Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - CLARIVATE Plc | tm206490d1_ex32.htm |

| EX-31 - EXHIBIT 31 - CLARIVATE Plc | tm206490d1_ex31.htm |

| EX-23.1 - EXHIBIT 23.1 - CLARIVATE Plc | tm206490d1_ex23-1.htm |

| EX-10.17 - EXHIBIT 10.17 - CLARIVATE Plc | tm206490d1_ex10-17.htm |

| EX-10.16 - EXHIBIT 10.16 - CLARIVATE Plc | tm206490d1_ex10-16.htm |

| EX-10.15 - EXHIBIT 10.15 - CLARIVATE Plc | tm206490d1_ex10-15.htm |

| EX-4.5 - EXHIBIT 4.5 - CLARIVATE Plc | tm206490d1_ex4-5.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _______

Commission File No. 001-38911

CLARIVATE ANALYTICS PLC

(Exact name of registrant as specified in its charter)

| Jersey, Channel Islands | Not applicable | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| Friars House, 160 Blackfriars Roads London SE1 8EZ United Kingdom (Address of principal executive offices) |

Not applicable (Zip Code) |

Registrant's telephone number, including area code: +44 207 4334000

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Trading Symbol(s) |

Name of exchange on which registered |

| Ordinary shares | CCC | New York Stock Exchange |

| Warrants to purchase ordinary shares | CCC.WS | NYSE American |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | ¨ |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ¨ No x

The aggregate market value of the approximately 68.0 million ordinary shares held by non-affiliates of the Company (assuming for these purposes, but without conceding, that all executive officers and directors of the Company are affiliates of the Company) as of June 30, 2019, the last day of business of our most recently completed second fiscal quarter, was $1.05 billion, based on the closing sale price of the ordinary shares of $15.38 on June 28, 2019 as reported by the New York Stock Exchange.

The number of ordinary shares of the Company outstanding as of February 26, 2020 was 361,663,054.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

2

Note on Defined Terms and Presentation

We employ a number of defined terms in this annual report for clarity and ease of reference, which we have capitalized so that you may recognize them as such. Generally, we explain a defined term the first time it is used. As used throughout this annual report, unless otherwise indicated or the context otherwise requires, the terms “Clarivate,” the “Company,” “our,” “us” and “we” refer to Clarivate Analytics Plc and its consolidated subsidiaries; “Baring” refers to the affiliated funds of Baring Private Equity Asia Pte Ltd that from time to time hold our ordinary shares; and “Onex” refers to the affiliates of Onex Partners Advisor LP that from time to time hold our ordinary shares.

Unless otherwise indicated, dollar amounts throughout this annual report are presented in thousands of dollars, except for per share amounts.

Website and Social Media Disclosure

We use our website (www.clarivate.com) and corporate Twitter account (@Clarivate) as routine channels of distribution of company information, including news releases, analyst presentations, and supplemental financial information, as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, investors should monitor our website and our corporate Twitter account in addition to following press releases, SEC filings, and public conference calls and webcasts. Additionally, we provide notifications of news or announcements as part of our investor relations website. Investors and others can receive notifications of new information posted on our investor relations website in real time by signing up for email alerts.

None of the information provided on our website, in our press releases, public conference calls, and webcasts, or through social media channels is incorporated into, or deemed to be a part of, this annual report or in any other report or document we file with the SEC, and any references to our website or our social media channels are intended to be inactive textual references only.

Foreign Private Issuer Status and Financial Presentation

We currently qualify as a foreign private issuer (“FPI”) under the rules of the SEC. We currently anticipate that we will retain FPI status until at least December 31, 2020. However, even though we qualify as an FPI, we report our financial results in accordance with U.S. generally accepted accounting principles (“GAAP”) and, beginning with this annual report, we have elected to file our periodic and current reports on Forms 10-K, 10-Q and 8-K.

Industry and Market Data

The market data and other statistical information used throughout this annual report are based on industry publications and surveys, public filings and various government sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. Statements as to our ranking, market position and market estimates (including estimates of the sizes and future growth rates of our markets) are based on independent industry publications, government publications, third-party forecasts and management’s good faith estimates and assumptions about our markets and our internal research. We have not independently verified such third-party information nor have we ascertained the underlying economic assumptions relied upon in those sources, and we are unable to assure you of the accuracy or completeness of such information contained in this annual report. While we are not aware of any misstatements regarding our market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors. See “Item 1A. Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in this annual report.

3

Overview

We are a leading global information services and analytics company serving the scientific research, intellectual property and life sciences end-markets. We provide structured information and analytics to facilitate the discovery, protection and commercialization of scientific research, innovations and brands. Our product portfolio includes well-established, market-leading brands such as Web of Science, Derwent Innovation, Life Sciences, CompuMark and MarkMonitor. We believe that our flagship products hold a #1 or #2 global position by revenues across the respective markets they serve, including abstracting and indexing databases, life science regulatory and competitive intelligence and intellectual property protection (including patent, trademarks and brand protection). We serve a large, diverse and global customer base. As of December 31, 2019, we served over 40,000 entities in more than 170 countries, including the top 30 pharmaceutical companies by revenues and 50 global patent offices. We believe that the strong value proposition of our content, user interfaces, visualization and analytical tools, combined with the integration of our products and services into customers’ daily workflows, leads to our substantial customer loyalty as evidenced by their high propensity to renew their subscriptions with us.

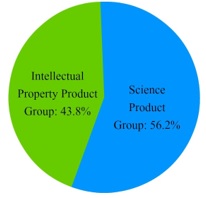

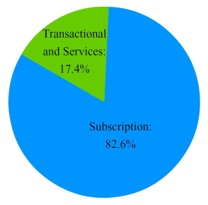

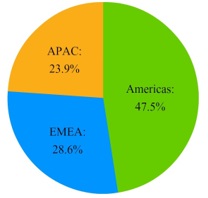

Our structure is comprised of two product groups: Science and Intellectual Property (“IP”). The Science Group consists of the Web of Science and Life Science Product Lines. The IP Group consists of the Derwent, CompuMark and MarkMonitor Product Lines. This structure enables a sharp focus on cross-selling opportunities within the markets we serve and provides substantial scale.

Corporations, government agencies, universities, law firms and other professional services organizations around the world depend on our high-value, curated content, analytics and services. Unstructured data has grown exponentially over the last decade. This trend has resulted in a critical need for unstructured data to be meaningfully filtered, analyzed and curated into relevant information that facilitates key operational and strategic decisions made by businesses, academic institutions and governments worldwide. Our highly curated, proprietary information created through our sourcing, aggregation, verification, translation and categorization of data has resulted in our solutions being embedded in our customers’ workflow and decision-making processes.

For the year ended December 31, 2019, we generated approximately $974,345 of revenues. We generated recurring revenues through our subscription-based model, which accounted for 82.6% of our revenues for the year ended December 31, 2019. In each of the past three years, we have also achieved annual revenue renewal rates in excess of 90%. (For information on annual revenue renewal rates, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Key Performance Indicators — Annual Revenue Renewal Rates.”) No single customer accounted for more than 1% of revenues and our ten largest customers represented only 5% of revenues for the year ended December 31, 2019.

