Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Party City Holdco Inc. | d936049dex991.htm |

| EX-10.2 - EX-10.2 - Party City Holdco Inc. | d936049dex102.htm |

| EX-10.1 - EX-10.1 - Party City Holdco Inc. | d936049dex101.htm |

| 8-K - 8-K - Party City Holdco Inc. | d936049d8k.htm |

Exhibit 99.2

PRESENTATION MATERIALS PROVIDED TO THE CONSENTING NOTEHOLDERS

| I. | Overview of Anagram’s Business |

| II. | Certain Selected Financial Information |

I.

|

|

|

|

This document and the information contained herein are being provided by Party City Holdco Inc. and certain of its affiliates (collectively, the “Company” or “Party City”) in connection with the evaluation and negotiation of a potential financial transaction. These materials are preliminary and summary in nature and do not include all of the information that should be evaluated in considering a possible transaction. This document and the information contained herein are governed by the non-disclosure agreement between Party City and recipient. This document and the information contained herein are confidential and constitute Confidential Information, as such term is defined in the non-disclosure agreement between recipient and Party City, and shall be used and maintained as Confidential Information solely in accordance with the terms of such non-disclosure agreement. This document may contain material non-public information concerning the Company, its affiliates and/or their respective securities. By accepting this document or any portion hereof, the recipient agrees to use and maintain this document and any such information in accordance with its compliance policies, contractual obligations and applicable laws, rules and regulations, including federal and state securities laws. To the maximum extent permitted by law, none of the Company, its directors, officers, shareholders, advisors, employees or agents, nor any other person accepts any liability, including, without limitation, any liability arising out of fault or negligence for any loss arising from the use of the information contained in this presentation. The information contained in this presentation is not investment or financial product advice and is not intended to be used as the basis for making an investment decision. This document has been prepared without taking into account the investment objectives, financial situation or particular needs of any particular person. Each person who receives this information acknowledges and agrees that it is going to perform its own investigation regarding any decision and affirmatively disclaims reliance on any information, representation, or warranties other than those specifically set forth in the relevant credit documents. Forward Looking Statements Disclaimer. Some of the statements in this presentation are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. The Company generally identifies forward-looking statements in this presentation using words like “believe,” “intend,” “target,” “expect,” “estimate,” “may,” “should,” “plan,” “project,” “contemplate,” “anticipate,” “predict” or similar expressions. Recipient can also identify forward-looking statements by discussions of strategy, plans or intentions. These forward- looking statements are based on the Company’s expectations, assumptions, estimates and projections about its business and the industry in which it operates as of the date of this presentation. These statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s or its industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: the Company’s ability to compete effectively in a competitive industry; any impact or other disruption to or interruption of the Company’s business resulting from COVID-19, including any related governmental restrictions; fluctuations in commodity prices; the Company’s ability to appropriately respond to changing merchandise trends and consumer preferences; successful implementation of the Company’s store growth strategy; decreases in the Company’s Halloween sales; disruption to the transportation system or increases in transportation costs; product recalls or product liability; economic slowdown affecting consumer spending and general economic conditions; loss or actions of third party vendors and loss of the right to use licensed material; disruptions at the Company’s manufacturing facilities; and the additional risks and uncertainties set forth in “Risk Factors” in the Company’s latest Form 10-K and in subsequent reports filed with or furnished to the Securities and Exchange Commission. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future events, outlook, guidance, results, actions, levels of activity, performance or achievements. Recipient is cautioned not to place undue reliance on these forward-looking statements. The Company assumes no obligation to publicly update or revise such forward-looking statements, which are made as of the date hereof or the earlier date specified herein, whether as a result of new information, future developments or otherwise. Non-GAAP Information Certain financial measures included in this document are supplemental measures of Party City’s performance and are not U.S. generally accepted accounting principles (“GAAP”) measures.

|

|

The Balloon Industry

|

|

Foil Balloon Uses Aoral add-on toy decoration party gift novalty social expression p.o.p.

|

|

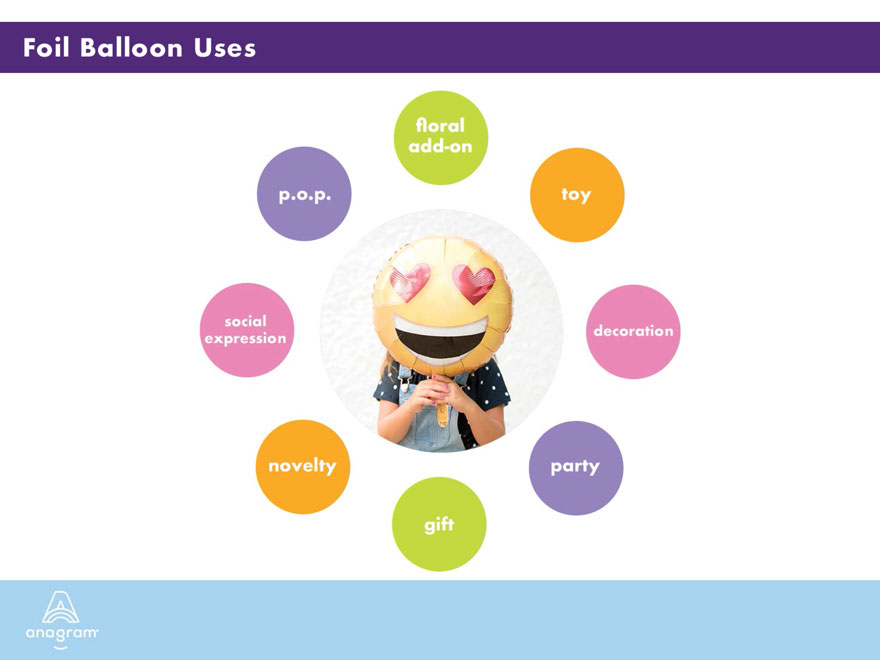

Size of the Balloon Market Anagram share Retail US & Canada 55 - 60% $ 600 - $ 700 Europe & Middle East 50 - 55% $ 200 - $ 300 Mexico & Latin America 50-60% $ 100 - $ 150 Asia, Japan & Australia 35-50% $ 25 - $ 50 TOTAL 50-55% $925 - $1200

