Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - DigitalBridge Group, Inc. | ex9922020q3supp.htm |

| EX-99.1 - EX-99.1 - DigitalBridge Group, Inc. | ex9912020q3pr.htm |

| 8-K - 8-K - DigitalBridge Group, Inc. | clny-20201106.htm |

THIRD QUARTER 2020 EARNINGS PRESENTATION November 6, 2020 1

Disclaimer This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the control of Colony Capital, Inc. (the “Company” or “Colony Capital”), and may cause the Company’s actual results to differ significantly from those expressed in any forward-looking statement. Factors that might cause such a difference include, without limitation, the Company’s ability to execute on its digital transformation in the manner and within the timeframe contemplated if at all, the demand for and growth in the digital infrastructure market, the earnings profile for digital investments and the predictability of such earnings, the potential impact of COVID-19 on the Company’s business and operations, including the ability to execute on or accelerate the Company’s initiatives related to digital transformation, whether the Company will achieve its projected deployment rate in digital infrastructure, whether the Company will realize the anticipated benefits of Wafra’s strategic investment in the Company’s digital investment management business, including whether the Wafra investment will become subject to redemption and the amount of commitments Wafra will make to the Company’s digital investment products, the performance of DataBank, including whether the pending zColo transaction will be consummated and if so, whether it will transform DataBank into a leading U.S. edge data center operator or result in any of the other anticipated benefits, the actual amount of third party capital to be raised by the Company in the zColo transaction, DataBank’s ability to complete additional strategic investments and realize any benefits from such investments, the success and performance of the Company’s future investment product offerings, including the Digital Equity franchise and Digital Credit initiative, whether the Company will realize the anticipated benefits of its investment in Vantage Data Centers, including the performance and stability of its portfolio, the impact of the Company’s capital structure on the trading price of its stock, whether the Company’s liquidity will be sufficient to fund growth in digital transformation, the Company’s ability to monetize certain legacy assets in the timing and in the amounts anticipated or at all and the impact of such monetizations on the Company’s liquidity, simplify its business and continue to grow its digital assets under management, the Company’s ability to bring high quality digital assets onto the balance sheet, the Company’s ability to consummate the pending hospitality exit transaction and whether any of the anticipated strategic and financial benefits of the transaction will be realized, including the amount of net proceeds to be received by the Company from the transaction, whether balance sheet investments combined with investment management will result in anticipated benefits for the Company’s stockholders, whether the Company’s operations of its non-digital business units will result in maximizing cash flows and value over time, including the impact of COVID-19 on such operations and cash flows, the impact of impairments, the impact of changes to the Company’s management or board of directors, employee and organizational structure, the Company’s financial flexibility and liquidity, including borrowing capacity under its revolving credit facility (including as a result of the impact of COVID- 19), the use of sales proceeds and available liquidity, the performance of the Company’s investment in Colony Credit Real Estate, Inc. (CLNC) (including as a result of the impact of COVID-19), the impact of management changes at CLNC, the Company’s ability to minimize balance sheet commitments to its managed investment vehicles, rent escalators, whether the Company’s future investments will be accretive, the Company’s ability to raise third party capital in new vehicles including through new strategies, the Company's expected taxable income and net cash flows, excluding the contribution of gains, whether the Company will maintain or produce higher Core FFO per share (including or excluding gains and losses from sales of certain investments) in the coming quarters, or ever (including as a result of the impact of COVID-19), the Company’s fee earning equity under management (FEEUM), digital investment management revenue and fee related earnings and its ability to continue growth of such metrics at the current pace or at all, the Company’s ability to pay or grow the dividend at all in the future, whether the Company will continue to pay preferred dividends, the Company’s trading multiples, the ability to achieve targeted G&A savings including the impact of such savings of the Company’s operations, the impact of any changes to the Company’s management agreements with NorthStar Healthcare Income, Inc. and CLNC and other managed investment vehicles, whether Colony Capital will be able to maintain its qualification as a REIT for U.S. federal income tax purposes, the timing of and ability to deploy available capital, including whether any redeployment of capital will generate higher total returns, the Company’s ability to maintain inclusion and relative performance on the RMZ, Colony Capital’s leverage, including the Company’s ability to reduce debt and the timing and amount of borrowings under its credit facility, increased interest rates and operating costs, adverse economic or real estate developments in Colony Capital’s markets, Colony Capital’s failure to successfully operate or lease acquired properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, increased costs of capital expenditures, defaults on or non-renewal of leases by tenants, the impact of economic conditions on the borrowers of Colony Capital’s commercial real estate debt investments and the commercial mortgage loans underlying its commercial mortgage backed securities, adverse general and local economic conditions, an unfavorable capital market environment, decreased leasing activity or lease renewals, and other risks and uncertainties, including those detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, under the heading “Risk Factors,” as such factors may be updated from time to time in our subsequent periodic filings with the U.S. Securities and Exchange Commission (“SEC”). All forward-looking statements reflect Colony Capital’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Additional information about these and other factors can be found in Colony Capital’s reports filed from time to time with the SEC. Colony Capital cautions investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. Colony Capital is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and Colony Capital does not intend to do so. This presentation may contain statistics and other data that has been obtained or compiled from information made available by third-party service providers. Colony Capital has not independently verified such statistics or data. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of Colony Capital. This information is not intended to be indicative of future results. Actual performance of Colony Capital may vary materially. 2

Agenda # Section 1 Business Update 2 3Q20 Financial Results 3 Executing The Digital Playbook 4 Q&A 3 3

1 Business Update 4

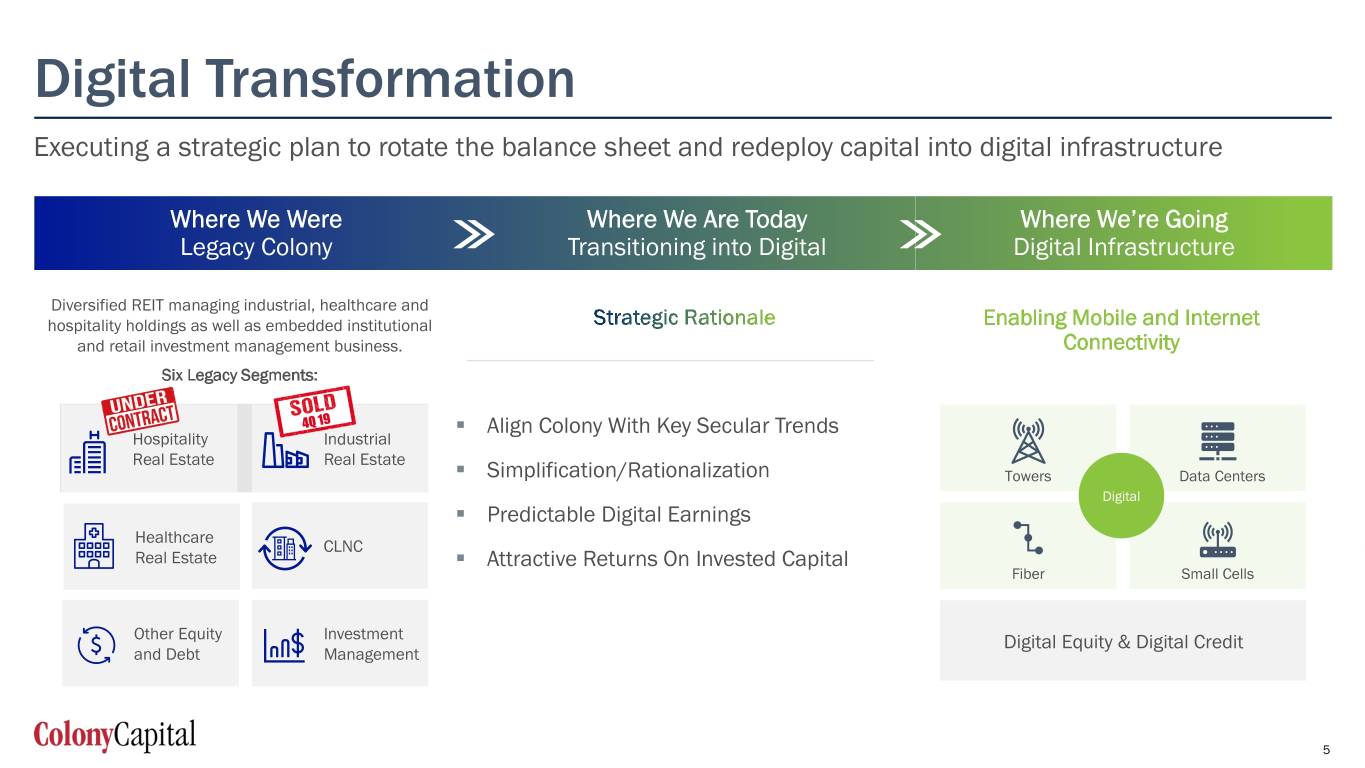

Digital Transformation Executing a strategic plan to rotate the balance sheet and redeploy capital into digital infrastructure Where We Were Where We Are Today Where We’re Going Legacy Colony Transitioning into Digital Digital Infrastructure Diversified REIT managing industrial, healthcare and hospitality holdings as well as embedded institutional Enabling Mobile and Internet and retail investment management business. Connectivity Six Legacy Segments: . Align Colony With Key Secular Trends Hospitality Industrial Real Estate Real Estate . Simplification/Rationalization Towers Data Centers Digital . Predictable Digital Earnings Healthcare CLNC Real Estate . Attractive Returns On Invested Capital Fiber Small Cells Other Equity Investment Digital Equity & Digital Credit and Debt Management 5

