Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CLARIVATE Plc | ex991q22020earningsrel.htm |

| 8-K - 8-K - CLARIVATE Plc | ccc-20200730.htm |

Q2 2020 Earnings Supplemental Materials July 30, 2020

Forward-Looking Statements These materials contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on management’s current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, outlook, anticipated cost savings, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are difficult to predict, and many are outside of our control. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include those factors discussed under the caption “Risk Factors” in our 2019 annual report on Form 10-K and our current report on Form 8-K filed on June 19, 2020, along with our other filings with the U.S. Securities and Exchange Commission (“SEC”). However, those factors should not be considered to be a complete statement of all potential risks and uncertainties. Forward-looking statements are based only on information currently available to our management and speak only as of the date of this press release. We do not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Please consult our public filings with the SEC or on our website at www.clarivate.com. Non-GAAP Financial Measures This presentation contains financial measures which have not been calculated in accordance with United States generally accepted accounting principles (“GAAP”), including Adjusted Revenues, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Diluted EPS, Free Cash Flow, Adjusted Free Cash Flow, Standalone Adjusted EBITDA, and net debt because they are a basis upon which our management assesses our performance and we believe they reflect the underlying trends and indicators of our business. Although we believe these measures may be useful for investors for the same reasons, these financial measures should not be considered as an alternative to GAAP financial measures as a measure of the Company’s financial condition, profitability and performance or liquidity. In addition, these financial measures may not be comparable to similar measures used by other companies. At the Appendix to this presentation, we provide further descriptions of these non-GAAP measures and reconciliations of these non-GAAP measures to the corresponding most closely related GAAP measures. Results excluding divestitures in this presentation exclude the November 2019 announced agreement to sell the MarkMonitor brand protection, antipiracy and antifraud products, and completed such divestiture on January 1, 2020. Clarivate retained the MarkMonitor Domain Management business. Required Reported Data We are required to report Standalone Adjusted EBITDA, which is identical to Consolidated EBITDA and EBITDA as such terms are defined under our credit agreement, and the indenture governing our senior secured notes due 2026, respectively, pursuant to the reporting covenants contained in such agreements. In addition, management of the Company uses Standalone Adjusted EBITDA to assess compliance with various incurrence-based covenants in these agreements. 2

Q2 Highlights Well-positioned business model to weather current environment SCIENCE GROUP: • New Web of Science beta released; New UI, Open Access content added to Journal Citation Reports • COVID Novel Super Virus data lake launched for advanced virology and infectious disease analytics Enhanced • Cortellis Drug Discovery Intelligence (Biomarkers and pharmacology analytical tools launched), Cortellis Generics Intelligence sourcing module launched Product • Decision Resources Group (“DRG”) organizational integration well advanced Portfolio IP GROUP: • Watch “lite” launched, client migration to new Derwent platform completed • Derwent content expansion; added full text from 45 new jurisdictions • CompuMark / Darts-ip content integration completed • Meeting or exceeding productivity and service level agreements despite COVID-19 customer workflow disruptions Efficiently • Implemented $30 million of cost savings initiatives to offset potential effects of COVID-19 • Delivering savings from existing $70-$75 million cost savings program; $45 million in 2020 Managing • Delivering DRG realized cost synergies of $10 million in 2020; running ahead of plan Business • DRG back office systems integration advanced • Significant resources of $609 million cash and untapped revolver of $250 million to re-invest in growth 3

