Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Zendesk, Inc. | q22020tweet.htm |

| EX-99.1 - EX-99.1 - Zendesk, Inc. | zen8-kq22020ex991.htm |

| 8-K - 8-K - Zendesk, Inc. | zen-20200727.htm |

Exhibit 99.2 Shareholder Letter Q2 2020 July 30, 2020

Introduction Q2 2020 REVENUE In a difficult and complex market environment, Zendesk delivered second-quarter revenue Q2 2020 Y/Y growth of 27% and improved GAAP and non-GAAP operating margins by 14 and 6 Mikkel Svane percentage points, respectively, year-over-year. CEO These results were driven by continued demand for our customer experience solutions, our ability to adapt quickly to a distributed business climate, and prudent expense management. Customer engagement has become the heartbeat During this crisis, we're investing in driving even of businesses as the global pandemic forces them faster time to value for our customers across our to change how they operate and communicate. In products, sales processes, and enablement, while a world that's more distributed and physically further building out our messaging solutions at a distant, the need to stay in touch with both time when connected customer conversations are customers and employees has become more critically important. essential, across more channels. Businesses require flexible and easier-to-use software As always, we are prioritizing customer Elena Gomez solutions to help them navigate new priorities and relationships in everything that we do. Many of our CFO shifts in business models. customers face challenges in this disruptive economic environment. We are working with them To meet these needs, we're focusing on what we to adjust contract terms, sacrificing potential do best: delivering fast time to value through short-term economics in favor of strengthening customer experience solutions that empower long-term relationships. These actions have organizations to communicate authentically and impacted and will continue to impact our seamlessly across channels. Organizations are near-term net expansion rate and overall financial implementing our software within days rather than performance, including free cash flow. We view weeks or months so they can quickly scale and this as a long-term investment in our customers meet fast-changing customer needs. that helps us both retain more business and create future expansion opportunities. Marc Cabi SVP, Finance, Strategy and IR Zendesk Shareholder Letter Q2 2020 - 2

We are fortunate to be in a position to help our customers while investing in our long-term growth initiatives. We have a strong balance sheet, a compelling subscription-based business model, and a large and diverse customer base of more than 160,000 customers across more than 160 countries and territories. We strengthened our financial position in June with the completion of a convertible debt offering, with part of the proceeds used to repurchase existing convertible debt. As of June 30, 2020, we had $1.3 billion of cash, cash equivalents, and marketable securities. Global economic conditions continue to be uncertain and volatile, and this may become a period of prolonged economic disruption. We have been disciplined in our business operations, are carefully prioritizing our investments, and prudently managing our expenses. While we expect near-term uncertainty, we believe we are in a solid position, operating effectively, and making the right investments to emerge stronger from the pandemic and deliver long-term growth Partner story and scale. Tata Consultancy Services Tata Consultancy Services (TCS) and Zendesk announced their partnership in March, combining TCS’ vast, expert network of global customer experience consultants with Zendesk’s powerfully simple, enterprise-grade CRM solutions. The partnership is part of Zendesk’s strategy to expand its network of global system integrators to better reach and help prospects, customers, and partners. TCS is using its business intelligence and technical acumen to build strong delivery capabilities with a dedicated Zendesk practice. The companies are currently collaborating on building various industry-specific solutions powered by the Zendesk Sunshine platform. Zendesk Shareholder Letter Q2 2020 - 3

Summary financial table Second quarter fiscal year 2020 (in thousands, except per share data) See a reconciliation of non-GAAP measures presented at the end of this letter. Zendesk Shareholder Letter Q2 2020 - 4

Current trends We’re seeing encouraging trends in demand for our customer experience solutions and the development of new use cases, although the economic climate and market uncertainty is undoubtedly creating significant headwinds. Sales of our solutions exhibited solid growth year-over-year in the second quarter. However, contraction in the second quarter was significantly elevated compared to prior periods as we worked with customers to address their business challenges. We saw solid market demand for our solutions as customers streamline communication and prioritize the use of analytics to improve the customer experience. In the second quarter, demand for the Zendesk Support Suite omnichannel bundle, our Explore data Customer story product, and Sunshine Conversations messaging platform were Children’s Council of San Francisco particularly strong. Support Suite features new messaging capabilities, supporting end customers’ need to feel Almost four months into California’s shelter-in-place order, the flood “always-connected” and to allow for the personalized, asynchronous of inquiries received by Children’s Council of San Francisco is holding communication between an organization and its customer that is so steady. The nonprofit connects healthcare workers and vulnerable critical today. families with access to the lifelines they need—emergency child care, virtual workshops on stress management and family dynamics, and other vital online resources. Since March 2020, the nonprofit has fielded a 10x increase in inquiries compared to the same period in 2019. Children’s Council uses Zendesk Support and Guide and maintains a multilingual help center with 80+ centralized articles that connect parents, child care professionals, and essential workers with critical information and expertise. With limited funding and resources, the nonprofit has relied on Zendesk’s flexibility and ease of use to create additional content and help execute programs to families in need. For example, it used Support and Guide to coordinate the distribution of 160 play-and-learn activity kits, reaching 440 children across nearly every zip code in San Francisco. In support of the Black Lives Matter movement, it used Guide to create a home for materials about how to talk to children about race and social justice. Zendesk Shareholder Letter Q2 2020 - 5

Zendesk’s solutions are easy to use, agile, and allow organizations to quickly scale and see rapid time to value. These qualities allowed organizations to use our software in critical ways in their business: ● Many organizations transitioned to remote work or distance learning and needed better ways to communicate with employees or students ● Delivery, communications, entertainment, and gaming companies scaled quickly to meet rapidly rising customer volume ● Retailers accelerated their move to e-commerce, converted in-store representatives to online consultants, and/or implemented curbside pickup ● Consumer products companies engaged more directly with Customer story their customers and, in some circumstances, began selling DFO Global directly to customers ● Healthcare companies offered more online information and DFO Global is a growing performance marketing agency that virtual assistance specializes in e-commerce. To keep costs down while scaling its ● Governmental and non-governmental agencies and support operation, the company is implementing Zendesk organizations leveraged new technologies to more effectively Support, Chat, and Guide. Advanced self-service offerings will provide help for communities in need. Zendesk became help DFO Global deflect many of its approximately 150K monthly FedRAMP authorized in the second quarter, which will allow inquiries and hasten agent onboarding. By working in a certain government agencies and their affiliates to evaluate consolidated omnichannel platform, agents will be able to using Zendesk’s customer service and engagement platform seamlessly converse with customers across channels to provide with confidence that it meets the Low Impact a better, and scalable, customer experience. Software-as-a-Service (LI-SaaS) baseline of security standards. Given restrictions in the LI-SaaS standard verification, not all agencies or use cases can be supported at this verification level. Zendesk Shareholder Letter Q2 2020 - 6

