Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PROVIDENT FINANCIAL SERVICES INC | pfs-20200527.htm |

Q1 2020 INVESTOR PRESENTATION

Forward Looking Statements Certain statements contained herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” "project," "intend," “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those set forth in Item 1A of the Company's Annual Report on Form 10-K, as supplemented by its Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, and those related to the economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in accounting policies and practices that may be adopted by the regulatory agencies and the accounting standards setters, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. In addition, the COVID-19 pandemic is having an adverse impact on the Company, its customers and the communities it serves. Given its ongoing and dynamic nature, it is difficult to predict the full impact of the COVID-19 outbreak on our business. The extent of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated and when and how the economy may be reopened. As the result of the COVID-19 pandemic and the related adverse local and national economic consequences, we could be subject to any of the following risks, any of which could have a material, adverse effect on our business, financial condition, liquidity, and results of operations: the demand for our products and services may decline, making it difficult to grow assets and income; if the economy is unable to substantially reopen, and high levels of unemployment continue for an extended period of time, loan delinquencies, problem assets, and foreclosures may increase, resulting in increased charges and reduced income; collateral for loans, especially real estate, may decline in value, which could cause loan losses to increase; our allowance for loan losses may increase if borrowers experience financial difficulties, which will adversely affect our net income; the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us; as the result of the decline in the Federal Reserve Board’s target federal funds rate to near 0%, the yield on our assets may decline to a greater extent than the decline in our cost of interest-bearing liabilities, reducing our net interest margin and spread and reducing net income; our wealth management revenues may decline with continuing market turmoil; we may face the risk of a goodwill write-down due to stock price decline; and our cyber security risks are increased as the result of an increase in the number of employees working remotely. The Company cautions readers not to place undue reliance on any such forward-looking statements which speak only as of the date made. The Company advises readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not have any obligation to update any forward-looking statements to reflect events or circumstances after the date of this statement. NYSE: PFS 2

Corporate Profile Bank founded: 1839 Stock symbol: PFS (NYSE) Branches: 83 serving northern and central New Jersey and eastern Pennsylvania Market capitalization: $879.1 Million as of 5/26/20 $10.1 Billion in Total Assets Balance sheet as of 3/31/20: $7.3 Billion in Net Loans $7.2 Billion in Total Deposits Strong core funding: 62 bps cost of deposits Expenses / Average Assets: 2.13% Efficient operator: Efficiency Ratio: 59.14% Wealth management business Beacon Trust Company ~$2.8 Billion AUM as of 3/31/20: NYSE: PFS 3

Successful & Disciplined Acquirer Acquired Acquired First Sentinel First Morris Bank & Acquired Pending Acquisition IPO NYSE Bancorp Trust Team Capital Bank of SB One Bancorp PFS Assets: $2.6B Assets: $554M Assets: $964M Assets: $2.0B 1839 Founded 2003 2004 2007 2011 2014 2015 2019 2020 Acquired Acquired Acquired The MDE Group Tirschwell & Beacon Trust Company AUM: $1.3B Loewy, Inc. AUM: $1.5B AUM: $822M NYSE: PFS 4

Strong Presence in Attractive Markets POPULATION Densely populated, lucrative markets (2020 Estimates) Highly educated, wealthy population NJ – 8,926,519 Diverse economy proximate to New York City and Philadelphia metro areas PA – 12,817,939 Bucks – 629,125 Lehigh – 371,790 Northampton – 306,669 MEDIAN INCOME AND NATIONAL RANK NJ - $86,883 – 3rd nationwide PA - $64,654 – 25th nationwide NYSE: PFS Note: Information is updated annually on July 1 Source: S&P Global - Claritas 5

