Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PAR PACIFIC HOLDINGS, INC. | a20200603-form8xkxq120.htm |

INVESTOR PRESENTATION I MAY 2020

Forward-Looking Statements / Disclaimers The information contained in this presentation has been prepared to assist you in making your own evaluation of the company and does not purport to contain all of the information you may consider important. Any estimates or projections with respect to future performance have been provided to assist you in your evaluation but should not be relied upon as an accurate representation of future results. Certain statements, estimates and financial information contained in this presentation constitute forward-looking statements. Such forward-looking statements involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from the results implied or expressed in such forward-looking statements. While presented with numerical specificity, certain forward-looking statements are based (1) upon assumptions that are inherently subject to significant business, economic, regulatory, environmental, seasonal and competitive uncertainties, contingencies and risks including, without limitation, our ability to maintain adequate liquidity, to realize the potential benefit of our net operating loss tax carryforwards, to obtain sufficient debt and equity financings, our capital costs, well production performance, and operating costs, anticipated commodity pricing, differentials or crack spreads, anticipated or projected pricing information related to oil, NGLs, and natural gas, realize the potential benefits of our supply and offtake agreements, our ability to realize the benefit of our investment in Laramie Energy, LLC, assumptions related to our investment in Laramie Energy, LLC, including completion activity and projected capital contributions, Laramie Energy, LLC’s financial and operational performance and plans, including estimated production growth and Adjusted EBITDAX, our ability to meet environmental and regulatory requirements, our ability to increase refinery throughput and profitability, estimated production, our ability to evaluate and pursue strategic and growth opportunities, our estimates of anticipated Adjusted EBITDA, Adjusted Net income per share, and Adjusted earnings per share, the amount and scope of anticipated capital expenditures and turnaround activities, estimates regarding our diesel hydrotreater project, Washington renewable fuels project, other maintenance and growth capital projects, anticipated 10 year and next 12 months turnaround schedule and expenditures, including costs, timing, and benefits, anticipated throughput, production costs, on-island and export sales expectations in Hawaii, anticipated throughput and distillate yield expectations in Wyoming, our estimates related to the annual gross margin impact of changes in RINs prices, the ability of our refinery in Wyoming to provide supply in the Northwest region, estimates related to the impact of COVID-19 on our business, results of operations, financial position, and liquidity, as well as our expectations related to our reduction in capital and operating expenditures and the idling of certain refining units at our Par West facility in Kapolei, Hawaii, expectations regarding Par Pacific’s posted market indices and the other metrics we utilize, (including free cash flow, Adjusted EBITDA, Adjusted Net income per share, and Adjusted earnings per share), and other known and unknown risks (all of which are difficult to predict and many of which are beyond the company's control), some of which are further discussed in the company’s periodic and other filings with the SEC and (2) upon assumptions with respect to future business decisions that are subject to change. There can be no assurance that the results implied or expressed in such forward-looking statements or the underlying assumptions will be realized and that actual results of operations or future events will not be materially different from the results implied or expressed in such forward-looking statements. Under no circumstances should the inclusion of the forward-looking statements be regarded as a representation, undertaking, warranty or prediction by the company or any other person with respect to the accuracy thereof or the accuracy of the underlying assumptions, or that the company will achieve or is likely to achieve any particular results. The forward-looking statements are made as of the date hereof and the company disclaims any intent or obligation to update publicly or to revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable law. Recipients are cautioned that forward-looking statements are not guarantees of future performance and, accordingly, recipients are expressly cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein. This presentation contains non-GAAP financial measures, such as Adjusted EBITDA, Adjusted Net Income (loss), and Laramie Energy Adjusted EBITDAX. Please see the Appendix for the definitions and reconciliations to GAAP of the non- GAAP financial measures that are based on reconcilable historical information. 1

Company Highlights • Owner & operator of essential energy infrastructure in growing PADD IV and V markets • 208,000 bpd petroleum refining capacity • Multimodal integrated logistics network with 9 MMbbls of storage, and marine, rail and pipeline assets • 124 fuel retail locations in Hawaii and the Pacific Northwest • 46% ownership interest in Laramie Energy, a natural gas E&P company • $1.4 billion in federal tax attributes as of December 31, 2019 Disciplined Focus on Increasing Adjusted EPS and Free Cash Flow 2

Demonstrated Operating Improvements and Growth HAWAII WYOMING WASHINGTON Operating Strategy • Improved crude selection and • Increased annual throughput • Optimizes product flows between mechanical reliability • Developed rail transport capability Hawaii, Northwest Retail, and Wyoming business units • Aggressive in-state commercial • Increased distillate yield through strategy facility modifications • Improved crude selection • Creative working capital strategy • Increased logistics capability Organic Growth • $27 million diesel hydrotreater • Refined product tanks enhance • Renewable fuels logistics project Investments project seasonal positioning • Butane sweetening project reduces gasoline pool sulfur content • Improved flexibility enables increased crude throughput and optimized product yields 3

Financial Metrics Full Year Full Year Full Year LTM Q1 As of March 31, 2020 2017 2018 2019 1 2020 1 Adjusted EBITDA ($ millions) Share Price 2 $9.45 Refining $114 $92 $169 $123 Logistics 40 40 76 83 Enterprise Value 2 $1,078 Retail 31 46 59 61 Corporate & Other (44) (46) (44) (44) Net Debt $569 Adjusted EBITDA $ 141 $132 $260 $223 Diluted Adjusted Net Income $1.37 $1.06 $1.79 $1.06 Liquidity $137 per Share 1 2019 and 2020 results include contribution from the Washington Refinery Acquisition, which closed on January 11, 2019. 2 Equity value of approximately $509 MM reflects share price of $9.45 and outstanding share count of approximately 53.9 MM as of May 1, 2020. 4

Integrated Downstream Network Seattle WA REFINERY • Well-positioned in WA Spokane 33 growing markets MT Portland ND • Advantaged access to Billings HI REFINERIES OR inland crudes Boise ID WY REFINERY 91 Hawaii SD Dedicated shipping to Rapid City • WY handle Hawaii – West Coast movements NE Cheyenne NV • Rail fleet to move refined Salt Lake City Denver products between Refinery Retail Locations UT CO markets Refined Products Inflows / Outflows Las Vegas 5

Growing Retail and Logistics Segments Balance Refining Trending Retail & Logistics Adj. EBITDA ($MM) LTM Q1-20 Adj. EBITDA Split by Segment 23% 46% $267 million LTM Q1-20 Business Segment Contribution 1 31% Logistics Retail Refining 6 1 Excludes Corporate & Other Adjusted EBITDA of $44 million.

