Attached files

| file | filename |

|---|---|

| EX-31.2 - GENESIS FINANCIAL INC | ex32-1.htm |

| EX-31.1 - GENESIS FINANCIAL INC | ex31-1.htm |

| EX-21.1 - GENESIS FINANCIAL INC | ex21-1.htm |

| EX-10.32 - GENESIS FINANCIAL INC | ex10-32.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to _____________

Commission File No.: 000-55943

GENESIS FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| Wyoming | 03-0377717 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 445 Park Avenue, Suite 922, New York, New York | 10022 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (800) 485-8085

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| None |

Securities registered pursuant to Section 12(g) of the Act:

| Common Stock, par value $0.001 per share |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [X] | Smaller reporting company [X] | |

| Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the voting stock held by non-affiliates of the registrant at June 30, 2018, the last business day of the registrant’s most recently completed second fiscal quarter was $38,716,191 based on the last reported sales price of the registrant’s common stock as reported by the OTC Markets on that date.

As of August 13, 2020, there were an aggregate of 56,688,110 shares of the Registrant’s common stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

GENESIS FINANCIAL, INC.

FORM 10-K

December 31, 2018

TABLE OF CONTENTS

| 2 |

PART I

Cautionary Note Regarding Forward-Looking Statements

Statements in this Current Report on Form 10-K may be “forward-looking statements.” Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described herein and those risks discussed from time to time in this report, including the risks described under “Risk Factors” in other documents which we may file with the SEC. In addition, such statements could be affected by risks and uncertainties related to:

| ● | Our ability to raise funds for general corporate purposes and operations; |

| ● | The commercial feasibility and success of our technology; and |

| ● | Our ability to recruit qualified management and technical personnel |

Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of such statements.

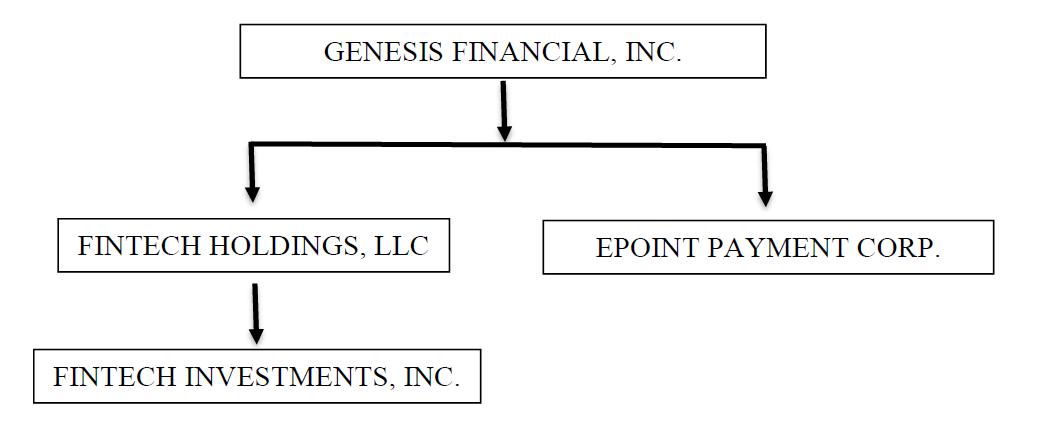

The terms the “Company,” “we,” “us,” and “our” refer to the combined enterprises of Genesis Financial, Inc. (“Genesis Financial”), Epoint Payment Corp. (“Epoint”) , Fintech Holdings, LLC and Fintech Investments, Inc. after giving effect to the Exchange Agreement and the related transactions described below, except with respect to information for periods before the consummation of the Exchange Agreement which refer expressly to Epoint or Genesis Financial, as specifically indicated.

Reverse Merger with EPOINT Payment Corp.

On February 15, 2018, Genesis Financial and Epoint completed the transactions contemplated by the previously disclosed Capital Stock Exchange Agreement (the “Exchange Agreement”) entered into as of September 8, 2017, as subsequently amended. Under the Exchange Agreement, Genesis acquired 100% of the outstanding capital stock of Epoint, following which Epoint became a wholly-owned subsidiary of Genesis. The transaction was structured as a tax-free reorganization and exempt from registration under the Securities Act of 1933, as amended (the “Act”). Pursuant to the Exchange Agreement, Genesis issued to Epoint’s shareholders an aggregate of 8,231,536 shares of its common stock in exchange for all of their capital holdings in Epoint. At the closing, Genesis also issued to Epoint’s shareholders warrants to purchase up to an additional 845,000 shares of common stock in exchange for an equal number of Epoint common stock warrants. The warrants are exercisable through February 12, 2028 at a per share exercise price of $3.00.

On February 12, 2018, Epoint issued warrants to purchase 1,970,250 shares of common stock to certain partners, associates, and designees of Whitestone Investment Network, Inc., a mergers and acquisition advisory group which was instrumental in introducing the management of Epoint to Genesis, and in structuring the Exchange Agreement. At the closing of the Exchange Agreement on February 15, 2018, Genesis also issued to these entities warrants to purchase up to 1,970,250 shares of its common stock in exchange for an equal number of Epoint common stock warrants. The warrants are exercisable through February 12, 2023 at a per share exercise price of $3.00.

At the closing of the Exchange Agreement on February 15, 2018, noteholders of $250,000 in principal amount of convertible loans payable (described in Note 5) voluntarily elected to convert their loans into 100,000 shares of Genesis common stock at a conversion rate of $2.50 per share.

Prior to the closing, Genesis was engaged in the business of buying and selling seller financed real estate loans and originating commercial real estate loans and providing start-up funding (the “Prior Business”). In connection with the closings and as mandated by the terms of the Exchange Agreement, Genesis and the Coghlan Family Corporation (the “Coghlan Family Corporation”), an entity controlled by John R. Coghlan, one of the directors and the holder of the majority of the outstanding debt of Genesis prior to the closing, entered into an agreement with Genesis pursuant to which the Coghlan Family Corporation agreed, at a mutually agreeable date after the closings, to assume and otherwise discharge all of Genesis’ outstanding debt, except for a loan of $100,000 payable to Coghlan Family Corporation (the “CFC Loan”), in consideration of the transfer to it by Genesis of the assets related to the Prior Business (the “Purchase and Sale Agreement”). The CFC Loan bears interest at an annual rate of 6% and the maturity date was extended to May 15, 2019. Upon extension of the note in May 2018, Genesis issued to Coghlan Family Corporation 65,000 shares of Common Stock.

In accordance with Financial Accounting Standards Board Accounting Standards Codification section 805, “Business Combinations”, Genesis has accounted for the Exchange Agreement transaction as a reverse business combination using the acquisition method. This determination is based on Epoint shareholders obtaining voting control as well as management and Board control of the combined entity. Accordingly, the assets and liabilities and the historical operations that are reflected in these consolidated financial statements are those of Epoint and are recorded at the historical cost basis of Epoint, and the assets and liabilities of Genesis at the merger date were recorded at their fair values.

| 3 |

For accounting purposes, Genesis is deemed to have issued 879,765 common shares to the legacy shareholders of Genesis. Using an estimated fair value of common stock on February 15, 2018 of $2.00 per share, the purchase price of the 879,765 shares held by the legacy shareholders of Genesis was approximately $1,759,500. The difference between the fair value of these shares and the recorded fair value of assets acquired and liabilities assumed of Genesis totaling $1,835,684 was allocated to Goodwill. The preliminary fair value estimates for the consideration paid and the assets acquired and liabilities assumed for our acquisition is based on preliminary calculations and valuations and our estimates and assumptions are subject to change as we obtain additional information for our estimates during the measurement period (up to one year from the acquisition date). The primary areas of those preliminary estimates that were not yet finalized related to valuation of goodwill and fair value of common stock.