Strong Presence in Attractive Markets Deposit Share* Average client tenure as of 4/30/20*** Provident ranks 9th in our footprint in NJ and 28th in PA Business < 1 year 8% 1 – 2 years 16% Businesses in market (excluding franchises) ** 3 – 5 years 18% NJ (13 counties where Provident has branches) has 300,417 businesses 6 – 9 years 20% PA (3 counties where Provident has branches) has 52,878 businesses 10+ years 38% Household Profile*** Consumer As of Services per < 1 year 3% Households 4/15/20 Household 1 – 2 years 8% 3 – 5 years 10% Business 19,493 1.90 6 – 9 years 11% Consumer 101,480 2.23 10+ years 67% NYSE: PFS Source: *FDIC as of 6/30/19 **S&P Global MI as of 4/16/20 6 ***MCIF

Proven Consistent Performance 1.40% 1.75% 1.72% 1.26% 1.22% 1.70% 1.20% 1.15% 1.68% 1.05% 1.65% 1.63% 0.99% 1.00% 1.60% 0.80% 1.55% 1.53% 0.61% 1.49% 0.60% 1.50% 1.46% 1.45% 0.40% 1.40% 0.20% 1.35% 0.00% 1.30% 2017 2018 2019 2017 2018 2019 Q3 2019 Q3 2019 Q4 2020 Q1 Q3 2019 Q3 2019 Q4 2020 Q1 ROAA PTPP ROAA(1) NYSE: PFS (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. 7

Proven Consistent Performance 10.00% 14.00% 13.07% 12.97% 8.93% 8.90% 9.00% 11.71% 8.07% 12.00% 8.00% 10.82% 10.56% 7.28% 7.29% 7.00% 10.00% 6.00% 8.00% 5.00% 4.22% 6.10% 6.00% 4.00% 3.00% 4.00% 2.00% 2.00% 1.00% 0.00% 0.00% 2017 2018 2019 2017 2018 2019 Q3 2019 Q3 2019 Q4 2020 Q1 Q3 2019 Q3 2019 Q4 2020 Q1 ROAE ROATE(1) NYSE: PFS (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. 8

Strong Track Record of Returns 2014 2015 2016 2017 2018 2019 $1.82 7% $1.74 CAGR Diluted Earnings $1.45 per Share $1.33 $1.38 $1.22 5% $14.85 $14.18 CAGR Tangible Book $13.20 $12.54 Value per Share (1) $11.40 $11.75 $0.23 +53% $0.21 $0.20 Regular Quarterly $0.19 Cash Dividend per $0.17 Share (2) $0.15 5-year 3.4% 3.4% 3.5% 3.7% TSR Dividend Yield 3.0% 2.7% 63.49% NYSE: PFS (1) See Appendix for a reconciliation of GAAP and non-GAAP financial measures. (2) Does not include special cash dividends of $0.15 in 2017 and $0.20 in 2019. 9