Sales to small businesses and larger enterprise organizations were solid during the quarter. We believe that many of our initiatives to differentiate how we serve those customers are beginning to come to fruition and helped to maintain momentum despite the uncertainties brought on by COVID-19. However, sales to midsized customers experienced some headwinds as expansions slowed below historical patterns. We believe this was due to customer conservatism given the state of the macro environment. Our quick time to value and rapid deployment remains compelling for organizations of all sizes. With our small customers, we’re benefiting from continued improvements to our learn-try-and-buy and in-product adoption experiences. We have successfully hired both sales leaders and experienced Customer story enterprise sales professionals across all our regions, including the U.S. Holland & Barrett This has deepened our capabilities in selling to midsized and larger enterprise organizations. We’ve invested in account coverage and are Health and wellness giant Holland & Barrett is the largest of its continuing to mature our outbound selling approach. Our investment kind in Europe, operating over 1,300 shops in markets as diverse in our partner ecosystem has also led to a higher percentage of as Asia and the Middle East. It started using The Zendesk Suite in partner-involved bookings in the second quarter. 2018 to consolidate a number of legacy solutions and enable more effortless conversations. As social distancing orders rolled out In light of the current environment, second-quarter sales were globally at the beginning of 2020, the company saw online orders particularly strong in our EMEA region, with sales growth levels spike as more customers remained at home. Ever nimble despite exceeding pre-COVID levels, although contraction was above its mammoth reach, the company decided to convert a number of historical trends. its in-store employees to online customer support agents to bolster support in this area. Its agility has ensured that the same While our sales trends have been encouraging, contraction is friendly faces that Holland & Barrett’s customers are used to elevated. Many customers face end-market demand challenges, seeing in stores are empowered to continue doing what they do especially in the travel, hospitality, and ridesharing industries. best: help customers get what they need to stay healthy and well. Additionally, more than 4,000 customers have reached out to us for financial relief since the onset of COVID-19, which we have managed, where appropriate, through modifications to billings and/or subscription terms. The highest volume of these requests were received in March and April, with volume having slowed as we exited the quarter and in recent weeks. Zendesk Shareholder Letter Q2 2020 - 7

Investments The pandemic has changed the way people interact and do business. We expect many of the customer service trends that have emerged during this time to continue long term, such as demand for online and delivery services and the ability to work and serve customers remotely. We believe organizations also will continue to prioritize software investments that deliver quick time to value and agility. These are areas where Zendesk excels, and we’re making investments that build on these opportunities for the long term and position us for growth and strength as we come out of the current crisis. Our assumption is that the macro environment will remain challenging into 2021. We are ruthlessly prioritizing investments, being Customer story very prudent with our expenses, and instilling simplicity into Conrad everything we do. Forced to close all of its brick-and-mortar locations, German Some of our near-term investments include democratizing access to electronics retailer and B2B distributor Conrad has shifted its focus messaging. We want every company to be able to get up and running to improving e-commerce customer experiences during the on major social messaging channels and with native messaging built pandemic. It extended its marketplace team to add categories and into their apps and services. We are planning for deeper integration of onboard new sellers to its e-commerce site, making it easier for social and native messaging capabilities in our Support Suite, which customers to navigate its vast catalog of 5M+ products. This meant we launched earlier this year with a new agent workspace and initial Conrad also had to scale its digital support and worked with its two messaging features. BPO partners to ensure that the 200+ agents were prepared to continue to use Zendesk Support, Chat, and Guide as they transitioned to working from home. The company is implementing Zendesk Sell across its 150-person sales team to provide the data and tools needed to meet revenue targets. Conrad’s improvements have simplified, centralized, and enhanced its B2C and B2B customer experiences, helping it to emerge as a stronger, more resilient company that its customers can continue to depend on. Zendesk Shareholder Letter Q2 2020 - 8

We’ll continue to broaden our self-service capabilities and enhance customer onboarding to scale our sales to small customers. For midsized and large enterprise customers, we’ve recently made three key hires: SVP Sales of EMEA, SVP Sales of APAC, and COO of APAC. These leaders bring unique perspectives, operational rigor, and experience in enterprise-selling motions to the team. They are working to share best practices, extend the reach of our technical expertise, and foster alignment across all our regions. We are also continuing to build our partner ecosystem to extend our reach with customers. Customer story Sprout Social Sprout Social’s platform helps businesses manage their social media presence—especially important during a time when nearly all business is transacted online. The company started using Zendesk Support in 2012 and over time expanded its use to include Guide, Chat, Talk Partner Edition, and Explore to offer 24/7 global support. With modern, flexible tools already in place, the team was prepared to handle the initial surge in billing and account-related requests during the onset of COVID-19; and a number of strategic, data-driven projects had freed resources ahead of time. For example, one Explore-driven project led to a product improvement that resulted in a 36 percent reduction in ticket volume, and a 29 percent reduction in chat volume for one of its busiest support topics. Leveraging data in this way has allowed Sprout Social’s support team to remain stable amidst greater change. Zendesk Shareholder Letter Q2 2020 - 9

