Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF WITHUMSMITH+BROWN, PC, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - MedAvail Holdings, Inc. | f10k2017ex23-1_myosrenstech.htm |

| EX-32.1 - CERTIFICATION - MedAvail Holdings, Inc. | f10k2017ex32-1_myosrenstech.htm |

| EX-31.1 - CERTIFICATION - MedAvail Holdings, Inc. | f10k2017ex31-1_myosrenstech.htm |

| EX-10.10 - 2012 EQUITY INCENTIVE PLAN, AS AMENDED - MedAvail Holdings, Inc. | f10k2017ex10-10_myosrens.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2017

Or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 000-53298

| MYOS RENS TECHNOLOGY INC. |

| (Exact name of small business issuer as specified in its charter) |

| Nevada | 90-0772394 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

45 Horsehill Road, Suite 106

Cedar Knolls, New Jersey 07927

(Address of Principal Executive Offices)

(973) 509-0444

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Exchange Act:

Common Stock, $0.001 par value

Series A Preferred Stock Purchase Rights, $0.001 par value

(Title of class)

Securities registered under Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the outstanding common stock, other than shares held by persons who may be deemed affiliates of the registrant, computed by reference to the closing sales price of $1.82 for the registrant’s common shares on June 30, 2017, as reported on the Nasdaq Capital Market, was approximately $10.6 million.

As of March 27, 2018, there were 6,480,899 shares of the registrant’s common stock outstanding.

Table of Contents

| i |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Report”) includes certain “forward-looking statements” relating to such matters as anticipated financial performance, future revenues or earnings, business prospects, projected ventures, new products and services, anticipated market performance and similar matters. The words “may,” “will,” expect,” anticipate,” “continue,” “estimate,” “project,” “intend,” and similar expressions are intended to identify forward-looking statements regarding events, conditions, and financial trends that may affect future plans of operations, business strategy, operating results, and financial position.

We caution readers that a variety of factors could cause actual results to differ materially from anticipated results or other matters expressed in forward-looking statements. These risks and uncertainties, many of which are beyond our control, include:

| ● | our ability to market and generate sales of our products, including Fortetropin®, Qurr, and other products;

| |

| ● | our ability to successfully expand into new market categories, as well as geographic markets;

| |

| ● | our ability to adequately protect our intellectual property; | |

| ● | our ability to develop and introduce new products and mitigate competitive threats from other providers and products; | |

| ● | our ability to generate future sales and achieve profitability; | |

| ● | our ability to attract and retain key members of our management team; | |

| ● | our ability to collect our accounts receivable from our customers; | |

| ● | our reliance on third-party processors; | |

| ● | our ability to maintain and expand our manufacturing capabilities and reduce the cost of our products; | |

| ● | shortages in the supply of, or increases in the prices of, raw materials or shelf life limits on ingredients or finished product; | |

| ● | our ability to conduct research and development activities and the success of such activities to create new products and further validate our existing ones, including continued research on Fortetropin® and its impact on muscular disorders; | |

| ● | our ability to maintain raw material import permits, obtain regulatory approvals in countries of interest and comply with government regulations; | |

| ● | future financing plans; | |

| ● | our ability to attract additional investors, increase shareholder value and continue to comply with NASDAQ’s continuing listing standards; | |

| ● | anticipated needs for working capital; | |

| ● | anticipated trends in our industry; | |

| ● | the effect of economic conditions; and | |

| ● | competition existing today or that will likely arise in the future. |

Although management believes the expectations reflected in these forward-looking statements are reasonable, such expectations cannot guarantee future results, levels of activity, performance or achievements.

| ii |

| Item 1. | Business. |

Overview

We are an emerging bionutrition and biotherapeutics company focused on the discovery, development and commercialization of products that improve muscle health and function essential to the management of sarcopenia, cachexia and degenerative muscle diseases, and as an adjunct to the treatment of obesity. As used in this report, the “Company”, “MYOS”, “our”, or “we” refers to MYOS RENS Technology Inc. and its wholly-owned subsidiary, unless the context indicates otherwise.

We were incorporated under the laws of the State of Nevada on April 11, 2007. On March 17, 2016, we merged with our wholly-owned subsidiary and changed our name from MYOS Corporation to MYOS RENS Technology Inc. Prior to February 2011, we did not have any operations and did not generate revenues. In February 2011, we entered into an intellectual property purchase agreement pursuant to which our subsidiary purchased from Peak Wellness, Inc., or Peak, the intellectual property pertaining to Fortetropin®, a dietary supplement that has been shown in clinical studies to temporarily decrease the levels of serum myostatin, MYO-T12, a proprietary formulation containing Fortetropin®, certain trademarks, trade secrets, patent applications and certain domain names.

Since February 2011, our principal business activities have been to: (i) deepen our scientific understanding of the activity of Fortetropin®, which refers to a proprietary proteo-lipid composition derived from fertilized eggs of specific chicken species processed using a patented methodology which preserves the bioactivity of the constituent proteins and lipids, specifically as a natural, reversible, temporary reducing agent of myostatin, and to leverage this knowledge to strengthen and build our intellectual property; (ii) conduct research and development activities to evaluate myostatin modulation in a range of both wellness and disease states; (iii) identify other products and technologies which may broaden our portfolio and define a business development strategy to protect, enhance and accelerate the growth of our products; (iv) reduce the cost of manufacturing through process improvement; (v) identify contract manufacturing organizations that can fully meet our future growth requirements; (vi) develop a differentiated and advantaged consumer positioning, brand name and iconography; and, (vii) create sales and marketing capabilities to maximize near-term and future revenues.

We believe that existing wellness and therapeutic targets, such as myostatin, represent a rational entry point for additional drug discovery efforts and are evaluating a separate, concurrent objective in this area. We continue to pursue additional distribution and branded sales opportunities. We expect to continue developing our own core branded products in markets such as functional foods, sports and fitness nutrition and rehabilitation and restorative health and to pursue international sales opportunities. There can be no assurance that we will be able to secure distribution arrangements on terms acceptable to us, or that we will be able to generate significant sales of our current and future branded products.

Our executive offices are currently located at 45 Horsehill Road, Suite 106, Cedar Knolls, New Jersey 07927 and our telephone number is (973) 509-0444. Our corporate website address is http://www.myosrens.com and our new muscle health education and product website is http://www.qurr.com. Neither the information on our current or future website is, nor shall such information be deemed to be, a part of this Report or incorporated in filings we make with the Securities and Exchange Commission.

1

General

Following our purchase of Fortetropin® in February 2011, we have been focusing on the discovery, development, and commercialization of nutritional ingredients, functional foods, therapeutic products, and other technologies aimed at maintaining or improving the health and performance of muscle tissue. Our officers, directors and members of our Scientific Advisory Board, including Dr. Robert Hariri, Dr. Louis Aronne, Dr. Neilank Jha and Dr. Caroline Apovian, have significant research and development experience.

Fortetropin® is the Company’s proprietary all-natural food ingredient clinically shown to increase muscle size, lean body mass and strength as part of resistance training. Fortetropin® is made from fertilized chicken egg yolks using a proprietary process that retains the biological integrity and bioactivity of the product. In an animal study, Fortetropin® was shown to up-regulate muscle building pathways and down-regulate muscle degrading pathways. While Fortetropin® is our first proprietary ingredient, we plan to discover, develop, formulate and/or acquire additional products in the future.