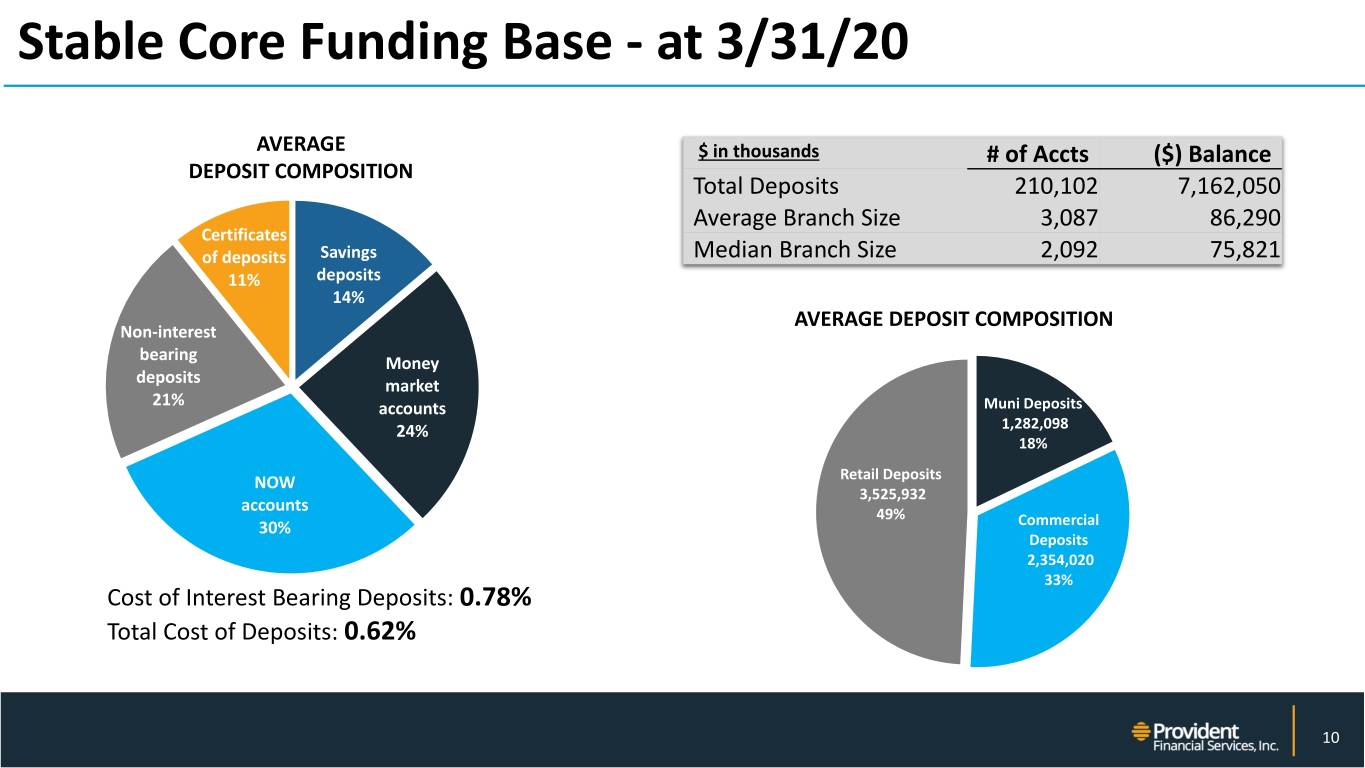

Stable Core Funding Base - at 3/31/20 AVERAGE $ in thousands # of Accts ($) Balance DEPOSIT COMPOSITION Total Deposits 210,102 7,162,050 Average Branch Size 3,087 86,290 Certificates of deposits Savings Median Branch Size 2,092 75,821 11% deposits 14% AVERAGE DEPOSIT COMPOSITION Non-interest bearing Money deposits market 21% accounts Muni Deposits 24% 1,282,098 18% NOW Retail Deposits 3,525,932 accounts 49% 30% Commercial Deposits 2,354,020 33% Cost of Interest Bearing Deposits: 0.78% Total Cost of Deposits: 0.62% NYSE: PFS 10

Diversified Loan Portfolio Consumer Loans 379,597 As of 3/31/20 5% ($ in thousands) Residential Mortgage Loans Commercial 1,107,197 Total Loans 15% 1,703,669 Gross Loans 23% Loan to Deposit: Commercial $7,377,021 108.68%Mortgage Loans 2,555,177 Multi-Family 35% Commercial Loans Construction Loans 1,222,437 408,944 17% 5% NYSE: PFS 11

Solid Credit Posture 2017 2018 2019 Q3 19 Q4 19 Q1 20 1.02% Total allowance to total loans 0.82% 0.77% 0.76% 0.79% 0.76% Non-performing assets to loans + REO 0.57% 0.58% 0.57% 0.58% 0.54% 0.38% 0.55% 0.55% 0.55% 0.48% 0.48% Non-performing loans to total loans 0.35% 0.44% 0.44% Non-performing assets to total 0.42% 0.42% 0.39% assets 0.28% 0.39% 0.33% Annualized Net charge-off ratio 0.26% 0.18% 0.16% 0.10% 12