Customer story Customer story Packlink Madison Reed Packlink is an online shipping service offering individuals and As barbers and salons closed during the pandemic, Madison Reed e-commerce merchants a fast and easy way of booking parcel resolved to help people do their own hair and achieve salon-quality deliveries with the world's top couriers. The company felt results. Faced with closing its brick-and-mortar locations and meeting COVID-19’s effects early on, first in Italy and then as the virus a sharp uptick in e-commerce demand, Madison Reed used Zendesk moved through Europe. Ticket volume increased by 138 percent to quickly convert in-store colorists to online colorists. The company’s and help center views by 80 percent. With Zendesk Support, speedy pivot has kept Madison Reed’s experts employed and enabled Guide, Gather, and Chat in place, the support team quickly the company to meet customers where they are: online, at home. transitioned to working from home and was able to swiftly onboard Madison Reed uses Zendesk Support, Chat, Talk, and Guide to keep new remote agents to help with the increased volume. So far, CSAT track of every conversation across each customer’s channel of choice. is up by six points and the team is answering 75 percent of requests in less than 24 hours. New customers easily find answers about how the service works on its Guide-powered help center, reducing extra ticket volume. Packlink credits Zendesk’s flexibility and ease of use with the team’s ability to scale, bolster its self-service, and adjust to its new working model. Zendesk Shareholder Letter Q2 2020 - 10

Scaling for the future Archana Agrawal, Board Member Zendesk is well-positioned to continue its leadership in customer experience innovation and deliver long-term growth. To help us achieve our objectives, we continue to add new talent and leadership to our company that have proven experience scaling businesses. On July 27, 2020, Archana Agrawal joined our board of directors, bringing nearly two decades of experience as a seasoned leader in the SaaS space. Archana has a unique background in bringing data science into enterprise marketing and customer acquisition. Archana has served as the Chief Marketing Officer of Airtable, a low-code app development platform, since March 2020 and as a member of the board of directors of MongoDB, Inc. since August 2019. Previously, Archana served as the Head of Enterprise and Cloud Marketing at Atlassian, an enterprise software company, from May 2016 to March 2020. Archana joined Atlassian in 2013 as Head of Data Science and Growth Marketing. Prior to that, Archana was at Ladders, Inc. from 2007 until 2013, where she led corporate-wide analytics. She began her career at the IBM Almaden Research Center. She holds an M.B.A. from Harvard Business School and received her M.S. in computer science from the University of Illinois at Urbana-Champaign. Archana Agrawal Board Member Zendesk Shareholder Letter Q2 2020 - 11

Guidance For the quarter ending September 30, 2020, we expect to report: We believe our financial performance will continue to be impacted by ● Revenue in the range of $250 - 255 million uncertain and highly disrupted global economic conditions. Many ● GAAP operating income (loss) in the range of $(42) - (38) customers continue to face end-market demand challenges and we are million, which includes share-based compensation and seeing higher levels of contraction compared to historical trends. We related expenses of approximately $48 million, amortization continue to partner with customers who are undergoing business of purchased intangibles of approximately $2 million, and challenges to help them with modified invoicing and subscription acquisition-related expenses of approximately $2 million terms. These conditions and actions have impacted and will continue to ● Non-GAAP operating income (loss) in the range of $10 - 14 impact our near-term net expansion rate and overall financial million, which excludes share-based compensation and performance, and have played a role in impacting our free cash flow related expenses of approximately $48 million, amortization generation. We are being disciplined and prudent in how we manage of purchased intangibles of approximately $2 million, and our business. acquisition-related expenses of approximately $2 million ● Approximately 116 million weighted average shares Longer term, with improved macroeconomic conditions, we continue outstanding (basic) to believe the fundamentals of our business model will drive ● Approximately 122 million weighted average shares meaningful revenue growth. In particular, we believe that our customer outstanding (diluted) experience solutions will continue to lead in innovation and be more compelling relative to traditional large enterprise competitors. We will continue to innovate and improve our product offering and how we operate and engage with consumers. These initiatives give us confidence in our plan to deliver high revenue growth and operating leverage. Zendesk Shareholder Letter Q2 2020 - 12

We withdrew our annual guidance last quarter, and we have not We have not reconciled free cash flow guidance to net cash from provided any updated forecast for free cash flow, a financial metric we operating activities for the full year 2020 because we do not provide have typically only provided on an annual basis. While we continue to guidance on the reconciling items between net cash from operating provide guidance on a quarterly basis only, after a full quarter to activities and free cash flow, as a result of the uncertainty regarding, assess impact on free cash flow, we do expect free cash flow and the potential variability of, these items. The actual amount of such performance to be positive over the second half and that our full year reconciling items will have a significant impact on our free cash flow 2020 free cash flow will be neutral to slightly positive as customer and, accordingly, a reconciliation of net cash from operating activities mitigation efforts decrease and benefits of ongoing expense to free cash flow for the full year 2020 is not available without management are realized. This will be dependent on our ongoing unreasonable effort. experience with bookings, renewals, and collections as well as our Additionally, Zendesk’s estimates of share-based compensation and ongoing efforts at expense management. We are confident that the related expenses, amortization of purchased intangibles, prudent approach we are taking to management leaves us well acquisition-related expenses, weighted average shares outstanding, situated to continue our investments in growth given the strength of and free cash flow in future periods assume, among other things, the our balance sheet. occurrence of no additional acquisitions, investments, or In 2015, we set the ambitious goal of achieving $1 billion in revenue restructurings and no further revisions to share-based compensation by 2020, and we are optimistic that despite the current economic and related expenses. disruption we will be able to reach this goal. There are many factors that can affect our actual results, which are discussed below and in the risk factors in our filings with the Securities and Exchange Commission. Some of the key risk factors include global macroeconomic conditions, the impact of the novel coronavirus and resulting COVID-19 disease pandemic on our business, business conditions of customers in challenged industries, the effect on demand for our products from customers, and the ability of our customers to manage the current severe economic downturn. Zendesk Shareholder Letter Q2 2020 - 13

