Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Designer Brands Inc. | dsw-2017128exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - Designer Brands Inc. | dsw-2017128exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - Designer Brands Inc. | dsw-2017128exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - Designer Brands Inc. | dsw-2017128exhibit311.htm |

| EX-24.1 - EXHIBIT 24.1 - Designer Brands Inc. | dsw-2017128exhibit241.htm |

| EX-23.1 - EXHIBIT 23.1 - Designer Brands Inc. | dsw-2017128exhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - Designer Brands Inc. | dsw-2017128exhibit211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended January 28, 2017

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from | to | ||

Commission file number 1-32545

DSW INC. |

(Exact name of registrant as specified in its charter) |

Ohio | 31-0746639 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

810 DSW Drive, Columbus, Ohio | 43219 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code: (614) 237-7100

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Class A Common Shares, without par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. þ Yes o No | |||||||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes þ No | |||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No | |||||||

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No | |||||||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ | |||||||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. | |||||||

Large accelerated filer | þ | Accelerated filer | o | ||||

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes þ No | |||||||

The aggregate market value of voting stock held by non-affiliates of the registrant computed by reference to the price at which such voting stock was last sold, as of July 30, 2016, was $1,625,827,325. | |||||||

Number of shares outstanding of each of the registrant's classes of common stock, as of March 17, 2017: 72,460,969 Class A Common Shares and 7,732,807 Class B Common Shares. | |||||||

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive proxy statement relating to the 2017 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on

Form 10-K.

DSW INC.

TABLE OF CONTENTS

Page | ||

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

All references to "we," "us," "our," "DSW Inc.," or the "Company" in this Annual Report on Form 10-K mean DSW Inc. and its wholly owned subsidiaries. DSW refers to the DSW segment, which includes DSW stores and dsw.com. We own many trademarks and service marks. This Annual Report on Form 10-K may contain trademarks, trade dress, and tradenames of other companies. Use or display of other parties' trademarks, trade dress or tradenames is not intended to and does not imply a relationship with the trademark, trade dress or tradename owner.

i

DSW INC.

TABLE OF CONTENTS TO FINANCIAL STATEMENTS

Page | |

ii

Cautionary Statement Regarding Forward-Looking Information for Purposes of the "Safe Harbor" Provisions of the Private Securities Litigation Reform Act of 1995

Some of the statements in this Annual Report on Form 10-K contain forward-looking statements which reflect our current views with respect to, among other things, future events and financial performance. Examples of such forward-looking statements include references to our future expansion and our acquisitions. You can identify these forward-looking statements by the use of forward-looking words such as "outlook," "believes," "expects," "potential," "continues," "may," "should," "seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates," or the negative version of those words or other comparable words. Any forward-looking statements contained in this Annual Report on Form 10-K are based upon current plans, estimates, expectations and assumptions relating to our operations, results of operations, financial condition, growth strategy and liquidity. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Such forward-looking statements are subject to numerous risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In addition to other factors discussed elsewhere in this report, including those factors described under "Part I, Item 1A. Risk Factors," some important factors that could cause actual results, performance or achievements for DSW Inc. to differ materially from those discussed in forward-looking statements include, but are not limited to, the following:

• | our success in growing our store base and digital demand; |

• | our ability to protect our reputation; |

• | maintaining strong relationships with our vendors; |

• | our ability to anticipate and respond to fashion trends; |

• | our success in meeting customer expectations; |

• | disruption of our distribution and/or fulfillment operations; |

• | continuation of agreements and the financial condition of our affiliated business and international partners; |

• | our ability to successfully integrate Ebuys, Inc.; |

• | fluctuation of our comparable sales and quarterly financial performance; |

• | risks related to our information systems and data; |

• | failure to retain our key executives or attract qualified new personnel; |

• | our competitiveness with respect to style, price, brand availability and customer service; |

• | our reliance on our DSW Rewards program and marketing to drive traffic, sales and customer loyalty; |

• | uncertain general economic conditions; |

• | our reliance on foreign sources for merchandise and risks inherent to international trade; |

• | risks related to our handling of sensitive and confidential data; |

• | risks related to leases of our properties; |

• | risks related to prior and current acquisitions; |

• | risks related to future legislation, regulatory reform or policy changes; |

• | foreign currency exchange risk; and |

• | risks related to our cash and investments. |

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results, performance or achievements may vary materially from what we have projected. Furthermore, new factors emerge from time to time and it is not possible for management to predict all such factors, nor can management assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

iii

PART I

ITEM 1. | BUSINESS |

General

DSW Inc. was incorporated in the state of Ohio in 1969, and we opened our first DSW store in Dublin, Ohio in 1991. DSW is the destination for fabulous footwear and accessory brands at a great value every single day. With a breathtaking assortment of shoes, handbags and accessories for women, men and kids in 501 stores nationwide and on dsw.com, DSW strives to delight customers with finding the perfect shoe at an incredible price. Our DSW stores average approximately 21,000 square feet and carry approximately 22,000 pairs of shoes. In addition, our DSW Rewards loyalty program means shopping comes with perks; members earn points towards certificates every time they purchase. We believe this combination of assortment, convenience and value differentiates us from our competitors and appeals to consumers from a broad range of socioeconomic and demographic backgrounds.

As a segment of DSW Inc., the Affiliated Business Group ("ABG") partners with multi-category retailers to develop strategies and business models for targeted shoe assortments. ABG provides service to 395 store locations and e-commerce channels through leased partnerships with Stein Mart, Gordmans and Frugal Fannie's.

We also have an equity investment in Town Shoes Limited ("Town Shoes"). Town Shoes is the market leader in branded footwear in Canada, with sales of over $345 million Canadian dollars ("CAD") in fiscal 2016. As of January 28, 2017, Town Shoes operated 182 locations across Canada under The Shoe Company, Shoe Warehouse, Town Shoes and DSW banners, as well as an e-commerce site. In 2014, we entered into a licensing agreement with Town Shoes, which allows Town Shoes to use the DSW Designer Shoe Warehouse tradename for their new larger concept Canadian stores. As of January 28, 2017, there are 23 DSW Designer Shoe Warehouse stores in Canada.

We completed several transactions that supported our efforts to grow market share within footwear and accessories domestically and internationally. On March 4, 2016, we acquired Ebuys, Inc. ("Ebuys"), a leading off price footwear and accessories retailer operating in digital marketplaces. Ebuys sells products to customers located in North America, Europe, Australia and Asia. On August 2, 2016, we signed an agreement with the Apparel Group as an exclusive franchise partner in the Gulf Coast region of the Middle East. The agreement is expected to expand the DSW banner by up to 40 stores across the territory, both in malls and on high street locations within Saudi Arabia, Bahrain, Qatar, Kuwait, United Arab Emirates and Oman, with the first stores opening in fiscal 2017.

See our consolidated financial statements and the notes thereto in Item 8 of this Annual Report on Form 10-K for financial information about our two reportable segments: the DSW segment, which includes DSW stores and dsw.com, and the ABG segment. Additionally, a five year summary of certain financial and operational information is included in Item 6 of this Annual Report.

We follow a 52/53-week fiscal year that ends on the Saturday nearest to January 31 in each year. The periods presented in these financial statements and selected financial data are the fiscal years ended January 28, 2017 ("fiscal 2016"), January 30, 2016 ("fiscal 2015"), January 31, 2015 ("fiscal 2014"), February 1, 2014 ("fiscal 2013") and February 2, 2013 ("fiscal 2012"). Fiscal 2016, 2015, 2014 and 2013 each consisted of 52 weeks, while fiscal 2012 consisted of 53 weeks. Our next fiscal year ending February 3, 2018 ("fiscal 2017") will consist of 53 weeks.

