Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Designer Brands Inc. | dbi-20200710.htm |

DESIGNER BRANDS INC. Corporate Update July 2020

CAUTIONARY STATEMENT RELATING TO FORWARD-LOOKING INFORMATION Forward-Looking Statements Any statements in this presentation that are not historical facts are forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on the Company's current expectations and involve known and unknown risks, uncertainties and other factors that could cause actual results, performance or achievements to materially differ from those expressed or implied by the forward-looking statements because of factors discussed in this corporate update and in the risk factors section identified in our Form 10-K for the fiscal year ended February 1, 2020, as amended, and in our other reports and filings with the Securities and Exchange Commission. The Company undertakes no obligation to revise the forward-looking statements included in this presentation to reflect any future events or circumstances, except as may be required by law. Non-GAAP Financial Measures Free Cash Flow, Adjusted EBITDA, and Normalized Adjusted EBITDA are measures of performance which meet the definition of a non-GAAP financial measure. “Non-GAAP financial measure" is defined as a numerical measure of a company's financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flow of the Company. These measures should be used in addition to and in conjunction with results presented in accordance with GAAP, and should not be relied upon to the exclusion of GAAP financial measures. Management Estimates Unless otherwise indicated, information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on that information and knowledge, which we believe to be reasonable. 1

Business Overview 2

3

4

WHO WE ARE DBI At a Glance Key Highlights U.S. RETAIL BRAND PORTFOLIO ~13% +30M #1 Vertical Brands Loyalty Omnichannel Retailer(1) Penetration Members 500+ +20M $257M DSW Stores within FY 2019 Pairs Produced by 20 miles of ~70% of Normalized Adjusted the Camuto Group the U.S. Population EBITDA(2) $ Sales % T o tal $ Sales % T o tal $M $2,745M 77% $448M 13 % $3,493 $3,178 $2,806 $2,713 $2,620 $ Sales % T o tal $ Sales % T o tal $249M 7% $122M 3% 2015A 2016A 2017A 2018A 2019A CANADA RETAIL Sales (1) Source: TotalRetail’s Top 100 Omnichannel Retailers Report for 2017 and 2018 ranking 100 publicly-traded retailers. (2) See non-GAAP reconciliation on page 36. 5

HISTORY OF GROWTH & INNOVATION 1960s 1970s 1980s 1990s 2002 2005 2008 Company Growth Through Open-Sell Concept First DSW Opens in 100 DSW DSW Inc. DSW.com Founded as Leased Business Launched Dublin, Ohio Stores Goes Public Launched Shonac Shoes Loyalty Program Launched Special Make Ups (SMUs) Introduced 2009 2014 2015 2016 2017 2018 2020 300 DSW Formation of Infrastructure Begin Expansion Tested 1st W Nail Relaunched Partnership with Stores Innovation Team Investments: Site into Kids Category Bar Concept Loyalty Program Jennifer Lopez Upgrade; Announced Responsive Design DSW Inc. Acquires Interest Acquired Redesigned Website to Drive Vertically Produced and Improved Mobile Product Penetration Experience Acquired Remaining Interest 500 DSW Stores in Town Shoes of Canada 6

HIGHLIGHTS One of the Largest Players with ~12% Wallet Share of the Women’s Non-Athletic 1 Footwear Market in the U.S. and Canada, Poised to Gain Share Amidst Footwear Retail Sector Rationalization Award-Winning Omnichannel Platform with Full Suite of Superior 2 Capabilities 3 Best-in-Class Loyalty Program Loved By +30M Members Brand Builder with Vertical Capabilities to Deliver Differentiated 4 Products at Attractive Margins 5 Strong and Stable Free Cash Flow Generation 6 Superior Merchandising Capabilities Drive Growth and Profitability 7 Retail Partner of Choice for Top National Vendors Resilient Business Model to Weather COVID-19 and Mitigate Future 8 Shocks 9 Deeply Talented and Experienced Leadership Team 7

