Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE REVISED - JOHN WILEY & SONS, INC. | exhibit99_1.htm |

| 8-K/A - FY20 Q4 FORM 8K/A - JOHN WILEY & SONS, INC. | fy20q4_8ka.htm |

Safe Harbor StatementThis presentation contains certain forward-looking statements concerning the

Company's operations, performance, and financial condition. Reliance should not be placed on forward-looking statements, as actual results may differ materially from those in any forward-looking statements. Any such forward-looking statements

are based upon a number of assumptions and estimates that are inherently subject to uncertainties and contingencies, many of which are beyond the control of the Company and are subject to change based on many important factors. Such factors

include, but are not limited to: (i) the level of investment in new technologies and products; (ii) subscriber renewal rates for the Company's journals; (iii) the financial stability and liquidity of journal subscription agents; (iv) the

consolidation of book wholesalers and retail accounts; (v) the market position and financial stability of key online retailers; (vi) the seasonal nature of the Company's educational business and the impact of the used book market; (vii)

worldwide economic and political conditions; (viii) the Company's ability to protect its copyrights and other intellectual property worldwide (ix) the ability of the Company to successfully integrate acquired operations and realize expected

opportunities; (x) the Company’s ability to realize operating savings over time and in fiscal year 2020 in connection with our multi-year Business Optimization Program; (xi) the impact of COVID-19 on our operations, performance, and financial

condition; and (xii) other factors detailed from time to time in the Company's filings with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any such forward-looking statements to reflect

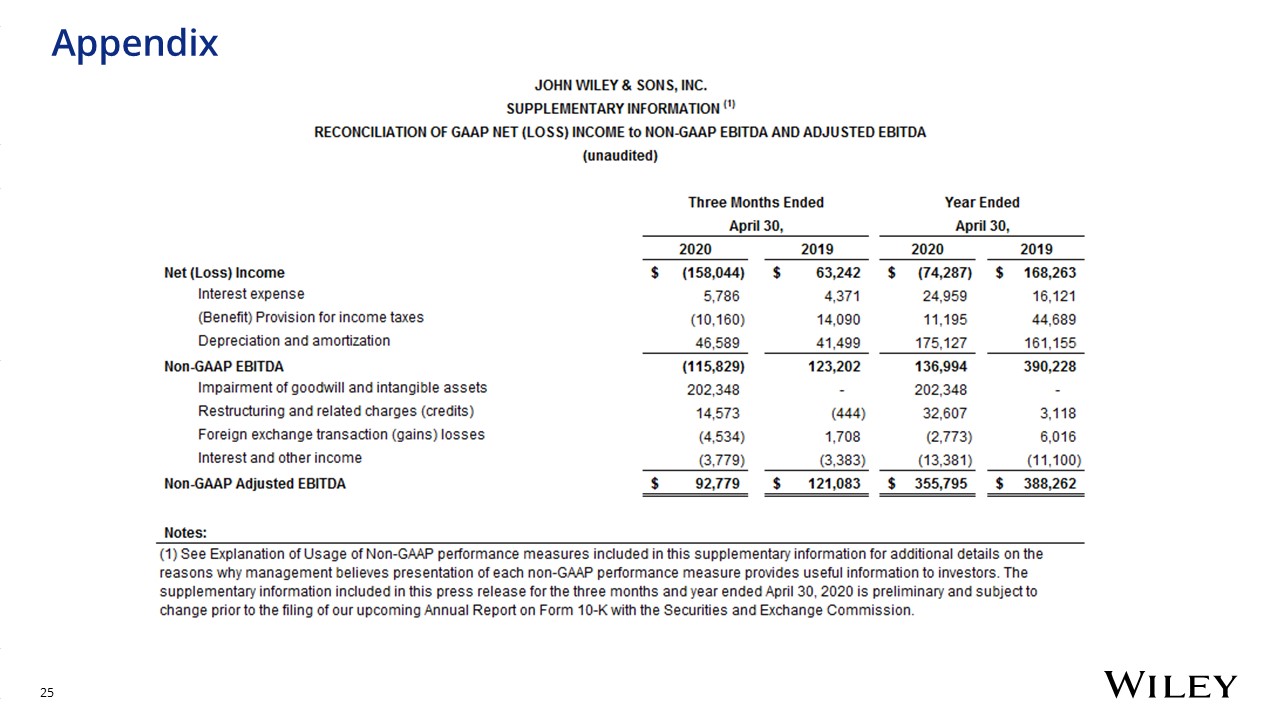

subsequent events or circumstances. Non-GAAP MeasuresIn this presentation, management provides the following non-GAAP performance measures:Adjusted Earnings Per Share (“Adjusted EPS”);Free Cash Flow less Product Development Spending;Adjusted

Revenue;Adjusted Operating Income and margin;Adjusted Contribution to Profit (“Adjusted CTP”) and margin;Adjusted EBITDA;Organic revenue; andResults on a constant currency (“CC”) basis.Management believes non-GAAP financial measures, which

exclude the impact of restructuring charges and credits and other items, provide supplementary information to support analyzing operating results and earnings and are commonly used by shareholders to measure our performance. Free Cash Flow less

Product Development Spending helps assess our ability over the long term to create value for our shareholders. Results on a constant currency basis removes distortion from the effects of foreign currency movements to provide better

comparability of our business trends from period to period. We measure our performance before the impact of foreign currency (or at “constant currency” “CC”), which means that we apply the same foreign currency exchange rates for the current

and equivalent prior period.

Business Review Brian Napack, President and CEO

Executive Summary Wiley’s Q4 performance adversely impacted by global pandemicWe have transitioned

smoothly to remote work environment and are fully focused on supporting our colleagues, customers and communitiesDisruption from the pandemic led to a guidance update on April 9th; We finished the quarter above those dampened expectationsOur

business remains strong and is supported by good cash flow and ample liquidity; nonetheless, we face near-term market uncertainty that will impact resultsWe should benefit from accelerating favorable trends in our core markets, which are

aligned with our strategies and investmentsWe are accelerating business optimization initiatives and prioritizing our investments to best capitalize on market opportunitiesNear-term visibility is too limited to provide accurate guidance; we

will be transparent about key drivers and leading indicators

WileyTransitioned successfully to working remotely worldwidePrior tech investment enabled quick pivot to

WFHHigh colleague productivity and engagement“Safe workplace” plans under way for return; some offices outside the US reopeningEnhanced Diversity, Equity, and Inclusion programs in motion Supporting Our Colleagues and

Communities ResearchOpened access to critical scientific and healthcare researchStreamlined publishing processes to accelerate research disseminationPartnered with GetUsPPE.org to deliver PPE to healthcare workers

worldwide EducationProviding 60K educators with webinars and online teaching toolsProviding free digital courseware to studentsDelivering WFH skills training, content and support to corporate learning partnersJoined “Digital US” coalition