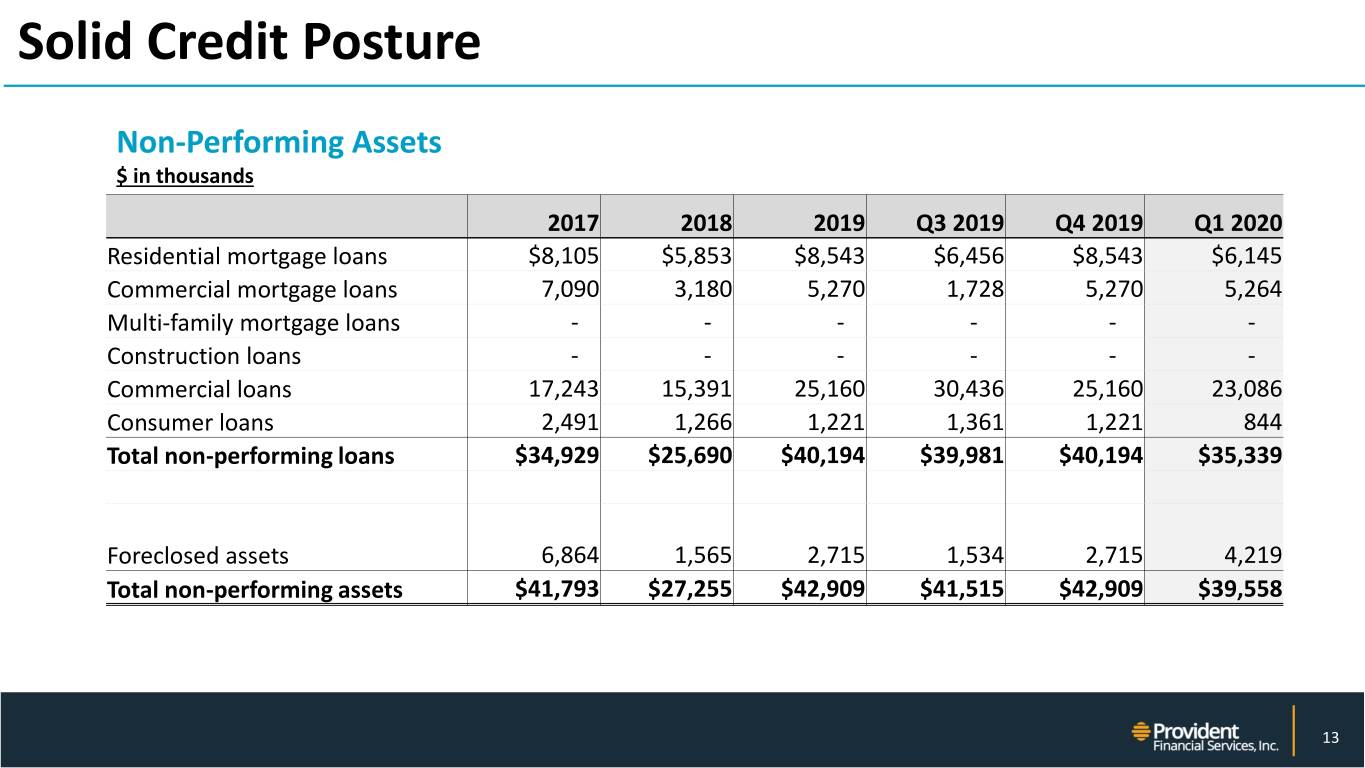

Solid Credit Posture Non-Performing Assets $ in thousands 2017 2018 2019 Q3 2019 Q4 2019 Q1 2020 Residential mortgage loans $8,105 $5,853 $8,543 $6,456 $8,543 $6,145 Commercial mortgage loans 7,090 3,180 5,270 1,728 5,270 5,264 Multi-family mortgage loans - - - - - - Construction loans - - - - - - Commercial loans 17,243 15,391 25,160 30,436 25,160 23,086 Consumer loans 2,491 1,266 1,221 1,361 1,221 844 Total non-performing loans $34,929 $25,690 $40,194 $39,981 $40,194 $35,339 Foreclosed assets 6,864 1,565 2,715 1,534 2,715 4,219 Total non-performing assets $41,793 $27,255 $42,909 $41,515 $42,909 $39,558 NYSE: PFS 13

