Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASHFORD HOSPITALITY TRUST INC | aht-investorpresentati.htm |

June 2020

Forward Looking Statements and Non - GAAP Measures In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, the degree and nature of our competition, legislative and regulatory changes, including changes to the Internal Revenue Code of 1986, as amended (the “Code”), and related rules, regulations and interpretations governing the taxation of REITs; and limitations imposed on our business and our ability to satisfy complex rules in order for us to qualify as a REIT for federal income tax purposes. These and other risk factors are more fully discussed in the company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price or debt amount. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC or in the appendix to this presentation. The calculation of implied equity value is derived from an estimated blended capitalization rate (“Cap Rate”) for the entire portfolio using the capitalization rate method. The estimated Cap Rate is based on recent Cap Rates of publically traded peers involving a similar blend of asset types found in the portfolio, which is then applied to Net Operating Income (“NOI”) of the company’s assets to calculate a Total Enterprise Value (“TEV”) of the company. From the TEV, we deduct debt and preferred equity and then add back working capital to derive an equity value. The capitalization rate method is one of several valuation methods for estimating asset value and implied equity value. Among the limitations of using the capitalization rate method for determining an implied equity value are that it does not take into account the potential change or variability in future cash flows, potential significant future capital expenditures, the intended hold period of the asset, or a change in the future risk profile of an asset. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security. Our business has been and will continue to be materially adversely affected by the impact of, and the public perception of a risk of, a pandemic disease. In December 2019, a novel strain of coronavirus (COVID-19) was identified in Wuhan, China, which has subsequently spread to other regions of the world, and has resulted in increased travel restrictions and extended shutdown of certain businesses in affected regions, including in nearly every state in the United States. Since late February, we have experienced a significant decline in occupancy and RevPAR and we expect the significant occupancy and RevPAR reduction associated with the novel coronavirus (COVID-19) to likely continue as we are recording significant reservation cancellations as well as a significant reduction in new reservations relative to prior expectations. The continued outbreak of the virus in the U.S. has and will likely continue to further reduce travel and demand at our hotels. The prolonged occurrence of the virus has resulted in health or other government authorities imposing widespread restrictions on travel or other market impacts. The hotel industry and our portfolio have and we expect will continue to experience the postponement or cancellation of a significant number of business conferences and similar events. At this time those restrictions are very fluid and evolving. We have been and will continue to be negatively impacted by those restrictions. Given that the type, degree and length of such restrictions are not known at this time, we cannot predict the overall impact of such restrictions on us or the overall economic environment. In addition, even after the restrictions are lifted, the propensity of people to travel and for businesses to hold conferences will likely remain below historical levels for an additional period of time that is difficult to predict. We may also face increased risk of litigation if we have guests or employees who become ill due to COVID-19. As such, the impact these restrictions may have on our financial position, operating results and liquidity cannot be reasonably estimated at this time, but the impact will likely be material. Additionally, the public perception of a risk of a pandemic or media coverage of these diseases, or public perception of health risks linked to perceived regional food and beverage safety has materially further adversely affected us by reducing demand for our hotels. Currently, no vaccines have been developed, and there can be no assurance that an effective vaccine can be discovered in time to protect against a potential pandemic. These events have resulted in a sustained, significant drop in demand for our hotels and could have a material adverse effect on us. Prior to investing in Ashford Hospitality Trust, Inc. potential investors should carefully review Ashford Hospitality Trust, Inc.’s periodic filings made with the Security and Exchange Commission, including but not limited to Ashford Hospitality Trust Inc.’s most current Form 10-K, Form 10-Q and Form 8-K’s, including the risk factors included therein. 2

Management Team Proven Experience J. Robison Hays Jeremy Welter Deric Eubanks Robert Haiman C h i e f E x e c u t i v e C h i e f O p e r a t i n g Chief Financial EVP, General O f f i c e r O f f i c e r O f f i c e r C o u n s e l . 15 years of hospitality . 15 years of hospitality . 20 years of hospitality . 16 years of hospitality experience experience experience experience . 15 years with Ashford . 10 years with Ashford (5 . 17 years with Ashford . 2 year with Ashford (14 . 3 years of M&A years with predecessor) . 3 years with ClubCorp years with Ashford experience at Dresser predecessor) . 5 years with Stephens . CFA Charterholder Inc. & Merrill Lynch Investment Bank . Amherst College, BA . Southern Methodist . Princeton University, AB . Oklahoma State University, University, BBA . Duke University, JD BS 3

Portfolio High Quality W Atlanta Downtown Marriott Beverly Hills La Concha Le Pavillon Atlanta, GA Beverly Hills, CA Key West, FL New Orleans, LA One Ocean Le Meridien Minneapolis W Minneapolis The Silversmith Jacksonville, FL Minneapolis, MN Minneapolis, MN Chicago, IL Hyatt Coral Gables The Churchill Renaissance Nashville Hyatt Savannah Coral Gables, FL Washington, D.C. Nashville, TN Savannah, GA 4