We are developing nutritional and therapeutic products aimed at maintaining and improving the health and performance of muscle tissue. Our research is focused on developing strategies and therapeutic interventions to address muscle related conditions including sarcopenia, cachexia, and inherited and acquired muscle diseases as described in more detail below.

| ● | Sarcopenia is a degenerative process characterized by the progressive loss of muscle mass with advancing age. The loss of muscle affects all individuals regardless of ethnicity or gender although the rate and degree of muscle loss varies between individuals and is affected by many factors. Those individuals who have lost significant amounts of muscle mass and strength often require assistance for accomplishing daily living activities, which has a significant economic burden on a nation’s healthcare system and impacts the overall economy. In addition to the many direct costs, sarcopenia adversely affects the overall quality of life. |

| ● | Cachexia is a syndrome that occurs in many diseases such as cancer, chronic heart failure, chronic kidney failure and AIDS. It is characterized by a significant loss of body weight as a consequence of pathological changes in different metabolic pathways, with the loss of muscle mass as the core component of the syndrome. Cachexia leads to a poor quality of life and increased mortality. As skeletal muscle is diminished, individuals experience a reduced ability to move, a loss of strength, and an increase in conditions associated with immobility such as thrombosis, pneumonia, respiratory failure and ultimately death. Weight loss is an important prognosticator in cancer therapy with the greater the weight loss, generally the shorter the survival time. Weight loss in cancer patients due to cachexia arises from the loss of both adipose tissue and skeletal muscle. | |

| ● | Inherited and acquired muscle diseases, such as muscular dystrophy and muscle dysfunction that occur as a consequence of denervation such as seen in amyotrophic lateral sclerosis (ALS), are conditions marked by the progressive deterioration of muscle tissue that results in weakness and impairs normal function. These diseases are typified by difficulty with walking, balance, and coordination with many such diseases affecting speech, swallowing, and breathing. There are currently very few treatment options for most degenerative muscle diseases. |

2

Myostatin

Myostatin, which is a natural regulatory protein, plays a central role in skeletal muscle health. Interest in myostatin continues to grow within the medical community. Research on animals and humans with genetic deficiency for producing myostatin have shown an increased muscle mass, suggesting that myostatin is responsible for down-regulating muscle growth and development.

A 1997 article in the journal Nature first described the discovery of a novel member of the transforming growth factor-β (TGF-β) superfamily of growth and differentiation factors. This factor was expressed specifically in adult skeletal muscle and referred to as growth/differentiation factor-8 (GDF-8) (McPherron et al., 1997). The researchers created “knockout” mice, whereby they disrupted the expression of GDF-8 throughout the organism, with the resulting mice showing a large and widespread increase in skeletal muscle mass. Individual muscles of mutant animals weighted 2-3 times more than those of wild-type animals, with the increase a result of both muscle cell hypertrophy and hyperplasia. The newly created mice were subsequently named “mighty mice”. Based on the phenotype, the researchers dubbed the newly discovered protein myostatin.

This work suggests myostatin exerts an effect on both muscle hypertrophy and hyperplasia, as myostatin knock-out “mighty mice” were shown to have an increase in both the number of muscle fibers and in fiber sizes. Hypertrophy refers to the enlargement of a tissue or organ due to the enlargement of its component cells. In contrast, hyperplasia refers to an increase in the number of cells or a proliferation of cells. Both of these processes can lead to enlargement of an organ.

Skeletal muscle is the primary producer of myostatin, where it is secreted into the blood stream and acts as a negative regulator of muscle differentiation and growth. The protein begins as a 375 amino acid dimer that is cleaved by proteases to a 109 amino acid active domain. The active form of the protein binds to activin type II receptors, ActRIIA and ActRIIB (Lee et al., 2001). Binding to the receptors initiates a signaling cascade that results in an increase in protein breakdown and subsequent inhibition of protein synthesis.

3

Clinical Research to Evaluate Effects of Fortetropin®

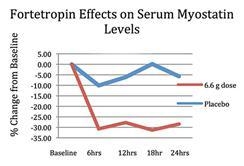

In March 2013, we completed a human clinical trial which demonstrated the beneficial effects of Fortetropin® in suppressing free serum myostatin levels. In this double blind, randomized, placebo-controlled, parallel, single dose study involving 12 healthy adult male subjects per arm, test subjects in the active arm were administered a 6.6 gram dose of Fortetropin® mixed with vanilla fat free/sugar free pudding. An equal amount of vanilla fat free/sugar free pudding alone was given to the placebo arm. Blood samples were collected at baseline (before dosing) and at 6, 12, 18, and 24 hours post dose intervals for measurement of myostatin blood concentration. Results demonstrated greater than 30% decrease in serum myostatin levels compared to baseline during the 24 hour period. No study related adverse events were reported during this study.

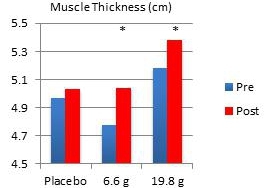

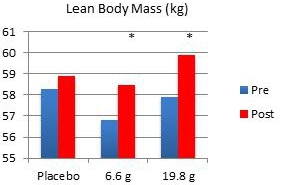

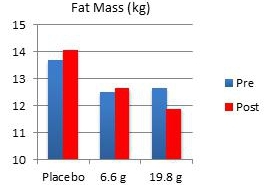

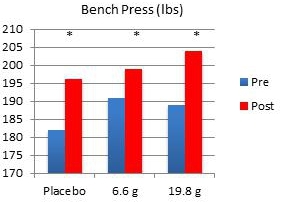

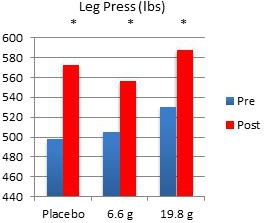

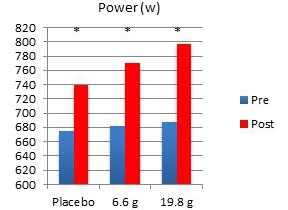

In another study performed on our behalf at the University of Tampa, a randomized, double-blind, placebo-controlled trial examined the effects of Fortetropin® on skeletal muscle growth, lean body mass, strength, and power in recreationally trained individuals who rely heavily on satellite cell activation. Forty-five subjects were divided into placebo, 6.6 gram and 19.8 gram dosing arms of Fortetropin® daily for a period of 12 weeks. All exercise sessions were conducted and monitored by trained personnel. Standardized diets consisted of roughly 54% carbohydrates, 22% fat and 24% protein. There were no differences in total calories and macronutrients between groups. Dual emission X-ray absorptiometry (DEXA) was utilized to measure lean body mass and fat mass. Direct ultrasound measurements determined muscle thickness of the quadriceps.

