Attached files

| file | filename |

|---|---|

| EX-99.1 - ADVISORY AGREEMENT - KBS Real Estate Investment Trust II, Inc. | kbsrii8k-exhibit991.htm |

| 8-K - FORM 8-K - KBS Real Estate Investment Trust II, Inc. | kbsrii8k-webinarmay2020.htm |

Exhibit 99.2 Portfolio Update Meeting May 28, 2020 1

The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Real Estate Investment Trust II’s (the “Company” or “KBS REIT II”) Annual Report on Form 10-K for the year ended December 31, 2019 (the “Annual Report”), and in the Company’s Quarterly Report on Form 10-Q for the period Important ended March 31, 2020 (the “Quarterly Report”), including the “Risk Factors” contained therein. Disclosures Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. You should interpret many of the risks identified in this presentation, in our Annual Report and in our Quarterly Report as being heightened as a result of the ongoing and numerous adverse impacts of the COVID-19 pandemic. On November 13, 2019, the Special Committee and board of directors of KBS REIT II unanimously approved the sale of all of KBS REIT II’s assets and its dissolution pursuant to the terms of KBS REIT II’s plan of complete liquidation and dissolution (the “Plan of Liquidation”). The principal purpose of the Plan of Liquidation is to provide liquidity to stockholders by selling KBS REIT II’s assets, paying its debts and distributing the net proceeds from liquidation to stockholders. On March 5, 2020, KBS REIT II’s stockholders approved the Plan of Liquidation. For more information, see the Plan of Liquidation, which is included as an exhibit to the Annual Report. There are many factors that may affect the amount of liquidating distributions ultimately paid to KBS REIT II’s stockholders, including, among other things, the ultimate sale price of each asset, changes in market demand for office properties during the sales process, the amount of taxes, transaction fees and expenses relating to the liquidation and dissolution, and unanticipated or contingent liabilities that could arise. No assurance can be given as to the amount or timing of liquidating distributions KBS REIT II will ultimately pay to its stockholders. If KBS REIT II underestimated its existing obligations and liabilities or if unanticipated or contingent liabilities arise, the amount of liquidating distributions ultimately paid to KBS REIT II’s stockholders could be less than estimated. WWW. KBS.COM 2

Forward-Looking Statements Important The COVID-19 pandemic, together with the resulting restrictions on travel and quarantines imposed, has had a negative impact on the economy and business activity globally. The extent to which the COVID-19 pandemic impacts the Company’s operations and those of its tenants and the Company’s implementation of the Plan of Liquidation, will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the Disclosures pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. Given the uncertainty and current business disruptions as a result of the outbreak of COVID-19, the Company’s implementation of the Plan of Liquidation (cont.) may be materially and adversely impacted and this may have a material effect on the ultimate amount and timing of liquidating distributions received by stockholders. Actual events may cause the value and returns on the Company’s investments to be less than that used for purposes of the Company’s estimated NAV per share and estimated net proceeds from liquidation. The Company’s estimated range in net proceeds from liquidation is based on the range in estimated value per share of the Company’s common stock approved by the Company’s board of directors on November 13, 2019, adjusted for estimated costs and fees the Company would incur during the implementation of the Plan of Liquidation. For a full description of the methodologies, limitations and assumptions used in the calculation of the estimated range in net proceeds from liquidation, see the Company’s definitive proxy statement filed with the SEC on December 9, 2019. Even small changes to these assumptions could result in significant differences in the appraised values of the appraised properties, the estimated value per share and the estimated net proceeds from liquidation. The risks presented by the COVID-19 pandemic are not priced into the estimated net proceeds from liquidation. The Company adopted the liquidation basis of accounting as of and for the periods subsequent to February 1, 2020. Net assets in liquidation represents the remaining estimated liquidation value available to stockholders upon liquidation. The liquidation value of real estate represents the estimated amount of cash that the Company will collect through the disposal of its assets, including any residual value attributable to lease intangibles, as it carries out the Plan of Liquidation. The Company estimated the liquidation value of its investments in real estate based on internal valuation methodologies using a combination of the direct capitalization approach and discounted cash flow analyses and in one case an offer received which the Company intends to accept. The internal valuation methodologies used by the Company assume the properties realize the projected net operating income and expected exit cap rates and that investors would be willing to invest in such properties at yields equal to the expected discount rates. Due to the uncertainty in the timing of the sale of the Company's remaining real estate properties and the estimated cash flows from operations, actual liquidation costs and sale proceeds may differ materially from the amounts estimated, which risks are heightened as a result of the outbreak of COVID-19. The statements herein also depend on factors such as: future economic, competitive and market conditions; the Company’s ability to maintain and/or improve occupancy levels and rental rates at its real estate properties during the liquidation; the Company’s ability to sell its real estate properties at the times and at the prices it expects; the Company’s ability to successfully negotiate modifications, extensions or any needed refinancing of its debt obligations; the Company’s ability to successfully implement the Plan of Liquidation; and other risks identified in Part I, Item 1A of the Company’s Annual Report and in Part II, Item 1A of the Company’s Quarterly Report. WWW. KBS.COM 3

The Impact of COVID-19 on Capital Markets and US Real Estate Investments WWW. KBS.COM 4

COVID-19 Impact Introduction Since initially being reported in December 2019, COVID-19 has spread around the world, including to every state in the United States. On March 11, 2020, the World Health Organization declared COVID-19 a pandemic, and on March 13, 2020, the United States declared a national emergency with respect to COVID- 19. The COVID-19 pandemic has severely impacted global economic activity and caused significant volatility and negative pressure in financial markets. The global impact of the pandemic is rapidly evolving and many countries, including the United States, have reacted by instituting quarantines, mandating business and school closures and restricting travel. As a result, the COVID-19 pandemic is negatively impacting almost every industry, including the real estate industry and the industries of our tenants, directly or indirectly. The extent to which the COVID-19 pandemic impacts our operations and those of our tenants and our implementation of the Plan of liquidation will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. Nevertheless, the COVID-19 pandemic presents material uncertainty and risk with respect to our business, financial condition, results of operations and cash flows. We continue to evaluate the impact and uncertainty of the COVID-19 pandemic on our real estate portfolio’s ongoing cash flows and our implementation of the Plan of liquidation. WWW. KBS.COM 5

COVID-19 As one would expect, leasing activity has come to a near halt for property tours and inquiries for new prospects. In addition, many of the leasing transactions that were in various stages of negotiation have Impact (cont.) slowed but continue to move forward slowly. The Federal Government has issued a guideline of three phases for states to begin easing social distancing measures and stay-at-home orders. Across the portfolio the range of expected phase 1 openings of local business varies with the majority of states beginning to ease restrictions under phase 1. Few if any sales transactions are occurring at the moment. Investments that were in various phases of the marketing process have been removed from the market and investments that were under due diligence have also slowed or been dropped by potential purchasers. Lenders remain selective on completing loan originations and are charging higher interest rate spreads, though all in rates remain low due to current LIBOR being near historic lows. WWW. KBS.COM 6

