Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MedAvail Holdings, Inc. | medavailmyos8-k7272020.htm |

Exhibit 99.1

Corporate Presentation

t be resold by the p subject

2 Safe Harbor Statements Forward-Looking Statements. MedAvail, Inc. (“MedAvail”) cautions you that the statements in this presentation that are not a description of historical fact are forward- looking statements which may be identified by use of the words such as “anticipate,” “believe,” “expand,” “expect,” “grow,” “intend,” “opportunity,” “plan,” “potential,” “project”, “target” and “will” among others. MedAvail may not actually achieve the proposed merger with MYOS RENS Technology, Inc. (“MYOS”), or any plans or product development goal in a timely manner, if at all, or otherwise carry out the intentions or meet the expectations or projections disclosed in its forward-looking statements and, you should not place undue reliance on these forward- looking statements. These forward-looking statements are based on MedAvail’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward- looking statements as a result of various risks and uncertainties, which include, without limitation, risks and uncertainties associated with the ability to consummate the proposed merger between MedAvail and MYOS, the ability to project future cash utilization and resources need for contingent future liabilities and business operations, the availability of sufficient resources for combined company operations and to conduct or continue planned product development activities, the ability to execute on commercial objectives, regulatory developments and the timing and ability of MedAvail and MYOS to raise additional capital to fund operations. The risks and uncertainties may be amplified by the COVID-19 pandemic, which has caused significant economic uncertainty. The extent to which the COVID-19 pandemic impacts MYOS’s and MedAvail’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. MedAvail undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law. The securities to which this presentation relates have not been and will not be registered for offer or sale in the United States with the SEC or any state securities authority and, accordingly, may not be resold by the purchaser thereof unless registered or subject to an exemption therefrom.

3 Safe Harbor Statements Additional Information about the Proposed Merger and Where to Find It. MYOS plans to file with the SEC, and the parties plan to furnish to the security holders of MYOS and MedAvail, a Registration Statement on Form S-4, which will constitute a proxy statement/prospectus of MYOS and will be included in an information statement of MedAvail, in connection with the proposed Merger, whereby a wholly-owned subsidiary of MYOS shall merge with and into MedAvail, with MedAvail being the surviving corporation and a wholly-owned subsidiary of MYOS. The proxy statement/prospectus/information statement described above will contain important information about MYOS, MedAvail, the proposed Merger and related matters. Investors are urged to read the proxy statement/prospectus/information statement carefully when it becomes available. Investors will be able to obtain free copies of these documents, and other documents filed with the SEC by MYOS, through the website maintained by the SEC at www.sec.gov. In addition, investors will be able to obtain free copies of these documents from MYOS by going to the MYOS Investor Relations web page at https://ir.myosrens.com/ and clicking on the link titled “SEC Filings” or by contacting MYOS’s Investor Relations group at the following: MYOS Technology, Inc.: Joanne Goodford, 973-509-0444, jgoodford@myosrenscorp.com. No Offer or Solicitation. This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Participants in the Solicitation. The respective directors and executive officers of MYOS and MedAvail may be deemed to be participants in the solicitation of stockholder proxies from the security holders of MYOS and written consent of the stockholders of MedAvail in connection with the proposed Merger. Information regarding the interests of these directors and executive officers in the proposed Merger will be included in the proxy statement/prospectus/information statement described above.

4 Transforming Pharmacy Healthcare is being transformed by technology, consumer demands and the essential need to drive down cost while increasing access New entrants are disrupting major markets with breakthrough ‘blank slate’ offerings - Teladoc, One Medical, Livongo, Invitae... MedAvail is transforming the $300B U.S. pharmacy market with a full-stack technology- enabled solution utilizing robotics, telemedicine and exceptional service levels Initially, MedAvail is focused on high value Medicare members, which is a $16.5B market PROPRIETARY 2020© MedAvail 2020

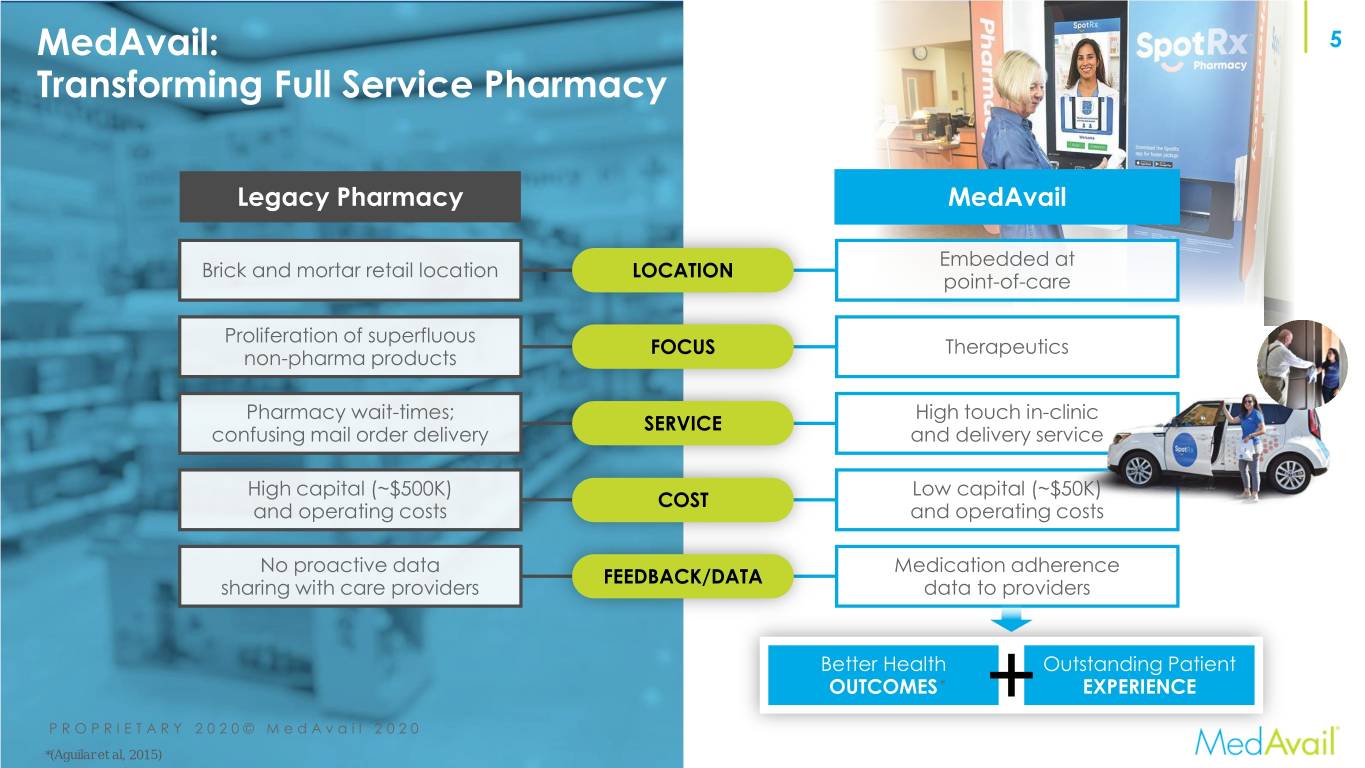

MedAvail: 5 Transforming Full Service Pharmacy Legacy Pharmacy MedAvail Embedded at Brick and mortar retail location LOCATION point-of-care Proliferation of superfluous FOCUS Therapeutics non-pharma products Pharmacy wait-times; High touch in-clinic SERVICE confusing mail order delivery and delivery service High capital (~$500K) Low capital (~$50K) COST and operating costs and operating costs No proactive data Medication adherence FEEDBACK/DATA sharing with care providers data to providers Better Health Outstanding Patient OUTCOMES * EXPERIENCE PROPRIETARY 2020© MedAvail 2020 *(Aguilar et al, 2015)

