Attached files

| file | filename |

|---|---|

| 8-K - 8-K - C. H. ROBINSON WORLDWIDE, INC. | chrw-20200728.htm |

| EX-99.1 - EX-99.1 - C. H. ROBINSON WORLDWIDE, INC. | ex991earningsreleaseq2.htm |

Earnings Conference Call – Second Quarter 2020 July 29, 2020 Bob Biesterfeld, CEO Mike Zechmeister, CFO Chuck Ives, Director of Investor Relations 1

Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to such factors as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; competition and growth rates within the third party logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; changes in relationships with existing contracted truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; our ability to successfully integrate the operations of acquired companies with our historic operations; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with operations outside of the United States; risks associated with the potential impact of changes in government regulations; risks associated with the produce industry, including food safety and contamination issues; fuel price increases or decreases, or fuel shortages; cyber-security related risks; the impact of war on the economy; changes to our capital structure; risks related to the elimination of LIBOR; changes due to catastrophic events including pandemics such as COVID-19; and other risks and uncertainties detailed in our Annual and Quarterly Reports. 2 2

Q2 2020 Opening Remarks ▪ Solid performance from all business segments despite unprecedented volatility ▪ Continued market share gains in NAST ▪ Results benefited from diverse portfolio of logistics services ▪ Productivity improvements driven by technology investments and cost control ▪ Improved liquidity to $1.6 billion from strong Q2 cash flow 3 3

Results Q2 2020 in thousands, except per share amounts and headcount Three Months Ended June 30 Six Months Ended June 30 2020 2019 % Change 2020 2019 % Change Total Revenues $3,627,846 $3,908,840 (7.2%) $7,432,854 $7,660,050 (3.0%) Total Net Revenues $614,453 $695,216 (11.6%) $1,182,406 $1,374,016 (13.9%) Net Revenue Margin % 16.9% 17.8% (90 bps) 15.9% 17.9% (200 bps) Personnel Expenses $300,483 $338,886 (11.3%) $630,703 $678,984 (7.1%) Selling, General, and Admin $125,183 $128,795 (2.8%) $253,476 $242,947 4.3% Income from Operations $188,787 $227,535 (17.0%) $298,227 $452,085 (34.0%) Operating Margin % 30.7% 32.7% (200 bps) 25.2% 32.9% (770 bps) Depreciation and Amortization $25,758 $25,082 2.7% $50,151 $49,642 1.0% Net Income $143,939 $169,180 (14.9%) $222,085 $330,968 (32.9%) Earnings Per Share (Diluted) $1.06 $1.22 (13.1%) $1.64 $2.39 (31.4%) Average Headcount 15,294 15,712 (2.7%) 15,338 15,557 (1.4%) Average Full-Time Equivalents(1) 14,620 15,340 (4.7%) 14,772 15,199 (2.8%) ▪ Decline in net revenues driven primarily by margin compression in truckload and less-than- truckload (LTL), partially offset by margin expansion in airfreight ▪ Decrease in operating expenses driven by approximately $40 million of short-term cost reductions and a decline in variable compensation expense, partially offset by an $11.5 million loss on the sale-leaseback of a company-owned data center 4 4 (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

Q2 2020 Other Income Statement Items ▪ Q2 effective tax rate of 19.4% vs. 23.4% in Q2 2019 ▪ Lower tax rate due to tax benefit from delivery of a one-time deferred stock award granted to prior CEO in 2000 ▪ Expect full-year 2020 effective tax rate to be 20.0%-22.0% ▪ $1.8 million favorable impact from currency revaluation, versus a $2.8 million favorable impact in Q2 2019 ▪ Interest expense declined modestly versus Q2 2019 due to lower average interest rates ‹#› 5