Competitive Strengths

We are a leading footwear retailer with a history of growth and financial strength that is leveraging our operating model to gain market share. We believe that having a leading market position is driven by our competitive strengths: assortment, convenience and value.

Assortment

Our goal is to excite our customers with a competitive, compelling assortment of shoes and complementary accessories that fulfill a broad range of style and fashion preferences. DSW sells a large assortment of brand name, designer and private brand merchandise. We purchase directly from over 450 domestic and foreign vendors, primarily in-season footwear found in specialty and department stores and branded make-ups (shoes made exclusively for a retailer). We offer a broad assortment of handbags, hosiery, jewelry and other accessories which appeal to our brand and fashion conscious customers. We also make opportunistic and close-out purchases to offer value to our customers.

1

Our vendors include suppliers who manufacture their own merchandise, or supply merchandise manufactured by others, or both. Most of our domestic vendors import a large portion of their merchandise from abroad. We have quality control programs under which our buyers are involved in establishing standards for quality and fit, and our personnel examine incoming merchandise in regards to color, material and overall quality. As our sales volume grows, we believe there will continue to be adequate sources available to acquire a sufficient supply of quality merchandise in a timely manner and on satisfactory economic terms. Our top three vendors in the aggregate supply approximately 18% of our merchandise.

Our merchandising group continuously monitors current fashion trends, as well as historical sales trends, to identify popular styles and styles that may become popular in the upcoming season. We track performance and sales trends on a weekly basis and have a flexible buying process that allows us to reorder successful styles and cancel underperforming styles throughout each season. To keep our product mix fresh and on target, we test new fashions and actively monitor sell-through rates. We also identify new vendor and category opportunities. After a successful launch during fiscal 2016, we will continue to add new locations in fiscal 2017 that will bring DSW kids to close to 60% of the total chain.

We separate our DSW merchandise into three primary categories: women's footwear; men's footwear; and accessories and other (which includes kids' footwear). The following table sets forth the approximate percentages of DSW segment sales attributable to each merchandise category for the fiscal years below:

Fiscal | |||||||||

Category | 2016 | 2015 | 2014 | ||||||

Women's footwear | 69 | % | 69 | % | 69 | % | |||

Men's footwear | 22 | % | 22 | % | 22 | % | |||

Accessories and other | 9 | % | 9 | % | 9 | % | |||

Convenience

We provide our customers with the highest level of convenience based on our belief that customers should be empowered to control and personalize their shopping experiences.

In stores, our merchandise is displayed on the selling floor with self-service fixtures to enable customers to view and touch the merchandise. We believe this shopping experience provides our customers with maximum convenience as they are able to browse and try on merchandise without feeling rushed or pressured to make a purchasing decision. Merchandise is organized in a logical manner that groups together similar styles, such as dress, casual, seasonal and athletic merchandise, for easy browsing.

Our omni-channel capabilities create an endless aisle for the customer. Customers can order additional styles, sizes, widths and categories that can be fulfilled from other DSW stores, our fulfillment center or directly from our suppliers (referred to as "drop ship"). To further meet customer demand of how they receive products, we allow our customers the option to buy online, pickup in store and buy online, ship to store.

Value For Our Customers

Our buying organization aims to provide customers with high quality, in-season fashion styles at attractive prices compared to the sale prices found at specialty retailers and department stores. We have historically employed a consistent pricing strategy that provides customers with the same price on our merchandise from the day it arrives in store until it enters our planned clearance rotation. Our pricing strategy differentiates us from our competitors who usually price and promote merchandise at discounts available only for limited time periods. We find that customers appreciate shopping for everyday value when it is most convenient for them, rather than waiting for a sale event.

We provide additional value through our DSW Rewards loyalty program where members earn points towards discounts on future purchases. Members also receive promotional offers and gifts with purchase offers. We employ a variety of methods, including email, direct mail and social media, to communicate exclusive offers to our rewards customers. Through our co-branded credit card, DSW Rewards members earn points for any purchases made with the credit card, including transactions outside of DSW.

Approximately 24 million members are enrolled in our DSW Rewards program and have made at least one purchase over the course of the last two years. In fiscal 2016, shoppers in the loyalty program generated approximately 90% of DSW segment sales.

2

Growth Strategy

Our growth strategy is to strengthen our position as a leading footwear and accessories retailer by expanding into new markets with the right banners and store format, extending our customer reach through new categories, and creating a differentiated customer experience and strong value proposition. We will also continue utilizing our financial strength to invest in key initiatives.

Expanding Our Presence

We opened 34 DSW stores and closed one DSW store in fiscal 2016, and we plan to open approximately 15 to 17 DSW stores and close two to four DSW stores in fiscal 2017. With our stores increasingly playing a key role in supporting our strong online demand growth and increasing fulfillment of that demand, we are regularly evaluating our real estate strategy to optimize how we can best serve the customers' shopping preferences. When we decide to open a new store in either new or existing markets, our primary focus is on power strip centers. We also look to reposition existing stores as opportunities arise. Depending on the market, we also consider regional malls, lifestyle centers and urban street locations. In general, our evaluation of potential new stores integrates information on demographics, co-tenancy, retail traffic patterns, site visibility and accessibility, store size and configuration, and lease terms. Our real estate decision-making entails an analysis of underlying demand for our products through both physical and digital channels. Our analysis also looks at current penetration levels in markets we serve and our ability to deepen our market share and acquire new customers.

As of January 28, 2017, we operated 501 DSW stores in 43 states, the District of Columbia and Puerto Rico. The following table sets forth the number of our DSW stores by state and territory:

Location | Number of Stores | Location | Number of Stores | Location | Number of Stores | |||||||

Alabama | 6 | Louisiana | 4 | North Dakota | 1 | |||||||

Arizona | 10 | Maine | 1 | Ohio | 21 | |||||||

Arkansas | 1 | Maryland | 20 | Oklahoma | 3 | |||||||

California | 47 | Massachusetts | 17 | Oregon | 6 | |||||||

Colorado | 11 | Michigan | 20 | Pennsylvania | 25 | |||||||

Connecticut | 11 | Minnesota | 11 | Puerto Rico | 2 | |||||||

Delaware | 1 | Mississippi | 1 | Rhode Island | 2 | |||||||

Florida | 30 | Missouri | 5 | South Carolina | 3 | |||||||

Georgia | 16 | Nebraska | 3 | Tennessee | 8 | |||||||

Idaho | 1 | Nevada | 3 | Texas | 43 | |||||||

Illinois | 28 | New Hampshire | 2 | Utah | 3 | |||||||

Indiana | 12 | New Jersey | 19 | Virginia | 22 | |||||||

Iowa | 2 | New Mexico | 1 | Washington | 12 | |||||||

Kansas | 3 | New York | 37 | District of Columbia | 3 | |||||||

Kentucky | 4 | North Carolina | 10 | Wisconsin | 10 | |||||||

Total | 501 | |||||||||||

Through our investment in Town Shoes, we serve Canadian customers with great values on branded footwear and accessories within a variety of concepts, including DSW Designer Shoe Warehouse stores. As of January 28, 2017, there are 23 DSW Designer Shoe Warehouse stores in Canada. Through our franchise arrangement with the Apparel Group, we expect to expand DSW by up to 40 stores in the Gulf Coast region of the Middle East, both in malls and on high street locations, with the first stores opening in fiscal 2017. With our acquisition of Ebuys, we are expanding our presence into several fast-growing digital marketplaces that appeal to value-oriented customers.

