Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ModivCare Inc | q32020pressrelease991.htm |

| 8-K - 8-K - ModivCare Inc | prsc-20201106.htm |

THE PROVIDENCE SERVICE CORPORATION November 6, 2020 NASDAQ: PRSC Q3 2020 EARNINGS PRESENTATION

FORWARD LOOKING STATEMENTS Certain statements contained in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are predictive in nature and are frequently identified by the use of terms such as “may,” “will,” “should,” “expect,” “believe,” “estimate,” “intend,” and similar words indicating possible future expectations, events or actions. Such forward-looking statements are based on current expectations, assumptions, estimates and projections about our business and our industry, and are not guarantees of our future performance. These statements are subject to a number of known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control or predict, which may cause actual events to be materially different from those expressed or implied herein, including but not limited to: the early termination or non-renewal of contracts; our ability to successfully respond to governmental requests for proposal; our ability to fulfill our contractual obligations; our ability to identify and successfully complete and integrate acquisitions; our ability to identify and realize the benefits of strategic initiatives; the loss of any of the significant payors from whom we generate a significant amount of our revenue; our ability to accurately estimate the cost of performing under certain capitated contracts; our ability to match the timing of the costs of new contracts with its related revenue; the outcome of pending or future litigation; our ability to attract and retain senior management and other qualified employees; our ability to successfully complete recent divestitures or business termination; the accuracy of representations and warranties and strength of related indemnities provided to us in acquisitions or claims made against us for representations and warranties and related indemnities in our dispositions; our ability to effectively compete in the marketplace; inadequacies in or security breaches of our information technology systems, including our ability to protect private data; the impact of COVID-19 on us (including: the duration and scope of the pandemic; governmental, business and individuals’ actions taken in response to the pandemic; economic activity and actions taken in response; the effect on our clients and client demand for our services; and the ability of our clients to pay for our services); seasonal fluctuations in our operations; impairment of long-lived assets; the adequacy of our insurance coverage for automobile, general liability, professional liability and workers’ compensation; damage to our reputation by inaccurate, misleading or negative media coverage; our ability to comply with government healthcare and other regulations; changes in budgetary priorities of government entities that fund our services; failure to adequately comply with patient and service user information regulations; possible actions under Medicare and Medicaid programs for false claims or recoupment of funds for noncompliance; changes in the regulatory landscape applicable to Matrix; changes to our estimated income tax liability from audits or otherwise; our ability to meet restrictive covenants in our credit agreement; the costs of complying with public company reporting obligations; and the accuracy of our accounting estimates and assumptions. The Company has provided additional information in our annual report on Form 10-K and subsequent filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to update or revise any forward- looking statements contained in this release, whether as a result of new information, future events or otherwise, except as required by applicable law. Non-GAAP Financial Information In addition to the financial results prepared in accordance with generally accepted accounting principles in the United States ("GAAP"), this presentation includes EBITDA and Adjusted EBITDA for the Company and its segments, as well as Adjusted Net Income and Adjusted EPS, which are performance measures that are not recognized under GAAP. EBITDA is defined as income (loss) from continuing operations, net of taxes, before: (1) interest expense, net, (2) provision (benefit) for income taxes and (3) depreciation and amortization. Adjusted EBITDA is calculated as EBITDA before certain items, including (as applicable): (1) restructuring and related charges, including costs related to our corporate reorganization, (2) equity in net (income) loss of investee, (3) certain litigation related expenses, settlement income or other negotiated settlements relating to certain matters from prior periods, (4) certain transaction and related costs, and (5) COVID-19 related costs. Adjusted Net Income is defined as income from continuing operations, net of taxes, before certain items, including (1) restructuring and related charges, (2) equity in net (income) loss of investee, (3) certain litigation related expenses, settlement income or other negotiated settlements relating to certain matters from prior periods, (4) intangible asset amortization, (5) certain transaction and related costs, (6) COVID-19 related costs, (7) tax impacts from the Coronavirus Aid, Relief, and Economic Security Act (the "CARES Act") and (8) the income tax impact of such adjustments. Adjusted EPS is calculated as Adjusted Net Income less (as applicable): (1) dividends on convertible preferred stock and (2) adjusted net income allocated to participating stockholders, divided by the diluted weighted-average number of common shares outstanding as calculated for Adjusted Net Income. Our non-GAAP performance measures exclude certain expenses and amounts that are not driven by our core operating results and may be one time in nature. Excluding these expenses makes comparisons with prior periods as well as to other companies in our industry more meaningful. We believe such measures allow investors to gain a better understanding of the factors and trends affecting the ongoing operations of our business. We consider our core operations to be the ongoing activities to provide services from which we earn revenue, including direct operating costs and indirect costs to support these activities. In addition, our net gain or loss in equity investee is excluded from these measures, as we do not have the ability to manage the venture, allocate resources within the venture, or directly control its operations or performance. Our non- GAAP financial measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently. In addition, there are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by other companies, and exclude expenses that may have a material impact on our reported financial results. The presentation of non-GAAP financial information is not meant to be considered in isolation from or as a substitute for the directly comparable financial measures prepared in accordance with GAAP. We urge you to review the reconciliations of our non-GAAP financial measures to the comparable GAAP financial measures included below, and not to rely on any single financial measure to evaluate our business. THE PROVIDENCE SERVICE CORPORATION // 2