Refining Overview Refining Segment Highlights Refinery Crude Capacity Mbpd • Focus on process safety, environmental Par Hawaii East 94 compliance and operational reliability Par Hawaii West 1 54 • 208,000 bpd petroleum refining capacity Washington 42 Wyoming 18 • Distillate-oriented yield profile Par Pacific System 208 • Throughput and yield optimized to serve local market needs 46% Distillates • Q1-20 system-wide production cost reduced to $3.70 per barrel 6% Other Products Q1-20 Combined Product Yield 5% Asphalt 28% Gasoline 15% LSFO 1 As of March 24, 2020, certain refining units at Par West have been idled in response to reduced refined product demand in Hawaii resulting from COVID-19. 7

Crude Sourcing Q1-20 Inland vs. Waterborne Crude Exposure WCS and Bakken (Clearbrook) Diffs $/bbl 8% Powder River Basin $10 $5 50% Other $0 $0 Waterborne Bakken Clearbrook ($10) ($5) 24% Bakken ($20) ($10) WCS ($30) ($15) 9% ANS ($40) ($20) 9% Cold Lake ($50) ($25) Jul-16 Jul-17 Jul-18 Jul-19 Jul-20 Jan-16 Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Oct-16 Oct-17 Oct-18 Oct-19 Oct-20 Apr-16 Apr-17 Apr-18 Apr-19 Apr-20 Apr-21 Inland exposure Waterborne exposure WCS - WTI WCS - WTI Futures Bakken (Clearbrook) - WTI Bakken (Clearbrook) - WTI Futures • Access to discounted Western Canadian, Powder River Basin, and Bakken crudes $/bbl WCS – WTI Bakken (Clearbrook) – WTI Q1-2020 $(18.02) $(3.31) 12-Mo Future Avg. $(15.29) $(6.68) • Increased exposure to favorable WTI-Brent spread from Source: CME & Platts historical data, CalRock forward data (avg. forward prices from 4/1/20 to 4/28/20). Washington refinery 12 month future averages reflect May-20 to Apr-21 forward data. 8

Upcoming Turnaround Schedule Q3-19 Q4-20 Par West Wyoming Turnaround Turnaround $10MM $17MM 6-7 year cycle 4-5 year cycle No anticipated major turnarounds 2019 2020 2021 2022 2023 2024 2025 Q3-20 Q1-21 Par East Washington Turnaround Turnaround $35MM $35MM 3-4 year cycle 3-4 year cycle Our 10 year estimated turnaround outlay is $200 million 9

Hawaii Performance Drivers Hawaii Performance Drivers Hawaii Production Cost ($/bbl) $3.72 • Market recently became balanced $3.65 $3.60 • 67% distillate and LSFO yield in 2019 • Generally outperforms in over-supplied crude market $3.36 environment $3.25 • Annual performance generally back-end weighted 2016 2017 2018 2019 Q1-20 Response to COVID-19 Demand Downturn COVID-19 Demand Impact (Mbpd) • Idled Par West location and eliminated jet imports to 88 balance production with demand • Deferred turnaround to late Q3 2020 46 • Reduction of capital expenditures and operating expense 27 15 • Shifting to lower cost waterborne crude 4 3 • Benefiting from lower interest rate environment for Jet Fuel, ULSD, LSFO & Gasoline, Naphtha & LPG HSFO, HSVGO & Asphalt working capital facility <0.5% HSD Pre-COVID 19 Demand Post-COVID 19 Demand 10

Leading Retail Position in Attractive Markets Kauai Hawaii Retail Retail Segment Growth Oahu • 91 locations across four islands 125 124 11 Maui including “76” and Hele branded 117 $129 $127 61 locations Hawaii 7 High real estate costs, scarcity of • 93 $107 land, and logistics complexity 12 strengthen competitive position $77 $59 $61 $46 Northwest Retail WA $31 • 33 Cenex® Zip Trip branded 33 locations in Washington and Idaho • Washington and Wyoming 2017 2018 2019 LTM Q1-20 ID refineries well-positioned to supply Adj. Gross Margin ($MM) Adj. EBITDA ($MM) the region Fuel Volumes (Millions of Gallons) 11

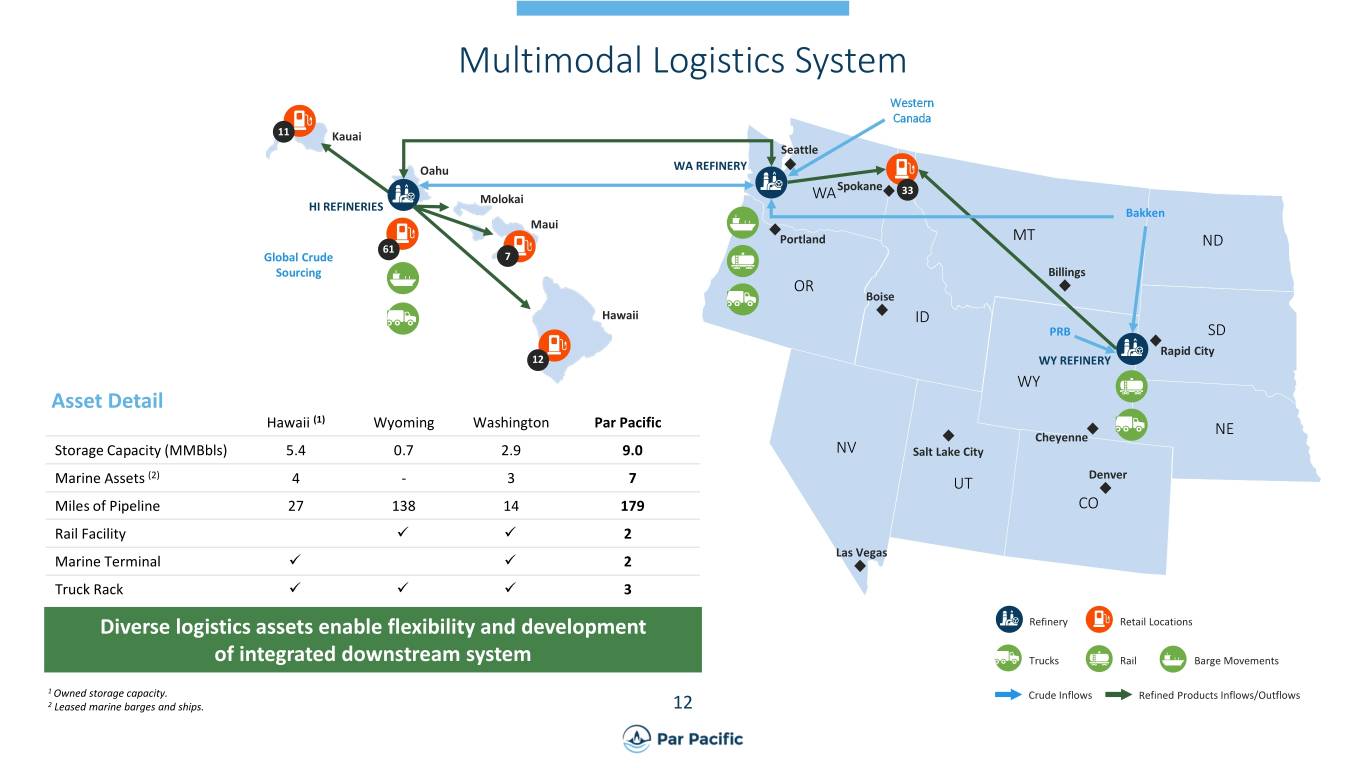

Multimodal Logistics System Western Canada 11 Kauai Seattle Oahu WA REFINERY Spokane 33 Molokai WA HI REFINERIES Bakken Maui Portland MT ND 61 Global Crude 7 Sourcing Billings OR Boise Hawaii ID PRB SD Rapid City 12 WY REFINERY WY Asset Detail (1) Hawaii Wyoming Washington Par Pacific NE Cheyenne Storage Capacity (MMBbls) 5.4 0.7 2.9 9.0 NV Salt Lake City Marine Assets (2) 4 - 3 7 UT Denver Miles of Pipeline 27 138 14 179 CO Rail Facility 2 Las Vegas Marine Terminal 2 Truck Rack 3 Diverse logistics assets enable flexibility and development Refinery Retail Locations of integrated downstream system Trucks Rail Barge Movements 1 Owned storage capacity. Crude Inflows Refined Products Inflows/Outflows 2 Leased marine barges and ships. 12