Investment in Our Infrastructure

We continue to invest in systems in order to enhance our customers' experience, both in-store and online, which includes supporting our omni-channel capabilities. We are also enhancing systems for back-office support. Over the past few years, we have completed investments in our supply chain to support assortment planning, size replenishment and size optimization.

3

Our primary distribution center is located in an approximately 625,000 square foot facility in Columbus, Ohio. The distribution center operates to facilitate the prompt delivery of purchases and fast-selling footwear so we can take full advantage of each selling season. To further ensure prompt delivery, we engage a logistics service provider to receive orders originating from suppliers on the West Coast and some imports entering at a West Coast port of entry through a West Coast facility we utilize. Merchandise is transported either from the West Coast facility or our primary distribution center to our pool points and then on to stores.

Our order routing optimization system determines the best location to fulfill digitally demanded products, which allows us to optimize our operating profit. Orders originating online can be fulfilled from a store or our fulfillment center, which is also located in Columbus, Ohio. The fulfillment center processes orders, which are shipped to a customer's home or to a store when an order is placed through buy online, ship to store. Orders originating from a store that cannot be fulfilled immediately in that store can either be fulfilled from our ship from store capability, from the fulfillment center, or drop shipped from a vendors' warehouse.

In order to support the planned growth of Ebuys' operations, we are transitioning Ebuys' existing fulfillment centers into a single larger facility in Nashville, Tennessee that will double its supply chain capabilities.

Utilizing Our Financial Strength

Over the past five years, our net sales have grown at a compounded annual growth rate of 6%. In addition, we have consistently generated positive operating cash flows and profitable operating results. Our liquidity, strong vendor relationships and talented associates enable us to differentiate our assortment and run a profitable business compared to our peers.

We are committed to a disciplined process in capital allocation. We believe cash generated from operations, together with our cash and investments of $287.1 million as of January 28, 2017, is sufficient to maintain our ongoing operations, support seasonal working capital requirements, fund capital expenditures, and make quarterly dividend payments and opportunistic share repurchases. In addition, our strong balance sheet allows us to pursue inorganic growth through investments like Town Shoes and Ebuys.

Affiliated Business Group

The Affiliated Business Group partners with multi-category retailers to develop strategies and business models for targeted shoe assortments. We leverage our sourcing network to produce a merchandise assortment that meets the needs of our affiliated business customers. We have renewable supply agreements to provide merchandise for the shoe departments in Stein Mart, Gordmans, and Frugal Fannie's stores through December 2017, January 2019 and April 2018, respectively. As of January 28, 2017, we supplied merchandise to 288 Stein Mart stores and Steinmart.com, 106 Gordmans stores and Gordmans.com, and one Frugal Fannie's store. We continue to pursue opportunities for new affiliated business partners.

Additional Information

Competition

The retail footwear market is highly competitive with few barriers to entry. We compete against a diverse group of retailers, both small and large, including department stores, mall-based shoe stores, national chains, independent shoe retailers, single-brand specialty retailers, online shoe retailers, brand-oriented discounters, multi-channel specialty retailers and brand suppliers who sell directly to consumers. Many of our competitors generally offer a more limited assortment at higher initial prices in a less convenient format than DSW and without the benefits of the DSW Rewards program. In addition, we believe we successfully compete against retailers who have attempted to duplicate our format because they typically offer assortments with fewer recognizable brands and more styles from prior seasons, unlike DSW's current on-trend merchandise. We believe that our brick and mortar stores provide a competitive advantage by stimulating digital sales, driving growth in DSW segment sales and providing a convenient location for customers to pick up and return products ordered online, as well as serving as geographically appropriate shipment centers for our digitally demanded products.

4

Intellectual Property

We have registered a number of trademarks, service marks and domain names in the United States and internationally, including DSW®, DSW Shoe Warehouse® and DSW Designer Shoe Warehouse®. We licensed our DSW Designer Shoe Warehouse trademark to Town Shoes and the Apparel Group. We also have registered trademarks through our acquisition of Ebuys including Apparel Save®, ShoeMetro®, ShoeMetro.com® and SM ShoeMetro®. We believe our trademarks and service marks, especially those related to the DSW concept, have significant value and are important to building our name recognition. To protect our brand identity, we have also protected the DSW trademark in several foreign countries. We also hold patents related to our unique store fixtures, which gives us greater efficiency in stocking and operating those stores that currently have the fixtures. We aggressively protect our patented fixture designs, as well as our packaging, private brand names, store design elements, marketing slogans and graphics.

Associates

As of January 28, 2017, we employed approximately 12,600 associates. None of our associates are covered by any collective bargaining agreements. We offer competitive wages, paid time off, comprehensive medical and dental insurance, vision care, company-paid and supplemental life insurance programs, associate-paid long-term disability and company-paid short-term disability insurance and a 401(k) plan to our full-time associates and some of our part-time associates. We have not experienced any work stoppages, and we consider our relations with our associates to be good.

Seasonality

Our business is subject to seasonal merchandise trends driven by the change in weather conditions and our customers' interest in new seasonal styles. New spring styles are primarily introduced in the first quarter and new fall styles are primarily introduced in the third quarter.

Available Information

DSW Inc. electronically files reports with the Securities and Exchange Commission ("SEC"), including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments to such reports. The public may read and copy any materials that DSW Inc. files with the SEC at:

SEC Public Reference Room

100 F Street N.E.

Washington, D.C. 20549

The public may obtain information on the operation at the SEC Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. Additionally, information about DSW Inc., including its reports filed with or furnished to the SEC, is available through DSW Inc.'s website at www.dswinc.com. Such reports are accessible at no charge through DSW Inc.'s website and are made available as soon as reasonably practicable after such material is filed with or furnished to the SEC.

Copies of any of the above-referenced documents will also be made available, free of charge, upon written request to:

DSW Inc.

Investor Relations

810 DSW Drive

Columbus, OH 43219

We have included our website addresses throughout this report as textual references only. The information contained on our websites is not incorporated into this Form 10-K.

5

ITEM 1A. | RISK FACTORS |

In addition to the other information in this Annual Report on Form 10-K, shareholders or prospective investors should carefully consider the following risk factors when evaluating DSW Inc. If any of the events described below occurs, our business, financial condition, results of operations and future growth prospects could be negatively affected.

Risks Relating to Our Business

Our strategy of growing our store base and digital demand could strain our resources and have a material adverse effect on our business and financial performance.

Our continued and future growth in part depends on our ability to successfully open and operate new DSW stores on a profitable basis. We also continue to invest in our digital capabilities in order to deliver a high-quality, coordinated shopping experience for our customers, which requires substantial investment in technology. This continued growth could place increased demands on our financial, managerial, operational and administrative resources. We may not achieve our planned growth on a timely and profitable basis or achieve results in new locations similar to those achieved in existing locations in prior periods.