Acquisition of Fintech – Immediately following the closing of the Exchange Agreement, on February 15, 2018, Genesis and Fintech Holdings, LLC (“Fintech LLC”), an Oregon limited liability company, signed and closed a Membership Interest Exchange Agreement between Genesis and Fintech LLC (the “Fintech Exchange Agreement”; together with the Exchange Agreement, the “Exchange Agreements”) pursuant to which Genesis issued to the members of Fintech LLC an aggregate of 26,435,604 shares of Common Stock. Fintech Investments Inc., the wholly-owned subsidiary of Fintech LLC (“Fintech Investments”) and a company formerly owned and operated by Gary Larkin, the former Executive Co-Chairman of Genesis, holds the intellectual property licenses of Epoint’s proprietary platform technologies. Given that the entities were under common control, all of the transactions performed by Fintech Investments were done at the direction of Epoint, and substantially all of the fair value of gross assets acquired is concentrated in a group of similar identifiable assets, management determined that the assets acquired do not represent a business. Accordingly, the assets and liabilities of Fintech LLC and Fintech Investments have been recorded at their historical cost basis at the merger date, and are included in the Company’s consolidated financial statements.

Henceforth, all references to the “Company” shall mean and include Genesis Financial., Inc. and its subsidiaries, following the closing of the Exchange Agreements.

| 4 |

Overview of the Business of the Company

Genesis Financial, Inc., through its wholly-owned subsidiary, Epoint Payment Corp., is engaged in providing a range of diverse alternate financial products designed for cost-efficient delivery via a smart phone or other mobile device. Epoint intends to initiate financial services with an integrated “Mobile First” enabled program targeting underbanked and unbanked consumers, initially in North America, which will include micro credit, mobile phone device financing programs, money transfers, prepaid debit cards, bill payments, mobile top up, check processing, insurance and travel.

We intend to leverage our relationships and agreements with key technology and media participants, together with appropriate financial institutions and distribution partners, to offer target customers a wide range of price leading and more convenient local and international financial services, including money transfer, bill payment, mobile top up, Point of Sale (POS) payments, instant micro loans, check processing, insurance and travel services, all of which are to be delivered via an advanced proprietary platform technology.

We plan to initiate our service offering with products designed to appeal to key underbanked consumer market segments including ex-patriate Spanish speaking consumers in the United States.

The Epoint value proposition has been achieved through strong collaboration with leading players from within the existing payment and mobile telephony industries which leverages the existing infrastructure in a manner not previously achieved, to create cost efficiencies and expanded functionality designed specifically to cater to the Epoint customers.

Prior to the closing, Genesis was engaged in the business of buying and selling seller financed real estate loans and originating commercial real estate loans and providing start-up funding. Following the closing of the reverse acquisition between Genesis Financial, Inc. and Epoint Payment Corp., pursuant to which Epoint became a wholly-owned subsidiary of Genesis, these operations have been discontinued.

Industry Background

For most people, having a bank account is as natural as breathing. But according to the 2016 FDIC National Survey of Unbanked and Underbanked Households, 15.6 million adults are completely unbanked and 27% of U.S. households, or approximately 68 million consumers, are underbanked, which means they have no credit history or only nonbank credit. These unbanked and underbanked consumers tend to rely solely upon alternate financial services or in many instances are forced supplement their bank relationship with alternative financial services. In both categories, consumers often turn to non-bank financial products that many consumer advocates describe as predatory at worst and insufficient at best.

In addition to those consumers who have traditionally fallen into the under-banked and unbanked category, there is an emerging segment of consumers, including millennials, who are drawn to less formal banking preferring to manage their finances through prepaid debit cards and/or more recently reloadable mobile wallets. As merchants have moved to replace legacy credit/debit card processing terminals with more secure Micro Chip (EMV Chip), Near Field Communication (NFC) and Biometric capable devices we have seen emergence of more mobile device payment services (i.e. Apple Pay, Bank of America mobile wallet programs). We expect a substantial growth in mobile wallet managed purchases leading to reductions and or possible elimination of the traditional physical card over the coming years.

According to the Nielsen’s fifth report on the Latino consumer in the annual Diverse Intelligence Series, Hispanic power and influence is surging: 50% of U.S. population growth from 2010 to 2015 has come from Hispanics, and the U.S. Census expects the U.S. Latino population to more than double within the next two generations. Almost 57 million strong, Hispanics represent almost 18% of the U.S. population, and they’re expected to continue showing growth, reaching 24% of the population by 2040. To put this in perspective, the report notes, “if U.S. Hispanics were a standalone country, their market buying power would be one of the top twenty economies in the world.” Based on these projections the unbanked Hispanic consumer controls annual spending of over $300 billion.

We believe a unique window of opportunity exists to establish a “Lifestyle Brand” for the under-banked consumer, initially with the Hispanic market segment in the U.S. Existing financial services providers (e.g., Amex, Visa, MasterCard, Capital One, Discover, MoneyGram, Western Union and almost all US Banks) are not generally regarded as positive lifestyle brands to the Hispanic consumer.

Epoint leverages several key distinctions:

| ● | Our target customer already uses prepaid cards and alternate financial services, just not typically through a single channel or brand; and |

| ● | Our target customer is highly mobile connected and relies heavily on their mobile phone to maintain contact with their loved ones. |

| 5 |

A substantial segment of our target consumer base relies heavily on remittances from the Hispanic population in the United States to Spanish-speaking Latin American countries. A remittance is a transfer of money by a foreign worker to an individual in his or her home country. According to a World Bank report released October 3, 2017 remittances to Latin America and the Caribbean in 2017 were expected have risen by 6.9 percent to $79 billion. The World Bank also predicts that remittances to the region will likely continue to grow, to approximately $82 billion in 2018.

The Epoint Solution

The Epoint solutions technology ecosystem incorporates a range of discrete and proprietary platforms interfaced with industry leading third parties which deliver either core network, gateway payment or third-party product solutions. The key elements of our proprietary solutions include the following:

Epoint eWallet Platform Technology

Epoint has developed a proprietary platform for the delivery of mobile App enabled financial solutions. This secure, regulatory compliant and fully scalable platform has been developed and is supported by a permanent IT staff of experienced developers. Our team possesses substantial domain expertise within the banking, payments and remittance segments of the global financial services industry.

The eWallet platform meets all existing regulatory requirements for Payment Card Industry (PCI) compliance. In addition to PCI compliance, Epoint has integrated advanced data security protocols to further protect its clients and end-users from financial and personal information theft and fraud.

Our eWallet mobile solutions are designed to fulfil the regulatory requirements of the financial service industry including that of international remittance which must comply with stringent OFAC, FINCIN and Patriot Act requirements.

