Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CEDAR FAIR L P | fun-20200812.htm |

Investor Presentation August 2020

Forward-Looking Statements Some of the information in this presentation that is not historical in nature constitutes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements as to the Company's expectations, beliefs and strategies regarding the future. These forward- looking statements may involve risks and uncertainties that are difficult to predict, may be beyond our control and could cause actual results to differ materially from those described in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. Important factors, including the impacts of the COVID-19 pandemic, general economic conditions, adverse weather conditions, competition for consumer leisure time and spending, unanticipated construction delays, changes in the Company’s capital investment plans and projects and other factors discussed from time to time by the Company in its reports filed with the Securities and Exchange Commission (the “SEC”) could affect attendance at the Company’s parks and cause actual results to differ materially from the Company's expectations or otherwise to fluctuate or decrease. Additional information on risk factors that may affect the business and financial results of the Company can be found in the Company's Annual Report on Form 10-K and in the filings of the Company made from time to time with the SEC. The Company undertakes no obligation to publicly update or revise any forward- looking statements, whether as a result of new information, future events, information, circumstances or otherwise that arise after the publication of this document. 1

FUN Overview 2

Cedar Fair Executive Team Brian Witherow Duff Milkie CFO GC Tim Fisher COO Kelley Semmelroth CMO Richard Zimmerman Dave Hoffman CEO CAO Craig Heckman HRO 3

OUR VISION TO BE THE PREFERRED CHOICE for regional entertainment. OUR MISSION TO MAKE PEOPLE HAPPY by providing them fun, dynamic and memorable experiences they can share with their family and friends year after year. 4 4

PARKS PORTFOLIO KEY STATISTICS Own and operate Entertained 11 28M amusement parks visitors in 2019 9 outdoor water parks 841 (in-park) rides and attractions 4 124 outdoor water parks roller coasters (unique gates) 2,300+ 1 hotel rooms indoor water park resort 5

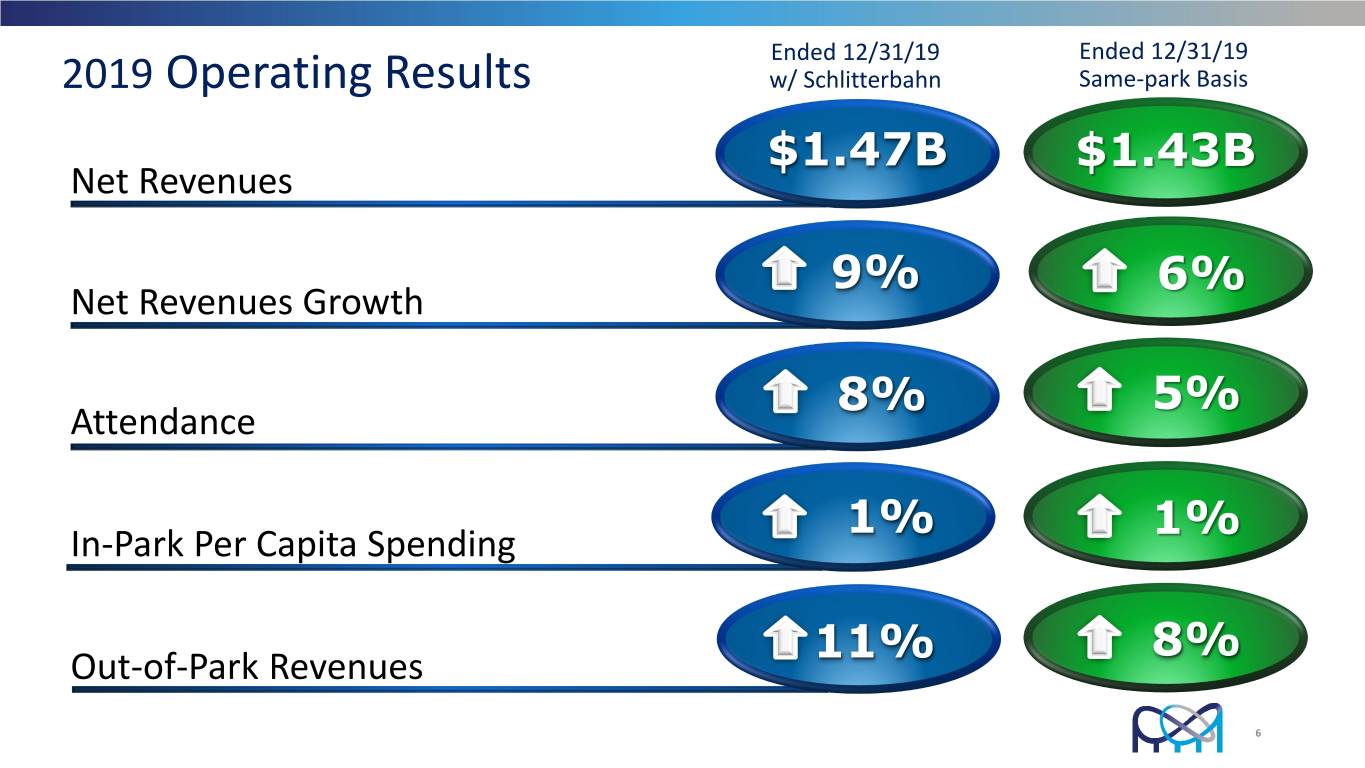

Ended 12/31/19 Ended 12/31/19 2019 Operating Results w/ Schlitterbahn Same-park Basis $1.47B $1.43B Net Revenues 3% 4% 9% 6% Net Revenues Growth 1% 8% 5% Attendance 1% 1% In-Park Per Capita Spending 11% 8% Out-of-Park Revenues 6

