Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HERITAGE COMMERCE CORP | tm2020812d1_8k.htm |

Exhibit 99.1

|

Welcome to the Virtual Annual Meeting of Shareholders Thursday, May 21, 2020 at 1:00 p.m. Pacific Daylight Time (PDT) |

|

Virtual Annual Meeting of Shareholders Agenda DRAFT 05/18/20 3:30 PM 1. Call to Order and Opening Remarks 2. New Business / Proposals a. To elect 12 members of the Board of Directors, each for a term of one year; b. To approve an amendment to the Heritage Commerce Corp 2013 Equity Incentive Plan to increase the number of shares for issuance under the Plan; c. To approve an advisory proposal on the Company’s 2019 executive compensation; d. To ratify the selection of Crowe LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2020; and 3. Voting on Proposals 4. Closing of the Formal Meeting / Begin Presentation |

|

Virtual Annual Meeting of Shareholders Presentation May 21, 2020 |

|

Forward Looking Statement Disclaimer Forward-looking statements are based on management’s knowledge and belief as of today and include information concerning Heritage Commerce Corp, the holding company (the “Company” or “Heritage”) for Heritage Bank of Commerce (the “Bank”), possible or assumed future financial condition, and its results of operations, business and earnings outlook. These forward-looking statements are subject to risks and uncertainties. For a discussion of risk factors which could cause results to differ, please see the Company’s reports on Forms 10-K and 10-Q as filed with the Securities and Exchange Commission and the Company’s press releases. Readers should not place undue reliance on the forward-looking statements, which reflect management's view only as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect subsequent events or circumstances. 4 |

|

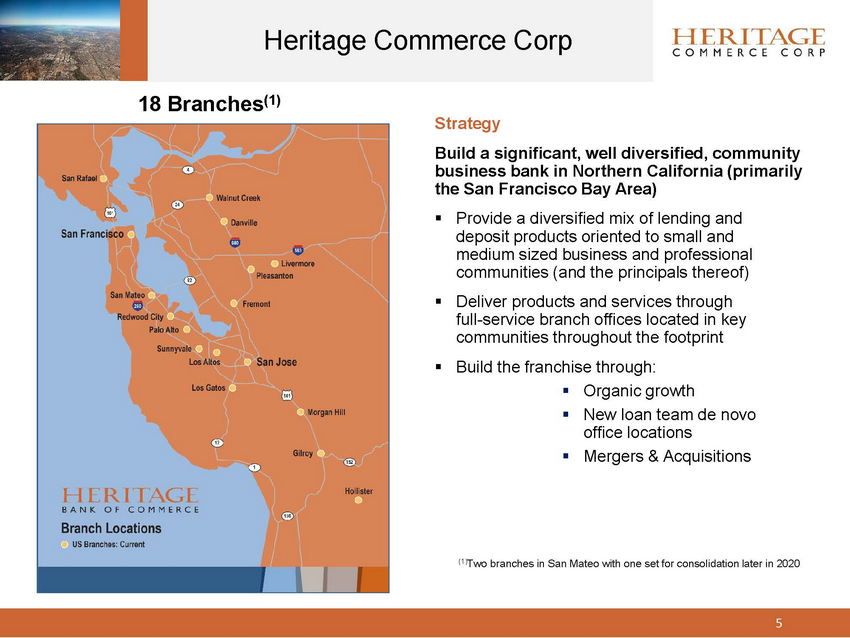

Heritage Commerce Corp 18 Branches(1) Strategy Build a significant, well diversified, community business bank in Northern California (primarily the San Francisco Bay Area) ▪ Provide a diversified mix of lending and deposit products oriented to small and medium sized business and professional communities (and the principals thereof) Deliver products and services through full-service branch offices located in key communities throughout the footprint Build the franchise through: ▪ ▪ ▪ ▪ Organic growth New loan team de novo office locations Mergers & Acquisitions ▪ (1)Two branches in San Mateo with one set for consolidation later in 2020 5 |