The Epoint Micro Credit or MLOC capability and Program Platform (the “MLOC Platform”) was sub-licensed to Epoint by Fintech Investments. The unique MLOC Platform has been designed to support a variety of market applications dependent upon the specific channel partner’s requirements. This flexibility enables the optimum reach into developing markets with minimal development or ramp-up time.

Epoint has been able to craft a unique, integrated suite of financial services products that can be offered to end consumers as an “IN-NETWORK” package. These initial integrated service offerings will include:

| ● | A secure debit card issued by participating regulated banks and differentiated by a range of bundled financial services, that provides the convenience of retail and online purchasing within the U.S. and Latin American markets. |

| ● | Fast and cost efficient international Money Transfer at a consumer price point significantly less than currently available options. |

| ● | In-market and cross-border bill payment solutions (Pay by phone, mobile or Internet for less than half of current market cost). |

| ● | Domestic & cross-border Remote mobile top up (conveniently reload prepaid mobile minutes anywhere anytime) |

| ● | A complete mobile financial services solution for the under-banked. Easy download and complete remote financial services transaction management for everyone |

| ● | Cash in/cash out services at thousands of convenient retail locations |

| ● | Remote check cashing via mobile phone (No more standing in lines and paying high fees to cash checks) |

| ● | Domestic and cross border rewards and loyalty programs |

| ● | Emergency credit facilities. |

Product Offerings

Epoint will offer a comprehensive and fully integrated set of cost efficient mobile enabled financial services targeted to the under-banked and unbanked consumer, including:

| ● | Debit Cards & eWallets: Delivering a combination of both traditional general purpose reloadable debit cards and network integrated mobile phone wallets, will enable the Epoint customer to take full advantage of their purchasing power at all participating retailers, ATMs and online merchants. |

| ● | Money Transfer: Low cost and ultra-convenient way for consumers to send money anywhere anytime using the convenient fully compliant mobile remittance application. Offering lower cost money transfer with the convenience of mobile payment saves our customers many lost hours of time spent in lines at traditional retail remittance locations. |

| 6 |

| ● | Bill Payment: Epoint mobile enabled bill payment services will provide consumers with a convenient and cost-efficient way to pay recurring and one-off household bills. Instead of standing in lines at retail counters to purchase money order for rent or utility payments, Epoint empowered consumers can take care of their monthly household utility and recurring bills utilizing their mobile communication devices. |

| ● | Check Cashing: Using a convenient online mobile remote check capture will allow our consumers to save both time and money converting payroll checks into cash or instant purchasing power. |

| ● | Mobile Top Up: The unbanked and under-banked consumer is predominately a prepaid mobile services customer, because achieving monthly account status is almost impossible without established credit and banked history. Epoint enables pay as you go customers to buy competitively priced wireless plans directly from their mobile phone, thereby reducing both cost and time. |

| ● | Loyalty & Rewards: Well-banked customers have come to expect competitive and valuable rewards and loyalty programs from their credit and debit card providers. These programs have matured over the last ten years and resulted in movement from one network card to another based solely on loyalty (i.e. American Express Costco Rewards, Airline mileage credit card programs etc.). The unbanked and under-banked customers have not been able to participate in these increasingly valuable consumer marketing activities. Through an Epoint enabled Loyalty & Rewards Plan, including cross-border loyalty/rewards programs, our future customers would be able to earn valuable benefits, discounts and preferred pricing based upon their purchase history. |

| ● | Insurance Services: Auto, home, death and disability insurance products are desirable and sought-after products in the under-banked communities. Epoint intends to present products which can be purchased through the Epoint Consumer Portal and paid for online with the Epoint debit card. |

| ● | Credit Services: Today’s unbanked and under-banked consumer typically looks to either a Pay Day lender or a Pawn Shop as a source for short-term credit, with medium and long-term credit options completely out of reach. Epoint intends to introduce a range of affordable credit options including: |

| ○ | Payroll based credit programs: These will be made available in the U.S following pending regulation for the re-introduction of products of this nature. | |

| ○ | Credit Card Services: As a secondary phase expansion, Epoint intends to introduce a Credit Card for the sub-prime consumer. This is a strong market opportunity with many able partners ready to support a well-branded move into this market segment. | |

| ○ | Cross Border Credit: Current credit regulation and policy in the U.S. excludes the sub-prime consumer. We plan to expand into Mexico and offer the Mexican consumer a small dollar value credit solution, or a micro loan, which will be linked to a recurring Mexico bound remittance from a U.S. based Epoint cardholder. |

Competitive Advantages of the Epoint Solution

We believe that Epoint has a disruptive competitive advantage which will be rooted in our unique and exclusive coupling of established payment networks and electronically automated processes which cannot easily, if at all, be replicated by existing market providers.

Existing financial services providers including banks, money transfer agents and alternate financial services bureaus have created expensive retail infrastructures to support their required physical interaction with a customer. These groups together with traditional debit/credit card networks including Visa, MasterCard and Discover are further hampered by embedded economic distribution models that were developed decades ago to protect once essential individual channel partners, which Epoint will efficiently circumvents with its streamlined processes. In the following bullet points we have briefly described the competitive infrastructure and compared it to the Epoint solution:

| ● | Debit/Credit Card Financial Services: The card networks have focused solely upon providing a backbone to enable the use of a card at the Point of Sales (“POS”). These transactions generate fees and interchange that create the vast majority of network revenues. These Network competitors have relied upon their pervasiveness within the banking industry to retain customers rather than expand their financial services offerings to assist the unbanked or under-banked by providing valuable network delivered and cost effective ancillary financial services. Their origins, as previously bank owned entities, have led to their deferral of all ancillary services to their bank partners. |

| ● | International Money Transfer/Remittance: The long-term leaders in the enormous remittance market including Western Union, MoneyGram and Travelex together with newcomers such as XOOM, rely heavily upon a physical transaction capture and/or distribution networks. |

| 7 |

| ○ | This expensive and cumbersome retail presence has layered in historical costs that have continued to keep remittance charges higher than necessary, often exceeding 10% of the funds being sent, and rarely less than $4.99 per transaction. The Epoint “In-Network” remittance program leverages our network partner relationships with leading industry participant such as FIS for their reach throughout the U.S. and Latin America. | |

| ○ | Epoint is able to utilize the low-cost cross-border Mexico debit network to profitably send money instantly and at unprecedented ultra-low costs that cannot be easily matched by any of the traditional remittance competition or newcomer Internet service providers. | |

| ○ | Even the largest of US banks (Wells Fargo) which recently announced it would be introducing a new remittance service to its existing customers, projects a retail price of over $7 per transaction. | |

| ○ | Cost of pre-existing infrastructure — inability to easily gain equivalent relationships with core financial network operators in the U.S and Mexico, together with existing high cost of established distribution structures are all ongoing impediments for our competitors within the remittance product segment. |

| ● | Cross Border Bill Payment & Mobile Top-Up: We believe the unmatched resources of Epoint, FIS and its partners within Mexico will provide the most efficient and cost effective cross-border bill payment and mobile money top-up between US and Mexico, ensuring we maintain both the “best of breed” customer solution and the lowest possible market price. |