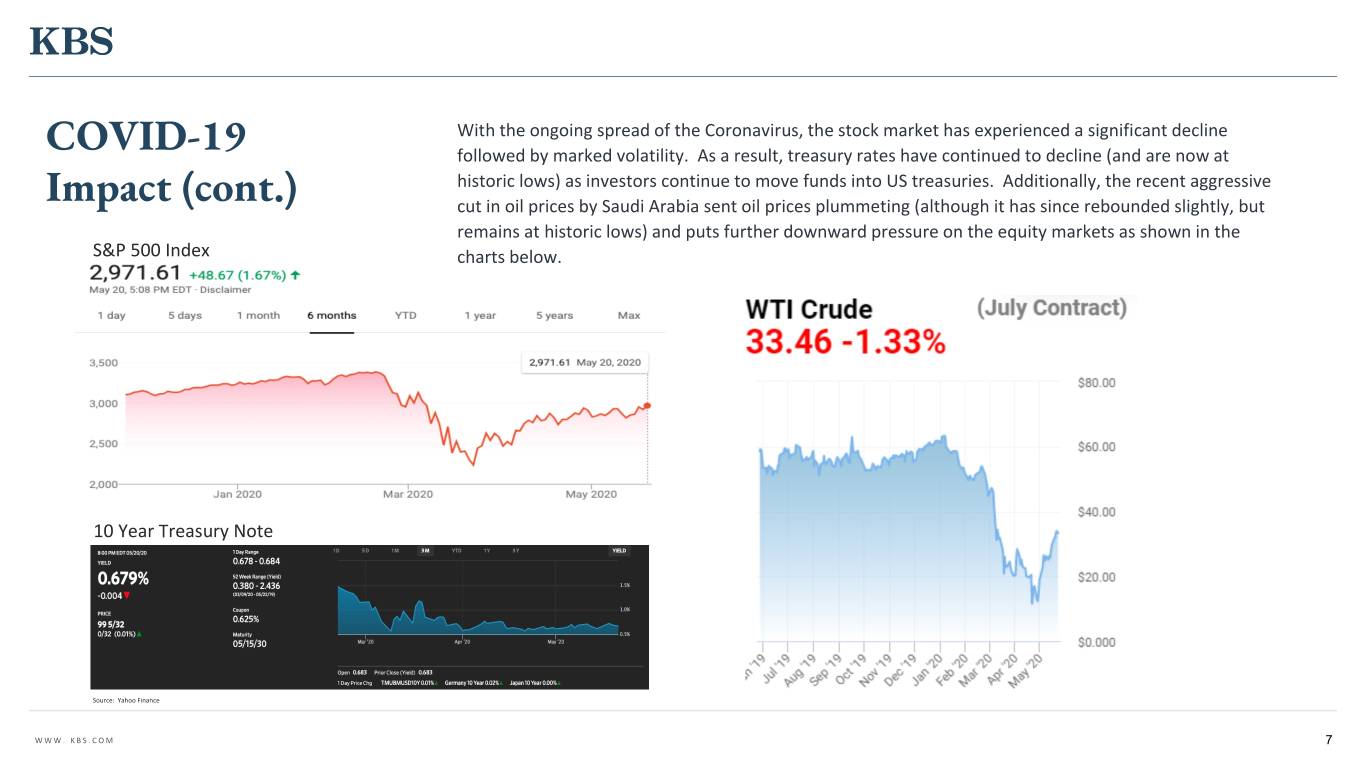

With the ongoing spread of the Coronavirus, the stock market has experienced a significant decline COVID-19 followed by marked volatility. As a result, treasury rates have continued to decline (and are now at historic lows) as investors continue to move funds into US treasuries. Additionally, the recent aggressive Impact (cont.) cut in oil prices by Saudi Arabia sent oil prices plummeting (although it has since rebounded slightly, but remains at historic lows) and puts further downward pressure on the equity markets as shown in the S&P 500 Index charts below. 10 Year Treasury Note Source: Yahoo Finance WWW. KBS.COM 7

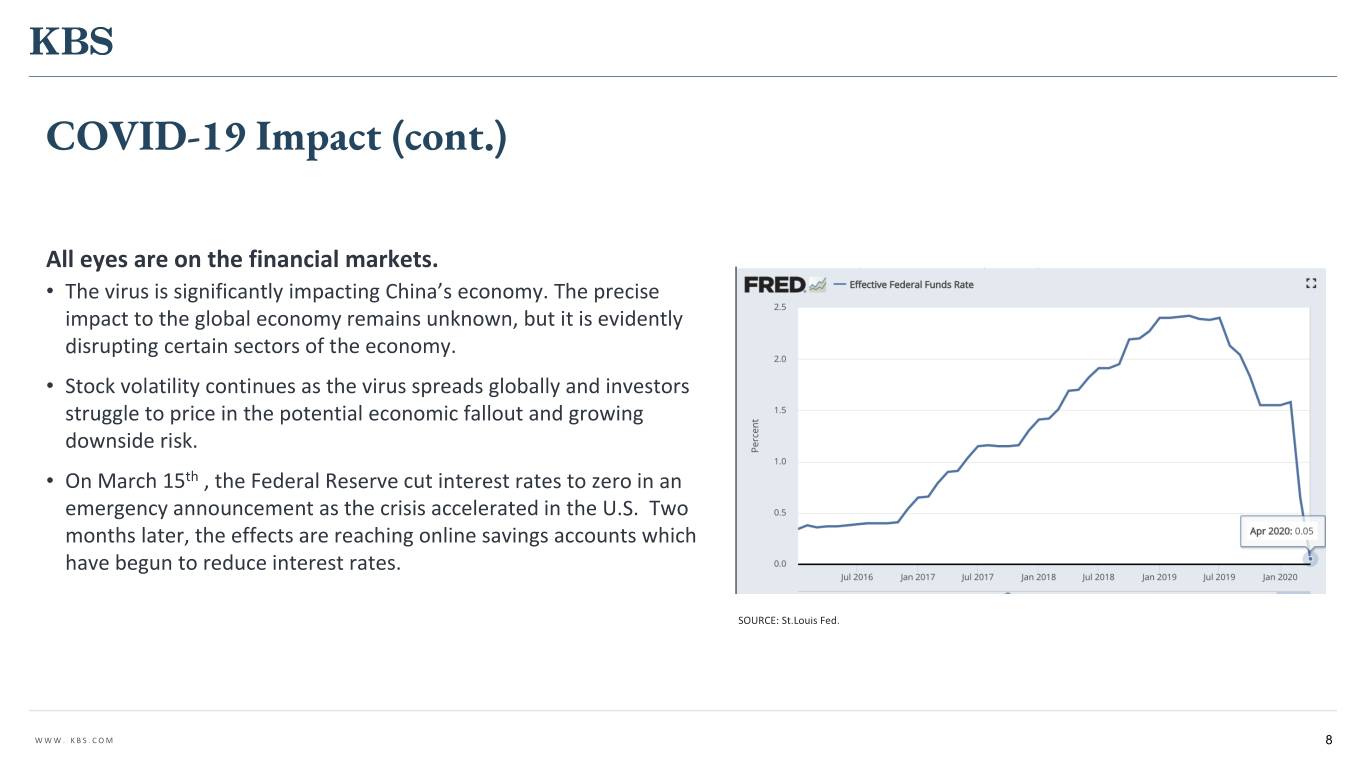

COVID-19 Impact (cont.) All eyes are on the financial markets. • The virus is significantly impacting China’s economy. The precise impact to the global economy remains unknown, but it is evidently disrupting certain sectors of the economy. • Stock volatility continues as the virus spreads globally and investors struggle to price in the potential economic fallout and growing downside risk. • On March 15th , the Federal Reserve cut interest rates to zero in an emergency announcement as the crisis accelerated in the U.S. Two months later, the effects are reaching online savings accounts which have begun to reduce interest rates. SOURCE: St.Louis Fed. WWW. KBS.COM 8

COVID-19 Impact (cont.) It is premature to draw strong inferences about the virus’s impact on property markets. • The commercial real estate sector is not the stock market. It’s slower moving and the leasing fundamentals don’t change significantly from day to day. If the virus has a sustained and material impact on the broader economy in the long term, then the impact on the real estate market can be expected to follow. Governors face mounting court challenges • The outbreak has also prompted a flight to quality, driving investors into the over coronavirus lockdown orders. bond markets, where lower rates are creating more attractive debt/refinance options. • If past outbreaks are a useful guide, then COVID-19 could be contained by mid- year 2020, which could lead to a strong rebound in markets in the second half of the year. • News was just released recently that the CDC now says the coronavirus does not spread easily’ via contaminated surfaces. Many state governors are also facing potential lawsuits over what many view as excessive orders limiting public gatherings. WWW. KBS.COM 9

COVID-19 A number of tenants have reached out to us in light of the impact of COVID-19 on their businesses. Our process when we receive such requests is generally as follows: Impact (cont.) • Process for Tenants We encourage the tenants to first look to government relief through the CARES act. In addition, Requesting Rent Modification we request tenants to respond to a COVID-19 questionnaire form which requests additional information related to their current financial standing. Through this process, many requests are denied. • Continue dialogue with tenants who have completed the form and/or we deem to be in immediate need of rent relief. • Consider whether there is any available TI/free rent allowance in the tenant’s lease that can be applied to near term rent. • Once these steps have been taken we then work through a process to modify the lease and offer them a short term deferral generally between one to three months. WWW. KBS.COM 10

