Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CIRCOR INTERNATIONAL INC | cirq103292020ex991.htm |

| 8-K - 8-K - CIRCOR INTERNATIONAL INC | q10329208k.htm |

INDUSTRIAL AEROSPACE & DEFENSE First Quarter 2020 Investor Review May 29, 2020

Safe Harbor This presentation contains certain statements that are “forward-looking statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 (the “Act”). The words “may,” “hope,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” and other expressions, which are predictions of or indicate future events and trends and which do not relate to historical matters, identify forward-looking statements, although not all forward-looking statements are accompanied by such words. We believe that it is important to communicate our future expectations to our stockholders, and we, therefore, make forward-looking statements in reliance upon the safe harbor provisions of the Act. However, there may be events in the future that we are not able to accurately predict or control and our actual results may differ materially from the expectations we describe in our forward-looking statements. Forward-looking statements, including statements about the expected and potential direct or indirect impacts of the COVID-19 pandemic on our business, the realization of cost reductions from restructuring activities and expected synergies, the expected impact of tariff increases and future cash flows from operating activities, involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: the duration and severity of the COVID-19 pandemic and its impact on the global economy; changes in the price of and demand for oil and gas in both domestic and international markets; our ability to successfully integrate acquired businesses and dispose of businesses that are held for sale as contemplated; any adverse changes in governmental policies; variability of raw material and component pricing; changes in our suppliers’ performance; fluctuations in foreign currency exchange rates; changes in tariffs or other taxes related to doing business internationally; our ability to hire and retain key personnel; our ability to operate our manufacturing facilities at efficient levels including our ability to prevent cost overruns and reduce costs; our ability to generate increased cash by reducing our working capital; our prevention of the accumulation of excess inventory; our ability to successfully implement our divestiture; restructuring or simplification strategies; fluctuations in interest rates; our ability to successfully defend product liability actions, any actions of stockholders or others in response to expiration of the recent unsolicited tender offer and the cost and disruption of responding to those actions; as well as the uncertainty associated with the current worldwide economic conditions and the continuing impact on economic and financial conditions in the United States and around the world, including as a result of COVID-19, natural disasters, terrorist attacks, current Middle Eastern conflicts and other similar matters. BEFORE MAKING ANY INVESTMENT DECISIONS REGARDING OUR COMPANY, WE STRONGLY ADVISE YOU TO READ FURTHER ABOUT THESE AND OTHER RISK FACTORS SET FORTH IN THE “RISK FACTORS” OF OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2019, WHICH IS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ("SEC") AND IS AVAILABLE ON THE SEC'S WEBSITE AT WWW.SEC.GOV, AND SUBSEQUENT REPORTS ON FORMS 10-Q, WHICH CAN BE ACCESSED UNDER THE "INVESTORS" LINK OF OUR WEBSITE AT WWW.CIRCOR.COM. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. See page 15 for information on the use of non-GAAP financial measures. 2

Managing through the COVID-19 Pandemic • Pandemic response team meeting daily • Deep cleaning and PPE at all facilities Prioritize Health & Safety • Tight protocol for handling exposure to COVID-19 • Detailed returned to work protocol • All plants operational and deemed essential Support Customers • Collaborating with customers/suppliers to ensure continuity Maintain Business Continuity • Most sites operating at normal production levels • Executed structural as well as temporary cost actions Maintain Financial Flexibility • Reducing CAPEX and improving working capital • Exiting cash flow negative Distributed Valves in Q2 • Accelerating actions in 18-month plan Remain focused on long term strategy • Preserving growth capacity despite cost reduction • Launching new products at an increasing rate • Positioning company to capitalize on recovery 3

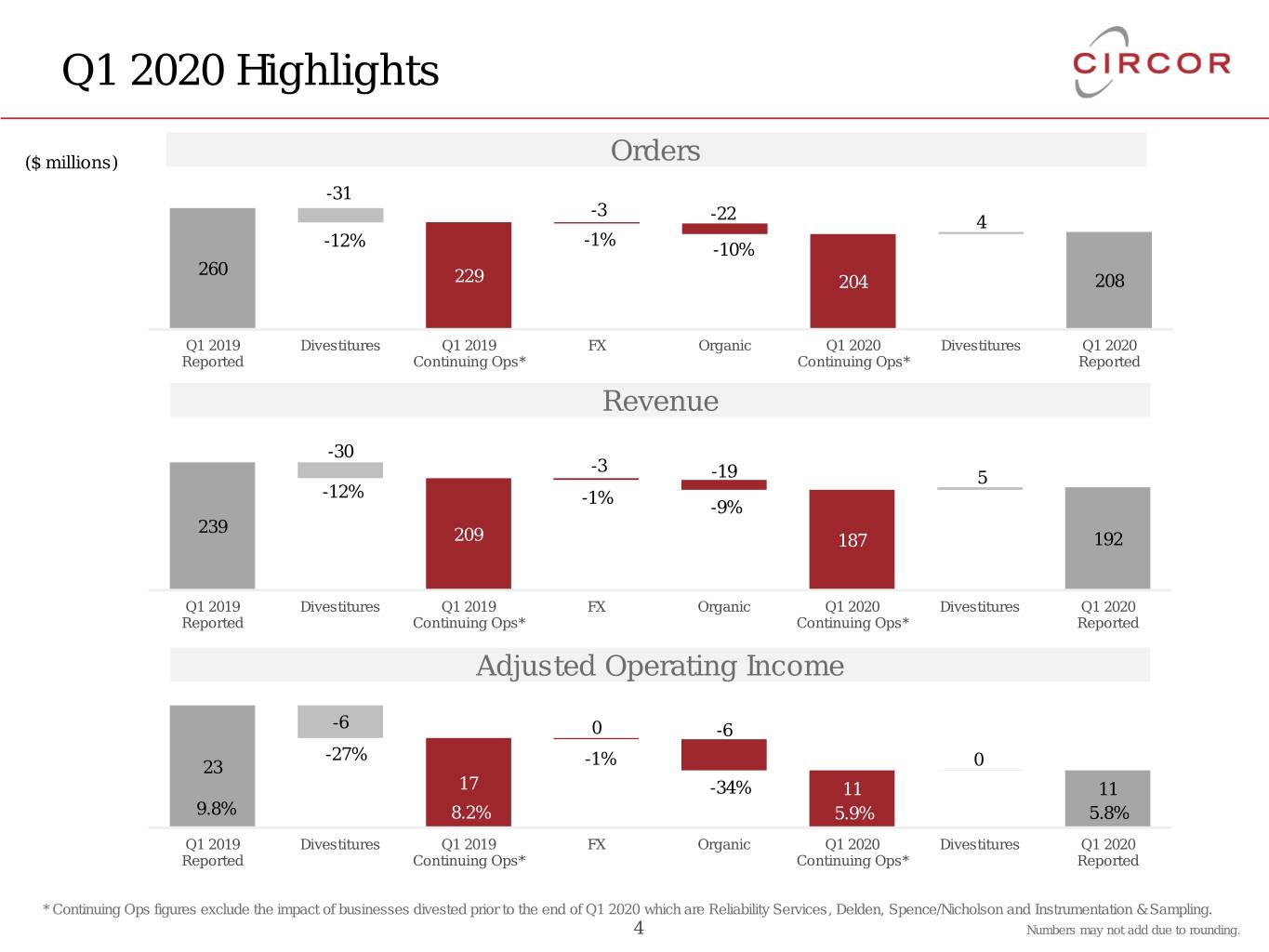

Q1 2020 Highlights ($ millions) Orders -31 -3 -22 4 -12% -1% -10% 260 229 204 208 Q1 2019 Divestitures Q1 2019 FX Organic Q1 2020 Divestitures Q1 2020 Reported Continuing Ops* Continuing Ops* Reported Revenue -30 -3 -19 5 -12% -1% -9% 239 209 187 192 Q1 2019 Divestitures Q1 2019 FX Organic Q1 2020 Divestitures Q1 2020 Reported Continuing Ops* Continuing Ops* Reported Adjusted Operating Income -6 0 -6 -27% 23 -1% 0 17 -34% 11 11 9.8% 8.2% 8.2% 5.9% 5.8% Q1 2019 Divestitures Q1 2019 FX Organic Q1 2020 Divestitures Q1 2020 Reported Continuing Ops* Continuing Ops* Reported * Continuing Ops figures exclude the impact of businesses divested prior to the end of Q1 2020 which are Reliability Services, Delden, Spence/Nicholson and Instrumentation & Sampling. 4 Numbers may not add due to rounding.

