Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DLH Holdings Corp. | form8-kjuly2020pptn027.htm |

Your Mission Is Our Passion Investor Presentation ZACH PARKER | PRESIDENT & CEO KATHRYN JOHNBULL | CFO JULY 21, 2020 © Copyright 2020 DLH Holdings Corp. All Rights Reserved. © Copyright 2020 DLH Holdings Corp. All Rights Reserved.

Forward-looking Statements "Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or DLH`s future financial performance. Any statements that refer to expectations, projections or other characterizations of future events or circumstances or that are not statements of historical fact (including without limitation statements to the effect that the Company or its management “believes”, “expects”, “anticipates”, “plans”, “intends” and similar expressions) should be considered forward looking statements that involve risks and uncertainties which could cause actual events or DLH’s actual results to differ materially from those indicated by the forward-looking statements. Forward-looking statements in this release include, among others, statements regarding, estimates of future revenues, operating income, earnings, earnings per share, backlog, and cash flows. These statements reflect our belief and assumptions as to future events that may not prove to be accurate. Our actual results may differ materially from such forward-looking statements made in this release due to a variety of factors, including: the outbreak of the novel coronavirus (“COVID-19”), including the measures to reduce its spread, and its impact on the economy and demand for our services, are uncertain, cannot be predicted, and may precipitate or exacerbate other risks and uncertainties; the risk that we will not realize the anticipated benefits of an acquisition; the challenges of managing larger and more widespread operations resulting from the acquisition; contract awards in connection with re-competes for present business and/or competition for new business; compliance with new bank financial and other covenants; changes in client budgetary priorities; government contract procurement (such as bid protest, small business set asides, loss of work due to organizational conflicts of interest, etc.) and termination risks; the ability to successfully integrate the operations of future acquisitions; and other risks described in our SEC filings. For a discussion of such risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s periodic reports filed with the SEC, including our Annual Report on Form 10-K for the fiscal year ended September 30, 2019, as well as subsequent reports filed thereafter. The forward-looking statements contained herein are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our industry and business. Such forward-looking statements are made as of the date hereof and may become outdated over time. The Company does not assume any responsibility for updating forward-looking statements, except as may be required by law. © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 2

Agenda OVERVIEW 2 FINANCIAL HIGHLIGHTS Zach Parker Kathryn M. JohnBull QUESTIONS AND President & CEO Chief Financial Officer, ANSWERS DLH Holdings Corp. DLH Holdings Corp. © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 3