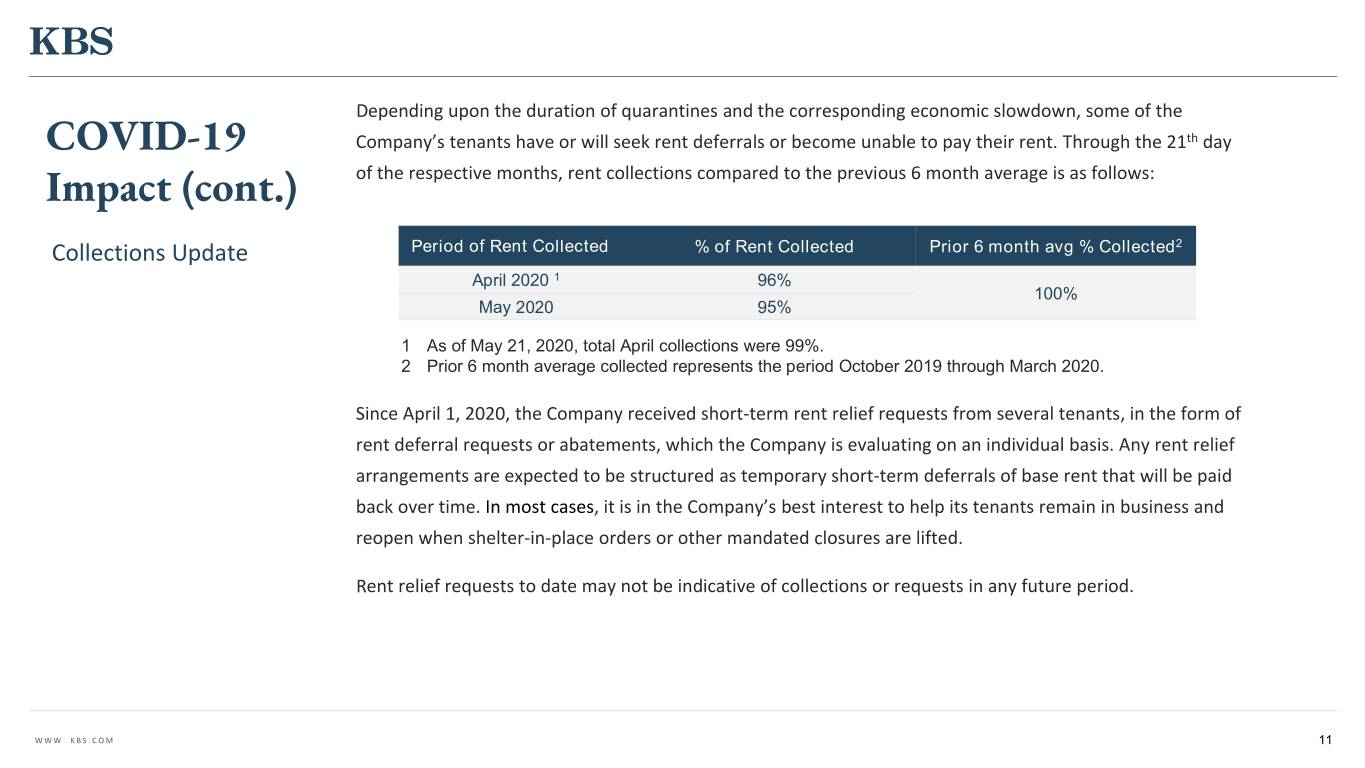

Depending upon the duration of quarantines and the corresponding economic slowdown, some of the COVID-19 Company’s tenants have or will seek rent deferrals or become unable to pay their rent. Through the 21th day Impact (cont.) of the respective months, rent collections compared to the previous 6 month average is as follows: Collections Update Period of Rent Collected % of Rent Collected Prior 6 month avg % Collected2 April 2020 1 96% 100% May 2020 95% 1 As of May 21, 2020, total April collections were 99%. 2 Prior 6 month average collected represents the period October 2019 through March 2020. Since April 1, 2020, the Company received short-term rent relief requests from several tenants, in the form of rent deferral requests or abatements, which the Company is evaluating on an individual basis. Any rent relief arrangements are expected to be structured as temporary short-term deferrals of base rent that will be paid back over time. In most cases, it is in the Company’s best interest to help its tenants remain in business and reopen when shelter-in-place orders or other mandated closures are lifted. Rent relief requests to date may not be indicative of collections or requests in any future period. WWW. KBS.COM 11

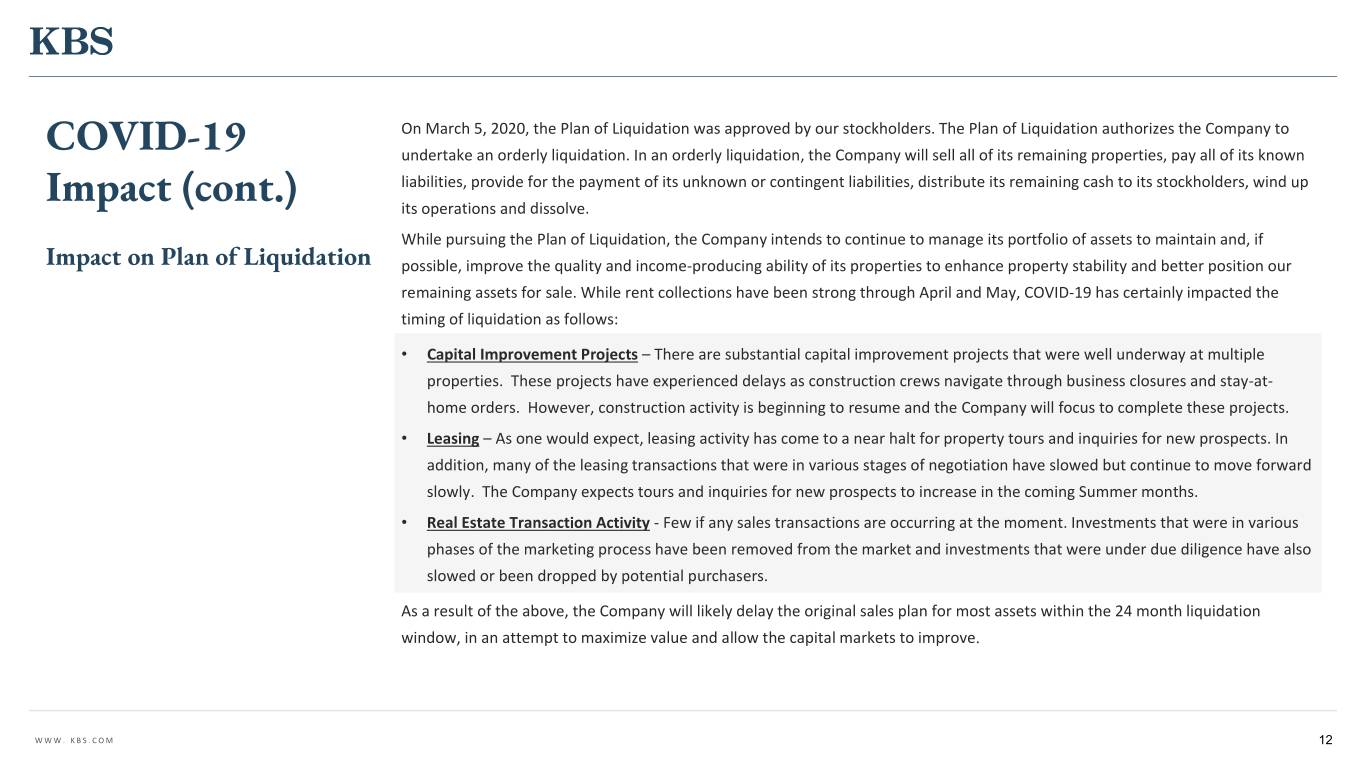

On March 5, 2020, the Plan of Liquidation was approved by our stockholders. The Plan of Liquidation authorizes the Company to COVID-19 undertake an orderly liquidation. In an orderly liquidation, the Company will sell all of its remaining properties, pay all of its known liabilities, provide for the payment of its unknown or contingent liabilities, distribute its remaining cash to its stockholders, wind up Impact (cont.) its operations and dissolve. While pursuing the Plan of Liquidation, the Company intends to continue to manage its portfolio of assets to maintain and, if Impact on Plan of Liquidation possible, improve the quality and income-producing ability of its properties to enhance property stability and better position our remaining assets for sale. While rent collections have been strong through April and May, COVID-19 has certainly impacted the timing of liquidation as follows: • Capital Improvement Projects – There are substantial capital improvement projects that were well underway at multiple properties. These projects have experienced delays as construction crews navigate through business closures and stay-at- home orders. However, construction activity is beginning to resume and the Company will focus to complete these projects. • Leasing – As one would expect, leasing activity has come to a near halt for property tours and inquiries for new prospects. In addition, many of the leasing transactions that were in various stages of negotiation have slowed but continue to move forward slowly. The Company expects tours and inquiries for new prospects to increase in the coming Summer months. • Real Estate Transaction Activity - Few if any sales transactions are occurring at the moment. Investments that were in various phases of the marketing process have been removed from the market and investments that were under due diligence have also slowed or been dropped by potential purchasers. As a result of the above, the Company will likely delay the original sales plan for most assets within the 24 month liquidation window, in an attempt to maximize value and allow the capital markets to improve. WWW. KBS.COM 12