Continuing Progress On Rotation Key 3Q Highlights Demonstrates Ability to Deliver The Digital Transformation Landmark sale of Hospitality Business DataBank Acquisition of zColo INVEST IN DIGITAL . $2.8B transaction value . $1.4B acquisition led by Colony Capital . Reduces consolidated debt by $2.7B . DataBank emerges as a leading national EDGE colocation operator . Generates significant strategic and financial benefits for CLNY . Serving 29 key markets via 64 data centers and shareholders over 1 million sq ft HARVEST . Expanded footprint provides broad geographic . Removes management distraction and LEGACY coverage and scale oversight REPEAT . Colony deploys $145M from balance sheet, raises . Simplifies CLNY’s business to focus $500M of incremental co-invest FEEUM exclusively on digital infrastructure assets . Accretive transaction relative to initial investment and publicly traded peers . Synergies and business optimization initiatives will further enhance economics and returns 6

Hospitality Sale Simplifies Business Profile Key Milestone in Digital Transformation Significant Decrease in Debt and Leverage Ratio(1) TOTAL DEBT (CLNY Share) Agreement to sell hospitality portfolios in $2.8B transaction 67% . $67.5M of gross consolidated proceeds to CLNY Debt/Assets (1) . Represents an 8.5% cap rate on 2019 NOI and 3.3% cap rate on 54% trailing twelve-month NOI as of 9/30/20 $6.8B Sale of a non-core legacy business highly impacted by COVID-19 $3.8B with minimal expected cash flows for the next two or three years as the lodging market recovers 9/30/2020 Pro Forma Buyer is strong hospitality steward with an excellent track record, (2) will assume all debt and contingent liabilities Performance During Pandemic 2020 (1) Shedding significant CLNY share of debt of $3.0B with annual Apr May Jun Jul Aug Sept cash interest savings of $110M Occupancy 22% 30% 39% 45% 52% 49% Anticipate approximately $7M of annual G&A savings RevPAR $20 $27 $39 $46 $53 $50 NOI before FF&E ($M) ($6.3) ($1.3) $1.0 $4.8 $5.7 $3.2 Qtrly Cash Interest Exp. ($M) $24.7 $23.4 Qtrly Core FFO ($M) ($39.6) ($12.8) (1) Decrease in CLNY’s share of debt includes $702 million of CLNY share of debt in the Inland hotel portfolio, which is under receivership and not part of the hospitality portfolio sale. (2) Includes prior hospitality segment results only, does not include THL hotel portfolio results. 7

DataBank + zColo: Transformative Acquisition zColo is Highly Complementary to the DataBank Platform Scaled Pro Forma Footprint . DataBank emerges as a leading U.S. EDGE colocation operator for hyperscale, Pro Forma technology and content customers Combined . zColo adds a diverse mix of strategically-important enterprise and interconnect data centers Markets 9 23 29 across attractive new markets Data Centers 20 44 64 . Scale customer relationships and geographic coverage crucial to capturing Edge demand from Carrier Hotels 5 13 18 technology firms looking to monetize the Edge (incl. in Data Centers) Built MW 54 84 138 . Expanded footprint provides broad geographic coverage and scale Colo SF 457k 778k 1,235k . Larger DataBank portfolio will serve expansion of cloud/content workloads into primary and Cross Connects 6.8k 23.1k 29.9k secondary Edge markets with exceptional base of diversified, blue-chip customers Revenue (LQA) $176M $280M $456M . Deal leverages strong leadership with track record of successful growth National Edge Footprint Serves Cloud and Edge Demand . 5 acquisitions in past 3 years; 10%+ organic top-line growth since original acquisition . Optimization opportunities already identified . $1.4B acquisition led by Colony Capital . Colony investing $145M from balance sheet to maintain 20% ownership . Additional $500M in new coinvest FEEUM . Accretive acquisition economics 8