Appendix 13

Singapore 3.1.2 Crack Spread 5-Yr Average 1 = $10.11 ($/bbl) Singapore 3.1.2 Crack $10.02 $11.70 $10.54 $10.93 $10.49 $11.39 $10.79 $9.15 $9.39 $12.41 $12.12 $8.11 Average Brent Price $50.79 $52.17 $61.46 $67.19 $74.92 $75.93 $68.60 $63.83 $68.47 $62.03 $62.42 $50.82 Memo: Singapore 4.1.2.1 Crack $6.95 $8.20 $6.82 $6.38 $6.42 $7.81 $8.23 $6.88 $6.22 $9.36 $4.34 $4.19 1 Company calculation based on a rolling five-year quarterly average Singapore 3-1-2 Daily: computed by taking 1 part gasoline (RON 92) and 2 parts middle distillates (Sing Jet & Sing Gasoil) as created from a barrel of Brent Crude. Month (CMA): computed using all available pricing days for each marker. Quarter/Year: computed using calendar day weighted CMAs for each marker. 14

Wyoming 3.2.1 Crack Spread 5-Yr Average 1 = $21.64 ($/bbl) Wyoming 3.2.1 Crack $21.47 $25.29 $23.79 $15.65 $24.99 $26.25 $23.97 $15.09 $28.89 $27.32 $28.26 $15.86 Average WTI Price $48.15 $48.20 $55.30 $62.89 $67.91 $69.43 $59.34 $54.90 $59.91 $56.44 $56.87 $45.98 1 Company calculation based on a rolling five-year quarterly average Rapid City Daily: Computed by taking 2 part gasoline and 1 part distillate (ULSD) as created from three barrels of West Texas Intermediate Crude (WTI). Denver Daily: Computed by taking 2 part gasoline and 1 part distillate (ULSD) as created from three barrels of WTI. Wyoming 3-2-1 Daily: computed using a weighted average of 50% Rapid City and 50% Denver. Month (CMA): computed using all available pricing days for each marker. Quarter/Year: computed using calendar day weighted CMAs for each marker. 15

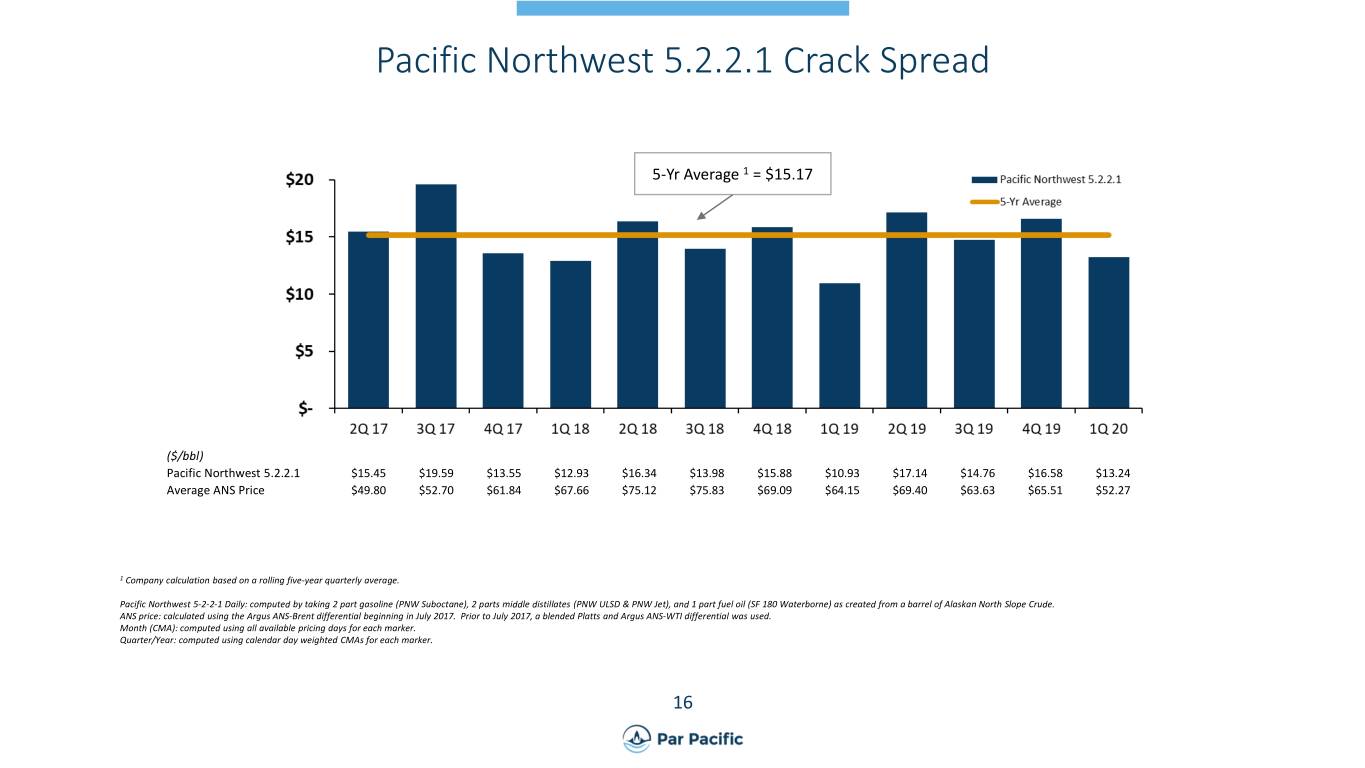

Pacific Northwest 5.2.2.1 Crack Spread 5-Yr Average 1 = $15.17 ($/bbl) Pacific Northwest 5.2.2.1 $15.45 $19.59 $13.55 $12.93 $16.34 $13.98 $15.88 $10.93 $17.14 $14.76 $16.58 $13.24 Average ANS Price $49.80 $52.70 $61.84 $67.66 $75.12 $75.83 $69.09 $64.15 $69.40 $63.63 $65.51 $52.27 1 Company calculation based on a rolling five-year quarterly average. Pacific Northwest 5-2-2-1 Daily: computed by taking 2 part gasoline (PNW Suboctane), 2 parts middle distillates (PNW ULSD & PNW Jet), and 1 part fuel oil (SF 180 Waterborne) as created from a barrel of Alaskan North Slope Crude. ANS price: calculated using the Argus ANS-Brent differential beginning in July 2017. Prior to July 2017, a blended Platts and Argus ANS-WTI differential was used. Month (CMA): computed using all available pricing days for each marker. Quarter/Year: computed using calendar day weighted CMAs for each marker. 16