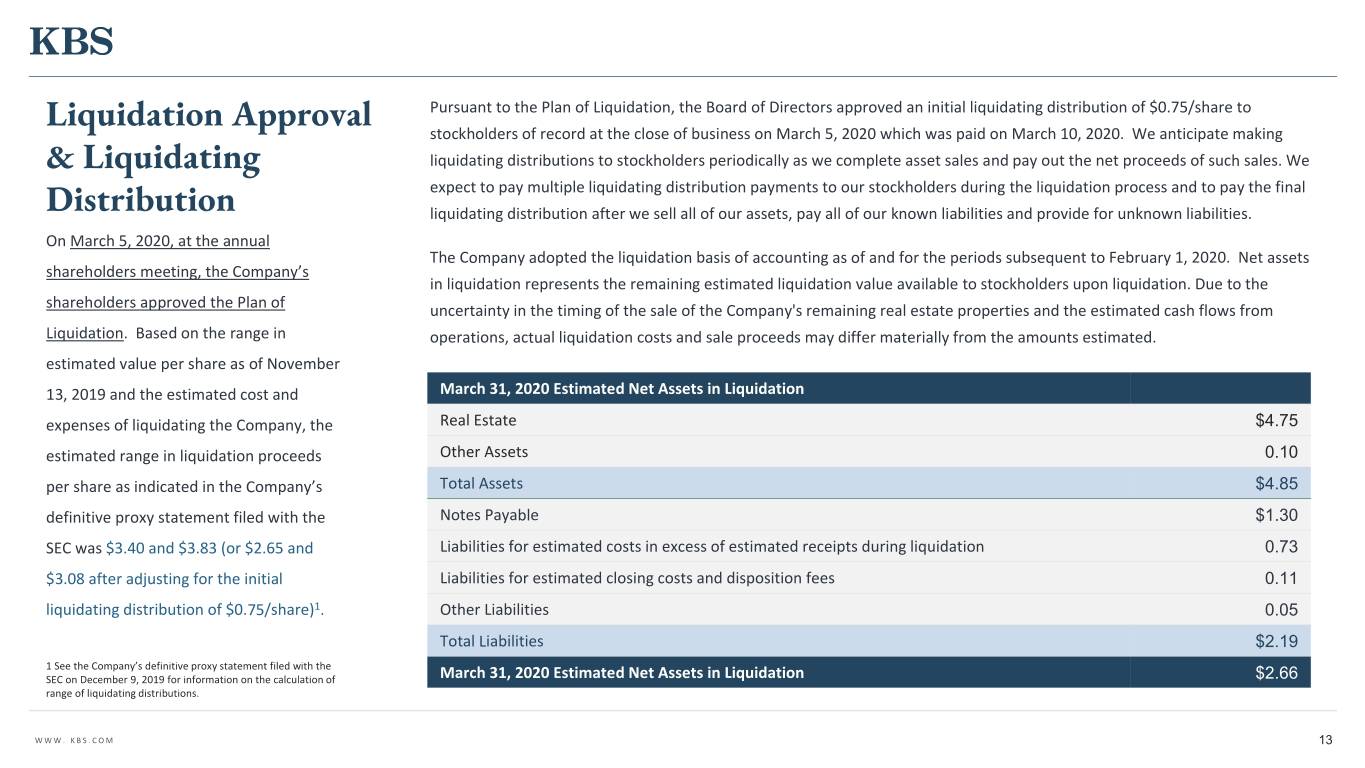

Pursuant to the Plan of Liquidation, the Board of Directors approved an initial liquidating distribution of $0.75/share to Liquidation Approval stockholders of record at the close of business on March 5, 2020 which was paid on March 10, 2020. We anticipate making & Liquidating liquidating distributions to stockholders periodically as we complete asset sales and pay out the net proceeds of such sales. We expect to pay multiple liquidating distribution payments to our stockholders during the liquidation process and to pay the final Distribution liquidating distribution after we sell all of our assets, pay all of our known liabilities and provide for unknown liabilities. On March 5, 2020, at the annual The Company adopted the liquidation basis of accounting as of and for the periods subsequent to February 1, 2020. Net assets shareholders meeting, the Company’s in liquidation represents the remaining estimated liquidation value available to stockholders upon liquidation. Due to the shareholders approved the Plan of uncertainty in the timing of the sale of the Company's remaining real estate properties and the estimated cash flows from Liquidation. Based on the range in operations, actual liquidation costs and sale proceeds may differ materially from the amounts estimated. estimated value per share as of November 13, 2019 and the estimated cost and March 31, 2020 Estimated Net Assets in Liquidation expenses of liquidating the Company, the Real Estate $4.75 estimated range in liquidation proceeds Other Assets 0.10 per share as indicated in the Company’s Total Assets $4.85 definitive proxy statement filed with the Notes Payable $1.30 SEC was $3.40 and $3.83 (or $2.65 and Liabilities for estimated costs in excess of estimated receipts during liquidation 0.73 $3.08 after adjusting for the initial Liabilities for estimated closing costs and disposition fees 0.11 liquidating distribution of $0.75/share)1. Other Liabilities 0.05 Total Liabilities $2.19 1 See the Company’s definitive proxy statement filed with the SEC on December 9, 2019 for information on the calculation of March 31, 2020 Estimated Net Assets in Liquidation $2.66 range of liquidating distributions. WWW. KBS.COM 13

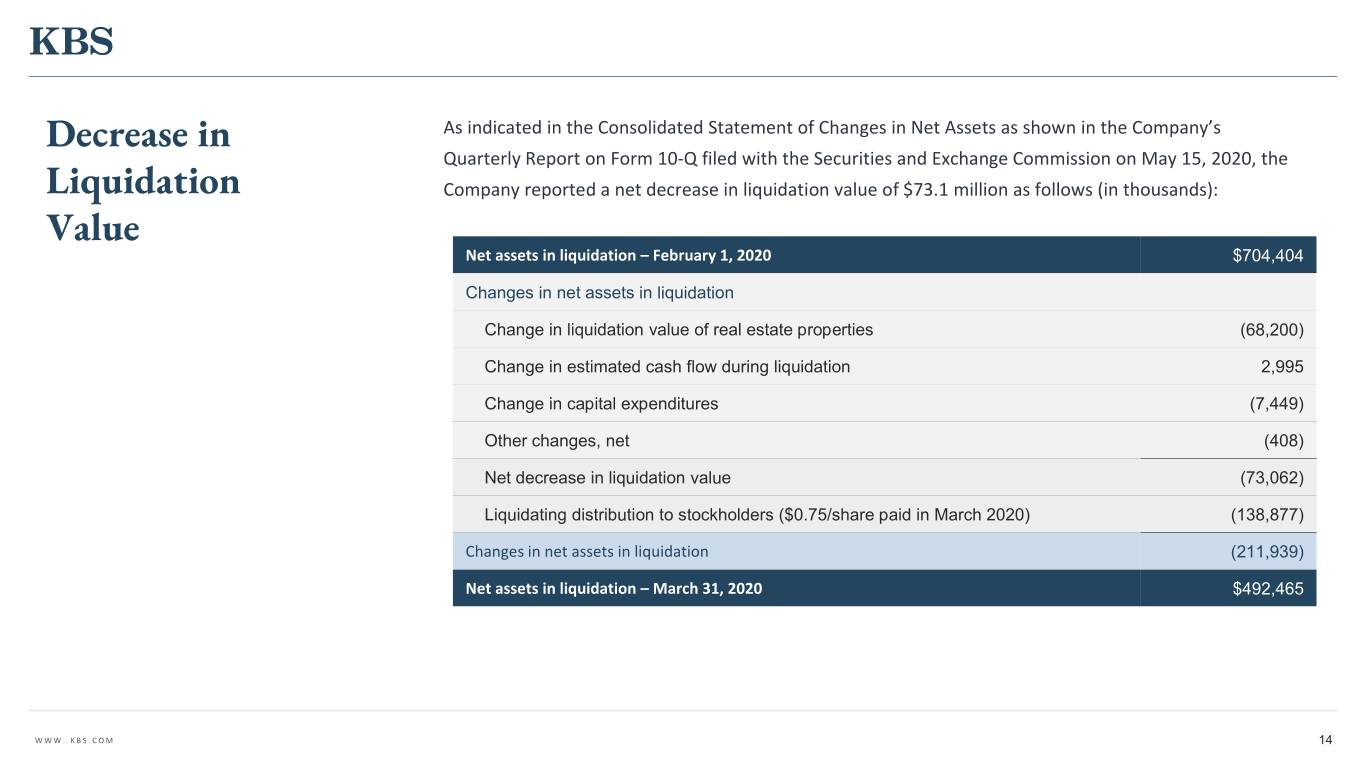

Decrease in As indicated in the Consolidated Statement of Changes in Net Assets as shown in the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 15, 2020, the Liquidation Company reported a net decrease in liquidation value of $73.1 million as follows (in thousands): Value Net assets in liquidation – February 1, 2020 $704,404 Changes in net assets in liquidation Change in liquidation value of real estate properties (68,200) Change in estimated cash flow during liquidation 2,995 Change in capital expenditures (7,449) Other changes, net (408) Net decrease in liquidation value (73,062) Liquidating distribution to stockholders ($0.75/share paid in March 2020) (138,877) Changes in net assets in liquidation (211,939) Net assets in liquidation – March 31, 2020 $492,465 WWW. KBS.COM 14

