Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 SECTION 906 CERTIFICATION - DAKOTA TERRITORY RESOURCE CORP | f10k033120_ex32z2.htm |

| EX-32.1 - EXHIBIT 32.1 SECTION 906 CERTIFICATION - DAKOTA TERRITORY RESOURCE CORP | f10k033120_ex32z1.htm |

| EX-31.2 - EXHIBIT 31.2 SECTION 302 CERTIFICATION - DAKOTA TERRITORY RESOURCE CORP | f10k033120_ex31z2.htm |

| EX-31.1 - EXHIBIT 31.1 SECTION 302 CERTIFICATION - DAKOTA TERRITORY RESOURCE CORP | f10k033120_ex31z1.htm |

| EX-10.3 - EXHIBIT 10.3 AT-WILL EMPLOYMENT ARRANGEMENT FOR WM. CHRIS MATHERS - DAKOTA TERRITORY RESOURCE CORP | f10k033120_ex10z3.htm |

| EX-10.2 - EXHIBIT 10.2 AT-WILL EMPLOYMENT ARRANGEMENT FOR GERALD ABERLE - DAKOTA TERRITORY RESOURCE CORP | f10k033120_ex10z2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2020

Commission file number 000-501191

Dakota Territory Resource Corp.

(Exact Name of Registrant as Specified in its charter)

Nevada |

| 98-0201259 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

10580 N. McCarran Blvd., Building 115-208 Reno, Nevada |

| 89503 |

(Address of principal executive offices) |

| (Zip Code) |

(713) 542-5161

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. [ ]

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer | [ ] | Accelerated Filer | [ ] |

Non-Accelerated Filer | [ ] | Smaller Reporting Company | [X] |

|

| Emerging Growth Company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

As of September 30, 2019, the aggregate market value of the registrant’s voting common stock held by non-affiliates of the registrant was $2,123,736 based upon the closing sale price of the common stock as reported by the OTC:QB.

As of June 12, 2020, there were outstanding 66,914,964 shares of common stock.

2

TABLE OF CONTENTS

|

| Page |

| Glossary of Terms | 4 |

| Cautionary Notice Regarding Forward-Looking Statements | 6 |

|

|

|

| Part I |

|

Item 1 | Business | 8 |

Item 1A | Risk Factors | 12 |

Item 1B | Unresolved Staff Comments | 19 |

Item 2 | Properties | 19 |

Item 3 | Legal Proceedings | 24 |

Item 4 | Mine Safety Disclosure | 24 |

|

|

|

| Part II |

|

Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 25 |

Item 6 | Selected Financial Data | 26 |

Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 26 |

Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 28 |

Item 8 | Financial Statements and Supplementary Data | F-1 |

Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 29 |

Item 9A | Controls and Procedures | 29 |

Item 9B | Other Information | 30 |

|

|

|

| Part III |

|

Item 10 | Directors, Executive Officers and Corporate Governance | 31 |

Item 11 | Executive Compensation | 33 |

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 34 |

Item 13 | Certain Relationships and Related Transactions and Director Independence | 36 |

Item 14 | Principal Accountant Fees and Services | 37 |

|

|

|

| Part IV |

|

Item 15 | Exhibits, Financial Statement Schedules | 38 |

| Signatures | 39 |

3

PRELIMINARY NOTES

As used in this annual report on Form 10-K (“annual report”), references to “Dakota”, “Dakota Territory”, “the Company,” “we,” “our,” or “us” mean Dakota Territory Resources Corp. and its predecessors, as the context requires.

GLOSSARY OF TERMS | ||

Alteration |

| Any physical or chemical change in a rock or mineral subsequent to its formation. |

|

|

|

Breccia |

| A rock in which angular fragments are surrounded by a mass of fine-grained minerals. |

|

|

|

Brownfield |

| A property, the expansion, redevelopment, or reuse of which may be complicated by the presence or potential presence of a hazardous substance, pollutant, or contaminant. |

|

|

|

Concession |

| A grant of a tract of land made by a government or other controlling authority in return for stipulated services or a promise that the land will be used for a specific purpose. |

|

|

|

Core |

| The long cylindrical piece of a rock, about an inch in diameter, brought to the surface by diamond drilling. |

|

|

|

Diamond drilling |

| A drilling method in which the cutting is done by abrasion using diamonds embedded in a matrix rather than by percussion. The drill cuts a core of rock, which is recovered in long cylindrical sections. |

|

|

|

Drift |

| A horizontal underground opening that follows along the length of a vein or rock formation as opposed to a cross-cut which crosses the rock formation. |

|

|

|

Exploration |

| Work involved in searching for ore, usually by drilling or driving a drift. |

|

|

|

Exploration expenditures |

| Costs incurred in identifying areas that may warrant examination and in examining specific areas that are considered to have prospects that may contain mineral deposit reserves. |

|

|

|

Grade |

| The average assay of a ton of ore, reflecting metal content. |

|

|

|

Host rock |

| The rock surrounding an ore deposit. |

|

|

|

Intrusive |

| A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface. |

|

|

|

Lode |

| A mineral deposit in solid rock. |

|

|

|

Ore |

| The naturally occurring material from which a mineral or minerals of economic value can be extracted profitably or to satisfy social or political objectives. The term is generally but not always used to refer to metalliferous material, and is often modified by the names of the valuable constituent; e.g., iron ore. |

|

|

|

Ore body |

| A continuous, well-defined mass of material of sufficient ore content to make extraction economically feasible. |

|

|

|

Mine development |

| The work carried out for the purpose of opening up a mineral deposit and making the actual ore extraction possible. |

|

|

|

Mineral |

| A naturally occurring homogeneous substance having definite physical properties and chemical composition, and if formed under favorable conditions, a definite crystal forms. |

|

|

|

Mineralization |

| The presence of minerals in a specific area or geological formation. |

4

Mineral reserve | That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of “Ore” when dealing with metalliferous minerals. |