|

Heritage Commerce Corp Profile History: ▪Heritage Bank of Commerce, a community business bank founded in 1994 headquartered in San Jose, California Heritage Commerce Corp, a California corporation organized in 1997, the holding company for Heritage Bank of Commerce Relationship Banking Offers a full range of banking services to small and medium sized businesses (and their principals), and to professionals using a “Consultative” relationship banking approach Core Clientele ▪ ▪ ▪ Small to medium sized closely held businesses (and their principals and key employees) Professionals High net worth individuals Specialty Expertise ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ Small Business Administration (“SBA”) Lending and loan sales Dental Lending Corporate Finance/Asset-Based Lending Factoring Construction Lending Cash Management Non-profit organizations, education, and churches Homeowner Association Services (“HOA”) 6 |

|

Heritage Commerce Corp Recent Highlights ▪ Acquired Tri-Valley Bank in 2Q18 ▪ Acquired United American Bank in 2Q18 Celebrated 25th Anniversary in 2019 ▪ ▪ Walter Kaczmarek President & CEO retired on August 8, 2019 ▪ Keith Wilton promoted to President & CEO of Heritage Commerce Corp effective August 8, 2019 ▪ Acquired Presidio Bank in 4Q19, the largest acquisition in our history ▪ Reported record earnings of $40.5 million for the full year of 2019 ▪ Presidio Bank systems and integration successfully completed in 1Q20 7 |

|

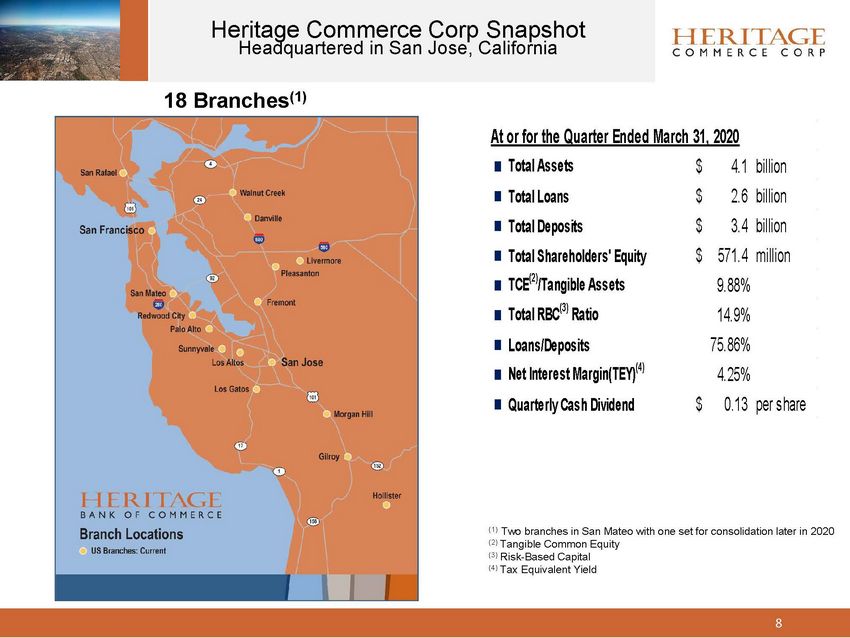

Heritage Commerce Corp Snapshot Headquartered in San Jose, California 18 Branches(1) At or for the Qua rte r Ende d Ma rch 31, 2020 Total Assets Total Loans Total Deposits Total Shareholders' Equity TCE(2)/Tangible Assets Total RBC(3) Ratio Loans/Deposits Net Interest Margin(TEY)(4) Quarterly Cash Dividend $ $ $ $ 4.1 2.6 3.4 571.4 9.88% 14.9% 75.86% 4.25% billion billion billion million $ 0.13 per share (1) Two branches in San Mateo with one set for consolidation later in 2020 (2) Tangible Common Equity (3) Risk-Based Capital (4) Tax Equivalent Yield 8 |