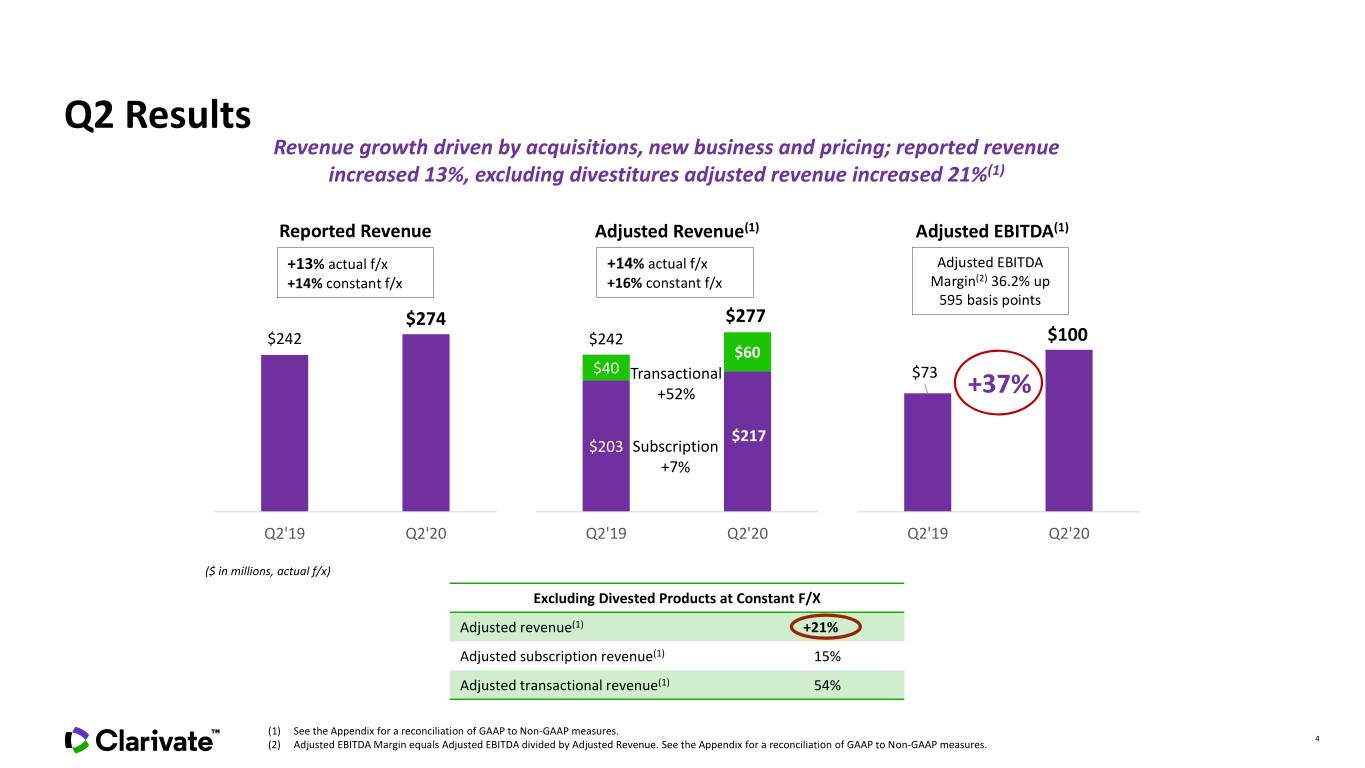

Q2 Results Revenue growth driven by acquisitions, new business and pricing; reported revenue increased 13%, excluding divestitures adjusted revenue increased 21%(1) Reported Revenue Adjusted Revenue(1) Adjusted EBITDA(1) +13% actual f/x +14% actual f/x Adjusted EBITDA +14% constant f/x +16% constant f/x Margin(2) 36.2% up 595 basis points $274 $277 $242 $242 $100 $60 $40 Transactional $73 +52% +37% $217 $203 Subscription +7% Q2'19 Q2'20 Q2'19 Q2'20 Q2'19 Q2'20 ($ in millions, actual f/x) Excluding Divested Products at Constant F/X Adjusted revenue(1) +21% Adjusted subscription revenue(1) 15% Adjusted transactional revenue(1) 54% (1) See the Appendix for a reconciliation of GAAP to Non-GAAP measures. 4 (2) Adjusted EBITDA Margin equals Adjusted EBITDA divided by Adjusted Revenue. See the Appendix for a reconciliation of GAAP to Non-GAAP measures.

Q2 Financial Highlights… Solid topline growth and cost efficiencies drove double-digit Adjusted EBITDA(1) growth and significant margin expansion June 30, Excluding ($ in millions except per share data) 2020 2019 % Change Organic(2) Commentary Divestitures(2) Recent acquisitions, new business including several large contracts entered into Subscription revenue(1) $217 $203 7% 15% 4% during June ‘20, and price increases within both the Science and IP Product Groups, partially offset by the MarkMonitor divested products Recent acquisitions, partially offset by divested businesses, a decrease in backfile Transactional revenue(1) 60 40 52% 54% (13%) sales and lower CompuMarkTM search volumes primarily due to an overall decrease in demand driven by economic conditions resulting from COVID-19 pandemic Adjusted total revenues, net(1) 277 242 14% 21% 1% Annual Contract Value (“ACV”) 853 783 9% 16% 5% Addition of DRG , organic growth and annual price increases Revenue growth, acquisitions, portfolio rationalization and benefit of cost savings Adjusted EBITDA(1) 100 73 37% --- --- initiatives Adjusted EBITDA margin(1) 36% 30% 595bps --- --- Strong revenue flow-through and benefit of cost savings Other income, net 9 7 33% --- --- Primarily related to gains in foreign currency exchange Primarily difference in timing of the recognition of profits/losses at the mix of Benefit/(Provision) for income taxes 5 (4) 245% --- --- jurisdictions for the interim tax periods of Q2 ‘19 and Q2 ‘20 Q2 ‘19 - payments were made for prior tax years (2017 and 2018) of foreign Cash taxes 8 15 (45%) --- --- jurisdictions; Q2 ‘20, due to the COVID-19 pandemic, US Fed estimated tax payments were deferred until July 15th GAAP net loss (1.5) (77.8) 98% Adjusted net income(1) 70 N/A --- --- --- GAAP loss per share 0.00 (0.29) 100% Adjusted diluted EPS(1) $0.18 N/A --- --- --- 5 (1) See the Appendix for a reconciliation of GAAP to Non-GAAP measures. (2) At constant currency.

…Q2 Financial Highlights Continued Significant resources including $609 million in cash and untapped $250 million revolver to continue to invest in strategic growth opportunities June 30, December 31, ($ in millions) $ Change Commentary on Change 2020 2019 Proceeds of ~$278 million received from the voluntary exercise of ~24 million warrants in exchange Cash and cash equivalents $609 $76 $533 for ordinary shares of Clarivate in Q1 ’20 and ~$304 million from sale of ordinary shares in June 2020 $360 million incurred to fund a portion of the DRG acquisition offset by a $65 million repayment of the Total debt outstanding $1,954 $1,665 $289 revolver in full Net debt(1) $1,346 $1,589 ($243) Increase in cash partially offset by debt issuance June calculation includes proforma adjusted EBITDA for last twelve months for the acquisition of DRG Gross leverage ratio(1) 4.5x 5.0x (0.5x) completed end of Feb. 2020 Decline in leverage ratio due to increase in cash and higher standalone last twelve months adjusted Net leverage ratio(1) 3.1x 4.7x (1.6x) EBITDA YTD June 30, 2020 YTD June 30, 2019 Addition of DRG, acceleration of product development with significant cadence of new releases for Capital expenditures $53 $25 $28 renovated product, and with COVID more time spent on application development so higher proportion of time is capitalized Cash flow from operations $108 $43 $65 Driven by increased revenues and lower GAAP operating loss Free cash flow(1) $55 $18 $37 Revenue growth and expense control Driven by improvement in cash flow from operations. Primarily adds back cash paid for transaction, Adjusted free cash flow(1) $120 $45 $75 transition, transformation and integration expenses related to recent acquisitions, and streamlining operations by simplifying the organization following public offering in May 2019 6 (1) See the Appendix for a reconciliation of GAAP to Non-GAAP measures.

Efficiently Managing Cost Structure and Freeing up Resources Approximately $105-$110 million in permanent cost reductions ($ in millions) Total Savings Permanent Savings Timing NEW $30M $5 million Q1-Q4 2020 COVID related $45 million in 2020; $70-75 million run- Cost savings 2019 $70-$75 million $70-$75 million rate exiting Q1 2021 $10 million in 2020; $30 million run-rate DRG synergies(1) $30 million $30 million within 18 months of close Total Cost Savings $130-$135 million $105-$110 million 7 (1) DRG acquisition completed February 28, 2020.

