Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

Commission File Number: 000-23189

C.H. ROBINSON WORLDWIDE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 41-1883630 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 14701 Charlson Road, Eden Prairie, Minnesota | 55347-5088 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 952-937-8500

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $.10 per share Preferred Share Purchase Rights |

The NASDAQ National Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2009 was approximately $8,641,788,000 (based upon the closing price of $52.15 per common share as quoted on The NASDAQ National Market).

As of February 22, 2010, the number of shares outstanding of the registrant’s Common Stock, par value $.10 per share, was 166,567,389.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement relating to its Annual Meeting of Stockholders to be held May 13, 2010 (the “Proxy Statement”), are incorporated by reference in Parts I and III.

Table of Contents

ANNUAL REPORT ON FORM 10-K

For the year ended December 31, 2009

TABLE OF CONTENTS

2

Table of Contents

Part I

| Item 1. | BUSINESS |

Overview

C.H. Robinson Worldwide, Inc. (“C.H. Robinson,” “the company,” “we,” “us,” or “our”) is one of the largest third party logistics companies in the world with 2009 consolidated total revenues of $7.6 billion. We provide freight transportation services and logistics solutions to companies of all sizes, in a wide variety of industries. During 2009 we handled approximately 7.5 million shipments for more than 35,000 customers. We operate through a network of 235 offices, which we call branches, in North America, Europe, Asia, South America, Australia, and the Middle East. We have developed global multimodal transportation and distribution networks to provide logistics services worldwide. As a result, we have the capability of facilitating most aspects of the supply chain on behalf of our customers.

We do not own the transportation equipment that is used to transport our customers’ freight. Through our contractual relationships with approximately 47,000 transportation companies, including motor carriers, railroads (primarily intermodal service providers), air freight and ocean carriers, we select and hire the appropriate transportation to meet our customers’ freight needs. Because we rely on subcontractors to transport freight, we can be flexible and focus on seeking solutions that work for our customers, rather than focusing on asset utilization. As an integral part of our transportation services, we provide a wide range of value-added logistics services, such as supply chain analysis, freight consolidation, core carrier program management, and information reporting.

In addition to multimodal transportation services, we have two other services: fresh produce sourcing and fee-based information services.

Our Sourcing business is the buying, selling, and marketing of fresh produce. It was our original business when we were founded in 1905. Much of our logistics expertise can be traced to our significant experience in handling produce and perishable commodities. We purchase fresh produce through our network of independent produce suppliers. Our customers include regional and national grocery retailers and restaurants, produce wholesalers, and foodservice distributors. In many cases, we also arrange the transport of the fresh produce we sell through our contractual relationships with owners of specialized transportation equipment. We have developed our own brands of produce including The Fresh 1® and OurWorld® Organics, and we also have entered into licensing agreements to distribute produce under other national brand names. The produce for these brands is sourced through a preferred grower network and packed to order through contract packing agreements. We have instituted quality assurance and monitoring procedures as part of our Sourcing business.

Information Services is comprised of a C.H. Robinson subsidiary, T-Chek Systems, Inc., (T-Chek). T-Chek is a business-to-business provider of spend management and payment processing services. T-Chek’s customers are primarily motor carriers and truck stop chains. T-Chek’s platform supports open and closed loop networks that facilitate a variety of funds transfer, vendor payments, fuel purchasing, and online expense management.

Our business model has been the main driver of our historical results and has positioned us for continued growth. One of our competitive advantages is our branch network of 235 offices, staffed by approximately 5,800 salespeople. These branch employees are in close proximity to both customers and transportation providers, which gives them broad knowledge of their local markets and enables them to respond quickly to customers’ and transportation providers’ changing needs. Branch employees act as a team in their sales efforts, customer service, and operations. Approximately 32 percent of our truckload shipments are shared transactions between branches. Our branches work together to complete transactions and collectively meet the needs of our customers. For large multi-location customers, we often coordinate our efforts in one branch and rely on multiple branch locations to deliver specific geographic or modal needs. Our methodology of providing services is very similar across all branches. Our North American branches have a common technology platform that they use to match customer needs with supplier capabilities, to collaborate with other branch locations, and to utilize centralized support resources to complete all facets of the transaction. A significant portion of our branch employees’ compensation is performance-oriented, based on the profitability of their branch and their contributions to the success of the branch. We believe this makes our sales employees more service-oriented, focused, and creative.

We are a service company. We act primarily to add value and expertise in the procurement and execution of transportation and logistics, including sourcing of produce products for our customers. Our total revenues represent the total dollar value of services and goods we sell to our customers. Our net revenues are our total revenues less purchased transportation and related services, including contracted motor carrier, rail, ocean, air, and other costs, and the purchase price and services related to the products we source. Our net revenues are the primary indicator of our ability to source, add value, and sell services and products that are provided by third parties, and we consider them to be our primary performance measurement. Accordingly, the discussion of our results of operations focuses on the changes in our net revenues.

3

Table of Contents

Historically, we have grown primarily through internal growth, by expanding current offices, opening new branch offices, and hiring additional salespeople. We have augmented our growth through selective acquisitions. On June 12, 2009, we acquired the operating subsidiaries of Walker Logistics Overseas, Ltd. (“Walker”). Walker was a leading international freight forwarder headquartered in London, England. Walker was a global, fully integrated import and export door-to-door provider specializing in air freight, ocean freight warehousing, courier, and logistics solutions. Its customers were primarily in electronics, telecommunications, medical, sporting goods, and military industries. The majority of their revenues were from air and ocean freight.

On July 7, 2009, we acquired certain assets of International Trade & Commerce, Inc. (“ITC”). ITC was a United States customs brokerage company specializing in warehousing, distribution, and cross-border services between the United States and Mexico. ITC was headquartered in Laredo, Texas, and had approximately 40 employees and staff. ITC provided a broad range of services facilitating customers’ international customs brokerage needs across all modes of transportation. ITC strengthened our ability to provide customers a seamless cross-border service package across the United States and Mexico border.

On September 14, 2009, we acquired certain assets of Rosemont Farms Corporation, Inc., a produce marketing company, and an affiliated company Quality Logistics, LLC (together referred to as “Rosemont”), a transportation provider that focused on produce transportation. Rosemont was headquartered in Boca Raton, Florida, and had approximately 100 employees. Rosemont offered produce and logistics solutions to retail and foodservice customers.

Multimodal Transportation and Logistics Services

C.H. Robinson provides freight transportation and related logistics and supply-chain services. Our services range from commitments on a specific shipment to much more comprehensive and integrated relationships. We execute these service commitments by hiring and training people, developing proprietary systems and technology processes, and utilizing our network of subcontracted transportation providers, including contract motor carriers, railroads, air freight carriers, and ocean carriers. We make a profit on the difference between what we charge to our customers for the totality of services provided to them and what we pay to the transportation provider to handle or transport the freight. While industry definitions vary, given our extensive subcontracting to create a flexible network of solutions, we are generally referred to in the industry as a third-party logistics company.