|

|

Paleoplacer deposits | Consist of placer (ancient) concentrations of minerals in which the host material is a consolidated rock. |

|

|

Probable (Indicated) reserves | Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

|

|

Prospect | A mining property, the value of which has not been determined by exploration. |

|

|

Proven (Measured) reserves | Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

|

|

SEC Guide 7 Compliant Reserves | Mineral reserves that satisfy the guidelines set forth in Guide 7 of the Securities Act Industry Guide. |

|

|

Tonne | A metric ton which is equivalent to 2,200 pounds. |

|

|

Trend | A general term for the direction or bearing of the outcrop of a geological feature of any dimension, such as a layer, vein, ore body, or fold. |

|

|

Unpatented mining claim | A parcel of property located on federal lands pursuant to the General Mining Law and the requirements of the state in which the unpatented claim is located, the paramount title of which remains with the federal government. The holder of a valid, unpatented lode-mining claim is granted certain rights including the right to explore and mine such claim. |

|

|

Vein | A mineralized zone having a more or less regular development in length, width, and depth, which clearly separates it from neighboring rock. |

5

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains “forward-looking statements” concerning our anticipated results and developments in our operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements in this annual report include, but are not limited to:

the progress, potential and uncertainties of our exploration program at our properties located in the Homestake District of the Black Hills of South Dakota (the “Project”);

the success of getting the necessary permits for future drill programs and future project exploration;

expectations regarding the ability to raise capital and to continue our exploration plans on our properties; and

plans regarding anticipated expenditures at the Project.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

risks associated with lack of defined resources that are not SEC Guide 7 Compliant Reserves, and may never be;

risks associated with our history of losses and need for additional financing;

risks associated with our limited operating history;

risks associated with our properties all being in the exploration stage;

risks associated with our lack of history in producing metals from our properties;

risks associated with our need for additional financing to develop a producing mine, if warranted;

risks associated with our exploration activities not being commercially successful;

risks associated with ownership of surface rights at our Project;

risks associated with increased costs affecting our financial condition;

risks associated with a shortage of equipment and supplies adversely affecting our ability to operate;

risks associated with mining and mineral exploration being inherently dangerous;

risks associated with mineralization estimates;

risks associated with changes in mineralization estimates affecting the economic viability of our properties;

risks associated with uninsured risks;

risks associated with mineral operations being subject to market forces beyond our control;

risks associated with fluctuations in commodity prices;

risks associated with permitting, licenses and approval processes;

risks associated with the governmental and environmental regulations;

risks associated with future legislation regarding the mining industry and climate change;

risks associated with potential environmental lawsuits;

risks associated with our land reclamation requirements;

risks associated with gold mining presenting potential health risks;

risks related to title in our properties

risks related to competition in the gold and silver mining industries;

risks related to economic conditions;

risks related to our ability to manage growth;

risks related to the potential difficulty of attracting and retaining qualified personnel;

risks related to our dependence on key personnel;

risks related to our United States Securities and Exchange Commission (the “SEC”) filing history; and

risks related to our securities.

6

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this annual report. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as required by law, we disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the forward-looking statements contained in this annual report by the foregoing cautionary statements.

7

PART I

Item 1. Business

Our Company is engaged in the business of acquisition and exploration of mineral properties within the Homestake Gold District of the Black Hills of South Dakota. To date, while no development or mining activities have commenced, our strategy is to move projects from exploration to development and finally on to mining as results of exploration may dictate. Dakota Territory’s management and technical teams have extensive mining and exploration experience in the Homestake District and we intend to leverage our experience together with our business presence in South Dakota to create value for our shareholders. The Company currently holds four brownfield project areas in the district comprised of 404 unpatented claims and a combination of surface and mineral leases covering a total of approximately 7,166 acres. Our goal is to obtain sufficient capital to advance our current property portfolio, to fund acquisition of additional prospective mineral property, and for the general working capital needs of the Company.

Recent Developments

Dakota Territory entered into an agreement with JR Resources Corp. (“JR”) in May 2020 (“Agreement”) whereby JR loaned the Company $1,150,000 and the Company granted JR the right to purchase up to 142,566,667 shares of common stock at $0.15 per share (approximate 64.24% on a fully diluted basis) in one or more closings on or prior to October 15, 2020 (“Termination Date”). The Agreement allows Dakota to advance its current mineral property acquisition strategy with a seasoned team of mining and exploration executives with a track record of building mines and mining companies from quality assets. The Company intends to use proceeds from this loan to acquire up to $350,000 of mineral interests or properties, up to $500,000 to conduct an airborne geophysical survey, and the balance for general corporate and working capital purposes.

Upon execution of this Agreement, JR and the Company entered into an amended and restated promissory note in the amount of $1,450,000, of which $300,000 was advanced in February 2020 and $1,150,000 was advanced in May 2020. The note is unsecured and bears interest at the annual rate of 0.25%, compounded annually, payable on December 31, 2021. Upon a closing of a change of control transaction with JR as a result of the purchase of shares of common stock pursuant to the Agreement (“Change of Control Closing”), JR will be required to exercise, and will in fact be deemed to have exercised, its right to convert the principal of and accrued interest on the note into Company common stock at the rate of $0.15 per share. On the maturity date, the principal amount of the note, together with any accrued but unpaid interest, will be due and payable in cash, provided that, if and to the extent that the Company does not pay this note in cash on the maturity date, then JR will be required to exercise, and will in fact be deemed to have exercised, its right to convert such unpaid portion of the note into shares of Company common stock. The conversion price is $0.15 per share through December 31, 2020 and, thereafter, the lesser of $0.15 per share and the volume weighted average price of Company common stock for the five consecutive trading days immediately preceding the date of such conversion (with a floor of $0.10 per share). The note has customary event of default provisions and, upon an event of default, JR will be required to convert the unpaid portion of the note into the shares of Company common stock, if not paid prior thereto in cash by the Company.