|

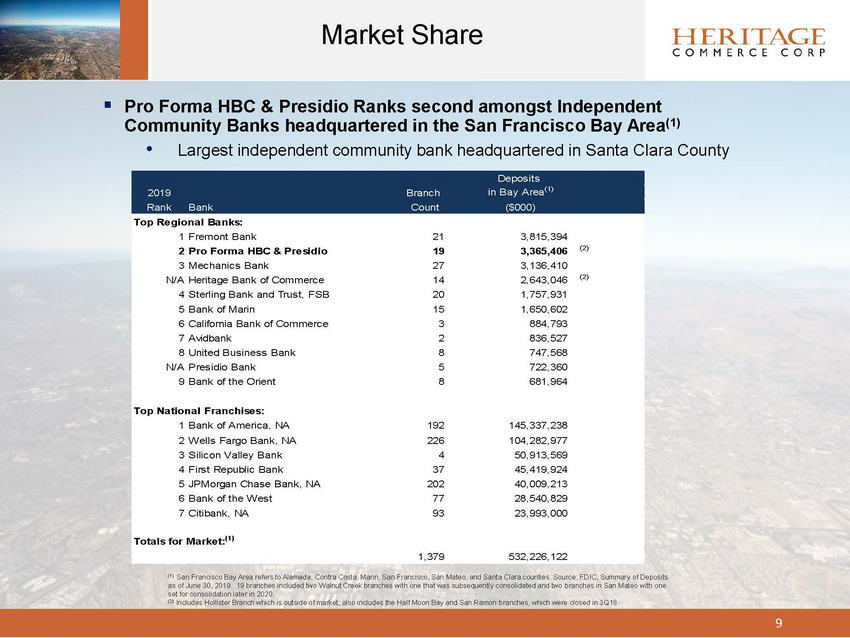

Market Share ▪ Pro Forma HBC & Presidio Ranks second amongst Independent Community Banks headquartered in the San Francisco Bay Area(1) • Largest independent community bank headquartered in Santa Clara County Top Regional Banks: 1 Fremont Bank 2 Pro Forma HBC & Presidio 3 Mechanics Bank N/A Heritage Bank of Commerce 4 Sterling Bank and Trust, FSB 5 Bank of Marin 6 California Bank of Commerce 7 Avidbank 8 United Business Bank N/A Presidio Bank 9 Bank of the Orient 21 19 27 14 20 15 3 2 8 5 8 3,815,394 3,365,406 3,136,410 2,643,046 1,757,931 1,650,602 884,793 836,527 747,568 722,360 681,964 (2) (2) Top National Franchises: 1 Bank of America, NA 2 Wells Fargo Bank, NA 3 Silicon Valley Bank 4 First Republic Bank 5 JPMorgan Chase Bank, NA 6 Bank of the West 7 Citibank, NA 192 226 4 37 202 77 93 145,337,238 104,282,977 50,913,569 45,419,924 40,009,213 28,540,829 23,993,000 Totals for Market:(1) 1,379 532,226,122 (1) San Francisco Bay Area refers to Alameda, Contra Costa, Marin, San Francisco, San Mateo, and Santa Clara counties. Source: FD IC, Summary of Deposits as of June 30, 2019. 19 branches included two Walnut Creek branches with one that was subsequently consolidated and two branches in San Mateo with one set for consolidation later in 2020. (2) Includes Hollister Branch which is outside of market; also includes the Half Moon Bay and San Ramon branches, which were closed in 3Q18. 9 Deposits 2019 Branchin Bay Area(1) Rank Bank Count ($000) |

