Attached files

| file | filename |

|---|---|

| 10-Q - Nano Magic Holdings Inc. | form10-q.htm |

| EX-32.1 - Nano Magic Holdings Inc. | ex32-1.htm |

| EX-31.2 - Nano Magic Holdings Inc. | ex31-2.htm |

| EX-31.1 - Nano Magic Holdings Inc. | ex31-1.htm |

| EX-10.3 - Nano Magic Holdings Inc. | ex10-3.htm |

| EX-10.2 - Nano Magic Holdings Inc. | ex10-2.htm |

| EX-10.1 - Nano Magic Holdings Inc. | ex10-1.htm |

Exhibit 10.4

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT IN ACCORDANCE WITH REGULATION S-K ITEM 601(a)(6) BECAUSE IT WOULD CONSTITUTE A CLEARLY UNWARRANTED INVASION OF PERSONAL PRIVACY. [*] INDICATES THAT INFORMATION HAS BEEN REDACTED.”;

NOWaccount Network Corporation

2300 Peachtree Road NW Suite C-102 Atlanta, GA 30309

www.nowaccount.com

Instructions for Completing the

NOWaccount® Merchant Services Agreement and

Client Information Form

| 1. | Please read the details of the NOWaccount Merchant Services Agreement (“MSA”) contained in Exhibit A that follows the Cover Page and the Client Information Form. |

| 2. | Sign the MSA Cover Page. |

| 3. | Complete the Client Information Form. |

| 4. | A copy of the signed Agreement will be emailed to you. |

If there are any questions, please call

the NOWaccount Membership Team at:

855-9-NOWHELP (855-966-9435), Extension 3

or email us at membership@nowaccount.com.

NOWACCOUNT MERCHANT SERVICES AGREEMENT

Version 2.2f (March 1, 2019)

(Cover Page)

By its signature below, the undersigned (“Client” or “we” or “us”) hereby adopts and agrees to be bound by and agrees to all of the terms and conditions set forth in the NOWaccount Merchant Services Agreement, Version 2.2f. rev (August 19, 2020) , attached hereto as Exhibit A (the “MSA”), which terms and conditions are incorporated herein by reference. Each capitalized term used herein and not otherwise defined herein has the meaning given to it in the MSA.

We request that payments of the Purchase Price and other payments to be credited or debited to our account accordance with the MSA be credited or debited to the bank deposit account listed Bank ACH Deposit Directions form, attached hereto.

The MSA shall not become effective until accepted by NOW in Atlanta, Georgia, notice of which acceptance is hereby waived by us.

IN WITNESS WHEREOF, the undersigned has caused the MSA to be signed, sealed and delivered on the date specified below.

| Authorized Signatory: | ||

| Date: _____9-1-20________ ___, 20___ | /s/ Tom J. Berman | |

| Legal Name of Business: Nano Magic LLC | ||

| Title: | President & CEO | |

| [Seal] | ||

| Company EIN: _[*]__ |

| Accepted in Atlanta, Georgia, as of the date specified above: | ||

| NOWaccount Network Corporation | ||

| By: | /s/ Earl Camp | |

| Name: | Earl Camp | |

| Page 2 of 20 |

Client Information Form and ACH Deposit Directions

What do you expect your total revenue (sales) to be for the next 12 months? $___[*]__________. (We need this information to estimate how much capital and customer credit to allocate for your businesses.)

Please provide the information on the bank deposit account where the funds from

NOWaccount will be deposited via ACH or wire, if you request a wire. Please note that some banks have ACH and wire deposit bank numbers that are different from the routing numbers on the face of a check. (We will debit the amount of the Annual NOW Network Membership Fee from this account to verify. Please let us know the exact date of the debit to complete this process.)

| Either: |

| ● | Email to start@nowaccount.com a voided copy (picture is fine) of your check for the deposit account, or | |

| ● | Provide the information below: |

Deposit Account in Name of _____[*]__________________________________________

(This is usually the business legal name)

Bank Deposit Account Number: [*] __________________________

ACH Routing Number (9 digits): [*]__________________ (See directions below) *Wire Routing Number (Verify with your bank): _____________________(See asterisk below)

(Please see next page for example of Deposit Account Number and Routing Code)

Name of Financial Institution: _____[*]_______

_____________________________________________________________________

Address of Financial Institution:

* Bank wire routing numbers may be different from ACH routing numbers.

| Page 3 of 20 |

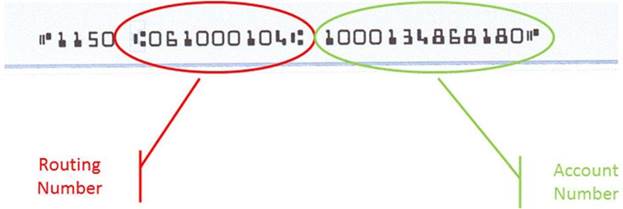

Finding Routing Numbers and Account Numbers

The following example shows where to find the Account Number and the 9 digit ACH Routing Number on most checks. The ACH Routing Number is the one usually found on checks, but NOT the one found on deposit slips.

Note that some financial institutions have a separate routing number for ACH deposits and Wire Transfers. NOWaccount will make deposits to your account via ACH unless you request a Wire Transfer. (A fee applies for each Wire Transfer – See Schedule 1 for Fees.). We may ask you to contact your bank to obtain the correct routing numbers before we can transfer funds.

You may also send a copy (picture is fine) of a voided check for us to double check the routing and account numbers. If you send the voided check, please also complete the form above.

Please email: start@nowaccount.com if help is needed!

Exhibit A

NOWaccount® Merchant Services Agreement

Version 2.2f. rev (August 19, 2020)

| 1. | DEFINITIONS. Capitalized terms not herein defined shall have the meaning set forth in the Uniform Commercial Code as adopted and in force in the State of Georgia (the “UCC”). The terms “you” and “your” and “Seller” mean the organization executing this Agreement; and the terms “us” and “we” and “NOW” mean NOWaccount Network Corporation, a Delaware business corporation with its principal place of business in Atlanta, Georgia. In addition, the following terms shall have the following meanings (terms defined in the singular to have the same meaning when used in the plural, and vice versa): |

| Page 4 of 20 |

“Account Related Property” means, with respect to any Purchased Account owed by a Buyer, all of your rights, interests, securities, guaranties and Liens with respect to such Account, including (a) all unpaid seller’s rights (including rights of rescission, replevin, reclamation, and stoppage in transit), (b) all claims of Lien filed or held by you on any property of the Buyer or any other Person, (c) all rights and interests in the Inventory sold to the extent returned by or repossessed from the Buyer, (d) all rights, remedies and benefits under all instruments or agreements between you and the Buyer, (e) all Documents, Instruments, Chattel Paper (including Electronic Chattel Paper), General Intangibles (including Payment Intangibles) that are given to evidence the terms or amount of payment or the terms of sale in respect of such Account, and (f) without duplication, all Supporting Obligations and Letter-of-Credit Rights related to or assuring payment of such Account.

“Applicable Law” means any law, rule, or regulation (whether state, federal or foreign) that may be applicable to the agreement, conduct, transaction, proceeding, other matter in question.

“Application” means the application made by you to us for the establishment of a NOWaccount.