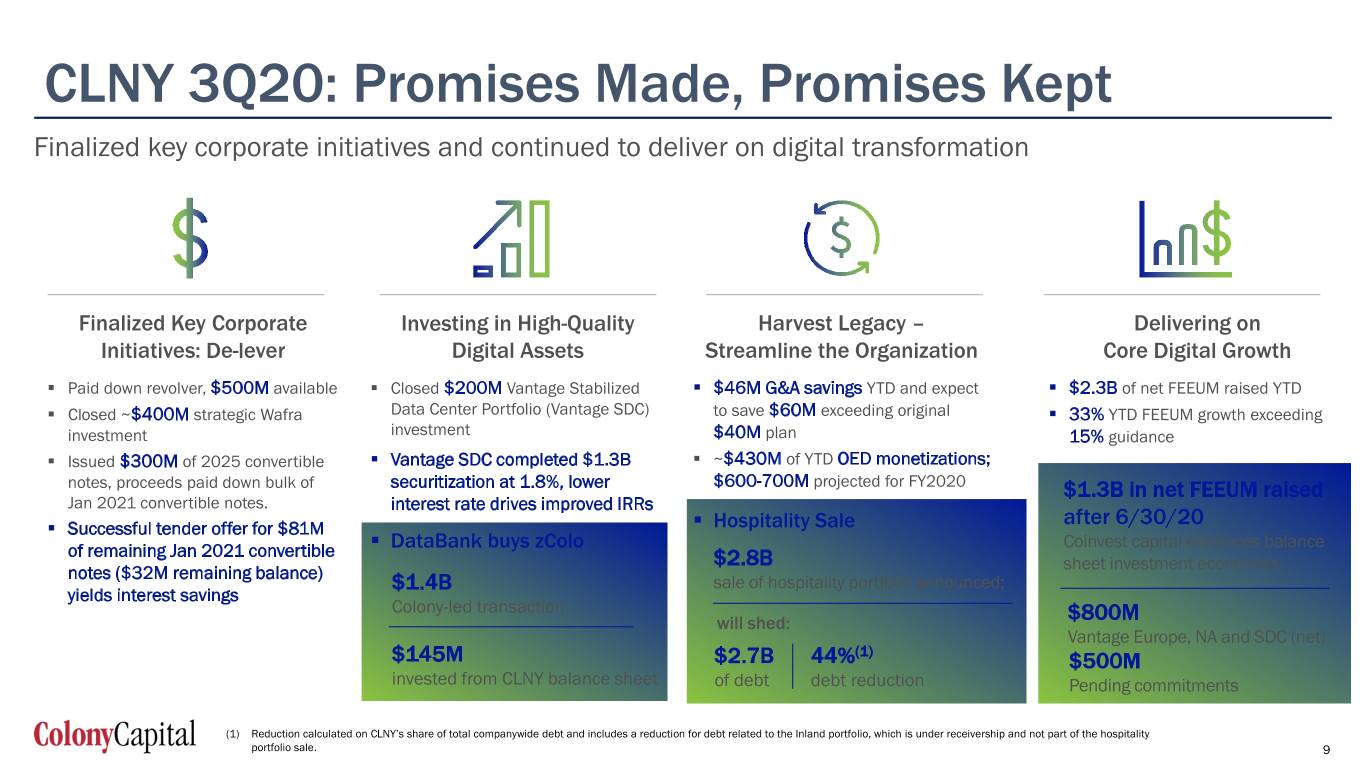

CLNY 3Q20: Promises Made, Promises Kept Finalized key corporate initiatives and continued to deliver on digital transformation Finalized Key Corporate Investing in High-Quality Harvest Legacy – Delivering on Initiatives: De-lever Digital Assets Streamline the Organization Core Digital Growth . Paid down revolver, $500M available . Closed $200M Vantage Stabilized . $46M G&A savings YTD and expect . $2.3B of net FEEUM raised YTD . Closed ~$400M strategic Wafra Data Center Portfolio (Vantage SDC) to save $60M exceeding original . 33% YTD FEEUM growth exceeding investment investment $40M plan 15% guidance . Issued $300M of 2025 convertible . Vantage SDC completed $1.3B . ~$430M of YTD OED monetizations; notes, proceeds paid down bulk of securitization at 1.8%, lower $600-700M projected for FY2020 $1.3B in net FEEUM raised Jan 2021 convertible notes. interest rate drives improved IRRs after 6/30/20 . Successful tender offer for $81M . Hospitality Sale . Coinvest capital enhances balance of remaining Jan 2021 convertible DataBank buys zColo $2.8B sheet investment economics notes ($32M remaining balance) $1.4B sale of hospitality portfolio announced; yields interest savings Colony-led transaction will shed: $800M Vantage Europe, NA and SDC (net) $145M $2.7B 44%(1) $500M invested from CLNY balance sheet of debt debt reduction Pending commitments (1) Reduction calculated on CLNY’s share of total companywide debt and includes a reduction for debt related to the Inland portfolio, which is under receivership and not part of the hospitality portfolio sale. 9

2 3Q20 Financial Results 10

3Q20 Summary Results ($ millions except per share & AUM) 3Q19 2Q20 3Q20 Q/Q% Total Company Consolidated Revenues $359.0 $286.7 $316.7 +10% Core FFO (ex Gains/Loss) $106.0 ($19.3) $4.8 Nm per share $0.20 ($0.04) $0.01 Net Income (CLNY Shareholder) ($555.0) ($2,042.8) ($205.8) Nm per share ($1.16) ($4.33) ($0.44) AUM ($B) $45.5 $45.7 $46.8 +3% % Digital 30% 47% 50% +3% Core Digital Segments(1) Consolidated Revenues $14.5 $62.7 $118.7 +89% CLNY share of Revenues(2) $14.5 $29.1 $29.4 +1% Consolidated FRE / Adjusted EBITDA $10.1 $25.9 $54.5 >100% CLNY share of FRE / Adjusted EBITDA(2) $10.1 $12.6 $13.3 +5% Core FFO (ex Gains/Loss) $7.1 $9.5 $10.1 +6% per share $0.01 $0.02 $0.02 +6% AUM ($B) $13.8 $21.6 $23.3 +8% (1) Includes Digital Operating and Digital Investment Management segments. Excludes Digital Other segment. (2) Excludes non-controlling interest. Refer to the appendix for Non-GAAP Reconciliations. 11

Expanding Digital Disclosures Prior Segmentation TRANSFORMATION New Segmentation As we continue to 1 Digital Investment Management Expanded streamline and simplify Digital 1 Digital Operating Disclosure 2 our businesses and 3 Digital Other further the Digital transformation, we are also streamlining and Healthcare/Wellness Infra 2 4 Wellness Infra Unchanged simplifying our financial Other Investment Mgmt 3 disclosures while Other (with similar subsegment CLNC 4 5 emphasizing our Combined disclosures) Digital results Other Equity & Debt 5 Discontinued Hospitality 6 No longer a segment Ops(1) (1) Purchase agreement for the entire Hospitality segment signed in October 2020; Sale not expected to be completed until 2021. 12

3Q20 – Return to Positive Core FFO Continued Execution of Strategic Plan Driving Q/Q Improvements While Advancing an All-Digital Future +$16M $4.8M +$3M +$2M +$3M ($19.3M) 2Q20 Digital Acquisitions and G&A Reduction Lower Interest Expense Improved Legacy 3Q20 Growth . Acquisition of Vantage . Reduction of 42 non- . Paydown of revolver: . Improvements at hyperscale datacenters Digital FTEs since $400M in 3Q20, Hospitality due to $600M YTD COVID related re- . zColo acquisition will YE2019 openings fuel further growth in . $40M G&A reduction . Paydown of 2021 4Q20 plan on track Convertible notes . Reduction of QoQ . Expected run-rate . Zero near-term impairment losses G&A of $100-$120M maturities (>$2B in 2Q20) by 2023 13

Digital Earnings Summary Core Digital Revenues(1) Consolidated Digital FRE / Adjusted EBITDA(1) ($ in millions) ($ in millions) Digital Operating Digital IM Digital Operating Digital FRE Combined Margin $118.7 $54.5 $20.1 $8.9 Q/Q Q/Q $62.7 $25.9 $20.7 $98.6 $9.3 $45.6 46% $10.1 41% $14.5 $42.0 $$16.68M $14.5 $10.1 CLNY % 3Q19 2Q20 3Q20 3Q19 2Q20 3Q20 Digital IM 100% 100% 69% 100% 100% 69% Digital Operating n/a 20% 16% n/a 20% 15% Consolidated Digital Revenues increased to $119M in 3Q20, driven by Consolidated Digital FRE and Adjusted EBITDA increased to $54M acquisitions of Databank in 4Q19 and Vantage in 3Q20 during 3Q20 . Fee revenues in 3Q19 were a stub period following acquisition of Digital Bridge . Recurring margins increased 500 basis points quarter to quarter to 46% in July 2019 . FRE expected to be $9.9M pro forma for run-rate fee earnings from pending zColo, ExteNet and Vantage transactions (1) Includes Digital Operating and Digital Investment Management segments. Excludes Digital Other segment. 14

Progress Towards 2023 Targets Investment Management Digital Fee Revenues1 Digital IM FRE1 20-30% 30-40% $110M Digital IM revenue and FRE is $200M ANNUAL GROWTH ANNUAL GROWTH anticipated to grow rapidly as Colony $80M $150M RANGE expands the magnitude and scope of its RANGE investment products Investments in professionals to support future product growth impacted 3Q20 FRE margin $79M $84M $38M $40M 2 2 2Q20 PF 3Q20 2023 2Q20 PF 3Q20 2023 Digital Operating Digital Operating EBITDA3 Digital Operating FFO3 $225M Digital operating businesses on the $200M $175M balance sheet increased earnings RANGE $150M contribution due to the investment in RANGE Vantage SDC in July 2020 >100% >100% Q/Q Increase Q/Q Increase Additional earnings anticipated upon closing of the zColo transaction and as $28M $13M $6M $18M balance sheet continues to rotate 2Q20 3Q20 2023 2Q20 3Q20 2023 (1) Represents annualized 3Q20 consolidated results, normalized to exclude a one-time expense gross-up during 2Q20. (2) Includes pro-forma adjustments for run-rate fee earnings expected from announced zColo, ExteNet and Vantage transactions anticipated to close in 4Q20. (3) Represents annualized 3Q20 pro-rata results; excludes Digital Other segment. 15