The following charts illustrate our revenues for the year ended December 31, 2019 by group, type and geography:

| Revenue by Product Group | Revenue by Type | Revenue by Geography |

|

|

|

4

Our Products

Our product portfolio is summarized below.

| Science Group | Intellectual Property Group | ||||||

| Web of Science | Life Sciences | Derwent | CompuMark | MarkMonitor | |||

| Product Description | Used to navigate scientific and academic research discoveries, conduct analysis and evaluate research impact | Used by life sciences firms for drug research, market intelligence and regulatory compliance | Used to search and analyze patents | Used to monitor trademarks on an ongoing basis | Used to register and manage portions of web domains | ||

| Curated Information Set | Database of 1B+ citations, 166mm+ index records | 73,000+ drug program records, 340,000 clinical trial records | Database of 80mm+ patent filings across 50 patent offices | 180+ patent and trademark offices | Database of 1.3mm corporate domain names | ||

| Customers | 7,000+ leading academic institutions and governments and research intensive corporations use Web of Science and its Journal Impact Factor | Trusted by the top 30 pharma companies and hundreds of research groups | Used by 50 patent offices, large R&D organizations of Fortune 1000 companies and various universities | 15 industrial databases, 70 Pharma in-use databases | MarkMonitor manages 44% of the top 50 most trafficked corporate website domain portfolios | ||

| Notable Products | Web of Science InCites ScholarOne | Cortellis RI Integrity Newport | Derwent Innovation TechStreet | Watch Screen Search | Domain Management Brand Protection | ||

Our Strategy

The Clarivate management team, led by Executive Chairman and Chief Executive Officer Jerre Stead, is implementing a transformation strategy designed to improve operations, increase cash flow and accelerate revenues growth. Our transition to standalone operations since our 2016 separation from Thomson Reuters Corporation and its affiliates (“Thomson Reuters”) has required extensive management time and focus and involved significant expenditures, including sizeable payments to Thomson Reuters under the transition services agreement formerly in effect. We believe that our transition to a standalone company positions us to implement our transformation strategy and to improve our productivity compared to other leaders in the information services sector on a revenues per employee basis and in terms of our Adjusted EBITDA margins.

Under Mr. Stead’s leadership, we are embarking on a race to deliver excellence to the markets we serve and continue our evolution as a world-class organization. As we move forward, the focus will be on three basic principles; focus, simplify and execute. This means:

| 1. | Focusing on our core capabilities and the greatest opportunities for growth. |

| 2. | Simplifying our organization and processes. The focus on two product groups will be the driver for streamlining our operations. |

| 3. | Relentlessly driving execution of our strategy and growth plans. |

These changes will help us operate with greater focus and urgency. They will ensure that we put our clients first, drive accountability throughout the organization, accelerate decision-making, and promote consistency. These tenets will enable us to deliver long-term, sustainable growth.

5

With a proven operational playbook, we have quickly pursued initiatives to set ourselves on a growth trajectory. Our results for the year ended December 31, 2019 are among the first proof points that our transformation is underway.

| Proven Playbook with Multiple Levers | Fourth Progress Report | ||||

| Accelerate Revenue Growth | 2019 Earnings(1) | ||||

| ~ | Product and pricing enhancement strategies | 1. | Revenue growth 0.6% (2) | ||

| ~ | Increased pipeline of new products | 2. | Adjusted revenue growth (at constant currency) 3.1% (2) | ||

| ~ | Build strength in Asia Pacific | 3. | Subscription revenue growth 1.4% | ||

| ~ | Optimizing pricing and cross-sell | 4. | Adjusted subscription revenue growth (at constant currency) 4.3%(2) | ||

| 5. | Transactional revenue growth (4.7)% | ||||

| 6. | Adjusted Transactional revenue growth (at constant currency) (2.3%) | ||||

| Enhance Margins | 7. | ACV growth (at constant currency) 3.5% (3) | |||

| ~ | Benefit from top-line initiatives | 8. | 90.1% retention rate (4) | ||

| ~ | Simplifying G&A structure | 9. | Net loss $210,977 (Net loss margin and margin improvement not meaningful; reduction in Net loss of 12.9%) (2) | ||

| ~ | Consolidating footprint | 10. | Adjusted EBITDA margin 30.2% (2) | ||

| ~ | Increase automation and cloud infrastructure | 11. | Adjusted EBITDA margin improvement 150 bps (2) | ||

| 12. | Adjusted EBITDA growth 7.7% (2) | ||||

| 13. | Exited TSA six months ahead of schedule | ||||

1. For a reconciliation of our non-GAAP measures to the corresponding most closely related measures calculated in accordance with GAAP, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Certain Non-GAAP Measures.”

2. Results calculated for the year ended December 31, 2019 as compared to the year ended December 31, 2018.

3. “ACV” or “annualized contract value” refers to the annualized value for a 12-month period following a given date of all subscription-based client license agreements, assuming that all license agreements that come up for renewal during that period are renewed. The figure above represents the year-over-year growth in the annual value of our subscriptions as of December 31, 2019 as compared to December 31, 2018. For information on ACV, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Key Performance Indicators – Annualized Contract Value.”

4. Retention rate measurement period is for the year ended December 31, 2019.

Operational Improvement Initiatives

We are in the process of implementing several cost-saving and margin improvement initiatives designed to generate substantial incremental cash flow. We have engaged a strategic consulting firm to assist us in optimizing our structure and cost base. The focus of these initiatives is to identify significant cost reductions to be implemented over the next several quarters, enabling us to deliver margins consistent with those of our peer group. Some examples include:

| • | decreasing costs by simplifying organizational structures and rationalizing general and administrative functions to enhance a customer-centric focus; |

| • | using artificial intelligence and the latest technologies to reduce costs and increase efficiencies for content sourcing and curation; |

| • | moving work performed by contractors in-house to best-cost geographic locations, particularly India, where we have significant scale that can be leveraged; |

| • | achieving headcount productivity benchmarks and operational efficiency metrics based on alignment with quantified sector leader benchmarks; |

| • | expanding existing operations in best-cost geographic locations, aligning with business objectives; |

| • | minimizing our real estate footprint by reducing facility locations substantially over the next three years; and |

| • | divesting non-core assets. |

6

Revenues Growth Initiatives

We believe a significant opportunity exists for us to accelerate revenues growth by increasing the value of our products and services, developing new products, cross-selling certain products and optimizing sales force productivity. Actions to achieve such revenues growth are expected to include:

| • | developing new value-added products and services; |

| • | delivering an enhanced client experience through ongoing renovations to our products’ user interface and user experience; |

| • | offering additional analytics that enhance existing products and services; |

| • | moving up the value chain by providing our clients with predictive and prescriptive analytics, allowing for stronger growth and higher retention rates; |

| • | expanding our footprint with new and existing customers, with significant opportunity for growth in the Asia Pacific and emerging markets; |

| • | broadening our consulting capabilities, in particular in the Science Group, where there is considerable opportunity for us to deliver high value consulting services to drive significant revenues growth; |

| • | optimizing product pricing and packaging based on customer needs; |

| • | increasing sales force focus on large accounts; |

| • | expanding our inside sales capability to improve account coverage; and |

| • | restructuring our incentive plans to drive new business, as well as cross-selling among similar products and overlapping buying centers. |

The above actions are part of an overarching effort to improve retention rates and new business growth rates to best-in-class levels across our portfolio.