equipping U.S. workers with essential digital skills

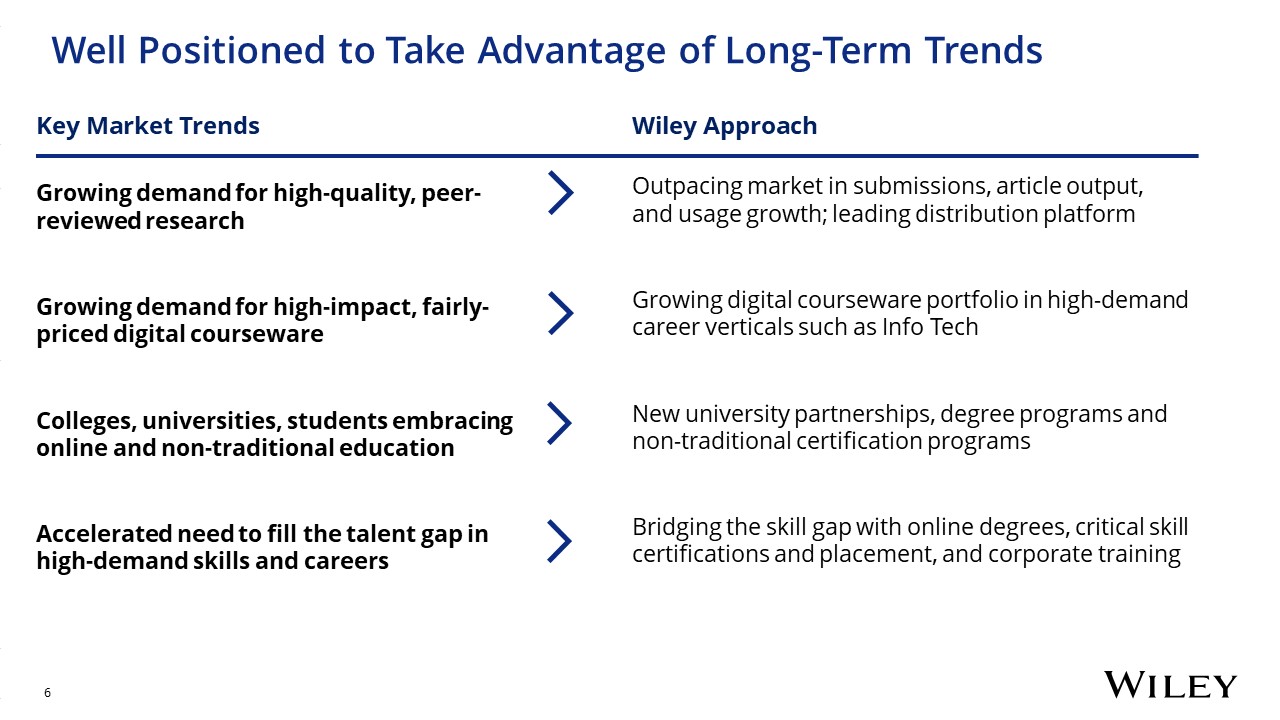

Well Positioned to Take Advantage of Long-Term Trends Growing demand for high-quality, peer-reviewed

research Growing demand for high-impact, fairly-priced digital courseware Colleges, universities, students embracing online and non-traditional educationAccelerated need to fill the talent gap in high-demand skills and careers Outpacing

market in submissions, article output, and usage growth; leading distribution platformGrowing digital courseware portfolio in high-demand career verticals such as Info TechNew university partnerships, degree programs and non-traditional

certification programsBridging the skill gap with online degrees, critical skill certifications and placement, and corporate training Key Market Trends Wiley Approach

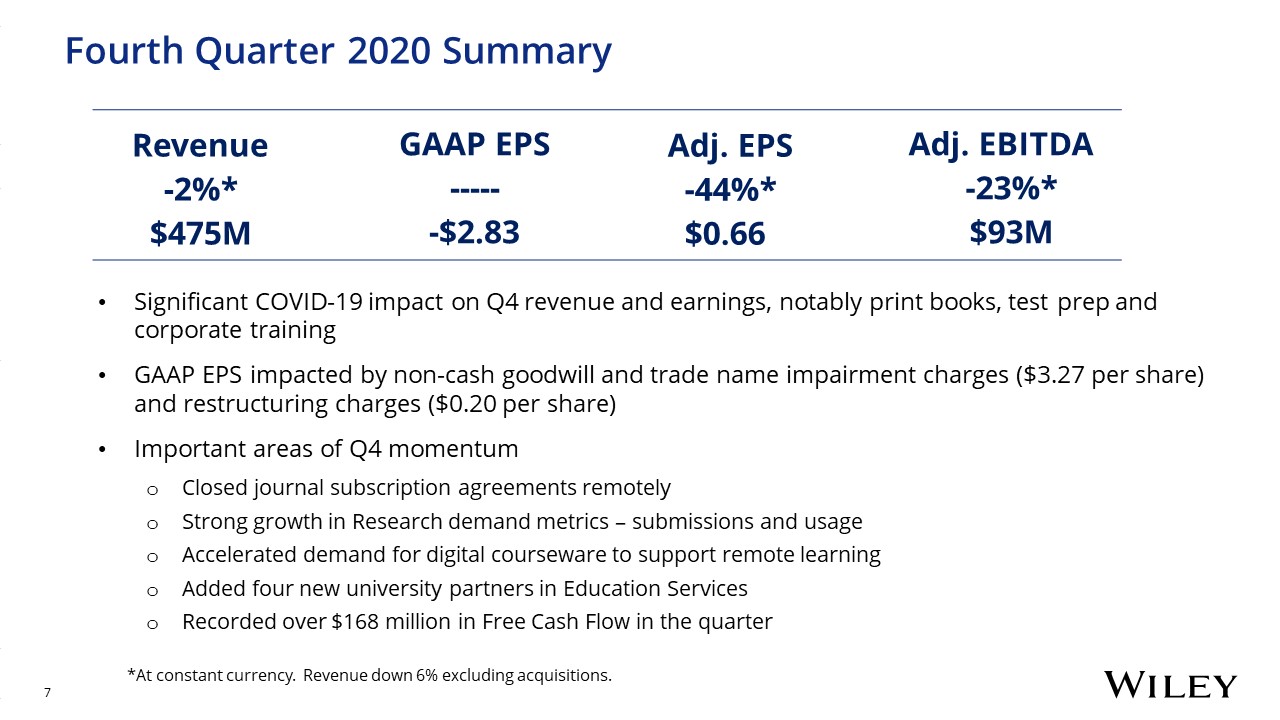

Fourth Quarter 2020 Summary Revenue-2%*$475M Adj. EBITDA-23%* $93M Adj.

EPS-44%*$0.66 Significant COVID-19 impact on Q4 revenue and earnings, notably print books, test prep and corporate trainingGAAP EPS impacted by non-cash goodwill and trade name impairment charges ($3.27 per share) and restructuring charges

($0.20 per share)Important areas of Q4 momentumClosed journal subscription agreements remotely Strong growth in Research demand metrics – submissions and usageAccelerated demand for digital courseware to support remote learningAdded four new

university partners in Education ServicesRecorded over $168 million in Free Cash Flow in the quarter *At constant currency. Revenue down 6% excluding acquisitions. GAAP EPS------$2.83