Emphasis on Fee Income Non-Interest Income $60,000 $ in thousands $50,000 $40,000 $30,000 $20,000 $10,000 $0 2017 2018 2019 Q3 2019 Q4 2019 Q1 2020 Fees $27,218 $28,084 $28,321 $7,634 $7,704 $6,529 Wealth management income 17,604 17,957 22,503 6,084 6,097 6,251 Bank-owned life insurance 6,693 5,514 6,297 1,272 2,044 787 Net gain on securities transactions 57 2,221 72 - 43 11 Other income 4,125 4,900 6,601 3,057 1,837 3,413 Total non-interest income $55,697 $58,676 $63,794 $18,047 $17,725 $16,991 NYSE: PFS 14

Focus on Wealth Management Business 2020 Revenue (actual YTD thru March 31, 2020) Trust & Estate Advisory $ 5,672,743 9% Trust & Estate $ 508,570 Tax $ 70,115 Private Banking Private Banking $ 90,422 * 1% Total $ 6,341,850 Advisory Tax 89% 1% NYSE: PFS * Represents interest on lines of credit to Beacon clients, whose investment accounts are pledged as collateral. 15

Focus on Wealth Management Business AVERAGE EBITDA & NET INCOME CLIENT SIZE EBITDA (YTD thru March 31, 2020) $ 2,834,000 Net Income (YTD thru March 31, 2020) $ 1,696,000 CROSSOVER PROVIDENT/BEACON $2,950,000 (HOW MANY PROVIDENT CUSTOMERS ARE BEACON CLIENTS) As of March 2020, based on AUM of $2.8B for 953 family relationships 94 Provident Bank households are also Beacon clients AVERAGE FEE 78 bps NYSE: PFS 16

Adoption of Digital Channels & A Future Architecture Technology & Transformational Investments Successfully delivered a new Online/Mobile solution on March 10, 2020 – Adoption already exceeding previous solution Zelle also delivered - 100% adoption increase over previous solution Covid-19 accelerated the deployment of mobility solutions internally greatly improving our ability to react to incidents, etc. Creating a competitive advantage with data Efficiencies through robotic process automation Deploying operational process improvements Renegotiated contract with core provider, saving in excess of $2M annually. Pursuing other renegotiation opportunities. NYSE: PFS 17