We provide all of the following transportation and logistics services:

| • | Truckload — Through our contracts with motor carriers, we have access to dry vans, temperature controlled vans, and flatbeds. We also offer time-definite and expedited truck transportation. In many instances, we will consolidate partial shipments for several customers into full truckloads. |

| • | Less Than Truckload (“LTL”) — LTL transportation involves the shipment of small packages and single or multiple pallets of freight, up to and including full trailer load freight. We focus on shipments of a single pallet or larger, although we handle any size shipment. Through our contracts with motor carriers and our operating system, we consolidate freight and freight information to provide our customers with a single source of information on their freight. |

| • | Intermodal — Our intermodal transportation service is the shipment of freight in trailers or containers, by a combination of truck and rail. We have intermodal marketing agreements with container owners, stacktrain operators, and all Class 1 railroads in North America, and we arrange local pickup and delivery (known as drayage) through local contracted motor carriers. |

| • | Ocean — We consolidate shipments, determine routing, select ocean carriers, contract for ocean shipments, provide for local pickup and delivery of shipments, and arrange for customs clearance of shipments, including the payment of duties. |

| • | Air — We provide door-to-door service as a full-service international and domestic air freight forwarder. |

| • | Other Logistics Services — We provide fee-based transportation management services, customs brokerage, warehousing services, and other services. |

Customers communicate their freight needs, typically on a shipment-by-shipment basis, to the branch salesperson responsible for their account. Customers communicate with us by means of telephone, fax, internet, email, or Electronic Data Interchange (EDI). The branch employee ensures that all appropriate information about each shipment is entered into our proprietary operating system. With the help of information provided by the operating system, the salesperson then selects a contracted carrier or carriers, based upon his or her knowledge of the carrier’s service capability, equipment availability, freight rates, and other relevant factors. Based on the information he or she has about the market and rates, the salesperson may either determine an appropriate price at that point or wait to communicate with a contracted carrier directly before setting a price. In

4

Table of Contents

many cases, employees from different branch offices collaborate to hire the appropriate contracted carrier for our customer’s freight, and the branch offices agree to an internal profit split.

Once the contracted carrier is selected, the salesperson communicates with the contract carrier to agree on the price for the transportation and the contract carrier’s commitment to provide the transportation. We are in contact with the contract carrier through numerous means of communication (including EDI, our proprietary website CHRWTrucks® (www.chrwtrucks.com), email, fax, and telephone) to meet our customers’ requirements as well as track the status of the shipment from origin to delivery.

For most of our transportation and logistics services, we are a service provider. By accepting the customer’s order, we accept certain responsibilities for transportation of the shipment from origin to destination. The carrier’s contract is with us, not the customer, and we are responsible for prompt payment of freight charges. In the cases where we have agreed (either contractually or otherwise) to pay for claims for damage to freight while in transit, we pursue reimbursement from the contracted carrier for the claims. In our transportation management business, we are acting as a shipper’s agent. In those cases, the carrier’s contract is with the customer, and we collect a fee for our services.

As a result of our logistics capabilities, some of our customers have us handle all, or a substantial portion, of their freight transportation requirements to or from a particular manufacturing facility or distribution center. Our branch employees price our services to provide a profit to us for the totality of services performed for the customer. In some cases, our services to the customer are priced on a spot market, or transactional, basis. In a number of instances, we have contracts with the customer in which we agree to handle an estimated number of shipments usually to specified destinations, such as from the customer’s plant to a distribution center. Our commitments to handle the shipments are usually at specific rates. Most of our rate commitments are for one year or less and therefore allow for renegotiation. As is typical in the transportation industry, most of these contracts do not include specific volume commitments. When we enter into prearranged rate agreements for truckload services with our customers, we have fuel surcharge agreements in addition to the underlying line-haul portion of the rate.

The majority of our truckload freight is priced to our contract carriers on a spot market, or transactional, basis, even when we are working with the customer on a contractual basis. When we enter into spot transactions with contract motor carriers, we generally negotiate a mutually-agreed upon total market rate that includes all costs, including any applicable fuel expense. However, if requested by the contract carrier, we will estimate and report fuel separately. In a small number of cases, we may get advance commitments from one or more contract carriers to transport contracted shipments for the length of our customer contract. In those cases, where we have prearranged rates with contract carriers, there is a calculated fuel surcharge based on a mutually-agreed-upon formula.

In the course of providing day-to-day transportation services, our branch employees often identify opportunities for additional logistics services as they become more familiar with our customer’s daily operations and the nuances of its supply chain. We offer a wide range of logistics services on a worldwide basis that reduce or eliminate supply chain inefficiencies. We will analyze the customer’s current transportation rate structures, modes of shipping, and carrier selection. We can evaluate a customer’s core carrier program by establishing a program to measure and monitor key quality standards for those core carriers. We can identify opportunities to consolidate shipments for cost savings. We will suggest ways to improve operating and shipping procedures and manage claims. We can help customers minimize storage through cross-docking and other flow-through operations. We may also examine the customer’s warehousing and dock procedures. Many of these services are bundled with underlying transportation services and are not typically priced separately. They are usually included as a part of the cost of transportation services provided by us, based on the nature of the customer relationship. In addition to these transportation services, we may supply sourcing, contract warehousing, consulting, fee-based transportation management, and other services, for which we are usually paid separately.

As we have emphasized integrated logistics solutions, our relationships with many customers have broadened, and we have become key providers to our customers, responsible for helping them manage a greater portion of their supply chain. We may serve our customers through specially created teams and through several branches. Our multimodal transportation services are provided to numerous international customers through our worldwide branch network. See Note 1 in Item 8 for an allocation of our total revenues from domestic and foreign customers for the years ended December 31, 2009, 2008, and 2007 and our long-lived assets as of December 31, 2009, and 2008 in the United States and in foreign locations.

5

Table of Contents

The table below shows our net revenues by transportation mode for the periods indicated:

Transportation Net Revenues

(in thousands)

| Year Ended December 31, | |||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| Truck(1) |

$ | 1,040,703 | $ | 1,030,070 | $ | 949,277 | $ | 822,954 | $ | 666,605 | |||||

| Intermodal |

35,245 | 43,618 | 38,670 | 36,176 | 31,392 | ||||||||||

| Ocean |

54,188 | 62,094 | 43,530 | 37,150 | 29,182 | ||||||||||

| Air |

32,662 | 35,390 | 31,315 | 21,533 | 13,321 | ||||||||||

| Other Logistics Services |

44,784 | 41,407 | 35,240 | 28,152 | 19,824 | ||||||||||

| Total |

$ | 1,207,582 | $ | 1,212,579 | $ | 1,098,032 | $ | 945,965 | $ | 760,324 | |||||

| (1) | Includes truckload and LTL net revenues. |

Transportation services accounted for approximately 88 percent of our net revenues in 2009, 2008, and 2007.