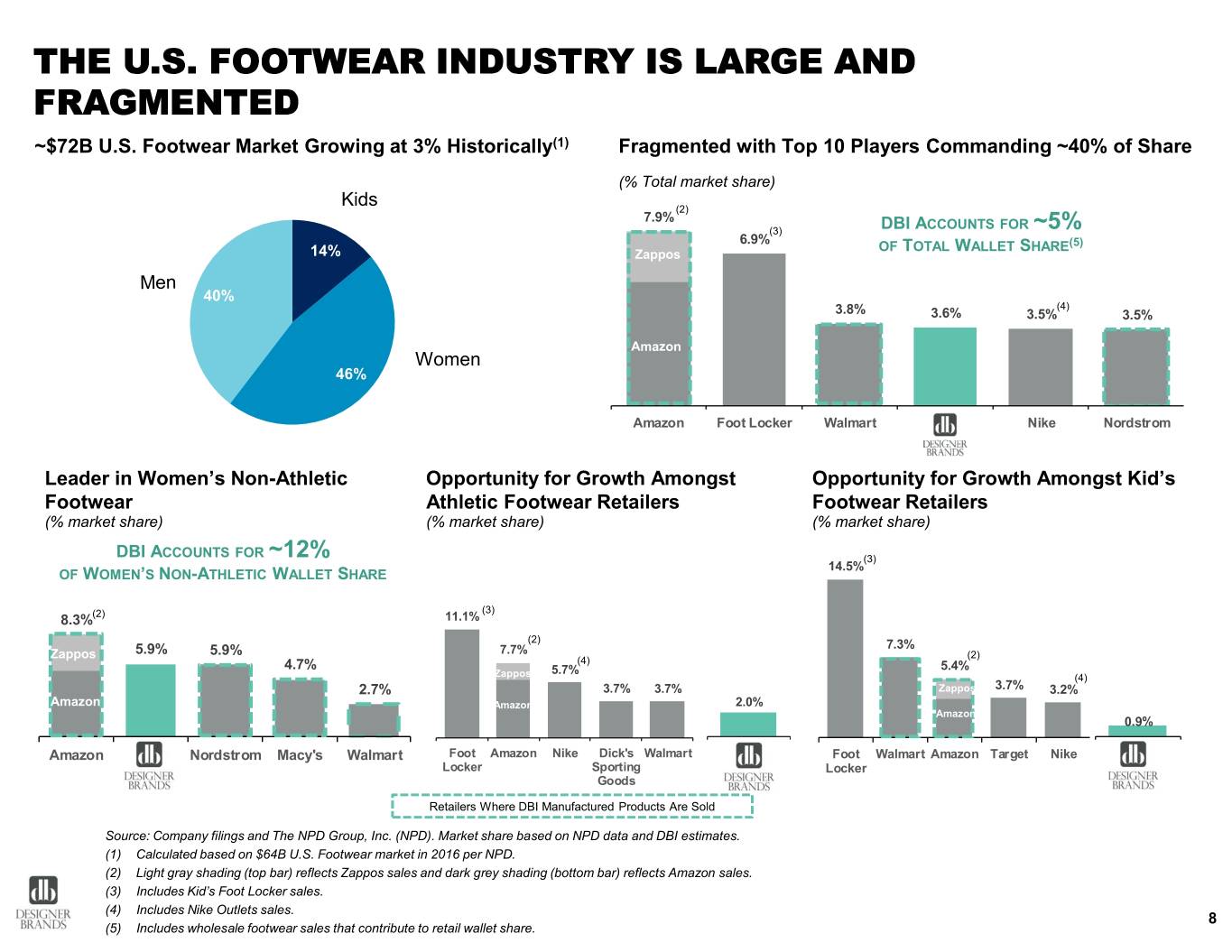

THE U.S. FOOTWEAR INDUSTRY IS LARGE AND FRAGMENTED ~$72B U.S. Footwear Market Growing at 3% Historically(1) Fragmented with Top 10 Players Commanding ~40% of Share (% Total market share) Kids (2) 7.9% (3) DBI ACCOUNTS FOR ~5% 6.9% OF TOTAL WALLET SHARE(5) 14% Zappos 40% (4) 3.8% 3.6% 3.5% 3.5% Amazon Women 46% Amazon Foot Locker Walmart DSW + ABG Nike Nordstrom Leader in Women’s Non-Athletic Opportunity for Growth Amongst Opportunity for Growth Amongst Kid’s Footwear Athletic Footwear Retailers Footwear Retailers (% market share) (% market share) (% market share) DBI ACCOUNTS FOR ~12% (3) 14.5% OF WOMEN’S NON-ATHLETIC WALLET SHARE (3) 8.3%(2) 11.1% (2) 7.3% Zappos 5.9% 5.9% 7.7% (2) (4) 4.7% 5.7% 5.4% Zappos (4) 2.7% 3.7% 3.7% Zappos 3.7% 3.2% Amazon Amazon 2.0% Amazon 0.9% Amazon DSW + Nordstrom Macy's Walmart Foot Amazon Nike Dick's Walmart DSW + ABG Foot Walmart Amazon Target Nike DSW + ABG ABG Locker Sporting Locker Goods Retailers Where DBI Manufactured Products Are Sold Source: Company filings and The NPD Group, Inc. (NPD). Market share based on NPD data and DBI estimates. (1) Calculated based on $64B U.S. Footwear market in 2016 per NPD. (2) Light gray shading (top bar) reflects Zappos sales and dark grey shading (bottom bar) reflects Amazon sales. (3) Includes Kid’s Foot Locker sales. (4) Includes Nike Outlets sales. 8 (5) Includes wholesale footwear sales that contribute to retail wallet share.

WE ARE WELL POSITIONED TO TAKE SHARE AS MARKET CONSOLIDATES POST-COVID STRUCTURAL CHANGES IN DEPARTMENT STORE CHANNEL DRIVES CONTINUED RATIONALIZATION Select Bankruptcies Shrinking Footprint Others Online / Catalogs Dept Store / National Chains Shoe Store Chains Athletic Specialty/ Select Bankruptcies Shrinking Footprint Mass / Off- Sporting Price / Outlet / Warehouse ACCELERATED MOMENTUM IN DBI SHARE GAIN, WITH ADDITIONAL SHARE UP FOR GRABS Every Percentage ~5.0% of Market Share 3.1% 3.3% Gain Represents ~$0.7B OF INCREMENTAL RETAIL SALES 2011A 2012A 2013A 2014A 2015A 2016A 2017A 2018A 2019A OPPORTUNITY Source: Company filings, NPD, Euromonitor and FDRA (Footwear Distributors & Retailers of America) ShoeEconomy. 9

HOW WE WIN OUR BUSINESS STRATEGY Desirable Customer Base Differentiated Products Differentiated Experiences Attractive Market Potential 29 10

DIVERSE AND HEALTHY CORE CUSTOMER BASE 80% WOMEN 14% MEN 6% KIDS Boomers+ Gen Z & Millennials 35% 33% 32% Gen X 62% Of Customers have ~29% Household Income Loyalty Member for >$75k +10 Years 11

EXEMPLARY LOYALTY PROGRAM WITH STRONG CUSTOMER ENGAGEMENT One of the MOST INNOVATIVE LOYALTY PROGRAMS Exemplary $157 47% (SHOPIFY) Innovative Customer Demand per Member Loyalty Program(2) Active Member Margin %(3) +30M LOYALTY MEMBERS 54% RETENTION RATE ~90% OF TOTAL REVENUE +3% (1) Highest tier of the rewards program; achieved when the Member spends over $500 in a calendar year. (1) (2) Source: Shopify. GROWTH IN FILE TO ELITE (3) Represents sales (including discounts) less cost of goods sold, divided by sales. Excludes margin from non-members, 1122 returns / shipping expenses or accounting entries for shrink or other immaterial charges.