Global diversity, equity, and inclusion Our commitments We believe that diversity, equity, and a culture of inclusion make Zendesk is committed to playing an active role in establishing a more Zendesk a more innovative and competitive company, and we value equitable society and laid out five ways we are going to address these the talent and contributions of our employees from all cultures and challenges as a company. backgrounds. The recent deaths of Black Americans at the hands of police stand against our values as a company and led us to make new commitments to bolster our own efforts against discrimination and racism. 1 Supporting our employees We responded publicly following the death of George Floyd with a simple message: We can’t be silent. We followed those words with a 2 Empowering managers series of steps both internally and externally to commit to playing an active role in establishing a more equitable society, and to expand our Formalizing a policy own diversity, equity, and inclusion efforts. We hosted listening and 3 discussion sessions with employees globally, called empathy circles, to learn, grieve, and heal together. We made donations to the 4 Investing in global diversity, equity, and inclusion Southern Poverty Law Center and National Association for the Advancement of Colored People to combat racism and discrimination more broadly. And we began an initiative to embed diversity, equity, 5 Financial assistance and inclusion into how we hire, develop, and retain employees. During the quarter, we continued our tradition of celebrating Pride month, and for the first time in our company’s history, we celebrated Mental Health Awareness month and Memorial Day by launching a series of video interviews with members of our Global Veterans Network Employee Resource Group, who shared how they were able to emerge from past periods of isolation with resilience. We also created a unique day of educational experiences on Juneteenth by hosting a series of virtual events and learning engagements where employees could share their intersectional experiences and learn more about diverse communities. Zendesk Shareholder Letter Q2 2020 - 14

Timeline Note: Timeline not to scale. *Annual revenue run rate was calculated by multiplying our revenue for the most recent applicable quarter by four. For more information about our revenue run rate, please see the “About Operating Metrics” section at the back of this letter. Zendesk Shareholder Letter Q2 2020 - 15

Conversica Customers Accelerating revenue with Intelligent Virtual Assistants Among the customers to join or expand with us recently are: Canadian Red Cross A Canadian non-profit DFO Global organization A performance marketing company Cargas Systems A financial software and Fred Hutchinson Cancer consulting company Research Center A cancer research center Children’s Council Holland & Barrett of San Francisco A health and wellness retailer A non-profit organization Collective Health Latitude Financial Simplifies employee healthcare Services Australia for U.S. companies with A digital payments and technology solutions that make finance company healthcare work for everyone Conrad Libbey A German retailer of A glassware company electronic products Zendesk Shareholder Letter Q2 2020 - 16

Customers Among the customers to join or expand with us recently are: Madison Reed Personio A hair care and hair color brand An HR operating system Marley Spoon Salling Group A meal delivery company A Denmark-based retail group NTT Data Intramart Sprout Social A business process platform An industry-leading provider of social media management software Packlink SPVIE Assurances An online shipping service An insurance solution company Penn National Gaming Turo A gaming and racing properties A car sharing marketplace owner and operator Zendesk Shareholder Letter Q2 2020 - 17

We’re working our magic June 2020 Gartner Magic Quadrant for the CRM Customer Engagement Center In June 2020, our efforts were again Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only recognized by Gartner. For the fifth year those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all in a row, Gartner Inc. named Zendesk a warranties, expressed or implied, with respect to this research, including any Leader in the Magic Quadrant for the warranties of merchantability or fitness for a particular purpose. The Gartner content described herein, (the "Gartner Content") represent(s) research opinion or viewpoints published, as part of a syndicated CRM Customer Engagement Center. subscription service, by Gartner, Inc. ("Gartner"), and are not representations of fact. Gartner Content speaks as of its original publication date (and not as of the date of this Shareholder Letter) and the opinions expressed in the Gartner Content are subject to change without notice. Zendesk Shareholder Letter Q2 2020 - 18

In June 2020, Frost & Sullivan named Zendesk as a recipient of its 2020 North American Omnichannel Digital Customer Engagement Competitive Strategy Innovation and Leadership award. In July 2020, Frost & Sullivan recognized Zendesk with the 2020 North American Product Leadership Award for its Sell sales force automation (SFA) solution. Zendesk Shareholder Letter Q2 2020 - 19

Operating metrics % of total quarter-ending Support ARR from paid customer accounts with 100+ Support agents A key metric we use to gauge our penetration within larger organizations is represented by the percentage of Support ARR generated by customers with 100 or more Support agents. That percentage was approximately 43% at the end of the second quarter Q2 2020 of 2020, compared to 43% at the end of the first quarter of 2020 100+ agents % and 42% as reported at the end of the second quarter of 2019. 43 Dollar-based net expansion rate Our dollar-based net expansion rate, which we use to quantify our annual expansion within existing customers, was 111% at the end of the second quarter, compared to 115% at the end of the first quarter of 2020. Our dollar-based net expansion rate was 117% at the end of the second quarter of 2019. Consistent with expectations in prior quarters, we believe a healthy dollar-based net expansion rate for Zendesk in a normal market environment is 110% - 120%. Zendesk Shareholder Letter Q2 2020 - 20

We believe an indicator of our midsized and large enterprise execution is encompassed in the growth of remaining performance obligations (RPO). RPO represents future revenues that are under contract but have not yet been recognized. As we continue to move upmarket to serve large enterprise customers and deliver more complex and strategic use cases, we typically enter into contracts with longer subscription terms. In the second quarter of 2020, RPO growth and the mix of long-term and short-term RPO were impacted by a reduction in average subscription term driven by customer conservatism in light of economic conditions and the elevated churn and contraction we experienced in the quarter. Remaining performance obligations (RPO) in millions Short-term RPO Long-term RPO Zendesk Shareholder Letter Q2 2020 - 21

Select financial measures (in millions) Quarter-over-quarter comparisons (q/q) are for the three months ended June 30, 2020, compared to the three months ended March 31, 2020. Year-over-year comparisons (y/y) are for the three months ended June 30, 2020, compared to the three months ended June 30, 2019. See a reconciliation of non-GAAP measures presented at the end of this letter. Zendesk Shareholder Letter Q2 2020 - 22

Condensed consolidated statements of operations (in thousands, except per share data; unaudited) Zendesk Shareholder Letter Q2 2020 - 23

Condensed consolidated balance sheets (in thousands, except par value; unaudited) Zendesk Shareholder Letter Q2 2020 - 24