We plan to open approximately 15 to 17 DSW stores in fiscal 2017. Our ability to open and operate new DSW stores on a timely and profitable basis depends on many factors, including our ability to: identify suitable markets and sites for new store locations with financially stable co-tenants and landlords; negotiate acceptable lease terms; build-out or refurbish sites on a timely and effective basis; obtain sufficient levels of inventory to meet the needs of new stores; obtain sufficient financing and capital resources or generate sufficient operating cash flows from operations to fund growth; open new stores at costs not significantly greater than those anticipated; successfully open new DSW stores in markets in which we currently have few or no stores; control the costs of other capital investments associated with store openings; hire, train and retain qualified managers and store personnel; and successfully integrate new stores into our existing infrastructure, operations, management and distribution systems or adapt such infrastructure, operations and systems to accommodate our growth. As a result, we may be unable to open new stores at the rates expected or at all. If we fail to successfully implement our growth strategy, the opening of new DSW stores could be delayed or prevented, could cost more than anticipated and could divert resources from other areas of our business, any of which could have a material adverse effect on our business. To the extent that we open new DSW stores in our existing markets, we may experience reduced net sales in existing stores in those markets. As our store base increases, our stores will become more concentrated in the markets we serve. As a result, the number of customers and financial performance of individual stores may decline and the average sales per square foot at our stores may be reduced, which could have a material adverse effect on our business.

As we introduce enhancements to dsw.com and m.dsw.com, the DSW mobile site, we could experience downtime or other technical issues, which could have a material adverse effect on our business. In addition, the growth in digital demand could result in a diversion of traffic from our stores.

Our failure to protect our reputation could have a material adverse effect on our brands.

The value of our brand is largely dependent on the success of our merchandise assortment and our ability to provide a consistent, high quality customer experience. Any negative publicity about us or the significant brands we offer may reduce demand for our merchandise. Failure to comply with ethical, social, product, labor, health and safety, accounting or environmental standards could also jeopardize our reputation and potentially lead to various adverse consumer actions. Consumer actions could include boycotts and negative publicity through social or digital media. Public perception about us or the products we carry, whether justified or not, could impair our reputation, involve us in litigation, damage our brand and have a material adverse effect on our business.

We rely on our strong relationships with vendors to purchase brand name and designer merchandise at favorable prices. If these relationships were to be impaired, we may not be able to obtain a sufficient assortment of merchandise at attractive prices, and we may not be able to respond promptly to changing fashion trends, either of which could have a material adverse effect on our business and financial performance.

Our success depends, to a significant extent, on the willingness and ability of our vendors to supply us with sufficient inventory to stock our sales channels as we generally do not have long-term supply agreements or exclusive arrangements with any vendors. If we fail to maintain strong relationships with our existing vendors or to ensure the quality of merchandise they supply us, and if we cannot maintain or acquire new vendors of in-season brand name and designer merchandise, our ability to obtain a sufficient amount and variety of merchandise at favorable prices may be limited, which could have a negative impact

6

on our business. In addition, our inability to stock our sales channels with in-season merchandise at attractive prices could result in lower net sales and decreased customer interest in our sales channels, which could have a material adverse effect on our business. Further, if our merchandise costs increase due to increases incurred by our vendors in raw materials, energy, labor, or duties and taxes on imports, or other reasons, our ability to respond or the effect of our response could adversely affect our net sales or gross profit. During fiscal 2016, three key vendors together supplied approximately 18% of our merchandise. The loss of, or a reduction in, the amount and quality of merchandise supplied by any one of these vendors could have an adverse effect on our business. In addition, any negative brand image, wide-spread product defects, or negative publicity related to these three key vendors, or other vendors, could have an adverse effect on our brand reputation and on our business.

We may be unable to anticipate and respond to fashion trends, consumer preferences and changing customer expectations, which could have a material adverse effect on our business.

Our merchandising strategy is based on having the proper mix of products in each store to attract our target customers or having those products available via our omni-channel capabilities. This requires us to anticipate and respond to numerous and fluctuating variables in fashion trends and other conditions in the markets in which our stores are situated. A variety of factors will affect our ability to maintain the proper mix of products in each store, including: local economic conditions impacting customers' discretionary spending; unanticipated fashion trends; our ability to provide timely access to in-season merchandise at attractive prices; our success in distributing merchandise to our stores in an efficient manner; and changes in weather patterns, which in turn affect consumer preferences. If we are unable to anticipate and fulfill the merchandise needs of our customers, we may experience decreases in our net sales and may be forced to increase markdowns in relation to slow-moving merchandise, either of which could have a material adverse effect on our business.

Being an omni-channel retailer is a business necessity to meet changing customer experience expectations and an opportunity to create a competitive advantage. It is a business necessity because the DSW customer expects to be able to shop across all sales channels. The omni-channel strategy can also create distance between DSW and single channel competitors as well as multi-channel competitors who either do not operate in an omni-channel way or do not define omni-channel as broadly as DSW. In the event that our omni-channel strategy does not meet customer expectations, it may have a material adverse effect on our business.

The loss or disruption of our distribution and/or fulfillment centers could have a material adverse effect on our business and operations.

For our DSW stores and affiliated businesses, the majority of our inventory is shipped directly from suppliers to our distribution center in Columbus, Ohio and a West Coast facility operated by a third party, where the inventory is then processed, sorted and shipped to one of our pool locations located throughout the country and then on to the stores. Our inventory can also be shipped directly from our fulfillment center, also located in Columbus, Ohio, and supported by a third party, to our customers. Through our ship from store capability, our inventory is shipped directly from our DSW stores. Through our drop ship program, inventory is shipped from the vendors' warehouse directly to the customer. In order to support the planned growth of Ebuys' operations, we are transitioning Ebuys' existing fulfillment centers into a single larger facility in Nashville, Tennessee that will double its supply chain capabilities.

Our operating results depend on the orderly operation of our receiving and distribution process, which in turn depends on third-party vendors' adherence to shipping schedules and our effective management of our distribution facilities. We may not anticipate all the changing demands that our expanding operations will impose on our receiving and distribution system, and events beyond our control, such as disruptions in operations due to catastrophic events, labor disagreements, disruptions with the Ebuys' facility transition, or shipping problems, that may result in delays in the delivery of merchandise to our stores and customers. While we maintain business interruption and property insurance, in the event our distribution and fulfillment centers shut down for any reason or if we were to incur higher costs and longer lead times in connection with a disruption at our distribution and fulfillment centers, our insurance may not be sufficient to cover the impact to the business.

7

The discontinuation of the ABG business could have a material adverse effect on our business and financial performance.

On March 13, 2017, Gordmans, one of our affiliated partners in the ABG segment, filed for relief under Chapter 11 of the United States Bankruptcy Code and announced its plan to liquidate inventory and other assets. The ultimate outcome of the filing and liquidation sale is subject to the oversight and approval of the bankruptcy court. We are monitoring the status of the filing and are taking appropriate actions to maximize the recovery value of the inventory we own at Gordmans locations. As of January 28, 2017, inventory we owned at Gordmans locations was approximately $8.0 million at cost, we had a receivable balance due from Gordmans of $0.3 million, and net property and equipment located in their stores of approximately $0.3 million. Our current estimated annual after-tax loss as a result of Gordmans' actions is approximately $4.0 million to $8.0 million, which includes projected loss in operating profit, additional markdowns of inventory, and the write-down of other assets.

Our contractual termination date for the supply agreement with Stein Mart is December 2017. For fiscal 2016, the total sales from our ABG segment represented 6% of our total company net sales. With the anticipated loss of the Gordmans business, if Stein Mart were to terminate our supply agreement, close a significant number of stores or liquidate, it could have a material adverse effect on our business and financial performance. Further, we may not be able to proportionately reduce expenses compared to the reduction of net sales related to ABG.

We are constantly exploring new business opportunities and implementing initiatives. The failure to successfully execute our strategies may have a material adverse effect on our business, results of operations or financial condition.