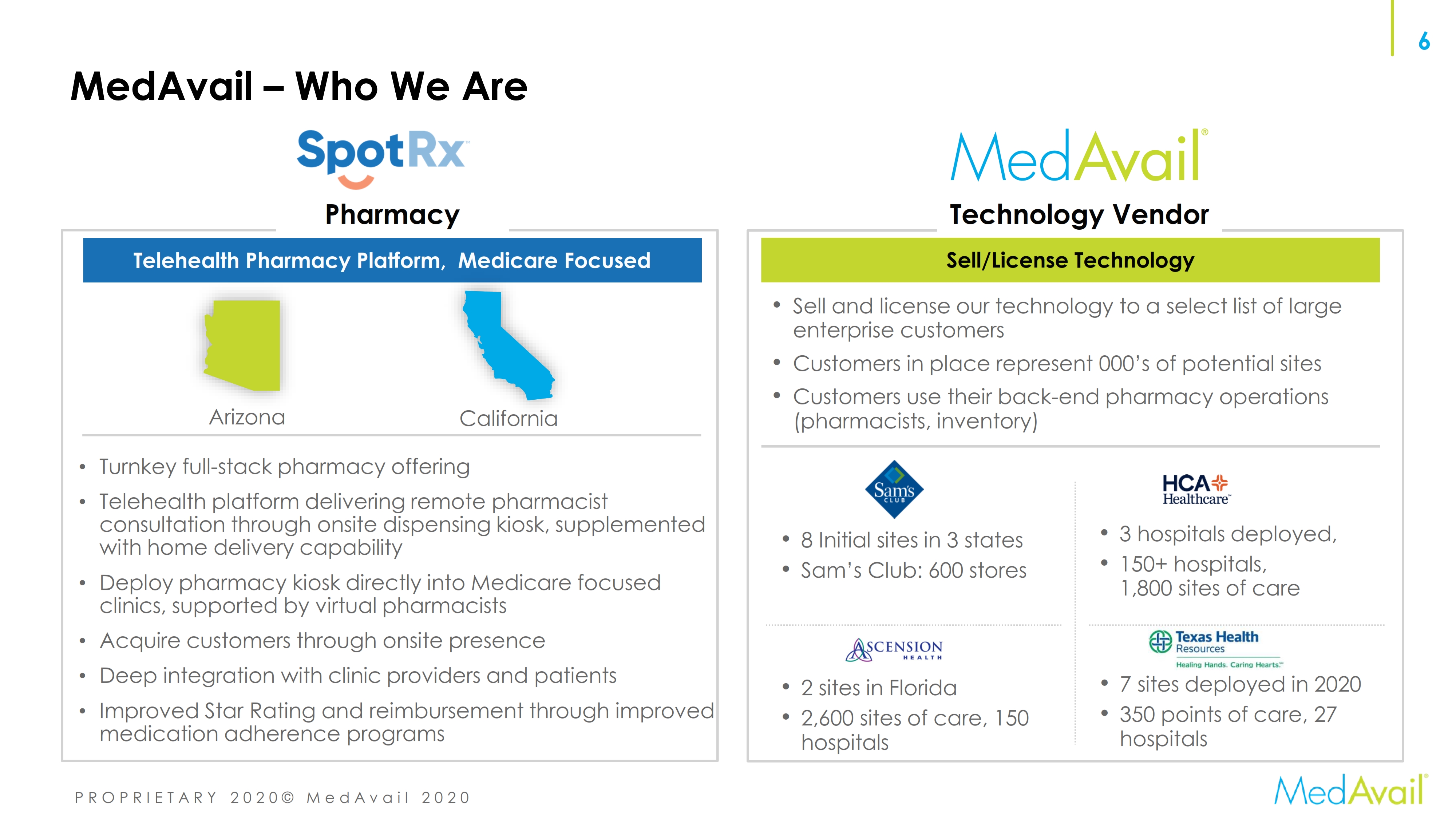

6 MedAvail - Who We Are Pharmacy Technology Vendor Telehealth Pharmacy Platform, Medicare Focused Sell/License Technology Sell and license our technology to a select list of large enterprise customers Customers in place represent 000’s of potential sites Customers use their bank-end pharmacy operations Arizona California (pharmacists, inventory) Turnkey full-stack pharmacy offering Telehealth platform delivering remote pharmacist consultation through onsite dispensing kiosk, supplemented 3 hospitals deployed, with home delivery capability 8 Initial sites in 3 states Sam’s Club: 600 stores 150+ hospitals, Deploy pharmacy kiosk directly into Medicare focused 1,800 sites of care clinics, supported by virtual pharmacists Acquire customers through onsite presence Deep integration with clinic providers and patients 2 sites in Florida 7 sites deployed in 2020 Improved Star Rating and reimbursement through improved 2,600 sites of care, 150 350 points of care, 27 medication adherence programs hospitals hospitals PROPRIETARY 2020© MedAvail 2020

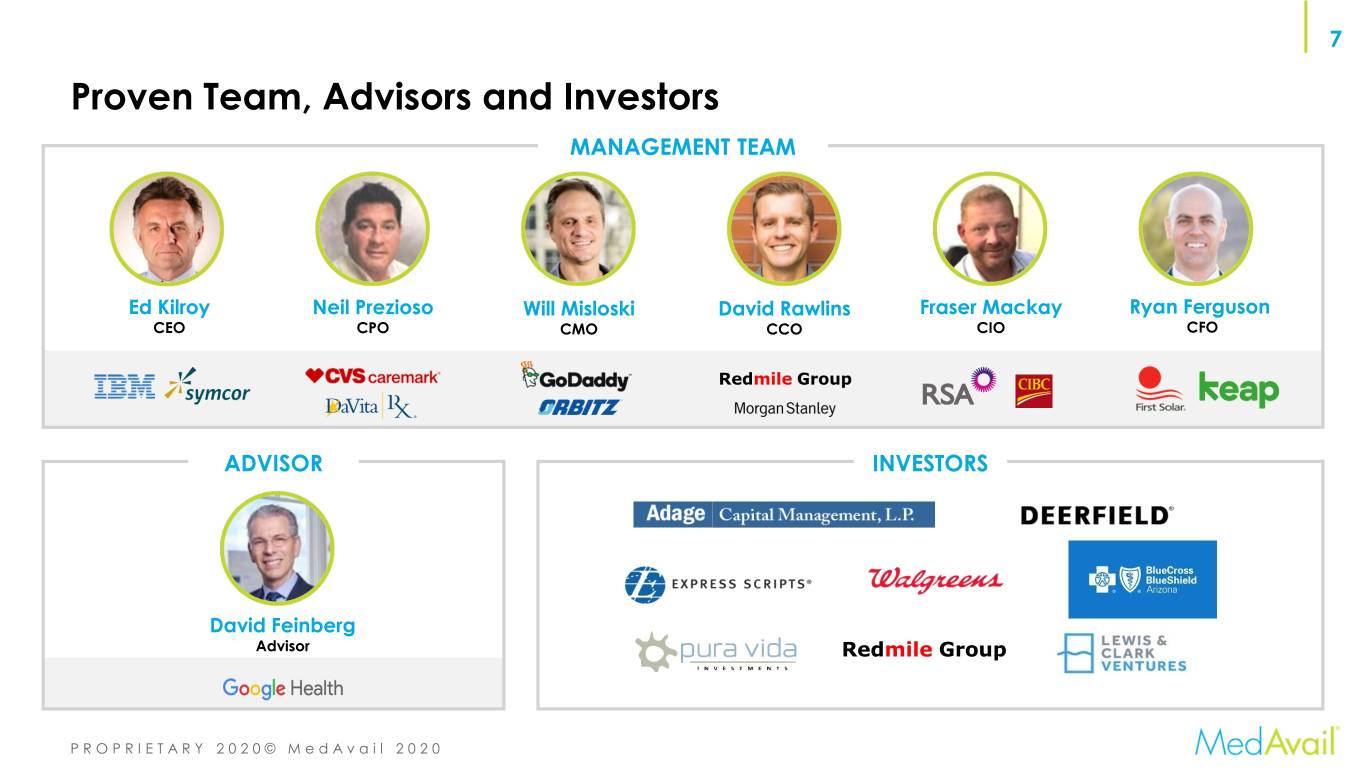

7 Proven Team, Advisors and Investors MANAGEMENT TEAM Ed Kilroy Neil Prezioso Will Misloski David Rawlins Fraser Mackay Ryan Ferguson CEO CPO CMO CCO CIO CFO ADVISOR INVESTORS David Feinberg Advisor Redmile Group PROPRIETARY 2020© MedAvail 2020

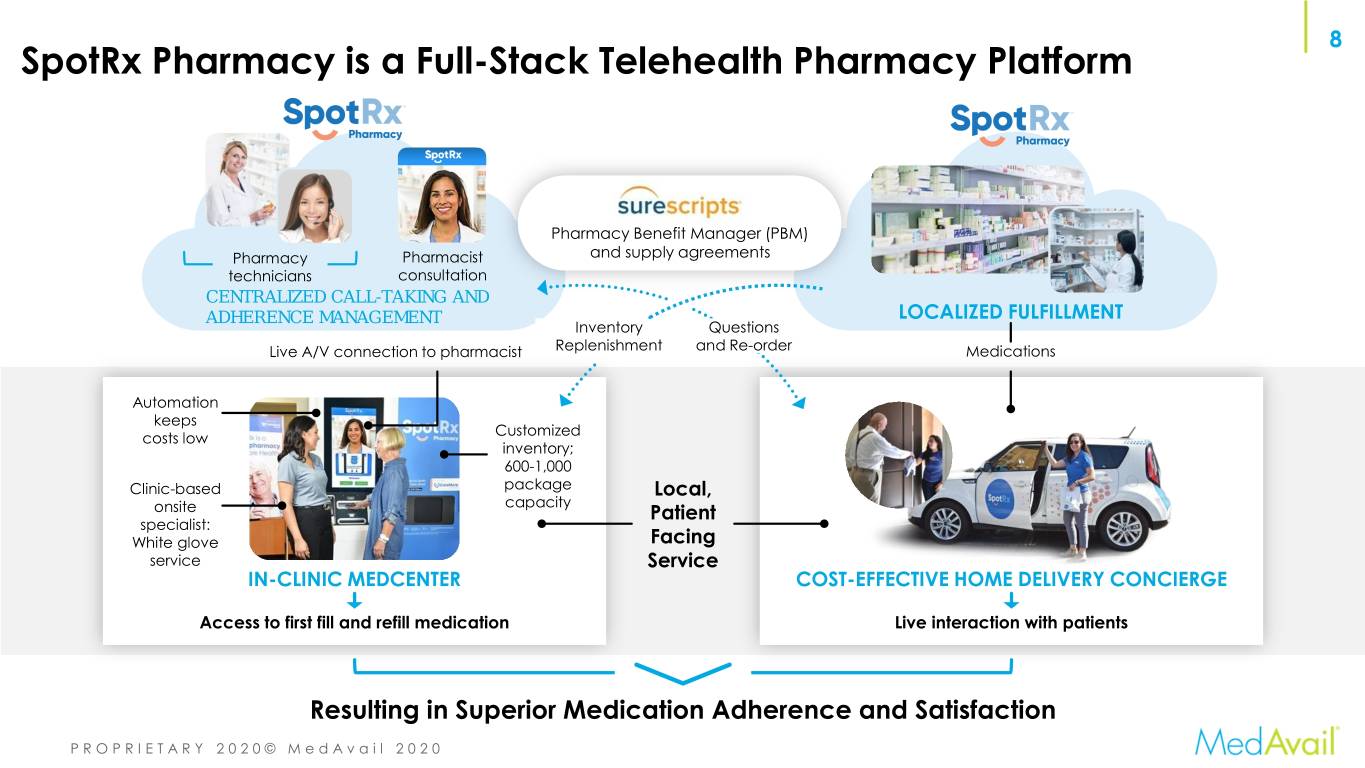

8 SpotRx Pharmacy is a Full-Stack Telehealth Pharmacy Platform Pharmacy Benefit Manager (PBM) Pharmacy Pharmacist and supply agreements technicians consultation CENTRALIZED CALL-TAKING AND ADHERENCE MANAGEMENT LOCALIZED FULFILLMENT Inventory Questions Live A/V connection to pharmacist Replenishment and Re-order Medications Automation keeps Customized costs low inventory; 600-1,000 Clinic-based package Local, capacity onsite Patient specialist: White glove Facing service Service IN-CLINIC MEDCENTER COST-EFFECTIVE HOME DELIVERY CONCIERGE Access to first fill and refill medication Live interaction with patients Resulting in Superior Medication Adherence and Satisfaction PROPRIETARY 2020© MedAvail 2020