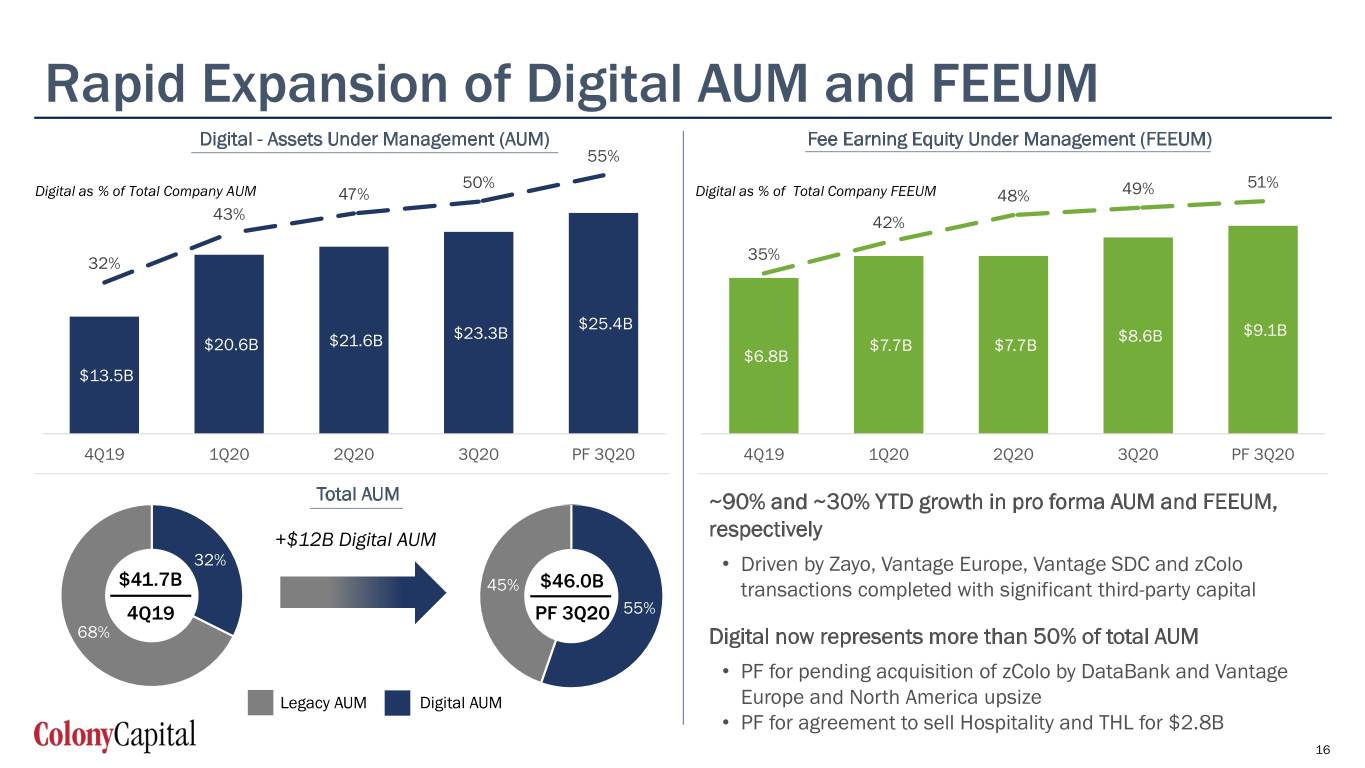

Rapid Expansion of Digital AUM and FEEUM Digital - Assets Under Management (AUM) Fee Earning Equity Under Management (FEEUM) 55% 50% 51% Digital as % of Total Company AUM 47% Digital as % of Total Company FEEUM 48% 49% 43% 42% 35% 32% $25.4B $23.3B $8.6B $9.1B $20.6B $21.6B $7.7B $7.7B $6.8B $13.5B 4Q19 1Q20 2Q20 3Q20 PF 3Q20 4Q19 1Q20 2Q20 3Q20 PF 3Q20 Total AUM ~90% and ~30% YTD growth in pro forma AUM and FEEUM, +$12B Digital AUM respectively 32% • Driven by Zayo, Vantage Europe, Vantage SDC and zColo $41.7B 45% $46.0B transactions completed with significant third-party capital 4Q19 PF 3Q20 55% 68% Digital now represents more than 50% of total AUM • PF for pending acquisition of zColo by DataBank and Vantage Legacy AUM Digital AUM Europe and North America upsize • PF for agreement to sell Hospitality and THL for $2.8B 16

Investment Management FEEUM Growth 33% growth in digital FEEUM in first 10 months of 2020…far exceeding our 15% guidance for the year High Quality Relationships and Fees Exceeding Expectations . Leveraging long-standing relationships built on success . Zayo (1Q20): Landmark $14.3B take-private added PF YTD ~$700M was fee-bearing co-invest capital . Vantage Europe (1Q20 – 3Q20): to accelerate Pending net FEEUM European expansion raised net ~$130M of FEEUM increase in 1Q20 and another ~$180M FEEUM in the 3Q20. $9.1B . Vantage SDC (3Q20): Raised net ~$600M FEEUM $8.6B alongside CLNY balance sheet investment . Pending Commitments: ~$500M of net FEEUM which includes zColo and additional Vantage $6.8B platform fundings 12/31/19 1Q20 3Q20 9/30/20 Pending PF FEEUM 17

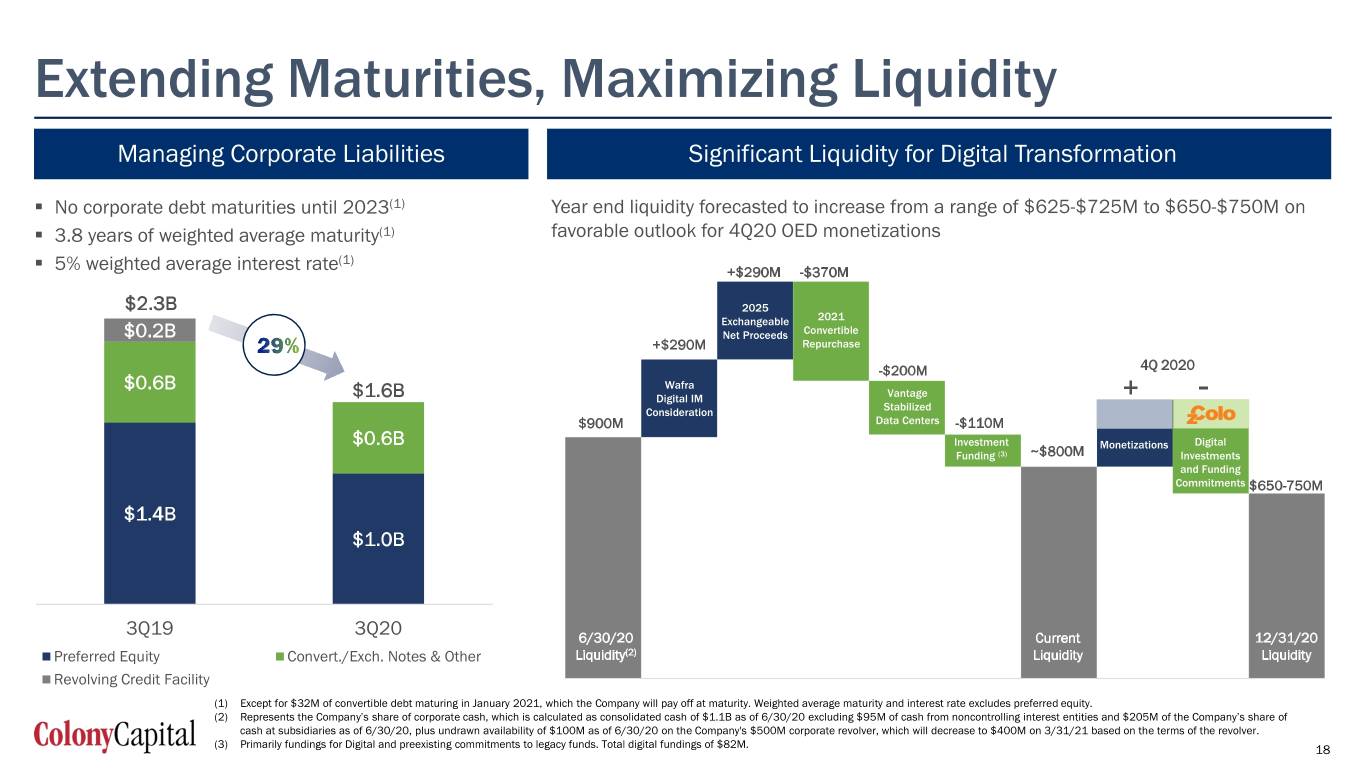

Extending Maturities, Maximizing Liquidity Managing Corporate Liabilities Significant Liquidity for Digital Transformation . No corporate debt maturities until 2023(1) Year end liquidity forecasted to increase from a range of $625-$725M to $650-$750M on . 3.8 years of weighted average maturity(1) favorable outlook for 4Q20 OED monetizations . (1) 5% weighted average interest rate +$290M -$370M $2.3B 2025 Exchangeable 2021 $0.2B Net Proceeds Convertible +$290M Repurchase -$200M 4Q 2020 $0.6B Wafra $1.6B Digital IM Vantage + - Consideration Stabilized $900M Data Centers -$110M $0.6B Investment Monetizations Digital Funding (3) ~$800M Investments and Funding Commitments $650-750M $1.4B $1.0B 3Q19 3Q20 6/30/20 Current 12/31/20 Preferred Equity Convert./Exch. Notes & Other Liquidity(2) Liquidity Liquidity Revolving Credit Facility (1) Except for $32M of convertible debt maturing in January 2021, which the Company will pay off at maturity. Weighted average maturity and interest rate excludes preferred equity. (2) Represents the Company’s share of corporate cash, which is calculated as consolidated cash of $1.1B as of 6/30/20 excluding $95M of cash from noncontrolling interest entities and $205M of the Company’s share of cash at subsidiaries as of 6/30/20, plus undrawn availability of $100M as of 6/30/20 on the Company's $500M corporate revolver, which will decrease to $400M on 3/31/21 based on the terms of the revolver. (3) Primarily fundings for Digital and preexisting commitments to legacy funds. Total digital fundings of $82M. 18