Pursue Acquisition Opportunities

Given the fragmented nature of the broader information services industry, we track and, where appropriate, will continue to pursue opportunities across our product groups. From 2017 through 2019, we completed five small add-on acquisitions to augment our existing portfolio of assets and provide additional datasets and services for our customers. Our completed acquisitions include Publons and Kopernio in Science and TrademarkVision, SequenceBase and Darts-ip in IP. Certain of these acquisitions are fully integrated into our platform. while others continue to be integrated, and we believe they have already provided additional value to our customers.

In February 2020, we consummated the acquisition of Decision Resources Group, our largest acquisition to date. See “— Recent Developments.”

We are evaluating additional acquisition opportunities to supplement our existing platform and enable us to enter new markets. Our focus is on disciplined and accretive investments that leverage our core strengths and enhance our current product, market, geographic and customer strategies. We believe that the combination of Mr. Stead’s successful acquisition track record and our scale and status as a global information services leader uniquely positions us to create value through additional acquisitions.

Positive Sector Dynamics Support Our Trajectory

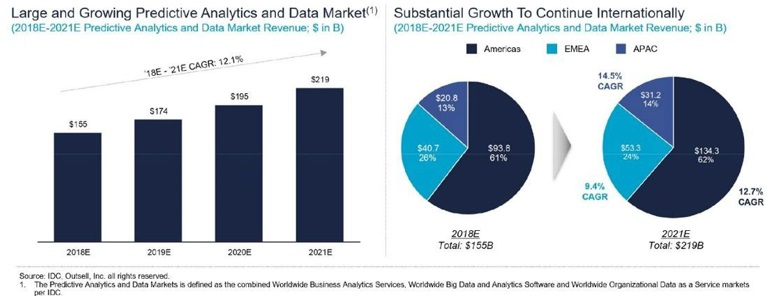

We operate in the global information services and analytics sector, which is experiencing robust growth due to many factors. Data and analytics have become critical inputs into broader corporate decision-making in today’s marketplace, and companies and institutions are seeking services like ours to enhance the predictive nature of their analysis. In addition to greater demand for our services, rapid innovation within our customers’ businesses has created new use cases for our services. Third-party industry reports estimate the global data and analytics market will grow from $155 billion in 2018 to $219 billion by 2021, a 12.1% compound annual growth rate over the period. This represents the target addressable market across verticals that have a need for data and analytical services.

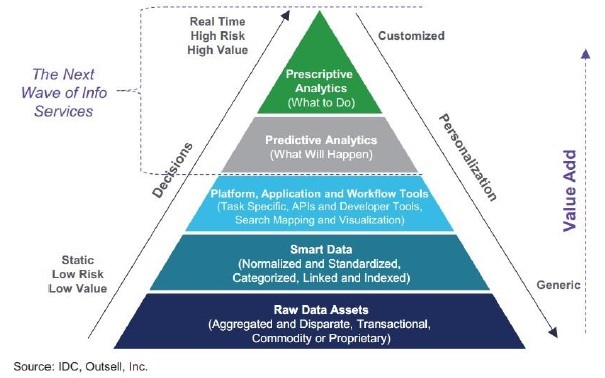

Customers of data and analytics products continue to approach complex business decisions in new ways. We believe that these customers are placing greater emphasis and value on the ability to embed predictive and prescriptive analytics into their decision-making processes. These customers are using smart data to anticipate what will happen in the future, as opposed to using historical data to study what has happened in the past. As such, we are investing in these critical, forward-facing products and solutions. We believe offering these types of products will increase the value clients place on our products, allow for stronger growth and open new addressable markets, as illustrated below.

7

Significant Move Up the Value Chain with Smart Data Offerings

Our Competitive Strengths

Leading Market Positions in Attractive and Growing Global Markets

We offer a collection of high-quality, market-leading information and analytic products and solutions serving the intellectual property, scientific research and life sciences end-markets. Through our products and services, we address the large and growing demand from corporations, government agencies, universities, law firms and other professional services organizations worldwide for comprehensive, industry-specific content and analytical tools to facilitate the discovery, development, protection, commercialization and measurement of scientific research, innovations and brands. We believe that our flagship products hold a #1 or #2 by revenue across the respective markets they serve, including abstracting and indexing databases, life science regulatory and competitive intelligence and intellectual property protection (including patent, trademarks and brand protection). We also believe that the outlook for growth in each of our Product Lines is compelling because of customer demand for curated high-quality data, underpinned by favorable end-market trends, such as rising global R&D spending, growing demand for information services in emerging markets, the acceleration of e-commerce and the increasing number of patent and trademark applications.

A Trusted Partner Delivering Highly Curated Content Embedded Within Customer Workflows

We believe the substantial increase in unstructured data over the last decade has increased the importance of our proprietary, curated databases to our customers. This trend has resulted in a critical need for unstructured data to be meaningfully filtered, analyzed and curated into relevant information that facilitates key operational and strategic decisions made by businesses, academic institutions and governments worldwide. Our suite of branded information and analytic solutions provides access to content that has been collected, curated and standardized over decades, making our products and services highly valued and increasingly important for our customers. Our content curation and editorial teams include over 930 employees, who clean, analyze and classify unstructured data to ensure high-quality content and an enhanced user experience. We believe our solutions and commitment to excellence provide us with a significant advantage in both retaining existing and attracting new customers.

8

Attractive Business Model with Strong Free Cash Flow Profile

Approximately 82.6% of revenues for the year ended December 31, 2019 were generated through annual or multi-year subscription agreements. In addition, we have been able to achieve annual revenues renewal rates in excess of 90% over the past two years. We believe our business has strong and attractive free cash flow characteristics due to our highly visible and recurring subscription revenues stream, attractive Adjusted EBITDA margins, low capital expenditure requirements and favorable net working capital characteristics. Anticipated revenues growth, margin improvement, the recently-completed separation from Thomson Reuters and effective working capital management are expected to result in strong free cash flow generation. We believe this will create capacity to invest further into the business so that we can grow and maximize shareholder returns.

Diversified Product Lines with Longstanding Customer Relationships

We believe that the diversified nature of our Product Lines enhances the stability of our entire platform as we are not dependent on any one end-market, product, service or customer. We serve a large, diverse and global customer base, and as of December 31, 2019, we served over 40,000 entities in more than 170 countries, including the top 30 pharmaceutical companies by revenues and 50 global patent offices. No single customer accounted for more than 1% of revenues and our ten largest customers represented only 5% of revenues for the year ended December 31, 2019. We believe the strong value proposition offered by our content, combined with the integration of our products and services into our customers’ daily workflows and decision-making processes, leads to substantial customer loyalty. Our relationships with our top 50 customers by revenues span an average tenor of over 15 years. Our diverse global footprint is highlighted by the distribution of our revenues for the year ended December 31, 2019 by geography: Americas (47.5%), Europe/Middle East/Africa (28.6%), and Asia Pacific (23.9%).

Resilience Through Economic Cycles

We believe our business is resilient across economic cycles because our products and services are an integral part of our customers’ decision-making processes. We believe multi-year agreements also help to maintain this resiliency. During the most recent economic downturn, three of our key products — Web of Science, Life Sciences and Derwent Innovation — realized year-over-year revenues increases from 2008 to 2009. In addition, our diverse global footprint reduces our exposure to national and regional economic downturns.