2020 Outlook Assumptions Business Model to Weather Current Environment • “Must-have” products and services focused on B2B markets with unique content • Sell into durable end markets including government, research institutions and life sciences • Solutions to clients on digital basis and consumed anywhere Outlook Assumptions • Highly resilient with ~80% recurring / re-occurring revenue streams • Monitoring freer movement of labor mid-to-late Q3 2020 • Strong revenue retention rates • Recovery starting early Q4 2020 • Low levels of capital intensity and cash taxes 8

2020 Outlook*(1) ($ in millions, except per share information) Outlook Low High Adjusted Revenue $1,130 $1,160 Adjusted EBITDA $395 $420 Adjusted EBITDA margin % 35% 36% Adjusted Diluted EPS(2) $0.53 $0.59 Adjusted Free Cash Flow $220 $240 Our target is to exit 2021 with 6% - 8% organic revenue growth and adjusted EBITDA margin of 37% - 40%(2) *See Appendix for reconciliation of GAAP to Non-GAAP measures. (1) Clarivate standalone only. Excludes the proposed combination with CPA Global announced on July 29, 2020. (2) Adjusted diluted EPS for 2020 is calculated based on approximately 381.9 million fully diluted weighted average shares outstanding, an increase of approximately 52.1 million shares or 16%, compared to 329.8 million shares outstanding at the end of December 31, 2019. The increase in shares is primarily driven by the February 2020 offering of 27.6 million shares, with proceeds used to fund a portion of the cash consideration for the acquisition of DRG, and the issuance of approximately 29 million ordinary shares upon exercise of outstanding warrants. 9

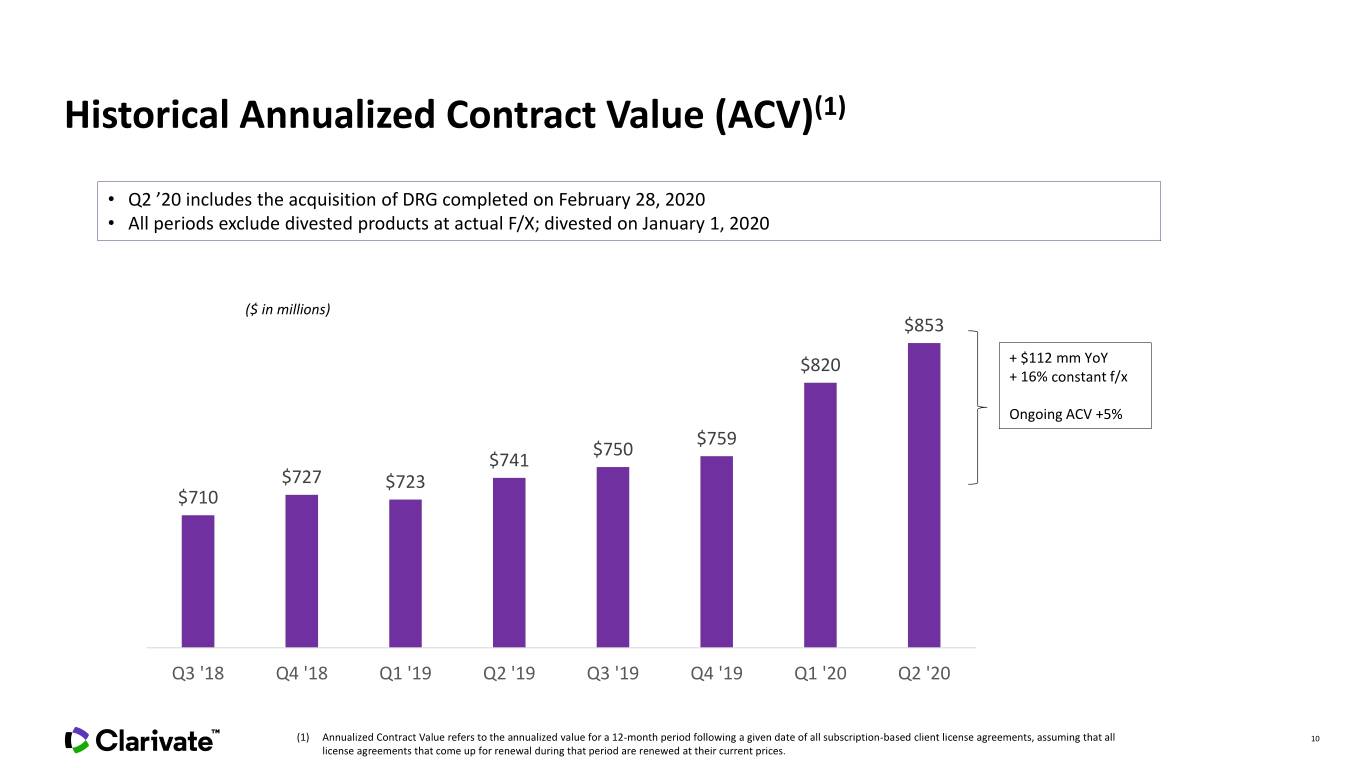

Historical Annualized Contract Value (ACV)(1) • Q2 ’20 includes the acquisition of DRG completed on February 28, 2020 • All periods exclude divested products at actual F/X; divested on January 1, 2020 ($ in millions) $853 $820 + $112 mm YoY + 16% constant f/x Ongoing ACV +5% $759 $750 $741 $727 $723 $710 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 (1) Annualized Contract Value refers to the annualized value for a 12-month period following a given date of all subscription-based client license agreements, assuming that all 10 license agreements that come up for renewal during that period are renewed at their current prices.

Our recent colleague engagement survey had a response rate of 91%, up 10% from 2019 Engagement score = 76 2019 = 69 (Benchmark Average is 72) 2020 goal: 74 Company’s response to COVID-19 scored 93% favorable 11

Improving customer delight scorecard reflects our commitment to delivering high-value to our customers May ‘20 2019 Information & insights 90 85 Quality of products & services 85 86 Overall Easy to do business with 59 55 customer delight = 79 Overall customer delight 79 76 (Best Practice is 82) Customer feedback tells us: 2020 • Insight into decision-making critical goal: • Products highly valued 78 • Offerings perceived as best-in-class • Big opportunity to enhance user experience Customer Delight Surveys were conducted in May 2020 (2,500+ participants) and in June/July and October 2019 (10,000+ participants) by CustomerFirstNow.