Significant Agreements and Arrangements

The provision of the Epoint solution requires the collaboration of various market participants with whom Epoint currently has agreements and others with whom it is in discussion with relating to various collaboration efforts. Below is a summary of these agreements and arrangements.

| ● | Epoint has a long-term Network operational services agreement with FIS, the world’s largest payment processing group. This agreement provides Epoint with turnkey acceptance of Epoint issued debit cards at over 2.0 million US retail locations and more than 450,000 ATMs. In addition, this network support enables our Bank and Program management partners to create mobile wallet and other virtual accounts. |

| ● | Epoint has a master services agreement with FIS’s PayNet Group for the provision of all U.S. outbound remittance services. Under this agreement FIS will offer Epoint access at most favorable rates to all FIS global remittance distribution as well as its secure and compliant remittance transaction-processing services. |

| ● | A strategic teaming agreement with AMDOCS for Epoint to provide financial services to AMDOCS key customers. AMDOCS, a leader in provision of essential services to the world’s largest mobile carriers including AT&T/Crickett, Tracfone, Sprint, Airtel, Vodafone, America Movil, and Telefonica. |

| ● | Epoint has secured an agreement with StreetCred Capital, LLC, (StreetCred), a prominent provider of lead generation for finance within the mobile telephony industry. Under this agreement Epoint intends to develop and deliver a rent-to-own (“RTO”) mobile phone device financing program for certain StreetCred mobile carrier clients in the U.S. and Mexico. |

| ● | Epoint is working to enter into several agreements with US and Central American distribution and support partners to secure direct distribution rights for its diverse mobile financial services suite of products, of which no guarantee can be provided as to ultimate success. |

Market Penetration Strategy

Exploiting the Existing Distribution Channels

We intend to partner with leading prepaid issuing banks and their key program manager to position our financial products and our card /mobile wallet account services to the under-banked consumer. Epoint further plans to exploit strategic partnerships with prominent industry distribution channel partners including AMDOCS, StreetCred, leading carriers within the mobile segment, prominent program managers within the prepaid debit card segment, and others. We believe that the unique relationships Epoint has forged with FIS and its nationally operated payment network NYCE, will allow Epoint to in distribution within the U.S. market.

Card and Mobile Wallets

We intend to establish partnership agreements with both traditional debit card and emerging mobile wallet programs. Through these partnerships, our customers will be able to choose either traditional debit cards or where applicable their mobile wallet to efficiently complete purchase transactions. Well-established brand marketers generally manage these payment programs for sponsoring banks. We intend to enter into agreements with a number of major mobile carriers both directly and as part of the AMDOCS Teaming agreement. In addition, we are finalizing a regional Distribution and Services support agreement covering Central America with a leading credit services group based in Mexico.

| 8 |

Financial Institution Program Sponsors

We are in the process of finalizing agreements with several banks to support Epoint programs for initial launch within the U.S.

In addition, we intend to form additional partnerships with other prepaid sponsor banks which also have strong reach into the pre-paid debit card market.

Community banks and Credit Unions within the U.S. are struggling to capture and retain customers. The increased regulatory burdens imposed upon banks for basic consumer financial services including prepaid debit card issuance, remittance, bill payment and other daily financial services have exceeded the revenue potential of the programs. While the largest of the national banks can afford to support the internal compliance and operational overheads necessary to satisfy their regulators, smaller regional financial institutions have been crowded out losing any competitive edge.

The initial national acceptance of the Epoint card at all PIN Debit retail locations and ATMs provides our end user customers with the necessary coverage to conduct all daily purchase and cash back transactions.

Our Revenue Model

Epoint intends to deploy a channel partner lead “Business to Business to Consumer” (B2B2C) marketing distribution strategy designed to enable Epoint to reach its intended target customer base. This strategy has the distinct advantage of capturing consumers in large groups often with a common known socio-economic or ethnic make-up which allows for more precise message targeting for higher conversion rates.

While it is subject to change as our business develops, Epoint has devised a structured pricing model that provides shared revenue with the channel partners based on the conversion and revenue generated directly from their consumers. Each of Epoint’s financial services has a distinct economic yield and channel partners are able to adjust end-user costs basis to assist in driving higher aggregate program yields based on the unique characteristics of their own customers.

All the pricing and revenue share elements are configurable within the advanced Epoint platform and program results are published in real-time through the secure reporting portal so that our partners can track inter-daily program usage and performance.

Competition

The payment and financial services industries are highly competitive, and our continued growth depends on our ability to compete effectively. Although we do not face direct competition from any competitor in exactly the same combined lines of business, we face competition from a variety of financial and non-financial business groups. These competitors include retail banks, non-traditional payment service providers, such as retailers and mobile network operators, traditional kiosk and terminal operators and electronic payment system operators, as well as other companies that provide various forms of payment services, including electronic payment and payment processing services. Competitors in our industry seek to differentiate themselves by features and functionalities such as speed, convenience, network size, accessibility, hours of operation, reliability and price. A significant number of our competitors have greater financial, technological and marketing resources than we have, operate robust networks and are highly regarded by consumers.

We expect to face varied competition across our anticipated full product service offerings including:

| PRODUCT / SERVICE | COMPETITOR EXAMPLES | |

| Debit Card Issue | Visa, MasterCard, Capital One, Discover & American Express | |

| Community Banking Services | Jack Henry, First Data, FISERV | |

| Money Transfer | MoneyGram, Western Union, Xoom, Uniteller, Travelex | |

| Bill Payment | MoneyGram, Online Bill Payment & Hybrid Debit Card Solutions | |

| Mobile Top Up | Prepaid Telco retail, Unidos, EMIDA | |

| Loyalty & Rewards | None Known Currently | |

| Insurances | Online and Hispanic Specialty Retail | |

| Travel Programs | Online and Hispanic Specialty Retail |

| 9 |

Intellectual Property

The Company does not hold any patents. Fintech Investments Inc., the wholly-owned subsidiary of Fintech LLC (“Fintech Investments”) and a company formerly owned and operated by Gary Larkin, the Executive Co-Chairman of Genesis, holds the intellectual property licenses of Epoint’s proprietary platform technologies. We rely on a combination of contractual rights, copyright, trademark and trade secret laws to establish and protect our proprietary technology.

As a “smaller reporting company,” we are not required to provide the information required by this item.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

At December 31, 2018, our executive offices were located at 11920 Southern Highlands Parkway, Suite 200, Las Vegas, Nevada 89141. We leased these premises under a lease agreement which started on March 1, 2018 and ends on February 28, 2021. The lease was terminated in January 2019.