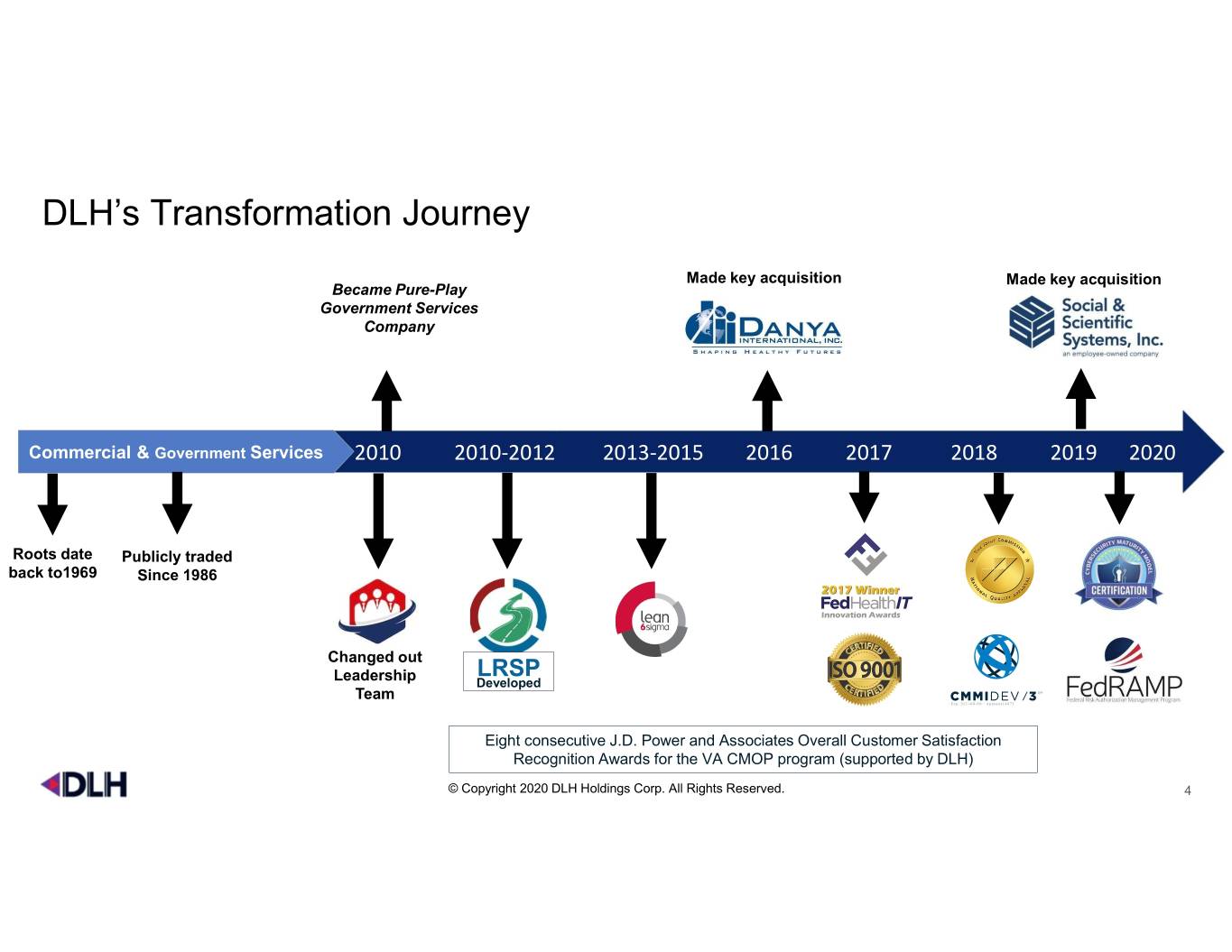

DLH’s Transformation Journey Made key acquisition Made key acquisition Became Pure-Play Government Services Company Commercial & Government Services 2010 2010-2012 2013-2015 2016 2017 2018 2019 2020 Roots date Publicly traded back to1969 Since 1986 Changed out LRSP Leadership Developed Team Eight consecutive J.D. Power and Associates Overall Customer Satisfaction Recognition Awards for the VA CMOP program (supported by DLH) © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 4

Business Overview Overview Technology Enabled Services and Solutions Program Monitoring & Founded 1969 Healthcare Research Disease Prevention Patient Care Services Evaluation Headquarters: Atlanta, GA Complementary Offices: Silver Spring, MD Durham, NC Kampala, UG 3 Market Focus Areas Benefits Consolidation Nasdaq Public Since Defense and 1986 Human Services Public Health & DLHC Veterans & Solutions Life Sciences Solutions • ~2,000 employees • Located in > 30 Locations in the US and overseas © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 5

Strong Portfolio of Services Key Federal Customers DOD & Veteran Health Services Market Human Services & Pro Forma Annual Solutions Market Revenue: ~$90M Pro Forma Annual Revenue: ~$40M 20% 45% ~$200M Pro Forma Annual Revenue 35% Public Health & Life Sciences Market MRDC Pro Forma Annual Revenue: ~$70M 6 © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 6

Unique Value Proposition Evidence-based Decision-making Defense and Services Veterans Solutions Cloud Migration and Computing Secure Human Services Data & Solutions Analytics Business and Health Systems Cybersecurity Public Health & Life Sciences Infrastructure DLH InfiniByte Cloud © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 79