|

|

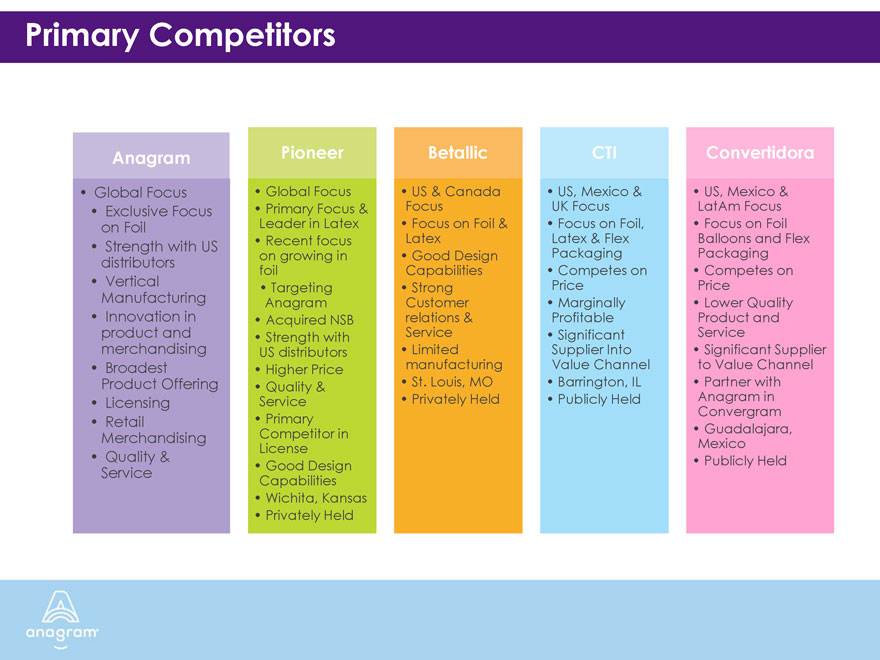

Primary Competitors

Anagram‰ Gloabal Focus ‰ Exclusive Focus on Foil ‰ Strength with US distributors ‰ Vertical Manufacturing ‰ Innovation in product and merchandising ‰ Broadest Product Offering ‰ Licensing ‰ Retail Merchandising ‰ Quality & Service Pioneer ‰ Global Focus ‰ Primary Focus & Leader in Latex ‰ Recent focus on growing in foil ‰ Targeting Anagram ‰ Acquired NSB ‰ Strength with US disrtibutors ‰ Higher Price ‰ Quality & Service ‰ Primary Competitor in License ‰ Good Design Capabilities ‰ Wichita, Kansas ‰ Privately Held Betallic ‰ US & Canada Focus ‰ Focus on Foil & Latex ‰ Good Design Capabilities ‰ Strong Customer relations & Service ‰ Limited manufacturing ‰ St.Louis,MO ‰ Privately Held CTI ‰ US, Mexico & UK ‰ Focus Focus on Foil,Latex & Flex Packaging ‰ Competes on Price ‰ Marginally Profitable ‰ Significant Supplier into Value Channel ‰ Barrington, IL ‰ Publicly Held Convertidora ‰ US, Mexico & LatAm Focus ‰ Focus on Foil Balloons and Flex Packaging ‰ Competes on Price ‰ Lower Quality Product and Service ‰ Singinficant Supplier to Value Channel ‰ Partner with Anagram in Convergram ‰ Guadalajara, Mexico ‰ Publicly Held

|

|

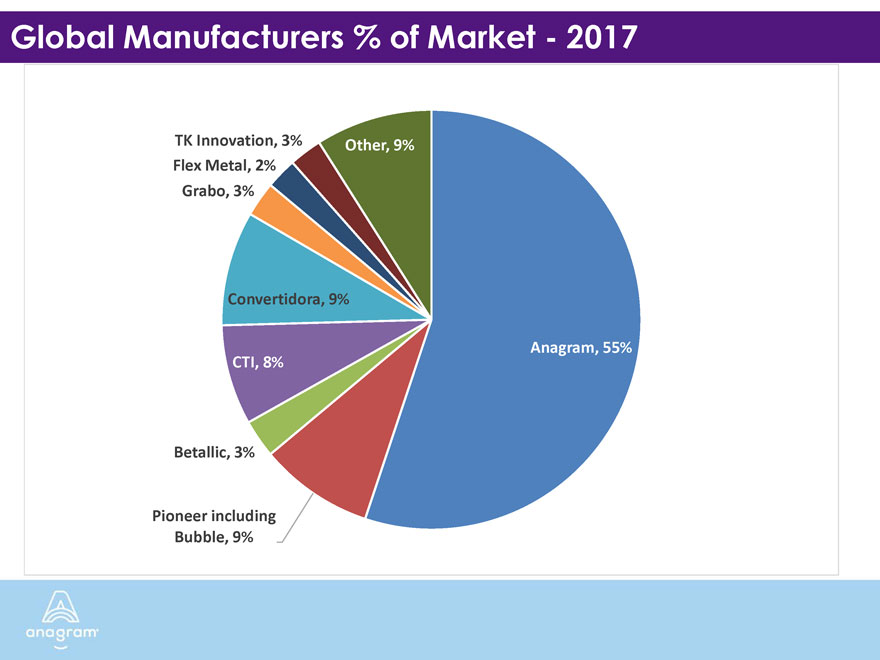

Global Manufacturers % of Market - 2017 Other, 9% Anagram, 55% Pioneer including Bubble, 9% Betallic, 3% CTI,8% Convertidora, 9% Grabo, 3% Flex Metal , 2% TK Innovation, 3%

|

|

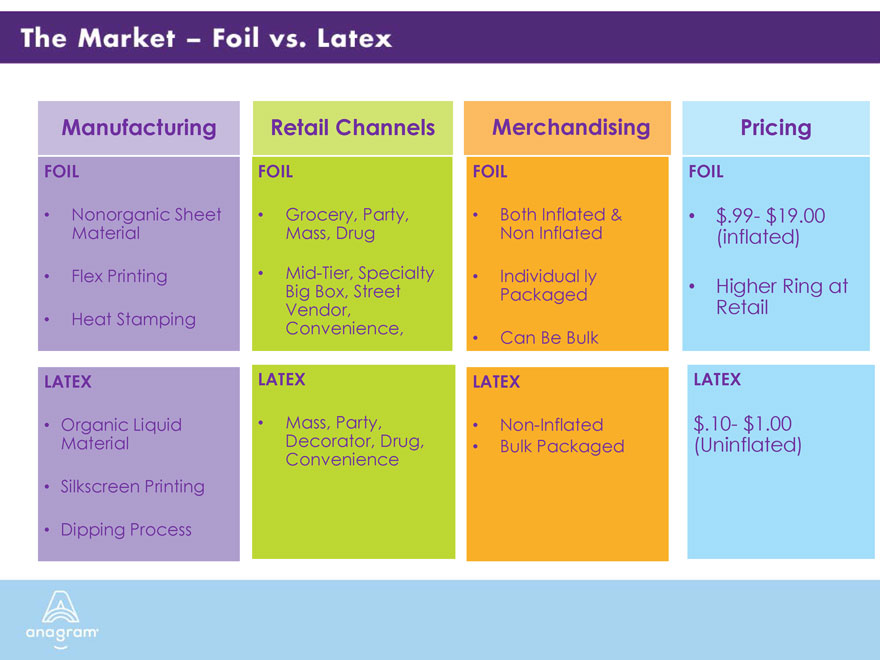

The Market – Foil vs, Latex Manufacturing Retail Channels Merchandising Pricing FOIL FOIL FOIL FOIL • Nonorganic Sheet • Grocery, Party, • Both Inflated & • $.99- $19.00 Material Mass, Drug Non Inflated (inflated) • Flex Printing • Mid-Tier, Specialty • Individual ly Big Box, Street Packaged • Higher Ring at Vendor, Retail • Heat Stamping Convenience, • Can Be Bulk LATEX LATEX LATEX LATEX • Organic Liquid • Mass, Party, • Non-Inflated $.10- $1.00 Material Decorator, Drug, • Bulk Packaged (Uninflated) Convenience • Silkscreen Printing • Dipping Process

|

|

The Market – Air vs. Helium 90-95% sales helium filled 5- 10% sales air-filled Incremental Opportunity is in air-filled Helium filled balloons requires In Store Labor and limits online competition Air-filled represents online sales opportunities and new retail channels and outlets

|

|

Historical Consumer Kids & Social Sentiments

|

|

Anagram’s Emerging Consumer Core Consumer 25-35 (Millenial) Female Like to decorate Married Live on social media % share with friends College Educated Like to be inspired Employed want “Pinterest-worthy” items simple to execute They like to celebrate and even make up their own reasons to celebrate! They live socially on Instagram & Pinterest

|

|

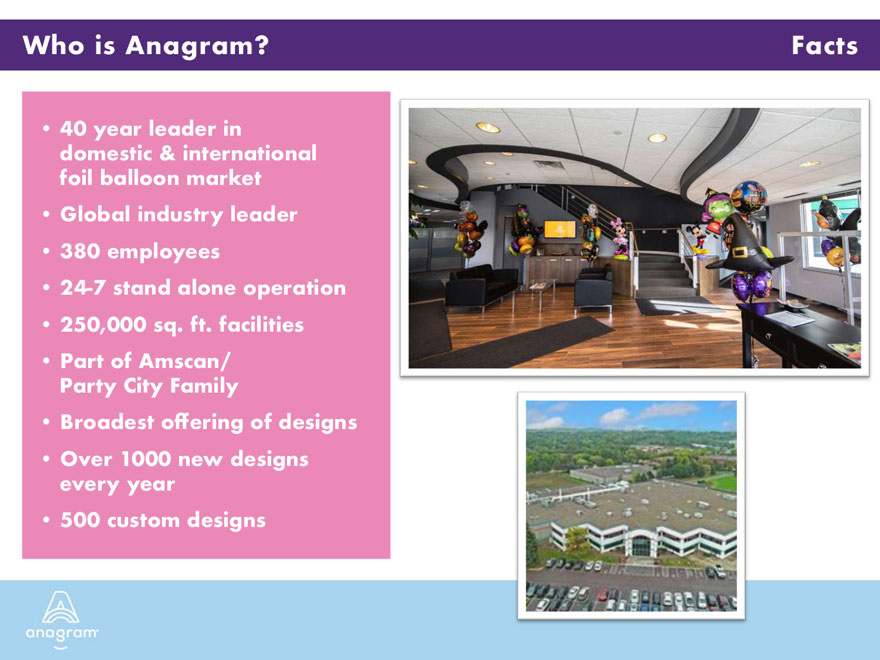

Who is Anagram?