Our performance is largely due to the sectors we serve and the deep integration of our products with our customers’ workflows, which provides for a resilient business model even during an economic downturn.

Proven and Experienced Leadership

Mr. Stead is a proven business operator with demonstrated success in shareholder value creation. At Clarivate, Mr. Stead brings his decades of expertise in the information services sector to guide a talented and experienced management team sourced from world-class, global companies, most of whom have decades of experience in their respective areas of expertise.

9

Background and History

Clarivate Analytics Plc was registered on January 7, 2019 and is organized under the laws of Jersey, Channel Islands. Our registered office is located at 4th Floor, St Paul’s Gate, 22-24 New Street, St. Helier, Jersey JE1 4TR. Our principal business offices are located at Friars House, 160 Blackfriars Road, London SE1 8EZ, United Kingdom, where our main telephone number is +44 207 4334000. We maintain a website at www.clarivate.com. In addition, the SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers (including Clarivate) that file electronically with the SEC at www.sec.gov.

Our predecessors date back to the acquisition of two industry-leading information services businesses: Derwent World Patents Index (“DWPI”) and Institute for Scientific Information (“ISI”). DWPI was founded in 1951 by Monte Hyams who first began abstracting and publishing British patents on a weekly basis. This platform was then launched as the first online patent search tool in 1974. ISI was founded in 1957 by Dr. Eugene Garfield as a series of databases which laid the foundation for modern day bibliometrics and the influential Journal Impact Factor indicator. Thomson Reuters acquired DWPI in 1984 and ISI in 1992; it made further investments in complementary businesses centered on life science research, domain management and brand protection.

Since Thomson Reuters acquired DWPI and ISI, the business now known as Clarivate has emerged as the leading global information services and analytics company serving the scientific research, intellectual property and life sciences end-markets. Through product development, investment and acquisitions, we have developed a full suite of solutions providing high-value structured information that facilitates the discovery, protection and commercialization of scientific research, innovations and brands.

During the majority of its time under prior ownership, the Company operated as a set of non-core, separate divisions until Thomson Reuters decided in 2015 to divest them. This decision led to two key transformative events.

The first transformative event occurred in October 2016, when Onex and Baring acquired subsidiaries and assets comprising the intellectual property and science business of Thomson Reuters for $3,566,599 and formed Clarivate.

Onex, Baring and the new executive team they put in place focused on transitioning us to be a standalone company and completed a substantial number of operational improvements, including:

| • | building a new senior executive management team; |

| • | investing in our core products to upgrade their content, functionality, analytical tools and user interfaces; |

| • | completing the acquisitions of Publons, Kopernio, TrademarkVision, and SequenceBase to complement our product offerings; |

| • | implementing initial cost savings initiatives; and |

| • | fully transitioning the business from reliance on Thomson Reuters. |

The second transformative event occurred in January 2019, when Churchill Capital Corp, a special purpose acquisition company led by Mr. Stead, announced that it would combine with Clarivate in a transaction completed in May 2019. Following the merger, the ordinary shares and warrants of Clarivate began trading on the New York Stock Exchange (“NYSE”) and the NYSE American under the symbols “CCC” and “CCC.WS,” respectively.

10

Recent Developments

Acquisition of Decision Resources Group

On January 17, 2020, we entered into an agreement to acquire Decision Resources Group (“DRG”), a premier provider of high-value data, analytics and insights products and services to the healthcare industry, from Piramal Enterprises Limited, which is a part of global business conglomerate Piramal Group. The acquisition closed on February 28, 2020.

The aggregate consideration paid in connection with the closing of the DRG acquisition was approximately $950,000, comprised of $900,000 in cash paid on the closing date and approximately $50,000 in Clarivate ordinary shares to be issued to Piramal Enterprises Limited following the one-year anniversary of closing.

In February 2020, we completed an underwritten public offering of 27,600,000 of our ordinary shares, generating net proceeds of $540,736, which we used to fund a portion of the cash consideration for the DRG acquisition. In addition, we incurred an incremental $360,000 of term loans under our term loan facility and used the net proceeds from such borrowings, together with cash on hand, to fund the remainder of the cash consideration for the DRG acquisition and to pay related fees and expenses.

Redemption of Public Warrants

On February 20, 2020, we announced the redemption of all of our outstanding public warrants to purchase our ordinary shares that were issued as part of the units sold in the Churchill Capital Corp initial public offering and remain outstanding at 5:00 p.m. New York City time on March 23, 2020, for a redemption price of $0.01 per public warrant. In addition, our board of directors elected that, upon delivery of the notice of the redemption on February 20, 2020, all public warrants are to be exercised only on a “cashless basis.” Accordingly, by virtue of the cashless exercise of public warrants, exercising public warrant holders will receive 0.4626 of an ordinary share for each public warrant. Assuming all outstanding public warrants called for redemption on March 23, 2020 are exercised prior to redemption, an additional 4,749,616 ordinary shares would be issued.

In addition, during the period from January 1, 2020 through February 21, 2020, 24,132,666 of our outstanding public warrants were exercised for one ordinary share per whole warrant at a price of $11.50 per share.

The private warrants issued in a private placement concurrently with the Churchill Capital Corp initial public offering and still held by their initial holders are not subject to this redemption.

MarkMonitor Brand Protection, Antipiracy and Antifraud Disposition

In November 2019, we announced an agreement to sell the MarkMonitor™ brand protection, antipiracy and antifraud businesses, and completed such divestiture on January 1, 2020. We retained the MarkMonitor Domain Management business.

Our Product Lines

SCIENCE GROUP (56.2% of revenues for the year ended December 31, 2019)

Our Science Group consists of our Web of Science and Life Science Product Lines. Both provide curated, high-value, structured information that is delivered and embedded into the workflows of our customers, which include research intensive corporations, life science organizations and universities world-wide.

Web of Science Product Line

Our Web of Science Product Line (“WOSPL”) provides products and services to organizations that plan, fund, implement and utilize research. We deliver search and discovery services to researchers with proprietary scientific data; we help researchers cite their research with workflow tools; we provide data and analytics to allow for global measures of research excellence and university rankings; we support governments and policy makers worldwide in assessment programs; and we inform a wide range of sector specific consultation and reporting activities to national and institutional research agencies across the G20 countries. We believe that the high quality and unique nature of WOSPL’s products and the informed approach of our professional service expertise have resulted in our information, services and workflow tools becoming embedded within the fabric of the research community. Key products include Web of Science, InCites, Journal Citation Reports, EndNote, ScholarOne, Converis, Publons and Kopernio.

Web of Science (“WOS”), our flagship product, holds a unique and pivotal role in the infrastructure of R&D and is frequently utilized as a reference standard in the academic, institutional and corporate sectors. It provides publication records and essential metadata from trusted published assets and is linked and indexed together via over one billion tracked citations from over 166 million index records going back to 1900 within the core Web of Science, and back to 1864 in Zoological Record. A key metric we provide is the “Journal Impact Factor” (“JIF”), which we believe is the most influential and best-known research metric of the last 50 years. Its primary value is as a journal-level metric to assess what journals are the most impactful, but universities and research funders use JIF to inform their evaluation of research excellence when assessing faculty and selecting funding grantees. Researchers also rely on the JIF to identify top-tier journals where they should publish their content.