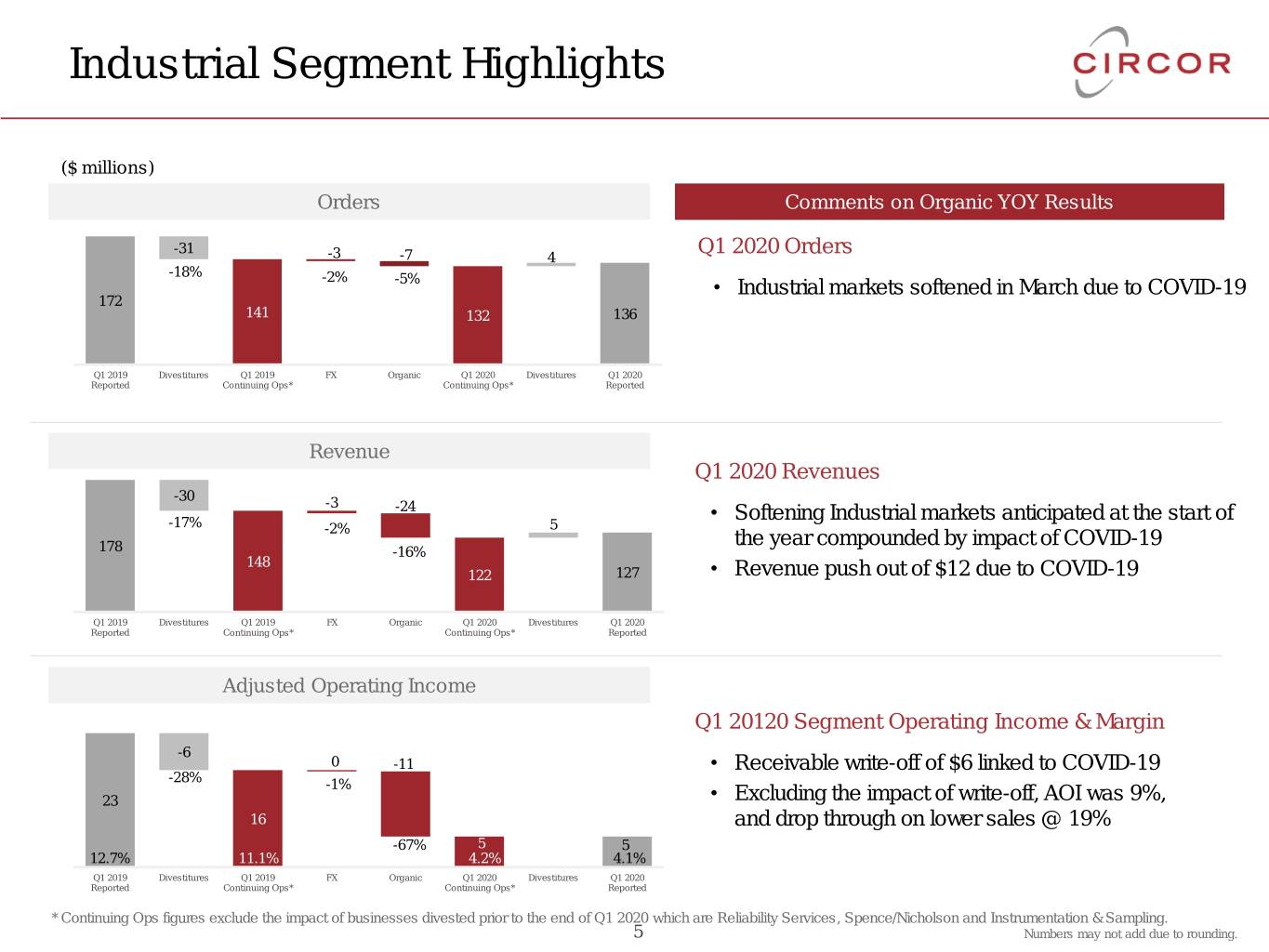

Industrial Segment Highlights ($ millions) Orders Comments on Organic YOY Results -31 Q1 2020 Orders -3 -7 4 -18% -2% -5% • Industrial markets softened in March due to COVID-19 172 141 132 136 Q1 2019 Divestitures Q1 2019 FX Organic Q1 2020 Divestitures Q1 2020 Reported Continuing Ops* Continuing Ops* Reported Revenue Q1 2020 Revenues -30 -3 -24 • Softening Industrial markets anticipated at the start of -17% 5 -2% the year compounded by impact of COVID-19 178 -16% 148 122 127 • Revenue push out of $12 due to COVID-19 Q1 2019 Divestitures Q1 2019 FX Organic Q1 2020 Divestitures Q1 2020 Reported Continuing Ops* Continuing Ops* Reported Adjusted Operating Income Q1 20120 Segment Operating Income & Margin -6 0 -11 • Receivable write-off of $6 linked to COVID-19 -28% -1% 23 • Excluding the impact of write-off, AOI was 9%, 16 and drop through on lower sales @ 19% -67% 5 5 12.7% 11.1% 4.2% 4.1% Q1 2019 Divestitures Q1 2019 FX Organic Q1 2020 Divestitures Q1 2020 Reported Continuing Ops* Continuing Ops* Reported * Continuing Ops figures exclude the impact of businesses divested prior to the end of Q1 2020 which are Reliability Services, Spence/Nicholson and Instrumentation & Sampling. 5 Numbers may not add due to rounding.