|

|

Who is Anagram? Facts 40 year leader in domestic & international foil ballon market Global industry leader 380 employees 24-7 stand alone operation 250,000 sq. ft. facilities Part of Amsacan/ Party City Family Broadest offering of designs Over 1000 new designs every year 500 custom designs

|

|

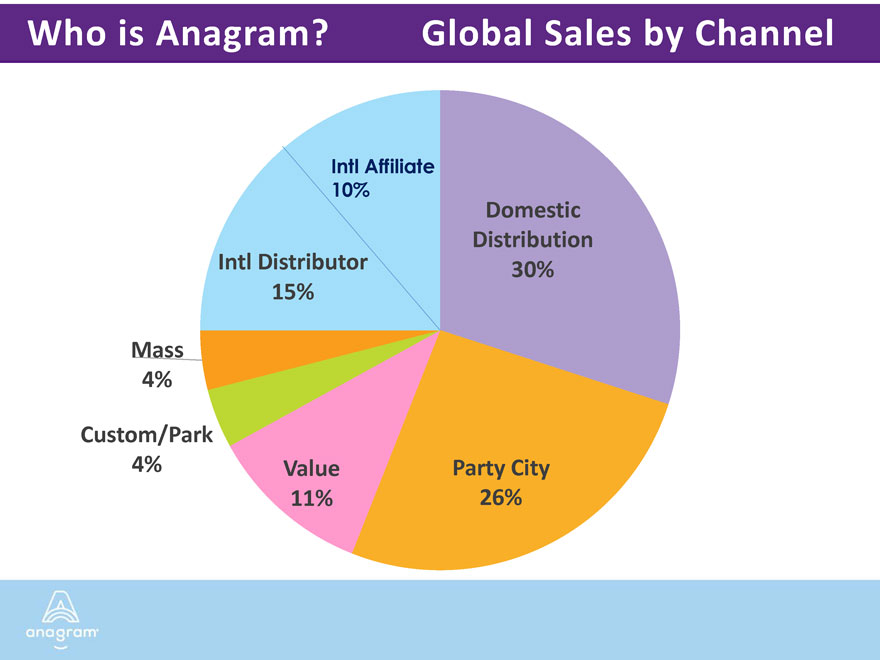

Who is Anagram? Global Sales by Channel Intl Affiliate 10% Domestic Distribution 30% Party City 26% Value 11% Custom/Park 4% Mass 4% Intl Distributor 15%

|

|

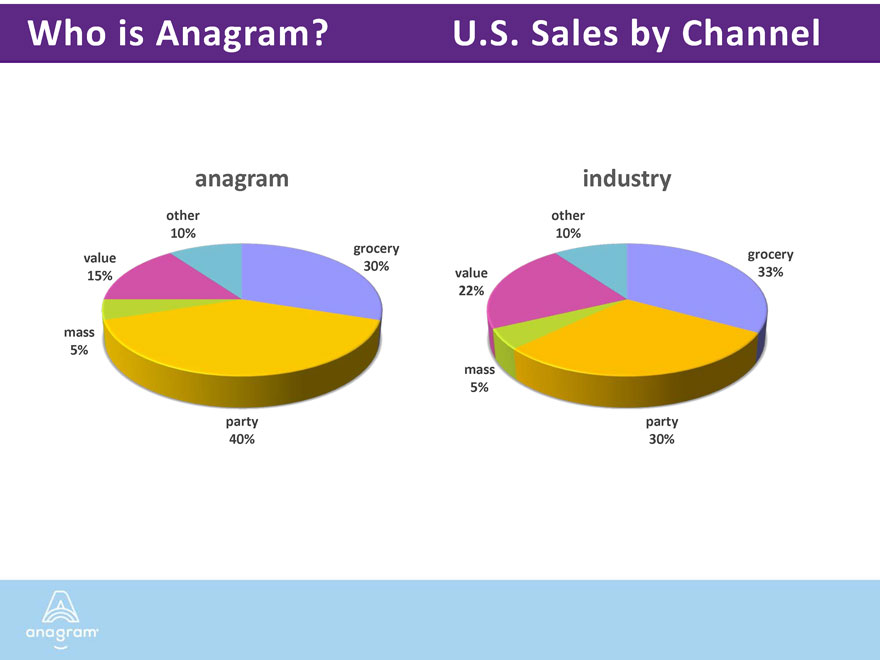

Who is Anagram? U.S. Sales by Channel anagram other 10% grocery 30% party 40% mass 5% value 15% industry other 10% grocery 33% party 30% mass 5% value 22%

|

|

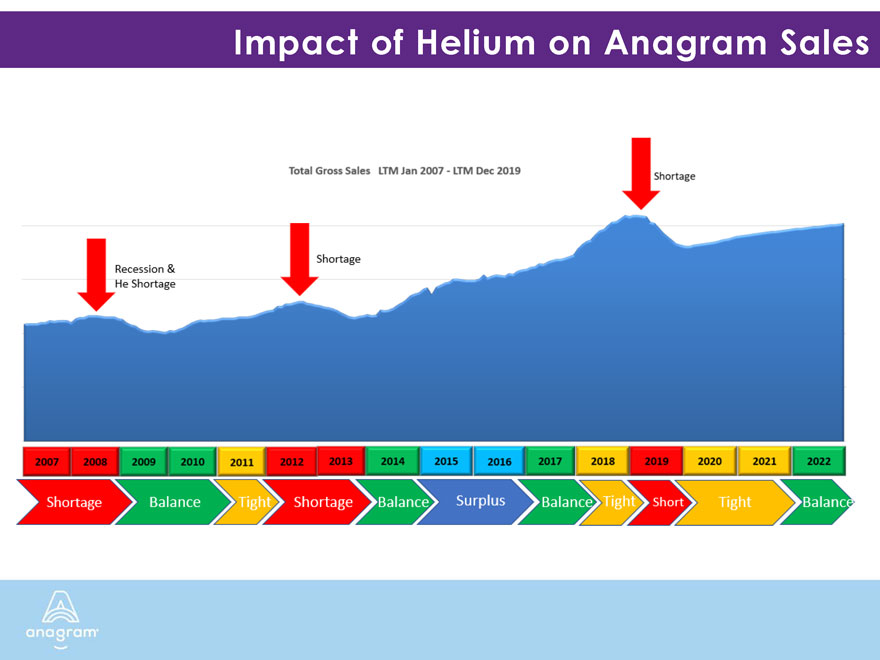

Impact of Helium on Anagram Sales Total Gross Sales LTM Jan 2017- LTM Dec 2019 Shortage Shortage Recession & He Shortage 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Shortage Balance Tight Shortage Balance Surplus Balance Tight Short Tight Balance

|

|

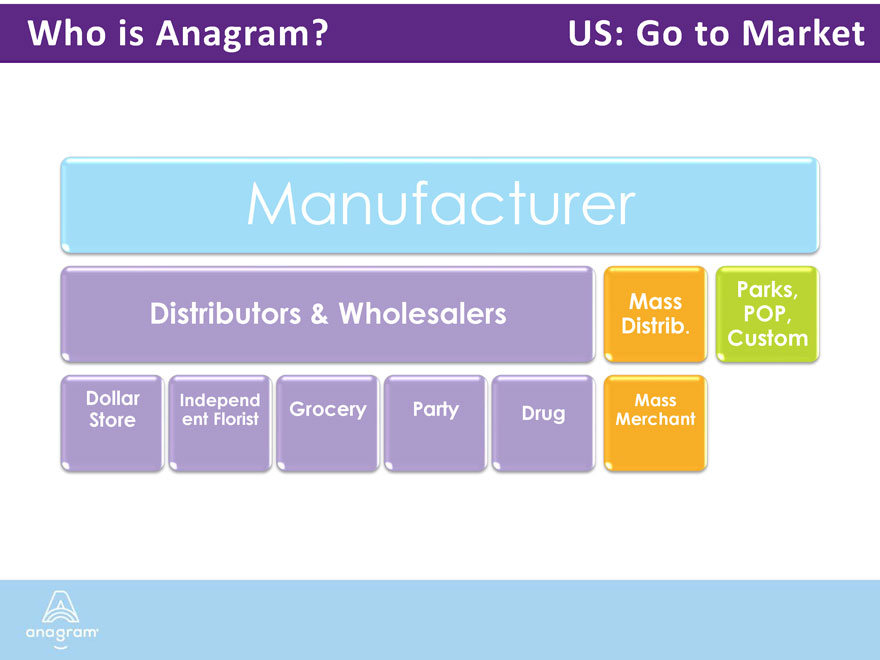

Who is Anagram? US: Go to Market Manufacturer Mass Distrib. Distributors & Wholesalers Parks, POP, Custom Dollar Store Independent Florist Grocery Party Drug Mass Merchant