|

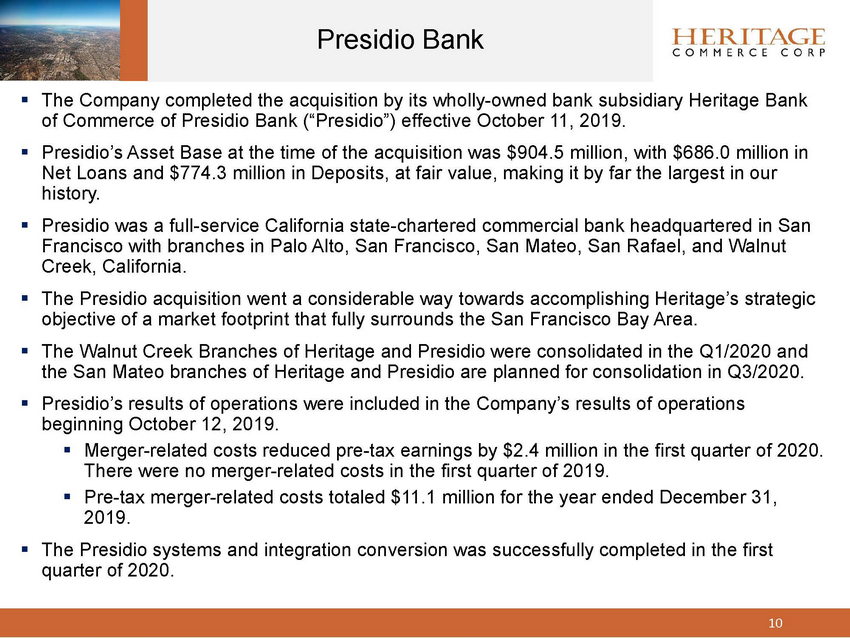

Presidio Bank ▪ The Company completed the acquisition by its wholly-owned bank subsidiary Heritage Bank of Commerce of Presidio Bank (“Presidio”) effective October 11, 2019. Presidio’s Asset Base at the time of the acquisition was $904.5 million, with $686.0 million in Net Loans and $774.3 million in Deposits, at fair value, making it by far the largest in our history. Presidio was a full-service California state-chartered commercial bank headquartered in San Francisco with branches in Palo Alto, San Francisco, San Mateo, San Rafael, and Walnut Creek, California. The Presidio acquisition went a considerable way towards accomplishing Heritage’s strategic objective of a market footprint that fully surrounds the San Francisco Bay Area. The Walnut Creek Branches of Heritage and Presidio were consolidated in the Q1/2020 and the San Mateo branches of Heritage and Presidio are planned for consolidation in Q3/2020. Presidio’s results of operations were included in the Company’s results of operations beginning October 12, 2019. ▪ Merger-related costs reduced pre-tax earnings by $2.4 million in the first quarter of 2020. There were no merger-related costs in the first quarter of 2019. ▪Pre-tax merger-related costs totaled $11.1 million for the year ended December 31, 2019. The Presidio systems and integration conversion was successfully completed in the first quarter of 2020. ▪ ▪ ▪ ▪ ▪ ▪ 10 |