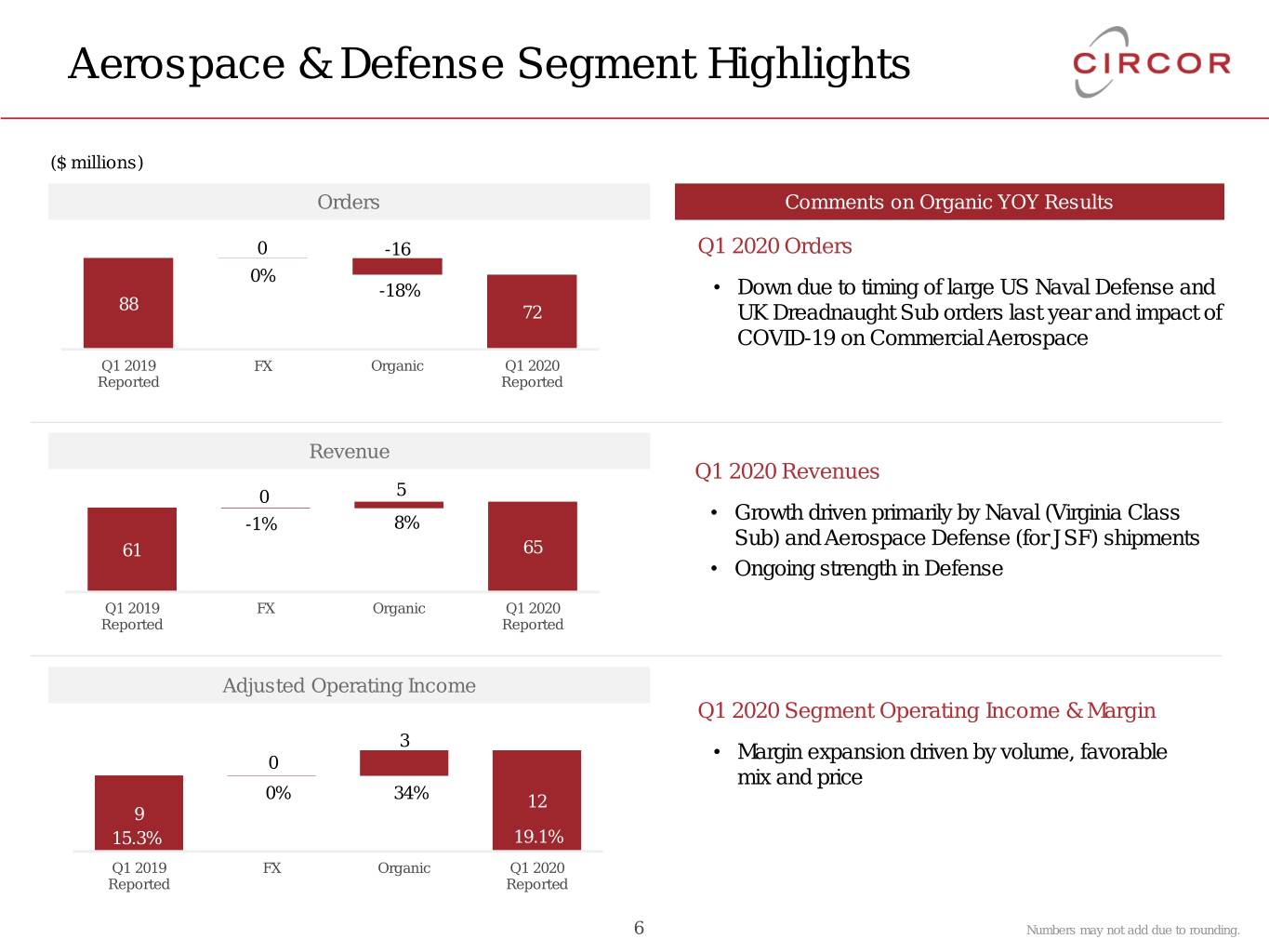

Aerospace & Defense Segment Highlights ($ millions) Orders Comments on Organic YOY Results 0 -16 Q1 2020 Orders 0% -18% • Down due to timing of large US Naval Defense and 88 72 UK Dreadnaught Sub orders last year and impact of COVID-19 on Commercial Aerospace Q1 2019 FX Organic Q1 2020 Reported Reported Revenue Q1 2020 Revenues 0 5 • Growth driven primarily by Naval (Virginia Class -1% 8% Sub) and Aerospace Defense (for JSF) shipments 61 65 • Ongoing strength in Defense Q1 2019 FX Organic Q1 2020 Reported Reported Adjusted Operating Income Q1 2020 Segment Operating Income & Margin 3 • Margin expansion driven by volume, favorable 0 mix and price 0% 34% 12 9 15.3% 19.1% Q1 2019 FX Organic Q1 2020 Reported Reported 6 Numbers may not add due to rounding.

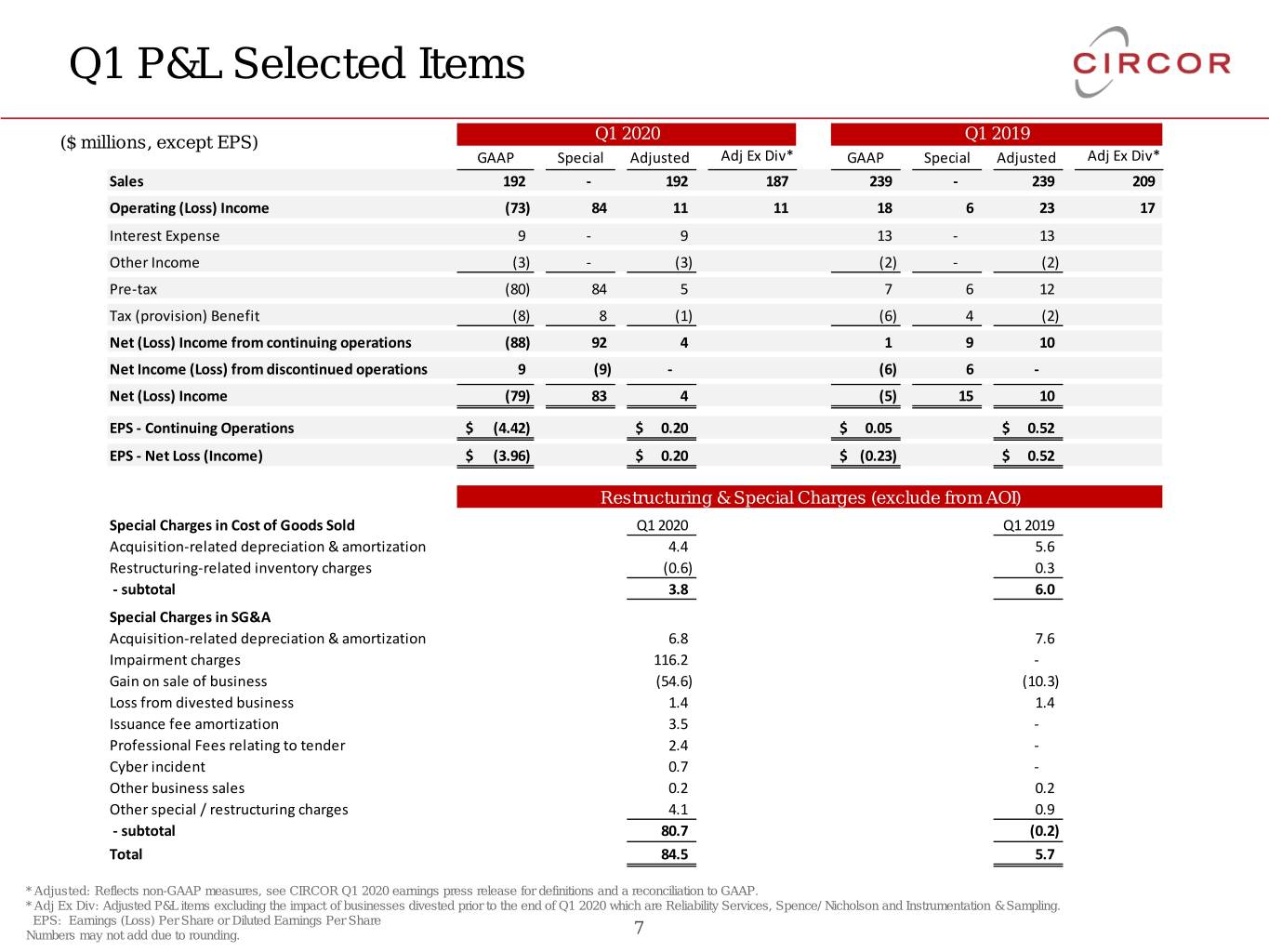

Q1 P&L Selected Items Q1 2020 Q1 2019 ($ millions, except EPS) GAAP Special Adjusted Adj Ex Div* GAAP Special Adjusted Adj Ex Div* Sales 192 - 192 187 239 - 239 209 Operating (Loss) Income (73) 84 11 11 18 6 23 17 Interest Expense 9 - 9 13 - 13 Other Income (3) - (3) (2) - (2) Pre-tax (80) 84 5 7 6 12 Tax (provision) Benefit (8) 8 (1) (6) 4 (2) Net (Loss) Income from continuing operations (88) 92 4 1 9 10 Net Income (Loss) from discontinued operations 9 (9) - (6) 6 - Net (Loss) Income (79) 83 4 (5) 15 10 EPS - Continuing Operations $ (4.42) $ 0.20 $ 0.05 $ 0.52 EPS - Net Loss (Income) $ (3.96) $ 0.20 $ (0.23) $ 0.52 Restructuring & Special Charges (exclude from AOI) Special Charges in Cost of Goods Sold Q1 2020 Q1 2019 Acquisition-related depreciation & amortization 4.4 5.6 Restructuring-related inventory charges (0.6) 0.3 - subtotal 3.8 6.0 Special Charges in SG&A Acquisition-related depreciation & amortization 6.8 7.6 Impairment charges 116.2 - Gain on sale of business (54.6) (10.3) Loss from divested business 1.4 1.4 Issuance fee amortization 3.5 - Professional Fees relating to tender 2.4 - Cyber incident 0.7 - Other business sales 0.2 0.2 Other special / restructuring charges 4.1 0.9 - subtotal 80.7 (0.2) Total 84.5 5.7 * Adjusted: Reflects non-GAAP measures, see CIRCOR Q1 2020 earnings press release for definitions and a reconciliation to GAAP. * Adj Ex Div: Adjusted P&L items excluding the impact of businesses divested prior to the end of Q1 2020 which are Reliability Services, Spence/ Nicholson and Instrumentation & Sampling. EPS: Earnings (Loss) Per Share or Diluted Earnings Per Share Numbers may not add due to rounding. 7