We are not currently subject to any material legal proceedings; however, we could be subject to legal proceedings and claims from time to time in the ordinary course of our business. Regardless of the outcome, litigation is time consuming and expensive to resolve, and it diverts management resources.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the OTC Markets under the symbol “GFNL.” The following table sets forth the high and low closing prices of our common stock (USD) for the last fiscal year, as reported by the OTC Markets and represents inter dealer quotations, without retail mark-up, mark-down or commission and may not be reflective of actual transactions. During the fourth quarter of 2017, the Company implemented a twenty for one (20:1) reverse stock split resulting in a higher share prices. Limited trading of our common stock has occurred since the completion of the Exchange Agreement on February 15, 2018; therefore, only limited historical price information is available. The market prices reported above have be adjusted to give retroactive effect to the reverse split.

| 2018 | High | Low | ||||||

| First quarter | $ | 5.75 | $ | 3.25 | ||||

| Second quarter | 5.24 | 3.75 | ||||||

| Third quarter | 4.10 | 2.50 | ||||||

| Fourth quarter | 2.50 | 1.51 | ||||||

| 2017 | High | Low | ||||||

| First quarter | $ | 2.40 | $ | 1.60 | ||||

| Second quarter | 2.00 | 1.40 | ||||||

| Third quarter | 3.40 | 1.50 | ||||||

| Fourth quarter | 4.00 | 2.80 | ||||||

Shareholders

Our shares of common stock are issued in registered form. The registrar and transfer agent for our shares of common stock is Columbia Stock Transfer Company: 1869 E Seltice Way #292, Post Falls, ID 83854. Telephone (208) 777-8998.

As of August 13, 2020, there were 56,688,110 shares of our common stock outstanding, which were held by approximately 159 record stockholders. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of shares of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

| 10 |

Dividend Policy

We have not paid cash dividends on our common stock since our inception, and we do not contemplate paying dividends in the foreseeable future.

Recent Sales of Unregistered Securities

During the twelve months ended December 31, 2018, we issued unregistered securities as follows:

| 1. | On February 15, 2018, the Company and Epoint completed the transactions contemplated under the Exchange Agreement where Genesis acquired 100% of the outstanding capital stock of Epoint, following which Epoint became a wholly-owned subsidiary of Genesis. Pursuant to the Exchange Agreement, Genesis issued to former Epoint shareholders an aggregate of 8,231,536 shares of its common stock in exchange for all of their capital holdings in Epoint. |

| 2. | On February 15, 2018, Genesis also issued to former Epoint shareholders warrants to purchase up to an additional 845,000 shares of common stock in exchange for an equal number of Epoint common stock warrants. The warrants are exercisable through February 12, 2028 at a per share exercise price of $3.00. |

| 3. | On February 12, 2018, Epoint issued warrants to purchase 1,970,250 shares of common stock to certain partners, associates, and designees of Whitestone Investment Network, Inc., a mergers and acquisition advisory group which was instrumental in introducing the management of Epoint to Genesis, and in structuring the Exchange Agreement. At the closing of the Exchange Agreement on February 15, 2018, Genesis also issued to these entities warrants to purchase up to 1,970,250 shares of its common stock in exchange for an equal number of Epoint common stock warrants. The warrants are exercisable through February 12, 2023 at a per share exercise price of $3.00. |

| 4. | On February 15, 2018, noteholders of $250,000 of convertible loans payable voluntarily elected to convert their loans into 100,000 shares of Genesis common stock at a conversion rate of $2.50 per share. |

| 5. | On February 15, 2018, Genesis and Fintech LLC signed and closed the Fintech Exchange Agreement pursuant to which Genesis issued to the members of Fintech LLC an aggregate of 26,435,604 shares of common stock. |

| 6. | In May 2018, the Company issued 65,000 shares of its common stock to a lender as debt issuance costs under a loan extension and modification agreement. |

| 7. | In August 2018, the Company issued 1,550,000 warrants to purchase shares of its common stock to lenders as debt issuance costs under loan extension and modification agreements. |

These securities were not registered under the Securities Act of 1933, as amended (the “Securities Act”), but qualified for exemption under Section 4(a)(2) of the Securities Act. The securities were exempt from registration under Section 4(a)(2) of the Securities Act a because the issuance of such securities by the Company did not involve a “public offering,” as defined in Section 4(a)(2) of the Securities Act, the investor’s representations that it is acquiring the securities for its own account for investment purposes and not as nominee or agent, and not with a view to the resale or distribution thereof, and that the investor understands that the securities may not be sold or otherwise disposed of without registration under the Securities Act and any applicable state securities laws, or an applicable exemption therefrom.

Securities authorized for issuance under equity compensation plans.

The Company does not have any equity compensation plans.

Item 6. SELECTED FINANCIAL DATA

Not applicable.

| 11 |

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

In this Form 10-K and in other documents incorporated herein, as well as in oral statements made by the Company, statements that are prefaced with the words “may,” “will,” “expect,” “anticipate,” “continue,” “estimate,” “project,” “intend,” “designed,” and similar expressions, are intended to identify forward-looking statements regarding events, conditions, and financial trends that may affect the Company’s future plans of operations, business strategy, results of operations, and financial position. Examples include those statements set forth above under “Item 1. Business - Cautionary Note Regarding Forward-Looking Statements.” These statements are based on the Company’s current expectations and estimates as to prospective events and circumstances about which the Company can give no assurance. Further, any forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation to update any forward-looking statement to reflect future events or circumstances. Forward-looking statements should not be relied upon as a prediction of actual future financial condition or results. These forward-looking statements, like any forward-looking statements, involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. Such risks and uncertainties include the factors set forth above and the other information set forth in this Form 10-K.

Overview of the Business of the Company

Genesis Financial, Inc., through its wholly-owned subsidiary, Epoint Payment Corp., is engaged in providing a range of diverse alternate financial products designed for cost-efficient delivery via a smart phone or other mobile device. Epoint intends to initiate financial services with an integrated “Mobile First” enabled program targeting underbanked and unbanked consumers, initially in North America, which will include micro credit, mobile phone device financing programs, money transfers, prepaid debit cards, bill payments, mobile top up, check processing, insurance and travel.

For most people, having a bank account is as natural as breathing. But according to the 2016 FDIC National Survey of Unbanked and Underbanked Households, 15.6 million adults are completely unbanked and 27% of U.S. households, or approximately 68 million consumers, are underbanked, which means they have no credit history or only nonbank credit. These unbanked and underbanked consumers tend to rely solely upon alternate financial services or in many instances are forced supplement their bank relationship with alternative financial services. In both categories, consumers often turn to non-bank financial products that many consumer advocates describe as predatory at worst and insufficient at best. In addition to those consumers who have traditionally fallen into the under-banked and unbanked category, there is an emerging segment of consumers, including millennials, who are drawn to less formal banking preferring to manage their finances through prepaid debit cards and/or more recently reloadable mobile wallets.

We intend to leverage our relationships and agreements with key technology and media participants, together with appropriate financial institutions and distribution partners, to offer target customers a wide range of price leading and more convenient local and international financial services, including money transfer, bill payment, mobile top up, Point of Sale (POS) payments, instant micro loans, check processing, insurance and travel services, all of which are to be delivered via an advanced proprietary platform technology.

We plan to initiate our service offering with products designed to appeal to key underbanked consumer market segments including ex-patriate Spanish speaking consumers in the United States.

Prior to the closing, Genesis was engaged in the business of buying and selling seller financed real estate loans and originating commercial real estate loans and providing start-up funding. Following the closing of the reverse acquisition between Genesis Financial, Inc. and Epoint Payment Corp., pursuant to which Epoint became a wholly-owned subsidiary of Genesis, these operations have been discontinued.

Reverse Merger

On February 15, 2018, Genesis Financial and Epoint completed the transactions contemplated under the Exchange Agreement where Genesis acquired 100% of the outstanding capital stock of Epoint, following which Epoint became a wholly-owned subsidiary of Genesis. Immediately following the closing of the Exchange Agreement, on February 15, 2018, Genesis and Fintech Holdings, LLC (“Fintech LLC”), an Oregon limited liability company, signed and closed a Membership Interest Exchange Agreement between Genesis and Fintech LLC (the “Fintech Exchange Agreement”).