APPENDIX

Presentation of Certain Non-GAAP Financial Measures This presentation contains financial measures which have not been calculated in accordance with GAAP, including Adjusted Revenues and Adjusted EBITDA, because they are a basis upon which our management assesses our performance and we believe they reflect the underlining trends and indicators of our business. Adjusted Revenues Adjusted Revenues excludes the impact of the deferred revenues purchase accounting adjustment (primarily recorded in connection with recent acquisitions). Our presentation of Adjusted Revenues is presented for informational purposes only and is not necessarily indicative of our future results. You should compensate for these limitations by relying primarily on our GAAP results and only using Adjusted Revenues for supplementary analysis. Adjusted EBITDA Adjusted EBITDA is calculated using net (loss) income before provision for income taxes, depreciation and amortization and interest income and expense adjusted to exclude acquisition or disposal-related transaction costs (such costs include net income from continuing operations before provision for income taxes, depreciation and amortization and interest income), stock-based compensation, unrealized foreign currency gains/(losses), transition services agreement costs entered into with Thomson Reuters in 2016 ("Transition Services Agreement"), separation and integration costs, transformational and restructuring expenses, acquisition-related adjustments to deferred revenues, non-cash income/(loss) on equity and cost method investments, non-operating income or expense, the impact of certain non-cash and other items that are included in net income for the period that the Company does not consider indicative of its ongoing operating performance, and certain unusual items impacting results in a particular period. In future periods, the Company will need to make additional capital expenditures in order to replicate capital expenditures associated with previously shared services on a stand-alone basis. You are encouraged to evaluate these adjustments and the reasons the Company considers them appropriate for supplemental analysis. These measures are not measurements of the Company’s financial performance under GAAP and should not be considered in isolation or as alternatives to net income, net cash flows provided by operating activities, total net cash flows or any other performance measures derived in accordance with GAAP or as alternatives to net cash flows from operating activities or total net cash flows as measures of the Company’s liquidity. Reduction of ongoing standalone and Transition Services Agreement costs have been, and are expected to continue to be, a component of the Company’s strategy as it finalizes its transition to a standalone company following the 2016 Transaction. Certain of the adjustments included to arrive at Adjusted EBITDA are related to the Company’s transition to an independent company. In evaluating Adjusted EBITDA you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the included adjustments. The Company’s presentation of Adjusted EBITDA should not be construed as an inference that the Company’s future results will be unaffected by any of the adjusted items, or that the Company’s projections and estimates will be realized in their entirety or at all. 14

Presentation of Certain Non-GAAP Financial Measures The use of Adjusted EBITDA instead of GAAP measures has limitations as an analytical tool, and you should not consider Adjusted EBITDA in isolation, or as a substitute for analysis of the Company’s results of operations and operating cash flows as reported under GAAP. For example, Adjusted EBITDA does not reflect: – the Company’s cash expenditures or future requirements for capital expenditures – changes in, or cash requirements for, the Company’s working capital needs – interest expense, or the cash requirements necessary to service interest or principal payments, on the Company’s debt – any cash income taxes that the Company may be required to pay – any cash requirements for replacements of assets that are depreciated or amortized over their estimated useful lives and may have to be replaced in the future – all non-cash income or expense items that are reflected in the Company’s statements of cash flows The Company’s definition of and method of calculating Adjusted EBITDA may vary from the definitions and methods used by other companies when calculating adjusted EBITDA, which may limit their usefulness as comparative measures. The Company prepared the information included in this presentation based upon available information and assumptions and estimates that it believes are reasonable. The Company cannot assure you that its estimates and assumptions will prove to be accurate. Because the Company incurred transaction, transition, integration, transformation, restructuring, and Transition Services Agreement costs in connection with the 2016 Transaction and the transition, borrowed money in order to finance its operations, and used capital and intangible assets in its business, and because the payment of income taxes is necessary if the Company generates taxable income after the utilization of its net operating loss carryforwards, any measure that excludes these items has material limitations. As a result of these limitations, these measures should not be considered as a measure of discretionary cash available to the Company to invest in the growth of its business or as a measure of its liquidity. Adjusted EBITDA Margin Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Adjusted Revenues. 15

Presentation of Certain Non-GAAP Financial Measures Adjusted Net Income and Adjusted Diluted EPS We have begun to use Adjusted Net Income and Adjusted Diluted Earnings Per Share ("Adjusted Diluted EPS") in our analysis of the financial performance of the Company. We believe Adjusted Net Income and Adjusted Diluted EPS are meaningful measures of the performance of the Company because they adjust for items that do not directly affect our ongoing operating performance in the period. Adjusted Net Income is calculated using net income (loss), adjusted to exclude acquisition or disposal-related transaction costs (such costs include net income from continuing operations before provision for income taxes, depreciation and amortization and interest income and expense from the divested business), amortization related to acquired intangible assets, stock-based compensation, unrealized foreign currency gains/(losses), Transition Services Agreement costs, separation and integration costs, transformational and restructuring expenses, acquisition-related adjustments to deferred revenues, non-cash income (loss) on equity and cost method investments, non- operating income or expense, the impact of certain non-cash and other items that are included in net income for the period that the Company does not consider indicative of its ongoing operating performance, certain unusual items impacting results in a particular period, and the income tax impact of any adjustments. We calculate Adjusted Diluted EPS by using Adjusted Net Income divided by diluted weighted average shares for the period. Standalone Adjusted EBITDA We are required to report Standalone Adjusted EBITDA pursuant to the reporting covenants contained in the Credit Agreement and the Indenture. Standalone Adjusted EBITDA is identical to Consolidated EBITDA and EBITDA as such terms are defined under the Credit Agreement and the Indenture, respectively. In addition, the Credit Agreement and the Indenture contain certain restrictive covenants that govern debt incurrence and the making of restricted payments, among other matters. These restrictive covenants utilize Standalone Adjusted EBITDA as a primary component of the compliance metric governing our ability to undertake certain actions otherwise proscribed by such covenants. Standalone Adjusted EBITDA reflects further adjustments to Adjusted EBITDA for cost savings already implemented and excess standalone costs. Because Standalone Adjusted EBITDA is required pursuant to the terms of the reporting covenants under the Credit Agreement and the Indenture and because this metric is relevant to lenders and noteholders, management considers Standalone Adjusted EBITDA to be relevant to the operation of its business. It is also utilized by management and the compensation committee of the Board as an input for determining incentive payments to employees. Excess standalone costs are the difference between our actual standalone company infrastructure costs, and our estimated steady state standalone infrastructure costs. We make an adjustment for the difference because we have had to incur costs under the Transition Services Agreement after we had implemented the infrastructure to replace the services provided pursuant to the Transition Services Agreement, after we had implemented the infrastructure to replace the services provided pursuant to the Transition Services Agreement, thereby incurring dual running costs. Furthermore, there has been a ramp up period for establishing and optimizing the necessary standalone infrastructure. Since our separation from Thomson Reuters, we have had to transition quickly to replace services provided under the Transition Services Agreement, with optimization of the relevant standalone functions typically following thereafter. Cost savings reflect the annualized “run rate” expected cost savings, net of actual cost savings realized, related to restructuring and other cost savings initiatives undertaken during the relevant period. Standalone Adjusted EBITDA is calculated under the Credit Agreement and the Indenture by using our Net Income for the trailing twelve month period (defined in the Credit Agreement and the Indenture as our GAAP net income adjusted for certain items specified in the Credit Agreement and the Indenture) adjusted for items including: taxes, interest expense, depreciation and amortization, non-cash charges, expenses related to capital markets transactions, acquisitions and dispositions, restructuring and business optimization charges and expenses, consulting and advisory fees, run-rate cost savings to be realized as a result of actions taken or to be taken in connection with an acquisition, disposition, restructuring or cost savings or similar initiatives, “run rate” expected cost savings, operating expense reductions, restructuring charges and expenses and synergies related to the transition following the separation of the Company’s business from Thomson Reuters (the “2016 Transaction”) projected by us, costs related to any management or equity stock plan, other adjustments that were presented in the offering memorandum used in connection with the issuance of the Notes and earnout obligations incurred in connection with an acquisition or investment. 16