VENDOR OF CHOICE WITH SUPERIOR MERCHANDISING CAPABILITIES STRATEGIC GOALS >50% PROPRIETARY, DIFFERENTIATED PRODUCT 50 Core Brands Making Up across Full-Price and Value / Discount 70% PRODUCT MIX Ability to FAST INVENTORY AINTAIN FULL CHURN Enabled by M Opportunistic Buying PRICE INTEGRITY and Pricing Visibility with vendors while OFFERING VALUE to loyalty members OFF PRICE REG PRICE SPECIAL MAKE UPS Unique Capability to CREATE DEMAND & FILL THE VOID in Brand Architecture Denotes Vertical Brands 13

AWARD-WINNING OMNICHANNEL PLATFORM & CAPABILITIES STORES RECONCEPTUALIZED TO FUEL ECOMMERCE GROWTH 500+ DSW stores within 20 miles of 70% of the U.S. population ▪ Higher online sales in regions with store presence, benefitting from brand halo ▪ Stores as online fulfillment centers providing faster speed to customer 85% of Customers Start ▪ Stores as online return centers recouping meaningful in-store returns with a new Their Journey Online purchase Contactless Curbside Pickup, Returns & Donations Mobile or Self Check-out 40-60% of Online Orders Fulfilled In-Store ~25% of Demand Generated Digitally in 2019 and Continues to Grow Double Digits Y-o-Y Full Suite of Omnichannel Capabilities Implemented ▪ Products ship directly from store Triple Digit Growth in ▪ Orders are routed using an optimization algorithm st ▪ Clearance items are sold online Canada (1 ahead of ▪ BOPIS (Buy online, pick up in store) Amazon) 2017 2018 Top 100 Top 100 Omnichannel Omnichannel Retailers Retailers 14

ENHANCED IN-STORE EXPERIENCE TO DRIVE TRAFFIC AND TICKET STRONG VENDOR RELATIONSHIPS DESTINATION FOR IN-STORE SERVICES ▪ Strong relationships with key national brands to showcase premiere brand ▪ Enhance customer engagement with services located in front and back of the experience and assortments box that also complement and enrich the existing “treasure hunt” experience ▪ Prioritizing distribution through DBI channels ▪ Services include nail bar, orthotics, shoe repair and shoe concierge ▪ Improving allocations of most in-demand products ▪ Brands investing in our business through shop-in- shops, marketing programs, etc. Customers who bought a product and experienced a service, on average, have increased merchandise demand of ▪ Increasingly important partner to brands as department store challenges proliferate 40% OR MORE (1) 21 (1) Evidence based on trials in Polaris and Easton in-store services for a limited time. 15

BRAND BUILDER WITH EXCEPTIONAL VERTICAL CAPABILITIES ▪ Track record of creating leading brands offering high quality products at exceptional value ▪ Higher margin: DBI retains full vertical margins (~500 bps vs. 3rd party agent and ~1,500 bps vs. balance of assortment) EXCLUSIVE BRANDS SALES & PENETRATION ~$1B $366M Increasing vertical $285M brand penetration 13% continues to be a key 10% driver of our growth strategy 2018 2019 Future WHOLESALE PRODUCTION DESIGN SOURCING DEVELOPMENT DISTRIBUTION CENTER 5,400+ 50+ 4 350 13 state of the art RETAIL DOORS FACTORIES OFFICES EMPLOYEES COUNTRIES commissioned in WORLD-CLASS 2018 DESIGN & SOURCING CAPABILITIES 16

GROWING CANADA THROUGH EXCELLENT EXECUTION AND THE SHOE COMPANY ACQUISITION Overview of The Shoe Company #1 Dominant Kids 118 Women’s Footwear Retailer in Category Stores(1) Canada 5M 7.2% #1 Loyalty Members Comparable Sales (2) In eComm Growth(3) ~20k ~5k Store Size sq. ft. Deliver differentiated experiences through banner-specific loyalty programs and increased marketing investment Leverage scale by optimizing cross-border inventory and increasing buying power with vendors Drive growth through increased digital penetration and new stores Last Mile Solution with (1) Store count includes The Shoe Company and Shoe Warehouse retail stores. Excludes DSW Canada locations. Small Box Format (2) Represents comparable sales change for the Canada Retail segment in Fiscal 2019 (compared to Fiscal 2018). (3) Based on top ten retailers’ dollar sales growth for the 12 months ending April 2020. 1177

~12% OF WOMEN’S NON-ATHLETIC SHOE PURCHASES IN THE U.S. & CANADA ARE DESIGNED, SOURCED OR SOLD BY DBI AFFILIATED BUSINESS GROUP % Source: Company management and NPD. 18