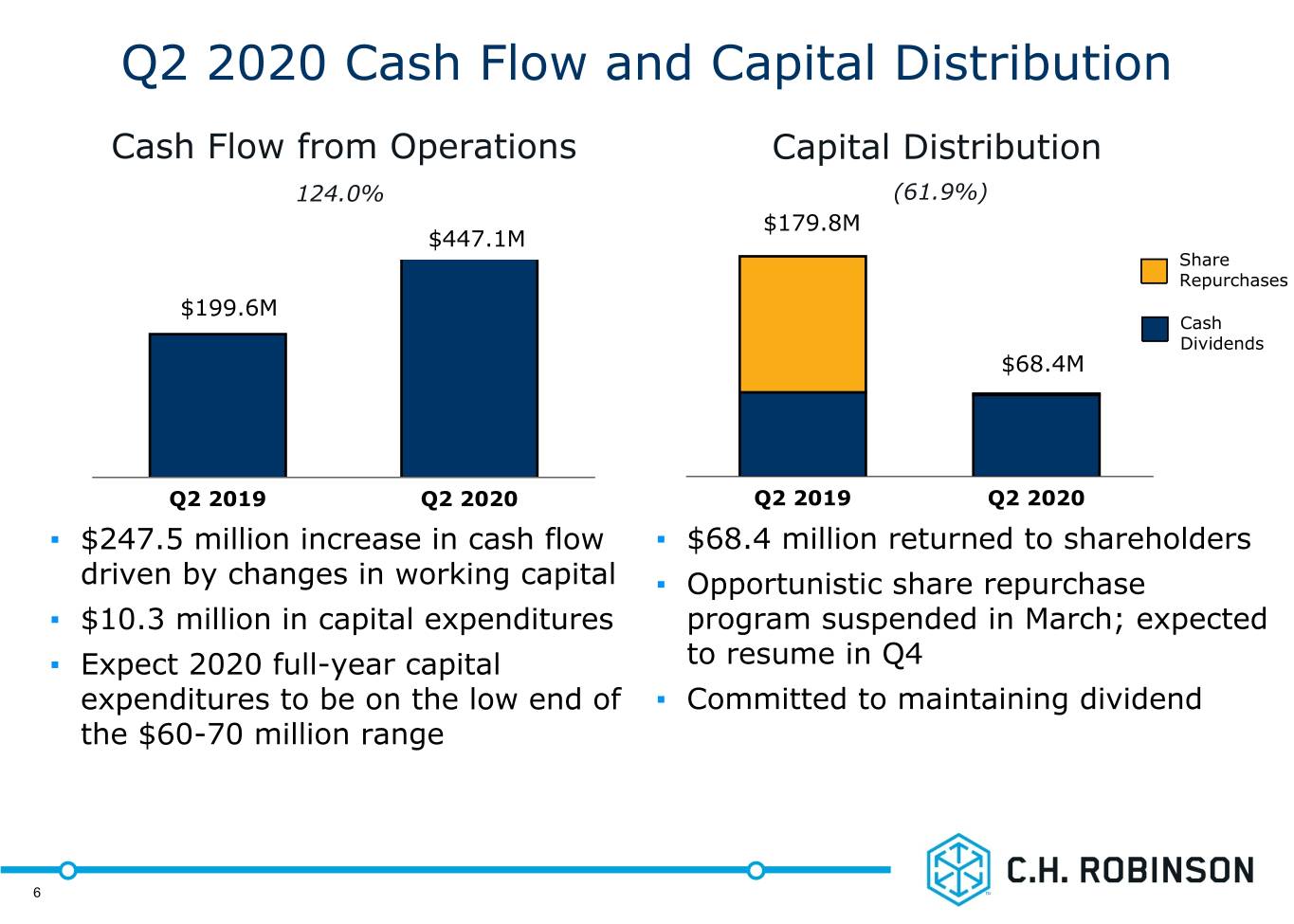

Q2 2020 Cash Flow and Capital Distribution Cash Flow from Operations Capital Distribution 124.0% (61.9%) $179.8M $447.1M Share Repurchases $199.6M Cash Dividends $68.4M Q2 2019 Q2 2020 Q2 2019 Q2 2020 ▪ $247.5 million increase in cash flow ▪ $68.4 million returned to shareholders driven by changes in working capital ▪ Opportunistic share repurchase ▪ $10.3 million in capital expenditures program suspended in March; expected ▪ Expect 2020 full-year capital to resume in Q4 expenditures to be on the low end of ▪ Committed to maintaining dividend the $60-70 million range ‹#› 6