The continued development and implementation of new business opportunities and strategies could distract management from our core business. During fiscal 2014, we acquired an equity interest in Town Shoes and entered into a licensing agreement, which allows Town Shoes to use the DSW Designer Shoe Warehouse tradename for their new larger concept Canadian stores. During fiscal 2016, we completed the acquisition of Ebuys and we signed an agreement with the Apparel Group as an exclusive franchise partner in the Gulf Coast region of the Middle East. In the event that we lose focus on our core business or are unsuccessful in the execution of our concept, it may have a material adverse effect on our business, results of operations or financial condition.

New acquisitions could disrupt our ongoing business and adversely impact our results of operations.

The integration of Ebuys may disrupt our business or divert the attention of our management. Achieving the expected benefits depends in large part on our successful integration of the Ebuys operations, systems and personnel with our own in a timely and efficient manner. We cannot ensure that all of our integration efforts will be completed as quickly as expected. Our operating results or financial condition may be adversely impacted by pre-existing claims or liabilities, both known and unknown. In addition, the integration process may strain our financial and managerial controls and reporting systems and procedures and may result in the diversion of management and financial resources from the core business objectives. There can be no assurance that we will successfully integrate our businesses or that we will realize the anticipated benefits of the acquisitions after we complete our integration efforts.

If our international franchisees do not run the stores according to our standards, our brand reputation could be negatively impacted.

We are exposed to risks through international relationships. During fiscal 2014, we entered into a licensing agreement that allows Town Shoes to use the DSW Designer Shoe Warehouse tradename for their new larger concept Canadian stores. During fiscal 2016, we signed a franchise agreement that will permit our franchisee to operate our DSW Designer Shoe Warehouse stores in the Gulf Coast region of the Middle East. Although we evaluated and selected our franchisee and will do so with further franchisees, our ability to impact the success of their operations is limited. Our franchisees may not run the stores according to our standards, which could have a material adverse effect on our brand reputation and our business. We are also subject to certain U.S. laws, including the Foreign Corrupt Practices Act, as well as compliance with the laws of foreign countries in which we operate. Violations of these laws could subject us to sanctions or other fines or penalties that could have a material adverse effect on our business.

8

Our sales and quarterly financial performance may fluctuate for a variety of reasons, including seasonal variability.

Our business is sensitive to consumer spending patterns, which in turn are subject to prevailing regional and national economic conditions and the general level of economic activity. Our comparable sales and quarterly results of operations have fluctuated in the past, and we expect them to continue to fluctuate in the future. A variety of other factors affect our sales and quarterly financial performance, including: uncertain macro-economic conditions and changes in the retail sales environment; changes in our merchandising strategy; timing and concentration of new DSW store openings and related new store and other start-up costs; expenses associated with new DSW stores, our omni-channel strategy and marketing expenses; changes in our merchandise mix; changes in and regional variations in demographic and population characteristics; timing of promotional events; seasonal fluctuations due to weather conditions; and actions by our competitors.

Accordingly, our results for any one fiscal quarter are not necessarily indicative of the results to be expected for any other quarter, and comparable sales for any particular future period may increase or decrease. Our future financial performance may fall below the expectations of securities analysts and investors.

In addition, our business is subject to seasonal merchandise trends when our customers' interest in new seasonal styles increases. New spring styles are introduced in the first quarter and new fall styles are introduced in the third quarter. As a result of seasonal merchandise trends, any factors negatively affecting us during these periods, including adverse weather, the timing and level of markdowns, fashion trends or unfavorable economic conditions, could have a material adverse effect on our business.

The loss or disruption of information technology services could affect our ability to implement our growth strategy and have a material adverse effect on our business.

Our information technology systems are an integral part of our growth strategy in efficiently operating our business, in managing operations and protecting against security risks related to our electronic processing and transmitting of confidential customer and associate data. The requirements to keep our information technology systems operating at peak performance may be higher than anticipated and could strain our capital resources, management of any system upgrades, implementation of new systems and the related change management processes required with new systems and our ability to protect ourselves from any future information security breaches. In addition, any significant disruption of our data center could have a material adverse effect on those operations dependent on those systems, most specifically, store operations, dsw.com, our distribution and fulfillment centers and our merchandising team. While we maintain business interruption and property insurance, in the event our data center was to be shut down, our insurance may not be sufficient to cover the impact to the business.

We accept orders through dsw.com and m.dsw.com, as well as the operations of Ebuys on various digital marketplaces. We are subject to various risks of operating online and mobile selling capabilities such as: the failure of our information technology infrastructure, including any third-party hardware or software, resulting in downtime or other technical issues; reliance on third-party logistics providers to deliver our products to customers; inability to respond to technological changes; violations of state or federal laws; credit card fraud; or other information security breaches. Failure to mitigate these risks could have a material adverse effect on our business.

We face security risks related to our electronic processing of sensitive and confidential customer and associate data. If our data is breached, it could damage our reputation and have a material adverse effect on our business.

Given the nature of our business, we collect, process and retain sensitive and confidential customer data. While we have removed all cardholder data from our environment by upgrading our systems, and despite our current security measures, our facilities and systems, and those of our third-party service providers, may be vulnerable to information security breaches, acts of vandalism, computer viruses or other similar attacks. An information security breach involving the disclosure of confidential data could damage our reputation and our customers' willingness to shop in our stores, on dsw.com and m.dsw.com, and subject us to possible legal liability. In addition, we may incur material remediation costs as a result of an information security breach, including liability for stolen customer or associate data, repairing system damage or providing credit monitoring or other benefits to customers or associates affected by the breach. While we have insurance, in the event we experience an information security breach, our insurance may not be sufficient to cover the impact to the business. Failure to mitigate these risks could have a material adverse effect on our business.

9

Our failure to retain our existing senior management team and to continue to attract qualified new personnel could adversely affect our business.

Our business requires disciplined execution at all levels of our organization, which requires an experienced and talented management team. If we were to lose the benefit of the experience, efforts and abilities of any of our key executives and buying personnel, our business could be adversely affected. We have entered into employment agreements with several key executives and also offer compensation packages designed to attract and retain talent. Furthermore, our ability to manage our expansion will require us to continue to train, motivate and develop our employees to maintain a high level of talent for future challenges and succession planning. Competition for these types of personnel is intense, and we may not be successful in attracting and

retaining the personnel required to grow and operate our business.

We are dependent on our DSW Rewards program and marketing to drive traffic, sales and loyalty, and any decrease in membership or purchases from members could have a material adverse effect on our business.

Customer traffic is influenced by our marketing and our DSW Rewards programs. DSW Rewards is a customer loyalty program that we rely on to drive customer traffic, sales and loyalty. DSW Rewards members earn reward certificates of discounts on future purchases. Approximately 24 million members are enrolled in our DSW Rewards program and have made at least one purchase over the course of the last two years. In fiscal 2016, shoppers in the DSW Rewards program generated approximately 90% of DSW segment sales. In the event that our DSW Rewards members do not continue to shop at DSW, we fail to add new members, the number of members decreases, or our marketing is not effective in driving customer traffic, this could have a material adverse effect on our business.

We are exposed to risk through leases of certain properties.

We have certain portions of our owned properties that are leased to unrelated parties, which provides rental income. The largest tenant's lease renewed for another two-year term in June 2015, but that tenant can terminate at any time with 60 days notice. In addition, we own an office space where we are the tenant under a ground lease that expires in 2024. We sublease the entire space to an unrelated third party at a rent that is lower than the rent for the ground lease. The sublease was renewed for a two-year term in June 2015, but that tenant can terminate at any time with 60 days notice. As a result of a previous merger, we provided a guarantee for a lease commitment that is scheduled to expire in 2024 of a location that has been leased to a third party. In the event that one or more of the third parties does not renew or terminates their arrangement, the foregoing circumstances or events could have a material adverse effect on our financial condition.