TODAY’S AGENDA • Opening Remarks – Dan Greenleaf, President and Chief Executive Officer ‒ Six-Pillar Strategic Highlights o Technology enhancements o Transformational growth National MedTrans Food delivery program Simplura Health Group o Corporate rebranding update ‒ Vision: drive value as a “one-stop shop” for Social Determinants of Health solutions • Discussion of Financial Results – Kevin Dotts, Chief Financial Officer • Q&A THE PROVIDENCE SERVICE CORPORATION // 3

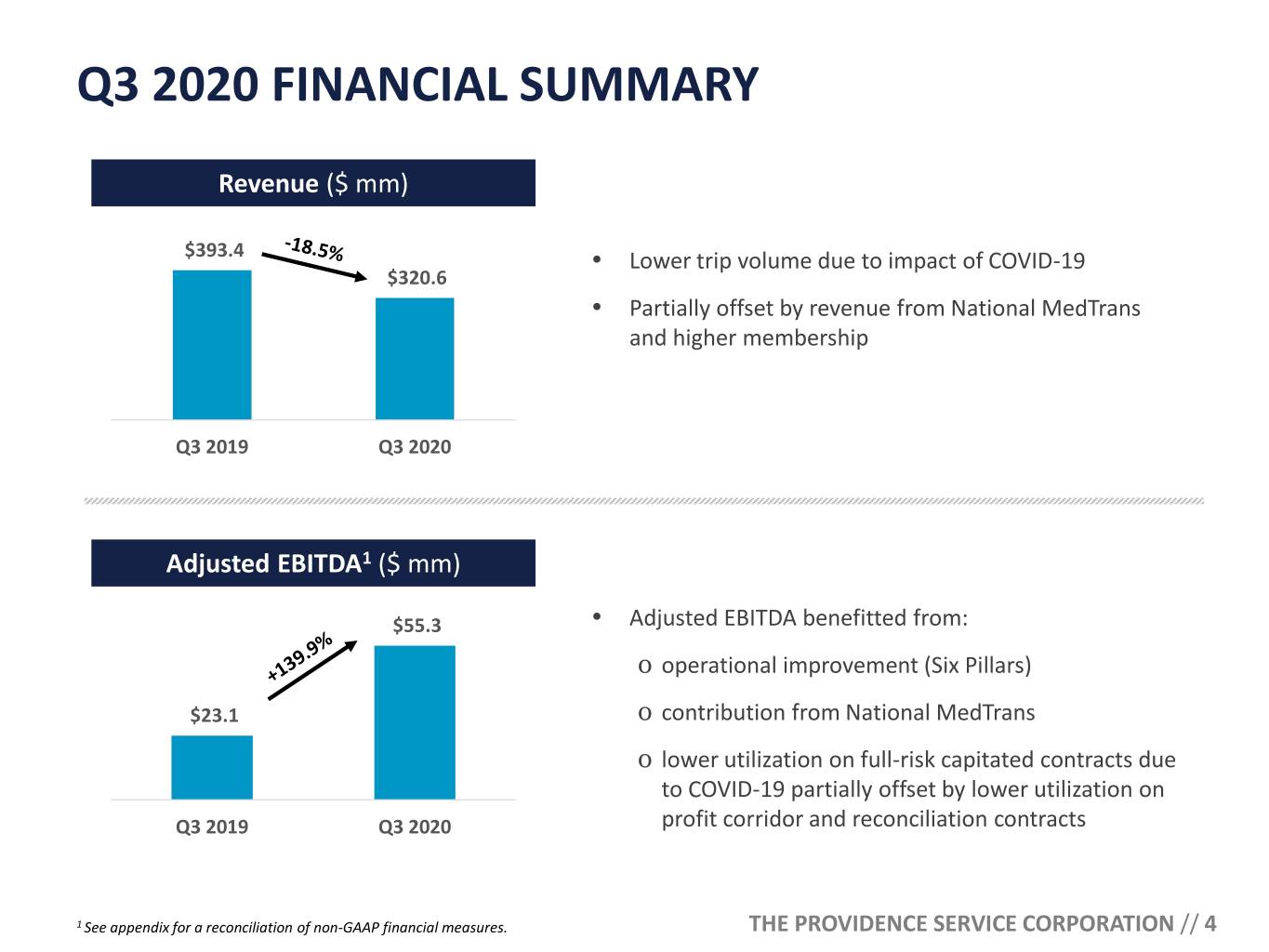

Q3 2020 FINANCIAL SUMMARY Revenue ($ mm) $393.4 • Lower trip volume due to impact of COVID-19 $320.6 • Partially offset by revenue from National MedTrans and higher membership Q3 2019 Q3 2020 Adjusted EBITDA1 ($ mm) $55.3 • Adjusted EBITDA benefitted from: o operational improvement (Six Pillars) $23.1 o contribution from National MedTrans o lower utilization on full-risk capitated contracts due to COVID-19 partially offset by lower utilization on Q3 2019 Q3 2020 profit corridor and reconciliation contracts 1 See appendix for a reconciliation of non-GAAP financial measures. THE PROVIDENCE SERVICE CORPORATION // 4