|

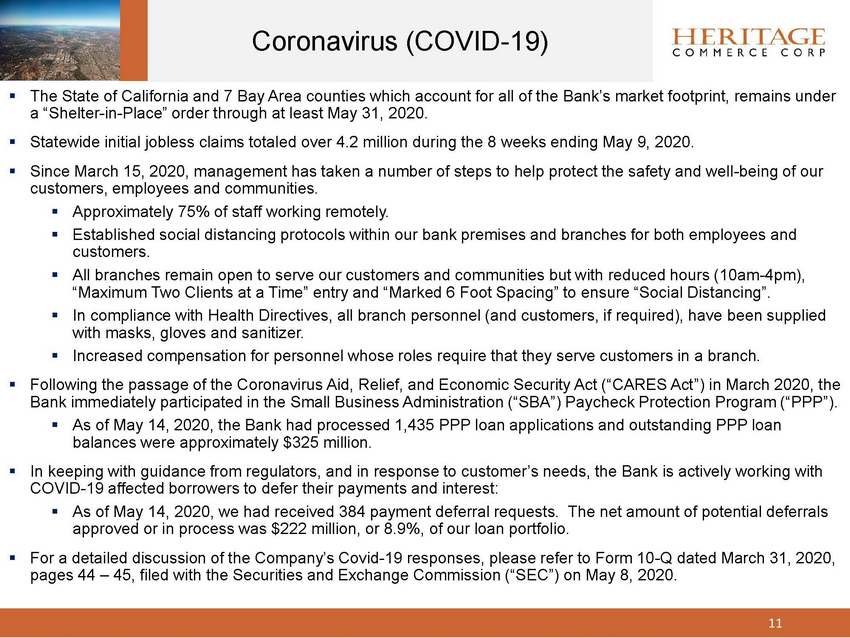

Coronavirus (COVID-19) ▪ The State of California and 7 Bay Area counties which account for all of the Bank’s market footprint, remains under a “Shelter-in-Place” order through at least May 31, 2020. Statewide initial jobless claims totaled over 4.2 million during the 8 weeks ending May 9, 2020. Since March 15, 2020, management has taken a number of steps to help protect the safety and well-being of our customers, employees and communities. ▪ ▪ ▪ ▪ Approximately 75% of staff working remotely. Established social distancing protocols within our bank premises and branches for both employees and customers. All branches remain open to serve our customers and communities but with reduced hours (10am-4pm), “Maximum Two Clients at a Time” entry and “Marked 6 Foot Spacing” to ensure “Social Distancing”. In compliance with Health Directives, all branch personnel (and customers, if required), have been supplied with masks, gloves and sanitizer. Increased compensation for personnel whose roles require that they serve customers in a branch. ▪ ▪ ▪ ▪ Following the passage of the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) in March 2020, the Bank immediately participated in the Small Business Administration (“SBA”) Paycheck Protection Program (“PPP”). ▪As of May 14, 2020, the Bank had processed 1,435 PPP loan applications and outstanding PPP loan balances were approximately $325 million. In keeping with guidance from regulators, and in response to customer’s needs, the Bank is actively working with COVID-19 affected borrowers to defer their payments and interest: ▪As of May 14, 2020, we had received 384 payment deferral requests. The net amount of potential deferrals approved or in process was $222 million, or 8.9%, of our loan portfolio. For a detailed discussion of the Company’s Covid-19 responses, please refer to Form 10-Q dated March 31, 2020, pages 44 – 45, filed with the Securities and Exchange Commission (“SEC”) on May 8, 2020. ▪ ▪ 11 |