|

|

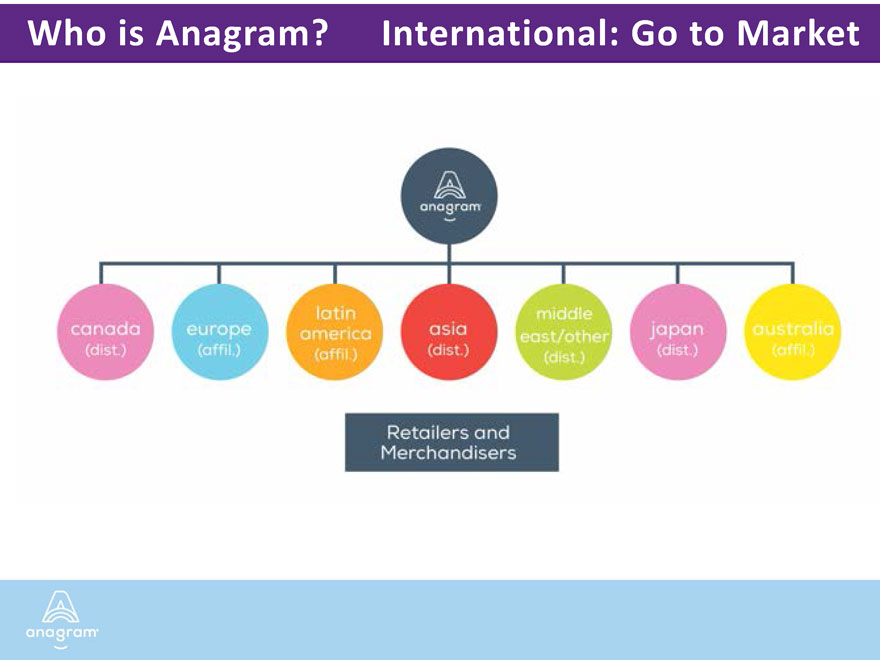

Who is Anagram? International: Go to Market anagram canada (dist.) europe (affil.) latin america (affil.) asia (dist.) middle east/other (dist.) japan (dist.) australia (affil.) Retailers and Merchandisers anagram

|

|

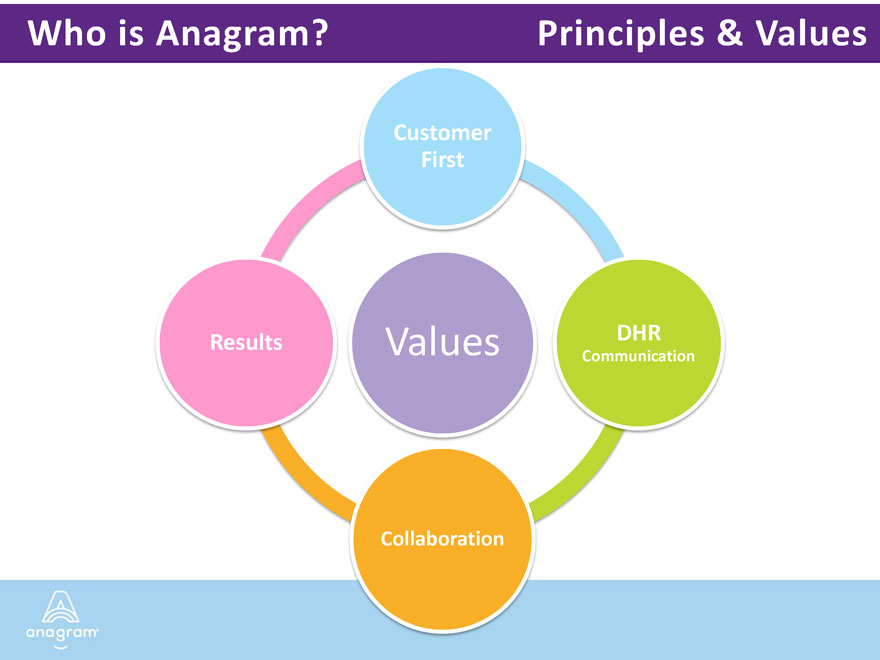

Who is Anagram? Principles & Values Customer First Results Values DHR Communication Collaboration

|

|

Who is Anagram? People

|

|

Who is Anagram? What do we do? Anagram makes THE BEST foil balloons EVERY product is put through a rigorous process… Bridging the best in CREATIVITY ENGINEERING SCIENCE

|

|

Who is Anagram? What do we do? We live foil balloons because we only DO foil balloons! Our focus? To ensure THE BEST foil balloons In the market!

|

|

Who is Anagram? What do we do? 120,000 Ft. Distribution Center Sales Customer Service

|

|

Why is Anagram? Anagram Brand Video

|

|

Who is Anagram? The Anagram Brand Filled with more… to capture those special moments

|

|

Why Anagram?

|

|

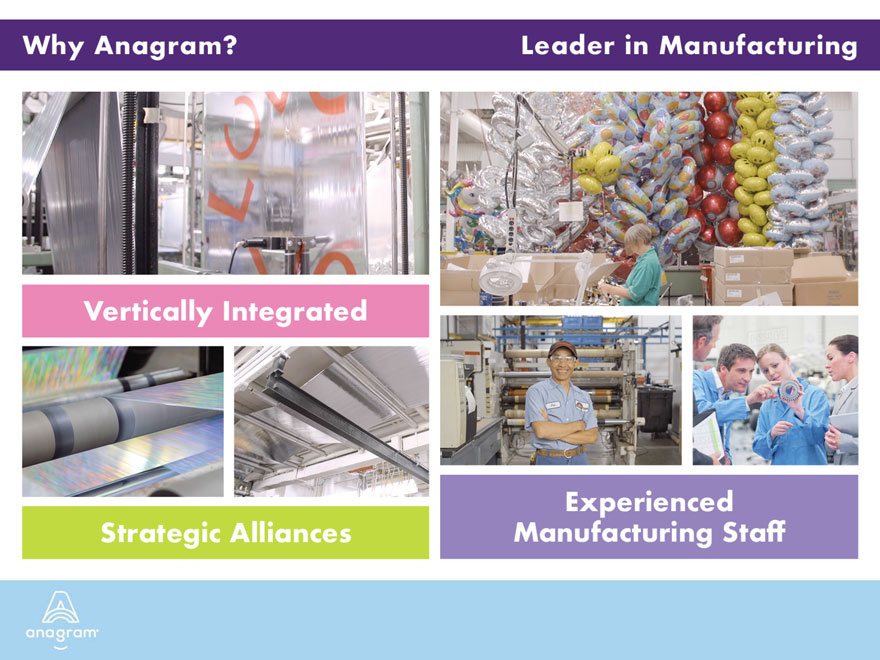

Why Anagram? Leader in Manufacturing Vertically Integrated Strategic Alliances Experienced Manufacturing Staff

|

|

Why Anagram? Leader in Service & Quality FOCUSED ON Person FOIL Chain Machine Quality Assurance Method Material

|

|

Why Anagram? Leader in Safety Extremely robust product safety policies and procedures Partnerships with third party labs in addition to our own in-house safety testing program In House Engineering Team dedicated to quality & Safety Experienced Staff

|

|

Why Anagram? Leader in Social Responsibility Supporting Diversity Commitment to a smaller carbon footprint REDUCE REUSE RECYCLE Giving Back