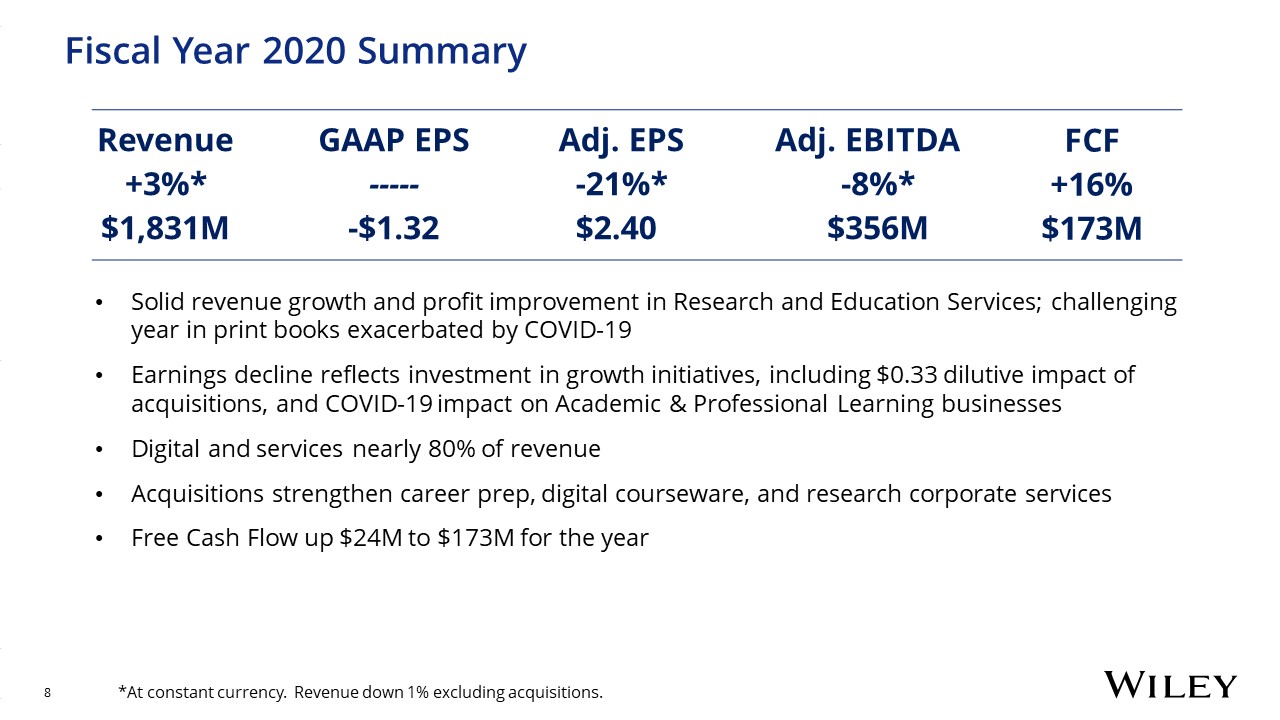

Fiscal Year 2020 Summary Revenue+3%*$1,831M Adj. EBITDA-8%* $356M Adj. EPS-21%*$2.40 Solid

revenue growth and profit improvement in Research and Education Services; challenging year in print books exacerbated by COVID-19Earnings decline reflects investment in growth initiatives, including $0.33 dilutive impact of acquisitions, and

COVID-19 impact on Academic & Professional Learning businessesDigital and services nearly 80% of revenueAcquisitions strengthen career prep, digital courseware, and research corporate servicesFree Cash Flow up $24M to $173M for the

year *At constant currency. Revenue down 1% excluding acquisitions. GAAP EPS------$1.32 FCF+16% $173M

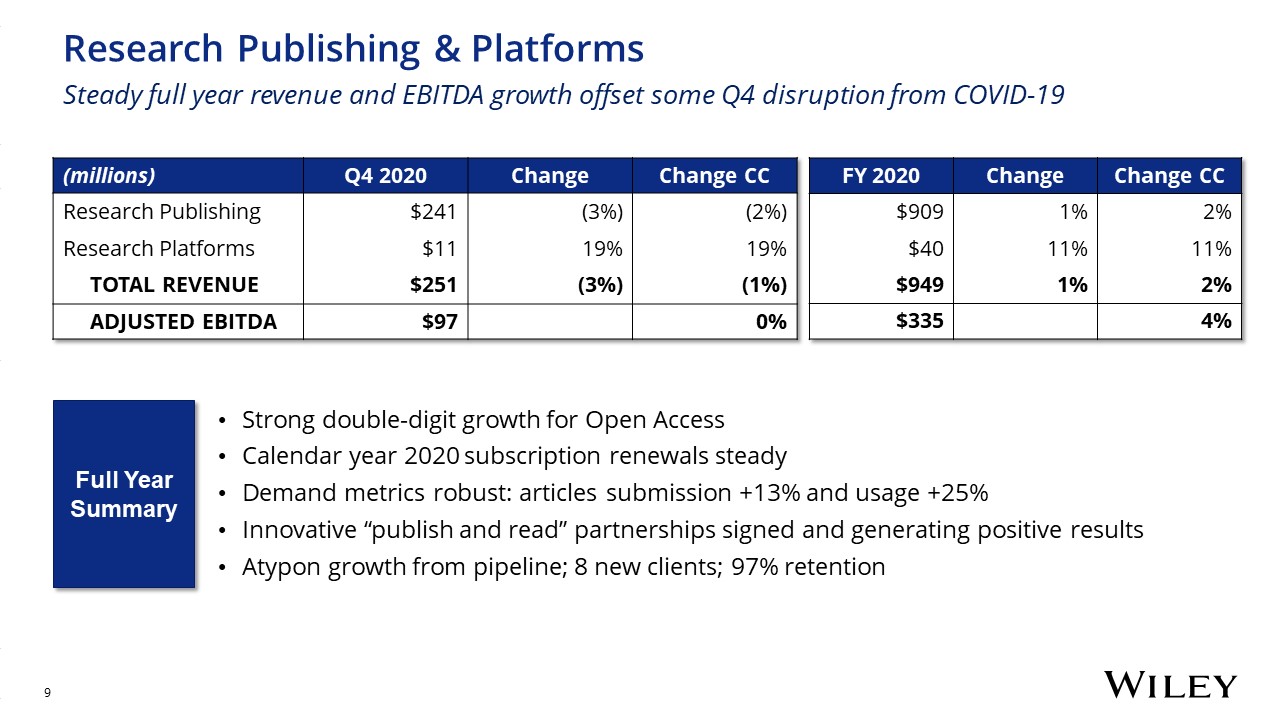

(millions) Q4 2020 Change Change CC Research Publishing $241 (3%) (2%) Research

Platforms $11 19% 19% TOTAL REVENUE $251 (3%) (1%) ADJUSTED EBITDA $97 0% FY 2020 Change Change CC $909 1% 2% $40 11% 11% $949 1% 2% $335 4% Strong double-digit growth for Open AccessCalendar year 2020

subscription renewals steadyDemand metrics robust: articles submission +13% and usage +25%Innovative “publish and read” partnerships signed and generating positive resultsAtypon growth from pipeline; 8 new clients; 97% retention Full

YearSummary Research Publishing & PlatformsSteady full year revenue and EBITDA growth offset some Q4 disruption from COVID-19

Fiscal Year 2021 Focus Areas Continue to drive article volume growth and lead in Open AccessSuccessfully

navigate CY 2021 journal renewal season Increase presence in China to source more research Continue to diversify revenue streams in corporate services and research platformsAccelerate workflow, publishing efficiency and cost base

improvements Research Publishing & Platforms SnapshotRecession-tolerant business with must-have content, brands, and platforms Adj. EBITDA Margin 35% Revenue$949M52% of total