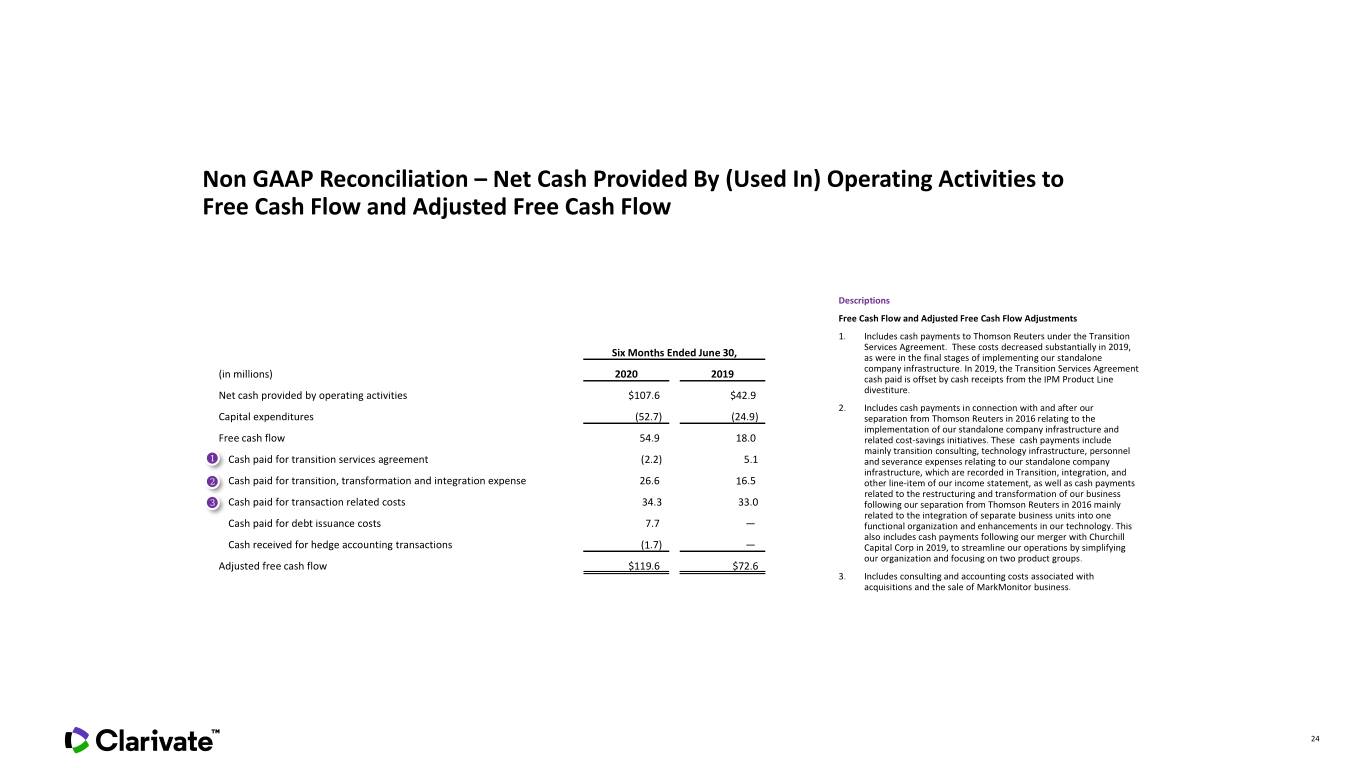

Presentation of Certain Non-GAAP Financial Measures Free Cash Flow and Adjusted Free Cash Flow We use free cash flow and adjusted free cash flow in our operational and financial decision-making and believe free cash flow and adjusted free cash is useful to investors because similar measures are frequently used by securities analysts, investors, ratings agencies and other interested parties to evaluate our competitors and to measure the ability of companies to service their debt. Free cash flow is calculated using net cash provided by operating activities less capital expenditures. Adjusted free cash flow is calculated as free cash flow, less cash paid for transition services agreement, transition, transformation and integration expenses, transaction related costs and debt issuance costs offset by cash received for hedge accounting transactions. The following table reconciles our non-GAAP free cash flow measure to net cash provided by operating activities: 17