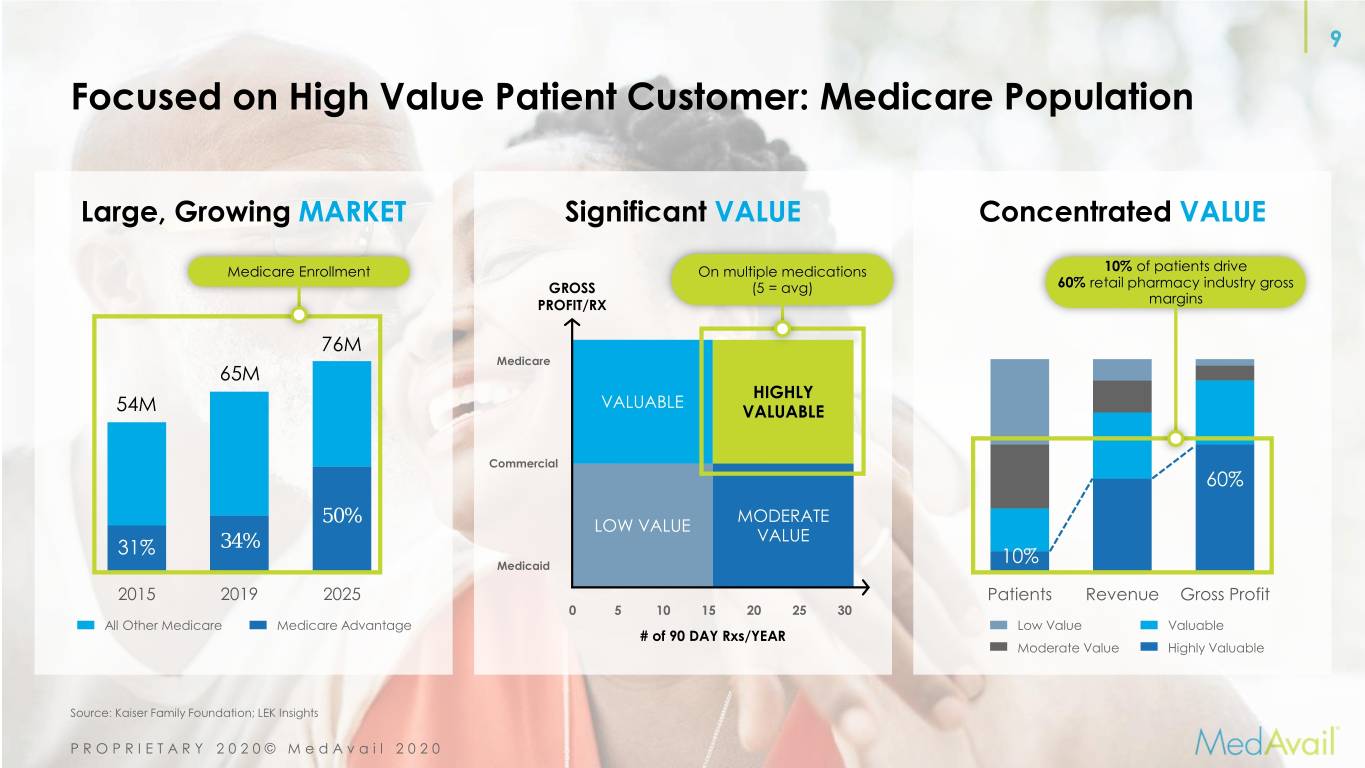

9 Focused on High Value Patient Customer: Medicare Population Large, Growing MARKET Significant VALUE Concentrated VALUE Medicare Enrollment On multiple medications 10% of patients drive GROSS (5 = avg) 60% retail pharmacy industry gross PROFIT/RX margins 76M Medicare 65M HIGHLY VALUABLE 54M VALUABLE Commercial 60% 50% MODERATE LOW VALUE VALUE 31% 34% Medicaid 10% 2015 2019 2025 Patients Revenue Gross Profit 0 5 10 15 20 25 30 All Other Medicare Medicare Advantage Low Value Valuable # of 90 DAY Rxs/YEAR Moderate Value Highly Valuable Source: Kaiser Family Foundation; LEK Insights PROPRIETARY 2020© MedAvail 2020

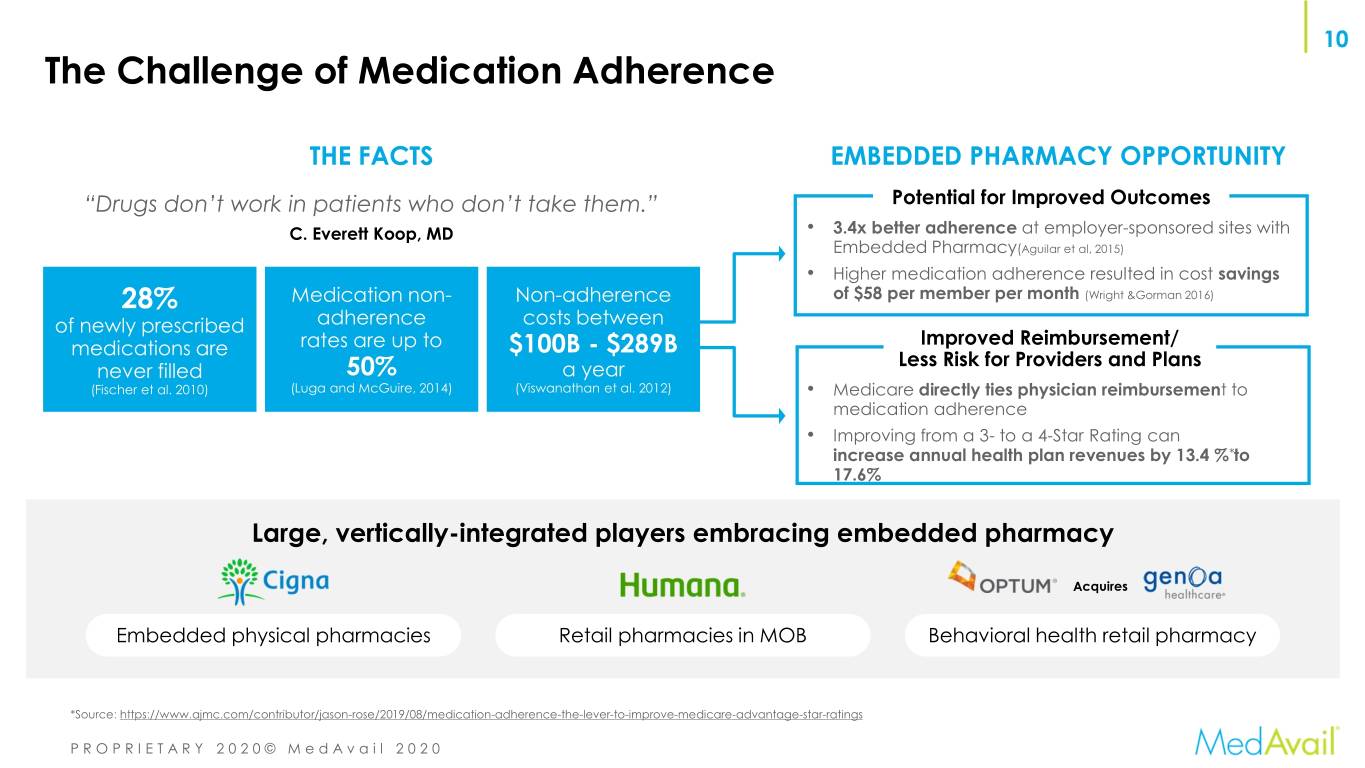

10 The Challenge of Medication Adherence THE FACTS EMBEDDED PHARMACY OPPORTUNITY “Drugs don’t work in patients who don’t take them.” Potential for Improved Outcomes C. Everett Koop, MD 3.4x better adherence at employer-sponsored sites with Embedded Pharmacy(Aguilar et al, 2015) Higher medication adherence resulted in cost savings 28% Medication non- Non-adherence of $58 per member per month (Wright &Gorman 2016) of newly prescribed adherence costs between Improved Reimbursement/ medications are rates are up to $100B - $289B Less Risk for Providers and Plans never filled 50% a year (Fischer et al. 2010) (Luga and McGuire, 2014) (Viswanathan et al. 2012) Medicare directly ties physician reimbursement to medication adherence Improving from a 3- to a 4-Star Rating can increase annual health plan revenues by 13.4 % *to 17.6% Large, vertically-integrated players embracing embedded pharmacy Acquires Embedded physical pharmacies Retail pharmacies in MOB Behavioral health retail pharmacy *Source: https://www.ajmc.com/contributor/jason-rose/2019/08/medication-adherence-the-lever-to-improve-medicare-advantage-star-ratings PROPRIETARY 2020© MedAvail 2020