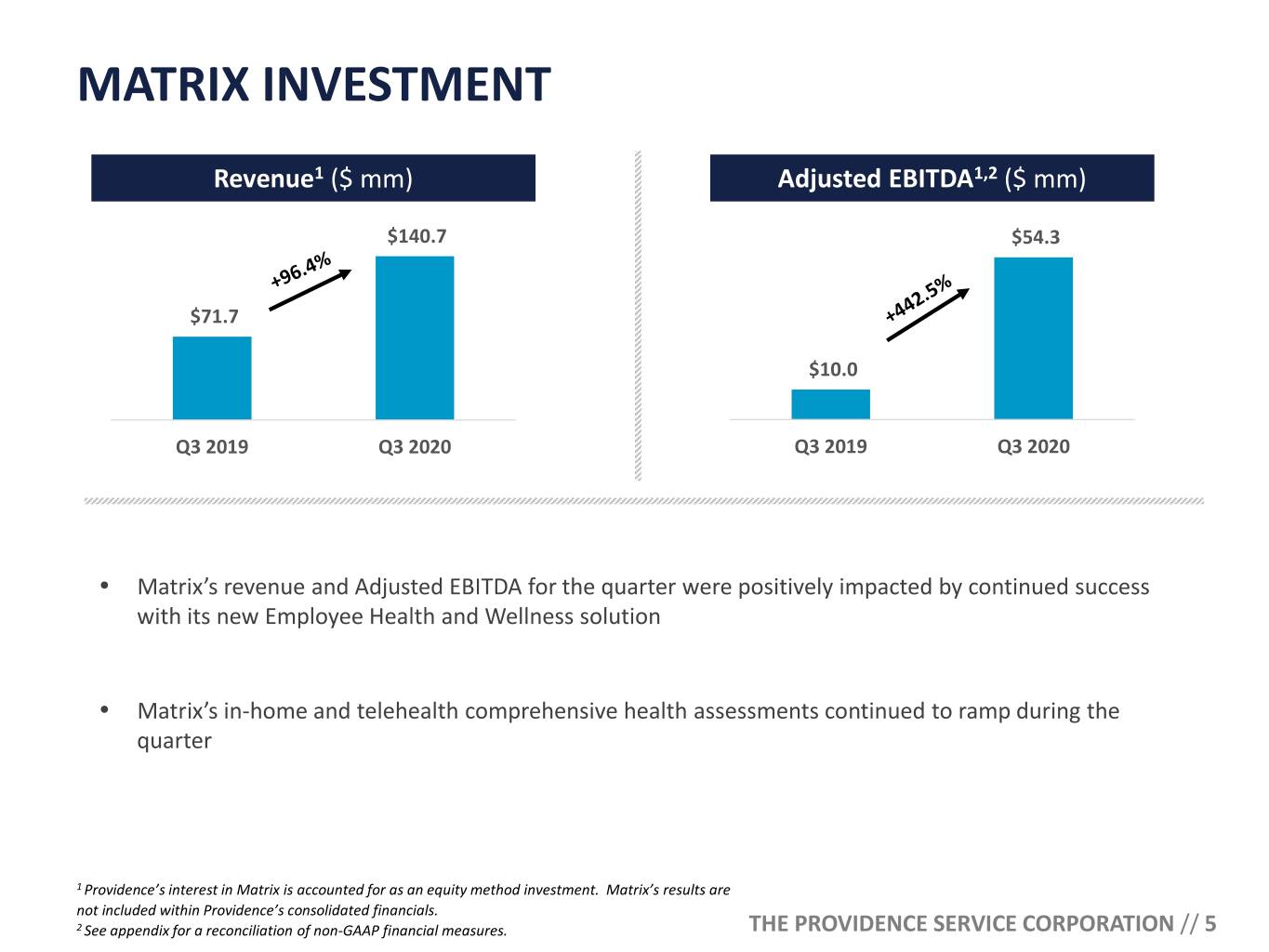

MATRIX INVESTMENT Revenue1 ($ mm) Adjusted EBITDA1,2 ($ mm) $140.7 $54.3 $71.7 $10.0 Q3 2019 Q3 2020 Q3 2019 Q3 2020 • Matrix’s revenue and Adjusted EBITDA for the quarter were positively impacted by continued success with its new Employee Health and Wellness solution • Matrix’s in-home and telehealth comprehensive health assessments continued to ramp during the quarter 1 Providence’s interest in Matrix is accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated financials. 2 See appendix for a reconciliation of non-GAAP financial measures. THE PROVIDENCE SERVICE CORPORATION // 5