Results demonstrated a statistically significant increase in both muscle thickness and lean body mass in subjects taking Fortetropin® but not in subjects taking a placebo. Strength and power endpoints, as measured by bench press, leg press and Wingate power, significantly increased from baseline in all study groups. No study related adverse events were reported during the study.

|

|

4

|

|

|

|

* p <0.05 post measurement compared to pre

Association between Muscular Strength and Mortality

In a clinical study at the Karolinska Institutet’s Department of Biosciences and Nutrition at NOVUM, Unit for Preventive Nutrition, in Huddinge, Sweden, 8,762 men aged 20-80 were evaluated over an average period of 18.9 years in a prospective cohort study to measure the association between muscular strength and mortality in men. After adjusting for age, physical activity, smoking, alcohol intake, body mass index, baseline medical conditions, and family history of cardiovascular disease, the study found that muscular strength is inversely and independently associated with deaths from all causes and cancer in men. The findings were valid for men of normal weight, those who were overweight, and younger or older men, and were valid even after adjusting for several potential confounders, including cardiorespiratory fitness. This study extends previous studies that showed the importance of muscular strength as a predictor of death from all causes, cardiovascular disease, and cancer in a large cohort of men. Several prospective studies have also shown that muscular strength is inversely associated with all-cause mortality. These data suggests that muscular strength adds to the protective effect of cardiorespiratory fitness against the risk of death in men. Moreover, it might be possible to reduce all-cause mortality among men by promoting regular resistance training.

5

WADA Compliance

Fortetropin® has received Certified Drug Free® certification from the Banned Substances Control Group (BSCG). The BSCG Certified Drug Free® program is a comprehensive certification program for the dietary supplement industry and includes screening for substances prohibited by the World Anti-Doping Agency (WADA) along with most U.S. professional sports leagues. WADA is a foundation created through a collective initiative led by the International Olympic Committee to promote, coordinate and monitor the fight against drugs in sports.

Research and Development

As an advanced nutrition and biotherapeutics company, we are dedicated to basic and clinical research that supports our existing and future product portfolio. We are focused on the following areas of research:

Basic Research

| ● | Biochemical characterization of Fortetropin®, including cutting edge proteomic and lipidomic approaches | |

| ● | Novel biotherapeutics products | |

| ● | Computational design of novel peptide inhibitors of myostatin | |

| ● | Identifying proteins, peptides, and lipids responsible for pro-myogenic activity | |

| ● | Pro-myogenic activity of novel bioactive molecules and formulations |

Pre-Clinical Research

| ● | Effect of Fortetropin® to reverse disuse atrophy in dogs after orthopedic surgery to repair the cranial cruciate ligament (CCL) | |

| ● | PK/PD studies of novel bioactive molecules with pro-myogenic activity |

Clinical Research

| ● | Effect of Fortetropin® on lean muscle mass, thickness and strength in older adults | |

| ● | Effect of Fortetropin® on muscle function and recovery after orthopedic procedures | |

| ● | We expect our investment in research and development to continue in the future |

Our research program is actively evaluating the many active proteins, lipids and peptides in Fortetropin®. We believe our research programs will establish a basis for the continued prosecution of patent applications in order to protect and augment our intellectual property assets. We are dedicated to protecting our innovative technology.

6

Clinical and Basic Research Programs

We invest in research and development activities externally through academic and industry collaborations aimed at enhancing our products, optimizing manufacturing and broadening the product portfolio. We have developed the following collaborations with various academic centers:

| ● | In March 2018, we entered into a research agreement with Rutgers University, The State University of New Jersey, to work with Rutgers researchers in a program focused on discovering compounds and products for improving muscle health and performance. |

| ● | In December 2017, we entered into an agreement with the University of California, Berkeley’s Department of Nutritional Sciences & Toxicology. The research project will study the effects of Fortetropin® on increasing the fractional rate of skeletal muscle protein synthesis in men and women between 60 and 75 years old. The Principal Investigator for this clinical study is William J. Evans, PhD, Adjunct Professor of Human Nutrition at the Department of Nutritional Sciences & Toxicology at the University of California, Berkeley campus. Professor Evans, a leading authority in muscle health research, will coordinate the activities of a multi-disciplinary team of scientists and physicians. In this randomized, double-blind, placebo-controlled clinical study, 20 subjects, men and women 60 – 75 years of age, will consume either Fortetropin® or a placebo for 21 days along with daily doses of a heavy water tracer. After 21 days, a micro-biopsy will be collected from each subject to determine the fractional rate of muscle protein synthesis. MYOS anticipates the clinical study will be completed and its results announced in the second half of 2018. |

| ● | In April 2017, we entered into an agreement with the College of Veterinary Medicine at Kansas State University to study the impact of Fortetropin® on reducing muscle atrophy in dogs after tibial-plateau-leveling osteotomy (TPLO) surgery to repair the cranial cruciate ligament (CCL). The study is expected to be completed by the end of the second quarter of 2018. |

| ● | In May 2015, we initiated a dose response clinical study led by Jacob Wilson, Ph.D., CSCS*D, Professor of Health Sciences and Human Performance at the University of Tampa, to examine the effects of Fortetropin® supplementation on plasma myostatin levels at various dosing levels in young adult males and females. This study is intended to help us better define the dose response curve, the minimal effective dose and effects of Fortetropin® on serum myostatin. In this double blind placebo controlled clinical study, 80 male and female subjects ranging in ages between 18 and 22 were randomized into four groups such that no significant differences in serum myostatin concentration existed between groups. Following assignment to one of the four groups, blood samples were collected to establish baseline values. Subjects were subsequently supplemented with three different doses of Fortetropin® (2.0g, 4.0g and 6.6g) and a matching placebo for one week. Following one week of supplementation, blood samples were collected and serum myostatin levels were assayed. Results demonstrated that Fortetropin® is effective as a myostatin reducing agent at daily doses of 4.0g and 6.6g. This research, which continues to build upon our current understanding of Fortetropin®, may result in the formulation of new products. An abstract of this study was presented at the 2016 International Conference on Frailty & Sarcopenia Research (Philadelphia, PA) in April 2016. |

| ● | In August 2014, we entered into a research agreement with Human Metabolome Technologies America, Inc., (“HMT”), to apply their proprietary, state-of-the-art capillary electrophoresis-mass spectrometry (CE-MS) technologies to characterize the metabolomic profiles of plasma samples obtained from healthy male subjects who used either Fortetropin® or placebo with the goal of identifying metabolites with pro-myogenic activity in the plasma samples of subjects who took Fortetropin® as well as examining the effect on glucose and fat metabolism. HMT used a metabolite database of over 290 lipids and over 900 metabolites to identify potential plasma biomarkers of muscle growth. The study was completed during the fourth quarter of 2014. Initial data from this study indicated that subjects who received Fortetropin® displayed differential metabolomic profiles relative to subjects who received placebo. The results of this study enhance our understanding of the mechanism of action of Fortetropin® and provides guidance for the development of biotherapeutics based on Fortetropin®. Additionally, the early indications of plasma biomarkers may guide future study design for Fortetropin® clinical trials by identifying clinically-relevant endpoints and potential stratification of patient populations. The results from this study were presented at the Sarcopenia, Cachexia and Wasting Disorders Conference (Berlin, Germany) in December 2016. |