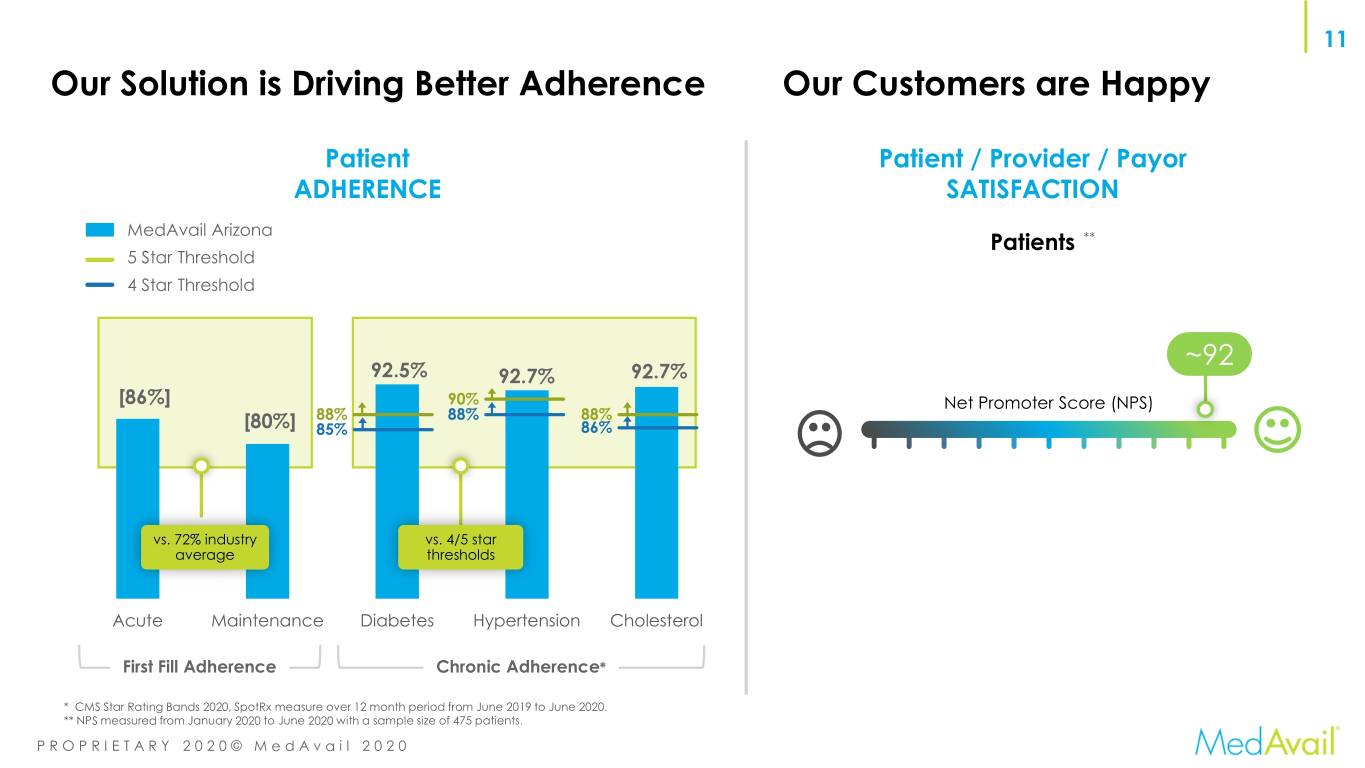

11 Our Solution is Driving Better Adherence Our Customers are Happy Patient Patient / Provider / Payor ADHERENCE SATISFACTION MedAvail Arizona Patients ** 5 Star Threshold 4 Star Threshold ~92 92.5% 92.7% 92.7% [86%] 90% Net Promoter Score (NPS) 88% 88% 88% [80%] 85% 86% vs. 72% industry vs. 4/5 star average thresholds Acute Maintenance Diabetes Hypertension Cholesterol First Fill Adherence Chronic Adherence* * CMS Star Rating Bands 2020, SpotRx measure over 12 month period from June 2019 to June 2020. ** NPS measured from January 2020 to June 2020 with a sample size of 475 patients. PROPRIETARY 2020© MedAvail 2020

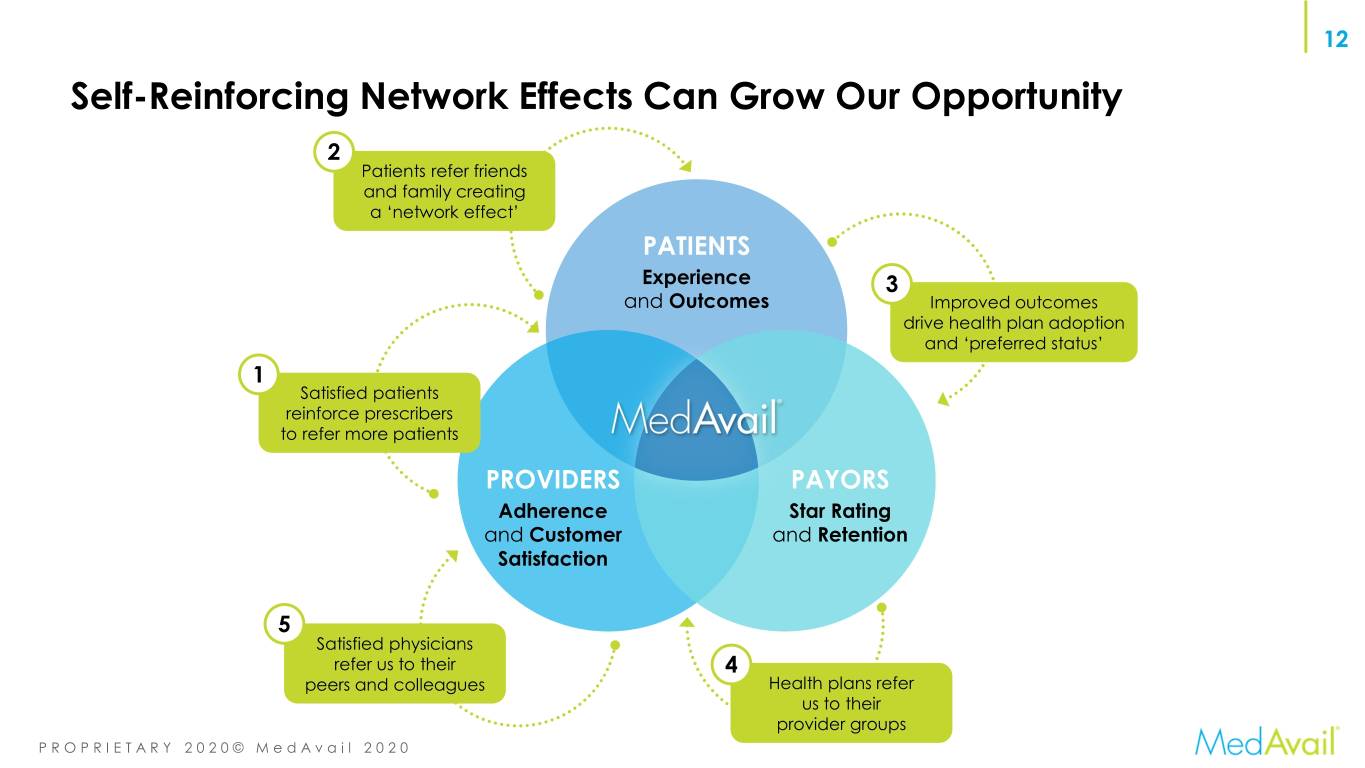

12 Self-Reinforcing Network Effects Can Grow Our Opportunity 2 Patients refer friends and family creating a ‘network effect’ PATIENTS Experience 3 and Outcomes Improved outcomes drive health plan adoption and ‘preferred status’ 1 Satisfied patients reinforce prescribers to refer more patients PROVIDERS PAYORS Adherence Star Rating and Customer and Retention Satisfaction 5 Satisfied physicians refer us to their 4 peers and colleagues Health plans refer us to their provider groups PROPRIETARY 2020© MedAvail 2020

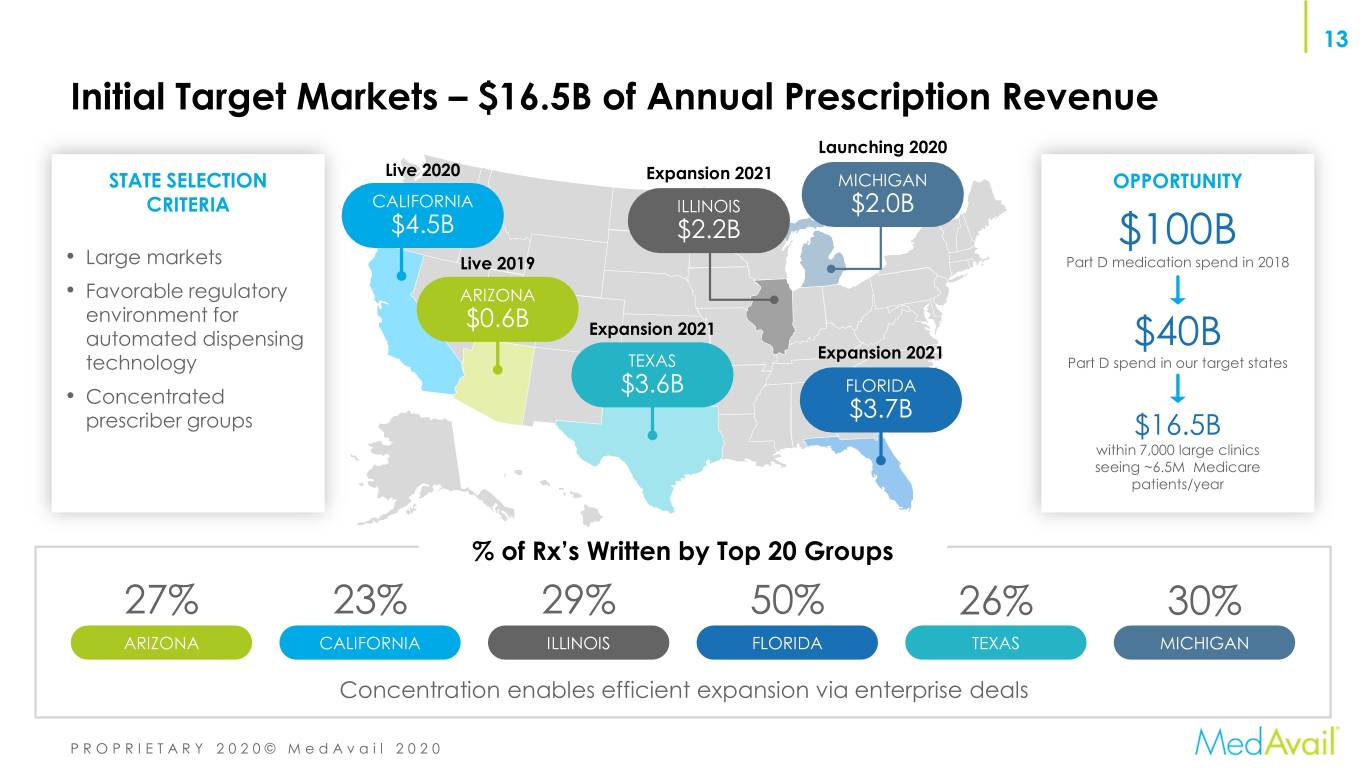

13 Initial Target Markets - $16.5B of Annual Prescription Revenue Launching 2020 Live 2020 STATE SELECTION Expansion 2021 MICHIGAN OPPORTUNITY CRITERIA CALIFORNIA ILLINOIS $2.0B $4.5B $2.2B $100B Large markets Live 2019 Part D medication spend in 2018 Favorable regulatory ARIZONA environment for $0.6B Expansion 2021 automated dispensing $40B Expansion 2021 technology TEXAS Part D spend in our target states $3.6B FLORIDA Concentrated $3.7B prescriber groups $16.5B within 7,000 large clinics seeing ~6.5M Medicare patients/year % of Rx’s Written by Top 20 Groups 27% 23% 29% 50% 26% 30% ARIZONA CALIFORNIA ILLINOIS FLORIDA TEXAS MICHIGAN Concentration enables efficient expansion via enterprise deals PROPRIETARY 2020© MedAvail 2020