Quarterly Financial Summary ($ in millions) Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Revenues, net $242.9 $245.2 $234.0 $242.3 $243.0 $255.0 $240.6 $273.5 Deferred revenue adjustment $0.5 $0.2 $0.2 $0.1 $0.1 $0.1 $1.9 $3.4 IPM Product Line ($7.8) $ - $ - $ - $ - $ - $ - $ - Adjusted Revenue(1) $235.6 $245.5 $234.2 $242.4 $243.1 $255.1 $242.5 $276.9 Subscription revenues $204.3 $197.6 $192.5 $202.7 $200.8 $209.5 $193.2 $216.5 IPM Product Line ($6.8) $- $ - $ - $ - $ - $ - $ - Adj. Subscription Revenue(1) $197.5 $197.6 $192.5 $202.7 $200.8 $209.5 $193.2 $216.5 Transactional revenues $39.1 $47.8 $41.7 $39.7 $42.3 $45.6 $49.2 $60.4 IPM Product Line ($1.0) $- $ - $ - $ - $ - $ - $ - Adj. Transactional Revenue(1) $38.1 $47.8 $41.7 $39.7 $42.3 $45.6 $49.2 $60.4 Net Income (Loss) ($54.7) ($43.5) ($59.3) ($77.8) $10.8 ($84.8) ($74.0) ($1.5) Adjusted EBITDA(2) $66.3 $75.8 $59.2 $73.2 $77.0 $84.6 $78.2 $100.1 Adjusted EBITDA margin %(2) 28.1% 30.9% 25.3% 30.2% 31.7% 33.2% 32.2% 36.2% 18 1. Adjusted Revenue excludes the divested IPM business revenues for the period, and adds back the deferred revenue purchase accounting adjustment. 2. See the Appendix for a reconciliation of GAAP to non-GAAP financial measures.

Diluted Share Count Enterprise Value Build @$21 @$23 @$26 (Forecasted as of and for the year ended December 31, 2020, $ in millions except for per share values) Share Price Ticker Current Share (Live) $ 21.00 $ 23.00 $ 26.00 1 Enterprise Value Build 2 Basic Shares Outstanding 373,517,786 373,517,786 373,517,786 Comments (+) Stock Dilution 18,641,142 20,560,188 22,912,237 Forecasted Fully Diluted Shares Outstanding 392,158,928 394,077,974 396,430,023 Note: the analysis is not intended to replace the Treasury Stock Method as required under ASC 260, Earnings per Share (x) Share Price $ 21.00 $ 23.00 $ 26.00 1. Inconsistent with the requirements of ASC 260, but for illustrative Equity Value ($ in millions) 8,235.3 9,063.8 10,307.2 purposes, this analysis uses hypothetical shares prices and not the actual (+) Debt ($ in millions) 1,925.8 1,925.8 1,925.8 3 average share price for the period as required under US GAAP. (-) Cash ($ in millions) 610.5 610.5 610.5 3 2. Includes the impact of the Merger Shares subsequent to the lifting of the Enterprise Value ($ in millions) 9,550.6 10,379.1 11,622.5 performance vesting conditions as described in the Company's F-1 filed Stock Options 2/3/20. Shares Contributing to Dilution 14,377,067 14,524,563 14,674,287 4 3. Debt and cash amounts reflect 6/30/20 balances. Weighted-average Exercise Price Various Various Various 4 4. Per the requirements of the Treasury Stock Method this excludes all Options Dilution 5,551,712 6,321,222 7,280,564 4 management options that are antidilutive at the assumed share prices in this analysis and includes consideration of unrecognized compensation cost Public Warrants Outstanding - - - on unvested options. 5 Warrants Contributing to Dilution 4,363,896 4,363,896 4,363,896 5. All public warrants have been redeemed as of June 30, 2020. Weighted-average Exercise Price $ 11.50 $ 11.50 $ 11.50 6. Consists of actual 2019 and 2020, as well as forecasted 2020 RSUs and their Public Warrants Dilution 1,974,143 2,181,948 2,433,711 related activity. This includes 0.3M issued RSUs for the year ended Private Warrants Outstanding 18,300,000 18,300,000 18,300,000 December 31, 2019, as well as forecasted issuances of 2.4M RSUs in 2020. Exercisable as of December 31, 2020 18,300,000 18,300,000 18,300,000 7. Consistent with the requirements of ASC 260, performance conditions for Weighted-average Exercise Price $ 11.50 $ 11.50 $ 11.50 the 0.5M PSUs granted in 2020 have not been achieved as of this time, and Private Warrants Dilution 8,278,571 9,150,000 10,205,769 therefore are excluded from this dilution analysis. 8. Consistent with the requirement of ASC 260, the impact of 2.9M estimated RSUs Outstanding - 2019 Issued and 2020 Forecast 1,384,928 1,384,928 1,384,928 6 shares to be issued on the one-year anniversary of acquisition of DRG Weighted-average Exercise Price - - - (February 28, 2021) is included within this dilution analysis. Amount shown RSU Dilution 399,949 470,252 555,426 is the weighted average of the shares estimated to be issued based on the closing of the DRG transaction on February 28, 2020. PSUs - 2020 Forecast - - - 7 Weighted-average Exercise Price - - - 9. The analysis assumes no share buy backs by the company during the period PSU Dilution - - - DRG Contingent Consideration 2,436,766 2,436,766 2,436,766 8 Weighted-average Exercise Price - - - DRG Contingent Consideration Dilution 2,436,766 2,436,766 2,436,766 Total Stock Dilution 18,641,142 20,560,188 22,912,237 19

Reconciliation of Non-GAAP Financial Measures and Required Reported Data The following tables present the amounts of our subscription and transactional revenues, including as a percentage of our total revenues, for the periods indicated, as well the drivers of the variances between periods. Variance Increase/(Decrease) Percentage of Factors Increase/(Decrease) Total Three Months Ended Variance Total Variance June 30, (Dollars) (Percentage) Acquisitive Disposal FX Impact Organic (in millions, except percentages) 2020 2019 Subscription revenues $ 216.5 $202.7 $13.8 6.8 % 11.4 % (6.9)% (1.3)% 3.6 % Transactional revenues 60.4 39.7 20.7 52.1 % 66.1 % (0.6)% (0.8)% (12.6)% 1 Deferred revenues adjustment(1) (3.4) (0.1) (3.3) NM NM — % — % 75.5 % Revenues, net 273.5 242.3 31.2 12.9 % 18.9 % (5.9)% (1.3)% 1.2 % 1 Deferred revenues adjustment(1) 3.4 0.1 3.3 NM NM — % — % (75.5)% Adjusted revenues, net $276.9 $242.4 $34.5 14.2 % 20.3 % (5.9)% (1.3)% 1.1 % (1) Reflects the deferred revenues adjustment made as a result of purchase accounting. 20