Executing The Digital Playbook 3 Colony Grows At The Edge 19

The Emerging Edge Opportunity Exponential Growth in New & Emerging Use Cases… …Pushes Demand Back to The EDGE… ADOPTION SCALE AI/Big Data IOT COST EFFICIENCY AR/VR The next users of cloud-scale compute are machines, not people… Secular use cases enabled by 5G set CLOUD to takeoff 1940s-1960s 1960s-1990s 2000s-2010s 2020+ Source: Verizon …Driving Strong Growth in Edge Server Deployment …Forcing Changes in Network Architecture… TRADITIONAL CLOUD DISTRIBUTED CLOUD Estimated that 1.6M Edge Servers will support 10% of cloud workloads by 2028 Source: Verizon Source: Cowen and Company Edge Servers (000s) % Cloud Workloads Complemented with Edge LOWER LATENCY, FASTER SPEEDS, GREATER RESOURCE EFFICIENCY 20

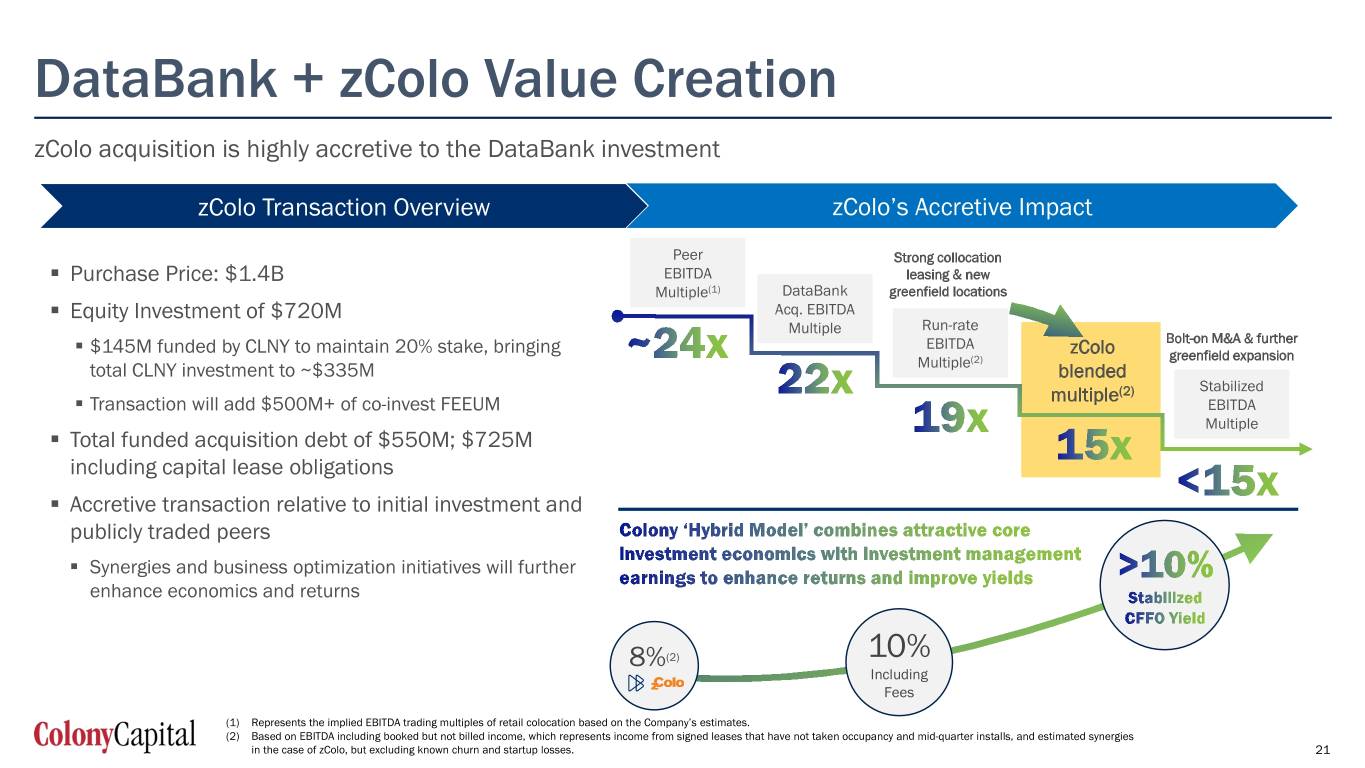

DataBank + zColo Value Creation zColo acquisition is highly accretive to the DataBank investment zColo Transaction Overview zColo’s Accretive Impact Peer Strong collocation . Purchase Price: $1.4B EBITDA leasing & new Multiple(1) DataBank greenfield locations . Equity Investment of $720M Acq. EBITDA Multiple Run-rate . $145M funded by CLNY to maintain 20% stake, bringing EBITDA zColo Bolt-on M&A & further (2) greenfield expansion total CLNY investment to ~$335M Multiple blended multiple(2) Stabilized . Transaction will add $500M+ of co-invest FEEUM EBITDA Multiple . Total funded acquisition debt of $550M; $725M including capital lease obligations . Accretive transaction relative to initial investment and publicly traded peers . Synergies and business optimization initiatives will further enhance economics and returns 8%(2) 10% Including Fees (1) Represents the implied EBITDA trading multiples of retail colocation based on the Company’s estimates. (2) Based on EBITDA including booked but not billed income, which represents income from signed leases that have not taken occupancy and mid-quarter installs, and estimated synergies in the case of zColo, but excluding known churn and startup losses. 21