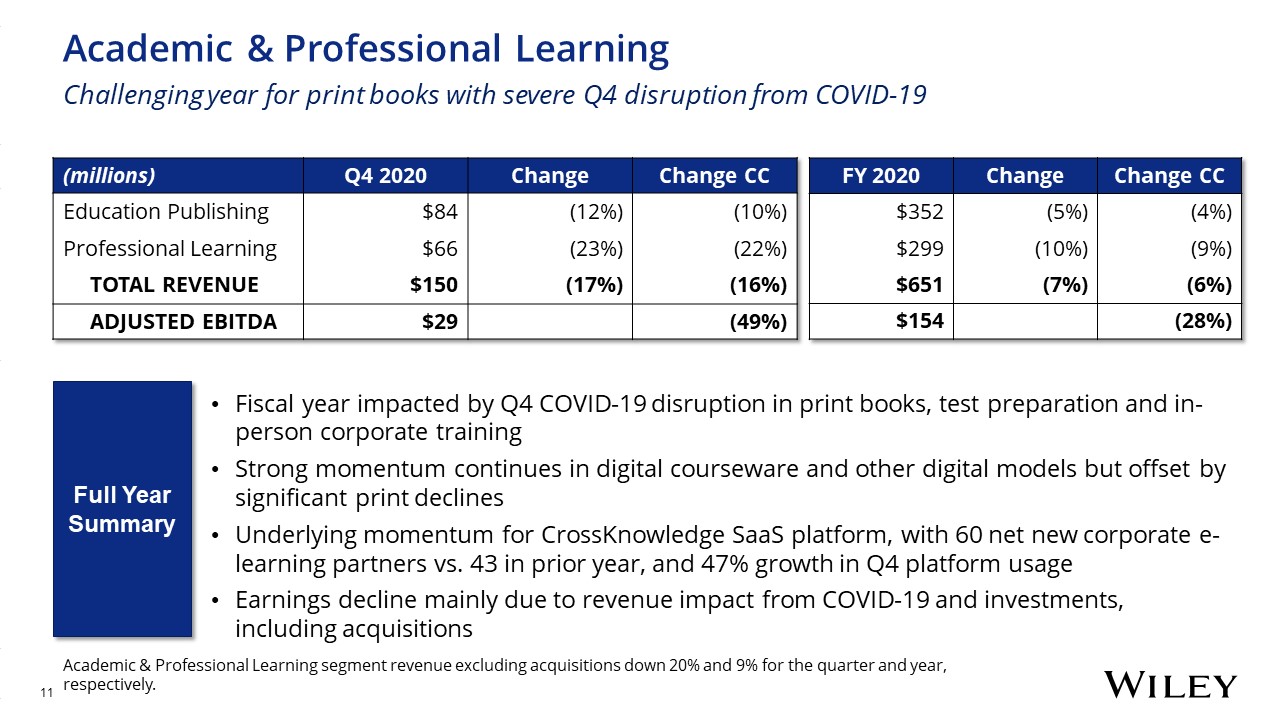

Academic & Professional LearningChallenging year for print books with severe Q4 disruption from

COVID-19 (millions) Q4 2020 Change Change CC Education Publishing $84 (12%) (10%) Professional Learning $66 (23%) (22%) TOTAL REVENUE $150 (17%) (16%) ADJUSTED EBITDA $29 (49%) FY 2020 Change Change

CC $352 (5%) (4%) $299 (10%) (9%) $651 (7%) (6%) $154 (28%) Fiscal year impacted by Q4 COVID-19 disruption in print books, test preparation and in-person corporate trainingStrong momentum continues in digital courseware and other

digital models but offset by significant print declinesUnderlying momentum for CrossKnowledge SaaS platform, with 60 net new corporate e-learning partners vs. 43 in prior year, and 47% growth in Q4 platform usageEarnings decline mainly due to

revenue impact from COVID-19 and investments, including acquisitions Full YearSummary Academic & Professional Learning segment revenue excluding acquisitions down 20% and 9% for the quarter and year, respectively.

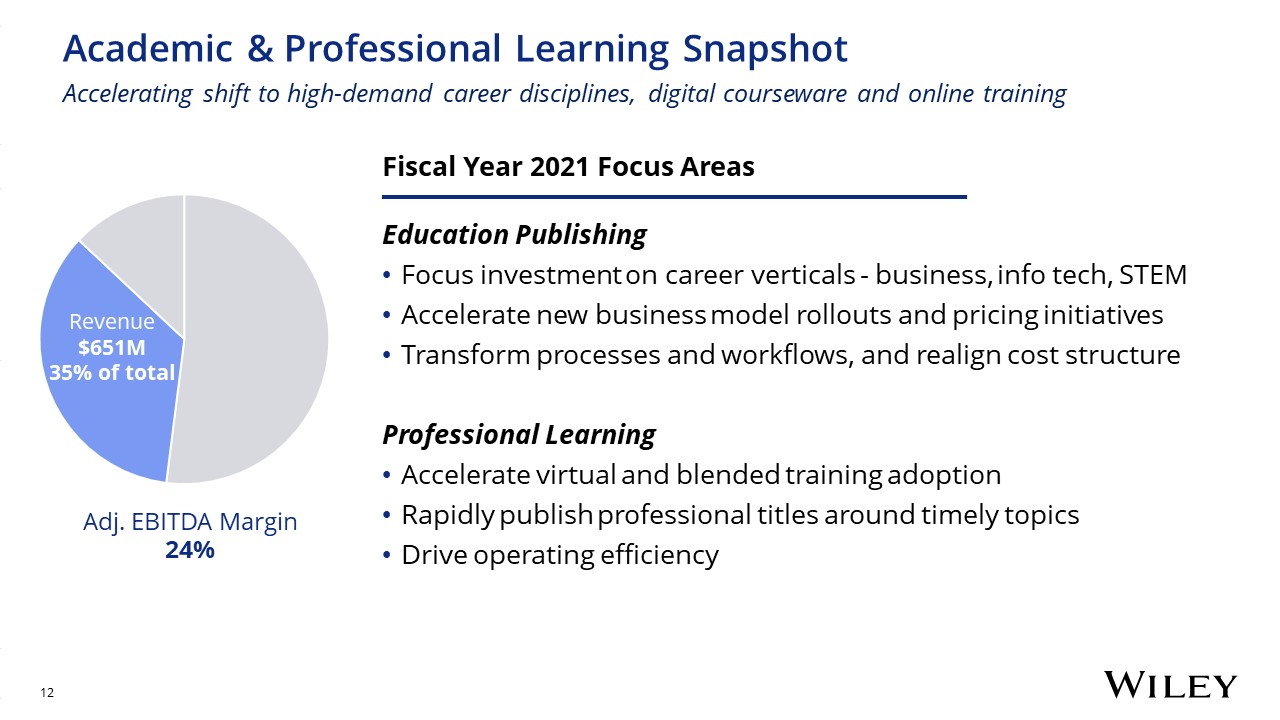

Fiscal Year 2021 Focus Areas Education PublishingFocus investment on career verticals - business, info

tech, STEM Accelerate new business model rollouts and pricing initiativesTransform processes and workflows, and realign cost structureProfessional LearningAccelerate virtual and blended training adoptionRapidly publish professional titles

around timely topicsDrive operating efficiency Academic & Professional Learning SnapshotAccelerating shift to high-demand career disciplines, digital courseware and online training Adj. EBITDA Margin 24% Revenue$651M35% of total