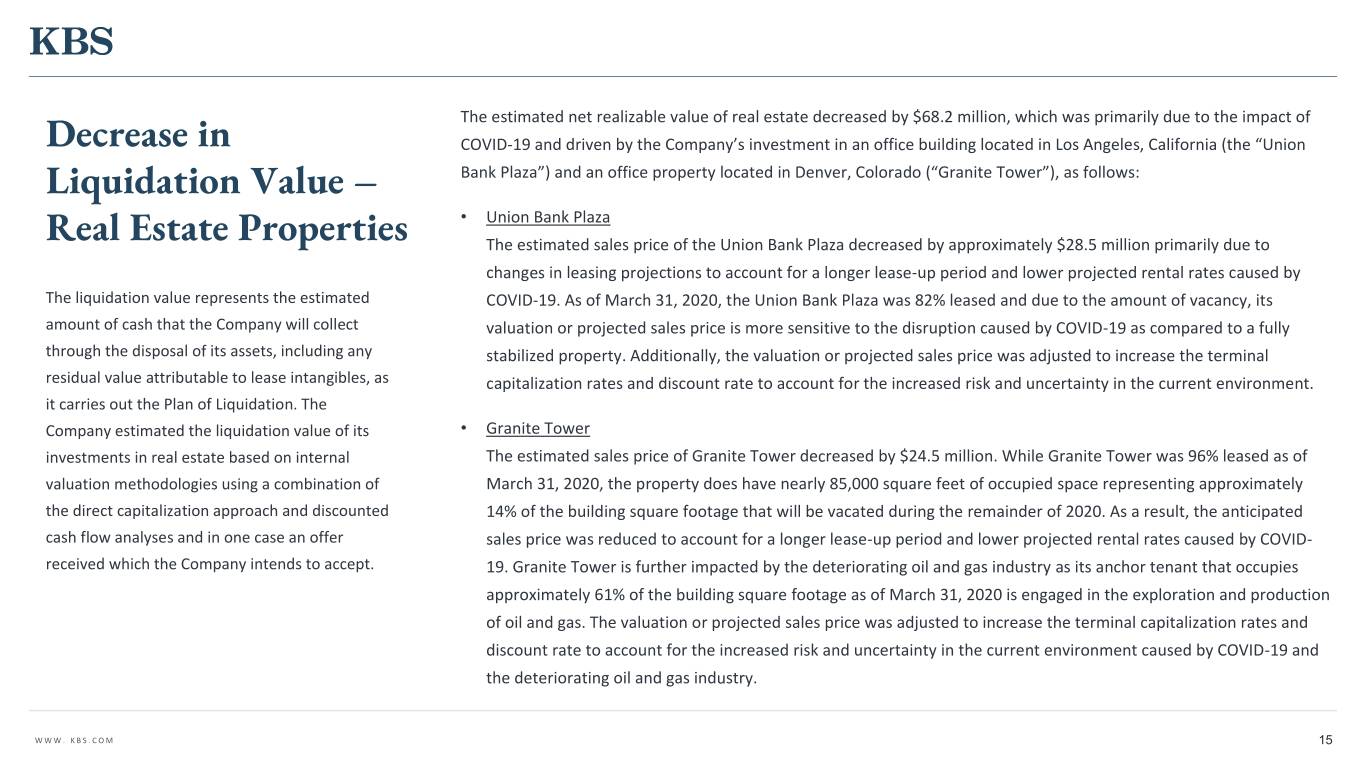

The estimated net realizable value of real estate decreased by $68.2 million, which was primarily due to the impact of Decrease in COVID-19 and driven by the Company’s investment in an office building located in Los Angeles, California (the “Union Liquidation Value – Bank Plaza”) and an office property located in Denver, Colorado (“Granite Tower”), as follows: • Union Bank Plaza Real Estate Properties The estimated sales price of the Union Bank Plaza decreased by approximately $28.5 million primarily due to changes in leasing projections to account for a longer lease-up period and lower projected rental rates caused by The liquidation value represents the estimated COVID-19. As of March 31, 2020, the Union Bank Plaza was 82% leased and due to the amount of vacancy, its amount of cash that the Company will collect valuation or projected sales price is more sensitive to the disruption caused by COVID-19 as compared to a fully through the disposal of its assets, including any stabilized property. Additionally, the valuation or projected sales price was adjusted to increase the terminal residual value attributable to lease intangibles, as capitalization rates and discount rate to account for the increased risk and uncertainty in the current environment. it carries out the Plan of Liquidation. The Company estimated the liquidation value of its • Granite Tower investments in real estate based on internal The estimated sales price of Granite Tower decreased by $24.5 million. While Granite Tower was 96% leased as of valuation methodologies using a combination of March 31, 2020, the property does have nearly 85,000 square feet of occupied space representing approximately the direct capitalization approach and discounted 14% of the building square footage that will be vacated during the remainder of 2020. As a result, the anticipated cash flow analyses and in one case an offer sales price was reduced to account for a longer lease-up period and lower projected rental rates caused by COVID- received which the Company intends to accept. 19. Granite Tower is further impacted by the deteriorating oil and gas industry as its anchor tenant that occupies approximately 61% of the building square footage as of March 31, 2020 is engaged in the exploration and production of oil and gas. The valuation or projected sales price was adjusted to increase the terminal capitalization rates and discount rate to account for the increased risk and uncertainty in the current environment caused by COVID-19 and the deteriorating oil and gas industry. WWW. KBS.COM 15

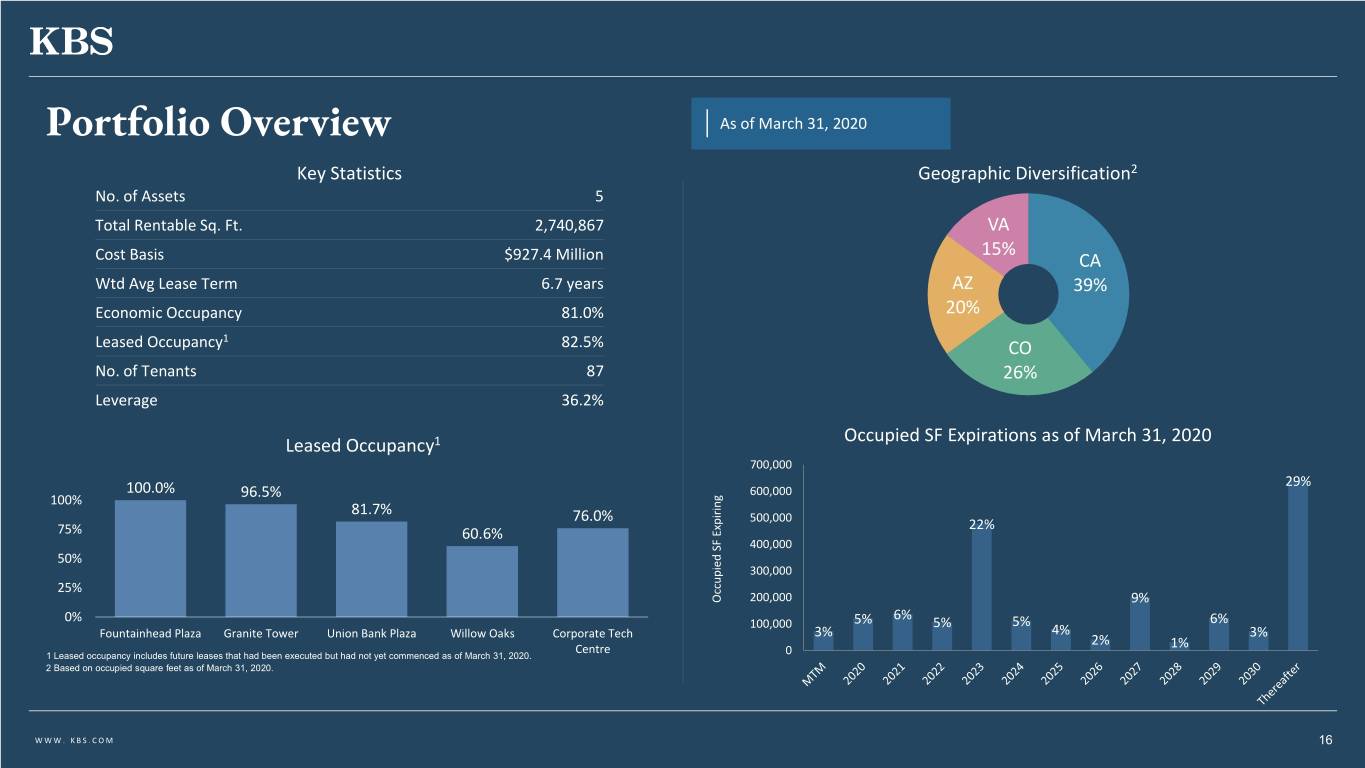

Portfolio Overview As of March 31, 2020 Key Statistics Geographic Diversification2 No. of Assets 5 Total Rentable Sq. Ft. 2,740,867 VA 15% Cost Basis $927.4 Million CA Wtd Avg Lease Term 6.7 years AZ 39% Economic Occupancy 81.0% 20% 1 Leased Occupancy 82.5% CO No. of Tenants 87 26% Leverage 36.2% Occupied SF Expirations as of March 31, 2020 Leased Occupancy1 700,000 29% 100.0% 600,000 100% 96.5% 81.7% 76.0% 500,000 22% 75% 60.6% 400,000 50% 300,000 25% Occupied SF SF Expiring Occupied 200,000 9% 6% 0% 100,000 5% 5% 5% 6% 3% 4% 3% Fountainhead Plaza Granite Tower Union Bank Plaza Willow Oaks Corporate Tech 2% Centre 1% 1 Leased occupancy includes future leases that had been executed but had not yet commenced as of March 31, 2020. 0 2 Based on occupied square feet as of March 31, 2020. WWW. KBS.COM 16