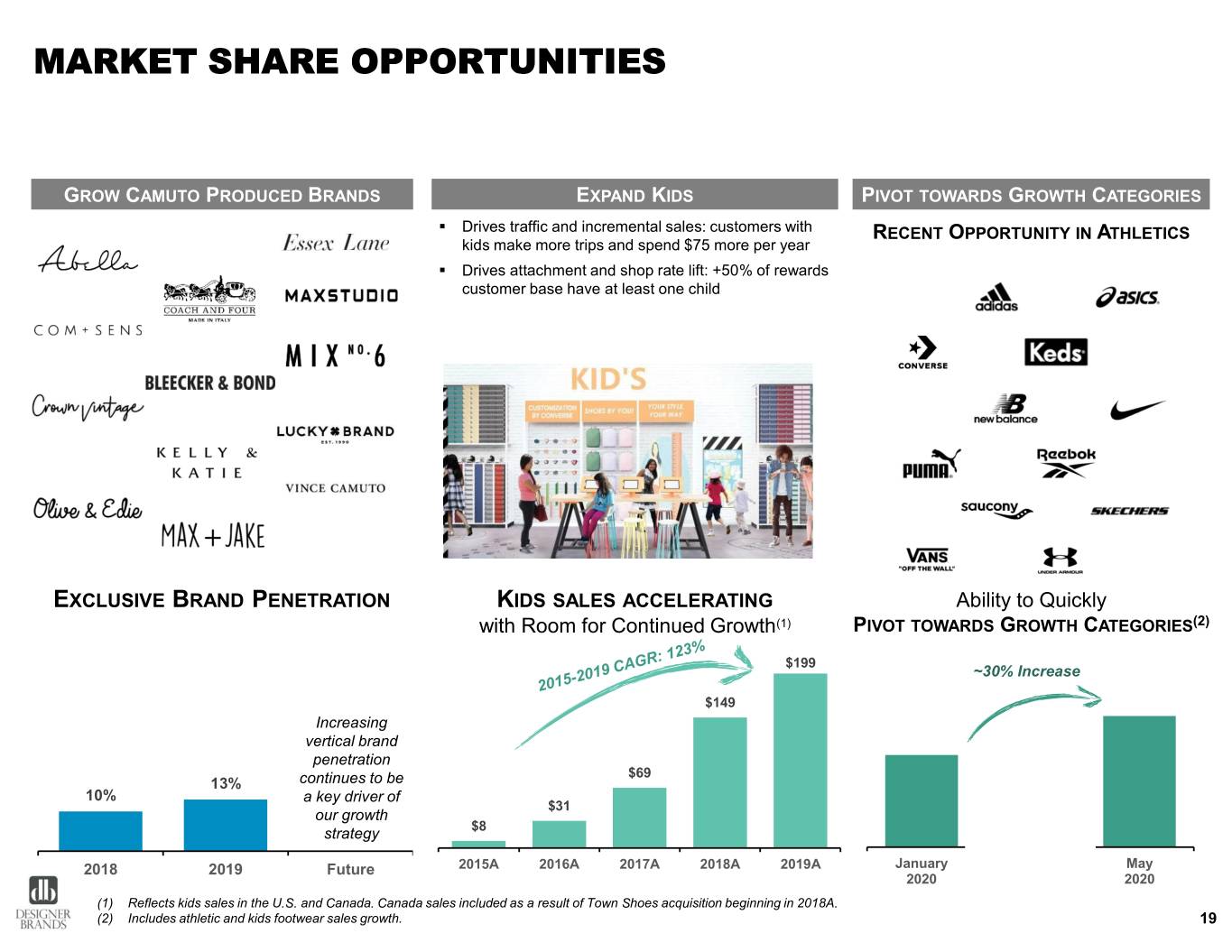

MARKET SHARE OPPORTUNITIES GROW CAMUTO PRODUCED BRANDS EXPAND KIDS PIVOT TOWARDS GROWTH CATEGORIES ▪ Drives traffic and incremental sales: customers with RECENT OPPORTUNITY IN ATHLETICS kids make more trips and spend $75 more per year ▪ Drives attachment and shop rate lift: +50% of rewards customer base have at least one child EXCLUSIVE BRAND PENETRATION KIDS SALES ACCELERATING Ability to Quickly with Room for Continued Growth(1) PIVOT TOWARDS GROWTH CATEGORIES(2) $199 ~30% Increase $149 Increasing vertical brand penetration $69 13% continues to be 10% a key driver of $31 our growth strategy $8 2018 2019 Future 2015A 2016A 2017A 2018A 2019A January May 2020 2020 (1) Reflects kids sales in the U.S. and Canada. Canada sales included as a result of Town Shoes acquisition beginning in 2018A. (2) Includes athletic and kids footwear sales growth. 19

RECENT DEVELOPMENTS 20

COVID-19 PANDEMIC RESPONSE ▪ Continue to evaluate additional inventory ▪ As of March 18, 2020, all North American retail discipline, liquidity management, and Stores stores were temporarily closed Operating Expenses reductions to expense and capital expenditure plans ▪ The Company has removed all guidance for 2020 and beyond due to the ongoing COVID- Guidance ▪ Notified landlords of withheld rent payments 19 pandemic while stores remained closed; renegotiations regarding payment terms are ongoing ▪ Furloughed ~88% of total workforce, without Leases pay (benefits continuing) ▪ Engaged a large national lease workout firm to Employees ▪ Remaining associates’ wages reduced 5-20%, aid in the lease deferral and concession depending on title process ▪ Taken swift actions to significantly reduce both ▪ Tax program expected to allow for carryback of Spring receipts in retail segments and Spring CARES Act net operating losses (NOLs), resulting in an Inventory production at Camuto anticipated ~$140M cash inflow in 2021 Management ▪ Reduced projected Fall receipts, moving from "Open to Buy" to "Chase Mode" for Fall 2020 ▪ Amended revolver to allow for the expected pressure on covenants that COVID-19 has ▪ Met with and negotiated new payment plans Credit Facility brought and extended payment terms with nearly all Payables top vendors ▪ Nearly all payables have been extended to at least 90 days ▪ Reduced quarterly cash dividend declared on Dividends March 17 by 60% to $0.10 per share and ▪ Suspended all non-essential capital projects indefinitely suspended future dividends Capital (FY2020 Capital Expenditures budget reduced Expenditures from $79M to approximately $25M-$35M) ▪ Invested over $8M in Personal Protective Reopening Equipment (“PPE”), store layout, and deep ▪ Continued to operate e-commerce business, Action Plan cleaning services to ensure the safety of E-commerce distribution centers, and IT centers customers and employees 21