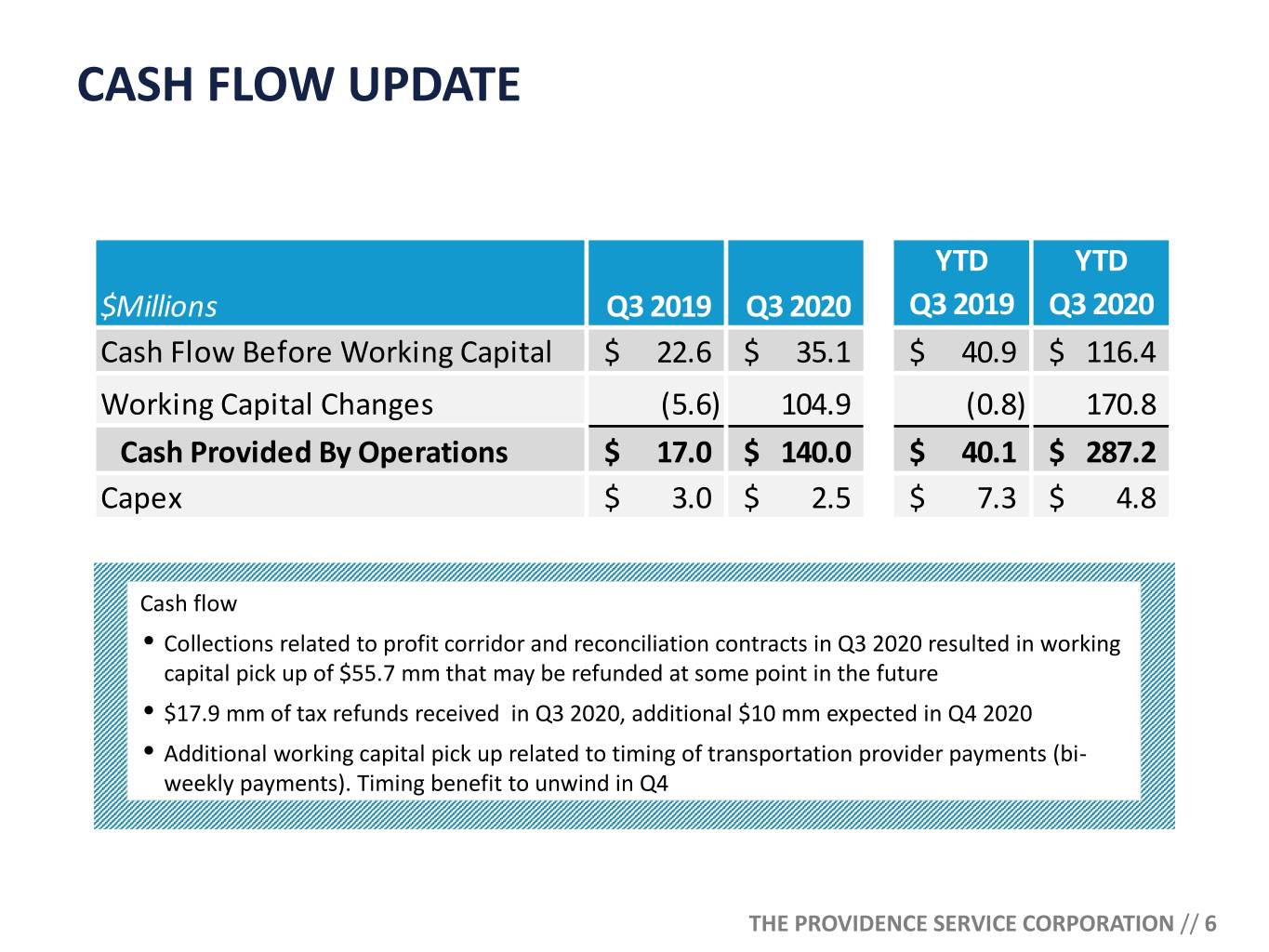

CASH FLOW UPDATE YTD YTD $Millions Q3 2019 Q3 2020 Q3 2019 Q3 2020 Cash Flow Before Working Capital $ 22.6 $ 35.1 $ 40.9 $ 116.4 Working Capital Changes (5.6) 104.9 (0.8) 170.8 Cash Provided By Operations $ 17.0 $ 140.0 $ 40.1 $ 287.2 Capex $ 3.0 $ 2.5 $ 7.3 $ 4.8 Cash flow • Collections related to profit corridor and reconciliation contracts in Q3 2020 resulted in working capital pick up of $55.7 mm that may be refunded at some point in the future • $17.9 mm of tax refunds received in Q3 2020, additional $10 mm expected in Q4 2020 • Additional working capital pick up related to timing of transportation provider payments (bi- weekly payments). Timing benefit to unwind in Q4 THE PROVIDENCE SERVICE CORPORATION // 6