Hawaii Market Fundamentals Pre-COVID 19 Post-COVID 19 Production & Demand 1 Petroleum Use 2 32% Air Mbbl/d Transportation 45 42 3% Commercial 40 35 35 9% Industrial 29 30 28 25 Total Production 25% Electric 20 Total Demand Power 15 27% Ground 10 Transportation 5 - Distillate Other Products 4% Marine Transportation Millions of Visitors Air Travel 2 Pre-COVID 19 Electricity 11.0 10.5 10.7 2, 3 10.3 10.4 Production by Source 10.0 9.8 13% Solar 9.3 8.8 9.0 8.6 8.4 62% Petroleum 8.2 7.9 8.0 12% Coal 8.0 7.0 5% Wind 3% Biomass 6.0 1% Geothermal 2012 2013 2014 2015 2016 2017 2018 2019E 2020E * 2021E 2022E 2023E * 2020E based on Q1-20 annualized visitor count. 4% Other 1 Source: Par Pacific internal estimates as of Q1-20. 17 2 Source: EIA and Department of Business, Economic Development and Tourism (“DBEDT”) as of Q1-20. Totals may not sum to 100% due to rounding. Air travel estimates are calculated as DBEDT total Hawaii visitor arrivals forecast less 10 year avg of cruise ship visitor arrivals. 3 Includes EIA estimate for rooftop solar of 10%.

Capital Expenditure and Turnaround Summary MAINTENANCE / REGULATORY GROWTH TURNAROUND • Expected annual recurring base • Anticipated 2020 growth projects include: • $35MM Par East turnaround in late Q3 maintenance capital expenditures of o Washington NextGen renewable fuels • $17MM Wyoming turnaround in early Q4 $35-40 MM logistics project • 2020 spend is expected to be higher than o Debottlenecking projects in normal run-rate to rebuild process Washington and Wyoming equipment and maintain tank farm in o Rebranding of Northwest retail Wyoming locations $120-135 $95-110 $94 $56-61 $10 $47-52 $48 $55 $21-26 $10-15 $32 $19 $6 $43-48 $25 $29 $29 $38-43 2017 2018 2019 2020 Original Guidance 2020 Revised Guidance Maintenance, Regulatory, and IT Growth Turnaround 18

Corporate Structure $49 MM 5% Convertible Notes due 6/15/2021 Par Pacific Holdings Inc. $44 MM L + 1.5% Term NYSE: PARR Loan due 4/1/2024 1 ABL Revolver due 12/21/2022 2 $300 MM 7.75% Senior Secured Notes due 12/15/2025 Par Petroleum, LLC $234 MM L + 6.75% Term Loan B due 1/11/2026 Hermes Laramie Energy, Supply and Offtake Par Hawaii Consolidated, LLC Par Hawaii, LLC Par Tacoma, LLC LLC 3 Agreement Refining, LLC d/b/a Wyoming 46% Interest Refining Company Note: Chart omits certain intermediate subsidiaries between parent and operating subsidiaries for brevity, as well as certain immaterial debt obligations. Debt balances outstanding as of May 1, 2020, unless otherwise stated. Intermediation 1 On March 29, 2019, Par Pacific Hawaii Property Company, LLC entered into a term loan agreement as borrower, with Bank of Hawaii as lender. Agreement 2 $85 mm ABL Revolver with availability of $49 mm as of March 31, 2020. Co-borrowers are Par Petroleum, LLC, a Delaware limited liability company, Par Hawaii, LLC, a Delaware limited liability company, Hermes Consolidated, LLC (d/b/a Wyoming Refining Company), a Delaware limited liability company, and Wyoming Pipeline Company LLC, a Wyoming limited liability company. 3 Laramie Energy has a $400 mm reserve based revolving credit facility with a borrowing base set at $220 mm as of March 31, 2019. Recourse limited to pledge of equity interest of Par Piceance Energy Equity, LLC. 19

Trended Capital Structure Twelve Months Ended 12/31/2017 12/31/2018 12/31/2019 3/31/2020 Debt ($ millions) 7.75% Senior Secured Notes $300 $300 $300 $300 Term Loan B - - 241 238 Other Loans - 1 45 45 Total Secured Debt 300 301 586 583 5% Convertible Note 115 115 49 49 Total Debt 415 416 635 631 Cash 118 75 126 62 Net Debt 297 341 509 569 LTM Adj. EBITDA 141 132 260 223 Net Debt to Adj. EBITDA 2.1 x 2.6 x 2.0 x 2.5 x Total stockholders' equity $448 $512 $648 $430 Net debt to total capitalization 40% 40% 44% 57% 20