Organic Growth Drivers Clinical Trials Secure Data & Laboratory Case Analytics Services Management Performance Strategic Digital Evaluation Communications Operational System Logistics & Modernization Readiness © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 8

Healthy Growth Profile Key Target Agencies As of March 31, 2020, the DLH pipeline Opportunities of qualified new business opportunities was over $1 billion An estimated $600-$700 million of those Timing opportunities are expected to be decided in late FY20 or throughout FY21 New opportunities are well distributed Markets across DLH end markets, targeting existing and adjacent agencies. © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 9

COVID-19 Impact / Opportunities Defense & Veterans Human Services and Public Health and Life Health Solutions Solutions Sciences DLH TACKLING COVID-19 FOR THE VA, DOD, CDC, NIH, AND OTHERS • Care and treatment of military • Specialized communications • Clinical trials for therapeutics • Rx expansion for veterans • Pandemic-related websites and vaccine development • Prospects for behavioral health • Social media outreach / metrics • Preparedness & Response • Environmental Implications © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 10

New COVID-19 Public Health & Life Sciences Work CLINICAL RESEARCH TRIALS & LABORATORY SERVICES • Over $15 million of new awards thus far in calendar 2020 • Conducting trials of the safety and efficacy of investigational therapeutics for the treatment of COVID-19 • Observational studies of outpatients with COVID-19 • Clinical Research Organization support services to provide infrastructure to exchange data among scientific stakeholders • Large network consortium of partner medical centers, clinics, academic institutions • Study of immune aging in smokers in relation to COVID susceptibility • Investigating interactions of COVID-19 with chronic diseases including types of cancer, heart disease, lung disease, and more © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 11

DLH Achieves FedRAMP Ready Status Opens Door to Federal Business Opportunities for Cloud-Based Platform-As-A-Service (PaaS) DLH Infinibyte® Cloud • Our new DLH Infinibyte® Cloud solution has achieved Federal Risk and Authorization Management Program (“FedRAMP”) “Ready” status. • This achievement – approved by the General Services Administration – indicates to federal customers that DLH has undergone a security capabilities assessment and has a high likelihood of achieving FedRAMP Authorization. Secure Data Analytics Platform • DLH’s InfiniByte® Cloud solution is now available on the FedRAMP Marketplace, the central portal for cloud offerings for federal agencies. • The designation significantly expands opportunities for the Company, enabling it to meet the cyber security requirements of civilian agencies as well as the U.S. Department of Defense. • Provisional status enables DLH to pursue a FedRAMP Authorization to Operate. © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 12

Financial Highlights Kathryn JohnBull | CFO © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 13

A History of Growth… Historical Revenue $200 June 2019 acquired $180 Social & Scientific $160 Systems $140 $120 May 2016 acquired $100 Danya $199.9 International $ millions $ $80 $160.4 $133.2 $60 $115.7 $40 $85.6 $60.5 $65.3 $53.5 $20 $0 FY13 FY14 FY15 FY16 FY17 FY18 FY19 TTM* Growth driven by performance excellence, customer engagement and acquired capabilities *TTM is the trailing twelve months ending March 31, 2020 © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 14

And Expanding Value Historical EBITDA $20 $18 June 2019 $16 acquired Social & $14 Scientific Systems $12 May 2016 $10 acquired Danya $18.5 $ millions $ $8 International $13.9 $6 $11.0 $4 $8.4 $2 $4.5 $0.4 $2.6 $0.9 $0 FY13 FY14 FY15 FY16 FY17 FY18 FY19 TTM An experienced team leading thoughtful integration and leveraging combined capabilities *TTM is the trailing twelve months ending March 31, 2020 © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 15

Fiscal Q2 Results (Three Months Ended 3/31/2020) Revenue Operating Income $4.0 $40 $54.8 $3.5 $3.8 $3.0 $30 $33.8 $2.5 $20 $2.0 $2.3 $1.5 $10 $1.0 $0.5 $0 $0.0 FY19Q2 FY20Q2 FY19Q2 FY20Q2 © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 16