Reconciliation of Non-GAAP Financial Measures and Required Reported Data Descriptions Three Months Ended June 30, Six Months Ended June 30, Adjusted EBITDA adjustments (in millions) 2020 2019 2020 2019 1. In 2020, this is related to a new transition services agreement and offset by the reverse transition services agreement from the sale of MarkMonitor assets. In 2019, this includes Net loss $(1.5) $(77.8) $(75.5) $(137.0) payments to Thomson Reuters under the Transition Services Agreement. Provision for income taxes (5.4) 3.7 9.4 4.0 2. Includes costs incurred in connection with and after our separation from Thomson Depreciation and amortization 56.1 43.1 107.6 101.2 Reuters in 2016 relating to the implementation of our standalone company infrastructure and related cost-savings initiatives. These costs include mainly transition Interest, net 21.1 37.5 52.1 70.6 consulting, technology infrastructure, personnel and severance expenses relating to our standalone company infrastructure, which are recorded in Transition, integration, and 1 Transition services agreement costs (0.8) 2.5 0.8 7.7 other line-item of our income statement, as well as expenses related to the restructuring 2 Transition, transformation and integration expense 1.3 11.3 3.6 13.8 and transformation of our business following our separation from Thomson Reuters in 2016, mainly related to the integration of separate business units into one functional 3 Deferred revenues adjustment 3.4 0.1 5.3 0.3 organization and enhancements in our technology. 4 Transaction related costs 8.5 23.2 35.2 33.4 3. Reflects the deferred revenues adjustment as a result of purchase accounting. Share-based compensation expense 6.9 33.9 24.3 37.1 4. Includes costs incurred to complete business combination transactions, including 5 Restructuring 15.8 — 23.6 — acquisitions and dispositions, and typically include advisory, legal and other professional and consulting costs. 6 Other (5.3) (4.3) (8.1) 1.3 5. Reflects costs incurred in connection with the initiative, following our merger with Adjusted EBITDA $100.1 $73.2 $178.3 $132.4 Churchill Capital Corp in 2019, to streamline our operations by simplifying our organization and focusing on two product groups. 6. Includes primarily the net impact of foreign exchange gains and losses related to the re- measurement of balances and other items that do not reflect our ongoing operating performance. 21

Reconciliation of Non-GAAP Financial Measures and Required Reported Data Descriptions Twelve Months Adjusted EBITDA adjustments Ended June 30, (in millions) 2020 1. In 2020, this is related to a new transition services agreement and offset by the reverse transition services agreement from the sale of MarkMonitor assets. In 2019, this includes payments to Thomson Reuters Net loss $ (149.4) under the Transition Services Agreement. (Benefit) provision for income taxes 15.6 2. Includes cash payments in connection with and after our separation from Thomson Reuters in 2016 Depreciation and amortization 206.9 relating to the implementation of our standalone company infrastructure and related cost-savings Interest, net 139.2 initiatives. These cash payments include mainly transition consulting, technology infrastructure, personnel and severance expenses relating to our standalone company infrastructure, which are recorded 1 Transition Services Agreement costs 3.5 in Transition, integration, and other line-item of our income statement, as well as cash payments related 2 Transition, transformation and integration expense 14.1 to the restructuring and transformation of our business following our separation from Thomson Reuters in 2016 mainly related to the integration of separate business units into one functional organization and 3 Deferred revenues adjustment 5.5 enhancements in our technology. This also includes cash payments following our merger with Churchill 4 Transaction related costs 48.0 Capital Corp in 2019, to streamline our operations by simplifying our organization and focusing on two product groups. Share-based compensation expense 38.6 5 Restructuring 39.3 3. Reflects the deferred revenues adjustment as a result of purchase accounting. Legal settlement (39.4) 4. Includes costs incurred to complete business combination transactions, including acquisitions and dispositions, and typically include advisory, legal and other professional and consulting costs. Impairment on assets held for sale 18.4 6 Other (0.3) 5. Reflects costs incurred in connection with the initiative, following our merger with Churchill Capital Corp in 2019, to streamline our operations by simplifying our organization and focusing on two product groups. Adjusted EBITDA 340.0 Realized foreign exchange gain (6.8) 6. Includes primarily the net impact of foreign exchange gains and losses related to the re-measurement of balances and other items that do not reflect our ongoing operating performance. 7 DRG Adjusted EBITDA Impact 35.8 8 Cost savings 39.7 7. Represents DRG Adjusted EBITDA for the period beginning July 1, 2020 until the acquisition date of February 28, 2020 to reflect the company's Standalone EBITDA as though material acquisitions occurred at 9 Excess standalone costs 30.1 the beginning of the presented period Standalone Adjusted EBITDA $ 438.8 8. Reflects the estimated annualized run-rate cost savings, net of actual cost savings realized, related to restructuring and other cost savings initiatives undertaken during the period (exclusive of any cost reductions in our estimated standalone operating costs). 9. Reflects the difference between our actual standalone company infrastructure costs, and our estimated steady state standalone operating costs. 22