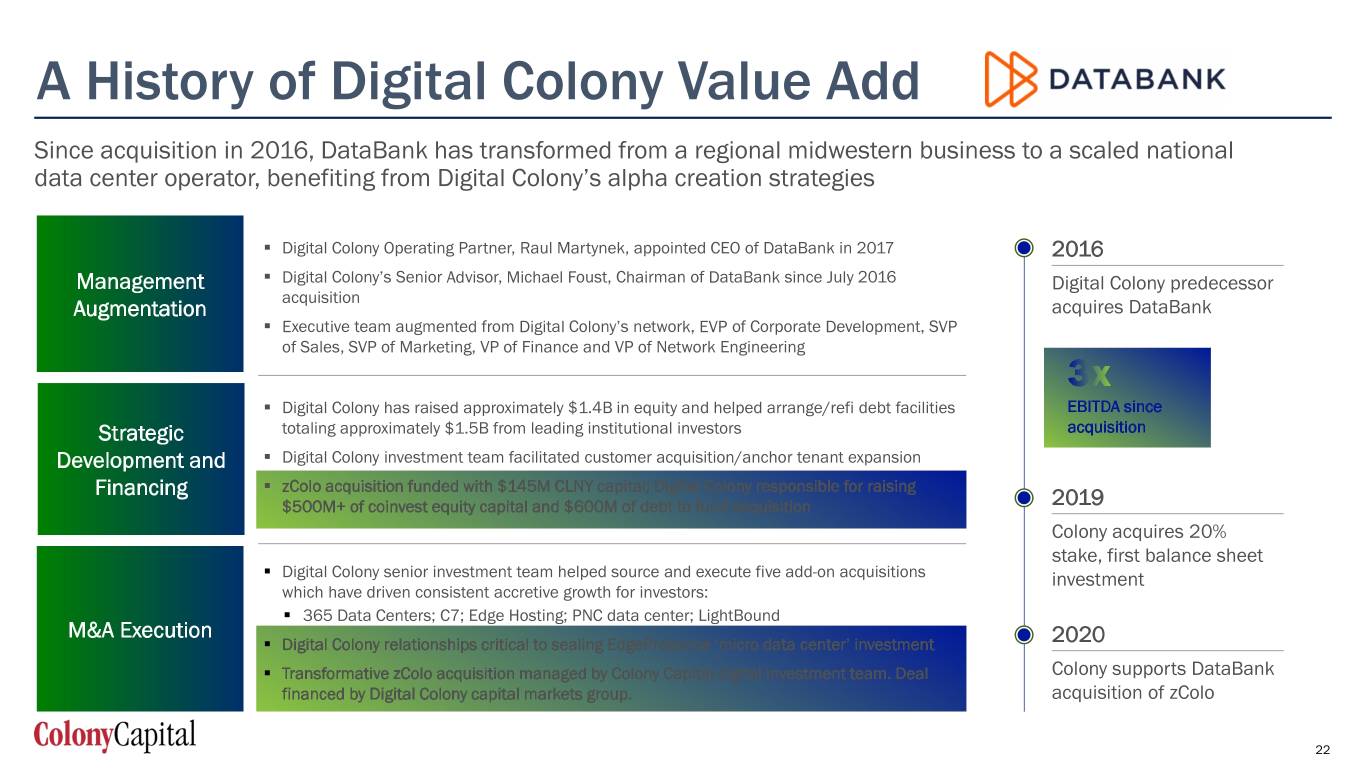

A History of Digital Colony Value Add Since acquisition in 2016, DataBank has transformed from a regional midwestern business to a scaled national data center operator, benefiting from Digital Colony’s alpha creation strategies . Digital Colony Operating Partner, Raul Martynek, appointed CEO of DataBank in 2017 2016 Management . Digital Colony’s Senior Advisor, Michael Foust, Chairman of DataBank since July 2016 Digital Colony predecessor acquisition Augmentation acquires DataBank . Executive team augmented from Digital Colony’s network, EVP of Corporate Development, SVP of Sales, SVP of Marketing, VP of Finance and VP of Network Engineering . Digital Colony has raised approximately $1.4B in equity and helped arrange/refi debt facilities EBITDA since Strategic totaling approximately $1.5B from leading institutional investors acquisition Development and . Digital Colony investment team facilitated customer acquisition/anchor tenant expansion Financing . zColo acquisition funded with $145M CLNY capital; Digital Colony responsible for raising $500M+ of coinvest equity capital and $600M of debt to fund acquisition 2019 Colony acquires 20% stake, first balance sheet . Digital Colony senior investment team helped source and execute five add-on acquisitions investment which have driven consistent accretive growth for investors: . 365 Data Centers; C7; Edge Hosting; PNC data center; LightBound M&A Execution . Digital Colony relationships critical to sealing EdgePresence ‘micro data center’ investment 2020 . Transformative zColo acquisition managed by Colony Capital digital investment team. Deal Colony supports DataBank financed by Digital Colony capital markets group. acquisition of zColo 22

DataBank Executing On Converged Networks Strategic investments enable DataBank customers access to Edge connectivity and the entire Colony digital ecosystem From a scaled national footprint with onramps …to the “far Edge” with modular data centers at to global internet traffic… the foot of cell towers 30K X-Connects DataBank $30M strategic investment in Edge Presence Oct-20 Ecosystem Benefits $1.4B Acquisition Edge Presence also partnering with Digital Colony announced portfolio company Vertical Bridge, the largest Sep-20 private tower owner in the US; currently deploying at 12 Vertical Bridge locations 23

Continuing to Deliver on Our Commitments Commitment YTD Highlights Future Paid down 2021 converts, issued $300M Address Near-Term Corporate Debt of new 2025 converts. Amended revolver to COMPLETED Maturities and Enhance Liquidity clear Path-to-Digital Another significant balance sheet Commit Significant Capital Towards Deployed over $530M between DataBank/ investment within the next six months, Digital Infrastructure Growth zColo and Vantage SDC in the last year Pipeline is robust +33% growth in digital FEEUM, exceeding Deliver on Core Digital Investment Focus on growth of flagship Digital 15% original guidance and updated 30% Management Growth Equity and emerging Credit franchises target Simplification – Legacy Asset Monetized $430M of legacy assets to-date; By end of year, achieve $600-700M Monetizations and Cost Reductions Hospitality business sale under contract; total legacy asset sales, sharpen focus $46M run-rate G&A savings YTD on G&A, hit $60M run-rate savings Building Long-Term Value for Colony Capital Shareholders 24

4 Q&A Session 25

Digital Colony Universe Our companies operate and manage ~350,000 sites, >140,000 route miles of dense metro fiber, >40,000 small cell nodes and >95 data centers globally ( ) EUROPE 2016 2016 2013 2014 2015 2017 2018 2018 2019 2019 2019 2020 2020 2020 2020 /2017 /2020 ~32,300 13 2 operating (3) ~5,000 1 operating nodes operating ~300 tower 136,000+ hyper ~2,400 ~6,300 ~3,000 nodes ~3,200 on- ~580 active hyper ~430 hyper sites route miles, scale active sites active sites (3) active sites 64 data ~5,000 14 data net sites ~2,600 scale networks scale 1,400+ ~35,000 campus ~5,100 ~289,000 ~39,000 centers(4) towers(5) centers locations ~713 total total sites campus; ~3,600 campuses; total sites(2) on-net 1 currently total sites(2) total sites(2) total sites(2) ~150 ~2,400 sites(2),(3) 6 currently route miles 4 currently buildings under dev. (3) networks(5) route miles under dev. fiber under dev. Enterprise Hyperscale Enterprise Outdoor Hyperscale Hyperscale Towers Towers Small Cells Towers Small Cells Towers Fiber Towers Fiber DC DC DC Digital Infra DC DC Capital Source Earnings Stream 15 Distinct Digital Operating Companies/Platforms Across Four Capital Sources Original Digital Bridge Management Fees Separately Capitalized Cos Digital Colony Management Fees Partners I (DCPI) (1) & Carried Interest Management Fees Co-Invest Capital & Carried Interest CLNY Earnings From Balance Sheet Investment Notes: All figures as of September 30, 2020 except otherwise noted. With respect to ATP, DataBank, ExteNet, MTP, Vantage Europe, Vantage North America, and Vertical Bridge, in addition to Colony Capital’s indirect ownership in DataBank and Vantage North America and Digital Colony Partners’ ownership in ATP and Vantage Europe, Digital Colony provides investment advisory services to investment vehicles that have invested in such business and provides certain business services to such businesses. In addition, certain employees of Digital Colony serve on the boards of directors (or similar governing bodies) of such companies or holding companies thereof. (1) CLNY balance sheet has a $250M commitment to DCP I, of which $172M has been funded; (2) “Active sites” represents owned and other revenue generating sites, while “total sites” includes other sites on which the company has marketing/management rights; for Digita, “total sites” includes certain micro data centers and IoT sites; (3) Includes contracted and in construction (“CIC”) networks; (4) Includes under26 construction sites and signed but not closed transactions; (5) Includes BBNB (contracted) sites and other active near-term pipeline opportunities. 26

