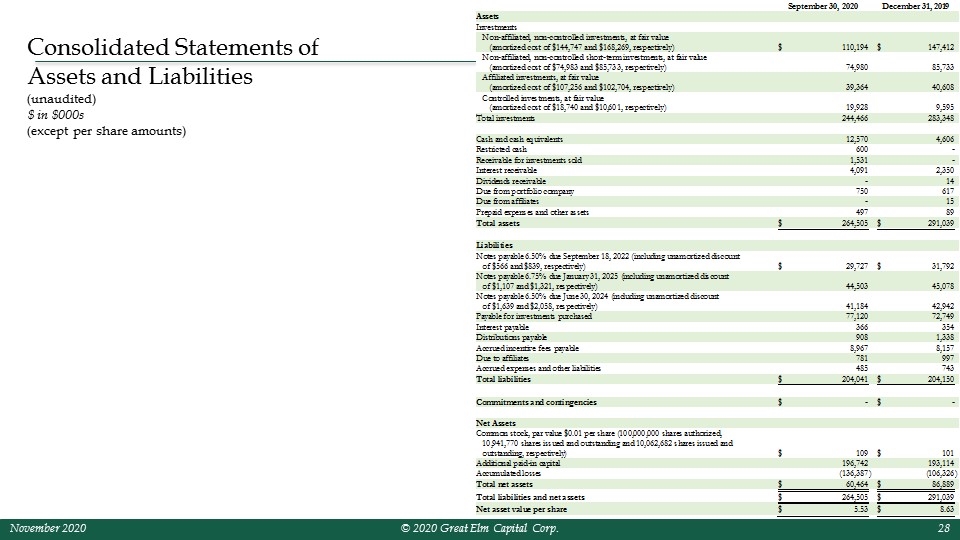

Consolidated Statements of Assets and Liabilities (unaudited) $ in $000s (except per share amounts)

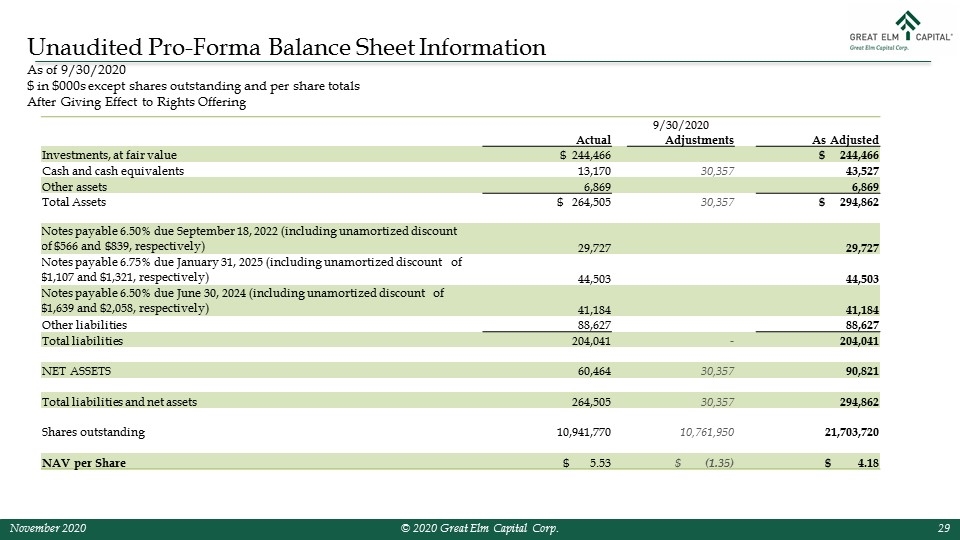

Unaudited Pro-Forma Balance Sheet Information As of 9/30/2020 $ in $000s except shares outstanding and per share totals After Giving Effect to Rights Offering 9/30/2020 Actual Adjustments As Adjusted Investments, at fair value $ 244,466 $ 244,466 Cash and cash equivalents 13,170 30,357 43,527 Other assets 6,869 6,869 Total Assets $ 264,505 30,357 $ 294,862 Notes payable 6.50% due September 18, 2022 (including unamortized discount of $566 and $839, respectively) 29,727 29,727 Notes payable 6.75% due January 31, 2025 (including unamortized discount of $1,107 and $1,321, respectively) 44,503 44,503 Notes payable 6.50% due June 30, 2024 (including unamortized discount of $1,639 and $2,058, respectively) 41,184 41,184 Other liabilities 88,627 88,627 Total liabilities 204,041 - 204,041 NET ASSETS 60,464 30,357 90,821 Total liabilities and net assets 264,505 30,357 294,862 Shares outstanding 10,941,770 10,761,950 21,703,720 NAV per Share $ 5.53 $ (1.35) $ 4.18

Appendix: General Risks Debt instruments are subject to credit and interest rate risks. Credit risk refers to the likelihood that an obligor will default in the payment of principal or interest on an instrument. Financial strength and solvency of an obligor are the primary factors influencing credit risk. In addition, lack or inadequacy of collateral or credit enhancement for a debt instrument may affect its credit risk. Credit risk may change over the life of an instrument, and debt instruments that are rated by rating agencies are often reviewed and may be subject to downgrade. Our debt investments either are, or if rated would be, rated below investment grade by independent rating agencies. These “junk bonds” and “leveraged loans” are regarded as having predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may be illiquid and difficult to value and typically do not require repayment of principal before maturity, which potentially heightens the risk that we may lose all or part of our investment. Interest rate risk refers to the risks associated with market changes in interest rates. Interest rate changes may affect the value of a debt instrument indirectly (especially in the case of fixed rate obligations) or directly (especially in the case of an instrument whose rates are adjustable). In general, rising interest rates will negatively impact the price of a fixed rate debt instrument and falling interest rates will have a positive effect on price. Adjustable rate instruments also react to interest rate changes in a similar manner although generally to a lesser degree (depending, however, on the characteristics of the reset terms, including the index chosen, frequency of reset and reset caps or floors, among other factors). GECC utilizes leverage to seek to enhance the yield and net asset value of its common stock. These objectives will not necessarily be achieved in all interest rate environments. The use of leverage involves risk, including the potential for higher volatility and greater declines of GECC’s net asset value, fluctuations of dividends and other distributions paid by GECC and the market price of GECC’s common stock, among others. The amount of leverage that GECC may employ at any particular time will depend on, among other things, our Board’s and our adviser’s assessment of market and other factors at the time of any proposed borrowing. As part of our lending activities, we may purchase notes or make loans to companies that are experiencing significant financial or business difficulties, including companies involved in bankruptcy or other reorganization and liquidation proceedings. Although the terms of such financings may result in significant financial returns to us, they involve a substantial degree of risk. The level of analytical sophistication, both financial and legal, necessary for successful financing to companies experiencing significant business and financial difficulties is unusually high. We cannot assure you that we will correctly evaluate the value of the assets collateralizing our investments or the prospects for a successful reorganization or similar action. In any reorganization or liquidation proceeding relating to a portfolio company, we may lose all or part of the amounts advanced to the borrower or may be required to accept collateral with a value less than the amount of the investment advanced by us to the borrower.

Investor Relations 800 South Street, Suite 230 Waltham, MA 02453 Phone: +1 (617) 375-3006 investorrelations@greatelmcap.com Adam Prior The Equity Group Inc. +1 (212) 836-9606 aprior@equityny.com Contact Information