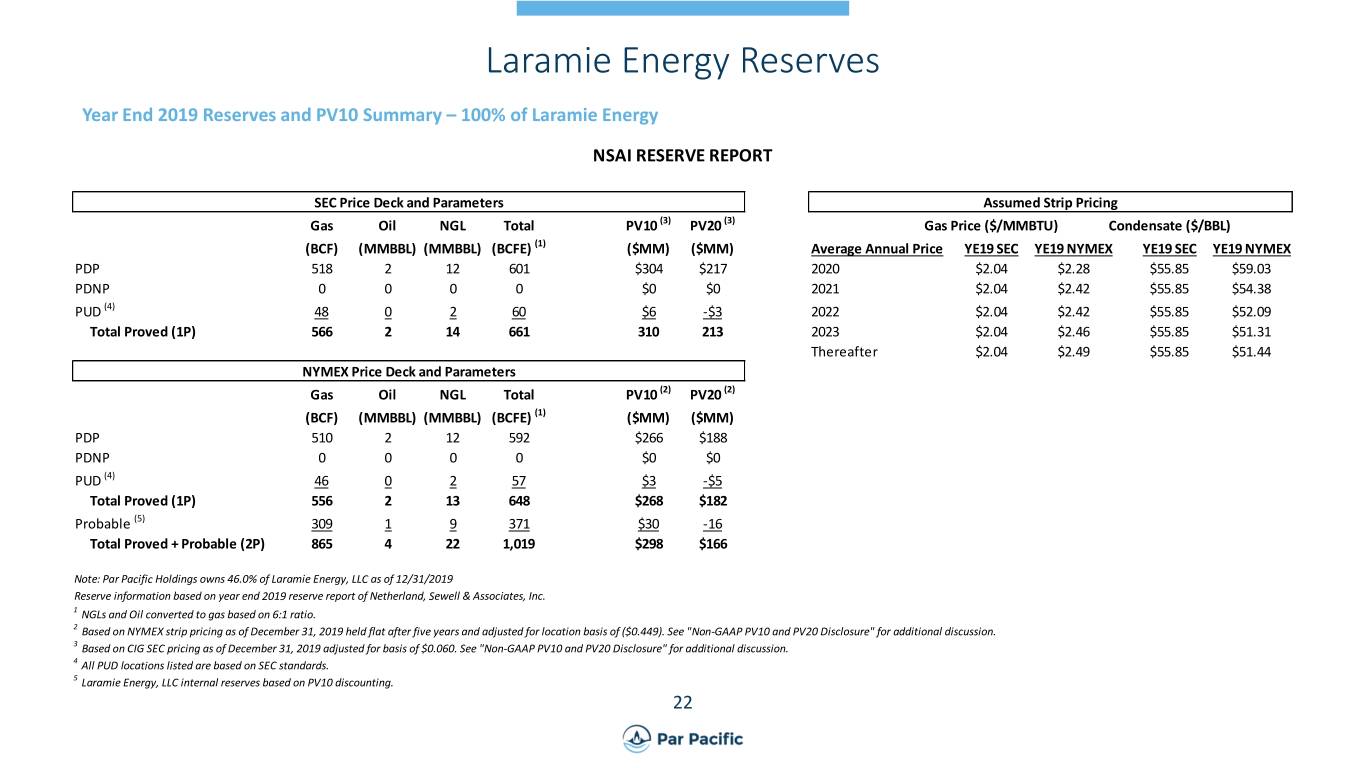

Non-GAAP PV10 and PV20 Disclosures Non-GAAP PV10 and PV20 Disclosure PV10 and PV20 are considered non-GAAP financial measures under SEC regulations because they do not include the effects of future income taxes, as is required in computing the standardized measure of discounted future net cash flows. However, our PV10/PV20 and our standardized measure of discounted future net cash flows are equivalent as we do not project to be taxable or pay cash income taxes based on our available tax assets and additional tax assets generated in the development of reserves because the tax basis of our oil and gas properties and NOL carryforwards exceeds the amount of discounted future net earnings. PV10/PV20 should not be considered a substitute for, or superior to, measures prepared in accordance with U.S. generally accepted accounting principles. We believe that PV10 and PV20 are important measures that can be used to evaluate the relative significance of our natural gas and oil properties to other companies and that PV10 and PV20 are widely used by securities analysts and investors when evaluating oil and gas companies. PV10 and PV20 are computed on the same basis as the standardized measure of discounted future net cash flows but without deducting income taxes. 21

Laramie Energy Reserves Year End 2019 Reserves and PV10 Summary – 100% of Laramie Energy NSAI RESERVE REPORT SEC Price Deck and Parameters Assumed Strip Pricing Gas Oil NGL Total PV10 (3) PV20 (3) Gas Price ($/MMBTU) Condensate ($/BBL) (BCF) (MMBBL) (MMBBL) (BCFE) (1) ($MM) ($MM) Average Annual Price YE19 SEC YE19 NYMEX YE19 SEC YE19 NYMEX PDP 518 2 12 601 $304 $217 2020 $2.04 $2.28 $55.85 $59.03 PDNP 0 0 0 0 $0 $0 2021 $2.04 $2.42 $55.85 $54.38 PUD (4) 48 0 2 60 $6 -$3 2022 $2.04 $2.42 $55.85 $52.09 Total Proved (1P) 566 2 14 661 310 213 2023 $2.04 $2.46 $55.85 $51.31 Thereafter $2.04 $2.49 $55.85 $51.44 NYMEX Price Deck and Parameters Gas Oil NGL Total PV10 (2) PV20 (2) (BCF) (MMBBL) (MMBBL) (BCFE) (1) ($MM) ($MM) PDP 510 2 12 592 $266 $188 PDNP 0 0 0 0 $0 $0 PUD (4) 46 0 2 57 $3 -$5 Total Proved (1P) 556 2 13 648 $268 $182 Probable (5) 309 1 9 371 $30 -16 Total Proved + Probable (2P) 865 4 22 1,019 $298 $166 Note: Par Pacific Holdings owns 46.0% of Laramie Energy, LLC as of 12/31/2019 Reserve information based on year end 2019 reserve report of Netherland, Sewell & Associates, Inc. 1 NGLs and Oil converted to gas based on 6:1 ratio. 2 Based on NYMEX strip pricing as of December 31, 2019 held flat after five years and adjusted for location basis of ($0.449). See "Non-GAAP PV10 and PV20 Disclosure" for additional discussion. 3 Based on CIG SEC pricing as of December 31, 2019 adjusted for basis of $0.060. See "Non-GAAP PV10 and PV20 Disclosure" for additional discussion. 4 All PUD locations listed are based on SEC standards. 5 Laramie Energy, LLC internal reserves based on PV10 discounting. 22