“Books and Records” has the meaning given to it in Section 22 hereof.

“Buyer” means a Person to whom you sell Inventory or render services in the ordinary course of your business (each such Buyer being an “account debtor” as defined in the UCC) identified on Schedule 3 as amended from time to time by agreement of the parties.

“Buyer Claims” has the meaning given to it in Section 9 hereof.

“Buyer Credit Line” means, with respect to any Buyer, a credit line authorized by our credit department with respect to such Buyer.

“ Collateral “ has the meaning given to it in Section 19 hereof.

“Contract Year” means period beginning on the acceptance of this Agreement by NOW and ending twelve (12) months thereafter.

“Cover Page of this Agreement” means a page to which this Agreement is attached that references and incorporates the terms and conditions set forth herein (whether that page exists in physical form or electronic form) and is executed between you and us, such execution witnessed by physical signatures, electronic signatures pursuant to the Uniform Electronic Transaction Act, or otherwise.

“Credit Approval” means, with respect to any Buyer, a credit approval by our Credit Department of the Buyer, your terms of sale to such Buyer, and the amount and duration of a Buyer Credit Line for such Buyer.

“Event of Default” has the meaning given to it in Section 26 hereof.

“Funding Source” has the meaning given to it in Section 25 hereof.

“Immediate Payment” has the meaning given to it in Sections 3 and 14 hereof.

“Insolvency Proceeding” means a case or proceeding that is filed by or against a Person under any Applicable Law: (i) to obtain the appointment of a receiver, custodian, trustee or conservator for such Person or any such Person’s assets; (ii) as an assignment or trust mortgage for the benefit of creditors of such Person; or (iii) for an order for relief under the Bankruptcy Code or any other insolvency law.

| Page 5 of 20 |

“Lien” means a security interest, mortgage, or statutory lien or other encumbrance, whether arising by contract or under Applicable Law.

“NOW Risk Account” has the meaning given to it in Section 5 hereof.

“NOWaccount” means the services provided to the Seller under this Agreement.

“Obligations” means all indebtedness, liabilities and other obligations owed by you to us at any time or times, whether due or to become due, absolute or conditional, direct or indirect, secured or unsecured and whether arising or incurred under this Agreement, any other agreement or otherwise, including all fees and charges set forth in Section 23 hereof and charge-backs under Section 16 hereof.

“Online System” has the meaning given to it in Section 4 hereof.

“Other Funding Source” has the meaning given to it in Section 25 hereof.

“Payment Admin Account” has the meaning given to it in Section 3.

“Person” means any individual or entity, including a corporation, partnership, limited liability company, trust or state, federal or foreign government or any agency, department or subdivision thereof.

“Purchased Account” has the meaning given to it in Section 3 hereof.

“Purchase Price” has the meaning given to it in Section 11 hereof.

“SBCC” has the meaning given to it in Section 25 hereof.

“Seller Credit Line” has the meaning given to it in Section 21 hereof.

“Statement of Account” has the meaning given to it in Section 18 hereof.

| 2. | TERM; TERMINATION. This Agreement shall remain effective for a term of two (2) years, unless sooner terminated as provided herein. At least thirty (30) days prior to the expiration of the term of this Agreement, we will review your status with us and notify you if we will not be able to renew this Agreement. You may terminate this Agreement at any time by giving us at least fifteen (15) days prior written notice, provided that on or before the effective date of such termination you have paid all Obligations in full and all NOW Risk Accounts are paid in full. Any notice of termination is ineffective and shall not be recognized as long as there are Obligations and NOW Risk Accounts outstanding. We may terminate this Agreement immediately, without prior notice to you, upon or after the occurrence of an Event of Default. All Obligations shall become immediately due and payable upon any termination of this Agreement without further notice to or demand upon you. Upon termination of this Agreement, we will not purchase from you any new Accounts. Upon payment in full of all Obligations, we shall record any terminations or satisfactions of any Lien we hold in your property (other than Purchased Accounts and Account Related Property in respect of Purchased Accounts). All of our rights, remedies and Liens hereunder shall continue in full force and effect after any termination of this Agreement. No termination of this Agreement shall diminish, release or otherwise affect any of our rights, remedies, Liens, powers, or privileges hereunder, or any of your covenants, duties or Obligations hereunder, until indefeasible payment in full of all of the Obligations. |

| Page 6 of 20 |

| 3. | SALE OF ACCOUNTS. You agree to sell and assign to us, and, subject to all of the terms and conditions hereof, we agree to purchase as absolute owner, all Accounts at any time due from each Buyer identified on Schedule 3, to the extent that such Accounts qualify as Immediate Payment Accounts (also called PaymentNOW accounts) and arise from your sales of Inventory or your rendition of services to that Buyer in the ordinary course of your business, including any sales made by you under any trade names (including any trade names listed on Cover Page of this Agreement), through any divisions and through any selling agent (such Accounts purchased by us are referred to as the “Purchased Accounts” and individually as a “Purchased Account”). Other accounts owed to you from those Buyers will be Payment Admin Accounts under this Agreement (Payment Admin Accounts). You agree to deliver to each Buyer under a Purchased Account, and concurrently deliver a copy of us, no later than thirty (30) days after delivery of the goods or completion of the services for which the Purchased Account arises an invoice or other request for payment, in a form acceptable to us and you agree to give us copies of invoices for all Payment Admin Accounts.. |

| Each such sale, assignment, and transfer automatically shall become effective upon the creation of the respective Purchased Account, and is intended to be unconditional, absolute, and remain effective in accordance with the terms of this Agreement even if a bankruptcy case is filed by or against you or you otherwise become insolvent. You irrevocably authorize us to file financing statements, and all amendments and continuations with respect thereto, to perfect our ownership of the Purchased Accounts. You will notify us of the existence of each Purchased Account by sending us copies of the invoice and files as specified in Sections 4 and 22. Each Purchased Account will be for a Buyer who is credit approved as provided in Section 4 hereof so that it is “Immediate Payment and a NOW Risk Account as provided in Section 5. Other accounts due from that Buyer will not be purchased accounts, but will be Payment Admin Accounts under this Agreement. | |

| 4. | CREDIT APPROVAL. Requests for Credit Approval for any Buyer to be added to Schedule 3 must be submitted to our Credit Department via our Online System URL specified on the Cover Page of this Agreement or such other URL as we may direct (“Online System”). All credit decisions by our Credit Department (including approvals, declines, or holds) will be sent to you via the Online System by a Credit Decision Report, which constitutes the official record of our credit decision. Credit Approvals will be effective only for Accounts that represent sales of Inventory or services to Buyers whose principal place of business, primary assets and jurisdiction of organization is in the United States of America, Canada, or a country listed in the Country List published on the Online System as updated from time to time (excluding private individuals not carrying out a commercial activity). We may in our discretion at any time withdraw Credit Approval of any Buyer or terms of sale to such Buyer and reflect the change on the Online System. Withdrawal of Credit Approval of a Buyer will not change the terms applicable to a NOW Risk Account in existence immediately prior to such withdrawal being reflected on the Online System. |