Debt Paydown Strategy in Place 6/7/2019 9/30/2019 3/31/2020 Debt Balance* $70 M $56 M $55 M Less cash on hand $1.9 $1.8 $1.1 Net Debt $68.1 M $54.2 M $53.9 M** *$70M originally, after acquisition of S3 **3/31/20 balances reflect delays from financial system integration Increased operating cash flow anticipated in subsequent quarters leading to a projected year-end debt balance of $42 to $45 million. Net Debt is a non-GAAP metric used by investors and lenders and management believes it provides relevant and useful information to investors and other users of our financial data. Net Debt is calculated by subtracting cash and cash equivalents from the sum of current and long-term debt © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 17

Our Four Levers of Value Creation Revenue Stream Stability Sustainable Margin Expansion • Focus on Federal agencies with • Concentrate capture effort on projects critical missions and sustained that align with core competencies and bipartisan support 1 2 expand operating income margins • Optimize workforce and service • Pursue excellence across key dimensions delivery of agility and cost efficiency Long-Term Cash Flow Growth Balanced Capital Deployment • Expand EBITDA and balance 3 4 • Drive growth – organic and through M&A sheet optimization • Appropriate allocation of debt and equity • Drive working capital efficiency financing and free cash flow • Utilize long-term tax shield © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 18

Q&A Session Zach Parker | President and CEO Kathryn JohnBull | CFO © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 19 19

Appendix Non-GAAP Reconciliations: This document contains non-GAAP financial information. Management uses this information in its internal analysis of results and believes this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. A reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document follows.. © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 20 20