|

|

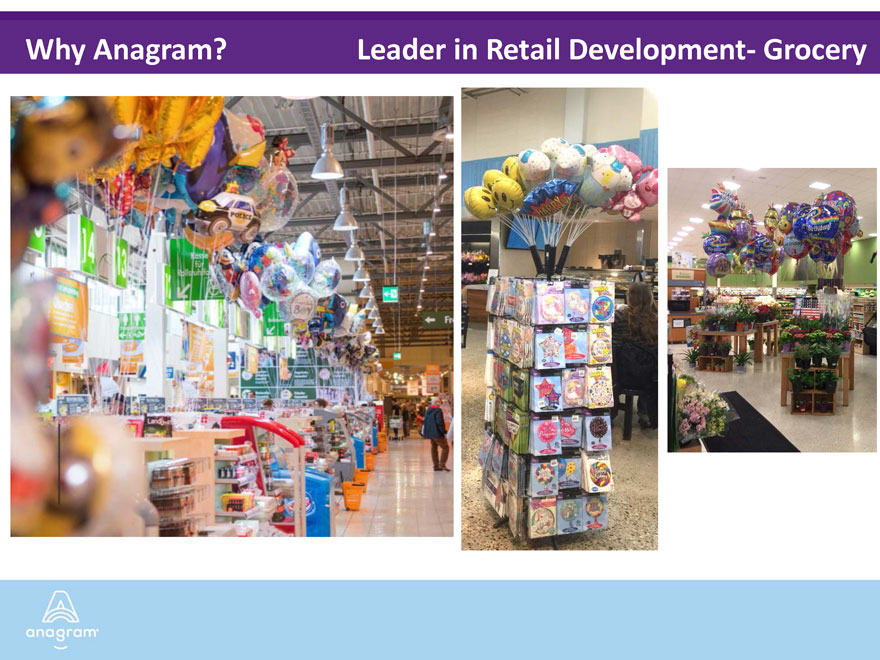

Why Anagram? Leader in Retail Development- Grocery

|

|

Why Anagram? Leader in Retail Development- Party Marketing, Merchandising, Promotions

|

|

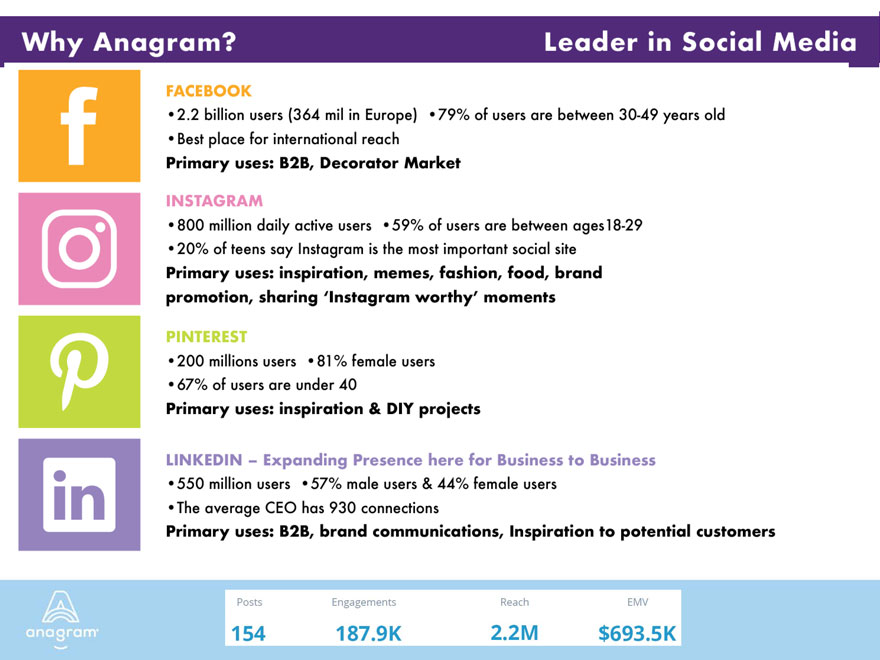

Why Anagram? Leader in Social Media FACEBOOK 2.2 billion users (364 mil in Europe) 79% of users are between 3.-49 years old Best place for international reach Primary uses: B2B, Decorator Market INSTAGRAM 800 million daily active users 59% of users are between ages 18-29 20% of teens say Instagram is the most important social site Primary uses: inspiration, memes, fashion, food, brand, promotion, sharing ‘Instagram worthy’ moments PINTEREST 200 million users 81% female users 67% of users are under 40 Primary uses: inspiration & DYI projects LINKEDIN - Expanding Presence here for Business to Business 550 million users 57% male users & 44% female users The average CEO has 930 connections Primary uses: B2B, brand communications, Inspiration to potential customers

|

|

[Graphic Appears Here]

|

|

Why Anagram? Leader in Price Points We sell more products at higher price points Global Mix 7% 34% 27% 32% Retail $ 2.49 – 3.99 $ 1.99 – 3.99 $ 6.99 – 7.99 $ 7.99 – 24.99