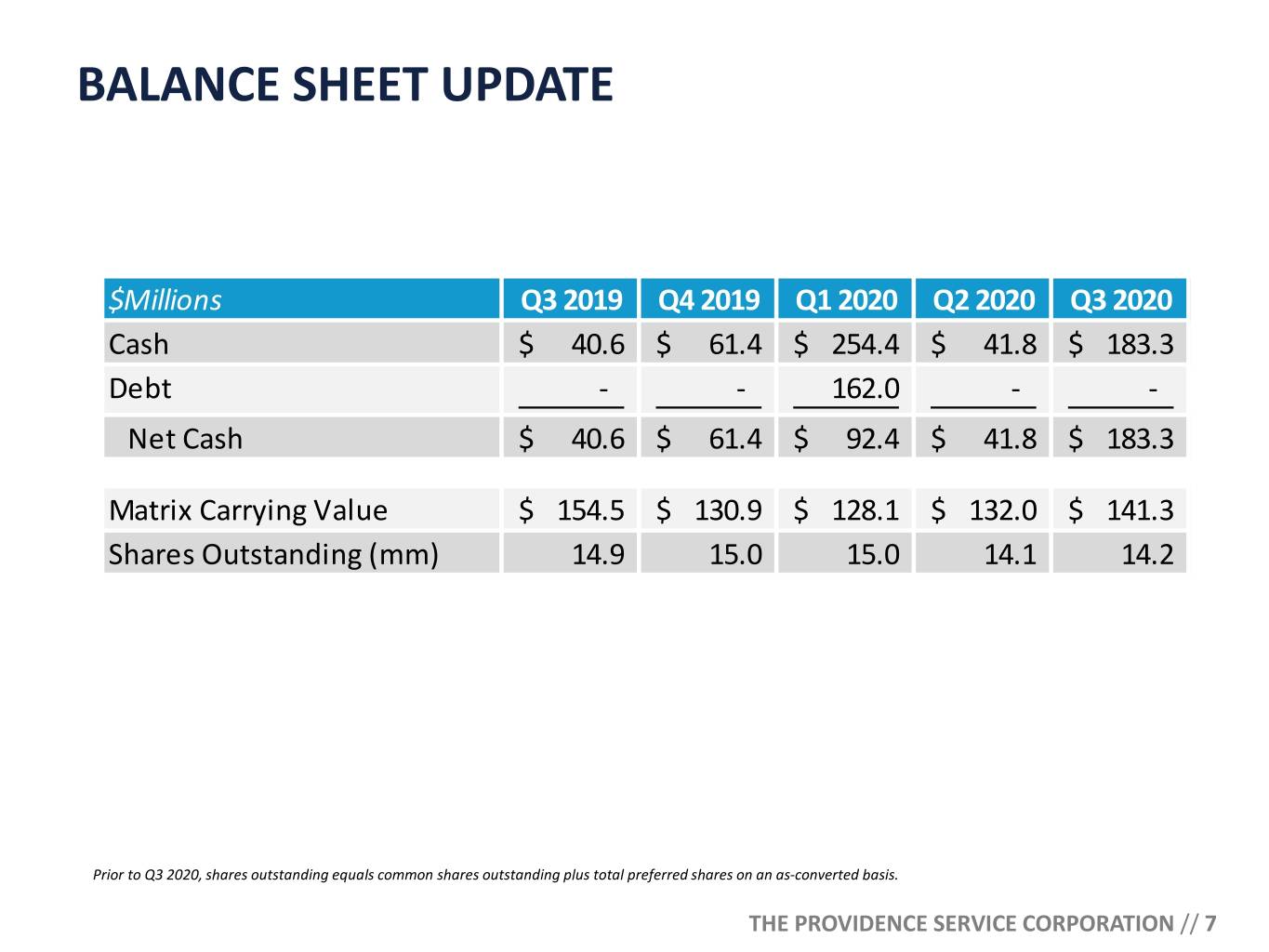

BALANCE SHEET UPDATE $Millions Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Cash $ 40.6 $ 61.4 $ 254.4 $ 41.8 $ 183.3 Debt - - 162.0 - - Net Cash $ 40.6 $ 61.4 $ 92.4 $ 41.8 $ 183.3 Matrix Carrying Value $ 154.5 $ 130.9 $ 128.1 $ 132.0 $ 141.3 Shares Outstanding (mm) 14.9 15.0 15.0 14.1 14.2 Prior to Q3 2020, shares outstanding equals common shares outstanding plus total preferred shares on an as-converted basis. THE PROVIDENCE SERVICE CORPORATION // 7