APPENDIX

Reconciliation of GAAP to Non-GAAP Financial Measures ($ in thousands, except per share data) 2017 2018 2019 Q3 2019 Q4 2019 Q1 2020 PTPP ROAA: Net Income $ 93,949 $ 118,387 $ 112,633 $ 31,399 $ 25,951 $ 14,931 Note: The Company has presented the following non-GAAP (Generally Add: provision for credit losses 5,600 23,700 13,100 500 2,900 14,717 Accepted Accounting Principles) Add: provision for credit losses for off-balance sheet credit exposure - - - 1,000 financial measures because it believes Add: income tax expense 46,528 25,530 34,455 9,938 8,026 5,257 that these measures provide useful and PTPP earnings $ 146,077 $ 167,617 $ 160,188 $ 41,837 $ 36,877 $ 35,905 comparative information to assess trends in the Company’s results of operations and financial condition. Annualized PTPP earnings $ 146,077 $ 167,617 $ 160,188 $ 165,984 $ 146,305 $ 144,409 Presentation of these non-GAAP Average assets $ 9,534,785 $ 9,736,449 $ 9,820,832 $ 9,899,693 $ 9,848,909 $ 9,923,457 financial measures is consistent with PTPP ROAA (Annualized PTPP earnings/average assets) 1.53% 1.72% 1.63% 1.68% 1.49% 1.46% how the Company evaluates its performance internally and these non- ROATE: GAAP financial measures are frequently Net income $ 93,949 $ 118,387 $ 112,633 $ 31,399 $ 25,951 $ 14,931 used by securities analysts, investors and other interested parties in the Annualized net income $ 93,949 $ 118,387 $ 112,633 $ 124,572 $ 102,958 $ 60,052 evaluation of companies in the Company’s industry. Investors should Average stockholders' equity $ 1,289,973 $ 1,325,211 $ 1,394,859 $ 1,399,583 $ 1,412,725 $ 1,421,748 recognize that the Company’s Less: average intangible assets 421,628 419,271 433,189 438,906 437,304 436,757 presentation of these non-GAAP Average tangible stockholders' equity $ 868,345 $ 905,940 $ 961,670 $ 960,677 $ 975,421 $ 984,991 financial measures might not be comparable to similarly-titled measures ROATE (Annualized net income/average tangible stockholders' equity) 10.82% 13.07% 11.71% 12.97% 10.56% 6.10% of other companies. These non-GAAP financial measures should not be 2014 2015 2016 2017 2018 2019 considered a substitute for GAAP basis Tangible book value per share: measures and the Company strongly Stockholders' equity $ 1,144,099 $ 1,196,065 $ 1,251,781 $ 1,298,661 $ 1,358,980 $ 1,413,840 encourages a review of its consolidated Less: intangible assets 404,422 426,277 422,937 420,290 418,178 437,019 financial statements in their entirety. Tangible stockholders' equity $ 739,677 $ 769,788 $ 828,844 $ 878,371 $ 940,802 $ 976,821 Shares outstanding 64,905,905 65,489,354 66,082,283 66,535,017 66,325,458 65,787,900 Tangible book value per share (Tangible stockholders' equity/shares outstanding) $ 11.40 $ 11.75 $ 12.54 $ 13.20 $ 14.18 $ 14.85 NYSE: PFS 19

Loan Type Outstanding by Geography – 3/31/20 6,000,000,000 5,000,000,000 4,000,000,000 3,000,000,000 2,000,000,000 1,000,000,000 0 NJ PA NY MD All Other States Grand Total 5,581,192,580 1,062,431,293 256,339,871 70,205,137 400,688,545 % of Total Portfolio 75.72% 14.41% 3.48% 0.95% 5.44% Home Equity 1st Lien Position 216,753,902 1,539,876 413,034 1,108,780 Residential Mortgage 988,462,768 84,410,135 7,275,588 6,794,694 20,510,875 Other Consumer Loans 147,135,296 5,782,072 764,469 132,486 5,404,729 Construction 274,399,063 70,070,708 19,617,993 44,856,101 Multifamily Mortgage 819,898,477 241,861,471 64,142,826 17,368,301 79,180,695 Commercial Mortgages 1,651,535,201 498,917,348 136,241,547 32,659,035 233,084,085 Commercial Loans 1,483,007,875 159,849,682 27,884,414 13,250,621 16,543,281 NYSE: PFS 20