Sourcing

Since we were founded in 1905, we have been in the business of sourcing fresh produce. Much of our logistics expertise can be traced to our significant experience in handling produce and other perishable commodities. Because of its perishable nature, produce must be rapidly packaged, carefully transported within tight timetables usually in temperature controlled equipment, and quickly distributed to replenish high-turnover inventories maintained by retailers, wholesalers, foodservice companies, and restaurants. In many instances, we consolidate individual customers’ produce orders into truckload quantities at the point of origin and arrange for transportation of the truckloads, often to multiple destinations.

For several years, we have actively sought to expand our Sourcing customer base by focusing on large multistore grocery retailers, restaurant chains, and foodservice providers. Historically, grocery retailers have relied primarily on regional or even local purchases from food wholesalers for produce sourcing and store-level distribution. As these retailers have expanded through store openings and industry consolidation, these methods have become inefficient. Our logistics and perishable commodities sourcing expertise can improve the retailers’ produce purchasing and provide consistent quality across regions and stores.

Our Sourcing services have expanded to include just-in-time replenishment, commodity management, and business analysis. We have various national and regional branded produce programs, including both proprietary brands and national licensed brands. These programs contain a wide variety of fresh bulk and value added fruits and vegetables that are high in quality. These brands have expanded our market presence and relationships with many of our retail customers. We have also instituted quality assurance and monitoring programs as part of our branded and preferred supplier programs.

Sourcing accounted for approximately nine percent of our net revenues in 2009 and eight percent in 2008 and 2007.

Information Services

T-Chek’s customers are primarily motor carriers and truck stop chains. T-Chek provides its customers with fuel management services, funds transfer, spend management reporting, driver payroll services, permits, and online access to customized business intelligence, all through the use of its proprietary automated systems. These systems enable customers to track and manage certain expenses, including fuel and maintenance. For several companies and truck stop chains, T-Chek captures sales and fuel cost data, provides management information to the seller, and invoices the carrier for fuel, cash advances, and our fee.

Information Services accounted for approximately three percent of our net revenues in 2009 and four percent in 2008 and 2007.

Organization

To keep us close to our customers and markets, we operate through a network of offices, which we call “branches.” We currently have 235 branches, up from 228 in 2008. Our branches are supported by our corporate executives and other centralized, shared services. Approximately 13 percent of our employees are corporate employees who provide these

6

Table of Contents

centralized, shared services. Approximately 30 percent of these corporate employees are information technology personnel who develop and maintain our proprietary operating system software and our wide area network.

Branch Network

We currently have branches in the following areas of the world:

| Region |

Number of Branches | |

| North America |

180 | |

| Europe |

29 | |

| Asia |

20 | |

| South America |

4 | |

| Australia |

1 | |

| Middle East |

1 |

Each branch is responsible for its own growth and profitability. Our branch salespeople are responsible for developing new business, negotiating and pricing services, receiving and processing service requests from customers, and contracting with carriers to provide the transportation requested. In addition to routine transportation, salespeople are often called upon to handle customers’ unusual, seasonal, and emergency needs. Shipments to be transported by truck are priced at the branch level, and branches cooperate with each other to hire contract carriers to provide transportation. Branches may rely on expertise in other branches when contracting LTL, intermodal, international ocean, and air shipments. Multiple branches may also work together to service larger, national accounts where the expertise and resources of more than one branch are required to meet the customer’s needs. Their efforts are usually coordinated by one “lead” branch on the account.

Salespeople in the branches both sell to and service their customers. Sales opportunities are identified through our internal database, referrals from current customers, leads generated by branch office personnel through knowledge of their local and regional markets, and third party sources such as industry directories. Salespeople are also responsible for recruiting new contract carriers, who are referred to our centralized carrier services group to make sure they are properly licensed and insured and have acceptable safety ratings.

Branch Expansion. We expect to continue to open new branch offices. New branch offices are viewed as a long-term contributor to overall company growth. In addition to market opportunity, a major consideration in opening a new branch is whether we have branch salespeople that are ready to manage a new branch. Additional branches are sometimes opened within a geographic area previously served by another branch, such as within major cities, as the volume of business in a particular area warrants opening a separate branch. A modest amount of capital is required to open a new branch, usually involving a lease for a small amount of office space, communications and hardware, and often employee compensation guaranties for a short time. We have also augmented our branch office network through selective acquisitions.

Branch Employees. Because the quality of our employees is essential to our success, we are highly selective in our hiring. Our applicants typically have college degrees, and some have business experience, although not necessarily within the transportation industry.

Early in their tenure, most newly-hired branch employees go through centralized training that emphasizes development of the necessary skills, including technology training on our proprietary systems and our customer service philosophy, to become productive members of a branch team. Centralized training is followed by ongoing, on-the-job training at the branch level. We expect most new salespeople to start contributing to the success of the branch in a matter of weeks.

Employees at a branch operate and are compensated in large part on a team basis. The team structure is motivated by our performance-based compensation system, in which a significant portion of the cash compensation of most branch managers and salespeople is dependent on the profitability of their particular branch. Branch managers and salespeople who have been employed for at least one complete year are paid a performance-based bonus which is a portion of the branch’s earnings for that calendar year. The percentage they can potentially earn is predetermined in an annual bonus contract and is based on their productivity and contributions to the overall success of the branch. Employees can also receive profit sharing contributions that depend on our overall profitability and other factors in our 401(k) plan. In some special circumstances, such as opening new branches, we may guarantee a level of compensation to the branch manager and key salespersons for a short period of time.

All of our managers and certain other employees who have significant responsibilities are eligible to participate in our amended 1997 Omnibus Stock Plan. Within that plan, in 2003 we began regularly issuing restricted stock and restricted stock units as our primary equity awards because we believe these awards are an effective tool for creating long-term ownership

7

Table of Contents

and alignment between employees and our shareholders. For most restricted equity awards, restricted stock and units are available to vest over five calendar years, based on the company’s earnings growth.

Individual salespeople benefit both through the growth and profitability of individual branches and by achieving individual goals. They are motivated by the opportunity to advance in a variety of career paths, including branch management, corporate sales, and large account management. We have a “promote from within” philosophy and fill nearly all branch management positions with current employees.

Under our decentralized business structure, branch managers, while retaining autonomy for their branch performance, receive guidance and support from the executives at our central corporate office. These executives provide training and education, develop new services and applications to be offered to customers, analyze and monitor branch productivity and performance metrics, share operations and management guidance, and provide broad market analysis.