Condensed consolidated statements of cash flows (in thousands; unaudited) Zendesk Shareholder Letter Q2 2020 - 25

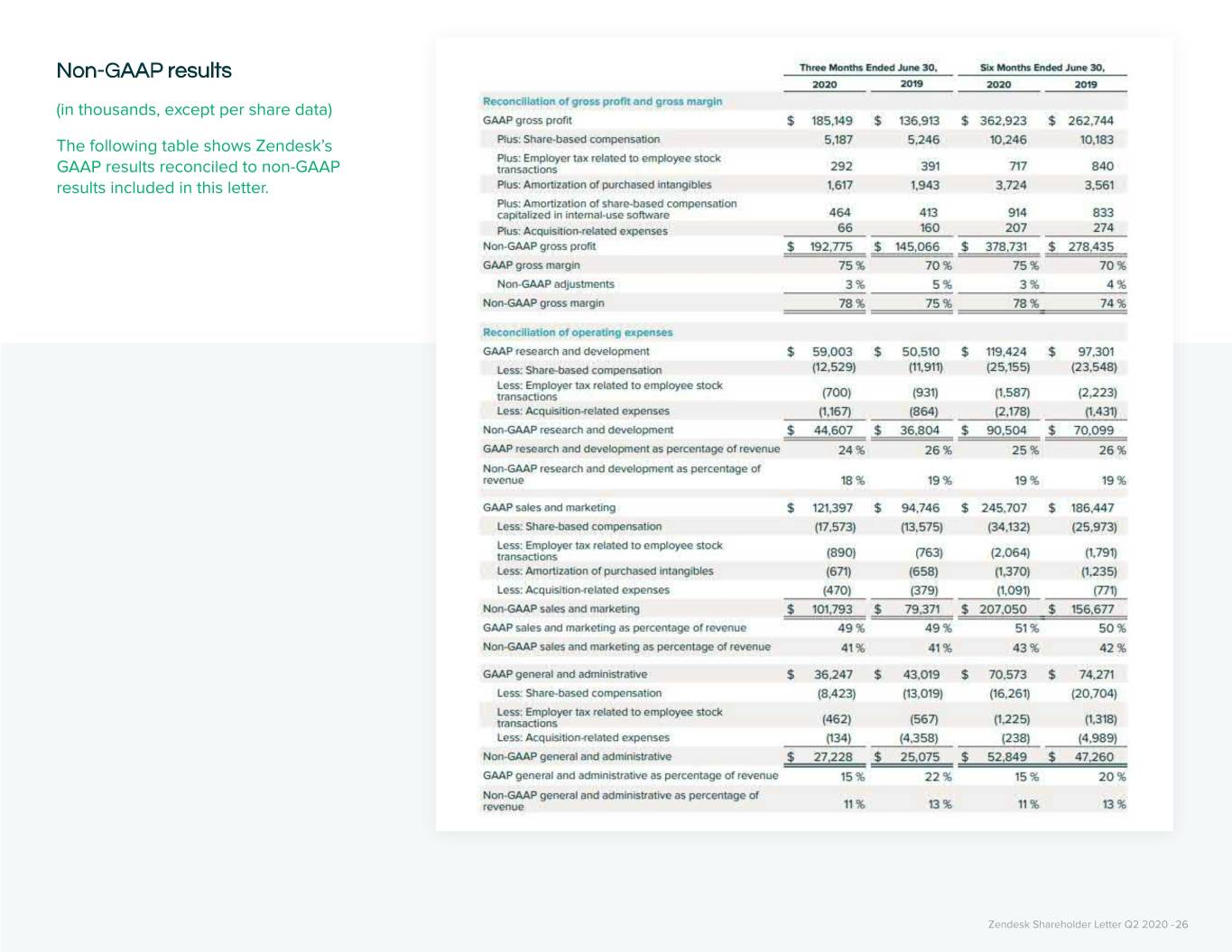

Non-GAAP results (in thousands, except per share data) The following table shows Zendesk’s GAAP results reconciled to non-GAAP results included in this letter. Zendesk Shareholder Letter Q2 2020 - 26

Non-GAAP results (continued) (in thousands, except per share data) The following table shows Zendesk’s GAAP results reconciled to non-GAAP results included in this letter. Zendesk Shareholder Letter Q2 2020 - 27

Non-GAAP results (continued) (in thousands, except per share data) The following table shows Zendesk’s GAAP results reconciled to non-GAAP results included in this letter. Zendesk Shareholder Letter Q2 2020 - 28