Loans by NAICS Sector – 3/31/20 CRE NAICS Sector Loan Count $ Exposure $ Balance C & I - (Includes owner occupied) Real Estate and Rental and Leasing 1,284 3,468,078,287 3,390,012,647 Accommodation and Food Services 32 181,226,146 179,451,146 NAICS Sector Loan Count $ Exposure $ Balance Real Estate and Rental and Leasing 353 404,665,053 336,623,845 Construction 24 131,258,499 128,365,623 Health Care and Social Assistance 306 310,023,232 275,711,265 Other Services (except Public Administration) 36 22,028,532 21,005,478 Construction 249 258,802,389 108,377,069 Retail Trade 12 11,507,478 11,507,478 Wholesale Trade 188 214,202,796 167,219,170 Management of Companies and Enterprises 2 10,708,147 10,708,147 Manufacturing 175 212,889,267 161,761,301 Arts, Entertainment, and Recreation 4 8,652,754 8,652,754 Accommodation and Food Services 111 144,490,192 117,895,390 Health Care and Social Assistance 10 7,428,195 7,428,195 Retail Trade 150 120,878,830 97,422,948 Finance and Insurance 6 5,252,993 5,252,993 Educational Services 50 108,276,702 78,259,015 Manufacturing 4 3,724,621 3,724,621 Arts, Entertainment, and Recreation 75 104,227,610 95,018,489 Transportation and Warehousing 7 2,862,731 2,728,885 Finance and Insurance 39 93,764,450 52,625,472 Information 1 2,166,341 2,166,341 Professional, Scientific, and Technical Services 203 85,585,626 46,692,571 Wholesale Trade 1 2,000,000 2,000,000 Other Services (except Public Administration) 130 76,046,540 63,355,538 Public Administration 26 1,146,644 1,146,644 Administrative and Support and Waste 120 52,221,379 32,347,882 Professional, Scientific, and Technical Services 2 738,033 738,033 Management and Remediation Services Summary 1,451 3,858,779,401 3,774,888,985 Utilities 36 37,461,013 19,852,350 Transportation and Warehousing 94 35,606,870 30,279,317 Construction Information 11 19,743,385 16,652,863 Management of Companies and Enterprises 5 4,260,388 2,157,307 NAICS Sector Loan Count $ Exposure $ Balance Public Administration 21 3,234,852 2,784,852 Real Estate and Rental and Leasing 50 599,750,027 293,712,173 Agriculture, Forestry, Fishing and Hunting 4 2,562,214 1,791,262 Construction 12 108,904,455 70,799,853 Mining, Quarrying, and Oil and Gas Extraction 2 441,700 0 Health Care and Social Assistance 2 30,210,683 19,585,501 Commercial ODs/ACH ODs 85 1,769,080 605,632 Accommodation and Food Services 1 17,700,000 6,564,871 Summary 2,407 2,291,153,570 1,707,433,537 Other Services (except Public Administration) 4 12,608,428 871,573 Manufacturing 2 10,264,281 10,054,688 Arts, Entertainment, and Recreation 1 6,800,000 6,795,207 Retail Trade 1 2,700,000 560,000 Summary 73 788,937,873 408,943,865 NYSE: PFS 21