COVID-19 OPERATIONAL IMPACT PRE-COVID COVID IMPACT / OUTLOOK ($M) +2.2% (62.3)% ▪ Over the last three years, March- $1,016 April has accounted for nearly 20% of annual sales and over 30% of annual operating profit ▪ The Company's leading $383 omnichannel capabilities Total Demand Total $313 $320 positioned DBI for the rapid channel shift witnessed across 1/1/19 - 3/5/19 1/1/20 - 3/5/20 3/6/19 - 5/30/19 3/6/20 - 5/30/20 retail ▪ The Company rapidly exited spring inventory and ceased inventory buys, leaving DBI well +5.5% +49.0% positioned with clean inventories heading into the peak fall season ▪ Going forward, Camuto is expected to replace third party $84 $89 $168 $250 manufacturers for a majority of Digital Demand 1/1/19 - 3/5/19 1/1/20 - 3/5/20 3/6/19 - 5/30/19 3/6/20 - 5/30/20 DBI exclusive brands, which will drive further margin improvement Decline in total demand due to Pre-COVID, FY2020 was off to a ▪ Stores have begun to reopen meaningful deterioration in store strong start, continuing the significant with traffic and demand comp traffic beginning on March 6th, and performance improvements seen in showing improvement week over the trajectory materially worsened Q4 FY2019, with strength in digital week through April and May by the time all North American demand stores were closed on March 18th Source: Management and internal financial reporting. Note: For DBI cumulative totals, $CAD converted to $USD at $0.73. 22

UPDATE ON STORE REOPENINGS ▪ Management decision to reopen stores is based on: – Guidance from local authorities – Overall assessment of environmental safety at each location – Actions of peers in neighboring vicinity, as well as proximity of other DSW retail stores (likely to reopen in clusters / markets) • We have created a taskforce that is dedicated to protect the health and safety of our customers and employees: – Deep cleaning services engaged – PPE (e.g., gloves, masks, single-use aprons, point-of-sale sneeze guards) for associates and customers distributed to stores – Store layouts optimized after conducting a rigorous study of existing layouts and actions undertaken in similar industries (e.g., supermarkets and other essential businesses) • Queue line spacing and crowd management controls • Associate greeting customers at the door and offering PPE • Returns management / sanitization procedures • As of June 9th, 579 out of our 666 store fleet have re-opened at reduced capacity 23

SEQUENTIAL IMPROVEMENT IN DEMAND ▪ Beginning with April Week 4, reopened stores are realizing an average weekly improvement of +8% in demand; the chart below shows demand through June Week 1 – Demand improved +8% during 4th week of May vs. the prior week ▪ Demand comp has improved +30% since the end of April (-86% v. -56% in 4th week of May) Demand Comp % - Reopened DSW Locations <-- Reopen to the Public --> Group Store Count Apr Wk1 Apr Wk2 Apr Wk3 Apr Wk4 May Wk1 May Wk 2 May Wk 3 May Wk 4 Jun Wk1 April Week 1 3 -98% -95% -91% -89% -81% -72% -58% -53% -41% April Week 3 11 N/A N/A -95% -86% -71% -65% -53% -45% -39% April Week 4 79 N/A N/A N/A -86% -78% -74% -65% -53% -41% May Week 1 69 N/A N/A N/A N/A -78% -69% -60% -49% -39% May Week 2 58 N/A N/A N/A N/A N/A -70% -63% -51% -40% May Week 3 59 N/A N/A N/A N/A N/A N/A -68% -67% -50% May Week 4 65 N/A N/A N/A N/A N/A N/A N/A -65% -57% June Week 1 69 N/A N/A N/A N/A N/A N/A N/A N/A -61% Total 413 -98% -95% -94% -86% -78% -71% -63% -56% -47% I/(D) v. Prior Wk N/A 2% 2% 8% 8% 6% 8% 8% 8% Note: Apr Week 1 data is from 4/10 - 4/11/2020 24

RESILIENT BUSINESS MODEL Business Model Better Positioned to Weather a Downturn… Sales 2x $3.5B 2x 2016(1) 2019 $1.5B ~13% EMAND D CALE ~25% S IGITAL ~87% ~75% 2008 2019 D Stores 298 666 % Camuto Produced Exclusive Brands Members ~3x >60% +30M RANDS B USTOMERS C ~10M ERTICAL 0% V OYALTY L 2008 Today 2008 2019 Source: Company filings. National Retail Federation Consumer Survey. (1) Company had relatively low to no digital demand in 2008. 25