Risks Relating to the External Environment

We may be unable to compete in our highly competitive market, which could have a material adverse effect on our business.

The retail footwear market is highly competitive with few barriers to entry. We compete against a diverse group of retailers, both small and large, including department stores, mall-based shoe stores, national chains, independent shoe retailers, single-brand specialty retailers, online shoe retailers, brand-oriented discounters, multi-channel specialty retailers and brand suppliers who sell directly to consumers. Our success depends on our ability to remain competitive with respect to assortment, convenience and value. The performance of our competitors, as well as a change in their pricing policies as a result of the current economic environment, marketing activities and other business strategies, could have a material adverse effect on our business.

Internet and mobile networks have rapidly evolved while consumer receptiveness to shopping online has substantially increased. Competition from ecommerce and mobile players has significantly increased due to their ability to provide improved user experience, greater ease of buying goods, low or no shipping fees, faster shipping times and more favorable return policies. Businesses, including our suppliers, can easily launch online sites and mobile platforms at nominal costs by using commercially available software or partnering with any of a number of successful digital marketplace providers. Competitors with other revenue sources may also be able to devote more resources to marketing and promotional campaigns, adopt more aggressive pricing policies and devote more resources to website, mobile platforms and applications and systems development.

10

We rely on foreign sources for our merchandise, and our business is therefore subject to risks associated with international trade.

We purchase merchandise from domestic and foreign vendors. In addition, many of our domestic vendors import a large portion of their merchandise from abroad, primarily from China, Brazil and Italy. We believe that almost all the merchandise we purchased during fiscal 2016 was manufactured outside the United States, and the majority was manufactured in China. For this reason, we face risks inherent in purchasing from foreign suppliers, such as: economic and political instability in countries where these suppliers are located; international hostilities or acts of war or terrorism affecting the United States or foreign countries from which our merchandise is sourced; increases in shipping costs; transportation delays and interruptions, including increased inspections of import shipments by domestic authorities; work stoppages; U.S. laws affecting the importation of goods, including duties, tariffs and quotas and other non-tariff barriers; expropriation or nationalization; changes in foreign government administration and governmental policies; changes in import duties or quotas; compliance with trade and foreign tax laws; and local business practices, including compliance with foreign laws and with domestic and international labor standards.

We require our vendors to operate in compliance with applicable laws and regulations and our internal requirements. However, we do not control our vendors or their labor and business practices. The violation of labor or other laws by one of our vendors could have a material adverse effect on our business.

Future legislation, regulatory reform or policy changes could have a material adverse effect on our business.

Various federal corporate tax reform bills and other proposals have been or are currently under consideration. These proposals include, among other items: corporate income tax rate changes in varying, uncertain, or unspecified amounts; the reduction or elimination of certain corporate tax incentives; the disallowance of tax deductions for imported merchandise; border adjustments; tariffs on imports; an increase in customs duties; and the renegotiation of U.S. trade agreements. It is not clear whether, or to what extent, these proposals may be enacted. Any potential changes in tax and trade policies in the United States, and the potential corresponding actions by other countries, could have a material adverse effect on our business.

Uncertain economic conditions in the United States and other world events can adversely affect consumer confidence and consumer spending habits, which could result in reduced net sales.

Consumer spending habits, including spending for the footwear and accessories that we sell, are affected by, among other things: prevailing economic conditions; levels of employment; salaries and wage rates; prevailing interest rates; income tax rates and policies; consumer confidence; and consumer perception of economic conditions. In addition, consumer purchasing patterns may be influenced by consumers' disposable income. Consumer confidence is also affected by the domestic and international political environment. The outbreak or escalation of war, natural disasters, or the occurrence of terrorist acts or other hostilities in or affecting the United States, could lead to a decrease in spending by consumers. In an economic slowdown, we could experience lower net sales than expected on a quarterly or annual basis and be forced to delay or slow our expansion plans. Reduced net sales may result in reduced operating cash flows if we are not able to appropriately manage inventory levels or leverage expenses. These negative economic conditions could have a material adverse effect on our business.

Restrictions in our secured revolving credit facility and letter of credit agreement could limit our operational flexibility.

We have a $100 million secured revolving credit agreement and a $50 million letter of credit agreement with terms expiring in July 2018 and August 2018, respectively. The secured revolving credit agreement is secured by a lien on substantially all of our personal property assets and subsidiaries with certain exclusions and may be used to provide funds for general corporate purposes, to provide for ongoing working capital requirements, and to make permitted acquisitions. In addition, both the secured revolving credit agreement and the letter of credit agreement contain restrictive covenants relating to our management and the operation of our business. These covenants, among other things, limit or restrict our ability to grant liens on our assets, limit our ability to incur additional indebtedness, limit our capital expenditures to $200 million annually (the secured revolving credit agreement only), limit our ability to enter into transactions with affiliates and limit our ability to merge or consolidate with another entity. These covenants could restrict our operational flexibility, and any failure to comply with these covenants or our payment obligations would limit our ability to borrow under the secured revolving credit facility and, in certain circumstances, may allow the lenders thereunder to require repayment.

Our cash and investments are subject to risks that could affect the liquidity of these investments.

As of January 28, 2017, we had cash and investments of $287.1 million. A portion of these are held as cash in operating accounts that are with third-party financial institutions. While we regularly monitor the cash balances in our operating accounts

11

and when possible adjust the balances as appropriate to be within Federal Deposit Insurance Corporation insurance limits, these cash balances could be lost or inaccessible if the underlying financial institutions fail or are subject to other adverse conditions in the financial markets.

While we generally invest in lower risk investments, investment risk has been and may further be exacerbated by credit and liquidity issues that have affected various sectors of the financial markets. Our access to cash and investments, their earning potential or our ability to invest in highly rated, low risk investments may be impacted by adverse conditions in the U.S. financial markets. These market risks associated with our cash and investments could have a material adverse effect on our business.

Risks Relating to our Common Shares

Our amended articles of incorporation, amended and restated code of regulations and Ohio state law contain provisions that may have the effect of delaying or preventing a change in control of DSW Inc. This could adversely affect the value of our Common Shares.

Our amended articles of incorporation authorize our Board of Directors to issue up to 100,000,000 preferred shares and to determine the powers, preferences, privileges, rights, including voting rights, qualifications, limitations and restrictions on those shares, without any further vote or action by the shareholders. The rights of the holders of our Class A Common Shares will be subject to, and may be adversely affected by, the rights of the holders of any preferred shares that may be issued in the future. The issuance of preferred shares could have the effect of delaying, deterring or preventing a change in control and could adversely affect the voting power of our Common Shares.

In addition, provisions of our amended articles of incorporation, amended and restated code of regulations and Ohio law, together or separately, could discourage potential acquisition proposals, delay or prevent a change in control or limit the price that certain investors might be willing to pay in the future for our Common Shares. Among other things, these provisions establish a staggered board, require a supermajority vote to remove directors, and establish certain advance notice procedures for nomination of candidates for election as directors and for shareholder proposals to be considered at shareholders' meetings.

We do not expect a trading market for the Company's Class B Common Shares to develop and therefore any investment in the Class B Common Shares may be effectively illiquid, unless such shares are converted into the Company's Class A Common Shares.