APPENDIX THE PROVIDENCE SERVICE CORPORATION // 8

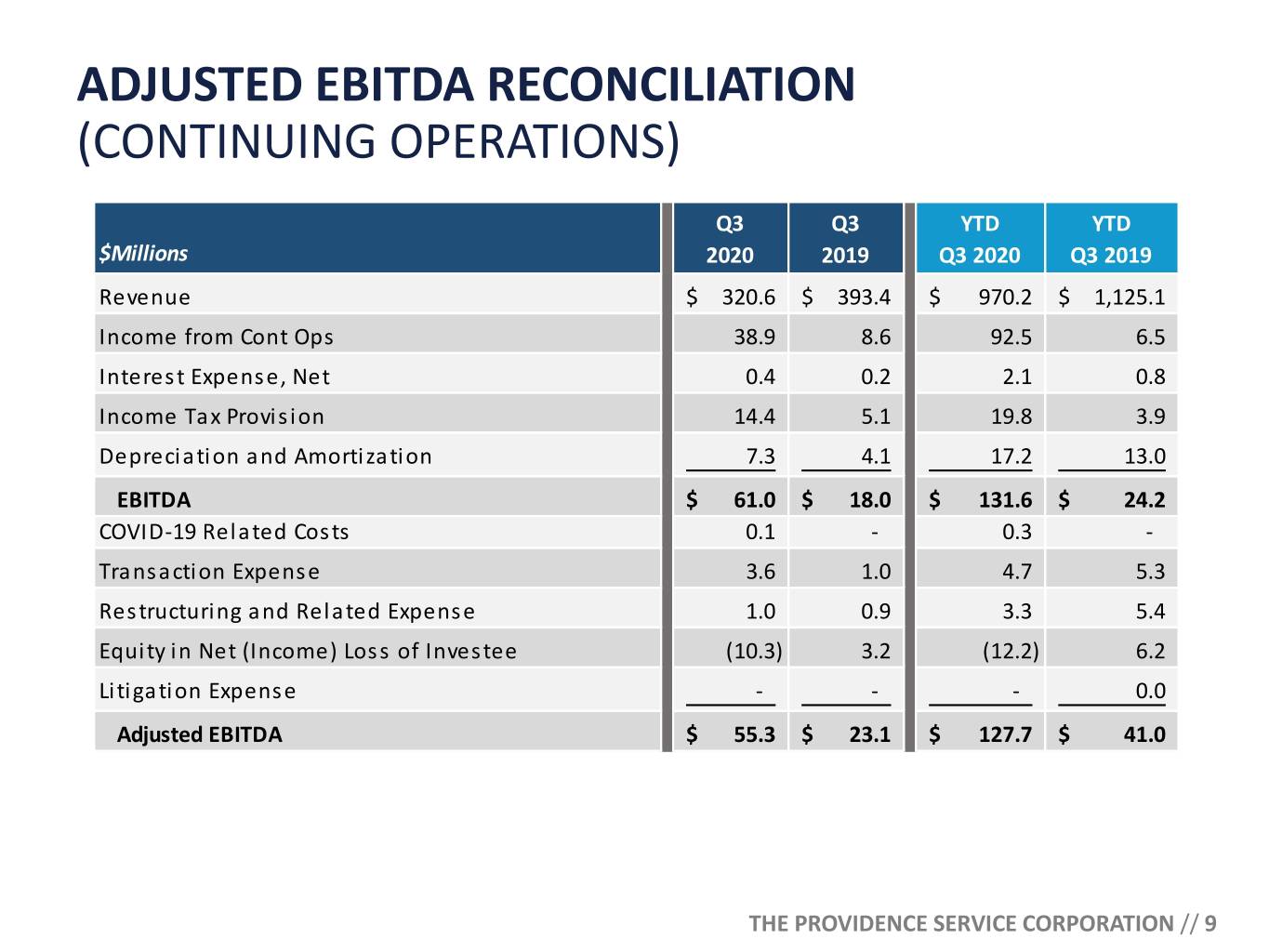

ADJUSTED EBITDA RECONCILIATION (CONTINUING OPERATIONS) Q3 Q3 YTD YTD $Millions 2020 2019 Q3 2020 Q3 2019 Revenue $ 320.6 $ 393.4 $ 970.2 $ 1,125.1 Income from Cont Ops 38.9 8.6 92.5 6.5 Interest Expense, Net 0.4 0.2 2.1 0.8 Income Tax Provision 14.4 5.1 19.8 3.9 Depreciation and Amortization 7.3 4.1 17.2 13.0 EBITDA $ 61.0 $ 18.0 $ 131.6 $ 24.2 COVID-19 Rel a ted Cos ts 0.1 - 0.3 - Transaction Expense 3.6 1.0 4.7 5.3 Restructuring and Related Expense 1.0 0.9 3.3 5.4 Equity in Net (Income) Loss of Investee (10.3) 3.2 (12.2) 6.2 Litigation Expense - - - 0.0 Adjusted EBITDA $ 55.3 $ 23.1 $ 127.7 $ 41.0 THE PROVIDENCE SERVICE CORPORATION // 9