The Board of Directors designates the executive officers annually. Below are the names, ages, and positions of the executive officers:

| Name |

Age | Position | ||

| John P. Wiehoff | 48 | Chief Executive Officer and Chairman of the Board | ||

| James E. Butts | 54 | Senior Vice President | ||

| Ben G. Campbell | 44 | Vice President, General Counsel and Secretary | ||

| James P. Lemke | 42 | Senior Vice President | ||

| Chad M. Lindbloom | 45 | Senior Vice President and Chief Financial Officer | ||

| Scott A. Satterlee | 41 | Senior Vice President | ||

| Mark A. Walker | 52 | Senior Vice President |

John P. Wiehoff has been chief executive officer of C.H. Robinson since May 2002, president of the company since December 1999, a director since 2001, and became the chairman in January 2007. Previous positions with the company include senior vice president from October 1998, chief financial officer from July 1998 to December 1999, treasurer from August 1997 to June 1998, and corporate controller from 1992 to June 1998. Prior to that, John was employed by Arthur Andersen LLP. John also serves on the Boards of Directors of Polaris Industries Inc. (NYSE: PII) and Donaldson Company, Inc. (NYSE: DSI). He holds a Bachelor of Science degree from St. John’s University.

James E. Butts was named senior vice president in December 2007, having served as an executive and officer of C.H. Robinson since April 2002. Previous positions with the company include transportation manager at the Chicago South and Detroit branches. Jim has been with C.H. Robinson since 1978 and holds a Bachelor of Arts degree from Wayne State University and a Masters of Business Administration from Phoenix University. Jim serves on the Advisory Board of Logistics Quarterly and on the University of Minnesota, Carlson School of Management’s Supply Chain and Operations Board of Advisors. Jim is also a member of the Board of Directors of Store to Door, a non-profit agency that delivers groceries to adults who are unable to shop for themselves.

Ben G. Campbell was named vice president, general counsel and secretary in January 2009. Ben joined C.H. Robinson in 2004 and most recently held the position of assistant general counsel. Before coming to C.H. Robinson, Ben was a partner at Rider Bennett, LLP, in Minneapolis. Ben holds a Bachelor of Science degree from St. John’s University and a Juris Doctor from William Mitchell Law School.

James P. Lemke was named senior vice president in December 2007, having served as vice president, sourcing since 2003. Prior to that time, he served as the vice president and manager of C.H. Robinson’s Corporate Procurement and Distribution Services branch. Jim joined the company in 1989. Jim holds a Bachelor of Arts degree in International Relations from the University of Minnesota. Jim also serves on the Board of Directors of the United Fresh Produce Association.

Chad M. Lindbloom was named a senior vice president in December 2007. He has served as an executive and as chief financial officer since 1999. From June 1998 until December 1999, he served as corporate controller. Chad joined the company in 1990. Chad holds a Bachelor of Science degree and a Masters of Business Administration from the Carlson School of Management at the University of Minnesota. Chad also serves on the Board of Directors of Xata Corporation (NASDAQ: XATA), a provider of vehicle data and fleet operations services to the trucking industry, and is a member of the Board of Directors of Children’s Hospitals and Clinics of Minnesota.

Scott A. Satterlee was named a senior vice president in December 2007. He has served as an executive and officer of C.H. Robinson since February 2002. Additional positions with C.H. Robinson include director of operations and manager of the Salt Lake City branch. Scott joined the company in 1991. Scott holds a Bachelor of Arts degree from the University of St.

8

Table of Contents

Thomas. Scott also serves on the Board of Directors of Fastenal (NASDAQ: FAST), the largest fastener distributor in the nation.

Mark A. Walker was named senior vice president in December 2007, after serving as a vice president and officer since December 1999. Additional positions with C.H. Robinson include chief information officer from December 1999 to October 2001 and president of T-Chek Systems. Mark joined the company in 1980. Mark holds a Bachelor of Science degree from Iowa State University and a Masters of Business Administration from the University of St. Thomas.

Employees

As of December 31, 2009, we had a total of 7,347 employees, 6,377 of whom were located in our branch offices. Services such as accounting, information technology, legal, marketing, human resource support, credit and claims management, and carrier services are supported centrally.

Customers and Marketing

We seek to establish long-term relationships with our customers and to increase the amount of business done with each customer by providing them with a full range of logistics services. During 2009, we served over 35,000 customers worldwide, ranging from Fortune 100 companies to small businesses in a wide variety of industries. During 2009, no customer accounted for more than seven percent of total revenues or more than approximately three percent of net revenues. In recent years, we have grown by adding new customers and by increasing our volumes with, and providing more services to, our existing customers.

We believe that our decentralized structure enables our salespeople to better serve our customers by developing a broad knowledge of logistics and local and regional market conditions, as well as the specific logistics issues facing individual customers and certain vertical industries. With the guidance of experienced branch managers (who have an average tenure of 12 years with C.H. Robinson), branches are given significant latitude to pursue opportunities and to commit our resources to serve our customers.

Branches seek additional business from existing customers and pursue new customers based on their knowledge of local markets and the range and value of logistics services that we can provide. We have also expanded our corporate sales and marketing support to enhance branch sales capabilities. Branches also call on our executives and our corporate sales staff to support them in the pursuit of new business with companies that have more complex logistics requirements.

Relationships with Transportation Providers

We continually work on establishing contractual relationships with qualified transportation providers that also meet our service requirements to assure dependable services, favorable pricing, and contract carrier availability during periods when demand for transportation equipment is greater than the supply. Because we do not own any transportation equipment or employ the people directly involved with the delivery of our customers’ freight, these relationships are critical to our success.

As of December 31, 2009, we had worked with approximately 47,000 transportation providers worldwide, of which the vast majority are contracted motor carriers. To strengthen and maintain our relationships with motor carriers, our salespeople regularly communicate with carriers and try to assist them by increasing their equipment utilization, reducing their empty miles, and repositioning their equipment. To make it easier for contract carriers to work with us, we have a policy of prompt payment upon receipt of proof of delivery. For those contract carriers who would like a faster payment, we also offer payment within 48 hours of receipt of proof of delivery in exchange for a discount, along with offering in-trip cash advances through our T-Chek subsidiary.

These contracted motor carriers provide access to temperature controlled vans, dry vans, and flatbeds. These contract carriers are of all sizes, including owner-operators of a single truck, small and mid-size fleets, private fleets, and the largest national trucking companies. Consequently, we are not dependent on any one contract carrier. Our largest truck transportation provider was approximately one percent of our total cost of transportation in 2009. Motor carriers that had fewer than 100 tractors transported approximately 75 percent of our truckload shipments in 2009. Every carrier with which we do business is required to execute a contract which establishes that the carrier is acting as an independent contractor. At the time the contract is executed, and periodically thereafter, we verify that each carrier is properly licensed and insured, has the necessary federally-issued authority to provide transportation services, and has the ability to provide the necessary level of service on a dependable basis. Our motor carrier contracts require that the carrier issue invoices only to and accept payment solely from us, and allow us to withhold payment to satisfy previous claims or shortages. Our standard contracts do not include volume commitments, and the initial contract rate is modified each time we confirm an individual shipment with a carrier.

We also have intermodal marketing agreements with container owners, stacktrain operators, and all Class 1 railroads in North America, giving us access to additional trailers and containers. Our contracts with railroads specify the transportation services

9

Table of Contents

and payment terms by which our intermodal shipments are transported by rail. Intermodal transportation rates are typically negotiated between us and the railroad on a customer-specific basis.