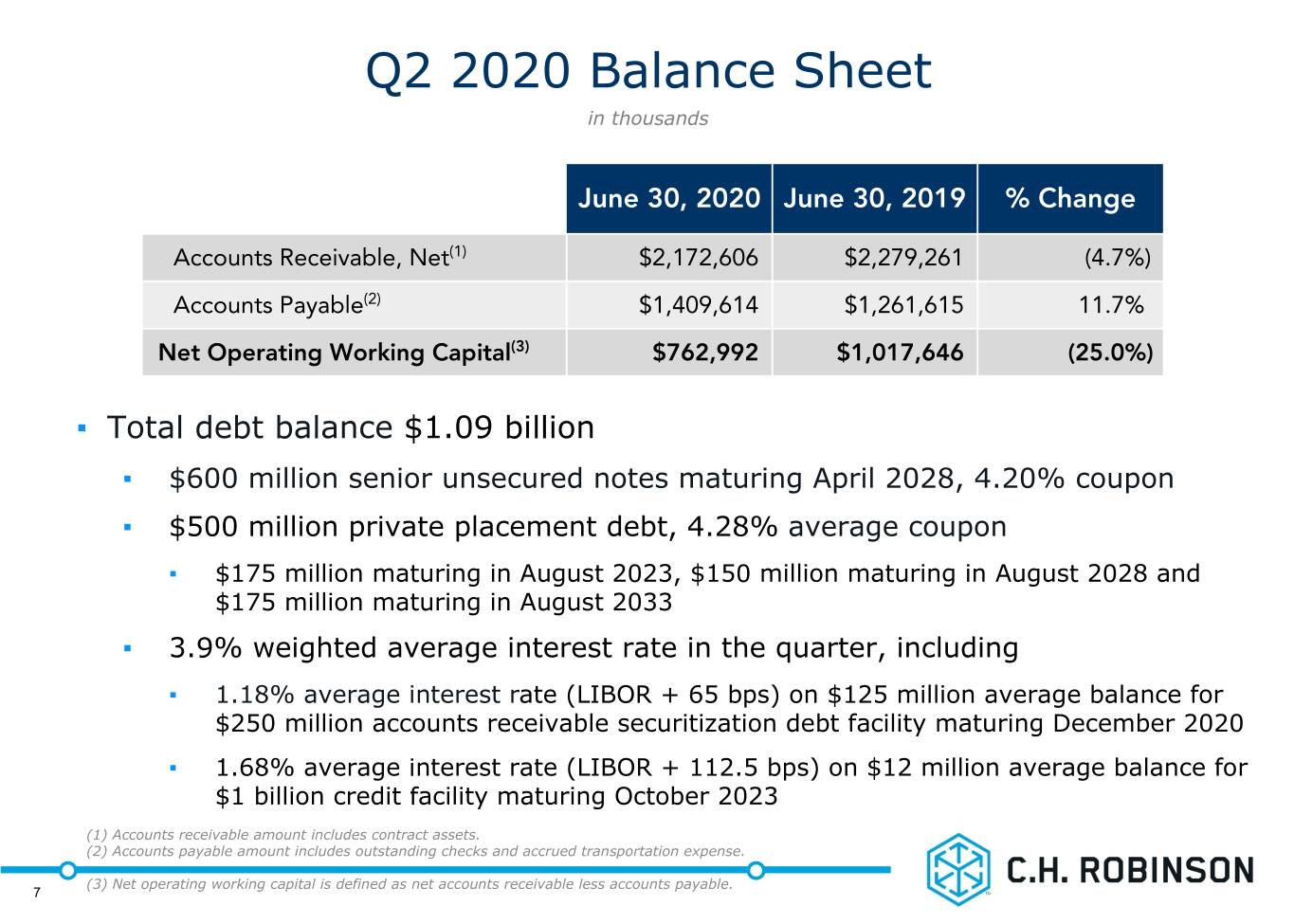

Q2 2020 Balance Sheet in thousands June 30, 2020 June 30, 2019 % Change Accounts Receivable, Net(1) $2,172,606 $2,279,261 (4.7%) Accounts Payable(2) $1,409,614 $1,261,615 11.7% Net Operating Working Capital(3) $762,992 $1,017,646 (25.0%) ▪ Total debt balance $1.09 billion ▪ $600 million senior unsecured notes maturing April 2028, 4.20% coupon ▪ $500 million private placement debt, 4.28% average coupon ▪ $175 million maturing in August 2023, $150 million maturing in August 2028 and $175 million maturing in August 2033 ▪ 3.9% weighted average interest rate in the quarter, including ▪ 1.18% average interest rate (LIBOR + 65 bps) on $125 million average balance for $250 million accounts receivable securitization debt facility maturing December 2020 ▪ 1.68% average interest rate (LIBOR + 112.5 bps) on $12 million average balance for $1 billion credit facility maturing October 2023 (1) Accounts receivable amount includes contract assets. (2) Accounts payable amount includes outstanding checks and accrued transportation expense. ‹#› (3) Net operating working capital is defined as net accounts receivable less accounts payable. 7