| 5. | CREDIT RISK. Subject to our rights of charge-back under Section 16 hereof, we assume the Credit Risk on all Immediate Payment Accounts for each Buyer that is credit approved at the time the Accounts are purchased as and to the extent stated in the Credit Decision Report. “Credit Risk” means, with respect to any Purchased Account, the Buyer’s failure to pay the Purchased Account when due by its longest maturity date solely because of the Buyer’s financial inability to pay. A Purchased Account on which we bear the Credit Risk is a “NOW Risk Account” and all Purchased Accounts hereunder will be NOW Risk Accounts. If there is any change in the amount, terms, shipping date, or delivery date for any shipment of Inventory or rendition of services (other than accepting returns and granting allowances as provided in this Agreement), you must submit a change of terms notice to us in writing. If any NOW Risk Account is not paid for any reason other than Credit Risk (including as a result of any Buyer Claims), you will promptly notify us and we will on discovery charge your account accordingly, and we shall have the rights provided for in this Agreement with respect to such NOW Risk Account, including, but not limited to, charge-back rights as provided in Section 16. |

| Page 7 of 20 |

| 6. | NO LIABILITY; NO FIDUCIARY DUTIES. We will have no liability to you or to any other Person for declining, withholding, or withdrawing Credit Approval of any Buyer, or declining to approve or reducing the amount of any requested Buyer Credit Line. If we decline to approve credit on a Buyer and furnish to you any information regarding the credit standing of that Buyer, such information is confidential, and you agree not to reveal same to any Person other than the Buyer or your sales agent. You agree that we have no obligation to perform, in any respect, any of your contracts or obligations relating to any Accounts, whether or not the same are Purchased Accounts. You acknowledge and agree that we have no fiduciary duties to you, and any sums that we may be required to pay or turn over to you at any time shall be owed solely pursuant to a debtor/creditor relationship. |

| 7. | BUYER NON-APPROVAL. We will not grant Credit Approval (and any Credit Approval that is granted by us shall be deemed to have been withdrawn without notice to you) for any Buyer if at the time such Buyer is submitted to us for such Credit Approval: (a) payment of any Account that is proposed for purchase by us is overdue, (b) any other Account owing by such Buyer to you is ninety (90) days or more overdue, (c) the due date of any Account owing by such Buyer to you that is proposed for purchase is more than ninety (90) days from invoice date. In addition, we will not grant Credit Approval for a Buyer if when submitted for Credit Approval if (d) the amount of the Account would increase our exposure to the Buyer beyond the Buyer Credit Line for such Buyer, or (e) any of the following apply with respect to such Buyer: (i) an Insolvency Proceeding is filed by or against such Buyer; (ii) there is outstanding against such Buyer or any of its assets an unsatisfied order or judgment of a court or award of an arbitrator; (iii) the Buyer has made an offer of settlement or compromise to its creditors generally (or a majority thereof), whether or not such offer of settlement or compromise has become final and binding; (iv) if such Buyer is an individual (whether or not operating a business under a trade name or as a sole proprietor), such Buyer absconds, is adjudicated mentally incompetent by a court or law, or dies; (v) all or a material part of the assets of such Buyer are subject to a local, state, federal or foreign Lien for unpaid taxes that are not being actively contested in good faith and by appropriate proceedings; (vi) such Buyer sells, assigns or otherwise transfers, in bulk, all or a substantial part of such Buyer’s stock in trade or proposes to do so; (vii) such Buyer has been indicted or convicted of a crime that is punishable as a felony under the laws of the applicable jurisdiction; (viii) an event has occurred elsewhere than in the United States of America, which is, in our sole opinion, substantially equivalent in effect under Applicable Law to any of the events listed above; or (ix) such situations or events occur or are threatened which, in our sole opinion, impair the credit, trustworthiness, or integrity of such Buyer or any of its principals. |

| Page 8 of 20 |

| 8. | INVOICING; STATEMENTS; NOTICES. You agree to place a conspicuous notice (in form and content acceptable to us and as initially specified on Schedule 1 of this Agreement and as we may specify from time to time on the Online System) on each invoice (including invoices transmitted to your Buyers electronically), or other request for payment, that the Purchased Account and any Payment Admin Account is payable only at the address and in the manner specified on Schedule 1 of this Agreement or as otherwise specified by us, and, at our election, that such Purchased Account is sold and assigned to us (or a party we designate); and you agree to take all steps necessary to instruct Buyers to make all payments and remittances to us, including at our sole discretion and at our sole expense the use of third-party notification or remittance security services. We may, in our sole discretion, change at any time the notice specified herein and the remittance address. Unless we otherwise direct, all invoices for Buyers will be promptly mailed or otherwise transmitted by you to us after delivery to your Buyers. You will provide us, within five (5) business days after our request therefor, with paper or electronic copies of all confirmation of the sale of the Purchased Accounts to us, proof of shipment, proof of delivery, proof of rendering service, and other documents relating to the sale or services, all as we may request. If you fail to provide us with copies of such invoices or other requests for payment, or such proof or documents as we request, on a timely basis after requested by us, the Purchased Accounts of those Buyers will be subject to our charge-back rights under Section 16. At our sole discretion, we may send to Buyer a statement of account of their Accounts on a monthly or other basis; and such statements may bear your name as the Seller and our remittance addresses and telephone numbers. You agree that we can disclose to Buyer, and send to any Buyer notices of, the sale and assignment of any Purchased Account at any time or times, and we will be free to inform any Buyer of the sale of such Accounts upon inquiry by Buyer. |

| 9. | ACCOUNT REPRESENTATIONS AND WARRANTIES. You represent and warrant to us that (a) each of your Accounts with a Buyer arises from a bona fide sale and delivery of Inventory or rendition of services made by you in the ordinary course of your business, and no such sale and delivery of Inventory or rendition of services is unlawful or illegal; (b) any Inventory being sold by you to a Buyer and each Purchased Account created and Purchased Account Related Property are your exclusive property and are not, and will not be, subject to any Lien or consignment arrangement other than Liens in favor of us and Liens otherwise disclosed to us in writing prior to your entering into this Agreement; (c) all amounts in respect of your Accounts with Buyers are due and payable in U.S. dollars; (d) all original invoices with respect to Purchased Accounts conform to the notice requirements of Section 8; (e) any taxes or fees relating to your Accounts or Inventory are solely your responsibility; (f) none of the Purchased Accounts represents a sale to any subsidiary, affiliate, or parent company of Seller; (g) you have absolute and indefeasible ownership in, and title to, all of your Accounts with Buyers, with full right and power to assign, transfer, and sell them to us (and, upon your sale of such Accounts to us, they shall be), free and clear of all Liens other than Liens disclosed to us in writing prior to your entering into this Agreement; and (h) if you have disclosed a Lien pursuant to Section 9(b) other than a Lien in favor of us, your sale of Accounts to us that are subject to any such Lien and our receipt and retention of the proceeds of such Purchased Account does not violate the terms of any agreement that you have with the holder of such Lien. You also warrant and represent that with respect to all Accounts with Buyers: your Buyers have accepted the goods or services and owe and are obligated to pay the full amounts stated in the invoices according to their terms, without dispute, claim, offset, defense, deduction, rejection, recoupment, counterclaim, or contra account, other than as to returns and allowances as provided in this Agreement (the foregoing being referred to as “Buyer Claims”). |