Following the closings, each of Epoint and Fintech LLC became wholly-owned subsidiaries of the Company.

| 12 |

Results of Operations

Years ended December 31, 2018 and 2017

| 2018 | 2017 | |||||||

| Revenues: | ||||||||

| Financial services and other revenue, net | $ | 72,732 | $ | - | ||||

| Expenses: | ||||||||

| Impairment of capitalized technology and goodwill | 2,195,048 | - | ||||||

| Professional services | 2,003,074 | 336,698 | ||||||

| Compensation, payroll taxes and benefits | 356,557 | 341,890 | ||||||

| Technologies and telecom | 140,349 | 163,623 | ||||||

| Loss of deposits on planned acquisition of SmartPay Leasing, LLC | 200,000 | - | ||||||

| Gain on extinguishment of accrued expenses | (429,200 | ) | - | |||||

| Depreciation and amortization | 141,191 | 52,917 | ||||||

| Taxes, licenses and insurance | 82,526 | 2,454 | ||||||

| Occupancy and equipment | 78,472 | 5,301 | ||||||

| Loss on disposal of fixed assets | 32,262 | - | ||||||

| Other operating expenses | 66,024 | 30,556 | ||||||

| Total operating expenses | 4,866,303 | 933,439 | ||||||

| Net loss from operations | (4,793,571 | ) | (933,439 | ) | ||||

| Other income | 50,000 | - | ||||||

| Interest income | 114 | 48 | ||||||

| Interest expense | (857,919 | ) | (14,433 | ) | ||||

| Net loss | $ | (5,601,376 | ) | $ | (947,824 | ) | ||

Year Ended December 31, 2018 Compared to the Year Ended December 31, 2017

Revenues

The Company had revenues of $72,732 for the year ended December 31, 2018 and no revenue for the year ended December 31, 2017.

Expenses

The Company recorded a $2.2 million charge for impairment of capitalized technology and goodwill for the year ended December 31, 2018 for the carrying values of the assets that exceeded the fair values.

Professional services expenses for the year ended December 31, 2018 increased to $2.0 million from $0.3 million for the year ended December 31, 2017. The increase is primarily attributable to increased legal, accounting and consulting expenses related to the Exchange Agreement closing, Fintech Exchange Agreement closing and the preparation of the SmartPay MIPA, and included $1.1 million of stock-based compensation expense calculated by the Black-Scholes pricing model relating to the issuance of options to purchase 1,900,000 shares of common stock to Genesis directors and officers, and warrants to purchase 1,970,250 shares of common stock to certain partners, associates, and designees of Whitestone Investment Network, Inc., a mergers and acquisition advisory group which was instrumental in introducing the management of Epoint to Genesis, and in structuring the Exchange Agreement.

Compensation, payroll taxes and benefits expenses for the year ended December 31, 2018 increased to $0.4 million from $0.3 million for the year ended December 31, 2017. The increase is primarily attributable to the headcount additions after the closing of the Exchange Agreement and the Fintech Exchange Agreement, including the Chief Executive Officer and Chief Financial Officer, and an Epoint Project Manager, offset by headcount and salary reductions in the fourth quarter of 2018. Due to cash flow deficiencies from the termination of the SmartPay MIPA, the Company was forced to significantly curtail its operations in the fourth quarter of 2018. This included reaching separation agreements with its CEO, CFO and President/COO and cutting back third party consultants work on the Epoint eWallet and MLOC technology platforms to focus primarily on servicing existing customer contracts.

Technologies and telecom expenses for the year ended December 31, 2018 decreased to $0.1 million from $0.2 million for the year ended December 31, 2017. The decrease is primarily attributable to decreased platform support services in the fourth quarter of 2018, where third party consultants perform routine maintenance and testing of the Epoint eWallet and MLOC platforms.

| 13 |

A loss of $0.2 million of deposits on the planned acquisition of SmartPay Leasing, LLC was taken in the year ended December 31, 2018, when the acquisition agreement was terminated on July 15, 2018.

In a prior year, Fintech entered into a license agreement with 3rd Rock to acquire global license rights to certain intellectual property licensed to 3rd Rock by Cash America Holdings, Inc. and Enova Financial, LLC, for the exploitation of a micro-credit program. Under this agreement, Fintech committed to pay to 3rd Rock a gross sum of $500,000 periodically through September 2018 and made scheduled payments to 3rd Rock in the amount of $75,000. The intellectual property is included in Technology and equipment. The payable of $425,000 was canceled on December 31, 2018 in a settlement agreement with 3rd Rock, and is included in Gain on extinguishment of accrued expenses on the consolidated statements of operations.

Interest expense is higher due to the increase in the principal balance of notes payable.

Liquidity and Capital Resources

Year Ended December 31, 2018

The Company does not have cash or liquidity to pay down maturing debt and maintain operations. Our primary capital requirements are for cash used in operating activities. Funds for such purposes have historically been generated from short-term credit in the form of extended payment terms from suppliers, convertible debt and equity financings.

Historically, we have funded our cash and liquidity needs through the issuance of equity, equity-linked or debt securities. We incurred a net loss of $5.6 million and have an accumulated deficit of $63.3 million as of and for the year ended December 31, 2018. To date, we have depended on raising capital from debt and equity financings to meet our needs for cash flow used in operating activities. For the year ended December 31, 2018, we raised $0.9 million from financing activities to meet cash flow used in operating activities. This situation creates uncertainties relating to our ability to execute our business plan, finance operations, and indicates substantial doubt about our ability to continue as a going concern for at least one year from the date these financial statements were issued.

At December 31, 2018, we had $9,421 of cash on hand with a negative working capital of $2.4 million. Our ability to meet ongoing operating cash needs is dependent on raising additional working capital on an immediate basis and ultimately generating positive cash flow, primarily through generating revenue and controlling expenses. During the first quarter of 2018, we began entering into an eWallet transaction processing services agreements. The revenue pertaining to those service agreements was initially deferred, until we began to recognize the revenue in the fourth quarter of 2018 as control of these services were transferred to the customer.

We need to raise additional funds on an immediate basis in order to be able to satisfy our cash requirements, pay down maturing debt and maintain operations. At December 31, 2018, debt obligations totaling approximately $2.2 million matured. We currently do not have sufficient funds to repay those debt obligations and must secure additional equity or debt capital in order to repay those obligations or obtain additional extensions of maturity, of which no assurance can be provided that we can obtain the needed funding or maturity extension on commercially reasonable terms or at all. We have been actively seeking additional capital. At the present time, we have no commitments for financing and no assurance can be given that we will be able to raise the needed capital on commercially acceptable terms or at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us, our ability to or support our business and to respond to business challenges will be significantly limited and we may need to further curtail or cease operations.