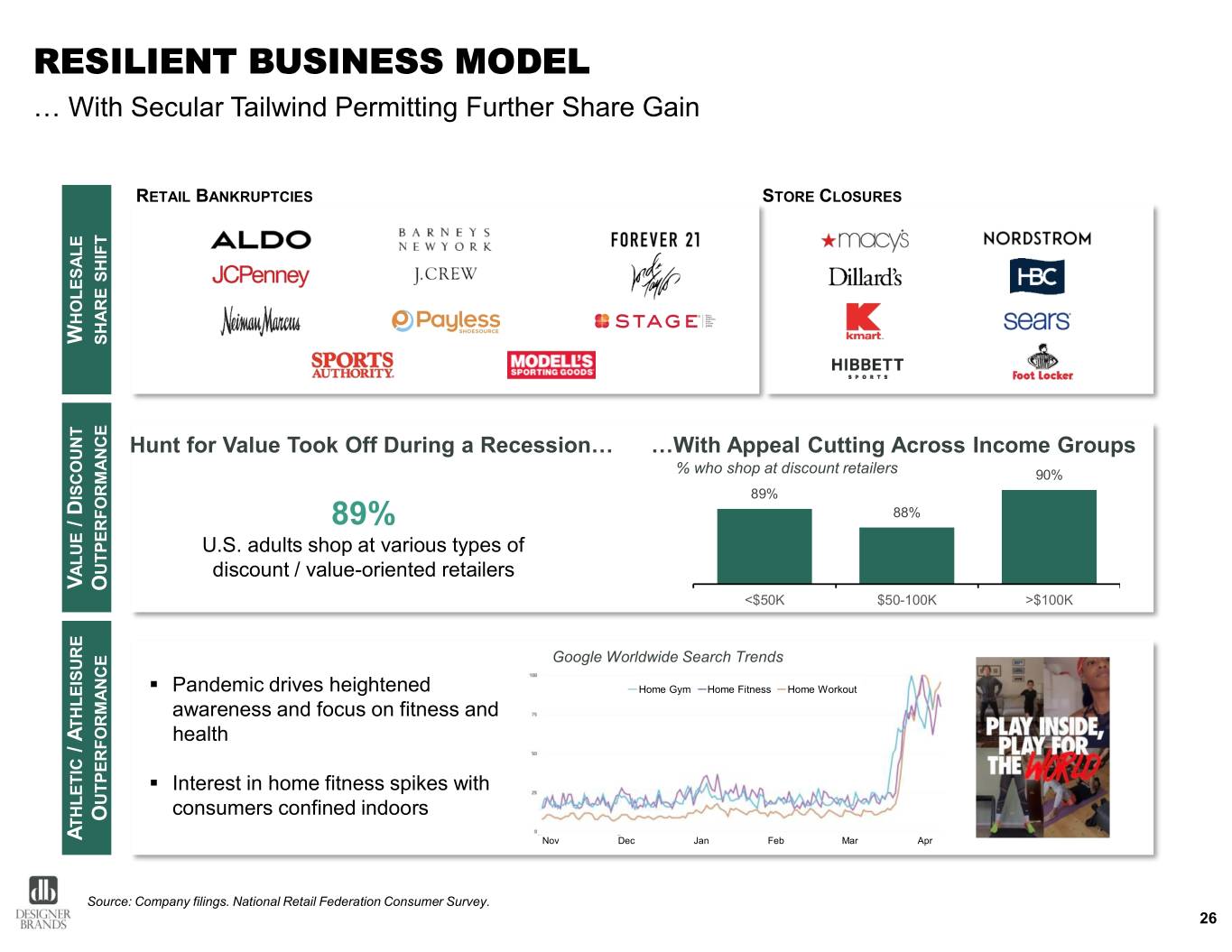

RESILIENT BUSINESS MODEL … With Secular Tailwind Permitting Further Share Gain RETAIL BANKRUPTCIES STORE CLOSURES SHIFT HOLESALE W SHARE Hunt for Value Took Off During a Recession… …With Appeal Cutting Across Income Groups % who shop at discount retailers 90% ISCOUNT 89% 88% / D 89% U.S. adults shop at various types of UTPERFORMANCE ALUE discount / value-oriented retailers V O <$50K $50-100K >$100K Google Worldwide Search Trends ▪ Pandemic drives heightened Home Gym Home Fitness Home Workout awareness and focus on fitness and THLEISURE A health / ▪ Interest in home fitness spikes with UTPERFORMANCE consumers confined indoors O THLETIC A Nov Dec Jan Feb Mar Apr Source: Company filings. National Retail Federation Consumer Survey. 26

ILLUSTRATIVE “COVID 2.0” SCENARIO ▪ Illustrative “COVID 2.0” analysis assumes a stress case scenario with: – Cash & equivalents of $251M and $393M outstanding under the revolver and $5M in letters of credit issued, resulting in $2M available for borrowings and $253M of liquidity (as of quarter ended May 2, 2020) – Weekly cash inflows of $23M(1) based on the trough period during the weeks ended March 27 and April 3, when all of the Company’s stores were closed, cash receipts were generated solely from e-commerce, and there was little spend on advertising to drive traffic to its e- commerce website; and – Cash outflows of $32M(2) based on operating expenses during the weeks ended March 20 through June 19, including expenses to begin bringing vendors and landlords current on prior amounts due • While cash inflows includes receipts only from e-commerce sales, the Company did pay ~$18 million in rent expense during this period, which is included in the cash outflows ▪ Assuming this scenario indefinitely, the weekly cash outflows would be approximately $9M (or approximately $37M per month), which would imply ~7 months of months of liquidity, assuming no additional capital is raised – Excludes estimated cash NOL tax refund of ~$140 million expected to be received in FY2021 ▪ The Company has planned conservatively for this Fall’s selling season to maximize financial flexibility: – Bought Fall inventory significantly down versus last year – ~20% of planned inventory purchases marked as “open to buy,” with no requirement to purchase or fund – Inventory purchase skewed heavily towards athletic category to maximize on growing trend during nationwide lockdown ▪ We are actively pursuing further options to increase financial flexibility. While there is no immediate need to raise capital, we intend to evaluate assessing the financing markets and may look to raise capital, when and if we deem it prudent, to further strengthen our balance sheet. – There can be no assurance that we will raise additional capital, or as to the timing or terms of any such additional capital. If additional liquidity is needed, we may take additional actions including adjusting our marketing spend, implementing further employee furloughs, reducing the store labor requirements, and forgoing additional capital expenditures and other discretionary expenses. (1) Reflects average weekly cash receipts for each of the weeks ended March 27 and April 3, which reflects the period of time when all of the Company’s stores were closed and cash receipts were generated from digital business only. (2) Reflects average weekly total cash outflows (including payroll, rent, merchandise expense, vendor expense, interest, taxes and all other cash payments) during the weeks ended March 20 through June 19. The Company successfully negotiated to defer approximately two-thirds of rent for this period (rent expense would have otherwise been ~$54 million) and entered into extended payment plans for approximately $100 million of vendor payables. 27