Portfolio Overview Key Metrics 116 24,746 30 HOTELS (1) HOTEL ROOMS (1) STATES (1) Portfolio by Hotel EBITDA(2) IHG INTERSTATE 2% HYATT LUXURY <1% 5% UPPER HYATT 4% MIDSCALE 4% SELECT-SERVICE 2% 28% INDEPENDENT HILTON 6% INDEPENDENT 7% 6% PROPERTY SERVICE CHAIN HOTEL BRAND MANAGER TYPE SCALE 32% 27% MARRIOTT UPSCALE 32% 56% 57% 72% 60% HILTON MARRIOTT REMINGTON FULL-SERVICE UPPER UPSCALE (1) As of March 31, 2020 (2) Pro forma TTM as of December 31, 2019 excludes WorldQuest 5

3% Geographically Diverse SMALL METRO Portfolio Location RESORT 8% <1% (1)(2) Portfolio by Hotel EBITDA AIRPORT INTERSTATE 16% LOCATION TYPE 35% 38% URBAN SUBURBAN OTHER 9% Top 10 Markets % Total TOP 50 Washington, D.C. 10.3% 17% San Francisco/Oakland, CA 8.3% New York/New Jersey 8.1% Los Angeles, CA 6.8% Nashville, TN 6.6% Atlanta, GA 6.1% Boston, MA 5.5% MSA’s Dallas Fort-Worth, TX 5.4% Austin, TX 2.7% Miami, FL 2.3% Other Areas 37.9% TOP 25 74% Total 100.0% (1) TTM as of December 31, 2019, excludes WorldQuest (2) Due to the economic effects of the COVID-19 pandemic on the Company, the lodging industry and the broader economy, the information provided should not be relied upon as an accurate representation of the current or future financial condition of the Company. 6

COVID-19 Impact on the Industry SA Real RevPAR $ (as of Apr 20) 2020 STR Forecast 2021 STR Forecast $76 Supply -14.9% +15.6% $66 $56 Demand -51.2% +81.8% $46 $36 Occupancy -42.6% +57.3% $26 $16 $16 ADR -13.9% +3.7% RevPAR -50.6% +63.1% SA Occupancy (as of Apr 20) SA Real ADR (2012 $'s, as of Apr 20) 66% $120 60% $110 54% $100 48% 42% $90 36% $80 30% 24% $70 $65 24% $60 7 Source: STR