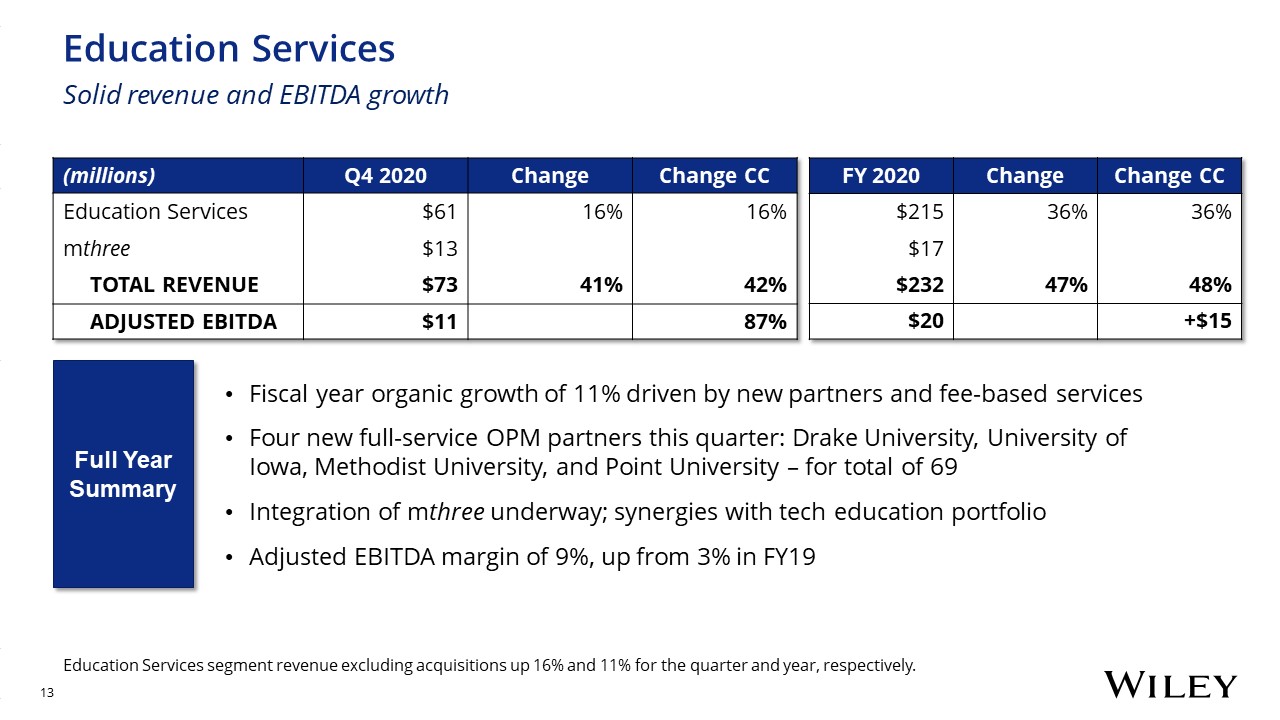

Education ServicesSolid revenue and EBITDA growth (millions) Q4 2020 Change Change CC Education

Services $61 16% 16% mthree $13 TOTAL REVENUE $73 41% 42% ADJUSTED EBITDA $11 87% FY 2020 Change Change CC $215 36% 36% $17 $232 47% 48% $20 +$15 Fiscal year organic growth of 11% driven by new partners

and fee-based servicesFour new full-service OPM partners this quarter: Drake University, University of Iowa, Methodist University, and Point University – for total of 69Integration of mthree underway; synergies with tech education

portfolioAdjusted EBITDA margin of 9%, up from 3% in FY19 Full Year Summary Education Services segment revenue excluding acquisitions up 16% and 11% for the quarter and year, respectively.

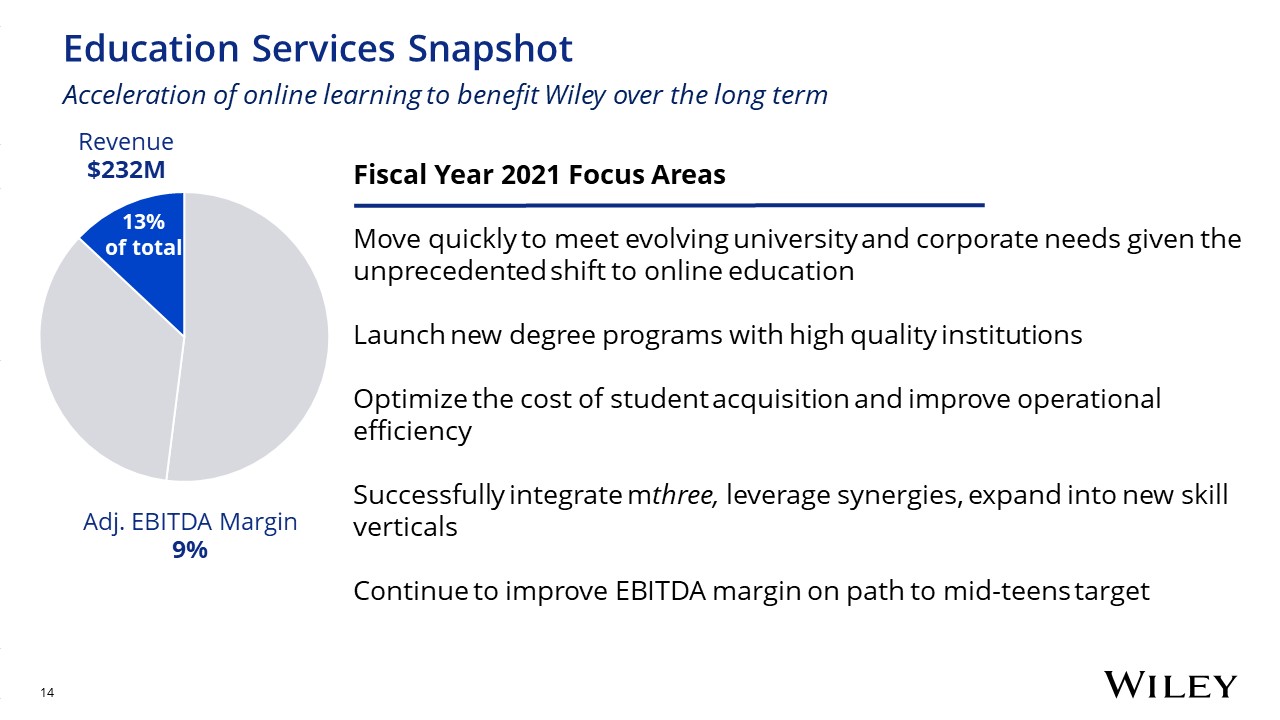

Fiscal Year 2021 Focus Areas Move quickly to meet evolving university and corporate needs given the

unprecedented shift to online educationLaunch new degree programs with high quality institutionsOptimize the cost of student acquisition and improve operational efficiencySuccessfully integrate mthree, leverage synergies, expand into new skill

verticalsContinue to improve EBITDA margin on path to mid-teens target Education Services SnapshotAcceleration of online learning to benefit Wiley over the long term Adj. EBITDA Margin 9% 13% of total Revenue$232M