NAST Truckload Cost and Price Change(1)(2) 25% 20% 15% 10% 5% 0% -5% -10% YoY Price Change YoY Cost Change -15% YO Y % CHANGE IN COST AND PRICE -20% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 NAST Q2 Truckload ▪ 65% / 35% truckload contractual to transactional volume mix Volume(2) (4.5%) ▪ Average routing guide depth from Managed Services business Pricing(2)(3)(4) (5.5%) of 1.2 for the sixth consecutive quarter Cost(2)(3)(4) (2.0%) Net Revenue (1) North American Surface Transportation ("NAST") truckload cost and price change chart represents Margin truckload shipments in North America. (2) Growth rates are rounded to the nearest 0.5 percent. ‹#› 8 (3) Pricing and cost measures exclude the estimated impact of the change in fuel prices. (4) Represents price and cost YoY change for North America shipments across all segments.

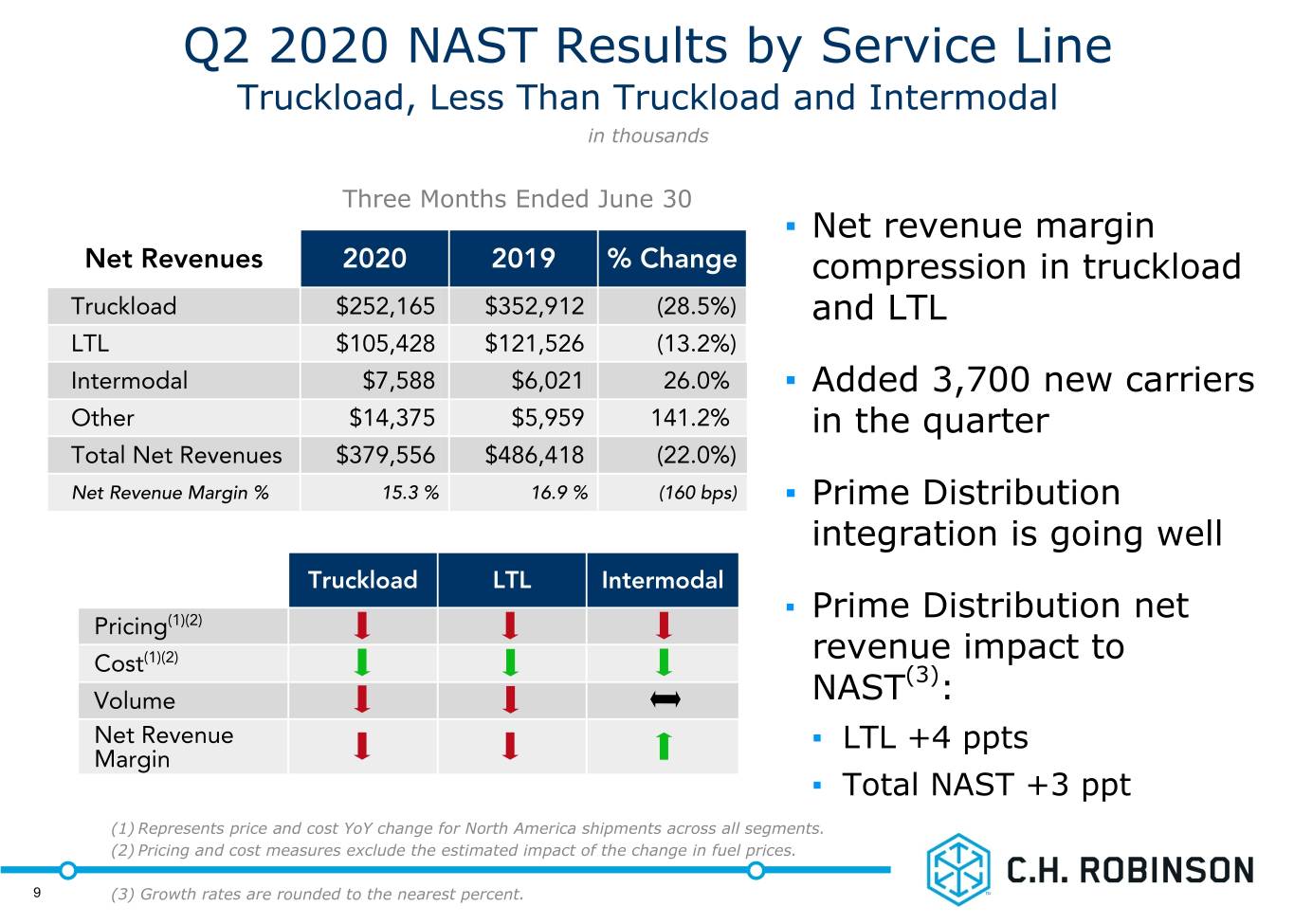

Q2 2020 NAST Results by Service Line Truckload, Less Than Truckload and Intermodal in thousands Three Months Ended June 30 ▪ Net revenue margin Net Revenues 2020 2019 % Change compression in truckload Truckload $252,165 $352,912 (28.5%) and LTL LTL $105,428 $121,526 (13.2%) Intermodal $7,588 $6,021 26.0% ▪ Added 3,700 new carriers Other $14,375 $5,959 141.2% in the quarter Total Net Revenues $379,556 $486,418 (22.0%) Net Revenue Margin % 15.3 % 16.9 % (160 bps) ▪ Prime Distribution integration is going well Truckload LTL Intermodal ▪ Prime Distribution net Pricing(1)(2) (1)(2) revenue impact to Cost (3) Volume NAST : Net Revenue ▪ LTL +4 ppts Margin ▪ Total NAST +3 ppt (1) Represents price and cost YoY change for North America shipments across all segments. (2) Pricing and cost measures exclude the estimated impact of the change in fuel prices. ‹#› 9 (3) Growth rates are rounded to the nearest percent.