|

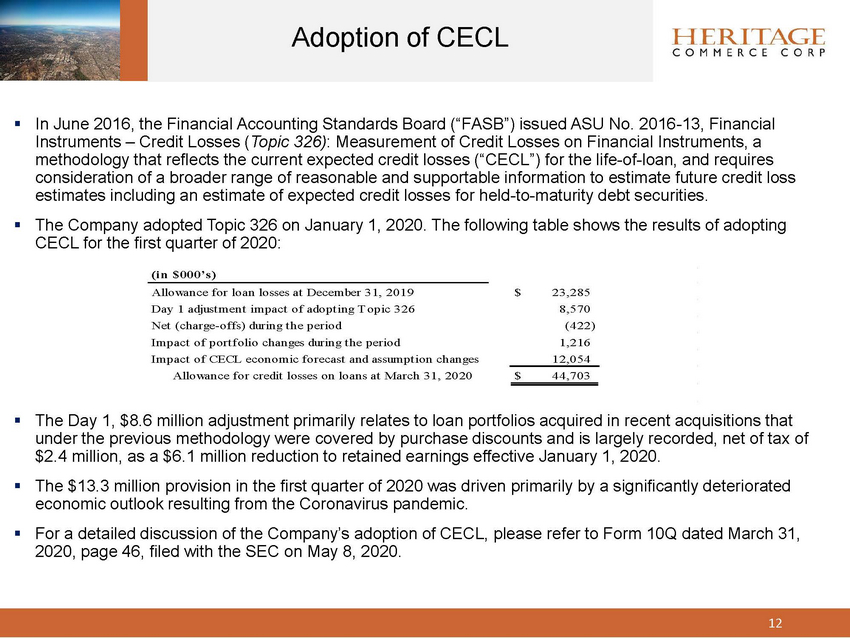

Adoption of CECL ▪ In June 2016, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, a methodology that reflects the current expected credit losses (“CECL”) for the life-of-loan, and requires consideration of a broader range of reasonable and supportable information to estimate future credit loss estimates including an estimate of expected credit losses for held-to-maturity debt securities. The Company adopted Topic 326 on January 1, 2020. The following table shows the results of adopting CECL for the first quarter of 2020: ▪ (i n $000’s ) Allowance for loan losses at December 31, 2019 Day 1 adjust ment impact of adopt ing T opic 326 Net (charge-offs) during t he period Impact of port folio changes during t he period Impact of CECL economic forecast and assumpt ion changes Allowance for credit losses on loans at March 31, 2020 $ 23,285 8,570 (422) 1,216 12,054 $ 44,703 ▪ The Day 1, $8.6 million adjustment primarily relates to loan portfolios acquired in recent acquisitions that under the previous methodology were covered by purchase discounts and is largely recorded, net of tax of $2.4 million, as a $6.1 million reduction to retained earnings effective January 1, 2020. The $13.3 million provision in the first quarter of 2020 was driven primarily by a significantly deteriorated economic outlook resulting from the Coronavirus pandemic. For a detailed discussion of the Company’s adoption of CECL, please refer to Form 10Q dated March 31, 2020, page 46, filed with the SEC on May 8, 2020. ▪ ▪ 12 |

|

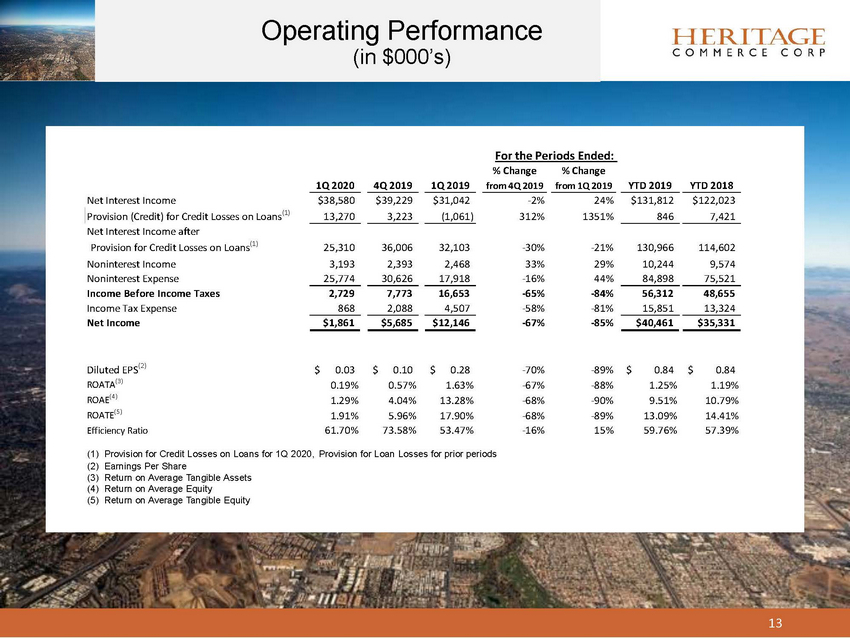

Operating Performance (in $000’s) 13 For the Periods Ended: % Change % Change 1Q 2020 4Q 2019 1Q 2019 from 4Q 2019from 1Q 2019YTD 2019 YTD 2018 Net Interest Income $38,580 $39,229 $31,042 -2% 24% $131,812 $122,023 Provision (Credit) for Credit Losses on Loans(1) 13,270 3,223 (1,061) 312% 1351% 846 7,421 Net Interest Income after Provision for Credit Losses on Loans(1) 25,310 36,006 32,103 -30% -21% 130,966 114,602 Noninterest Income 3,193 2,393 2,468 33% 29% 10,244 9,574 Noninterest Expense 25,774 30,626 17,918 -16% 44% 84,898 75,521 Income Before Income Taxes 2,729 7,773 16,653 -65% -84% 56,312 48,655 Income Tax Expense 868 2,088 4,507 -58% -81% 15,851 13,324 Net Income $1,861 $5,685 $12,146 -67% -85% $40,461 $35,331 Diluted EPS(2) $ 0.03 $ 0.10 $ 0.28 -70% -89% $ 0.84 $ 0.84 ROATA(3) 0.19% 0.57% 1.63% -67% -88% 1.25% 1.19% ROAE(4) 1.29% 4.04% 13.28% -68% -90% 9.51% 10.79% ROATE(5) 1.91% 5.96% 17.90% -68% -89% 13.09% 14.41% Efficiency Ratio 61.70% 73.58% 53.47% -16% 15% 59.76% 57.39% (1) Provision for Credit Losses on Loans for 1Q 2020, Provision for Loan Losses for prior periods (2) Earnings Per Share (3) Return on Average Tangible Assets (4) Return on Average Equity (5) Return on Average Tangible Equity |