There is currently no public market for the Company's Class B Common Shares. We do not intend to list the Class B Common Shares on any securities exchange or any automated quotation system. As a result, there can be no assurance that a secondary market will develop, and we do not expect any market makers to participate in a secondary market. Because the Class B Common Shares are not listed on a securities exchange or an automated quotation system, it may be difficult to obtain pricing information with respect to the shares. Accordingly, there may be a limited number of buyers if a holder decided to sell their Class B Common Shares. This may affect the price a holder would receive upon such sale. Alternatively, a holder of such shares could convert them into Class A Common Shares, on a share for share basis, prior to selling. However, such conversion could affect the timing of any such sale, which may in turn affect the price a holder may receive upon such sale.

The Schottenstein Affiliates, entities owned by or controlled by Jay L. Schottenstein, the executive chairman of the DSW Inc. Board of Directors, and members of his family, directly control or substantially influence the outcome of matters submitted for DSW Inc. shareholder votes, and their interests may differ from other shareholders.

As of January 28, 2017, the Schottenstein Affiliates have approximately 51% of the voting power of the Company's outstanding common shares. The Schottenstein Affiliates directly control or substantially influence the outcome of all matters submitted to DSW Inc.'s shareholders for approval, including the election of directors, approval of mergers or other business combinations, and acquisitions or dispositions of assets. The interests of the Schottenstein Affiliates may differ from or be opposed to the interests of other shareholders, and their level of ownership and voting power in the Company may have the effect of delaying or preventing a subsequent change in control that may be favored by other shareholders.

The Schottenstein Affiliates engage in a variety of businesses, including, but not limited to, business and inventory liquidations, apparel companies and real estate investments. Opportunities may arise in the area of potential competitive business activities that may be attractive to the Schottenstein Affiliates and us. Our amended and restated articles of incorporation provide that the Schottenstein Affiliates are under no obligation to communicate or offer any corporate opportunity to us. In addition, the Schottenstein Affiliates have the right to engage in similar activities as us, do business with our suppliers and customers, and, except as limited by agreement, employ or otherwise engage any of our officers or employees.

12

Risks Relating to our Equity Investment in Town Shoes Limited

We are exposed to investment risk with the acquisition of an equity interest in Town Shoes.

During fiscal 2014, we acquired an equity interest in Town Shoes. We are exposed to risk of the success of the Town Shoes business. We are also exposed to risk of adverse reactions to the transaction or changes to business relationships; competitive responses; inability to maintain key personnel and changes in general economic conditions in Canada. If Town Shoes fails to perform to our expectations, it could have a material adverse effect on our results of operations or financial condition.

We are exposed to foreign currency risk with the acquisition of an equity interest in Town Shoes.

As a result of our equity investment in Town Shoes, we are exposed to foreign currency rate risk. We currently do not utilize hedging instruments to mitigate foreign currency exchange risks. During fiscal 2015, we invested $100 million CAD in available-for-sale securities in Canada and, as a result, any gains or losses due to translation are recorded in other comprehensive income. If the funds are transferred to cash, we will be exposed to foreign currency rate risk due to the impact of the translation being recorded in our statement of operations.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

ITEM 2. | PROPERTIES |

We own our corporate office headquarters and the DSW segment distribution center. As of January 28, 2017, all 501 DSW stores, our fulfillment center and our Ebuys distribution centers are leased or subleased, including 17 DSW stores and our fulfillment center that are leased or subleased from Schottenstein Affiliates. Most of the DSW store leases provide for a minimum annual rent plus a percentage of gross sales over specified breakpoints and are for a fixed term with options for extension periods, exercisable at our option. The lease for our fulfillment center expires in September 2022 and has two renewal options with terms of five years each. Our DSW segment distribution facility, our corporate office headquarters and our dsw.com fulfillment center are located in Columbus, Ohio. Our Ebuys distribution centers are located in San Diego, California and Nashville, Tennessee. Refer to Item 1. Business of this Annual Report on Form 10-K for the number of our DSW stores by state and territory.

ITEM 3. | LEGAL PROCEEDINGS |

The information set forth in Note 15, Commitments and Contingencies - Legal Proceedings, of the Consolidated Financial Statements of this Annual Report on Form 10-K is incorporated herein by reference.

ITEM 4. | MINE SAFETY DISCLOSURES |

Not Applicable.

PART II

ITEM 5. | MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Common Shares

Our Class A Common Shares are listed for trading under the ticker symbol "DSW" on the New York Stock Exchange ("NYSE"). There is currently no public market for the Company's Class B Common Shares, but the Class B Common Shares can be exchanged for the Company's Class A Common Shares at the election of the holder on a share for share basis. Holders of Class A Common Shares are entitled to one vote per share and holders of Class B Common Shares are entitled to eight votes per share on matters submitted to shareholders for approval. As of March 17, 2017, there were 192 holders of record of our Class A Common Shares and 28 holders of record of our Class B Common Shares. The number of holders of record is based upon the actual number of holders registered at such date and does not include holders of shares in "street names" or persons, partnerships, associates, corporations, or other entities identified in security position listings maintained by depositories. The following table sets forth the high and low prices of our Class A Common Shares as reported on the NYSE for each quarter in fiscal 2016 and 2015:

13

Fiscal 2016 | Fiscal 2015 | ||||||||||||||

Market Price | |||||||||||||||

High | Low | High | Low | ||||||||||||

First Quarter | $ | 29.53 | $ | 21.99 | $ | 39.58 | $ | 34.04 | |||||||

Second Quarter | 24.98 | 18.51 | 36.92 | 30.75 | |||||||||||

Third Quarter | 26.22 | 20.07 | 33.81 | 23.61 | |||||||||||

Fourth Quarter | 25.96 | 20.08 | 25.46 | 21.23 | |||||||||||

Dividends

The payment of any future dividends is at the discretion of our Board of Directors and is based on our future earnings, cash flow, financial condition, capital requirements, changes in taxation laws, general economic condition and any other relevant factors. It is anticipated that dividends will be declared on a quarterly basis. Our Credit Facility allows the payment of dividends by us or our subsidiaries, provided that we meet the minimum cash and investments requirement, as defined in our Credit Facility, of $125 million. The cash dividend was $0.20 per Class A Common Share and Class B Common Share for each quarter in fiscal 2016 and 2015.

Share Repurchase Program

On November 2, 2015, the Board of Directors approved an additional $200 million share repurchase program after the previous $150 million authorization was fully utilized. The share repurchase program may be suspended, modified or discontinued at any time, and we have no obligation to repurchase any amount of our common shares under the program. We will determine the amount of shares to repurchase based on generated and expected cash flow and cash usage needs, past and anticipated business performance and available alternative investment opportunities. Shares will be repurchased in the open market at times and in amounts based on price and market conditions.