Q2 2020 NAST Operating Income Operating Income Operating Margin % (33.2%) (600 bps) $204.7M 42.1% 36.1% $136.8M Q2 2019 Q2 2020 Q2 2019 Q2 2020 ▪ Decrease in net revenues vs. historically high net revenue in Q2 2019 ▪ Lower personnel expenses and reduced SG&A expenses ▪ Average headcount including furloughed employees decreased 7.6% ▪ Prime Distribution acquisition contributed 4.5 percentage points to NAST headcount growth(1) ▪ Average full-time equivalents decreased 10.9%(2) ‹#› (1) Growth rates are rounded to the nearest 0.5 percent. 10 (2) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

Q2 2020 Global Forwarding Results by Service Line Ocean, Air and Customs in thousands Three Months Ended June 30 ▪ Air net revenue increase Net Revenues 2020 2019 % Change due to unusually high rates Ocean $78,734 $85,389 (7.8%) and market share gains Air $51,541 $25,212 104.4% ▪ Air market impacted by Customs $19,459 $23,296 (16.5%) reduced air cargo capacity, Other $13,226 $8,039 64.5% increased charter flights Total Net Revenues $162,960 $141,936 14.8% and larger shipment sizes Net Revenue Margin % 23.0% 24.0% (100 bps) ▪ Ocean and customs net Ocean Air revenue declines due to Pricing lower volume Volume Net Revenue Margin ‹#› 11

Q2 2020 Global Forwarding Operating Income Operating Income Operating Margin % 120.8% 1,730 bps 36.1% $58.8M 18.8% $26.6M Q2 2019 Q2 2020 Q2 2019 Q2 2020 ▪ 14.8% increase in net revenues ▪ Lower personnel expenses and reduced SG&A expenses ▪ 0.9% decrease in average headcount including furloughed employees ▪ 1.7% decrease in average full-time equivalents(1) ‹#› 12 (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