In our non-vessel operating common carrier (NVOCC) ocean transportation and freight forwarding business, we have contracts with most of the major ocean carriers which support a variety of service and rate needs for our customers. We negotiate annual contracts that establish the predetermined rates we agree to pay our ocean carriers. The rates are negotiated based on expected volumes from our customers, specific trade lane requirements, and anticipated growth in the international shipping marketplace. These contracts are often amended throughout the year to reflect changes in market conditions for our business, such as additional trade lanes.

In our air freight forwarding business, we purchase transportation services from approximately 200 air carriers through charter services, block space agreements, and transactional spot market negotiations. Through charter services, we contract part or all of an airplane to meet customer requirements. Our block space agreements are annual contracts that include fixed allocations for predetermined flights at agreed upon rates that are reviewed annually or throughout the year. The transactional negotiations afford us the ability to capture excess capacity at prevailing market rates for a specific shipment.

Competition

The transportation services industry is highly competitive and fragmented. We compete against a large number of logistics companies, trucking companies, property freight brokers, carriers offering logistics services, and freight forwarders. We also buy from and sell transportation services to companies that compete with us.

In our Sourcing business, we compete with produce brokers, produce growers, produce marketing companies, produce wholesalers, and foodservice buying groups. We also buy from and sell produce to companies that compete with us.

The primary business of our Information Services business is fuel card services. The fuel card processing industry is very consolidated and a small number of companies represent the majority of the market.

We often compete with respect to price, scope of services, or a combination thereof, but believe that our most significant competitive advantages are:

| • | Our branch network, which enables our salespeople to gain broad knowledge about individual customers, carriers and the local and regional markets they serve, and to provide superior customer service based on that knowledge. This network also offers customers higher service as responsibility for shipments is commonly shared across branches, to provide nationwide coverage and local market knowledge; |

| • | Our 47,000 contracted carrier relationships; |

| • | Our size, relative to other providers, is an advantage in attracting more carriers, which in turn enables us to serve our customers more efficiently and earn more business. Additionally, because of the large number of transactions we do annually, 7.5 million in 2009, we have greater opportunity to efficiently identify available capacity for our customers’ needs; |

| • | Our business model, which enables us to remain flexible in our service offerings to our customers; |

| • | Our dedicated employees and entrepreneurial culture, which are supported by our performance-based compensation system; |

| • | Our proprietary information systems; |

| • | Our ability to provide a broad range of logistics services; and |

| • | Our ability to provide door-to-door services on a worldwide basis. |

Communications and Information Systems

Our information systems are essential to our ability to efficiently communicate, service our customers and contracted carriers, and manage our business. Our proprietary information systems help our employees efficiently manage more than 7.5 million shipments annually, 35,000 customer relationships, and 47,000 contracted carrier relationships. Our employees are linked with each other and with our customers, carriers, and suppliers by telephone, fax, internet, email, and/or EDI to communicate shipment requirements and availability, and to confirm and bill orders.

Our branch employees use our information systems to identify freight matching opportunities, communicate and coordinate activity with other branches, and “cross-cover” or find equipment for other branches’ freight. Our systems help our salespeople service customer orders, select the optimal modes of transportation, build and consolidate shipments, and select routes, all based on customer-specific service parameters. Our systems also make shipment data visible to the entire sales team as well as customers and contracted carriers, enabling our salespeople to select contracted carriers and track shipments

10

Table of Contents

in progress. Our systems automatically provide alerts to arising problems. Our systems also provide performance and productivity reports that our managers and executives can use to more efficiently manage our business.

Through our internet sites CHRWonline® (www.chrwonline.com) and CHRWTrucks® (www.chrwtrucks.com), customers and contracted carriers can contract for shipments or equipment as well as track and trace shipments, including delivery confirmation. Customers, contracted carriers, and suppliers also have access to other information in our operating systems through the internet. Our systems use data captured from daily transactions to generate various management reports that are available to our customers and contracted carriers. These reports provide them with information on traffic patterns, product mix, and production schedules, and support analysis of their own customer base, transportation expenditure trends, and the impact on out-of-route costs.

Government Regulation

We are subject to licensing and regulation as a property freight broker and are licensed by the U.S. Department of Transportation (“DOT”) to arrange for the transportation of property by motor vehicle. The DOT prescribes qualifications for acting in this capacity, including certain surety bonding requirements. We are also subject to regulation by the Federal Maritime Commission as an ocean freight forwarder and a NVOCC for which we maintain separate bonds and licenses for each. We operate as an indirect air carrier of cargo subject to commercial standards set forth by the International Air Transport Association and federal regulations issued by the Transportation Security Administration and provide customs brokerage services as a customs broker under a license issued by the Bureau of U.S. Customs and Border Protection. We also have and maintain other licenses as required by law.

Although Congress enacted legislation in 1994 that substantially preempts the authority of states to exercise economic regulation of motor carriers and brokers of freight, some intrastate shipments for which we arrange transportation may be subject to additional licensing, registration or permit requirements. We generally contractually require and/or rely on the carrier transporting the shipment to ensure compliance with these types of requirements. We, along with the contracted carriers that we rely on in arranging transportation services for our customers, are also subject to a variety of federal and state safety and environmental regulations. Although compliance with the regulations governing licensees in these areas has not had a materially adverse effect on our operations or financial condition in the past, there can be no assurance that such regulations or changes thereto will not adversely impact our operations in the future. Violation of these regulations could also subject us to fines as well as increased claims liability.

We source fresh produce under licenses issued by the U.S. Department of Agriculture as required by the Perishable Agricultural Commodities Act (“PACA”). Other sourcing and distribution activities may be subject to various federal and state food and drug statutes and regulations. Our T-Chek operations are subject to federal and state regulations, including, but not limited to, the Bank Secrecy Act of 1970.

Risk Management and Insurance

We contractually require all motor carriers we work with to carry at least $750,000 in automobile liability insurance and $25,000 in cargo insurance. We also require all motor carriers to maintain workers compensation and other insurance coverage as required by law. Many carriers have insurance exceeding these minimum requirements. Railroads, which are generally self-insured, provide limited common carrier liability protection, generally up to $250,000 per shipment.

As a property freight broker, we are not legally liable for damage to our customers’ cargo. In our customer contracts, we may agree to assume cargo liability up to a stated maximum. We do not assume cargo liability to our customers above minimum industry standards in our international freight forwarding, ocean transportation, and air freight businesses. We offer our customers the option to purchase ocean marine cargo coverage to insure goods in transit. When we agree to store goods for our customers for longer terms, we provide limited warehouseman’s coverage to our customers and contract for warehousing services from companies that provide us the same degree of coverage.

We maintain a broad cargo liability insurance policy to protect us against catastrophic losses that may not be recovered from the responsible contracted carrier. We also carry various liability insurance policies, including automobile and general liability, with a $200 million umbrella in 2008 and 2009. Our contingent automobile liability coverage has a retention of $3 million per incident for 2007 and 2008, and $5 million per incident in 2009 and 2010.