|

|

Product Innovation Leader

|

|

Why Anagram? Leader in Product Marblez

|

|

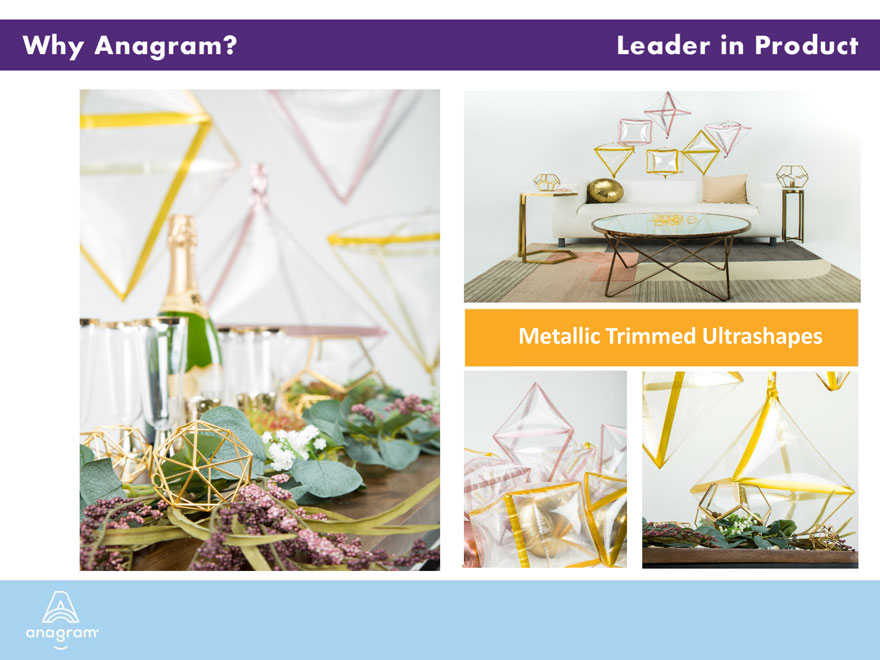

Why Anagram? Leader in Product Metallic Trimmed Ultrashapes

|

|

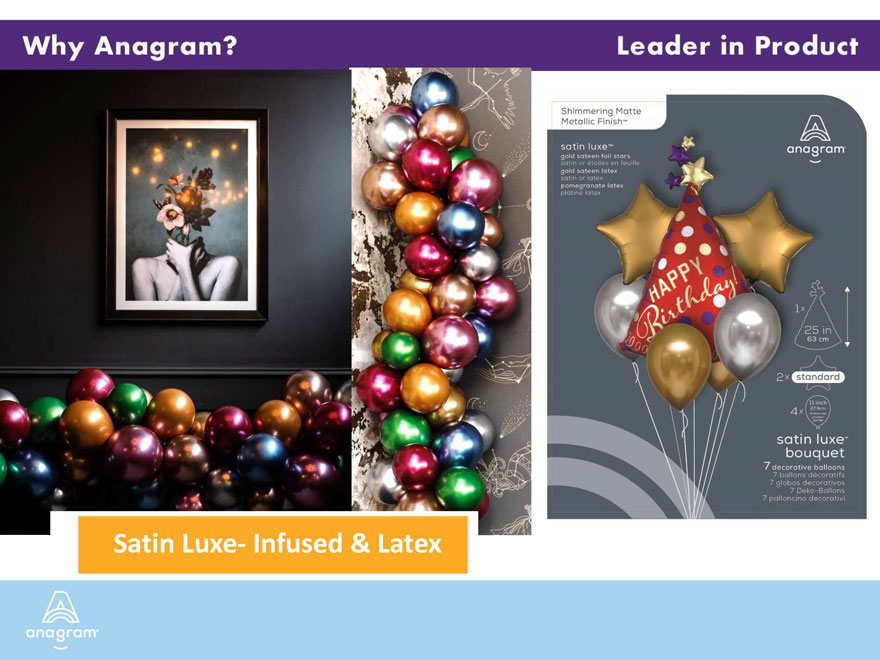

why Anagram? Leader in Product Satin Luxe- Infused & Latex

|

|

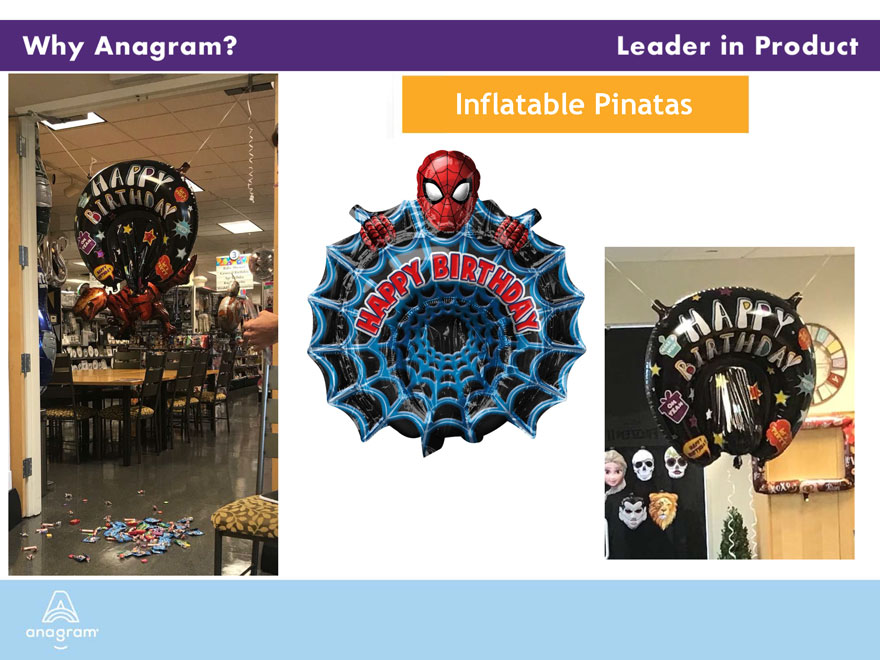

Inflatable Pinatas why Anagram? Leader in Product

|

|

Leader in Product Helium Saving Product Standard Shapes

|

|

Leader in Product Gift Giving Product Concept: Plush Shapes with Matching Balloons (Valentines & Grad Program)

|

|

Air Balloonz- 50” Air Filled Shapes -Each has only 2 inflation points ! Why Anagram Leader in Innovatin

|

|

FILLED WITH MORE OPPORTUNITY

|

|

Who is Anagram? Top Initiatives New Products Non- Conductive Helium

|

|

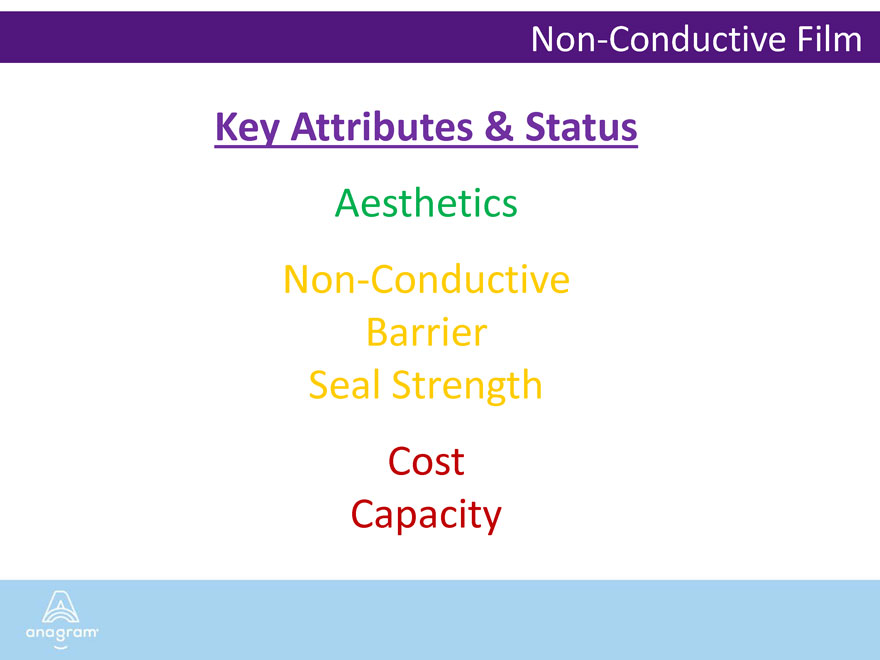

Non-Conductive Film Key Attributes & Status Aesthetics Non-Conductive Barrier Seal Strength Cost Capacity

|

|

Anagram Helium Advantage Balloon Sales Per Tank

|

|

Anagram Helium Advantage

|

|

Online Balloon Sales THE WONDER OF BALLONS SHOP NOW Ballons Made Simple Buy online, free in store pick up NEWI Ballons Delivery in select store. Learn more > Balloon Catalog Over 40 pages of inspiratin > DIY Balloon Decor Create custom balloon decor with tutorials amazon try prime

|

|

Making a balloon HAPPY BIRTHDAY!

|

|

Why Anagram? Facility Tour

|

|

THANK YOU

II.

|

|

This document and the information contained herein are being provided by Party City Holdco Inc. and certain of its affiliates (collectively, the “Company” or “Party City”) in connection with the evaluation and negotiation of a potential financial transaction. These materials are preliminary and summary in nature and do not include all of the information that should be evaluated in considering a possible transaction. This document and the information contained herein are governed by the non-disclosure agreement between Party City and recipient. This document and the information contained herein are confidential and constitute Confidential Information, as such term is defined in the non-disclosure agreement between recipient and Party City, and shall be used and maintained as Confidential Information solely in accordance with the terms of such non-disclosure agreement. This document may contain material non-public information concerning the Company, its affiliates and/or their respective securities. By accepting this document or any portion hereof, the recipient agrees to use and maintain this document and any such information in accordance with its compliance policies, contractual obligations and applicable laws, rules and regulations, including federal and state securities laws. To the maximum extent permitted by law, none of the Company, its directors, officers, shareholders, advisors, employees or agents, nor any other person accepts any liability, including, without limitation, any liability arising out of fault or negligence for any loss arising from the use of the information contained in this presentation. The information contained in this presentation is not investment or financial product advice and is not intended to be used as the basis for making an investment decision. This document has been prepared without taking into account the investment objectives, financial situation or particular needs of any particular person. Each person who receives this information acknowledges and agrees that it is going to perform its own investigation regarding any decision and affirmatively disclaims reliance on any information, representation, or warranties other than those specifically set forth in the relevant credit documents. Forward Looking Statements Disclaimer. Some of the statements in this presentation are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. The Company generally identifies forward-looking statements in this presentation using words like “believe,” “intend,” “target,” “expect,” “estimate,” “may,” “should,” “plan,” “project,” “contemplate,” “anticipate,” “predict” or similar expressions. Recipient can also identify forward-looking statements by discussions of strategy, plans or intentions. These forward- looking statements are based on the Company’s expectations, assumptions, estimates and projections about its business and the industry in which it operates as of the date of this presentation. These statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s or its industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: the Company’s ability to compete effectively in a competitive industry; any impact or other disruption to or interruption of the Company’s business resulting from COVID-19, including any related governmental restrictions; fluctuations in commodity prices; the Company’s ability to appropriately respond to changing merchandise trends and consumer preferences; successful implementation of the Company’s store growth strategy; decreases in the Company’s Halloween sales; disruption to the transportation system or increases in transportation costs; product recalls or product liability; economic slowdown affecting consumer spending and general economic conditions; loss or actions of third party vendors and loss of the right to use licensed material; disruptions at the Company’s manufacturing facilities; and the additional risks and uncertainties set forth in “Risk Factors” in the Company’s latest Form 10-K and in subsequent reports filed with or furnished to the Securities and Exchange Commission. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future events, outlook, guidance, results, actions, levels of activity, performance or achievements. Recipient is cautioned not to place undue reliance on these forward-looking statements. The Company assumes no obligation to publicly update or revise such forward-looking statements, which are made as of the date hereof or the earlier date specified herein, whether as a result of new information, future developments or otherwise. Non-GAAP Information Certain financial measures included in this document are supplemental measures of Party City’s performance and are not U.S. generally accepted accounting principles (“GAAP”) measures.