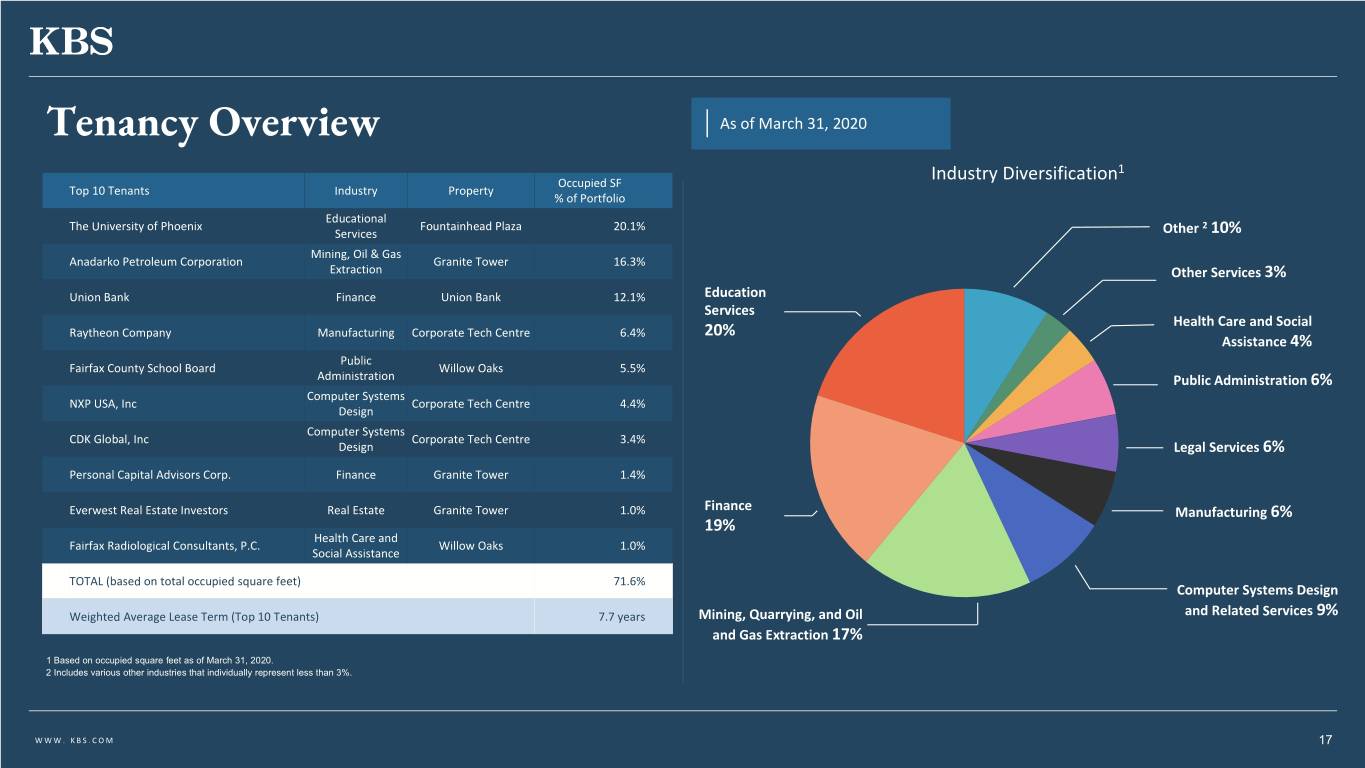

Tenancy Overview As of March 31, 2020 1 Occupied SF Industry Diversification Top 10 Tenants Industry Property % of Portfolio Educational The University of Phoenix Fountainhead Plaza 20.1% 2 Services Other 10% Mining, Oil & Gas Anadarko Petroleum Corporation Granite Tower 16.3% Extraction Other Services 3% Union Bank Finance Union Bank 12.1% Education Services Health Care and Social Raytheon Company Manufacturing Corporate Tech Centre 6.4% 20% Assistance 4% Public Fairfax County School Board Willow Oaks 5.5% Administration Public Administration 6% Computer Systems NXP USA, Inc Corporate Tech Centre 4.4% Design Computer Systems CDK Global, Inc Corporate Tech Centre 3.4% Design Legal Services 6% Personal Capital Advisors Corp. Finance Granite Tower 1.4% Everwest Real Estate Investors Real Estate Granite Tower 1.0% Finance Manufacturing 6% 19% Health Care and Fairfax Radiological Consultants, P.C. Willow Oaks 1.0% Social Assistance TOTAL (based on total occupied square feet) 71.6% Computer Systems Design Weighted Average Lease Term (Top 10 Tenants) 7.7 years Mining, Quarrying, and Oil and Related Services 9% and Gas Extraction 17% 1 Based on occupied square feet as of March 31, 2020. 2 Includes various other industries that individually represent less than 3%. WWW. KBS.COM 17

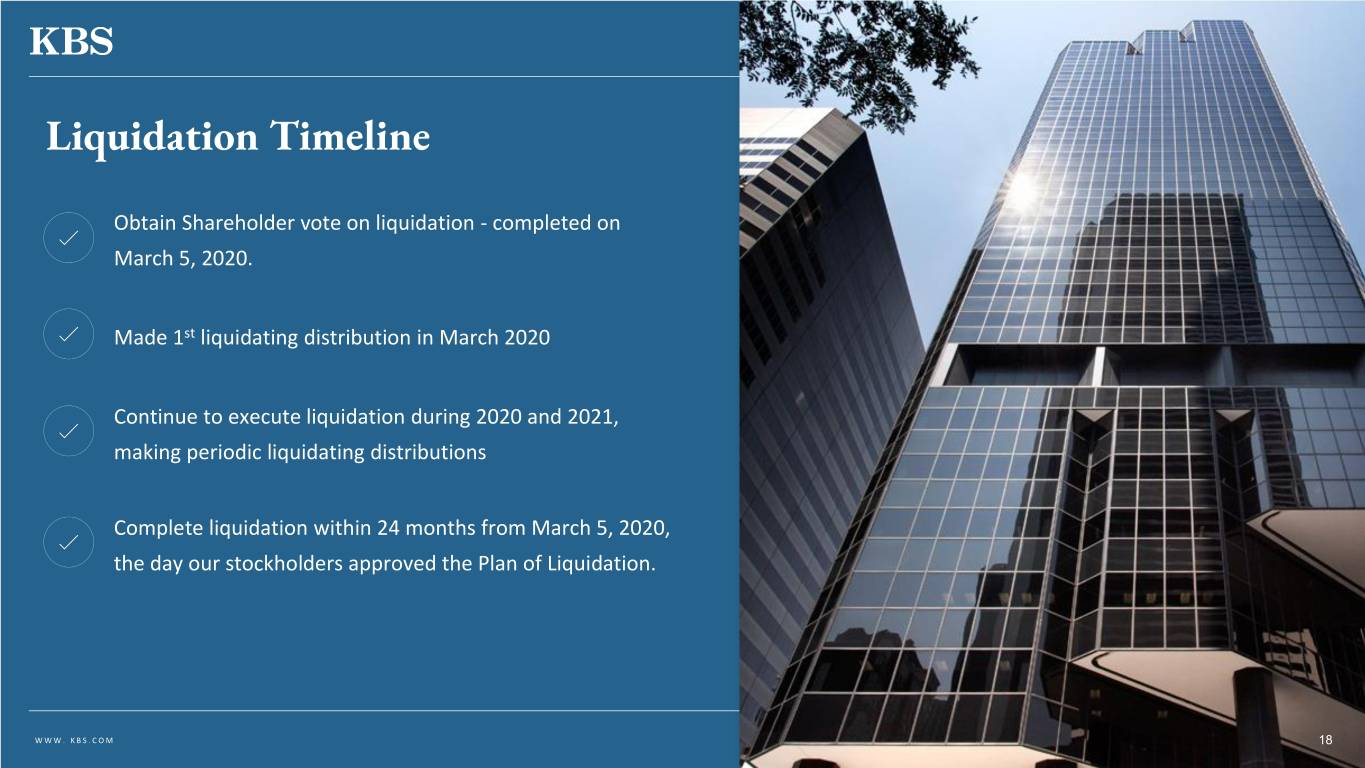

Liquidation Timeline Obtain Shareholder vote on liquidation - completed on March 5, 2020. Made 1st liquidating distribution in March 2020 Continue to execute liquidation during 2020 and 2021, making periodic liquidating distributions Complete liquidation within 24 months from March 5, 2020, the day our stockholders approved the Plan of Liquidation. WWW. KBS.COM 18

Property Updates 19

Campus Drive Buildings Sale Campus Drive Buildings (100 & 200 Campus Drive and 300-600 Campus Drive) Both Campus Drive buildings were sold on January 22, 2020 for a gross sale price of $311.0 million and net proceeds after debt paydown of approximately $160 million. The sale was completed at a price consistent with the November 2019 valuation of the property. WWW. KBS.COM 20