Subject to the terms and conditions set forth in the Agreement, JR shall have the right, prior to the Termination Date, to purchase the 142,566,667 shares (for a purchase price of up to $21,385,000, reduced by the amount of note converted) in one or more closings from the Company. Each closing is subject to negotiation of closing deliverables and satisfaction of closing conditions to be mutually agreed upon by the Company and JR, including agreement on how the proceeds will be utilized. In the event of a Change of Control Closing, the closing deliverables to be negotiated and mutually agreed upon include the application of the use of proceeds, negotiation of employment agreements, agreement on equity grants pursuant to an equity compensation plan to be adopted, and amended bylaws to be adopted that will govern the appointment of JR director designees. There is no assurance that closing deliverables will be agreed upon and that any closing will occur, as JR is not obligated to purchase any of the 142,566,667 shares of common stock.

JR and the Company agree to set up a technical committee to identify and pursue attractive acquisition opportunities, plan and conduct field programs, develop a framework and platform for the Company’s database, conduct data research, compile and assemble data, organize work programs to evaluate potential mineral inventories and develop long term exploration and mining strategies including capital and operating budgets.

Until the Termination Date, the Company has agreed to conduct its business in the ordinary course consistent with past practice, and without the prior consent of JR the Company shall not:

adopt or propose any amendment to its articles of incorporation or bylaws;

effect any equity financings in excess of $250,000, exclusive of any common stock issued upon, and any proceeds received from, the exercise of outstanding derivative securities and common stock issued upon conversion by JR of the note;

incur any additional debt or issue any debt securities other than in the ordinary course of business;

8

make any material loans or advances or assume or guarantee any obligations, except for existing financing arrangements or otherwise in the ordinary course of business;

sell, transfer, assign, relinquish or dispose of any material asset or property; and

other than in the ordinary course of business, modify or amend in any material respect or terminate any material contract.

If and upon a Change of Control Closing, it is contemplated that the Company board shall consist of JR designees and certain current Company directors, as Company designees, it being understood that the number of Company directors shall not exceed five, and that the number of JR designees at any given time shall be one more than the number of Company designees. In the event of any vacancy in the office of any JR designee, a majority of the remaining JR designees shall have the right to designate a replacement, and in the event of any vacancy in the office of any Company designee, a majority of the remaining Company designees shall have the right to designate a replacement, in each case to fill such vacancy. These rights will be incorporated in amended bylaws to be negotiated and mutually agreed upon. Prior to such appointment of JR director nominees, the Company shall cause a Schedule 14f-1 to be filed with the SEC and mailed to the Company shareholders. It is expected that the amended bylaws shall provide for, among other things, the board composition mechanisms during the Standstill Period (as defined in the following sentence). The Standstill Period means the period ending on the earlier of (i) 18 months from a Change of Control Closing and (ii) the uplisting of the Company common stock (or the common stock of a successor-in-interest to the Company) to the NYSE or the Nasdaq Stock Market.

During the Standstill Period, JR has agreed to the following corporate governance provisions, among others:

to not vote its shares of common stock to remove any Company designee without the consent of a majority of the Company designees or approve a material amendment to the articles of incorporation or the amended bylaws unless approved and recommended by a majority of the Company Designees;

JR shall vote its shares of common stock for the election of Company designees;

any transaction between JR or any of its affiliates, on the one hand, and the Company, on the other hand (including, without limitation, the issuance of Company capital stock or derivative securities to JR or any of its affiliates and entering into certain business combinations by and between JR, the Company and any of their respective affiliates), shall be subject to approval by the Company designees and the JR designees shall recuse themselves from voting on the approval of such transactions; and

not to engage in proxy solicitations or certain communications (other than in connection with a sale of the Company to a third party), or acquire additional shares of Company common stock or assets of the Company, in each case without the approval of the Company designees.

In June 2020, the Company secured the services of New-Sense Geophysics Ltd. (“New-Sense”) to undertake a high resolution helicopter-borne district scale magnetic and radiometric survey of the Northern Black Hills of South Dakota. New-Sense is an industry leader in the collection and data processing of airborne geophysics. Robert B. Ellis (EGC Inc.) has also been engaged to consult on the design of the survey for Dakota Territory and will oversee data acquisition, provide additional processing and modeling of the data, and work with the Dakota Territory’s technical team to integrate the high resolution geophysics with the Company’s geology and geochemistry data sets.

Subsequent to March 31, 2020, outstanding warrants entitling the holders to purchase an aggregate of 2,200,000 shares of common stock were exercised. We received proceeds in the amount of $220,000 from the exercise of these warrants.

Corporate History

The Company was incorporated in Nevada in 2002. The Company has been in the exploration stage since its formation and has not realized any revenues from operations. The Company’s gold initiatives included:

The September 2012 acquisition of North Homestake Mining Company, a private Nevada corporation that owned the Blind Gold Property located in the Black Hills of South Dakota. The Blind Gold Property was initially comprised of eighty-four unpatented mining claims covering approximately 1,600 acres and is located approximately four miles northwest of the historic Homestake Gold Mine. The Blind Gold Property is underlain by the Homestake Formation, an iron-formation that is the unique host for gold mineralization at the Homestake Mine. The two founders of North Homestake have 44-years of combined exploration, mining and management experience at the Homestake Mine, and own a 5% net smelter return royalty recorded on the original eighty-four claims that comprised the property acquired through the transaction.

9

The December 2012 acquisition of three groups of unpatented lode mining claims from Black Hills Gold Exploration LLC. Comprised of fifty-seven unpatented lode mining claims, the property acquisition covers approximately 853 acres in total. Twenty-three of the claims acquired are situated to the west, south and southeast of the Company's Blind Gold Property, with the balance of the claims establishing the Homestake Paleoplacer and City Creek Properties. All three groups of unpatented claims are brownfields exploration targets based on the previous work performed by Homestake Mining Company. With the addition of the new property in 2012, Dakota Territory increased the size of its land package in the Black Hills by approximately 50% to nearly 2,466 acres in total.