|

|

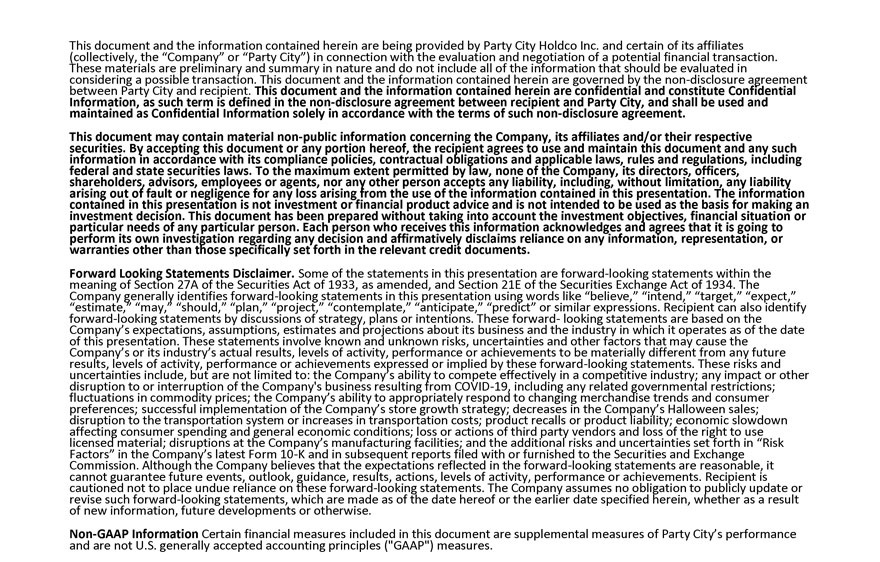

PCHI—Select Consolidated Financial Information ($ millions) Forecast 2020F 2021F Q1 Q2 Q3 Q4 FY Total Revenues 414,043 146,825 426,139 673,670 2,186,277 Adjusted EBITDA (12,185) (104,373) 23,914 139,132 268,850 Management anticipates a need of ~$75-100mm to fund operations through year end based on liquidity forecasts

|

|

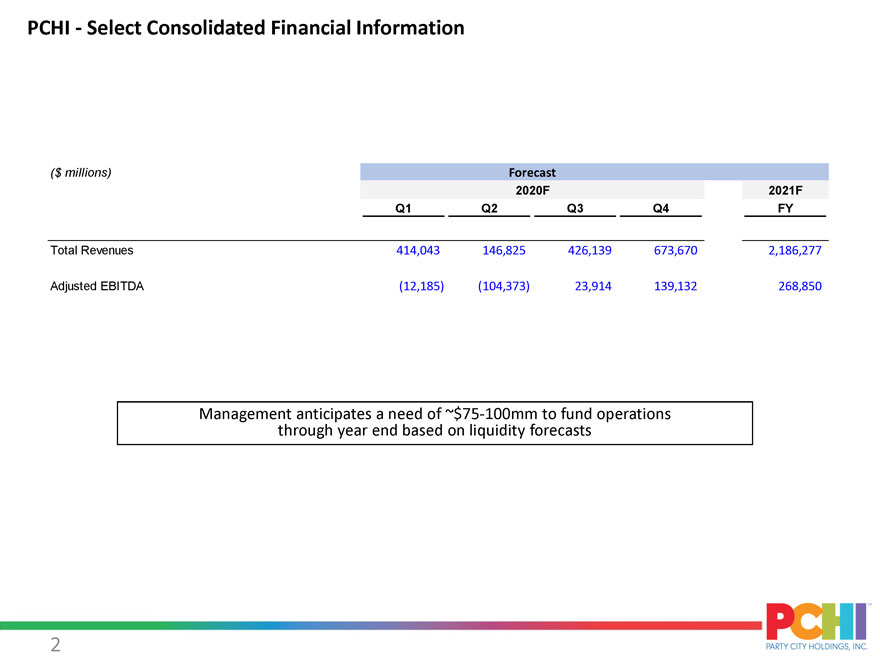

PCHI—Select Consolidated Financial Information 2020 Third Party Sales by Division – YOY Revenue Variance % Variance YOY Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 PCRG -20% -74% -17% -9% -29% Canada Retail Total Big Box Retail -24% -76% -23% -9% -32% NACP -14% -59% -8% -6% -21% International 9% -84% -30% -2% -27% Total Revenue -19% -74% -21% -8% -29% Total Revenue ex Canada Retail in PY -16% -73% -17% -8% -27%

|

|

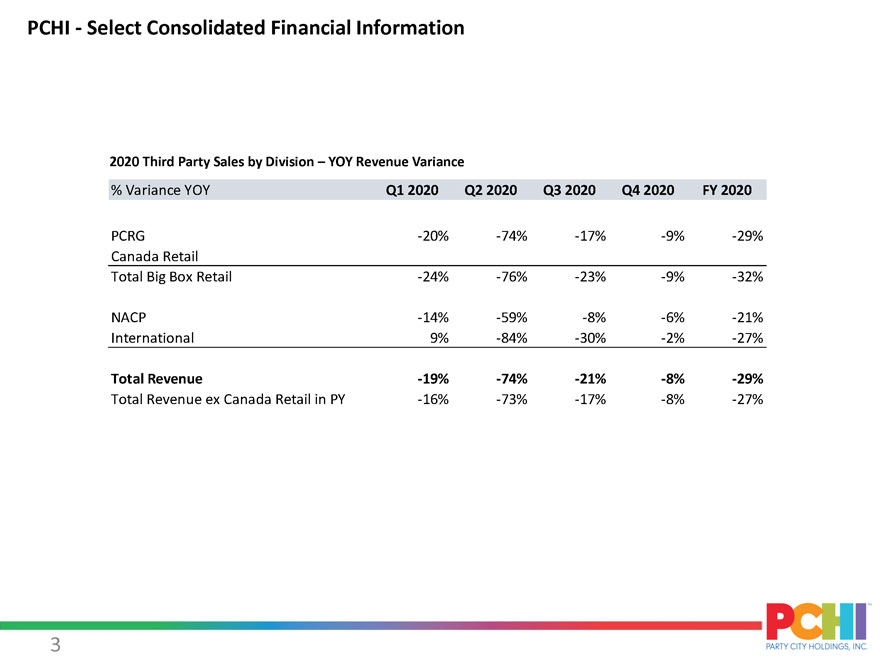

Anagram—Select Financial Information $ millions Forecast 2020 2021 2022 2023 2024 Net Trade Sales 72 92 102 108 114 Net Sales to Affiliates 56 65 71 75 79 Total Revenue 128 157 173 183 194 Gross Profit 38 47 52 55 58 SG&A 18 20 21 22 23 Operating Income 20 27 31 33 35 Adjusted EBITDA 27 33 37 39 42 Cap Ex 5 7 7 7 7 Selected Balance Sheet Information: 12/31/2019 Accounts Receivable (Net) 23 Inventory (Net) 38

