Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESCO INTERNATIONAL INC | wcc-20201104.htm |

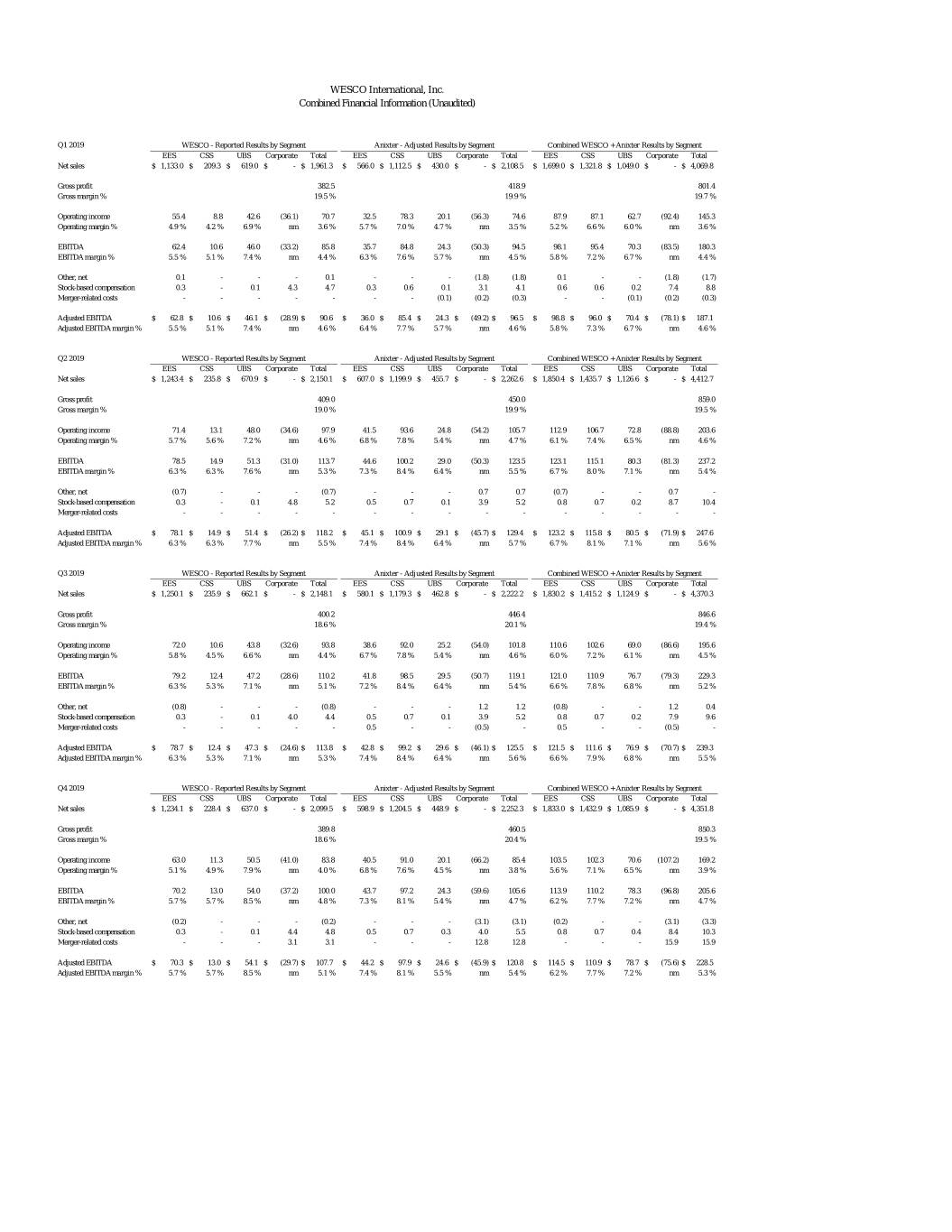

WESCO International, Inc. Combined Financial Information (Unaudited) Q1 2019 WESCO - Reported Results by Segment Anixter - Adjusted Results by Segment Combined WESCO + Anixter Results by Segment EES CSS UBS Corporate Total EES CSS UBS Corporate Total EES CSS UBS Corporate Total Net sales $ 1,133.0 $ 209.3 $ 619.0 $ - $ 1,961.3 $ 566.0 $ 1,112.5 $ 430.0 $ - $ 2,108.5 $ 1,699.0 $ 1,321.8 $ 1,049.0 $ - $ 4,069.8 Gross profit 244.3 45.5 92.7 - 382.5 127.7 235.5 55.7 - 418.9 801.4 Gross margin % 21.6 % 21.7 % 15.0 % nm 19.5 % 22.6 % 21.2 % 13.0 % nm 19.9 % 19.7 % Operating income 55.4 8.8 42.6 (36.1) 70.7 32.5 78.3 20.1 (56.3) 74.6 87.9 87.1 62.7 (92.4) 145.3 Operating margin % 4.9 % 4.2 % 6.9 % nm 3.6 % 5.7 % 7.0 % 4.7 % nm 3.5 % 5.2 % 6.6 % 6.0 % nm 3.6 % EBITDA 62.4 10.6 46.0 (33.2) 85.8 35.7 84.8 24.3 (50.3) 94.5 98.1 95.4 70.3 (83.5) 180.3 EBITDA margin % 5.5 % 5.1 % 7.4 % nm 4.4 % 6.3 % 7.6 % 5.7 % nm 4.5 % 5.8 % 7.2 % 6.7 % nm 4.4 % Other, net 0.1 - - - 0.1 - - - (1.8) (1.8) 0.1 - - (1.8) (1.7) Stock-based compensation 0.3 - 0.1 4.3 4.7 0.3 0.6 0.1 3.1 4.1 0.6 0.6 0.2 7.4 8.8 Merger-related costs - - - - - - - (0.1) (0.2) (0.3) - - (0.1) (0.2) (0.3) Adjusted EBITDA $ 62.8 $ 10.6 $ 46.1 $ (28.9) $ 90.6 $ 36.0 $ 85.4 $ 24.3 $ (49.2) $ 96.5 $ 98.8 $ 96.0 $ 70.4 $ (78.1) $ 187.1 Adjusted EBITDA margin % 5.5 % 5.1 % 7.4 % nm 4.6 % 6.4 % 7.7 % 5.7 % nm 4.6 % 5.8 % 7.3 % 6.7 % nm 4.6 % Q2 2019 WESCO - Reported Results by Segment Anixter - Adjusted Results by Segment Combined WESCO + Anixter Results by Segment EES CSS UBS Corporate Total EES CSS UBS Corporate Total EES CSS UBS Corporate Total Net sales $ 1,243.4 $ 235.8 $ 670.9 $ - $ 2,150.1 $ 607.0 $ 1,199.9 $ 455.7 $ - $ 2,262.6 $ 1,850.4 $ 1,435.7 $ 1,126.6 $ - $ 4,412.7 Gross profit 260.7 50.1 98.2 - 409.0 136.0 253.1 60.9 - 450.0 859.0 Gross margin % 21.0 % 21.2 % 14.6 % nm 19.0 % 22.4 % 21.1 % 13.4 % nm 19.9 % 19.5 % Operating income 71.4 13.1 48.0 (34.6) 97.9 41.5 93.6 24.8 (54.2) 105.7 112.9 106.7 72.8 (88.8) 203.6 Operating margin % 5.7 % 5.6 % 7.2 % nm 4.6 % 6.8 % 7.8 % 5.4 % nm 4.7 % 6.1 % 7.4 % 6.5 % nm 4.6 % EBITDA 78.5 14.9 51.3 (31.0) 113.7 44.6 100.2 29.0 (50.3) 123.5 123.1 115.1 80.3 (81.3) 237.2 EBITDA margin % 6.3 % 6.3 % 7.6 % nm 5.3 % 7.3 % 8.4 % 6.4 % nm 5.5 % 6.7 % 8.0 % 7.1 % nm 5.4 % Other, net (0.7) - - - (0.7) - - - 0.7 0.7 (0.7) - - 0.7 - Stock-based compensation 0.3 - 0.1 4.8 5.2 0.5 0.7 0.1 3.9 5.2 0.8 0.7 0.2 8.7 10.4 Merger-related costs - - - - - - - - - - - - - - - Adjusted EBITDA $ 78.1 $ 14.9 $ 51.4 $ (26.2) $ 118.2 $ 45.1 $ 100.9 $ 29.1 $ (45.7) $ 129.4 $ 123.2 $ 115.8 $ 80.5 $ (71.9) $ 247.6 Adjusted EBITDA margin % 6.3 % 6.3 % 7.7 % nm 5.5 % 7.4 % 8.4 % 6.4 % nm 5.7 % 6.7 % 8.1 % 7.1 % nm 5.6 % Q3 2019 WESCO - Reported Results by Segment Anixter - Adjusted Results by Segment Combined WESCO + Anixter Results by Segment EES CSS UBS Corporate Total EES CSS UBS Corporate Total EES CSS UBS Corporate Total Net sales $ 1,250.1 $ 235.9 $ 662.1 $ - $ 2,148.1 $ 580.1 $ 1,179.3 $ 462.8 $ - $ 2,222.2 $ 1,830.2 $ 1,415.2 $ 1,124.9 $ - $ 4,370.3 Gross profit 256.8 48.6 94.8 - 400.2 132.9 251.9 61.6 - 446.4 846.6 Gross margin % 20.5 % 20.6 % 14.3 % nm 18.6 % 22.9 % 21.4 % 13.3 % nm 20.1 % 19.4 % Operating income 72.0 10.6 43.8 (32.6) 93.8 38.6 92.0 25.2 (54.0) 101.8 110.6 102.6 69.0 (86.6) 195.6 Operating margin % 5.8 % 4.5 % 6.6 % nm 4.4 % 6.7 % 7.8 % 5.4 % nm 4.6 % 6.0 % 7.2 % 6.1 % nm 4.5 % EBITDA 79.2 12.4 47.2 (28.6) 110.2 41.8 98.5 29.5 (50.7) 119.1 121.0 110.9 76.7 (79.3) 229.3 EBITDA margin % 6.3 % 5.3 % 7.1 % nm 5.1 % 7.2 % 8.4 % 6.4 % nm 5.4 % 6.6 % 7.8 % 6.8 % nm 5.2 % Other, net (0.8) - - - (0.8) - - - 1.2 1.2 (0.8) - - 1.2 0.4 Stock-based compensation 0.3 - 0.1 4.0 4.4 0.5 0.7 0.1 3.9 5.2 0.8 0.7 0.2 7.9 9.6 Merger-related costs - - - - - 0.5 - - (0.5) - 0.5 - - (0.5) - Adjusted EBITDA $ 78.7 $ 12.4 $ 47.3 $ (24.6) $ 113.8 $ 42.8 $ 99.2 $ 29.6 $ (46.1) $ 125.5 $ 121.5 $ 111.6 $ 76.9 $ (70.7) $ 239.3 Adjusted EBITDA margin % 6.3 % 5.3 % 7.1 % nm 5.3 % 