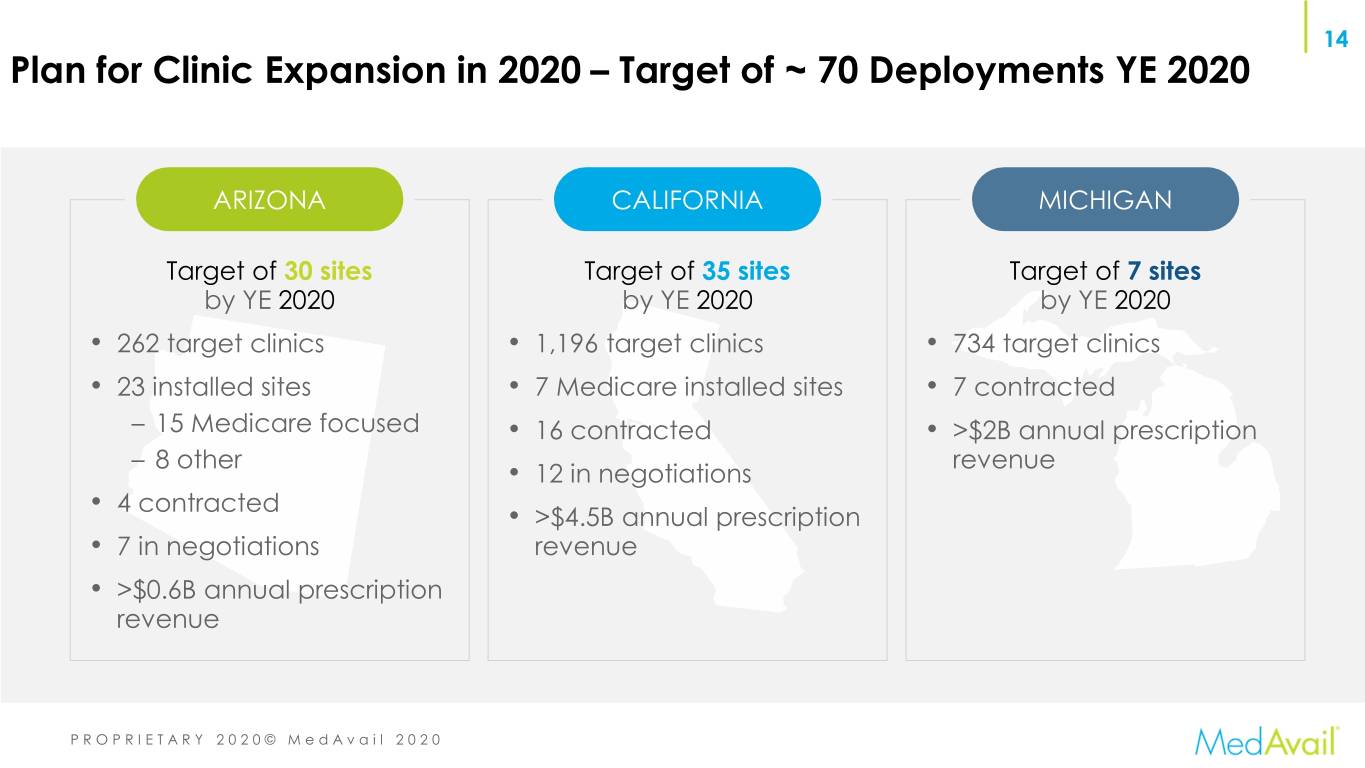

14 Plan for Clinic Expansion in 2020 - Target of ~ 70 Deployments YE 2020 ARIZONA CALIFORNIA MICHIGAN Target of 30 sites Target of 35 sites Target of 7 sites by YE 2020 by YE 2020 by YE 2020 262 target clinics 1,196 target clinics 734 target clinics 23 installed sites 7 Medicare installed sites 7 contracted - 15 Medicare focused 16 contracted >$2B annual prescription - 8 other revenue 12 in negotiations 4 contracted >$4.5B annual prescription 7 in negotiations revenue >$0.6B annual prescription revenue PROPRIETARY 2020© MedAvail 2020

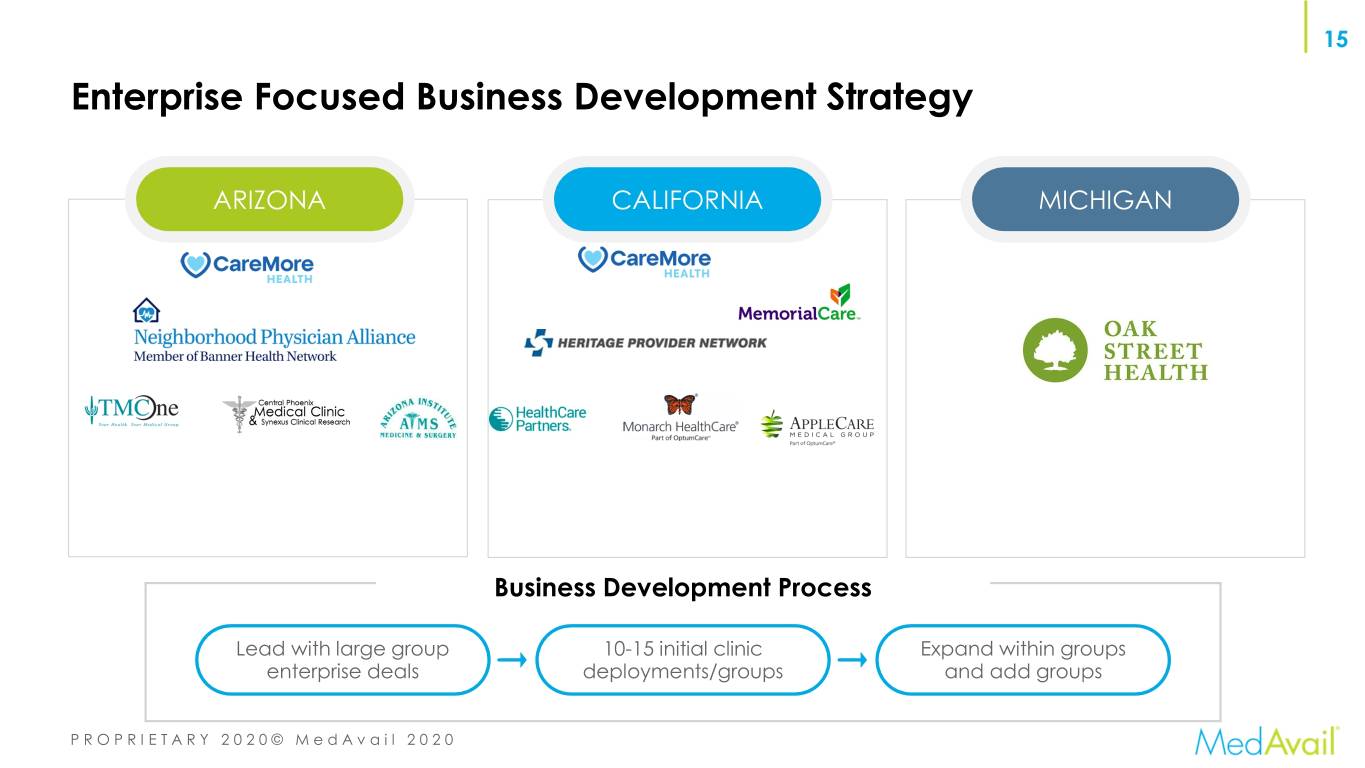

15 Enterprise Focused Business Development Strategy ARIZONA CALIFORNIA MICHIGAN Business Development Process Lead with large group 10-15 initial clinic Expand within groups enterprise deals deployments/groups and add groups PROPRIETARY 2020© MedAvail 2020