Non-GAAP Reconciliations Total CLNY for the Three Months Ended Core Digital Segments(7) for the Three Months Ended Hospitality for the Three Months Ended Core Funds from Operations (in thousands, except per share) September 30, 2020 June 30, 2020 September 30, 2019 September 30, 2020 June 30, 2020 September 30, 2019 September 30, 2020 June 30, 2020 Net income (loss) attributable to common stockholders $ (205,784) $ (2,042,790) $ (554,953) $ (3,067) $ (2,476) $ 38,160 $ (38,967) $ (633,323) Adjustments for FFO attributable to common interests in Operating Company and common stockholders: Net income (loss) attributable to noncontrolling common interests in Operating Company (22,651) (225,057) (53,560) (337) (273) 3,681 (4,290) (69,779) Real estate depreciation and amortization 162,705 131,722 116,615 70,474 25,773 29 27,397 35,462 Impairment of real estate 142,767 1,474,262 177,900 – – – (69) 660,752 Gain from sales of real estate (12,332) 4,919 (12,928) – – – 11 (1) Less: Adjustments attributable to noncontrolling interests in investment entities (146,905) (329,601) (67,498) (60,086) (20,595) – (1,784) (35,855) FFO attributable to common interests in Operating Company and common stockholders (82,200) (986,545) (394,424) 6,984 2,429 41,870 (17,702) (42,744) Additional adjustments for Core FFO attributable to common interests in Operating Company and common Gains and losses from sales of depreciable real estate within the Other Equity and Debt segment, net of (10,529) 741 (39,959) – – – – – depreciation, amortization and impairment previously adjusted for FFO (1) Gains and losses from sales of investment management businesses and impairment write-downs associated 7,546 515,698 387,000 3,832 – – – – investment management CLNC Core Earnings and NRE Cash Available for Distribution adjustments (2) (27,256) 266,016 5,063 – – – – – Equity-based compensation expense 8,380 10,716 11,590 338 978 – 202 230 Straight-line rent revenue and expense (6,282) (5,240) (466) (2,821) 1,410 38 (14) (15) Amortization of acquired above- and below-market lease values, net (1,376) (583) (3,569) 790 1,723 – – – Amortization of deferred financing costs and debt premiums and discounts 4,382 9,963 16,158 (3,208) – – 2,302 3,552 Unrealized fair value losses on interest rate and foreign currency hedges, and foreign currency 1,952 (7,482) 93,322 (87) – – – – Acquisition and merger-related transaction costs 7,963 332 101 5 596 – 2,500 – Restructuring and merger integration costs (3) 6,839 13,046 18,592 – – – – – Amortization and impairment of investment management intangibles 8,849 11,625 65,158 6,319 9,103 4,711 – – Non-real estate fixed asset depreciation, amortization and impairment 3,873 14,065 1,588 2,714 226 27 – – Gain on consolidation of equity method investment – – (51,400) – – (51,400) – – Amortization of gain on remeasurement of consolidated investment entities – 12,891 – – – – – – Tax effect of Core FFO adjustments, net (5,410) 2,263 (5,500) (4,391) (5,002) 11,822 – – Less: Adjustments attributable to noncontrolling interests in investment entities 6,572 (11,717) (1,653) (409) (1,952) – (91) (215) Core FFO attributable to common interests in Operating Company and common stockholders $ (76,697) $ (154,211) $ 101,601 $ 10,066 $ 9,511 $ 7,068 $ (12,803) $ (39,192) Less: Core FFO (gains) losses 81,479 134,888 4,429 – – – – (389) Core FFO ex-gains/losses attributable to common interests in Operating Company and common stockholders $ 4,782 $ (19,323) $ 106,030 $ 10,066 $ 9,511 $ 7,068 $ (12,803) $ (39,581) Core FFO per common share / common OP unit (4) $ (0.14) $ (0.29) $ 0.19 $ 0.02 $ 0.02 $ 0.01 $ (0.02) $ (0.07) Core FFO per common share / common OP unit—diluted (4)(5)(6) $ (0.14) $ (0.29) $ 0.18 $ 0.02 $ 0.02 $ 0.01 $ (0.02) $ (0.07) Core FFO ex-gains/losses per common share / common OP unit (4) $ 0.01 $ (0.04) $ 0.20 $ 0.02 $ 0.02 $ 0.01 $ (0.02) $ (0.07) Core FFO ex-gains/losses per common share / common OP unit—diluted (4)(5)(6) $ 0.01 $ (0.04) $ 0.20 $ 0.02 $ 0.02 $ 0.01 $ (0.02) $ (0.07) W.A. number of common OP units outstanding used for Core FFO per common share and OP unit (4) 536,516 535,938 534,772 536,516 535,938 534,772 536,516 535,938 W.A. number of common OP units outstanding used for Core FFO per common share and OP unit-diluted (4)(5)(6) 536,516 535,938 562,709 536,516 535,938 562,709 536,516 535,938 (1) For the three months ended September 30, 2020, June 30, 2020 and September 30, 2019, net of $23.7 million consolidated or $8.9 million CLNY OP share, $2.1 million consolidated or $0.6 million CLNY OP share and $47.4 million consolidated or $41.8 million CLNY OP share, respectively, of depreciation, amortization and impairment charges previously adjusted to calculate FFO. (2) Represents adjustments to align the Company’s Core FFO and NRE’s Cash Available for Distribution (“CAD”) with CLNC’s definition of Core Earnings and NRE's definition of CAD to reflect the Company’s percentage interest in the respective company's earnings. (3) Restructuring and merger integration costs primarily represent costs and charges incurred as a result of corporate restructuring and reorganization to implement the digital evolution. These costs and charges include severance, retention, relocation, transition, shareholder settlement and other related restructuring costs, which are not reflective of the Company’s core operating performance and the Company does not expect to incur these costs subsequent to the completion of the digital evolution. (4) Calculated based on weighted average shares outstanding including participating securities and assuming the exchange of all common OP units outstanding for common shares. (5) For the three months ended September 30, 2020 and June 30, 2020 excluded from the calculation of diluted Core FFO per share is the effect of adding back interest expense associated with convertible senior notes and weighted average dilutive common share equivalents for the assumed conversion of the convertible senior notes as the effect of including such interest expense and common share equivalents would be antidilutive; and weighted average performance stock units, which are subject to both a service condition and market condition. (6) For the three months ended September 30, 2019, included in the calculation of diluted Core FFO per share is the effect of adding back $4.4 million of interest expense associated with convertible senior notes and 25.4 million of weighted average dilutive common share equivalents for the assumed conversion of the convertible senior notes; and are 2,451,400 weighted average performance stock units, which are subject to both a service condition and market condition, and 67,300 weighted average shares of non-participating restricted stock. (7) Includes Digital Operating and Digital Investment Management segments; excludes Digital Other. 27

Non-GAAP Reconciliations Three Months Ended Three Months Ended (In thousands) September 30, 2020 June 30, 2020 September 30, 2019 (In thousands) September 30, 2020 June 30, 2020 CLNY Share of Consolidated Revenues Digital Operating Adjusted EBITDA Determined as Follows Total Revenues $316,677 $286,734 $359,000 Net income (loss) from continuing operations ($38,479) ($21,142) Less: Non-controlling interest (151,533) (99,721) (82,344) Adjustments: CLNY pro-rata share of Revenues $165,144 $187,013 $276,656 Interest expense 18,589 8,170 Income tax (benefit) expense (6,091) (2,673) Digital Net Income (Loss) Depreciation and amortization 73,107 28,571 Digital Investment Management $3,539 $1,880 $41,841 Other (gain) loss 45 – Digital Operating (38,479) (21,142) – EBITDAre 47,171 12,926 Digital Other 6,757 12,716 (251) Straight-line rent expenses and amortization of Digital Net Income (Loss) ($28,183) ($6,546) $41,590 above- and below-market lease intangibles (2,106) 3,055 Amortization of leasing costs – (1,218) Compensation expense—equity-based 148 296 Digital Investment Management FRE Determined as Follows Installation services (65) 493 Net income (loss) $3,539 $1,880 $41,841 Restructuring & integration costs 470 445 Adjustments: Transaction, investment and servicing costs (50) 576 Interest income (2) (4) (7) Adjusted EBITDA $45,568 $16,573 Interest expense – – 1,585 CLNY ownership 15.2% 20.0% Depreciation and amortization 10,259 6,604 4,753 CLNY pro-rata share of Adjusted EBITDA $6,948 $3,318 Compensation expense—equity-based 1,101 682 – Administrative expenses—straight-line rent 14 16 37 Transaction Costs – – 199 Hospitality NOI Equity method earnings (losses)(1) (6,134) (157) 14 Net income (loss) from discontinued operations ($45,735) ($741,621) Other gain (loss), net (32) 8 (51,401) Adjustments: Income tax expense (benefit) 144 278 13,090 Straight-line rent revenue and amortization of Fee related earnings $8,889 $9,307 $10,111 above- and below-market lease intangibles (15) (16) Interest income (16) – Fee income $20,048 $20,173 $13,989 Interest expense 27,248 29,889 Other income 87 552 521 Transaction, investment and servicing costs 3,779 799 Compensation expense—cash (9,414) (9,208) (3,891) Depreciation and amortization 27,397 35,462 Administrative expenses (1,832) (2,210) (1,370) Impairment loss (69) 660,751 Equity method earnings (losses)(1) n/a n/a 862 Compensation and administrative expense 994 1,793 Fee related earnings $8,889 $9,307 $10,111 Other (gain) loss, net 123 (354) CLNY ownership 70.9% 100.0% 100.0% Income tax (benefit) expense (51) 6,691 CLNY pro-rata share of FRE $6,306 $9,307 $10,111 Hospitality NOI $13,655 ($6,606) (1) For the three months ended September 30, 2019, FRE includes the equity method earnings from the 50% interest in the manager of the $4 billion Digital Colony Partners fund prior to the closing of the DBH acquisition. 28