Agricultural chemicals used on agricultural commodities intended for human consumption are subject to various approvals, and the commodities themselves are subject to regulations on cleanliness and contamination. Concern about particular chemicals and alleged contamination can lead to product recalls, and tort claims may be brought by consumers of allegedly affected produce. As a seller of produce, we may, under certain circumstances, have legal responsibility arising from produce sales. We carry product liability coverage under our general liability and umbrella policies to cover tort claims. In addition, in the event of a recall, we may be required to bear the costs of repurchasing, transporting, and destroying any allegedly contaminated product, as well as potential consequential damages, which are generally not insured. Any recall or allegation

11

Table of Contents

of contamination could affect our reputation, particularly of our proprietary and licensed branded produce programs. Loss due to spoilage (including the need for disposal) is also a routine part of the sourcing business.

Investor Information

We were reincorporated in Delaware in 1997 as the successor to a business existing, in various legal forms, since 1905. Our corporate office is located at 14701 Charlson Road, Eden Prairie, Minnesota, 55347-5088, and our telephone number is (952) 937-8500. Copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website (www.chrobinson.com) as soon as reasonably practicable after we electronically file the material with the Securities and Exchange Commission.

Cautionary Statement Relevant to Forward-Looking Information

This Annual Report on Form 10-K and our financial statements, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of this report and other documents incorporated by reference contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this Form 10-K and in our other filings with the Securities and Exchange Commission, in our press releases, presentations to securities analysts or investors, in oral statements made by or with the approval of any of our executive officers, the words or phrases “believes,” “may,” “could,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements.

Except for the historical information contained in this Form 10-K, the matters set forth in this document may be deemed to be forward-looking statements that represent our expectations, beliefs, intentions, or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to, such factors such as changes in economic conditions such as a recession; decreased consumer confidence; changes in market demand and pressures on the pricing for our services; competition and growth rates within the third party logistics industry; freight levels and availability of truck capacity or alternative means of transporting freight; changes in relationships with existing contracted truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; our ability to integrate the operations of acquired companies with our historic operations successfully; risks associated with litigation and insurance coverage; risks associated with operations outside of the U.S.; risks associated with the potential impacts of changes in government regulations; risks associated with the produce industry, including food safety and contamination issues; fuel shortages and the impact of war on the economy; and other risks and uncertainties, including those described below.

| ITEM 1A. | RISK FACTORS |

You should consider carefully the following cautionary statements if you own our common stock or are planning to buy our common stock. We intend to take advantage of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) by providing this discussion. We are not undertaking to address or update each factor in future filings or communications regarding our business or results except to the extent required by law.

Economic recessions could have a significant, adverse impact on our business. The transportation industry historically has experienced cyclical fluctuations in financial results due to economic recession, downturns in business cycles of our customers, interest rate fluctuations, and other economic factors beyond our control. Deterioration in the current economic environment subjects our business to various risks, which may have a material impact on our operating results and cause us to not reach our long-term growth goals:

| • | Decrease in volumes—A reduction in overall freight volumes in the marketplace reduces our opportunities for growth. A significant portion of our freight is transactional or “spot” market opportunities. The transactional market may be more impacted than the freight market overall by the economic recession. In addition, if a downturn in our customers’ business cycles causes a reduction in the volume of freight shipped by those customers, particularly among certain national retailers or in the food, beverage, retail, manufacturing, paper, or printing industries, our operating results could be adversely affected. Slower freight volumes in the marketplace also impact growth in our Information Services business due to reduced use of their fuel card services. A sustained period of slow freight demand is the most challenging environment for our business. Due to overall economic conditions and the decline in North American truckload volumes in 2009, which are our largest source of net revenues, we did not achieve our long-term growth goal of 15 percent in 2009. Because of the continued existence of overall recessionary conditions, we do not anticipate that our annual performance in 2010 will meet our long-term growth goals. |

12

Table of Contents

| • | Credit risk and working capital—Due to the economic recession and the difficulties many of our customers are facing, our customers may not be able to pay us and some may go out of business. In addition, some customers may not pay us as quickly as they have in the past, causing our working capital needs to increase. |

| • | Transportation provider failures—A significant number of our transportation providers may go out of business and we may be unable to secure sufficient equipment or other transportation services to meet our commitments to our customers. |

| • | Expense management—We may not be able to appropriately adjust our expenses to changing market demands. Personnel is our largest expense. In order to maintain high variability in our business model, it is necessary to adjust staffing levels to changing market demands. In periods of rapid change, it is more difficult to match our staffing level to our business needs. In addition, we have other variable expenses that are fixed for a period of time, and we may not be able to adequately adjust them in a period of rapid change in market demand. |

| • | Instability of financial markets and low interest rates—The current interest rate environment has significantly reduced our investment income and may continue to do so in the future. |

Higher carrier prices may result in decreased net revenue margin. Carriers can be expected to charge higher prices to cover higher operating expenses, and our net revenues and income from operations may decrease if we are unable to pass through to our customers the full amount of higher transportation costs.

Changing fuel costs may have an impact on our net revenue margins. In our truckload transportation business, which is the largest source of our net revenues, rising fuel prices may result in a decreased net revenue margin. When we enter into prearranged rate agreements for truckload services with our customers, we have fuel surcharge agreements in addition to the underlying line-haul portion of the rate. When we are purchasing transportation services, the majority of our truckload freight is priced to our contract carriers on a spot market, or transactional, basis, even when we are working with the customer on a contractual basis. For spot transactions with contract motor carriers, we generally negotiate a mutually-agreed upon total market rate that includes all costs, including any applicable fuel expense. However, we will estimate and report fuel separately, if requested by the contracted carrier. While our different pricing arrangements with customers and contracted carriers make it very difficult to measure the precise impact, we believe that fuel costs essentially act as a pass-through to our business. Therefore, in times of higher fuel prices, our net revenue margin percentage declines.

We depend upon others to provide equipment and services. We do not own or control the transportation assets that deliver our customers freight, and we do not employ the people directly involved in delivering the freight. We are dependent on independent third parties to provide truck, rail, ocean, and air services and to report certain events to us including delivery information and freight claims. This reliance could cause delays in reporting certain events, including recognizing revenue and claims. If we are unable to secure sufficient equipment or other transportation services to meet our commitments to our customers, our operating results could be materially and adversely affected, and our customers could switch to our competitors temporarily or permanently. Many of these risks are beyond our control including:

| • | equipment shortages in the transportation industry, particularly among contracted truckload carriers, |

| • | interruptions in service or stoppages in transportation as a result of labor disputes, |

| • | changes in regulations impacting transportation, and |

| • | unanticipated changes in transportation rates. |

We have international operations. We provide services within and between continents on an increasing basis. Our business outside of the United States is subject to various risks, including:

| • | changes in economic and political conditions and in governmental policies, |

| • | changes in and compliance with international and domestic laws and regulations, |

| • | wars, civil unrest, acts of terrorism, and other conflicts, |

| • | natural disasters, |

| • | changes in tariffs, trade restrictions, trade agreements, and taxations, |

| • | difficulties in managing or overseeing foreign operations, |

| • | limitations on the repatriation of funds because of foreign exchange controls, |

| • | different liability standards, and |

| • | intellectual property laws of countries which do not protect our rights in our intellectual property, including, but not limited to, our proprietary information systems, to the same extent as the laws of the United States. |

13

Table of Contents

The occurrence or consequences of any of these factors may restrict our ability to operate in the affected region and/or decrease the profitability of our operations in that region.