The February 2014 acquisition of surface and mineral title to the 26.16 acres of the Squaw and Rubber Neck Lodes that comprise Mineral Survey 1706 in the Black Hills of South Dakota. Located immediately to the north and adjoining the Company’s Homestake Paleoplacer Property, Mineral Survey 1706 was explored by Homestake Mining Company in the late 1980’s.

The March 2014 acquisition of approximately 565.24 mineral acres in the Northern Black Hills of South Dakota. The acquisition increased our mineral interests in the Homestake District by nearly 23%, to over 3,057 acres. As part of the property acquisition, we purchased an additional 64.39 mineral acres located immediately southwest and contiguous to our Paleoplacer Property, including mineral title to the historic Gustin, Minerva and Deadbroke Gold Mines. The March 2014 acquisition consolidated and extended our Paleoplacer Property position to a distance extending approximately 3,100 feet along the trend of the channel.

The April 2017 acquisition of a combination of surface and mineral title to 284 acres in the Homestake District of the Northern Black Hills of South Dakota. The acquisition included 61 acres located immediately south and contiguous with our City Creek Property; 82 acres located approximately one half mile south of our Blind Gold Property at the western fringe of the historic Maitland Gold Mine; and 141 acres located immediately north and contiguous to our Homestake Paleoplacer Property, which added approximately 2,600 feet of the channel trend to our property position.

The November 2018 acquisition of 42 unpatented lode mining claims covering approximately 718 acres located immediately to the north and adjacent to the Company’s City Creek Property. The acquisition was based on our inversion modeling of magnetic and gravity geophysical survey data. Through this staking, the City Creek project area was expanded from approximately 449 acres to 1,167 acres.

The September 2019 acquisition of 106 unpatented lode mining claims covering approximately 1,167 acres in close proximity to the historic Tinton Gold Camp. The Tinton area was the site of placer mining activity between 1876 and the turn of the century, the lode source for which has not been discovered. The Company has based the acquisition of this property on extensive research conducted by members of our technical team at Homestake Mining Company.

The March 6, 2020 acquisition of 65 unpatented lode mining claims covering approximately 1,152 acres in the Homestake District of the Black Hills of South Dakota. The property is contiguous to the Company's Blind Gold Property and is the subject to historic prospecting activity that we believe suggests the occurrence of gold and/or silver mineralization at multiple locales on the property. We believe that the property is also a target for Pre-Cambrian Homestake style gold mineralization under the younger cover rocks based on the Company’s projections of the Homestake stratigraphic sequence (Ellison, Homestake, and Poorman Formations) and inversion modeling of geophysical survey data completed by our technical team in late 2018.

U.S. Investors are cautioned not to assume that any defined resources will ever be converted into SEC Guide 7 Compliant Reserves. We have not established that any of our properties contain proven or probable reserves under SEC Industry Guide 7.

Competitors

The mining industry is highly competitive. We will be competing with numerous companies, some with greater financial resources available to them. We therefore will be at a significant disadvantage in the course of acquiring mining properties and obtaining materials, supplies, labor, and equipment. Additionally, there are established and well-financed companies active in the mining industry that will have an advantage over us if they are competing for the same properties.

10

Government Approvals

The exploration, drilling and mining industries operate in a legal environment that requires permits to conduct virtually all operations. Thus, permits are required by local, state and federal government agencies. Local authorities, usually counties, also have control over mining activity. The various permits address such issues as prospecting, development, production, labor standards, taxes, occupational health and safety, toxic substances, air quality, water use, water discharge, water quality, noise, dust, wildlife impacts, as well as other environmental and socioeconomic issues.

Prior to receiving the necessary permits to explore or mine, the operator must comply with all regulatory requirements imposed by all governmental authorities having jurisdiction over the project area. Very often, in order to obtain the requisite permits, the operator must have its land reclamation, restoration or replacement plans pre-approved. Specifically, the operator must present its plan as to how it intends to restore or replace the affected area. Often all or any of these requirements can cause delays or involve costly studies or alterations of the proposed activity or time frame of operations, in order to mitigate impacts. All these factors make it more difficult and costly to operate and have a negative and sometimes fatal impact on the viability of the exploration or mining operation. Finally, it is possible that future changes in these laws or regulations could have a significant impact on our business, causing those activities to be economically re-evaluated at that time.

Effect of Existing or Probable Government and Environmental Regulations

Mineral exploration, including mining operations are subject to governmental regulation. Our operations may be affected in varying degrees by government regulation such as restrictions on production, price controls, tax increases, expropriation of property, environmental and pollution controls or changes in conditions under which minerals may be marketed. An excess supply of certain minerals may exist from time to time due to lack of markets, restrictions on exports, and numerous factors beyond our control. These factors include market fluctuations and government regulations relating to prices, taxes, royalties, allowable production and importing and exporting minerals. The effect of these factors cannot be accurately determined, and we are not aware of any probable government regulations that would impact the Company. This section is intended as a brief overview of the laws and regulations described herein and is not intended to be a comprehensive treatment of the subject matter.

Overview. Like all other mining companies doing business in the United States, we are subject to a variety of federal, state and local statutes, rules and regulations designed to protect the quality of the air and water, and threatened or endangered species, in the vicinity of its operations. These include “permitting” or pre-operating approval requirements designed to ensure the environmental integrity of a proposed mining facility, operating requirements designed to mitigate the effects of discharges into the environment during exploration, any mining operations, and reclamation or post-operation requirements designed to remediate the lands affected by a mining facility once any commercial mining operations have ceased.