Financial Review John Kritzmacher, Executive Vice President and CFO

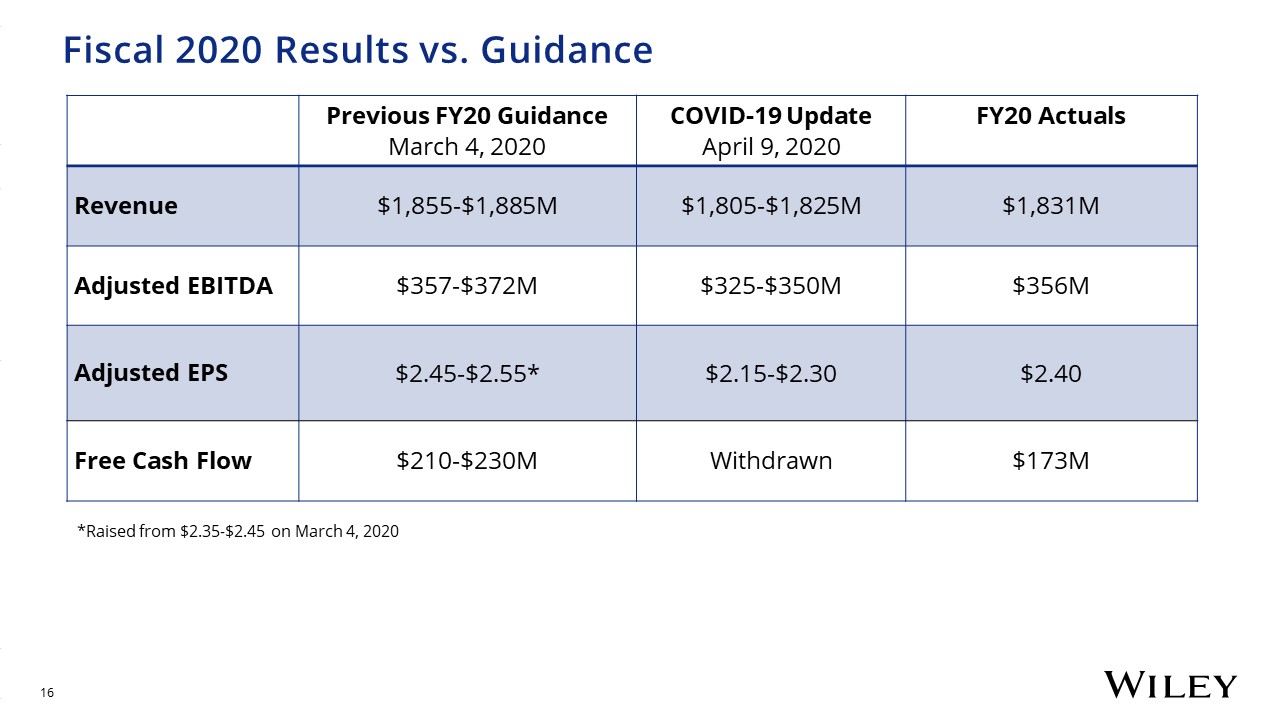

Fiscal 2020 Results vs. Guidance Previous FY20 GuidanceMarch 4, 2020 COVID-19 UpdateApril 9,

2020 FY20 Actuals Revenue $1,855-$1,885M $1,805-$1,825M $1,831M Adjusted EBITDA $357-$372M $325-$350M $356M Adjusted EPS $2.45-$2.55* $2.15-$2.30 $2.40 Free Cash Flow $210-$230M Withdrawn $173M *Raised from $2.35-$2.45 on

March 4, 2020

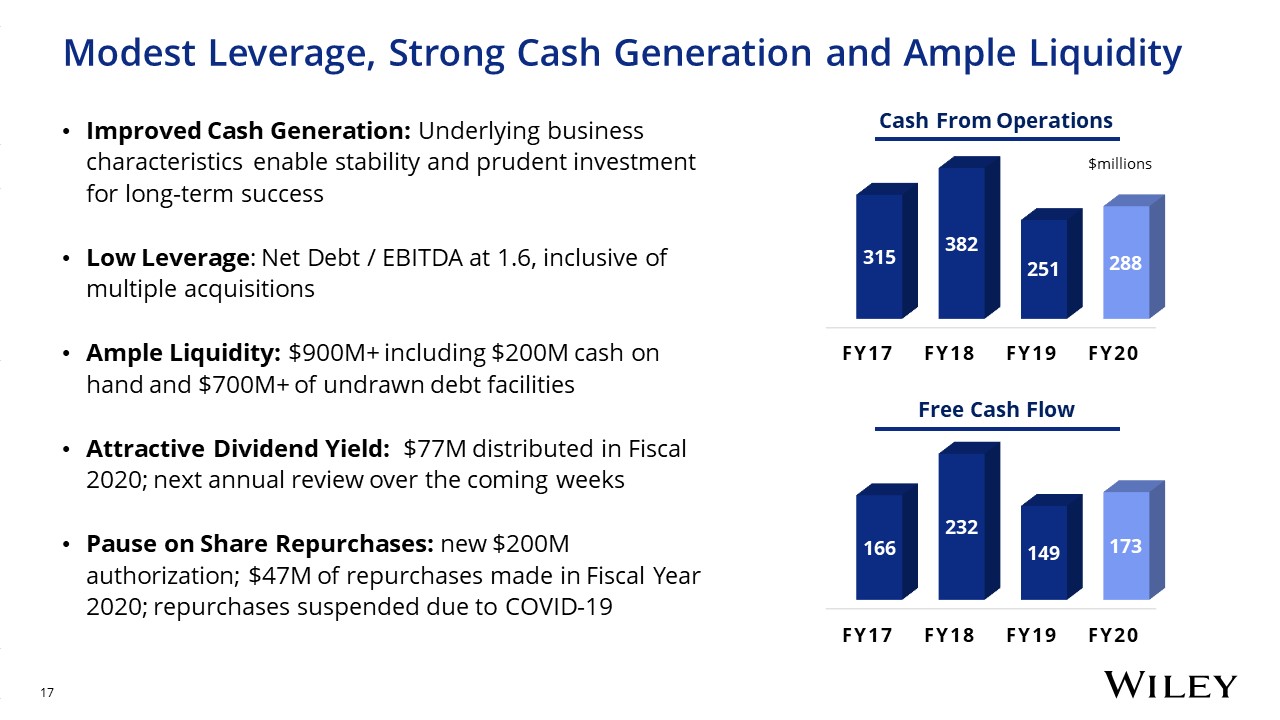

Modest Leverage, Strong Cash Generation and Ample Liquidity Improved Cash Generation: Underlying

business characteristics enable stability and prudent investment for long-term successLow Leverage: Net Debt / EBITDA at 1.6, inclusive of multiple acquisitionsAmple Liquidity: $900M+ including $200M cash on hand and $700M+ of undrawn debt

facilities Attractive Dividend Yield: $77M distributed in Fiscal 2020; next annual review over the coming weeksPause on Share Repurchases: new $200M authorization; $47M of repurchases made in Fiscal Year 2020; repurchases suspended due to