FINANCIAL OVERVIEW 28

ANNUAL FINANCIAL PERFORMANCE Sales Adjusted EBITDA (% Margin) (2) ($M) $3,493 $3,178 $301 $2,806 $284 $288 $278 $2,620 $2,713 $257 6.1% 11.5% 10.5% 10.3% 0.8% (0.4%) 0.8% 8.8% 7.3% (3.0%) FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 (1) Sales % Comparable Sales Adjusted EBITDA % Margin Capital Expenditures Free Cash Flow (Adjusted EBITDA – Capital Expenditures) (2) $104 $232 $88 $213 $78 $197 $196 $179 $65 $56 80.5% 76.5% 65.4% 69.2% 69.7% FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 Free Cash Flow Free Cash Flow Conversion %(3) Source: Public company filings. (1) Reflects total company comparable sales. A store is considered a comparable when in operation for at least 14 months at the beginning of a fiscal year. Includes e-commerce sales. (2) See non-GAAP reconciliation on page 36. (3) Free Cash Flow (FCF) Conversion defined as (Adjusted EBITDA – Capital Expenditures) / Adjusted EBITDA. 29

STRONG FREE CASH FLOW GENERATION AND HEALTHY BALANCE SHEET Last 10 Years of FCF Cumulative: ~$1,900M ($M) Average Yearly: ~$190M $229 $232 $223 $213 $201 $197 $196 $179 Strong $125 $138 Free Cash Flow (1) FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 0.8x 0.6x Low Gross Leverage 0.1x 0.1x 0.0x 0.0x 0.0x 0.0x 0.0x 0.0x FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 $474 $335 $294 (2) $211 Liquidity $180 $162 $167 $161 $132 $109 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 Source: Public company filings. Statistics are not pro forma for $205 million revolver draw subsequent to FY 2019 as a precautionary measure to increase cash position. (1) See non-GAAP reconciliation on page 36. (2) Defined as revolver size minus revolver borrowings and letters of credit under the revolver plus cash. 30

KEY DRIVERS FOR ADJUSTED EBITDA MARGIN DECLINE Over the last several years, management have strategically re-invested Adjusted EBITDA Margins to drive long-term growth Investment in Digital & Omnichannel ▪ Always negotiating shipping costs Capabilities ▪ Partner with other digital platforms for exclusive brands (Amazon, Walmart) Rising shipping and other costs associated with ▪ Leverage existing digital infrastructure to grow Camuto direct to consumer increased investment in digital and higher (DTC) and Canada digital business with little investment needed eComm sales ▪ Re-evaluating lease obligations 2018 Strategic Acquisitions to Gain ▪ Took swift actions in Canada to close Town Shoes banner; turned Strategic Market Access and Vertical Capabilities business around within ~18 months and now a thriving business with Margin Re- Invested in Canada to gain access with small box growing margins Investments format ▪ Aggressively grow Camuto-produced brands to increase vertical brand penetration and capture highly attractive vertical margins Acquired Camuto to unlock vertical margins by For Long-Term ▪ Examining future of Camuto Wholesale, editing brands and customers and bringing designing, sourcing and production in Success rightsizing expense infrastructure house Acquire, Engage and Retain Customers ▪ Relaunched VIP Loyalty Program to activate new and existing customers, gain data insights to inform product design, pricing and marketing, and Increased investments in customer loyalty, ultimately drive sales and conversion by delivering non-transactional ways experiential shopping and value-add service to for customers to engage with brand grow customer base and enhance engagement / ▪ Investing in Services (Nailbar & Shoe Repair) to drive non-promotional loyalty foot traffic and grow tickets Increased Competition External Market ▪ Product and pricing differentiation provided by merchandising strategy Heightened competition from Amazon and brands Environment around branded Special Make Ups going DTC ▪ Focus on top vendors to improve assortment and enhance economics Unseasonable Weather Warmest Fall on record in 2019 impacted seasonal ▪ Shifting seasonal risk back to vendors with greater use of "Cancelable inventory Backups and Lockerstock" Non-Recurring, 2019 POS Roll-Out Issues ▪ Remedied by late 2019 without lingering issues One-Time Items Unintended discount stacking at register Camuto Excess Inventory ▪ Installed new internal controls around producing speculative inventory Liquidation of 2019 excess inventory ▪ Stood up new Merchandise Planning function 31

Q1 2020 PERFORMANCE Q1 2020 Revenue ₋ For the three month period ended May 2, 2020, net sales decreased 44.7% to $483M (1) (vs. $873M during the same period last year) ₋ U.S. Retail segment comparable sales decreased 42.4% (vs. +3.0% in Q1 2019); Digital demand net sales in U.S. Retail was better relative to the store performance, up 43.7% ₋ Canada Retail segment comparable sales decreased 32.4%; Digital strength in Canada was even REVENUE & more robust, with digitally sourced comparable sales up 348.0% during the first quarter versus EBITDA last year ₋ Brand Portfolio segment comparable sales increased 92.8% (2) Q1 2020 Normalized Adjusted EBITDA ₋ For the three month period ended May 2, 2020, DBI generated Normalized Adjusted EBITDA of ($72M), which includes a normalization of markdowns of $112M (vs. $72M of Normalized Adjusted EBITDA during the same period last year) (3) ₋ As of quarter ended May 2, 2020, the Company had: ₋ Cash & equivalents of $251M BALANCE ₋ Debt of $393M with $2M availability under the revolver bringing total liquidity to $253M (4) SHEET ₋ The increase in borrowings under the revolver is as a result of a drawdown in Q1 2020 as a precautionary measure to increase cash position (1) Revenue for Q1'20 contains a +$3M reclassification to adjust for new accounting policy. (2) For the Brand Portfolio segment, sales from the direct-to-consumer www.vincecamuto.com e-commerce site were added to the comparable base beginning with the Q4 of fiscal 2019. (3) See non-GAAP reconciliation on page 36. (4) Total liquidity equal to cash & investments plus revolver availability less letters of credit outstanding of $5.0M. 32