7

| ● | In May 2014, we entered into an agreement with the University of Tampa to study the effects of Fortetropin® supplementation in conjunction with modest resistance training in18-21 year old males. The study was a double-blind, placebo-controlled trial which examined the effects of Fortetropin® on skeletal muscle growth, lean body mass, strength, and power in recreationally trained males. Forty-five subjects were divided into placebo, 6.6g and 19.8g dosing arms of Fortetropin® daily for a period of 12 weeks. Results demonstrated a statistically significant increase in both muscle thickness and lean body mass in subjects taking Fortetropin® but not in subjects taking placebo. The clinical study also analyzed blood myostatin and cytokines levels via high-sensitivity enzyme-linked immunosorbent assay (“ELISA”) based analysis. Serum was analyzed for a plethora of relative cytokine levels via high-sensitivity enhanced chemiluminescent-based methods. The Interferon-Gamma (“IFN-γ”) inflammatory cytokine protocol screening showed no statistically significant changes in serum levels of IFN-γ for subjects in the placebo group. However, subjects in both Fortetropin® daily dosing arms experienced statistically significant decreases (p < 0.05) in serum levels of the IFN-γ inflammatory cytokine. IFN-γ is recognized as a signature pro-inflammatory cytokine protein that plays a central role in inflammation and autoimmune diseases. Excess levels of inflammatory cytokines are associated with muscle-wasting diseases such as sarcopenia and cachexia. The lipid serum safety protocol demonstrated that daily use of Fortetropin® at recommended and three times the recommended dose had no adverse lipid effect and did not adversely affect cholesterol, HDL or triglyceride levels. Data from the study was presented at the American College of Nutrition’s 55th annual conference. A separate mechanism of action study at the University of Tampa demonstrated that in addition to reducing serum myostatin levels, Fortetropin® showed activity in mTOR and Ubiquitin pathways, two other crucial signaling pathways in the growth and maintenance of healthy muscle. Specifically, the preclinical data showed that Fortetropin® up-regulates the mTOR regulatory pathway. The mTOR pathway is responsible for production of a protein kinase related to cell growth and proliferation that increases skeletal muscle mass. Up-regulation of the mTOR pathway is important in preventing muscle atrophy. We believe Fortetropin®’s ability to affect the mTOR pathway may have a significant impact in treating patients suffering from degenerative muscle diseases and suggests that Fortetropin®-based products may help slow muscle loss secondary to immobility and denervation. The preclinical data also demonstrated that Fortetropin® acts to reduce the synthesis of proteins in the Ubiquitin Proteasome Pathway, a highly selective, tightly regulated system that serves to activate muscle breakdown. Over-expression of the Ubiquitin Proteasome Pathway is responsible for muscle degradation. We believe Fortetropin®’s ability to regulate production in the Ubiquitin Proteasome Pathway may have significant implications for repairing age-related muscle loss and for patients suffering from chronic diseases such as cachexia. |

| ● | In May 2014, we entered into a three-year master service agreement with Rutgers University. The initial phase under the agreement was to develop cell-based assays for high-throughput screening studies of next generation myostatin inhibitors. Additionally, we initiated a second phase of the agreement to develop a secondary assay for measuring myostatin activity using a genetically engineered muscle cell line that fluoresce in the presence of myostatin. Phase I and II were completed in 2015. We believe the assays developed will enable us to elucidate the specific molecules in Fortetropin® that impart activity as it relates to the development of muscle tissue. |

The foregoing agreements are an integral part of our business strategy and we believe they will provide a clear scientific rationale for Fortetropin®’s role as an advanced nutritional product and support its use in different medical and health applications in the future.

We are also building a small molecule and biologics discovery program aimed at regulators of myostatin synthesis and activation and the different pathways that act upon muscle development. In July 2014, we entered into a research and development agreement with Cloud Pharmaceuticals, Inc., (“Cloud”), to discover product candidates related to the inhibition of targets in the myostatin regulatory pathway as well as inflammatory mediators associated with sarcopenia and cachexia. Cloud utilizes cloud computing technology to identify and design small molecule drug candidates based on their proprietary Inverse Design drug discovery platform. The research is focusing on the development of product candidates related to the myostatin pathway. Cloud has identified several peptides that may have myostatin inhibition properties based on computational modeling. We intend to evaluate the physiological activity of these peptides on myostatin.

We intend to pursue additional clinical studies and medical research to support differentiated and advantaged marketing claims, to build and enhance our competitive insulation through an aggressive intellectual property strategy, to develop product improvements and new products in consumer preferred dosage forms, to enhance overall marketing, to establish a scientific foundation for therapeutic applications for our technology, and to pursue best in class personnel.

Market Overview

According to the Natural Marketing Institute, the Dietary Supplement, Functional Food and Beverage, and Natural Personal Care markets represent more than $250 billion in annual worldwide sales. The global market for functional foods alone in 2017 was worth an estimated $54 billion. In 2018, it is expected to continue to grow and the United States is expected to be the fastest growing market for functional foods. The global sports nutrition market was valued at $30.7 billion in 2017, and is expected to grow at a compounded annual growth rate of 8.1% during the period from 2018 to 2022 up to $45 billion. We believe our proprietary ingredient, Fortetropin®, which is the only clinically proven natural supplement available in the market that temporarily reduces free serum myostatin level, is well-positioned to market to a wide base of consumers looking for nutritional and performance maximization as well as for wellness and maintenance products as they age. Additionally, the medical community has increased its focus on muscle health, specifically focusing on the aging U.S. population that can benefit most from myostatin modulation.

We believe the combination of the foregoing marketplace characteristics, combined with the experience of our directors and our management team and our current and future products, will enable our business model to succeed.

8

Strategy

Our strategy is to understand the complex genetic and molecular pathways regulating muscle mass and function as well as other disease mechanisms. Understanding the impact of complex regulatory pathways which act to build and maintain healthy lean muscle is central to our biotherapeutic research. We are developing nutritional products that target specific mechanisms to promote muscle health in ways that cannot be met by other diets or lifestyle changes.

We will seek to gain market share for our core branded products in functional foods, sports and fitness nutrition and rehabilitation and restorative health verticals by (i) formulating and developing new and complementary product lines, (ii) expanding U.S. distribution by increasing the channels of sale, (iii) expanding distribution geography beyond the U.S. and (iv) seeking strategic relationships with other distributors. Our strategy is to utilize the revenue and awareness generated by the sales and marketing of Fortetropin® to further advance our research and development of therapeutic treatments for muscular disorders, including sarcopenia.

Marketing, Sales and Distribution

Our commercial focus is to leverage our clinical data to develop multiple products to target the large, but currently underserved markets focused on muscle health. The sales channels through which we sell our products are evolving. The first product we introduced was MYO-T12, which was sold in the sports nutrition market. MYO T-12 is a proprietary formula containing Fortetropin® and other ingredients. The formula was sold under the brand name MYO-T12 and later as MYO-X through an exclusive distribution agreement with Maximum Human Performance (“MHP”). The exclusive distribution agreement with MHP terminated in March 2015 and there were no subsequent sales to MHP.

In February 2014, we expanded our commercial operations into the age management market through a distribution agreement with Cenegenics Product and Lab Services, LLC (“Cenegenics”), under which Cenegenics distributed and promoted a proprietary formulation containing Fortetropin® through its age management centers and its community of physicians focused on treating a growing population of patients focused on proactively addressing age-related health and wellness concerns. The distribution agreement with Cenegenics expired in December 2016. As of December 31, 2016 we recognized all of the deferred revenue. In 2017, we recorded $200 of sales to Cenegenics.