As we expand our business in foreign countries we will expose the company to increased risk of loss from foreign currency fluctuations and exchange controls as well as longer accounts receivable payment cycles. We have limited control over these risks, and if we do not correctly anticipate changes in international economic and political conditions, we may not alter our business practices in time to avoid adverse effects.

Our ability to appropriately staff and retain employees is important to our variable cost model. Our continued success depends upon our ability to attract and retain a large group of motivated salespersons and other logistics professionals. In order to maintain high variability in our business model, it is necessary to adjust staffing levels to changing market demands. In periods of rapid change, it is more difficult to match our staffing level to our business needs. We cannot guarantee that we will be able to continue to hire and retain a sufficient number of qualified personnel. Because of our comprehensive employee training program, our employees are attractive targets for new and existing competitors. Continued success depends in large part on our ability to develop successful employees into managers.

We face substantial industry competition. Competition in the transportation services industry is intense and broad-based. We compete against logistics companies as well as transportation providers that own their own equipment, third party freight brokers, internet matching services, internet freight brokers, and carriers offering logistics services. We also compete against carriers’ internal sales forces. We often buy and sell transportation services from and to many of our competitors. Increased competition could create downward pressure on freight rates, and continued rate pressure may adversely affect our net revenue and income from operations.

We are reliant on technology to operate our business. We have internally developed the majority of our operating systems. Our continued success is dependent on our systems continuing to operate and to meet the changing needs of our customers. We are reliant on our technology staff and vendors to successfully implement changes to and maintain our operating systems in an efficient manner. Computer viruses could cause an interruption to the availability of our systems. Unauthorized access to our systems with malicious intent could result in the theft of proprietary information and in systems outages. An unplanned systems outage or unauthorized access to our systems could materially and adversely affect our business.

Because we manage our business on a decentralized basis, our operations may be materially adversely affected by inconsistent management practices. We manage our business on a decentralized basis through a network of branch offices throughout North America, Europe, Asia, South America, Australia, and the Middle East, supported by executives and services in a central corporate office, with branch management retaining responsibility for day-to-day operations, profitability, personnel decisions and the growth of the business in their branch. Our decentralized operating strategy can make it difficult for us to implement strategic decisions and coordinated procedures throughout our global operations. In addition, certain of our branches operate with management, sales, and support personnel that may be insufficient to support growth in their respective branch without significant central oversight and coordination. Our decentralized operating strategy could result in inconsistent management practices and materially and adversely affect our overall profitability and expose us to litigation.

Our earnings may be affected by seasonal changes in the transportation industry. Results of operations for our industry generally show a seasonal pattern as customers reduce shipments during and after the winter holiday season. In recent years, our operating income and earnings have been lower in the first quarter than in the other three quarters. Although seasonal changes in the transportation industry have not had a significant impact on our cash flow or results of operations, we expect this trend to continue and we cannot guarantee that it will not adversely impact us in the future.

We are subject to claims arising from our transportation operations. We use the services of thousands of transportation companies in connection with our transportation operations. From time to time, the drivers employed and engaged by the carriers we contract with are involved in accidents which may result in serious personal injuries. The resulting types and/or amounts of damages may be excluded by or exceed the amount of insurance coverage maintained by the contracted carrier. Although these drivers are not our employees and all of these drivers are employees, owner-operators, or independent contractors working for carriers, from time to time, claims may be asserted against us for their actions, or for our actions in retaining them. Claims against us may exceed the amount of our insurance coverage, or may not be covered by insurance at all. In addition, our automobile liability policy has a retention of $3 million per incident for 2007 and 2008, and $5 million per incident in 2009 and 2010. A material increase in the frequency or severity of accidents, liability claims or workers’ compensation claims, or unfavorable resolutions of claims could materially and adversely affect our operating results. In addition, significant increases in insurance costs or the inability to purchase insurance as a result of these claims could reduce our profitability.

Our Sourcing business is dependent upon the supply and price of fresh produce. The supply and price of fresh produce is affected by weather and growing conditions (such as drought, insects, and disease), and other conditions over which we

14

Table of Contents

have no control. Commodity prices can be affected by shortages or overproduction and are often highly volatile. If we are unable to secure fresh produce to meet our commitments to our customers, our operating results could be materially and adversely affected, and our customers could switch to our competitors temporarily or permanently.

Sourcing and reselling fresh produce exposes us to possible product liability. Agricultural chemicals used on fresh produce are subject to various approvals, and the commodities themselves are subject to regulations on cleanliness and contamination. Product recalls in the produce industry have been caused by concern about particular chemicals and alleged contamination, often leading to lawsuits brought by consumers of allegedly affected produce. Because we sell produce, we may face claims for a variety of damages arising from the sale which may include potentially uninsured consequential damages. While we are insured for up to $201 million in 2008 and 2009 for product liability claims, settlement of class action claims is often costly, and we cannot guarantee that our liability coverage will be adequate and will continue to be available. If we have to recall produce, we may be required to bear the cost of repurchasing, transporting, and destroying any allegedly contaminated product, as well as consequential damages, which our insurance does not cover. Any recall or allegation of contamination could affect our reputation, particularly of our proprietary and/or licensed branded produce programs. Loss due to spoilage (including the need for disposal) is also a routine part of the sourcing business.

Our business depends upon compliance with numerous government regulations. We are licensed by the U.S. Department of Transportation as a broker authorized to arrange for the transportation of general commodities by motor vehicle. We must comply with certain insurance and surety bond requirements to act in this capacity. We are also licensed by the Federal Maritime Commission as an ocean freight forwarder, which requires us to maintain a non-vessel operating common carrier bond and by the Transportation Security Administration as an independent air carrier. We are also licensed by the Bureau of U.S. Customs and Border Protection. We source fresh produce under a license issued by the U.S. Department of Agriculture. Our failure to comply with the laws and regulations applicable to entities holding these licenses could materially and adversely affect our results of operations or financial condition.

Legislative or regulatory changes can affect the economics of the transportation industry by requiring changes in operating practices or influencing the demand for, and the cost of providing, transportation services. As part of our logistics services, we operate leased warehouse facilities. Our operations at these facilities include both warehousing and distribution services, and we are subject to various federal and state environmental, work safety, and hazardous materials regulations. We may experience an increase in operating costs, such as costs for security, as a result of governmental regulations that have been and will be adopted in response to terrorist activities and potential terrorist activities. No assurances can be given that we will be able to pass these increased costs on to our customers in the form of rate increases or surcharges.