Federal legislation in the United States and implementing regulations adopted and administered by the Environmental Protection Agency, the Forest Service, the Bureau of Land Management (“BLM”), the United States Fish and Wildlife Service (“USFWS”), the Army Corps of Engineers and other agencies—in particular, legislation such as the federal Clean Water Act, the Clean Air Act, the National Environmental Policy Act, the Endangered Species Act, the National Forest Management Act, the Wilderness Act, and the Comprehensive Environmental Response, Compensation and Liability Act—have a direct bearing on domestic mining operations. These federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations.

The Clean Water Act. The federal Clean Water Act is the principal federal environmental protection law regulating mining operations in the United States as it pertains to water quality.

At the state level, water quality is regulated by the Department of Environment and Natural Resources of the State of South Dakota. If our exploration or any future development activities might affect a ground water aquifer, it will have to apply for a Ground Water Discharge Permit from the Ground Water Quality Bureau in compliance with the Groundwater Regulations. If exploration affects surface water, then compliance with the Surface Water Regulations is required.

The Clean Air Act. The federal Clean Air Act establishes ambient air quality standards, limits the discharges of new sources and hazardous air pollutants and establishes a federal air quality permitting program for such discharges. Hazardous materials are defined in the federal Clean Air Act and enabling regulations adopted under the federal Clean Air Act include various metals. The federal Clean Air Act also imposes limitations on the level of particulate matter generated from mining operations.

National Environmental Policy Act (NEPA). NEPA requires all governmental agencies to consider the impact on the human environment of major federal actions as therein defined.

11

Endangered Species Act (ESA). The ESA requires federal agencies to ensure that any action authorized, funded or carried out by such agency is not likely to jeopardize the continued existence of any endangered or threatened species or result in the destruction or adverse modification of their critical habitat. In order to facilitate the conservation of imperiled species, the ESA establishes an interagency consultation process. When a federal agency proposes an action that “may affect” a listed species, it must consult with the USFWS and must prepare a “biological assessment” of the effects of a major construction activity if the USFWS advises that a threatened species may be present in the area of the activity.

National Forest Management Act. The National Forest Management Act, as implemented through title 36 of the Code of Federal Regulations, provides a planning framework for lands and resource management of the National Forests. The planning framework seeks to manage the National Forest System resources in a combination that best serves the public interest without impairment of the productivity of the land, consistent with the Multiple Use Sustained Yield Act of 1960.

Wilderness Act. The Wilderness Act of 1964 created a National Wilderness Preservation System composed of federally owned areas designated by Congress as “wilderness areas” to be preserved for future use and enjoyment.

The Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). CERCLA imposes clean-up and reclamation responsibilities with respect to discharges into the environment, and establishes significant criminal and civil penalties against those persons who are primarily responsible for such discharges.

The Resource Conservation and Recovery Act (RCRA). RCRA was designed and implemented to regulate the disposal of solid and hazardous wastes. It restricts solid waste disposal practices and the management, reuse or recovery of solid wastes and imposes substantial additional requirements on the subcategory of solid wastes that are determined to be hazardous. Like the Clean Water Act, RCRA provides for citizens’ suits to enforce the provisions of the law.

National Historic Preservation Act. The National Historic Preservation Act was designed and implemented to protect historic and cultural properties. Compliance with the Act is necessary where federal properties or federal actions are undertaken, such as mineral exploration on federal land, which may impact historic or traditional cultural properties, including native or Indian cultural sites.

In the fiscal year ended March 31, 2020, we incurred minimal costs in complying with environmental laws and regulations in relation to our operating activities, although costs may increase in future periods.

Employees

We have no employees. Our management, all of whom are consultants, conducts our operations. Given the early stage of our exploration properties, we intend to continue to outsource our professional and personnel requirements by retaining consultants on an as needed basis. However, if we are successful in our initial and any subsequent drilling programs, we may retain employees.

Insurance

We currently do not maintain any insurance coverage to cover losses or risks incurred in the ordinary course of business.

Research and Development

The Company has spent only nominal amounts during each of the last two fiscal years on research and development activities.

Office Facilities

Our principal executive offices are located at 10580 N. McCarran, Building 115-208, Reno, NV 89503. Our telephone number is (713) 542-5161.

Item 1A. Risk Factors

Much of the information included in this annual report includes or is based upon estimates, projections or other “forward-looking statements”. Such forward-looking statements include projections or estimates made by the Company in connection with its business operations. These forward-looking statements, and any assumptions upon which they are based, reflect our current judgment regarding the direction of our business. Actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggested herein.

12

Such estimates, projections or other “forward-looking statements” involve various risks and uncertainties as outlined below. We caution readers of this annual report that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other “forward-looking statements”.

Risk Associated with Our Business

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from these properties, and our business could fail.

We have not established that any of our mining properties contain commercially viable mineral or metal reserves, nor can there be any assurance that our properties will contain commercially viable mineral or metal reserves. The ability of us to conclude that an individual prospect having a mineral or metal reserve that meets the requirements of Guide 7 of the SEC Industry Guides requires further efforts and any funds that we spend on exploration may be lost. Even if we do eventually discover commercially viable mineral or metal reserves on one or more of our properties, there can be no assurance that they can be developed into producing mines and we can extract those resources. Both mineral exploration and development involve a high degree of risk and few properties, which are explored and mined, are ultimately developed into commercially viable producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral or metal deposit, the proximity of the resource to infrastructure, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Even if commercial viability of a mineral or metal deposit is established, we may be required to expend significant resources until production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to both establish proven and probable reserves and then in order to implement drilling operations. Because of these uncertainties, no assurance can be given that any of our potential drilling programs will result in commercially viable operations and the establishment or expansion of resources or reserves, the failure of which will adversely impact our Company and business.

If we establish the existence of commercially viable mineral or metal resources on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into production. If we cannot raise this additional capital, we will not be able to exploit the resource, and our business could fail.

If we do discover mineral and metal resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, engage in drilling operations and develop extraction and processing facilities (or make arrangements therefor) and infrastructure. We do not have adequate capital to develop necessary facilities and infrastructure and will need to raise additional funds. Although we may derive substantial benefits from the discovery of a commercially exploitable deposits, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Our exploration and extraction activities may not be commercially successful.