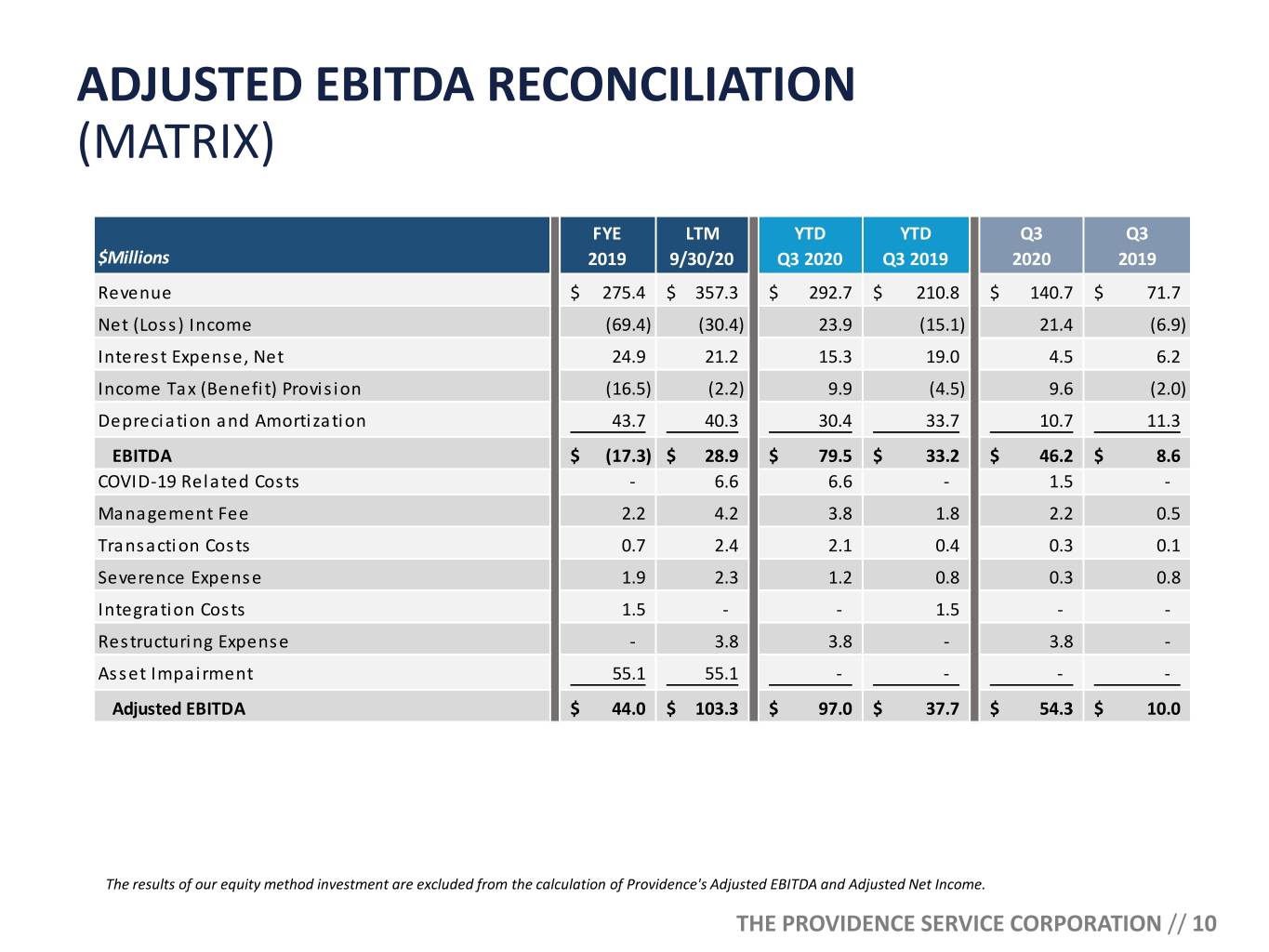

ADJUSTED EBITDA RECONCILIATION (MATRIX) FYE LTM YTD YTD Q3 Q3 $Millions 2019 9/30/20 Q3 2020 Q3 2019 2020 2019 Revenue $ 275.4 $ 357.3 $ 292.7 $ 210.8 $ 140.7 $ 71.7 Net (Loss) Income (69.4) (30.4) 23.9 (15.1) 21.4 (6.9) Interest Expense, Net 24.9 21.2 15.3 19.0 4.5 6.2 Income Tax (Benefit) Provision (16.5) (2.2) 9.9 (4.5) 9.6 (2.0) Depreciation and Amortization 43.7 40.3 30.4 33.7 10.7 11.3 EBITDA $ (17.3) $ 28.9 $ 79.5 $ 33.2 $ 46.2 $ 8.6 COVID-19 Rel a ted Cos ts - 6.6 6.6 - 1.5 - Management Fee 2.2 4.2 3.8 1.8 2.2 0.5 Transaction Costs 0.7 2.4 2.1 0.4 0.3 0.1 Severence Expense 1.9 2.3 1.2 0.8 0.3 0.8 Integration Costs 1.5 - - 1.5 - - Restructuring Expense - 3.8 3.8 - 3.8 - Asset Impairment 55.1 55.1 - - - - Adjusted EBITDA $ 44.0 $ 103.3 $ 97.0 $ 37.7 $ 54.3 $ 10.0 The results of our equity method investment are excluded from the calculation of Providence's Adjusted EBITDA and Adjusted Net Income. THE PROVIDENCE SERVICE CORPORATION // 10