| Page 9 of 20 |

| 10. | SELLER REPRESENTATIONS AND WARRANTIES; INFORMATION COVENANTS. In addition to all other representations and warranties that you have made to us in writing or by electronic means, you further represent and warrant that (a) your legal name is exactly as set forth on Cover Page; (b) you are a duly organized and validly existing business organization incorporated, registered, or otherwise lawfully organized in the state set forth on the Cover Page or in the Application, and are qualified to do business in all states where required; (c) all information provided in the Application or any other document submitted to us is true and complete and accurately and properly reflects your business, financial condition, and principal partners, owners, and officers; (d) each Person signing this Agreement on your behalf has the authority to execute and perform this Agreement and the power to bind you to all provisions of this Agreement; (e) your signature and performance of this Agreement will not violate any Applicable Law or conflict with any other agreement to which you are subject; (f) there is no action, suit, or proceeding pending or, to your knowledge, threatened against you or any of your property which if decided adversely would impair your ability to carry on your business as presently conducted or adversely affect your financial condition or operations; and (g) the most recent financial statements provided by you to us from time to time accurately reflect your financial condition as of that date and there has been no material adverse change in your financial condition since the date of those financial statements. You shall furnish us, via our Online System where possible, with such information concerning your business affairs, financial condition, and the Collateral as we may reasonably request from time to time, including quarterly financial statements in an electronic form and final annual financial statements as of the end of each of your fiscal years. You shall promptly notify us of any changes in or to the following: your name, state of organization, location of and contact information for your chief executive office, place(s) of business, and legal or business structure and of any change in control of the ownership of your business organization, any material adverse change in your business, and of lawsuits, proceedings, or other legal claims asserted against you or any of your assets. |

| 11. | PURCHASE PRICE FOR ACCOUNTS. The purchase price for each Purchased Account shall be the gross amount of the invoice less (a) discounts (calculated on the shortest terms), credits, allowances, present or future taxes, levies, imposts, duties, fees, assessments, deductions, retainage, offsets, withholdings or similar charges, or other discounts available to or taken by a Buyer, and (b) our fees and other charges pursuant to Section 23 hereof (the “Purchase Price”). Our purchase of the Purchased Accounts will be reflected on the Statement of Account (defined in Section 18 below), which we shall render to you via our Online System. You will promptly update the Online System to reflect all credits and discounts made available to your Buyers. |

| 12. | [Reserved.] |

| 13. | PAYMENT OF OBLIGATIONS; RECOUPMENT AND SET-OFF. All Obligations and any other amounts you owe us, including any debit balance in your Seller Position Account (described in Section 18 below), are payable upon termination of this Agreement whether or not demand for payment thereof has ever been made. All Obligations shall be deemed to be and shall be treated as loans or other extensions of credit by us to you. We have the right of recoupment and set-off, which means that we may offset any outstanding Obligations against any amounts we would otherwise be obligated to pay you, under this Agreement, provided that prior to termination of this Agreement or default, offset will be limited as stated in Section 16. Our rights in this Section are not intended to be exclusive of each other or of any of our other rights and remedies in this Agreement, at law or in equity; rather, each of our rights under this Agreement, at law or in equity, is concurrent with and in addition to every other right. |

| Page 10 of 20 |

| 14. | TIMING AND REMITTANCE OF ACCOUNT PAYMENTS. We will pay you the Purchase Price of such Purchased Account by remittance to you or to the bank account you designate on the Cover Sheet or otherwise in writing to us, provided that, if we receive notice of the existence of any Lien in respect of any Purchased Account, we may, in our discretion, remit such payment to the holder of such Lien and, if the amount of such payment exceeds the amount secured by such Lien, we shall have no liability to you and you shall address and resolve any claim for such excess solely and directly with such holder. We will remit to you for Immediate Payment, the Purchase Price, within five (5) business day after we purchase an Account. Notwithstanding the foregoing, if the aggregate amount of Immediate Payment Purchased Accounts owed by a Buyer on any date exceeds the Buyer Credit Line for such Buyer in effect on that date, we may defer payment of the Purchase Price on Immediate Payment Purchased Accounts owed by such Buyer until such time as the aggregate amount of Immediate Purchased Accounts owed by such Buyer is equal to or less than the Buyer Credit Line for such Buyer and, until that time, the Account will be a Payment Admin Account. Subject to charge-backs under Section 16, we will remit to you promptly, and in any even within five (5) business days after receipt, Payments we receive from Buyers with respect to Payment Admin Accounts. |

| 15. | BUYER CLAIMS AND CREDIT MEMOS. You shall notify us promptly of any matter affecting the validity, enforceability, or collectability of any Purchased Account, including all Buyer Claims. You shall promptly issue credit memoranda or otherwise adjust each Purchased Account upon accepting returns or granting allowances with respect thereto. We shall cooperate with you in the adjustment of Buyer Claims for Payment Admin Accounts, but we retain the right to adjust Buyer Claims on NOW Risk Accounts directly with the Buyer upon such terms as we in our discretion may deem advisable. You agree to provide us via our Online System with an explanation and supporting documentation for any credit memo or other account adjustment you provide to a Buyer. |

| 16. | CHARGE-BACKS. We will maintain sub-accounts for each Buyer for which there are Purchased Accounts or Payment Admin Accounts and may at any time charge-back to your account for a Buyer the amount of: (a) any NOW Risk Account with that Buyer that is not paid in full when due for any reason other than Credit Risk; (b) any NOW Risk Account with that Buyer that is not paid in full when due because of an act of force majeure, civil strife, or war or other political risk; (c) any Purchased Account subject to any Buyer Claims from that Buyer; and (d) any Purchased Account with that Buyer in respect of which there is a breach of any representation or warranty made by you or a breach of any of your obligations in Section 8 hereof. We shall immediately charge to a Buyer’s sub-account under your account any deduction taken by that Buyer. A charge-back does not constitute a reassignment of an Account, but you may request that an Account that has been charged back be reassigned to you and we may at our sole discretion make that reassignment to you, provided that such reassignment does not comprise or otherwise limit our ability to collect from that Buyer on other Accounts owned by us or otherwise compromise our position. We will take charge-backs related to accounts with a particular Buyer, and will apply amounts received from a particular Buyer, only to the sub-account related to that Buyer, and charge-backs related to accounts with a different Buyer or payments received from the different Buyer will only be taken and applied with respect to the sub-account maintained for that Buyer. |

| Page 11 of 20 |

| 17. | HANDLING AND COLLECTING ACCOUNTS; POWER OF ATTORNEY. You acknowledge that, pursuant to Section 9-318 of the UCC, you do not retain any legal or equitable interest in any of the Purchased Accounts. As owner of the Purchased Accounts, we have the sole and exclusive right to (a) bring suit, or otherwise enforce collection, in your name or ours, (b) modify the terms of payment, (c) settle, compromise, or release, in whole or in part, any amounts owing, and (d) issue credits in your name or ours. To the extent applicable, you waive any and all claims and defenses based on suretyship. You agree that you will not deposit any checks or other items received from Buyers for whom unpaid Purchased Accounts exist, even if that payment relates to a Payment Admin Account with such a Buyer or does not relate to a Purchased Account with that Buyer. Any checks, cash, notes, or other documents or instruments, proceeds, or property you receive with respect to the Purchased Accounts shall be held by you in trust for us (“Trust Funds”), separate from your own property, and immediately turned over to us with proper endorsements. You acknowledge that failure to turn over Trust Funds in a timely basis may constitute theft. We may endorse your name or ours on any such check, draft, instrument, or document. Without limiting the generality of the foregoing, you hereby appoint NOW as your agent and attorney-in-fact, with full authority in the place and stead of Seller and in the name of Seller or otherwise, from time to time in our discretion to take any action and to execute any instrument which we may deem necessary or advisable to obtain payment of Purchased Accounts (but NOW shall not be obligated to and shall have no liability to Seller or any other Person for failure to do so). This appointment and power of attorney, being coupled with an interest, shall be irrevocable. |