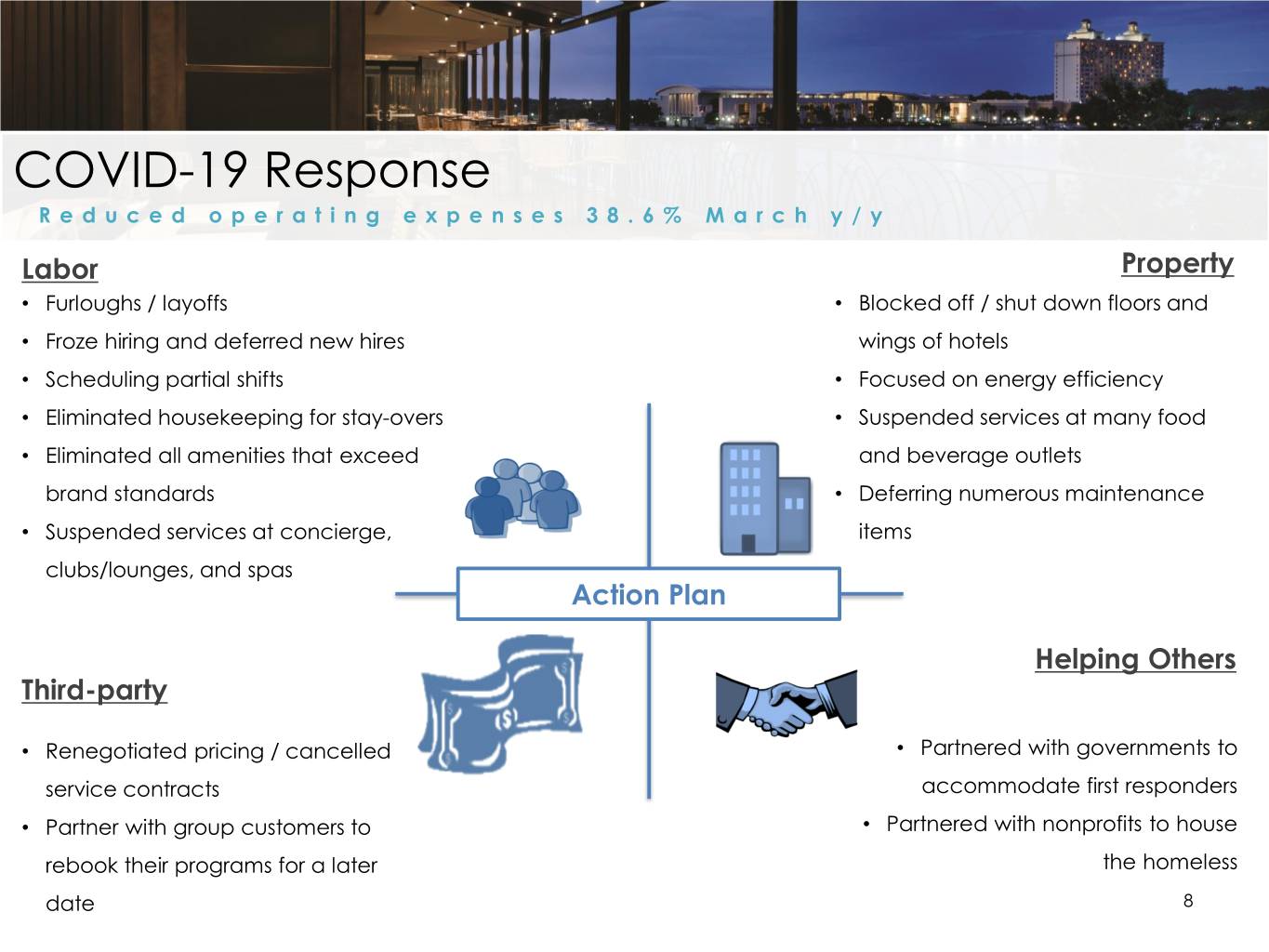

COVID-19 Response Reduced operating expenses 38.6% March y/y Labor Property • Furloughs / layoffs • Blocked off / shut down floors and • Froze hiring and deferred new hires wings of hotels • Scheduling partial shifts • Focused on energy efficiency • Eliminated housekeeping for stay-overs • Suspended services at many food • Eliminated all amenities that exceed and beverage outlets brand standards • Deferring numerous maintenance • Suspended services at concierge, items clubs/lounges, and spas Action Plan Helping Others Third-party • Renegotiated pricing / cancelled • Partnered with governments to service contracts accommodate first responders • Partner with group customers to • Partnered with nonprofits to house rebook their programs for a later the homeless date 8

Relationship with Managers Strong Relationships REMINGTON Affiliate Advantage Operating expenses at Remington managed hotels decreased 41.8% in March, outpacing portfolio totals Implemented a lean staffing model, 2-2-1 model, which consists of two associates in the morning, two in the evening and one overnight, with general managers and other executive staff covering front desk and overnight shifts Comparable RevPAR at our 80 Remington managed hotels decreased 22.8%, and hotel EBITDA flow- through was 41%, outperforming our portfolio totals during the first quarter MARRIOTT/HILTON Brand Manager Assistance Giving access to reserves Suspending brand standards Managing assets with lean staffing models 9

COVID Crisis Action Items Short- term Priorities Building Liquidity • Instituted plans to immediately minimize cash utilization • Suspended common dividends in March resulting in $7MM quarterly savings • Suspended debt service at vast majority of assets/loan pools in April • 2020 capital expenses cut to roughly $30-$50MM from roughly $125-$145MM Minimizing Operating Expenses • Massive cuts to field and corporate monthly operating costs • 90% of field employees furloughed or laid off • 25% cut to corporate cash G&A and cash reimbursables Engage Lenders & Negotiate Forbearance • Began sending forbearance requests and engaging lenders in forbearance discussions in April • Have successfully agreed to forbearance terms with several lenders 10

COVID Crisis Action Items Short- term Priorities Getting assets back to cash flow positive(1) • Portfolio will likely benefit from being well diversified and having a mix of select service and full-service hotels • Leisure most likely to recover quickly with group lagging • Drive to markets will likely experience a quicker recovery – Transient segment accounted for nearly 4x as many room nights as group in 2019 • Smaller hotels will likely recover sooner – our average hotel size is 213 rooms, and many of our hotels are smaller Advantage with affiliates • OpenKey & Pure offer unique, strategic advantages for contactless check- in/skip-the-desk and hypoallergenic/deep clean rooms • Potential to roll out on a bigger scale 11 (1) No assurances can be made that the company’s hotels will return to profitability.

Liquidity Nearly $300M of NWC as of Q1 Net Working Capital 3/31/2020 Cash and cash equivelants 240,316 Restricted cash 126,649 Accounts receiveable, net 29,129 Prepaid expenses 28,329 Investment in securities 437 Due from third-party hotel managers, net 16,162 Total current assets 441,022 Accounts payable & accrued expenses 135,993 Dividends and distributions payable 11,740 Due to affiliates, net 830 Totl current liabilities 148,563 Net working capital 292,459 As of March 31, 2020 12

June 2020