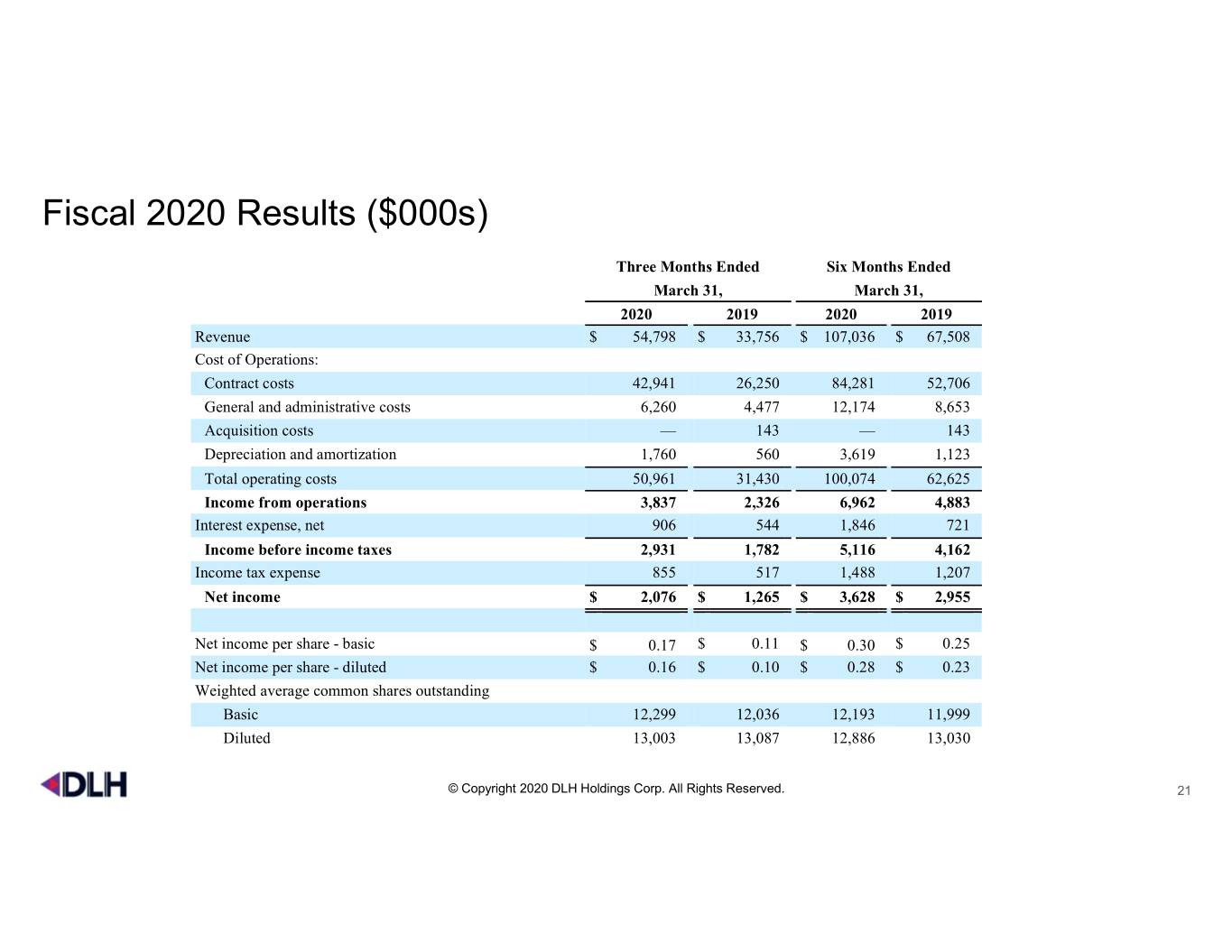

Fiscal 2020 Results ($000s) Three Months Ended Six Months Ended March 31, March 31, 2020 2019 2020 2019 Revenue $ 54,798 $ 33,756 $ 107,036 $ 67,508 Cost of Operations: Contract costs 42,941 26,250 84,281 52,706 General and administrative costs 6,260 4,477 12,174 8,653 Acquisition costs — 143 — 143 Depreciation and amortization 1,760 560 3,619 1,123 Total operating costs 50,961 31,430 100,074 62,625 Income from operations 3,837 2,326 6,962 4,883 Interest expense, net 906 544 1,846 721 Income before income taxes 2,931 1,782 5,116 4,162 Income tax expense 855 517 1,488 1,207 Net income $ 2,076 $ 1,265 $ 3,628 $ 2,955 Net income per share - basic $ 0.17 $ 0.11 $ 0.30 $ 0.25 Net income per share - diluted $ 0.16 $ 0.10 $ 0.28 $ 0.23 Weighted average common shares outstanding Basic 12,299 12,036 12,193 11,999 Diluted 13,003 13,087 12,886 13,030 © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 21

Trending EBITDA Reconciliation Twelve Months Ended September 30, Amounts in $000s 2013 2014 2015 2016 2017 2018 2019 TTM* Net (loss)/income $ (159) $ 5,357 $ 8,728 $ 3,384 $ 3,288 $ 1,836 $ 5,324 $ 5,995 (i) Interest expense/other (income) 407 4 (744) 823 1,228 1,116 2,473 3,599 (ii) (Benefit)/provision for taxes - (4,597) (5,488) (938) 2,114 5,830 2,171 2,453 (iii) Depreciation and amortization 121 106 55 1,244 1,754 2,242 3,956 6,452 EBITDA $ 369 $ 870 $ 2,551 $ 4,513 $ 8,384 $ 11,024 $ 13,924 $ 18,499 *TTM is the trailing twelve months ending March 31, 2020 © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 22

RESEARCH TRIANGLE CORPORATE HEADQUARTERS NATIONAL CAPITAL DURHAM, NORTH CAROLINA ATLANTA HQ REGION HQ OFFICES 3565 Piedmont Road, NE 8757 Georgia Avenue 4505 Emperor Boulevard Building 3 | Suite 700 Suite 1200 Suite 400 Atlanta, GA 30305 Silver Spring, MD 20910 Durham, NC 27703 Your Mission Is Our Passion © Copyright 2020 DLH Holdings Corp. All Rights Reserved. 23