11

Example Use Cases

| • | A physics professor planning a research program and making a grant proposal accesses WOS to evaluate the current state of research in her discipline, identify emerging trends within highly regarded and relevant scientific journals and select a research topic, while the grant-making institutions will use WOS’s analytic tools to measure the professor’s credentials. |

| • | A university provost interested in evaluating her university’s chemistry department accesses WOS and our analytical tool InCites to measure the strength of the university’s research output and benchmark it against comparable institutions, find the best researchers to bolster the university’s ranking and improve the caliber of research and find highly cited researchers, departments and laboratories. |

Life Sciences Product Line

Our Life Sciences Product Line (“LSPL”) provides products and services primarily to pharmaceutical and biotechnology companies. Our products are market leaders in regulatory intelligence and competitive intelligence, and our clinical trial offering is rapidly gaining share. We believe we provide a unique end-to-end proposition, which links to early research workflows, and believe there is an opportunity to stretch further into the approval and post-approval phases of drug development. Key products include Cortellis, Newport and Integrity.

Cortellis, our flagship LSPL product, is used by strategy, business development, drug development, medical affairs and clinical professionals at pharmaceutical and biotechnology companies to support research, market intelligence and competitive monitoring in connection with the development and commercialization of new drugs. Our customers use the database to access and evaluate scientific data, drug pipeline data, clinical trial information, drug monographs, pharmaceutical M&A data and regulatory information, all of which has been aggregated, curated and classified by our team of scientific experts who evaluate and select data for inclusion in the database from a wide array of sources. In addition, our team of experts creates high-value content from this data, such as analytics, abstracts, conference summaries and regulatory reports. As of December 31, 2019, our data included more than 73,000 drug program records and more than 340,000 clinical trial records.

Example Use Case

| • | An analyst at a pharmaceutical firm who is evaluating several potential R&D programs will access the Cortellis database to assess competitive products in the drug development pipeline, review clinical trial data and summarize regulatory information. |

INTELLECTUAL PROPERTY GROUP (43.8% of revenues for the year ended December 31, 2019)

Our Intellectual Property Group consists of our Derwent, CompuMark and MarkMonitor Product Lines. These Product Lines help manage customer’s end-to-end portfolio of intellectual property from patents to trademarks to corporate website domains.

12

Derwent Product Line

Our Derwent Product Line (“DPL”) enables customers to evaluate the novelty of potential new products, confirm freedom to operate with respect to their product design, help them secure patent protection, assess the competitive technology landscape and ensure that their products comply with required industry standards. We provide a range of analytics capabilities and data visualization tools to improve the efficiency and accuracy of IP-driven decisions. Key products include Derwent Innovation, Techstreet and IP Professional Services.

Derwent Innovation, our flagship DPL product, is used by R&D professionals and lawyers to monitor patent filings, search existing patents and analyze data to support R&D decision-making. It is a critical resource to help our customers secure patent protection and address litigation of patent infringement. The product is powered by Derwent World Patents Index, our proprietary database of over 80 million patent publications from 50 patent offices, which represented 98% of all patents published globally in 2018 and has been developed and curated for over 50 years. The database combines data science with our team of domain experts who correct, enrich and abstract over six million global patents per year in over 30 languages, as of December 31, 2019. We provide customers with easy-to-understand summaries of patent filings that are prepared by our domain experts, who index and translate the highly technical and intentionally obscure patent filings into understandable abstracts that provide insights into a patent’s novelty, use and advantage over prior patents.

Example Use Case

| • | An employee developing a new product or idea (e.g., a chemical engineer or a product designer) will access the Derwent Innovation database of patents to evaluate the novelty and determine the patentability of the new product or idea. |

CompuMark Product Line

Our CompuMark Product Line (“CPL”) provides trademark research and protection services for businesses and law firms globally and relies on our leading trademark database. CompuMark’s offerings span the entire life cycle of a trademark, from determining availability of a proposed trademark to monitoring for infringement post registration. CPL provides global trademark research and protection to corporations and law firms globally. Over the last 30 years, the organization has curated content from more than 180 patent and trademark offices. Coupled with industry specific sources, including over 15 industrial design databases and 70 Pharma In-Use Databases as of December 31, 2019, CompuMark delivers the most comprehensive data set for trademark professionals available.

Key products include trademark screening, trademark searching and trademark watching. We do this by (i) providing customers with sophisticated self-service tools to narrow large lists of potential trademarks, which we refer to as “screening”; (ii) preparing detailed, custom reports post screening that uncover potential risks related to a proposed trademark, which we refer to as “clearance searching”; and (iii) monitoring trademark applications and other data sources on a recurring subscription revenues basis to alert clients to potential instances of infringement post registration, which we refer to as “watching.”

Example Use Case

| • | An attorney for a large law firm helps clear a trademark for use by its corporate customer as part of a new product launch. The attorney first conducts a “knock-out” search as part of a preliminary screening process using our trademark research tool and then later orders an analyst curated “Full Search” report by CompuMark to ensure the availability of the proposed trademark in the markets in which the customer will be operating. In this way, the attorney can clear both the word and image mark for use by his/her client. The lawyer will then subscribe to CompuMark’s trademark watching services to continually ensure that none of their customers’ valuable trademarks are being infringed upon. |

13

MarkMonitor Product Line

Our MarkMonitor Product Line (“MPL”) helps global enterprises establish, manage, optimize and protect their online presence. MPL provides a suite of technology services for brand managers, IT managers, marketing teams, and legal counsel in corporations to register and manage portfolios of domain names critical for their business. This allows customers to achieve the right balance of being easily found online without overpaying for domains that generate little to no Internet user traffic. MPL also provides data and domain industry insights which help enterprises maximize the power of their portfolios, and mitigate cyber squatters’ attempts to register domains aimed to defraud consumers.

Example Use Case

| • | An in-house counsel uses MarkMonitor to ensure that important domain names are registered and protected from security threats such as domain hijacking, spam, and other forms of DNS abuse. |

Customers

We serve a large, diverse and global customer base and, as of December 31, 2019, we served over 40,000 entities in more than 170 countries as well as the top 30 pharmaceutical companies by revenue and 50 global patent offices. Our customers either use our databases on an exclusive basis or on a dual-sourced basis.

No single customer accounted for more than 1% of revenues and our ten largest customers represented only 5%, 6%, and 7% of revenues for the years ended December 31, 2019, 2018, and 2017 respectively.

Competitive Environment

We believe the principal competitive factors in our business include the quality of content embedded in our databases and those of our competitors, customers’ perception of our products relative to the value that they deliver, user interface of the products and the quality and breadth of our overall offerings. We believe we compete favorably with respect to each of these factors.

We believe no single competitor currently offers the same scope of services and market coverage we provide, nor do we provide the same scope of services and market coverage as our competitors. The breadth of markets we serve exposes us to a broad range of competitors as described below.