During the second quarter of 2015 we launched Rē Muscle HealthTM, our own direct-to-consumer brand with a portfolio of muscle health bars, meal replacement shakes and daily supplement powders each powered by a full 6.6 gram single serving dose of Fortetropin®. Our Rē Muscle Health products were sold through our e-commerce website, remusclehealth.com, and amazon.com until March 2017 when we introduced our new Qurr line of products.

On March 13, 2017 we launched Qurr, a Fortetropin®-powered product line formulated to support the vital role of muscle in overall well-being as well as in fitness. Qurr is a line of flavored puddings, powders, and shakes for daily use. Our Qurr line of muscle-focused over-the-counter products are available through a convenient, direct-to-consumer e-commerce platform. All Qurr products contain Fortetropin®, our proprietary ingredient which has been clinically demonstrated to reduce serum myostatin levels which helps increase muscle size and lean body mass in conjunction with resistance training.

We expect to launch our Fortetropin based pet product in the near future. Two veterinarian hospitals, which performed some informal observational studies with older dogs experiencing muscle atrophy and saw positive results after taking our pet product, are seeking to purchase our product. We believe that the positive feedback we are receiving from these two hospitals, together with the potential results from our Kansas State University study, will enable us to launch and grow our pet business product line.

We continue to pursue additional distribution and branded sales opportunities. There can be no assurance that we will be able to secure distribution arrangements on terms acceptable to us, or that we will be able to generate significant sales of our current and future branded products. We expect to continue developing our own core branded products in markets such as functional foods, sports and fitness nutrition and to pursue international sales opportunities. The growing awareness of the potential uses of myostatin reducing ingredients supports continued development of our own core products. We remain committed to continuing our focus on various clinical trials in support of enhancing our commercial strategy as well as enhancing our intellectual property assets, to develop product improvements and new products, and to reduce the cost of our products by finding more efficient manufacturing processes and contract manufacturers.

Intellectual Property

We have adopted a comprehensive intellectual property strategy, the implementation of which is ongoing. We are focusing our efforts on ensuring our current commercial products and processes, and those currently under development, are being protected to the maximum extent possible. We are in the process of filing multiple patent applications in the United States and abroad, and we are currently prosecuting pending patent applications in the United States, all of which are directed towards our compositions and methods of manufacturing the same. In addition to a proactive protection strategy, we are conducting defensive due diligence to ensure our products and processes do not encroach upon the rights of third parties. Moreover, we are also engaged in a survey of the intellectual property landscape of potential competitors, and are devising a proactive path to stay ahead of such potential competitors.

9

In August 2014, the U.S. Patent and Trademark Office, or USPTO, issued U.S. Patent No. 8,815,320 B2 to us covering our proprietary methods of manufacturing Fortetropin®. The patent entitled “Process for Producing a Composition Containing Active Follistatin,” provides intellectual property protection for manufacturing Fortetropin®, the key ingredient in our core commercial muscle health products, and carries a patent term through early 2033. Additionally, we are currently prosecuting a core patent application covering the basic science on which our business was built, which is currently undergoing examination at the USPTO. The scope of this application covers the various applications of avian follistatin products and the benefits thereof. In particular, this application is focused on the composition currently in our commercially available Fortetropin®-powered products and the known benefits thereof.

We intend to file as many applications as possible as continuation/divisional/continuation-in-part applications. Several additional pending patent applications that we are pursuing include:

| ● | Method of obtaining effective amounts of avian follistatin - covering a method of controlling the amount of avian follistatin and the concentrations thereof within a product by extracting the proteins from various parts of fertilized and unfertilized avian eggs. | |

| ● | Methods of treating degenerative muscle disease – covering methods of treating various degenerative muscle diseases, such as sarcopenia, with avian egg-based products and the compositions thereof. | |

| ● | Methods and products for increasing muscle mass – covering various combinations of proteins, lipids and other molecules, which are active in the natural form of our core commercial products, which may be combined in advantageous amounts to yield improved products and methods for increasing muscle mass. |

| ● | Egg-based product containing hydroxymethylbutyrate, or HMB, for the treatment of degenerative muscle disease – covering a line of products combining avian egg-based products with HMB for improved treatment of degenerative muscle diseases and the methods of treating the same. | |

| ● | Egg-based product containing leucine for treatment of degenerative muscle disease - covering a line of products combining avian egg-based products with leucine for improved treatment of degenerative muscle diseases and the methods of treating the same. | |

| ● | Methods of treatment of degenerative muscle disease using egg-based products and testosterone replacement therapy – covering methods of treating degenerative muscle disease in combination with testosterone replacement therapy for improved results. | |

| ● | Methods of treatment of cancer using avian egg powder. | |

| ● | Methods of treatment of insulin resistance and Type II diabetes using avian egg powder. | |

| ● | Methods of treatment of neurological diseases using avian egg powder. | |

| ● | Method of enhancing overall health and longevity using avian egg powder. |

In addition to patent protection, we are also engaged in protecting our brands, including corporate brands and product brands, and have sought trademark registrations in the United States for the same. We have implemented a clearance strategy for new brands that we intend to launch, to ensure any risk of encroaching on the rights of third parties is minimized.

We regard our trademarks and other proprietary rights as valuable assets and believe that protecting our key trademarks is crucial to our business strategy of building strong brand name recognition. These trademarks are crucial elements of our business, and have significant value in the marketing of our products. Federally registered trademarks have a perpetual life, provided that they are maintained and renewed on a timely basis and used correctly as trademarks, subject to the rights of third parties to attempt to cancel a trademark if priority is claimed or there is confusion of usage. We rely on common law trademark rights to protect our unregistered trademarks. Common law trademark rights generally are limited to the geographic area in which the trademark is actually used, while a United States federal registration of a trademark enables the registrant to stop the unauthorized use of the trademark by third parties in the United States. Much of our ongoing work, including our research and development, is kept highly confidential. As such, we have adopted corporate confidentiality policies that comply with the Uniform Trade Secrets Act and the New Jersey Trade Secret Act to protect our most valuable intellectual property assets.

10

Regulatory Environment

The importing, manufacturing, processing, formulating, packaging, labeling, distributing, selling and advertising of our current and future products may be subject to regulation by one or more federal or state agencies. The Food and Drug Administration, or the FDA, has primary jurisdiction over our products pursuant to the Federal Food, Drug and Cosmetic Act, as amended by the Dietary Supplement and Health Education Act, or the FDCA, and the regulations promulgated thereunder. The FDCA provides the regulatory framework for the safety and labeling of dietary supplements, foods and medical foods. In particular, the FDA regulates the safety, manufacturing, labeling and distribution of dietary supplements. In addition, the Animal Plant Health and Inspection Service, or APHIS, regulates the importation of our primary product from Germany. The Federal Trade Commission, or the FTC, and the FDA share jurisdiction over the promotion and advertising of dietary supplements. Pursuant to a memorandum of understanding between the two agencies, the FDA has primary jurisdiction over claims that appear on product labels and labeling and the FTC has primary jurisdiction of product advertising.