COVID-19 Free Cash Flow $millions Cash From Operations

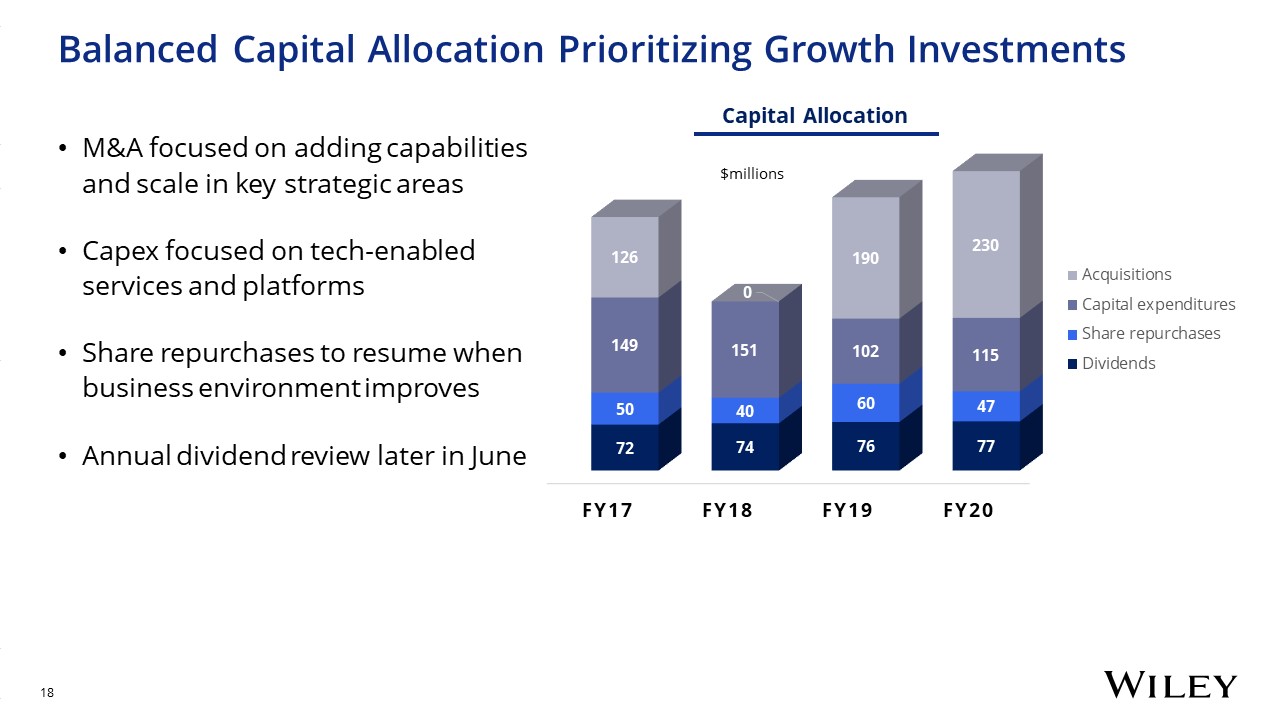

Balanced Capital Allocation Prioritizing Growth Investments M&A focused on adding capabilities and

scale in key strategic areasCapex focused on tech-enabled services and platformsShare repurchases to resume when business environment improvesAnnual dividend review later in June $millions Capital Allocation

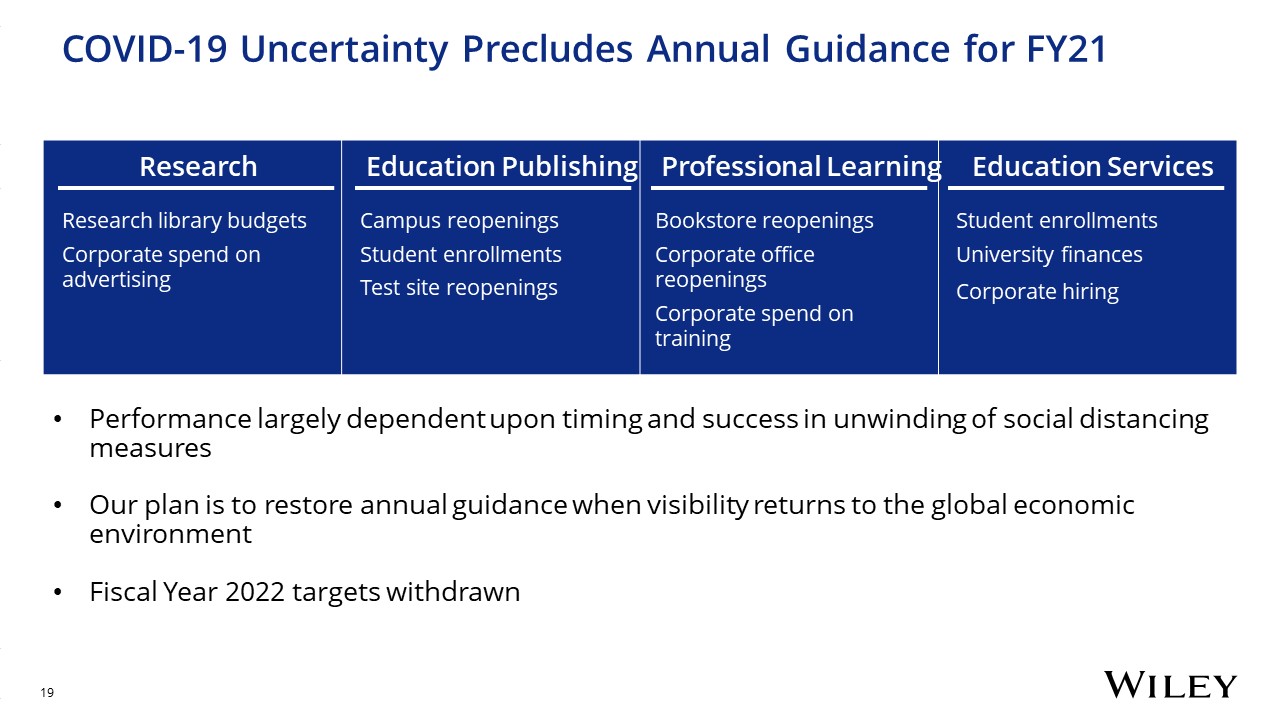

COVID-19 Uncertainty Precludes Annual Guidance for FY21 Research Research library

budgetsCorporate spend on advertising Education Publishing Campus reopeningsStudent enrollmentsTest site reopenings Professional Learning Bookstore reopeningsCorporate office reopeningsCorporate spend on training Education

Services Student enrollmentsUniversity financesCorporate hiring Performance largely dependent upon timing and success in unwinding of social distancing measuresOur plan is to restore annual guidance when visibility returns to the global

economic environmentFiscal Year 2022 targets withdrawn

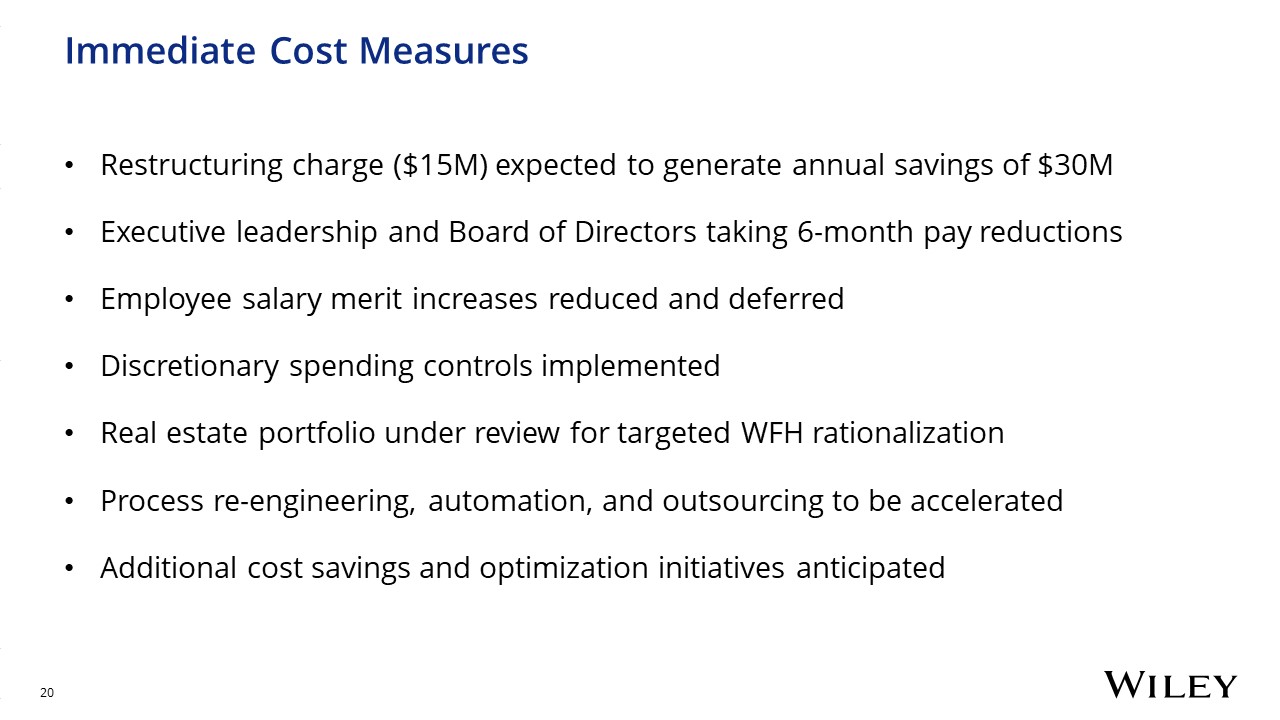

Immediate Cost Measures Restructuring charge ($15M) expected to generate annual savings of $30MExecutive

leadership and Board of Directors taking 6-month pay reductionsEmployee salary merit increases reduced and deferredDiscretionary spending controls implementedReal estate portfolio under review for targeted WFH rationalizationProcess

re-engineering, automation, and outsourcing to be accelerated Additional cost savings and optimization initiatives anticipated