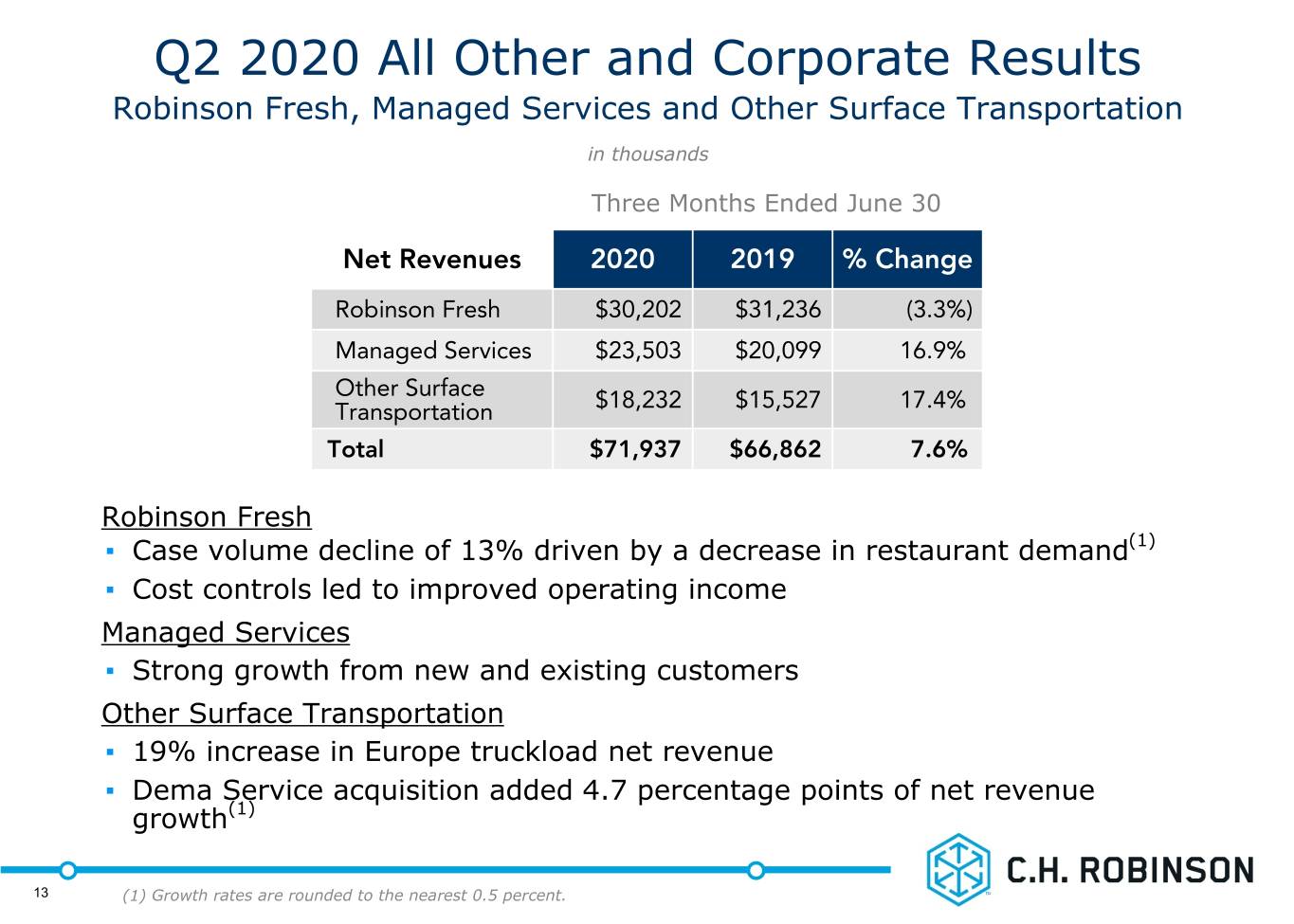

Q2 2020 All Other and Corporate Results Robinson Fresh, Managed Services and Other Surface Transportation in thousands Three Months Ended June 30 Net Revenues 2020 2019 % Change Robinson Fresh $30,202 $31,236 (3.3%) Managed Services $23,503 $20,099 16.9% Other Surface Transportation $18,232 $15,527 17.4% Total $71,937 $66,862 7.6% Robinson Fresh ▪ Case volume decline of 13% driven by a decrease in restaurant demand(1) ▪ Cost controls led to improved operating income Managed Services ▪ Strong growth from new and existing customers Other Surface Transportation ▪ 19% increase in Europe truckload net revenue ▪ Dema Service acquisition added 4.7 percentage points of net revenue growth(1) ‹#› 13 (1) Growth rates are rounded to the nearest 0.5 percent.