| 18. | STATEMENT OF ACCOUNT. After the end of each month, we will provide you, via our Online System, certain reports reflecting Purchased Accounts, Payment Admin Accounts, amounts paid, fees and charges, and all other financial transactions between NOW and you and between NOW and Buyers who are account debtors on Purchased Accounts and Payment Admin Accounts during that month (“Reports”). The Reports provided to you each month will include a Statement of Account reflecting transactions in three sections: Accounts Receivable, Seller Position Account, and a Statement of Funds reflecting transactions. Each statement, report, or accounting rendered or issued by us to you shall be deemed conclusively accurate and binding on you, absent manifest error, unless within thirty (30) days after the date we notify you that the report is ready you notify us to the contrary , setting forth with specificity the reasons why you believe such statement, report, or accounting is inaccurate, as well as what you believe to be correct amount(s) therefor and your computation thereof. Your failure to access our Online System shall not relieve you of the responsibility to review such statements, and your failure to do so shall nonetheless bind you to whatever our records report. |

| 19. | GRANT OF SECURITY INTEREST. As security for the payment and performance of all of the Obligations, you hereby assign and grant to us a continuing security interest in all of your right, title, and interest in and to all of the following types and items of your property, whether now owned or existing or hereafter created or arising and wherever located (herein collectively the “Collateral”): (a) Purchased Accounts, (b) all Account Related Property in respect of each Purchased Account, and (c) all Books and Records that evidence or relate to or evidence any of the foregoing. The foregoing security interest, to the extent that it is granted in any Purchased Account and Account Related Property in respect of such Purchased Account, is in addition to and not in lieu of the ownership interest obtained by us in respect of all Purchased Accounts and Account Related Property in respect of such Purchased Accounts pursuant to Applicable Law (including Section 9-102(a)(72)(D) of the UCC), it being the intent hereof that you sell, grant and convey to us, and we acquire from you, absolute title and full ownership rights with respect to all of the Purchased Accounts and Account Related Property in respect of such Purchased Accounts. |

| Page 12 of 20 |

| 20. | PERFORMANCE AND COMPLIANCE. We shall have no obligation to perform, in any respect, any contracts relating to any of your Accounts. You agree to comply with all Applicable Law to perfect our security interest in the Collateral, and to execute such documents as we may require to effectuate the foregoing and to implement this Agreement. You irrevocably authorize us to file financing statements, and all amendments and continuations with respect thereto, in order to create, perfect, or maintain our security interest in the Collateral, and you hereby ratify and confirm any and all financing statements, amendments, and continuations with respect thereto heretofore and hereafter filed by us pursuant to the foregoing authorization. With respect to such security interest, we will have all rights afforded under the UCC, any other Applicable Law, and in equity. You shall not grant or assign, or suffer to exist, any security interest in or other Lien upon any of the Collateral other than in favor of us and statutory Liens that may attach to any Collateral under any Applicable Law in the ordinary course of your business so long as any such statutory Lien is at all times junior and subordinate in priority to the security interests granted by you to us in the Collateral. |

| 21. | SELLER LINE OF CREDIT. In order for us to approve the purchase of Accounts from you by which you may now or in the future incur Obligations or other indebtedness to us, we will establish a line of credit for you (the “Seller Credit Line”) in an amount equal to or greater than the total amount of all Purchased Accounts that we expect to be outstanding at any one time. We may at our cost, but will have no duty to, secure credit insurance or credit guarantees in connection with the any Accounts or Seller Credit Line at any time. You agree to provide such additional information as may be necessary for us to obtain the Seller Credit Line, insurance, or guarantees. We may increase, reduce, or cancel the Seller Credit Line at any time in our sole discretion, in which case we will notify you of such change; provided, however, that our failure to notify you of a change in the Seller Credit Line in no way alters our right to make or the effectiveness of such changes. Should we elect in our discretion to purchase from you Accounts in an aggregate amount outstanding at any time that is greater than the Seller Credit Line, that election will not be deemed to be a change in the Seller Credit Line. |

| 22. | BOOKS AND RECORDS; EXAMINATIONS; AUDITS. You shall provide to us any financial information required in this Agreement within fifteen (15) days after the end of period covered by the report. You shall reflect our ownership of the Purchased Accounts therein. “Books and Records” means your accounting and financial records (whether maintained in paper, computer, or electronic media), data, tapes, discs, or other media, and all programs, files, records, and procedure manuals relating thereto, wherever located. You shall send to us electronically at least monthly a copy from your accounting system of the Buyer file for Purchased Accounts and Payment Admin Accounts, and invoice file reflecting Purchased Accounts and Payment Admin Accounts with each Buyer. You further authorize us to make, from time to time, any business and personal credit or other inquiries we consider necessary to review the Application or continue to provide services under this Agreement. You also authorize any Person or credit reporting agency to compile information to answer those credit inquiries and to furnish such information to us. |

| Page 13 of 20 |

| 23. | FEES AND OTHER CHARGES. For our services hereunder, you will pay us the fees as set forth in Schedule 2 of this Agreement as adjusted annually as described in this Section 23. We will notify you at least thirty (30) days prior if there are to be any changes in the fees. For each Purchased Account, you will pay us a transaction fee as reflected on Schedule 2 that includes a cost of funds and risk fee, as it may be modified by us from time to time as our system-wide cost of funds and risk increase. If we elect to deduct such additional fees, those fees will be applied pro-rata for all Sellers system-wide. The annual membership fee will be paid at the beginning of each Contract Year. The transaction fees will be charged as transactions with respect to Purchased Accounts are entered. For Accounts arising from the sales to Buyers located outside of the United States of America you will pay us an additional fee that is the greater of (a) the international surcharge listed in Schedule 2, and (b) the country fee as listed in the Country Fee Schedule posted on our Online System from time-to-time. Certain high-risk Buyers, domestic and international, may incur an additional charge, of which you will be advised either at the time credit is requested or renewed or posted on your list of Buyer credit lines on our Online System. |

| 24. | TAXES. Any tax, fee or other charge of any governmental authority imposed on or arising from any transactions between us, any sales made by you, or any Inventory relating to such sales, is your sole responsibility (other than income and franchise taxes imposed on us which are not related to any specific transaction between us). If we are required to withhold or pay any such tax, fee or other charge, or any interest or penalties thereon, you hereby indemnify and hold us harmless therefrom and we shall charge your account with the full amount thereof. |