The term “medical foods” does not pertain to all foods fed to sick patients. Medical foods are prescription foods specially formulated and intended for the dietary management of a disease that has distinctive nutritional needs that cannot be met by normal diet alone. They were defined in the FDA’s 1988 Orphan Drug Act Amendments and are subject to the general food safety and labeling requirements of the FDCA but are exempt from the labeling requirements for health claims and nutrient content claims under the Nutrition Labeling and Education Act of 1990. Medical foods are distinct from the broader category of foods for special dietary use and from traditional foods that bear a health claim. In order to be considered a medical food, a product must, at a minimum, be a specially formulated and processed product (as opposed to a naturally occurring food in its natural state) for oral ingestion or tube feeding (nasogastric tube), be labeled for the dietary management of a specific medical disorder, disease or condition for which there are distinctive nutritional requirements and be intended to be used under medical supervision.

Compliance with applicable federal, state, and local laws and regulations is a critical part of our business. We endeavor to comply with all applicable laws and regulations. However, as with any regulated industry, the laws and regulations are subject to interpretation and there can be no assurances that a government agency would necessarily agree with our interpretation of the governing laws and regulations. Moreover, we are unable to predict the nature of such future laws, regulations, interpretations or applications, nor can we predict what effect additional governmental regulations or administrative orders, when and if promulgated, would have on our business in the future. These regulations could, however, require the reformulation of our products to meet new standards, market withdrawal or discontinuation of certain products not able to be reformulated. The risk of a product recall exists within the industry although we endeavor to minimize the risk of recalls by distributing products that are not adulterated or misbranded. However, the decision to initiate a recall is often made for business reasons in order to avoid confrontation with the FDA.

Our products are required to be prepared in compliance with the FDA’s Good Manufacturing Practices, or GMPs, as set forth in 21 CFR Part 111. Fortetropin®, the active ingredient in our products, must be imported into the United States in conformance with USDA-APHIS’s requirements for egg products. Other statutory obligations include reporting all serious adverse events on a Medwatch Form 3500A. To date, we have not filed a Medwatch Form 3500A with the FDA nor have we been placed on notice regarding any serious adverse events related to any of our products. Since eggs are considered a major food allergen under the Food Allergen Labeling and Consumer Protection Act of 2004, we are required to label all our products containing Fortetropin® to note that they contain egg product.

Advertising of dietary supplement products is subject to regulation by the FTC under the Federal Trade Commission Act, or FTCA, which prohibits unfair methods of competition and unfair or deceptive trade acts or practices in or affecting commerce. The FTCA provides that the dissemination of any false advertising pertaining to foods, including dietary supplements, is an unfair or deceptive act or practice. Under the FTC’s substantiation doctrine, an advertiser is required to have a reasonable basis for all objective product claims before the claims are made. All advertising is required to be truthful and not misleading. All testimonials are required to be typical of the results the consumer may expect when using the product as directed. Accordingly, we are required to have adequate substantiation of all material advertising claims made for our products. Failure to adequately substantiate claims may be considered either deceptive or unfair practices.

11

In addition, medical foods must comply with all applicable requirements for the manufacturing of foods, including food Current Good Manufacturing Practices (“cGMP”), registration of food facility requirements and, if applicable, FDA regulations for low acid canned food and emergency permit controls. The FDA considers the statutory definition of medical foods to narrowly constrain the types of products that fit within this category of food. The FDA inspects medical food manufacturers annually to assure the safety and integrity of the products. Failure of our contract manufacturers to comply with applicable requirements could lead to sanctions that could adversely affect our business.

We cannot predict what effect additional domestic or international governmental legislation, regulations, or administrative orders, when and if promulgated, would have on our business in the future. New legislation or regulations may require the reformulation of certain products to meet new standards, require the recall or discontinuance of certain products not capable of reformulation, impose additional record keeping or require expanded documentation of the properties of certain products, expanded or different labeling or scientific substantiation.

Manufacturing; Raw Materials and Suppliers

We are committed to producing and selling highly efficacious products that are trusted for their quality and safety. To date, our products have been outsourced to third party manufacturers where the products are manufactured in full compliance with cGMP standards set by the FDA. All of the raw materials for our current products are currently sourced from third-party suppliers. Any shortages in our raw materials could result in materially higher raw material prices and adversely affect our ability to source our product. Since the beginning of 2012, we have been focusing on the efficiency and economics of manufacturing Fortetropin®. Our management has examined the production cost and is working to achieve cost savings in production.

We currently have an agreement with only one third-party manufacturer of Fortetropin®, who will manufacture the formula exclusively for us in perpetuity, and may not manufacture the formula for other entities. We have multiple vendors for blending, packaging and labeling our products.

Competition

Given the large populations that could potentially benefit from myostatin modulation, a number of pharmaceutical companies are currently developing various types of myostatin inhibitors. Eli Lilly and Co., Novartis AG, Pfizer Inc., Scholar Rock and Acceleron Pharma Inc, are among the companies that we are aware of that are testing new compounds in the field of myostatin inhibition. The market for nutritional supplements is highly competitive. Companies operating in the space include PepsiCo Inc., Glanbia Plc. GNC Holdings, The Coca-Cola Company, GlaxoSmithKline, Abbott Laboratories, Nestle S.A. and Universal Nutrition. Competition is based on price, quality, customer service, marketing and product effectiveness. Our competition includes numerous nutritional supplement companies that are highly fragmented in terms of geographic market coverage, distribution channels and product categories. In addition, large pharmaceutical companies and packaged food and beverage companies compete with us in the nutritional supplement market. These companies and certain nutritional supplement companies have broader product lines and/or larger sales volumes than us and have greater financial and other resources available to them and possess extensive manufacturing, distribution and marketing capabilities. Other companies are able to compete more effectively due to a greater extent of vertical integration. Private label products of our competitors, which in recent years have significantly increased in certain nutrition categories, compete directly with our products. In several product categories, private label items are the market share leaders. Increased competition from such companies, including private label pressures, could have a material adverse effect on our results of operations and financial condition. Many companies within our industry are privately-held and therefore, we are unable to assess the size of all of our competitors or where we rank in comparison to such privately-held competitors with respect to sales.

Insurance

We maintain commercial liability, including product liability coverage, and property insurance. Our policy provides for a general liability of $5.0 million per occurrence, and $10.0 million annual aggregate coverage. We carry property coverage on our main office facility to cover our legal liability, tenant’s improvements, business property, and inventory. We maintain commercial general liability and products liability insurance with coverage of up to $5.0 million.

Employees

We currently have ten full-time employees (including one executive officer). We also employ several consultants. None of our employees are represented by a labor union and we consider our employee relations to be good.

12

| Item 1A. | Risk Factors. |

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risk factors set forth below, and other information contained in this Report including our financial statements and the related notes thereto. The risks and uncertainties set forth below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also adversely affect us. If any of the described risks occur, our business, financial condition or results of operations could be materially harmed. In such case, the value of our securities could decline and you may lose all or part of your investment. Amounts in this section are in thousands, unless otherwise indicated.

RISKS RELATING TO OUR BUSINESS

Our limited operating history makes it difficult to evaluate our future prospects and results of operations.

We are an early stage company and have a limited operating history. Our future prospects should be considered in light of the risks and uncertainties experienced by early stage companies in evolving markets such as the market for our current and future products, if any, in the United States. We will continue to encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

| ● | build a strong and compelling consumer brand; | |

| ● | adequately protect and build our intellectual property; | |

| ● | develop new products; | |

| ● | conduct successful research and development activities; | |

| ● | increase awareness of our products and develop customer loyalty; | |

| ● | respond to competitive market conditions; | |

| ● | respond to requirements and changes in our regulatory environment; | |

| ● | maintain effective control of our costs and expenses; | |

| ● | availability of sufficient capital resources to adequately promote and market our products; and | |

| ● | attract, retain and motivate qualified personnel. |

If we are unable to address any or all of the foregoing risks, our business may be materially and adversely affected.