While we believe there are positive indicators that our properties may contain commercially exploitable minerals and metals, such belief has been based solely on preliminary tests that we have conducted and data provided by third parties. There can be no assurance that the tests and data upon which we have relied is correct or accurate. Moreover, mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. Unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labor are risks involved in the conduct of exploration programs. The success of mineral exploration and development is determined in part by the following factors:

the identification of potential mineralization based on analysis;

the availability of permits;

the quality of our management and our geological and technical expertise; and

the capital available for mining operations.

Our potential revenue and profitability based upon exploitation and development of the Blind Gold, City Creek, Tinton, West Corridor and Homestake Paleoplacer Properties is contingent upon our gaining certain governmental permits and approvals. We must apply and go through regulatory approval in order to implement any development plans. If we fail to obtain the governmental permits and approvals, we may have difficulty implementing our exploration, mining and business plans.

13

Substantial expenditures and time are required to establish existing proven and probable reserves through drilling and analysis, and to develop the mines and facilities and infrastructure at any site chosen for mining. Whether a mineral or metal deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely, and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. If our exploration and extraction activities are not successful, our business will likely fail.

There may be challenges to the title of our mineral properties.

The Company has acquired properties held primarily by unpatented claims and mineral and surface ownership. The validity of title to many types of natural resource property depends upon numerous circumstances and factual matters (many of which are not discoverable of record or by other readily available means) and is subject to many uncertainties of existing law and its application. We cannot assure you that the validity of our titles to our properties will be upheld or that third parties will not otherwise invalidate those rights. In the event the validity of our titles are not upheld, such an event would have a material adverse effect on us.

Mineral operations are subject to applicable law and government regulations. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters.

Companies such as ours that plan to engage in exploration and extraction activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Issuance of permits for our activities is subject to the discretion of government authorities, and we may be unable to obtain or maintain such permits. Permits required for future exploration or development may not be obtainable on reasonable terms or on a timely basis. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration or development of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could face difficulty and/or fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to do so. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

Environmental hazards unknown to us, which have been caused by previous or existing owners or operators of the properties, may exist on the properties in which we hold an interest. It is possible that our properties could be located on or near the site of a Federal Superfund cleanup project. Although we will endeavor to avoid such sites, it is possible that environmental cleanup or other environmental restoration procedures could remain to be completed or mandated by law, causing unpredictable and unexpected liabilities to arise. We are not currently aware of any environmental issues or litigation relating to any of our current or former properties. Neighboring landowners and other third parties could file claims based on environmental statutes and common law for personal injury and property damage allegedly caused by the release of hazardous substances or other waste material into the environment on or around our properties. There can be no assurance that our defense of such claims will be successful. A successful claim against us could have an adverse effect on our business prospects, financial condition and results of operation.

The exploration, possible future development and any production phases of our business will be subject to federal, state and local environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation and set out limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments, and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes in environmental regulations, if any, may adversely affect our operations. If we fail to comply with any of the applicable environmental laws, regulations or permit requirements, we could face regulatory or judicial sanctions. Penalties imposed by either the courts or administrative bodies could delay or stop our operations or require a considerable capital expenditure. Although we intend to comply with all environmental laws and permitting obligations in conducting our business, there is a possibility that those opposed to exploration and mining will attempt to interfere with our operations, whether by legal process, regulatory process or otherwise.

14

Competition in the mining industry is intense, and we have limited financial and personnel resources with which to compete.

Competition in the mining industry for desirable properties, investment capital, equipment and personnel is intense. Numerous companies headquartered in the United States, Canada and elsewhere throughout the world compete for properties on a global basis. We are currently an insignificant participant in the mining industry due to our limited financial and personnel resources. We may be unable to attract the necessary investment capital or a joint venture partner to fully develop our mineral properties, be unable to acquire other desirable properties, be unable to attract and hire necessary personnel, or be unable to purchase necessary equipment.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses.

The business of exploring for and extracting minerals and metals involves a high degree of risk. Few properties are ultimately developed into producing mines. Whether a mineral deposit can be commercially viable depends upon a number of factors, including the particular attributes of the deposit, including size, grade and proximity to infrastructure, metal prices, which can be highly variable, and government regulation, including environmental and reclamation obligations. These factors are not within our control. Uncertainties as to the metallurgical amenability of any minerals discovered may not warrant the mining of these metals or minerals on the basis of available technology. Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral or metal properties, such as, but not limited to:

encountering unusual or unexpected formations;

environmental pollution;

personal injury, flooding and landslides;

variations in grades of minerals or metals;

labor disputes; and

a decline in the price of gold.

We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down on our investment in such property interests. All of these factors may result in losses in relation to amounts spent which are not recoverable. The payment of any liabilities that arise from any such occurrence would have a material, adverse impact on our Company.

No assurance that the May 2020 purchase right will be exercised.

In May 2020, the Company granted JR the right to purchase up to 142,566,667 shares of Company common stock on or before October 15, 2020 at a purchase price of $0.15 per share (for up to $21,385,000). There can be no assurance that JR will exercise this option, in full or in part, prior to its expiration date. The failure of JR to exercise this purchase right may delay or restrict the Company from implementing its business strategy to acquire additional properties in the Black Hills and conduct operations, causing us to seek financing from other parties, the availability of which is uncertain.

We have had historically negative cash flows from operations and if we are not able to obtain further financing our business operations may fail.

To date we have had negative cash flows from operations and we have been dependent on sales of our equity securities and debt financing to meet our cash requirements and have incurred a net loss of approximately $1,114,000 for the year ended March 31, 2020, and cumulative losses of approximately $5,378,000 as of March 31, 2020. We do not expect to generate positive cash flow from operations in the near future. There is no assurance that actual cash requirements will not exceed our estimates. Any decision to further expand our operations is anticipated to involve consideration and evaluation of several significant factors that could adversely affect our ability to meet our business plans including, but not limited to:

Costs to bringing the property into production, including, but not limited to: exploration work, preparation of production feasibility studies, and allowance for production facilities;

Availability and costs of financing;

Ongoing costs of production;

Environmental compliance regulations and restraints; and

Political climate and/or governmental regulation and control.