| 25. | SUCCESSORS AND ASSIGNS; ASSIGNMENT OF AGREEMENT. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns; provided, however, that you may not assign this Agreement or any of your rights, powers or privileges hereunder, in whole or in part, without our prior express written consent (which may be given or withhold in our absolute discretion) and any attempted assignment in violation of this provision shall be void and of no force and effect. We have advised you, and you hereby acknowledge, consent and agree, that we may (a) transfer, sell and assign to Small Business Credit Cooperative, Inc., a Georgia non-profit corporation (“SBCC”),all of our right, title and interest in, to and under this Agreement, including all of the Obligations, the Purchased Accounts, the Liens granted to us hereunder, and all remedies, powers and privileges hereunder (collectively, the “Assigned Assets”) and (b) delegate to SBCC the performance of all of our covenants and undertakings under this Agreement. From and after the transfer, sale, assignment and delegation to it, SBCC shall be deemed to be a party to this Agreement in the place and stead of NOW, and NOW shall no longer have any obligations hereunder to you; all references herein to “us,” “we” or “NOW” shall be understood to mean SBCC and its successors and assigns; SBCC may grant a security interest in all of SBCC’s right, title and interest in and to the Assigned Assets; to or in favor of one or more Persons (or collateral agents for such Persons) that are SBCC’s funding sources and that provide funding to SBCC to facilitate its purchase of the Purchased Accounts (each such Person and each collateral agent for such Person, is called a “Funding Source”); and SBCC may, in its discretion at any time, with or without notice to you and without your consent, transfer, sell and assign all of its right, title and interest in and to the Assigned Assets to a Person who shall thereupon become substituted for SBCC and in its place and stead, with SBCC thereupon having no further liability hereunder. In no event shall any claims that you may have under this Agreement be made against any Person other than a Person who at the time of the assertion of such claim is the present owner and holder of all right, title and interest in and to the Assigned Assets; and in no event shall any Person that holds a security interest in the Assigned Assets to secure payment of any indebtedness owed by the owner of such Assigned Assets have any liability or responsibility to you hereunder, even after the date on which the holder of such security interest may become the owner of the Assigned Assets as result of enforcement of its security interest therein. In the event of any assignment to SBCC, we may be engaged by SBCC as servicing agent and, if so, you will be authorized to interact with us and to utilize the Online System as provided herein, as if we had not assigned the Assigned Assets to SBCC; provided, however, that you will ultimately be authorized and directed to take direction with respect to the Assigned Assets from any Person whom either we or SBCC has identified as one of SBCC’s funding sources. We have advised you, and you hereby acknowledge, consent and agree, that we may transfer, sell, and assign to a funding source other than SBCC (an “Other Funding Source”) all of our right, title and interest in, to and under this Agreement, including all of the Obligations, the Purchased Accounts, the Liens granted to us hereunder, and all remedies, powers and privileges hereunder (collectively, the “Assigned Assets”), and delegate to the Other Funding Source the performance of all of our covenants and undertakings under this Agreement. In the event we make such transfer, sale, or assignment to an Other Funding Source, such Other Funding Source shall have the all of the rights and privileges otherwise afforded to SBCC in this Section 25. |

| Page 14 of 20 |

| 26. | EVENTS OF DEFAULT; REMEDIES UPON DEFAULT. The occurrence of any one or more of the following events or conditions shall constitute an “Event of Default” hereunder and shall entitle us to exercise any or all of the rights and remedies specified herein, in any other agreement between us, or otherwise available to us under Applicable Law: (a) any Insolvency Proceeding is commenced by or against you; (b) any representation or warranty made by you in this Agreement shall prove to be false in any material respect or you breach any covenant contained in this Agreement, including covenants set forth in any attachment or other addendum to this Agreement; (c) you fail to pay any of the Obligations when due; (d) any breach or default shall have occurred under any other agreement or arrangement between us; or (e) any guarantor of the whole or any part of the Obligations shall become insolvent, revoke or attempt to revoke its guaranty or dispute its liability thereunder. After the occurrence and during the continuance of an Event of Default, we may terminate this Agreement without notice to you (whereupon all of the Obligations will become immediately due and payable as provided in Section 2 hereof), demand payment of any and all of the Obligations (provided that all of the Obligations shall become immediately due and payable, without notice or demand, if an Event of Default occurs under clause (a) of this Section 26), and exercise all rights and remedies available to us under this Agreement or Applicable Law, including the right to collect from and settle Buyer Claims with Buyers in respect of Purchased Accounts owed by such Buyers. We shall continue to have a security interest in and access to all Collateral. Furthermore, as may be necessary to administer and enforce our rights in the Accounts and any other Collateral, or to facilitate the collection or realization thereof, we may use (at your expense) your personnel, supplies, equipment, computers and space, at your place of business or elsewhere, and to open and inspect any mail delivered to you and to remove therefrom any checks or other items of payment that constitute proceeds of any of the Collateral. We may without advertisement, sell, lease or otherwise dispose of any or all of the Collateral, at public or private sale, for cash, on credit, or otherwise in our discretion, and we may bid or become purchasers at any such sale, free from any right of redemption, which is hereby expressly waived by you. If notice of intended disposition of any Collateral is required by law, it is agreed that ten (10) business days-notice constitutes reasonable notice. The cash proceeds resulting from the exercise of any of the foregoing rights, after deducting all charges, costs, and expenses, including attorneys’ fees, will be applied by us to the payment or satisfaction of the Obligations, whether due or to become due, in such order as we may elect. You remain liable to us for any deficiencies. With respect to Purchased Accounts, you hereby confirm that we are the owners thereof, and that our rights of ownership permit us to deal with this property as owner and you confirm that you have no interest therein. We shall be entitled to any form of equitable relief that may be appropriate without having to establish any inadequate remedy at law or other grounds other than to establish that our Accounts or the Collateral are subject to being improperly used, moved, dissipated, or withheld from us. If we deem it necessary to seek equitable relief, including injunctive or receivership remedies, as a result of any Event of Default, you waive any requirement that we post or otherwise obtain or procure any bond. Alternatively, if we, in our discretion elect to do so, we may procure and file with the court a bond in an amount up to and not greater than $1,000 notwithstanding any common or statutory law requirement to the contrary. Upon our posting of such bond, we shall be entitled to all benefits as if such bond was posted in compliance with Applicable Law. We shall have no duty to undertake to collect (or make further efforts to collect) any Account, including those concerning which we receive information from a Buyer that Buyer Claims exist or those concerning which we have received information that causes us to conclude that there is little likelihood of recovery. If we undertake to collect from or enforce an obligation of a Buyer or other Person obligated on Collateral and ascertain that the possibility of collection is outweighed by the likely costs and expenses that will be incurred, we may at any such time cease any further collection efforts and such action shall be considered commercially reasonable. You agree to reimburse us for all costs associated with collecting unpaid Obligations, including without limitation attorneys’ fees, and the fees of other parties, including accountants, field examiners, and collection agencies. All of the rights, remedies, powers and privileges conferred upon us hereunder shall be deemed to be conferred upon and be exercisable by each Funding Source in connection with the repayment of loans or other extensions of credit to us by such Funding Source. |