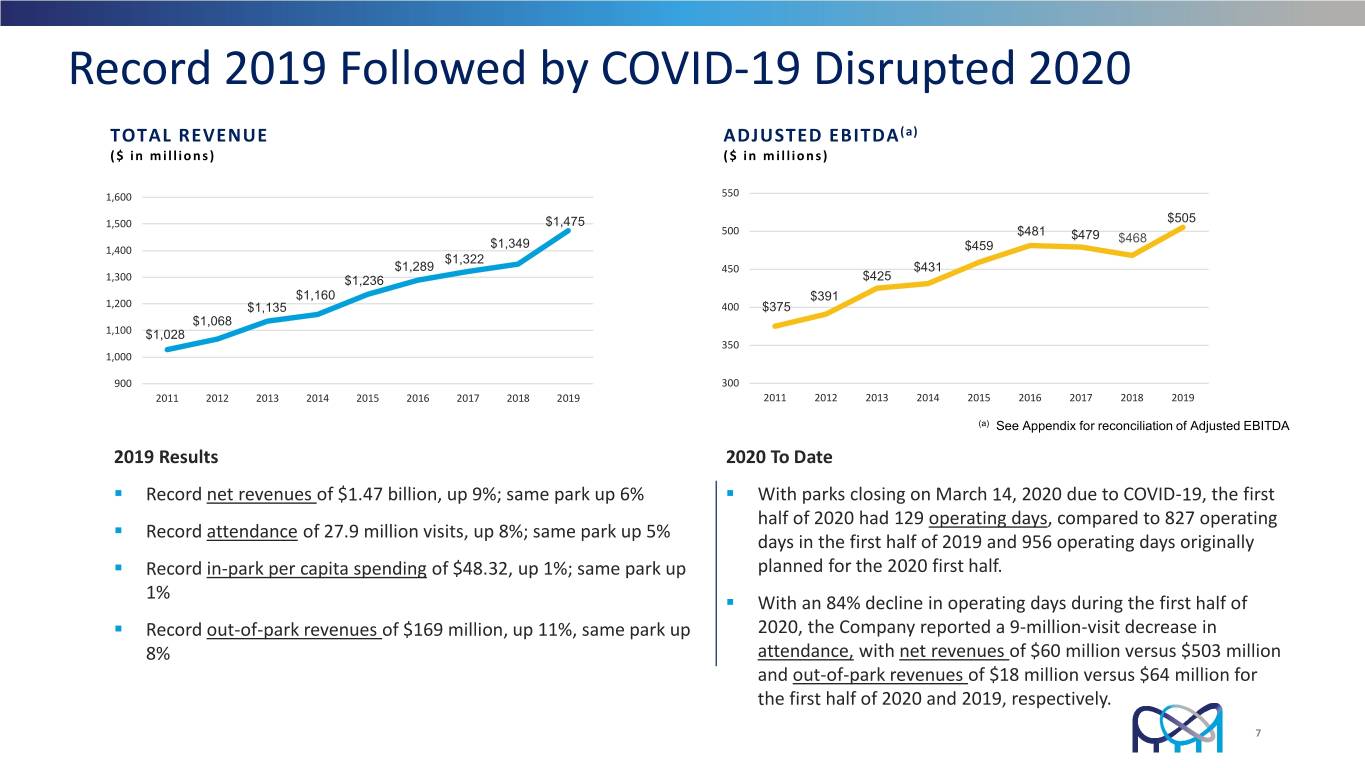

Record 2019 Followed by COVID-19 Disrupted 2020 TOTAL REVENUE ADJUSTED EBITDA(a) ($ in millions) ($ in millions) 1,600 550 1,500 $1,475 $505 500 $481 $479 $468 1,400 $1,349 $459 $1,322 $1,289 450 $431 1,300 $1,236 $425 $1,160 $391 1,200 $1,135 400 $375 $1,068 1,100 $1,028 350 1,000 900 300 2011 2012 2013 2014 2015 2016 2017 2018 2019 2011 2012 2013 2014 2015 2016 2017 2018 2019 (a) See Appendix for reconciliation of Adjusted EBITDA 2019 Results 2020 To Date . Record net revenues of $1.47 billion, up 9%; same park up 6% . With parks closing on March 14, 2020 due to COVID-19, the first half of 2020 had 129 operating days, compared to 827 operating . Record attendance of 27.9 million visits, up 8%; same park up 5% days in the first half of 2019 and 956 operating days originally . Record in-park per capita spending of $48.32, up 1%; same park up planned for the 2020 first half. 1% . With an 84% decline in operating days during the first half of . Record out-of-park revenues of $169 million, up 11%, same park up 2020, the Company reported a 9-million-visit decrease in 8% attendance, with net revenues of $60 million versus $503 million and out-of-park revenues of $18 million versus $64 million for the first half of 2020 and 2019, respectively. 7