About Zendesk ended March 31, 2020. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that Zendesk makes Zendesk is a service-first CRM company that builds support, sales, and customer engagement with the Securities and Exchange Commission from time to time, including its Quarterly Report on software designed to foster better customer relationships. From large enterprises to startups, we Form 10-Q for the quarter ended June 30, 2020. believe that powerful, innovative customer experiences should be within reach for every company, Forward-looking statements represent Zendesk’s management’s beliefs and assumptions only as no matter the size, industry or ambition. Zendesk serves more than 160,000 customers across a of the date such statements are made. Zendesk undertakes no obligation to update any multitude of industries in over 30 languages. Zendesk is headquartered in San Francisco, and forward-looking statements made in this shareholder letter to reflect events or circumstances operates offices worldwide. Learn more at www.zendesk.com. after the date of this shareholder letter or to reflect new information or the occurrence of Forward-looking statements unanticipated events, except as required by law. About non-GAAP financial measures This shareholder letter contains forward-looking statements, including, among other things, statements regarding Zendesk’s future financial performance, its continued investment to grow its To provide investors and others with additional information regarding Zendesk’s results, the business, and progress toward its long-term financial objectives. Words such as “may,” “should,” following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases that denote future margin, non-GAAP operating expenses, non-GAAP operating income (loss) and operating expectation or intent regarding Zendesk’s financial results, operations, and other matters are margin, non-GAAP net income (loss), non-GAAP net income (loss) per share, basic and diluted, intended to identify forward-looking statements. You should not rely upon forward-looking free cash flow, and free cash flow margin. statements as predictions of future events. Specifically, Zendesk excludes the following from its historical and prospective non-GAAP The outcome of the events described in these forward-looking statements is subject to known and financial measures, as applicable: unknown risks, uncertainties, and other factors that may cause Zendesk’s actual results, performance, or achievements to differ materially, including (i) the effect of uncertainties related to Share-Based Compensation and Amortization of Share-Based Compensation Capitalized in the COVID-19 pandemic on U.S. and global markets, Zendesk’s business, operations, revenue results, Internal-use Software: Zendesk utilizes share-based compensation to attract and retain cash flow, operating expenses, demand for its solutions, sales cycles, customer retention, and its employees. It is principally aimed at aligning their interests with those of its stockholders and at customers' businesses; (ii) other adverse changes in general economic or market conditions; (iii) long-term retention, rather than to address operational performance for any particular period. As Zendesk’s ability to adapt its products to changing market dynamics and customer preferences or a result, share-based compensation expenses vary for reasons that are generally unrelated to achieve increased market acceptance of its products; (iv) Zendesk’s ability to effectively expand its financial and operational performance in any particular period. sales capabilities; (v) Zendesk’s substantial reliance on its customers renewing their subscriptions and purchasing additional subscriptions; (vi) Zendesk’s expectation that the future growth rate of its Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of employer revenues will decline, and that, as its costs increase, Zendesk may not be able to generate sufficient taxes related to its employee stock transactions as an expense that is dependent on its stock revenues to achieve or sustain profitability; (vii) the intensely competitive market in which Zendesk price, employee exercise and other award disposition activity, and other factors that are beyond operates and the difficulty that Zendesk may have in competing effectively; (viii) Zendesk’s ability to Zendesk’s control. As a result, employer taxes related to its employee stock transactions vary for effectively market and sell its products to larger enterprises; (ix) Zendesk’s ability to introduce and reasons that are generally unrelated to financial and operational performance in any particular market new products and to support its products on a shared services platform; (x) Zendesk’s ability period. to maintain and develop its strategic relationships with third parties; (xi) Zendesk’s ability to prevent, mitigate, and respond effectively to both historical and future data breaches and to securely maintain Amortization of Purchased Intangibles: Zendesk views amortization of purchased intangible customer data; (xii) Zendesk’s ability to effectively manage its growth and organizational change, assets, including the amortization of the cost associated with an acquired entity’s developed including its international expansion strategy; (xiii) Zendesk’s ability to integrate acquired businesses technology, as items arising from pre-acquisition activities determined at the time of an and technologies successfully or achieve the expected benefits of such acquisitions; (xiv) Zendesk's acquisition. While these intangible assets are evaluated for impairment regularly, amortization of ability to comply with privacy and data security regulations; (xv) potential service interruptions or the cost of purchased intangibles is an expense that is not typically affected by operations during performance problems associated with Zendesk’s technology and infrastructure; (xvi) the any particular period. development of the market for software as a service business software applications; (xvii) real or perceived errors, failures, or bugs in its products; and (xviii) Zendesk’s ability to accurately forecast Acquisition-Related Expenses: Zendesk views acquisition-related expenses, such as transaction expenditures on third-party managed hosting services. costs, integration costs, restructuring costs, and acquisition-related retention payments, including amortization of acquisition-related retention payments capitalized in internal-use software, as The forward-looking statements contained in this shareholder letter are also subject to additional events that are not necessarily reflective of operational performance during a period. In risks, uncertainties, and factors, including those more fully described in Zendesk’s filings with the particular, Zendesk believes the consideration of measures that exclude such expenses can Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for the quarter assist in the comparison of operational performance in different periods which may or may not include such expenses. Zendesk Shareholder Letter Q2 2020 - 29