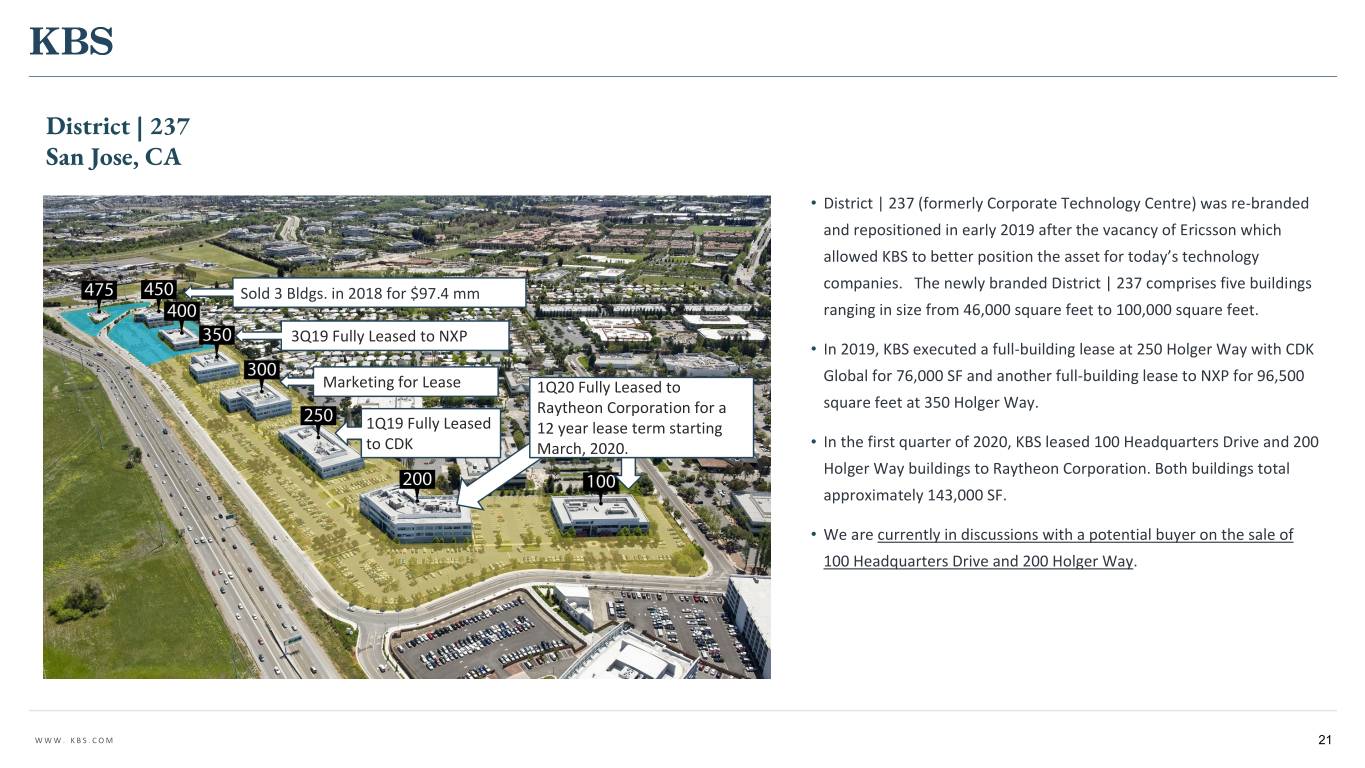

District | 237 San Jose, CA • District | 237 (formerly Corporate Technology Centre) was re-branded and repositioned in early 2019 after the vacancy of Ericsson which allowed KBS to better position the asset for today’s technology companies. The newly branded District | 237 comprises five buildings Sold 3 Bldgs. in 2018 for $97.4 mm ranging in size from 46,000 square feet to 100,000 square feet. 3Q19 Fully Leased to NXP • In 2019, KBS executed a full-building lease at 250 Holger Way with CDK Global for 76,000 SF and another full-building lease to NXP for 96,500 Marketing for Lease 1Q20 Fully Leased to Raytheon Corporation for a square feet at 350 Holger Way. 1Q19 Fully Leased 12 year lease term starting to CDK March, 2020. • In the first quarter of 2020, KBS leased 100 Headquarters Drive and 200 Holger Way buildings to Raytheon Corporation. Both buildings total approximately 143,000 SF. • We are currently in discussions with a potential buyer on the sale of 100 Headquarters Drive and 200 Holger Way. WWW. KBS.COM 21

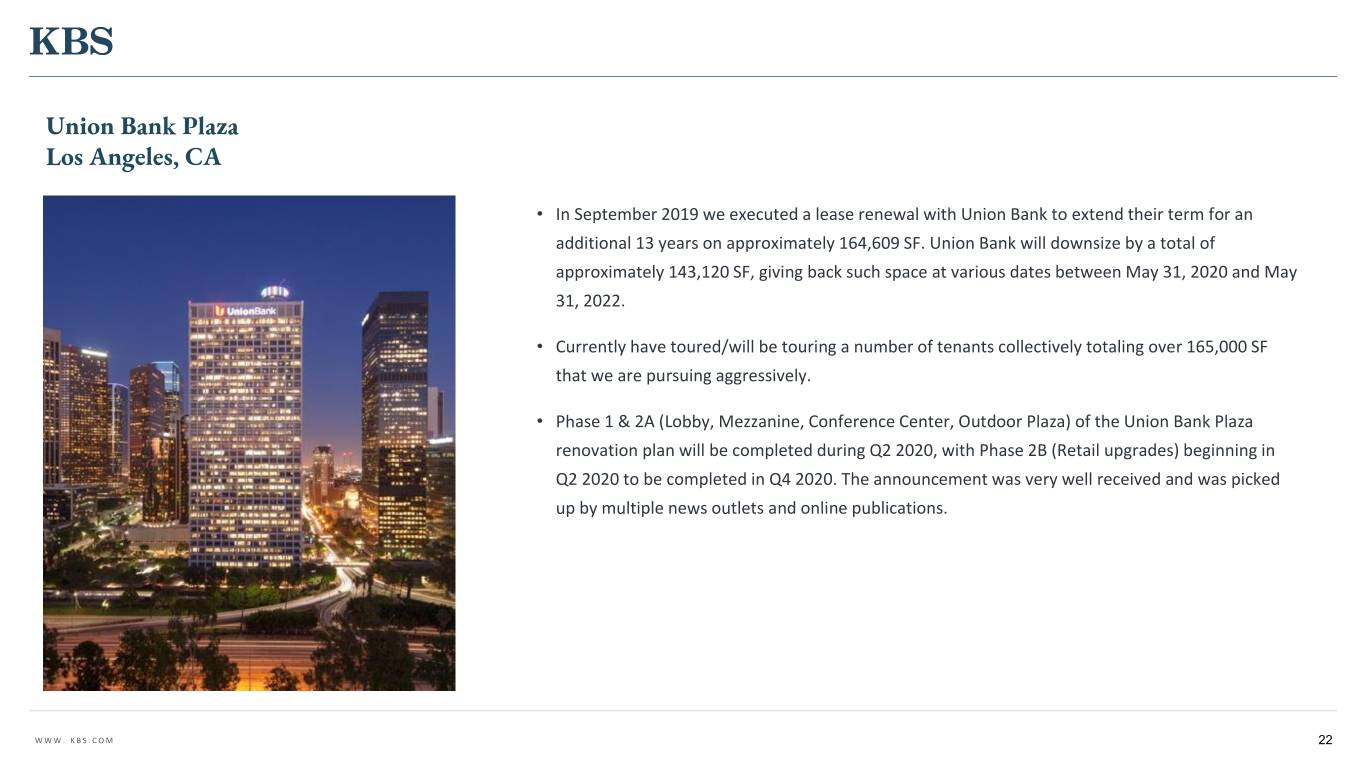

Union Bank Plaza Los Angeles, CA • In September 2019 we executed a lease renewal with Union Bank to extend their term for an additional 13 years on approximately 164,609 SF. Union Bank will downsize by a total of approximately 143,120 SF, giving back such space at various dates between May 31, 2020 and May 31, 2022. • Currently have toured/will be touring a number of tenants collectively totaling over 165,000 SF that we are pursuing aggressively. • Phase 1 & 2A (Lobby, Mezzanine, Conference Center, Outdoor Plaza) of the Union Bank Plaza renovation plan will be completed during Q2 2020, with Phase 2B (Retail upgrades) beginning in Q2 2020 to be completed in Q4 2020. The announcement was very well received and was picked up by multiple news outlets and online publications. WWW. KBS.COM 22