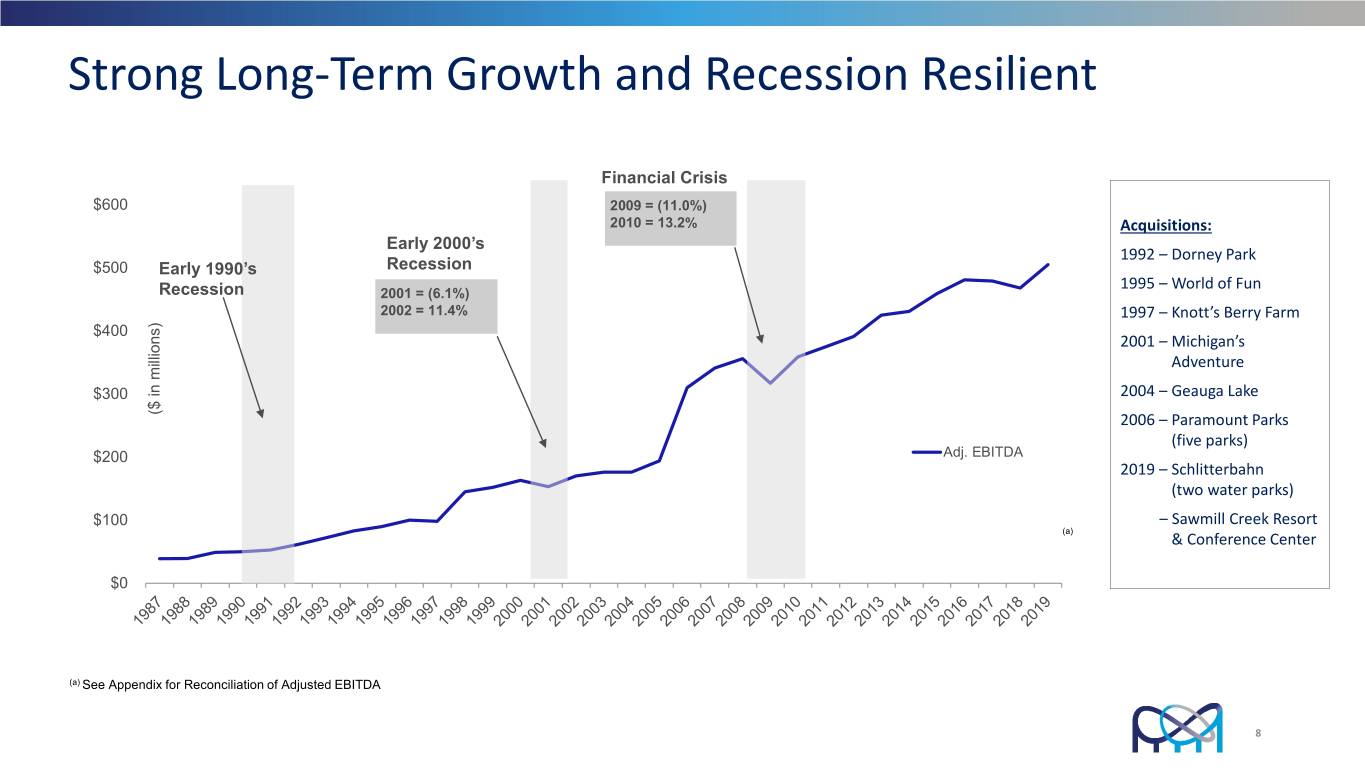

Strong Long-Term Growth and Recession Resilient Financial Crisis $600 2009 = (11.0%) 2010 = 13.2% Acquisitions: Early 2000’s 1992 – Dorney Park $500 Early 1990’s Recession 1995 – World of Fun Recession 2001 = (6.1%) 2002 = 11.4% 1997 – Knott’s Berry Farm $400 2001 – Michigan’s Adventure $300 2004 – Geauga Lake ($ in millions) 2006 – Paramount Parks (five parks) $200 Adj. EBITDA 2019 – Schlitterbahn (two water parks) $100 – Sawmill Creek Resort (a) & Conference Center $0 (a) See Appendix for Reconciliation of Adjusted EBITDA 8

Compelling Investment Rationale 1 Best-in-class parks and brands with loyal, high-repeat customer base 2 High quality assets and significant real estate holdings (and underlying asset value) 3 High barriers to entry 4 Strong business model and steady growth in revenues and free cash flow 5 Resilient operating performance through economic cycles 6 Industry-experienced management with history of delivering results Cedar Fair entered the COVID-19 disruption from a position of strength 9

COVID-19 Measures 10

COVID-19 – Impact on 2020 Park Openings / Closings Park Name Location Status Schlitterbahn Waterpark & Resort New Braunfels New Braunfels, Tex. Opened June 13 Schlitterbahn Waterpark Galveston Galveston, Tex. Opened June 13 Worlds of Fun (1) Kansas City, Mo. Opened June 22 Kings Island Mason, Ohio Opened July 2 Dorney Park & Wildwater Kingdom Allentown, Pa. Opened July 8 Cedar Point Sandusky, Ohio Opened July 9 Michigan's Adventure (2) Muskegon, Mich. Opened July 16 Knott's Berry Farm Buena Park, Calif. State of Readiness Canada's Wonderland Vaughan, Ontario State of Readiness California's Great America Santa Clara, Calif. Closed for Season Carowinds Charlotte, N. Car. Closed for Season Cedar Point Shores Waterpark Sandusky, Ohio Closed for Season Gilroy Gardens (3) Gilroy, Calif. Closed for Season Kings Dominion & Soak City Richmond, Va. Closed for Season Knott's Soak City Waterpark Buena Park, Calif. Closed for Season Valleyfair Shakopee, Minn. Closed for Season (1) Amusement park open; Oceans of Fun closed for season (2) Water park open, amusement park closed for season (3) Cedar Fair operates park, does not own 11

COVID-19 – Senior Secured Notes Offering Completed • Secured $1.0 billion of 5.5% senior secured notes due 2025 • $463 million used to repay a portion of senior secured term loan • Credit facility amended, suspends total leverage ratio financial maintenance covenant after Q1 2020 • Total leverage ratio covenant replaced by senior secured leverage ratio covenant • Commencing Q1 2021 through Q3 2021, leverage calculation substitutes results from Q2 2020 through Q4 2020 with results from Q2 2019 through Q4 2019 • Prevents the effects of COVID-19 from distorting covenant calculations • Removes distractions from prudent management of the business • Requirements of amended credit facility: • Must maintain minimum liquidity level of $125.0 million • Subject to payment restrictions, such as distributions, generally through December 2021 • Added incremental $100 million of revolving credit commitments to existing revolving credit facility • Total size of revolver now $375 million 12

COVID-19 – Measures Taken to Reduce Monthly Cash Burn • Proactive steps taken to reduce operating expenses during the COVID-19 pandemic: • Eliminated nearly all seasonal and part-time labor costs at parks while closed • Suspended all advertising and marketing expenses, and reduced general and administrative spend and other park-level operating expenses to better align with the disruption in operations • Temporarily reduced or deferred portions of base salaries for salaried employees, and reduced scheduled hours for full-time hourly employees, while all parks were closed • Additional proactive steps taken to provide incremental liquidity and enhanced financial flexibility: • Suspended quarterly unitholder distribution payments until market visibility improves and distribution payments can be reinstituted under our recently revised debt covenants • Took proactive measures to reduce 2020 capital spending by approximately $75-100 million, including the suspension of capital projects planned for the 2020 and 2021 operating seasons • While we prepare properties for the 2021 season, we may reactivate certain capital projects over the next twelve months resulting in capital spending that could vary from earlier estimates 13

COVID-19 – Liquidity Outlook • Based on the measures taken to date, we anticipate our cash burn rate for the remainder of 2020 to be approximately $30-40 million per month on average including: • A reduced level of operating costs, net of any revenues generated, with 7 parks open, 2 parks in a state of readiness to open, and 6 parks closed • Capital expenditures, including potential reactivation of select capital investment projects suspended in March 2020 • Interest payments • Liquidity position as of June 28, 2020, was $661 million • Reflects $360 million in available revolver capacity (net of approximately $15 million letters of credit) and $301 million in cash on hand • Ample liquidity to meet cash obligations through the end of 2021, even if another pandemic-related shutdown should occur • Company continues to explore ways to further reduce cash outflows and enhance its liquidity position going forward 14

COVID-19 – Customer Initiatives • Extended 2020 season pass privileges through the end of 2021 season • Extension represents effort to proactively manage demand for the 2021 season • Helps to compensate passholders for any lost operating days during 2020 due to the effects of the pandemic • At parks not opening in 2020, Season Passholders will also receive a Pass PerksTM Loyalty Reward valid for purchases within the parks for next season • Paused collection of guest payments on installment purchase products at our parks that are currently closed • Added enhancements to mobile app technologies, focused on usable tools and applications helpful for guests throughout their park visits • New technologies such as new cashless payment app promotes safer guest and associate interactions • Strengthens safety measures recommended by health officials while offering exciting, guest-friendly alternatives to enhance the overall guest experience 15