The following table sets forth the Class A Common Share repurchases during the most recent quarter:

(a) Total Number of Shares Purchased | (b) Average Price Paid per Share | (c) Total Number of Shares Purchased as Part of Publicly Announced Programs | (d) Approximate Dollar Value of Shares that May Yet Be Purchased Under the Programs | ||||||||||

(in thousands, except per share amounts) | |||||||||||||

October 30, 2016 to November 26, 2016(1) | 351 | $ | 20.80 | 351 | $ | 33,469 | |||||||

November 27, 2016 to December 31, 2016(2) | 4 | $ | 24.45 | — | $ | 33,469 | |||||||

January 1, 2017 to January 28, 2017 | — | $ | — | — | $ | 33,469 | |||||||

355 | $ | 20.84 | 351 | ||||||||||

(1) | The total number of shares repurchased includes shares repurchased as part of publicly announced programs (the average price paid per share includes any broker commissions). |

(2) | The total number of shares repurchased relates to shares withheld in connection with tax payments due upon vesting of employee restricted stock awards. |

14

Performance Graph

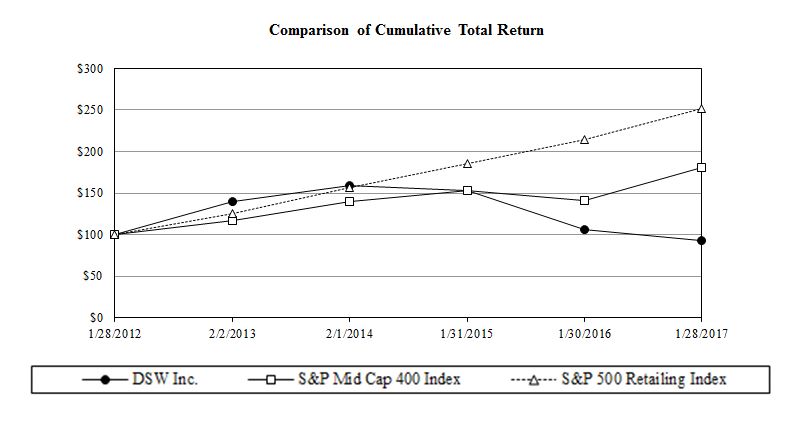

The following graph compares our cumulative total shareholder return on our Class A Common Shares with the cumulative total returns of the Standard and Poor's ("S&P") MidCap 400 Index and the S&P Retailing Index, both of which are published indexes. The comparison of the cumulative total returns for each investment assumes that $100 was invested on January 28, 2012 and that all dividends were reinvested. This comparison includes the period ended January 28, 2012 through the period ended January 28, 2017.

Fiscal years ended | ||||||||||||||||||||||||

Company / Index | 1/28/2012 | 2/2/2013 | 2/1/2014 | 1/31/2015 | 1/30/2016 | 1/28/2017 | ||||||||||||||||||

DSW Inc. | $ | 100.00 | $ | 139.92 | $ | 158.89 | $ | 153.55 | $ | 106.43 | $ | 93.25 | ||||||||||||

S&P MidCap 400 Index | $ | 100.00 | $ | 116.75 | $ | 140.21 | $ | 153.24 | $ | 140.71 | $ | 181.17 | ||||||||||||

S&P 500 Retailing Index | $ | 100.00 | $ | 125.90 | $ | 156.47 | $ | 185.81 | $ | 214.72 | $ | 251.84 | ||||||||||||

15

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth various selected financial information. Such selected consolidated financial data should be read in conjunction with our Consolidated Financial Statements, including the notes thereto, set forth in Item 8 of this Annual Report on Form 10-K and Management's Discussion and Analysis of Financial Condition and Results of Operations set forth in Item 7 of this Annual Report on Form 10-K.

Fiscal(1) | |||||||||||||||||||

2016(2) | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

(in thousands, except per share data, store count and per square foot data) | |||||||||||||||||||

Statement of Operations Data: | |||||||||||||||||||

Net sales | $ | 2,711,444 | $ | 2,620,248 | $ | 2,496,092 | $ | 2,368,668 | $ | 2,257,778 | |||||||||

Gross profit(3) | $ | 771,833 | $ | 768,369 | $ | 755,021 | $ | 739,287 | $ | 724,720 | |||||||||

Operating expenses | $ | (591,816 | ) | $ | (554,818 | ) | $ | (512,536 | ) | $ | (497,863 | ) | $ | (481,797 | ) | ||||

Operating profit | $ | 200,168 | $ | 213,551 | $ | 242,485 | $ | 241,424 | $ | 236,802 | |||||||||

Income from continuing operations, net of tax | $ | 124,535 | $ | 136,034 | $ | 153,027 | $ | 151,302 | $ | 145,186 | |||||||||

Income from discontinued operations, net of tax | $ | — | $ | — | $ | 272 | $ | — | $ | 1,253 | |||||||||

Net income | $ | 124,535 | $ | 136,034 | $ | 153,299 | $ | 151,302 | $ | 146,439 | |||||||||

Earnings per Share Data: | |||||||||||||||||||

Diluted earnings per share from continuing operations | $ | 1.52 | $ | 1.54 | $ | 1.69 | $ | 1.65 | $ | 1.60 | |||||||||

Diluted earnings per share from discontinued operations | $ | — | $ | — | $ | 0.00 | $ | — | $ | 0.01 | |||||||||

Diluted earnings per share | $ | 1.52 | $ | 1.54 | $ | 1.69 | $ | 1.65 | $ | 1.62 | |||||||||

Weighted average number of diluted shares outstanding | 82,135 | 88,501 | 90,612 | 91,901 | 90,606 | ||||||||||||||

Balance Sheet Data: | |||||||||||||||||||

Cash and investments(4) | $ | 287,091 | $ | 330,475 | $ | 447,128 | $ | 579,307 | $ | 409,890 | |||||||||

Inventory | $ | 499,995 | $ | 484,236 | $ | 450,836 | $ | 397,768 | $ | 393,794 | |||||||||

Total assets | $ | 1,428,476 | $ | 1,369,109 | $ | 1,438,243 | $ | 1,421,244 | $ | 1,262,103 | |||||||||

Total shareholders' equity | $ | 937,488 | $ | 904,924 | $ | 1,011,120 | $ | 998,544 | $ | 858,579 | |||||||||

Other Data: | |||||||||||||||||||

Comparable sales change(5) | (3.0 | )% | 0.8 | % | 1.8 | % | 0.2 | % | 5.5 | % | |||||||||

DSW stores (excluding licensed stores): | |||||||||||||||||||

Beginning of period | 468 | 431 | 394 | 364 | 326 | ||||||||||||||

New stores | 34 | 40 | 37 | 30 | 39 | ||||||||||||||

Closed stores | (1 | ) | (3 | ) | — | — | (1 | ) | |||||||||||

End of period | 501 | 468 | 431 | 394 | 364 | ||||||||||||||

DSW square footage(6) | 10,336 | 9,805 | 9,277 | 8,687 | 8,120 | ||||||||||||||

Average gross square footage(7) | 10,063 | 9,591 | 9,009 | 8,415 | 7,690 | ||||||||||||||

DSW segment net sales per average gross square foot(8) | $ | 246 | $ | 258 | $ | 261 | $ | 265 | $ | 276 | |||||||||

Number of affiliated business departments at the end of period | 395 | 379 | 371 | 356 | 344 | ||||||||||||||

Cash dividends per share | $ | 0.800 | $ | 0.800 | $ | 0.750 | $ | 0.375 | $ | 1.435 | |||||||||

16

____________

(1) | All fiscal years are based on a 52-week year, except for fiscal 2012, which is based on a 53-week year. |

(2) | Fiscal 2016 includes the results of operations of Ebuys, which we acquired on March 4, 2016. |

(3) | Gross profit is defined as net sales less cost of sales. Cost of sales includes the cost of merchandise, which includes markdowns and shrinkage, and expenses associated with distribution and fulfillment (including depreciation) and store occupancy (excluding depreciation and including store impairments). The calculation of gross profit varies across the retail industry and, as a result, the calculations of other retail companies may not be consistent with our calculation. |

(4) | Includes cash and cash equivalents, short-term and long-term investments. |