Our primary competitors differ by product line and include the following companies and product offerings:

| • | Abstracting and Indexing Database Market: Elsevier (Scopus, SciVal), Digital Science (Dimensions) and ProQuest (RefWorks); | |

| • | Patent Protection Market: CPA Global (Innography and IP services), IHS Markit (Engineering Workbench, ecommerce store), LexisNexis (TotalPatent), Minesoft (PatBase), Questel (Orbit) and SAI Global (i2i, ecommerce store); | |

| • | Life Sciences Regulatory and Competitive Intelligence Market: Evaluate (Evaluate Pharma), Global Data (Global Data Pharmaceuticals), Informa (Pharma Intelligence, BioMedTracker, Pharmaprojects, Trialtrove, Sitetrove), IQVIA (Tarius) and Qiagen (Qiagen Services); |

14

| • | Trademark Protection Market: Corsearch (Contour, Corsearch Screening, search and watch services), TrademarkNow (NameCheck, LogoCheck, NameWatch) and Markify (ComprehensiveSearch, ProSearch and trademark and domain watch); and | |

| • | Domain Management and Brand Protection Market: Corporation Service Company (CSC) (domain name management, online brand protection, anti-counterfeiting services), Incopro (online brand protection, content protection intelligence, site blocking intelligence and advertising Monitoring), Yellow (anti-piracy, anti-counterfeiting and IP protection), Phish Labs (phishing incident response and brand protection), Friend MTS (anti-piracy and content management) and AppDetex (domain management and online brand protection) and Red Point Solutions (anti-piracy and brand protection). |

Sources of Data

The data supporting our products and services is sourced principally through two different types of arrangements. First, we source data generally at little or no cost from public sources, including federal, state and local governments. Second, we purchase data from third-party data aggregators under contracts that reflect prevailing market pricing for the data elements purchased.

Technology

Our information technology systems are fundamental to our success. They are used for the storage, processing, access and delivery of the data which forms the foundation of our business and the development and delivery of our solutions provided to our customers.

Much of the technology we use and provide to our customers is developed, maintained and supported by approximately 800 employees and approximately 570 contractors, as of December 31, 2019. We generally own or have secured ongoing rights to use for the purposes of our business all the customer-facing applications which are material to our operations.

We are continually transforming our content, products, services and company to better meet our customers’ needs. We also are focused on securing our customer data and global systems as we implement and enhance our security programs. We are migrating the infrastructure for several of our customer applications and content databases to a third-party service provider, which provides a distributed computing infrastructure platform for business operations, or what is commonly referred to as a “cloud” computing service.

Intellectual Property

As of December 31, 2019, we owned approximately 644 registered trademarks, 276 trademark applications, 2,846 domain names, 68 granted patents and 58 patent applications. We also own certain proprietary software. In addition, we are licensed to use certain third-party software, and obtain significant content and data through third-party licensing arrangements with content providers. We consider our trademarks, service marks, databases, software and other IP to be proprietary, and we rely on a combination of statutory (e.g., copyright, trademark, trade secret and patent), contractual and technical safeguards to protect our IP rights. We believe that the IP we own and license is sufficient to permit us to carry on our business as presently conducted.

Our agreements with our customers and business partners place certain restrictions on the use of our IP. As a general practice, employees, contractors and other parties with access to our proprietary information sign agreements that prohibit the unauthorized use or disclosure of our IP and confidential information.

15

New Product Development

We believe that innovation is essential to our success and is one of our primary bases of competition. We believe we are uniquely positioned to help shape how professionals find, evaluate, interact with, consume and act upon information. We are focused on developing capabilities to improve our products’ user interfaces, analytical tools, searching algorithms and content curation processes. Our current focus includes building out a technology platform focused on search technologies, big data and analytics, machine learning, social computing and natural language technologies. This will enable more rapid product development as we shift our investment focus toward new products rather than maintenance of legacy technology.

We also add to our business line offerings through acquisitions. Since our separation from Thomson Reuters in 2016, we have completed five small add-on acquisitions to augment our existing portfolio of assets and provide additional datasets and services for our customers. Given the fragmented nature of the broader information services industry, we track and, where appropriate, have pursued opportunities across our Product Lines. These include Publons and Kopernio in WOSPL, SequenceBase in DPL and TrademarkVision and Darts-ip in CompuMark Product Line. Certain of these acquisitions are fully integrated into our platform. while others continue to be integrated, and we believe they have already provided additional value to our customers.

When we find it advantageous, we augment our proprietary data sources and systems by forming alliances with other leading information providers and technology companies and integrating their product offerings into our offerings. This approach gives our customers the opportunity to obtain the information they need from a single source and more easily integrate the information into their workflows.

Enforcement of Civil Liabilities

U.S. laws do not necessarily extend either to us or our officers or directors. We are incorporated under the laws of Jersey, Channel Islands. Some of our directors and officers reside outside of the United States. Substantially all of our assets and the assets of our directors and officers are located outside the United States. As a result, it may not be possible for investors to effect service of process on either us or our officers and directors within the United States, or to enforce against these persons or us, either inside or outside the United States, a judgment obtained in a U.S. court predicated upon the civil liability provisions of the federal securities or other laws of the United States or any U.S. state.

We have appointed Vistra USA, LLC, as our agent to receive service of process with respect to any action brought against us in the United States under the federal securities laws of the United States or of the laws of any state of the United States.

A judgment of a U.S. court is not directly enforceable in Jersey, but constitutes a cause of action which may be enforced by Jersey courts provided that:

| • | the applicable U.S. courts had jurisdiction over the case, as recognized under Jersey law; |

| • | the judgment is given on the merits and is final, conclusive and non-appealable; |

| • | the judgment relates to the payment of a sum of money, not being taxes, fines or similar governmental penalties; |

| • | the defendant is not immune under the principles of public international law; |

| • | the same matters at issue in the case were not previously the subject of a judgment or disposition in a separate court; |

| • | the judgment was not obtained by fraud; and |

| • | the recognition and enforcement of the judgment is not contrary to public policy in Jersey. |

16

Jersey courts award compensation for the loss or damage actually sustained by the plaintiff. Although punitive damages are generally unknown to the Jersey legal system, there is no prohibition on them either by statute or customary law. Whether a particular judgment may be deemed contrary to Jersey public policy depends on the facts of each case, though judgments found to be exorbitant, unconscionable, or excessive will generally be deemed as contrary to public policy. Moreover, certain defendants may qualify for protection under Protection of Trading Interests Act 1980, an act of the UK extended to Jersey by the Protection of Trading Interests Act 1980 (Jersey) Order, 1983. This Act provides that a qualifying defendant is not liable for multiple damages, in excess of that required for actual compensation. A “qualifying defendant” for these purposes is a citizen of the UK and its Colonies (as defined in the Act), a corporation or other limited liability entity organized under the laws of the UK, Jersey or other territory for whose international relations the UK is responsible or a person conducting business in Jersey.

Jersey courts cannot enter into the merits of the foreign judgment and cannot act as a court of appeal or review over the foreign courts. It is doubtful that an original action based on U.S. federal or state securities laws could be brought before Jersey courts. In addition, a plaintiff who is not resident in Jersey may be required to provide a security bond in advance to cover the potential of the expected costs of any case initiated in Jersey. In addition, Clarivate has been further advised by our legal counsel in Jersey that it is uncertain as to whether the courts of Jersey would entertain original actions or enforce judgments from U.S. courts against us or our officers and directors which originated from actions alleging civil liability under U.S. federal or state securities laws.