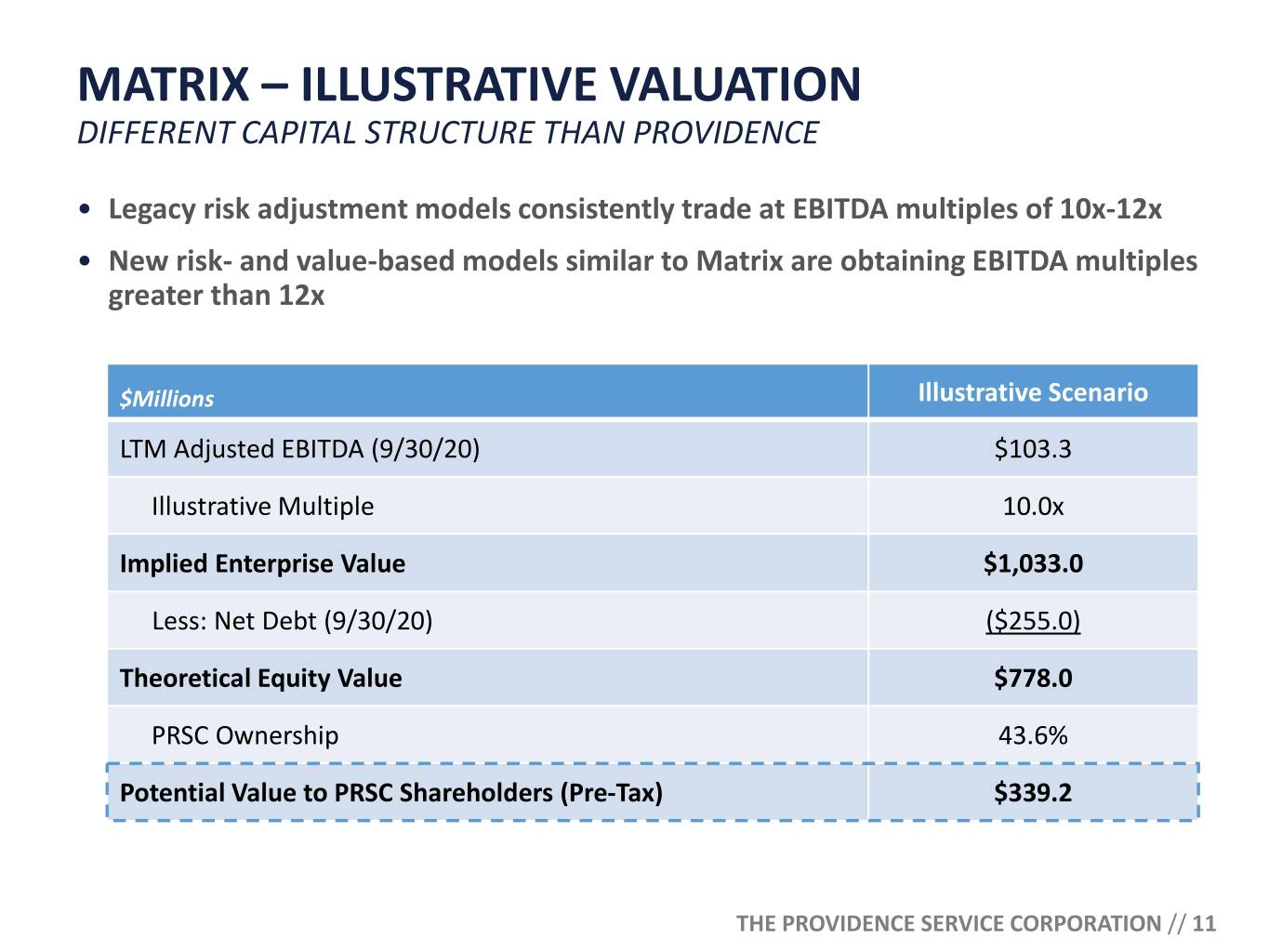

MATRIX – ILLUSTRATIVE VALUATION DIFFERENT CAPITAL STRUCTURE THAN PROVIDENCE • Legacy risk adjustment models consistently trade at EBITDA multiples of 10x-12x • New risk- and value-based models similar to Matrix are obtaining EBITDA multiples greater than 12x $Millions Illustrative Scenario LTM Adjusted EBITDA (9/30/20) $103.3 Illustrative Multiple 10.0x Implied Enterprise Value $1,033.0 Less: Net Debt (9/30/20) ($255.0) Theoretical Equity Value $778.0 PRSC Ownership 43.6% Potential Value to PRSC Shareholders (Pre-Tax) $339.2 THE PROVIDENCE SERVICE CORPORATION // 11