|

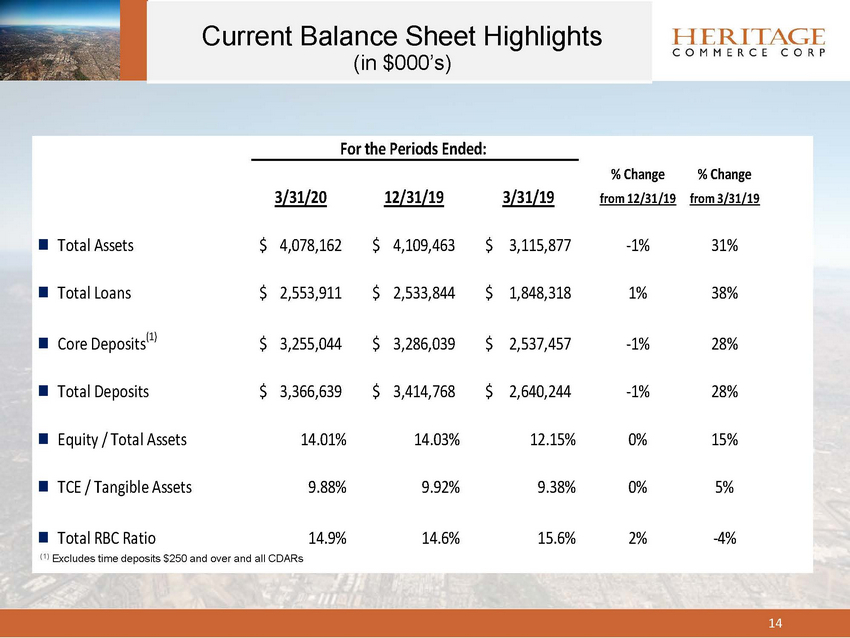

Current Balance Sheet Highlights (in $000’s) For the Periods Ended: % Change from 12/31/19 % Change from 3/31/19 3/31/20 12/31/19 3/31/19 Total Assets $ 4,078,162 $ 4,109,463 $ 3,115,877 -1% 31% Total Loans $ 2,553,911 $ 2,533,844 $ 1,848,318 1% 38% Core Deposits(1) $ 3,255,044 $ 3,286,039 $ 2,537,457 -1% 28% Total Deposits $ 3,366,639 $ 3,414,768 $ 2,640,244 -1% 28% Equity / Total Assets 14.01% 14.03% 12.15% 0% 15% TCE / Tangible Assets 9.88% 9.92% 9.38% 0% 5% Total RBC Ratio 14.9% 14.6% 15.6% 2% -4% (1) Excludes time deposits $250 and over and all CDARs 14 |

|

Management Team Keith A. Wilton President and Chief Executive Officer 408.494.4534 Deborah K. Reuter Executive Vice President Chief Risk Officer & Corporate Secretary 408.494.4542 Michael E. Benito Executive Vice President Business Banking Manager 408.792.4085 Robertson Clay Jones Executive Vice President President of Community Business Banking Group 408.792.4010 Margo G. Butsch Executive Vice President Chief Credit Officer 408.200.8738 May K.Y. Wong Executive Vice President Controller 408.494.4596 Lawrence D. McGovern Executive Vice President Chief Financial Officer 408.494.4562 Jeff L. Javits Executive Vice President Chief Information Officer 408.494.4520 Teresa L. Powell Executive Vice President Director of HOA & Deposit Services 408.200.8712 Corporate Headquarters 150 Almaden Boulevard San Jose, CA 95113 NASDAQ: HTBK 15 |

|

For more information contact: Deborah K. Reuter Executive Vice President Chief Risk Officer & Corporate Secretary 408-494-4542 |