7.4 % 8.4 % 6.4 % nm 5.6 % 6.6 % 7.9 % 6.8 % nm 5.5 % Q4 2019 WESCO - Reported Results by Segment Anixter - Adjusted Results by Segment Combined WESCO + Anixter Results by Segment EES CSS UBS Corporate Total EES CSS UBS Corporate Total EES CSS UBS Corporate Total Net sales $ 1,234.1 $ 228.4 $ 637.0 $ - $ 2,099.5 $ 598.9 $ 1,204.5 $ 448.9 $ - $ 2,252.3 $ 1,833.0 $ 1,432.9 $ 1,085.9 $ - $ 4,351.8 Gross profit 248.4 48.0 93.4 - 389.8 137.9 262.5 60.1 - 460.5 850.3 Gross margin % 20.1 % 21.0 % 14.7 % nm 18.6 % 23.0 % 21.8 % 13.4 % nm 20.4 % 19.5 % Operating income 63.0 11.3 50.5 (41.0) 83.8 40.5 91.0 20.1 (66.2) 85.4 103.5 102.3 70.6 (107.2) 169.2 Operating margin % 5.1 % 4.9 % 7.9 % nm 4.0 % 6.8 % 7.6 % 4.5 % nm 3.8 % 5.6 % 7.1 % 6.5 % nm 3.9 % EBITDA 70.2 13.0 54.0 (37.2) 100.0 43.7 97.2 24.3 (59.6) 105.6 113.9 110.2 78.3 (96.8) 205.6 EBITDA margin % 5.7 % 5.7 % 8.5 % nm 4.8 % 7.3 % 8.1 % 5.4 % nm 4.7 % 6.2 % 7.7 % 7.2 % nm 4.7 % Other, net (0.2) - - - (0.2) - - - (3.1) (3.1) (0.2) - - (3.1) (3.3) Stock-based compensation 0.3 - 0.1 4.4 4.8 0.5 0.7 0.3 4.0 5.5 0.8 0.7 0.4 8.4 10.3 Merger-related costs - - - 3.1 3.1 - - - 12.8 12.8 - - - 15.9 15.9 Adjusted EBITDA $ 70.3 $ 13.0 $ 54.1 $ (29.7) $ 107.7 $ 44.2 $ 97.9 $ 24.6 $ (45.9) $ 120.8 $ 114.5 $ 110.9 $ 78.7 $ (75.6) $ 228.5 Adjusted EBITDA margin % 5.7 % 5.7 % 8.5 % nm 5.1 % 7.4 % 8.1 % 5.5 % nm 5.4 % 6.2 % 7.7 % 7.2 % nm 5.3 %

WESCO International, Inc. Combined Financial Information (Unaudited) Fiscal Year 2019 WESCO - Reported Results by Segment Anixter - Adjusted Results by Segment Combined WESCO + Anixter Results by Segment EES CSS UBS Corporate Total EES CSS UBS Corporate Total EES CSS UBS Corporate Total Net sales $ 4,860.6 $ 909.4 $ 2,589.0 $ - $ 8,359.0 $ 2,352.0 $ 4,696.2 $ 1,797.4 $ - $ 8,845.6 $ 7,212.6 $ 5,605.6 $ 4,386.4 $ - $ 17,204.6 Gross profit 1,010.2 192.2 379.1 - 1,581.5 534.5 1,003.0 238.3 - 1,775.8 3,357.3 Gross margin % 20.8 % 21.1 % 14.6 % nm 18.9 % 22.7 % 21.4 % 13.3 % nm 20.1 % 19.5 % Operating income 261.8 43.8 184.9 (144.3) 346.2 153.1 354.9 90.2 (230.7) 367.5 