Department of Homeland Security regulations applicable to our customers who import goods into the United States and our contracted ocean carriers can impact our ability to provide and/or receive services with and from these parties. Enforcement measures related to violations of these regulations can slow and or prevent the delivery of shipments, which may negatively impact our operations.

We cannot predict what impact future regulations may have on our business. Our failure to maintain required permits or licenses, or to comply with applicable regulations, could result in substantial fines or revocation of our operating permits and licenses.

We derive a significant portion of our total revenues and net revenues from our largest customers. Our top 100 customers comprise approximately 35 percent of our consolidated total revenues and 30 percent of consolidated net revenues. Our largest customer comprises approximately six percent of our consolidated total revenues and three percent of our consolidated net revenues. The sudden loss of many of our major clients could materially and adversely affect our operating results.

We may be unable to identify or complete suitable acquisitions and investments. We may acquire or make investments in complementary businesses, products, services, or technologies. We cannot guarantee that we will be able to identify suitable acquisitions or investment candidates. Even if we identify suitable candidates, we cannot guarantee that we will make acquisitions or investments on commercially acceptable terms, if at all. If we acquire a company, we may have difficulty integrating its businesses, products, services, technologies, and personnel into our operations. Acquired companies or operations may have unexpected liabilities, and we may face challenges in retaining significant customers of acquired companies. These difficulties could disrupt our ongoing business, distract our management and workforce, increase our expenses, and adversely affect our results of operations. In addition, we may incur debt or be required to issue equity securities to pay for future acquisitions or investments. The issuance of any equity securities could be dilutive to our stockholders.

Our growth and profitability may not continue, which may result in a decrease in our stock price. Historically, our long-term growth objective has been 15 percent for net revenues, operating income, and earnings per share. There can be no assurance that our long-term growth objective will be achieved or that we will be able to effectively adapt our management,

15

Table of Contents

administrative, and operational systems to respond to any future growth. Future changes in and expansion of our business, or changes in economic or political conditions, could adversely affect our operating margins. Slower or less profitable growth or losses could adversely affect our stock price.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

Our corporate headquarters is in Eden Prairie, Minnesota. The total square footage of our four buildings in Eden Prairie is 343,000. This total includes our new data center of approximately 18,000 square feet and 110,000 square feet used for branch operations.

All but one of our branch offices are leased from third parties under leases with initial terms ranging from three to fifteen years. Our office locations range in space from 1,000 to 153,000 square feet. The following table lists our largest locations:

| Location |

Approximate Square Feet | |

| Eden Prairie, MN |

153,000 | |

| Eden Prairie, MN (1) |

105,000 | |

| Chicago, IL(1) |

80,000 | |

| Eden Prairie, MN |

67,000 | |

| Atlanta, GA |

27,350 | |

| Chicago, IL |

20,847 | |

| Southfield, MI |

18,464 | |

| Eden Prairie, MN(1) |

18,000 | |

| Woodridge, IL |

16,914 | |

| Fort Worth, TX |

15,000 | |

| Coralville, IA |

14,440 | |

| Elk Grove Village, IL |

13,163 | |

| Hong Kong |

12,900 | |

| Monterrey, CA |

12,712 | |

| Madison, WI |

12,400 | |

| Kansas City, KS |

12,174 | |

| Boca Raton, FL |

11,681 | |

| Cordova, TN |

11,617 | |

| Lisle, IL |

11,613 | |

| Sartell, MN |

11,444 | |

| Chicago, IL |

11,355 | |

| Fishers, IN |

11,027 | |

| Shanghai, CHN |

10,700 |

We also own or lease approximately 600,000 square feet of warehouse space throughout the United States. The following table lists our largest warehouses:

| Location |

Approximate Square Feet | |

| Vancouver, WA |

79,000 | |

| Plant City, FL(1) |

64,000 | |

| Compton, CA |

62,000 | |

| Miramar, FL |

57,000 | |

| Bethlehem, PA |

55,000 | |

| Rochester, NY |

54,000 | |

| Cobden, IL(1) |

52,000 | |

| Edinburg, TX |

48,000 | |

| Laredo, TX |

47,000 | |

| Lemont, IL |

45,000 |

| (1) | These properties are owned. All other properties in the tables above are leased from third parties. |

16

Table of Contents

We consider our current office spaces and warehouse facilities adequate for our current level of operations. We have not had difficulty in obtaining sufficient office space and believe we can renew existing leases or relocate branches to new offices as leases expire.

| ITEM 3. | LEGAL PROCEEDINGS |

Gender Discrimination Lawsuit—As we previously disclosed, certain gender discrimination class claims were settled in 2006. The settlement was within our insurance coverage limits and was fully funded by insurance.

Although the gender class settlement was fully funded by insurance, those insurers reserved the right to seek a court ruling that a portion of the settlement was not covered under their policies, and also to dispute payment of certain defense costs incurred in that litigation. Insurance coverage litigation between us and one of our insurance carriers concerning these issues and insurance coverage for individual lawsuits that were not part of the class settlement is pending in Minnesota State Court.

The settlement of the gender discrimination class claims did not include claims of putative class members who subsequently filed individual Equal Employment Opportunity Commission (“EEOC”) charges after the denial of class status. Fifty-four of those EEOC claimants filed lawsuits. Fifty-three of those suits have been settled or dismissed. The settlement amounts were not material to our financial position, results of operations, or cash flows. We are vigorously defending the remaining lawsuit.

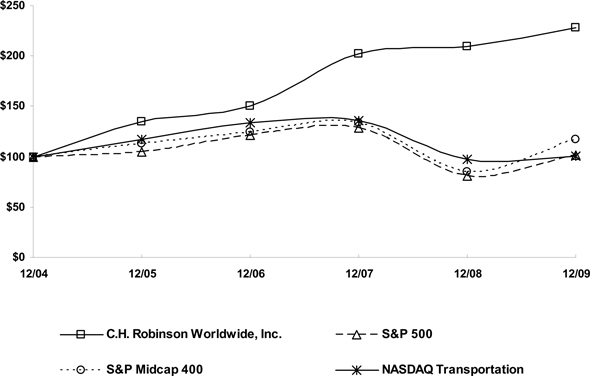

Accident Litigation—On March 20, 2009, a jury in Will County, Illinois, entered a verdict of $23.75 million against us, a federally authorized motor carrier with which we contracted, and the motor carrier’s driver. The award was entered in favor of three named plaintiffs following a consolidated trial, stemming from an accident that occurred on April 1, 2004. The motor carrier and the driver both admitted that at the time of the accident the driver was acting as an agent for the motor carrier, and that the load was being transported according to the terms of our contract with the motor carrier. Our contract clearly defined the motor carrier as an independent contractor. The verdict has the effect of holding us vicariously liable for the damages caused by the admitted negligence of the motor carrier and its driver. There were no claims that our selection or retention of the motor carrier was negligent.