Our cash flow related information for the years ended December 31, 2018 and 2017 are as follows:

| Years

Ended December 31, | ||||||||

| 2018 | 2017 | |||||||

| Net cash flows provided by (used in): | ||||||||

| Operating activities | $ | (1,341,335 | ) | $ | (828,177 | ) | ||

| Investing activities | (279,950 | ) | (567 | ) | ||||

| Financing activities | 874,191 | 1,330,500 | ||||||

Operating Activities

In the year ended December 31, 2018, the net loss plus non-cash adjustments was approximately $1.2 million compared to $0.9 million during the same period in 2017. The increase in cash usage can be primarily attributed to the larger net loss incurred in 2018 as compared to 2017. Non-cash adjustments in the aggregate were about $4.3 million higher in 2018. In addition, there was a $0.1 million increase in accounts payable and accrued liabilities in 2018. In 2017, there was no significant change in working capital items.

| 14 |

Investing Activities

Cash used in investing activities consists primarily of $0.2 million of deposits on the planned acquisition of SmartPay Leasing, LLC paid in the year ended December 31, 2018, which agreement has as of July 15, 2018 been terminated. In addition, capital expenditures for the purchases of technology and equipment were $0.1 million and $Nil in the years ended December 31, 2018 and 2017, respectively. Cash acquired in acquisitions was $40,353 in the year ended December 31, 2018.

Financing Activities

During the year ended December 31, 2018, operating losses and working capital needs discussed above were met by raising cash in debt financing of $0.9 million.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations is based upon its consolidated financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires us to make significant estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. These items are monitored and analyzed by management for changes in facts and circumstances, and material changes in these estimates could occur in the future. The more judgmental estimates are summarized below. Changes in estimates are recorded in the period in which they become known. We base our estimates on historical experience and various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ from the Company’s estimates if past experience or other assumptions do not turn out to be substantially accurate.

Revenue Recognition

We expect to derive revenues primarily from providing a range of alternate financial products related to providing financial services to underbanked and unbanked individuals. These services are expected to include micro-credit, mobile phone financing, money transfers, prepaid debit cards, bill payments and related services. Revenues will be recognized when control of these services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those services.

We determine revenue recognition through the following steps:

| ● | Identification of the contract, or contracts, with a customer | |

| ● | Identification of the performance obligations in the contract | |

| ● | Determination of the transaction price | |

| ● | Allocation of the transaction price to the performance obligations in the contract | |

| ● | Recognition of revenue when, or as, we satisfy a performance obligation |

Technology and Equipment

Technology and equipment, including furniture, equipment, leasehold improvements, purchased custom software and internally developed software is carried at cost less accumulated depreciation and amortization. We capitalize expenditures or betterments that substantially increase asset lives, and charges ordinary repairs and maintenance to operations as incurred. We compute depreciation using the straight-line method over estimated useful lives of three to five years. Estimated useful lives are periodically reviewed, and where appropriate, changes are made prospectively.

We capitalize certain software development costs incurred in connection with its eWallet and Micro Line of Credit products. Costs incurred in the preliminary stages of development are expensed as incurred. Once a product has reached the application development stage, internal and external costs, if direct and incremental, are capitalized until the product is substantially complete and ready for its intended use. Capitalization ceases upon completion of all substantial testing. We also capitalize costs related to specific upgrades and enhancements when it is probable the expenditures will result in additional functionality; that is, modifications that enable the software to perform tasks that it previously was incapable of performing. Maintenance costs are expensed as incurred.

Goodwill

Goodwill was created at the time of purchase where the purchase price paid for Genesis exceeded the fair value of the tangible and identifiable intangible net assets acquired. Goodwill is tested for impairment on an annual basis on December 31st, or more frequently if events or changes in circumstances indicate that the reporting units might be impaired. The approach for the review of goodwill has two steps: identifying a potential impairment and measuring the amount of the impairment loss, if any. Factors that are considered important in determining whether an impairment of goodwill might exist include significant, continued underperformance compared to peers, significant changes in our business and products, material and ongoing negative industry or economic trends or other factors specific to each reporting unit being evaluated. Any changes in key assumptions about our business and our prospects, or changes in market conditions or other externalities, could result in an impairment charge. We use an income and market valuation hybrid approach, as it was considered to be the most appropriate method to isolate the estimated equity value of the Company. This valuation approach involved utilizing a forecasted future cash flow model discounted back at the estimated cost of equity as well as public company market comparables. Our projected cash flow model assumed revenue and operating expense growth over the five-year projected period. At December 31, 2018, a $2.2 million impairment loss was recognized. No impairment loss was recognized at December 31, 2017.

| 15 |

Stock-Based Compensation

The Company recognizes as compensation expense all stock-based awards issued to employees and nonemployees. The compensation cost is measured based on the grant-date fair value of the related stock-based awards and is recognized over the service period of stock-based awards, which is generally the same as the vesting period. The fair value of warrants and options is determined using the Black-Scholes valuation model, which estimates the fair value of each award on the date of grant based on a variety of assumptions including expected stock price volatility, expected terms of the awards, risk-free interest rate, and dividend rates, if applicable. Stock-based awards issued to nonemployees are recorded at fair value on the measurement date and are subject to periodic market adjustments at the end of each reporting period and as the underlying stock-based awards vest.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material.

Recent Accounting Pronouncements

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows – Classification of Certain Cash Receipts and Cash Payments and in November 2016 issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. The new standards will be effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years, and amends the existing accounting standards for the statement of cash flows. The amendments provide guidance on the following nine cash flow issues: debt prepayment or debt extinguishment costs; settlement of zero-coupon or other debt instruments with coupon interest rates that are insignificant in relation to the effective interest rate of the borrowing; contingent consideration payments made after a business combination; proceeds from the settlement of insurance claims; proceeds from the settlement of corporate-owned life insurance policies; distributions received from equity method investees; beneficial interests in securitization transactions; separately identifiable cash flows and application of the predominance principle; and restricted cash. The adoption on January 1, 2018 of ASU 2016-15 and ASU 2016-18 did not have a material effect on the consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, which amends guidance on revenue recognition from contracts with customers. The standard outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most contract revenue recognition guidance, including industry-specific guidance. In July 2015, FASB deferred by one year the effective dates of its new revenue recognition standard for public and nonpublic entities. In addition, in March 2016, the FASB issued ASU 2016-08, which further clarifies the implementation guidance on principal versus agent considerations contained in ASU 2014-09. In April 2016, the FASB issued ASU 2016-10, to clarify the implementation guidance on identifying performance obligations and licensing. The ASU is effective for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. The adoption on January 1, 2018 of ASU 2014-09 did not have a material effect on the consolidated financial statements as we did not have any contracts with customers prior to January 1, 2018.