414.9 398.7 275.1 (375.0) 713.7 Operating margin % 5.4 % 4.8 % 7.1 % nm 4.1 % 6.5 % 7.6 % 5.0 % nm 4.2 % 5.8 % 7.1 % 6.3 % nm 4.1 % EBITDA 290.3 50.9 198.5 (130.0) 409.7 165.8 380.7 107.1 (210.9) 442.7 456.1 431.6 305.6 (340.9) 852.4 EBITDA margin % 6.0 % 5.6 % 7.7 % nm 4.9 % 7.0 % 8.1 % 6.0 % nm 5.0 % 6.3 % 7.7 % 7.0 % nm 5.0 % Other, net (1.6) - - - (1.6) - - - (3.0) (3.0) (1.6) - - (3.0) (4.6) Stock-based compensation 1.2 - 0.4 17.5 19.1 1.8 2.7 0.6 14.9 20.0 3.0 2.7 1.0 32.4 39.1 Merger-related costs - - - 3.1 3.1 0.5 - (0.1) 12.1 12.5 0.5 - (0.1) 15.2 15.6 Adjusted EBITDA $ 289.9 $ 50.9 $ 198.9 $ (109.4) $ 430.3 $ 168.1 $ 383.4 $ 107.6 $ (186.9) $ 472.2 $ 458.0 $ 434.3 $ 306.5 $ (296.3) $ 902.5 Adjusted EBITDA margin % 6.0 % 5.6 % 7.7 % nm 5.1 % 7.1 % 8.2 % 6.0 % nm 5.3 % 6.3 % 7.7 % 7.0 % nm 5.2 % Q1 2020 WESCO - Reported Results by Segment Anixter - Adjusted Results by Segment Combined WESCO + Anixter Results by Segment EES CSS UBS Corporate Total EES CSS UBS Corporate Total EES CSS UBS Corporate Total Net sales $ 1,114.5 $ 223.7 $ 630.4 $ - $ 1,968.6 $ 542.2 $ 1,080.6 $ 448.9 $ - $ 2,071.7 $ 1,656.7 $ 1,304.3 $ 1,079.3 $ - $ 4,040.3 Gross profit 233.7 46.6 96.1 - 376.4 125.6 229.8 61.0 - 416.4 792.8 Gross margin % 21.0 % 20.8 % 15.2 % nm 19.1 % 23.2 % 21.3 % 13.6 % nm 20.1 % 19.6 % Operating income 43.3 9.9 41.8 (34.1) 60.9 32.2 70.5 23.6 (54.9) 71.4 75.5 80.4 65.4 (89.0) 132.3 Operating margin % 3.9 % 4.4 % 6.6 % nm 3.1 % 5.9 % 6.5 % 5.3 % nm 3.4 % 4.6 % 6.2 % 6.1 % nm 3.3 % EBITDA 50.2 11.8 45.3 (30.3) 77.0 35.2 76.9 28.0 (58.2) 81.9 85.4 88.7 73.3 (88.5) 158.9 EBITDA margin % 4.5 % 5.3 % 7.2 % nm 3.9 % 6.5 % 7.1 % 6.2 % nm 4.0 % 5.2 % 6.8 % 6.8 % nm 3.9 % Other, net - - - - - - - - 6.6 6.6 - - - 6.6 6.6 Stock-based compensation 0.4 - 0.1 4.1 4.6 0.4 0.8 0.2 3.2 4.6 0.8 0.8 0.3 7.3 9.2 Merger-related costs - - - 4.6 4.6 - - - 2.9 2.9 - - - 7.5 7.5 Adjusted EBITDA $ 50.6 $ 11.8 $ 45.4 $ (21.6) $ 86.2 $ 35.6 $ 77.7 $ 28.2 $ (45.5) $ 96.0 $ 86.2 $ 89.5 $ 73.6 $ (67.1) $ 182.2 Adjusted EBITDA margin % 4.5 % 5.3 % 7.2 % nm 4.4 % 6.6 % 7.2 % 6.3 % nm 4.6 % 5.2 % 6.9 % 6.8 % nm 4.5 % Q2 2020 WESCO - Reported Results by Segment Anixter - Adjusted Results by Segment Combined WESCO + Anixter Results by Segment EES CSS UBS Corporate Total EES CSS UBS Corporate Total EES CSS UBS Corporate Total Net sales $ 993.0 $ 215.7 $ 656.2 $ - $ 1,864.9 $ 471.0 $ 1,044.4 $ 438.9 $ - $ 1,954.3 $ 1,464.0 $ 1,260.1 $ 1,095.1 $ - $ 3,819.2 Gross profit 205.0 46.3 97.4 - 348.7 111.3 222.4 58.8 - 392.5 741.2 Gross margin % 20.6 % 21.5 % 14.8 % nm 18.7 % 23.6 % 21.3 % 13.4 % nm 20.1 % 19.4 % Operating income 42.0 14.6 48.6 (96.4) 8.8 29.8 82.9 25.5 (88.1) 50.1 71.8 97.5 74.1 (184.5) 58.9 Operating margin % 4.2 % 6.8 % 7.4 % nm 0.5 % 6.3 % 7.9 % 5.8 % nm 2.6 % 4.9 % 7.7 % 6.8 % nm 1.5 % EBITDA 48.7 16.4 52.1 (101.4) 15.8 33.1 90.4 29.9 (77.2) 76.2 81.8 106.8 82.0 (178.6) 92.0 EBITDA margin % 4.9 % 7.6 % 7.9 % nm 0.8 % 7.0 % 8.7 % 6.8 % nm 3.9 % 5.6 % 8.5 % 7.5 % nm 2.4 % Other, net 0.7 - - - 0.7 - - - (1.0) (1.0) 0.7 - - (1.0) (0.3) Stock-based compensation 0.4 - 0.1 4.5 5.0 1.3 2.1 0.5 9.5 13.4 1.7 2.1 0.6 14.0 18.4 Merger-related costs - - - 61.5 61.5 - 0.6 - 39.2 39.8 - 0.6 - 100.7 101.3 Adjusted EBITDA $ 49.8 $ 16.4 $ 52.2 $ (35.4) $ 83.0 $ 34.4 $ 93.1 $ 30.4 $ (29.5) $ 128.4 $ 84.2 $ 109.5 $ 82.6 $ (64.9) $ 211.4 Adjusted EBITDA margin % 5.0 % 7.6 % 8.0 % nm 4.5 % 7.3 % 8.9 % 6.9 % nm 6.6 % 5.8 % 8.7 % 7.5 % nm 5.5 % Q2 2020 - GAAP Results Reported Results by Segment (1) EES CSS UBS Corporate Total Net sales $ 1,043.0 $ 341.9 $ 701.8 $ - $ 2,086.7 Gross profit 215.8 74.4 103.6 - 393.8 Gross margin % 20.7 % 21.8 % 14.8 % nm 18.9 % Operating income 45.7 28.1 51.8 (110.3) 15.3 Operating margin % 4.4 % 8.2 % 7.4 % nm 0.7 % EBITDA 53.1 32.2 55.9 (116.8) 24.4 EBITDA margin % 5.1 % 9.4 % 8.0 % nm 1.2 % Other, net 0.7 - - - 0.7 Stock-based compensation 0.4 0.1 0.1 5.3 5.9 Merger-related costs - - - 73.4 73.4 Adjusted EBITDA $ 54.2 $ 32.3 $ 56.0 $ (38.1) $ 104.4 Adjusted EBITDA margin % 5.2 % 9.4 % 8.0 % nm 5.0 % (1) Includes the impact of the Anixer merger for the period June 22 to June 30, 2020