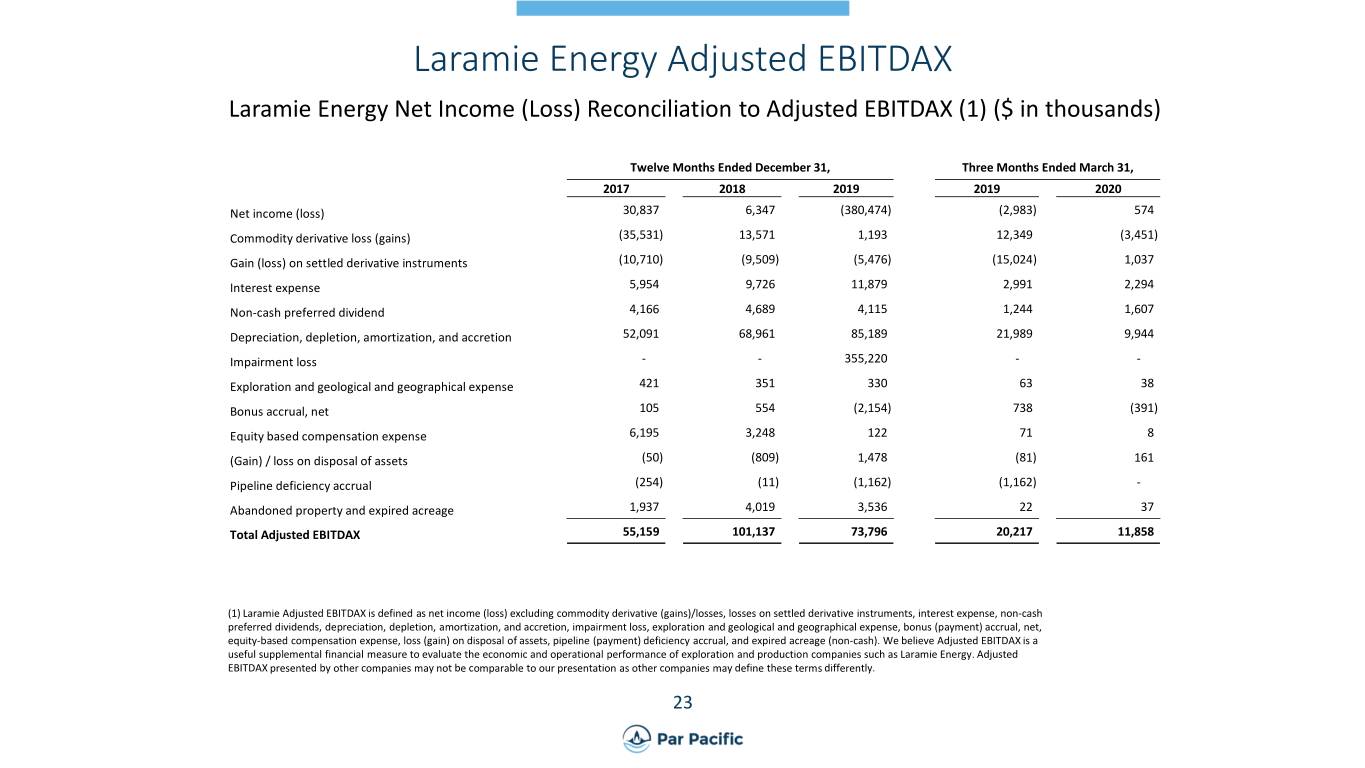

Laramie Energy Adjusted EBITDAX Laramie Energy Net Income (Loss) Reconciliation to Adjusted EBITDAX (1) ($ in thousands) Twelve Months Ended December 31, Three Months Ended March 31, 2017 2018 2019 2019 2020 Net income (loss) 30,837 6,347 (380,474) (2,983) 574 Commodity derivative loss (gains) (35,531) 13,571 1,193 12,349 (3,451) Gain (loss) on settled derivative instruments (10,710) (9,509) (5,476) (15,024) 1,037 Interest expense 5,954 9,726 11,879 2,991 2,294 Non-cash preferred dividend 4,166 4,689 4,115 1,244 1,607 Depreciation, depletion, amortization, and accretion 52,091 68,961 85,189 21,989 9,944 Impairment loss - - 355,220 - - Exploration and geological and geographical expense 421 351 330 63 38 Bonus accrual, net 105 554 (2,154) 738 (391) Equity based compensation expense 6,195 3,248 122 71 8 (Gain) / loss on disposal of assets (50) (809) 1,478 (81) 161 Pipeline deficiency accrual (254) (11) (1,162) (1,162) - Abandoned property and expired acreage 1,937 4,019 3,536 22 37 Total Adjusted EBITDAX 55,159 101,137 73,796 20,217 11,858 (1) Laramie Adjusted EBITDAX is defined as net income (loss) excluding commodity derivative (gains)/losses, losses on settled derivative instruments, interest expense, non-cash preferred dividends, depreciation, depletion, amortization, and accretion, impairment loss, exploration and geological and geographical expense, bonus (payment) accrual, net, equity-based compensation expense, loss (gain) on disposal of assets, pipeline (payment) deficiency accrual, and expired acreage (non-cash). We believe Adjusted EBITDAX is a useful supplemental financial measure to evaluate the economic and operational performance of exploration and production companies such as Laramie Energy. Adjusted EBITDAX presented by other companies may not be comparable to our presentation as other companies may define these terms differently. 23

Non-GAAP Financial Measures Twelve Months Ended Consolidated Adjusted EBITDA and Adjusted Net Income Reconciliation (1) ($ in thousands) 2015 2016 2017 2018 2019 Q1 2020 Net income (loss) $ (39,911) $ (45,835) $ 72,621 $ 39,427 $ 40,809 $ (242,620) Adjustments to Net Income (loss): Inventory valuation adjustment 6,689 25,101 (1,461) (16,875) 13,441 85,408 RINs loss (gain) in excess of net obligation — — — 4,544 (3,398) 7,716 Unrealized loss (gain) on derivatives 10,896 (12,034) (623) (1,497) 8,988 25,522 Acquisition and integration costs 2,006 5,294 395 10,319 4,704 2,485 Debt extinguishment and commitment costs 19,669 — 8,633 4,224 11,587 6,091 Changes in valuation allowance and other deferred tax items (2) (16,759) (8,573) — (660) (68,792) (21,814) Change in value of common stock warrants 3,664 (2,962) 1,674 (1,801) 3,199 (2,353) Change in value of contingent consideration 18,450 (10,770) — 10,500 — — Severance costs 637 105 1,595 — — 149 Impairments of Laramie Energy, LLC (3) 41,081 — — — 83,152 128,446 Par's share of Laramie Energy's unrealized loss (gain) on derivatives 5,508 17,278 (19,568) 1,158 (1,969) (1,848) Impairment expense 9,639 — — — — 67,922 Adjusted Net Income (loss) (4) 61,569 (32,396) 63,266 49,339 91,721 55,104 Depreciation, depletion and amortization 19,918 31,617 45,989 52,642 86,121 86,447 Interest expense and financing costs, net 20,156 28,506 31,632 39,768 74,839 74,803 Equity losses (earnings) from Laramie Energy, LLC, excluding Par's share of unrealized loss (gain) on derivatives and impairment losses 9,394 5,103 1,199 (10,622) 8,568 8,485 Income tax expense (benefit) (29) 661 (1,319) 993 (897) (1,353) Adjusted EBITDA $ 111,008 $ 33,491 $ 140,767 $ 132,120 $ 260,352 $ 223,486 _____________________________________________ (1) We believe Adjusted Net Income (Loss) and Adjusted EBITDA are useful supplemental financial measures that allow investors to assess: (1) The financial performance of our assets without regard to financing methods, capital structure or historical cost basis, (2) The ability of our assets to generate cash to pay interest on our indebtedness, and (3) Our operating performance and return on invested capital as compared to other companies without regard to financing methods and capital structure. Adjusted Net Income (Loss) and Adjusted EBITDA should not be considered in isolation or as a substitute for operating income (loss), net income (loss), cash flows provided by operating, investing and financing activities, or other income or cash flow statement data prepared in accordance with GAAP. Adjusted Net Income (Loss) and Adjusted EBITDA presented by other companies may not be comparable to our presentation as other companies may define these terms differently. (2) Includes increases in (releases of) our valuation allowance associated with business combinations and changes in deferred tax assets and liabilities that are not offset by a change in the valuation allowance. These tax expenses (benefits) are included in Income tax benefit on our condensed consolidated statements of operations. 24 (3) Included in Equity earnings (losses) from Laramie Energy, LLC on our condensed consolidated statements of operations. (4) For the periods presented herein, there was no (gain) loss on sale of assets.

Non-GAAP Financial Measures Consolidated Adjusted EBITDA by Segment Reconciliation (1) For the twelve months ended March 31, 2020 ($ in thousands) Corporate and Refining Logistics Retail Other Operating income (loss) $ (89,152) $ 65,432 $ 21,072 $ (51,968) Adjustments to operating income (loss): Unrealized loss (gain) on derivatives 25,566 — — (44) Acquisition and integration costs — — — 2,485 Inventory valuation adjustment 85,408 — — — RINs loss in excess of net obligation 7,716 — — — Depreciation, depletion and amortization 54,948 17,788 10,460 3,251 Severance costs 88 — — 61 Impairment expense 38,105 — 29,817 — Other income/expense — — — 2,453 Adjusted EBITDA $ 122,679 $ 83,220 $ 61,349 $ (43,762) _____________________________________________ (1) Adjusted EBITDA by segment is defined as operating income (loss) by segment excluding unrealized (gains) losses on derivatives, inventory valuation adjustment, acquisition and integration costs, severance costs, RINs loss (gain) in excess of net obligation, impairment expense, depreciation, depletion and amortization expense, and other income/expense. We believe Adjusted EBITDA by segment is a useful supplemental financial measure to evaluate the economic performance of our segments without regard to financing methods, capital structure or historical cost basis. Adjusted EBITDA by segment presented by other companies may not be comparable to our presentation as other companies may define these terms differently. Adjusted EBITDA for the Corporate and Other segment also includes Other income, net, which is presented below operating income (loss) on our consolidated statements of operations. 25