Long-Range Plan 16

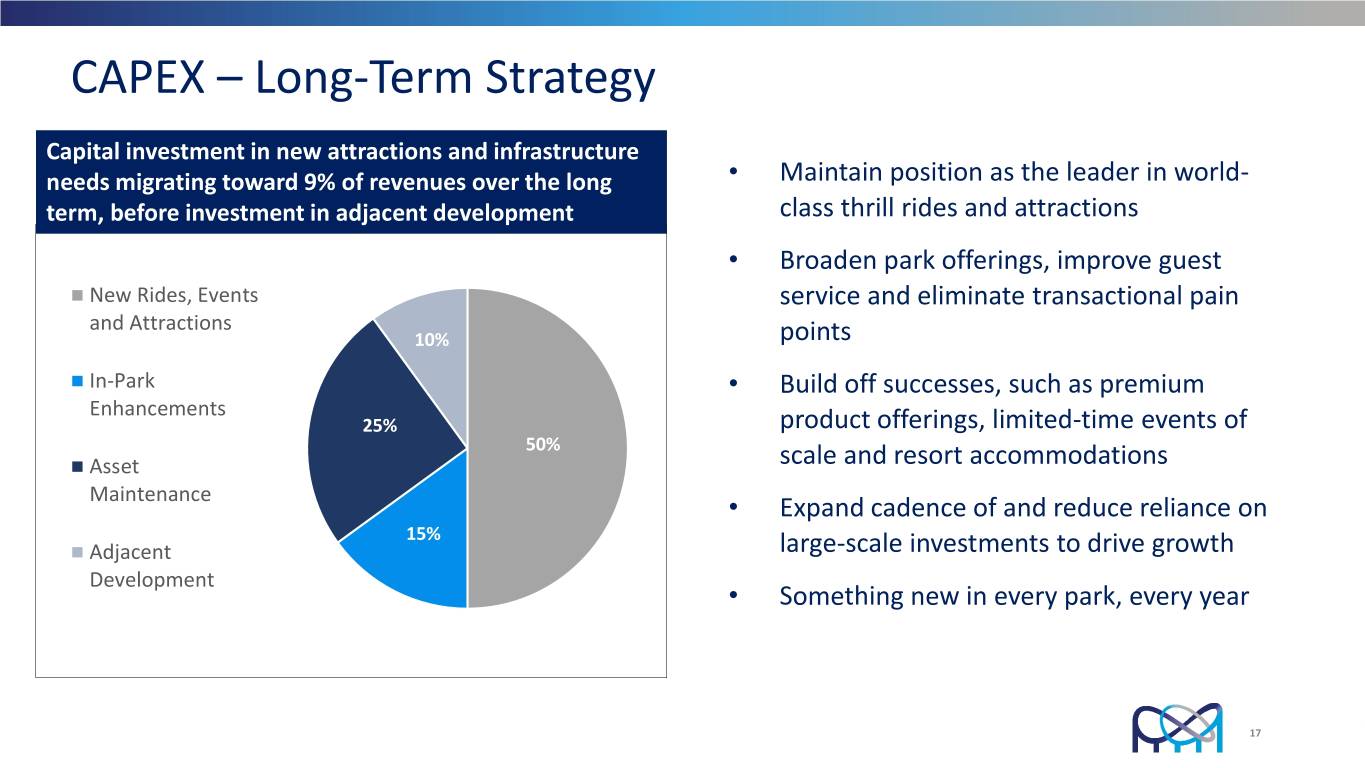

CAPEX – Long-Term Strategy Capital investment in new attractions and infrastructure needs migrating toward 9% of revenues over the long • Maintain position as the leader in world- term, before investment in adjacent development class thrill rides and attractions • Broaden park offerings, improve guest New Rides, Events service and eliminate transactional pain and Attractions 10% points In-Park • Build off successes, such as premium Enhancements 25% product offerings, limited-time events of 50% Asset scale and resort accommodations Maintenance • Expand cadence of and reduce reliance on 15% Adjacent large-scale investments to drive growth Development • Something new in every park, every year 17

Consumer Insights Research We’ve held numerous Focus Groups to explore which types of entertainment experiences are most likely to motivate visitation. Key Findings: • Something for everyone - consumers are seeking entertainment options that can accommodate all types of people, ages and interests • Disconnecting to connect – despite the pervasiveness of technology, people still appreciate simple fun that fosters connection • Consumers are on the hunt for “never before” experiences • Craving atmosphere and experiences with a “sense of place” • Consumers see “local” as more authentic • Authentic diversity is differentiating – consumers are drawn to places that celebrate the diversity of the area in an authentic way 18

Consumer Insights Research Rides and events remain top reasons for visiting our parks, with high-park-interest guests driven by water parks and family coasters. Top Reasons to Visit Parks: • Family Rides • Thrill Coasters • Water Rides • Seasonal Events • Anniversary Celebrations 19

Long-Range Plan: Core Strategies • Broaden the Guest Experience o Aimed at driving more visits from existing guests and incremental visits from new, unique guests o Traditional rides, such as roller coasters and water attractions, still play an important role o Expanded use of limited-duration events and more immersive experiences – “Seasons of FUN” model that drives urgency to visit o Food & beverage to continue to play an outsized role in the guest experience • Expand the Season Pass Program o Remains our strongest growing channel – approximately 53% of total attendance in 2019 o Continued evolution of the program, including the broad rollout of PassPerks, our season pass loyalty program • Increase Market Penetration through Targeted Marketing Efforts o Key opportunities exist with several demographic groups with the fastest population growth rates • Pursue Adjacent Development o Continued evolution of our accommodations and resort offerings 20