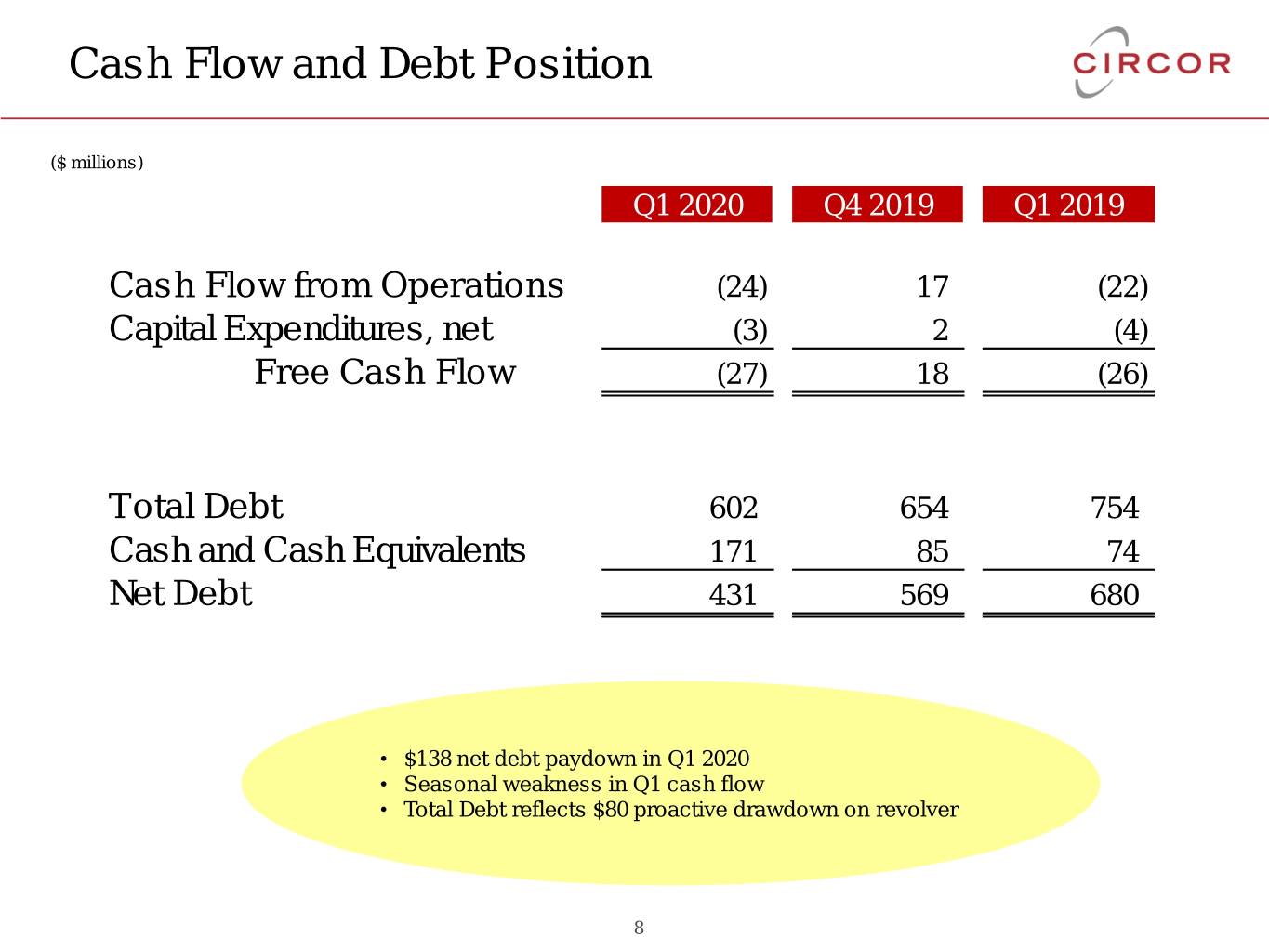

Cash Flow and Debt Position ($ millions) Q1 2020 Q4 2019 Q1 2019 Cash Flow from Operations (24) 17 (22) Capital Expenditures, net (3) 2 (4) Free Cash Flow (27) 18 (26) Total Debt 602 654 754 Cash and Cash Equivalents 171 85 74 Net Debt 431 569 680 • $138 net debt paydown in Q1 2020 • Seasonal weakness in Q1 cash flow • Total Debt reflects $80 proactive drawdown on revolver 8

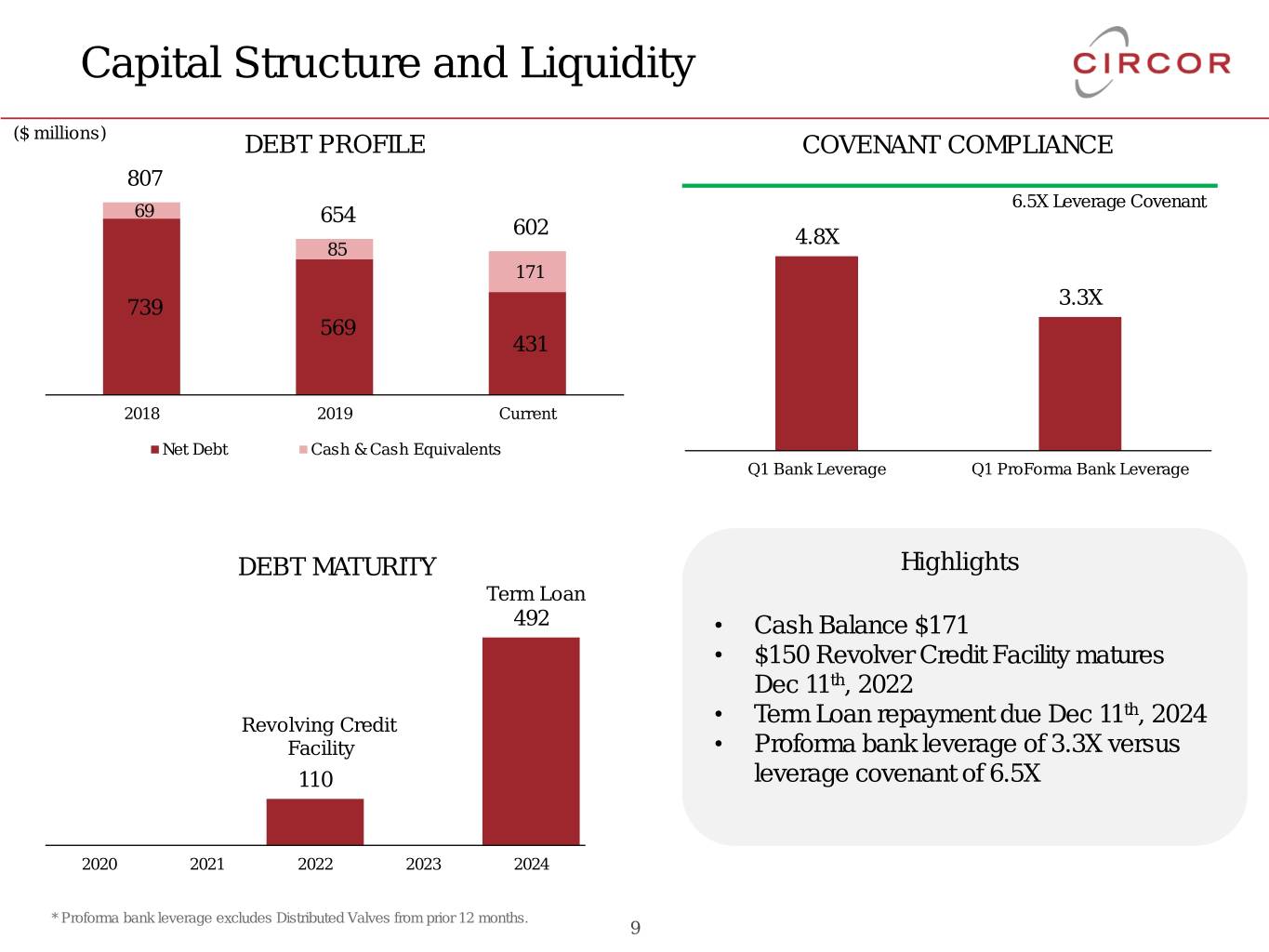

Capital Structure and Liquidity ($ millions) DEBT PROFILE COVENANT COMPLIANCE 807 6.5X Leverage Covenant 69 654 602 4.8X 85 171 739 3.3X 569 431 2018 2019 Current Net Debt Cash & Cash Equivalents Q1 Bank Leverage Q1 ProForma Bank Leverage DEBT MATURITY Highlights Term Loan 492 • Cash Balance $171 • $150 Revolver Credit Facility matures Dec 11th, 2022 th Revolving Credit • Term Loan repayment due Dec 11 , 2024 Facility • Proforma bank leverage of 3.3X versus 110 leverage covenant of 6.5X 2020 2021 2022 2023 2024 * Proforma bank leverage excludes Distributed Valves from prior 12 months. 9