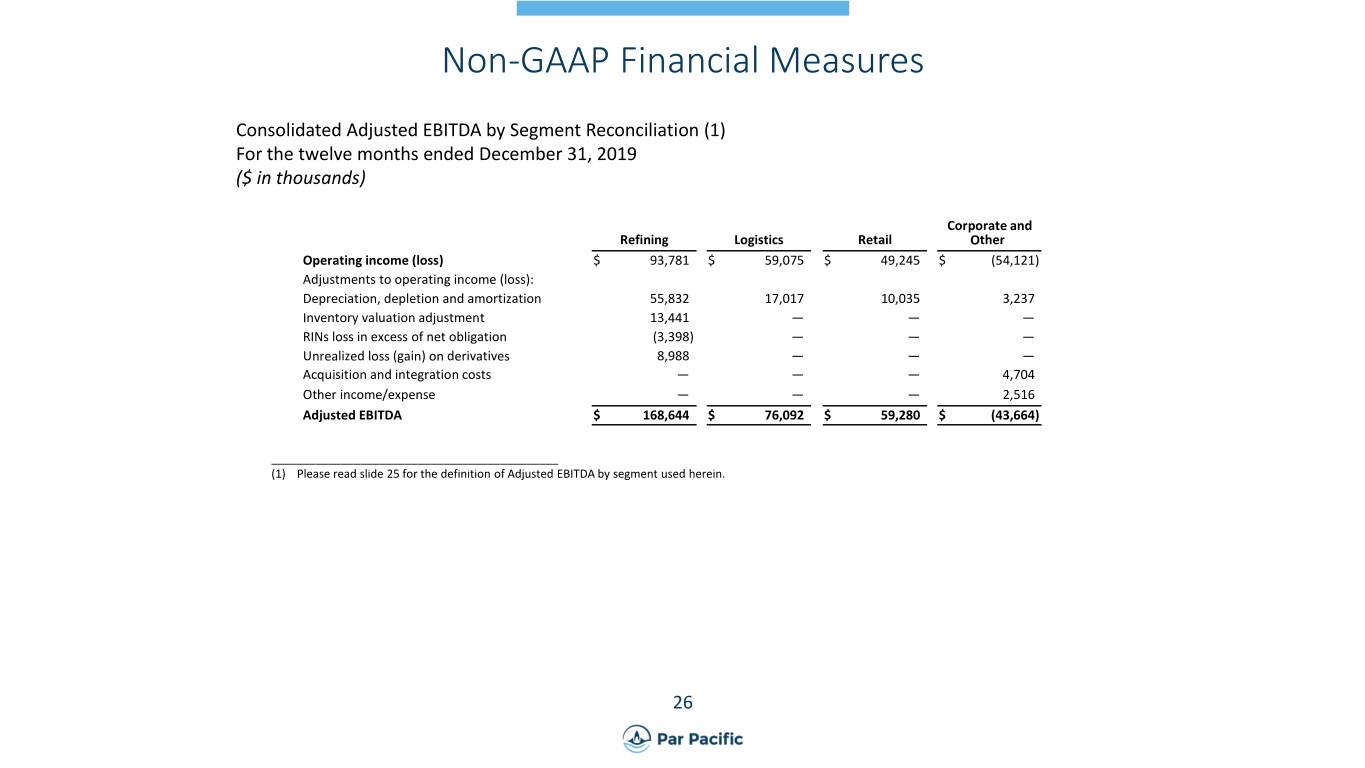

Non-GAAP Financial Measures Consolidated Adjusted EBITDA by Segment Reconciliation (1) For the twelve months ended December 31, 2019 ($ in thousands) Corporate and Refining Logistics Retail Other Operating income (loss) $ 93,781 $ 59,075 $ 49,245 $ (54,121) Adjustments to operating income (loss): Depreciation, depletion and amortization 55,832 17,017 10,035 3,237 Inventory valuation adjustment 13,441 — — — RINs loss in excess of net obligation (3,398) — — — Unrealized loss (gain) on derivatives 8,988 — — — Acquisition and integration costs — — — 4,704 Other income/expense — — — 2,516 Adjusted EBITDA $ 168,644 $ 76,092 $ 59,280 $ (43,664) _____________________________________________ (1) Please read slide 25 for the definition of Adjusted EBITDA by segment used herein. 26

Non-GAAP Financial Measures Consolidated Adjusted EBITDA by Segment Reconciliation (1) For the twelve months ended December 31, 2018 ($ in thousands) Corporate and Refining Logistics Retail Other Operating income (loss) $ 73,269 $ 33,389 $ 37,232 $ (61,949) Adjustments to operating income (loss): Depreciation, depletion and amortization 32,483 6,860 8,962 4,337 Inventory valuation adjustment (16,875) — — — RINs loss in excess of net obligation 4,544 — — — Unrealized loss (gain) on derivatives (1,497) — — — Acquisition and integration costs — — — 10,319 Other income/expense — — — 1,046 Adjusted EBITDA $ 91,924 $ 40,249 $ 46,194 $ (46,247) _____________________________________________ (1) Please read slide 25 for the definition of Adjusted EBITDA by segment used herein. 27

Non-GAAP Financial Measures Consolidated Adjusted EBITDA by Segment Reconciliation (1) For the twelve months ended December 31, 2017 ($ in thousands) Corporate and Refining Logistics Retail Other Operating income (loss) $ 86,016 $ 33,993 $ 24,700 $ (50,748) Adjustments to operating income (loss): Depreciation, depletion and amortization 29,753 6,166 6,338 3,732 Inventory valuation adjustment (1,461) — — — Unrealized loss (gain) on derivatives (623) — — — Acquisition and integration costs — — — 395 Severance costs 395 — — 1,200 Other income/expense — — — 911 Adjusted EBITDA $ 114,080 $ 40,159 $ 31,038 $ (44,510) _____________________________________________ (1) Please read slide 25 for the definition of Adjusted EBITDA by segment used herein. 28

Non-GAAP Financial Measures Consolidated Adjusted EBITDA by Segment Reconciliation (1) For the twelve months ended December 31, 2016 ($ in thousands) Corporate and Refining Logistics Retail Other Operating income (loss) $ (10,934) $ 21,422 $ 22,194 $ (52,331) Adjustments to operating income (loss): Depreciation, depletion and amortization 17,565 4,679 6,372 3,001 Inventory valuation adjustment 29,056 — — (3,955) RINs loss in excess of net obligation — — — — Unrealized loss (gain) on derivatives (12,438) — — 404 Acquisition and integration costs — — — 5,294 Severance costs — — — 105 Gain on curtailment of pension obligation (2) — — — 3,067 Other income/expense — — — (10) Adjusted EBITDA $ 23,249 $ 26,101 $ 28,566 $ (44,425) _____________________________________________ (1) Please read slide 25 for the definition of Adjusted EBITDA by segment used herein. (2) Line item has been added to the Adjusted EBITDA presentation as part of the adoption of ASU 2017-07, Compensation—Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost 29