“Seasons of FUN” Model: Creates Urgency to Visit 21

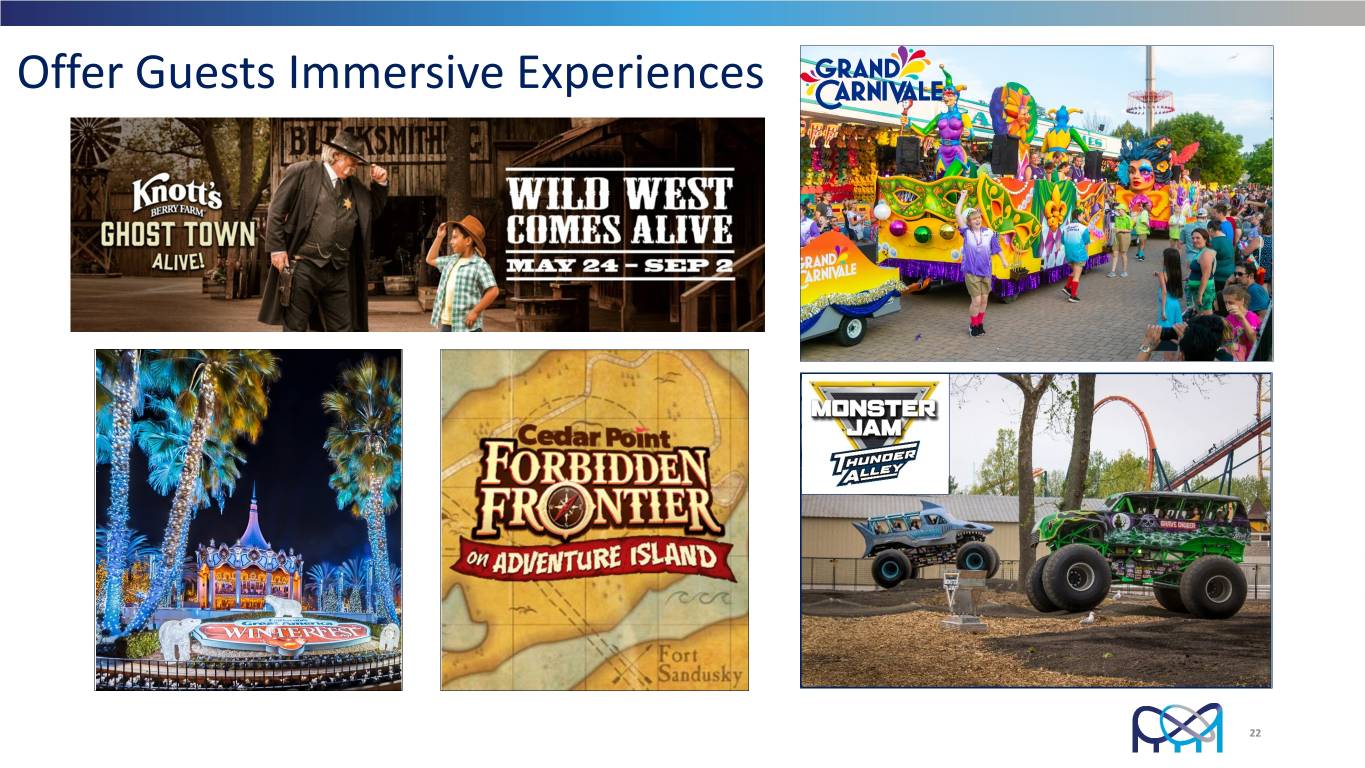

Offer Guests Immersive Experiences 22

Food & Beverage Playing A Key Role • Our research confirms food and beverage today play a critical role in the guest experience • Consumers want unique experiences, offerings they can’t get at home • We have enhanced existing F&B facilities, added more immersive dining experiences • Executive chefs and additional culinary talent hired at each park • Since 2011, F&B revenues up more than 50%; F&B per cap up more than 35% 23

The Changing Landscape of Food & Beverage 24

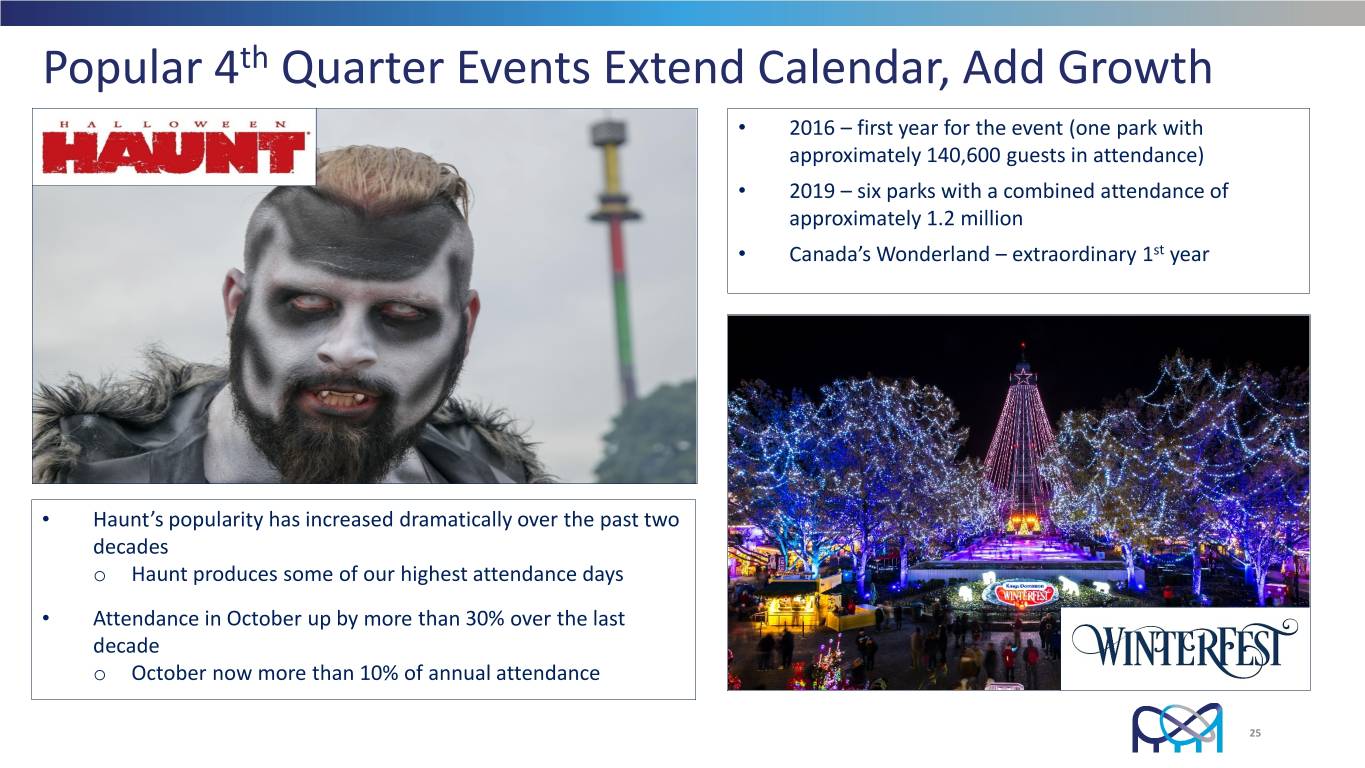

Popular 4th Quarter Events Extend Calendar, Add Growth • 2016 – first year for the event (one park with approximately 140,600 guests in attendance) • 2019 – six parks with a combined attendance of approximately 1.2 million • Canada’s Wonderland – extraordinary 1st year • Haunt’s popularity has increased dramatically over the past two decades o Haunt produces some of our highest attendance days • Attendance in October up by more than 30% over the last decade o October now more than 10% of annual attendance 25