If we are unable to successfully market and promote our own core branded products, we will not be able to increase our sales and our business and results of operations would be adversely affected.

In March 2017, we launched Qurr, our proprietary branded products, using multiple delivery formats. Successfully marketing and promoting products is a complex and uncertain process, dependent on the efforts of management, outside consultants and general economic conditions, among other things. There is no assurance that we will successfully market and/or promote our own core branded products. Any factors that adversely impact the marketing or promotion of our products including, but not limited to, competition, acceptance in the marketplace, or delays related to production and distribution or regulatory issues, will likely have a negative impact on our cash flow and operating results. The commercial success of our products also depends upon various other factors including:

| ● | the quality and acceptance of other competing brands and products; | |

| ● | creating effective distribution channels and brand awareness; |

| ● | critical reviews; | |

| ● | the availability of alternatives; | |

| ● | general economic conditions; and | |

| ● | the availability of sufficient capital resources to adequately promote and market our products. |

Each of these factors is subject to change and cannot be predicted with certainty. We cannot assure you that we will be successful in marketing or promoting any of our own core branded products. If we are unable to successfully market and promote our own core branded products or any enhancements to our products which we may develop, we will not be able to increase our sales, and our results of operations would be adversely affected.

13

If distributors are unable or unwilling to purchase our products and we are unable to secure alternative distributors or customers, our operating results and financial condition will be adversely affected since historically this represents a large percentage of our sales.

We have previously sold our products primarily through two distributors, MHP and Cenegenics. For the year ended December 31, 2017, our net sales were $526, of which 38% was attributable to Cenegenics. For the year ended December 31, 2016, our net sales were $327, of which 50% was attributable to Cenegenics. We did not sell any products through MHP during the years ended December 31, 2016 and 2017.

In March 2017 we launched a new product line Qurr which we sell direct to consumers. About 80% of our sales were purchased via our website www.qurr.com and the remainder were purchased via our amazon.com site.

If we decide to continue selling our products to distributors and our prior distributors are unable or unwilling to purchase our products and we are unable to secure alternative distributors or customers, our operating results and financial condition will be adversely affected.

We have a history of losses and cash flow deficits, and we expect to continue to operate at a loss and to have negative cash flow for the foreseeable future, which could cause the price of our stock to decline.

At December 31, 2017, we had cumulative net losses from inception of $31,844. Our net loss for the years ended December 31, 2017 and 2016 were $4,058 and $4,341, respectively. We also had negative cash flow from operating activities. Historically, we have funded our operations from the proceeds from the sale of equity securities, debt issuances, and to a lesser extent, internally generated funds. Our strategic business plan is likely to result in additional losses and negative cash flow for the foreseeable future. We cannot give assurances that we will ever become profitable.

There is no assurance that we will be able to increase our sales.

Our sales for the year ended December 31, 2017 were $526 and our sales for the year ended December 31, 2016 were $327. We cannot give assurances that our current business model will enable us to increase our sales.

The report of our independent registered public accounting firm expresses substantial doubt about our ability to continue as a going concern.

Our auditors have indicated in their report on our financial statements for the years ended December 31, 2017 and December 31, 2016 that conditions exist that raise substantial doubt about our ability to continue as a going concern since we may not have sufficient capital resources from operations and existing financing arrangements to meet our operating expenses and working capital requirements. A “going concern” opinion could impair our ability to finance our operations through the sale of equity, incurring debt, or other financing alternatives. There can be no assurance that we will be able to generate the level of operating revenues projected in our business plan, or if additional sources of financing will be available on acceptable terms, if at all. If no additional sources of financing become available, our future operating prospects may be adversely affected and investors may lose all or a part of their investment.

Our intangible assets, which represent a significant amount of our total assets, are subject to impairment testing and may result in impairment charges, which would adversely affect our results of operations and financial condition.

At December 31, 2017, our total assets were $4,795, of which $1,640, or approximately 34%, represents intangible assets, net of accumulated amortization. Our intangible assets primarily relate to intellectual property pertaining to Fortetropin®, including the MYO-T12 formula, trademarks, trade secrets, patent application and domain names acquired from Peak Wellness, Inc. in February 2011. The intellectual property asset was initially recorded as an indefinite-lived intangible asset and tested annually for impairment or more frequently if events or circumstances changed that could potentially reduce the fair value of the asset below its carrying value. Impairment testing requires the development of significant estimates and assumptions involving the determination of estimated net cash flows, selection of the appropriate discount rate to measure the risk inherent in future cash flow streams, assessment of an asset’s life cycle, competitive trends impacting the asset as well as other factors. Our forecasted future results and related net cash flows contemplate the direct offering of product and successfully establishing future sales channels among other factors. Changes in these underlying assumptions could significantly impact the asset’s estimated fair value.

In 2011, based on (i) assessment of current and expected future economic conditions, (ii) trends, strategies and projected revenues and (iii) assumptions similar to those that market participants would make in valuing our intangible assets, management determined that the carrying values of the intellectual property asset exceeded its fair value. Accordingly, we recorded noncash impairment charges totaling $2,662 and reduced the intellectual property asset to its fair value of $2,000. During the second quarter of 2015, management made an assessment and based on expansion into new markets and introduction of new formulas determined that the intellectual property had a finite useful life of ten (10) years and began amortizing the carrying value of the intellectual property asset over its estimated useful life. Management made a separate determination that no further impairment existed at that time. Based on fourteen consecutive quarters of minimal revenues combined with changes in the sales channels through which we sell our products and our inability to predict future orders, if any, from MHP or Cenegenics or to what extent we will be able to secure new distribution arrangements, we tested the intellectual property for impairment in the fourth quarter of 2017 and 2016 and determined that the asset value was recoverable and therefore no impairment was recognized. Nevertheless, a significant amount of our total assets are subject to impairment testing and may result in noncash impairment charges, which would adversely affect our results of operations and financial condition.

14

We will need to raise additional funds in the future to continue our operations. If we are unable to raise funds as needed, we may not be able to maintain our business.

We expect that our current funds will not be sufficient to fund our projected operations through December 2018. We require substantial funds for operating expenses, research and development activities, to establish manufacturing capability, to develop consumer marketing and retail selling capability, and to cover public company costs. In addition, we have incurred substantial costs in connection with our litigation with Mr. Ren and RENS Technology Inc., or the RENS litigation See “Part 1 Item 3 – Legal Proceedings” for additional information regarding the RENS litigation. The extent of our capital needs will depend on numerous factors, including (i) our profitability, (ii) the release of competitive products, (iii) the level of investment in research and development, (iv) the amount of our capital expenditures, (v) the amount of our working capital including collections on accounts receivable, (vi) the sales, marketing and distribution investment needed to develop and launch our own core branded products, (vii) cash generated by sales of those products and (viii) the status of the RENS litigation. We expect that we will need to seek additional funding in 2018 through public or private financing or through collaborative arrangements with strategic partners.