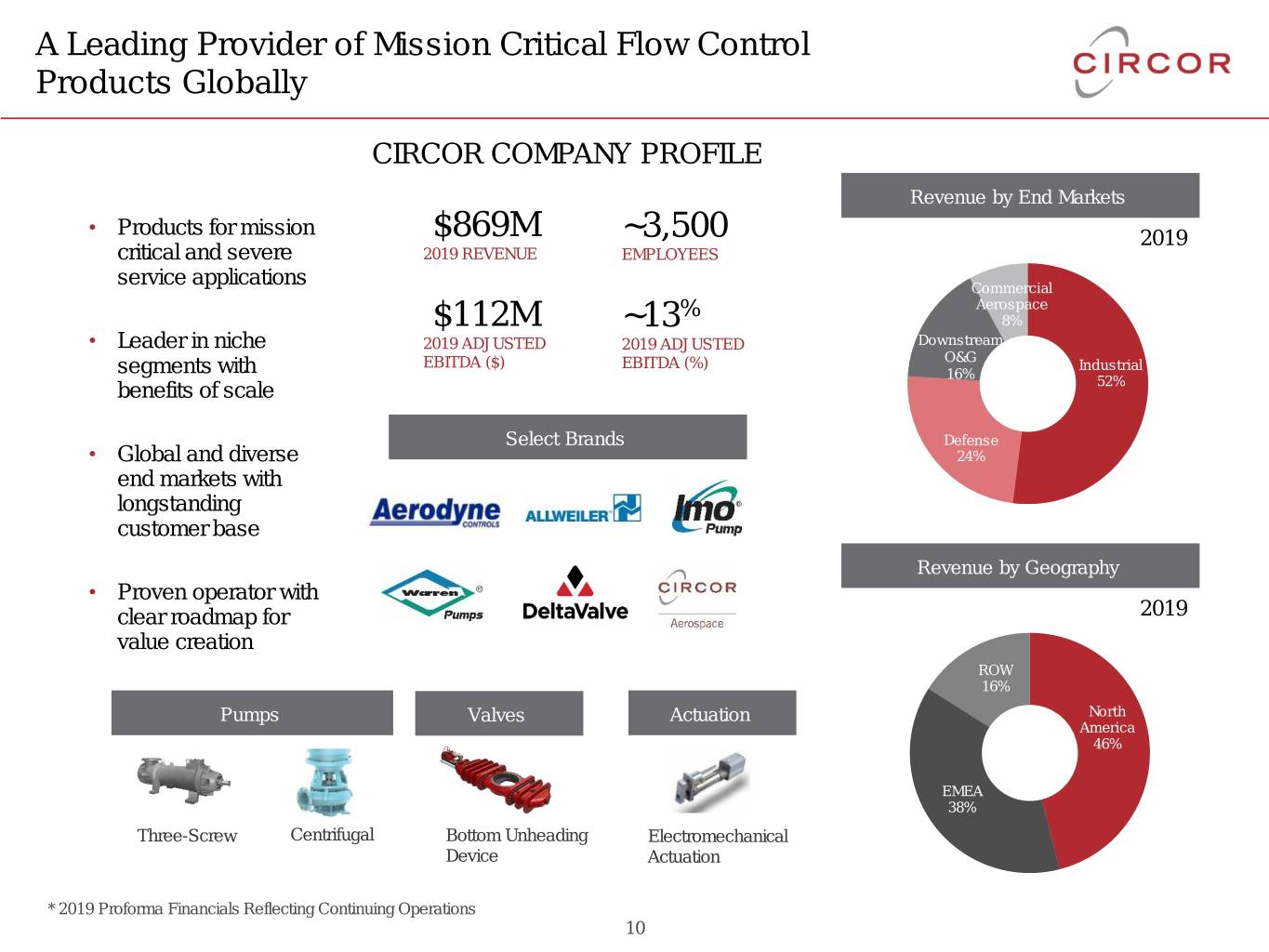

A Leading Provider of Mission Critical Flow Control Products Globally CIRCOR COMPANY PROFILE Revenue by End Markets • Products for mission $869M ~3,500 2019 critical and severe 2019 REVENUE EMPLOYEES service applications Commercial % Aerospace $112M ~13 8% • Leader in niche 2019 ADJUSTED 2019 ADJUSTED Downstream O&G EBITDA ($) EBITDA (%) Industrial segments with 16% benefits of scale 52% Select Brands Defense • Global and diverse 24% end markets with longstanding customer base Revenue by Geography • Proven operator with clear roadmap for 2019 value creation ROW 16% Pumps Valves Actuation North America 46% EMEA 38% Three-Screw Centrifugal Bottom Unheading Electromechanical Device Actuation * 2019 Proforma Financials Reflecting Continuing Operations 10