Appendix 33

CAMUTO GROUP ACQUISITION TRANSFORMS OUR BUSINESS OVERVIEW AND STRATEGIC RATIONALE BENEFITS ◼ In Nov. 2018, DBI acquired 100% of Camuto Group’s operations for � Immediate scale and market share gain $166M and 40% of Camuto’s brands for $57M via a joint venture with � Fully captured vertical margin through manufacturing and Authentic Brands operating capabilities ◼ Grow DBI’s private brands supported by full vertical capabilities across � Attractive brand portfolio design, sourcing and manufacturing � Well-established design, sourcing and manufacturing capabilities ◼ Obtain additional royalty stream and growth upside from through Authentic Brands JV � Additional upside from brand building expertise and incremental revenue stream provided by the Authentic Brands JV ◼ Strengthen DTC TRANSACTION STRUCTURE ~$308M OPERATING INFRASTRUCTURE (~$166M) INTELLECTUAL PROPERTY (~$142M) 100% 40% (~$57M) 60% ◼ Core Wholesale Operations Camuto Owned Brands: 33 ABG Brands Include: ◼ Manufacturing facilities in China and Brazil ◼ eComm operations ◼ New distribution center in New Jersey ◼ Brand License of: 34

APPRAISALS OF CERTAIN ASSETS REAL ESTATE ASSETS APPRAISED COLLATERAL VALUE Home Office Distribution Center Appraised Asset ($ in M) Value DSW Home Office $42 DSW Distribution Center 46 Total Real Estate Appraised Value $88 INTELLECTUAL PROPERTY / BRANDS DSW / The Shoe Company Retail Banner Names (Incl. Loyalty Program) $240 Retail Banner Names (Incl. Loyalty Program) DBI Legacy Exclusive Brands 52 Total Intellectual Property / Brands Appraised Value $292 Total $380 Legacy Exclusive Brands (100% Owned) Note: Excludes DBI’s 40% ownership of ABG-Camuto brands, which is not included in the collateral package. Camuto brands were valued at $205M in total, implying an $82M value to DBI’s 40% ownership interest. 35

NON-GAAP RECONCILIATION ($M) Fiscal Year Q1 2015 2016 2017 2018 2019 2019 2020 Reported Operating Income / (Loss) $213.6 $200.0 $125.1 $59.0 $127.3 $44.0 ($324.0) Depreciation & Amortization 73.6 82.8 80.9 79.0 86.6 21.4 23.1 EBITDA $287.1 $282.8 $205.9 $138.1 $213.9 $65.4 ($300.8) Stock Based Compensation 13.5 12.7 14.7 17.4 17.1 4.4 4.9 Camuto Group Inventory Step-Up -- -- -- 5.3 -- -- -- Ebuys Inventory Write-Down -- -- 9.3 -- -- -- -- Ebuys Inventory Step-Up -- 1.8 -- -- -- -- -- Change in Fair Value of Contingent Considerations -- (20.2) (32.7) -- -- -- -- Acquisition Related Costs -- 2.3 0.7 27.9 -- -- -- Lease Exit and Other Termination Options -- -- -- 23.0 -- -- -- Impairment Charges -- -- 89.4 60.8 7.8 -- 112.5 Restructuring Expenses -- 4.5 1.2 5.6 17.7 2.5 1.7 COVID-19 Incremental Costs / (Credits) -- -- -- -- -- -- (2.7) Adjusted EBITDA $300.6 $283.9 $288.4 $278.1 $256.5 $72.3 ($184.4) Markdowns Normalization(1) -- -- -- -- -- -- 112.0 Normalized Adjusted EBITDA $300.6 $283.9 $288.4 $278.1 $256.5 $72.3 ($72.4) Adjusted EBITDA $300.6 $283.9 $288.4 $278.1 $256.5 $72.3 ($184.4) Capital Expenditures (103.9) (87.6) (56.3) (65.4) (77.8) (24.9) (14.6) Free Cash Flow $196.7 $196.3 $232.1 $212.7 $178.7 $47.4 ($199.0) (1) Markdown normalization adjusts for U.S. Retail, ABG and Camuto segment markdowns attributable to the impact of the COVID-19 pandemic, as estimated by the Company’s management based on historical sales and other relevant factors. For the U.S. Retail and ABG segments, the adjustment is calculated based on the difference between (a) the 3-year average historical markdowns as a percent of retail sales for each month in Q1, and (b) the markdowns as a percent of retail sales realized for each month in Q1 2020, multiplied by the actual amount of retail sales during each month in Q1 2020. For the Camuto segment, which generates a portion of revenue as a wholesaler of footwear, the adjustment is calculated based on the difference between (a) the 2-year average historical sales returns and allowances, co-op advertising and cost of goods sold (COGS) as a percent of revenue (which includes gross sales and commission income) for each month in Q1, and (b) the sales returns and allowances, co-op advertising and COGS as a percent of revenue realized for each month in Q1 2020, multiplied by the actual amount of revenue during each month in Q1 2020. For the Canada Retail segment, the adjustment is calculated based on the difference between (a) the 2019 historical gross profit as a percent of retail sales for each month in Q1, and (b) the gross profit as a percent of retail sales realized for each month in Q1 2020, multiplied by the actual amount of retail sales during each month in Q1 2020. 36