15

We depend almost exclusively on outside capital to pay for the exploration and development of our property. Such outside capital may include the sale of additional stock and/or commercial borrowing. Capital may not be available if necessary to meet these continuing development costs or, if the capital is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us may result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and, as a result, we may be required to scale back, diversify or cease our business operations, the result of which would be that our stockholders would lose some or all of their investment.

A decline in the price of our common stock or gold prices in general could affect our ability to raise further working capital and adversely impact our operations.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because our operations have been primarily financed through the sale of equity securities, a decline in the price of our common stock could be especially detrimental to our liquidity and our continued operations. Any reduction in our ability to raise equity capital in the future would force us to reallocate funds from other planned uses and may have a significant negative effect on our business plans and operations, including our ability to develop new products and continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

The value of our assets, our ability to raise capital and any future economic returns are substantially dependent on the prices of gold. The gold price fluctuates on a daily basis and is affected by numerous factors beyond our control. Factors tending to influence gold prices include:

gold sales or leasing by governments and central banks or changes in their monetary policy, including gold inventory management and reallocation of reserves;

speculative short positions taken by significant investors or traders in gold;

the relative strength of the U.S. dollar;

expectations of the future rate of inflation;

interest rates;

changes to economic activity in the United States, China, India and other industrialized or developing countries;

geopolitical conflicts;

changes in industrial, jewelry or investment demand;

changes in supply from production, disinvestment and scrap; and

forward sales by producers in hedging or similar transactions.

We have a history of losses and fluctuating operating results that raises doubt about our ability to continue as a going concern.

From inception through March 31, 2020, we have incurred aggregate losses of approximately $5,378,000. There is no assurance that we will operate profitably or will generate positive cash flow in the future. In addition, our operating results in the future may be subject to significant fluctuations due to many factors not within our control, such as general economic conditions, market price of minerals and exploration and development costs. If we cannot generate positive cash flows in the future, or raise sufficient financing to continue our operations, then we may be forced to scale down or even close our operations. Until such time as we generate revenues, we expect an increase in development costs and operating costs. Consequently, we expect to incur operating losses and negative cash flow until our properties enter commercial production (if such event occurs).

16

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have no history of revenues from operations, no earnings and there can be no assurance that we will ever operate profitably. We have a limited operating history and must be considered in the exploration stage. The success of our Company is significantly dependent on a successful acquisition, exploration, development and production program. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves or operate on a profitable basis. We are in the exploration stage and potential investors should be aware of the difficulties normally encountered by enterprises in the exploration stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

We will be subject to operating hazards and risks that may adversely affect our financial condition.

Exploration involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks normally incidental to exploration, development and production, such as unusual or unexpected formations, cave-ins or pollution, all of which could result in work stoppages, damage to property and possible environmental damage. We currently do not have general liability insurance. We intend to obtain such liability insurance upon a successful financing by the Company and before we commence exploration. Payment of any liabilities as a result could have a materially adverse effect upon our company's financial condition.

We currently rely on certain key individuals and the loss of one of these certain key individuals could have an adverse effect on our company.

Our success depends to a certain degree upon certain key members of our management, including specifically our chief executive officer. These individuals are a significant factor in our company's growth and success. We do not have key employee insurance in place in respect of any of our senior officers or personnel and we do not anticipate obtaining such insurance in the near future. The loss of the service of members of our management and certain key contractors could have a material adverse effect on our company.

Dependence on our ability to hire qualified contractors required to conduct exploration drill programs and the ability to hire qualified and experienced technical staff and or consultants materially impacts our business operations.

Future success is also dependent on our ability to identify, hire, train and retain other qualified contractors, technical staff and consultants. Competition for these entities and individuals is intense and we may not be able to attract, assimilate, or retain qualified contractors and technical personnel. Failure to do so could have a material adverse effect on our business, financial condition and results of operations.

Uncertainty of agreements to secure access to property from adjacent landowners may affect our ability to remain in business.

Our potential revenue and profitability based upon our exploitation and development of the Blind Gold, City Creek and Homestake Paleoplacer Properties may be contingent upon our gaining additional access to the properties through ingress and egress routes that are owned by private land owners. We may require agreements with those landowners to facilitate ingress and egress to our properties. If we fail to enter into such agreements on favourable terms, we may have difficulty conducting exploration, development and mining operations, which may result in our inability to implement our business plans.

Pandemics, including the recent outbreak of the coronavirus, could cause delays in our exploration and development activities and could negatively impact the availability and cost of future borrowings.

In March 2020, the World Health Organization designated the new coronavirus (“COVID-19”) as a global pandemic. Federal, state and local governments have mandated orders to slow the transmission of the virus, including but not limited to shelter-in-place orders, quarantines, restrictions on travel, and work restrictions that prohibit many employees from going to work. Uncertainty with respect to the economic effects of the pandemic has resulted in significant volatility in the financial markets. The restrictions put in place by federal, state and local governments could delay our exploration and any development plans related to our properties. Furthermore, the impact of the pandemic on the global economy could also negatively impact the availability and cost of future borrowings should the need arise.

17

Risks Associated with Our Common Stock

Investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities.

Our articles of incorporation authorize the issuance of 310,000,000 shares, consisting of 300,000,000 shares of common stock and 10,000,000 shares of preferred stock. As of June 12, 2020, we have 66,914,964 shares of common stock issued and outstanding. If the May 2020 purchase right is exercised in full, 142,566,667 shares of common stock will be issued to JR, resulting in JR owning approximately 64.24% of the common stock to be issued and outstanding. This will result in the significant dilution of current ownership percentages of existing shareholders. The issuance of any additional shares to raise financing may be dilutive, depending on the price at which such securities are sold. If we issue any such additional shares, such issuances will cause a reduction in the proportionate ownership and voting power of all other shareholders.