In January 2017, the FASB issued ASU 2017-04, Intangibles-Goodwill and Other (Topic 350) – Simplifying the Test for Goodwill Impairment. ASU 2017-04 will simplify the subsequent measurement of goodwill by eliminating Step 2 from the goodwill impairment test. Current guidance requires that companies compute the implied fair value of goodwill under Step 2 by performing procedures to determine the fair value at the impairment testing date of its assets and liabilities following the procedure that would be required in determining the fair value of assets acquired and liabilities assumed in a business combination. ASU 2017-04 will require companies to perform annual or interim goodwill impairment tests by comparing the fair value of a reporting unit with its carrying amount, and recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value. However, the loss recognized should not exceed the total amount of goodwill allocated to that reporting unit. ASU 2017-04 will be effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years, and will be applied prospectively. Early adoption of this standard is permitted. The Company is currently in the process of evaluating the impact of ASU 2017-04 on its consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). This standard requires the recognition of a right-of-use asset and lease liability on the balance sheet for all leases. This standard also requires more detailed disclosures to enable users of financial statements to understand the amount, timing, and uncertainty of cash flows arising from leases. This guidance is effective for interim and annual reporting periods beginning after December 15, 2018, and should be applied through a modified retrospective transition approach for leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, and early adoption is permitted. The Company expects to adopt this guidance on January 1, 2019. Although the Company is in the process of evaluating the impact of adoption of the ASU, the Company currently believes the adoption of this guidance will have an insignificant impact on its consolidated financial statements.

| 16 |

In July 2018, the FASB issued ASU 2018-11, Leases (Topic 842). This guidance provides an additional (and optional) transition method whereby the new lease standard is applied at the adoption date and recognized as an adjustment to retained earnings. In addition, this ASU provides a practical expedient, by class of underlying asset, to not separate nonlease components from the associated lease and instead account for the lease as a single component if both the timing and pattern of transfer of the nonlease component(s) are the same, and if the lease would be classified as an operating lease. These amendments have the same effective date as ASU 2016-02.

In June 2018, the FASB issued ASU No. 2018-07, Compensation – Stock Compensation (Topic 718) – Improvements to Nonemployee Share-Based Payment Accounting, which aligns the accounting for share-based payment awards issued to employees and nonemployees. Under ASU 2018-07, the existing employee guidance will apply to nonemployee share-based transactions (as long as the transaction is not effectively a form of financing), with the exception of specific guidance related to the attribution of compensation cost. The cost of nonemployee awards will continue to be recorded as if the grantor had paid cash for the goods or services. In addition, the contractual term will be able to be used in lieu of an expected term in the option-pricing model for nonemployee awards. The new standard is effective on January 1, 2019, and early adoption is permitted, including in interim periods, and should be applied to all new awards granted after the date of adoption. The Company is currently assessing the potential impact this ASU will have on our consolidated results of operations, financial position, and cash flows.

Item 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

| 17 |

Item 8. FINANCIAL STATEMENTS SUPPLEMENTARY DATA

| 18 |

Report of Independent Registered Public Accounting Firm

To the shareholders and the board of directors of Genesis Financial, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Genesis Financial, Inc. as of December 31, 2018 and 2017, the related statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2018 and 2017, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Substantial Doubt about the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered recurring losses from operations and has a significant accumulated deficit. In addition, the Company continues to experience negative cash flows from operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/S/ BF Borgers CPA PC

BF Borgers CPA PC

We have served as the Company’s auditor since 2019

Lakewood, CO

August 13, 2020

| F-1 |

Genesis Financial, Inc. and Subsidiaries

Audited Consolidated Balance Sheets

December 31, 2018 and 2017

| December 31, 2018 | December 31, 2017 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | 9,421 | $ | 756,515 | ||||

| Prepaid expenses and other current assets | 25,000 | 25,000 | ||||||

| Total current assets | 34,421 | 781,515 | ||||||

| Technology and equipment, net | - | 171,889 | ||||||

| Other assets | 5,622 | 1,000 | ||||||

| Total Assets | $ | 40,043 | $ | 954,404 | ||||

| Liabilities and Stockholders’ Deficit | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 243,182 | $ | 112,437 | ||||

| Loans payable and accrued interest, net | 2,235,942 | 1,344,933 | ||||||

| Total liabilities | 2,479,124 | 1,457,370 | ||||||

| Stockholders’ deficit: | ||||||||

| Preferred stock, $0.0001 par value, 6,000,000 total authorized, 2,500,000 authorized are designated as Series A 8% cumulative convertible preferred, Nil and 1,190,021 Series A 8% cumulative convertible preferred issued and outstanding at December 31, 2018 and December 31, 2017 (liquidation values of $Nil and $5,070,000), respectively | - | 2,943,265 | ||||||

| Series A common stock, $0.0001 par value, 15,000,000 authorized, Nil and 7,041,515 issued and outstanding at December 31, 2018 and December 31, 2017, respectively | - | - | ||||||

| Common stock, $0.001 par value; 100,000,000 authorized, 35,711,905 and Nil issued and outstanding at December 31, 2018 and December 31, 2017, respectively | 35,712 | - | ||||||

| Additional paid-in capital | 60,827,937 | 1,218,490 | ||||||

| Accumulated deficit | (63,302,730 | ) | (4,664,721 | ) | ||||

| Total stockholders’ deficit | (2,439,081 | ) | (502,966 | ) | ||||

| Total Liabilities and Stockholders’ Deficit | $ | 40,043 | $ | 954,404 | ||||

See accompanying Notes to Consolidated Financial Statements

| F-2 |

Genesis Financial, Inc. and Subsidiaries

Audited Consolidated Statements of Operations

Years ended December 31, 2018 and 2017

| 2018 | 2017 | |||||||

| Revenues: | ||||||||

| Financial services and other revenue, net | $ | 72,732 | $ | - | ||||

| Expenses: | ||||||||

| Impairment of capitalized technology and goodwill | 2,195,048 | - | ||||||

| Professional services | 2,003,074 | 336,698 | ||||||

| Compensation, payroll taxes and benefits | 356,557 | 341,890 | ||||||

| Technologies and telecom | 140,349 | 163,623 | ||||||

| Depreciation and amortization | 141,191 | 52,917 | ||||||

| Loss of deposits on planned acquisition of SmartPay Leasing, LLC | 200,000 | - | ||||||

| Occupancy and equipment | 78,472 | 5,301 | ||||||

| Taxes, licenses and insurance | 82,526 | 2,454 | ||||||

| Loss on disposal of fixed assets | 32,262 | - | ||||||

| Gain on extinguishment of accrued expenses | (429,200 | ) | - | |||||

| Other operating expenses | 66,024 | 30,556 | ||||||

| Total operating expenses | 4,866,303 | 933,439 | ||||||

| Net loss from operations | (4,793,571 | ) | (933,439 | ) | ||||

| Other income | 50,000 | - | ||||||

| Interest income | 114 | 48 | ||||||

| Interest expense | (857,919 | ) | (14,433 | ) | ||||

| Net loss | $ | (5,601,376 | ) | $ | (947,824 | ) | ||

| Loss per share of common stock, basic and diluted | $ | (0.17 | ) | $ | (0.13 | ) | ||

| Weighted-average number of common shares outstanding, basic and diluted | 32,153,871 | 7,041,519 | ||||||

See accompanying Notes to Consolidated Financial Statements

| F-3 |

Genesis Financial, Inc. and Subsidiaries

Audited Consolidated Statements of Stockholder’s Deficit

Years ended December 31, 2018 and 2017

Series A 8% Cumulative Convertible Preferred Stock | Series A Common Stock | Common Stock | Additional Paid-in | Accumulated | Total Stockholders’ | |||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Deficit | ||||||||||||||||||||||||||||

| Balance – December 31, 2016 | 1,190,021 | $ | 2,943,265 | 7,041,515 | $ | - | - | $ | - | $ | 1,218,490 | $ | (3,716,897 | ) | $ | 444,858 | ||||||||||||||||||||