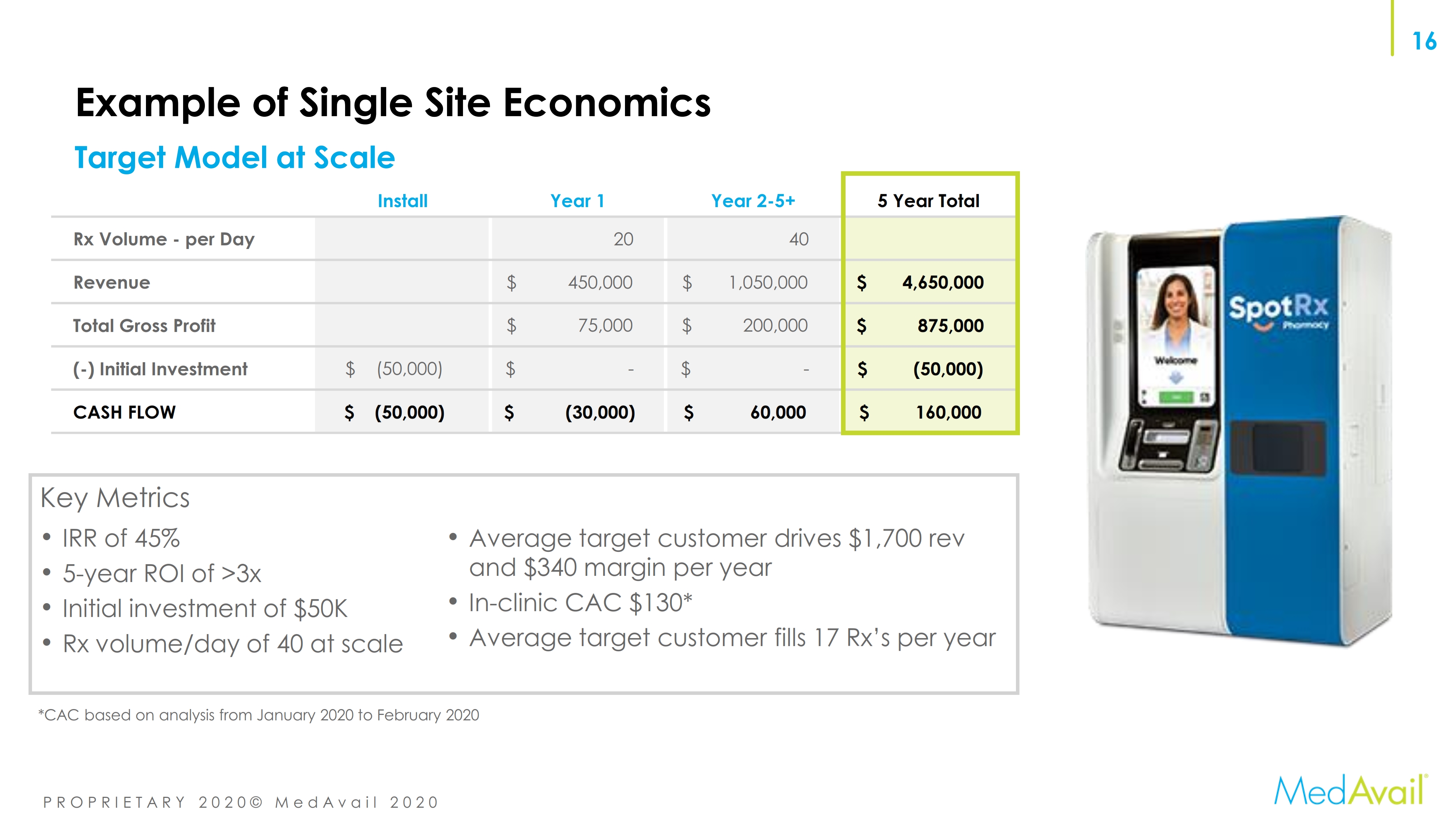

16 Example of Single Site Economics Target Model at Scale Install Year 1 Year 2-5+ 5 Year Total Rx Volume - per Day 20 40 Revenue $ 450,000 $ 1,050,000 $ 4,650,000 Total Gross Profit $ 75,000 $ 200,000 $ 875,000 (-) Initial Investment $ (50,000) $ - $ - $ (50,000) CASH FLOW $ (50,000) $ (30,000) $ 60,000 $ 160,000 Key Metrics IRR of 45% Average customer drives $1,700 rev and 5-year ROI of >3x $340 margin per year Initial investment of $50K In-clinic CAC $130* Rx volume/day of 40 at scale Average customer fills 17 Rx’s per year *CAC based on analysis from January 2020 to February 2020 PROPRIETARY 2020© MedAvail 2020

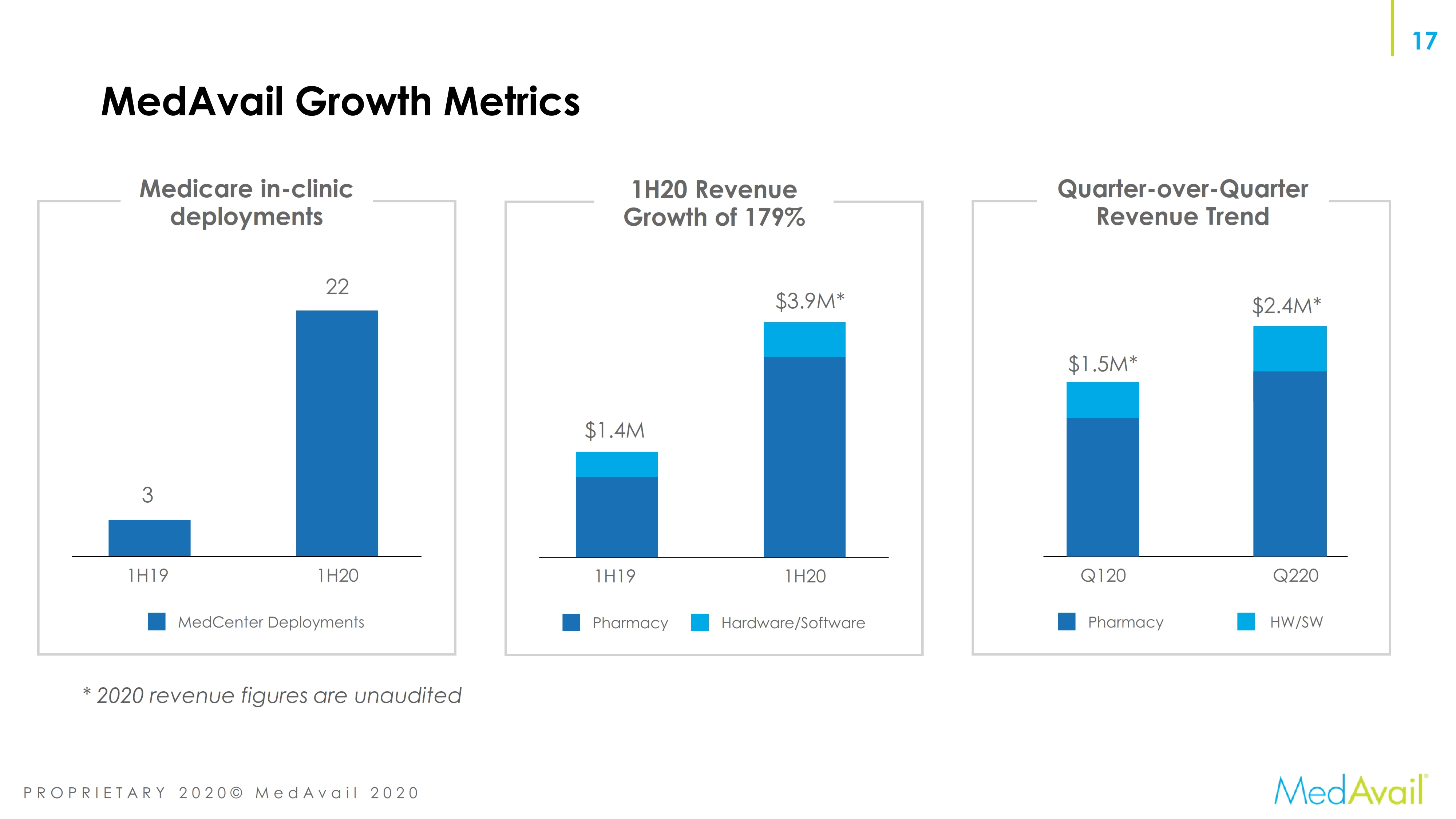

17 MedAvail Growth Metrics Medicare in-clinic 1H20 Revenue Quarter-over-Quarter deployments Growth of 179% Revenue Trend 22 $3.9M* $2.4M* $1.5M* $1.4M 3 1H19 1H20 1H19 1H20 Q120 Q220 MedCenter Deployments Pharmacy Hardware/Software Pharmacy HW/SW * 2020 revenue figures are unaudited PROPRIETARY 2020© MedAvail 2020

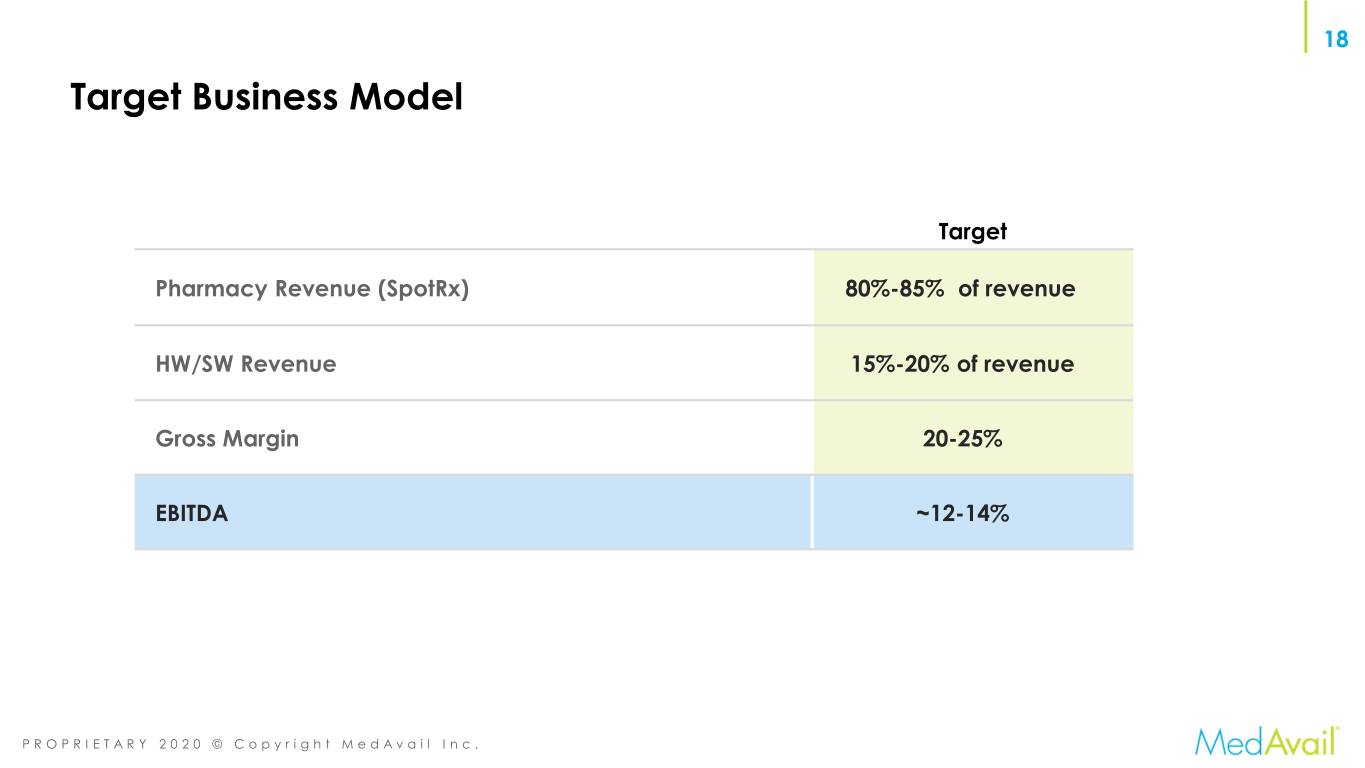

18 Target Business Model Target Pharmacy Revenue (SpotRx) 80%-85% of revenue HW/SW Revenue 15%-20% of revenue Gross Margin 20-25% EBITDA ~12-14% PROPRIETARY 2020 © Copyright MedAvail Inc.