Trading in our common shares on the OTC:QB is limited and sporadic, making it difficult for our shareholders to sell their shares or liquidate their investments.

Our common shares are currently quoted on the OTC:QB. The trading price of our common shares has been subject to wide fluctuations. Trading prices of our common shares may fluctuate in response to a number of factors, many of which will be beyond our control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies in the development stage. There can be no assurance that trading prices previously experienced by our common shares will be matched or maintained. These broad market and industry factors may adversely affect the market price of our common shares, regardless of our operating performance. In the past, following periods of volatility in the market price of a company's securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs and a diversion of management's attention and resources.

Because of the early stage of exploration and the nature of our business, our securities are considered highly speculative.

Resource exploration is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover valuable deposits, but from finding deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of resources acquired or discovered by us may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment and such other factors as government regulation, including regulations relating to royalties, allowable production and environmental protection, the combination of which factors may result in our Company not generating an adequate return on investment capital.

Trading of our stock may be restricted by the SEC’s “Penny Stock” regulations that may limit a stockholder's ability to buy and sell our stock.

The SEC has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors.” The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

18

The Financial Industry Regulatory Authority, or FINRA, sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

We have never paid any cash dividends.

We have never declared or paid any cash or stock dividends on our capital stock.

The sale of our common stock by existing stockholders may depress the price of our common stock due to the limited trading market that exists.

Any sales of a significant amount of common stock by existing shareholders may depress the price of our common stock and the price of our common stock may decline.

A small number of existing shareholders own a significant portion of our common stock, which could limit your ability to influence the outcome of any shareholder vote.

Under our articles of incorporation and Nevada law, the vote of a majority of the shares outstanding is generally required to approve most shareholder action. As a result, these individuals and entities will be able to influence the outcome of shareholder votes for the foreseeable future, including votes concerning the election of directors, amendments to our articles of incorporation or proposed mergers or other significant corporate transactions. If JR exercises its option in full, it will be the majority holder of our outstanding shares of common stock.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

We have not established that any of our properties, mineral interests or rights contain proven or probably reserves, as defined under SEC Industry Guide 7. Exploration by us on our properties has been limited to field sampling programs, field mapping programs and a campaign to acquire historic data sets that were known to exist for our property and the balance of the Homestake District. Much of the important historic data has been digitized and assembled to our new database in electronic form. In the case of historic geophysical data, the data has been digitized and reprocessed.

Drill plans and budgets have been prepared for each of the Homestake Paleoplacer Property, City Creek Property, Tinton Property and the Blind Gold Property iron-formation and tertiary aged replacement targets. The Homestake Paleoplacer Property has been permitted with SDDENR and we believe to be ready to drill upon on deposit of the $25,000 reclamation bond. Current drill plans for the City Creek Property, Tinton Property and Blind Gold Property may be modified pending the results of the Company’s airborne magnetic and radiometric survey that is scheduled to be flown in the summer of 2020. The airborne program is funded and awarded, as is the interpretation and modeling of the data to be acquired. Dakota Territory’s technical team has field programs planned and funded to reconcile geologic conditions with the high-resolution geophysics and to integrate new data with the Company’s extensive geology and geochemistry data sets.

None of our property is sufficiently drilled to prepare a preliminary economic assessment. However, our management and technical teams have prepared internal scoping studies for the Homestake Paleoplacer Property and the Blind Gold Property iron-formation and tertiary aged replacement targets. Based on our experience in the district, Dakota Territory has modeled the exploration, development, mining and closure for the size and grade of similar deposits in a similar geological setting elsewhere in the district for those properties. The strategy of this financial modeling is to determine whether, if we are technically successful defining our deposit expectation with drill holes, any identified deposit would make commercial sense to ultimately develop.

19

The Black Hills has well developed power infrastructure. All four of our properties has power on the property now, with the potential to be upgraded for production if exploration proves successful. The Company believes access to water will not be a significant issue for any development purpose at any property.

Gold Properties - Black Hills General

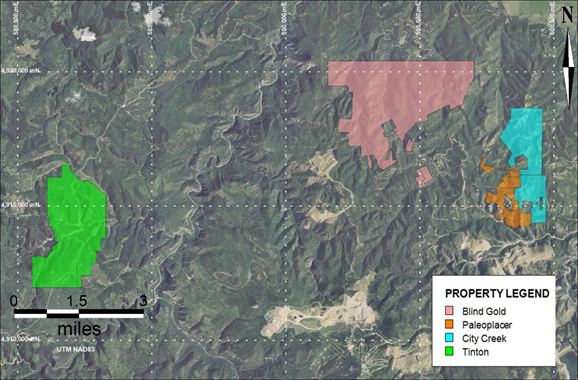

Dakota Territory maintains 100% ownership of four mineral properties in the district comprised of 404 unpatented claims and a combination of surface leases and mineral ownership covering a total of approximately 7,166 acres. located in the Black Hills of South Dakota, including the Blind Gold, City Creek, Tinton and Homestake Paleoplacer Properties, all of which are located in the heart of the Homestake District.

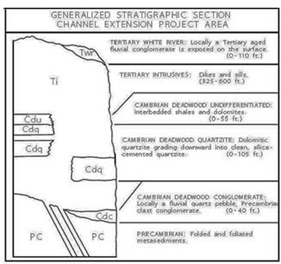

The Homestake District is a favorable geologic gold setting with three unique gold deposit types that we believe have yielded approximately 44.6 million ounces of gold production over the past 140 years, including Proterozoic-age Homestake iron-formation hosted gold deposits, Tertiary-age replacement gold deposits and Eo-Cambrian Homestake Paleoplacer gold deposits.