| Page 15 of 20 |

| 27. | INDEMNIFICATION. You agree to indemnify, defend, and hold us and our employees, officers, directors, and agents, harmless from and against, and reimburse us for: (a) all claims (including claims made by third parties), losses, damages, liabilities or expenses (including attorneys’ fees) arising out of this Agreement, (b) all costs and expenses (including attorneys’ fees), that we may incur in administering or enforcing this Agreement, preparing any documents prepared in connection herewith, or in protecting, preserving, or enforcing any Lien or other right granted by you to us or arising under Applicable Law, whether or not a suit is brought; (c) the actual costs, including photocopying, travel, attorneys’ fees, and expenses incurred in complying with any subpoena or other legal process attendant to any litigation in which you or we are a party; (d) all reasonable costs and expenses, including attorneys’ fees, which we may incur in connection herewith, or in connection with any federal or state insolvency proceeding commenced by or against you, including those (i) arising out the automatic stay, (ii) seeking dismissal or conversion of the bankruptcy case, or (iii) opposing confirmation of any reorganization or liquidation plan filed in any such case. Notwithstanding the foregoing, you are not required to indemnify us for actions or omission by us or by our employees, officers, directors or agents that are grossly negligent or deliberately, knowingly or willfully taken in breach of this Agreement or Applicable Law. The foregoing indemnification shall survive any termination of this Agreement. |

| 28. | ATTORNEYS’ FEES. agree that we shall be entitled to recover any attorneys’ fees and costs that may be incurred by us in connection with any action, suit or other proceeding arising out of or related to this Agreement or any act or failure to act hereunder or as a result of any Event of Default. |

| 29. | CONFIDENTIALITY; PROPRIETARY INTEREST. You will at all times keep confidential and protect and conserve all our Confidential Information. You will not disclose any of our Confidential Information to any Person except as required by Applicable Law. NOW will at all times keep confidential and protect and preserve all your Confidential Information. NOW will not disclose any of your Confidential Information to any Person except as required by Applicable Law. If you receive a password from us to access any of our databases or services, you will (i) keep the password confidential, (ii) not allow any Person to use the password or gain access to our databases or services, (iii) be liable for any actions taken by any user of the password, and (iv) promptly notify us if you believe that our databases or services or your information has been compromised by the use of the password. You have no interest whatsoever, including copyright interests, franchise interests, license interests, patent rights, property rights, or other interest in any services, software, systems, models, or hardware we provide. Nothing in this Agreement will be construed as granting you any patent rights or patent license in any patent that we may obtain with respect to our services, software, systems, models, or hardware. “Confidential Information” means all information that is proprietary to either party and to which the other party obtains knowledge of or access to as a result of the relationship created by this Agreement or other agreements between us. |

| Page 16 of 20 |

| 30. | MISCELLANEOUS. This Agreement, and all attendant documentation (including all attachments, exhibits, addenda, and the Application), as the same may be amended or supplemented from time to time, constitutes the entire agreement between us with regard to the subject matter hereof, and supersedes any prior or contemporaneous agreements or understandings, whether written or oral, regarding the same subject matter. Our failure or delay in exercising any right or remedy hereunder will not constitute a waiver thereof or bar us from exercising any of our rights or remedies at any time. Section headings are for convenience of reference only and shall not affect the meaning or interpretation of this Agreement. |

| 31. | ONLINE GUIDE. The NOW Seller Service Guide, as supplemented and amended from time to time (the “Guide”) has been furnished to you via our Online System concurrently with the signing of this Agreement, and by your signature below you acknowledge the existence thereof. The Guide provides information on Credit Approval processes and accounting procedures and other information specified in this Agreement. The procedures for electronic transmission of credit requests and invoices are covered in the Guide. From time to time, we may provide you with amendments, additions, modifications, revisions, or supplements to the Guide via publication on our Online System, which will be operative for transactions between us. All information and exhibits contained in the Guide, on any screen accessed by you, and on any print-outs, reports, statements, or notices received by you are, and will be, our exclusive property and are not to be disclosed to, or used by, anyone other than you, your employees, or your professional advisors, in whole or in part, unless we have consented in writing. |

| 32. | THIRD PARTY BENEFICIARIES. We shall be permitted to deliver to each Funding Source a copy of any information we deliver or otherwise make available to you pursuant to this Agreement and any information that you have provided to us, and each Funding Source shall be a third party beneficiary of and under this Agreement. Except as expressly provided in this Section 32, no Person who is not a party hereto shall be deemed a beneficiary of any of the provisions of this Agreement. |

| Page 17 of 20 |

| 33. | CONSTRUCTION. The word “including” means “including without limitation.” All references to our “discretion” shall be understood to mean our sole and absolute discretion. All amounts to be paid by us to you hereunder, or to be paid by you to us hereunder, and all amounts to be paid in respect of any Account shall be paid in U.S. dollars. If any provision of this Agreement is contrary to, prohibited by, or otherwise deemed invalid or unenforceable under Applicable Law, such provision will be inapplicable and deemed omitted to such extent, but the remainder of the provisions hereof will not be invalidated thereby and will be given effect so far as possible, and the invalidity or unenforceability of that provision will not affect any of the remaining provisions. |

| 34. | NOTICES. Your notices to us shall be made by (i) email to the Official Email address listed on Cover Page, (ii) such other Official Email as has been entered into our Online System, or (iii) by posting a notice on our Online System. . You agree to notify us promptly of any changes in your address. Our notices to you shall be made by (i) email to the Official Email address listed on Cover Page, (ii) such other Official Email as has been entered into our Online System, or (iii) by posting a notice on our Online System. |

| 35. | CONTACTING BUYERS. You authorize us to contact any Buyers who are account debtors under Purchased Accounts if we determine that such contact is necessary to obtain information about any transaction between you and such Buyer, whether or not an Event of Default exists. |

| 36. | LIMITATIONS ON LIABILITY. You acknowledge that our transaction fees and other fees for the services provided by us to you hereunder are very small in relation to the Purchase Price and, consequently, our willingness to provide such services is induced by the following limitation of liability. Therefore, in addition to any other limitations on our liability that may be provided elsewhere, our liability under this Agreement, whether to you or any other Person and regardless of the basis therefor, shall not exceed, in the aggregate, the unpaid Purchase Price reflected on your Statement of Account at the time notice of such breach is first given to us, in writing. Under no circumstances shall we be liable for any incidental, special, consequential, punitive or exemplary damages, including loss of goodwill, loss of profit, or any other losses associated therewith, whether we did or did not have any reason to know of a loss that may result from any general or particular requirement of yours. We make no other warranty, express or implied, regarding our services, and nothing contained in this Agreement will constitute such a warranty. We will not be liable for any failure or delay in our performance of this Agreement if such failure or delay arises for reasons beyond our control and without our fault or negligence. Our relationship shall be that of seller and purchaser of Accounts, and neither party is or shall be deemed a fiduciary of or to the other except to the extent that you will be deemed to owe us a fiduciary duty and serve as our trustee with respect to all payments you receive on Accounts from Buyers in violation of the notice of assignment provided in Section 8. |

| 37. | BANKRUPTCY. This Agreement shall be deemed to be one of financial accommodation and shall not be assumable in any bankruptcy case without our express written consent and may be suspended in the event a petition in bankruptcy is filed by or against you. |