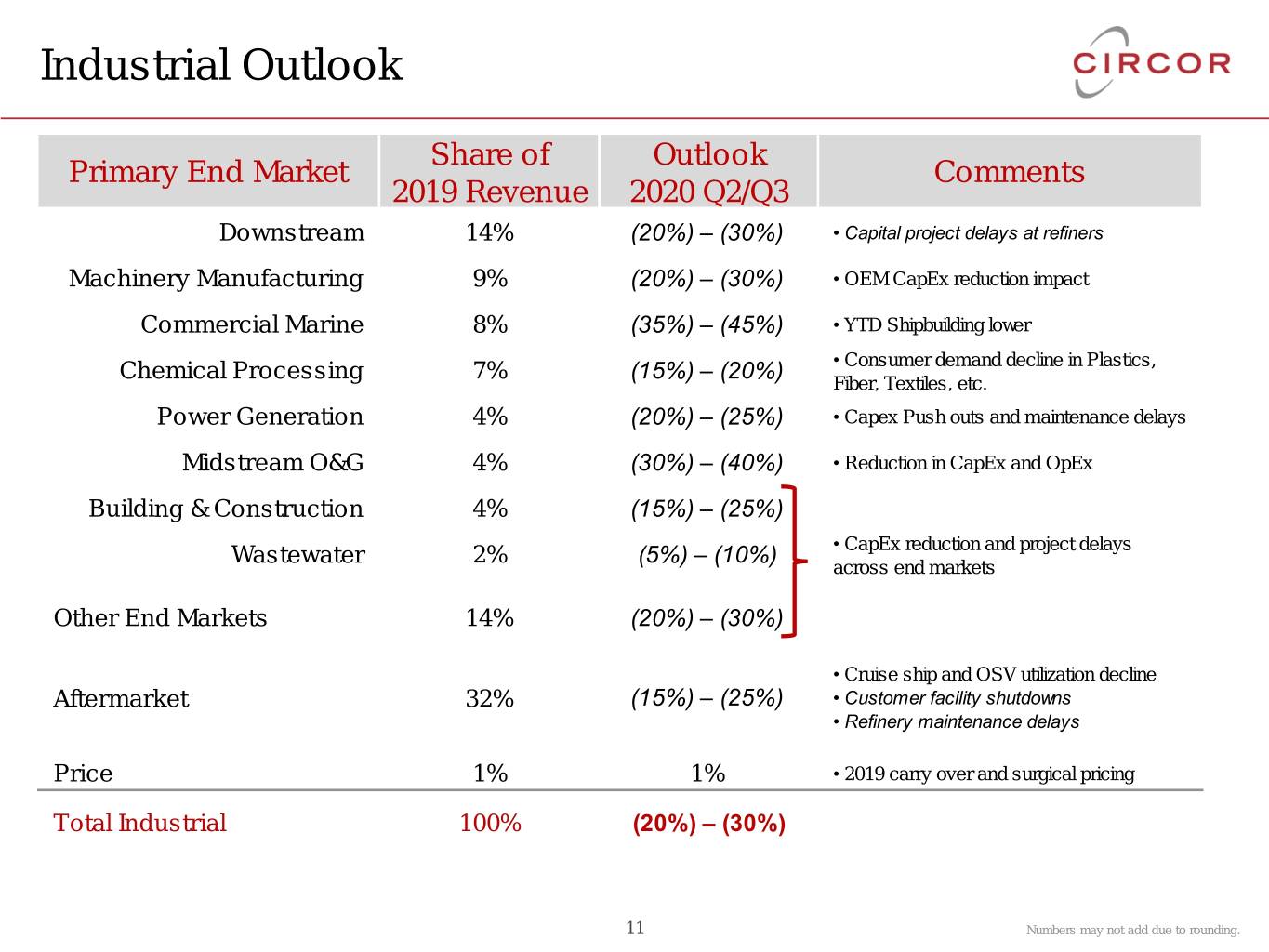

Industrial Outlook Share of Outlook Primary End Market Comments 2019 Revenue 2020 Q2/Q3 Downstream 14% (20%) – (30%) • Capital project delays at refiners Machinery Manufacturing 9% (20%) – (30%) • OEM CapEx reduction impact Commercial Marine 8% (35%) – (45%) • YTD Shipbuilding lower Chemical Processing 7% (15%) – (20%) • Consumer demand decline in Plastics, Fiber, Textiles, etc. Power Generation 4% (20%) – (25%) • Capex Push outs and maintenance delays Midstream O&G 4% (30%) – (40%) • Reduction in CapEx and OpEx Building & Construction 4% (15%) – (25%) Wastewater 2% (5%) – (10%) • CapEx reduction and project delays across end markets Other End Markets 14% (20%) – (30%) • Cruise ship and OSV utilization decline Aftermarket 32% (15%) – (25%) • Customer facility shutdowns • Refinery maintenance delays Price 1% 1% • 2019 carry over and surgical pricing Total Industrial 100% (20%) – (30%) 11 Numbers may not add due to rounding.

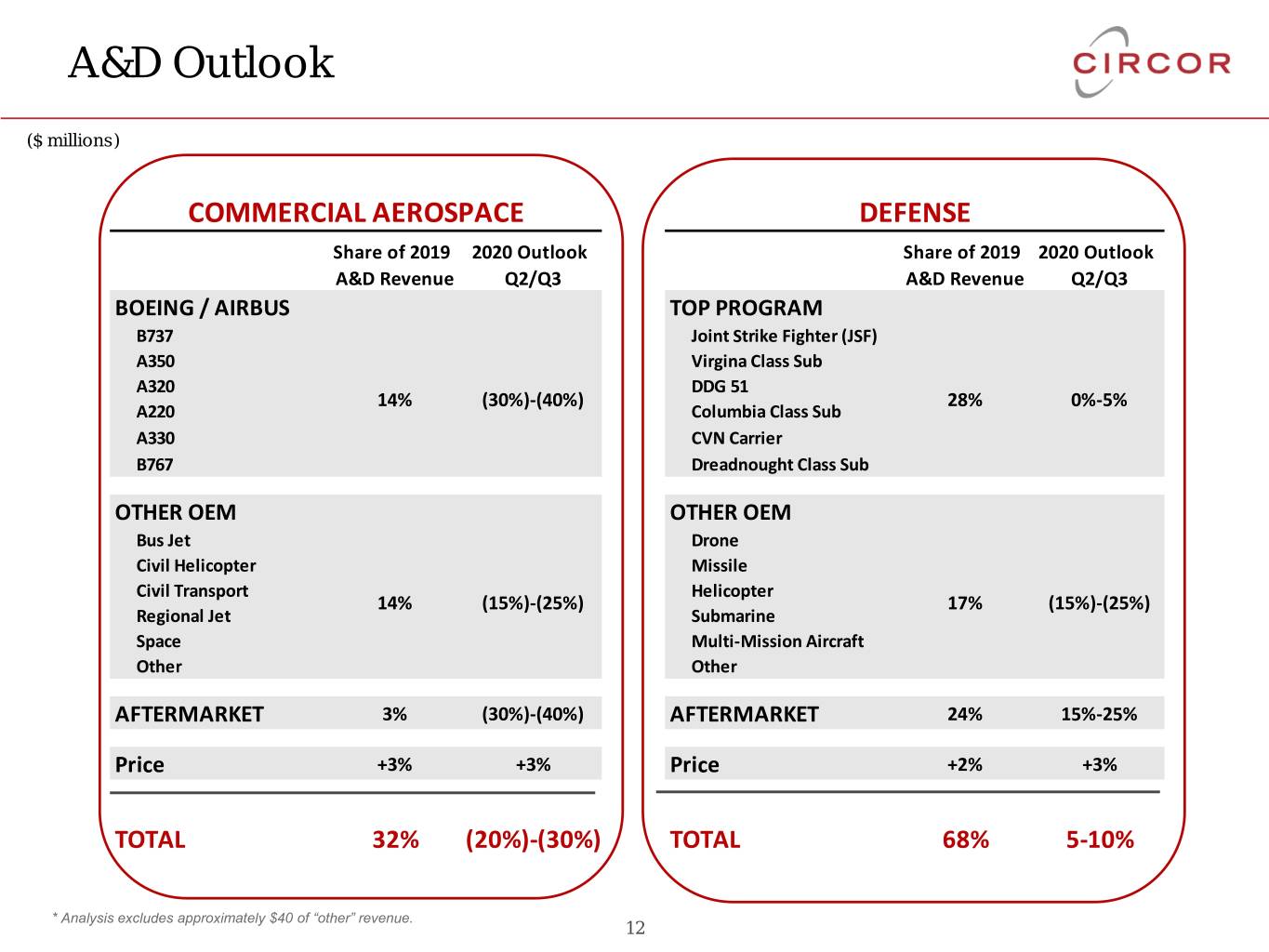

A&D Outlook ($ millions) COMMERCIAL AEROSPACE DEFENSE Share of 2019 2020 Outlook Share of 2019 2020 Outlook A&D Revenue Q2/Q3 A&D Revenue Q2/Q3 BOEING / AIRBUS TOP PROGRAM B737 Joint Strike Fighter (JSF) A350 Virgina Class Sub A320 DDG 51 14% (30%)-(40%) 28% 0%-5% A220 Columbia Class Sub A330 CVN Carrier B767 Dreadnought Class Sub OTHER OEM OTHER OEM Bus Jet Drone Civil Helicopter Missile Civil Transport Helicopter 14% (15%)-(25%) 17% (15%)-(25%) Regional Jet Submarine Space Multi-Mission Aircraft Other Other AFTERMARKET 3% (30%)-(40%) AFTERMARKET 24% 15%-25% Price +3% +3% Price +2% +3% TOTAL 32% (20%)-(30%) TOTAL 68% 5-10% * Analysis excludes approximately $40 of “other” revenue. 12