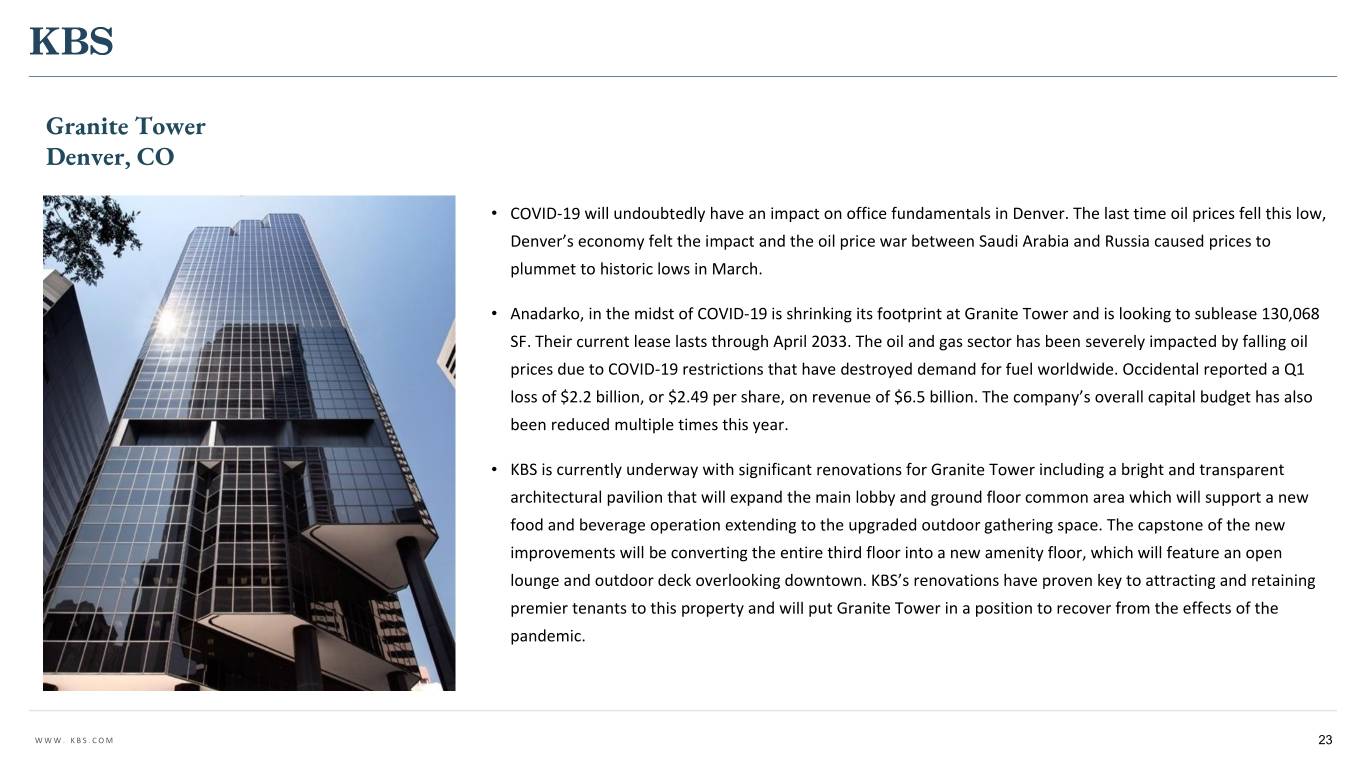

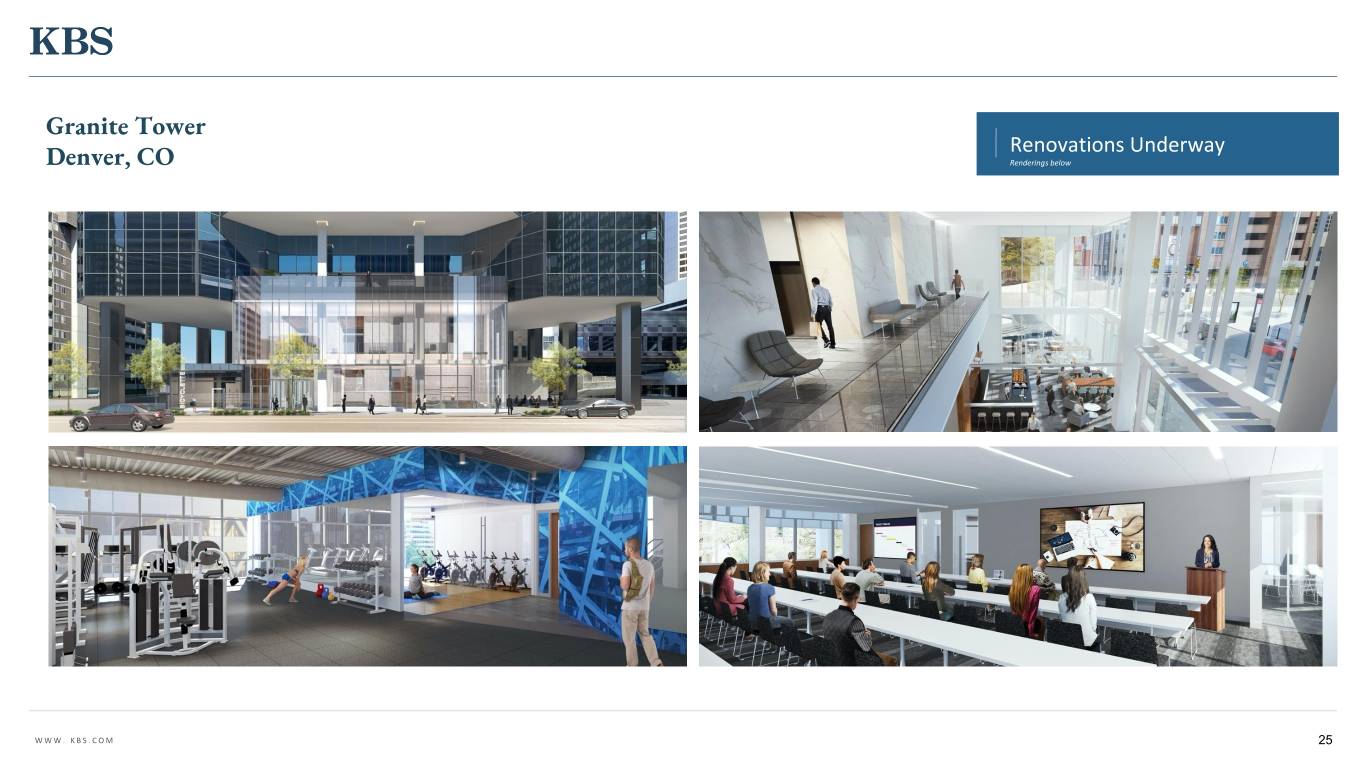

Granite Tower Denver, CO • COVID-19 will undoubtedly have an impact on office fundamentals in Denver. The last time oil prices fell this low, Denver’s economy felt the impact and the oil price war between Saudi Arabia and Russia caused prices to plummet to historic lows in March. • Anadarko, in the midst of COVID-19 is shrinking its footprint at Granite Tower and is looking to sublease 130,068 SF. Their current lease lasts through April 2033. The oil and gas sector has been severely impacted by falling oil prices due to COVID-19 restrictions that have destroyed demand for fuel worldwide. Occidental reported a Q1 loss of $2.2 billion, or $2.49 per share, on revenue of $6.5 billion. The company’s overall capital budget has also been reduced multiple times this year. • KBS is currently underway with significant renovations for Granite Tower including a bright and transparent architectural pavilion that will expand the main lobby and ground floor common area which will support a new food and beverage operation extending to the upgraded outdoor gathering space. The capstone of the new improvements will be converting the entire third floor into a new amenity floor, which will feature an open lounge and outdoor deck overlooking downtown. KBS’s renovations have proven key to attracting and retaining premier tenants to this property and will put Granite Tower in a position to recover from the effects of the pandemic. WWW. KBS.COM 23

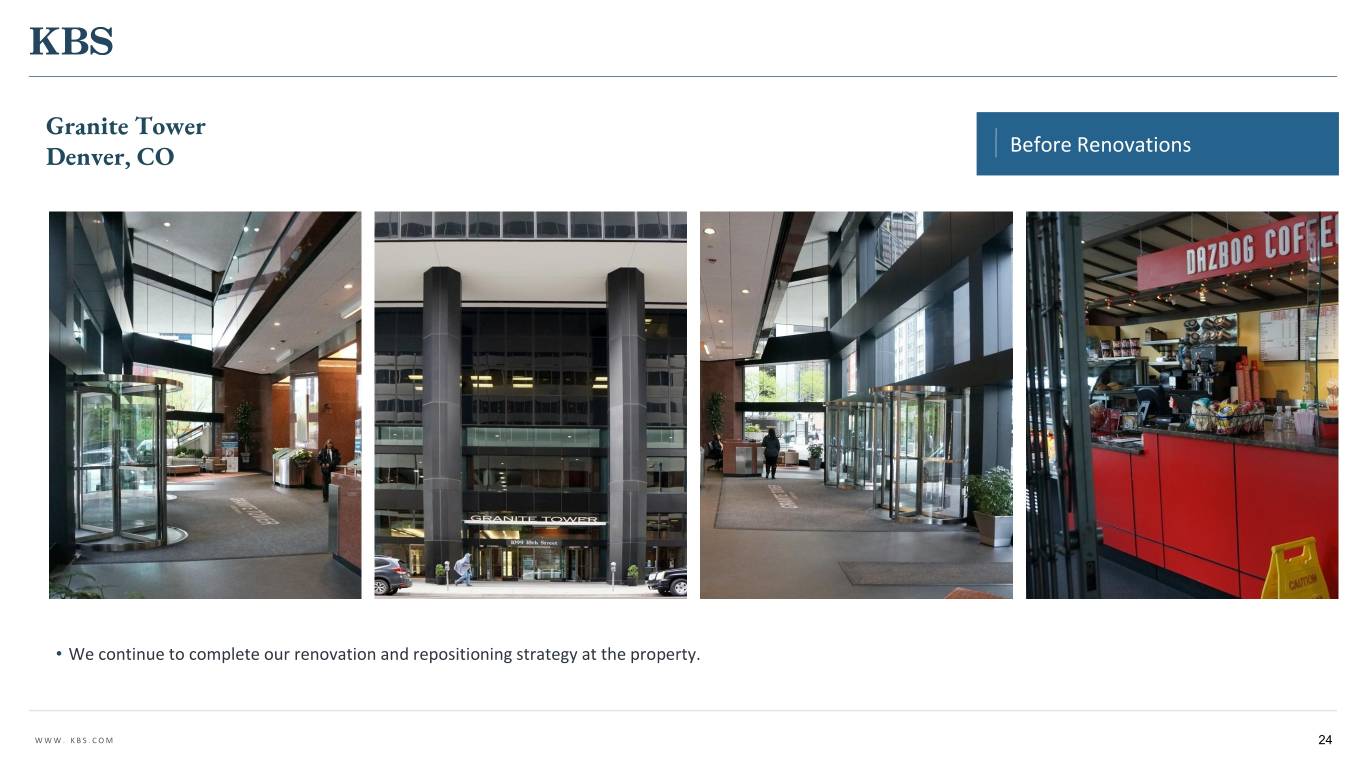

Granite Tower Before Renovations Denver, CO • We continue to complete our renovation and repositioning strategy at the property. WWW. KBS.COM 24

Granite Tower Renovations Underway Denver, CO Renderings below WWW. KBS.COM 25

REIT II Goals & Objectives Efficiently manage the real estate portfolio throughout the COVID 19 crisis in order to maximize asset values upon sale Carefully evaluate all tenant rent deferral requests to make sure we are providing rent relief only where it is necessary, while being repaid on such deferrals in the future or through lease extensions Complete capital projects, such as renovations or amenity enhancements, to attract quality buyers Continue to execute plan of liquidation and make liquidating distributions to stockholders from assets sales proceeds WWW. KBS.COM 26

Q&A For additional questions, contact KBS Capital Markets Group Investor Relations (866) 527-4264 27