Non-GAAP Financial Measures Consolidated Adjusted EBITDA by Segment Reconciliation (1) For the twelve months ended December 31, 2015 ($ in thousands) Corporate and Refining Logistics Retail Other Operating income (loss) $ 66,756 $ 25,170 $ 27,149 $ (63,345) Adjustments to operating income (loss): Depreciation, depletion and amortization 9,522 3,117 5,421 1,858 Impairment expense — — — 9,639 Inventory valuation adjustment 5,178 — — 1,511 RINs loss in excess of net obligation — — — — Unrealized loss (gain) on derivatives 10,284 — — 612 Acquisition and integration costs — — — 2,006 Severance costs — — — 637 Gain on curtailment of post-retirement medical plan obligation (2) 4,884 280 431 — Other income/expense — — — (102) Adjusted EBITDA $ 96,624 $ 28,567 $ 33,001 $ (47,184) _____________________________________________ (1) Please read slide 25 for the definition of Adjusted EBITDA by segment used herein. (2) Line item has been added to the Adjusted EBITDA presentation as part of the adoption of ASU 2017-07, Compensation—Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost 30

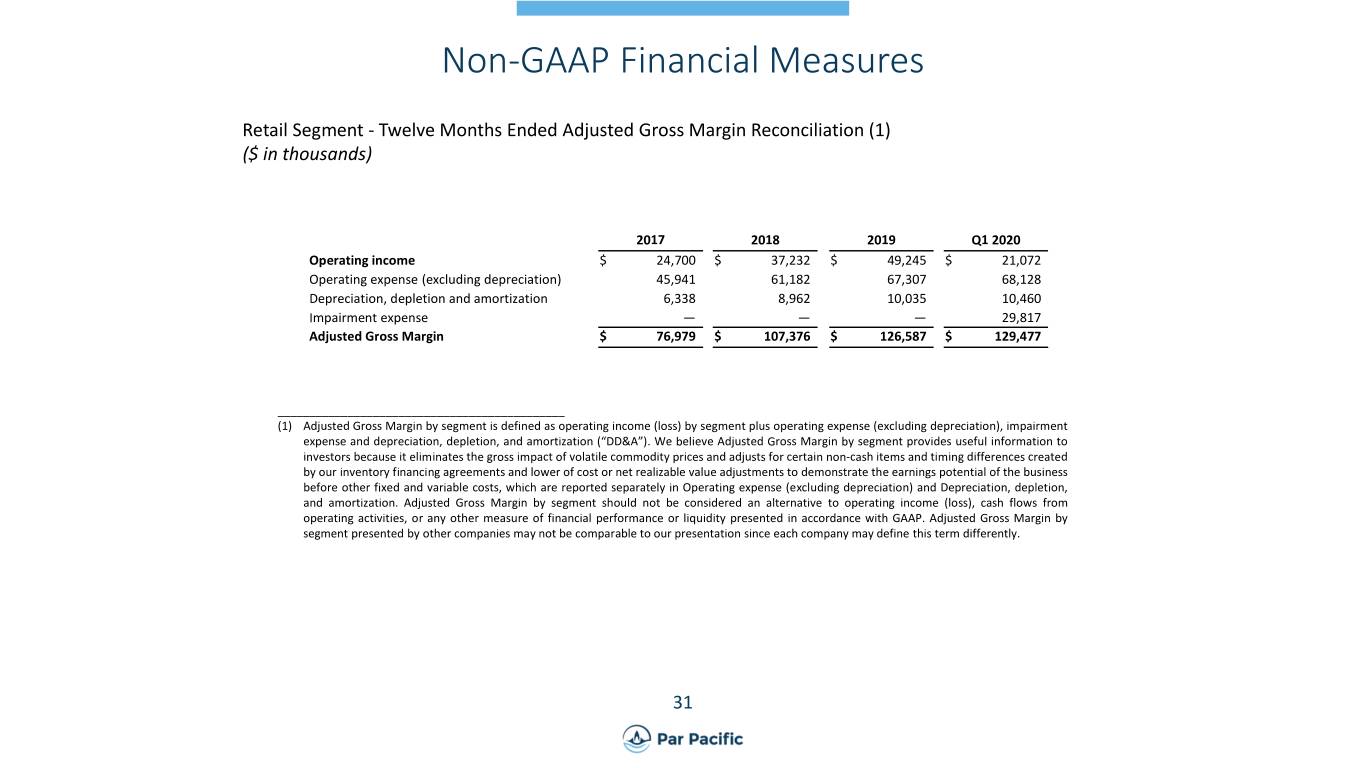

Non-GAAP Financial Measures Retail Segment - Twelve Months Ended Adjusted Gross Margin Reconciliation (1) ($ in thousands) 2017 2018 2019 Q1 2020 Operating income $ 24,700 $ 37,232 $ 49,245 $ 21,072 Operating expense (excluding depreciation) 45,941 61,182 67,307 68,128 Depreciation, depletion and amortization 6,338 8,962 10,035 10,460 Impairment expense — — — 29,817 Adjusted Gross Margin $ 76,979 $ 107,376 $ 126,587 $ 129,477 _____________________________________________ (1) Adjusted Gross Margin by segment is defined as operating income (loss) by segment plus operating expense (excluding depreciation), impairment expense and depreciation, depletion, and amortization (“DD&A”). We believe Adjusted Gross Margin by segment provides useful information to investors because it eliminates the gross impact of volatile commodity prices and adjusts for certain non-cash items and timing differences created by our inventory financing agreements and lower of cost or net realizable value adjustments to demonstrate the earnings potential of the business before other fixed and variable costs, which are reported separately in Operating expense (excluding depreciation) and Depreciation, depletion, and amortization. Adjusted Gross Margin by segment should not be considered an alternative to operating income (loss), cash flows from operating activities, or any other measure of financial performance or liquidity presented in accordance with GAAP. Adjusted Gross Margin by segment presented by other companies may not be comparable to our presentation since each company may define this term differently. 31

Non-GAAP Financial Measures Diluted Adjusted Net Income per Share for the Twelve Months Ended (in thousands, except per share amounts) 2017 2018 2019 Q1 2020 Adjusted Net Income (Loss) $ 63,266 $ 49,339 $ 91,721 $ 55,104 Undistributed Adjusted Net Income allocated to participating securities (1) 765 695 984 581 Adjusted Net Income attributable to common stockholders 62,501 48,644 90,737 54,523 Plus: effect of convertible securities — — 8,978 — Numerator for diluted income per common share $ 62,501 $ 48,644 $ 99,715 $ 54,523 Basic weighted-average common stock shares outstanding 45,543 45,726 50,352 51,387 Add dilutive effects of common stock equivalents 40 29 5,240 134 Diluted weighted-average common stock shares outstanding 45,583 45,755 55,592 51,521 Basic Adjusted Net Income (Loss) per common share $ 1.37 $ 1.06 $ 1.80 $ 1.06 Diluted Adjusted Net Income (Loss) per common share $ 1.37 $ 1.06 $ 1.79 $ 1.06 _____________________________________________ (1) Participating securities include restricted stock that has been issued but had not yet vested. These shares vested during the year ended December 31, 2019. 32