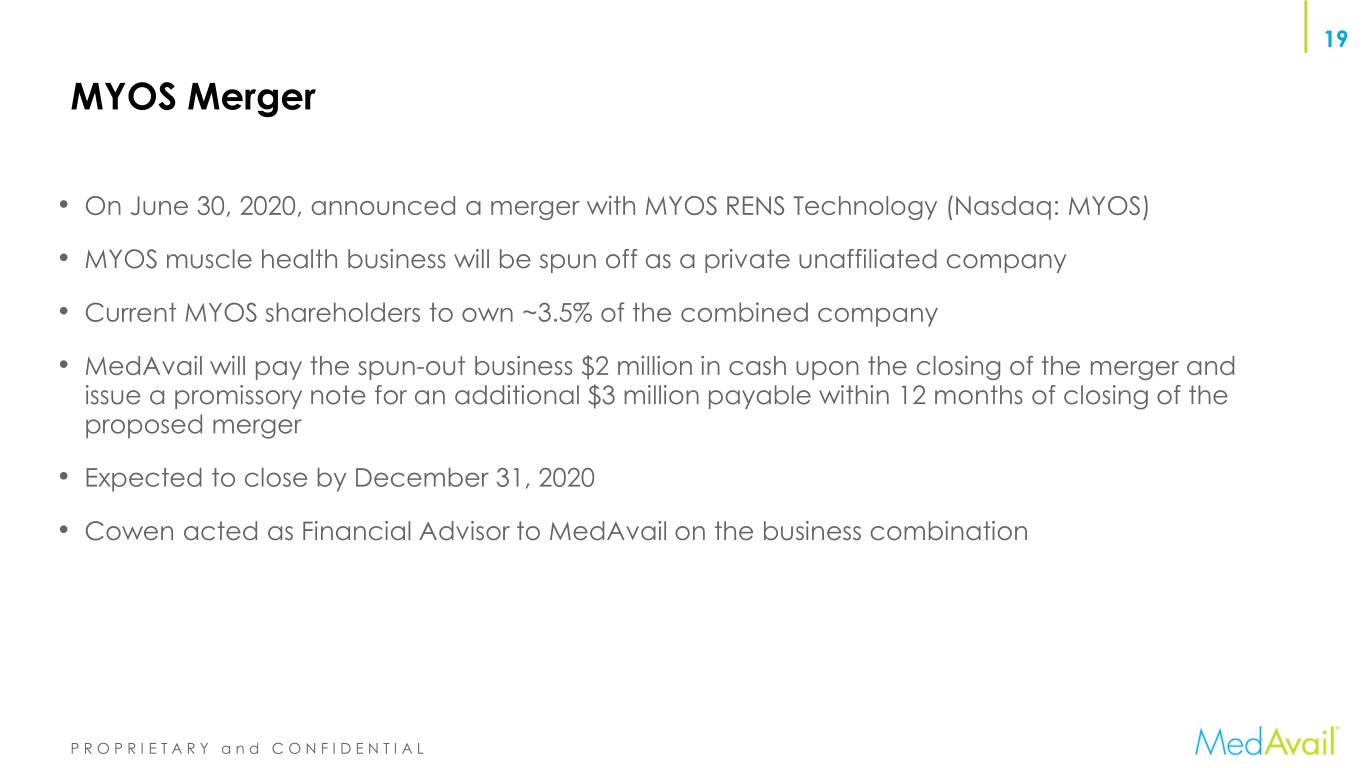

19 MYOS Merger On June 30, 2020, announced a merger with MYOS RENS Technology (Nasdaq: MYOS) MYOS muscle health business will be spun off as a private unaffiliated company Current MYOS shareholders to own ~3.5% of the combined company MedAvail will pay the spun-out business $2 million in cash upon the closing of the merger and issue a promissory note for an additional $3 million payable within 12 months of closing of the proposed merger Expected to close by December 31, 2020 Cowen acted as Financial Advisor to MedAvail on the business combination PROPRIETARY and CONFIDENTIAL

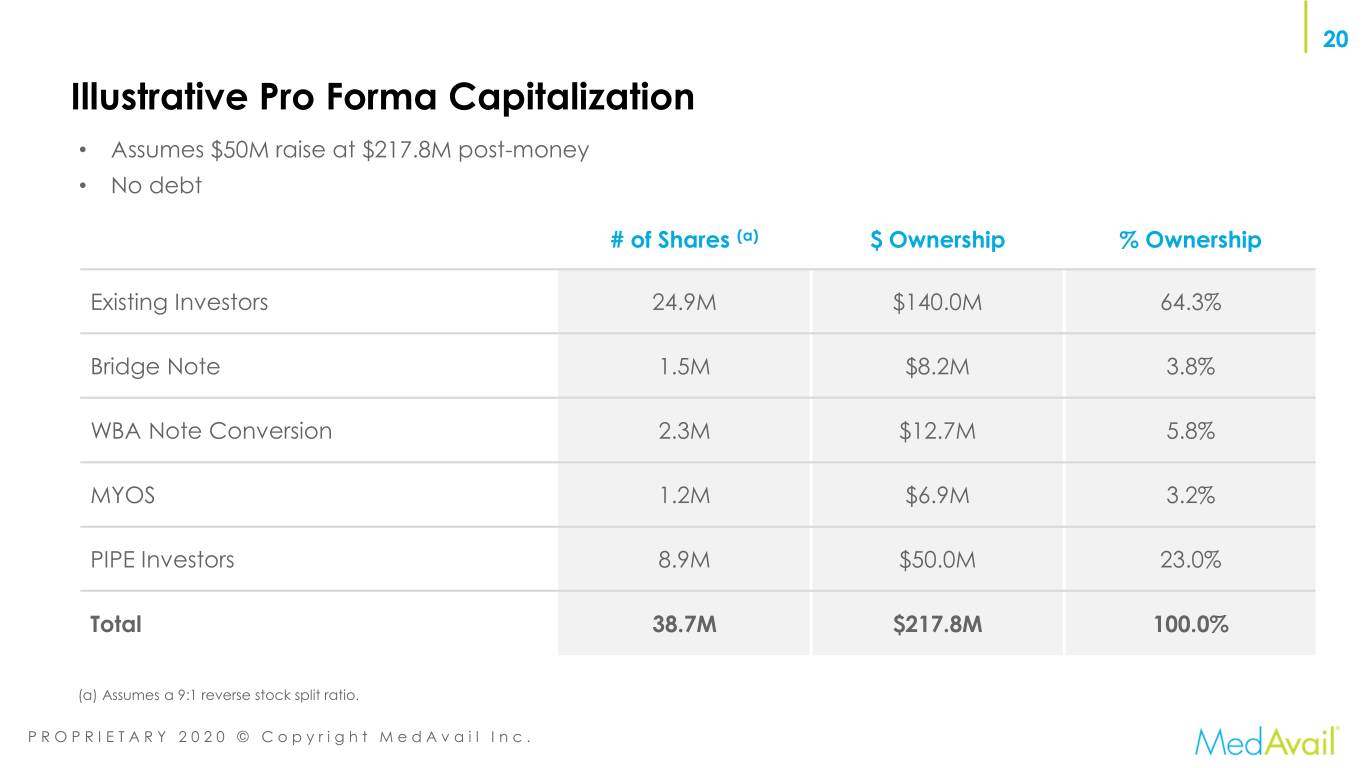

20 Illustrative Pro Forma Capitalization Assumes $50M raise at $217.8M post-money No debt # of Shares (a) $ Ownership % Ownership Existing Investors 24.9M $140.0M 64.3% Bridge Note 1.5M $8.2M 3.8% WBA Note Conversion 2.3M $12.7M 5.8% MYOS 1.2M $6.9M 3.2% PIPE Investors 8.9M $50.0M 23.0% Total 38.7M $217.8M 100.0% (a) Assumes a 9:1 reverse stock split ratio. PROPRIETARY 2020 © Copyright MedAvail Inc.