|

|

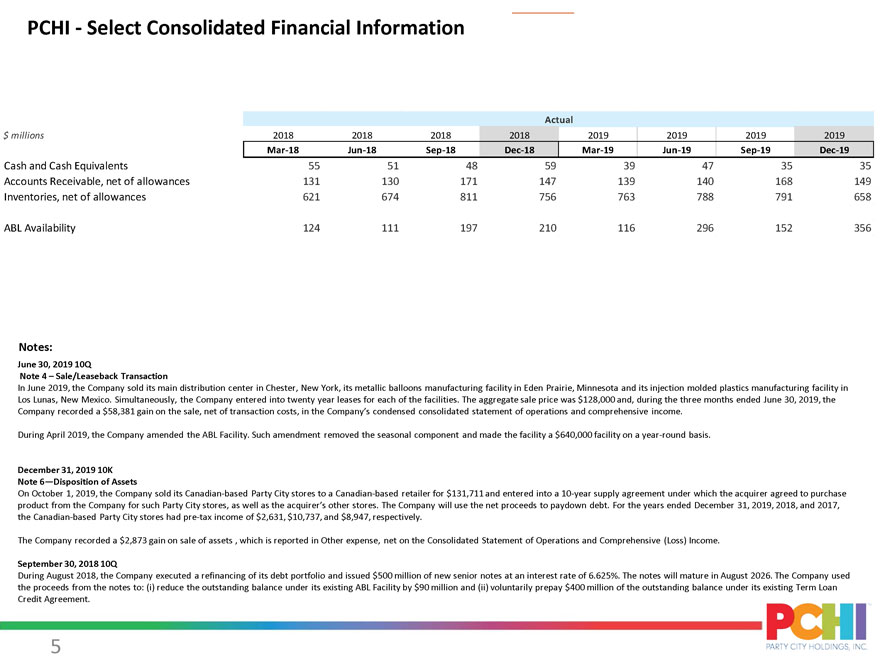

PCHI—Select Consolidated Financial Information Actual millions 2018 2018 2018 2018 2019 2019 2019 2019 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Cash and Cash Equivalents 55 51 48 59 39 47 35 35 Accounts Receivable, net of allowances 131 130 171 147 139 140 168 149 Inventories, net of allowances 621 674 811 756 763 788 791 658 ABL Availability 124 111 197 210 116 296 152 356 Notes: June 30, 2019 10Q Note 4 – Sale/Leaseback Transaction In June 2019, the Company sold its main distribution center in Chester, New York, its metallic balloons manufacturing facility in Eden Prairie, Minnesota and its injection molded plastics manufacturing facility in Los Lunas, New Mexico. Simultaneously, the Company entered into twenty year leases for each of the facilities. The aggregate sale price was $128,000 and, during the three months ended June 30, 2019, the Company recorded a $58,381 gain on the sale, net of transaction costs, in the Company’s condensed consolidated statement of operations and comprehensive income. During April 2019, the Company amended the ABL Facility. Such amendment removed the seasonal component and made the facility a $640,000 facility on a year-round basis. December 31, 2019 10K Note 6—Disposition of Assets On October 1, 2019, the Company sold its Canadian-based Party City stores to a Canadian-based retailer for $131,711 and entered into a 10-year supply agreement under which the acquirer agreed to purchase product from the Company for such Party City stores, as well as the acquirer’s other stores. The Company will use the net proceeds to paydown debt. For the years ended December 31, 2019, 2018, and 2017, the Canadian-based Party City stores had pre-tax income of $2,631, $10,737, and $8,947, respectively. The Company recorded a $2,873 gain on sale of assets , which is reported in Other expense, net on the Consolidated Statement of Operations and Comprehensive (Loss) Income. September 30, 2018 10Q During August 2018, the Company executed a refinancing of its debt portfolio and issued $500 million of new senior notes at an interest rate of 6.625%. The notes will mature in August 2026. The Company used the proceeds from the notes to: (i) reduce the outstanding balance under its existing ABL Facility by $90 million and (ii) voluntarily prepay $400 million of the outstanding balance under its existing Term Loan Credit Agreement.

|

|

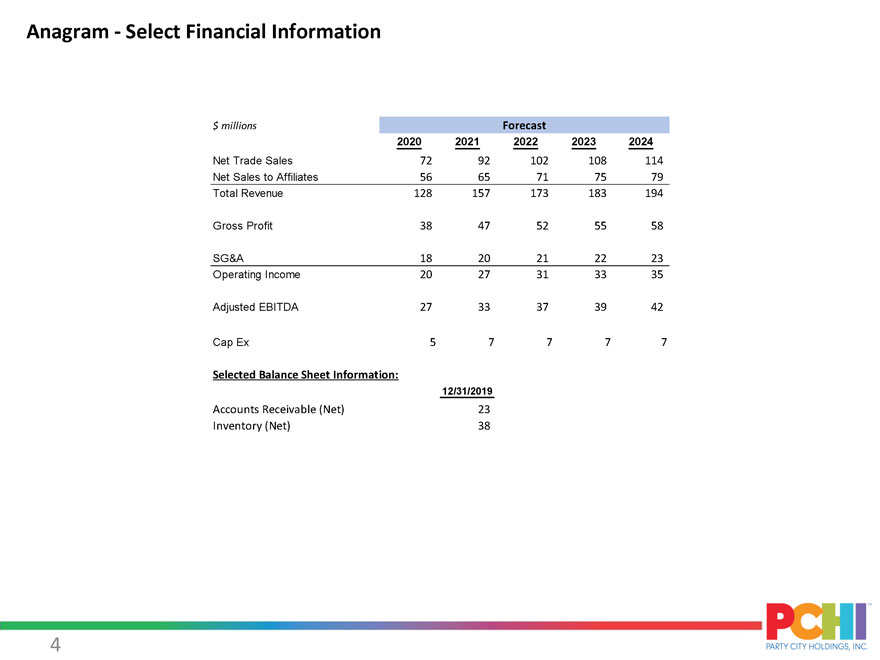

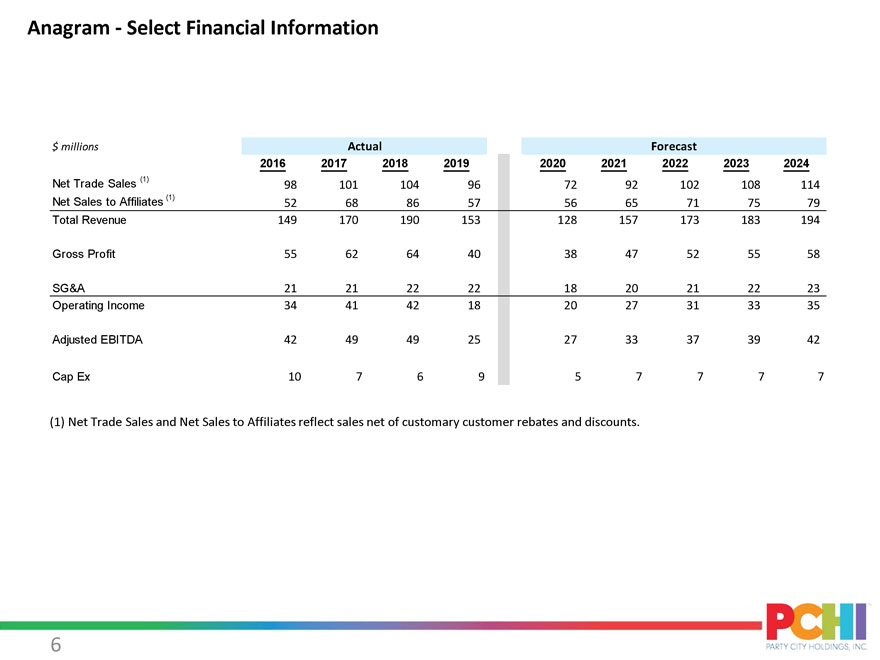

Anagram—Select Financial Information $ millions Actual Forecast 2016 2017 2018 2019 2020 2021 2022 2023 2024 Net Trade Sales (1) 98 101 104 96 72 92 102 108 114 Net Sales to Affiliates (1) 52 68 86 57 56 65 71 75 79 Total Revenue 149 170 190 153 128 157 173 183 194 Gross Profit 55 62 64 40 38 47 52 55 58 SG&A 21 21 22 22 18 20 21 22 23 Operating Income 34 41 42 18 20 27 31 33 35 Adjusted EBITDA 42 49 49 25 27 33 37 39 42 Cap Ex 10 7 6 9 5 7 7 7 7 (1) Net Trade Sales and Net Sales to Affiliates reflect sales net of customary customer rebates and discounts.