Final Comments ▪ Balancing continued investment in technology to drive growth with cost reductions ▪ Committed to emerging stronger from this time of uncertainty ‹#› 14

Appendix 15

Q2 2020 Transportation Results(1) in thousands Three Months Ended June 30 Six Months Ended June 30 Transportation 2020 2019 % Change 2020 2019 % Change Total Revenues $3,348,611 $3,638,612 (8.0%) $6,890,729 $7,143,544 (3.5%) Total Net Revenues $586,021 $665,614 (12.0%) $1,128,026 $1,317,290 (14.4%) Net Revenue Margin % 17.5% 18.3% (80 bps) 16.4% 18.4% (200 bps) Transportation Net Revenue Margin % 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Q1 17.2% 16.9% 16.3% 15.3% 16.8% 19.7% 17.3% 16.4% 18.6% 15.3% Q2 16.2% 14.9% 15.4% 16.0% 17.5% 19.3% 16.2% 16.2% 18.3% 17.5% Q3 16.4% 15.6% 15.0% 16.2% 18.4% 17.6% 16.4% 16.6% 16.9% Q4 16.3% 15.8% 15.1% 15.9% 19.0% 17.2% 16.6% 17.7% 15.6% Total 16.5% 15.8% 15.4% 15.9% 17.9% 18.4% 16.6% 16.7% 17.3% ‹#› 16 (1) Includes results across all segments.

Q2 2020 NAST Results in thousands, except headcount Three Months Ended June 30 Six Months Ended June 30 2020 2019 % Change 2020 2019 % Change Total Revenues $2,475,292 $2,872,053 (13.8%) $5,299,037 $5,668,837 (6.5%) Total Net Revenues $379,556 $486,418 (22.0%) $752,334 $972,968 (22.7%) Net Revenue Margin % 15.3% 16.9% (160 bps) 14.2% 17.2% (300 bps) Income from Operations $136,846 $204,732 (33.2%) $235,372 $416,015 (43.4%) Operating Margin % 36.1% 42.1% (600 bps) 31.3% 42.8% (1,150 bps) Depreciation and Amortization $7,201 $6,131 17.5% $12,455 $12,390 0.5% Total Assets $2,793,290 $2,685,477 4.0% $2,793,290 $2,685,477 4.0% Average Headcount 6,960 7,533 (7.6%) 6,981 7,486 (6.7%) Average Full-Time Equivalents(1) 6,610 7,416 (10.9%) 6,710 7,376 (9.0%) ‹#› 17 (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

Q2 2020 Global Forwarding Results in thousands, except headcount Three Months Ended June 30 Six Months Ended June 30 2020 2019 % Change 2020 2019 % Change Total Revenues $707,820 $592,483 19.5% $1,238,204 $1,130,050 9.6% Total Net Revenues $162,960 $141,936 14.8% $291,274 $269,172 8.2% Net Revenue Margin % 23.0% 24.0% (100 bps) 23.5% 23.8% (30 bps) Income from Operations $58,775 $26,618 120.8% $70,734 $40,821 73.3% Operating Margin % 36.1% 18.8% 1,730 bps 24.3 % 15.2 % 910 bps Depreciation and Amortization $9,206 $9,315 (1.2%) $18,355 $18,241 0.6% Total Assets $1,029,203 $1,014,235 1.5% $1,029,203 $1,014,235 1.5% Average Headcount 4,726 4,770 (0.9%) 4,763 4,728 0.7% Average Full-Time Equivalents(1) 4,546 4,624 (1.7%) 4,599 4,582 0.4% ‹#› 18 (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

Q2 2020 All Other and Corporate Results in thousands, except headcount Three Months Ended June 30 Six Months Ended June 30 2020 2019 % Change 2020 2019 % Change Total Revenues $444,734 $444,304 0.1% $895,613 $861,163 4.0% Total Net Revenues $71,937 $66,862 7.6% $138,798 $131,876 5.2% Income from Operations ($6,834) ($3,815) NM ($7,879) ($4,751) NM Depreciation and Amortization $9,351 $9,636 (3.0%) $19,341 $19,011 1.7% Total Assets $1,003,196 $984,397 1.9% $1,003,196 $984,397 1.9% Average Headcount 3,608 3,409 5.8% 3,594 3,343 7.5% Average Full-Time Equivalents(1) 3,464 3,300 5.0% 3,463 3,241 6.9% ‹#› 19 (1) Average full-time equivalents excludes furloughed employees and accounts for employees with reduced work hours.

20