Loss on Early Extinguishment of Debt: In March 2018, Zendesk issued $575 million aggregate The actual amount of such reconciling items will have a significant impact on Zendesk’s free cash principal amount of 0.25% convertible senior notes due in 2023 (the “2023 Notes”). In June 2020, flow and, accordingly, a reconciliation of net cash from operating activities to free cash flow for Zendesk issued $1,150 million aggregate principal amount of 0.625% convertible senior notes due the year ending December 31, 2020 is not available without unreasonable effort. in 2025 (the “2025 Notes”). In connection with the offering of the 2025 Notes, Zendesk used $618 million of the net proceeds from the offering of the 2025 Notes to repurchase $426 million Zendesk does not provide a reconciliation of its non-GAAP operating margin guidance to GAAP aggregate principal amount of the 2023 Notes in cash through individual privately negotiated operating margin beyond the fiscal quarter ending September 30, 2020 because Zendesk does transactions (the “2023 Notes Partial Repurchase”). Of the $618 million consideration, $393 not provide guidance on the reconciling items between GAAP operating margin and non-GAAP million and $225 million were allocated to the debt and equity components, respectively. As of operating margin for such periods, as a result of the uncertainty regarding, and the potential the repurchase date, the carrying value of the 2023 Notes subject to the 2023 Notes Partial variability of, these items. The actual amount of such reconciling items will have a significant Repurchase, net of unamortized debt discount and issuance costs, was $367 million. The 2023 impact on Zendesk’s non-GAAP operating margin and, accordingly, a reconciliation of GAAP Notes Partial Repurchase resulted in a $26 million loss on early debt extinguishment. As of June operating margin to non-GAAP operating margin guidance for such periods is not available 30, 2020, $149 million of principal remains outstanding on the 2023 Notes. The loss on early without unreasonable effort. extinguishment of debt is a non-cash item, and we believe the exclusion of this expense will Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include provide for a more useful comparison of our operational performance in different periods. adjustments to its expectations for its GAAP gross margin that exclude share-based Amortization of Debt Discount and Issuance Costs: The imputed interest rates of the 2023 compensation and related expenses in Zendesk’s cost of revenue, amortization of purchased Notes and the 2025 Notes were approximately 5.26% and 5.00%, respectively. This is a result of intangibles primarily related to developed technology, and acquisition-related expenses. The the debt discounts recorded for the conversion features of the Notes that are required to be share-based compensation and related expenses excluded due to such adjustments are primarily separately accounted for as equity, and debt issuance costs, which reduce the carrying value of comprised of the share-based compensation and related expenses for employees associated the convertible debt instruments. The debt discounts are amortized as interest expense together with Zendesk’s infrastructure and customer experience organization. with the issuance costs of the debt. The expense for the amortization of debt discount and debt Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP gross issuance costs is a non-cash item, and we believe the exclusion of this interest expense will margin for future periods because Zendesk does not provide guidance on the reconciling items provide for a more useful comparison of our operational performance in different periods. between GAAP gross margin and non-GAAP gross margin, as a result of the uncertainty Income Tax Effects: Zendesk utilizes a fixed long-term projected tax rate in its computation of regarding, and the potential variability of, these items. The actual amount of such reconciling non-GAAP income tax effects to provide better consistency across interim reporting periods. In items will have a significant impact on Zendesk’s non-GAAP gross margin and, accordingly, a projecting this long-term non-GAAP tax rate, Zendesk utilizes a financial projection that excludes reconciliation of GAAP gross margin to non-GAAP gross margin guidance for the period is not the direct impact of other non-GAAP adjustments. The projected rate considers other factors such available without unreasonable effort. as Zendesk’s current operating structure, existing tax positions in various jurisdictions, and key Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for internal legislation in major jurisdictions where Zendesk operates. For the year ending December 31, planning and forecasting purposes. Zendesk’s management does not itself, nor does it suggest 2020, Zendesk has determined the projected non-GAAP tax rate to be 21%. Zendesk will that investors should, consider such non-GAAP financial measures in isolation from, or as a periodically re-evaluate this tax rate, as necessary, for significant events, based on relevant tax substitute for, financial information prepared in accordance with GAAP. Zendesk presents such law changes, material changes in the forecasted geographic earnings mix, and any significant non-GAAP financial measures in reporting its financial results to provide investors with an acquisitions. additional tool to evaluate Zendesk’s operating results. Zendesk believes these non-GAAP Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from financial measures are useful because they allow for greater transparency with respect to key operating activities, plus repayment of convertible senior notes attributable to debt discount, less metrics used by management in its financial and operational decision-making. This allows purchases of property and equipment and internal-use software development costs. Free cash investors and others to better understand and evaluate Zendesk’s operating results and future flow margin is calculated as free cash flow as a percentage of total revenue. Zendesk uses free prospects in the same manner as management. cash flow, free cash flow margin, and other measures, to evaluate the ability of its operations to Zendesk’s management believes it is useful for itself and investors to review, as applicable, both generate cash that is available for purposes other than capital expenditures and capitalized GAAP information that may include items such as share-based compensation and related software development costs. Zendesk believes that information regarding free cash flow and free expenses, amortization of debt discount and issuance costs, amortization of purchased cash flow margin provides investors with an important perspective on the cash available to fund intangibles, and acquisition-related expenses, and the non-GAAP measures that exclude such ongoing operations. information in order to assess the performance of Zendesk’s business and for planning and Zendesk has not reconciled free cash flow guidance to net cash from operating activities for the forecasting in subsequent periods. year ending December 31, 2020 because Zendesk does not provide guidance on the reconciling items between net cash from operating activities and free cash flow, as a result of the uncertainty regarding, and the potential variability of, these items. Zendesk Shareholder Letter Q2 2020 - 30