Important Note Regarding Non-GAAP Financial Measures This presentation includes certain “non-GAAP” supplemental measures that are not defined by generally accepted accounting principles, or GAAP, including the financial metrics defined below, of which the calculations may from methodologies utilized by other REITs for similar performance measurements, and accordingly, may not be comparable to those of other REITs. FFO: The Company calculates funds from operations (“FFO”) in accordance with standards established by the Board of Governors of the National Association of Real Estate Investment Trusts, which defines FFO as net income or loss calculated in accordance with GAAP, excluding (i) extraordinary items, as defined by GAAP; (ii) gains and losses from sales of depreciable real estate; (iii) impairment write-downs associated with depreciable real estate; (iv) gains and losses from a change in control in connection with interests in depreciable real estate or in-substance real estate, plus (v) real estate-related depreciation and amortization; and (vi) including similar adjustments for equity method investments. Included in FFO are gains and losses from sales of assets which are not depreciable real estate such as loans receivable, equity method investments, as well as equity and debt securities, as applicable. Core FFO: The Company computes core funds from operations (“Core FFO”) by adjusting FFO for the following items, including the Company’s share of these items recognized by its unconsolidated partnerships and joint ventures: (i) gains and losses from sales of depreciable real estate within the Other Equity and Debt segment, net of depreciation, amortization and impairment previously adjusted for FFO; (ii) gains and losses from sales of businesses within the Investment Management segment and impairment write-downs associated with the Investment Management segment; (iii) equity- based compensation expense; (iv) effects of straight-line rent revenue and expense; (v) amortization of acquired above- and below market lease values; (vi) amortization of deferred financing costs and debt premiums and discounts; (vii) unrealized fair value gains or losses on interest rate and foreign currency hedges, and foreign currency remeasurements; (viii) acquisition and merger related transaction costs; (ix) restructuring and merger integration costs; (x) amortization and impairment of finite lived intangibles related to investment management contracts and customer relationships; (xi) gain on remeasurement of consolidated investment entities and the effect of amortization thereof; (xii) Non-real estate fixed asset depreciation, amortization and impairment; (xiii) change in fair value of contingent consideration; and (xiv) tax effect on certain of the foregoing adjustments. Beginning with the first quarter of 2018, the Company’s Core FFO from its interest in Colony Credit Real Estate (NYSE: CLNC) represented its percentage interest multiplied by CLNC’s Core Earnings. Refer to CLNC’s filings with the SEC for the definition and calculation of Core Earnings. FFO and Core FFO should not be considered alternatives to GAAP net income as indications of operating performance, or to cash flows from operating activities as measures of liquidity, nor as indications of the availability of funds for our cash needs, including funds available to make distributions. FFO and Core FFO should not be used as supplements to or substitutes for cash flow from operating activities computed in accordance with GAAP. The Company uses FFO and Core FFO as supplemental performance measures because, in excluding real estate depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that captures trends in occupancy rates, rental rates, and operating costs. The Company also believes that, as widely recognized measures of the performance of REITs, FFO and Core FFO will be used by investors as a basis to compare its operating performance with that of other REITs. However, because FFO and Core FFO exclude depreciation and amortization and capture neither the changes in the value of the Company’s properties that resulted from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of its properties, all of which have real economic effect and could materially impact the Company’s results from operations, the utility of FFO and Core FFO as measures of the Company’s performance is limited. FFO and Core FFO should be considered only as supplements to GAAP net income as a measure of the Company’s performance. Additionally, Core FFO excludes the impact of certain fair value fluctuations, which, if they were to be realized, could have a material impact on the Company’s operating performance. The Company also presents Core FFO excluding gains and losses from sales of certain investments as well as its share of similar adjustments for CLNC. The Company believes that such a measure is useful to investors as it excludes periodic gains and losses from sales of investments that are not representative of its ongoing operations. Digital Operating Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate (EBITDAre) and Adjusted EBITDA: The Company calculates EBITDAre in accordance with the standards established by the National Association of Real Estate Investment Trusts, which defines EBITDAre as net income or loss calculated in accordance with GAAP, excluding interest, taxes, depreciation and amortization, gains or losses from the sale of depreciated property, and impairment of depreciated property. The Company calculates Adjusted EBITDA by adjusting EBITDAre for the effects of straight- line rental income/expense adjustments and amortization of acquired above- and below-market lease adjustments to rental income, equity-based compensation expense, restructuring and integration costs, transaction costs from unsuccessful deals and business combinations, litigation expense, the impact of other impairment charges, gains or losses from sales of undepreciated land, and gains or losses on early extinguishment of debt and hedging instruments. Revenues and corresponding costs related to the delivery of services that are not ongoing, such as installation services, are also excluded from Adjusted EBITDA. The Company uses EBITDAre and Adjusted EBITDA as supplemental measures of our performance because they eliminate depreciation, amortization, and the impact of the capital structure from its operating results. However, because EBITDAre and Adjusted EBITDA are calculated before recurring cash charges including interest expense and taxes and are not adjusted for capital expenditures or other recurring cash requirements, their utilization as a cash flow measurement is limited. Fee Related Earnings (“FRE”): The Company calculates FRE for its investment management business within the digital segment as base management fees, other service fee income, and other income inclusive of cost reimbursements, less compensation expense (excluding equity-based compensation), administrative expenses, and other operating expenses related to the investment management business. The Company uses FRE as a supplemental performance measure as it may provide additional insight into the profitability of the digital investment management business. Net Operating Income (“NOI”): NOI for our real estate segments represents total property and related income less property operating expenses, adjusted for the effects of (i) straight-line rental income adjustments; (ii) amortization of acquired above- and below-market lease adjustments to rental income; and (iii) other items such as adjustments for the Company’s share of NOI of unconsolidated ventures. The Company believes that NOI is a useful measure of operating performance of its respective real estate portfolios as it is more closely linked to the direct results of operations at the property level. NOI also reflects actual rents received during the period after adjusting for the effects of straight-line rents and amortization of above- and below- market leases; therefore, a comparison of NOI across periods better reflects the trend in occupancy rates and rental rates of the Company’s properties. NOI excludes historical cost depreciation and amortization, which are based on different useful life estimates depending on the age of the properties, as well as adjust for the effects of real estate impairment and gains or losses on sales of depreciated properties, which eliminate differences arising from investment and disposition decisions. This allows for comparability of operating performance of the Company’s properties period over period and also against the results of other equity REITs in the same sectors. Additionally, by excluding corporate level expenses or benefits such as interest expense, any gain or loss on early extinguishment of debt and income taxes, which are incurred by the parent entity and are not directly linked to the operating performance of the Company’s properties, NOI provides a measure of operating performance independent of the Company’s capital structure and indebtedness. However, the exclusion of these items as well as others, such as capital expenditures and leasing costs, which are necessary to maintain the operating performance of the Company’s properties, and transaction costs and administrative costs, may limit the usefulness of NOI. NOI may fail to capture significant trends in these components of U.S. GAAP net income (loss) which further limits its usefulness. NOI should not be considered as an alternative to net income (loss), determined in accordance with U.S. GAAP, as an indicator of operating performance. In addition, the Company’s methodology for calculating NOI involves subjective judgment and discretion and may differ from the methodologies used by other comparable companies, including other REITs, when calculating the same or similar supplemental financial measures and may not be comparable with other companies. Pro-rata: The Company presents pro-rata financial information, which is not, and is not intended to be, a presentation in accordance with GAAP. The Company computes pro-rata financial information by applying its economic interest to each financial statement line item on an investment-by- investment basis. Similarly, noncontrolling interests’ share of assets, liabilities, profits and losses was computed by applying noncontrolling interests’ economic interest to each financial statement line item. The Company provides pro-rata financial information because it may assist investors and analysts in estimating the Company’s economic interest in its investments. However, pro-rata financial information as an analytical tool has limitations. Other equity REITs may not calculate their pro-rata information in the same methodology, and accordingly, the Company’s pro-rata information may not be comparable to such other REITs' pro-rata information. As such, the pro-rata financial information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP but may be used as a supplement to financial information as reported under GAAP. 29