Marketing, Sales and Customer Support

We primarily sell our products and services directly to our customers, although some of our products and services are sold through partners. Focusing some of our sales and marketing efforts on digital sales and marketing has allowed us to broaden our range of customers and reduce sales and marketing costs. We have a dedicated global sales force, which, as of December 31, 2019, consisted of approximately 1,155 people.

We annually develop sales, distribution and marketing strategies on a product-by-product and service-by-service basis. We leverage customer data, business and market intelligence and competitive profiling to retain customers and cross-sell products and services, while also working to promote unified brand recognition across all our products and services.

Our sales teams participate in both service and sales activities. They provide direct support, interacting frequently with assigned customers to assure a positive experience using our products and services. Sales people primarily seek out new sales opportunities, including existing customer retention and upsell, and work with the various sales teams to coordinate sales activity and provide the best solutions for our customers. A portion of our sales people’s compensation is tied to revenues retention. We believe our sales people’s product knowledge and local presence differentiates us from our competition.

In addition, we employ product specialists who are subject-matter experts and work with sales people on specific opportunities for their assigned products. Both sales people and product specialists have responsibility for identifying new sales opportunities. A team approach and a common customer relationship management system allow for effective coordination between the two groups.

Employees

As of December 31, 2019, approximately 4,090 full-time and approximately 113 part-time employees support our business operations. The employee count excludes employees related to the MarkMonitor Brand Protection, Antipiracy and Antifraud Disposition. See “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations — Factors Affecting the Comparability of Our Results of Operations” for information related to the disposition. None of our employees in the United States are represented by unions; however, customary representation by unions and works councils applies for certain of our non-U.S. employees. We consider our relationship with our employees to be good and have not experienced interruptions to operations due to labor disagreements.

17

Seasonality

Our cash flows from operations are generated primarily from payments from our subscription customers and the standard term of a subscription is typically 12 months. When a customer enters into a new subscription agreement, or submits a notice to renew their subscription, we typically invoice for the full amount of the subscription period, record the balance to deferred revenues and ratably recognize the deferral throughout the subscription period. As a result, we experience cash flow seasonality throughout the year, with a heavier weighting of operating cash inflows occurring during the first half, and particularly first quarter, of the year, when most subscription invoices are sent, as compared to the second half of the year.

Regulatory Environment

Certain of our Product Lines provide authorized customers with products and services such as access to public records. Our Product Lines that provide such products and services are subject to applicable privacy and consumer information laws and regulations, including U.S. federal and state and European Union (the “EU”) and member state regulation. Our compliance obligations vary from regulator to regulator, and may include, among other things, strict data security programs, submissions of regulatory reports, providing consumers with certain notices and correcting inaccuracies in applicable reports. Many of these laws and regulations are complex and their application to us, our customers or the specific services and relationships we have with our customers are not always clear. Our failure to accurately anticipate the application of these laws and regulations, or any failure to comply, could create liability for us, result in adverse publicity and otherwise negatively affect our business. See “Item 1A. Risk Factors” for more information about the impact of government regulation on our company.

We operate in highly competitive markets and may be adversely affected by this competition.

The markets for our products and services are highly competitive and are subject to rapid technological changes and evolving customer demands and needs. We compete on the basis of various factors, including the quality of content embedded in our databases and those of our competitors, customers’ perception of our products relative to the value that they deliver, user interface of the products and the quality of our overall offerings.

Many of our principal competitors are established companies that have substantial financial resources, recognized brands, technological expertise and market experience, and these competitors sometimes have more established positions in certain Product Lines and geographies than we do. We also compete with smaller and sometimes newer companies, some of which are specialized with a narrower focus than our company, and face competition from other Internet services companies and search providers.

Our competitors may be able to adopt new or emerging technologies or address customer requirements more quickly than we can. New and emerging technologies can also have the impact of allowing start-up companies to enter the market more quickly than they would have been able to in the past. We may also face increased competition from companies that could pose a threat to our business by providing more in-depth offerings, adapting their products and services to meet the demands of their customers or combining with one of their competitors to enhance their products and services. A number of our principal competitors may continue to make acquisitions as a means to improve the competitiveness of their offerings. In order to better serve the needs of our existing customers and to attract new customers, we must continue to:

| • | enhance and improve our existing products and services (such as by adding new content and functionalities); |

| • | develop new products and services; |

18

| • | invest in technology; and |

| • | strategically acquire additional businesses and partner with other businesses in key sectors that will allow us to offer a broader array of products and services. |

Our ability to compete successfully is also impacted by the growing availability of information from government information systems and other free sources, as well as competitors who aggressively market their products as a lower cost alternative. See “— Increased accessibility to free or relatively inexpensive information sources may reduce demand for our products and services.” Because some of our competitors are able to offer products and services that may be more cost effective than ours, including through the provision of price incentives for new customers, and because some of our competitors’ products and services may be seen as having greater functionality or performance than ours, the relative value of some of our products or services could be diminished. In addition, some of our competitors combine competing products with complementary products as packaged solutions, which could pre-empt use of our products or solutions. Competition from such free or lower cost sources may require us to reduce the price of some of our products and services (which may result in lower revenues) or make additional capital investments (which might result in lower profit margins). If we are unable or unwilling to reduce prices or make additional investments in the future, we may lose customers and our financial results may be adversely affected. In addition, implementation of annual price increases by us from time to time may also, in some cases, cause customers to use lower-cost competitors.

Certain of our distribution partners have licensing rights to portions of our content for use within their platforms. Over time they may become more directly competitive with us (subject to the terms of their agreements with us) if they were to advance their technology more efficiently and effectively than we do. Additionally, some of our customers may decide to develop independently certain products and services that they obtain from us, including through the formation of consortia. Educating our customers on the intricacies and uses of our products and services could, in certain cases, improve their ability to offer competing products and services as they look to expand their business models. If more of our customers become self-sufficient, demand for our products and services may be reduced. If we fail to compete effectively, our financial condition and results of operations would be adversely affected.

We may not be able to achieve the expected benefits of the DRG acquisition, including anticipated revenue and cost synergies, and costs associated with achieving synergies or integrating DRG may exceed our expectations.

We may not be able to achieve the expected benefits of the DRG acquisition, including anticipated revenue and cost synergies. There can be no assurance that the DRG acquisition will be beneficial to us. We may not succeed in cross-selling our other products and services to DRG’s customer base, or in cross-selling DRG’s products and services to our existing customer base. Moreover, we may not be able to integrate the assets acquired in the DRG acquisition or achieve our expected cost synergies without increases in costs or other difficulties. The integration process may be complex, costly and time-consuming. We expect to incur expenses in connection with the integration of DRG acquisition. While it is anticipated that certain expenses will be incurred to achieve operational synergies, such expenses are difficult to estimate accurately, and may exceed current estimates. Accordingly, the benefits from the DRG acquisition may be offset by costs incurred or delays in integrating the businesses. Any unexpected costs or delays incurred in connection with the integration of the DRG acquisition could have an adverse effect on our business, results of operations, financial condition and prospects, as well as the market price of our ordinary shares.