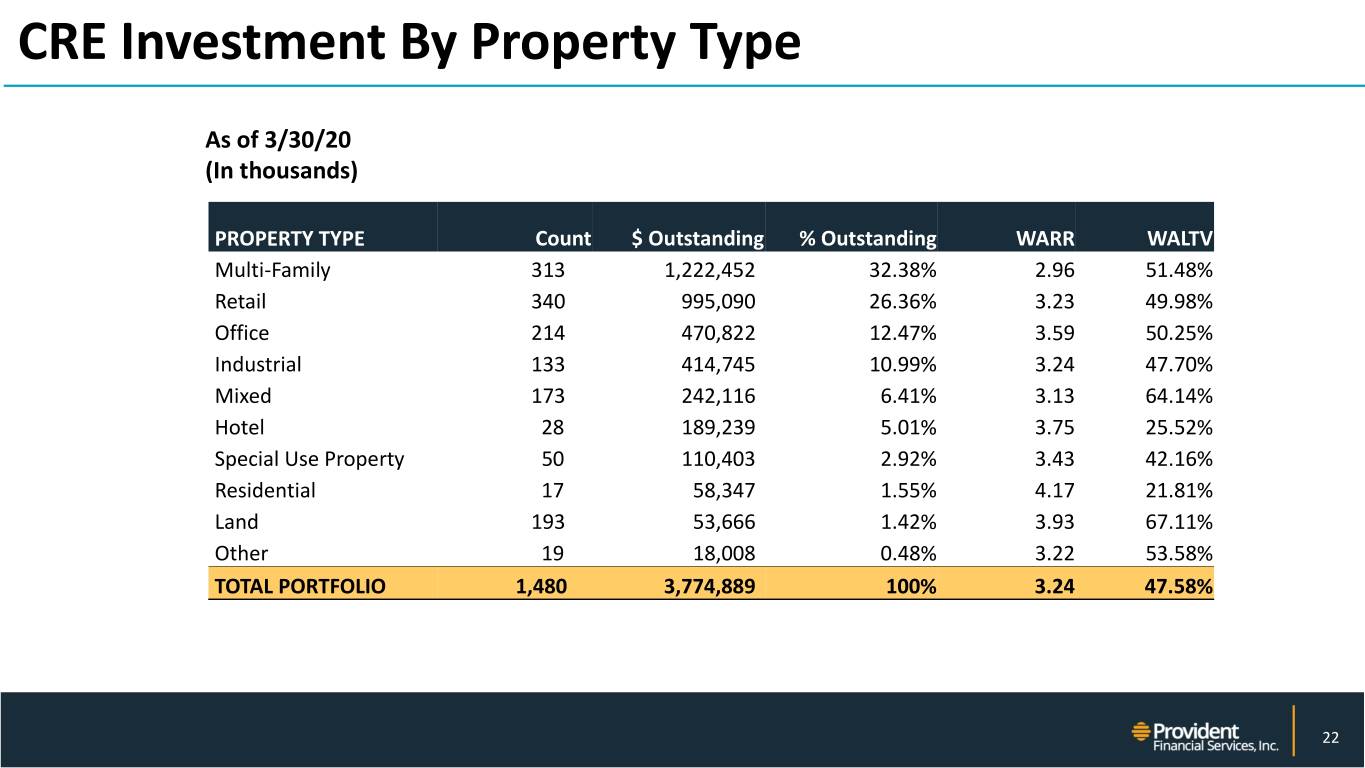

CRE Investment By Property Type As of 3/30/20 (In thousands) PROPERTY TYPE Count $ Outstanding % Outstanding WARR WALTV Multi-Family 313 1,222,452 32.38% 2.96 51.48% Retail 340 995,090 26.36% 3.23 49.98% Office 214 470,822 12.47% 3.59 50.25% Industrial 133 414,745 10.99% 3.24 47.70% Mixed 173 242,116 6.41% 3.13 64.14% Hotel 28 189,239 5.01% 3.75 25.52% Special Use Property 50 110,403 2.92% 3.43 42.16% Residential 17 58,347 1.55% 4.17 21.81% Land 193 53,666 1.42% 3.93 67.11% Other 19 18,008 0.48% 3.22 53.58% TOTAL PORTFOLIO 1,480 3,774,889 100% 3.24 47.58% NYSE: PFS 22

CRE To Total Risk-Based Capital Guideline is 300% of Regulatory Capital 500.0% 452.4% 430.0% 451.5% 438.3% 432.6% 422.2% 438.8% 450.0% 438.6% 428.6% 430.6% 418.4% 425.9% 400.0% 350.0% 300.0% 250.0% 200.0% 150.0% 100.0% 50.0% 0.0% 12/31/15 12/31/16 12/31/17 03/31/18 06/30/18 09/30/18 12/31/18 03/31/19 06/30/19 09/30/19 12/31/19 03/31/20 NYSE: PFS 23

Performance Ratios - Capital Tier 1 leverage capital Tier 1 risk-based capital Total risk-based capital 16.00 14.00 12.00 13.47 13.47 13.27 13.17 13.12 12.74 12.74 12.67 12.54 12.43 10.00 12.31 11.87 10.34 10.34 10.24 10.21 10.08 8.00 9.65 6.00 4.00 2.00 0.00 2017 2018 2019 Q3 2019 Q4 2019 Q1 2020 NYSE: PFS 24

Q1 2020 INVESTOR PRESENTATION