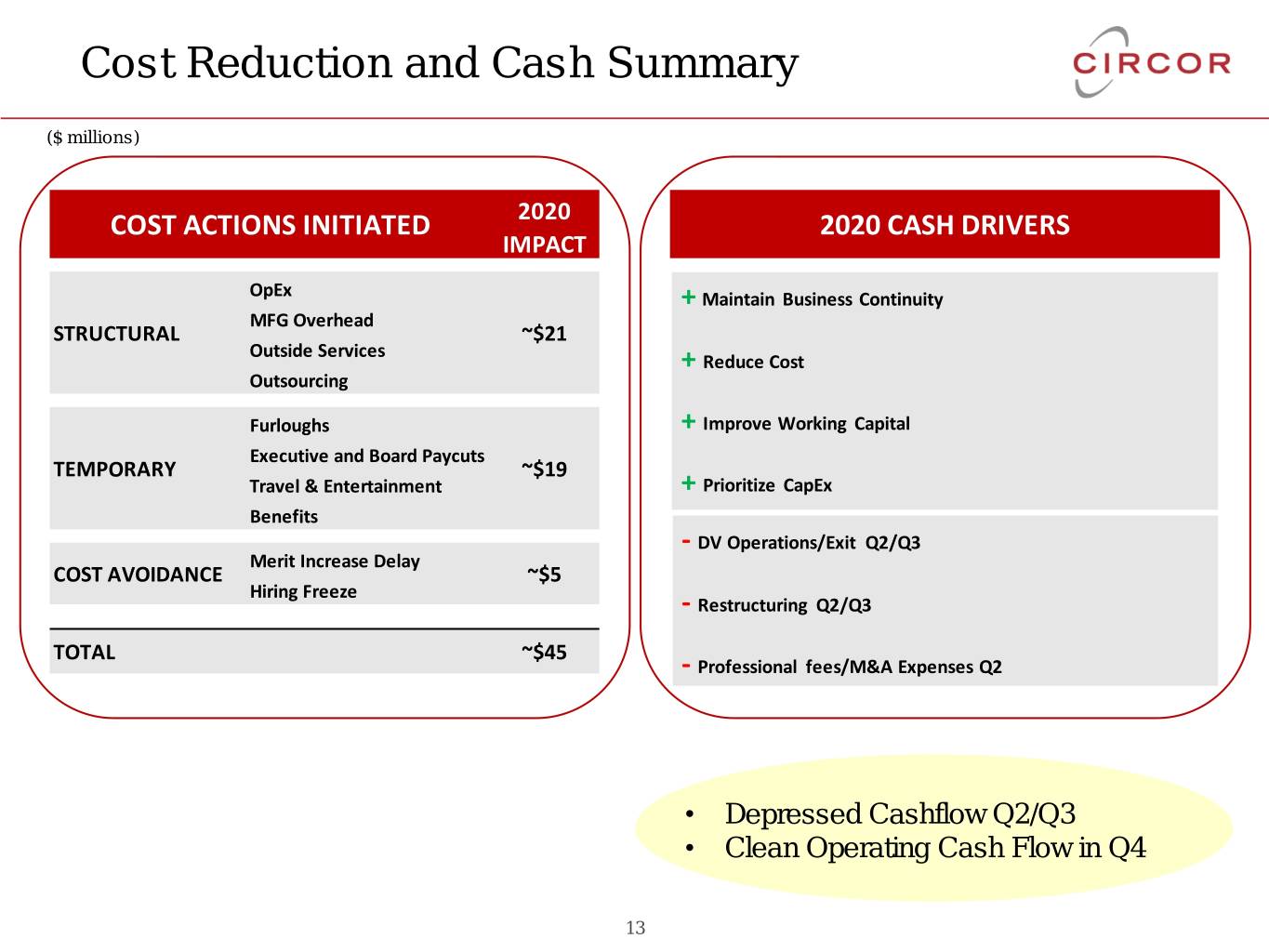

Cost Reduction and Cash Summary ($ millions) COST ACTIONS INITIATED 2020 2020 CASH DRIVERS IMPACT OpEx + Maintain Business Continuity MFG Overhead STRUCTURAL ~$21 Outside Services + Reduce Cost Outsourcing Furloughs + Improve Working Capital Executive and Board Paycuts TEMPORARY ~$19 Travel & Entertainment + Prioritize CapEx Benefits - DV Operations/Exit Q2/Q3 Merit Increase Delay COST AVOIDANCE ~$5 Hiring Freeze - Restructuring Q2/Q3 TOTAL ~$45 - Professional fees/M&A Expenses Q2 • Depressed Cashflow Q2/Q3 • Clean Operating Cash Flow in Q4 13

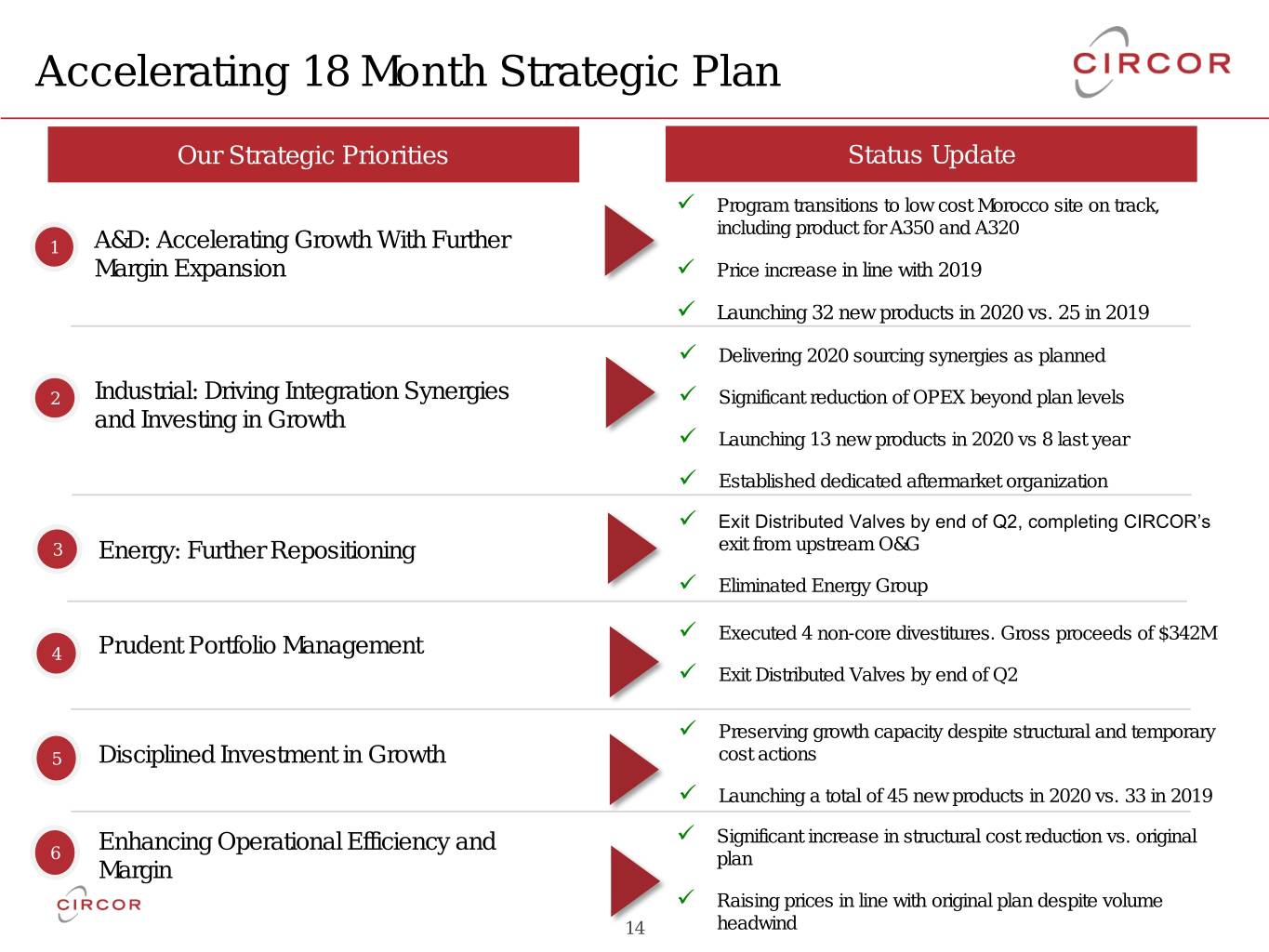

Accelerating 18 Month Strategic Plan Our Strategic Priorities Status Update ✓ Program transitions to low cost Morocco site on track, including product for A350 and A320 1◼ A&D: Accelerating Growth With Further Margin Expansion ✓ Price increase in line with 2019 ✓ Launching 32 new products in 2020 vs. 25 in 2019 ✓ Delivering 2020 sourcing synergies as planned 2◼ Industrial: Driving Integration Synergies ✓ Significant reduction of OPEX beyond plan levels and Investing in Growth ✓ Launching 13 new products in 2020 vs 8 last year ✓ Established dedicated aftermarket organization ✓ Exit Distributed Valves by end of Q2, completing CIRCOR’s 3◼ Energy: Further Repositioning exit from upstream O&G ✓ Eliminated Energy Group ✓ Executed 4 non-core divestitures. Gross proceeds of $342M 4◼ Prudent Portfolio Management ✓ Exit Distributed Valves by end of Q2 ✓ Preserving growth capacity despite structural and temporary 5◼ Disciplined Investment in Growth cost actions ✓ Launching a total of 45 new products in 2020 vs. 33 in 2019 ✓ Significant increase in structural cost reduction vs. original 6◼ Enhancing Operational Efficiency and Margin plan ✓ Raising prices in line with original plan despite volume 14 headwind