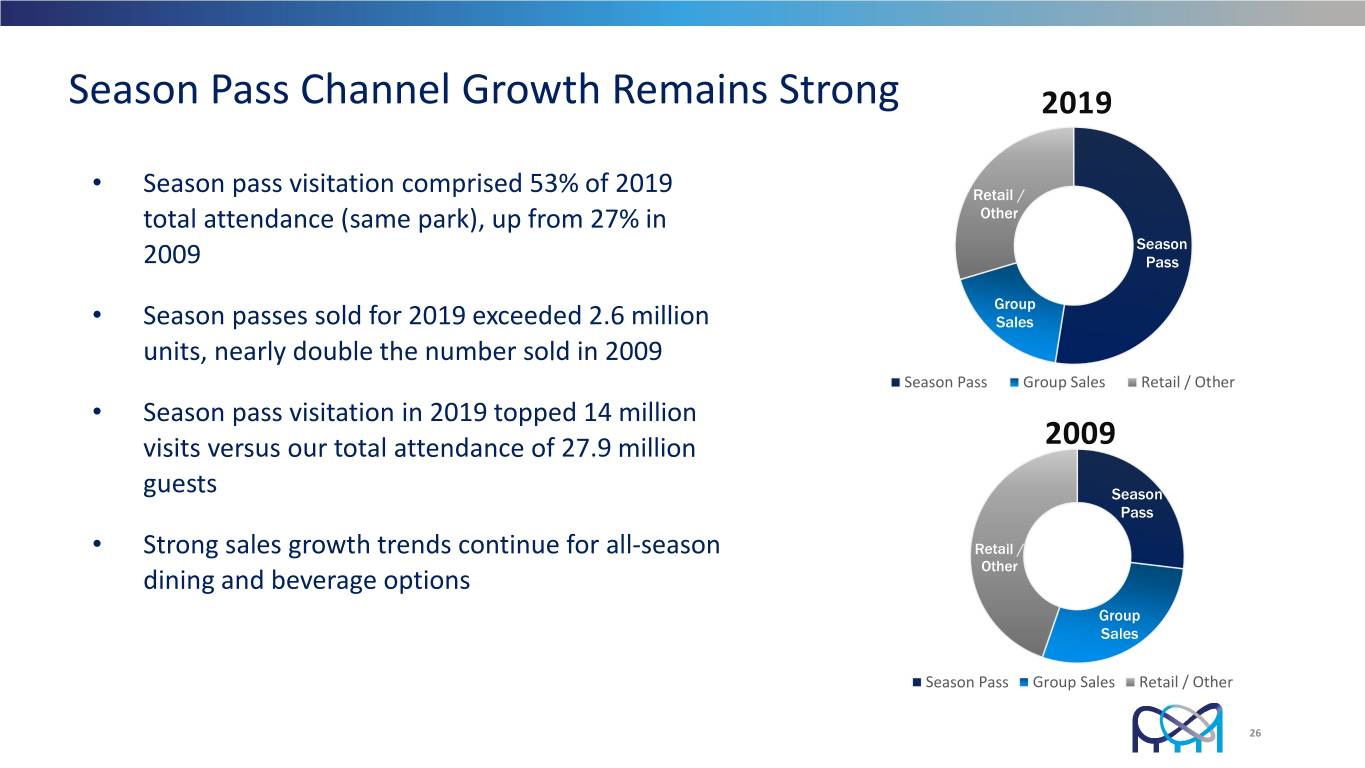

Season Pass Channel Growth Remains Strong 2019 • Season pass visitation comprised 53% of 2019 Retail / total attendance (same park), up from 27% in Other Season 2009 Pass Group • Season passes sold for 2019 exceeded 2.6 million Sales units, nearly double the number sold in 2009 Season Pass Group Sales Retail / Other • Season pass visitation in 2019 topped 14 million visits versus our total attendance of 27.9 million 2009 guests Season Pass • Strong sales growth trends continue for all-season Retail / Other dining and beverage options Group Sales Season Pass Group Sales Retail / Other 26

Evolution of the Season Pass Program Goal: Transition program to Long-term Relationship-based model (from Seasonal Transactional) . Loyalty Program builds lifetime value for guests Objectives: . Address affordability concerns for value-oriented guests while maintaining admissions price integrity . Drive higher unit sales through “stickier” retention . Increase the average visitation of our season passholder base 27

PASSPERKS Loyalty Program Objective: Deliver surprises and provide incentives to our most engaged guests – the season passholder • Offer a program that resonates with season passholders • Play into our guest’s emotions by delivering the unexpected • Drive incremental visits from passholders throughout the season • Incentivize renewals, driving retention rates higher • Systemwide program rollout planned for 2021 o Rewards are earned with each park visit o Offer monthly incentives, such as discounted “Bring-a-Friend” tickets, or in-park discounts on food and merchandise o Conduct lucky drawings monthly (based on visitation), featuring exclusive experiences as prizes 28