The overall integration of the businesses may result in material unanticipated problems, expenses, liabilities, competitive responses, loss of customer relationships, and diversion of management’s attention. In addition, even if the operations of our business and DRG’s business are integrated successfully, we may not realize the full benefits of the DRG acquisition, including the synergies, cost savings or sales or growth opportunities that we expect. These benefits may not be achieved within the anticipated time frame, or at all. Furthermore, additional unanticipated costs may be incurred in the integration of the businesses.

19

Our ability to make specified claims against the seller in the DRG acquisition generally expires over time and we may be left with no recourse for liabilities and other problems associated with the DRG acquisition that we do not discover prior to the expiration date related to such matters under our agreement to acquire DRG.

The market price of our ordinary shares may decline as a result of the DRG acquisition if, among other things, the integration of the entities to be acquired in the DRG acquisition is unsuccessful, if we fail to realize the anticipated cost or revenue synergies, or if the related liabilities, expenses or transaction costs are greater than expected. The market price of our ordinary shares may decline if we do not achieve the perceived benefits of the DRG acquisition as rapidly or to the extent anticipated by us or by securities market participants or if the effect of the DRG acquisition on our business, results of operations or financial condition or prospects is not consistent with our expectations or those of securities market participants. Furthermore, the DRG acquisition may subject us to new types of risks to which we were not previously exposed.

If our products and services do not maintain and/or achieve broad market acceptance, or if we are unable to keep pace with or adapt to rapidly changing technology, evolving industry standards and changing regulatory requirements, our revenues could be adversely affected.

Our business is characterized by rapidly changing technology, evolving industry standards and changing regulatory requirements. Our growth and success depend upon our ability to keep pace with such changes and developments and to meet changing customer needs and preferences. In order to enable our sales personnel to sell new products and services effectively, we must invest resources and incur additional costs in training programs on new products and services and key differentiators and business values.

The process of developing our products and services is complex and may become increasingly complex and expensive in the future due to the introduction of new platforms, operating systems and technologies. Our ability to keep pace with technology and business and regulatory changes is subject to a number of risks, including that we may find it difficult or costly to:

| • | update our products and services and develop new products and services quickly enough to meet our customers’ needs; |

| • | make some features of our products work effectively and securely over the Internet or with new or changed operating systems; |

| • | update our products and services to keep pace with business, evolving industry standards, regulatory requirements and other developments in the markets in which our customers operate; and |

| • | integrate or further develop acquired products or technologies successfully or at all. |

The items reflected in the adjustments included in Standalone Adjusted EBITDA may not be achieved.

We have made adjustments to net income (loss) to calculate Standalone Adjusted EBITDA. These adjustments reflect certain items related to our transition to a standalone operation since our 2016 separation from Thomson Reuters. For example, in calculating Standalone Adjusted EBITDA, we have added back, among other things, the annualization effect of cost savings implementation during the year and excess standalone costs, certain restructuring and integration costs, acquisition-related costs and other unusual and/or non-recurring items. We cannot provide assurance that our estimates and assumptions in calculating Standalone Adjusted EBITDA will prove to be accurate. For example, we believe that the standalone costs that we have incurred to date and expect to incur through 2020 are not reflective of the standalone costs that we expect that we will incur starting in 2021 and onwards (“steady state standalone costs”). As a result, we have made an adjustment when calculating Standalone Adjusted EBITDA to reflect the excess of current standalone costs to steady state standalone costs. If the actual annualized effect of cost savings we have implemented is less than our estimates, our cost savings initiatives adversely affect our operations or cost more or take longer to implement than we project, our steady state standalone costs are higher than our estimates, and/or if our assumptions prove to be inaccurate, our Standalone Adjusted EBITDA will be lower than we anticipate.

20

We may be unable to achieve some or all of the operational cost improvements and other benefits that we expect to realize.

We may not be able to realize all of the cost savings we expect to achieve. We believe that we will be able to achieve additional annual cost savings as a result of other initiatives, particularly by pursuing a number of operational cost improvements identified during diligence, increased overall focus on cost control as a stand-alone company and certain ongoing restructuring initiatives we plan to undertake. We cannot assure you that we will be able to successfully realize the expected benefits of these initiatives. A variety of risks could cause us not to realize some or all of the expected benefits. These risks include, among others, higher than expected standalone overhead expenses, delays in the anticipated timing of activities related to such initiatives, increased difficulty and cost in establishing ourselves as an independent company, lack of sustainability in cost savings over time, unexpected costs associated with operating our business, inability to eliminate duplicative back office overhead or redundant selling and general and administrative functions and inability to avoid labor disruptions in connection with any integration of the foregoing, particularly in connection with any headcount reductions. Our ability to successfully manage organizational changes is important for our future business success. In particular, our reputation and results of operations could be harmed if employee morale, engagement or productivity decline as a result of organizational or other changes.

Moreover, our implementation of these initiatives may disrupt our operations and performance, and our estimated cost savings from these initiatives are based on several assumptions that may prove to be inaccurate and, as a result, we cannot assure you that we will realize these cost savings. If, for any reason, the benefits we realize are less than our estimates, or our improvement initiatives adversely affect our operations or cost more or take longer to implement than we project, or if our assumptions prove inaccurate, our results of operations may be materially adversely affected.

We are dependent on third parties, including public sources, for data, information and other services, and our relationships with such third parties may not be successful or may change, which could adversely affect our results of operations.

Substantially all of our products and services are developed using data, information or services obtained from third-party providers and public sources, or are made available to our customers or are integrated for our customers’ use through information and technology solutions provided by third-party service providers.

We have commercial relationships with third-party providers whose capabilities complement our own and, in some cases, these providers are also our competitors. The priorities and objectives of these providers, particularly those that are our competitors, may differ from ours, which may make us vulnerable to unpredictable price increases and unfavorable licensing terms. Agreements with such third-party providers periodically come up for renewal or renegotiation, and there is a risk that such negotiations may result in different rights and restrictions which could impact our customers’ use of the content. Moreover, providers that are not currently our competitors may become competitors or be acquired by or merge with a competitor in the future, any of which could reduce our access to the information and technology solutions provided by those companies. If we were to expand our product and service offerings, whether through organic growth or acquisitions, we may launch products and services that compete with providers that are not currently our competitors, which could negatively impact our existing relationships. If we do not maintain, or obtain the expected benefits from, our relationships with third-party providers or if a substantial number of our third-party providers or any key service providers were to withdraw their services, we may be less competitive, our ability to offer products and services to our customers may be negatively affected, and our results of operations could be adversely impacted.

We also depend on public sources in the development of our products and services. These public sources are usually free to access or are available at minimal cost, and do not compete directly with our products and services. If such public sources were to begin competing with us directly, or were to increase the cost to access their data, prohibit us from collecting and synthesizing the data they provide or cease existing altogether, our results of operations could be adversely impacted.

21

Increased accessibility to free or relatively inexpensive information sources may reduce demand for our products and services.

In recent years, more public sources of free or relatively inexpensive information have become available, particularly through the Internet, and this trend is expected to continue. For example:

| • | some governmental and regulatory agencies have increased the amount of information they make publicly available at no cost; |

| • | several companies and organizations have made certain information publicly available at little or no cost; and |

| • | “open source” software that is available for free may also provide some functionality similar to that in some of our products. |