| Page 18 of 20 |

| 38. | NOTICE TO EMPLOYEES. You acknowledge that you have fully informed each of your employees involved in maintaining Books and Records relating to Accounts of (i) the duty to accurately provide information pertaining to and in the submission of offering Accounts to us for sale and that such obligations with respect thereto are non-delegable and that each of your principals has been fully informed that he or she shall remain fully responsible for the accuracy of all such information delivered to us regardless of who is delegated the responsibility to provide us such information, and (ii) the duties imposed by this Agreement. |

| 39. | COOPERATION. If any Collateral includes property that requires a method of perfection different from that under Article 9 of the UCC, you hereby agree that we are authorized to take such action as may be required to duly perfect our Liens, and that you will cooperate with us in that regard. |

| 40. | DISCLOSURE OF IDENTITY. You agree that we may identify you as a Seller, to banks and funding or financing sources, investors, auditors, lawyers, and other advisors. We may include data about our transactions with you in aggregate reporting and for analytical purposes; however, we agree to hold specific information about you (other than your name, industry, and location), in confidence, except for information provided to a Person that is providing funding for you, providing credit insurance or other credit protection on your Buyers, auditors or other advisors reviewing our books and records, rating agencies, or where we are compelled to do so by Applicable Law or legal process. |

| 41. | AMENDMENTS. We may propose amendments or additions to this Agreement, and, if we do so, we will inform you of any such proposed change in a periodic statement or other notice. You will be deemed to have agreed to this change if you do not object to the same by written notice to us within thirty (30) days of your receipt thereof. |

| 42. | EXECUTION. This Agreement may be signed in one or more counterparts, each of which shall constitute an original and all of which, taken together, shall constitute one and the same agreement. Delivery of the various documents and instruments comprising this Agreement may be accomplished by facsimile transmission, and such a signed facsimile transmission shall constitute a signed original. This Agreement may be executed electronically pursuant to the Uniform Electronic Transactions Act. |

| 43. | JURY TRIAL WAIVER. IN RECOGNITION OF THE HIGHER COSTS AND DELAY WHICH MAY RESULT FROM A JURY TRIAL, THE PARTIES HERETO WAIVE ANY RIGHT TO TRIAL BY JURY OF ANY CLAIM, DEMAND, ACTION, OR CAUSE OF ACTION (A) ARISING HEREUNDER, OR (B) IN ANY WAY CONNECTED WITH OR RELATED OR INCIDENTAL TO THE DEALINGS OF THE PARTIES HERETO OR ANY OF THEM WITH RESPECT HERETO, IN EACH CASE WHETHER NOW EXISTING OR HEREAFTER ARISING, AND WHETHER SOUNDING IN CONTRACT OR TORT OR OTHERWISE; AND EACH PARTY FURTHER WAIVES ANY RIGHT TO CONSOLIDATE ANY SUCH ACTION IN WHICH A JURY TRIAL HAS BEEN WAIVED WITH ANY OTHER ACTION IN WHICH A JURY TRIAL CANNOT BE OR HAS NOT BEEN WAIVED; AND EACH PARTY HEREBY AGREES AND CONSENTS THAT ANY SUCH CLAIM, DEMAND, ACTION, OR CAUSE OF ACTION SHALL BE DECIDED BY COURT TRIAL WITHOUT A JURY, AND THAT ANY PARTY HERETO MAY FILE AN ORIGINAL COUNTERPART OR A COPY OF THIS SECTION WITH ANY COURT AS WRITTEN EVIDENCE OF THE CONSENT OF THE PARTIES HERETO TO THE WAIVER OF THEIR RIGHT TO TRIAL BY JURY. |

| Page 19 of 20 |

| 44. | GOVERNING LAW; VENUE. This Agreement and all transactions contemplated hereunder or evidenced hereby shall be governed by, construed under, and enforced in accordance with the internal laws of the State of Georgia (without giving effect to its conflict of law rules), provided that if you are located in a state different than the State of Georgia, we shall be entitled to apply the internal laws of the State in which you are located (i.e., where you are incorporated, authorized to do business, or physically located) if such laws are more favorable to us with respect to any portion of this Agreement, including the waiver of jury trial provision contained in Section 43. You agree that we may elect to apply the law of such state in order to make any provision hereof enforceable. Either partyshall be entitled to require that any controversy or claim arising out of or relating to the Agreement, or any breach thereof, be settled by arbitration administered by the American Arbitration Association under its Commercial Arbitration Rules. The arbitration proceeding shall be conducted before one neutral arbitrator, who shall be a member of the State Bar of Georgia actively engaged in the practice of law for at least twenty (20) years. The arbitrator will have the authority to award any remedy or relief that a Georgia court could order or grant, including specific performance, issuance of an injunction, or imposition of sanctions for abuse or frustration of the arbitration process. The arbitrator shall have no authority to decide claims on a class action basis. The arbitration can decide only our or your claim and may not consolidate or join the claims of other Persons who may have similar claims. You and we agree that this Agreement involves interstate commerce and that, notwithstanding the above choice of law provisions, any arbitration shall be governed by the Federal Arbitration Act. |

| 45. | ADDITIONAL REMEDIES. Notwithstanding the foregoing, we shall be entitled to institute suit in order to obtain provisional relief in the form of prejudgment remedies, including replevin, self-help repossession, garnishment, attachment, foreclosure, or the like without being held to have waived our right to compel arbitration on all remaining issues and in such event any claim that you may wish to assert shall remain subject to arbitration. . |

Schedule 1: Remittance address to be placed on invoices

[*] [Or such other remittance address as NOWaccount may specify]

NOWaccount Merchant Services Agreement

Schedule 2: Schedule of Fees and Other Charges (Per Section 23)

| Immediate Payment Processing Option | ||||

| Base Transaction Fee for Invoices with up to “Net 30 Day” Payment Terms* Applied to Total Value of Invoice | 3.00 | % | ||

| Surcharge for Invoices with up to “Net 45 Day” Payment Terms* Applied to Total Value of Invoice | 0.50 | % | ||

| Surcharge for Invoices with up to “Net 60 Day” Payment Terms* Applied to Total Value of Invoice | 1.00 | % | ||

| Surcharge for Invoices with up to “Net 90 Day” Payment Terms* Applied to Total Value of Invoice | 2.00 | % | ||

| Surcharge for Invoices with up to “Net 120 Day” Payment Terms* Applied to Total Value of Invoice (special credit approval required) | 3.00 | % | ||

Minimum Transaction Fee Applied to Each Invoice (A transaction is a credit request followed by an invoice settlement. A credit request alone, or a settlement without a credit request, counts as a transaction.) | $ | 5 | ||

| Surcharge for International Buyers (Immediate Payment and Guaranteed Payment processing options) Applied to Total Value of Invoice | 1.00 | % | ||

| Traditional Payment Processing Option N/A | ||||

| Other Charges | ||||

| ACH Payment Fee | Free | |||

| Wire Transfer Fee Applied per Payment (where Client requests funds via wire transfer rather than ACH) | $ | 25 | ||

| Exception Handling (including payments received without invoice submitted) | $ | 50 | ||

| Annual NOW Network Membership Fee | $ | 750 | ||

*Note: The Payment Terms are the maximum stated payment terms shown on the invoice, not

the time it takes a buyer to pay.

Schedule 3: Buyers from Client whose accounts may be Purchased Accounts

| Page 20 of 20 |