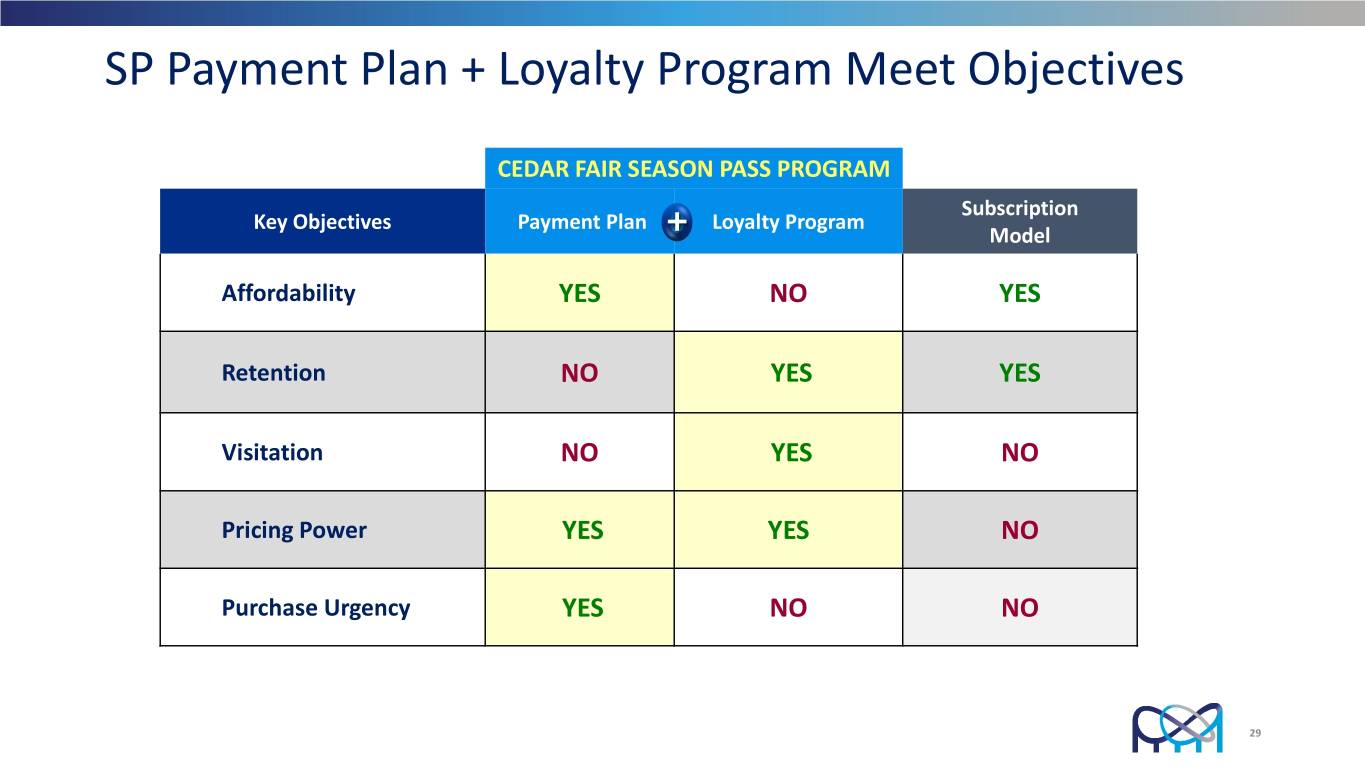

SP Payment Plan + Loyalty Program Meet Objectives CEDAR FAIR SEASON PASS PROGRAM Subscription Key Objectives Payment Plan Loyalty Program + Model Affordability YES NO YES Retention NO YES YES Visitation NO YES NO Pricing Power YES YES NO Purchase Urgency YES NO NO 29

Market Sizing Study Performed to better measure the current penetration of markets feeding our parks and gain a better understanding of the consumer segments within those markets. Key Findings: • Strong attendance penetration among demographic groups in decline o Lowest penetration among groups with the fastest population growth rates • Key opportunities exist with several demographic segments across multiple parks: o Older Non-Families o Families with Young Children o Millennial Non-Families o Asian American and U.S. Hispanic Households o High-Income Households • Near-term priority to focus on the tourism market in Southern California 30

Evolution of the Accommodations Channel • Substantial growth of accommodations portfolio last 8 years: o Total hotel rooms grew to more than 2,300 from 1,900 (includes Schlitterbahn and Sawmill Creek Resort) o Total luxury RV sites increased to more than 600 • Accommodations Revenue: o > $80 million in 2019, up 35% since 2011 (includes Schlitterbahn and Sawmill Creek Resort) 31

Adjacent Development – Accommodations • Charlotte – adjacent to Carowinds • Sandusky – minutes from Cedar Point • Opened November 2019 • 236-room hotel and conference center, • 130 well-appointed suites restaurants, Tom Fazio-designed golf course • Year-round accommodations • Rolling renovation paused for COVID-19 32

Cedar Point Sports Center Outdoor Facility • Opened March 2017 – prior to COVID-19, performance was pacing well ahead of the original pro-forma model • 10 multi-use fields with clubhouse • Baseball, softball, soccer, lacrosse Indoor Center • Opened January 2020 – initial bookings were very strong prior to COVID-19 disruption • 145,000 square feet • Court space accommodates 10 basketball courts and 20 volleyball courts • AAU basketball, JO volleyball, wrestling, cheer, gymnastics 33

Key Takeaways • COVID-19 Measures o Timely, proactive steps taken to further strengthen financial position if long-term disruption occurs o Completed $1 billion notes offering and dramatically reduced cash burn o Suspended quarterly unitholder distribution payments until market visibility improves and permitted to reinstitute under debt covenants o Implemented COVID-related safety procedures with upgraded technologies for park re-openings • Growth o As operations recover, confident long-term strategies and initiatives will continue to drive up attendance, per capita spending and revenue growth for the foreseeable future • Leverage o Top priority to responsibly reduce total leverage back below 5.0x as quickly as possible o Re-establish balance sheet flexibility to pursue future opportunities like Schlitterbahn • CAPEX o Critically evaluating the required level of capital investment necessary for the remainder of 2020; more efficient deployment of capital within each park over the long term o Evolving capital investments to coincide with the changing tastes of the consumer 34