Reconciliation of Non-GAAP Financial Measures and Required Reported Data Three Months Ended June 30, Six Months Ended June 30, Descriptions 2020 2020 Adjusted Net Income and Adjusted Diluted EPS adjustments (in millions, except per share amounts) Amount Per Share Amount Per Share 1. In 2020, this is related to a new transition services agreement and offset by the reverse transition services agreement from the sale of MarkMonitor assets. In 2019, this includes Net loss $(1.5) — $(75.5) $(0.21) payments to Thomson Reuters under the Transition Services Agreement. Dilutive impact of potential common shares — — — 0.01 2. Includes costs incurred in connection with and after our separation from Thomson Net loss (1.5) — (75.5) (0.20) Reuters in 2016 relating to the implementation of our standalone company infrastructure and related cost-savings initiatives. These costs include mainly transition 1 Transition services agreement costs (0.8) — 0.8 — consulting, technology infrastructure, personnel and severance expenses relating to our standalone company infrastructure, which are recorded in Transition, integration, and 2 Transition, transformation and integration expense 1.3 — 3.6 0.01 other line-item of our income statement, as well as expenses related to the restructuring 3 Deferred revenues adjustment 3.4 0.01 5.3 0.01 and transformation of our business following our separation from Thomson Reuters in 2016, mainly related to the integration of separate business units into one functional 4 Transaction related costs 8.5 0.02 35.2 0.09 organization and enhancements in our technology. Share-based compensation expense 6.9 0.02 24.3 0.06 3. Reflects the deferred revenues adjustment as a result of purchase accounting. Amortization related to acquired intangible assets 47.6 0.12 87.7 0.23 4. Includes costs incurred to complete business combination transactions, including 5 Restructuring 15.8 0.04 23.6 0.06 acquisitions and dispositions, and typically include advisory, legal and other professional and consulting costs. Debt extinguishment costs and refinancing related costs — — 8.6 0.02 5. Reflects costs incurred in connection with the initiative, following our merger with Churchill Capital Corp in 2019, to streamline our operations by simplifying our 6 Other (5.5) (0.01) (8.0) (0.01) organization and focusing on two product groups. Income tax impact of related adjustments (6.2) (0.02) (10.7) (0.03) 6. Includes primarily the net impact of foreign exchange gains and losses related to the re- Adjusted Net income and Adjusted Diluted EPS $69.5 $0.18 $94.9 $0.25 measurement of balances and other items that do not reflect our ongoing operating performance. Weighted average ordinary shares (Diluted) 394,596,443 380,955,231 23

Non GAAP Reconciliation – Net Cash Provided By (Used In) Operating Activities to Free Cash Flow and Adjusted Free Cash Flow Descriptions Free Cash Flow and Adjusted Free Cash Flow Adjustments 1. Includes cash payments to Thomson Reuters under the Transition Services Agreement. These costs decreased substantially in 2019, Six Months Ended June 30, as were in the final stages of implementing our standalone company infrastructure. In 2019, the Transition Services Agreement (in millions) 2020 2019 cash paid is offset by cash receipts from the IPM Product Line Net cash provided by operating activities $107.6 $42.9 divestiture. 2. Includes cash payments in connection with and after our Capital expenditures (52.7) (24.9) separation from Thomson Reuters in 2016 relating to the implementation of our standalone company infrastructure and Free cash flow 54.9 18.0 related cost-savings initiatives. These cash payments include mainly transition consulting, technology infrastructure, personnel 1 Cash paid for transition services agreement (2.2) 5.1 and severance expenses relating to our standalone company infrastructure, which are recorded in Transition, integration, and 2 Cash paid for transition, transformation and integration expense 26.6 16.5 other line-item of our income statement, as well as cash payments related to the restructuring and transformation of our business 3 Cash paid for transaction related costs 34.3 33.0 following our separation from Thomson Reuters in 2016 mainly related to the integration of separate business units into one Cash paid for debt issuance costs 7.7 — functional organization and enhancements in our technology. This also includes cash payments following our merger with Churchill Cash received for hedge accounting transactions (1.7) — Capital Corp in 2019, to streamline our operations by simplifying our organization and focusing on two product groups. Adjusted free cash flow $119.6 $72.6 3. Includes consulting and accounting costs associated with acquisitions and the sale of MarkMonitor business. 24

Non GAAP Reconciliation – Revenues, Net to Adjusted Revenues Reconciliation Year Ending December 31, 2020 Descriptions (Forecasted) Adjusted Revenues, net Adjustments ($ in millions) Low High 1. The Company is evaluating the purchase accounting impact, including the deferred revenue adjustment, related to the DRG acquisition. 1 Revenues, net $ 1,130.0 $ 1,160.0 Non GAAP Reconciliation – Net Income to Adjusted EBITDA Reconciliation Year Ending December 31, 2020 Descriptions (Forecasted) Adjusted EBITDA Adjustments Low High ($ in millions) 1. Includes restructuring costs, other cost optimization activities, and payments and receipts Net (loss) income $(70.6) $(45.6) under transition service agreements. Benefit for income taxes 7.8 7.8 2. Includes cost associated with merger and acquisition related activities. Depreciation and amortization 236.9 236.9 Interest, net 93.0 93.0 1 Transition, TSA and integration expenses 46.4 46.4 2 Transaction related costs 50.0 50.0 Share-based compensation expense 30.6 30.6 Other 0.9 0.9 Adjusted EBITDA $395.0 $420.0 Non GAAP Reconciliation –Adjusted EBITDA Margin Reconciliation Year Ending December 31, 2020 Descriptions (Forecasted) Adjusted EBITDA Margin Adjustments ($ in millions) Low High 1. The Company is evaluating the purchase accounting impact, including the deferred 1 Revenues, net $1,130.0 $1,160.0 revenue adjustment, related to the DRG acquisition. Adjusted EBITDA $395.0 $420.0 Adjusted EBITDA Margin 35% 36% 25

Non GAAP Reconciliation – Net Loss Per Fully Diluted Weighted Shares Outstanding to Adjusted Diluted EPS Year Ending December 31, 2020 Descriptions Reconciliation (Forecasted) Adjusted Diluted EPS Adjustments (in millions, except per share amounts) Low High Per Share Per Share 1. Includes restructuring costs, other cost optimization activities, and payments and receipts under transition service agreements. Net Loss $(0.17) $(0.11) 2. Includes cost associated with merger and acquisition related activities. 1 Transition, TSA and integration expenses 0.12 0.12 2 Transaction related costs 0.13 0.13 Share-based compensation 0.08 0.08 Amortization related to acquired intangible assets 0.40 0.40 Income tax impact of related adjustments (0.03) (0.03) Adjusted Diluted EPS $0.53 $0.59 Weighted average common shares (diluted) 394,077,974 Non GAAP Reconciliation – Free Cash Flow and Adjusted Free Cash Flow Year Ending December 31, 2020 Reconciliation Descriptions (Forecasted) Low High Adjusted Free Cash Flow Adjustments (in millions) 1. Includes cash payments related to restructuring and other cost optimization activities. Net cash provided by operating activities $ 212.8 $ 228.4 2. Includes cash payments related to merger and acquisition related activities. Capital expenditures $ (87.8) $ (91.4) Free Cash Flow $ 125.0 $ 137.0 1 Transition, transformation and integration expense $ 53.0 $ 60.0 2 Transaction related costs $ 42.0 $ 43.0 Adjusted Free Cash Flow $ 220.0 $ 240.0 26