We cannot assure you that we will be able to obtain additional financing or that such financing would be sufficient to meet our needs. If we cannot obtain additional funding, we may be required to limit our marketing efforts, decrease or eliminate capital expenditures or cease all or a portion of our operations, including any research and development activities. Any available additional financing may not be adequate to meet our goals.

Even if we are able to locate a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us.

Any future capital investments could dilute or otherwise materially adversely affect the holdings or rights of our existing stockholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. There is no assurance that any additional financing will be available, or if available, will be on terms favorable to us. In addition, any equity financing would result in dilution to stockholders.

Since our revenues are generated in U.S. dollars but a portion of our expenses are incurred in foreign currencies, our earnings may be reduced due to currency exchange rate fluctuations.

Our revenues are generated in U.S. dollars, while a portion of our expenses related to our supply agreement are incurred in foreign currencies, principally the payments to our primary manufacturer that are paid in euros. The exchange rates between the U.S. dollar and other currencies fluctuate and are affected by, among other things, changes in political and economic conditions. Any significant fluctuation in the exchange rate for these currencies may materially and adversely affect our earnings, cash flows and financial condition.

If we are unable to manage our infrastructure growth, our business results may be materially and adversely affected.

We need to manage our infrastructure growth to support and maximize our potential revenue growth and achieve our expected business results. Engaging the full capacity of our limited staff may place a significant strain on our management, operations, and accounting and information systems. We expect that we will need to continue to improve our financial controls, operating procedures and management information systems. The failure to manage our infrastructure growth could adversely affect our business results.

If we are not able to implement our business objectives, our operations and financial performance may be adversely affected.

Our principal objectives are to: (i) create a sales platform through marketing products containing our proprietary ingredient Fortetropin® in established, growing, and new markets and strategic selection of partnerships and collaborations to maximize near-term and future revenues, (ii) deepen the scientific understanding of the activity of Fortetropin®, specifically as a natural, reversible, temporary modulator of the regulatory protein myostatin, and to leverage this knowledge to strengthen and build our intellectual property, (iii) conduct research and development activities to evaluate myostatin modulation in a range of both wellness and disease states, (iv) identify other products and technologies which may broaden our portfolio and define a business development strategy to protect, enhance and accelerate the growth of our products, (v) reduce the cost of manufacturing through process improvement, and (vi) identify contract manufacturing organizations that can fully meet our future growth requirements. Our business plan is based on circumstances currently prevailing and assumptions that certain circumstances will or will not occur as well as the inherent risk and uncertainties involved in various stages of development. However, there is no assurance that we will be successful in achieving our objectives. If we are not able to achieve our objectives, our business operations and financial performance may be adversely affected.

15

If we lose the services of our key personnel, we may be unable to replace them, and our business, financial condition and results of operations could be adversely affected.

Our success largely depends on the continued skills, experience, efforts and policies of our management, directors and other key personnel and our ability to continue to attract, motivate and retain highly qualified employees. In particular, certain of our directors, including Dr. Robert Hariri and Dr. Louis Aronne have significant research and development experience and are integral to the creation of our future products and the execution of our business strategy. In addition, our prospects depend substantially on the services of our executive management team.

If one or more of our key employees or directors leaves us, we will need to find a replacement with the combination of skills and attributes necessary to execute our strategy. Because competition for skilled personnel is intense, and the process of finding qualified individuals can be lengthy and expensive, we believe that the loss of the services of key personnel could adversely affect our business, financial condition and results of operations. We cannot assure you that we will continue to retain such personnel.

Our success depends on our ability to anticipate and respond in a timely manner to changing consumer demands.

Our success depends on the appeal of our current and future products to a broad range of consumers whose preferences cannot be predicted with certainty and are subject to change. If our current and future products do not meet consumer demands, our sales may decline. In addition, our growth depends upon our ability to develop new products through product line extensions and product modifications, which involve numerous risks. We may not be able to accurately identify consumer preferences, translate our knowledge into customer accepted products, establish the appropriate pricing for our products or successfully integrate these products with our existing product platform or operations. We may also experience increased expenses incurred in connection with product development, marketing and advertising that are not subsequently supported by a sufficient level of sales, which would negatively affect our margins. Furthermore, product development may divert management’s attention from other business concerns, which could cause sales of our existing products to suffer. We cannot assure you that newly developed products will contribute favorably to our operating results.

Products often have to be promoted heavily in stores or in the media to obtain visibility and consumer acceptance. Acquiring distribution for products is difficult and often expensive due to slotting and other promotional charges mandated by retailers. Products can take substantial periods of time to develop consumer awareness, consumer acceptance and sales volume. Accordingly, some products may fail to gain or maintain sufficient sales volume and as a result may have to be discontinued.

If our current or future products fail to properly perform, our business could suffer due to increased costs and reduced income. Failure of our current or future products to meet consumer expectations could result in decreased sales, delayed market acceptance of our products, increased accounts receivable, unsaleable inventory and customer returns, and divert our resources to reformulation or alternative products.

Intense competition from existing and new entities may adversely affect our revenues and profitability.

We face competitors that will attempt to create, or are already creating, products that are similar to our current and future products. Many of our current and potential competitors have significantly longer operating histories and significantly greater managerial, financial, marketing, technical and other competitive resources, as well as greater brand recognition, than we do. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers or adopt more aggressive pricing policies. We cannot assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not harm our business.

Our business is dependent on continually developing or acquiring new and advanced products and processes and our failure to do so may cause us to lose our competitiveness and may adversely affect our operating results.

To remain competitive in our industry, we believe it is important to continually develop new and advanced products and processes. There is no assurance that competitive new products and processes will not render our existing or new products obsolete or non-competitive. Our competitiveness in the marketplace relies upon our ability to continuously enhance our current products, introduce new products, and develop and implement new technologies and processes. Our failure to evolve and/or develop new or enhanced products may cause us to lose our competitiveness in the marketplace and adversely affect our operating results.

Adverse publicity or consumer perception of our products and any similar products distributed by others could harm our reputation and adversely affect our sales and revenues.

We are highly dependent upon positive consumer perceptions of the safety, efficacy and quality of our products as well as similar products distributed by our competitors. Consumer perception of dietary supplements and our products in particular can be substantially influenced by scientific research or findings, national media attention including social media attention and other publicity about product use. Adverse publicity from such sources regarding the safety, efficacy or quality of dietary supplements, in general, and our products in particular, could harm our reputation and results of operations. The mere publication of reports asserting that such products may be harmful or questioning their efficacy could have a material adverse effect on our business, financial condition and results of operations, regardless of whether such reports are scientifically supported or whether the claimed harmful effects would be present at the dosages recommended for such products.

16

Marketing of our products through social media and other advertising methods could harm our business and reputation.

There are many considerations that can affect the marketing and advertising of our products through social media such as claims and concerns about safety, new discoveries, patent disputes and claims about adverse side effects. Further, claims and concerns about safety can result in a negative impact on product sales, product recalls or withdrawals, and/or consumer fraud, product liability and other litigation and claims. A video published online, a blog on the internet, or a post on a website, can be distributed rapidly and negatively harm our reputation.

Cyberattacks and other security breaches could compromise our proprietary and confidential information as well as our e-commerce infrastructure and customer database which could harm our business and reputation.