Appendix 35

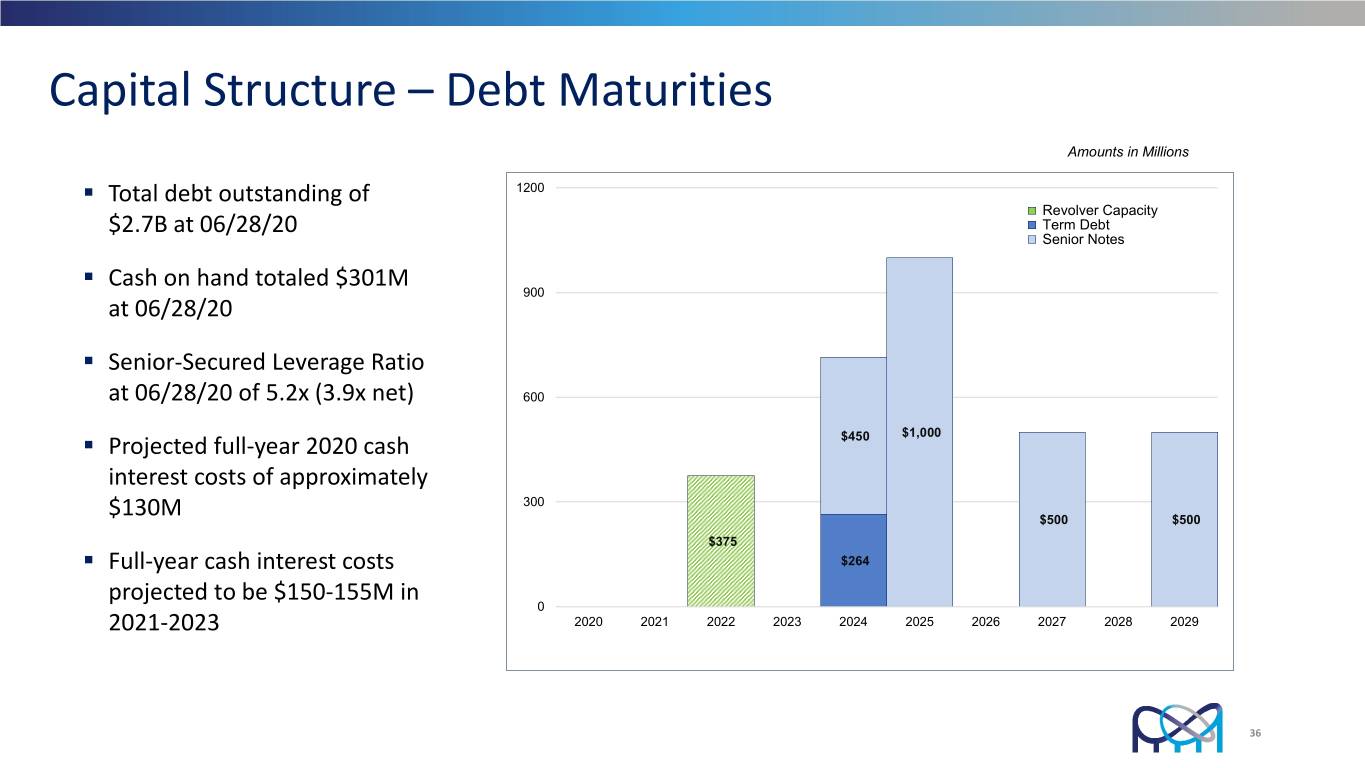

Capital Structure – Debt Maturities Amounts in Millions . Total debt outstanding of 1200 Revolver Capacity $2.7B at 06/28/20 Term Debt Senior Notes . Cash on hand totaled $301M 900 at 06/28/20 . Senior-Secured Leverage Ratio at 06/28/20 of 5.2x (3.9x net) 600 $1,000 . Projected full-year 2020 cash $450 interest costs of approximately 300 $130M $500 $500 $375 . Full-year cash interest costs $264 projected to be $150-155M in 0 2021-2023 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 36

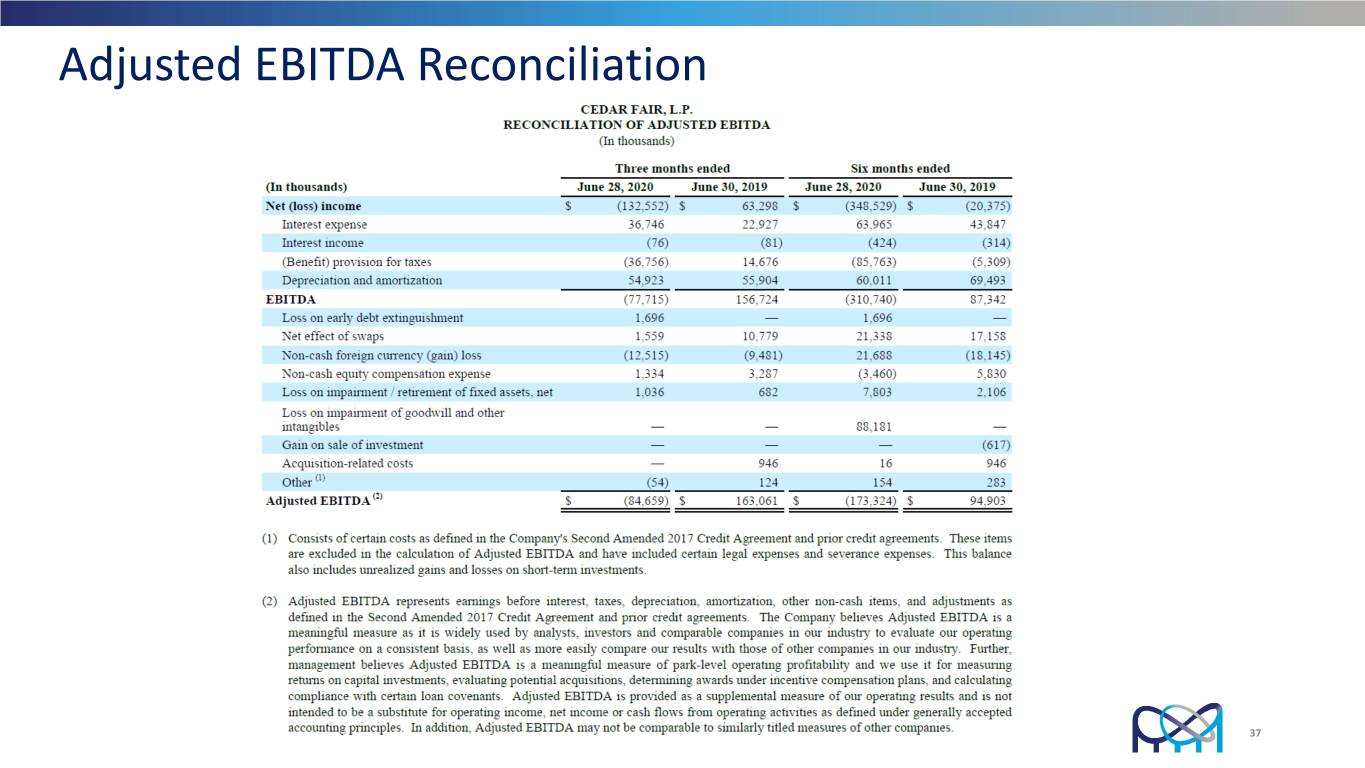

Adjusted EBITDA Reconciliation 37