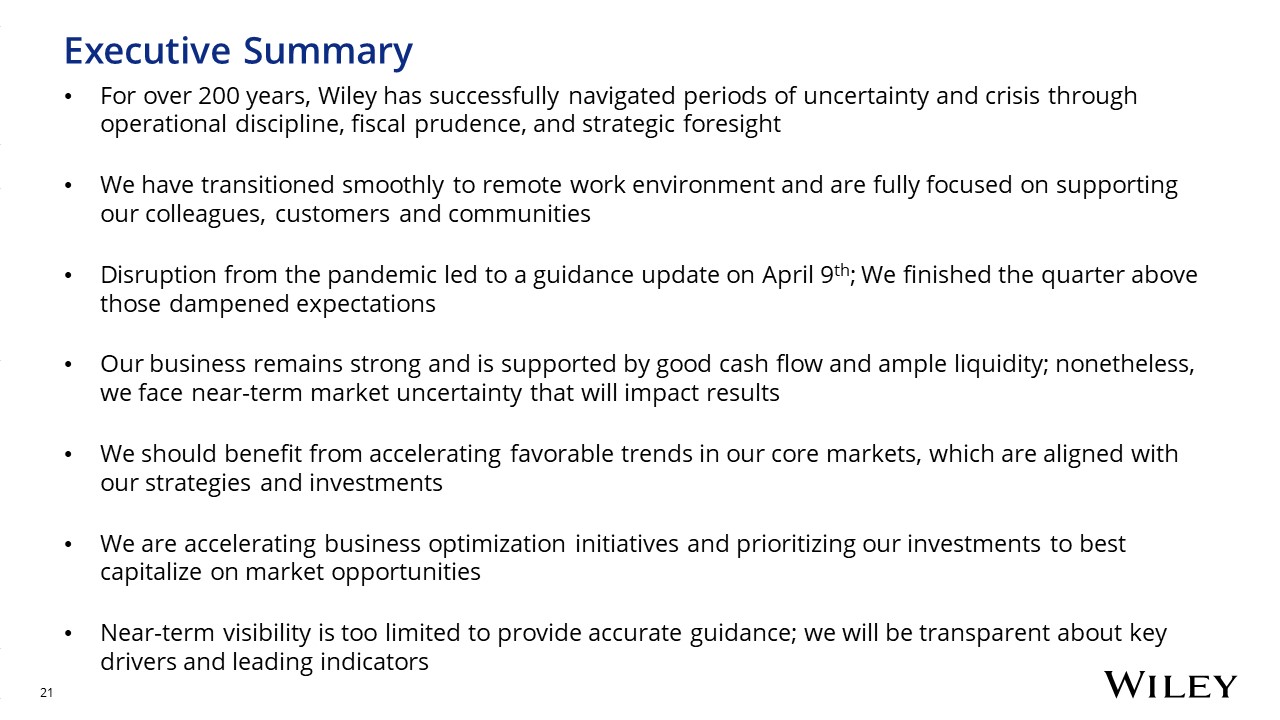

Executive Summary For over 200 years, Wiley has successfully navigated periods of uncertainty and crisis

through operational discipline, fiscal prudence, and strategic foresightWe have transitioned smoothly to remote work environment and are fully focused on supporting our colleagues, customers and communitiesDisruption from the pandemic led to a

guidance update on April 9th; We finished the quarter above those dampened expectationsOur business remains strong and is supported by good cash flow and ample liquidity; nonetheless, we face near-term market uncertainty that will impact

resultsWe should benefit from accelerating favorable trends in our core markets, which are aligned with our strategies and investmentsWe are accelerating business optimization initiatives and prioritizing our investments to best capitalize on

market opportunitiesNear-term visibility is too limited to provide accurate guidance; we will be transparent about key drivers and leading indicators

Thank you for joining usAll investor material available on website at

https://www.wiley.com/en-us/investorsQ1 Earnings Call – SeptemberContact us for follow-up at brian.campbell@wiley.com+1(201) 748-6874

APPENDIX

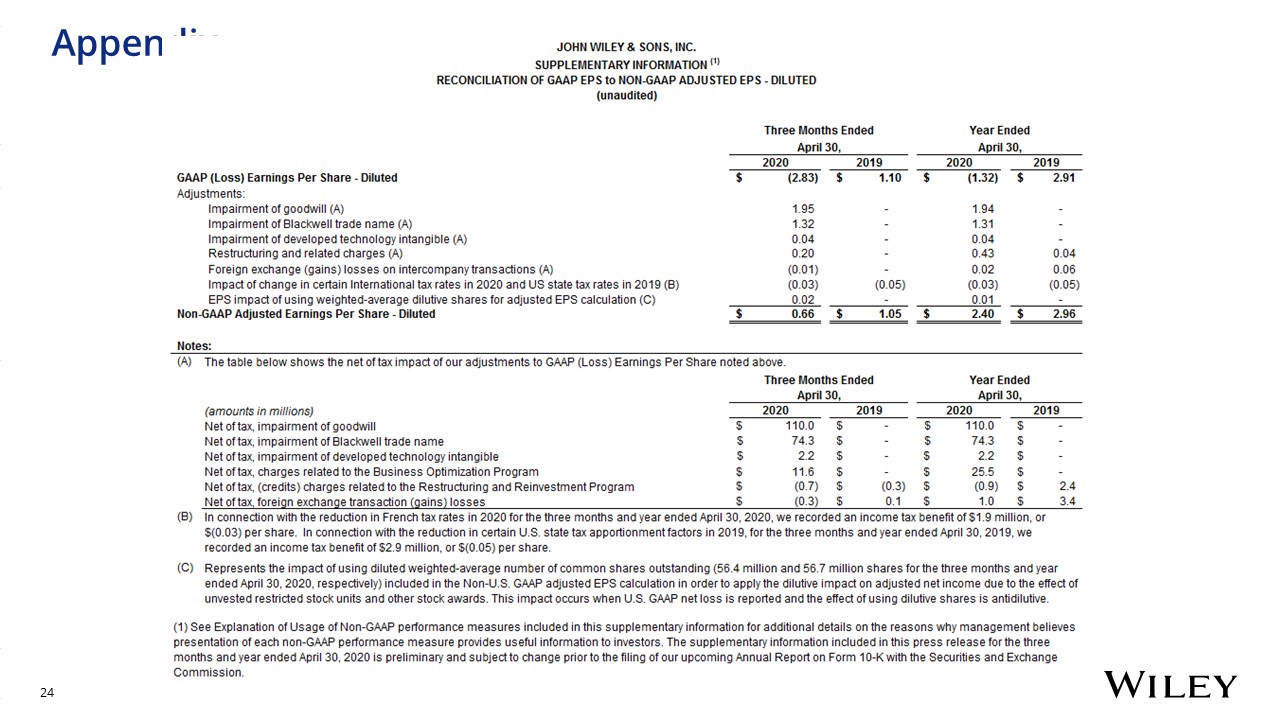

Appendix

Appendix