21 Appendix PROPRIETARY and CONFIDENTIAL

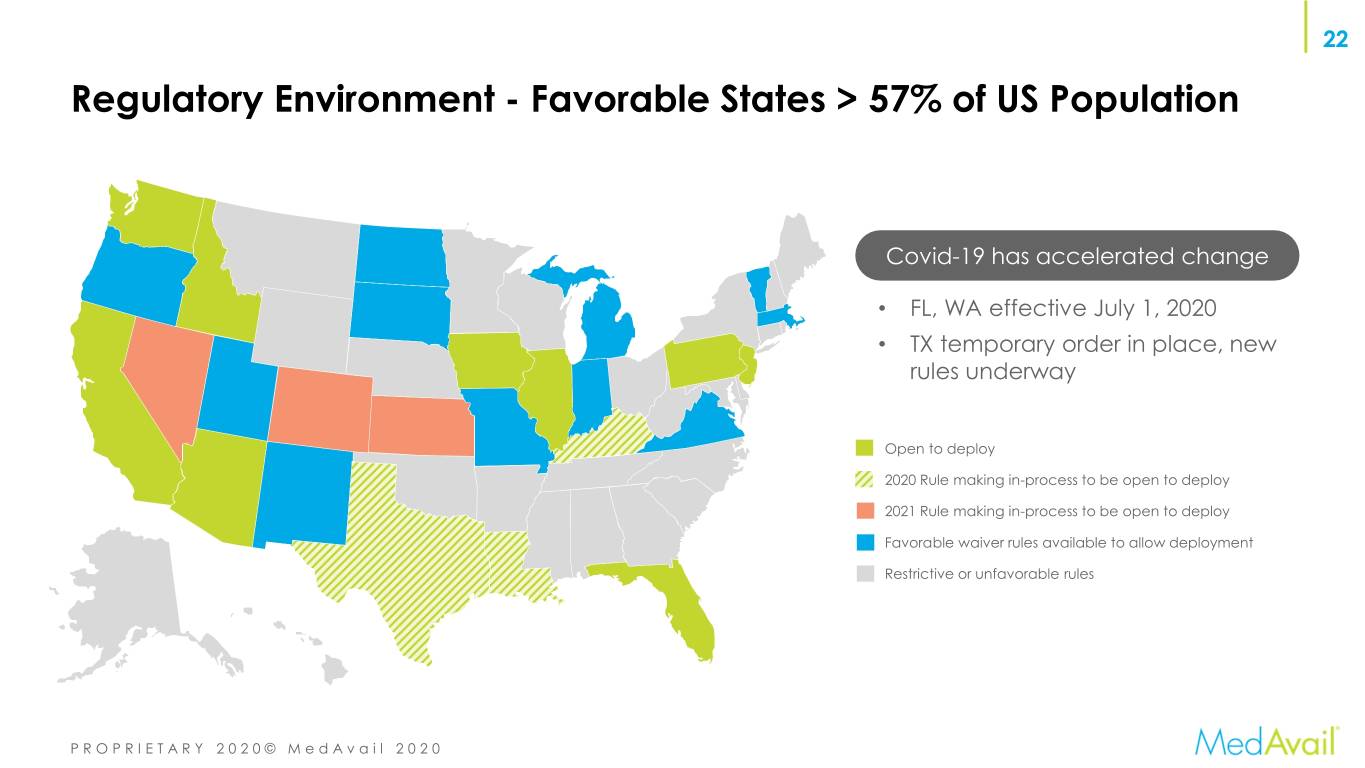

22 Regulatory Environment - Favorable States > 57% of US Population Covid-19 has accelerated change FL, WA effective July 1, 2020 TX temporary order in place, new rules underway Open to deploy 2020 Rule making in-process to be open to deploy 2021 Rule making in-process to be open to deploy Favorable waiver rules available to allow deployment Restrictive or unfavorable rules PROPRIETARY 2020© MedAvail 2020

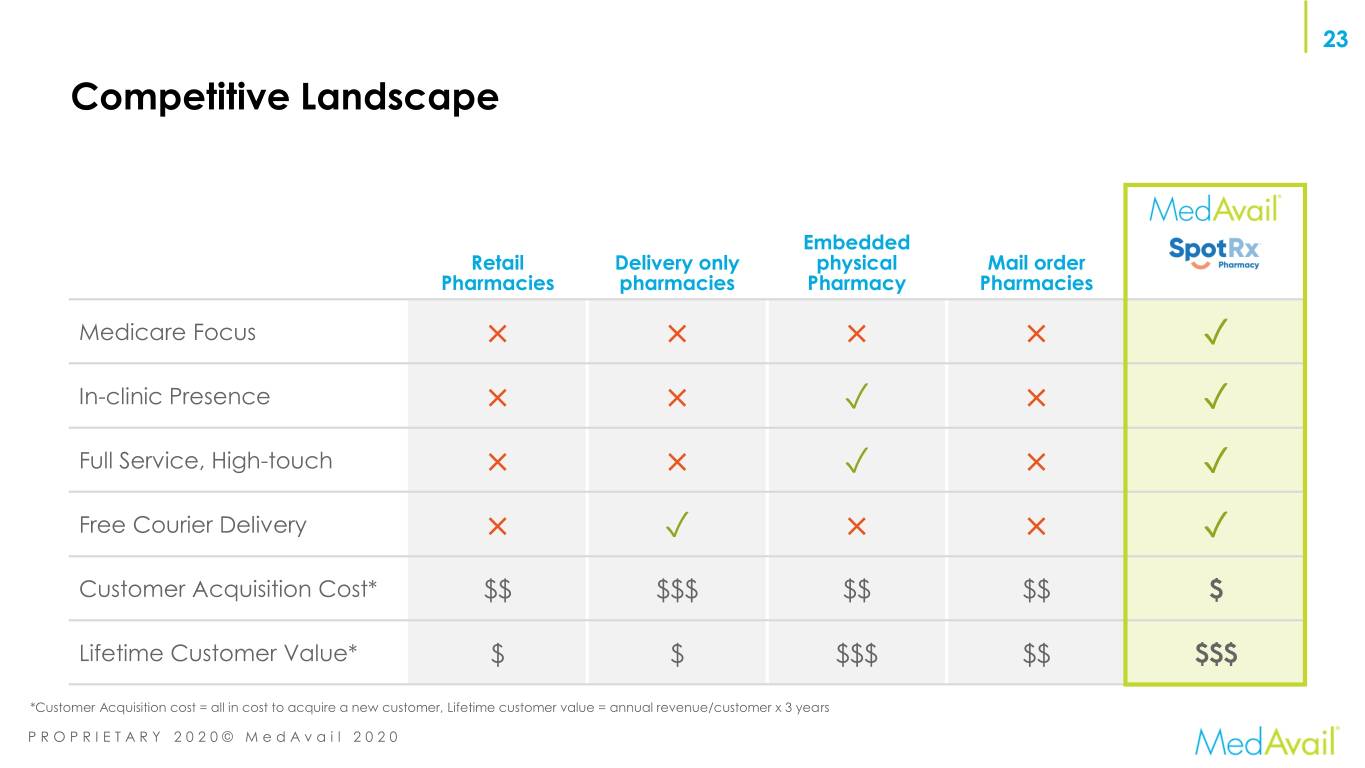

23 Competitive Landscape Embedded Retail Delivery only physical Mail order Pharmacies pharmacies Pharmacy Pharmacies Medicare Focus × × × × ✓ In-clinic Presence × × ✓ × ✓ Full Service, High-touch × × ✓ × ✓ Free Courier Delivery × ✓ × × ✓ Customer Acquisition Cost* $$ $$$ $$ $$ $ Lifetime Customer Value* $ $ $$$ $$ $$$ *Customer Acquisition cost = all in cost to acquire a new customer, Lifetime customer value = annual revenue/customer x 3 years PROPRIETARY 2020© MedAvail 2020

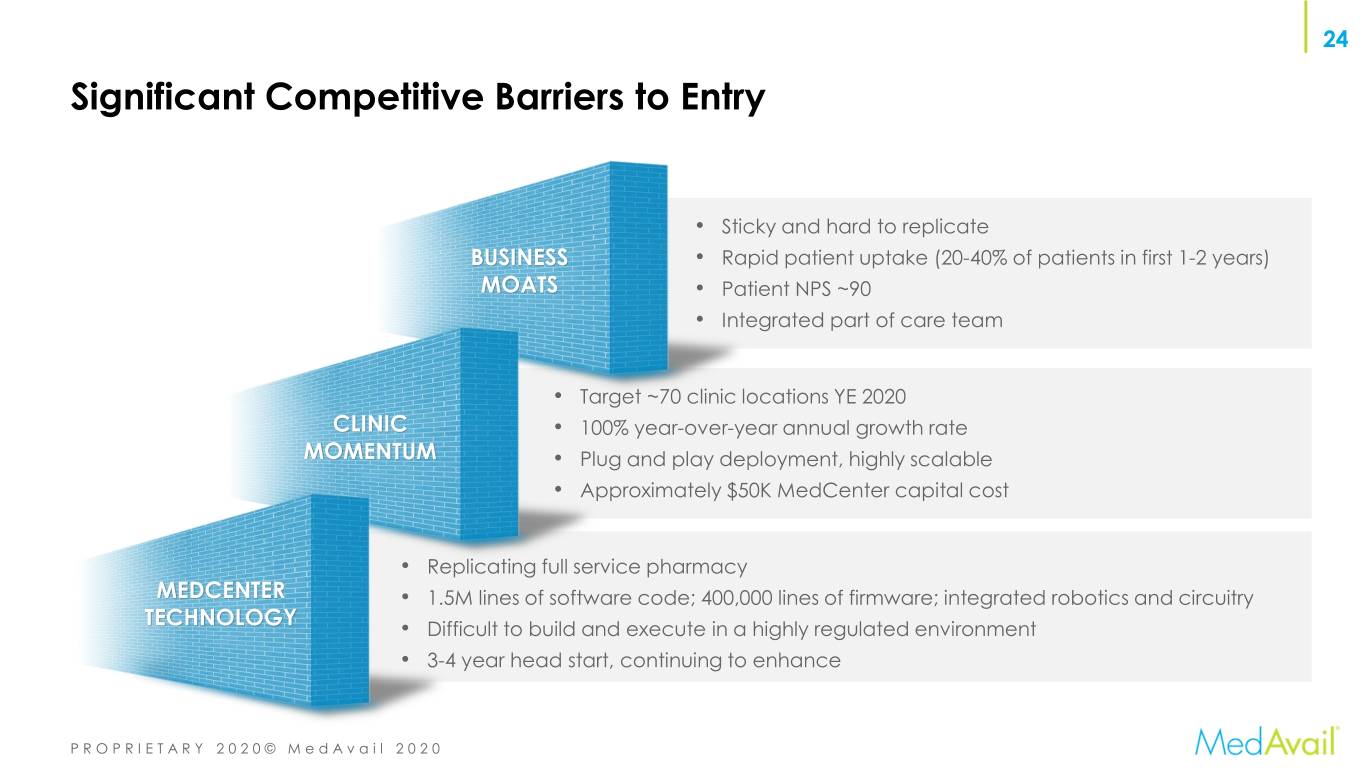

24 Significant Competitive Barriers to Entry Sticky and hard to replicate BUSINESS Rapid patient uptake (20-40% of patients in first 1-2 years) MOATS Patient NPS ~90 Integrated part of care team Target ~70 clinic locations YE 2020 CLINIC 100% year-over-year annual growth rate MOMENTUM Plug and play deployment, highly scalable Approximately $50K MedCenter capital cost Replicating full service pharmacy MEDCENTER 1.5M lines of software code; 400,000 lines of firmware; integrated robotics and circuitry TECHNOLOGY Difficult to build and execute in a highly regulated environment 3-4 year head start, continuing to enhance PROPRIETARY 2020© MedAvail 2020