When Zendesk uses such a non-GAAP financial measure with respect to historical periods, it The number of Sell Suite paid customer accounts are included in the number of paid customer provides a reconciliation of the non-GAAP financial measure to the most closely comparable accounts on products other than Support and Chat and are not included in the number of paid GAAP financial measure. When Zendesk uses such a non-GAAP financial measure in a customer accounts on Support or Chat. Each Duet paid customer account is included once in the forward-looking manner for future periods, and a reconciliation is not determinable without number of paid customer accounts on Support and once in the number of paid customer unreasonable effort, Zendesk provides the reconciling information that is determinable without accounts on products other than Support and Chat. unreasonable effort and identifies the information that would need to be added or subtracted from the non-GAAP measure to arrive at the most directly comparable GAAP measure. Investors Existing customers may also expand their utilization of Zendesk’s products by adding new are encouraged to review the related GAAP financial measures and the reconciliation of these accounts and a single consolidated organization or customer may have multiple accounts across non-GAAP financial measures to their most directly comparable GAAP financial measure as each of Zendesk’s products to service separate subsidiaries, divisions, or work processes. Other detailed above. than usage of Zendesk’s products through its omnichannel subscription offering, each of these accounts is also treated as a separate paid customer account. Non-GAAP gross margin for the first quarter of 2020 excludes $5.9 million in share-based compensation and related expenses (including $0.5 million of amortization of share-based Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase compensation capitalized in internal-use software and $0.4 million of employer tax related to revenue across its existing customer base through expansion of authorized agents associated employee stock transactions), $2.1 million of amortization of purchased intangibles, and $0.1 with a paid customer account, upgrades in subscription plans, and the purchase of additional million of acquisition-related expenses. Non-GAAP operating income and non-GAAP operating products as offset by churn, contraction in authorized agents associated with a paid customer margin for the first quarter of 2020 exclude $45.8 million in share-based compensation and account, and downgrades in subscription plans. Zendesk’s dollar-based net expansion rate is related expenses (including $3.3 million of employer tax related to employee stock transactions based upon annual recurring revenue for a set of paid customer accounts on its products. and $0.5 million of amortization of share-based compensation capitalized in internal-use Zendesk determines the annual recurring revenue value of a contract by multiplying the monthly software), $1.9 million of acquisition-related expenses, and $2.8 million of amortization of recurring revenue for such contract by twelve. purchased intangibles. Monthly recurring revenue for a paid customer account is a legal and contractual determination Free cash flow for the first quarter of 2020 includes cash used for purchases of property and made by assessing the contractual terms of each paid customer account, as of the date of equipment of $9.9 million and internal-use software development costs of $3.1 million. determination, as to the revenue Zendesk expects to generate in the next monthly period for that paid customer account, assuming no changes to the subscription and without taking into About operating metrics account any platform usage above the subscription base, if any, that may be applicable to such subscription. Beginning with the quarter ended June 30, 2019, we excluded the impact of Zendesk reviews a number of operating metrics to evaluate its business, measure performance, revenue that we expect to generate from fixed-term contracts that are each associated with an identify trends, formulate business plans, and make strategic decisions. These include the number existing account, are solely for additional temporary agents, and are not contemplated to last for of paid customer accounts on Zendesk Support, Zendesk Chat, and its other products, the duration of the primary contract for the existing account from our determination of monthly dollar-based net expansion rate, annual recurring revenue represented by its churned customers, recurring revenue. Monthly recurring revenue is not determined by reference to historical and the percentage of its annual recurring revenue from Support originating from customers with revenue, deferred revenue, or any other GAAP financial measure over any period. It is 100 or more agents on Support. forward-looking and contractually derived as of the date of determination. Zendesk defines the number of paid customer accounts at the end of any particular period as the Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue net of sum of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free trials, or contraction and churn by Zendesk’s base revenue. Zendesk defines its base revenue as the other free services, (ii) the number of accounts using Chat, exclusive of free trials or other free aggregate annual recurring revenue across its products for customers with paid customer services, and (iii) the number of accounts on all of its other products, exclusive of free trials and accounts as of the date one year prior to the date of calculation. Zendesk defines the retained other free services, each as of the end of the period and as identified by a unique account revenue net of contraction and churn as the aggregate annual recurring revenue across its identifier. In the quarter ended June 30, 2018, Zendesk began to offer an omnichannel products for the same customer base included in the measure of base revenue at the end of the subscription which provides access to multiple products through a single paid customer account, annual period being measured. The dollar-based net expansion rate is also adjusted to eliminate Zendesk Suite, and in the quarter ended June 30, 2019, Zendesk began to offer a subscription the effect of certain activities that Zendesk identifies involving the consolidation of customer which provides access to Sell and Support through a single paid customer account, Zendesk accounts or the split of a single paid customer account into multiple paid customer accounts. In Duet. In the quarter ended March 31, 2020, Zendesk began to offer two new omnichannel addition, the dollar-based net expansion rate is adjusted to include paid customer accounts in subscriptions, the Zendesk Support Suite and the Zendesk Sell Suite, which provide access to the customer base used to determine retained revenue net of contraction and churn that share multiple support solutions and sales solutions, respectively, through a single paid customer common corporate information with customers in the customer base that are used to determine account. The number of Support Suite paid customer accounts are included in the number of paid the base revenue. Giving effect to this consolidation results in Zendesk’s dollar-based net customer accounts on Suite, which are included in the number of paid customer accounts on expansion rate being calculated across approximately 108,300 customers, as compared to the products other than Support and Chat and are not included in the number of paid customer approximately 164,200 total paid customer accounts as of June 30, 2020. accounts on Support or Chat. Zendesk Shareholder Letter Q2 2020 - 31

To the extent that Zendesk can determine that the underlying customers do not share common corporate information, Zendesk does not aggregate paid customer accounts associated with reseller and other similar channel arrangements for the purposes of determining its dollar-based net expansion rate. While not material, Zendesk believes the failure to account for these activities would otherwise skew the dollar-based net expansion metrics associated with customers that maintain multiple paid customer accounts across its products and paid customer accounts associated with reseller and other similar channel arrangements. Zendesk does not currently incorporate operating metrics associated with its legacy analytics product, its legacy Outbound product, its legacy Starter plan, Sell, Sunshine Conversations, its legacy Smooch product, free trials, or other free services into its measurement of dollar-based net expansion rate. For a more detailed description of how Zendesk calculates its dollar-based net expansion rate, please refer to Zendesk’s periodic reports filed with the Securities and Exchange Commission. Zendesk’s percentage of annual recurring revenue from Support that is generated by customers with 100 or more agents on Support is determined by dividing the annual recurring revenue from Support for paid customer accounts with 100 or more agents on Support as of the measurement date by the annual recurring revenue from Support for all paid customer accounts on Support as of the measurement date. Zendesk determines the customers with 100 or more agents on Support as of the measurement date based on the number of activated agents on Support at the measurement date and includes adjustments to aggregate paid customer accounts that share common corporate information. For the purpose of determining this metric, Zendesk builds an estimation of the proportion of annual recurring revenue from Suite attributable to Support and includes such portion in the annual recurring revenue from Support. Zendesk does not currently incorporate operating metrics associated with products other than Support into its measurement of the percentage of annual recurring revenue from Support that is generated by customers with 100 or more agents on Support. Zendesk’s annual revenue run rate is based on its revenue for the most recent applicable quarter. Zendesk annualizes such results to estimate its annual revenue run rate by multiplying the revenue for its most recent applicable quarter by four. Zendesk’s annual revenue run rate is not a comprehensive statement of its financial results for such period and should not be viewed as a substitute for full annual or interim financial statements prepared in accordance with GAAP. In addition, Zendesk’s revenue for the most recent applicable quarter or annual revenue run rate are not necessarily indicative of the results to be achieved in any future period. Zendesk Shareholder Letter Q2 2020 - 32

Customer metrics June 30, September 30, December 31, March 31, June 30, 2019 2019 2019 2020 2020 Paid customer accounts on 77,100 79,600 81,200 82,600 84,100 Zendesk Support (approx.) + Paid customer accounts 44,300 43,600 42,600 41,800 40,600 on Zendesk Chat (approx.) + Paid customer accounts on other Zendesk products 27,500 30,600 33,200 36,100 39,400 (approx.) = Approximate number of 149,000 153,800 157,000 160,600 164,200 paid customer accounts* *Does not add up to total due to rounding Geographic information Contact Revenue mix by geography Investor contact Karen Sansot Q2’20 +1 415-852-3877 ir@zendesk.com United States 52.9% EMEA 27.9% Media contact APAC 10.8% Marissa Tree +1 415-609-4510 Other 8.4% press@zendesk.com Source: Zendesk, Inc. Zendesk Shareholder Letter Q2 2020 - 33