Use of Non-GAAP Financial Measures Within this presentation the Company uses non-GAAP financial measures, including Adjusted operating income, Adjusted operating margin, Adjusted net income, Adjusted earnings per share (diluted), EBITDA, Adjusted EBITDA, net debt, free cash flow and organic growth (and such measures further excluding Engineered Valves). These non-GAAP financial measures are used by management in our financial and operating decision making because we believe they reflect our ongoing business and facilitate period-to-period comparisons. We believe these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating the Company’s current operating performance and future prospects in the same manner as management does, if they so choose. These non-GAAP financial measures also allow investors and others to compare the Company’s current financial results with the Company’s past financial results in a consistent manner. For example: • We exclude costs and tax effects associated with restructuring activities, such as reducing overhead and consolidating facilities. We believe that the costs related to these restructuring activities are not indicative of our normal operating costs. • We exclude certain acquisition-related costs, including significant transaction costs and amortization of inventory and fixed-asset step-ups and the related tax effects. We exclude these costs because we do not believe they are indicative of our normal operating costs. • We exclude the expense and tax effects associated with the non-cash amortization of acquisition-related intangible assets because a significant portion of the purchase price for acquisitions may be allocated to intangible assets that have lives up to 25 years. Exclusion of the non-cash amortization expense allows comparisons of operating results that are consistent over time for both our newly acquired and long-held businesses and with both acquisitive and non-acquisitive peer companies. • We also exclude certain gains/losses and related tax effects, which are either isolated or cannot be expected to occur again with any predictability, and that we believe are not indicative of our normal operating gains and losses. For example, we exclude gains/losses from items such as the sale of a business, significant litigation-related matters and lump-sum pension plan settlements. • We exclude the results of discontinued operations. • We exclude goodwill impairment charges. • Due to the significance of recently sold businesses and to provide a comparison of changes in our orders and revenue, we also discuss these changes on an “organic” basis. Organic is calculated assuming the divestitures completed prior to March 29, 2020 were completed on January 1, 2019 and excluding the impact of changes in foreign currency exchange rates. CIRCOR’s management uses these non-GAAP measures, in addition to GAAP financial measures, as the basis for measuring the Company’s operating performance and comparing such performance to that of prior periods and to the performance of our competitors. We use such measures when publicly providing our business outlook, assessing future earnings potential, evaluating potential acquisitions and dispositions and in our financial and operating decision- making process, including for compensation purposes. Investors should recognize that these non-GAAP measures might not be comparable to similarly titled measures of other companies. These measures should be considered in addition and not as a substitute for or superior to, any measure of performance, cash flow or liquidity prepared in accordance with accounting principles generally accepted in the United States. A reconciliation of the non-GAAP financial measures to the most directly comparable GAAP measures is available in the Company’s first-quarter 2020 news release available on its website at www.CIRCOR.com. Figures labeled “Adjusted” exclude certain charges and recoveries. A description of these charges and recoveries and a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP measures is available in the Company’s fourth-quarter 2019 news release available on its website at www.CIRCOR.com. 15

Appendix 16

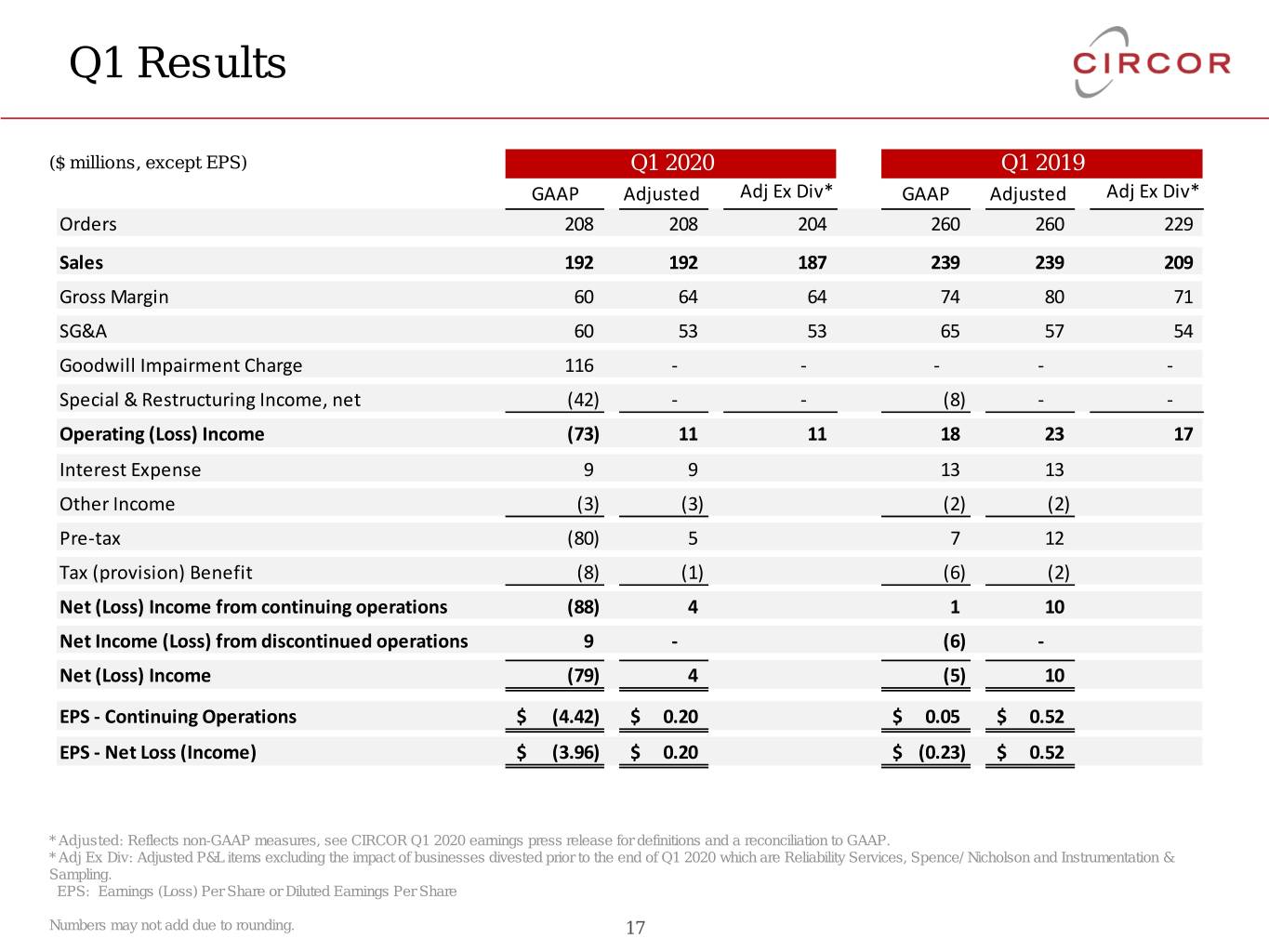

Q1 Results ($ millions, except EPS) Q1 2020 Q1 2019 GAAP Adjusted Adj Ex Div* GAAP Adjusted Adj Ex Div* Orders 208 208 204 260 260 229 Sales 192 192 187 239 239 209 Gross Margin 60 64 64 74 80 71 SG&A 60 53 53 65 57 54 Goodwill Impairment Charge 116 - - - - - Special & Restructuring Income, net (42) - - (8) - - Operating (Loss) Income (73) 11 11 18 23 17 Interest Expense 9 9 13 13 Other Income (3) (3) (2) (2) Pre-tax (80) 5 7 12 Tax (provision) Benefit (8) (1) (6) (2) Net (Loss) Income from continuing operations (88) 4 1 10 Net Income (Loss) from discontinued operations 9 - (6) - Net (Loss) Income (79) 4 (5) 10 EPS - Continuing Operations $ (4.42) $ 0.20 $ 0.05 $ 0.52 EPS - Net Loss (Income) $ (3.96) $ 0.20 $ (0.23) $ 0.52 * Adjusted: Reflects non-GAAP measures, see CIRCOR Q1 2020 earnings press release for definitions and a reconciliation to GAAP. * Adj Ex Div: Adjusted P&L items excluding the impact of businesses divested prior to the end of Q1 2020 which are Reliability Services, Spence/ Nicholson and Instrumentation & Sampling. EPS: Earnings (Loss) Per Share or Diluted Earnings Per Share Numbers may not add due to rounding. 17